Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Future Holdings Corp /TX/ | d8k.htm |

EFH

Corp. 2011 JPMorgan High Yield & Leveraged Finance Conference

Discussion Deck

Exhibit 99.1

February 28

th

-

March 2

nd |

1

Safe Harbor Statement

This

presentation

contains

forward-looking

statements,

which

are

subject

to

various

risks

and

uncertainties.

Discussion

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

management's

current

projections,

forecasts,

estimates

and

expectations

is

contained

in

EFH

Corp.'s

filings

with

the

Securities

and

Exchange

Commission

(SEC).

Regulation

G

This

presentation

includes

certain

non-GAAP

financial

measures.

A

reconciliation

of

these

measures

to

the

most

directly

comparable

GAAP

measures

is

included

in

the

appendix

to

this

presentation. |

2

Table of Contents

I.

Energy Future Holdings (EFH)

Overview…………………… 3 -

4

II.

Luminant

Overview…………………………...……………....

5

-

24

III.

TXU

Energy

Overview.……………………………………….

25

-

27

IV.

Oncor

Overview.………………………………………………

28 -

33

V.

EFH

Background……………………………………………...

34

-

36

VI.

Appendix

–

Reg

G…………………………………………….

37

-

41 |

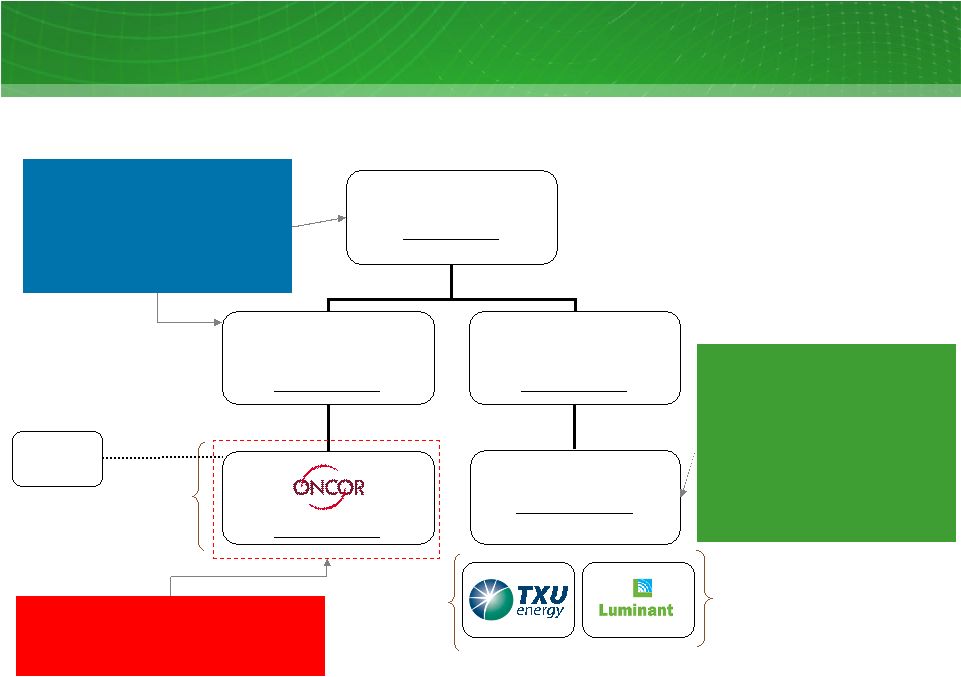

3

2

nd

largest competitive

electric generator in US

Largest lignite/coal and

nuclear baseload

generation fleet in Texas

Low-cost lignite reserves

Largest T&D utility in

Texas

Leader in smart-grid

development

Constructive regulatory

regime

Largest retail

electricity provider in

Texas

Strong customer value

proposition

The largest power generator, retail electricity provider and transmission &

distribution utility in Texas.

Energy Future Holdings Overview |

4

4

2010 FY Highlights

Monetized non-core assets (DFW

Midstream, Permian water rights)

13 of 14 CCNs

obtained for CREZ

transmission construction project

Operational

achievements

Solid safety performance

Oak Grove 1 & 2 COD¹

Baseload

plants achieved solid

performance

New ERCOT Summer and Winter

load peaks

Top decile

nuclear industry

performance for reliability and cost

Liability management program

–

Reduced net debt by $2 billion

–

Extended $5 billion of maturities

–

Projected interest savings of $1

billion thru 2014

New

TXUE

brand

launch

-

Brighten

Over 1.5 million AMS meters installed

through December 2010

ERCOT nodal transition

Reclamation program planted 1.2

million trees offsetting 26 million tons

of CO2

Competitive business generated ~$600

million in cash flows

Settled

1997

–

2002

IRS

audit

Prevailed in Alcoa lawsuit

Financial

achievements

Strategic

initiatives

1

COD = Commercial Operations Date

New nuclear development

–

CP3/4 licensing progress

TXU Energy retail electric provider

licensed in Pennsylvania |

5 |

6

Luminant

Generation Facilities

Generation capacity in ERCOT

At 12/31/10; MW

HOUSTON

SAN ANTONIO

AUSTIN

WACO

MIDLAND

LUFKIN

ODESSA

DALLAS

TYLER

FORT

WORTH

Power Plants

Natural gas

Coal

Coal, new build

Nuclear

Nuclear

2,300 MW

Coal

8,017

Natural gas¹

5,110

Total

15,427 MW

1

Includes four mothballed units (1,655 MW) not currently available for dispatch and eight units (1,268

MW) currently operated for unaffiliated parties. |

15%

2%

57%

26%

Business Profile

Generation

Largest baseload

generation fleet in ERCOT with

around-the-clock assets that dispatch at low heat rate

levels

Top decile

nuclear plant production and cost

performance

Top quartile coal fleet production and cost performance

Liquidity-light natural gas hedging program designed to

provide cash flow security (~62% hedged for Jan 1, 2011

–

Dec 31, 2014)

Comanche Peak expansion through Mitsubishi

partnership may provide a low-cost nuclear growth

option

14%

33%

38%

15%

Coal

Gas

Nuclear

Generating Capacity1

as of 12/31/10

Total Net Generation2, 2010

15,427 MW

76,631 GWh

New Build-Coal

Safety

Wholesale power prices

Natural gas hedge program

Baseload

reliability

Mining operations

Fuel costs

O&M costs

Operational excellence/continuous improvement

Competitive market

Value Drivers

1.33

1.35

2.71

1.74

2008-2010 Average

2013E

Lignite

Delivered PRB

Lignite vs. PRB Fuel Cost ($/MMBtu) Note: Total lignite and PRB fuel expense excluding

emissions. Luminant

is the largest power generator in Texas.

Luminant

Business Summary

7

1

Includes four mothballed units (1,655 MW) not currently available for dispatch and eight units (1,268

MW) currently operated for unaffiliated parties. 2

Excludes purchased power |

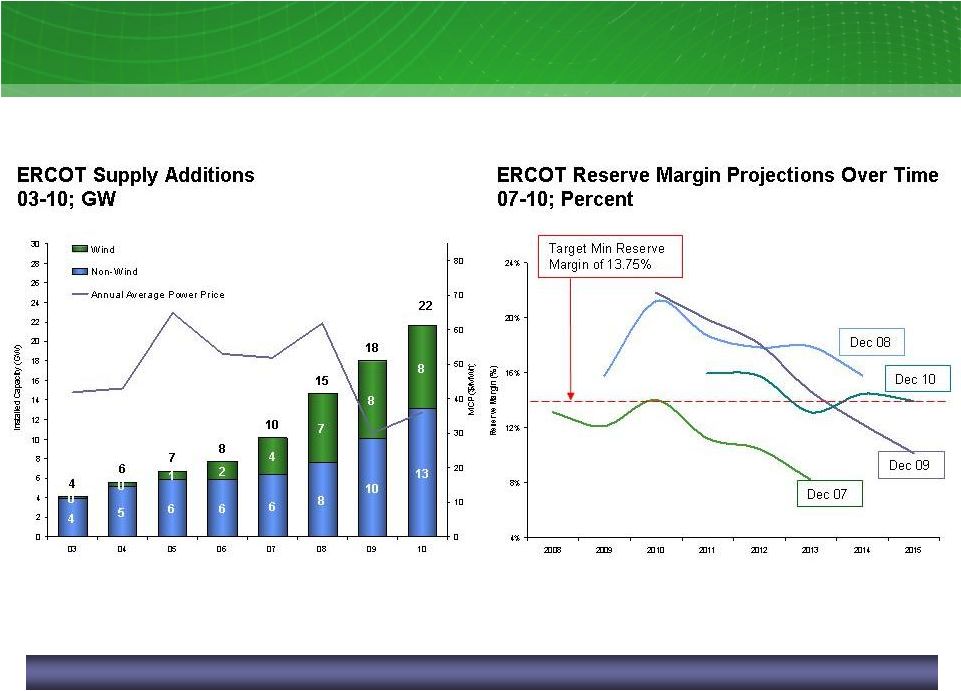

ERCOT

Fundamental Supply and Demand Dynamics Latest forecast shows an increase in

minimum reserve margin 8 |

9

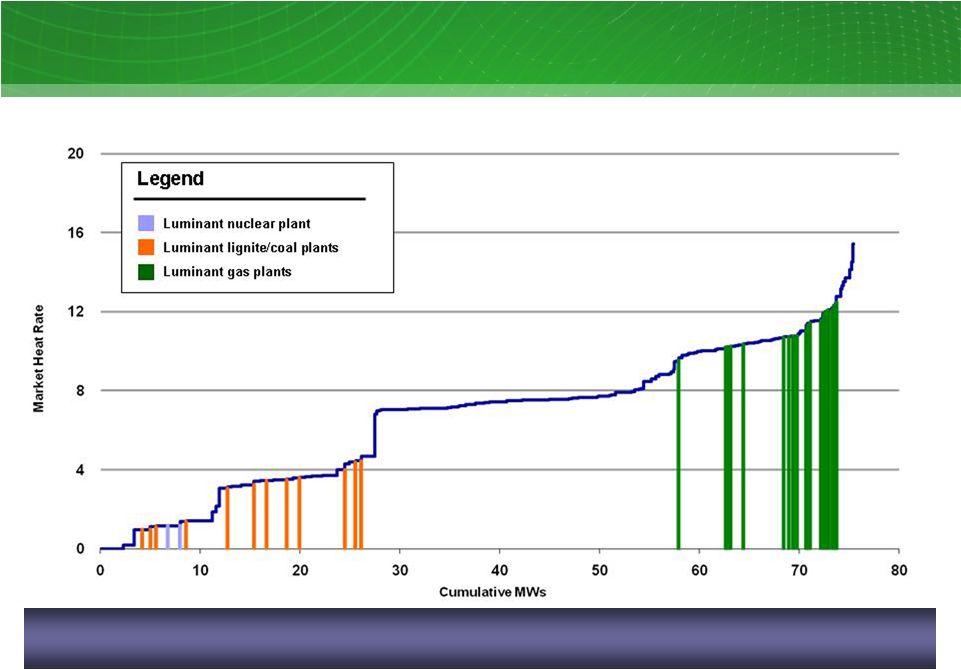

1

Summer 2011 ERCOT supply stack -

indicative

ERCOT Supply Stack

Sources: ERCOT and Energy Velocity

®, Ventyx Luminant

plants are typically on the “book-ends”

of the supply stack. ERCOT’s

marginal price is set by natural gas in most hours of the year.

|

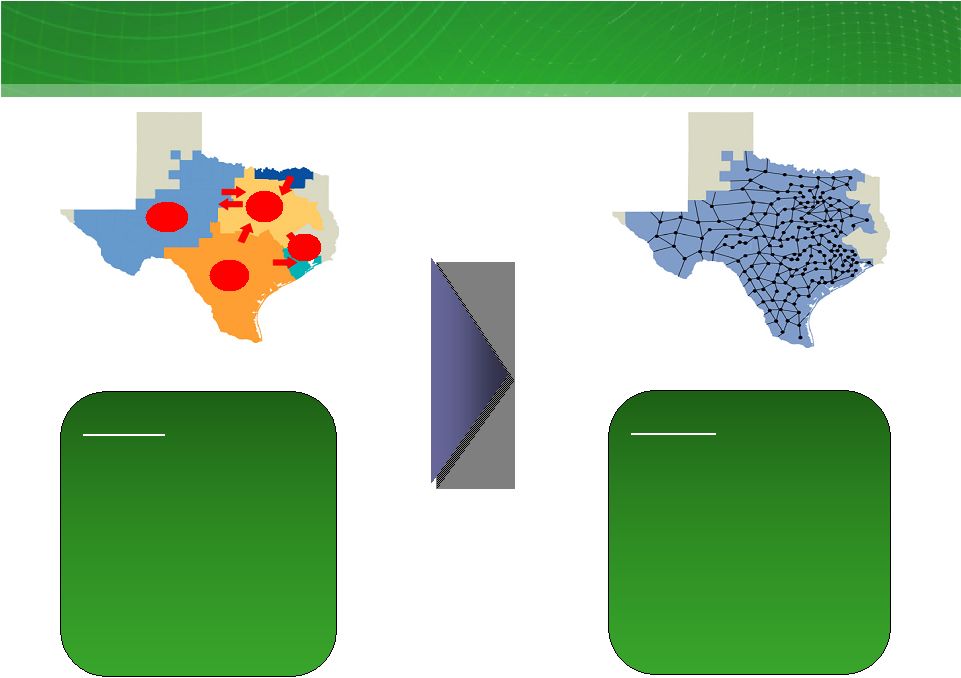

10

Zonal to Nodal Market Transition

N

W

S

H

ZONAL

•

Portfolio Dispatch

•

4 Market Clearing Prices for

Energy (MCPE)

•

Congestion resolved at zonal

level; local congestion uplifted to

all load in that area

NODAL

•ERCOT Dispatch (unit specific)

•Locational Marginal Pricing

(LMP) leads to ~550 Settlement

Point Prices

-

Generation Bus Nodes

-

Hubs

-

Load Zone

•“Day Ahead Market”

•Congestion will be managed on

a local basis |

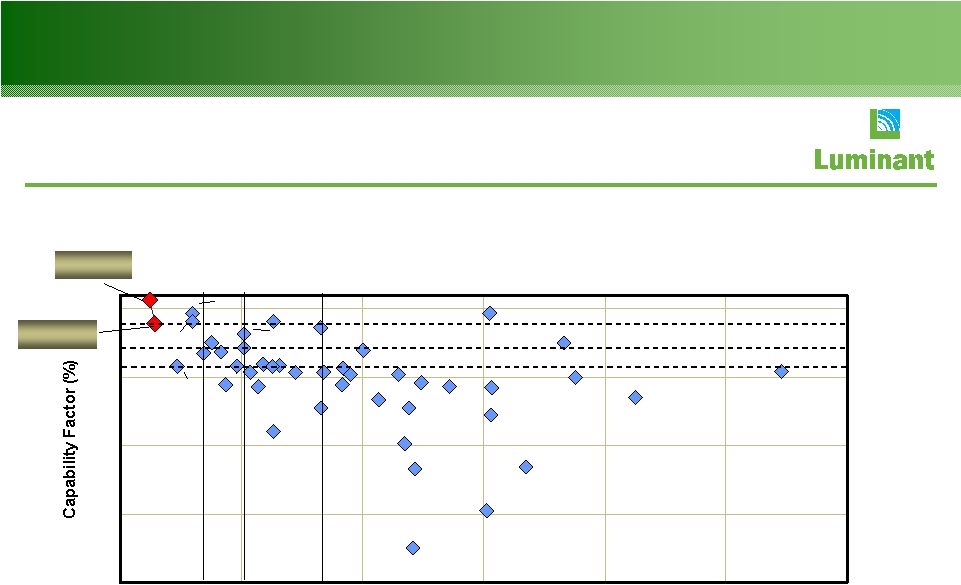

Nuclear Reliability vs. Cost Benchmarks

75

80

85

90

95

10

15

20

25

30

35

40

$/MWh

1

Benchmarking peer set defined as 18 month fuel cycle U.S. nuclear plants.

2

Source: Electric Utility Cost Group (EUCG) May 2010 release for Cost and World

Association of Nuclear Operators (WANO) for Capability Factors. Braidwood

Byron

STP

Decile

Quartile

Median

Decile

Quartile

Median

Vogtle

CPNPP 06-08

94.1

CPNPP 09

95.6

Nuclear capability factor and O&M cost performance

07-09; percent and $/MWh

11 |

12

0

10

20

30

40

50

60

70

2003

2004

2005

2006

2007

2008

2009

2010

EFH

Industry

16

17

18

19

20

2003

2004

2005

2006

2007

2008

2009

2010

0

1

2

3

EFH

# of Refueling Outages

Impact of Refueling Outages

Avg.

nuclear

fleet

refueling

outage

duration

1

-

18

month

cycle

units

03-10; days

Nuclear fleet output

03-10; thousand GWh

Nuclear Refueling Cycle

18 months

Duration: ~19-26 days

2010 Refueling Outage Impact

2010 outage was 24 days

3

rd

shortest Spring 2010 outage in the

industry

2011 Refueling Outage Impact

2011 outages planned at 20 days (Unit 1)

and 22 days (Unit 2)

1

2005

and

2008

were

dual

refueling

outage

years;

this

graph

shows

the

average

outage

duration

for

each

of

those

years.

2

Industry based on early release data from Electric Utility Cost Group (EUCG)

2

World record steam

generator outage

World record steam

generator outage |

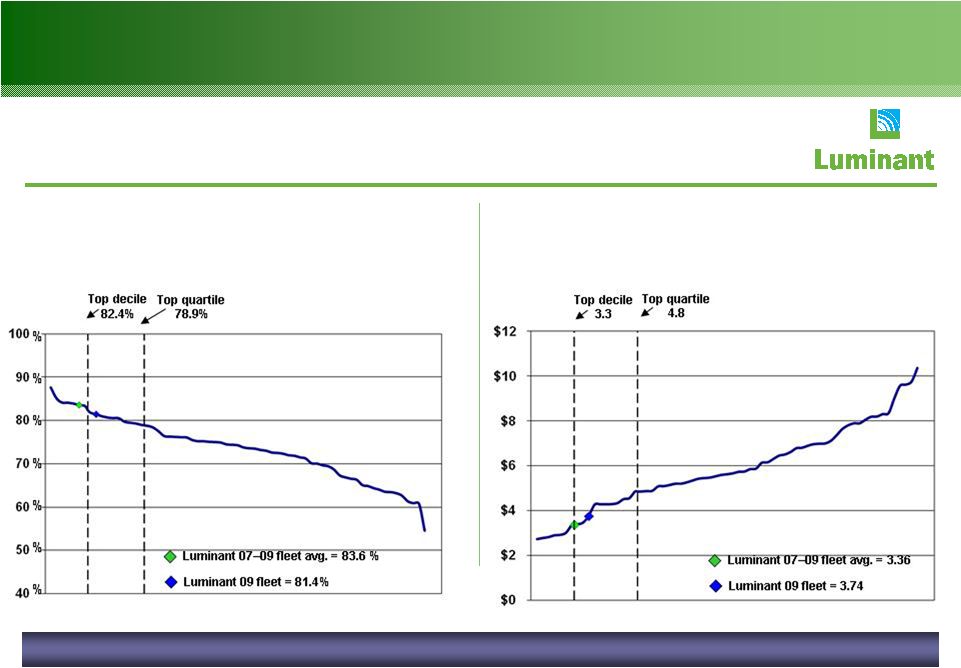

Source: GKS

Luminant

vs. US coal fleet net capacity

factors¹

Percent

Luminant

vs. US coal fleet O&M

$/MWh

Luminant

has industry leading performance relative to other coal-fueled generators.

High-Performance Coal Operator

13

1

Benchmarking net capacity factors based on GADS. Luminant is legacy lignite/coal fleet only and based

on net capacity of 5,837 MW. |

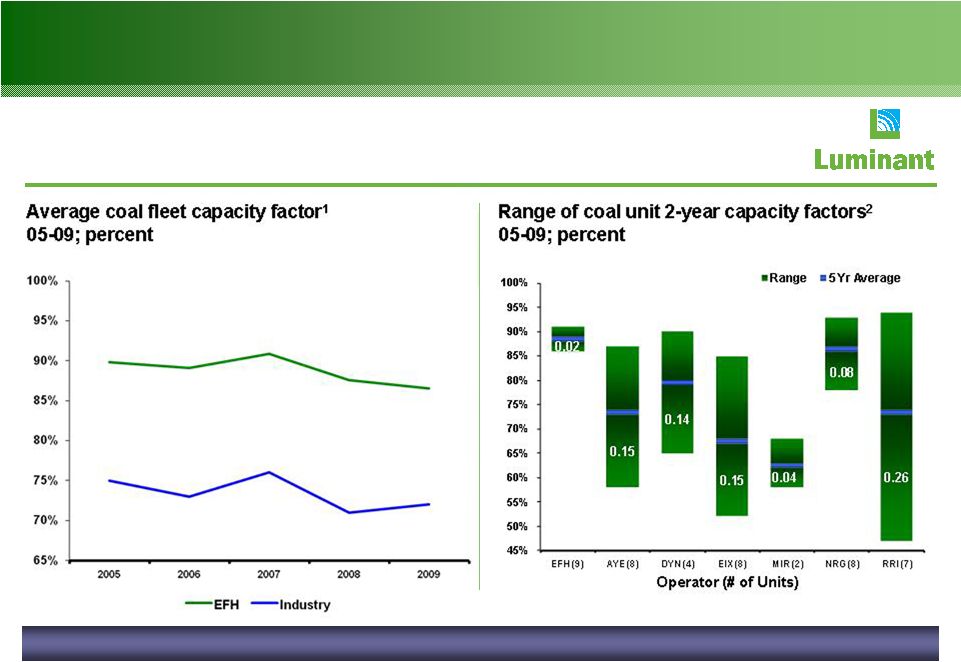

14

High-Performance Coal Operator

1

Based on unscrubbed

merchant units greater than 450 MW. Industry total excludes EFH

plants. EFH is legacy lignite/coal fleet only and based on net capacity of 5,837 MW.

2

Includes merchant units greater than 450 MW.

Source: Velocity Suite (Energy Velocity)

Consistent high performance

0.04 |

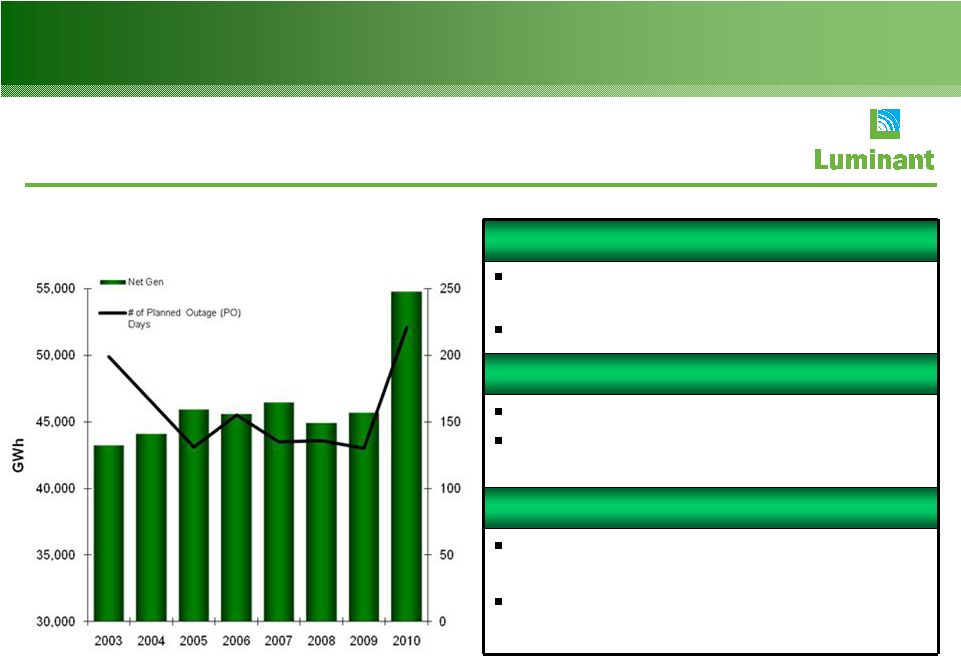

15

Coal Fleet Output

Coal

fleet

output

1,2

03-10; GWh

Coal Fleet Planned Outage Cycle

3 or 4 year overhaul cycle depending on

unit

Duration is scope dependent

2009 Planned Outage Impact

2009 reflects 130 planned outage days

2009 average major outage duration was

45 days

2010 Planned Outage Impact

2010 reflects 221 planned outage days

(41 at new units)

2010 average major outage duration was

48 days

1

2009 includes 1,443 GWh of new build generation (Sandow 5 and Oak Grove 1 units).

2

2010 includes 11,384 GWh of new build generation and 41 planned outage days (Sandow 5, Oak Grove

1 & 2 units). |

16

Nuclear Expansion Opportunity

HEAVY INDUSTRIES, LTD.

…partnering with

…partnering with

a world-class

a world-class

equipment provider…

equipment provider…

Luminant

is pursuing the licensing and potential construction of a next-

generation nuclear facility by

…

…

…

and leveraging favorable

and leveraging favorable

site characteristics and

site characteristics and

operational expertise.

operational expertise.

The proposed expansion includes two nuclear generation units each having

approximately

1,700

MW

(gross)

capacity.

Luminant/EFH

have

been

working

with

the

Department of Energy loan guarantee program office and its Japanese counterpart

(METI) to secure construction financing. |

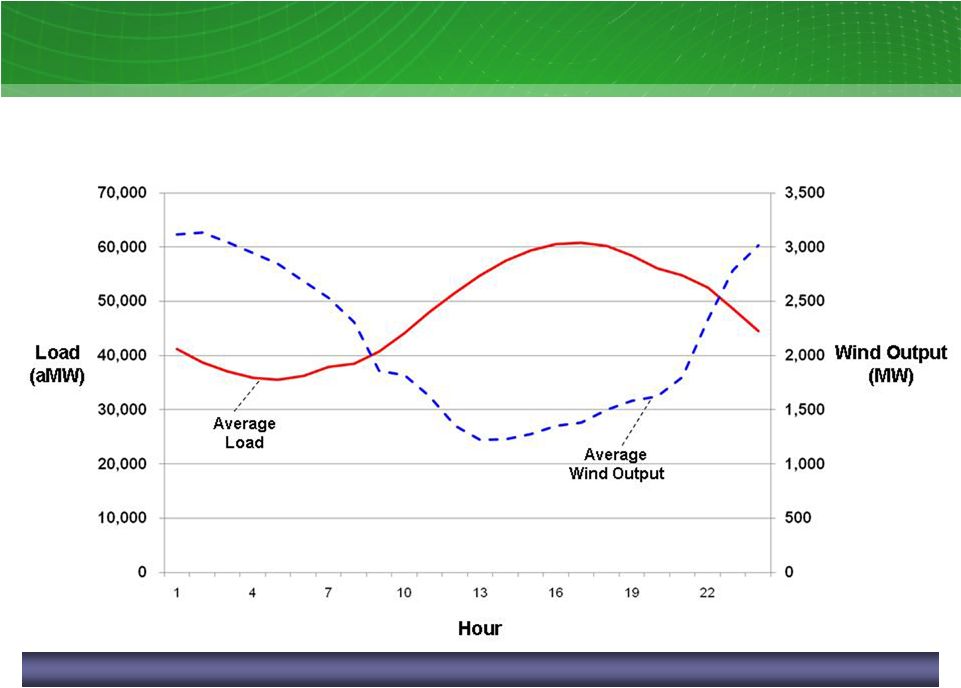

17

ERCOT Average Daily Profile of Load and Wind

Source: ERCOT

ERCOT average daily profile of load and wind output

August 10; mixed measures

Wind operating characteristics necessitate additional resources for

reliability. |

18

Texas Wind Additions

0

2,000

4,000

6,000

8,000

10,000

12,000

Pre 01

01

02

03

04

05

06

07

08

09

10

11E

12E

RPS

1

Target

of 2,880 MW

by 2009

RPS

1

Target

of 5,880 MW

by 2015

CREZs

Designated

ERCOT SGIA²

Cumulative wind capacity additions in Texas

Pre-01 -

10;11E -

12E; MW

1

Renewable Portfolio Standard

2

Signed Generation Interconnect Agreement

Source: ERCOT – January 2011 System Planning Report to the Reliability and Operations

Subcommittee |

Historical 2014 Forward Natural Gas Prices

Historical 2014 Forward Houston Ship Channel (HSC) Gas Prices

Q1’07-

Q4’10; $/MMBtu

$7.18

$7.37

$7.10

$8.12

$8.71

$10.92

$8.09

$6.96

$6.95

$7.23

$7.05

$6.73

$6.27

$5.97

$5.28

$5.36

$4

$5

$6

$7

$8

$9

$10

$11

$12

Q1'07

Q2'07

Q3'07

Q4'07

Q1'08

Q2'08

Q3'08

Q4'08

Q1'09

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Q3'10

Q4'10

19 |

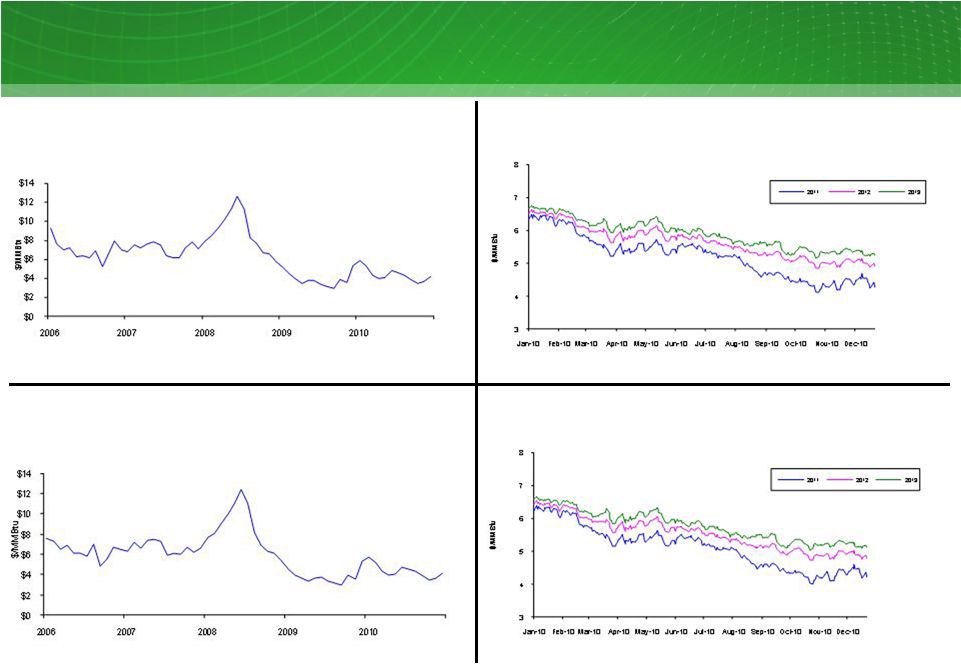

20

20

Houston

Ship

Channel

settled

natural

gas

prices

1

Jan 06-Dec 10; $/MMBtu

Market Price Snapshot

NYMEX

forward

natural

gas

prices

2

2011-2013; $/MMBtu

NYMEX

settled

natural

gas

prices

1

Jan 06-Dec10; $/MMBtu

Houston

Ship

Channel

forward

natural

gas

prices

2

2011-2013; $/MMBtu

1

Settled prices are monthly averages

2

Forward prices reflect market observable quotes during the 12 months ended Dec 31, 2010 for the

following delivery periods: 2011, 2012 and 2013 |

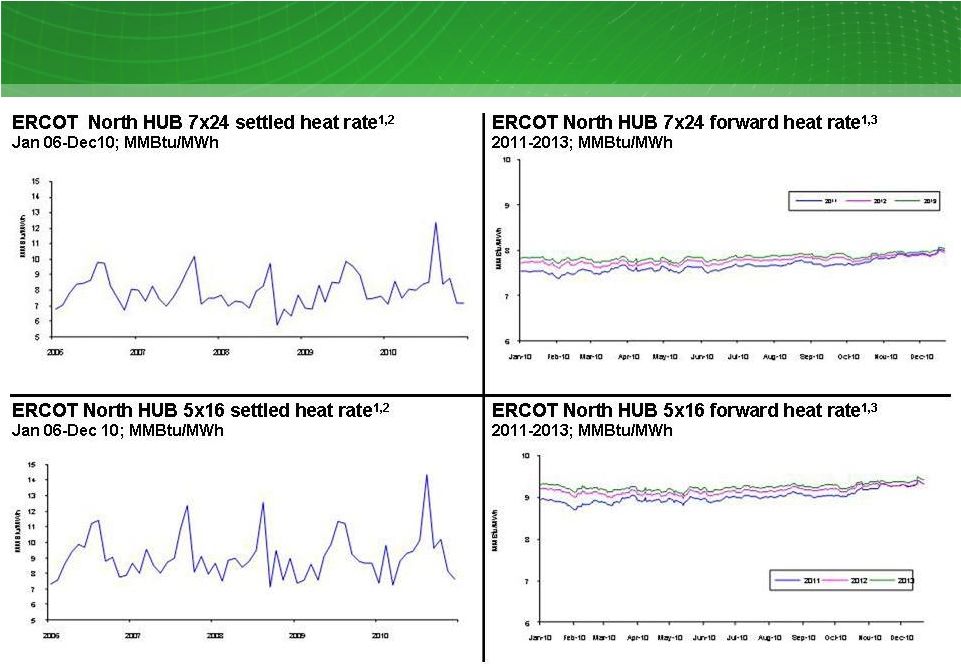

21

21

Market Price Snapshot

1

Market heat rate calculated by dividing 7x24 and 5x16 power prices, as appropriate,

by Houston Ship Channel natural gas prices 2

Settled prices are monthly averages

3

Forward prices reflect market observable quotes during the 12 months ended Dec 31,

2010 for the following delivery periods: 2011, 2012 and 2013 |

2010

and Beyond: Environmental Regulatory Timeline 22

The environmental regulatory framework has come increasingly to the forefront with

the failure of climate/RES legislation and recent EPA actions

|

23

EPA-Urged New Controls Based on Proposed New EPA Rules

Rule

Targeted Emission or

Objective

Potential Control

Required

Mercury MACT

1

/HAPS rule

Mercury and other

“hazardous air pollutants”

(HAPs)

Baghouse

+ Scrubber (FGD²)

+ ACI³

Clean Air Transport

NOx

and SO

2

SCR (NOx) and Scrubber

(FGD²

) (SO 2

)

NAAQS revisions

Ozone NAAQS Revision

NOx

SCR

4

SO2 NAAQS Revision

SO

2

Scrubber (FGD²)

PM NAAQS

Particulate Matter (PM)

Scrubber (FGD²)

316(b) -

Water

Reduce fish impingement at

cooling water intakes

Cooling towers

Coal Combustion Byproducts

Fly ash, bottom ash, and

scrubber & cooling tower

byproducts

New handling and landfills

1

MACT refers to the maximum achievable control technology.

2

FGD refers to flue gas desulfurization systems that reduce SO2 emissions with

co-benefits of other emissions reductions. 3

ACI refers to activated carbon injection systems that reduce mercury

emissions. 4

SCR refers to selective catalytic reduction systems.

|

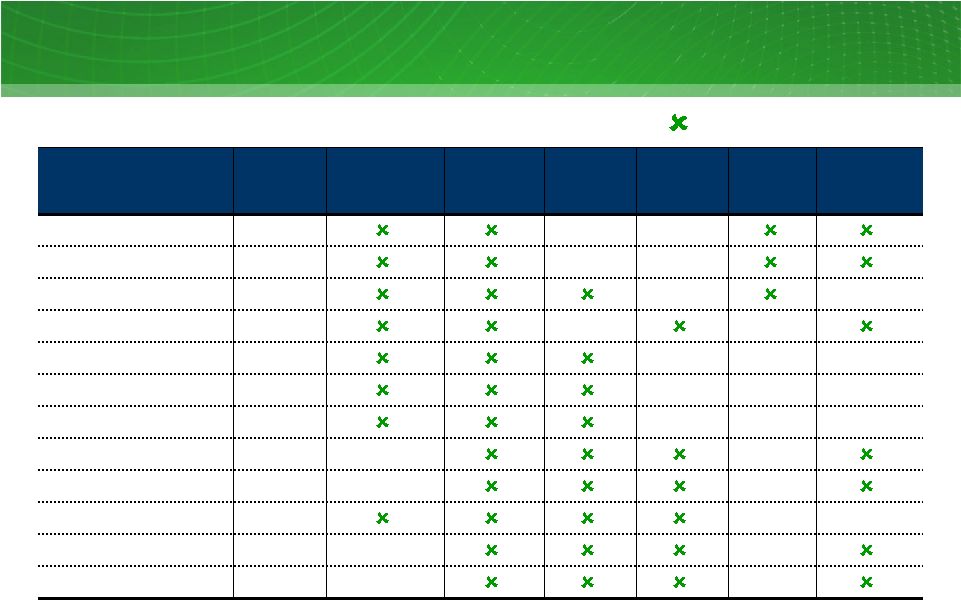

24

Currently Installed

1

Environmental Control Equipment At

Luminant

Coal Units

Coal Unit

Capacity

(MW)

FGD

(Scrubber)²

Activated

Carbon

Injection³

ESP

4

SNCR

5

SCR

5

Bag-

house

4

Oak Grove 1

800

Oak Grove 2

800

Sandow

4

557

Sandow

5

580

Martin Lake 1

750

Martin Lake 2

750

Martin Lake 3

750

Monticello 1

565

Monticello 2

565

Monticello 3

750

Big Brown 1

575

Big Brown 2

575

Currently installed

1

There is no assurance that the currently installed control equipment will satisfy the requirements

under any change to applicable law or any future Environmental Protection Agency or Texas

Commission on Environmental Quality regulations.

2

FGD refers to flue gas desulfurization systems that reduce SO2 emissions with co-benefits of other

emissions reductions. 3

Activated carbon injection systems reduce mercury emissions.

4

ESP refers to electro-static precipitation systems. ESP and bag-house systems reduce

particulate emissions with co-benefits of other emissions reductions. 5

SNCR refers to selective non-catalytic reduction systems. SCR refers to selective

catalytic reduction systems. Both systems reduce NOx emissions. |

25 |

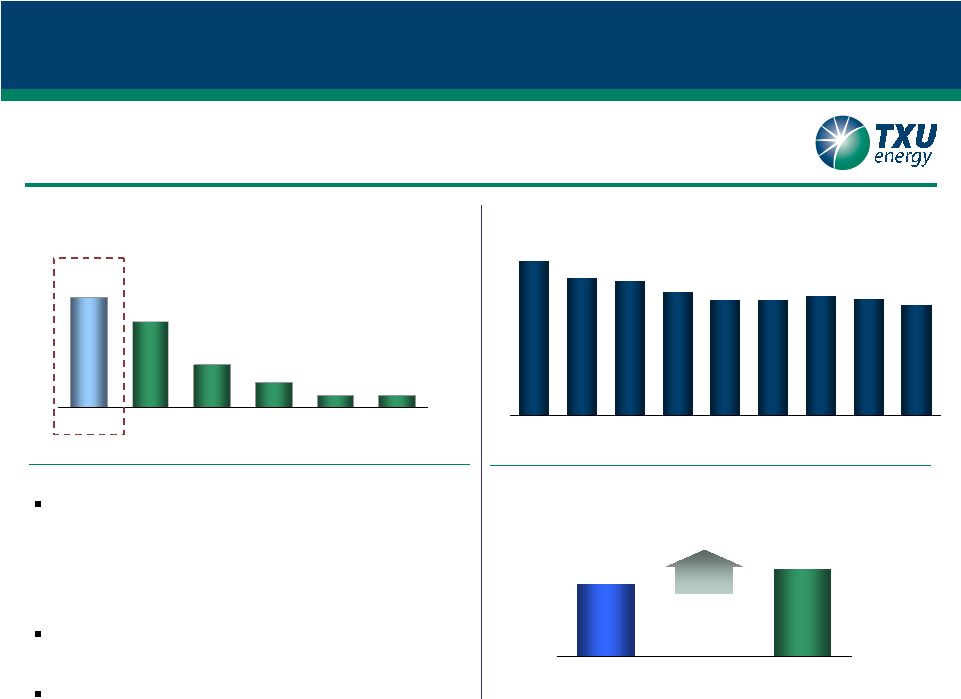

1.4

1.7

US Average

ERCOT

Strong customer value proposition

•

High brand recognition in Texas competitive areas

•

Competitive retail prices

•

Innovative products and services

•

Committed to low-income customer assistance

•

Improved customer care platform (SAP)

Balance Sheet

•

Combined TCEH risk management and liquidity efficient

capital structure

Expected margins (5–10% net)

1.8

1.4

0.7

0.4

0.2

0.2

TXU Energy

Reliant

Direct

Energy

Stream

Energy

Ambit

First Choice

Source: Latest available company filings, TXU Energy estimates.

Sources: NERC, ERCOT

1,771

1,862

1,914

1,850

1,982

2,145

2,207

2,477

1,856

2002

2003

2004

2005

2006

2007

2008

2009

2010

Residential Customers / Meters

(in millions)

TXU Energy is the leading electricity retailer in the ERCOT market

Residential Customers

(in thousands)

TXU Energy has maintained market position since 2006

Projected Annual Demand Growth

CAGR (2008A-2016E)

Value Drivers

TXU Energy is the largest electricity retailer in Texas.

TXU Energy Business Summary

21%

26 |

27

Mass Media in Market

TXU Energy Marketing Campaign

Acquisition -

Direct Mail

Mass Media –

Television and Radio |

28 |

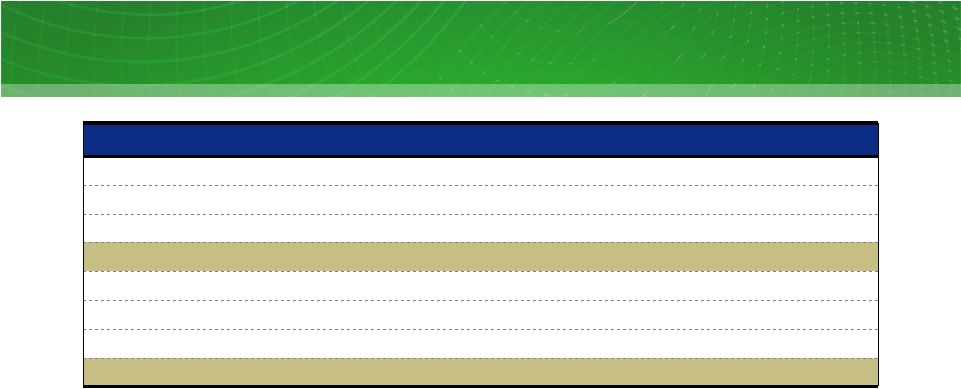

29

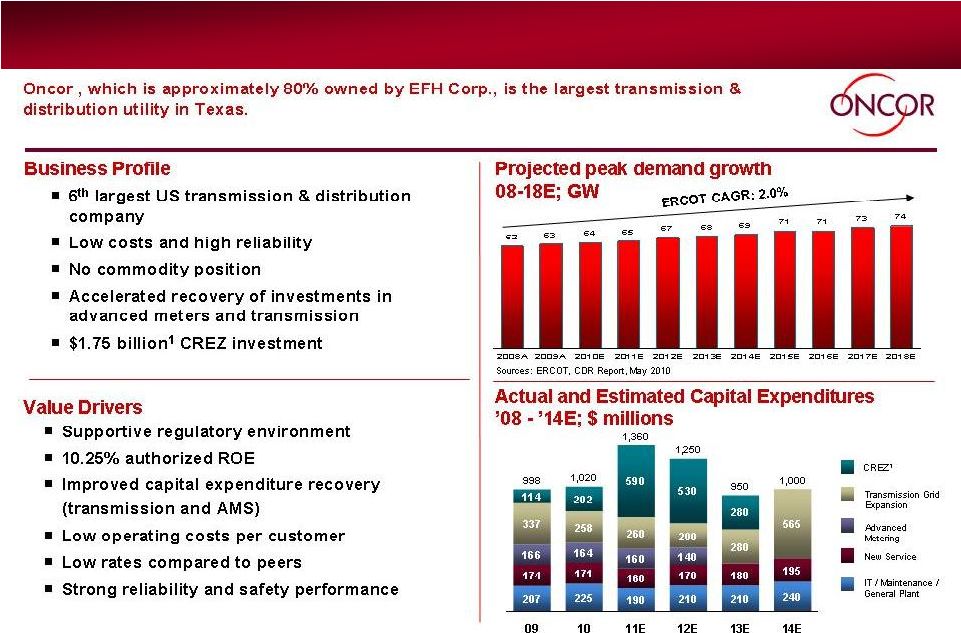

Oncor

Overview

1

Oncor currently estimates that the cost of the CREZ projects will be approximately $1.75 billion based

on the original ERCOT estimate of $1.3 billion, and current estimates for the 3 default

and 9 priority lines approved to date, the identification of additional costs not included in the

original ERCOT estimate and Oncor’s preferred routes for the remaining five subsequent projects. |

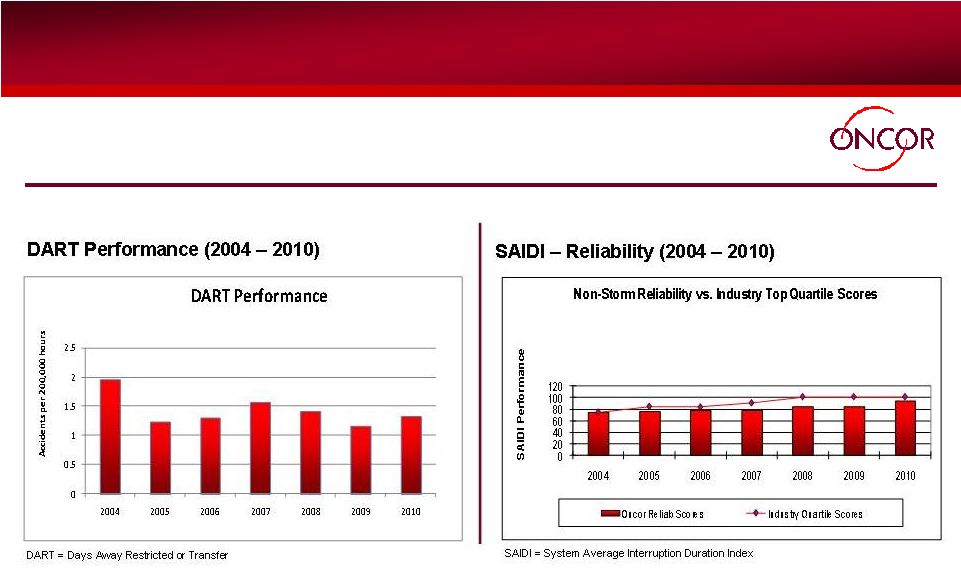

Oncor

Key Performance Metrics

30 |

31

New Oncor

Infrastructure

Oncor’s

investment in CREZ will receive accelerated recovery,

consistent with other transmission investment, mitigating regulatory delay.

1

Oncor currently estimates that the cost of these projects will be approximately $1.75 billion based on

the original ERCOT estimate of $1.3 billion, current estimates for the 3 default and 10 priority lines

approved to date, the identification of additional costs not included in the original ERCOT estimate

and Oncor’s preferred routes for the remaining five subsequent projects. |

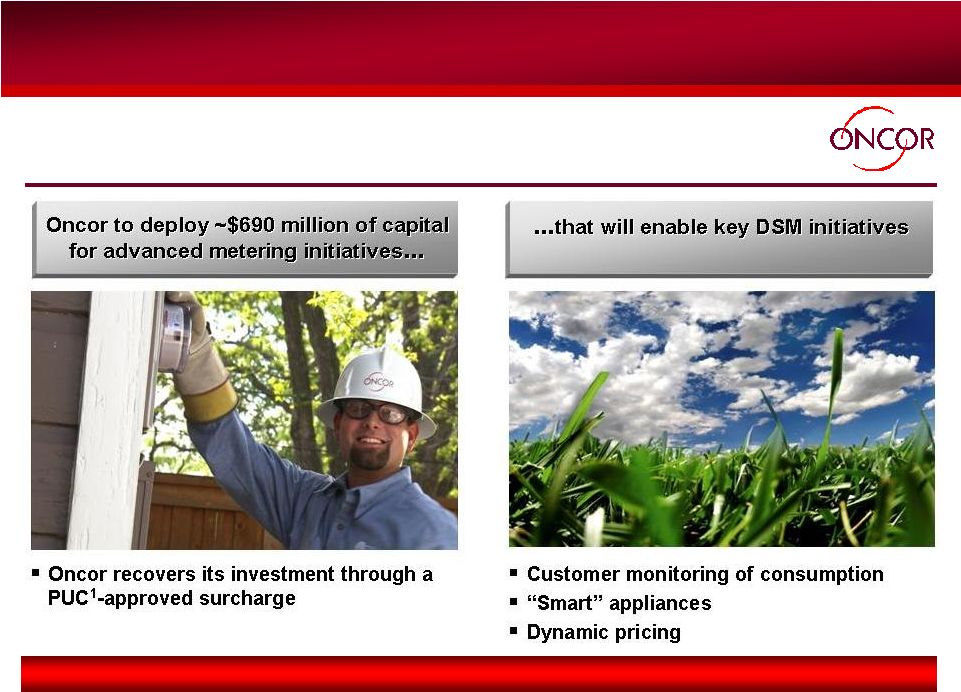

32

Oncor

Demand-Side Management

Oncor

is

leading

the

largest

advanced

metering

initiatives

deployment

in

the

US

with

a

commitment

to

have

3.2

million

meters

installed

by

the

end

of

2012

(over

1.5

million

meters

have

been

installed

through

December

2010)

Oncor’s

energy

efficiency

filing

has

been

approved

and

is

reflected

in

rates.

1

Public Utility Commission of Texas. |

33

Oncor

2011 Rate Case

Filed on January 7, 2011

Requested:

–

$353 million increase

–

11.25% ROE

–

55% Debt / 45% Equity Capital Structure

Hearings

Scheduled

for

May

2

nd

through

6

th

ALJs

Proposal

for

Decision

expected

June

30

th

Jurisdictional Deadline is July 31, 2011 |

Energy Future Holdings Corp.

Energy Future Holdings Corp.

34 |

EFH

$3.6B gross debt

Energy Future

Intermediate Holding

~ $2.3B gross debt

Energy Future

Competitive Holdings

~ $0.1B gross debt

~ $5.8B gross debt

TCEH

~ $30.0B gross debt³

Approx. 80% Ownership

$41.8B total gross

1

debt

$39.0B total net

2

debt

Ring-fenced entity

Texas

Transmission

Investment

LLC

Approx. 20%

Ownership

As of 12/31/10

$20.0B 1st Lien TLB due 2014

$1.1B 1st Lien Revolver due 2013

$1.3B Deposit LC

$1.6B 2

nd

Lien Notes @ 15% due

2021

$4.6B Unsecured LBO Notes @

10.25/10.5% due 2015 and 2016

$1.4B Unsecured PCRBs/Other

$3.5B 1st Lien Notes @ 9.75/10%

due in 2019/2020

$0.9B Unsecured LBO Notes @

10.875/11.25% due in 2017

$1.4B Unsecured Legacy Notes @

5.55 –

6.55%

$0.1B Unsecured Other

$0.4B Revolver @ L+27.5 due 2013

$4.8B @ avg. 6.5%

$0.6B @ avg. 5.2%

35

1

Gross debt includes amount currently due.

2

Total net debt equals total gross debt less total cash & equivalents and

restricted cash of ~$2.8 billion. 3

Excludes $96 million from A/R Securitization.

EFH Capital Structure Overview |

Progress in Balance Sheet Initiatives

1

Results to Date

Net Debt Reduction

$ 2B

Debt Maturity Extension

$ 5B

Projected reduction in Interest

Expense through 2014

$ 1B

EFH is focused on creating shareholder value through reducing debt and extending

maturities

1

Since inception of liability management program in October 2009.

36 |

Appendix –

Regulation G Reconciliations

37 |

38

Table 1: EFH Corp. Net Debt Reconciliation¹

As of December 31, 2010

$ millions

Description

12/31/10

Short-term borrowings²

1,125

Long-term debt due currently

669

Long-term debt, less amounts due currently

34,226

Total debt

36,020

Less:

Cash and cash equivalents

(1,534)

Restricted cash

(1,168)

Net debt

33,318

1

GAAP basis which reflects deconsolidation of Oncor. Oncor’s total debt

is ~$5.8 billion, added to EFH Corp.’s debt equals ~$41.8 billion.

2

Excludes $96 million at TXU Receivables Company related to the accounts receivable

securitization program. |

39

Table 2: TCEH Total Debt Reconciliation

As of December 31, 2010

$ millions

1

Excludes $96 million at TXU Receivables Company related to the accounts receivable

securitization program. Description

12/31/10

Short-term borrowings¹

1,125

Long-term debt due currently

649

Long-term debt, less amounts due currently

28,199

Total debt

29,973 |

40

Table 3: Oncor Net Debt Reconciliation

As of December 31, 2010

$ millions

Description

12/31/10

Short-term borrowings

377

Long-term debt due currently

113

Long-term debt, less amounts due currently

5,333

Total debt

5,823

Less:

Cash and cash equivalents

(33)

Restricted cash

(69)

Net debt

5,721 |

41

EFH Corp. Investor Relations Contacts

Rima Hyder

Director, Investor Relations

214-812-5090

rima.hyder@energyfutureholdings.com

Charles Norvell

Analyst, Investor Relations

214-812-8062

charles.norvell@energyfutureholdings.com

|