Attached files

| file | filename |

|---|---|

| 8-K - FORM8K - DYCOM INDUSTRIES INC | form8-k.htm |

| EX-99.1 - EXHIBIT99-1.HTM - DYCOM INDUSTRIES INC | exhibit99-1.htm |

Exhibit 99.2

2nd Quarter Presentation

March 2, 2011

1

Participants

|

Steven E. Nielsen

President & Chief Executive Officer H. Andrew DeFerrari

Chief Financial Officer Richard B. Vilsoet

General Counsel |

2

Forward-Looking Statements and Non-

GAAP Information

GAAP Information

Forward-Looking Statements and Non-

GAAP Information

GAAP Information

Fiscal 2011 second quarter results are unaudited. This presentation contains “forward-looking

statements” which are statements relating to future events, future financial performance,

strategies, expectations, and competitive environment. Words such as “believe,” “expect,”

“anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project” and similar

expressions, as well as statements in future tense, identify forward looking statements. You

should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or

results will be achieved. Forward looking statements are based on information available at the

time those statements are made and/or management’s good faith belief at that time with respect

to future events. Such statements are subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in or suggested by the forward

looking statements. Important factors that could cause such differences include, but are not

limited to factors described under Item 1A, “Risk Factors” of the Company’s Annual Report on

Form 10-K for the year ended July 31, 2010, and other risks outlined in the Company’s periodic

filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in

this presentation are expressly qualified in their entirety by this cautionary statement. Except as

required by law, the Company may not update forward-looking statements even though its

situation may change in the future.

statements” which are statements relating to future events, future financial performance,

strategies, expectations, and competitive environment. Words such as “believe,” “expect,”

“anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project” and similar

expressions, as well as statements in future tense, identify forward looking statements. You

should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or

results will be achieved. Forward looking statements are based on information available at the

time those statements are made and/or management’s good faith belief at that time with respect

to future events. Such statements are subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in or suggested by the forward

looking statements. Important factors that could cause such differences include, but are not

limited to factors described under Item 1A, “Risk Factors” of the Company’s Annual Report on

Form 10-K for the year ended July 31, 2010, and other risks outlined in the Company’s periodic

filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in

this presentation are expressly qualified in their entirety by this cautionary statement. Except as

required by law, the Company may not update forward-looking statements even though its

situation may change in the future.

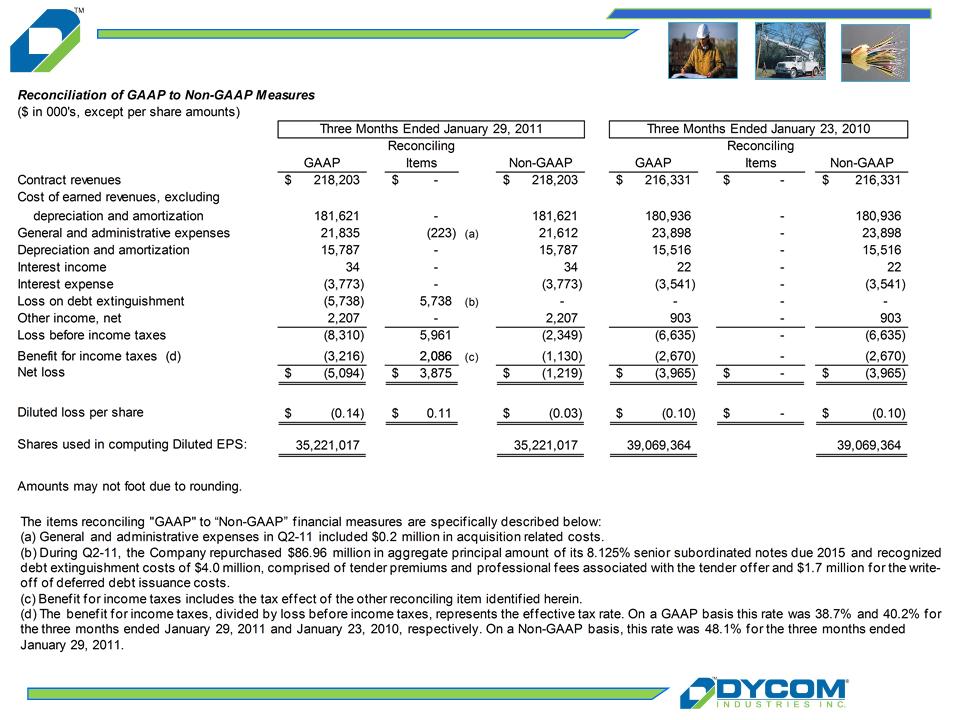

This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. As

required by the SEC we have provided a reconciliation of those measures to the most directly

comparable GAAP measures on the Regulation G slides included on slides 12 through 14 of this

presentation.

required by the SEC we have provided a reconciliation of those measures to the most directly

comparable GAAP measures on the Regulation G slides included on slides 12 through 14 of this

presentation.

3

Q2-2011 Overview

n Contract revenue of $218.2 million, increased year-over year but

declined organically 1.6% after adjusting for revenues from acquired

companies

declined organically 1.6% after adjusting for revenues from acquired

companies

n Non-GAAP loss of $0.03 per share compared to a loss of $0.10 per

share in the prior year

share in the prior year

n Capital expenditures, net of proceeds totaled $4.3 million and are

expected to range from $45 million to $50 million for the full fiscal year

expected to range from $45 million to $50 million for the full fiscal year

n Strong liquidity and operating cash flows

n Backlog increased by $299 million from substantial contract awards

Note: See “Regulation G Disclosure” slides 12-13 for a reconciliation of GAAP to Non-GAAP financial measures.

4

Q2-2011 Transactions

n M & A Activity

NeoCom Solutions, Inc.

Ø Acquired in December 2010 for $27.5 million in cash

Ø Provider of construction and maintenance services to the wireless industry

Ø Dycom’s first meaningful participation directly in the wireless communications industry

Communication Services, LLC

Ø Acquired in November 2010 for $9.7 million in total consideration

Ø Provider of construction and maintenance services to the rural telephone industry

n Financing Activities

Share repurchases

Ø 291,500 shares repurchased for $3.2 million, or $10.99 per share

Debt Refinance

Ø $187.5 million face value of new 10-year 7.125% senior subordinated notes issued in Q2-

11

11

Ø Repurchase of existing 8.125% notes completed in February

Ø Lowered interest rate on outstanding borrowings, extended debt maturities on a cost

effective basis until 2021 and secured over $41 million in incremental capital

effective basis until 2021 and secured over $41 million in incremental capital

5

Revenue Summary

n Top 5 customers from Q2-11 represented

61.1% of revenue in Q2-11 and 62.9% of

revenue in Q2-10

61.1% of revenue in Q2-11 and 62.9% of

revenue in Q2-10

n Contract revenue from non-Top 5

customers increased by 5.7%, with

growth from rural telecommunication

customers

customers increased by 5.7%, with

growth from rural telecommunication

customers

n Communication Services and NeoCom

contributed aggregate revenues of $5.3

million since acquisition

contributed aggregate revenues of $5.3

million since acquisition

n Excluding Verizon and revenue from

acquired businesses, organic growth at

4.1% in Q2-11 for all other customers on

a combined basis

acquired businesses, organic growth at

4.1% in Q2-11 for all other customers on

a combined basis

* For comparison purposes, CenturyLink includes combined revenues from CenturyTel, Inc. and Embarq Corporation for each period presented.

Note: See “Regulation G Disclosure” slide 12 for a reconciliation of GAAP to Non-GAAP financial measures.

** Organic revenue change excludes revenue from acquired businesses in Q2-11, storm restoration work in Q3-09, Q2-09 and Q1-09 and excludes the impact of an additional week in

Q4-10 to adjust for our 52/53 week fiscal calendar.

Q4-10 to adjust for our 52/53 week fiscal calendar.

6

Backlog and Awards

Current Awards and Extensions

|

Customers

|

Area

|

Description

|

Approximate Term

(in years) |

|

nVerizon

|

Maryland

|

Construction and maintenance services

|

6

|

|

nComcast

|

Colorado

|

Construction and maintenance services

|

1

|

|

nAT&T

|

Alabama, North Carolina, Tennessee

|

Construction and maintenance services

|

3

|

|

nWindstream

|

Kentucky

|

Construction and maintenance services

|

3

|

|

nAT&T

|

California

|

Locating services

|

3

|

7

Summary Results

|

Fully Diluted EPS -

Non-GAAP |

|

|

Q2-10

|

Q2-11

|

|

$(0.10)

|

$(0.03)

|

Note: See “Regulation G Disclosure” slides 12-13 for a reconciliation of GAAP to Non-GAAP financial measures.

0.9%

Total change

(1.6)%

Organic change

8

Selected Information

(a) See “Regulation G Disclosure” slides 13-14 for a reconciliation of GAAP to Non-GAAP financial measures.

(b) Amounts may not foot due to rounding.

|

|

Q2-11

|

Q2-10

|

Change (b)

|

|

|

|

($ in millions)

|

|

|

|||

|

Contract Revenues

|

$218.2

|

$216.3

|

$1.9

|

§Cost of earned revenues as a percentage of

revenue decreased primarily as a result of improved labor efficiency |

|

|

Cost of Earned Revenues

|

$181.6

83.2%

|

$180.9

83.6%

|

$0.7

(0.4)%

|

||

|

General & Administrative

- Non-GAAP (a) |

$21.6

10.0%

|

$23.9

11.0%

|

$(2.3)

(1.0)%

|

§G&A declined substantially from reduced payroll and

professional fees |

|

|

Depreciation &

Amortization |

$15.8

7.2%

|

$15.5

7.2%

|

$0.3

0.1%

|

§Depreciation and amortization increased primarily

from the impact of the acquisitions of Communication Services and NeoCom Solutions |

|

|

Interest expense

|

$3.8

1.7%

|

$3.5

1.6%

|

$0.2

0.1%

|

§Increased interest expense from higher debt

balances outstanding |

|

|

Other Income, Net

|

$2.2

1.0%

|

$0.9

0.4%

|

$1.3

0.6%

|

§Other income, net increased as more assets were

sold in the current period at better prices |

|

|

|

|

|

|

§Non-GAAP effective tax rate of 42.1% for the six

months ended January 29, 2011 |

|

9

Cash Flow and Liquidity

n Solid operating cash flows

n Combined days sales outstanding on trade

receivables and net unbilled revenues were

62 days in Q2-11 (a)

receivables and net unbilled revenues were

62 days in Q2-11 (a)

n Capital expenditures, net of disposals at

$4.3 million

$4.3 million

n Issuance of $187.5 million 7.125% senior

subordinated notes due 2021

subordinated notes due 2021

n Repurchase of remaining 8.125% senior

subordinated notes completed in February

2011

subordinated notes completed in February

2011

n 291,500 shares repurchased for

approximately $3.2 million, or $10.99 per

share, during Q2-11

approximately $3.2 million, or $10.99 per

share, during Q2-11

(a) Days sales outstanding is calculated as the summation of current accounts receivable, plus costs and estimated earnings in excess of billings, less

billings in excess of costs and estimated earnings, divided by average revenue per day during the respective quarter.

billings in excess of costs and estimated earnings, divided by average revenue per day during the respective quarter.

10

Summary

n Beginning to the feel the effects of an improving environment

n Notable contract awards which meaningfully increased backlog

n At the forefront of evolving industry opportunities including those

generated by rural broadband initiatives

generated by rural broadband initiatives

n Encouraged by deployment of new technologies by cable operators

which enable them to increase the effective bandwidth of their

networks

which enable them to increase the effective bandwidth of their

networks

n Responding to an increasing number of industry participants

aggressively extending or deploying fiber networks to provide

wireless backhaul services

aggressively extending or deploying fiber networks to provide

wireless backhaul services

11

Looking Ahead

n Organic revenue grows modestly reflecting increased opportunities

offset in part by a shift away from technician intensive services

offset in part by a shift away from technician intensive services

n Margins and earnings increase faster than revenues

n Continued solid and growing cash flows dedicated to accretive

acquisition opportunities and share repurchases as valuation and

projected returns direct

acquisition opportunities and share repurchases as valuation and

projected returns direct

n Confidence that trends will be improving for a sustained period

supports patience with respect to any individual quarterly result

supports patience with respect to any individual quarterly result

Q3 - 2011:

n Revenues which grow slightly year over year on an organic basis

n Margins which improve year over year

n Pre-tax loss on debt extinguishment of approximately $2.6 million

relating to the remaining repurchase of our 8.125% senior

subordinated notes

relating to the remaining repurchase of our 8.125% senior

subordinated notes

n Non-GAAP earnings which continue to improve year over year

12

Appendix: Regulation G Disclosure

Amounts may not foot due to rounding.

(a) Non-GAAP adjustments in Q2-11 reflect revenues from businesses acquired during Q2-11. Non-GAAP adjustments in Q4-10 result from the Company’s 52/53

week fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks.

The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP

basis for comparison purposes. The Non-GAAP adjustments in Q3-09, Q2-09, and Q1-09 reflect storm restoration revenues recognized during those periods.

week fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks.

The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP

basis for comparison purposes. The Non-GAAP adjustments in Q3-09, Q2-09, and Q1-09 reflect storm restoration revenues recognized during those periods.

(b) Year-over-year growth (decline) percentage is calculated as follows: (i) revenues in the quarterly period less (ii) revenues in the comparative prior year quarter

period; divided by (ii) revenues in the comparative prior year quarter period.

period; divided by (ii) revenues in the comparative prior year quarter period.

13

Appendix: Regulation G Disclosure

14

Appendix: Regulation G Disclosure

2nd Quarter Presentation

March 2, 2011