Attached files

| file | filename |

|---|---|

| EX-24 - CHINA MARINE FOOD GROUP LTD | v212886_ex24.htm |

| EX-31.2 - CHINA MARINE FOOD GROUP LTD | v212886_ex31-2.htm |

| EX-32.2 - CHINA MARINE FOOD GROUP LTD | v212886_ex32-2.htm |

| EX-31.1 - CHINA MARINE FOOD GROUP LTD | v212886_ex31-1.htm |

| EX-32.1 - CHINA MARINE FOOD GROUP LTD | v212886_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-34422

CHINA MARINE FOOD GROUP LIMITED

(Exact name of registrant as specified in its charter)

|

NEVADA

|

87-0640467

|

|

|

(State or other jurisdiction of

|

(IRS Employer Identification No.)

|

|

|

Incorporation or organization)

|

Da Bao Industrial Zone, Shishi City

Fujian, China

362700

(Address of principal executive offices)

86-595-8898-7588

(Issuer's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

COMMON STOCK

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨

Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $50,123,996 based on the February 25, 2011 closing sale price of $3.70 as reported on the NYSE AMEX. As of February 25, 2011, there were 28,977,976 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

China Marine Food Group Limited

FORM 10-K

For the Year Ended December 31, 2010

TABLE OF CONTENTS

|

PART I

|

|||

|

ITEM 1.

|

Business

|

4

|

|

|

ITEM 1A.

|

Risk Factors

|

30

|

|

|

ITEM 1B.

|

Unresolved Staff Comments

|

40

|

|

|

ITEM 2.

|

Properties

|

40

|

|

|

ITEM 3.

|

Legal Proceedings

|

41

|

|

|

PART II

|

|||

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer

|

||

|

Purchases of Equity Securities

|

41

|

||

|

ITEM 6.

|

Selected Financial Data

|

42

|

|

|

ITEM 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

43

|

|

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

64

|

|

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

F-1 – F-30

|

|

|

ITEM 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

65

|

|

|

ITEM 9A(T).

|

Controls and Procedures

|

66

|

|

|

ITEM 9B.

|

Other Information

|

66

|

|

|

PART III

|

|||

|

ITEM 10.

|

Directors and Executive Officers of the Registrant and Corporate Governance

|

66

|

|

|

ITEM 11.

|

Executive Compensation

|

70

|

|

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

74

|

|

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

75

|

|

|

ITEM 14.

|

Principal Accountant Fees and Services

|

76

|

|

|

PART IV

|

|||

|

ITEM 15

|

Exhibits, Financial Statement Schedules

|

76

|

|

|

SIGNATURES

|

80

|

2

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These statements relate to future events or our future financial performance. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue," the negative of such terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no duty to update any of the forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

Readers are also urged to carefully review and consider the various disclosures made by us which attempt to advise interested parties of the factors which affect our business, including without limitation the disclosures made in PART I. ITEM 1A. “Risk Factors” and PART II. ITEM 7 "Management's Discussion and Analysis or Plan of Operation" included herein.

3

PART I.

|

ITEM 1.

|

Business

|

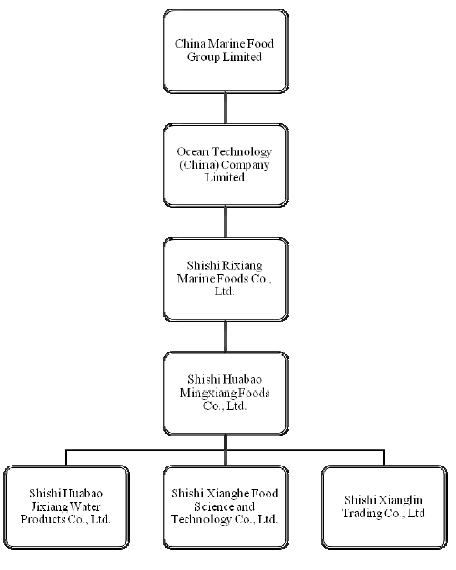

Through our direct, wholly owned subsidiary, Ocean Technology (China) Company Limited (“Ocean Technology’) and its subsidiaries, Shishi Rixiang Marine Food Co., Ltd. (“Rixiang”), Shishi Huabao Jixiang Water Products Co., Ltd.(“Jixiang”), Shishi Huabao Mingxiang Foods Co., Ltd. (“Mingxiang”) and Shishi Xianglin Trading Co., Ltd. (“Xianglin”), we engage in the business of processing, distribution and sale of processed seafood-based snack foods, as well as the sale of fresh and frozen marine catch. In 2010, we also became a manufacturer of algae-based soft drinks through our acquisition of Shishi Xianghe Food Science and Technology Co., Ltd. (“Xianghe”), which is also an operating subsidiary of Ocean Technology. Our objective is to establish

ourselves as a leading producer of processed seafood products in the PRC and overseas markets.

Our dried and flavored seafood-based snack foods are predominantly sold under our registered trademark, the “Mingxiang” brand. These products are sold to 18 exclusive distributors in seven provinces in the PRC, including Fujian, Guangdong, Jiangsu, Shandong, Zhejiang, Liaoning and Sichuan and in turn sub-distributed to about 3,200 retail points in the PRC (including major supermarkets and retailers such as Wal-Mart and Carrefour) throughout these provinces. Our frozen processed seafood products are sold to both domestic and overseas customers. Founded in 1994, China Marine has grown steadily and positioned its "Mingxiang" brand as a category leader. We have received "Famous Brand" and "Green Food" awards. Our marine catch is sold to distributors in Fujian, Shandong and Liaoning

provinces, some of whom directly export the marine catch to South Korea and Taiwan.

Our business premises, including our production plant, cold storage facility, office tower and staff dormitory, are located close to Xiangzhi Port, the largest fishing port in Fujian Province, which is one of the largest coastal provinces in the PRC and a vital navigation hub between the East China Sea and the South China Sea.

On January 1, 2010, Mingxiang acquired shares representing 80% of the registered capital stock of Xianghe. Xianghe is a manufacturer of the branded Hi-Power algae-based soft drinks. Xianghe has developed a network of distributors with exclusive territories in Fujian province which sell Hi-Power to retail food stores, restaurants food supply dealers and the hospitality industry. The algae-based beverage products are sold to six exclusive distributors and in turn sub-distributed to about 13,000 retail points in Fujian Province. We intend to expand distribution of the Hi-Power soft drinks to other parts of the PRC in 2011.

Our principal executive offices are located at Da Bao Industrial Zone, Shishi City, Fujian, China, 362700, and our telephone number at that location is 86-595-8898-7588.

Our Corporate Structure

We are a holding company organized under the laws of Nevada and Ocean Technology is a holding company organized under the laws of Hong Kong. The other subsidiaries are organized under the laws of the PRC. All subsidiaries are wholly-owned except for Xianghe, the beverage company, in which we own an 80% interest.

4

Our Corporate History

We were incorporated in the State of Nevada on October 1, 1999 under the name New Paradigm Productions, Inc. to engage in the production and marketing of meditation music and related supplies.

Starting January 1, 2000, we commenced a private placement of our common stock in reliance upon an exemption from registration under Section 4(2) of the Securities Act and Regulation D promulgated thereunder. We offered 100,000 shares of our common stock at $0.35 per share to certain accredited investors. The offering closed in March 2000 and we raised gross proceeds in the amount of $35,000. Pursuant to a registration statement on Form SB-2 that was declared effective on October 26, 2000, we sold 77,000 shares of our common stock, raising a total of $77,000 in gross proceeds. We discontinued our principal operations as of December 2002.

On September 13, 2007, we entered into a Stock Purchase Agreement (“SPA”) with Halter Financial Investments, L.P., a Texas limited partnership (“HFI”) pursuant to which we agreed to sell to HFI, 1,005,200 shares of our post reverse stock-split common stock for $400,000. After consummation of the transaction, HFI became the holder of 1,005,200 shares of our common stock, or 87.5% of the 1,148,826 shares of our then outstanding common stock. In addition, the terms of the SPA required us to declare and pay a special cash dividend of $0.364 per post stock-split share to our shareholders of record as of September 12, 2007. Stockholders holding a total of 1,077,000 shares received a special cash dividend in the total amount of $392,028 which amount was funded with proceeds from the stock sale.

Effective on September 25, 2007, we effectuated a 7.5 to 1 reverse stock split and increased our authorized shares of common stock to 100,000,000.

Acquisition of Ocean Technology and Related Financing

On November 17, 2007, we completed a reverse acquisition transaction with Ocean Technology through a share exchange with Ocean Technology’s former stockholders. Pursuant to the share exchange agreement, the shareholders of Ocean Technology exchanged 100% of their outstanding capital stock in Ocean Technology for approximately 15,624,034 shares of our common stock, or approximately 93.15% shares of our outstanding common stock after the share exchange. In connection with the share exchange, a majority of our shareholders of record as of November 16, 2007 approved a resolution by our Board of Directors to change our name from New Paradigm Productions, Inc. to China Marine Food Group Limited. The name change became effective on January 9, 2008 upon the filing of a Certificate of Amendment to our Amended

Articles of Incorporation with the State of Nevada on the twentieth day following the mailing of a Definitive Information Statement to our shareholders. Concurrently with the closing of the reverse acquisition on November 17, 2007, we completed a private placement of our securities to certain accredited investors who subscribed for units consisting one share of common stock and a warrant to purchase one-fifth of one share of our common stock. The investors subscribed for aggregate of 6,199,441 shares of our common stock and warrants to purchase an aggregate of 1,239,888 shares of our common stock at $3.214 per unit. The units were offered and sold pursuant to from registration under the Securities Act, including without limitation, Regulation D and Regulation S promulgated under the Securities Act. Each warrant issued to the investors has a term of three years and is exercisable at any time for a price equal to $4.1782 in cash or on a cashless exercise basis.

In connection with the private placement, our principal stockholder, Pengfei Liu, entered into a make good agreement pursuant to which Mr. Liu agreed, subject to certain conditions discussed below, to place into an escrow account, 6,199,441 shares of common stock of the Company he beneficially owns. If we had not generated net income of $10.549 million for the fiscal year ending December 31, 2008, up to 50% of the shares held in escrow would have been transferred to the private placement investors. If we did not generate net income of $14.268 million for the fiscal year ending December 31, 2009, the remaining shares held in escrow would have been transferred to the private placement investors, on a pro rata basis. Since the net income for 2008 and 2009 met the minimum net income thresholds, no

transfer of the escrowed shares was made to the private placement investors.

For accounting purposes, the share exchange transaction was treated as a reverse acquisition with Ocean Technology as the acquirer and China Marine Food Group Limited as the acquired party. When we refer herein to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Ocean Technology on a consolidated basis unless the context suggests otherwise.

On January 25, 2010, we sold an aggregate of 4,615,388 shares of common stock for an aggregate purchase price of $30,000,022 at a price of $6.50 per share pursuant to a shelf registration statement on Form S-3.

Background History of Ocean Technology

Prior to the establishment of Mingxiang, Pengfei Liu, our founder, Executive Chairman and CEO of our Company, was engaged in the trading of marine catch from 1983 to 1994. He bought marine catch from local suppliers and sold them to seafood traders in other regions such as Zhejiang Province.

In March 1994, Mr. Liu, through his company Shishi City Xiangzhi Dabao Seafood Processing Factory, entered into a joint venture with Zhoushan Fishery Processing Factory to establish Mingxiang, to engage in the processing and sale of seafood products. Mingxiang established its place of business close to Xiangzhi (Shishi) Port, which is one of the largest fishing ports in the Fujian Province, occupying premises with a land area of about 3,300 sq. m. Mingxiang then commenced business as a small enterprise processing and supplying roasted file fish to customers in Fujian and Zhejiang Provinces.

5

Our business grew steadily between 1994 and 1997. In 1997, to protect the goodwill that had been built up for our products sold under our “Mingxiang (明祥)” brand, we registered the “Mingxiang” brand in the PRC as a trademark. The trademark covers marine food products such as dried fish slices, roasted shelled prawns and shredded squid.

In 1998, we added shredded roasted squid to our range of products and expanded our production facilities to occupy a land area of about 8,000 sq. m. At that time, we employed about 40 employees. We also commenced the construction of cold storage facilities occupying a land area of about 2,000 sq. m. and with a storage capacity of 1,000 tons.

In 1999, we completed the construction of our cold storage facilities. The new cold storage facilities increased the shelf-life of and enabled the prolonged storage of the raw materials, works-in-progress and finished products of our processed seafood products. With the cold storage facilities, we became less susceptible to seasonal fluctuations in market demand and supply of raw materials and products. This significantly increased our processed seafood production capacity.

In 2000, we expanded our product range to include roasted prawns. We also acquired an additional land of about 7,300 sq. m. at our business premises to build additional production facilities as well as office and staff dormitory facilities.

Through a series of equity transfers agreements from 1996, Mr. Liu and his spouse Yazuo Qiu acquired full control of Mingxiang in 2001. With the change in shareholders’ control and the expanded scope of business to include export activities, we obtained a new business license for Mingxiang on April 9, 2001. In the same year, we obtained an import-export license from the Fujian Province International Trade Cooperation Bureau. We believe we were one of the first domestic companies in the processed seafood industry in Quanzhou City, Fujian Province to obtain this license. This was a significant milestone in our history as the license allowed us to export these products to foreign markets. In the same year, we commenced the export of our processed seafood products to Japan.

We also established Jixiang in 2001. Jixiang is our property-holding company, and owns the building ownership rights to all our properties save for two properties which are owned by Mingxiang.

All our land use rights and properties, including production plant, cold storage facility, office tower and staff dormitory, are managed by these two property holding companies, Mingxiang and Jixiang. The operations of these two property holding companies are solely property management. All rental income, which is relatively immaterial comparing to our principal revenues from sale of processed seafood products, beverage products and trading of marine catch, is recognized as "Other Income" in our financial statements. In particular, Mingxiang is responsible for the rental income related to the collection on the 31 shop spaces at our factory in Dabao Industrial Zone. The rental contracts are based on 1-year lease term. Whereas another subsidiary, Xianglin, is a dormant company.

In 2002, our “Mingxiang” brand was recognized as a “Fujian Province Famous Brand”. In June of the same year, we commenced our marine catch business, through the chartering of two fishing vessels with an aggregate net tonnage of 44 tons.

In 2003, we commenced the export of our dried processed seafood products to the Russian market. In May 2004, Ocean Technology, a company incorporated in Hong Kong and wholly-owned by Mr. Liu, established Rixiang, a limited liability company with a registered capital of US$1,000,000. Rixiang carried on the main businesses of processing and storage of marine food and marine catch. Since January 2005, Rixiang has been the operating subsidiary of our Company.

In 2003, we also completed the construction of additional cold storage facilities. The new cold storage facilities increased our cold storage capacity from 1,000 tons to 2,020 tons.

We also started selling frozen processed seafood products, which include frozen whole squids and fishes in 2003. Since then, our frozen processed seafood product range has expanded to include readily consumable products, including squid rings and slices and octopus cuts and slices.

In 2003 and 2004, the processing of our frozen seafood products involved only basic processing such as cleaning, washing, sorting and packing. From 2005, our frozen processed seafood products processes shifted to more advanced processing as we observed a growing market in processed seafood products such as squid slice, octopus cuts, octopus slices and squid rings.

In April 2006, our subsidiary Rixiang entered into a memorandum of understanding for research and development collaboration with the Ocean University of China in order to further develop our product development capabilities.

In November 2009, Mingxiang won the auction for the purchase of the 40-year use right of a land in Shishi City, Fujian. Covering an area of 8,691.4 sq. m., the land is located next to the fishing port and the Company’s processing facilities in Shishi City. We plan to build cold storage facilities on the land with a capacity of approximately 20,000 tons. We intend to complete the construction in the second half of 2011. See “Description of Business - Production Facilities and Process.”

In November 2009, Mingxiang entered into a Credit or Share Purchase Option Agreement (the “Option Agreement”) with Qiu Shang Jing, the former sole shareholder of Xianghe. Under the Option Agreement, Mingxiang loaned Xianghe RMB180,500,000 (approximately $26,400,000). In consideration for the loan, Mingxiang received the option to buy shares from Mr. Qiu representing eighty percent (80%) of Xianghe. The purchase price payable to Mr. Qiu consisted of RMB9,500,000 (approximately $1,400,000) payable by Mingxiang and RMB180,500,000 (approximately $26,400,000) payable by Xianghe. On January 1, 2010, Mingxiang exercised its option to acquire eighty percent (80%) of the registered capital stock of Xianghe. Xianghe began operations in June 2009.

We have grown from a domestic market-oriented seafood enterprise with over 80 employees in 2003 into a medium-sized nationwide seafood enterprise with advanced processing facilities and equipment. As of December 31, 2010, we had 972 employees. Our employees currently include 10 research and development staff.

6

OUR PRINCIPAL PRODUCTS AND THE MARKET

We are a seafood producer engaged in the processing, distribution and sale of processed seafood products under our “Mingxiang” brand, as well as the sale of marine catch. In 2010, we also became a manufacturer of algae-based soft drinks through our acquisition of Xianghe.

Our business philosophy may be summarized in the following phrase:

“To achieve benefits through innovation, and to develop new markets through branding”

Our branded “Hi-Power” algae-based soft beverage product was developed by the Yellow Sea Fisheries Research Institute Chinese Academy of Fishery Science in coordination with Xianghe’s founder, Qiu Shang Jing. Hi-Power beverage is marketed as a high-protein drink, low in calories and fat. Our target market focuses on middle class health-conscious consumers in China’s fast-growing beverage market. We have developed a network of exclusive distributors in Fujian province in China, which sell our Hi-Power beverage product to retail food stores, restaurant food supply dealer and hospitality industry in their respective distribution territories. The algae-based beverage products are sold to 6 exclusive distributors and in turn sub-distributed to about 13,000 retail points in Fujian Province. We

intend to expand distribution of the Hi-Power soft drinks to other parts of the PRC in 2011.

Our objective is to establish ourselves as a leading producer of processed seafood and algae-based soft drink products in the PRC and overseas markets.

Processed Seafood Products

Using a combination of Japanese traditional seafood processing methods and modern scientific seafood processing techniques as of December 31, 2010, our product development efforts have yielded 29 processed seafood products comprising dried seafood products such as roasted squid, roasted file fish, roasted prawns, shredded roasted squid, barbecued squid, sliced barbecued squid, sliced roasted octopus, spicy sliced octopus, spicy baby squid, spicy sliced squid and spicy squid head as well as frozen processed seafood products. Our frozen processed seafood products include frozen Japanese butter fish, frozen octopus and frozen squid rings. Our production facilities are located at Dabao Industrial Zone, Xiangzhi Town, Shishi City, Fujian Province, occupying a total land area of 17,600 sq. m. This includes cold storage

facilities with a total storage capacity of 2,020 tons. We have four production lines for the processing of our roasted file fish, roasted prawns, shredded roasted squid and roasted squid and one production line for frozen processed seafood products.

We have established sales networks in various large and medium sized cities in the PRC and our export markets, such as Japan, Philippines and Papua New Guinea. Although we didn’t have significant export sales since 2009, we may have opportunities to trade with overseas customers in the future. We believe our products are sold by some of our distributors to end-consumers in South Korea and Taiwan. Our dried processed seafood products are mainly sold in supermarkets in Fujian and Zhejiang Provinces and their surrounding areas, and through our sales network through 18 distributors, each of whom have its own sales network and are authorized by us to distribute our products exclusively in a specific vicinity.

Our sales to domestic and foreign markets for the fiscal years ended December 31, 2010, 2009 and 2008 are set out below:

Dried Processed Seafood Products

|

Year Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

(%)

|

(%)

|

(%)

|

||||||||||

|

PRC sales

|

100.0

|

100.0

|

99.2

|

|||||||||

|

Export sales (1)

|

0.0

|

0.0

|

0.8

|

|||||||||

Notes:

|

(1)

|

The decrease in export sales was mainly due to our increased marketing efforts in the PRC, which resulted in higher domestic sales.

|

7

Frozen Processed Seafood Products

|

Year Ended December 31,

|

|||||||||

|

2010

|

2009

|

2008

|

|||||||

|

(%)

|

(%)

|

(%)

|

|||||||

|

PRC sales (1)

|

0.0 | 0.0 | 48.9 | ||||||

|

Export sales (2)

|

0.0 | 0.0 | 51.1 | ||||||

Notes:

(1) These comprise sales to local distributors made on an ad hoc basis.

(2) These comprise sales to foreign distributors.

Our dried processed seafood products are predominantly sold under our registered trademark, the “Mingxiang” brand.

We discontinued sales of frozen processed seafood products in 2009 because management decided to focus on domestic sales of our products and the demand for the frozen processed seafood products was primarily from overseas. We maintain our production line for frozen processed seafood products and may sell the products again in the future.

With respect to preparation of our products, a portion of our frozen processed seafood products are consumed directly by end-consumers with little or no additional processing. All our dried and frozen processed seafood products are manufactured free of preservatives. We use ingredients such as sugar, salt and spices in the production of our dried processed seafood products. The raw materials for our processed seafood products are obtained through fresh marine catch and not from seafood breeding farms.

We have obtained the “Green Food” awards in respect of our roasted file fish, frozen fish, roasted king prawns and shredded squid. We are committed to the highest standards of quality control in the production of our processed seafood products, as evidenced by our ISO9001, ISO14001, HACCP certification and the EU export registration.

Our credit-worthiness, quality and processed seafood products have received considerable acknowledgement and favorable feedback from the public. Please refer to the section “Awards and Certification” for further details of the awards and certifications that we have received.

Our products are exported to many countries including Japan, Philippines and Papua New Guinea. Although we didn’t have significant export sales since 2009, we may have opportunities to trade with overseas customers in the future. We are a State-designated base for quality assurance testing of marine products. Please see the section “Quality Assurance” for more details.

Marine Catch

Starting from 2008, we did not charter any fishing vessels nor harvest the marine catch ourselves. Instead, we buy the marine catch from the suppliers and then sell to the customers on a direct basis. The marine catch is predominantly sold to distributors in Fujian, Shandong and Liaoning provinces, some of whom directly export the marine catch to South Korea and Taiwan.

Our Products

Our products can be divided into three main categories, namely (1) processed seafood products; (2) marine catch; and (3) “Hi-Power” algae-based beverage product. The production of the processed seafood products, marine catch and algae-based beverage products are either undertaken by our subsidiaries, Rixiang or Mingxiang.

The following table sets out some of our main products, as well as the main markets in which they are sold:

8

|

Processed Seafood

Products

|

Products / Species

|

Main Markets

Markets in the PRC

|

Foreign Markets

|

|||

|

(a) Dried processed seafood products

|

Roasted file fish, shredded roasted squid, roasted squid, roasted prawn, barbecued squid, sliced barbecued squid, sliced roasted octopus, spicy sliced octopus, spicy baby squid, spicy sliced squid, spicy squid head

|

Zhejiang Province

Fujian Province

Shandong Province

Greater Shanghai Region

Guangdong Province

Sichuan Province

Liaoning Province

|

Japan in 2008

|

|||

|

(b) Frozen processed seafood products

|

Cuttlefish, octopus, pomfret, shelled prawns, sliced squid

|

Shandong Province (for sale in South Korea)

Fujian Province (for sale in Taiwan)

|

Philippines and Papua New Guinea in 2008

|

|||

|

Marine Catch

|

Cuttlefish (Sepia esculenta), hairtail fish (Trichiurus japonicus), Japanese butter fish (Psenepis Anomala), squid (Loligo bleekeri), horse mackerel

|

Fujian Province

Shandong Province

Lianoing Province

|

Philippines and Papua New Guinea

|

|||

|

“Hi-Power” Algae-Based Beverage Product

|

Fujian Province

|

Nil

|

Processed Seafood Products

We purchase fresh seafood, the primary ingredient from which our dried and frozen processed seafood products are manufactured, from fishermen and traders. Our raw materials are stored in cold storage facilities located at our production facilities. The production processes of our dried and frozen processed seafood products are described in further detail under the section “Production Facilities and Process”.

Dried Processed Seafood Products

|

|

|

|

|

Roasted file fish

|

Roasted squid

|

Roasted prawn

|

The main dried processed seafood products manufactured by us are roasted file fish, shredded roasted squid, roasted squid and roasted prawn.

The ingredients used in the production of our dried processed seafood products are fresh seafood (such as fish, prawns and cuttlefish), natural flavoring, sugar, salt and spices.

Frozen Processed Seafood Products

|

|

|

|

|

Octopus

|

Shelled prawns

|

Sliced squid

|

9

Our frozen processed seafood products comprise cuttlefish, octopus, pomfret, shelled prawns and sliced squid. Some of our frozen seafood products (such as cuttlefish and squid) are packaged and can be consumed without additional processing. Our other frozen processed seafood products are intermediate products sold to our customers for further processing before sale to the end-consumer. Our frozen processed seafood products are mainly exported to Japan and South Korea directly or through our customers.

Marine Catch

The principal species of marine catch harvested in the East China Sea and Taiwan Strait and sold by our Company are as follows:

|

Cuttlefish (Sepia esculenta)

|

||

|

Cuttlefish is commonly found in the East China Sea and the Taiwan Strait. Cuttlefish is often processed and sold as fresh sushi and snacks.

|

|

|

Hairtail Fish (Trichiurus japonicus)

|

||

|

Hairtail fish, usually found in the East China Sea and the Taiwan Strait, is one of the best-selling marine catch in the PRC. It is a regular dish for home working and fine-dining restaurants

|

|

|

Japanese Butter Fish (Psenepis Anomala)

|

||

|

Japanese butter fish is usually found in the East China Sea and the Taiwan Strait between September and November every year.

|

|

|

Squid (Loligo bleekeri)

|

||

|

Squids are commonly found in the seas of the Taiwan Strait. Squid contains many nutrients such as proteins, fats, carbohydrate, calcium and phosphorus. Its fine taste and springy texture makes the squid a popular food with consumers.

|

|

| “Hi-Power” Algae-Based Beverage Product | ||

|

“Hi Power” drink is high in protein and low in calories and fat.

|

10

Production Facilities and Process

The production of our dried and frozen processed seafood products is carried out at our production facilities in Dabao Industrial Zone, Xiangzhi Town, Shishi City, Fujian Province. At December 31, 2010, we own four production lines for the manufacture of dried processed seafood products and one production line for the manufacture of frozen processed seafood products. After the upgrade of our production facilities in 2009, the maximum annual production capacities of our production lines increased to about 19,000 tons of dried processed seafood products and 1,000 tons of frozen processed seafood products. The construction of our new facilities was completed and commenced full operation by the third quarter end of 2009. We also own cold storage facilities with cold storage capacity of 2,020 tons.

On November 6, 2009, Mingxiang won the auction for the purchase of the 40-year use right of a land in Shishi City, Fujian. Covering an area of 8,691.4 sq. m., the land is located next to the fishing port and our processing facilities in Shishi City. The fishing port in Shishi is one of the five largest fishing ports in the PRC. The purchase price for the land use right is RMB 15.55 million ($2.28 million). We are building cold storage facilities on the land with a capacity of approximately 20,000 tons, to take advantage of its proximity to the port where we obtain fresh seafood catch to be processed into seafood products. We are financing the total estimated $20 million in land use right and construction costs from funds generated by operations and expect to complete the construction in the second half of

2011.

We place great emphasis on quality assurance at every stage of our production process and have clearly defined procedures to manufacture products of consistently high quality. Please refer to the section “Quality Assurance” for more details.

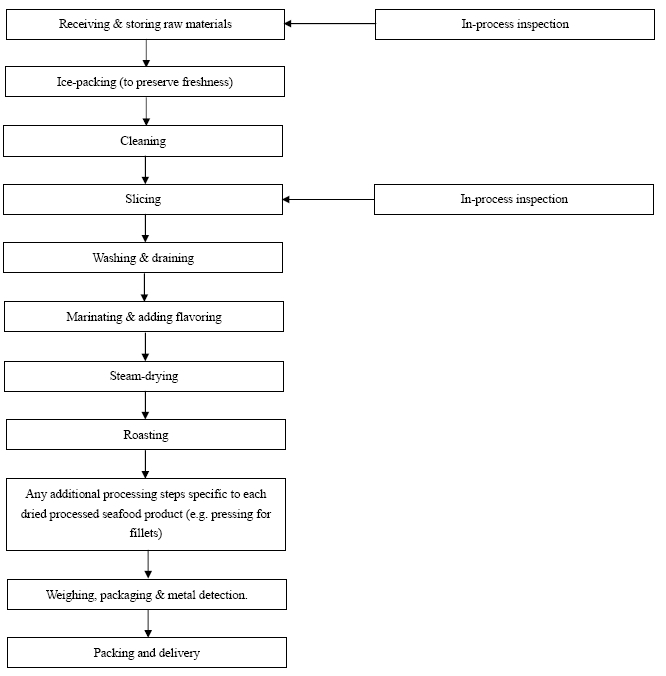

Dried Processed Seafood Products

The key stages of our production process for our dried processed seafood products are as follows:

|

|

1.

|

Receiving and storing raw and packaging materials. All raw materials undergo visual inspection to ensure freshness and firmness before they are accepted and stored. Inspection is carried out by way of random sampling.

|

Samples are taken from each batch of raw materials and sent to the quality control department where physical (e.g. visual inspection), chemical and micro-organism tests are conducted. Raw materials which do not adhere to our requirements are rejected.

Our other ingredients such as salt, sugar and spices are sourced from suppliers within the PRC. They are stored in warehouses or temperature-controlled facilities after inspection and approval.

Our packaging materials are kept in a warehouse after they have been inspected and approved.

11

|

|

2.

|

Ice-packing. To maintain the freshness of our raw materials, a portion of the raw materials is packed in ice and transported directly to our production facilities for processing, whereas the remaining raw materials are packed in ice and transported to our cold storage facilities for storage at minus two to two degrees Celsius for no longer than 24 hours, upon which they must be delivered to the production facilities for processing.

|

|

|

3.

|

Cleaning. At the production facilities, the raw materials are cleaned by removing unwanted portions such as heads, innards and shells.

|

|

|

4.

|

Slicing. The raw materials are then sliced on stainless steel tables.

|

|

|

5.

|

Washing and draining. The raw materials are then sent to the washing pool for washing so as to remove oil, blood stains, remnant innards and other stains. After washing, the raw materials are drained to remove excess water content.

|

|

|

6.

|

Marinating and adding flavoring. Other ingredients such as salt, sugar and spices are then added in the required amounts according to our recipes, left to marinate for a set period and mixed at stipulated intervals.

|

|

|

7.

|

Steam-drying / Roasting. The raw materials are arranged on wire mesh trays, which are stacked in trolleys and rolled into a heating machine. Roasting takes place under controlled temperatures via a roasting conveyor belt, where moisture levels are monitored. Depending on the product, we will slice or shred the raw materials after roasting.

|

|

|

8.

|

Weighing, packaging and metal detection. The dried processed seafood products are then packed into their respective packaging materials and sealed. After a calibrated metal detector to ensure that the products do not contain any traces of metal particles. Metal contamination might have been inherent in the raw materials or caused by production process of which some stages are automated.

|

|

|

9.

|

Packing and delivery. The packets of dried processed seafood products are then packed into boxes, which are then stored in our warehouse. Our products are delivered to customers on a “first in, first out” basis.

|

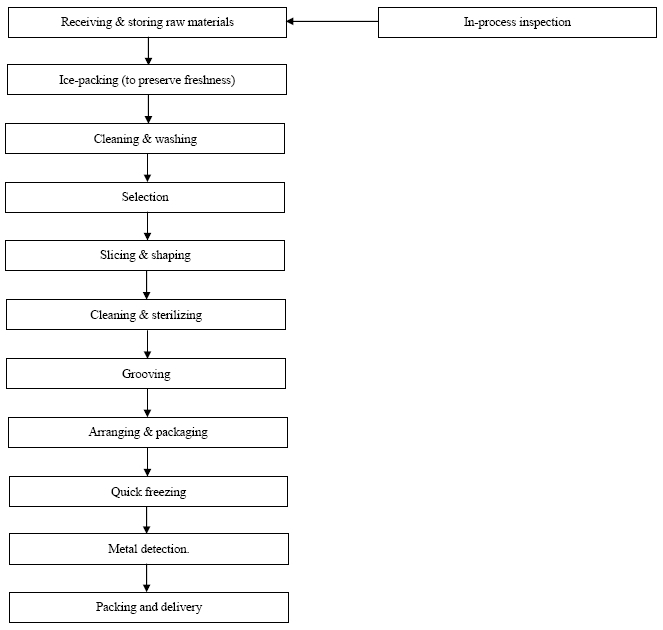

Frozen Processed Seafood Products

Part of the production of our frozen processed seafood products is carried out in a sterile sealed production unit. The key stages of our production process for our frozen processed seafood products are as follows:

12

|

|

1.

|

Receiving and storing raw materials. As with our dried processed seafood products, all the raw materials for our frozen processed seafood products undergo inspection and approval before they are accepted and stored. Inspection is carried out by way of random sampling. Samples are taken from each batch of raw materials and sent to the quality control department where physical (e.g. visual inspection), chemical and micro-organism tests are conducted. Raw materials which do not adhere to our requirements are rejected.

|

Packaging materials are kept in a warehouse after they have been inspected and approved.

|

|

2.

|

Ice-packing. To maintain the freshness of our raw materials, a portion of the raw materials is packed in ice and transported directly to our production facilities for processing, whereas the remaining raw materials are packed in ice and transported to our cold storage facilities for storage at minus two to two degrees Celsius for no longer than 24 hours, upon which they must be delivered to the production facilities for processing. These raw materials are removed from cold storage only immediately prior to processing.

|

|

|

3.

|

Cleaning and washing. At the production facilities, the raw materials are cleaned by removing unwanted portions such as heads, innards and shells.

|

|

|

4.

|

Selection. The raw materials are selected based on weight for further processing.

|

|

|

5.

|

Slicing and shaping. The raw materials are then cut into slices and trimmed in order to attain the desired dimensions.

|

|

|

6.

|

Cleaning and sterilizing. The raw materials then undergo further cleaning and sterilizing in order to remove bacteria.

|

|

|

7.

|

Grooving. Where necessary for some of our sliced products, grooves are made on the slices. The grooves enable better absorption of condiments during consumption.

|

|

|

8.

|

Arranging and packaging. The slices are then placed in neat arrangements in designated packs.

|

|

|

9.

|

Quick freezing. The slices are then sent for quick freezing to a temperature of minus thirty-five degrees Celsius.

|

|

|

10.

|

Metal detection. The products are then passed through a metal detector to ensure they do not contain any metal particles.

|

|

|

11.

|

Packing and delivery. The products are then packed and sealed. All the packaged products are then stored immediately in our cold storage facilities, where they are delivered in a “first in, first out” basis. Our products are transported in refrigerated containers which must comply with required standards of cleanliness and hygiene. Delivery is provided by a third-party logistics company using refrigeration containers at below minus 18 degrees Celsius.

|

“Hi-Power” Algae-Based Beverage Product

The “Hi-Power” beverage products are produced for us by two manufacturers. The key stages of our production process for our “Hi-Power” algae-based beverage products are as follows:

13

|

1.

|

Procurement of raw materials. Choose and buy natural algaes as raw materials from unpolluted sea areas.

|

Samples are taken from each batch of raw materials by way of random sampling and sent to the quality control department where physical (e.g. visual inspection), chemical and micro-organism tests are conducted. Raw materials which cannot meet our requirements are rejected.

|

2.

|

Cleaning. The algaes are cleaned to remove sediment and impurities.

|

|

3.

|

Stewing. The algaes are stewed in water at ratio of 30:70 at 80°C for 3 to 5 hours.

|

|

4.

|

Enzymolysis. Adding a certain amount of enzyme into stewed algae juice for enzymolysis at 50-60°C for 1 to 2 hours.

|

|

5.

|

Filtration and decolorization. After enzymolysis, the stewed algae juice will go through a process of filtration in the ultrafiltration machine. The filtered algae juice will become clear, transparent and free from impurities. The transparent algae juice will then be pumped into the resin tank for process of decolorization.

|

|

6.

|

Blending. The processed algae juice should be blended with the extract of honeysuckle, bamboo leaves, licorice and other auxiliary materials in accordance with a pre-defined formula.

|

|

7.

|

Heating and homogenizing. Using the tubular heater to heat the blended algae juice at 80-90°C for 5-10 seconds and then put it into the homogenizer at 20Mpa.

|

|

8.

|

Filtration. Put the drinks into 1μ filter for filtration.

|

|

9.

|

Canning. Washing the can, before canning and sealing by using the automated canning machine.

|

|

10.

|

Sterilization. Sterilizing the canned drinks with a sterilizing pot. Temperature should be controlled at 125°C for 15 minutes.

|

|

11.

|

Cooling. Cooling the drinks by using the spray cooling method at 30-40°C. Tune the production date and shelf life. Regular check on coding and ensure the accuracy of coding position. Packaging should refer to the specification of daily order requests.

|

|

12.

|

Delivery. The drinks can be sold and delivered.

|

14

Awards and Certifications

As testimony to the quality of our products, our credit worthiness in the PRC business community as well as our management capabilities, we have received several awards and certification in 2010, as listed below:

|

Year

|

Subsidiary

|

Award

|

Period

|

Awarding Body

|

Significance

|

|||||

|

May 17, 2010

|

Mingxiang

|

Green Food - roasted file fish

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Mingxiang

|

Green Food - dried shredded squid

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

15

|

May 17, 2010

|

Mingxiang

|

Green Food - frozen fish

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Mingxiang

|

Green Food - roasted king prawn

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food – roasted file fish

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food - dried shredded squid

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food – roasted yellow croaker

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food - roasted prawn

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food - roasted shredded squid

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food – roasted fish bones

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food - roasted squid

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

May 17, 2010

|

Rixiang

|

Green Food - squid slices

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

16

|

May 17, 2010

|

Rixiang

|

Green Food - roasted searobin fillet

|

May 2010 - May 2013

|

China Green Food Development Centre

|

Recognition of environmental awareness, non-pollution in our production chain

|

|||||

|

January 2004

|

Mingxiang

|

Civilized and Creditworthy Enterprise

|

2002 -2003

|

Shishi City Government Civilization Bureau, Shishi City Economic Bureau, Shishi National Tax Bureau, Shishi District Tax Bureau

|

Recognition of our regard for integrity in our operations, our creditworthiness and contribution to the economy

|

|||||

|

January 2004

|

Mingxiang

|

Quanzhou Agricultural Industrialization Leading Enterprise

|

January 2004 - December 2006

|

Quanzhou Department of Agriculture, Quanzhou Finance Bureau

|

Recognition of our efforts and contribution in the development of processed agricultural products

|

|||||

|

September 2008

|

Mingxiang

|

Key Leading Enterprise (Province level)

|

2008 - 2009

|

Fujian Province Agriculture Industrialization Leading Group

|

Recognition of our efforts and contribution in the development of processed agricultural products

|

|||||

|

December 2006

|

Mingxiang

|

A-Grade Tax Payer Credit Enterprise

|

2004 - 2005

|

Quanzhou National Tax Bureau, Quanzhou District Tax Bureau

|

Recognition of our tax creditworthiness

|

|||||

|

December 2004

|

Mingxiang

|

National Foodstuff Industry Excellent Leading Enterprise

|

2003 - 2004

|

China Foodstuff Industry Association

|

Recognition of quality of our products

|

|||||

|

May 2008

|

Mingxiang

|

2008 “AAA” bank-rated Creditworthy Enterprise

|

Valid until April 30, 2009

|

China Agricultural Bank, Fujian Branch

|

Recognition of the quality of our enterprise, economic standing, operational efficiency and potential for growth

|

|||||

|

September 2008

|

Mingxiang

|

Fujian Province Famous Brand

|

Valid for 3 years

|

Fujian Province Branded Products Authentication Committee

|

Recognition of our brand and our branding efforts

|

DISTRIBUTION

PROCESSED SEAFOOD PRODUCTS

Sales and Marketing

Our sales and marketing team comprises 52 employees, headed by our Executive Chairman, Director and CEO Mr. Pengfei Liu. The team is responsible for monitoring domestic sales, which includes co-coordinating orders from customers as well as distributing our products to the customers.

Distribution Network

We have established a wide distribution network which allows us to maintain our competitiveness in the industry. Our products are exported to various countries, including Japan, Philippines and Papua New Guinea. We believe our products are sold by some of our distributors to end-consumers in South Korea and Taiwan.

17

As of December 31, 2010, we have 18 distributors in seven provinces in the PRC, namely Fujian, Guangdong, Jiangsu, Shandong, Zhejiang, Sichuan and Liaoning, as follows:

|

Province

|

No. of Distributors

|

|

|

Fujian

|

6

|

|

|

Guangdong

|

1

|

|

|

Jiangsu

|

1

|

|

|

Shandong

|

2

|

|

|

Zhejiang

|

6

|

|

|

Liaoning

|

1

|

|

|

Sichuan

|

1

|

|

|

Total

|

18

|

These distributors in turn sub-distribute our dried processed seafood products to about 3,200 retail points (including major supermarkets and retailers such as Wal-Mart and Carrefour) throughout these provinces.

One of our main considerations when appointing distributors is the purchasing and consumer spending power in the particular region in which we intend to distribute our products.

Before we appoint new distributors or extend the distribution arrangement with existing distributors to distribute our products in a particular region or country, the potential distributor or existing distributor is subject to our stringent selection or review process. We will only appoint distributors who are able to meet our requirements such as sales target.

We select each distributor based on four criteria:

|

|

a.

|

Strong Financial Background. We require the distributor to provide us with its most recent audited financial statements so we may verify whether its financial status is strong and healthy. We further require the distributor to settle the bills in cash, without offering any credit terms, in the first year of doing business with us.

|

|

|

b.

|

Strong Distribution Network. The distributor should have a strong, well-established marketing and distribution network in the corresponding region.

|

|

|

c.

|

Good Reputation and Track Record. We only select those distributors with good reputations in the industry in regard to their business background, marketing experience and distribution network. In particular, the distributor should have a track record in developing and maintaining the brand images of the products it distributes.

|

|

|

d.

|

Marketing Strategy. We require the distributor to implement our overall marketing strategy for our products and to supplement it by designing its own marketing plans specifically for the respective region. The distributor should be able to assist us in building our brand image and achieving a significant market share in a said period of time.

|

We appoint different distributors for different products in different regions in the PRC and in various overseas markets.

We usually appoint one exclusive distributor to cover a specific county, district, city or province. Under the distributorship agreements, our distributors are obliged to price and sell our products in accordance with the indicative prices which we provide, and are not permitted to arbitrarily adjust the sale price of the products except in accordance with product promotions. The distributors must also duly carry out market operation activities and promotional methods which are jointly developed with us, and to bear the costs of its own advertisements and marketing activities. The distributorship agreements also contain provisions for the protection of our intellectual property rights.

In addition to selling products under our brands, we have also begun to distribute products under private labels. In September 2009, we reached agreement with a Hong Kong based confectionary store chain which used our seafood snack foods exclusively for a private label program for the chain’s store roll-out in China in 2009 and 2010.

For our export sales, we sell our products through sales agents or traders in the PRC or directly to distributors in the overseas market. As there are great growth potential and attractive profit margins in the PRC, we increased marketing efforts in the PRC, which resulted in higher domestic sales and decrease in export sales.

Our sales and marketing team is also responsible for marketing our products within the PRC. The team contacts and visits our customers regularly to obtain feedback and suggestions on our products, and to foster and build our relationships with them. We normally sign distributorship agreements with a one-year term. Our agreements stipulate the price range in which the distributors may sell our products and also stipulate sales targets which our distributors have to achieve before the agreements are renewed.

We advertise our products regularly in supermarket brochures, and outdoor billboards. We also participate in exhibitions in the PRC such as the China Export Trade Fair and the China Seafood Exposition, as well as overseas exhibitions such as those in South Korea, Japan and Boston, USA.

18

“HI-POWER” ALGAE-BASED BEVERAGE PRODUCTS

Sales and Marketing

Our sales and marketing team comprises 151 employees, headed by our Executive Chairman, Director and CEO Mr. Pengfei Liu. The team is responsible for developing and implementing the Company’s overall development and promotional strategy for our algae-based beverage products, which includes co-coordinating orders from customers as well as distributing our products to the customers.

Distribution Network

Xianghe has developed a network of distributors with exclusive territories in Fujian province, which sell Hi-Power to retail food stores, restaurant food supply dealers and the hospitality industry.

The algae-based soft drinks are sold to six exclusive distributors and in turn is sub-distributed to about 13,000 retail points in Fujian Province. We intend to expand distribution of Hi-Power to other parts of the PRC in 2011.

NEW PRODUCTS

Peptide and Protein Products

On April 28, 2006, our subsidiary Rixiang entered into a memorandum of understanding for collaboration with the Ocean University of China’s Food Sciences and Engineering Institute for the development of: (1) bioactive peptide products from leftovers of aquatic processed products; and (2) collagen protein and collagen peptide protein products from fish skin. For details, please see “Research and Development”.

COMPETITION

We operate in a competitive environment and we expect to face more intense competition from our existing competitors and new market entrants in the future. We believe that the principal competitive factors in our industry include, inter alia , brand awareness, product range and quality, customer and supplier relationships, cost and quality of raw materials, technical expertise in production and pricing. Of these factors, we believe that product quality is the most important.

To the best of our knowledge, our principal competitors within the PRC are the following major seafood product manufacturers in the PRC:

|

Business

|

Principal Competitors

|

|

|

Dried and Frozen Processed Seafood Products

|

(1) China Aquatic Zhoushan Marine Fisheries Corporation; and

(2) Liaoning Dalian Seafood Industry Group Co., Ltd.

Both in terms of their size and operations.

|

|

|

Marine Catch Products

|

(1) Fujian Seafood Industry Co., Ltd; and

(2) Fujian Huayang Aquatic Products Group Co., Ltd.

Both in terms of their geographical proximity to our customer base.

|

|

|

“Hi-Power” Algae-Based Beverage Product

|

No direct competitor.

|

There may be companies based in other countries which offer a similar product range as we do but which currently operate in different markets from us. In the future, we may face competition from these companies as we expand into their markets and vice versa.

Competitive Strengths

We believe that our competitive strengths are as follows:

|

1.

|

We have a wide distribution network

|

We have established a wide distribution network which allows us to maintain our competitiveness in the industry. We have 18 exclusive distributors in seven provinces in the PRC such as Fujian, Guangdong, Jiangsu, Shandong, Zhejiang, Sichuan and Liaoning. These distributors in turn sub-distribute our dried processed seafood products to about 3,200 retail points (including major supermarkets and retailers such as Wal-Mart and Carrefour) throughout these provinces. We also have a strong overseas customer base in various countries including Japan, Philippines and Papua New Guinea.

Besides, Xianghe has developed a network of distributors with exclusive territories in Fujian province which sell Hi-Power to retail food stores, restaurants food supply dealers and the hospitality industry.

Please refer to the section “Major Customers” for further details.

19

|

2.

|

We have an established brand name and track record

|

We have been involved in the production of processed seafood products since commencing our operations in 1994. Our “Mingxiang” brand has been conferred the “Famous Brand” award. In addition, we have also obtained the “Green Food” award in respect of our roasted file fish, shredded roasted squid, roasted king prawn and frozen fish products. This attests to the established standing of our “Mingxiang” brand and the high quality of our products. We have also received several other awards and accreditations as described in the section “Awards and Certifications”. We believe such accolades attest to our established reputation in the industry.

We also believe that our established track record in the processed seafood industry instills confidence in our products and attracts new customers from domestic and overseas markets. Our stable customer base and large distributor network in Fujian and Zhejiang provinces have enabled our Company to introduce new products into these markets in a shorter time and gain quicker market acceptance and recognition.

|

3.

|

We develop high quality products

|

We use fresh seafood as the primary ingredient for our processed seafood products. Our superior recipes and production know-how enable us to develop and produce products with high-quality taste and texture and which are well-received by end-consumers.

We have been awarded HACCP certification and have obtained the EU export registration, which enable us to export our products to the US and the EU, respectively. In addition, our products, namely our roasted file fish, shredded roasted squid, roasted squid, roasted prawn and frozen fish have been certified as “Green Food”, a recognition that the production of our products is carried out under certain sanitary conditions with limited use of chemical additives. We believe we are one of the first companies in the seafood industry in Fujian Province to be awarded this certification, which is a further testament to the quality of our products.

|

4.

|

We have a strong leadership as well as a dedicated and experienced management and procurement team

|

Our Company is led by our Executive Chairman and CEO, Pengfei Liu, who has more than 30 years of experience in the seafood industry. Mr. Liu’s drive and passion have been instrumental in our success to-date. He has conceptualized and implemented our strategies in the past and successfully led us in our transition from a small and local seafood enterprise to a nationwide seafood enterprise with advanced seafood processing facilities.

Mr. Liu is ably supported by a team of experienced managers, most of whom have an average of five to ten years’ experience in their respective fields. These personnel support our Executive Chairman and CEO in charting and managing our growth. We believe the members of our procurement team have a strong grasp and good understanding of industry trends, market cycles and seasonal factors, and have the ability to discern and procure high-quality seafood at reasonable prices.

The management team receives regular training in the course of our Company obtaining and renewing our ISO and HACCP qualifications. The training, which is conducted over 10 to 15 days every year, involves process management, quality control, sanitary and hygiene operating procedures and standards. We believe that such training raises our competence and environmental / sanitary awareness, and places us in an advantageous position compared to other operators in the seafood industry who do not undergo such training.

Besides, Hi-Power was developed by the Yellow Sea Fisheries Research Institute Chinese Academy of Fishery Sciences in coordination with the founder, Qiu Shang Jing, who had been engaged in the natural algae industry for over 10 years time and he had a profound expertise on algae products prior to his sale of Xianghe to us. We combined Xianghe’s experienced management team and other employees with additional managers after the acquisition.

|

5.

|

We have established strong relationships with our customers / distributors

|

We have maintained close working relationships with our customers who are reputable distributors of processed seafood products. Our relationships with some of our PRC customers and distributors have been established for more than ten years. In particular, we have enjoyed good relationships with, among others, Qingdao Haizhan Seafood Co., Ltd. (“Qingdao Haizhan”), Wenzhou Rixin Foodstuff Co., Ltd. (“Wenzhou Rixin”), and Zhejiang Ruian Laodu Seafood Wholesale Proprietor (“Zhejiang Ruian Laodu”), for an average of approximately 8 years.

Qingdao Haizhan is in the business of distributing dried and frozen seafood products. To the best of our knowledge, Qingdao Haizhan has a distribution network of over 1,100 retailers and a sales workforce of about 73 people.

Wenzhou Rixin is a distributor of dried seafood in Wenzhou City, Zhejiang Province. To the best of our knowledge, Wenhou Rixin has a distribution network of about 1,100 retailers and a sales workforce of about 87 people.

Zhejiang Ruian Laodu is a large distributor of dried seafood in Ruian City, Zhejiang Province. To the best of our knowledge, Zhejiang Ruian Laodu has a distribution network of about 600 retailers and a sales workforce of about 63 people.

Regarding the percentage of sales represented by each party listed above; please refer to the section “Major Customers” for details.

We view our customers as long-term business partners who are important in the strategic growth of our operations and broadening the geographic reach of our products.

20

|

6.

|

We are strategically located

|

We are based in Fujian province which is situated in southeast China on the coast of the East China Sea. Fujian is one of the nine coastal provinces in the PRC and is a vital navigation hub between the East China Sea and the South China Sea. It is also rich in agricultural and marine resources.

Our main raw materials for our marine catch business come from the Taiwan Strait, which is also where we conduct our marine catch operations. The Taiwan Strait is rich in marine resources. Our business operations and production facilities are located at Shishi City, Fujian province, where Xiangzhi (Shishi) Port has been designated as one of the national-level fishing ports. It is the largest port in Fujian province and is one of the five largest fishing ports in the PRC in terms of supply of marine catch and tonnage of fishing vessels. Fujian province is rich in agricultural and marine resources, which enables our procurement of raw materials for our processed seafood business at low cost. We believe our strategic location gives us access to an abundant supply of fresh marine products and hence allows us to

manage our costs more effectively.

|

7.

|

We have strong research and development capabilities

|

We place strong emphasis on the quality of our products and on our ability to develop new products. To ensure that our products are well-received by our customers and consumers, we have carried out research and development to improve the taste, texture and packaging of our processed seafood products. Through our research and development efforts, we have developed new products and improved the quality of our existing products, which have been well-received by our customers and consumers. These products include our crispy fish-bone snacks, roasted squid and roasted prawns, spicy sliced octopus, spicy baby squid, spicy sliced squid and spicy squid head.

Our strong product development capabilities allow us to constantly introduce new products into the market and maintain consumer interest and loyalty in our “Mingxiang” brand products. We believe that our strategic collaboration with the Ocean University of China will further strengthen our research and development capabilities.

Besides, Hi-Power was developed by the Yellow Sea Fisheries Research Institute Chinese Academy of Fishery Sciences in coordination with the founder. We will leverage the strong research and development capabilities from the Yellow Sea Fisheries Research Institute Chinese Academy of Fishery Sciences together with the Ocean University of China on product development going forward.

|

8.

|

We are a designated National Marine Products Quality Assurance Testing Base

|

We have been designated as a quality assurance testing base by the National Marine Foods Quality Supervision Testing Centre and our testing base is the only assessment base in the southern provinces of the PRC. We test the hygiene and quality of ingredients and products according to industrial standards. Our testing base caters to seafood processing companies from Fujian, Guangdong, Guangxi and Zhejiang provinces, the PRC. We believe our role in quality assurance testing further strengthens our reputation as a producer of quality processed seafood products.

For the above reasons, we believe that we will be able to maintain our market position and competitive edge over our competitors.

MAJOR SUPPLIERS

The following table sets out our five major suppliers of raw materials for processed seafood products, marine catch and algae-based beverage products for the years ended December 31, 2010, 2009, and 2008:

|

As a Percentage of Our Purchases of Raw

Materials (%)

|

||||||||||||

|

Year Ended December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Shishi City Dongfan Seafood Products Trading Proprietor

|

20.6

|

9.3

|

-

|

|||||||||

|

Shishi City Fugui Seafood Products Trading Proprietor

|

19.0

|

20.8

|

20.5

|

|||||||||

|

Shishi City Tianwang Seafood Products Trading Proprietor

|

18.5

|

27.8

|

23.6

|

|||||||||

|

Dalian Kangwei Trading Company Limited

|

13.3

|

14.4

|

-

|

|||||||||

|

Jinjiang City Shenhu Town Hongyuan Seafood Products Trading Proprietor

|

10.3

|

18.0

|

17.0

|

|||||||||

|

Dalian Xinghai Import & Export Co., Ltd.

|

-

|

-

|

17.9

|

|||||||||

|

Shishi City Huali Seafood Products Trading Proprietor

|

-

|

-

|

11.8

|

|||||||||

|

TOTAL

|

81.7

|

90.3

|

90.8

|

|||||||||

21

Trading in fresh fish and other seafood is mainly carried out by individual fishermen, who ply their trade in and around various fishing ports in Shishi City, Fujian province. The above major suppliers are fish and seafood traders in markets in and surrounding Shishi City, Fujian Province. We procure from these suppliers for fresh fish and other seafood, which are used as raw materials in the production of our processed seafood products. These suppliers also supply fresh fish and other seafood to other companies.

Though certain of our major suppliers accounted for more than 10% of our total purchases individually for the fiscal year ended December 31, 2010, we believe we are able to source our raw materials from alternative suppliers should the need arise.

None of our directors, executive officers and controlling shareholders is related to or has any interest in any of our major suppliers listed above. To the best of our knowledge, save as disclosed above, none of our major suppliers is related to or has any interest in one another, and none of our major suppliers is related to or has any interest in the customers stated in the section “Major Customers” below.

MAJOR CUSTOMERS

The following table sets out our major customers accounting for 5.0% or more of our Company’s sales of processed seafood products and marine catch for the years ended December 31, 2010, 2009 and 2008:

|

As a Percentage of Our Sales (%)

|

||||||||||||||

|

Year Ended December 31,

|

||||||||||||||

|

Products

|

2010

|

2009

|

2008

|

|||||||||||

|

Qingdao Haizhan Seafood Co., Ltd (1)

|

Dried and frozen processed seafood products

|

12.5

|

-

|

7.3

|

||||||||||

|

Dalian Jiyang Import and Export Co., Ltd. (2)

|

Marine catch, namely cuttlefish, squid, hairtail fish

|

7.9

|

16.9

|

-

|

||||||||||

|

Wenling City Xingfeng Foodstuff Co., Ltd. (3)

|

Dried processed seafood products

|

5.6

|

7.2

|

10.4

|

||||||||||

|

Jinjiang City Dongshun Seafood Products Trading Proprietor (4)

|

Marine catch, namely cuttlefish, squid, hairtail fish

|

5.3

|

5.1

|

-

|

||||||||||

|

Wenzhou Rixin Foodstuff Co., Ltd. (5)

|

Dried processed seafood products

|

5.1

|

7.3

|

9.5

|

||||||||||

|

Zhejiang Ruian Laodu Seafood Wholesale Proprietor (6)

|

Dried and frozen processed seafood products

|

-

|

6.0

|

8.7

|

||||||||||

|

Fuzhou Chaohui Foodstuff Company (7)

|

Dried processed seafood products

|

-

|

5.8

|

9.0

|

||||||||||

|

Shanghai City Yangpu Area Xianghui Seafood Products Company (8)

|

Dried processed seafood products

|

-

|

5.5

|

-

|

||||||||||

|

Shenzhen City Agricultural Products and Fenghu Specialty and Dried ProductsTown Rifenglong Company (9)

|

Dried processed seafood products

|

-

|

5.5

|

-

|

||||||||||

|

Shenjiamen Liyizhougan Seafood Products Trading Proprietor (10)

|

Dried and frozen processed seafood products

|

-

|

-

|

6.6

|

||||||||||

|

Zhoushan City Maoyuan Foodstuff Import and Export Co., Ltd. (11)

|

Dried and frozen processed seafood products

|

-

|

-

|

5.9

|

||||||||||

|

Zhouriyu Seafood Products Trading Proprietor (12)

|

Dried and frozen processed seafood products

|

-

|

-

|

5.4

|

||||||||||

|

TOTAL

|

36.4

|

59.3

|

62.8

|

|||||||||||

22

Notes:

|

|

1)

|