Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-32337

DREAMWORKS ANIMATION SKG, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 68-0589190 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| Campanile Building 1000 Flower Street Glendale, California |

91201 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (818) 695-5000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered | |

| Class A Common Stock, par value $0.01 per share |

Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

The aggregate market value of Class A common stock held by non-affiliates as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1,803,877,220 using the closing price of $28.55 as reported by the Nasdaq Global Select Market as of such date. As of such date, non-affiliates held no shares of Class B common stock. There is no active market for the Class B common stock. Shares of Class A common stock held by all executive officers and directors of the registrant and all persons holding more than 10% of the registrant’s Class A or Class B common stock have been deemed, solely for the purpose of the foregoing calculations, to be held by “affiliates” of the registrant as of June 30, 2010.

As of February 18, 2011, there were 73,652,549 shares of Class A common stock and 10,838,731 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this Annual Report on Form 10-K is incorporated by reference from the registrant’s definitive proxy statement (the “Proxy Statement”) to be filed pursuant to Regulation 14A with respect to the registrant’s 2011 annual meeting of stockholders. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, the Proxy Statement is not deemed to be filed as part hereof.

DreamWorks Animation SKG, Inc.

Form 10-K

For the Year Ended December 31, 2010

| Page | ||||||

| PART I |

||||||

| Item 1. |

1 | |||||

| Item 1A. |

13 | |||||

| Item 1B. |

30 | |||||

| Item 2. |

30 | |||||

| Item 3. |

31 | |||||

| Item 4. |

31 | |||||

| PART II |

||||||

| Item 5. |

35 | |||||

| Item 6. |

39 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

41 | ||||

| Item 7A. |

63 | |||||

| Item 8. |

63 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

63 | ||||

| Item 9A. |

64 | |||||

| Item 9B. |

64 | |||||

| PART III |

||||||

| Item 10. |

65 | |||||

| Item 11. |

65 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

65 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

65 | ||||

| Item 14. |

65 | |||||

| PART IV |

||||||

| Item 15. |

66 | |||||

Unless the context otherwise requires, the terms “DreamWorks Animation,” the “Company,” “we,” “us” and “our” refer to DreamWorks Animation SKG, Inc., its consolidated subsidiaries, predecessors in interest and the subsidiaries and assets and liabilities contributed to it by the entity then known as DreamWorks L.L.C. (“Old DreamWorks Studios”) on October 27, 2004 (the “Separation Date”) in connection with our separation from Old DreamWorks Studios (the “Separation”).

PART I

| Item 1. | Business |

Overview

DreamWorks Animation creates family entertainment, including animated feature films, television specials and series, live entertainment properties, an online virtual world and related consumer products, meant for audiences around the world. We have released a total of 21 animated feature films of which Shrek the Third, Shrek 2 and Madagascar were the highest-grossing animated films in the domestic box office in their respective years of release, and Shrek 2 remains the fifth-highest grossing film of all time in the domestic box office.

Historically, our business plan has generally been to release two animated feature films per year. In 2009, we announced that, beginning in 2010, we expect to release a total of five movies every two years. In 2010, we released three animated films, How to Train Your Dragon, Shrek Forever After and Megamind. We are currently producing five additional feature films, of which we expect to release two in 2011 and three in 2012. In addition, we have a substantial number of projects in creative and story development and production that are expected to fill the release schedule in 2013 and beyond. In 2007, we announced that all of our films, beginning with the release of Monsters vs. Aliens in 2009, would be released in stereoscopic 3D.

Our feature films are currently the source of a substantial portion of our revenue. We derive revenue from our distributors’ worldwide exploitation of our feature films in theaters and in ancillary markets such as home entertainment and pay and free broadcast television. In addition, we earn revenue from the licensing and merchandising of our films and characters in markets around the world. Effective January 31, 2006, our results reflect our distribution, servicing and other arrangements with Paramount Pictures Corporation and its affiliates and related entities, including Old DreamWorks Studios (collectively “Paramount”). Beginning with the fourth quarter of 2004 and continuing through January 31, 2006, our results reflect the effects of our distribution, servicing and other arrangements with Old DreamWorks Studios as also discussed. For a discussion of our distribution arrangements prior to January 31, 2006, see our Annual Report on Form 10-K for the year ended December 31, 2007. For a discussion of the Company’s business segment and of geographic information about the Company’s revenues, please see the Company’s consolidated financial statements and notes thereto included in this Annual Report on Form 10-K.

Company History

Prior to the Separation on October 27, 2004, we were a business division of Old DreamWorks Studios, the diversified entertainment company formed in October 1994 by Steven Spielberg, Jeffrey Katzenberg and David Geffen. As a division of Old DreamWorks Studios, we conducted our business primarily through Old DreamWorks Studios’ animation division. On October 28, 2004, our Class A common stock began trading on the New York Stock Exchange in connection with our initial public offering.

In connection with the Separation, we entered into a separation agreement (the “Separation Agreement”) and a number of other agreements with Old DreamWorks Studios to accomplish the

1

Separation and establish the terms of our various relationships with Old DreamWorks Studios. We completed the Separation in connection with our initial public offering in October 2004 by the direct transfer to us of certain of the assets and liabilities that comprise our business. Old DreamWorks Studios also transferred certain of its subsidiaries to us.

We conduct our business primarily in two studios—in Glendale, California, where we are headquartered, and in Redwood City, California. Our Glendale animation campus, where the majority of our animators and production staff are based, was custom built in 1997.

We generally retain the exclusive copyright and other intellectual property rights to all of our projects and characters, other than (i) co-ownership of the copyright and other intellectual property rights (including characters) in and to Flushed Away, which was co-produced with Aardman Animations, Ltd. (“Aardman”), (ii) Wallace & Gromit: The Curse of the Were-Rabbit, a film owned by Aardman for which we generally have worldwide distribution rights in perpetuity, excluding certain United Kingdom television rights and certain ancillary markets, (iii) co-ownership of the copyright and other intellectual property rights (including characters) in and to Chicken Run with Aardman Chicken Run Limited and Pathé Image and (iv) the animated television series The Penguins of Madagascar and Kung Fu Panda: Legends of Awesomeness, for which the copyright is owned by Nickelodeon.

Films in Production and Development

We are currently producing five animated feature films for release in 2011 and 2012. In addition, we have a substantial number of projects in development and production that are expected to fill our release schedule in 2013 and beyond. The table below lists all of our films that are expected to be released through the end of 2012.

| Title |

Expected Release Date* | |

| Kung Fu Panda 2 |

June 3, 2011 | |

| Puss in Boots |

November 4, 2011 | |

| The Croods |

First Quarter 2012 | |

| Madagascar 3 |

Second Quarter 2012 | |

| Rise of the Guardians |

Fourth Quarter 2012 |

| * | Release dates are tentative. Due to the uncertainties involved in the development and production of animated feature films, the date of completion can be significantly delayed. |

Non-Feature Film Businesses

Over the last few years, the Company has commenced a number of initiatives aimed at further capitalizing on its franchise film properties, such as Shrek, Madagascar and Kung Fu Panda. These business initiatives seek to diversify the Company’s revenue streams by exploiting the film properties in other areas of family entertainment, including the following:

Television Specials and Series

Since 2007 (with our Christmas special, Shrek the Halls), the Company has been producing half-hour television specials based on its films, Shrek, Kung Fu Panda, Madagascar and Monsters vs. Aliens. The Company has additional television specials/series in development based on its films

2

(including How to Train Your Dragon) for initial broadcast in 2011 and beyond. In connection with these specials/series, the Company entered into various network television distribution agreements. The Company retains all other distribution rights (such as DVD, other home entertainment and consumer product distribution rights) with respect to its television specials/series.

The animated television series, The Penguins of Madagascar, debuted on the Nickelodeon network in March 2009. Under the Company’s agreement with Paramount, an affiliate of Nickelodeon (which is discussed in greater length in “Distribution and Servicing Arrangements—How We Distribute, Promote and Market Our Films—Nickelodeon Television Development”), the Company is generally entitled to receive one-half of the revenues, as well as certain service fees, associated with home entertainment and consumer products sales related to the television series. The Company and Nickelodeon are currently producing an animated television series based on Kung Fu Panda, which the Company expects will debut on the Nickelodeon network in late 2011.

The Company is also producing an animated television series based on How to Train Your Dragon, for broadcast on the Cartoon Network.

Live Performances

From December 2008 until January 2010, the Company’s Shrek The Musical ran on Broadway. The play is based on the Company’s 2001 theatrical release, Shrek. In July 2010, the Company launched a national touring production of the play. The Company currently expects that a separate production of the play will begin public performances in London in May 2011. In January 2011, a live show based on the film Madagascar debuted in the United States. The Company is also developing live shows based on its theatrical properties Kung Fu Panda and How to Train Your Dragon.

Online Virtual World

The Company’s online virtual world based on the film Kung Fu Panda became available to the public in March 2010. The virtual world is aimed at children ages seven through 12. The Company currently realizes revenue from the virtual world through user subscription fees and advertising.

Distribution and Servicing Arrangements

On January 31, 2006, Viacom Inc. and certain of its affiliates (collectively, “Viacom”) (including Paramount) acquired Old DreamWorks Studios. In connection with this transaction, we terminated our prior distribution agreement with Old DreamWorks Studios (the “Old DreamWorks Studios Distribution Agreement”). Effective January 31, 2006, the worldwide theatrical and television distribution and home video fulfillment services for our films released after January 31, 2006 have been provided by Paramount. A detailed discussion of our distribution and fulfillment services agreements with Paramount is provided immediately below. For the period beginning October 1, 2004 to January 31, 2006, our films were distributed in the domestic theatrical and worldwide television market directly by Old DreamWorks Studios and in international theatrical and worldwide home entertainment markets by Universal Studios, Inc. (“Universal Studios”), as an approved subdistributor and fulfillment services provider of Old DreamWorks Studios, in each case

3

pursuant to the terms of the Old DreamWorks Studios Distribution Agreement. For a detailed discussion of these prior distribution and servicing arrangements, please see our Annual Report on Form 10-K for the year ended December 31, 2007.

How We Distribute, Promote and Market our Films

Overview

On January 31, 2006, we entered into a distribution agreement with Paramount and its affiliates (the “Paramount Distribution Agreement”), and our wholly owned subsidiary, DreamWorks Animation Home Entertainment, L.L.C. (“DreamWorks Animation Home Entertainment”), entered into a fulfillment services agreement (the “Paramount Fulfillment Services Agreement” and, with the Paramount Distribution Agreement, the “Paramount Agreements”) with an affiliate of Paramount.

Under the Paramount Distribution Agreement, subject to certain exceptions, Paramount advertises, publicizes, promotes, distributes and exploits our animated feature films in each territory and in each media designated by us. Under the Paramount Fulfillment Services Agreement, we have engaged Paramount to render worldwide home video fulfillment services and video-on-demand services in each territory designated by us for all films previously released for home entertainment exhibition and video-on-demand exhibition by us, and for every animated film licensed to Paramount pursuant to the Paramount Distribution Agreement with respect to which we own or control the requisite rights.

Paramount Distribution Agreement

The following is a summary of the Paramount Distribution Agreement, which is filed as an exhibit to this Form 10-K. This summary is qualified in all respects by such reference. Investors in our common stock are encouraged to read the Paramount Distribution Agreement.

Term of Agreement. Subject to certain exceptions, the Paramount Distribution Agreement grants Paramount the worldwide right to distribute all of our animated films, including previously released films, completed and available for release through the later of (i) our delivery to Paramount of 13 new animated feature films, and (ii) December 31, 2012, unless, in either case, the agreement is terminated earlier in accordance with its terms. To date, we have delivered a total of 10 animated feature films under the agreement. If we or Paramount terminate the Paramount Distribution Agreement, our existing and future films will generally be subject to the terms of any sub-distribution, servicing and licensing agreements entered into by Paramount that we have pre-approved. The distribution rights granted to Paramount generally include (i) domestic and international theatrical exhibition, (ii) domestic and international television licensing, including pay-per-view, pay television, network, basic cable and syndication, (iii) non-theatrical exhibition, such as on airlines, in schools and in armed forces institutions, and (iv) Internet, radio (for promotional purposes only) and new media rights, to the extent that we or any of our affiliates own or control the rights to the foregoing at the time of delivery. We retain all other rights to exploit our films, including domestic and international home entertainment exhibition and video-on-demand exhibition rights (and we have engaged Paramount under the Paramount Fulfillment Services

4

Agreement to render services in connection with our exploitation of these rights on a worldwide basis), and the right to make prequels and sequels, commercial tie-in and promotional rights with respect to each film, as well as merchandising, theme park, interactive, literary publishing, music publishing and soundtrack rights. Once Paramount has acquired the license to distribute one of our animated feature films, Paramount generally will have the right to exploit the film in the manner described above for 16 years from such film’s initial general theatrical release.

Distribution Services. Paramount is responsible for the worldwide distribution in the media mentioned above of all of our animated feature films, but may engage one or more sub-distributors and service providers in those territories and media in which Paramount subdistributes all or substantially all of its motion pictures, subject to our prior written approval. Our grant of distribution rights to Paramount is expressly subject to certain existing subdistribution and license agreements previously entered into by Old DreamWorks Studios. Pursuant to the Paramount Distribution Agreement, we are required to continue to license directly to Old DreamWorks Studios those distribution rights in and to our existing and future animated films, to the extent necessary for Old DreamWorks Studios to comply with such existing subdistribution and license agreements. Upon expiration of Old DreamWorks Studios’ existing agreements, all distribution rights that are subject to such agreements shall be automatically granted to Paramount for the remainder of each film’s respective license term under the Paramount Distribution Agreement.

Distribution Approvals and Control. Paramount is required to consult with and submit to us a detailed plan and budget regarding the theatrical marketing, release and distribution of each of our films. We have certain approval rights over these plans and are entitled to determine the initial domestic theatrical release dates for all of our films and to approve the initial theatrical release dates in the majority of the international territories, subject to certain limitations in the summer and holiday release periods. Generally, Paramount is not permitted to theatrically release any film owned or controlled by Paramount with an MPAA rating of “PG” or “G” or less within the period beginning one week prior to, and ending one week following, the initial domestic and international territories theatrical release dates of one of our films. Paramount has further agreed that all matters regarding the designation and movement of theatrical release dates for our films and the related release and marketing obligations under the Paramount Distribution Agreement shall be, at all times, subject to the terms and conditions of our worldwide promotional agreement with McDonald’s.

Expenses and Fees. The Paramount Distribution Agreement provides that we will be solely responsible for all of the costs of developing and producing our animated feature films, including contingent compensation and residual costs. Paramount will be responsible for all of the out-of-pocket costs, charges and expenses incurred in the distribution, advertising, marketing and publicizing of each film (collectively, the “Distribution Expenses”).

The Paramount Distribution Agreement provides that we and Paramount will mutually agree on the amount of Distribution Expenses to be incurred with respect to the initial theatrical release of each film in the domestic territory and in the majority of the international territories, including all print and advertising costs and media purchases (e.g., expenses paid for print advertising). However, in the event of a disagreement, Paramount’s decisions, based on its good-faith business judgment, will prevail. Unless we and Paramount otherwise agree, the aggregate amount of Distribution Expenses to be incurred with respect to any event film that is rated “PG 13” (or a less-restrictive

5

rating) and is released in the domestic territory on at least 2,000 screens will be equal to or greater than 90% of the average amount of Distribution Expenses incurred to release our three most recent event films, as measured on a rolling basis, subject to certain adjustments. However, if we determine in good faith that a film’s gross receipts will be materially enhanced by the expenditure of additional Distribution Expenses, we may cause Paramount to increase such expenditures, provided that we will be solely responsible for advancing to or reimbursing Paramount for those additional expenditures within five business days of receiving an invoice from Paramount.

Under the Paramount Distribution Agreement, Paramount is entitled to (i) retain a fee of 8.0% of revenue (without deduction for, among other things, distribution and marketing costs, third-party distribution fees and sales agent fees), and (ii) recoup all of its distribution and marketing costs with respect to our films on a title-by-title basis prior to our recognizing any revenue. For each film licensed to Paramount, revenues, fees and expenses for such film under the Paramount Distribution Agreement are combined with the revenues, fees and expenses for such film under the Paramount Fulfillment Services Agreement and we are provided with a single monthly accounting statement and, if applicable, payment for each film. For further discussion, see “—Expenses and Fees under the Paramount Distribution Agreement and Paramount Fulfillment Services Agreement” below.

Creative Control. We retain the exclusive right to make all creative decisions and initiate any action with respect to the development, production and acquisition of each of our films, including the right to abandon the development or production of a film, and the right to exercise final cut.

Reimbursement Amounts. Paramount has agreed to pay us an annual cost reimbursement amount (currently $7.0 million per year) during the period that we are delivering new films to Paramount pursuant to the Paramount Distribution Agreement.

Nickelodeon Television Development. As part of the Paramount Distribution Agreement, we agreed to license, subject to certain conditions and third party rights and restrictions, to Paramount (on behalf of Nickelodeon) the exclusive rights to develop animated television properties based on our films and the characters and elements contained in those films. The license to Paramount is expressly conditioned on Nickelodeon continuing to develop and commence production on television programs based on our film properties. Generally, if Nickelodeon does not determine whether to commence production on such programs based on a film property within a specified time, the animated television rights in such film property revert to us. We also retain the right to co-produce any television programs and maintain all customary creative approvals over any production using our film properties, including the selection of the film elements to be used as the basis for any television productions. The animated television series, The Penguins of Madagascar, which is based on our Madagascar films, debuted on the Nickelodeon network in March 2009. The Company and Nickelodeon are currently producing an animated television series based on Kung Fu Panda, which the Company expects will debut on the Nickelodeon network in late 2011.

Additional Services. Under the terms of the Paramount Distribution Agreement, Paramount has agreed to provide us at minimal cost certain production-related services, including but not limited to film music licensing, archiving of film materials, credits, participations, travel and residual accounting.

6

Termination. Upon the occurrence of certain events of default, which include the failure of either party to make a payment and the continuance thereof for five business days, material uncured breach of the agreement and certain bankruptcy-related events, the non-breaching party may terminate the agreement. If we fail to deliver to Paramount three qualifying theatrical films per five-year period, if applicable, of the Paramount Distribution Agreement (e.g., three films within the first five years, six films within the first 10 years), then Paramount has the right to terminate the agreement. In addition, if Paramount is in breach or default under any sub-distribution or third-party service agreements that have been pre-approved by us, and such breach or default has or will have a material adverse effect on Paramount’s ability to exploit the distribution rights in accordance with the terms of the Paramount Distribution Agreement, then we may terminate the agreement. If we terminate the agreement, we generally can require Paramount to stop distributing our films in the various territories and markets in which Paramount directly distributes our films, or we can terminate the remaining term of the Paramount Distribution Agreement, but require Paramount to continue distributing our films that are currently being distributed or are ready for release pursuant to the Paramount Distribution Agreement, subject, in each case, to the terms of any output agreements (such as any agreements that we may have with any television networks) or other agreements to which the films are then subject (provided that Paramount continues to pay us all amounts required to be paid to us and to perform its other obligations pursuant to the Paramount Distribution Agreement). Unless otherwise agreed, termination of the Paramount Distribution Agreement will not affect the rights that any sub-distributor or service provider has with respect to our films pursuant to sub-distribution, servicing and licensing agreements that we have approved. Moreover, we can elect to terminate the Paramount Distribution Agreement and, in our sole discretion, the Paramount Fulfillment Services Agreement, after January 1, 2011, if we experience a change in control (as defined therein) and pay a one-time termination fee. The amount of the termination fee is specified as $150 million if we terminated the Paramount Distribution Agreement on January 1, 2011, and the amount of the termination fee reduces ratably to zero during the period from January 2, 2011 to December 31, 2012. Upon termination by either party of the Paramount Distribution Agreement or the Paramount Fulfillment Services Agreement, we have the corresponding right to terminate the other agreement at our sole election.

Paramount Fulfillment Services Agreement

The following is a summary of the Paramount Fulfillment Services Agreement, which is filed as an exhibit to this Form 10-K. This summary is qualified in all respects by such reference. Investors in our common stock are encouraged to read the Paramount Fulfillment Services Agreement.

Term of Agreement and Exclusivity. Under the Paramount Fulfillment Services Agreement, we have engaged Paramount to render worldwide home video fulfillment services and video-on-demand services for all films previously released for home entertainment exhibition and video-on-demand exhibition by us, and for every animated film licensed to Paramount pursuant to the Paramount Distribution Agreement with respect to which we own or control the requisite rights at the time of delivery. Once Paramount has been engaged to render fulfillment services for one of our animated feature films, Paramount generally has the right to render such services in the manner described herein for 16 years from such film’s initial general theatrical release.

Fulfillment Services. Paramount is responsible for preparing marketing and home entertainment distribution plans with respect to our home entertainment releases, as well as arranging

7

necessary third-party services, preparing artwork, making media purchases for product marketing, maintaining secure physical inventory sites and arranging shipping of the home entertainment units.

Approvals and Controls. Paramount is required to render fulfillment services on a film-by-film, territory-by-territory basis as requested and directed by us, and Paramount cannot generally refuse to provide fulfillment services with respect to our home entertainment releases in any territory. We have certain approval rights over the marketing and home entertainment distribution plans mentioned above and are entitled to determine the initial home entertainment release dates for all of our films in the domestic territory and to approve home entertainment release dates in the majority of the international territories.

Expenses and Fees. The Paramount Fulfillment Services Agreement requires Paramount to pay all expenses relating to home entertainment distribution, including marketing, manufacturing, development and shipping costs and all services fees paid to subcontractors, excluding contingent compensation and residual costs (collectively, “Home Video Fulfillment Expenses”). The Paramount Fulfillment Services Agreement provides that we and Paramount will mutually agree on the amount of Home Video Fulfillment Expenses to be incurred. However, in the event of a disagreement, Paramount’s decision, based on its good-faith business judgment, will prevail. Unless we and Paramount otherwise agree, the aggregate amount of Home Video Fulfillment Expenses to be incurred with respect to any event film that is rated “PG 13” (or a less-restrictive rating) and is released in the domestic territory on at least 2,000 screens will be equal to or greater than 90% of the average amount of Home Video Fulfillment Expenses incurred to release our three most recent event films, as measured on a rolling basis, subject to certain adjustments. However, if we determine in good faith that a film’s gross receipts will be materially enhanced by the expenditure of additional Home Video Fulfillment Expenses, we may cause Paramount to increase such expenditures, provided that we will be solely responsible for advancing to or reimbursing Paramount for those additional expenditures within five business days of receiving an invoice from Paramount.

In return for the provision of fulfillment services to us, Paramount is entitled to (i) retain a service fee of 8% of home entertainment revenues (without deduction for any manufacturing, distribution and marketing costs and third party service fees) and (ii) recoup all of its Home Video Fulfillment Expenses with respect to our films on a title-by-title basis. For each film with respect to which Paramount is rendering fulfillment services, revenues, fees and expenses for such film under the Paramount Fulfillment Services Agreement are combined with the revenues, fees and expenses for such film under the Paramount Distribution Agreement and we are provided with a single monthly accounting statement and, if applicable, payment for each film. For further discussion see “—Expenses and Fees under the Paramount Distribution Agreement and Paramount Fulfillment Services Agreement” below.

Termination. The termination and remedy provisions under the Paramount Fulfillment Services Agreement are similar to those under the Paramount Distribution Agreement.

Expenses and Fees under the Paramount Distribution Agreement and Paramount Fulfillment Services Agreement

Each of our films is accounted for under the Paramount Distribution Agreement and the Paramount Fulfillment Services Agreement on a combined basis for each film. In such regard, all

8

revenues, expenses and fees under the Paramount Agreements for a given film are fully cross- collateralized. If a theatrical feature film does not generate revenue in all media, net of the 8.0% distribution and servicing fee, sufficient for Paramount to recoup its expenses under the Paramount Agreements, Paramount will not be entitled to recoup those costs from proceeds of our other theatrical feature films, and we will not be required to repay Paramount for such amounts.

Licensing

We have entered into a variety of strategic licensing arrangements with a number of consumer products companies and other retailers. Pursuant to our typical arrangements, we grant a single-picture license to use our characters or film elements in connection with a specified merchandise item or category in exchange for a percentage of net sales of the products and, in certain instances, minimum guaranteed payments. We may also enter into other arrangements, such as multi-picture agreements or multi-category license agreements, pursuant to which the licensee receives exclusive merchandising or promotional rights in exchange for royalty payments or guaranteed payments.

Strategic Alliances and Promotions

The success of our projects greatly depends not only on their quality, but also on the degree of consumer awareness that we are able to generate for their theatrical and home entertainment releases. In order to increase consumer awareness, we have developed key strategic alliances as well as numerous promotional partnerships worldwide. In general, these arrangements provide that we license our characters and storylines for use in conjunction with our promotional partners’ products or services. In exchange, we may receive promotional fees in addition to substantial marketing benefits from cross-promotional opportunities, such as inclusion of our characters and movie images in television commercials, on-line, print media and on promotional packaging.

We currently have strategic alliances with McDonald’s, Hewlett-Packard and Intel. We have also entered into a strategic alliance with Samsung related to 3D DVD versions of several of our films. We believe these relationships are mutually valuable. We benefit because of the consumer awareness generated for our films, and our partners benefit because these arrangements provide them the opportunity to build their brand awareness and associate with popular culture in unique ways.

9

How We Develop and Produce our Films

The Animated Filmmaking Process

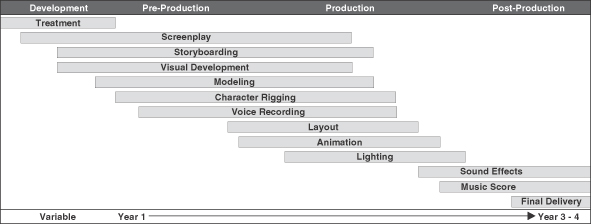

The filmmaking process starts with an idea. Inspiration for a film comes from many sources—from our in-house staff, from freelance writers or from existing literary or other works. Successful ideas are generally written up as a treatment (or story description) and then proceed to a screenplay, followed by the storyboarding process and then finally into the production process. Excluding the script and early development phase, the production process, from storyboarding to filming out the final image, for a full-length feature film can take approximately three to four years.

We employ small collaborative teams that are responsible for preparing storylines and ideas for the initial stages of development. These teams, through a system of creative development controls, are responsible for ensuring that ideas follow the best creative path within a desired budget and schedule parameters. The complexity of each project, the background environments, the characters and all of the elements in a project create a very intricate and time-consuming process that differs for each project. The table below depicts, in a very general manner, a timeline for a full-length feature film, and describes the four general and overlapping phases that constitute the process and their components:

The development phase generally consists of story and visual development. The duration of the development phase can vary project by project—from a matter of months to a number of years. In the pre-production phase, the script and story are further developed and refined prior to the majority of the film crew commencing work on the project. The production phase which follows can last up to two years depending on the length of the project (television specials/series will generally be shorter) and involves the largest number of staff. The Company’s introduction of stereoscopic 3D for its films provides the filmmakers with additional variables to review and decide upon during this production phase. Finally, in the post-production phase, the core visuals and dialogue are in place and we add important elements such as sound effects and the music/score.

10

Our Technology

Our technology plays an important role in the production of our projects. Our focus on user interface and tool development enables our artists to use existing and emerging technologies, allowing us to leverage our artistic talent. In addition, we have strategic relationships with leading technology companies that allow us to benefit from third-party advancements and technology at the early stages of their introduction.

Competition

Our films and other projects compete on a broad level with all forms of entertainment and even other consumer leisure activities. Our primary competition for film audiences comes from both animated and live-action films that are targeted at similar audiences and released into the theatrical market at the same time as our films. At this level, in addition to competing for box-office receipts, we compete with other film studios over optimal release dates and the number of motion picture screens on which our movies are exhibited. In addition, with respect to the home entertainment and television markets, we compete with other films as well as other forms of entertainment. We also face intense competition from other animation studios for the services of talented writers, directors, producers, animators and other employees and for the acquisition of rights to pre-existing literary and other works.

Competition for Film Audiences. Our primary competition for film audiences comes from both animated and live-action films that are targeted at similar audiences and released into the theatrical market at the same time as our films. Our feature films compete with both live-action and animated films for motion picture screens, particularly during national and school holidays when demand is at its peak. Due to the competitive environment, the opening weekend for a film is extremely important in establishing momentum for its box-office performance. Because we currently expect to release only two or three films per year, our objective is to produce so-called “event” films, attracting the largest and broadest audiences possible. As a result, the scheduling of optimal release dates is critical to our success. One of the most important factors we consider when determining the release date for any particular film is the expected release date of other films (especially 3D films) targeting similar audiences. In this regard, we pay particular attention to the expected release dates of other films produced by other animation studios, although we also pay attention to the expected release dates of live-action and other “event” films that are vying for similar broad audience appeal.

Disney/Pixar, Sony Entertainment, Fox Entertainment’s Blue Sky Studios and Illumination Entertainment are currently the animation studios that we believe target similar audiences and have comparable animated filmmaking capabilities. In addition, other companies and production studios continue to release animated films, which can affect the market in which our films compete.

Competition in Home Entertainment. In the home entertainment market, our films and television entertainment compete with not only other theatrical titles or direct-to-video titles and television series titles, but also other forms of home entertainment, such as online, casual or console games. As competition in the home entertainment market increases, consumers are given a greater number of choices for home entertainment products. In addition, once our films are released in the home entertainment market they may also compete with other films that are in their initial theatrical

11

release or in their subsequent theatrical re-release cycles. Historically, a significant portion of our revenues has been derived from consumer purchases of our home entertainment titles. In this regard, we compete with video-rental or video-on-demand services that offer consumers the ability to view home entertainment titles one or more times for a rental fee that is typically significantly less than the purchase of the title. Over the last couple of years, a number of companies have begun offering Internet-based services that allow consumers to stream home entertainment titles to their televisions, computers or mobile devices for a one-time or monthly subscription fee. Additionally, some existing subscription cable television channels are developing or have developed Internet-based services that offer subscribers the ability to also view content on computers or mobile devices. Our home entertainment titles also compete with these services. Finally, over the past several years, there has been an increase in competition for shelf space given by retailers for any specific title and for DVDs in general.

Competition for Talent. Currently, we compete with other animated film and visual effect studios for artists, animators, directors and producers. In addition, we compete for the services of computer programmers and other technical production staff with other animation studios and production companies and, increasingly, with video game producers. In order to recruit and retain talented creative and technical personnel, we have established relationships with the top animation schools and industry trade groups. We have also established in-house digital training and artistic development training programs.

Potential Competition. Barriers to entry into the animation field have decreased as technology has advanced. While we have developed proprietary software to create animated films, other film studios may not be required to do so, as technological advances have made it possible to purchase third-party software capable of producing high-quality images. Although we have developed proprietary technology, experience and know-how in the animation field (especially with respect to stereoscopic 3D) that we believe provide us with significant advantages over new entrants in the animated film market, there are no substantial technological barriers to entry that prevent other film studios from entering the field. Furthermore, advances in technology may substantially decrease the time that it takes to produce an animated feature film, which could result in a significant number of new animated films or products. The entrance of additional animation companies into the animated feature film market could adversely impact us by eroding our market share, increasing the competition for animated film audiences and increasing the competition for, and cost of, hiring and retaining talented employees, particularly animators and technical staff.

Employees

As of December 31, 2010, we employed approximately 2,100 people, many of whom were covered by employment agreements, which generally include non-disclosure agreements. Of that total, approximately two-thirds were directly employed in the production of our films as animators, modelers, story artists, visual development artists, layout artists, editors, technical directors, lighters and visual effects artists and production staff, approximately 300 were primarily engaged in supporting and developing our animation technology, and approximately 410 worked on general corporate and administrative matters, including our licensing and merchandising operations. We also hire additional employees on a picture-by-picture basis. The salaries of these additional employees, as well as portions of the salaries of certain full-time employees who provide direct production

12

services, are typically allocated to the capitalized costs of the related feature film. In addition, approximately 840 of our employees (and some of the employees or independent contractors that we hire on a project-by-project basis) were represented under three industry-wide collective bargaining agreements to which we are a party, namely agreements with Locals 700 and 839 of the International Alliance of Theatrical Stage Employees (“IATSE”), which generally cover certain members of our production staff, and an agreement with the Screen Actors Guild (“SAG”), which generally covers artists such as actors and singers. We believe that our employee and labor relations are good.

Where You Can Find More Information

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). These filings are not deemed to be incorporated by reference into this report. You may read and copy any documents filed by us at the Public Reference Room of the SEC, 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Our filings with the SEC are also available to the public through the SEC’s website at http://www.sec.gov.

Our common stock is currently listed on the Nasdaq under the symbol “DWA.” We maintain an Internet site at http://www.DreamworksAnimation.com. We make available free of charge, on or through our website, our annual, quarterly and current reports, as well as any amendments to these reports, as soon as reasonably practicable after electronically filing these reports with, or furnishing them to, the SEC. We have adopted a code of ethics applicable to our principal executive, financial and accounting officers. We make available free of charge, on or through our website’s investor relations page, our code of ethics. Our website and the information posted on it or connected to it shall not be deemed to be incorporated by reference into this or any other report we file with, or furnish to, the SEC.

| Item 1A. | Risk Factors |

This report and other documents we file with the SEC contain forward-looking statements that are based on current expectations, estimates, forecasts and projections about us, our future performance, our business or others acting on our behalf, our beliefs and our management’s assumptions. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. You should carefully consider the risks and uncertainties facing our business. The risks described below are not the only ones facing us. Our business is also subject to the risks that affect many other companies, such as general economic conditions and geopolitical events. Further, additional risks not currently known to us or that we currently believe are immaterial could have a material adverse effect on our business, financial condition or operating results.

Our success is primarily dependent on audience acceptance of our films, which is extremely difficult to predict and, therefore, inherently risky.

We cannot predict the economic success of any of our motion pictures because the revenue derived from the distribution of a motion picture (which does not necessarily directly correlate with

13

the production or distribution costs incurred) depends primarily upon its acceptance by the public, which cannot be accurately predicted. The economic success of a motion picture also depends upon the public’s acceptance of competing films, the availability of alternative forms of entertainment and leisure-time activities, general economic conditions and other tangible and intangible factors, all of which can change and cannot be predicted with certainty. Furthermore, part of the appeal of CG (“computer-generated”) animated films such as ours may be due to their relatively recent introduction to the market. We cannot assure you that the introduction of new animated filmmaking techniques, an increase in the number of CG animated films or the resurgence in popularity of older animated filmmaking techniques will not adversely affect the popularity of CG animated films.

In general, the economic success of a motion picture is dependent on its theatrical performance, which is a key factor in predicting revenue from other distribution channels and is largely determined by our ability to produce content and develop stories and characters that appeal to a broad audience and by the effective marketing of the motion picture. If we are unable to accurately judge audience acceptance of our film content or to have the film effectively marketed, the commercial success of the film will be in doubt, which could result in costs not being recouped or anticipated profits not being realized. Moreover, we cannot assure you that any particular feature film will generate enough revenue to offset its distribution, fulfillment services and marketing costs, in which case we would not receive any net revenues for such film from Paramount. In the past, some of our films have not recovered their production costs, after recoupment of marketing, fulfillment services and distribution costs, in an acceptable timeframe or at all.

Our business is currently substantially dependent upon the success of a limited number of film releases each year and the unexpected delay or commercial failure of any one of them could have a material adverse effect on our financial results.

Historically our business plan has been to release two animated feature films per year. In 2009, we announced that, beginning in 2010, we expect to release five animated feature films every two years. The unexpected delay in release or commercial failure of just one of these films could have a significant adverse impact on our results of operations in both the year of release and in the future. Historically, feature films that are successful in the domestic theatrical market are generally also successful in the international theatrical, home entertainment and television markets, although each film is different and there is no way to guarantee such results. If our films fail to achieve domestic box office success, their international box office and home entertainment success and our business, results of operations and financial condition could be adversely affected. Further, we can make no assurances that the historical correlation between domestic box office results and international box office and home entertainment results will continue in the future. In fact, over the last several years domestic theatrical results and foreign theatrical results have become less directly correlated than in the past. While we have generally seen growth in our foreign theatrical results, it has come in countries where the home entertainment market is not as robust as in the United States or Western Europe.

14

Our home entertainment business is currently experiencing significant changes as a result of rapid technological change and shifting consumer preferences and behavior. We cannot predict the effect that these changes and shifting preferences will have on the revenue from and profitability of our films.

During the last 10 years, a significant amount of our revenues and profitability have resulted from sales of DVDs in the home entertainment market. Since 2005, there has been a general decline in both the number of DVD units sold and the profitability of such units, and such decline accelerated during 2010. We believe that this decline is a result of various technological advances and changes in consumer preferences and behavior. Consumers (especially children) are spending an increasing amount of time on the Internet and mobile devices, and technology in these areas continues to evolve rapidly. In addition, consumers are increasingly viewing content on a time-delayed or on-demand basis from the Internet, on their televisions and on handheld or portable devices. As a result, we cannot assure you that consumers will continue to use the DVD format for their home entertainment. We must adapt our businesses to changing consumer behavior and preferences and exploit new distribution channels or find new and enhanced ways to deliver our films in the home entertainment market. There can be no assurances that we will be able to do so or that we will be able to achieve historical revenues or margin levels in such business. During 2010, three large retailers, Walmart, Target and Best Buy, accounted for approximately 53% of the Company’s domestic DVD sales. If these and other retailers’ support of the DVD format decreases, the Company’s results of operations could be materially adversely affected.

Our operating results fluctuate significantly.

We continue to expect significant fluctuations in our future quarterly and annual operating results because of a variety of factors, including the following:

| • | the potential varying levels of success of our feature films and other entertainment; |

| • | the timing of the domestic and international theatrical releases and home entertainment release of our feature films; |

| • | our distribution arrangements with Paramount, which cause us to recognize significantly less revenue from a film in the period of a film’s initial theatrical release than we would absent these agreements; and |

| • | the timing of development expenses and varying levels of success of our new business ventures. |

We currently operate principally in one business, the production of animated family entertainment, and our lack of a diversified business could adversely affect us.

Unlike most of the major studios, which are part of large diversified corporate groups with a variety of other operations, we currently depend primarily on the success of our feature films and other properties. For example, unlike us, many of the major studios are part of corporate groups that include television networks and cable channels that can provide stable sources of earnings and cash flows that offset fluctuations in the financial performance of their feature films. We, on the other hand, currently derive substantially all of our revenue from a single source—our animated family entertainment—and our lack of a diversified business model could adversely affect us if our feature films or other properties fail to perform to our expectations.

15

The Company has recently developed and is currently in the process of developing a number of projects that are not feature films, which will involve upfront and ongoing expenses and may not ultimately be successful.

As part of the Company’s plan of diversifying its revenue sources, the Company has recently produced and is currently developing a number of projects that are not feature films. These projects include several live shows, animated television specials and series and an online virtual world. Some of these new businesses are inherently riskier than the Company’s traditional animated feature film business. These projects also require varying amounts of upfront and ongoing expenditures, some of which are or may be significant, and may place a strain on the Company’s management resources. While the Company currently believes that it has adequate sources of capital to fund these development and operating expenditures, there can be no assurances that such resources will be available to the Company. Further, to the extent that the Company needs to hire additional personnel to develop or oversee these projects, the Company may be unable to hire talented individuals. Finally, we cannot provide any assurances that all or any of these projects will ultimately be completed or, if completed, successful. During the year ended December 31, 2010, the Shrek The Musical touring show and the Kung Fu Panda online virtual world did not achieve the operating results that had been expected. As a result, during the fourth quarter of 2010, the Company recorded an impairment charge of $11.9 million related to the online virtual world and $7.9 million related to the touring show.

Animated films are expensive to produce and the uncertainties inherent in their production could result in the expenditure of significant amounts on films that are abandoned or significantly delayed.

Animated films are expensive to produce. The production, completion and distribution of animated feature films is subject to a number of uncertainties, including delays and increased expenditures due to creative problems, technical difficulties, talent availability, accidents, natural disasters or other events beyond our control. Because of these uncertainties, the projected costs of an animated feature film at the time it is set for production may increase, the date of completion may be substantially delayed or the film may be abandoned due to the exigencies of production. In extreme cases, a film in production may be abandoned or significantly modified (including as a result of creative changes) after substantial amounts have been spent, causing the write-off of expenses incurred with respect to the film.

Animated films typically take longer to produce than live-action films, which increases the uncertainties inherent in their production and distribution.

Animated feature films typically take three to four years (or longer) to produce after the initial development stage, as opposed to an average of 12 to 18 months for live-action films. The additional time that it takes to produce and release an animated feature film increases the risk that our films in production will fall out of favor with target audiences and that competing films will be released in advance of or concurrently with ours, either of which risks could reduce the demand for or popular appeal of our films.

16

The production and marketing of animated feature films and other properties is capital-intensive and our capacity to generate cash from our films may be insufficient to meet our anticipated cash requirements.

The costs to develop, produce and market a film are substantial. In 2010, for example, we spent approximately $323.1 million to fund production costs (excluding overhead expense) and to make contingent compensation and residual payments. For the year ending December 31, 2011, we expect our commitments to fund production costs (excluding overhead expense) and to make contingent compensation and residual payments (on films released to date) will be approximately $397.0 million. Although we retain the right to exploit each of the films that we have previously released, the size of our film library is insubstantial compared to the film libraries of the major United States (“U.S.”) movie studios, which typically have the ability to exploit hundreds of library titles. Library titles can provide a stable source of earnings and cash flows that offset fluctuations in the financial performance of newly released films. Many of the major studios use these cash flows, as well as cash flows from their other businesses, to finance the production and marketing of new feature films. We are not able to rely on such cash flows and are required to fund our films in development and production and other commitments with cash retained from operations, the proceeds of films that are generating revenue from theatrical, home entertainment and ancillary markets and borrowings under our $125 million revolving credit facility. If our films fail to perform, we may be forced to seek substantial sources of outside financing. Such financing may not be available in sufficient amounts for us to continue to make substantial investments in the production of new animated feature films or may be available only on terms that are disadvantageous to us, either of which could have a material adverse effect on our growth or our business.

The costs of producing and marketing our feature films have steadily increased and may increase in the future, which may make it more difficult for a film to generate a profit or compete against other films.

The production and marketing of theatrical feature films require substantial capital and the costs of producing and marketing feature films have generally increased in recent years. These costs may continue to increase in the future, which may make it more difficult for our films to generate a profit or compete against other films. Historically, production costs and marketing costs have risen at a rate faster than increases in either domestic admission to movie theaters or admission ticket prices. A continuation of this trend would leave us more dependent for revenue from other media, such as home entertainment, television, international markets and new media.

Our decision to produce all of our films in stereoscopic 3D may lead to decreased profitability of our films.

We released our first 3D film, Monsters vs. Aliens in 2009. We expect that all of our future films will also be released in stereoscopic 3D. The Company has implemented a number of changes to its production processes in order to produce stereoscopic 3D films. These changes have increased the costs of producing our films, which may make it more difficult for a film to generate a profit. There are currently a limited number of movie theaters that are capable of screening films in stereoscopic 3D. Additionally, other entertainment companies are planning to release films in stereoscopic 3D, which has increased the competition for 3D screens. While the number of 3D-capable movie theaters has increased significantly and we believe will continue to increase over time, the costs to theater

17

owners of purchasing 3D screening equipment may slow this increase, especially if theater owners are concerned about the availability of sufficient 3D titles to justify the expense. Finally, there have been limited sales of televisions and DVD players capable of displaying stereoscopic 3D images. While we believe that consumers find the 3D movie experience to be at least as enjoyable as the two-dimensional experience, there can be no assurances that a sufficient number of consumers will be willing to pay higher prices for stereoscopic 3D films and DVDs, which may make it more difficult for us to recover the higher production costs.

We compete for audiences based on a number of factors, many of which are beyond our control.

The number of animated and live-action feature films released by competitors, particularly the major U.S. motion picture studios, may create an oversupply of product in the market and may make it more difficult for our films to succeed. In particular, we compete directly against other animated films and family-oriented live-action films. Oversupply of such products (especially of high-profile “event” films such as ours) may become most pronounced during peak release times, such as school holidays, national holidays and the summer release season, when theater attendance has traditionally been highest. Although we seek to release our films during peak release times, we cannot guarantee that we will be able to release all of our films during those times and, therefore, may miss potentially higher gross box-office receipts. In addition, a substantial majority of the motion picture screens in the U.S. typically are committed at any one time to only 10 to 15 films distributed nationally by major studio distributors. If our competitors were to increase the number of films available for distribution and the number of exhibition screens (especially screens capable of showing 3D films) remained unchanged, it could be more difficult for us to release our films during optimal release periods.

Changes in the United States, global or regional economic conditions could adversely affect the profitability of our business.

Beginning in 2008, the global economy began experiencing a significant contraction, with an almost unprecedented lack of availability of business and consumer credit. This decrease and any future decrease in economic activity in the U.S. or in other regions of the world in which we do business could significantly and adversely affect our results of operations and financial condition in a number of ways. Any decline in economic conditions may reduce the performance of our theatrical and home entertainment releases and purchases of our licensed consumer products, thereby reducing our revenues and earnings. We may also experience increased returns by the retailers that purchase our home entertainment releases. Further, bankruptcies or similar events by retailers, theater chains, television networks, other participants in our distribution chain or other sources of revenue may cause us to incur bad debt expense at levels higher than historically experienced or otherwise cause our revenues to decrease. In periods of generally increasing prices, or of increased price levels in a particular sector such as the energy sector, we may experience a shift in consumer demand away from the entertainment and consumer products we offer, which could also adversely affect our revenues and, at the same time, increase our costs.

18

The seasonality of our businesses could exacerbate negative impacts on our operations.

Our business is normally subject to seasonal variations based on the timing of theatrical motion picture and home entertainment releases. Release dates are determined by several factors, including timing of vacation and holiday periods and competition in the market. Also, revenues in our consumer products business are influenced by both seasonal consumer purchasing behavior and the timing of animated theatrical releases and generally peak in the fiscal quarter of a film’s theatrical release. Accordingly, if a short-term negative impact on our business occurs during a time of high seasonal demand (such as natural disaster or a terrorist attack during the time of one of our theatrical or home entertainment releases), the effect could have a disproportionate effect on our results for the year.

Strong existing film studios competing in the CG animated film market and the entrance of additional competing film producers could adversely affect our business in several ways.

CG animation has been successfully exploited by a growing number of film studios since the first CG animated feature film, Toy Story, was released by Pixar in 1995. In the past several years, a number of studios have entered the CG animated film market, thus increasing the number of CG animated films released per year. There are no substantial technological barriers to entry that prevent other film producers from entering the field. Furthermore, advances in technology may substantially decrease the time that it takes to produce a CG animated feature film, which could result in a significant number of new CG animated films or products. The entrance of additional companies into the CG animated feature film market could adversely impact us by eroding our market share, increasing the competition for CG animated film audiences and increasing the competition for, and cost of, hiring and retaining talented employees, particularly CG animators and technical staff.

Our success depends on certain key employees.

Our success greatly depends on our employees. In particular, we are dependent upon the services of Jeffrey Katzenberg, our other executive officers and certain creative employees such as directors and producers. We do not maintain key person life insurance for any of our employees. We have entered into employment agreements with Mr. Katzenberg and with all of our top executive officers and production executives. However, although it is standard in the motion picture industry to rely on employment agreements as a method of retaining the services of key employees, these agreements cannot assure us of the continued services of such employees. The loss of the services of Mr. Katzenberg or a substantial group of key employees could have a material adverse effect on our business, operating results or financial condition.

Our scheduled releases of animated feature films and other projects may place a significant strain on our resources.

We have established multiple creative and production teams so that we can simultaneously produce several animated feature films. In the past, we have been required, and may continue to be required, to expand our employee base, increase capital expenditures and procure additional resources and facilities in order to accomplish the scheduled releases of our entertainment projects. This growth and expansion has placed, and continues to place, a significant strain on our resources.

19

We cannot provide any assurances that any of our projects will be released as targeted or that this strain on resources will not have a material adverse effect on our business, financial condition or results of operations.

We are dependent on Paramount for the distribution and marketing of our feature films and related products.

In January 2006, we entered into the Paramount Agreements, pursuant to which Paramount and certain of its affiliates are responsible for the worldwide distribution and servicing of all of our films in substantially all audio-visual media. If Paramount fails to perform under either of the Paramount Agreements, it could have a material adverse effect on our business reputation, operating results or financial condition. In addition, our grant of distribution and servicing rights to Paramount is expressly subject to certain existing sub-distribution, servicing and license agreements previously entered into by Old DreamWorks Studios. Pursuant to the Paramount Agreements, we will continue to license to Old DreamWorks Studios those distribution and servicing rights in and to existing and future films, to the extent necessary for Old DreamWorks Studios to comply with such existing sub-distribution, servicing and license agreements, including the existing sub-distribution, servicing and licensing agreements that Old DreamWorks Studios has entered into with other third-party distributors and service providers. Upon expiration of our existing agreements, all distribution and servicing rights that are subject to such agreements will be automatically granted to Paramount for the remainder of the term of the Paramount Agreements. We cannot assure you that, upon expiration of such agreements, Paramount will be able to replace such sub-distribution, servicing and license agreements on terms as favorable as Old DreamWorks Studios’ existing sub-distribution, servicing and license agreements. For a description of the terms of the Paramount Distribution Agreement and the Paramount Fulfillment Services Agreement, see “Item 1—Business—Distribution and Servicing Arrangements—How We Distribute, Promote and Market Our Films.”

Although the Paramount Agreements obligate Paramount to distribute and service our films, Paramount is able to terminate the agreements upon the occurrence of certain events of default, including a failure by us to deliver to Paramount a minimum number of films over specified time periods. We are also able to terminate the agreements upon the occurrence of certain events of default. If Paramount fails to perform under the Paramount Agreements or the agreements are terminated, we may have difficulty finding a replacement distributor and service provider, in part because our films could continue to be subject to the terms of the existing sub-distribution, servicing and licensing agreements that Old DreamWorks Studios, Paramount or both have entered into with third-party distributors and service providers that we have approved. We cannot assure you that, as a result of existing agreements or for other reasons, we will be able to find a replacement distributor or service provider on terms as favorable as those in the Paramount Agreements.

Furthermore, in the event that the Paramount Agreements were terminated, depending on the arrangement that we negotiated with a replacement distributor or fulfillment services provider, we could be required to directly incur distribution, servicing and marketing expenses related to our films, which under the Paramount Agreements are incurred by Paramount. Because we would expense those costs as incurred, significant fluctuations in our operating results could result.

20

Paramount provides us with certain services, which, if terminated, may increase our costs in future periods.

Under the terms of the Paramount Distribution Agreement, Paramount and certain of its affiliates have agreed to provide us with a variety of services, including music licensing, music creative, music business affairs, archiving of film materials, casting, the calculation and administration of residuals and contingent compensation for our motion pictures, and compiling, preparing and checking credits to be accorded on our films and working and complying with MPAA rules and regulations (including obtaining the MPAA rating for all of our motion pictures). Paramount has the right to terminate a service Paramount is providing under the Paramount Distribution Agreement if we are in breach of a material provision related to such service. If any of the services provided to us by Paramount is terminated, we will be required to either enter into a new agreement with Paramount or another services provider or assume the responsibility for these functions ourselves. If we were to enter into a new agreement with Paramount regarding any such terminated services, hire a new services provider or assume such services ourselves, the economic terms of the new arrangement may be less favorable than our current arrangement with Paramount, which may adversely affect our business, financial condition or results of operations.

We are dependent on Paramount for the timely and accurate reporting of financial information related to the distribution of our films.

The amount of our net revenue and associated gross profit recognized in any given quarter or quarters from all of our films depends on the timing, accuracy and amount of information we receive from Paramount, our third party distributor and service provider. Although we obtain from Paramount the most current information available to recognize our revenue and determine our film gross profits, Paramount may make subsequent revisions to the information that it has provided, which could have a significant impact on us in later periods. In addition, if we fail to receive accurate information from Paramount or fail to receive it on a timely basis, it could have a material adverse effect on our business, operating results or financial condition.

We face risks relating to the international distribution of our films and related products.

In recent years, we have derived approximately 49% of our feature film revenue from the exploitation of our films in territories outside of the United States. Additionally, some of our newer non-feature film businesses are being or are expected to be conducted, at least partially, outside of the U.S. As a result, our business is subject to risks inherent in international trade, many of which are beyond our control. These risks include:

| • | fluctuating foreign exchange rates. For a more detailed discussion of the potential effects of fluctuating foreign exchange rates, please see “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” herein; |

| • | laws and policies affecting trade, investment and taxes, including laws and policies relating to the repatriation of funds and withholding taxes and changes in these laws; |

| • | differing cultural tastes and attitudes, including varied censorship laws; |

| • | differing degrees of protection for intellectual property; |

21

| • | financial instability and increased market concentration of buyers in foreign television markets; |

| • | the instability of foreign economies and governments; and |

| • | war and acts of terrorism. |

Piracy of motion pictures, including digital and Internet piracy, may decrease revenue received from the exploitation of our films.