Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED FEBRUARY 22, 2011 - UIL HOLDINGS CORP | uil_form8kdated2222011.htm |

| EX-99 - UIL EXHIBIT 99 - EARNINGS RELEASE - UIL HOLDINGS CORP | uil_exh99.htm |

1

4Q ’10 Earnings

4Q & FY 2010 Earnings Conference Call

February 23, 2011

EXHIBIT 99.1

2

4Q ’10 Earnings

Important Note to Investors

James P. Torgerson

President and Chief Executive Officer

Richard J. Nicholas

Executive Vice President and Chief Financial Officer

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or guidelines,

and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and services of UIL

Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut Natural Gas

Corporation and The Berkshire Gas Company. Such risks and uncertainties with respect to UIL Holdings’ recent acquisition of The

Southern Connecticut Gas Company, Connecticut Natural Gas Corporation and The Berkshire Gas Company include, but are not limited

to, the possibility that the expected benefits will not be realized, or will not be realized within the expected time period. The foregoing and

other factors are discussed and should be reviewed in UIL Holdings’ most recent Annual Report on Form 10-K and other subsequent

periodic filings with the Securities and Exchange Commission. Forward-looking statements included herein speak only as of the date hereof

and UIL Holdings undertakes no obligation to revise or update such statements to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events or circumstances.

3

4Q ’10 Earnings

2010 Accomplishments/Milestones

ü 13% increase in 2010 net income, excluding acquisition & transition related

expenses, compared to 2009

expenses, compared to 2009

ü Transformative gas companies acquisition completed within six months of

announcement

announcement

ü GenConn Devon became operational

ü GenConn Middletown - 92.4% complete as of year-end

ü Investing in Connecticut portion of New England East West Solution

projects

projects

ü Executing on 10-year capital expenditure plan - driving long-term earnings

growth

growth

4

4Q ’10 Earnings

Gas Company Integration

Working diligently internalizing the Transition Services Agreement (TSA)

› Support services such as IT, Finance and Human Resources provided by

Iberdrola, USA (IUSA) with the ability to terminate any service given 90 days

notice

Iberdrola, USA (IUSA) with the ability to terminate any service given 90 days

notice

Integration activities are well underway

› Implementation of these initiatives is expected to continue through this year with

most completed before 2012

most completed before 2012

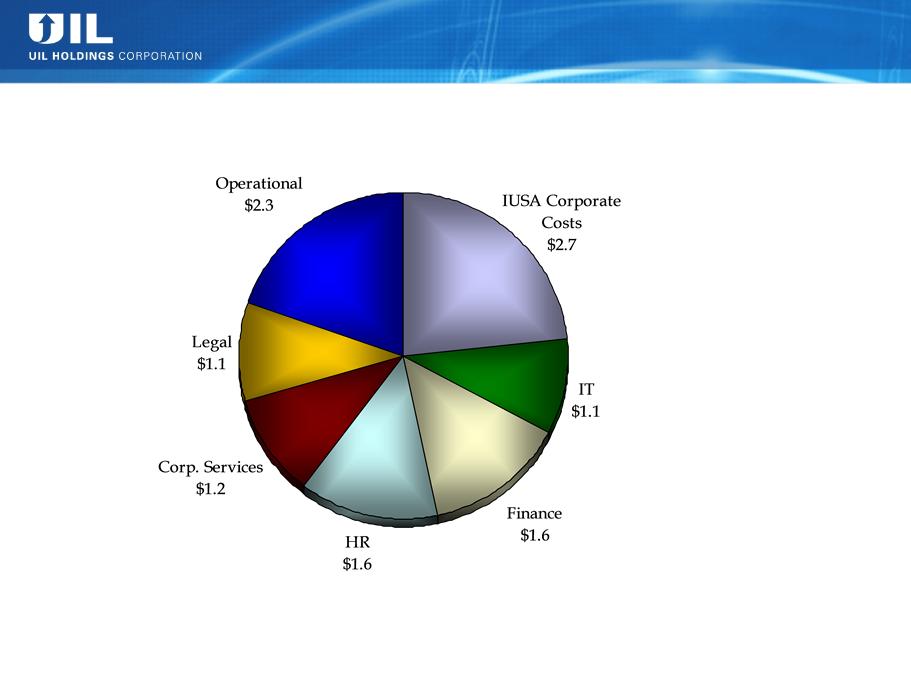

2012 savings opportunities - identified & quantified

› IUSA 2009 allocated corporate overheads, support costs and shared services

totaled $23M

totaled $23M

» $11.6M of expected savings to be in place in 2012

5

4Q ’10 Earnings

Expected $11.6M of Identified Savings

net

2012 Shared Services Identified Savings

6

4Q ’10 Earnings

› Scheduled: draft - 3/21/11, final - 4/13/11

› Continued until final decision on pilot to be

made as part of UI’s ’10 rate year decoupling

filing due by 4/4/11

made as part of UI’s ’10 rate year decoupling

filing due by 4/4/11

› As of 12/31/10 - approximately $1.9M owed to

customers

customers

|

|

|

|

|

|

SCG Potential Overearnings

Generic ROE Proceeding

UI Electric Decoupling

SCG/CNG Rate Case Appeals

› Potential for UI to file distribution rate case for rates in effect in 2012 to reflect

significant investments in distribution infrastructure

significant investments in distribution infrastructure

› DPUC docket opened 12/28/10

› Scheduled: draft - 3/25/11, final - 4/13/11

› Pending at the CT Supreme Court

› Previous allowed returns in effect pending

appeals - SCG 10%, CNG 10.1%

appeals - SCG 10%, CNG 10.1%

7

4Q ’10 Earnings

Cash*

EPS*

2010A

2011P

$97 million

(0.05)

$

Bonus Depreciation 2010 & 2011

* Based on current expectations

Efficient use of cash benefits from bonus depreciation

› Expected pension contributions of $65-$75M to the electric and gas pension

plans in 2011

plans in 2011

› Reduces pension costs and increases rate base

Expect no need for external equity for at least the next 3 years

8

4Q ’10 Earnings

9

4Q ’10 Earnings

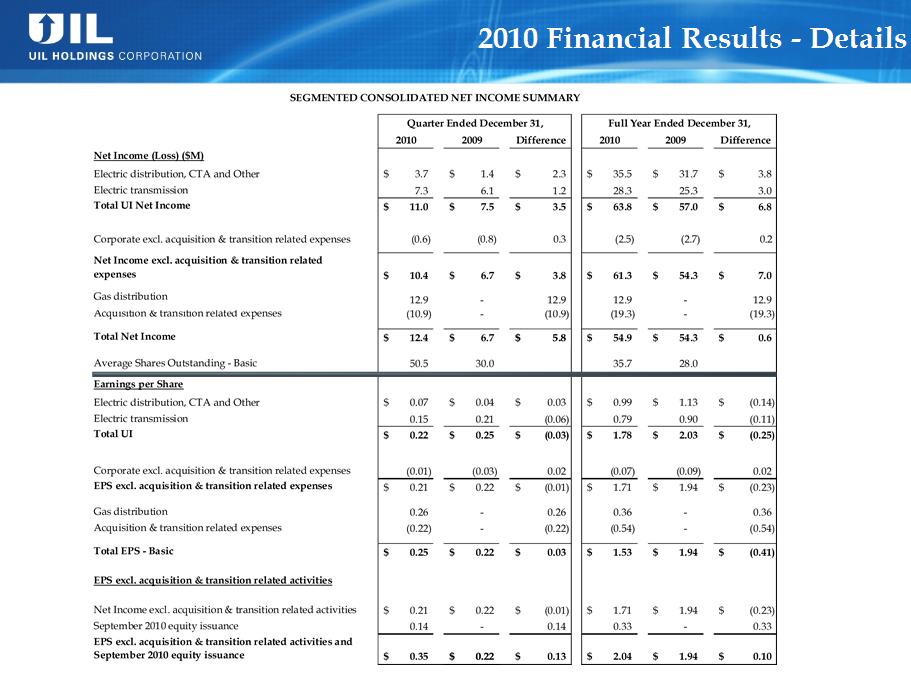

2010 Financial Results - Details

Electric distribution, CTA & other

› 12% increase in net income compared to ’09

» Increased operating income due to rate increase effective 1/1/10, partially offset by lower CTA rate

base

base

» Earnings of $1.2M from UI’s equity investment in GenConn

» Average earned ROE of 9.18% after sharing

Electric transmission

› 12% increase in net income compared to ’09

» Increase in AFUDC coupled with higher rate base

» Weighted average ROE of 12.5%

Gas distribution

› Net income of $12.9M from acquisition close (11/17/10 - 12/31/10)

› Expected final average ROEs; SCG 10.60% - 10.80%, CNG 8.95% - 9.05%

› 1.3% increase in customers in ‘10

Acquisition & transition related expenses - $19.3M after-tax

Bonus depreciation effect on ’10 results based on current expectations - ($0.6M)

EPS dilution from Sept. ’10 equity issuance - $0.33 per share

10

4Q ’10 Earnings

UI Equity Bridge Loan

UIL Debt retired 2/15/11

Liquidity Overview (12/31/10)

Near-Term Debt Maturities

($M)

*

* To be remarketed

Amounts may not add due to rounding.

No

Expect no need for external equity for at least the next 3 years

($M)

Debt Maturity and Liquidity Profile

11

4Q ’10 Earnings

($ millions)

The annual long-term capital spending update will be presented at the Fall EEI

Financial conference

Financial conference

Central Facility

New business main & services,

system improvements, fleet, IT

system improvements, fleet, IT

Capital costs relating to the

integration of the gas companies,

mainly IT-related

integration of the gas companies,

mainly IT-related

Major Variance Explanations

Note: *2010 Gas distribution capex reflects the full year amount; UIL ownership was for 6 weeks effective with the closing on the acquisition.

2011 Capex Update

12

4Q ’10 Earnings

12

Updated Near-Term Average Rate Base Profile

28%

23%

7%

30%

22%

5%

35%

3%

40%

1%

23%

38%

37%

39%

43%

22%

38%

24%

36%

40%

24%

Electric distribution

CTA

Gas distribution*

Electric transmission

UI’s 50% Share ($M): 2010A 2011P 2012P 2013P 2014P 2015P

Avg. GenConn RB Equivalent: $ 51 $ 140 $ 164 $ 156 $ 149 $ 142

Avg. Gen Conn Equity “Rate Base” $ 25 $ 70 $ 82 $ 78 $ 75 $ 71

Rate Base (Excluding GenConn Equity Investments):

GenConn Equity Investments:

Notes: *2010 Gas distribution average rate base reflects the full year; UIL ownership was for 6 weeks effective with the closing on the acquisition. For comparability purposes, Gas distribution excludes the impacts

of 338(h)(10) election.

of 338(h)(10) election.

Amounts may not add due to rounding.

42%

13

4Q ’10 Earnings

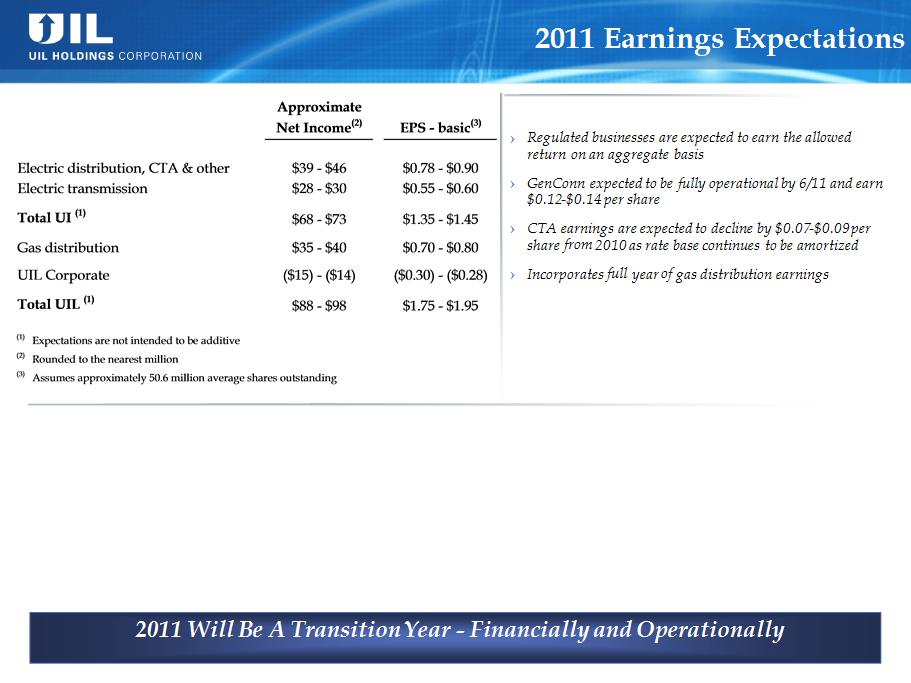

Assumptions

› Bonus depreciation is expected to have a net impact of

($0.05) per share

($0.05) per share

› Includes one-time costs for the transition of the gas

distribution business support services from IUSA, as well

as the on-going integration costs

distribution business support services from IUSA, as well

as the on-going integration costs

,

2011 Operational Snapshot

› Integration of all of the regulated businesses with an emphasis on process integration initiatives and best practices

› Exiting the TSA by year-end for vast majority of services

› Positioning to realize half of IUSA’s ‘09 allocated corporate charges of $23M à expected savings of $11.6M in 2012

› Continued focus on management of O&M expenses at each of our regulated businesses

› Execution of capital expenditure plan at each of our regulated businesses

14

4Q ’10 Earnings

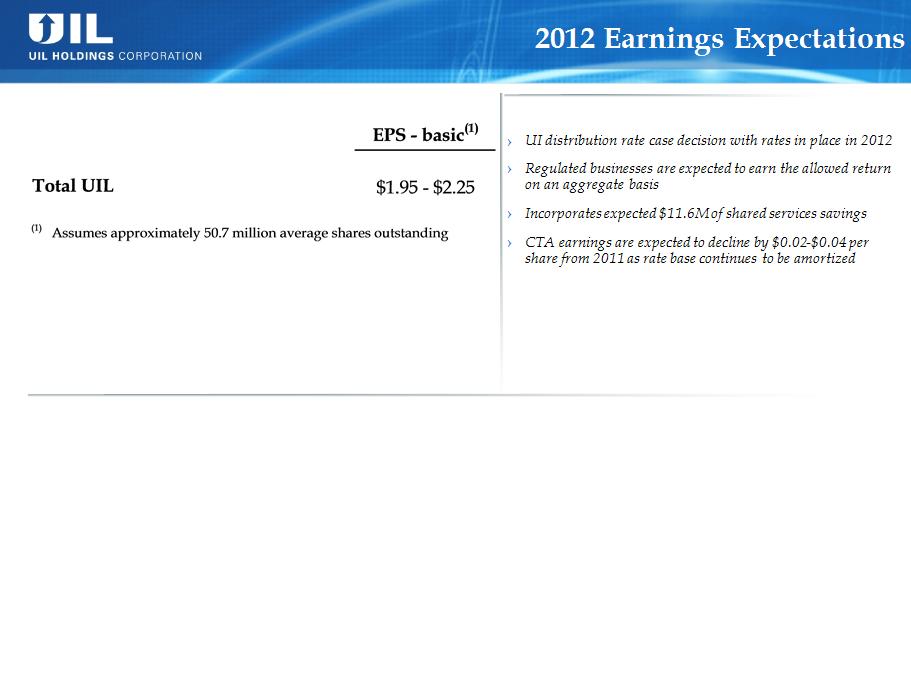

Assumptions

› Bonus depreciation is expected to have a net impact of ($0.10)

per share

per share

2012 Operational Snapshot

› Integration of all of the regulated businesses with an emphasis on process integration initiatives and best practices

› Completely exiting the TSA

› Continued focus on management of O&M expenses at each of our regulated businesses

› Execution of capital expenditure plan at each of our regulated businesses

15

4Q ’10 Earnings

Closing Remarks

Ø Closed on gas company acquisitions & moving forward with integration

activities with 2011 being a transition year

activities with 2011 being a transition year

Ø GenConn Devon operational - Middletown expected to be fully operational by

June 2011

June 2011

Ø Expecting to earn allowed returns on all regulated businesses on an aggregate

basis

basis

Ø Continued management of O&M expenses

Ø Executing on capital expenditure plan - realizing rate base growth

Ø Continue to seek out Transmission opportunities in our service territory and

beyond

beyond

Ø Expect no need for external equity for at least the next 3 years

16

Q&A

17

Appendix

18

Expected Impacts of Bonus Depreciation - 2010 & 2011

19

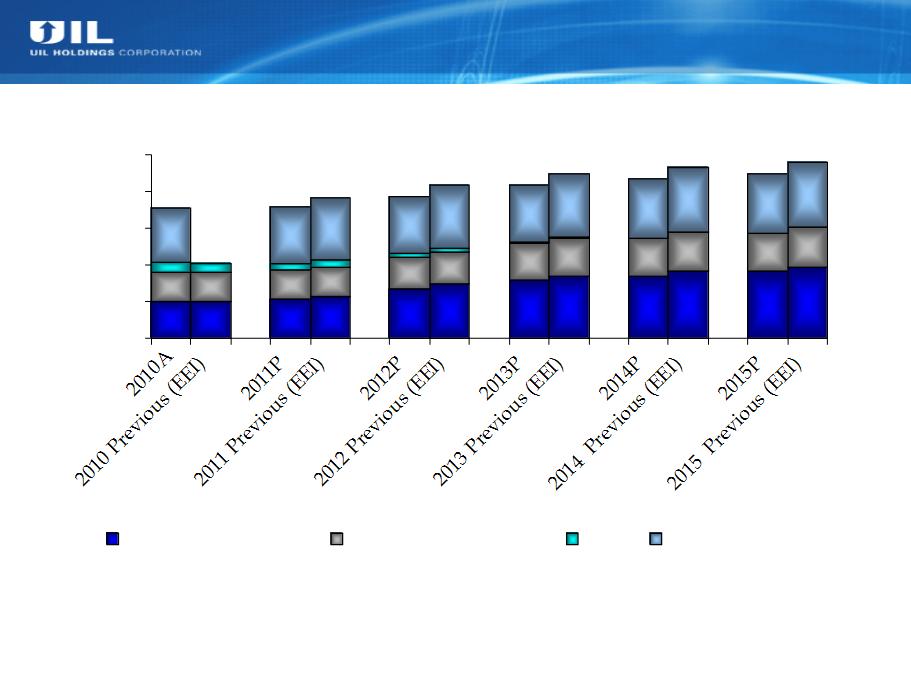

$494

$492

$535

$564

$681

$735

$798

$851

$853

$906

$906

$958

$405

$405

$401

$407

$422

$435

$496

$511

$514

$538

$529

$561

$766

$857

$777

$863

$788

$869

$799

$882

$811

$885

$751

$-

$500

$1,000

$1,500

$2,000

$2,500

Electric distribution

Electric transmission

CTA

Gas distribution

(1) CTA Avg Rate Base figures in current forecast are $127M ’10, $89 ’11, $50M ’12 and $11M ’13

(2) 2010 Gas distribution average rate base reflects the full year; UIL ownership was for 6 weeks effective with the closing on the acquisition. For comparability

purposes, Gas distribution excludes the impacts of 338(h)(10) election.

purposes, Gas distribution excludes the impacts of 338(h)(10) election.

Amounts may not add due to rounding.

(2)

(1)

($M)

$1,025

$1,791

$1,920

$1,930

$1,777

$2,087

$2,093

$2,246

$2,166

$2,326

$2,246

$2,404

Average Rate Base 2010 - 2015

Current Forecast vs. EEI Forecast

Current Forecast vs. EEI Forecast

20

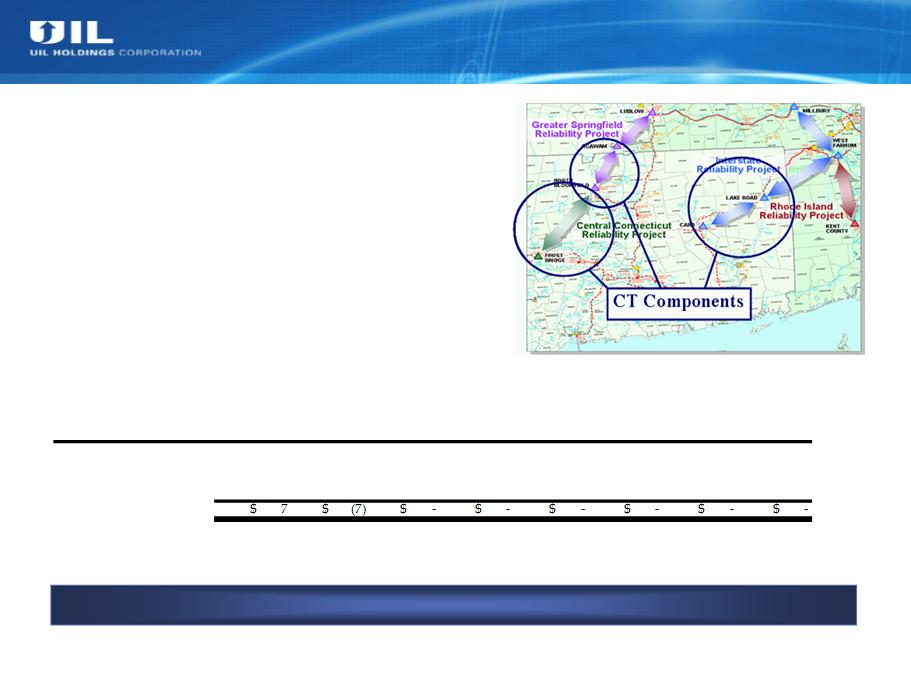

UI Transmission - NEEWS Investment

UI Participation in CL&P Project:

› UI’s portion of investment: greater of

$60M or 8.4% of CL&P’s costs for the

CT portions …

$60M or 8.4% of CL&P’s costs for the

CT portions …

› 8.4% currently estimated at

approximately $69M (increased from

original estimate of $60M)

approximately $69M (increased from

original estimate of $60M)

› First deposit made in December 2010

UI’s anticipated investment increased from $60M to $69M

Refreshed UI Investment Amounts and Timeline:

($ millions)

Potential UI Investment*

2010A

2011P

2012P

2013P

2014P

2015P

2016P

Total

Current Projection

7

$

3

$

9

$

8

$

12

$

23

$

7

$

69

$

Previous Projection

-

$

10

$

9

$

8

$

12

$

23

$

7

$

69

$

Difference

* Based on NU's latest projection of UI's Investment in CL&P's portion of the NEEWS Projects.

21

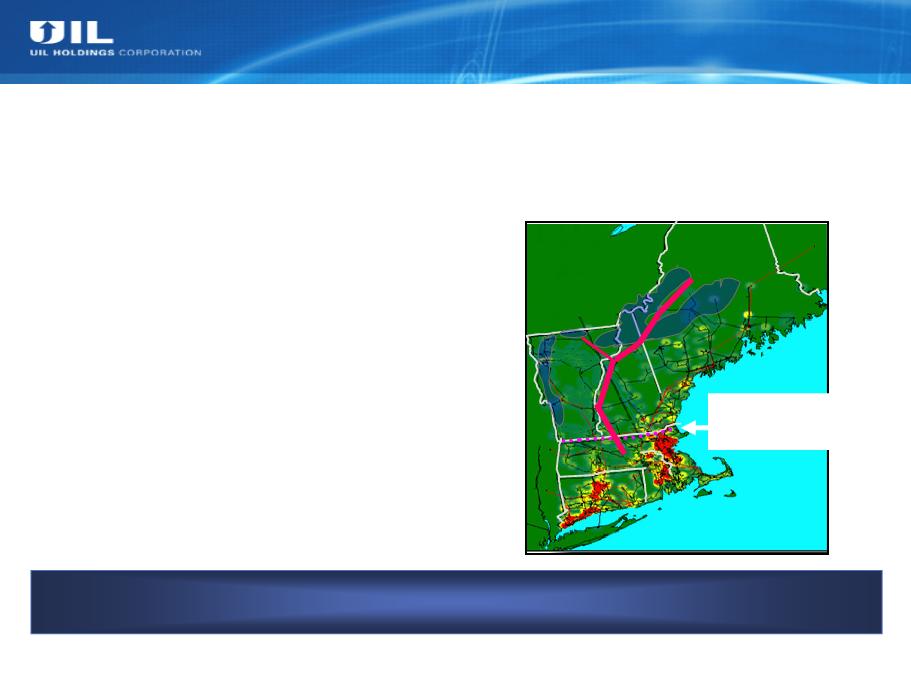

Renewable-Enabling Transmission

21

Collaborative effort: UI, NU, NSTAR, and NGrid …

to research / identify the most economical means of satisfying future RPS obligations

Significant Region-Wide Need:

› RPS requirement > 3x current

available renewables*

available renewables*

› CT requirement is > UI’s entire load

› Gap will be filled by renewables

remote from load

remote from load

N.E. Governors’ Blueprint:

› Significant transmission build-out

indicated

indicated

› Potential $7 to $10B range - could be

higher or lower to satisfy a 4,000 to

12,000 MW need

higher or lower to satisfy a 4,000 to

12,000 MW need

› Cost to New England likely much less

than Midwestern wind

than Midwestern wind

Potential Solutions Under Study

› Need will likely be satisfied by a portfolio

of projects

of projects

› One promising example is shown below

Notes: *From ISO-NE presentation dated 5/15/09 - driven by 2008 data.

Vast majority of

potential onshore

renewables (wind)

potential onshore

renewables (wind)

are in northern NE

North-South Interface:

80% of NE electric

load is below this line

load is below this line

22

22

UIL - Corporate Structure, Service Areas

› Service territory: 335 sq

miles

miles

› ~325,000 customers

› 1,095 employees

› Allowed Distribution ROE

of 8.75%

of 8.75%

› Earned ’10 Transmission

ROE (composite) of 12.5%

ROE (composite) of 12.5%

› 50% interest in GenConn

Energy LLC

Energy LLC

The United Illuminating

Company (UI)

Company (UI)

Note: (1) Includes 10 basis point penalty reduction. Previously authorized 10.0% & 10.1% at SCG & CNG respectively, in effect pending resolution of rate case appeals.

UIL Holdings

Corporation

Corporation

Service Area Key

SCG

CNG

UI

Berkshire

Overlapping Territory

› Service territory: 716 sq

miles - Greater Hartford-

New Britain & Greenwich

miles - Greater Hartford-

New Britain & Greenwich

› ~160,000 customers

› 319 employees

› 2,011 miles of mains with

~124,000 services

~124,000 services

Connecticut Natural Gas

(CNG)

(CNG)

› Service territory: 738 sq

miles in Western MA

including Pittsfield and

North Adams

miles in Western MA

including Pittsfield and

North Adams

› ~36,000 customers

› 120 employees

› 738 miles of mains

› Allowed ROE of 10.50%

Berkshire Gas Company

(Berkshire)

(Berkshire)

› Service territory: 512 sq

miles from Westport, CT to

Old Saybrook, CT

miles from Westport, CT to

Old Saybrook, CT

› ~178,000 customers

› 290 employees

› 2,269 miles of mains with

~131,000 services

~131,000 services

Southern Connecticut Gas

(SCG)

(SCG)

23

|

|

||||||

|

|

|

› Connecticut Department of Public Utility Control (DPUC)

› Currently operating under rates established in 2009*

› Allowed ROE of 8.75%, based on a capital structure of 50.0% equity

|

||||

|

|

|

› Federal Energy Regulatory Commission (FERC)

› Transmission trued up on an annual basis to allowed composite ROE based on FERC approved formula rate

› 2010 composite ROE of 12.5%, based on a capital structure of 50.0% equity

|

||||

|

› DPUC approved Contracts for Differences with CL&P (subsidiary of Northeast Utilities) and cost sharing agreement

(80% CL&P / 20% UI) › Allowed ROE has a lifetime floor of 9.75% based on a capital structure of 50.0% equity

|

||||||

|

|

|

› Connecticut Department of Public Utility Control (DPUC)

› 2009 rate case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place › Allowed ROE of 9.26% (previously allowed return of 10.0% in effect pending appeal), based on a capital structure of 52.0%

equity |

||||

|

|

› Massachusetts Department of Public Utilities (DPU)

› 10 year constructive rate plan expiring 1/31/12

› Rates adjusted annually based on inflation and other factors

|

|||||

Regulatory Overview

Distribution

Transmission

* The revenue decoupling mechanism will be reviewed by the DPUC in 2011.

› Connecticut Department of Public Utility Control (DPUC)

› 2009 Rate Case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place

rates currently in place

› Allowed ROE of 9.31% (previously allowed return of 10.1% in effect pending appeal), based on a capital structure of 52.5%

equity

equity