Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM _________ TO ___________

|

| ALTAIR NANOTECHNOLOGIES INC. |

| (Exact name of registrant as specified in its charter) |

|

Canada

|

1-12497

|

33-1084375

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission File No.)

|

(IRS Employer

Identification No.)

|

||

|

204 Edison Way

Reno, Nevada 89502-2306

|

||||

| (Address of principal executive offices, including zip code) | ||||

Registrant's telephone number, including area code: (775) 856-2500

Securities registered pursuant to Section 12(b) of the Act:

|

Common Shares, no par value

|

NASDAQ Capital Market

|

|

| (Title of Class) |

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES [ ] NO [X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ ] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Report or any amendment to this Report. [ ]

i

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

[ ] Large Accelerated Filer

|

[ ] Accelerated Filer

|

|

|

[ ] Non-accelerated Filer

(Do not check if a smaller reporting company)

|

[X] Smaller reporting Company

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): YES [ ] NO [X]

The aggregate market value of the common shares held by non-affiliates of the Registrant on June 30, 2010, based upon the closing stock price of the common shares on the NASDAQ Capital Market of $1.28 per share on June 30, 2010, was approximately $27.7 million. Common Shares held by each officer and director and by each other person who may be deemed to be an affiliate of the Registrant have been excluded.

As of February 23, 2011, the Registrant had 27,015,680 common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement on Schedule 14A for the Registrant’s 2011 Annual Meeting of Shareholders are incorporated by reference in Part III as specified.

ii

INDEX TO FORM 10-K

|

PART I

|

|

1

|

|

Item 1.

|

Business

|

1

|

|

Item 1A.

|

Risk Factors | 18 |

|

Item 1B.

|

Unresolved Staff Comments

|

32

|

|

Item 2.

|

Properties

|

32

|

|

Item 3.

|

Legal Proceedings

|

32

|

|

Item 4.

|

Reserved

|

32

|

|

PART II

|

33 | |

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

33

|

|

Item 6.

|

Selected Financial Data

|

35

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

35

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

48

|

|

Item 8.

|

Financial Statements and Supplementary Data.

|

49

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

49

|

|

Item 9A.

|

Controls and Procedures

|

49

|

|

Item 9B.

|

Other Information

|

50

|

|

PART III

|

|

51

|

|

Item 10.

|

Directors and Executive Officers of the Registrant

|

51

|

|

Item 11.

|

Executive Compensation

|

51

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters………

|

51

|

|

Item 13.

|

Certain Relationships and Related Transactions

|

51

|

|

Item 14.

|

Principal Accountant Fees and Services

|

51

|

|

PART IV

|

|

52

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

52

|

iii

PART I

This Annual Report on Form 10-K for the year ended December 31, 2010 (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve risks and uncertainties. Purchasers of any of the common shares (the “common shares”) of Altair Nanotechnologies Inc. are cautioned that our actual results will differ (and may differ significantly) from the results discussed in the forward-looking statements. Factors that could cause or contribute to such differences include those factors discussed herein under “Item 1A. Risk Factors” and elsewhere in this Report generally. The reader is also encouraged to review other filings made by us with the Securities and Exchange Commission (the “SEC”) describing other factors that may affect future results.

Unless the context requires otherwise, all references to “Altair,” “we,” “Altair Nanotechnologies Inc,” or the “Company” in this Report refer to Altair Nanotechnologies Inc. and all of its consolidated subsidiaries. Altair currently has one wholly owned subsidiary, Altair US Holdings, Inc., a Nevada corporation. Altair US Holdings, Inc. directly or indirectly wholly owns Altairnano, Inc., a Nevada corporation, Mineral Recovery Systems, Inc., a Nevada corporation and Fine Gold Recovery Systems, Inc., a Nevada corporation which was dissolved on December 30, 2008. AlSher Titania LLC, a Delaware limited liability company, was 70% owned by Altairnano, Inc. until we sold our interest to Sherwin-Williams on April 30, 2010. We have registered the following trademarks: Altair Nanotechnologies Inc® and Altairnano®. Any other trademarks and service marks used in this Report are the property of their respective holders.

We completed a four-for-one reverse stock split during November 2010. All share and per share amounts included in this filing have been restated for the effects of this reverse stock split.

Item 1. Business

We are a Canadian corporation, with principal assets and operations in the United States, whose primary business is developing, manufacturing and selling our nano lithium titanate battery products. Our primary focus is marketing our large-scale energy storage solutions to power companies and electric grid operators throughout the world. In addition, we market our battery products to electric and hybrid-electric mass-transit vehicle manufacturers. During 2010 we also started to expand our market focus to include use of our battery technology in additional industrial markets with applications requiring batteries that can provide high power quickly, a fast recharge, have a long cycle life, operate at a wide temperature range and are safe.

We also provide contract research services on select projects where we can utilize our resources to develop intellectual property and/or new products and technology. Although contract services revenue comprised a significant portion of our total revenues in recent years accounting for 50%, 65%, and 87%, respectively in 2010, 2009 and 2008, we expect a major decline in this percentage as our battery product sales increase.

On September 20, 2010 we entered into a Share Subscription Agreement (the “Share Subscription Agreement” and related agreements with Canon Investment Holdings Limited (“Canon”) pursuant to which Canon has agreed to acquire, subject to certain conditions precedent to closing and events of termination, a number of common shares such that, following closing, it will own 51% of our outstanding common shares on a fully diluted basis. A summary of the proposed Canon transaction is provided beginning on page 13.

Our Power and Energy Group

Our Primary Products

We are developing, marketing, producing and selling our proprietary rechargeable lithium ion batteries, which we refer to as our nano lithium titanate batteries. As explained in greater detail below, the principal features used to compare rechargeable batteries include charge and discharge rates, power and energy density, cycle and calendar life, operational safety and cleanliness, operating temperature range, and round trip efficiency. In laboratory and field tests, our nano lithium titanate batteries have performed extremely well in nearly all of these categories. In particular, our nano lithium titanate batteries show remarkable power, charge and discharge rates and cycle life, together with high functionality at both high and low temperatures. In some categories our batteries perform as much as an order of magnitude (a factor of 10) better than those of rechargeable batteries currently being used for our targeted applications. Battery uses requiring these strengths include electric utility services for frequency regulation, integration of renewable energy generation sources into the grid, uninterruptible power supplies, and hybrid-electric and full-electric vehicles particularly in the mass-transit market.

1

Our Target Markets

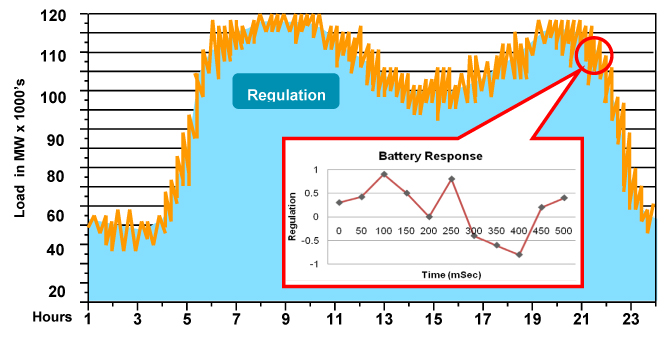

Power and Grid Operators. Power companies and grid operators are seeking cost effective ways to ensure that electric power supply matches electric power demand. There is essentially no inventory of electricity. Power and grid operators are constantly trying to match the electricity generated with the load demanded. They are very good at forecasting from hour to hour the load expected, but they cannot project from minute to minute the exact load anticipated. To maintain proper frequency of the grid (60Hz in the U.S.), the generation and load must be balanced within very tight tolerances. Maintaining these tolerances is typically achieved through the use of auxiliary generators. If the load is either higher or lower than the power being generated, an auxiliary generator is either started or stopped. However, it takes these generators from generally seven to 15 minutes to ramp up to full efficient operation or to shut down. During that period the load may change directions and the grid operator then must direct another auxiliary generator to shut down or ramp up. This is a very inefficient process with the grid operators constantly chasing a variable load. The process of managing these very short-term changes in energy demand is referred to as “frequency regulation.” The chart below depicts what a typical workday in the PJM Regional Transmission Organization that manages the electric grid in the Mid-Atlantic states region looks like and how our battery can help smooth out the fluctuations.

Electricity demand on a typical workday in the PJM electric grid covering the Mid-Atlantic states and District of Columbia

Utilities can address frequency regulation issues by maintaining on-line generating capacity at a level that is always higher than expected peak demand. However this is an expensive solution. Most U.S. utilities are required to maintain between 1% - 1.5% of their peak load capacity to provide frequency regulation. As an example, for the PJM Regional Transmission Organization, this requirement translates into a 900 megawatt daily requirement. In many foreign countries where the electric grid is not as well developed as it is in the U.S., utilities need to reserve up to 5% or more of their capacity strictly to provide frequency regulation. The Cleantech Group estimated in a November 2010 report that the current market for ancillary services is 6.5 gigawatts in the United States annually, or an estimated value in the range of $3-$10 billion depending on power prices and specific ancillary services applications. Globally, they estimate the market to be 33 gigawatts, or a dollar value of between $16 - $45 billion. While these estimates represent a “ballpark” figure and have a highly variable dollar range, the significant magnitude of the market is significant. To reduce the costs of providing frequency regulation, utilities and grid operators are seeking “fast response” energy storage systems. When supply exceeds demand for a short period, these systems accept a charge from the grid until operators reduce output; then when demand exceeds supply for a short period, these fast response storage systems deliver electric energy back to the grid for a short period to give operators time to reroute energy from another power generator or power-up a new power source. Our large-scale nano lithium titanate battery systems are a fast response energy storage system designed to respond in milliseconds and meet this need.

2

The need for a fast response energy storage technology like our large-scale nano lithium titanate battery is increased by the accelerated use of renewable energy sources. Photo Voltaic (PV) solar and wind power generation by nature are intermittent and unpredictable sources of energy that can fluctuate widely in a very short period of time. For example, it is not uncommon for a PV array to fluctuate +/- 50% in less than 90 seconds. With a small rooftop array, it isn’t an issue, because the size of the generator is too small to matter. However, with a 50+ megawatt array, problems arise as the electric grid isn’t currently built to handle this kind of a fluctuation. According to the Federal Energy Regulatory Commission as of August 2010, 29 states and the District of Columbia currently require the integration of renewables into the grid through legislated renewable portfolio standards as shown in the following table.

|

Final Target

|

Number

|

States with Renewable Mandates (RPS)

|

|

10% - 14%

|

6

|

Iowa, Mich., N.C., Ohio, Texas, Wis.

|

|

15% - 19%

|

7

|

Ariz., Mass., Mo., Mont., Pa., R.I., Wash.

|

|

20%

|

4

|

D.C., Kansas, Md., N.M.

|

|

23% - 24%

|

2

|

N.H., N.J.

|

|

25% - 29%

|

6

|

Conn., Del., Ill., Minn., Nev., Ore

|

|

30% - 39%

|

3

|

Calif., Colo., N.Y.

|

|

40%

|

2

|

Hawaii, Maine

|

Many of these states have established targets requiring the integration of renewable generation sources equal to or exceeding 25% of total generation within the next decade. For example, California has a mandate to generate 33% of its electricity from renewable sources by 2020. According to the August 2010 Pacific Gas and Electric Company, Long Term Procurement Plan Proceeding, the 2009 California regulation requirement was 419 megawatt and the California Independent System Operator (CAISO) predicts that to meet the 33% renewable portfolio standard by 2020, California will require 1,114 megawatt of regulation. These levels are substantially higher than what is available today. The mandated adoption of these renewable energy generation systems is likely to increase the need for effective, efficient, clean energy storage technologies to provide frequency regulation services and maintain the reliability and stability of the associated electric grid systems.

Electric and Hybrid Electric Buses. Large cities, counties and transit authorities are increasingly turning to electric and hybrid electric buses to reduce pollution and reliance on diesel fuel for their transportation systems. At this stage of the market development, electric and hybrid electric vehicles generally cost more than their conventional counterparts, although the upfront cost is partially offset by lower operating costs and a potentially longer operating life. Proterra LLC had one of its all electric buses using our batteries tested at the Altoona Test Track by Penn State University and demonstrated a 17.5 to 29.5 miles per gallon (mpg) fuel equivalent vs. a normal diesel bus that gets under 4 mpg. This difference translates into a fuel savings of about $350,000 over the life of the bus assuming fuel cost of $3.50 per gallon. This is in addition to the savings in maintenance costs over the life of the bus as a result of fewer mechanical systems and moving parts to maintain. We believe that cities, counties and mass transit operators are willing to accept the higher upfront costs in order to benefit from the expected savings in long-term operating costs and potentially longer operating life, as well as the environmental benefits.

3

Electric and hybrid electric buses require a significant amount of power, operate throughout the day, have a long expected life and run in all temperatures. The relative strengths of our nano lithium titanate batteries, including the high levels of power, rapid charge and discharge rates, long cycle life and ability to function at temperature extremes, are particularly well suited for electric and hybrid electric buses, giving us what we believe is a compelling competitive advantage in this market.

According to an October 2010 research report from the Freedonia Group Inc., the global market for buses is expanding at a 4.3% annual rate and is expected to hit 423,300 units in 2014. In a separate report published by Pike Research in November 2010, it is projected that the global demand for hybrid-electric buses will grow at a compound annual growth rate of 19.8% between 2010 and 2016. With the growing concern regarding the release of pollutants associated with burning fossil fuels, the attractiveness of all electric and hybrid electric buses is rapidly growing. Working with Proterra and other potential partners, we are attempting to establish our nano lithium titanate batteries as the power source of choice in this emerging market.

Military Uses. As a condition to close our pending funding transaction with Canon planned for May 2011, we ceased all operations in the military market effective December 31, 2010.

Key Features of Our Nano Lithium Titanate Batteries

One of the principal advantages of our nano lithium titanate battery is its rapid charge and discharge rate. The charge rate is the rate at which a battery’s energy is replenished, and the discharge rate is the rate at which the energy stored in a battery is transferred (or, in the case of self-discharge, leaked) out. Through the optimization of materials used in our nano lithium titanate battery cells, our current cells are capable of recharge times of 10 minutes to 95% or more of initial battery capacity. The rapid recharge ability is important in our target markets of frequency regulation and mass-transit buses.

Our nano lithium titanate batteries also discharge rapidly, symmetrical with their charging ability. This balanced charge and discharge capability can be important in frequency regulation. If a battery cannot be charged at the same rate at which it discharges, then over time, with random high rate up and down regulation, a less capable battery system may ultimately be fully discharged and therefore incapable of further regulation.

Our nano lithium titanate batteries have both a longer cycle life and calendar life than commercially available rechargeable battery technologies such as conventional lithium ion, nickel-metal hydride (NiMH) batteries and nickel cadmium (NiCd) batteries. The ability of any rechargeable battery to store energy will diminish as a result of repeated charge/discharge cycles. A battery’s “cycle life” is the number of times it can be charged and discharged without a significant reduction in its energy storage capacity. Our nano lithium titanate is termed a zero strain material, meaning that the material essentially does not change shape upon the entry and exit of a lithium ion in the material. Graphite, the most common material in conventional lithium ion batteries, will expand and contract as much as 8% with each charge/discharge cycle. This constant change in volume rapidly breaks down the battery resulting in significantly shorter calendar and cycle life than with our nano lithium titanate anodes. In a January 2007 test, we completed 25,000 deep charge/discharge cycles of our innovative cells. Even after 25,000 cycles, the cells still retained over 80% of their original charge capacity. This performance represents a significant improvement over conventional batteries, which typically retain that level of charge capacity only through approximately 1,000 to 3,000 deep charge/discharge cycles.

Our nano lithium titanate also represents a breakthrough in low and high-temperature performance. Nearly 90% of room temperature charge retention is realized at -30°C from our nano lithium titanate battery cells. In contrast, common lithium ion technology possesses virtually no charging capabilities at this low temperature, and the other rechargeable battery types such as lead acid, NiMH and NiCd take 10 to 20 times longer to charge at this low temperature. This breakthrough performance at extreme temperatures is important in our target markets, in which large vehicles and large-scale fast storage batteries are expected to function in a wide range of temperature conditions. Transit buses, for example, need to function equally well in the cold New England winters and the hot summers of the Southwest.

4

We also believe that relative safety is one of the strengths of our nano lithium titanate batteries. Any battery cell or large battery unit with lithium ion cell technology must take into account safety considerations, the most important of which is thermal runaway. Thermal runaway is the temperature at which the battery chemistry will break down causing the battery to overheat and potentially explode or catch fire. This temperature is often referred to as the critical temperature. Critical temperature for lithium ion battery cells using conventional graphite anodes is around 130° C, a direct result of chemical reaction between the graphite and the electrolyte. With our current nano lithium titanate anode in place of graphite and an appropriate cathode material, that critical temperature will be close to 200° C, an increase in safety margin of approximately 70° C. Materials we are using in our lab operate at 250oC before the critical temperature is reached. The batteries we and our partners are developing for high power applications often consist of dozens or even thousands of battery cells working together as part of a single modular battery unit. When a large number of cells are aggregated into a single battery unit, the likelihood of, and risks associated with, thermal runaway increases. In this context, we believe that the additional temperature margin our individual battery cells experience before reaching the critical temperature makes our battery cells better suited than competing lithium ion batteries for the high-power applications we are targeting.

The current generation of batteries made with our nano lithium titanate exhibit lower energy density at room temperatures than conventional lithium ion systems. Energy density is normally described as watt-hours per kilogram or watt-hours per liter and refers to the available energy per unit weight or per unit volume. A battery with high energy density will deliver more energy per unit weight or volume than a battery with lower energy density. Our batteries made with our nano lithium titanate have energy densities, watt-hours per kilogram, that are better than lead acid, NiCd and NiMH batteries and approximately 50-70% of conventional lithium ion batteries when operated at room temperature. However, this energy density disadvantage is significantly less compared to conventional lithium ion batteries as the operating temperature moves away from room temperature, particularly to colder environments, and less significant in environments such as large vehicles and utilities in which battery volume is not a significant issue. When the end use of the battery requires constant performance across a wide range of temperatures, such as the need for a hybrid bus to function comparably in both winter and summer, our nano lithium titanate cells may be the preferred solution. Also, conventional lithium ion batteries prefer to cycle between approximately 30% and 80% state of charge to achieve optimum cycle life. As a result, they only use about 50% of their nominal available energy. Our nano lithium titanate batteries, on the other hand, are not so limited and as a result can use approximately 90% of their nominal available energy.

Sources of Supply and Raw Materials

An important consideration as we begin to grow our revenue stream is to ensure that we have access to the various components and raw material we need to manufacture and assemble our various products. With a small product volume having multiple suppliers for each component is not practical. As we anticipate larger orders, establishing multiple sources for key components is becoming much more important to us.

Two raw materials are key components in the manufacture of our nano lithium titanate powder that is the basic building block of our battery products, namely compounds of lithium and of titanium. We currently source our lithium compound from two of the largest producers in the world and do not foresee any problems in scaling up our purchases as our volume of business increases. We source our titanium compound from a single provider who is a global leader in the field, and we are in the process of identifying and qualifying a second supplier for this key material. At this point we are not anticipating any problems or disruptions to our supply of these raw material compounds.

As of Q4 2010, we have two contract manufacturing sources for our nano lithium titanate cells. In 2009 we initiated the establishment of the second contract manufacturing supplier for our cells. In 2010 we completed validation for production readiness and released this supplier in Q4 to begin production for us. We are now receiving volume shipments of high quality battery cells from this second supplier. Once the final documentation steps are completed with this validation process, and all conditions are satisfied under the development contract and initial consignment and master supply agreement, we will initiate the long term contract with this second contract manufacturer. At that point, we will be required to purchase at least $15 million in product from such contract manufacturer over the next several years. During 2010 we continued to experience product quality issues with our first contract manufacturing supplier which limited our supply of new cells during 2010. These quality issues were identified through our quality control process before the cells were sold. We continue to be actively engaged with this supplier to rectify the quality problems. Altairnano is committed to a long-term strategy of a dual sourcing strategy of sourced products of comparable quality and performance and will continue building the maturity of our cell supply chain in line with this objective.

5

All of the other components and materials used in the manufacture of our nano lithium titanate battery products are readily available from multiple suppliers.

Key Business Developments in Power and Energy

Frequency Regulation. As part of a multi-year development program with AES Energy Storage, LLC (“AES”), a subsidiary of global power leader The AES Corporation, we delivered a 2 megawatt battery system, consisting of two 53-foot container-sized 1 megawatt units, to AES in late 2007. AES successfully completed testing of this 2 megawatt battery system in May 2008. The test consisted of AES connecting the battery to the electrical grid at a substation in Indiana and then performing a number of stringent tests to determine if it was capable of providing the services required. These tests were designed and overseen by KEMA, Inc., an independent outside engineering company, and demonstrated that the battery performed well in every respect, meeting or exceeding all expectations. Since then, one of the 1megawatt units has been put into commercial operation in Pennsylvania and has performed flawlessly. The second 1 megawatt unit was recently moved to a location in Texas to provide the same kind of service in that location.

Since May 2008, we have been refining our energy storage solution for the electrical power industry and meeting with potential customers. Because of the significant cost and customization involved in the purchase and sale of a multi-megawatt battery storage system, lead times are long in this industry. However, we are in active negotiations with a number of potential purchasers and have begun building and storing inventory in anticipation of 2011 orders. On February 4, 2011 we accepted a $1.6 million purchase order to supply the University of Hawaii - Hawaii Natural Energy Institute (“HNEI”) with a one-megawatt ALTI-ESS energy storage system for a test of wind energy integration. We anticipate shipping this system to HNEI during the third quarter of 2011. We were also selected by Inversiones Energéticas, S.A. de C.V. (INE), one of El Salvador’s largest electric utilities, to provide a turn-key 10 Megawatt ALTI-ESS advanced battery system for frequency control at its Talnique Power Station.

Hybrid Electric and All Electric Buses. We have been supplying Proterra Inc., a leading designer and manufacturer of heavy-duty drive systems, vehicle control systems, transit buses, and fast charging stations, with battery modules since 2009. In June of 2010 we formalized this relationship with the signing of a long-term supply agreement to provide our advanced lithium-ion battery modules for incorporation into Proterra’s all-electric and hybrid-electric buses. Proterra’s flagship EcoRideTM, BE-35 is a 35-foot all-electric transit bus designed from the ground up to enable transit agencies to replace conventional diesel buses on a one-for-one basis with the world’s first all-electric buses. This is accomplished by combining Proterra’s light-weight composite body, highly efficient ProDriveTM, advanced TerraVoltTM energy storage system and on-route rooftop FastFillTM station to provide the first full size transit vehicle that meets California’s Zero Emission Bus (Zbus) Rules. Proterra’s FastFillTM charge system is comprised of the software and hardware to rapidly charge the TerraVoltTM Energy Storage System (powered by our battery modules) from 0% to 95% with >92% energy charge efficiency in as little as six minutes. The combination of these systems provides a potentially disruptive solution to fleet vehicle operators offering fuel efficiencies between 17.5 and 29 miles per gallon (diesel equivalent range) which is on average more than 500% better than competing solutions.

Proterra is currently working on projects in California, Texas and Washington and recently announced that five major urban transit agencies received more than $25 million in grants from the Federal Transit Administration (FTA) to purchase 20 fast charge battery electric buses and 4 EV charging stations. To our knowledge, the only vehicles that can meet the specifications in the grants are Proterra's EcoRide BE-35™ buses and FastFill™ Charging Stations. Proterra expects to produce 81 transit buses in 2011 and has indicated it is close to closing large contracts in Europe and South America. To meet this increase in demand, Proterra is in the process of expanding its production capacity to a goal of more than 1,500 buses per year with the ability to expand further if necessary.

6

As Proterra continues to grow we look forward to expanding our relationship and working together to enhance the value of their transit solutions. Currently, Proterra is working on resolving investment funding issues. On January 14, 2011 the Securities and Exchange Commission obtained a court order freezing the assets of the Michael Kenwood Group and its related entity MK Energy + Infrastructure, which is Proterra’s lead equity investor. Without further funding from this investor, or from an alternative source,Proterra may not have funds sufficient to continue to purchase battery modules from us. Proterra is currently working with a prominent Silicon Valley investment firm that they anticipate will fund them $20 million by the end of March 2011.

Our Relationship with YTE. In addition, we, Altairnano and Zhuhai Yintong Energy Company Ltd. (“YTE”) entered into a Conditional Supply and Technology Licensing Agreement (the “Supply Agreement”) on September 20, 2010. Pursuant to the Supply Agreement, YTE has agreed to purchase nano lithium titanate, 11 Ahr battery cells and a 1 megawatt ALTI-ESS system from us for an aggregate purchase price of $6.6 million for delivery over the coming years. A portion of nano lithium titanate and the battery cells and ALTI-ESS have already shipped. Pursuant to the First Amendment to Subscription Agreement (the “SSA Amendment”) dated February 16, 2011 between Altair and Canon, YTE’s obligation to purchase the remainder of the nano lithium titanate has been deferred until the parties reach mutually satisfactory resolution on the technical issues relating to the transfer of technology. The Supply Agreement also includes an agreement to license our nano lithium titanate manufacturing technology at no cost to the owner of a manufacturing facility in China, as long as we own a majority of the owner of such facility. In addition, under the Supply Agreement, we grant to YTE a license to use our battery technology to manufacture batteries during a term commencing on the effective date of the Supply Agreement and continuing as long as YTE purchases at least 60 tons of nano lithium titanate annually. If the share purchase closes, the battery technology license will be exclusive in China (including Taiwan, Hong Kong and Macau) as long as YTE purchases at least 1,000 tons of nano lithium titanate per year after 2010 and is non-exclusive in the remainder of Asia (excluding the Middle East), Australia and New Zealand.

Military Relationships. In January 2008, we entered into a development agreement with the Office of Naval Research for $2,490,000. This was a cost reimbursement agreement whereby we developed a proof of concept battery system consisting of two 50-80 kilowatt hour batteries. All testing associated with ONR Phase I was successfully completed in November 2008. We entered into Phase II in May of 2009 and successfully completed all work in this final phase as of December 31, 2010. As a condition to closing our pending funding transaction with Canon planned for May 2011, we ceased all operations in the military market as of December 31, 2010.

Proprietary Rights

We have been awarded a total of 12 U.S. and 42 foreign patents. We have a total of 7 U.S. and 37 foreign patent applications pending. The granted patents cover our nano lithium titanate technology include: 1) Method for producing catalyst structures, 2) Method for producing mixed metal oxides and metal oxide compounds, 3) Process for making lithium titanate, and 4) Process for making nano-sized and sub-micron-sized lithium-transition metal oxides, 5) High performance Lithium Titanium spinel Li4Ti5o12 for electrode material. The U.S. patents expire beginning in 2020.

Pending patent applications are directed to a variety of inventions related to aspects of our electrochemical cells including: ”Lithium-Ion Batteries and the Methods of Operating the Same”; “Method for Preparing a Lithium-Ion Cell”; “Method for Preparing a Lithium-Ion Battery.”

Competition

Frequency Regulation and Fast Energy Storage. A number of battery producers have stated an intent to compete in the frequency regulation and fast energy storage markets; however, to date there are only two that we have directly competed against in customer frequency regulation opportunities and renewable energy integration projects. They are A123 Systems, Inc. (“A123”) and Beacon Power Corporation (“Beacon”). As we or others begin to demonstrate traction in this market we expect to see increasing levels of competition from other credible suppliers. A123 has installed a 2 megawatt battery system in Southern California working with The AES Corporation to demonstrate its ability to provide a frequency regulation service. Unlike the independently conducted stress and performance tests that our 2 megawatt battery system was subjected to in Indianapolis in 2008 where the conclusions of the tests were made publicly available, the performance results of the A123 battery system have not been made public. We are not aware of any direct sales of Beacon’s frequency regulation product to end customers. However, Beacon is constructing a 20 megawatt facility in Stephentown, New York that they will own and operate themselves to provide frequency regulation in the New York market. Unlike A123 or Altair, Beacon employs a flywheel technology to provide frequency regulation.

7

Our products typically compete with existing or alternative technologies for providing frequency regulation and renewables integration rather than a competitor battery manufacturer. However, we expect this situation to change as the market accepts this storage technology to a greater degree. Today most utilities and regional transmission organizations use existing coal, gas and diesel generating sources to provide frequency regulation. Although these sources are inefficient and highly polluting compared to our solution, they are known quantities and accepted by the various regulators and utilities. In many instances, particularly in the U.S., we are attempting to displace this accepted way of doing things. Consequently, there is a longer education and justification period required to help the customer understand the total costs of their current approach and the benefits, both financial and environmental, of switching to our solution. Another major challenge is the significantly lower cost of natural gas in the U.S. Much of the existing frequency regulation in the U.S. is provided by natural gas powered generators. As a result, there is less of a financial incentive for utilities to implement our solution. This cost environment, however, is not the case in many foreign countries. As a result we see greater immediate opportunities for our frequency regulation products outside of the U.S. Once this new energy storage capability starts to get market traction, we expect the rate of acceptance to accelerate. Until then, however, we are experiencing a long sales cycle and don’t expect that to materially change in the near future. We believe that once we demonstrate revenue traction and establish the fact that the market does exist and is very large, other larger suppliers may also target this market.

Electric and Hybrid Electric Bus Applications. In the automotive area there are a large number of battery manufacturers and systems integrators currently serving the market. Many of them are larger companies with substantially stronger financial resources than we have. We believe this market will be driven by low margins and volume. As a result we believe that only larger, well-capitalized companies will ultimately be successful in this market. The mass-transit market, on the other hand, presents a different set of dynamics. The characteristics of our batteries are an excellent fit to satisfy the requirements of this market, and the needs here are different than in the general consumer automotive market. We believe that we can be a successful competitor in this segment of the overall automotive market.

With respect to the electric and hybrid electric mass-transit markets, we are not aware of any commercially available products that have similar performance attributes as our nano lithium titanate batteries. Nonetheless, competitors have announced advanced lithium ion batteries and battery products aimed at these markets. Some may have greater energy density than our nano lithium titanate batteries. However, we believe that these batteries do not match the cycle life, rapid charge and discharge rates and performance at temperature extremes of our nano lithium titanate batteries.

Currently, NiMH batteries dominate the hybrid electric vehicle market, including the mass-transit market. NiMH batteries improve upon the energy capacity and power capabilities of older alternatives, such as NiCd (for the same size cell) by 30% to 40%. Since they contain fewer toxins than NiCd batteries, NiMH batteries are more environmentally friendly than NiCd batteries, although they are not as environmentally friendly as our nano lithium titanate battery. Like NiCd batteries, NiMH batteries can be charged in about 3 hours. Charging rates must be reduced by a factor of 5 to 10 at temperatures below 0°C (32°F) and above 40°C (104°F). NiMH batteries suffer from poor deep cycle ability (i.e. the ability to be discharged to 10% or less of their capacity), possessing a recharge capability following deep discharge on the order of 200 to 300 cycles. While NiMH batteries are capable of high power discharge, dedicated usage in high power applications limits cycle life even further. NiMH batteries also possess high self-discharge rates, which is unintentional leaking of a battery’s charge. NiMH batteries are intolerant to elevated temperature and, as a result, performance and capacity degrade sharply above room temperature. The most serious issue with NiMH, though, involves safety accompanying recharge. The temperature and internal pressure of a NiMH battery cell rises sharply as the cell nears 100% state of charge, necessitating the inclusion of complex cell monitoring electronics and sophisticated charging algorithms in order to prevent thermal runaway, and ultimately fire. A potential limiting factor for the widespread use of NiMH batteries may be the supply of nickel, potentially rendering the technology economically infeasible for these applications as demand continues to rise.

8

Producers of electric and hybrid electric vehicles are seeking to replace NiMH batteries with lithium ion batteries for several reasons. The demand for these vehicles is placing pressures on the limited supply of nickel, potentially rendering the technology economically infeasible for these applications as the demand continues to rise. Compared to NiMH batteries, conventional lithium ion batteries are stable, charge more rapidly (in hours), exhibit low self-discharge, and require very little maintenance. Except as explained below, the safety, cycle life, calendar life, environmental impact and power of lithium ion batteries is comparable to those of NiMH and NiCd batteries.

Conventional lithium ion batteries are the batteries of choice in small electronics, such as cell phones and portable computers, where high energy density and light weight are important. These same attributes are desired for electric vehicle, hybrid electric vehicle, fast energy storage and other markets. However, these applications are principally high power demand applications and/or pose other demands on usage, such as extremes of temperature, need for extremely short recharge times, and even longer extended lifetimes. Because of safety concerns related principally to the presence of graphite in conventional lithium ion batteries, conventional graphite-based lithium ion batteries sufficiently large for such power uses may raise safety concerns. In addition, current lithium ion technology is capable of about 1,000 to 3,000 cycles and has a life of about 3 years, whereas the vehicles in which they are used may have lifetimes as long as 10 to 15 years and require much larger cycle life. Conventional lithium ion batteries also do not function well at extremely hot or cold temperatures. Our batteries --which are safer, have a longer cycle life, rapid charge and discharge rates and function well at extreme temperatures -- are designed to address the power market by providing the key benefits of lithium ion batteries without the shortcomings relative to the power market.

Our All Other Division

Background

During 2008, we operated as three separate divisions – A Power and Energy Group, a Performance Materials Division and a Life Sciences Division. For all of 2010, we were organized into two divisions; a Power and Energy Group and an All Other division. Our All Other division includes the remaining activities of our Performance Materials and Life Sciences divisions.

Based on the results of a review of all our activities, strengths, weaknesses, competitive opportunities and the overall market that was conducted during 2008, we determined to focus our future efforts exclusively in the Power and Energy arena. As a result, we began in late 2008 and early 2009 to eliminate or sell our assets and efforts in the Life Sciences and Performance Materials divisions. As of December 31, 2009, all new efforts in the Life Sciences area had been stopped and the intellectual property rights associated with that division were assigned to Spectrum Pharmaceuticals, Inc. pursuant to an amendment to our existing license agreement. During 2010, the residual work done in the Performance Materials market to fulfill commitments with existing customers totaled $1.7 million in revenue. As of December 31, 2010 we have stopped all ongoing and new efforts in the Performance Materials market with the exception of the nanosensor initiative that we are working on with Western Michigan University (WMU). Although we have completed all of our work on this grant, WMU won’t complete its portion until mid-2011. At that point we will have no further efforts in the Performance Materials market.

9

AlSher Titania LLC

On April 30, 2010 we sold our 70% share in the AlSher Titania, LLC Joint Venture (AlSher) to Sherwin-Williams. Sherwin-Williams now owns 100% of AlSher.

Under terms of the agreement, certain intellectual property relating to the Altairnano Hydrochloride Process (AHP), along with certain other intellectual property owned by us, was licensed to AlSher. We may receive future payments from AlSher based upon future revenues generated from the AHP, or from royalty payments relating to the licensed intellectual property. The amount of future payments from AlSher to us is based on AlSher revenue. All payments are capped at $3,000,000. Payments to us and continuation of the intellectual property licenses are conditional upon certain milestones being achieved and payments being made to us. AlSher also has an option to purchase the licensed intellectual property for $2,000,000.

Life Sciences

Our Life Sciences division was focused on the development and marketing of RenazorbTM products, which were designed to support phosphate control in patients with Chronic Kidney Disease, hyperphosphatemia, and high phosphate levels in blood, associated with End Stage Renal Disease. Based on a comprehensive review of the Life Sciences division, its existing and potential products, the resources available, market opportunity and competition, among other considerations, a decision was made in late 2008 to exit the life sciences arena. Consistent with this decision, in August 2009 we announced an agreement in which we assigned ownership of all patent rights associated with Renazorb™ and Renalan™ to Spectrum Pharmaceuticals, Inc. (Nasdaq: SPPI). The patent assignment amends and restates an existing, limited licensing agreement for Renazorb™ and Renalan™ compounds to Spectrum Pharmaceuticals, which was announced in January 2005. Spectrum Pharmaceuticals now has exclusive worldwide rights to Renazorb™, Renalan™, and any related compounds in any field of use.

Under terms of the agreement, Altairnano received $750,000 in Spectrum Pharmaceuticals common stock, restricted until February 2010. We sold this stock in December 2010 for $649,000 in net proceeds. In addition to the royalty and other payments we were to receive under the prior license agreement, we will now receive 10% of any fees Spectrum Pharmaceuticals may receive from the sublicensing of Renazorb™, Renalan™, and any related compounds. With the execution of this contract with Spectrum Pharmaceuticals, we have completed our efforts to exit the life sciences market and are no longer devoting resources to this area.

Research and Development Expenses

Total research and development expenses were $8.2 million, $9.4 million and $13.0 million for the years ended December 31, 2010, 2009 and 2008, respectively, while research and development costs funded by customers were $4.3 million, $2.9 million and $5.0 million, for the years ended December 31, 2010, 2009 and 2008, respectively.

Dependence on Significant Customers

During the year ended December 31, 2010, we recorded revenues from two major customers in the Power and Energy Group who accounted for 34% and 33% of revenues as follows: Proterra Corporation revenues of $2.7 million and Office of Naval Research revenues of $2.6 million. Our largest customer in the All Other Division, the U.S. Army, had revenue of $1.3 million, or 17% of total revenues.

Government Regulation

Most of our current and proposed activities are subject to numerous federal, state, and local laws and regulations concerning machine and chemical safety and environmental protection. Such laws include, without limitation, the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, and the Comprehensive Environmental Response Compensation Liability Act. We are also subject to laws governing the packaging and shipment of some of our products, including our nano lithium titanate batteries. Such laws require that we take steps to, among other things, maintain air and water quality standards, protect threatened, endangered and other species of wildlife and vegetation, preserve certain cultural resources, reclaim processing sites and package potentially flammable materials in appropriate ways and pass stringent government mandated testing standards before shipping our battery products.

10

Compliance with federal, state, or local laws or regulations represents a small part of our present budget. If we fail to comply with any such laws or regulations, however, a government entity may levy a fine on us or require us to take costly measures to ensure compliance. Any such fine or expenditure may adversely affect our development.

We are committed to complying with and, to our knowledge, are presently in compliance with, all governmental regulations. In the course of completing our due diligence reviews associated with the Canon investment we discovered several instances in which we had not complied completely with certain International Traffic in Arms Regulations (ITAR). Those instances were reported to the appropriate government agency and have since been corrected. We were directed to comply with all appropriate regulations on a going forward basis, but did not receive any fines or other penalties as a result of those infractions. We cannot predict the extent to which future legislation and regulation could cause us to incur additional operating expenses, capital expenditures, and/or restrictions and delays in the development of our products and properties.

Government Contracts

A substantial portion of our current revenue has been derived from government grants and contracts. The government grants and contracts we enter into are subject to termination or delay of funding at the election of the government. As a result, any termination of such agreements would significantly reduce revenue and the capital to sustain operations and research. In order to comply with ITAR, one of the requirements for us to close the investment from Canon is that we abandon all of our military business, which we have done as of December 31, 2010. We may enter into future non-military government business, but we do not anticipate that this will be a significant portion of our future revenues.

Environmental Regulation and Liability

Any proposed processing operation at our main operating facilities in Reno, Nevada and Anderson, Indiana and any other property we use will be subject to federal, state, and local environmental laws. Under such laws, we may be jointly and severally liable with prior property owners for the treatment, cleanup, remediation, and/or removal of substances discovered at any other property used by us; to the extent the substances are deemed by the federal and/or state government to be toxic or hazardous. Courts or government agencies may impose liability for, among other things, the improper release, discharge, storage, use, disposal, or transportation of hazardous substances. We use hazardous substances in our testing and operations and, although we employ reasonable practicable safeguards to prevent any liability under applicable laws relating to hazardous substances, companies engaged in materials production are inherently subject to substantial risk that environmental remediation will be required.

Financial Information about Segments and Foreign Sales

Information with respect to assets, net sales, loss from operations and depreciation and amortization for the Power and Energy Group, and All Other Division is presented in Note 18, Business Segment Information, of Notes to Consolidated Financial Statements in Part IV.

Information with respect to foreign and domestic sales and related information is also presented in Note 18, Business Segment Information, of Notes to Consolidated Financial Statements in Part IV.

11

Subsidiaries

Altair Nanotechnologies Inc. was incorporated under the laws of the province of Ontario, Canada in April 1973 under the name Diversified Mines Limited, which was subsequently changed to Tex-U.S. Oil & Gas Inc. in February 1981, then to Orex Resources Ltd. in November 1986, then to Carlin Gold Company Inc. in July 1988, then to Altair International Gold Inc. in March 1994, then to Altair International Inc. in November 1996 and then to Altair Nanotechnologies Inc. in July 2002. In July 2002, Altair Nanotechnologies Inc. redomesticated from the Ontario Business Corporations Act to Canada’s federal corporate statute, the Canada Business Corporations Act.

Altair US Holdings, Inc. was incorporated by Altair in December 2003 for the purpose of facilitating a corporate restructuring and consolidation of all U.S. subsidiaries under a U.S. holding company. At the completion of the corporate restructuring, Fine Gold, MRS, and Altairnano, Inc. (f/k/a Altair Nanomaterials, Inc.) were direct wholly-owned subsidiaries of Altair US Holdings, Inc., while Tennessee Valley Titanium, Inc. previously a wholly-owned subsidiary of MRS, was dissolved on July 7, 2006.

Altair acquired Fine Gold in April 1994. Fine Gold has earned no operating revenues to date. Fine Gold acquired the intellectual property associated with the now defunct Altair jig, a fine particle separation device for use in minerals processing, in 1996. Fine Gold was formally dissolved on December 30, 2008.

Mineral Recovery Systems, Inc., or MRS, was incorporated in April, 1987 and was formerly known as Carlin Gold Company. MRS previously has been involved in the exploration for minerals on unpatented mining claims in Nevada, Oregon and California and the holding of mineral leases in Tennessee. MRS currently does not hold any properties or leases.

Altair Nanomaterials, Inc. was incorporated in 1998 as a wholly-owned subsidiary of MRS and holds all of our interest in our nanomaterials and titanium dioxide pigment technology and related assets. Altair Nanomaterials Inc. was subsequently renamed Altairnano, Inc. on July 6, 2006.

AlSher Titania LLC was incorporated in April 2007 as a joint venture company which was 70% owned by Altairnano, Inc. until this interest was sold to Sherwin-Williams on April 30, 2010. This company was formed to combine certain technologies of Altairnano, Inc. with the Sherwin-Williams Company in order to develop, market, and produce titanium dioxide pigment for use in a variety of applications.

Corporate History

Altair Nanotechnologies Inc. was incorporated under the laws of the Province of Ontario, Canada in April 1973 for the purpose of acquiring and exploring mineral properties. It was redomesticated in July 2002 from the Business Corporations Act (Ontario) to the Canada Business Corporations Act, a change that causes Altair to be governed by Canada's federal corporate statute. The change reduced the requirement for resident Canadian directors from 50% to 25% of the board of directors, which gave us greater flexibility in selecting qualified nominees to our board.

During the period from inception through 1994, we acquired and explored multiple mineral properties. In each case, sub-economic mineralization was encountered and the exploration was abandoned.

Beginning in 1996, we entered into leases for mineral property near Camden, Tennessee and owned the rights to the Altair jig. However, we have terminated our leases on all of the Tennessee mineral properties and during 2009 disposed of the remaining centrifugal jigs and abandoned the applicable patents since we were unable to identify an interested party to purchase them.

In November 1999, we acquired all the rights of BHP Minerals International, Inc., or BHP, in the nanomaterials and titanium dioxide pigment technologies and the nanomaterials and titanium dioxide pigment assets from BHP. We are employing the nanomaterials technology as a platform for the production and sale of metal oxide nanoparticles in our nano lithium titanate batteries.

12

During 2010 the Company investigated domesticating from Canada to the state of Nevada and secured shareholder approval to do so. However, in conjunction with the pending Canon investment, the Board determined that it was not in the best interests of shareholders to do so at the present time.

We have experienced an operating loss in every year of operation. In the fiscal year ended December 31, 2010, we experienced a net loss of $22.3 million.

We completed a four-for-one reverse stock split during November 2010. All share and per share amounts included in this filing have been restated for the effects of this reverse stock split.

Our Proposed Transaction With Canon

Share Subscription Agreement. We entered into the Share Subscription Agreement with Canon on September 20, 2010. Pursuant to the terms of the Share Subscription Agreement, Canon has agreed to acquire the number of common shares such that immediately following closing it will own 51% of our outstanding common shares on a fully diluted basis. The purchase price will be $1.5528 per share. Based upon the number of common shares and the rights to acquire common shares outstanding as of December 31, 2010, we estimate that the number of shares to be purchased will be 31,523,017, at an aggregate purchase price of $48,948,799.16. If we issue additional common shares prior to closing, as permitted by the SSA Amendment, the number of shares to be purchased, and the aggregate purchase price, will increase.

We entered into the SSA Amendment with Canon on February 16, 2011. The SSA Amendment (a) extended of the closing deadline and closing date under the Agreement to May 17, 2011 in order to permit the resolution of certain technology transfer issues and other matters, (b) authorized us to raise additional capital from third parties prior to May 1, 2011, subject to a dilution limit of less than 20% of outstanding common shares, and a further limit of US$7,500,000 in aggregate offerings if any issuance will be made at per share price, taking into account the implied value of any warrants issued in connection with such issuance, lower than $1.5528; (c) authorized Canon to terminate the Share Subscription Agreement if we issue our common shares prior to closing at a per share price, taking into account the implied value of any warrants issued in connection with such issuance, lower than $1.5528; and (d) defers the purchase and sale of nano lithium titanate under the existing Supply Agreement.

The obligations of Altair and Canon to close the transactions contemplated by the Share Subscription Agreement are subject to the satisfaction or waiver (where permissible under applicable law) of various closing conditions. Altair has satisfied all conditions to Canon’s obligation to close, other than deliveries to be made at closing; however, such conditions would no longer be satisfied if there were a material adverse change prior to the closing date.

Prior to the earlier of closing of the share purchase and the termination of the Share Subscription Agreement, Altair continues to be subject to certain operational limitations, including agreements that it will not, without Canon’s consent:

| · |

amend its articles or bylaws or other similar organizational documents (whether by merger, consolidation or otherwise);

|

| · |

change its jurisdiction of incorporation from the federal jurisdiction of Canada;

|

| · |

(i) split, combine or reclassify any shares of its capital stock, (ii) declare, set aside or pay any dividend or other distribution (whether in cash, stock or property or any combination thereof) in respect of its capital stock, or (iii) redeem, repurchase or otherwise acquire or offer to redeem, repurchase, or otherwise acquire any of its securities or those of its subsidiaries;

|

13

| · |

(i) issue, deliver or sell, or authorize the issuance, delivery or sale of, any of its securities or those of its subsidiaries, other than the issuance of (A) any common shares upon the exercise of stock options or warrants that are outstanding on the date of the Share Subscription Agreement in accordance with the terms of those options or warrants on the date of the Share Subscription Agreement and (B) any securities of its subsidiaries to it or any other subsidiary; however, as a result of the SSA Amendment, Altair may raise additional capital from third parties prior to May 1, 2011, subject to a dilution limit of less than 20% of outstanding common shares and a further limit of $7,500,000 in aggregate offerings if any issuance will be made at per share price, taking into account the implied value of any warrants issued in connection with such issuance, lower than $1.5528; or (ii) amend any term of any security or its subsidiaries (in each case, whether by merger, consolidation or otherwise);

|

| · |

incur any capital expenditures or any obligations or liabilities in respect thereof, except for (i) those contemplated by the capital expenditure budget made available to Canon and (ii) any unbudgeted capital expenditures not to exceed $75,000 individually;

|

| · |

acquire (by merger, consolidation, acquisition of stock or assets or otherwise), directly or indirectly, any assets, securities, properties, interests or businesses, other than (i) supplies in the ordinary course of the business of Altair and its subsidiaries in a manner that is consistent with past practice and (ii) acquisitions with a purchase price (including assumed indebtedness) that does not exceed $50,000 individually;

|

| · |

sell, lease or otherwise transfer, or create or incur any lien on, any of its assets, securities, properties, interests or businesses, other than (i) sales of its product, inventory or obsolete equipment in the ordinary course of business consistent with past practice, and (ii) sales of assets, securities, properties, interests or businesses with a sale price (including any related assumed indebtedness) that does not exceed $50,000 individually;

|

| · |

other than in connection with certain actions permitted by the Share Subscription Agreement, make any loans, advances or capital contributions to, or investments in, any other person, other than in the ordinary course of business consistent with past practice;

|

| · |

create, incur, assume, or otherwise be liable with respect to any indebtedness for borrowed money or guarantees thereof;

|

| · |

(i) enter into any material contract, agreement, arrangement or understanding or (ii) enter into, amend or modify in any material respect or terminate any material contract or otherwise waive, release or assign any material rights, claims or benefits;

|

| · |

enter into, amend or modify in any respect any government contract (including to extend the terms thereof, but excluding termination or assignment of the same to a third party) if such contract involves the manufacture or export of certain materials subject to the ITAR;

|

| · |

(i) with respect to any director, officer, employee or independent contractor or any of its subsidiaries whose annual base salary exceeds $100,000, (A) grant or increase any severance or termination pay to (or amend any existing severance pay or termination arrangement) or (B) enter into any employment, deferred compensation or other similar agreement (or amend any such existing agreement), (ii) increase benefits payable under any existing severance or termination pay policies, (iii) establish, adopt or amend (except as required by applicable law) any collective bargaining, bonus, profit-sharing, thrift, pension, retirement, deferred compensation, stock option, restricted stock or other benefit plan or arrangement or (iv) increase compensation, bonus or other benefits payable to any employee except, with respect to any director, officer, employee or independent contractor or any of its subsidiaries whose annual base salary does not exceed $100,000, for increases in the ordinary course of business consistent with past practice;

|

| · |

change its methods of accounting, except as required by concurrent changes in Generally Accepted Accounting Principles or in Regulation S-X of the Securities Exchange Act of 1934, as agreed to by its independent public accountants;

|

14

| · |

settle, or offer or propose to settle, (i) any material litigation, investigation, arbitration, proceeding or other claim involving or against it or any of its subsidiaries, (ii) any shareholder litigation or dispute against it or any of its officers or directors or (iii) any litigation, arbitration, proceeding or dispute that relates to the transactions contemplated hereby;

|

| · |

take any action that would make any representation or warranty of it under the Share Subscription Agreement, or omit to take any action necessary to prevent any representation or warranty of it hereunder from being, inaccurate in any respect at, or as of any time before, the closing date;

|

| · |

sell, lease, license, assign, transfer, abandon, allow to lapse or otherwise dispose of, encumber or subject to any lien, any intellectual property it owns other than in accordance with non-exclusive licenses to customers entered into in the ordinary course of business consistent with past practice; or

|

| · |

agree, resolve or commit to do any of the foregoing.

|

Under the Share Subscription Agreement, we have agreed not to solicit, engage in any negotiations with respect to or sign any agreements with respect to an alternative significant investment transactions, a sale of the company or a similar transaction, except that we may raise capital prior to May 1, 2011 as permitted by the SSA Amendment. Our right to accept superior proposals under certain conditions expired following shareholder approval of the transaction.

The Share Subscription Agreement may be terminated by mutual written agreement of Canon and Altair. The agreement may also be terminated by either us or Canon if:

|

|

·

|

the closing has not occurred on or before May 17, 2011 (but only by a party to the agreement whose breach of any provision of the agreement has not resulted in the closing not occurring by such date);

|

|

|

·

|

any applicable law makes the transactions contemplated by the Share Subscription Agreement illegal or enjoins either party from consummating such transactions;

|

|

|

·

|

the U.S. government shall have taken any action to suspend or prohibit the transactions contemplated by the Share Subscription Agreement or the other transaction documents or to impose a condition on Canon, Altair or any of its subsidiaries that would have an adverse effect on our business or that would limit Canon’s ability to exercise its ownership rights with respect to Altair.

|

Canon may terminate the Share Subscription Agreement if:

|

|

·

|

we have breached any of our obligations, representations or warranties set forth in the Share Subscription Agreement that would cause the closing conditions related to representations, warranties or pre-closing covenants not to be satisfied and such condition is incapable of being satisfied by May 17, 2011;

|

|

|

·

|

we have intentionally and materially breached any prohibitions related to alternative transactions;

|

|

|

·

|

we are required to divest any products, technology, or related services that Canon, in its reasonable discretion, deems essential to the transactions contemplated by the Share Subscription Agreement or the other contemplated transaction documents or to our business as a result of our obligation to divest itself of ITAR-controlled assets and technology and to cease manufacturing and exporting “defense articles” and providing “defense services”;

|

|

|

·

|

we are or will be prohibited from exporting or reexporting products, technology or related services possessed, produced, sold by, or under development to countries other than certain embargoed countries; or

|

|

|

·

|

we are or will be prohibited from manufacturing outside the United States products produced, sold by, or under development by us in countries other than certain embargoed countries.

|

15

We may terminate the Share Subscription Agreement if Canon shall have breached any of its obligations, representations or warranties set forth in the Share Subscription Agreement that would cause the closing conditions related to representations, warranties or pre-closing covenants not to be satisfied and such condition is incapable of being satisfied by May 17, 2011.

We will be required to pay to Canon a termination fee in the amount of $2,000,000 (the “Termination Fee”) if (1) the Share Subscription Agreement is terminated by Canon following our breach of any of our obligations, representations or warranties set forth in the Share Subscription Agreement that would cause the closing conditions related to representations, warranties or pre-closing covenants not to be satisfied and such condition is incapable of being satisfied by May 17, 2011; or (2) we intentionally and materially breach the prohibitions related to alternative transactions.

We will also be required to pay the Termination Fee if (1) the Share Subscription Agreement is terminated by either Altair or Canon based on the failure to close by May 17, 2011, we are required to divest essential products, technology or related services pursuant to the closing conditions related to ITAR, we are subject to certain exporting or reexporting restrictions, or we are prohibited from manufacturing our products outside the United States in countries other than certain embargoed countries, (2) a proposal for an alternative transaction is publicly announced or otherwise communicated to our Board or shareholders and (3) we consummate, enter into a definitive agreement with respect to, or recommend to our shareholders an alternative transaction within eighteen months of the Share Subscription Agreement being terminated. Upon termination of the Share Subscription Agreement in connection with the events identified in subsection (1) of this paragraph, we will also be required to reimburse Canon’s out-of-pocket fees and expenses (including attorney fees) in connection with the Share Subscription Agreement, up to an aggregate amount of $500,000.

Investor Rights Agreement. Simultaneous to our execution of the Share Subscription Agreement, we and Canon also entered into an Investor Rights Agreement, pursuant to which we granted certain rights to Canon following closing, including (i) rights to proportional representation on our Board of Directors, rounded up to the nearest director, (ii) the right to cause us to file a shelf registration statement two years after closing, together with certain demand and piggy-back registration rights, (iii) certain indemnification rights related to the registration rights, and (iv) an option to purchase our common shares at market price in an amount sufficient to maintain proportionate ownership in connection with future dilutive issuances.

Supply Agreement. In addition, we, Altairnano and YTE entered into the Supply Agreement. Pursuant to the Supply Agreement, YTE has agreed to purchase nano lithium titanate, 11 Ahr battery cells and a 1 megawatt ALTI-ESS system from us for an aggregate purchase price of $6.6 million for delivery over the coming years. A portion of nano lithium titanate and the battery cells and ALTI-ESS have already shipped. Pursuant to the SSA Amendment, YTE’s obligation to purchase the remainder of the nano lithium titanate has been deferred until the parties reach mutually satisfactory resolution on the technical issues relating to the transfer of technology. The Supply Agreement also includes an agreement to license our nano lithium titanate manufacturing technology at no cost to the owner of a manufacturing facility in China, as long as we own a majority of the owner of such facility. In addition, under the Supply Agreement, we grant to YTE a license to use our battery technology to manufacture batteries during a term commencing on the effective date of the Supply Agreement and continuing as long as YTE purchases at least 60 tons of nano lithium titanate annually. If the share purchase closes, the battery technology license will be exclusive in China (including Taiwan, Hong Kong and Macau) as long as YTE purchases at least 1,000 tons of nano lithium titanate per year after 2010 and is non-exclusive in the remainder of Asia (excluding the Middle East), Australia and New Zealand.

Waiver and Rights Agreement. We entered into a Waiver and Rights Agreement with Al Yousuf LLC on September 20, 2010. Under the Waiver and Rights Agreement, Al Yousuf LLC has waived its right of first offer with respect to the Share Subscription Agreement. Al Yousuf LLC has also agreed that, with respect to any underwritten demand registration under its pre-existing registration rights agreement with us, to the extent Canon exercises piggyback registration rights under the Investor Rights Agreement and there is an underwriter cutback, Canon and Al Yousuf LLC will participate on a pro rata basis proportionate to their share ownership.

16

We have agreed that, following the closing of the share issuance, Al Yousuf LLC will have the right to designate one director until such time as Al Yousuf LLC holds less than 5% of our outstanding common shares on a fully-diluted basis. During the period we have only nine directors, the director appointed by Al Yousuf LLC will be one of the independent directors and serve as a member of the audit committee of our Board of Directors.

We have further agreed that, at our next annual shareholder meeting following the closing of the transactions contemplated by the Share Subscription Agreement or if the Board decides to call a special shareholder meeting, at such shareholder meeting, we will propose to amend our articles to increase the size of the Board to no less than eleven directors and to nominate two new directors to the Board, one of whom to be designated by Canon and the other to be an independent director nominated by the Board pursuant our then-existing director nomination practice. Canon and Al Yousuf LLC have agreed to vote their common shares in favor of such proposal and the election of the two new directors. Under the Waiver and Rights Agreement, the parties have agreed that, upon closing of the share issuance, the lock up provisions applicable to the shares Al Yousuf LLC acquired from us will terminate.

Employees