Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-34781

Motricity, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 20-1059798 | |

| (State of Incorporation) | (IRS Employer Identification No.) |

601 108th Ave Northeast

Suite 800

Bellevue, WA 98004

(425) 957-6200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.001 per share | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

| Non-accelerated Filer | x (do not check if a smaller reporting company) | Smaller Reporting Company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

At June 30, 2010, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant (based upon the closing sale price of such shares on NASDAQ on June 30, 2010) was approximately $121.3 million. Shares of Registrant’s common stock held by each executive officer and director and by each entity or person that, to the Registrant’s knowledge, owned 5% or more of Registrant’s outstanding common stock as of June 30, 2010 have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock as of February 18, 2011:

| Title of Class |

Number of Shares | |

| Common Stock, $0.001 par value | 43,083,831 |

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the Registrant’s proxy statement for the 2011 annual meeting of stockholders, which will be filed no later than 120 days after the close of the Registrant’s fiscal year ended December 31, 2010. In the event such proxy statement is not filed within 120 days after the close of the Registrant’s fiscal year ended December 30, 2010, the required information will be filed as an amendment to this report on Form 10-K no later than that date.

PART I

| Item 1. | Business. |

Overview

We are a leading provider of mobile data solutions that enable wireless carriers and enterprises to deliver high value mobile data services to their subscribers and customers. We provide a comprehensive suite of hosted, managed service offerings, which includes services to access the Internet using a mobile device, services to market and distribute a wide range of mobile content and applications, messaging services and billing support and settlement services. These services enable wireless carriers to deliver customized, carrier-branded mobile data services and provide enterprises with a means to gain direct, interactive access to their customers through the mobile device.

Our mCore service delivery platform provides the tools for mobile subscribers to easily locate and access personally relevant and location-based content and services, engage in social networking and download content and applications. We also leverage our data-rich insights into subscriber behavior and our user interface expertise to provide a highly personalized mobile data experience and targeted mobile marketing solutions. By enabling wireless carriers to deliver a personalized subscriber experience, we enhance their ability to attract and retain mobile subscribers, increase the average revenue per user for mobile data services, or mobile data ARPU, and reduce network overhead and operating costs. We also facilitate effective monetization for mobile content and application providers by making it easier for them to reach millions of targeted subscribers with customized offerings. For enterprises, we enable the use of mobile data services to help attract new customers and retain existing customers while at the same time creating new opportunities for revenue generation and cost reduction for their existing business.

Our operations are predominantly based in the U.S., with international operations in the Europe, India and Southeast Asia. Our customers include the top U.S. wireless carriers, Verizon Wireless, AT&T and Sprint as well as leading international carriers, including members of the Axiata Group (XL, Celcom, Dialog, Robi and Hello) and Reliance. Since 2005, Motricity has generated over $2.7 billion in gross revenue for our carrier customers through the sale of content and applications and powered over 60 billion page views through access to the mobile Internet. For year ended December 31, 2010, we generated revenue of $133.4 million and incurred a net loss of $7.0 million. For the year ended December 31, 2009, we generated revenue of $113.7 million and incurred a net loss of $16.3 million. For the year ended December 31, 2008, we generated revenue of $103.2 million and incurred a net loss of $78.0 million. Revenue from managed services accounted for 68%, 72% and 83% of our revenues for the years ended December 31, 2010, 2009 and 2008, respectively, while revenue from professional services accounted for 32%, 28% and 17% of total revenues in each period, respectively. See Note 2 to our consolidated financial statements for revenues attributed to, and long-lived assets located in, the U.S. and all foreign countries.

History

Motricity, Inc., a Delaware corporation, was incorporated on March 17, 2004 under the name Power By Hand, Inc. (“PBH, Inc.”). PBH, Inc. was formed as a new entity to be the surviving corporation in the merger of Pinpoint Networks, Inc. (the acquiring corporation for accounting purposes) and Power By Hand Holdings, LLC (“PBH Holdings”), which occurred on April 30, 2004. On October 29, 2004, we changed our name from Power By Hand, Inc. to Motricity, Inc. In 2007, we acquired the assets of the mobile division of InfoSpace, Inc. (“InfoSpace Mobile”). Located in Bellevue, Washington, InfoSpace Mobile was a provider of mobile content solutions and services for the wireless industry. On June 23, 2010, we completed our offering of 6,000,000 shares of common stock in an initial public offering. Our common stock is currently traded publicly on the NASDAQ Global Market under the symbol “MOTR.”

2

Recent Developments

On January 31, 2011, we entered into an arrangement agreement (the “Arrangement Agreement”) with Adenyo, Inc., a corporation incorporated pursuant to the federal laws of Canada (“Adenyo”) and the other parties signatory thereto. Adenyo is a mobile marketing, advertising and analytics solutions provider with operations in the United States, Canada and France. Pursuant to the Arrangement Agreement, one of our wholly-owned subsidiaries will acquire all the outstanding common shares of Adenyo for an aggregate purchase price of approximately $100 million (plus a contingent “earn-out” payment of up to $50 million), subject to working capital and other customary adjustments, and Adenyo will become a wholly-owned subsidiary. We will pay no less than $50 million of the initial $100 million purchase price with cash consideration, and the remaining consideration will be payable in our discretion in cash, shares of Company common stock, or a mix of cash and shares. We expect to complete the acquisition of Adenyo in April 2011.

Industry background

The market for mobile data services

The number of mobile subscribers has grown rapidly over the past 10 years. The Yankee Group, an independent market research firm, estimates that the number of mobile subscribers in the U.S. will grow from 285 million in 2009 to 304 million in 2013, and worldwide will grow from 4.4 billion in 2009 to 5.3 billion in 2013. Emerging markets, such as those in Southeast Asia, India and Latin America, are experiencing the most rapid growth in mobile subscribers. Early mobile subscribers used mobile phones primarily for voice services, as mobile data services were not available on the initial wireless networks. The Yankee Group estimates that the proportion of U.S. subscribers owning smartphones increased to 12% in 2009 from 9% in 2008 and 6% in 2007. The share of smartphones as a percentage of the overall mobile device market is projected to continue growing. With the advent of the Internet and the evolution of wireless networks and mobile phones, mobile subscribers have increased their demand for mobile content, including information, images, music and video, and for mobile applications, including games and productivity tools.

The Yankee Group estimates that the mobile data services market in the U.S. will grow from $40 billion in 2009 to $48 billion in 2013, and worldwide will grow from $195 billion in 2009 to $253 billion in 2013. The mobile data services market predominantly includes data access, content and applications, commerce and messaging services. We believe the current market for our services is the mobile content delivery platform market, which includes portals and mobile marketplaces. Given the complexity of this market, wireless carriers often use third-party content delivery platforms to deliver mobile data services to their subscribers. The Yankee Group estimates that the North American market for mobile content delivery platforms will grow from $553 million in 2009 to $862 million in 2013, which represents a compound annual growth rate of 12%, and worldwide will grow from $2.9 billion in 2009 to $4.3 billion in 2013, which represents a compound annual growth rate of 11%. This market is projected to continue to grow as wireless carriers continue to improve the speed and quality, and lower the total cost, of mobile data services, and as mobile phone manufacturers continue to develop and deliver mobile phones with increasing levels of features and functions, addressing mobile subscriber demand. This will be especially the case in emerging markets, where wireless carriers are still in the process of rolling out 3G networks and will need to provide mobile data services that are differentiated, high value and cost effective to implement and to manage. Finally, as mobile data services become more heavily adopted, enterprises will increasingly desire to have a mobile presence and to include mobile as part of their overall marketing and distribution approach.

Wireless carrier dynamics

Wireless carriers operate in a highly competitive market and face growing challenges to attract and retain subscribers and expand total ARPU. As the demand for mobile data services continues to grow, the following industry dynamics affect wireless carriers:

Mobile voice ARPU declining. As the market for mobile voice services has matured and becomes more commoditized, competition among wireless carriers to acquire and retain subscribers has intensified, placing

3

greater downward pressure on voice services revenue. The Yankee Group estimates that monthly mobile voice ARPU in the U.S. will decline from $40.67 in 2009 to $36.34 in 2013, and worldwide will decline from $13.94 in 2009 to $11.89 in 2013.

Mobile data ARPU increasing. The rising capabilities of data-enabled mobile devices combined with the increasing capacity and speed of wireless networks has resulted in significant growth in the demand for mobile data services. Mobile data ARPU has been increasing, which we believe is due to wireless carriers aggressively marketing new mobile data services and pricing plans to attract and retain mobile subscribers. The Yankee Group estimates that the monthly mobile data ARPU in the U.S. will increase from $12.15 in 2009 to $13.16 in 2013, and worldwide will grow from $3.88 in 2009 to $4.06 in 2013. As wireless carriers continue to spend billions of dollars upgrading their wireless networks to handle the accelerated growth in data traffic, they are expected to continue to focus on growing mobile data revenue.

Smartphone market share increasing. With the launch of the newest versions of the iPhone, Android and Blackberry, smartphones are becoming an increased percentage of phones serviced by the wireless carriers. The Yankee Group estimates that the proportion of U.S. subscribers owning smartphones increased to 12% in 2009 from 9% in 2008 and 6% in 2007. The share of smartphones as a percentage of the overall mobile device market is projected to continue growing. We believe that these smartphone users tend to use more data services due to the enhanced capabilities of their devices. As the percentage of smartphones increases further, wireless carriers will need to understand how to extend their mobile data services to allow for application and content delivery to these new phones.

Premium content and applications revenue increasing. As the capabilities of mobile devices and mobile data networks continue to increase and as consumers come to expect more from their mobile experience, the market for premium content and applications will continue to expand. The Yankee Group estimates that consumer spending for premium mobile content and applications will grow from $9.5 billion in 2009 to $12.2 billion in 2013 in the U.S., and from $80.9 billion in 2009 to $114.9 billion in 2013 worldwide.

Competition increasing. The growth dynamics of the mobile data services market and mobile devices and their operating systems have attracted non-carrier participants into the market, including Apple and Google. These relatively new entrants are offering access to mobile content and applications through their own solutions and are capturing a greater portion of value being created in the mobile data market. We believe that, as Apple, Google and other participants continue to focus on this market opportunity, and as open standards continue to proliferate, wireless carriers will experience stronger competitive pressure to design, develop and deploy leading-edge mobile data service solutions that will enable them to compete in an increasingly open marketplace.

Mobile subscriber loyalty being challenged. Retaining mobile subscribers has become more difficult given the wider adoption of number portability, in which subscribers are able to retain their phone numbers even if they change wireless carriers, and the accelerated adoption of prepaid mobile service plans, particularly in international markets. The difficulty in retaining subscribers grows as new competitive mobile devices and platforms are introduced into the market and as new entrants take more aggressive approaches toward acquiring new customers. Additional threats arise as Internet incumbents like Google and Yahoo! enter the mobile market and offer mobile subscribers alternative means to access and consume mobile data services.

Mobile data ecosystem complexity increasing. A complex mobile data ecosystem has developed as a result of the large and growing mobile data services market opportunity, and the diversification of industry participants involved, including wireless carriers, mobile device manufacturers, operating system developers, and mobile content and application providers. This ecosystem will continue to change rapidly as new mobile devices and operating systems are introduced into the market, new mobile content and applications are developed, and as mobile subscribers continue to make greater demands for an enhanced and personalized subscriber experience.

Continued challenges of internally developed solutions. Historically, many wireless carriers provided mobile data services directly to their mobile subscribers through internally developed proprietary solutions. These solutions

4

predominantly consisted of point solutions for specific needs. As the mobile data ecosystem becomes more complex, wireless carriers are challenged to manage the ever-changing dynamics in the mobile data services market. Wireless carriers have to spend significant time, capital and other resources to develop, implement, maintain and upgrade their internal solutions. As wireless carriers are increasingly required to focus their efforts on wireless network deployment and subscriber acquisition, they have faced greater challenges in delivering the type of high value subscriber experience required to compete and fully capitalize on opportunities within the mobile data services market.

Mobile content and application provider dynamics

Mobile content and application providers operate in a highly fragmented market and face increasing challenges to cost-effectively reach the broadest base of mobile subscribers and monetize their offerings. As the demand for mobile data services grows, the following industry dynamics affect mobile content and application providers:

Limited reach and distribution. The mobile content and application provider community consists of hundreds of thousands of participants, most of whom, we believe, do not have the experience, scale or resources necessary to effectively and affordably access mobile subscribers.

Limited infrastructure. Most mobile content and application providers do not have the necessary infrastructure to effectively monetize their mobile offerings. They generally have limited capabilities with respect to delivery, quality assurance, purchase confirmation, billing and settlement. In addition, given the wide variety of mobile devices in the market, with different screen sizes and resolution, mobile content and applications must be adapted to each possible configuration in order to enhance the subscriber experience. Content and application providers continue to face challenges each year with non-delivered content and applications, poor customer service and mobile phone or wireless network compatibility issues.

Mobile subscriber dynamics

As the mobile phone increasingly becomes an indispensable part of their everyday lives, mobile subscribers are demanding an enhanced, personalized subscriber experience, with easy access to content and applications on a real-time basis. As the demand for mobile data services grows, the following industry dynamics affect mobile subscribers:

Increasing mobile device capabilities and aggressive pricing plans. Mobile subscribers are rapidly upgrading their mobile devices, and often select devices with the latest features and capabilities. In addition, through increased competition in the mobile data market, mobile subscribers have access to attractively priced mobile service plans and promotions.

Growth of wireless in emerging international markets. In many emerging international markets, mobile data services are expected to experience significant growth. In these markets, landline access is anticipated to be low as compared to mobile lines, with the result that mobile lines present the opportunity to be the primary means for consumers to access the Internet and mobile content and applications. As wireless networks continue to penetrate these emerging markets, mobile subscribers and the demand for mobile data services are expected to continue to expand.

Access to the increasing variety of mobile data services. Currently, mobile subscribers often have difficulty locating, connecting to, downloading and using the ever-increasing variety of mobile data services available on their mobile devices, such as checking email, keeping up with social networks, and downloading the latest content and applications. In addition, poorly designed user interfaces and content and applications that are not optimized for mobile devices often inhibit the mobile subscriber experience.

Enhanced personalization and customization. Mobile subscribers are demanding a more personalized experience with mobile data services, including real-time access to personally relevant and location-based content and

5

services and social networking. As the mobile phone becomes increasingly integrated into their everyday lives, mobile subscribers are demanding the ability to customize their mobile data experience to meet their preferences.

Enterprise dynamics

As the mobile data market expands and as consumers get more comfortable using their mobile phones to gain real-time, interactive access to content, applications, goods and services, enterprises are beginning to utilize this new medium to more efficiently and effectively reach their customers and employees. Mobile data services can help enterprises attract new customers and retain existing customers while at the same time creating new opportunities for revenue generation and cost reduction for their existing business. However, there are significant challenges related to enterprises’ ability to capitalize on this tremendous market opportunity, as they are faced with the same issues around increasing mobile data ecosystem complexity described above.

Demand for content delivery platforms

Given the complexity of the mobile data ecosystem, with evolving technologies and a proliferation of mobile devices and operating systems, the current landscape in the mobile data services market has become increasingly challenging for wireless carriers and enterprises to manage effectively on their own. We believe that, by partnering with a content platform provider, wireless carriers are able to more effectively leverage their brands to provide an enhanced subscriber experience with mobile data services, enabling them to attract and retain subscribers and increase mobile data ARPU. In addition, wireless carriers are seeking to utilize subscriber usage data to provide a more relevant, timely and personalized user experience that is secure, private, and customized for targeted offerings. For enterprises, partnering with a content platform provider allows them to leverage the power and potential of mobile data services to deliver a more effective and efficient means to interact with their customers. By partnering with a content delivery platform provider, wireless carriers and enterprises are able to optimize their mobile data services strategy, and to focus on their core competencies.

The Motricity solution

We have designed and developed the mCore service delivery platform to deliver numerous benefits, including the following:

Wireless carriers. We use customizable, modular solutions that enable wireless carriers to rapidly develop, deploy, and deliver mobile data services. Wireless carriers are able to deliver a high value, carrier-branded mobile data experience, which provides their mobile subscribers with easy access to desired content and applications across the wide range of devices present within their customer base, from feature phones up to advanced smart phones. We believe that this enhanced subscriber experience enables wireless carriers to attract and retain mobile subscribers and increase mobile data ARPU. At the same time, our platform can reduce wireless carrier network overhead and operating costs and simplify the relationships between wireless carriers and content and application providers.

Mobile content and application providers. We enable mobile content and application providers to reach millions of mobile subscribers across carriers and across a wide range of devices from feature phones to advanced smart phones and thereby more effectively monetize their mobile offerings. We believe mCore also facilitates efficient billing and settlement, and provides quality assurance for delivery of mobile content and applications.

Mobile subscribers. We enable wireless carriers to deliver a high value, highly personalized mobile data experience to their subscribers, with simple, real-time access to relevant and desired mobile content and applications. Our mCore platform provides the tools for mobile subscribers to easily locate and access personally relevant and location-based content and services, engage in social networking, and download, send and receive digital media. In addition, mCore allows mobile subscribers to manage the content and applications that they use most frequently.

6

Enterprises. We enable enterprises to deliver high value, highly personalized mobile data experiences to their customers and employees. Through the use of the mCore platform, we deliver mobile data solutions across a broad range of devices and types of networks. We work directly with each enterprise customer to determine which mobile data

services are best for it to utilize to meet its business objectives, and we deliver the optimal set of offerings through a unified, managed services approach.

Our strengths

Highly scalable platform. Our mCore service delivery platform has been built using a flexible modular architecture that enables wireless carriers to deliver a highly scalable and highly reliable, carrier-branded experience.

Comprehensive expertise in managed service operations. Through the delivery of our MaaS, Mobile as a Service™, solution, we develop, implement and operate a very large and complex managed service environment, serving tens of millions of monthly active users across multiple carriers and geographies with a carrier-grade level of quality and reliability. We deliver these services to some of the world’s leading carriers, application and content providers ranging in complexity from roll-out and testing of minor customizations to major new strategic initiatives involving numerous third parties and onboarding of content and roll-out of a continually expanding set of devices. Our managed service environment consists of thousands of servers across multiple datacenters and is capable and contracted to deliver highly reliable service delivery reaching up to 99.999% availability.

Strong relationships with wireless carriers. We have well-established relationships with the top wireless carriers in the U.S. market, including Verizon Wireless, AT&T and Sprint as well as relationships with top international wireless carriers, including members of the Axiata Group (XL, Celcom, Dialog, Robi and Hello) and Reliance. We believe that we have been an integral partner with our wireless carrier customers and have assisted them with all phases of their mobile data services strategies, including design, development, deployment, provisioning, management, billing and customer support.

Deep integration within the mobile data ecosystem. Our mCore service delivery platform is deeply integrated into our wireless carrier customers’ systems, with the result that we can more effectively deliver an enhanced mobile data experience to their subscribers. We connect directly into our wireless carrier customers’ wireless network infrastructure as well as their provisioning and billing systems and their customer care systems. We also provide various interfaces to enable our wireless carrier customers to directly manage the content and presentation of their mobile data service experience. In addition, as our platform becomes more deeply integrated with an increasing number of content and application providers, we provide carriers with greater access to content and application providers.

Expansive device portfolio and onboarding process. We customize, test and maintain highly personalized mobile data experiences for an ever expanding population of mobile devices ranging from entry level feature phones to smartphones that utilize advanced operating systems such as Symbian, Blackberry, Android, Windows Mobile and webOS. Our onboarding process includes device profiling, testing and performance management across each carrier customers’ handset portfolio.

Significant insights into subscriber behavior and effective user experiences. Our mCore platform can capture a wide range of subscriber behavior and usage patterns across multiple carriers. We are also a recognized leader in the design and development of user interfaces intended to enhance the mobile subscriber experience. We leverage our data-rich insights into subscriber behavior and our user interface expertise to provide a highly personalized subscriber experience and targeted mobile marketing solutions. Our solutions currently enable the delivery of mobile data services to tens of millions of mobile subscribers monthly, which gives us exposure to one of the largest mobile subscriber communities in the world.

7

Independence and neutrality. We are content, network, operating system and mobile device type independent, with a sole focus on effectively and efficiently delivering the most relevant content and applications to mobile subscribers in real-time. Our independent position enables our interests to be closely aligned with our wireless carrier partners, thereby fostering cooperation among the constituencies that comprise the mobile ecosystem for the benefit of mobile subscribers and their mobile data experiences. We leverage our design, deployment, provisioning, management, and customer support strategies across all participants in the mobile data ecosystem, thereby optimizing our mobile data solutions and services for the benefit of our customers and their subscribers.

Our growth strategy

Expand international presence. We intend to expand our business in developed and emerging international markets, such as those in Southeast Asia, India and Latin America. We recently entered into an agreement with XL Axiata, a wireless carrier in Indonesia as well as Reliance in India, Celcom in Malaysia, Robi in Bangladesh, Dialog in Sri Lanka and Hello in Cambodia. We intend to apply our expertise gained from the U.S. market and fully leverage the capabilities and scale of the mCore platform to enable the rapid deployment of advanced mobile data services in these new markets in a cost-effective and efficient manner.

Gain additional scale, technology and access to new markets through acquisitions. We have historically acquired various businesses and technologies to grow our revenue and service capabilities. We expect to continue targeting acquisition candidates in the mobile data services market that have revenue expansion opportunities or complementary technology and solutions. We also expect to evaluate acquisition candidates that will enable us to expand our business and to enter markets adjacent to our core business or into new geographic markets.

Expand our strong relationships with our wireless carrier customers. We intend to continue to expand our relationships with industry-leading participants, particularly top U.S. and international wireless carriers.

Advance into new market segments. We intend to leverage our core competencies, technologies and existing market position to broaden our offerings and customer base and advance into new market segments, including expanding our position serving enterprise customers. We intend to leverage our data-rich insights into subscriber behavior and our user interface expertise to expand our offerings of highly targeted mobile marketing solutions.

Maintain and extend our technological leadership. We believe that we are a market leader in mobile data services and solutions in terms of technological capabilities, market share and range of service offerings, and we intend to expand on this position. We intend to continue to enhance the mCore platform, and introduce new solutions that increase the total value we provide to our carrier and enterprise customers.

Enhance smartphone solutions. We intend to extend further our support for new versions of smartphones and extend our support for data-rich applications which have higher rates of data consumption on these mobile devices. In addition, we will continue to leverage our subscriber behavior insights and user interface expertise to offer more personalized and richer experiences to smartphones. We expect to fully capitalize on the extensive capabilities of smartphones and their significant market adoption.

Adenyo acquision. The proposed Adenyo acquisition will expand our market opportunity and strengthen our position as the leading mobile internet platform for the monetization of content and data. With Adenyo’s mobile advertising, marketing and analytics technology, we will be well positioned to capitalize on the exponential growth in our industry.

8

Our solutions and services

We design, develop, implement and support a comprehensive suite of hosted mobile data solutions, which we offer on a hosted, managed service basis. Our solutions include the following:

mCore Portal. mCore Portal is a carrier-branded mobile destination accessible through over 2,000 different mobile phone models, ranging from entry level feature phones to smartphones. mCore Portal provides an easy to reach entry point to the mobile Internet and gives wireless carriers an ongoing, high-value position in the evolving mobile data value chain.

mCore Connect. mCore Connect provides one-click mobile access to leading social networks and e-mail sites through a single, simple and user-friendly mobile interface. In addition to making it easier for consumers to reach their social networking and email content, mCore Connect also reduces the network overhead associated with these activities through providing a much more efficient means for users to access what they seek.

mCore Search. mCore Search, which we bundle with our other solutions, is a customizable search technology for the mobile Internet. A single search box enables mobile subscribers to search for any information, content or application on the Internet. Through deep integration with the wireless carrier’s advertising platform, mCore Search provides the ability for carriers to serve targeted, relevant and contextual ads.

mCore Managed Web. mCore Managed Web provides mobile subscribers with an optimized, powerful and easy-to-use mobile web browsing experience.

mCore Marketplace. mCore Marketplace is our new generation storefront that provides a means to connect the large community of content, application and widget providers to carriers through an open, integrated exchange that can serve a wide array of mobile devices and other target devices. Additionally, carriers themselves are able to offer their own services through this exchange as well as hard and soft goods for purchase. This solution provides consumers with a highly personalized shopping experience through insights gained from business intelligence, user preferences and carrier information.

mCore MobileCast. mCore MobileCast is a next generation content management solution that delivers real-time, consumer relevant content to a wide range of smartphones. This comprehensive offering is designed to give smartphone subscribers real-time, zero touch access to all the relevant content, applications, goods and services they care about most, directly to their “phonetop.” For carriers and enterprises, MobileCast will drive brand awareness, promotions and commerce all through a user’s personalized mobile experience.

mCore Gateway. mCore Gateway provides enterprises that are seeking to leverage mobile capabilities for direct customer contact with real-time, push-based access to mobile subscribers with SMS or multimedia messaging service (MMS) alerts. mCore Gateway allows these enterprise customers to reach over 200 million mobile subscribers in the U.S. and Europe and provides functionality to distribute millions of messages with a high degree of reliability and speed. mCore Gateway also provides a means to charge for the delivery of digital products through wireless carrier billing facilities.

Campaign Manager. Campaign Manager is a Web-based mobile marketing product that connects to the mCore Gateway and provides carriers and enterprises with a simple means to create, implement and manage mobile marketing campaigns.

Our professional services include the following:

Solution consulting. Our solution professionals actively engage with customers to define mobile trends, analyze effectiveness of existing solutions and recommend programs and solutions to enhance the mobile data subscriber experience. Our solution professionals have the experience and understanding of the mobile data ecosystem to enable our customers to optimize their mobile data strategies.

9

Mobile design. Our mobile design professionals enable wireless carriers to create unique, integrated mobile experiences for their mobile subscribers. We employ functional and technical design techniques across a number of design elements including subscriber experience, wireless network and mobile device features, system integration and processes. We have a comprehensive library of proven designs and tools that help us leverage our skill set across the mobile data ecosystem.

Solution implementation. Our implementation professionals provide expertise in every phase of the implementation process, including customization, configuration, integration, system launch and ongoing enhancement and maintenance.

Operational management and customer support. Once mCore is deployed, we provide support services to wireless carriers to maintain and monitor their service deployment, including content and technology management, the introduction of new phones and system billing and settlement. We also provide customer support to wireless carriers and their ecosystem of partners to resolve issues directly relating to the performance of the mCore platform.

Sales and marketing

We market and sell a wide range of mobile data services solutions to wireless carriers through our sales organization. Additionally, we sell our messaging gateway and billing services to the top mobile aggregators and enterprise customers through our sales organization. As of December 31, 2010 our sales and marketing organization consisted of 48 employees located predominantly in the U.S., with additional staff located in the United Kingdom, the Netherlands, Indonesia and Singapore.

Sales. A senior vice president for global sales centrally manages our sales organization. Within this organization, we have teams focused on selling to wireless carriers, mobile aggregators and enterprise customers. Employees in our sales support and sales engineering group are engaged during the design and implementation process to offer insight into customer requirements, technical solutions and cost evaluation. Our sales organization has been predominantly focused on selling to the top wireless carriers in the U.S. We have expanded our focus to Southeast Asia, India, Latin America, and other emerging markets.

Marketing and product management. Our marketing and product management organizations focus on defining our product requirements, educating wireless carriers, media and industry analysts on our managed services approach, building brand awareness and supporting the efforts of the sales organization. We market our solutions through industry events, public relations efforts, sales materials and our Internet site. Additionally, we work directly with wireless carriers to help them better target and promote our joint offerings. We leverage our data-rich insights into subscriber behavior and our user interface expertise to help drive subscriber adoption and usage. We believe the combination of these efforts creates awareness of our business, solutions and managed services approach, as well as helps drive our overall business growth.

10

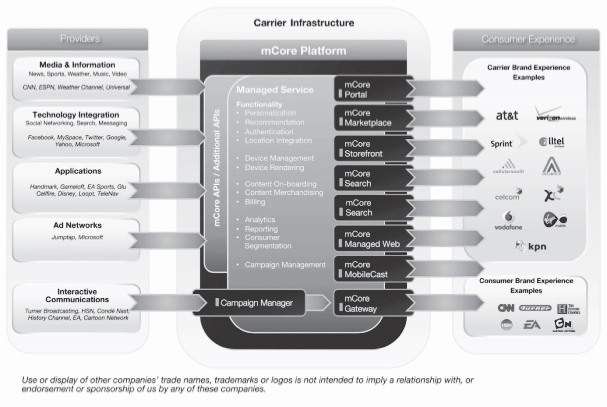

Platform and architecture

The mCore service delivery platform enables wireless carriers to design, configure, customize, and implement mobile data services. mCore is designed to bring together the three primary participants in the mobile data services ecosystem: wireless carriers, mobile content and application providers and mobile subscribers. By bringing these participants together, mCore facilitates the distribution and use of mobile content and applications, electronic commerce, and other mobile data marketing services. The mCore platform and its position in the mobile data services ecosystem are demonstrated in the figure below.

Key features and benefits of the mCore service delivery platform are as follows:

Tight integration with carriers’ systems. mCore is able to be integrated with our customers’ systems, including provisioning, billing and settlement, customer care and product analytics, and messaging. This integration provides a more customized and seamless user experience, enabling wireless carriers to offer one-click billing for digital products, as well as location-based services that can create a more compelling user experience.

Modular architecture. mCore is comprised of several mobile technology components that are modular in nature and provide the flexibility to integrate with our customers’ systems, or third-party mobile content and application providers, on an as-needed basis. This modular architecture, commonly referred to in the industry as Service-Oriented Architecture, enables us to insert, replace, or remove functionalities in targeted areas without impacting our customers’ systems. Additional resources can be added with little to no interruption of service to our customers and their subscribers. In addition, this modular architecture allows mCore to be adopted from the smallest of deployments to the largest, with customizable features and functions depending on the carriers’ requirements and specifications.

Cost-efficiency. mCore is a centralized, hosted solution through which we can deliver a broad range of mobile data services, on a managed service basis, at a total cost that we believe is lower than most internally developed solutions. By leveraging our solutions across the mobile data ecosystem and its participants, we are able to derive economies of scale that enable us to share the cost savings with our constituencies.

11

Reliability. mCore is hosted at a combination of our own carrier-grade hosting facilities and facilities hosted by the carriers themselves, in separate geographic-based datacenters. Our datacenters are highly reliable, using resilient and redundant network devices, servers, storage, HVACs, and power equipment as well as best-of-class service monitoring and management to deliver our services.

Adaptability. mCore separates core functionalities from customer-specific customization and integration through the use of adapters. These adapters are developed for each deployment to enable us to integrate our platform into the wireless carrier’s system, including authentication, billing, ringback tones and message service center. This design feature enables us to develop and deploy our product roadmap in parallel with deployment activities, which helps us achieve our time-to-market goals.

Flexible and scalable architecture. mCore was designed to deliver the highest quality, carrier-grade service to some of the largest carriers in the world. Today, mCore supports tens of millions of mobile subscribers monthly through its distributed architecture, hosts over 75 million unique pieces of mobile content or applications and provides the capability to reach over 400 million subscribers. mCore is designed to scale easily for mobile subscribers’ increased data consumption, expanding subscriber bases through the addition of individual service elements, such as servers and databases. mCore has also been designed with the flexibility and modularity to deliver a wide range of content, including text, graphics, audio and video to a wide range of mobile devices.

Design-time and run-time environment. mCore provides a design-time and run-time environment for the delivery of mobile data services. The design-time environment consists of management tools with workflow capabilities for service design and deployment, while the run-time environment is the live, in-production experience with which subscribers interact. The design-time environment enables our customers to design the layout of pages, provision new text and images and merchandise content that are subsequently published to the run-time environment. The design-time environment provides us and our customers with the ability to implement changes in the user experience without requiring a new code deployment, which decreases development time and breakage risk.

Mobile device and operating system independent. mCore is mobile device and operating system independent and is able to deliver mobile data services to over 13,000 different mobile phone models, ranging from entry level feature phones to smartphones, and most mobile operating systems. As mobile device and operating system capabilities become increasingly more varied, we believe mCore’s independent approach will enable wireless carriers to deliver an enhanced user experience to their subscribers without having to specifically develop products for each device and operating system.

Data-rich insights into subscriber behavior. mCore can store a comprehensive record of mobile subscriber activities, transactions and interactions. We and our customers are able to directly access this data or obtain custom analysis and reporting regarding subscriber behavior.

Security compliance. All security policies, processes and controls are aligned with the ISO 27001 Information Security Management standard as validated by an annual third party audit. Additionally, specific key operational processes—incident management, change management, release management, and service monitoring and control—were designed with support from third party subject matter experts to align with ITIL, the Industry standard framework for IT service management and support. A third-party audit has established that we are in compliance with the ISO 27001 Information Security Management standard. We have a comprehensive Information Security Management System in place that consists of an enterprise-wide security steering committee, adherence to statutory, legislative, and contractual security requirements, and an information security risk management program.

Post-deployment capabilities. mCore provides monitoring, reporting and ongoing insights into the overall health of the system for our customers as well as the entities that interact with it, including mobile subscribers. Monitors provide both “warning” and “error” states, enabling our customers to react to anomalies prior to an actual error

12

condition. mCore also includes customer care tools which enable a wireless carrier’s customer care representatives to view their mobile subscribers’ interactions with the system, and to troubleshoot and service subscriber inquiries in real-time.

Customers and vendors

Customers

As of December 31, 2010, our customers included 10 wireless carriers and over 57 enterprise customers worldwide. As discussed below, we have strong, established and strategic relationships with a number of industry-leading wireless carriers. In addition to those relationships, we have agreements to provide messaging services, such as standard text messaging programs and premium (paid) content delivery, to a wide array of entertainment, marketing and other customers.

Wireless carriers. We have customer agreements with the top U.S. wireless carriers and numerous other wireless carriers in the U.S. and internationally. We provide various services, including portal, marketplace and/or messaging services for these carriers. In addition, we have agreements with most U.S. wireless carriers for connectivity to our enterprise gateway. Our agreements vary as to the services we provide to each carrier and how we charge for those services. We charge using a combination of professional services fees, variable activity-based fees, revenue sharing arrangements and fixed monthly fees. Some of our agreements contain per subscriber fees for portal services and revenue sharing arrangements for marketplace services. Some of our agreements also contain service level agreements under which we commit to certain availability and performance metrics and are subject to financial penalties if we fail to perform at the agreed upon level.

AT&T Mobility. Our largest customer by revenue is AT&T Mobility, LLC. We have several agreements with AT&T including our Second Amended and Restated Wireless Services Agreement under which we host AT&T’s MediaNet and ATT.net portals, and our 2010 Master Services Agreement and accompanying Service Exhibit under which we host AT&T’s AppCenter, which utilizes mCore marketplace. Under the portal agreement, we receive a monthly fee based on the number of subscribers, with a volume discount, as well as certain fixed fees. The portal agreement contains service level agreements under which we commit to certain availability and performance metrics and are subject to financial penalties if we fail to perform at the agreed upon level. The portal agreement expires on April 22, 2011; however, it is subject to automatic extension unless terminated by either party upon six months notice, and is also terminable by AT&T without cause upon six months notice. The AppCenter agreement expires September 22, 2012, but AT&T has the right to terminate on 270 days notice, which can be given after March 31, 2011, and on 90 days notice, which can be given after September 30, 2011.

Verizon Wireless. After AT&T, our next largest customer is Cellco Partnership (d.b.a. Verizon Wireless). We host Verizon’s portals under our 2004 WAP 2.0 Hosting Agreement. Under our Verizon portal agreement, we receive a monthly fee based on the number of subscribers, with a volume discount, as well as certain fixed fees. The portal agreement contains service level agreements under which we commit to certain availability and performance metrics and are subject to financial penalties if we fail to perform at the agreed upon level. Verizon may terminate for convenience. Pursuant to an amendment to the 2004 WAP 2.0 Hosting Agreement entered into on June 30, 2010, the term of the Agreement was extended to June 30, 2012. After such date, Verizon Wireless may extend the term for up to two additional one year terms, which extension shall occur automatically unless Verizon provides notice of intent not to renew at least ninety days prior to the end of the then-current term. After June 30, 2014, the term shall be automatically renewed for successive one year periods unless either party provides written notice of termination. The Amendment also revised certain commercial terms of the Agreement for providing and hosting the portal and for device profiling, editorial, search and advertising integration and other mobile services and their related fees. The Company believes the economic terms of the Agreement are improved by the Amendment. The termination provisions of the Agreement were not altered.

13

Vendors

We utilize strategic relationships with offshore and domestic vendors to increase technical resource capacity in the areas of technical development and quality assurance. We have expanded these relationships to assist in the expansion of our product development efforts. On an as needed basis, these vendors can also be utilized to assist in sales engineering and demo development. We have agreements in place with our vendors, particularly offshore vendors, that allow us to properly manage and oversee vendor activities across the organization.

We have a strategic relationship with GlobalLogic, Inc., a leading software research and development company with over 3,000 employees providing services worldwide. Initially, GlobalLogic assisted us with customer implantation and custom projects, and we now use the company to supplement our Product Development group. Our Master Services Agreement with GlobalLogic became effective on September 30, 2008, and expires on December 29, 2011, unless renewed. We may terminate this agreement upon breach or change in control, or without cause upon 90 days notice and payment of a termination fee, if the termination without cause occurs more than 12 months before December 29, 2011. The agreement includes the option to convert GlobalLogic employees to Motricity employees for a fee.

We commit significant resources to research and development. Research and development expenses for the years ended December 31, 2010, 2009 and 2008 were $8,667, $5,792 and $3,045, respectively.

Competition

The mobile data communications market for products and services continues to be competitive and fragmented. The widespread and rising adoption of open industry standards, rapidly changing technology trends and burgeoning consumer demand has made it easier for new market entrants, existing competitors and non-traditional players to introduce new products and services that compete with our products. With the rapid growth and adoption of mobile data services, we expect competition to increase. As such, we believe there are a number of important factors to compete effectively in our market, including:

| • | strong mobile data expertise; |

| • | scalable and highly reliable products and services; |

| • | advanced user interface capabilities and subscriber insight; |

| • | continued innovation to stay ahead of the market and the technology curve; |

| • | knowledge and delivery capabilities across a wide array of content and applications; |

| • | service integration capabilities across a wide range of devices, networks and standards; |

| • | sufficient scale and operational efficiencies to be able to offer the most cost effective solutions; |

| • | high level of customer support; |

| • | ability to onboard a wide range of devices and content; and |

| • | adaptability to rapidly changing demand, technology and products external to our offerings. |

Our competitors include mobile device manufacturers, wired search engines, Internet portals and directories, and wireless service integrators. In our current offerings, we compete with, among others, Amdocs and Ericsson in the portal and marketplace businesses, and with Sybase, OpenMarket, Ericsson, mBlox and other wireless messaging providers in our messaging aggregation business. Additionally, we face the risk that our customers may seek to develop in-house products as an alternative to those currently being provided by us. Due to the dynamic and fragmented data services market, we are also increasingly encountering competition from new market entrants like Microsoft, IBM, Apple, Yahoo!, Google and other providers of software applications and content delivery solutions.

14

Intellectual property

Our intellectual property is an essential element of our business. We rely on a combination of trademark, copyright, trade secret, patent and other intellectual property laws of the U.S. and other countries, as well as confidentiality agreements and license agreements to protect our intellectual property. Our intellectual property includes trademarks, patents, copyrights, trade secrets, and we are involved in numerous licensing arrangements. Our employees and independent contractors are required to sign agreements acknowledging that all inventions, trade secrets, works of authorship, developments and other processes generated by them on our behalf are our property, and assigning to us any ownership that they may claim in those works.

Our core intellectual property is our software that we use to provide services to our customers. We generally host all of our software, although some customers have the right to self-host in some circumstances. We rely primarily on copyright and trade secrets to protect our software and other technology. We do not routinely register our copyrights in our software. Trade secrets are difficult to protect, but we seek to protect our proprietary technology and processes by, in part, confidentiality agreements with our employees, consultants, and other contractors.

We are the owner of trademarks registered with the United States Patent and Trademark office and internationally, including MOTRICITY and MCORE.

Employees

As of December 31, 2010, we had 339 employees. None of our employees are represented by a labor union or is covered by a collective bargaining agreement. We have never experienced any employment-related work stoppages and consider relations with our employees to be good.

Available Information

We maintain a website at www.motricity.com. The information on or available through our website is not, and should not be considered, a part of this report. You may access our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports, as well as other reports relating to us that are filed with or furnished to the Securities and Exchange commission (or “SEC”) free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. In addition, you may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, N.W., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site, www.sec.gov, that contains reports, proxy and information statements, and other information that we file electronically with the SEC.

| Item 1A. | Risk Factors. |

We depend on a limited number of customers for a substantial portion of our revenues. The loss of a key customer or any significant adverse change in the size or terms of a contract with a key customer could significantly reduce our revenues.

We depend, and expect to continue to depend, on a limited number of significant worldwide wireless carriers for a substantial portion of our revenues. Currently, a number of the top U.S. and International wireless carriers use our services. In the event that one or more of these major wireless carriers decides to reduce or stop using our managed and professional services, we could be forced to shift our marketing focus to smaller wireless carriers, which could result in lower revenues than expected and increased business development, marketing and sales expenses. This could cause our business to be less profitable and our results of operations to be adversely affected.

In addition, a change in the timing or size of a professional services project by any one of our key customers could result in significant variations in our revenue and operating results. Our operating results for the

15

foreseeable future will continue to depend on our ability to effect sales to a small number of customers. Any revenue growth will depend in part on our success in selling additional services to our large customers and expanding our customer base to include additional customers that deploy our solutions in large-scale networks serving significant numbers of subscribers.

In 2009, we generated approximately 53% of our total revenue from contracts with AT&T Mobility LLC and its affiliates, or AT&T, and 20% of our total revenue from contracts with Verizon Wireless and its affiliates. In 2010, we generated approximately 44% and 24% of our total revenue from contracts with AT&T and Verizon Wireless, respectively. Certain of our customer agreements expire in 2011, including one of our agreements with AT&T. Failure to renew our agreements with AT&T, Verizon Wireless or our other large customers would materially reduce our revenue and have a material adverse effect on our business, operating results and financial condition. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview” and “Business—Customers and Vendors—Customers” for more information.

The mobile data services industry is, and likely will continue to be, characterized by rapid technological changes, which will require us to develop new service enhancements, and could render our existing services obsolete.

The market for content and applications for mobile devices is characterized by rapid technological change, with frequent variations in user requirements and preferences, frequent new product and service introductions embodying new technologies and the emergence of new industry standards and practices. Our success will depend, in part, on our ability to enhance and expand our existing services, develop new technology that addresses the increasingly sophisticated and varied needs of wireless carriers and their subscribers, respond to technological advances and emerging industry standards and practices and license leading technologies that will be useful in our business in a cost-effective and timely way. We may not be able to successfully use new technologies or adapt our current and planned services to new customer requirements or emerging industry standards. The introduction of new products embodying new technologies or the emergence of new industry standards could render our existing services obsolete, unmarketable or uncompetitive from a pricing standpoint.

The market in which we operate is highly competitive and many of our competitors have significantly greater resources.

The mobile data communications services market is rapidly evolving and intensely competitive. Our competitors include mobile device manufacturers, search engines, portals and directories, and wireless service integrators. Competition in the wireless industry throughout the world continues to increase at a rapid pace as consumers, businesses and governments realize the market potential of wireless communications products and services. In addition, new competitors or alliances among competitors could emerge and rapidly acquire significant market share, to our detriment. There may be additional competitive threats from companies introducing new and disruptive solutions. Some of our competitors may be better positioned than we are. Although we have attained a significant position in the industry, many of our current and potential competitors may have advantages over us, including:

| • | longer operating histories and market presence; |

| • | greater name recognition; |

| • | access to larger customer bases; |

| • | single source solutions that deliver mobile devices, hardware, services and infrastructure; |

| • | economies of scale and cost structure advantages; |

| • | greater sales and marketing, manufacturing, distribution, technical, financial and other resources; and |

| • | government support. |

16

These competitors also have established or may establish financial or strategic relationships among themselves or with our existing or potential customers or other third parties. In addition, some of our competitors have used and may continue to use aggressive pricing or promotional strategies, have stronger relationships on more favorable terms with wireless carriers and may devote substantially greater resources to system development than we do. These relationships may affect customers’ decisions to purchase services from us.

We also face competition from existing service providers in the international markets in which we already compete or may enter. For example, in India we compete with numerous companies, some of which are solely focused on the local mobile data services market, are directly owned and managed by local citizens. These factors could provide local competitors with advantages over us, particularly if the local government enacts laws or policies that favor local competitors or restrict or disadvantage us because our international operations are part of a U.S.-domiciled company. Other competitors in international markets are subsidiaries of larger companies with established local operations, and with greater experience and resources. In other countries that we may enter, there may be incumbent competitors presently selling data services products. These incumbents may have competitive advantages that could impede our expansion and growth in these countries.

We rely heavily on our executive officers and other key employees for the success of our business and the loss of our executive team whether to a competitor or otherwise could adversely impact our business.

We believe our success will depend in part upon retaining the services of executive officers and other key employees. Many of our executive officers joined our company within the last two years and we operate in a very competitive environment. Although we have employment agreements with many of our key employees, such employees may receive employment offers that are competitive with or more attractive than their existing employment terms with us. If our executive officers or non-executive key employees leave and we cannot replace them with suitable candidates quickly, we could experience difficulty in managing our business properly. This could harm our business prospects, client relationships, employee morale and financial results. We currently maintain a key-person life insurance policy on our chief executive officer.

Competition for our employees is intense and failure to retain and recruit skilled personnel could negatively affect our financial results as well as our ability to maintain relationships with clients, service existing and new contracts, and drive future growth.

We provide sophisticated mobile data delivery platforms and services to our customers. To attract and retain customers and service our existing and new contracts, such as our agreements with Reliance India, Robi, Dialog and Hello, we believe we need to demonstrate professional acumen and build trust and strong relationships, and that we must retain, identify, recruit, and motivate new hardware and software engineers, programmers, technical support personnel and marketing and sales representatives. Competition is intense for skilled personnel with engineering, product development, technical and marketing and sales experience, and we may not be able to retain and/or recruit individuals that possess the necessary skills and experience, or we may not be able to employ these individuals on acceptable terms and conditions, or at all. Moreover, competition has been increasing the cost of hiring and retaining skilled professionals as, among other reasons, other companies in the technology sector may offer more compensation, particularly in the form of equity awards. This trend could adversely affect our operating margins and financial results. Our business and growth may suffer if we are unable to retain current personnel and hire other skilled personnel.

We believe our long-term success depends, in part, on our ability to expand the sales of our services to customers located outside of the U.S. As a result, our business is susceptible to risks associated with international sales and operations.

In addition to the U.S., we currently operate in the United Kingdom, the Netherlands, Indonesia, Singapore, India, Malaysia, Bangladesh, Sri Lanka and Cambodia and we intend to expand our offering of mobile data

17

services into a number of additional international markets in the near future. As a result, we are subject to the additional risks of conducting business outside the U.S., which may include:

| • | increased costs associated with localization of our services, including translations into foreign languages and adaptation to local practices and regulatory requirements; |

| • | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| • | difficulties managing and staffing international operations; |

| • | delays resulting from difficulty in obtaining export licenses, tariffs and other trade barriers and restrictions on export or import of technology; |

| • | less stringent intellectual property protections; |

| • | unexpected changes in, or impositions of, legislative, regulatory or tax requirements and burdens of complying with a wide variety of foreign laws and other factors beyond our control; |

| • | general geopolitical risks in connection with international operations, such as political, social and economic instability; |

| • | compliance with anti-corruption and bribery laws, including the Foreign Corrupt Practices Act of 1977; |

| • | changes in diplomatic, trade or business relationships; |

| • | foreign currency fluctuations that may substantially affect the dollar value of our revenue and costs in foreign markets; |

| • | foreign exchange controls that may prevent or limit our ability to repatriate income earned in foreign markets; and |

| • | increased financial accounting and reporting burdens. |

We may engage in acquisitions that could disrupt our business, cause dilution to our stockholders and harm our business, operating results or financial condition.

We expect to make selective domestic and international acquisitions of, and investments in, businesses that offer complementary products, services and technologies, augment our market coverage, and/or enhance our technological capabilities. For instance, on January 31, 2011, we entered in an agreement to acquire Adenyo. We may also enter into strategic alliances or joint ventures to achieve these goals. We may not be able to identify suitable acquisition, investment, alliance, or joint venture opportunities or consummate any such transactions or relationships on terms and conditions acceptable to us. Such transactions or relationships that we enter into may not be successful. In addition, acquisitions and investments outside of the U.S. involve unique risks related to integration of operations across different cultures and languages, currency risks and the particular economic, political and regulatory risks associated with specific countries.

These transactions or any other acquisitions or dispositions involve risks and uncertainties, which may have a material adverse effect on our business. The integration of acquired businesses may not be successful and could result in disruption to other parts of our business. In addition, the integration may require that we incur significant restructuring charges. To integrate acquired businesses, we must implement our management information systems, operating systems and internal controls, and assimilate and manage the personnel of the acquired operations. The difficulties of the integrations may be further complicated by such factors as geographic distances, lack of experience operating in the geographic market or industry sector of the acquired business, delays and challenges associated with integrating the business with our existing businesses, diversion of management’s attention from daily operations of the business, potential loss of key employees and customers of the acquired business, the potential for deficiencies in internal controls at the acquired business, performance problems with the acquired business’ technology, difficulties in entering markets in which we have no or limited direct prior experience, exposure to unanticipated liabilities of the acquired business, insufficient revenues to

18

offset increased expenses associated with the acquisition, and our ability to achieve the growth prospects and synergies expected from any such acquisition. Even when an acquired business has already developed and marketed products and services, there can be no assurance that product or service enhancements will be made in a timely fashion or that all pre-acquisition due diligence will have identified all possible issues that might arise with respect to such acquired assets.

Any acquisition may also cause us to assume liabilities, record goodwill and non-amortizable intangible assets that will be subject to impairment testing and potential impairment charges, incur amortization expense related to certain intangible assets, increase our expenses and working capital requirements, and subject us to litigation, which would reduce our return on invested capital. Failure to manage and successfully integrate the acquisitions we make could materially harm our business and operating results.

Any future acquisitions may require additional debt or equity financing, which in the case of debt financing, will increase our leverage and, in the case of equity financing, would be dilutive to our existing stockholders. Any decline in our perceived credit-worthiness associated with an acquisition could adversely affect our ability to borrow and result in more restrictive borrowing terms. As a result of the foregoing, we also may not be able to complete acquisitions or strategic transactions in the future to the same extent as in the past, or at all. These and other factors could harm our ability to achieve anticipated levels of profitability at acquired operations or realize other anticipated benefits of an acquisition, and could adversely affect our business, financial condition and results of operations.

Open mobile phone operating systems and new business models may reduce the wireless carriers’ influence over access to mobile data services, and may reduce the total size of our market opportunity.

The majority of our revenue is based on mobile subscribers accessing mobile content and applications through our customers’ carrier-branded mobile solutions. However, with the growth of the iPhone and smartphone business models, our customers’ services may be bypassed or become inaccessible. These business models, which exclude carrier participation beyond transport, along with the introduction of more mobile phones with open operating systems that allow mobile subscribers to browse the Internet and, in some cases, download applications from sources other than a carrier’s branded services, create a risk that some carriers will choose to allow this non-branded Internet access without offering a competitive value-added carrier-branded experience as part of their solution set. These so-called “open operating systems” include Symbian, BlackBerry, Android, Windows Mobile and webOS. We believe wireless carriers need to offer branded services that can compete head-to-head with the new business models and open technologies in order to retain mobile subscribers and increase ARPU. Although our solutions are designed to help wireless carriers deliver a high value, competitive mobile data experience, if mobile subscribers do not find these carrier-branded services compelling, there is a risk that mobile subscribers will use open operating systems to bypass carrier-branded services and access the mobile Internet. It is also possible one or more wireless carriers will adopt a non-carrier branded, third-party web portal model. To the extent this occurs, the total available market opportunity for providing our current services and solutions to carriers may be reduced.

Our sales cycle can be long, which may make our revenues and operating results less predictable.

Wireless carriers must typically make substantial investments to deploy our mobile data services solution. As a result, the typical sales cycle for our services is long, averaging nine to twelve months per customer. Many of the potential customers for our services have only recently begun to evaluate the benefits of expanding their offerings of mobile services, and many have only recently designated personnel to evaluate, procure and implement new mobile services. We believe that we may be required to spend a significant amount of time and resources educating potential customers on the use and benefits of our services, and in turn, we expect potential customers to spend a significant amount of time performing internal reviews and obtaining authorization to purchase our services. Furthermore, the emerging and evolving nature of mobile data technological standards and services may lead potential customers to postpone purchasing decisions.

19

We have a history of net operating losses and may continue to suffer losses in the future.

For the years ended December 31, 2006, 2007, 2008, 2009, and 2010, we had net losses of approximately $55.2 million, $77.9 million, $78.0 million, $16.3 million and $7.0, respectively. If we cannot become profitable, our financial condition will deteriorate, and we may be unable to achieve our business objectives.

We compete with in-house mobile data solutions similar to those we offer.