UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 2, 2011

CHINACAST EDUCATION CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-33771

|

20-178991

|

||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

Suite 08, 20/F, One International Financial Centre, 1 Harbour View Street

Central, Hong Kong

|

|

(Address of Principal Executive Offices and Zip Code)

|

Registrant’s telephone number, including area code: (852) 3960 6506

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

As a supplement to the shareholder letter provided on February 14, 2011, ChinaCast Education Corporation (“we,” “ChinaCast” and the “Company”) is providing further information on our university acquisitions:

We understand that some shareholders are confused by recent questions regarding the transparency of our university acquisitions posed by an analyst. We tried to address the analyst's questions in our letter to shareholders and the supplements but came to the impression that the analyst was drawing conclusions based on partial information of the internal restructuring of the holding companies of the universities before the actual acquisitions. Thus in this letter, instead of following the questions of the

analyst, we would like to describe the complete process of these transactions and the reason why these transactions had to be done in a certain way. Hopefully our shareholders can appreciate the fact that we have tried our best to acquire valuable assets at attractive valuations and at the same time assumed the minimum risk for the company.

1. Did any ChinaCast employees benefit personally from the Company’s three university acquisitions?

Absolutely not. It is Company corporate policy for officers and employees to disclose to the Company any transactions in which such officers or employees are interested or involved that may potentially constitute a conflict of interest with the Company. In addition, our Board of Directors, which consists of a majority of independent directors, is an integral part of the review process for each university acquisition transaction and thoroughly reviews the financial, legal and regulatory issues, as well as, performs site visits to the target universities as part of the due diligence process. As the Company has disclosed in SEC filings for its three university acquisitions since 2008, each of the transactions was

completed with a high degree of visibility and transparency by Company management, the Board of Directors and the Company’s legal and in house financial teams and no officers or employees of ChinaCast or their family members have benefited personally in these acquisitions.

2. Can you please provide more information on the acquisition process from sourcing the universities to the closing of the transaction?

The Company’s business development team sources acquisition targets through contacts in the education sector. Company executives will then perform due diligence on share ownership, land titles, etc., of the investments made by the sellers as well as the enrollment and academic standing of the universities. Once the key terms are agreed upon, a non-binding Memorandum of Understanding (“MOU”) is signed with the sellers. Although the MOU is non-binding, ChinaCast typically pays a refundable cash deposit to secure the deal terms so that the sellers can proceed to dispose other assets in the holding company other than the university assets and appoint their own auditors for their US

GAAP audit for the financial statement prior to the acquisition. All parties are fully aware of the sale value and deal terms, as such information is announced and filed with the SEC at the time of the entry into the MOU.

The terms and conditions of each university acquisition are specific to each transaction but the general condition is for the sellers to provide a clean holding company structure that holds one hundred percent of the university assets (and not any other assets). ChinaCast can then acquire the newly re-structured, clean holding company and take full ownership of the university assets.

For the Company’s first acquisition, The Foreign Trade and Business College of Chongqing Normal University (FTBC), the sellers were required to consolidate their ownership into two main PRC holding companies (since there were two separate transactions to fully acquire 100% of FTBC): Heng Tai and Chaosheng. For the Company’s second (Lijiang College, or “Lijiang”) and third (Hubei Industrial University Business College, or “HIUBC”) acquisitions, the conditions were for the sellers to set up offshore structures using a Wholly-Owned Foreign Enterprise (WOFE) holding company.

The new holding company structure normally takes the sellers approximately six months to complete. After the re-structuring is complete, the sellers and ChinaCast sign a Sales and Purchase (S&P) Agreement which is signed by all levels of the ownership of the university i.e.,

|

(a)

|

the shareholders of the re-structured holding company,

|

|

(b)

|

the offshore holding company,

|

|

(c)

|

the WOFE,

|

|

(d)

|

the holding company of the university,

|

|

(e)

|

the university itself.

|

The overseas shareholders in the acquisition of Lijiang and HIUBC represented the interest of the sellers and are not related to ChinaCast, its officers or employees.

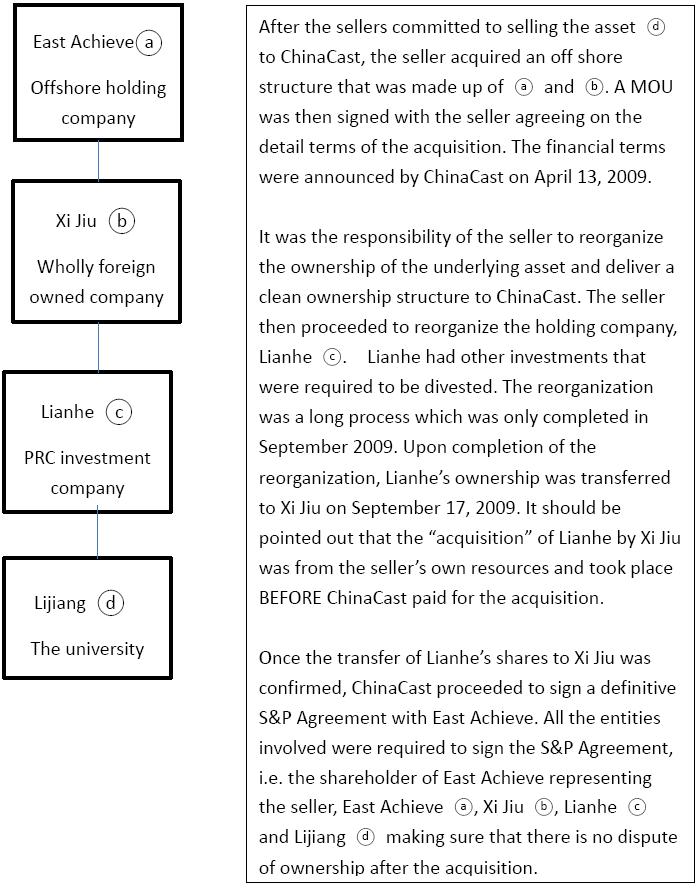

As an example, the following diagrams show how this was done in the acquisition of Lijiang College:

3. Can you provide more information on the details of the sellers’ re-structuring process?

The original holding companies of the universities were set up many years ago and frequently these holding companies have other assets (real estate business, trading business, etc.) not related to the university. ChinaCast, as the acquirer, is only interested in acquiring the universities. All other assets must be disposed of by the sellers via the re-structuring process and must be done BEFORE the S&P Agreement is signed. Transactions related to the re-structuring were funded by the sellers’ own resources. ChinaCast only paid for the acquisitions after conditions in the S&P were met.

The details of how the sellers disposed of the non-university assets prior to the signing of the S&P Agreement are not matters of concern to ChinaCast and are not required to be disclosed. Only matters related to the acquired asset, i.e., the universities, are disclosed in the Company filings.

4. Who are the selling shareholders and are they related to ChinaCast officers or employees?

The selling shareholders for East Achieve and Wintown and/or their nominees, i.e. Mr Xie Jiqing of East Achieve and Mr Wu Shixin of Wintown are not related to any officers or employees of ChinaCast or their family members. How the proceeds were allocated by the sellers is not the concern of ChinaCast. What matters to ChinaCast is that the asset itself is legally secure and any risk is minimized before the Company transfers funds as part of the S&P Agreement.

5. Was ChinaCast involved in the seller’s reorganization?

In some instances, ChinaCast helped the sellers to set up the offshore holding company structures in order to facilitate the transaction as the sellers lacked expertise in the area. This included helping the sellers to source the offshore holding company structures. *

The restructuring of the domestic structures typically involved resolving differences amongst the sellers’ shareholders or divesting or disposing non-university assets. ChinaCast was not involved in this part of the process in all the acquisitions.

* As mentioned in our previous supplement to the shareholder letter, for various regulatory, tax and accounting reasons in China, the acquisitions were structured as offshore transactions and pre-existing WOFEs were needed. Requirements for the pre-existing WOFEs include

(a) no active operating activities;

(b) a clean structure;

(c) a clean balance sheet; and

(d) a legal representative/director whom the sellers and the Company find trustworthy.

Mr. Song Hongtao, a former employee of ChinaCast Co., Ltd. (“CCL”, the legal 90% owner of ChinaCast Lixiang Co., Limited (“CCLX”) and CCLX is consolidated by the Group as a VIE) until his resignation from the Company in April 2007, had previously established WOFEs for his own business requirements but did not need the WOFEs anymore. Mr. Song had been the legal representative of those WOFEs since 2005 and the filing of the AIC records were performed by his assistant, Ms Hu Xiaoli.. Although Xijiu was set up in 2005 while Mr Song was an employee of CCL, these companies were not set up by ChinaCast or CCL.

In 2009, the seller of Lijiang College, our second university acquisition, assumed ownership of one of these WOFEs, Xijiu, as it met the requirements above and proceeded with their re-structuring process using Xijiu. Once the re-structuring was completed, the Company signed a S&P Agreement with East Achieve, the offshore holding company.

6. What did ChinaCast do to protect the investments?

The key concern for the Company in each of the acquisitions is to ensure that legal ownership is vested in the offshore structure prior to completion and any legal, regulatory and taxation risk to ChinaCast post acquisition is minimized. In addition, the Company needs to be satisfied that the audit under US GAAP is done or substantially done so that there will be no audit issues after completion of the acquisition.

Until the reorganization is completed, the risk rests with the sellers. If the ownership of a university cannot be transferred to the offshore structure or the audit revealed significant issues that cannot be rectified, ChinaCast has the right to terminate the deal.

7. Have Yupei (a ChinaCast holding company ) and Hai Lai (a holding company which owns 100% of FTBC) been audited by Deloitte post acquisition?

Yes, they are part of the ChinaCast group of companies. After the acquisitions in 2008, both companies became fully owned subsidiaries of ChinaCast and the group is audited by Deloitte Touche Tohmatsu CPA Ltd.

Final Comment

ChinaCast takes any allegation of irregularities or any doubts on the integrity of our officers and employees very seriously. Our Board of Directors and management will address any genuine concerns raised by our shareholders and analysts, and where necessary make clear statements on record about our position on the issues raised. The Company reserves the right to pursue legal action and / or to seek redress from the appropriate regulatory agencies in order to protect the rights of its shareholders.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: March 2, 2011

|

CHINACAST EDUCATION CORPORATION

|

||

|

|

By:

|

/s/ Antonio Sena | |

|

Name: Antonio Sena

|

|||

|

Title: Chief Financial Officer

|

|||