Attached files

| file | filename |

|---|---|

| 8-K - VECTREN CORP | vc_8k0302.htm |

| EX-99.2 - CAUTIONARY STATEMENT - VECTREN CORP | vc_8k0302ex992.htm |

Exhibit 99.1

New York & Boston

Presentations to the Financial

Community

Community

Carl Chapman - President and CEO

Jerry Benkert - Executive Vice President and CFO

March 3-4, 2011

2

Forward-Looking Statements

All statements other than statements of historical fact are forward-looking statements made

in good faith by the company and are intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. Such statements are

based on management’s beliefs, as well as assumptions made by and information currently

available to management and include such words as “believe”, “anticipate”, ”endeavor”,

“estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar

expressions intended to identify forward-looking statements.

in good faith by the company and are intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. Such statements are

based on management’s beliefs, as well as assumptions made by and information currently

available to management and include such words as “believe”, “anticipate”, ”endeavor”,

“estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar

expressions intended to identify forward-looking statements.

Vectren cautions readers that the assumptions forming the basis for forward-looking

statements include many factors that are beyond Vectren’s ability to control or estimate

precisely and actual results could differ materially from those contained in this document.

Forward-looking statements speak only as of the date on which our statement is made, and

we assume no duty to update them. More detailed information about these factors is set

forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s

2010 annual report on Form 10-K filed on February 17, 2011.

statements include many factors that are beyond Vectren’s ability to control or estimate

precisely and actual results could differ materially from those contained in this document.

Forward-looking statements speak only as of the date on which our statement is made, and

we assume no duty to update them. More detailed information about these factors is set

forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s

2010 annual report on Form 10-K filed on February 17, 2011.

Robert L. Goocher, Treasurer and VP - Investor Relations

rgoocher@vectren.com

812-491-4080

Ø NYSE Symbol: VVC

Ø 8-10% Target Annual Total

Shareholder Return

Shareholder Return

• Annual dividends paid increased

51st consecutive year in Dec. 2010

to annualized rate of $1.38 per

share

51st consecutive year in Dec. 2010

to annualized rate of $1.38 per

share

Ø Over 1.1 million utility customers

in Indiana and Ohio

in Indiana and Ohio

• Operate in constructive regulatory

environments with revenue

stabilization mechanisms

environments with revenue

stabilization mechanisms

Ø Well diversified nonutility portfolio

linked to core utility

linked to core utility

Ø $4.8 billion in assets

Ø $2.1 billion in revenues

Ø $2.1 billion market cap

Ø S&P: A-, Moody’s: A3

Stable outlook for both

Stable outlook for both

Utility Net Income

Consolidated Net Income*

Three Year Average (’08-’10)

Utility

84%

Nonutility

16%

Electric

50%

Gas

50%

3

* Excludes the 2009 Liberty charge of $11.9 million.

Vectren Corporation Overview

* Jointly owned (61%) with a subsidiary of Citizens Energy Group.

Vectren

Utility

Vectren

Nonutility

Vectren North

Indiana Gas

Vectren South

SIGECO -

Electric

Electric

Vectren South

SIGECO - Gas

Vectren Ohio

VEDO

Infrastructure

Services

Services

Energy

Services

Services

Coal Mining

Energy

Marketing

Marketing

Miller Pipeline

Energy

Systems Group

Prosperity Mine

Oaktown Mine 1

Oaktown Mine 2

(under development)

ProLiance

Energy*

Vectren

Source

4

Vectren at a Glance

5

Nonutility Business Operations - Offices

Vectren Energy Delivery of Indiana - North

Vectren Energy Delivery of Indiana - South

Vectren Energy Delivery of Ohio

Utility Service Territories

Vectren’s Footprint

OH

IN

Indianapolis

Columbus

Louisville

Cincinnati

Birmingham

Little Rock

York

South River

Kansas City

New Smyrna

Beach

Dayton

Evansville

St. Louis

Atlanta

Johnson City

Richmond

Raleigh

Nashville

Clearwater

Ft. Worth

Mobile

Houston

Greenville

Lansing

Traverse

City

Miller Pipeline

Energy Systems Group

Vectren Fuels

ProLiance Energy

Vectren Source

6

Looking Ahead - Strategies for 2011 and Beyond

Utility

Ø Execute strategies to consistently achieve annual utility earnings growth target of 3%

• Earn allowed returns in gas and electric utilities

– Implement new electric rates from pending base rate case

– Aggressively manage costs through performance management and strategic sourcing

– Seek continued support for alternative regulatory solutions that encourage customer

conservation and also reduce the size and frequency of traditional base rate cases

conservation and also reduce the size and frequency of traditional base rate cases

• Disciplined allocation of capital to operate at cash flow neutral

– Reinvest earnings to support necessary rate base growth

– Reduce external financing requirements

Nonutility

Ø Continued growth and profitability of existing portfolio of nonutility businesses

• Increase investments in Infrastructure and Energy Services businesses to drive longer term

earnings growth

earnings growth

• As demand continues to recover, open Oaktown #2 coal mine in 2012 and ramp up to full

production

production

• Focus on dramatically improving ProLiance’s profitability prospects through customer growth and

significant reductions in fixed cost structure

significant reductions in fixed cost structure

7

Generation Portfolio

Ø 5 Coal-fired base units - 1,000 MW

• 100% scrubbed for SO2

• 90% controlled for NOx

• Combination of pollution controls, including

fabric filter technology, have the co-benefit

of removing substantial levels of mercury

and particulate matter

fabric filter technology, have the co-benefit

of removing substantial levels of mercury

and particulate matter

Ø 6 Gas-fired peak-use turbines - 295 MW

Ø Purchased capacity - 100 MW thru 2012

Ø Renewable energy ~ 5%

• Land-fill gas generation facility - 3 MW

• Wind energy - 80 MW via purchased power

Vectren North - Indiana Gas

560,000 Gas Customers

Vectren South - SIGECO

110,000 Gas Customers

Vectren Ohio - VEDO

310,000 Gas Customers

Vectren South - SIGECO

141,000 Electric Customers

Vectren Utility

Holdings, Inc.

The Utility Group

8

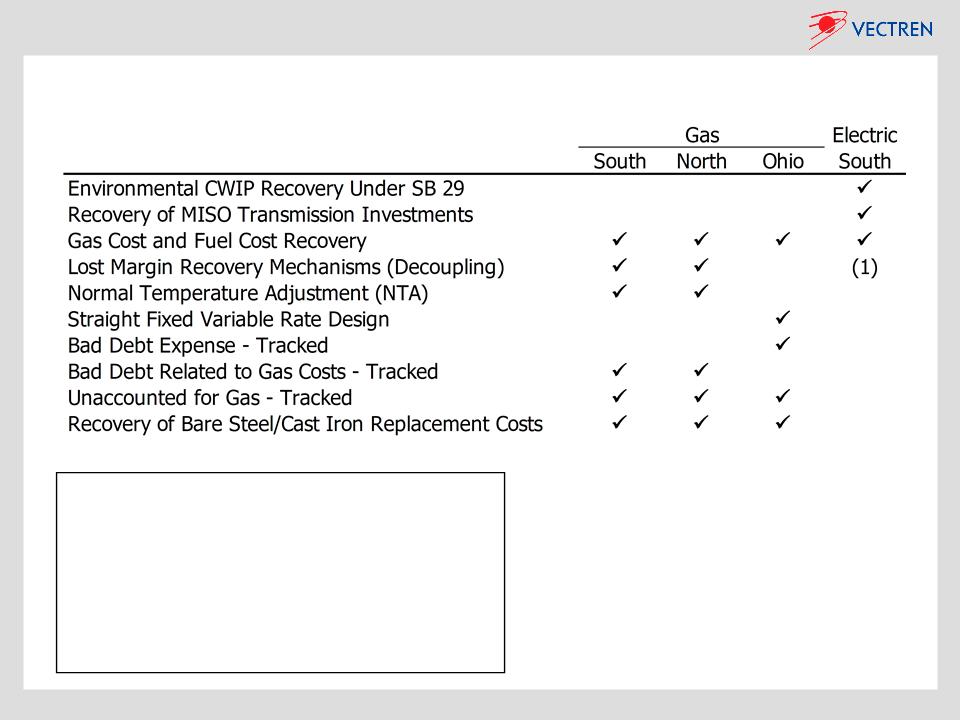

Constructive Utility Regulation - Mitigating Risk

(1)

Ø Electric base rate increase expected beginning in

1st half of 2011

1st half of 2011

• $34 million request at 10.7% ROE

• 2011 guidance includes ~$15-20 million of

revenue, which reflects partial year

revenue, which reflects partial year

• Decoupling rate design requested

Ø Gas Utilities’ Rate Base: ~$1.2 billion

• ~$0.9 billion Indiana

• ~$0.3 billion Ohio

Ø Electric Utility Rate Base: ~$1.3 billion

• All Indiana

Ø ~10.2% Total Gas & Electric Allowed ROE

9

Utility Investments and Cash Flow

Ø Anticipate achieving free cash flow neutral in 2011-2013, similar to 2010

• Depreciation & amortization expense of $190 to $200 million expected through 2013

Ø Favorable regulatory support in recovering capital spend on significant utility expenditures

• Incremental margins expected in 2011 from regulatory mechanisms for current recovery of Ohio bare steel/cast

iron (BS/CI) expenditures, and favorable BS/CI accounting treatment in IN

iron (BS/CI) expenditures, and favorable BS/CI accounting treatment in IN

• Total investment of ~$90 million in high voltage electric transmission line, timely recovered at FERC-approved

equity return of 12.38%, with completion in 2012; 2011 earnings to reflect a return on ~$75 million of the total

investment (~$30 million in 2010)

equity return of 12.38%, with completion in 2012; 2011 earnings to reflect a return on ~$75 million of the total

investment (~$30 million in 2010)

Ø Utilize cash generated from bonus depreciation to reduce external financing requirements and

accelerate planned funding of pension plans ($25 million)

accelerate planned funding of pension plans ($25 million)

• Estimate will generate ~$100 million of incremental cash in 2011-2013

Ø Utility Outlook

• 2011 earnings expected to grow roughly 3% from weather-normalized 2010 earnings

• New electric base rate increase expected to increase earnings beginning in 1st half of 2011

• Industrial gas and electric sales expected to be comparable to improved 2010 levels, as

economy in service territories continues to improve

economy in service territories continues to improve

• Aggressively manage costs with focus on improving processes and operating efficiencies

– 2011 O&M includes an $8 million increase for planned maintenance on several electric generating units

10

Utility Guidance & Outlook

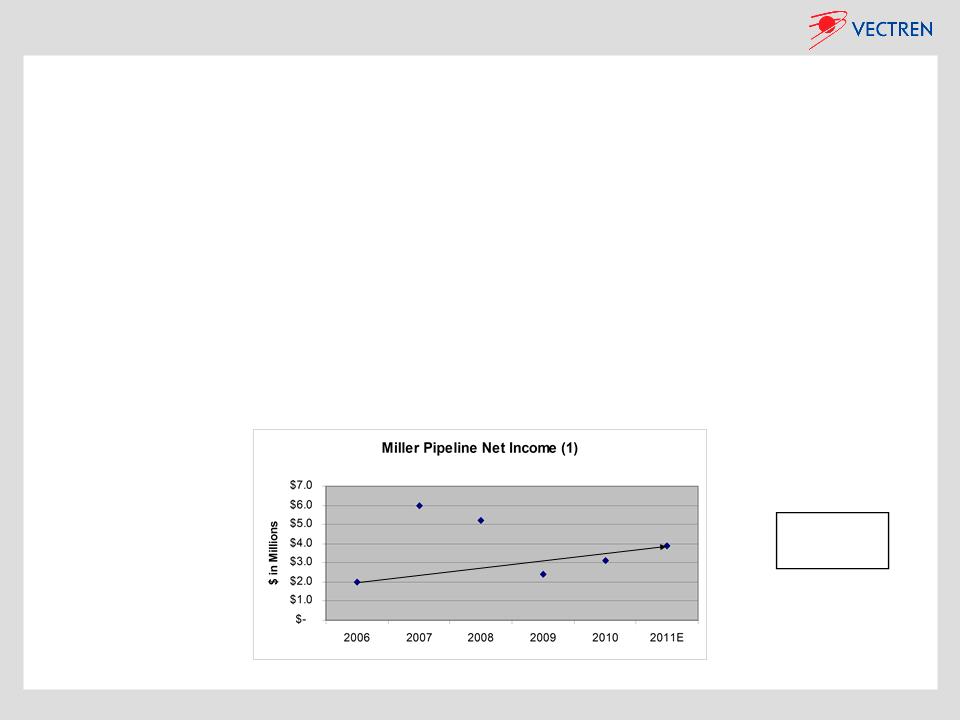

(1) Net income in 2007 and 2008 includes significant pipeline integrity work and strong pre-recession operating margins

~15% CAGR

2006-2011E

11

Nonutility Outlook

Infrastructure Services - Miller Pipeline

Ø 2011 earnings projected to increase ~25% over 2010; significant drivers for future growth include:

• New and existing customers - more projects as economy continues to rebound; availability of bonus depreciation

– Bare steel/cast iron replacement programs, along with waste water and sewer rehabilitation projects

– Increased emphasis on growing gas transmission construction business, building off successful 2010 projects

– Competing for growing number of new shale gas pipeline infrastructure projects

– Significant work expected related to gas pipeline infrastructure integrity assessments resulting from San Bruno

and other recent incidents

and other recent incidents

• Utilization of technology and other workforce improvement measures to drive improved productivity, efficiency and

control costs

control costs

• Infrastructure is a focused growth area for Vectren and may include strategic acquisitions in the future

(1) Net income in 2008 & 2009 included a significant renewables project each year

~20% CAGR

2006-2011E

12

Nonutility Outlook

Energy Services - Energy Systems Group (ESG)

Ø 2011 earnings projected to increase ~5% over 2010, even with ramp up of personnel

• Positive impacts on earnings of record backlog of $118 million at 12/31/10 ($70 million at beginning of 2010)

• Continue to expand geographic footprint, including Texas, Colorado, New Mexico, and the U.S. Virgin Islands

• On 2/8/11, selected to design, construct and operate a landfill gas-to-recycled natural gas processing facility for

DeKalb County, Georgia

DeKalb County, Georgia

• Competing for additional renewable energy projects; including making direct investments in strategic projects

• Projected earnings decrease by $2-3 million as additional employees and supporting infrastructure are added to

more aggressively grow the business

more aggressively grow the business

~35% CAGR

2006-2011E

13

Nonutility Outlook

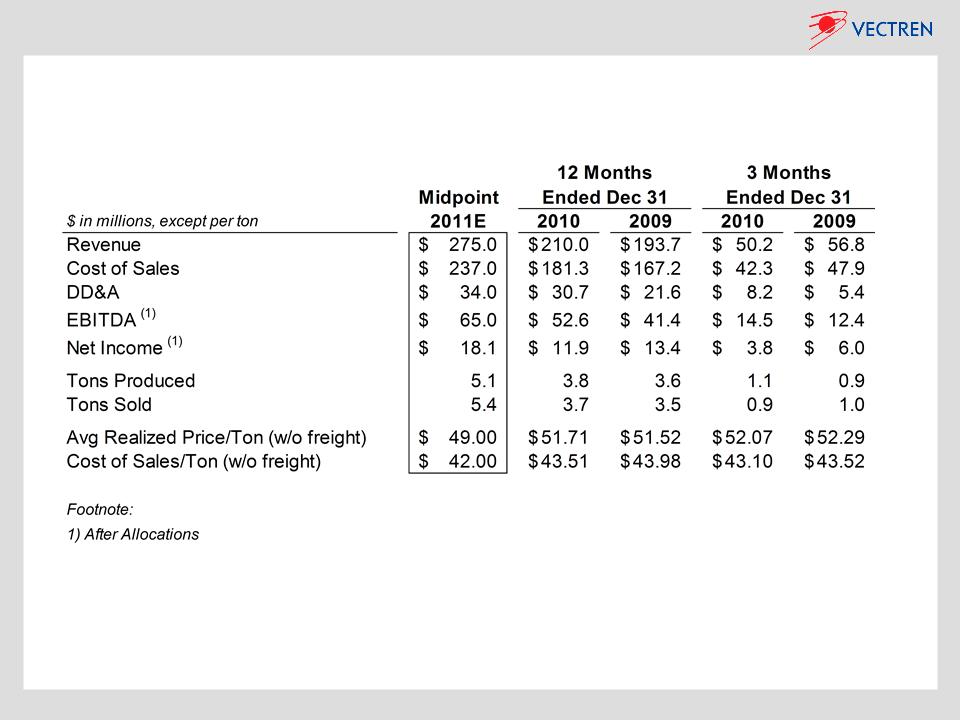

Coal Mining - Vectren Fuels

Ø 2011 earnings expected to increase ~50% over 2010

• Increasing volumes of coal produced of 5.1 million tons and sales of 5.4 million tons (sales of 3.7 million tons in ’10)

– Over 90% of 2011 total expected sales is already contracted and priced

– Vectren utilities expect to purchase 1.9 million tons in 2011, including 200k tons deferred from prior years

– Approximately 40% and 15%, respectively, of 2012 and 2013 expected production already contracted and priced

– 3rd and final section of continuous miners at 1st Oaktown mine expected to be in production in March 2011

• Reduced costs at Oaktown 1 due to additional volumes

• Aggressively managing mine production costs, including reconfiguration of older Prosperity mine

• As 2nd Oaktown mine comes online in 2012, production costs per ton expected to decline

– Will enable cost sharing of investments already made in wash plant, rail spur, etc., plus other operating efficiencies

• Through December 2010, $185 million in development costs already incurred of expected $205 million total for both

Oaktown mines

Oaktown mines

(1) Net income in 2009 resulted from market conditions as revenues on variable priced sales contracts fell more

slowly than unusually high natural gas costs

slowly than unusually high natural gas costs

~40% CAGR

2007-2011E

14

Nonutility Outlook

Energy Marketing - Vectren Source

Ø 2011 earnings projected to increase ~10% over 2010

• Growing customer base

– Projected to grow to 290,000 in 2011 from 227,000 in 2010

– Successfully competed in Ohio auction to provide gas to an additional 28,000 Vectren Ohio customers

beginning April 2011

beginning April 2011

• Considering expanding footprint to markets in additional states

• Evaluating additional products and service offerings for customer base

15

Nonutility Outlook

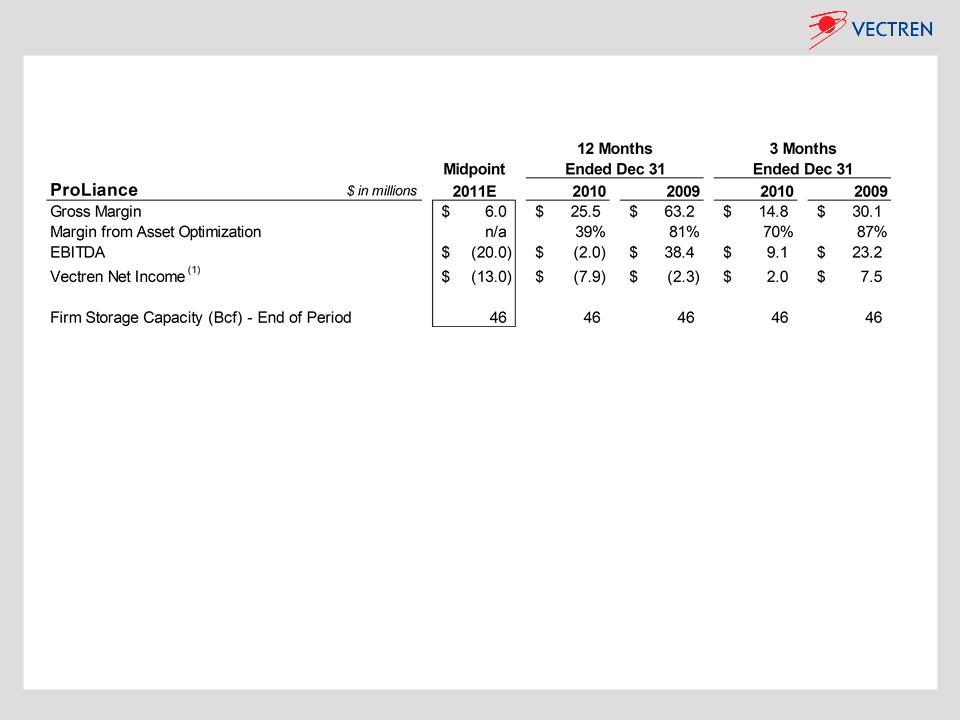

Energy Marketing - ProLiance

Ø 2011 results projected to reflect a net loss of ~$13 million

• Loss projected for 1st quarter 2011 estimated to be in the $9-13 million range

– Compares to ~$4 million of net income in the 1st quarter of 2010

– Driven by no seasonal storage value and virtually no cash to NYMEX being realized in the

quarter

quarter

• Near breakeven results projected for remainder of 2011 based on:

– For quarters 2 - 4 the forward price curve is currently in contango offering the month-to-month

price spreads needed for better storage optimization and cash to NYMEX opportunities

price spreads needed for better storage optimization and cash to NYMEX opportunities

– Summer to winter seasonal spread budgeted at $0.50 - $0.55/Dth beginning in the 4th quarter;

current spread is indicated to be ~$0.55/Dth

current spread is indicated to be ~$0.55/Dth

– Demand costs for pipeline and storage capacity are highest in the 1st quarter

– Indicated locational basis spreads are better for the remainder of the year

– For example, Panhandle Eastern Pipeline production area basis is indicated to be $0.15

- $0.20/Dth in the 1st quarter and $0.25 - $0.30/Dth during the remainder of the year

- $0.20/Dth in the 1st quarter and $0.25 - $0.30/Dth during the remainder of the year

16

Nonutility Outlook

Energy Marketing - ProLiance - cont’d

Ø ProLiance’s business model is being adapted to evolving market dynamics for long-term success

• Implementing new trading strategies, but within VaR limit of $2.5 million

• Initiatives underway to reduce G&A costs further; to date, reduced 15% vs. 2010 (annualized)

• Creating new margin opportunities by increasing sales to existing and new commercial and industrial (C&I) customers

through enhanced marketing programs

through enhanced marketing programs

– C&I customer count is up ~15% in 2010 vs. 2009

– C&I and power generation customers’ annual volumes up ~30% in 2010 vs. 2009

• Exploring various renegotiation strategies for transportation and storage contracts, including

– $25 million or one-third of contracts that expire over next 3 years and $40 million or half over next 5 years

Ø Forward price curve indicates potential for improved margins; each $0.10 change in seasonal storage

spreads equates to $4 million of margin at the ProLiance level

spreads equates to $4 million of margin at the ProLiance level

Ø Although there can be no assurance, current forward price curve of basis and seasonal spreads and

expected profitability improvement measures indicate ProLiance results may be breakeven in 2013 at the

Vectren level

expected profitability improvement measures indicate ProLiance results may be breakeven in 2013 at the

Vectren level

Ø Resources with optionality and highly rated marketer

• 46 Bcf of natural gas storage and diverse pipeline transportation network under contract

• Ranked #2 out of 32 gas marketers in 2010 Mastio customer satisfaction survey; in top 4 each of the past 5 years

• Unanimous settlement filed in IN for ProLiance’s continued provision of gas supply services to Vectren & Citizens for

an additional five years

an additional five years

17

Nonutility Guidance

Ø As ProLiance repositions itself in the marketplace, Vectren believes earnings-based multiples of a

projected loss do not accurately capture the long-term value of the business

projected loss do not accurately capture the long-term value of the business

• Balance sheet - $209 million of members’ equity (book value) at 12/31/10, virtually no debt or corporate guarantees

– Vectren’s 61% share of members’ equity is ~$127 million, partially funded with debt

• Although there can be no assurance, current forward price curve of basis and seasonal spreads and expected

profitability improvement measures indicate ProLiance results may be breakeven in 2013 at the Vectren level

profitability improvement measures indicate ProLiance results may be breakeven in 2013 at the Vectren level

• ProLiance has contributed significant earnings and cash dividends to Vectren over the years, though Vectren’s

common stock dividend is not contingent upon ProLiance’s earnings

common stock dividend is not contingent upon ProLiance’s earnings

• ProLiance has saved the customers of its parent companies a combined total of nearly $200 million in gas costs

since its inception

since its inception

ProLiance Valuation Considerations

18

Vectren Valuation Considerations Excluding ProLiance

Ø 2011 EPS Guidance Midpoint without ProLiance: $1.87 per share

Ø 2011 Combination Co. Peer Median PE: ~14 to 14.5 times; Gas Co. Peer Median PE: ~16.5 to 17 times

Ø Attractive total shareholder return targeted at 8-10% annually

• Including attractive dividend, with current yield > 5%; 51 consecutive years of increasing annual dividends paid

Ø Utilities operate in constructive regulatory environments with many revenue stabilization mechanisms

• Utility results make up 80% of 2011 guidance excluding ProLiance

Ø Well diversified nonutility portfolio linked to core utility

• Upside earnings opportunity on top of solid utility earnings prospects

19

* Reaffirmed with no change from conference call date of February 17, 2011.

2011 EPS Guidance*

Consolidated: $1.60 to $1.85 per share

Utility: $1.45 to $1.55 per share

Nonutility, excl. ProLiance: $0.32 to $0.42 per share

ProLiance: $(0.20) to $(0.10) per share

Notes on Adjustments

Ø Utility of ($0.08) - weather vs. normal

Ø Nonutility of $0.08 - charges related to legacy investments

20

Summary - Investment Fundamentals

Ø Attractive total shareholder return targeted at 8-10% annually

Ø Over 1.1 million utility customers in Indiana and Ohio

• Operate in constructive regulatory environments with numerous revenue stabilization mechanisms

• Utility growth driven by reinvestment of earnings in recoverable infrastructure improvements, increasing large

customer demand and implementation of new electric base rates

customer demand and implementation of new electric base rates

• Disciplined management of cap ex and operating expenses

• Resulting in more predictable earnings growth opportunities and strong cash flow

Ø Well diversified nonutility portfolio linked to core utility

• Upside earnings opportunity on top of solid utility earnings prospects

• Long-term growth primarily focused on significant growth in infrastructure and energy services businesses, along

with ramp up of coal mines to full production

with ramp up of coal mines to full production

• Executing on strategies to grow the Source customer base and return ProLiance to profitability

Ø Stable ‘A’ rated company (both Moody’s & S&P) with strong balance sheet, liquidity, and cash flows

Ø Experienced management team

Ø Attractive dividend

• 51 consecutive years of increasing annual dividends paid

• Attractive dividend yield

21

Appendix

22

(This page intentionally left blank.)

23

Appendix

Review of 2010 Highlights

Ø Utility Group

• Solid recovery year for large customer usage

• Summer cooling weather was significantly warmer than normal and 2009

• Continued progress on high voltage transmission line - earning a timely return on the investment

• Electric rate case process complete - awaiting final Commission order

Ø Nonutility Group

• Solid year for most businesses - on plan

• Well positioned for growth in 2011 and beyond, including continued progress on Oaktown mines

• Challenging year for gas marketers, including ProLiance; loss for the year and will continue into

2011

2011

Ø Other Highlights

• Strengthened liquidity profile via successful debt offerings, renewed credit facilities

• Moody’s upgrade to A3 - now ‘A’ rated by both Moody’s and S&P

• 51st consecutive year of dividend increases

• Carl Chapman becomes Vectren CEO as Niel Ellerbrook retires

24

Appendix

Consolidated 2010 Results

25

Infrastructure Services - Miller Pipeline

Ø Provides underground pipeline

construction and repair services for

natural gas, water and wastewater

companies

construction and repair services for

natural gas, water and wastewater

companies

• 2010 revenues of $197 million

• Over 1,600 employees

• Over 50 years in construction business

• Acquired 5 small regional pipeline

construction companies over past 4 years,

expanding location and scope of operation

construction companies over past 4 years,

expanding location and scope of operation

Ø Operates primarily in the Midwest, Mid-

Atlantic and Southern regions

Atlantic and Southern regions

• Major customers include Vectren,

NiSource, Duke, LG&E, Alagasco and

Citizens

NiSource, Duke, LG&E, Alagasco and

Citizens

• Continue to expand into new areas and

add new customers

add new customers

Ø Bare steel/cast iron replacement

programs as utilities receive regulatory

support and increase capital spending

programs as utilities receive regulatory

support and increase capital spending

Ø Significant work expected related to gas

pipeline infrastructure integrity

assessments resulting from San Bruno

and other recent incidents

pipeline infrastructure integrity

assessments resulting from San Bruno

and other recent incidents

Ø Longer-term opportunities expected from

the development and construction of

gathering and pipeline interconnects to

support the development and

transportation of shale gas

the development and construction of

gathering and pipeline interconnects to

support the development and

transportation of shale gas

Appendix

Appendix

26

Nonutility Metrics - Infrastructure Services

27

Energy Services - Energy Systems Group (ESG)

Ø Performance contracting and renewable

energy project group

energy project group

• 2010 revenues of $147 million

• More than 225 employees

Ø Operates primarily in the Midwest, Mid-

Atlantic and Southern regions, recently

expanding its territorial reach including Texas

and Arkansas

Atlantic and Southern regions, recently

expanding its territorial reach including Texas

and Arkansas

• Major customers include hospitals, universities,

governments and schools (HUGS)

governments and schools (HUGS)

Ø Provides energy-saving performance

contracting

contracting

• Design facility improvements that pay for

themselves from energy savings and

operational improvements

themselves from energy savings and

operational improvements

Ø Designs, constructs, manages and owns

renewable energy projects

renewable energy projects

• Successfully completed three landfill gas projects

• Recently selected to design, construct and

operate a landfill gas-to-recycled natural gas

processing facility in Georgia

operate a landfill gas-to-recycled natural gas

processing facility in Georgia

Ø ESG is partnering with eight gas/electric

utilities as conservation and renewable

energy contractor

utilities as conservation and renewable

energy contractor

• Subcontractor under the federal “area

wide” contractor mechanism to develop

energy efficiency conservation projects to

federal installations

wide” contractor mechanism to develop

energy efficiency conservation projects to

federal installations

Ø Energy Efficient Commercial Building

federal income tax deductions (Revenue

Code 179D) available through 2013

federal income tax deductions (Revenue

Code 179D) available through 2013

Appendix

Appendix

28

Nonutility Metrics - Energy Services

29

Coal Mining

Ø Mines and sells Indiana coal to Vectren’s

utility operations and other third parties

utility operations and other third parties

• 2010 revenues of $210 million

• 750 contract mining jobs with completion of

Oaktown mines

Oaktown mines

Ø Competitive location - 13 power plants

within 50 mile radius of underground mines

within 50 mile radius of underground mines

Ø 2011 sales estimated at 5.4 million tons

compared to 3.7 million in 2010

compared to 3.7 million in 2010

• Estimated margin of ~$7 per ton

Ø Prosperity Mine

• 33 million tons of reserves

• 4.0 lbs SO2 - 11,300 BTU

• Est. max annual production up to 3 million tons

Ø Prosperity Mine phase one reconfiguration

to be completed by 1st quarter 2011

to be completed by 1st quarter 2011

• Driving cost reductions

Ø Oaktown Mines 1 & 2

• 105 million tons of reserves

• Less than 6.0 lbs SO2 - 11,200 BTU

• Oaktown #1 - shipped coal in Feb 2010

• Oaktown #2 - In service 2012

• Est. max annual production

– Oaktown #1 up to 3 million tons

– Oaktown #2 up to 2 million tons

Ø Ramp up in production dependent on

contracts, negotiations continue

contracts, negotiations continue

Ø Long-term Illinois Basin coal demand

expected to continue increasing as economy

improves, inventory levels reduced, and

lower Appalachian production

expected to continue increasing as economy

improves, inventory levels reduced, and

lower Appalachian production

Appendix

Appendix

30

Nonutility Metrics - Coal Mining

31

Energy Marketing - ProLiance Energy

Ø Energy marketing affiliate with Vectren

(61%) and Citizens Energy Group (39%) -

equity accounting

(61%) and Citizens Energy Group (39%) -

equity accounting

• 2010 revenues of $1.5 billion

• 100 employees

• Operates throughout the Midwest and

Southeast U.S

Southeast U.S

Ø Provides bundled gas services, including

base load, peaking sales, risk management,

and other ancillary services

base load, peaking sales, risk management,

and other ancillary services

• Retail services to over 1,750 Commercial and

industrial customers

industrial customers

• Wholesale services to utilities, municipals,

power generators

power generators

Ø Storage & Transportation optimization is

the primary earnings driver (includes

arbitrage opportunities for price differences

across time and location in physical and

financial markets)

the primary earnings driver (includes

arbitrage opportunities for price differences

across time and location in physical and

financial markets)

• 46 Bcf of storage

• Balanced book approach - VaR capped at $2.5

million

million

Ø Margins associated with optimizing the

transportation and storage portfolio

reduced

transportation and storage portfolio

reduced

• General compression of natural gas prices

and reduction of firm transportation spread

values between the production areas and the

Midwest market area due to:

and reduction of firm transportation spread

values between the production areas and the

Midwest market area due to:

– Lower industrial demand

– New shale gas supplies

– New pipeline infrastructure in service

– Lower relative gas prices

Ø Near-term focus to improve margin

opportunities

opportunities

• Maintain flexibility to take advantage of price

volatility and widening seasonal spreads

volatility and widening seasonal spreads

• Focus on growing commercial and industrial

customer segment

customer segment

• Cost reductions

• Looking for opportunities to renegotiate

transportation and storage contracts

transportation and storage contracts

– $25 million (one-third) of contracts expire

over next 3 years and $40 million (half)

over next 5 years

over next 3 years and $40 million (half)

over next 5 years

Appendix

Appendix

32

Nonutility Metrics - Energy Marketing

33

Energy Marketing - Vectren Source

Ø Source provides natural gas and other

related products and services to retail

customers in the Midwest and Northeast

related products and services to retail

customers in the Midwest and Northeast

• 2010 revenues of $143 million

• Current staffing of over 50 FTE’s

• Operates in 7 LDC territories in 3 states -

Ohio, Indiana and New York, with highest

customer concentration in Ohio

Ohio, Indiana and New York, with highest

customer concentration in Ohio

Ø 12/31/10 customer count of 227,000, an

increase of 38,000 year over year

increase of 38,000 year over year

Ø Focus on customer retention with a

contract renewal rate above 90%

contract renewal rate above 90%

Ø Conservative risk management practices

• Good mix of fixed and variable price

customers

customers

Ø Ohio is transitioning to a fully deregulated

market, providing growth opportunities as

energy delivery companies exit the

merchant function of buying natural gas for

its customers

market, providing growth opportunities as

energy delivery companies exit the

merchant function of buying natural gas for

its customers

• Successfully bid on one tranche of Vectren

Ohio’s customers in the regulatory approved

auction to sell the gas commodity to specific

customers for a 12-month period

Ohio’s customers in the regulatory approved

auction to sell the gas commodity to specific

customers for a 12-month period

Ø Developing a residential energy efficiency

service with a pilot offering available in

Cleveland under GreenStreet Solutions SM

service with a pilot offering available in

Cleveland under GreenStreet Solutions SM

• General contractor role in home energy audits

and complete service to implement

recommendations

and complete service to implement

recommendations

• Positioned to take advantage of Home Star

program if approved by Congress

program if approved by Congress

• Will be expanding into Cincinnati/Dayton

market in 2011

market in 2011

Appendix

Appendix

34

Nonutility Metrics - Energy Marketing

Per share earnings contributions of the Utility Group, Nonutility Group, and Corporate and Other

are presented herein and are non-GAAP measures. Such per share amounts are based on the

earnings contribution of each group included in Vectren’s consolidated results divided by

Vectren’s basic average shares outstanding during the period. The earnings per share of the

groups do not represent a direct legal interest in the assets and liabilities allocated to the

groups, but rather represent a direct equity interest in Vectren Corporation's assets and

liabilities as a whole. These non-GAAP measures are used by management to evaluate the

performance of individual businesses. In addition, other items giving rise to period over period

variances, such as weather, are presented on an after tax and per share basis. These amounts

are calculated at a statutory tax rate divided by Vectren’s basic average shares outstanding

during the period. Accordingly, management believes these measures are useful to investors in

understanding each business’ contribution to consolidated earnings per share and in analyzing

consolidated period to period changes and the potential for earnings per share contributions in

future periods. Reconciliations of the non-GAAP measures to their most closely related GAAP

measure of consolidated earnings per share are included throughout the presentation

presented. The non-GAAP financial measures disclosed by the Company should not be

considered a substitute for, or superior to, financial measures calculated in accordance with

GAAP, and the financial results calculated in accordance with GAAP.

are presented herein and are non-GAAP measures. Such per share amounts are based on the

earnings contribution of each group included in Vectren’s consolidated results divided by

Vectren’s basic average shares outstanding during the period. The earnings per share of the

groups do not represent a direct legal interest in the assets and liabilities allocated to the

groups, but rather represent a direct equity interest in Vectren Corporation's assets and

liabilities as a whole. These non-GAAP measures are used by management to evaluate the

performance of individual businesses. In addition, other items giving rise to period over period

variances, such as weather, are presented on an after tax and per share basis. These amounts

are calculated at a statutory tax rate divided by Vectren’s basic average shares outstanding

during the period. Accordingly, management believes these measures are useful to investors in

understanding each business’ contribution to consolidated earnings per share and in analyzing

consolidated period to period changes and the potential for earnings per share contributions in

future periods. Reconciliations of the non-GAAP measures to their most closely related GAAP

measure of consolidated earnings per share are included throughout the presentation

presented. The non-GAAP financial measures disclosed by the Company should not be

considered a substitute for, or superior to, financial measures calculated in accordance with

GAAP, and the financial results calculated in accordance with GAAP.

Appendix

Use of Non-GAAP Performance Measures and Per Share Measures