Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - Innoviva, Inc. | a2202144zex-32.htm |

| EX-23.1 - EX-23.1 - Innoviva, Inc. | a2202144zex-23_1.htm |

| EX-31.1 - EX-31.1 - Innoviva, Inc. | a2202144zex-31_1.htm |

| EX-31.2 - EX-31.2 - Innoviva, Inc. | a2202144zex-31_2.htm |

| EX-10.46 - EX-10.46 - Innoviva, Inc. | a2202144zex-10_46.htm |

| EX-10.47 - EX-10.47 - Innoviva, Inc. | a2202144zex-10_47.htm |

| EX-10.45 - EX-10.45 - Innoviva, Inc. | a2202144zex-10_45.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File No. 0-30319

THERAVANCE, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

94-3265960 (I.R.S. Employer Identification No.) |

|

901 Gateway Boulevard, South San Francisco, California (Address of principal executive offices) |

94080 (Zip Code) |

Registrant's telephone number, including area code: 650-808-6000

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of Each Exchange On Which Registered | |

|---|---|---|

| Common Stock $0.01 Par Value | Nasdaq Global Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 205 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act (Check One):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity (consisting of Common Stock, $0.01 par value and Class A Common Stock, $0.01 par value) held by non-affiliates of the registrant based upon the closing price of the Common Stock on the Nasdaq Global Market on June 30, 2010 was $592,759,166.

On February 14, 2011, there were 73,459,110 shares of the registrant's Common Stock and 9,401,499 shares of the registrant's Class A Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant's definitive Proxy Statement to be issued in conjunction with the registrant's 2011 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the registrant's fiscal year ended December 31, 2010, are incorporated by reference into Part III of this Annual Report. Except as expressly incorporated by reference, the registrant's Proxy Statement shall not be deemed to be a part of this Annual Report on Form 10-K.

THERAVANCE, INC.

2010 Form 10-K Annual Report

Table of Contents

2

Special Note regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements involve substantial risks, uncertainties and assumptions. All statements in this Annual Report on Form 10-K, other than statements of historical facts, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans, intentions, expectations and objectives could be forward-looking statements. The words "anticipates," "believes," "designed," "estimates," "expects," "goal," "intends," "may," "plans," "projects," "pursuing," "will," "would" and similar expressions (including the negatives thereof) are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, expectations or objectives disclosed in our forward-looking statements and the assumptions underlying our forward-looking statements may prove incorrect. Therefore, you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions, expectations and objectives disclosed in the forward-looking statements that we make. Factors that we believe could cause actual results or events to differ materially from our forward-looking statements include, but are not limited to, those discussed below in "Risk Factors" in Item 1A, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 and elsewhere in this Annual Report on Form 10-K. Our forward-looking statements in this Annual Report on Form 10-K are based on current expectations and we do not assume any obligation to update any forward-looking statements.

Overview

Theravance is a biopharmaceutical company with a pipeline of internally discovered product candidates and strategic collaborations with pharmaceutical companies. We are focused on the discovery, development and commercialization of small molecule medicines across a number of therapeutic areas including respiratory disease, bacterial infections, and central nervous system (CNS)/pain. Our key development programs include: the RELOVAIR™ program, the LAMA/LABA ('719/vilanterol (VI)) program, and the Bifunctional Muscarinic Antagonist-beta2 Agonist (MABA) program, each with GlaxoSmithKline plc (GSK), and our Peripherally Selective Mu-Opioid Receptor Antagonist (PµMA) program. By leveraging our proprietary insight of multivalency to drug discovery, we are pursuing a best-in-class strategy designed to discover superior medicines in areas of significant unmet medical need. Our headquarters are located at 901 Gateway Boulevard, South San Francisco, California 94080. Theravance was incorporated in Delaware in November 1996 under the name Advanced Medicine, Inc. and began operations in May 1997. The Company changed its name to Theravance, Inc. in April 2002.

Our strategy focuses on the discovery, development and commercialization of medicines with superior efficacy, convenience, tolerability and/or safety. Our proprietary approach combines chemistry and biology to discover new product candidates using our expertise in multivalency. Multivalency refers to the simultaneous attachment of a single molecule to multiple binding sites on one or more biological targets. When compared to monovalency, whereby a molecule attaches to only one binding site, multivalency can significantly increase a compound's potency, duration of action and/or selectivity. Multivalent compounds generally consist of several individual small molecules, at least one of which is biologically active when bound to its target, joined by linking components. In addition, we believe that we can enhance the probability of successfully developing and commercializing medicines by identifying at least two structurally different product candidates, whenever practicable, in each therapeutic program.

3

In total, our research and development expenses, including stock-based compensation expense, incurred for all of our therapeutic programs in 2010, 2009, and 2008 were $75.1 million, $77.5 million and $82.0 million, respectively.

We have entered into the following collaboration arrangements with GSK and Astellas for the development and commercialization of our product candidates:

In November 2002, we entered into our long-acting beta2 agonist (LABA) collaboration with GSK to develop and commercialize once-daily LABA products for the treatment of chronic obstructive pulmonary disease (COPD) and asthma. For the treatment of COPD, the collaboration is developing combination products, RELOVAIR™ and the LAMA/LABA '719/VI. For the treatment of asthma, the collaboration is developing RELOVAIR™. RELOVAIR™ is an investigational once-daily combination medicine consisting of a LABA and an inhaled corticosteroid (ICS). '719/VI is an investigational once-daily combination medicine consisting of the long-acting muscarinic antagonist (LAMA) GSK573719 ('719) and the LABA, VI.

In March 2004 we entered into our strategic alliance agreement with GSK under which GSK received an option to license exclusive development and commercialization rights to product candidates from all of our full drug discovery programs initiated prior to September 1, 2007, on pre-determined terms and on an exclusive, worldwide basis. In 2005, GSK licensed our MABA program under this agreement and commenced a Phase 2b COPD study in December 2010 with GSK961081 ('081), the lead compound in this program.

Our 2005 collaboration arrangement with Astellas covers the development and commercialization of VIBATIV™ (telavancin), a bactericidal, once-daily injectable antibiotic developed by us for the treatment of Gram-positive infections, including methicillin-resistant Staphylococcus aureus. The U.S. Food and Drug Administration (FDA) has approved VIBATIV™ for the treatment of complicated skin and skin structure infections (cSSSI) caused by susceptible Gram-positive bacteria, including both methicillin-resistant (MRSA) and methicillin-susceptible (MSSA) strains of Staphylococcus aureus, in adult patients. VIBATIV™ is also approved in Canada for the treatment of cSSSI in adult patients and telavancin is under review by the European Medicines Agency for the treatment of nosocomial pneumonia (NP) and complicated skin and soft tissue infections (cSSTI) in adults.

Our Programs

Our drug discovery efforts are based on the principles of multivalency. Multivalency involves the simultaneous attachment of a single molecule to multiple binding sites on one or more biological targets. We have applied our expertise in multivalency to discover product candidates and lead compounds in a wide variety of therapeutic areas. We have conducted extensive research in both relevant laboratory and animal models to demonstrate that by applying the design principles of multivalency, we can achieve significantly stronger and more selective attachment of our compounds to a variety of intended biological targets. We believe that medicines that attach more strongly and selectively to their targets will be superior to many medicines by substantially improving potency, duration of action and/or safety.

4

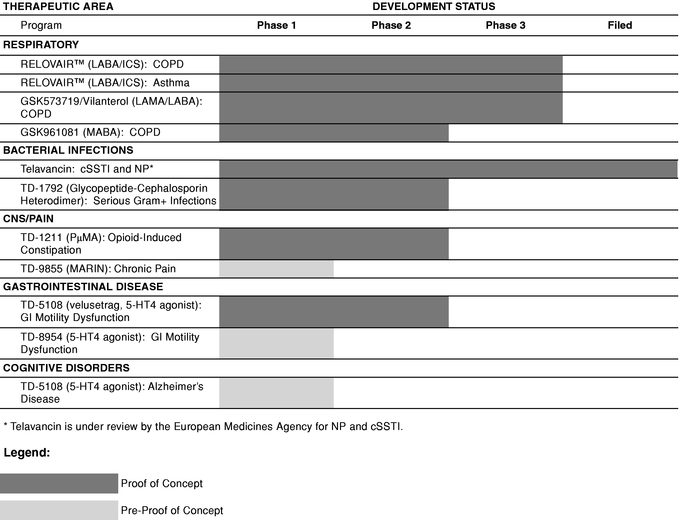

Prior to entering into human clinical studies, a product candidate undergoes preclinical studies which include formulation development or safety testing in animal models. The table below summarizes the status of our most advanced product candidates for internal development or co-development.

In the table above:

- •

- Development Status indicates the most advanced stage of development that has been completed or is in process.

- •

- Phase 1 indicates initial clinical safety testing in healthy volunteers, or studies directed toward understanding

the mechanisms of action of the drug.

- •

- Phase 2 indicates further clinical safety testing and preliminary efficacy testing in a limited patient population.

- •

- Phase 3 indicates evaluation of clinical efficacy and safety within an expanded patient population.

- •

- Filed indicates that a New Drug Application (NDA) or European Marketing Authorization Application (MAA) has been submitted

to and accepted for filing by the FDA or European Medicines Agency, respectively.

- •

- We consider programs in which at least one compound has successfully completed a Phase 2a study showing efficacy and tolerability as having achieved Proof-of-Concept.

5

Our Relationship with GlaxoSmithKline

LABA collaboration with GSK

In November 2002, we entered into our LABA collaboration with GSK to develop and commercialize once-daily LABA products for the treatment of COPD and asthma. For the treatment of COPD, the collaboration is developing combination products, RELOVAIR™ and the LAMA/LABA '719/VI. For the treatment of asthma, the collaboration is developing RELOVAIR™. RELOVAIR™ is an investigational once-daily combination medicine consisting of a LABA, vilanterol (VI), previously referred to as GW642444 or '444, and an ICS, fluticasone furoate (FF). The LAMA/LABA '719/VI is an investigational once-daily combination medicine consisting of the LAMA, '719, and the LABA, VI. The RELOVAIR™ program is aimed at developing a next generation respiratory product to succeed GSK's Advair®/Seretide® (salmeterol and fluticasone as a combination) franchise, which had reported 2010 sales of approximately $7.97 billion, and to compete with Symbicort® (formoterol and budesonide as a combination), which had reported 2010 sales of approximately $2.75 billion. '719/VI, which is also a combination product, is targeted as an alternative treatment option to Spiriva® (tiotropium), a once-daily, single-mechanism bronchodilator, which had reported 2009 sales of approximately $3.35 billion.

The current lead product candidates in our LABA collaboration, VI and FF, were discovered by GSK. In the event that VI is successfully developed and commercialized, we will be obligated to make milestone payments to GSK which could total as much as $220.0 million if both a single-agent and a combination product or two different combination products are launched in multiple regions of the world. If the results of the RELOVAIR™ Phase 3 studies are positive, a portion of these potential milestone payments could be payable to GSK within the next two years. We are entitled to annual royalties from GSK of 15% on the first $3.0 billion of annual global net sales and 5% for all annual global net sales above $3.0 billion. Sales of single-agent LABA medicines and combination medicines would be combined for the purposes of this royalty calculation. For other products combined with a LABA from the LABA collaboration, such as '719/VI, royalties are upward tiering and range from the mid-single digits to 10%. However, if GSK is not selling a LABA/ICS combination product at the time that the first other LABA combination is launched, then the royalties described above for the LABA/ICS combination medicine would be applicable.

In connection with the LABA collaboration, in 2002, we received from GSK an upfront payment of $10.0 million and sold to an affiliate of GSK shares of our Series E preferred stock for an aggregate purchase price of $40.0 million. Through December 31, 2010, we have received a total of $60.0 million in upfront and development milestone payments, and we do not currently expect to be eligible for any additional milestones under this collaboration.

2004 Strategic Alliance with GSK

In March 2004, we entered into our strategic alliance with GSK. Under this alliance, GSK received an option to license exclusive development and commercialization rights to product candidates from all of our full drug discovery programs initiated prior to September 1, 2007, on pre-determined terms and on an exclusive, worldwide basis. Pursuant to the terms of the strategic alliance agreement, we initiated three new full discovery programs between May 2004 and August 2007. These three programs are (i) our oral Peripherally Selective Mu-Opioid Receptor Antagonist (PµMA) program for opioid-induced constipation, (ii) our AT1 Receptor-Neprilysin Inhibitor (ARNI) program for cardiovascular disease and (iii) our MonoAmine Reuptake Inhibitor (MARIN) program for chronic pain. GSK still has the right to license the ARNI and MARIN programs, and must exercise this right no later than sixty days subsequent to the final delivery to GSK of all material, data and supporting documentation relating to achievement of clinical proof-of-concept of the first product candidate in the applicable program. For these programs, "proof-of-concept" is generally defined as the successful completion of a

6

Phase 2a clinical study showing efficacy and tolerability. Under the terms of the strategic alliance agreement, GSK has only one opportunity to license each of our programs.

Upon GSK's decision to license a program, GSK is responsible for funding all future development, manufacturing and commercialization activities for product candidates in that program. In addition, GSK is obligated to use diligent efforts to develop and commercialize product candidates from any program that it licenses. Consistent with our strategy, we are obligated to use diligent efforts at our sole cost to discover two structurally different product candidates for any programs on which GSK has an option under the alliance. If these programs are successfully advanced through development by GSK, we are entitled to receive clinical, regulatory and commercial milestone payments and royalties on any sales of medicines developed from these programs. For any programs licensed under this agreement, the royalty structure for a product containing one of our compounds as a single active ingredient would result in an average percentage royalty rate in the low double digits. For single-agent MABA products, we are entitled to receive royalties from GSK of between 10% and 20% of annual global net sales up to $3.5 billion, and 7.5% for all annual global net sales above $3.5 billion. For combination products, such as a MABA/ICS, the royalty rate is 70% of the rate applicable to sales of single-agent MABA medicines. If a product is successfully commercialized, in addition to any royalty revenue that we receive, the total upfront and milestone payments that we could receive in any given program that GSK licenses range from $130.0 million to $162.0 million for programs with single-agent medicines and up to $252.0 million for programs with both a single-agent and a combination medicine. If GSK chooses not to license a program, we retain all rights to the program and may continue the program alone or with a third party. To date, GSK has licensed our two COPD programs: LAMA and MABA. We received $5.0 million payments from GSK in connection with its license of each of our LAMA and MABA programs in August 2004 and March 2005, respectively. In 2009, GSK returned the LAMA program to us because the formulation of the lead product candidate was incompatible with GSK's proprietary inhaler device. GSK has chosen not to license our antibacterial, anesthesia, 5-HT4 and PµMA programs. There can be no assurance that GSK will license either of the two remaining programs under the alliance agreement, which could have an adverse effect on our business and financial condition.

In connection with the strategic alliance with GSK, we received from GSK an upfront payment of $20.0 million. Through December 31, 2010, we have received $46.0 million in upfront and milestone payments from GSK relating to the strategic alliance agreement.

In May 2004, GSK purchased through an affiliate 6,387,096 shares of our Class A common stock for an aggregate purchase price of $108.9 million and, upon the closing of our initial public offering on October 8, 2004, GSK purchased through an affiliate an additional 433,757 shares of Class A common stock for an aggregate purchase price of $6.9 million. In addition, on November 29, 2010, GSK purchased through an affiliate in a private placement 5,750,000 shares of our common stock for an aggregate purchase price of $129.4 million. GSK's ownership position of our outstanding stock was approximately 18.3% as of February 14, 2011.

Our Relationship with Astellas

2005 License, Development and Commercialization Agreement with Astellas

In November 2005, we entered into a collaboration arrangement with Astellas for the development and commercialization of telavancin. In July 2006, Japan was added to the collaboration, thereby giving Astellas worldwide rights to this medicine. Through December 31, 2010, we have received $191.0 million in upfront, milestone and other fees from Astellas. We are eligible to receive potential milestone payments related to regulatory approvals in various regions of the world.

Under this arrangement, we are responsible for substantially all costs to develop and obtain U.S. regulatory approval for telavancin and Astellas is responsible for substantially all other costs associated with commercialization of telavancin. We are entitled to receive royalties from Astellas on global net

7

sales of VIBATIV™ that, on a percentage basis, range from the high teens to the upper twenties depending on sales volume. The FDA has approved VIBATIV™ for the treatment of cSSSI caused by susceptible Gram-positive bacteria, including both methicillin-resistant (MRSA) and methicillin-susceptible (MSSA) strains of Staphylococcus aureus, in adult patients. VIBATIV™ is also approved in Canada for the treatment of cSSSI in adult patients and telavancin is under review by the European Medicines Agency for the treatment of NP and cSSTI in adults.

Development Programs

Respiratory Programs

RELOVAIR™

In October 2009, we and GSK announced that the first patient had commenced treatment in the Phase 3a program in COPD. The Phase 3a pivotal program in COPD consists of five studies, including two 12-month exacerbation studies, two six-month efficacy and safety studies and a detailed lung function profile study. In March 2010 we and GSK announced that the first patient had commenced treatment in the Phase 3a program in asthma. The Phase 3a program in asthma consists of eight studies, including an exacerbation study, a 12-month safety study (which also supports the COPD program), a 12-week efficacy study, a 24-week efficacy study, and three head-to-head studies and a hypothalamic-pituitary-adrenal (HPA) axis study. GSK is responsible for funding the aforementioned studies. The RELOVAIR™ Phase 3 programs in COPD and asthma are progressing.

In addition, other studies are planned to assess the potential for superiority of the fixed combination of VI and FF versus other treatments for COPD. In early February 2011, we and GSK announced the initiation of an extensive outcomes study of 16,000 patients across 1,100 global sites to assess the potential for the FF/VI combination to improve survival in patients with COPD and a history of, or at risk from, cardiovascular disease. This study will evaluate the clinical outcomes of patients receiving standard cardiovascular care (including cardiovascular medications) versus patients receiving FF/VI in addition to receiving standard cardiovascular care (including cardiovascular medications).

In March 2010, the FDA held an Advisory Committee to discuss the design of medical research studies (known as "clinical trial design") to evaluate serious asthma outcomes (such as hospitalizations, a procedure using a breathing tube known as intubation, or death) with the use of LABAs in the treatment of asthma in adults, adolescents, and children. It is unknown at this time what, if any, effect this FDA meeting or future FDA actions will have on the development of the RELOVAIR™ program. The current uncertainty regarding the FDA's position on LABAs for the treatment of asthma and the lack of consensus expressed at the March 2010 Advisory Committee may result in increased time and cost of the asthma clinical trials in the United States for RELOVAIR™ and may increase the overall risk of the RELOVAIR™ asthma program in the United States.

LAMA/LABA

The LAMA/LABA '719/VI combines two bronchodilator molecules currently under development, the LAMA GSK573719 ('719), and the LABA VI. In early February 2011, we and GSK announced the initiation of the Phase 3 COPD program for the once-daily '719/VI combination which will evaluate over 5,000 patients globally. A 52-week study to evaluate the long term safety and tolerability of '719 (125mcg) alone, as well as the combination '719/VI (125/25mcg), began in February 2011, and will be followed by four large pivotal studies that will compare improvements in lung function between '719/VI, its components, placebo and Spiriva® (tiotropium). The Phase 3 program also will include two further studies assessing the effect of '719/VI on exercise endurance. The Phase 3 program will investigate two doses of '719 (125mcg and 62.5mcg) and '719/VI (125/25mcg and 62.5/25mcg) across the six studies, which are expected to commence by mid-2011. GSK is responsible for funding the aforementioned studies.

8

Inhaled Bifunctional Muscarinic Antagonist-beta2 Agonist (MABA) Program

In our MABA program, we are developing with GSK a bifunctional long-acting inhaled bronchodilator, GSK961081 ('081) for the treatment of COPD. '081 is a single molecule with both muscarinic antagonist and beta2 receptor agonist activities. By combining bifunctional activity and high lung selectivity, we intend to develop a medicine with greater efficacy than single-mechanism bronchodilators (such as Spiriva® (tiotropium) or salmeterol) and equal or better tolerability.

In December 2010, we and GSK announced that the first patient had started treatment with '081 in a Phase 2b study. The overall aim of this Phase 2b study is to evaluate the safety and efficacy of '081 administered both once daily and twice daily over a 28-day period in patients with moderate to severe COPD to allow the selection of a well-tolerated and efficacious dose and dosing interval to take forward into Phase 3 development. GSK is responsible for funding all clinical studies in this program.

Central Nervous System (CNS)/Pain

Peripherally Selective Mu-Opioid Receptor Antagonist (PµMA) Program

In October 2010, we announced positive proof-of-concept results with TD-1211 in patients with opioid-induced constipation (OIC). TD-1211 is our investigational once-daily, orally-administered, peripherally selective, multivalent inhibitor of the mu-opioid receptor designed to alleviate gastrointestinal side effects of opioid therapy without affecting analgesia. We intend to progress TD-1211 into further Phase 2 work in 2011.

In January 2011, we announced that we retain sole ownership of our PµMA program as a result of GSK's decision not to exercise its right to license the program under the strategic alliance agreement.

Other Programs

In addition to RELOVAIR™, '719/VI, MABA and PµMA, we have a number of other clinical-stage programs for bacterial infections, gastrointestinal motility, CNS/pain and cognitive disorders.

Telavancin is under review by the European Medicines Agency (EMA) for the treatment of NP and cSSTI in adults. We anticipate a response from the EMA later in 2011 regarding the application.

In November 2010, the FDA issued new draft guidance for antibacterial clinical trial design for the treatment of NP with a focus on mortality as the primary efficacy endpoint. In late 2010, we received a Complete Response Letter from the FDA indicating that the telavancin Phase 3 clinical studies for NP (the ATTAIN studies) do not meet this draft guidance and that additional studies will be required for approval. We do not plan to conduct additional clinical studies for NP, but we do intend to continue a dialogue with the FDA concerning the NP application.

TD-1792 is our investigational heterodimer antibiotic that combines the antibacterial activities of a glycopeptide and a beta-lactam in one molecule. The goal of our program with TD-1792 is to develop a next-generation antibiotic for the treatment of serious infections caused by Gram-positive bacteria.

In our MARIN program for the treatment of neuropathic pain, we have successfully completed a single-ascending dose study and a multiple-ascending dose study with compound TD-9855.

Our Gastrointestinal (GI) Motility Dysfunction program is dedicated to finding new medicines for GI motility disorders such as chronic idiopathic constipation (CIC) and other disorders related to reduced gastrointestinal motility. Our lead compound in this area is TD-5108, a highly selective 5-HT4 receptor agonist that has successfully completed a 400 patient Phase 2 proof-of-concept study in CIC. The back-up compound in this program, TD-8954, has completed single-ascending and multiple-ascending dose Phase 1 studies.

9

In cognitive disorders, we are evaluating compound TD-5108 as a potential treatment for Alzheimer's disease. TD-5108 has successfully completed a Phase 1 study assessing CNS penetration.

Multivalency

Our proprietary approach combines chemistry and biology to discover new product candidates using our expertise in multivalency. Multivalency refers to the simultaneous attachment of a single molecule to multiple binding sites on one or more biological targets. When compared to monovalency, whereby a molecule attaches to only one binding site, multivalency can significantly increase a compound's potency, duration of action and/or selectivity. Multivalent compounds generally consist of several individual small molecules, at least one of which is biologically active when bound to its target, joined by linking components.

Our approach is based on an integration of the following insights:

- •

- many targets have multiple binding sites and/or exist in clusters with similar or different targets;

- •

- biological targets with multiple binding sites and/or those that exist in clusters lend themselves to multivalent drug

design;

- •

- molecules that simultaneously attach to multiple binding sites can exhibit considerably greater potency, duration of

action and/or selectivity than molecules that attach to only one binding site; and

- •

- greater potency, duration of action and/or selectivity provides the basis for superior therapeutic effects, including enhanced convenience, tolerability and/or safety compared to conventional drugs.

Our Strategy

Our objective is to discover, develop and commercialize new medicines with superior efficacy, convenience, tolerability and/or safety. The key elements of our strategy are to:

Apply our expertise in multivalency to discover and develop superior medicines in areas of significant unmet medical need. We intend to continue to concentrate our efforts on discovering and developing product candidates where:

- •

- existing drugs have levels of efficacy, convenience, tolerability and/or safety that are insufficient to meet an important

medical need;

- •

- we believe our expertise in multivalency can be applied to create superior product candidates that are more potent, longer

acting and/or more selective than currently available medicines;

- •

- there are established animal models that can be used to provide us with evidence as to whether our product candidates have

the potential to provide superior therapeutic benefits relative to current medicines; and

- •

- there is a relatively large commercial opportunity.

Identify two structurally different product candidates in each therapeutic program whenever practicable. We believe that we can increase the likelihood of successfully bringing superior medicines to market by identifying, whenever practicable, two product candidates for development in each program. Our second product candidates are typically in a different structural class from the first product candidate. Applying this strategy can reduce our dependence on any one product candidate and provide us with the potential opportunity to commercialize two compounds in a given area.

10

Partner with leading pharmaceutical companies. Our strategy is to seek collaborations with leading pharmaceutical companies to accelerate development and commercialization of our product candidates at the strategically appropriate time. The LABA collaboration and our strategic alliance with GSK and our telavancin collaboration with Astellas are examples of these types of partnerships.

Leverage the extensive experience of our people. We have an experienced senior management team with many years of experience discovering, developing and commercializing new medicines with companies such as Bristol-Myers Squibb Company, Gilead Sciences, Pfizer and ICOS Corporation.

Improve, expand and protect our technical capabilities. We have created a substantial body of know-how and trade secrets in the application of our multivalent approach to drug discovery. We believe this is a significant asset that distinguishes us from our competitors. We expect to continue to make substantial investments in drug discovery using multivalency and other technologies to maintain what we believe are our competitive advantages.

Manufacturing

Though we have limited in-house active pharmaceutical ingredient (API) production capabilities, we primarily rely on a number of third parties, including contract manufacturing organizations and our collaborative partners, to produce our active pharmaceutical ingredient and drug product. Manufacturing of compounds in the RELOVAIR™, '719/VI, and MABA programs is handled by GSK, and Astellas is now responsible for manufacture of VIBATIV™. Additionally, GSK will be responsible for the manufacture of any additional product candidates associated with the programs that it licenses under the strategic alliance agreement.

We believe that we have in-house expertise to manage a network of third-party manufacturers. We believe that we will be able to continue to negotiate third party manufacturing arrangements on commercially reasonable terms and that it will not be necessary for us to develop internal manufacturing capacity in order to commercialize our products. However, if we are unable to obtain contract manufacturing or obtain such manufacturing on commercially reasonable terms, or if manufacturing is interrupted at one of our suppliers, whether due to regulatory or other reasons, we may not be able to develop or commercialize our products as planned.

Government Regulation

The development and commercialization of our product candidates and our ongoing research are subject to extensive regulation by governmental authorities in the United States and other countries. Before marketing in the United States, any medicine we develop must undergo rigorous preclinical studies and clinical studies and an extensive regulatory approval process implemented by the FDA under the Federal Food, Drug, and Cosmetic Act. Outside the United States, our ability to market a product depends upon receiving a marketing authorization from the appropriate regulatory authorities. The requirements governing the conduct of clinical studies, marketing authorization, pricing and reimbursement vary widely from country to country. In any country, however, we will be permitted to commercialize our medicines only if the appropriate regulatory authority is satisfied that we have presented adequate evidence of the safety, quality and efficacy of our medicines.

Before commencing clinical studies in humans in the United States, we must submit to the FDA an Investigational New Drug application that includes, among other things, the results of preclinical studies. If the FDA accepts the Investigational New Drug submission, clinical studies are usually conducted in three phases and under FDA oversight. These phases generally include the following:

Phase 1. The product candidate is introduced into healthy human volunteers and is tested for safety, dose tolerance and pharmacokinetics.

11

Phase 2. The product candidate is introduced into a limited patient population to assess the efficacy of the drug in specific, targeted indications, assess dosage tolerance and optimal dosage, and identify possible adverse effects and safety risks.

Phase 3. If a compound is found to be potentially effective and to have an acceptable safety profile in Phase 2 evaluations, the clinical study will be expanded to further demonstrate clinical efficacy, optimal dosage and safety within an expanded patient population.

The results of product development, preclinical studies and clinical studies must be submitted to the FDA as part of a new drug application, or NDA. The NDA also must contain extensive manufacturing information. NDAs for new chemical entities are subject to performance goals defined in the Prescription Drug User Fee Act (PDUFA) which suggests a goal for FDA action within 6 months for applications that are granted priority review and 10 months for applications that receive standard review. For a product candidate no active ingredient of which has been previously approved by the FDA, the FDA must either refer the product candidate to an advisory committee for review or provide in the action letter on the application for the product candidate a summary of the reasons why the product candidate was not referred to an advisory committee prior to approval. In addition, under the 2008 Food and Drug Administration Amendments Act, the FDA has authority to require submission of a formal Risk Evaluation and Management Strategy (REMS) to ensure safe use of the product. At the end of the review period, the FDA communicates an approval of the NDA or issues a complete response listing the application's deficiencies.

Once approved, the FDA may withdraw the product approval if compliance with pre- and post-marketing regulatory standards is not maintained or if safety or quality issues are identified after the product reaches the marketplace. In addition, the FDA may require post-marketing studies, referred to as Phase 4 studies, to monitor the effect of approved products, and may limit further marketing of the product based on the results of these post-marketing studies. The FDA has broad post-market regulatory and enforcement powers, including the ability to suspend or delay issuance of approvals, seize products, withdraw approvals, enjoin violations, and institute criminal prosecution.

If we obtain regulatory approval for a medicine, this clearance to market the product will be limited to those diseases and conditions for which the medicine is effective, as demonstrated through clinical studies and included in the medicine's labeling. Even if this regulatory approval is obtained, a marketed medicine, its manufacturer and its manufacturing facilities are subject to continual review and periodic inspections by the FDA. The FDA ensures the quality of approved medicines by carefully monitoring manufacturers' compliance with its current Good Manufacturing Practice (cGMP) regulations. The cGMP regulations for drugs contain minimum requirements for the methods, facilities, and controls used in manufacturing, processing, and packing of a medicine. The regulations make sure that a medicine is safe for use, and that it has the ingredients and strength it claims to have. Discovery of previously unknown problems with a medicine, manufacturer or facility may result in restrictions on the medicine or manufacturer, including costly recalls or withdrawal of the medicine from the market.

We are also subject to various laws and regulations regarding laboratory practices, the experimental use of animals and the use and disposal of hazardous or potentially hazardous substances in connection with our research. In each of these areas, as above, the FDA and other regulatory authorities have broad regulatory and enforcement powers, including the ability to suspend or delay issuance of approvals, seize products, withdraw approvals, enjoin violations, and institute criminal prosecution, any one or more of which could have a material adverse effect upon our business, financial condition and results of operations.

Outside the United States our ability to market our products will also depend on receiving marketing authorizations from the appropriate regulatory authorities. Risks similar to those associated with FDA approval described above exist with the regulatory approval processes in other countries.

12

Patents and Proprietary Rights

We will be able to protect our technology from unauthorized use by third parties only to the extent that our technology is covered by valid and enforceable patents or is effectively maintained as trade secrets. Our success in the future will depend in part on obtaining patent protection for our product candidates. Accordingly, patents and other proprietary rights are essential elements of our business. Our policy is to seek in the United States and selected foreign countries patent protection for novel technologies and compositions of matter that are commercially important to the development of our business. For proprietary know-how that is not patentable, processes for which patents are difficult to enforce and any other elements of our drug discovery process that involve proprietary know-how and technology that is not covered by patent applications, we rely on trade secret protection and confidentiality agreements to protect our interests. We require all of our employees, consultants and advisors to enter into confidentiality agreements. Where it is necessary to share our proprietary information or data with outside parties, our policy is to make available only that information and data required to accomplish the desired purpose and only pursuant to a duty of confidentiality on the part of those parties.

As of December 31, 2010, we owned 228 issued United States patents and 748 granted foreign patents, as well as additional pending United States patent applications and foreign patent applications. The claims in these various patents and patent applications are directed to compositions of matter, including claims covering product candidates, lead compounds and key intermediates, pharmaceutical compositions, methods of use and processes for making our compounds along with methods of design, synthesis, selection and use relevant to multivalency in general and to our research and development programs in particular. In particular, we own, and license to Astellas, the following U.S. patents which are listed in the FDA Approved Drug Products with Therapeutic Equivalence Evaluations (Orange Book) for telavancin: U.S. Patent No. 6,635,618 B2, expiring on September 22, 2021; U.S. Patent No. 6,858,584 B2, expiring on August 24, 2022; U.S. Patent No. 6,872,701 B2, expiring on June 5, 2021; U.S. Patent No. 7,008,923 B2, expiring on May 6, 2021; U.S. Patent No. 7,208,471 B2, expiring on May 1, 2021; U.S. Patent No. 7,351,691 B2, expiring on May 1, 2021; U.S. Patent No. 7,531,623 B2, expiring on January 1, 2027; U.S. Patent No. 7,544,364 B2, expiring on May 1, 2021; and U.S. Patent No. 7,700,550 B2, expiring on May 1, 2021. On October 15, 2009, we filed patent term extension (PTE) applications in the United States Patent and Trademark Office (USPTO) for U.S. Patent Nos. 6,635,618 B2; 6,872,701 B2; and 7,208,471 B2. These PTE applications are currently pending and if granted, we will be permitted to extend the term of one of these patents for the period determined by the USPTO.

United States issued patents and foreign patents generally expire 20 years after filing. The patent rights relating to telavancin owned by us and licensed to Astellas currently consist of United States patents that expire between 2019 and 2027, additional pending United States patent applications and counterpart patents and patent applications in a number of jurisdictions, including Europe. Nevertheless, issued patents can be challenged, narrowed, invalidated or circumvented, which could limit our ability to stop competitors from marketing similar products and threaten our ability to commercialize our product candidates. Our patent position, similar to other companies in our industry, is generally uncertain and involves complex legal and factual questions. To maintain our proprietary position we will need to obtain effective claims and enforce these claims once granted. It is possible that, before any of our products can be commercialized, any related patent may expire or remain in force only for a short period following commercialization, thereby reducing any advantage of the patent. Also, we do not know whether any of our patent applications will result in any issued patents or, if issued, whether the scope of the issued claims will be sufficient to protect our proprietary position.

We have entered into a License Agreement with Janssen Pharmaceutica pursuant to which we have licensed rights under certain patents owned by Janssen covering an excipient used in the formulation of telavancin. We believe that the general and financial terms of the agreement with

13

Janssen are ordinary course terms. Pursuant to the terms of this license agreement, we are obligated to pay royalties and milestone payments to Janssen based on any commercial sales of telavancin. Astellas has agreed to assume responsibility for these payments under the terms of our license agreement with them. The license is terminable by us upon prior written notice to Janssen or upon an uncured breach or a liquidation event of one of the parties.

Competition

Our objective is to discover, develop and commercialize new medicines with superior efficacy, convenience, tolerability and/or safety. We expect that any medicines that we commercialize with our collaborative partners or on our own will compete with existing and future market-leading medicines.

Many of our potential competitors have substantially greater financial, technical and personnel resources than we have. In addition, many of these competitors have significantly greater commercial infrastructures than we have. Our ability to compete successfully will depend largely on our ability to leverage our experience in drug discovery and development to:

- •

- discover and develop medicines that are superior to other products in the market;

- •

- attract qualified scientific, product development and commercial personnel;

- •

- obtain patent and/or other proprietary protection for our medicines and technologies;

- •

- obtain required regulatory approvals; and

- •

- successfully collaborate with pharmaceutical companies in the discovery, development and commercialization of new medicines.

LABA Collaboration with GSK. We anticipate that, if approved, any product from our LABA collaboration with GSK, including RELOVAIR™ and the LAMA/LABA '719/VI, will compete with a number of approved bronchodilator drugs and drug candidates under development that are designed to treat asthma and COPD. These include but are not limited to Advair®/Seretide® (salmeterol and fluticasone as a combination) marketed by GSK, Foradil®/Oxis® (formoterol) marketed by a number of companies, Symbicort® (formoterol and budesonide as a combination) marketed by AstraZeneca Dulera®(formoterol and mometasone as a combination) marketed by Merck, and Spiriva® (tiotropium) marketed by Boehringer-Ingelheim and Pfizer. Onbrez®(indacaterol) is being developed as a single-agent by Novartis and, for markets outside of the United States, in combination with an ICS (mometasone). In addition, indacaterol combined with a muscarinic antagonist is being developed by Novartis. Boehringer-Ingelheim is developing a combination product with tiotropium and the long-acting beta agonist olodaterol for the treatment of COPD. In addition, several firms are reported to be developing new formulations of salmeterol-fluticasone and formoterol-budesonide which may be marketed as generics or branded generics relative to the existing products from GSK and AstraZeneca, respectively. All of these efforts represent potential competition for any product from our LABA collaboration.

VIBATIV™ (telavancin). VIBATIV™ competes with vancomycin, a generic drug that is manufactured by a variety of companies, as well as other drugs marketed to treat complicated skin and skin structure infections caused by Gram-positive bacteria. Currently marketed products include but are not limited to Cubicin® (daptomycin) marketed by Cubist Pharmaceuticals, Xyvox® (linezolid) marketed by Pfizer and Tygacil® (tigecycline) marketed by Wyeth. In addition, Teflaro™ (ceftaroline) to be marketed by Forest Laboratories was approved by the FDA in October 2010 and launch is expected in 2011. To compete effectively with these medicines, and in particular with the relatively inexpensive generic option of vancomycin, we and our partner Astellas will need to demonstrate to physicians that, based on experience, clinical data, side-effect profiles and other factors, VIBATIV™ is preferable to

14

vancomycin and other existing or subsequently-developed anti-infective drugs in certain clinical situations.

In addition, as the principles of multivalent medicine design become more widely known and appreciated based on patent and scientific publications and regulatory filings, we expect the field to become highly competitive. Pharmaceutical companies, biotechnology companies and academic and research institutions may seek to develop product candidates based upon the principles underlying our multivalent technologies.

Employees

As of December 31, 2010, we had 193 employees, 142 of which were primarily engaged in research and development activities. None of our employees are represented by a labor union. We consider our employee relations to be good.

Available Information

Our Internet address is www.theravance.com. Our investor relations website is located at http://ir.theravance.com. We make available free of charge on our investors relations website under "SEC Filings" our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, our directors' and officers' Section 16 Reports and any amendments to those reports as soon as reasonably practicable after filing or furnishing such materials to the U.S. Securities and Exchange Commission (SEC). The information found on our website is not part of this or any other report that we file with or furnish to the SEC. Theravance and the Theravance logo are registered trademarks of Theravance, Inc. Trademarks, tradenames or service marks of other companies appearing in this report are the property of their respective owners.

In addition to the other information in this Annual Report on Form 10-K, the following risk factors should be considered carefully in evaluating our business and us.

Risks Related to our Business

If the RELOVAIR™ Phase 3 program in asthma or chronic obstructive pulmonary disease (COPD) does not demonstrate safety and efficacy, the RELOVAIR™ program will be significantly delayed or terminated, our business will be harmed, and the price of our securities could fall.

The RELOVAIR™ Phase 3a program for COPD commenced in October 2009, the RELOVAIR™ Phase 3a program for asthma commenced in March 2010 and the RELOVAIR™ Phase 3b program for COPD commenced in February 2011. Any adverse developments or results or perceived adverse developments or results with respect to the RELOVAIR™ program will significantly harm our business and could cause the price of our securities to fall. Examples of such adverse developments include, but are not limited to:

- •

- the U.S. Food and Drug Administration (FDA) determining that additional clinical studies are required with respect to the

Phase 3a program in asthma or the Phase 3 program in COPD;

- •

- inability to gain, or delay in gaining, regulatory approval for the new delivery device used in the program;

- •

- safety or other concerns arising from ongoing preclinical or clinical studies in this program, including, without

limitation, the COPD extensive outcomes study initiated in February 2011;

- •

- safety or other concerns arising from the LAMA/LABA '719/VI Phase 3 program having to do with the LABA, VI, which

is also a component of RELOVAIR™;

- •

- the Phase 3a program in asthma or the Phase 3 program in COPD raising safety concerns or not demonstrating

efficacy; or

- •

- any change in FDA policy or guidance regarding the use of long-acting beta2 agonists (LABAs) to treat asthma.

15

On February 18, 2010, the FDA announced that LABAs should not be used alone in the treatment of asthma and will require manufacturers to include this warning in the product labels of these drugs, along with taking other steps to reduce the overall use of these medicines. The FDA will now require that the product labels for LABA medicines reflect, among other things, that the use of LABAs is contraindicated without the use of an asthma controller medication such as an inhaled corticosteroid, that LABAs should only be used long-term in patients whose asthma cannot be adequately controlled on asthma controller medications, and that LABAs should be used for the shortest duration of time required to achieve control of asthma symptoms and discontinued, if possible, once asthma control is achieved. In addition, on March 10 and 11, 2010, the FDA held an Advisory Committee to discuss the design of medical research studies (known as "clinical trial design") to evaluate serious asthma outcomes (such as hospitalizations, a procedure using a breathing tube known as intubation, or death) with the use of LABAs in the treatment of asthma in adults, adolescents, and children. It is unknown at this time what, if any, effect these or future FDA actions will have on the development of the RELOVAIR™ program. The current uncertainty regarding the FDA's position on LABAs for the treatment of asthma and the lack of consensus expressed at the March 2010 Advisory Committee may result in increased time and cost of the asthma clinical trials in the United States for RELOVAIR™ and may increase the overall risk of the RELOVAIR™ asthma program in the United States.

If the '719/VI Phase 3 program for the treatment of COPD does not demonstrate safety and efficacy, the '719/VI program will be significantly delayed or terminated, our business will be harmed, and the price of our securities could fall.

The '719/VI Phase 3 program with the combination of the LABA vilanterol, or VI, and the long-acting muscarinic antagonist (LAMA) GSK573719, or '719, for the treatment of COPD commenced in February 2011. Any adverse developments or results or perceived adverse developments or results with respect to the '719/VI program will significantly harm our business and could cause the price of our securities to fall. Examples of such adverse developments include, but are not limited to:

- •

- the FDA determining that additional clinical studies are required with respect to the Phase 3 program in COPD;

- •

- inability to gain, or delay in gaining, regulatory approval for the new delivery device used in the program;

- •

- safety or other concerns arising from ongoing preclinical or clinical studies in this program;

- •

- safety or other concerns arising from the RELOVAIR™ Phase 3 program having to do with the LABA, VI,

which is also a component of '719/VI;

- •

- the Phase 3 program in COPD raising safety concerns or not demonstrating efficacy; or

- •

- any change in FDA policy or guidance regarding the use of LABAs combined with a LAMA to treat COPD.

If the MABA Phase 2b study for the treatment of COPD does not demonstrate safety and efficacy, the MABA program will be significantly delayed or terminated, our business will be harmed, and the price of our securities could fall.

The Phase 2b COPD clinical study with the lead compound, GSK961081 ('081), in the bifunctional muscarinic antagonist-beta2 agonist (MABA) program with GSK commenced in December 2010. Any adverse developments or results or perceived adverse developments or results with respect to this study

16

will harm our business and could cause the price of our securities to fall. Examples of such adverse developments include, but are not limited to:

- •

- the FDA determining that additional pre-clincal or earlier stage clinical studies are required with respect to

the MABA program;

- •

- inability to gain, or delay in gaining, regulatory approval for the new delivery device used in the program;

- •

- safety or other concerns arising from ongoing preclinical or clinical studies in this program;

- •

- the Phase 2b study raising safety concerns or not demonstrating efficacy; or

- •

- any change in FDA policy or guidance regarding the use of MABAs to treat COPD.

If telavancin is not approved in additional countries and for additional indications, our business will be adversely affected and the price of our securities could fall.

On October 28, 2009, Astellas Pharma Europe B.V., a subsidiary of our telavancin partner, Astellas Pharma Inc. (Astellas), announced that it submitted a new European Marketing Authorization Application (MAA) for telavancin to the European Medicines Agency for the treatment of complicated skin and soft tissue infections (cSSTI) and nosocomial pneumonia (NP). On November 30, 2009, we announced that the European Medicines Agency had completed the validation phase for the MAA and the European Medicines Agency's scientific review process had begun. In October 2008, we announced that Astellas Pharma Europe B.V. voluntarily withdrew a previously filed MAA for telavancin for the treatment of cSSTI from the European Medicines Agency based on communications from the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency that the data provided were not sufficient to allow the CHMP to conclude a positive benefit-risk balance for telavancin for the sole indication of cSSTI at that time.

If the European Medicines Agency does not approve the MAA, requires data from additional clinical studies regarding telavancin, or if telavancin is ultimately approved by the European Medicines Agency but with restrictions, including labeling that may limit the targeted patient population, our business will be harmed and the price of our securities could fall.

Our first New Drug Application (NDA), for VIBATIV™ (telavancin) for the treatment of complicated skin and skin structure infections (cSSSI) caused by susceptible Gram-positive bacteria in adult patients, was approved by the FDA in September 2009. In January 2009, we submitted a second telavancin NDA to the FDA for the NP indication based on data from our two Phase 3 clinical studies referred to as the ATTAIN studies. During the fourth quarter of 2010 the FDA issued new draft guidance for antibacterial clinical trial design for the treatment of NP with a focus on mortality as the primary efficacy endpoint. The ATTAIN studies, which were conducted pursuant to then-current draft FDA guidelines and completed prior to the issuance of this new draft guidance, used clinical response as the primary efficacy endpoint. In late 2010, we received a Complete Response Letter from the FDA indicating that the ATTAIN studies do not meet the new draft guidance and that additional clinical studies will be required for approval. We do not plan to conduct additional clinical studies for NP, but we do intend to continue a dialogue with FDA concerning the NP NDA. Lack of FDA approval for use of telavancin to treat NP has adversely affected and will continue to adversely affect commercialization of this medicine in the United States.

17

If any product candidates, in particular those in any respiratory program with GSK, are determined to be unsafe or ineffective in humans, our business will be adversely affected and the price of our securities could fall.

Although our first approved product, VIBATIV™, was commercially launched in the U.S. by our partner Astellas in November 2009, we have not yet commercialized any of our other product candidates. We are uncertain whether any of our other product candidates will prove effective and safe in humans or meet applicable regulatory standards. In addition, our approach to applying our expertise in multivalency to drug discovery may not result in the creation of successful medicines. The risk of failure for our product candidates is high. For example, in late 2005, we discontinued our overactive bladder program based upon the results of our Phase 1 studies with compound TD-6301, and GSK discontinued development of TD-5742, the first LAMA compound licensed from us, after completing a single-dose Phase 1 study. The data supporting our drug discovery and development programs is derived solely from laboratory experiments, preclinical studies and clinical studies. A number of other compounds remain in the lead identification, lead optimization, preclinical testing or early clinical testing stages.

Several well-publicized Complete Response letters issued by the FDA and safety-related product withdrawals, suspensions, post-approval labeling revisions to include boxed warnings and changes in approved indications over the last few years, as well as growing public and governmental scrutiny of safety issues, have created an increasingly conservative regulatory environment. The implementation of new laws and regulations, and revisions to FDA clinical trial design guidance, have increased uncertainty regarding the approvability of a new drug. Further, there are additional requirements for approval of new drugs, including advisory committee meetings for new chemical entities, and formal risk evaluation and mitigation strategy (REMS) at the FDA's discretion. These new laws, regulations, additional requirements and changes in interpretation could cause non-approval or further delays in the FDA's review and approval of our product candidates.

With regard to all of our programs, any delay in commencing or completing clinical studies for product candidates and any adverse results from clinical or preclinical studies or regulatory obstacles product candidates may face, would harm our business and could cause the price of our securities to fall.

Each of our product candidates must undergo extensive preclinical and clinical studies as a condition to regulatory approval. Preclinical and clinical studies are expensive, take many years to complete and study results may lead to delays in further studies or decisions to terminate programs. For example, we had planned to commence the Phase 2b clinical study in our MABA program with GSK in 2009, but the program was delayed until late 2010.

The commencement and completion of clinical studies for our product candidates may be delayed by many factors, including:

- •

- lack of effectiveness of product candidates during clinical studies;

- •

- adverse events, safety issues or side effects relating to the product candidates or their formulation into medicines;

- •

- inability to raise additional capital in sufficient amounts to continue our development programs, which are very

expensive;

- •

- the need to sequence clinical studies as opposed to conducting them concomitantly in order to conserve resources;

- •

- our inability to enter into partnering arrangements relating to the development and commercialization of our programs and product candidates;

18

- •

- our inability or the inability of our collaborators or licensees to manufacture or obtain from third parties materials

sufficient for use in preclinical and clinical studies;

- •

- governmental or regulatory delays and changes in regulatory requirements, policy and guidelines;

- •

- failure of our partners to advance our product candidates through clinical development;

- •

- delays in patient enrollment and variability in the number and types of patients available for clinical studies;

- •

- difficulty in maintaining contact with patients after treatment, resulting in incomplete data;

- •

- varying interpretations of data by the FDA and similar foreign regulatory agencies; and

- •

- a regional disturbance where we or our collaborative partners are enrolling patients in our clinical trials, such as a pandemic, terrorist activities or war, political unrest or a natural disaster.

If our product candidates that we develop on our own or through collaborative partners are not approved by regulatory agencies, including the FDA, we will be unable to commercialize them.

The FDA must approve any new medicine before it can be marketed and sold in the United States. We must provide the FDA and similar foreign regulatory authorities with data from preclinical and clinical studies that demonstrate that our product candidates are safe and effective for a defined indication before they can be approved for commercial distribution. We will not obtain this approval for a product candidate unless and until the FDA approves a NDA. The processes by which regulatory approvals are obtained from the FDA to market and sell a new product are complex, require a number of years and involve the expenditure of substantial resources. In order to market our medicines in foreign jurisdictions, we must obtain separate regulatory approvals in each country. The approval procedure varies among countries and can involve additional testing, and the time required to obtain approval may differ from that required to obtain FDA approval. Approval by the FDA does not ensure approval by regulatory authorities in other countries, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. Conversely, failure to obtain approval in one or more jurisdictions may make approval in other jurisdictions more difficult.

Clinical studies involving our product candidates may reveal that those candidates are ineffective, inferior to existing approved medicines, unacceptably toxic, or that they have other unacceptable side effects. In addition, the results of preclinical studies do not necessarily predict clinical success, and larger and later-stage clinical studies may not produce the same results as earlier-stage clinical studies.

Frequently, product candidates that have shown promising results in early preclinical or clinical studies have subsequently suffered significant setbacks or failed in later clinical studies. In addition, clinical studies of potential products often reveal that it is not possible or practical to continue development efforts for these product candidates. If our clinical studies are substantially delayed or fail to prove the safety and effectiveness of our product candidates in development, we may not receive regulatory approval of any of these product candidates and our business and financial condition will be materially harmed and the price of our securities may fall.

VIBATIV™ may not be accepted by physicians, patients, third party payors, or the medical community in general.

The commercial success of VIBATIV™ depends upon its acceptance by physicians, patients, third party payors and the medical community in general. We cannot be sure that VIBATIV™ will be accepted by these parties. VIBATIV™ competes with vancomycin, a relatively inexpensive generic drug that is manufactured by a variety of companies, and a number of existing antibacterials manufactured and marketed by major pharmaceutical companies and others, and may compete against new

19

antibacterials that are not yet on the market. Even if the medical community accepts that VIBATIV™ is safe and efficacious for its indicated use, physicians may choose to restrict the use of VIBATIV™. If we and our partner, Astellas, are unable to demonstrate to physicians that, based on experience, clinical data, side-effect profiles and other factors, VIBATIV™ is preferable to vancomycin and other antibacterial drugs, we may never generate meaningful revenue from VIBATIV™ which could cause the price of our securities to fall. The degree of market acceptance of VIBATIV™ depends on a number of factors, including, but not limited to:

- •

- the demonstration of the clinical efficacy and safety of VIBATIV™;

- •

- the reactions of physicians, patients and payors to the approved cSSSI labeling for VIBATIV™ in the U.S.;

- •

- whether or not VIBATIV™ is approved by regulatory authorities in Europe or other jurisdictions;

- •

- the advantages and disadvantages of VIBATIV™ compared to alternative therapies;

- •

- potential negative perceptions of physicians related to our inability to obtain FDA approval of our NP NDA;

- •

- our and Astellas' ability to educate the medical community about the safety and effectiveness of VIBATIV™;

- •

- the reimbursement policies of government and third party payors; and

- •

- the market price of VIBATIV™ relative to competing therapies.

Even if our product candidates receive regulatory approval, such as VIBATIV™, commercialization of such products may be adversely affected by regulatory actions and oversight.

Even if we receive regulatory approval for our product candidates, this approval may include limitations on the indicated uses for which we can market our medicines or the patient population that may utilize our medicines, which may limit the market for our medicines or put us at a competitive disadvantage relative to alternative therapies. For example, VIBATIV™'s labeling contains a boxed warning regarding the risks of use of VIBATIV™ during pregnancy. Products with boxed warnings are subject to more restrictive advertising regulations than products without such warnings. These restrictions could make it more difficult to market VIBATIV™ effectively. Further, now that VIBATIV™ is approved, we remain subject to continuing regulatory obligations, such as safety reporting requirements and additional post-marketing obligations, including regulatory oversight of promotion and marketing.

In addition, the labeling, packaging, adverse event reporting, advertising, promotion and recordkeeping for the approved product remain subject to extensive and ongoing regulatory requirements. If we become aware of previously unknown problems with an approved product in the U.S. or overseas or at contract manufacturers' facilities, a regulatory agency may impose restrictions on the product, the contract manufacturers or on us, including requiring us to reformulate the product, conduct additional clinical studies, change the labeling of the product, withdraw the product from the market or require the contract manufacturer to implement changes to its facilities. In addition, we may experience a significant drop in the sales of the product, our royalties on product revenues and reputation in the marketplace may suffer, and we could face lawsuits.

We are also subject to regulation by regional, national, state and local agencies, including the Department of Justice, the Federal Trade Commission, the Office of Inspector General of the U.S. Department of Health and Human Services and other regulatory bodies with respect to VIBATIV™, as well as governmental authorities in those foreign countries in which any of our product candidates are

20

approved for commercialization. The Federal Food, Drug, and Cosmetic Act, the Public Health Service Act and other federal and state statutes and regulations govern to varying degrees the research, development, manufacturing and commercial activities relating to prescription pharmaceutical products, including preclinical and clinical testing, approval, production, labeling, sale, distribution, import, export, post-market surveillance, advertising, dissemination of information and promotion. If we or any third parties that provide these services for us are unable to comply, we may be subject to regulatory or civil actions or penalties that could significantly and adversely affect our business. Any failure to maintain regulatory approval will limit our ability to commercialize our product candidates, which would materially and adversely affect our business and financial condition, which may cause our stock price to decline.

We have incurred operating losses in each year since our inception and expect to continue to incur substantial losses for the foreseeable future.

We have been engaged in discovering and developing compounds and product candidates since mid-1997. Our first approved product, VIBATIV™, was launched by our partner Astellas in the U.S. in November 2009, and to date we have received modest royalty revenues. From the commercial launch through December 31, 2010, Astellas recorded VIBATIV™ net sales of $10.5 million. We recognize royalty revenue from Astellas in the period the royalties are earned based on net sales of VIBATIV™ by Astellas as reported to us by Astellas. We may never generate sufficient revenue from the sale of medicines or royalties on sales by our partners to achieve profitability. As of December 31, 2010, we had an accumulated deficit of approximately $1.2 billion.

We expect to incur substantial expenses as we continue our drug discovery and development efforts, particularly to the extent we advance our product candidates into and through clinical studies, which are very expensive. As a result, we expect to continue to incur substantial losses for the foreseeable future. We are uncertain when or if we will be able to achieve or sustain profitability. Failure to become and remain profitable would adversely affect the price of our securities and our ability to raise capital and continue operations.

If we fail to obtain the capital necessary to fund our operations, we may be unable to develop our product candidates and we could be forced to share our rights to commercialize our product candidates with third parties on terms that may not be favorable to us.

We need large amounts of capital to support our research and development efforts. If we are unable to secure capital to fund our operations we will not be able to continue our discovery and development efforts and we might have to enter into strategic collaborations that could require us to share commercial rights to our medicines to a greater extent than we currently intend. Based on our current operating plans, milestone and royalty forecasts and spending assumptions, we believe that our cash and cash equivalents and marketable securities will be sufficient to meet our anticipated operating needs for at least the next twelve months. We are likely to require additional capital to fund operating needs thereafter. Though we have no current intention to do so, if we were to conduct additional studies to support the telavancin NP NDA and we were required to fund such studies, our capital needs could increase substantially. We intend to continue clinical development of the lead compounds in our PµMA and MARIN programs, and anticipate initiating additional Phase 2 and Phase 2b studies for PµMA and additional Phase 1 studies and a Phase 2 study for MARIN. We also intend to conduct a number of other preclinical and clinical studies in other programs. In addition, under our LABA collaboration with GSK, in the event that vilanterol (VI), which is the current lead LABA product candidate in the RELOVAIR™ and LAMA/LABA ('719/VI) programs and which was discovered by GSK, is approved and launched in multiple regions of the world as both a single agent and a combination product or two different combination products, we will be obligated to pay GSK milestone payments that could total as much as $220.0 million and we would not be entitled to receive any

21

further milestone payments from GSK . We cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Even if we are able to raise additional capital, such financing may result in significant dilution to existing security holders. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to make additional reductions in our workforce and may be prevented from continuing our discovery and development efforts and exploiting other corporate opportunities. This could harm our business, prospects and financial condition and cause the price of our securities to fall.

If our partners do not satisfy their obligations under our agreements with them, or if they terminate our partnership with them, we will be unable to develop our partnered product candidates as planned.