Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE OF 1934 |

For the quarterly period ended December 31, 2010

or

o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE OF 1934 |

For the transition period from _______ to _______

Commission file number: 000-30311

GOLD HORSE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

Florida | 22-3719165 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

No. 31 Tongdao South Road, Hohhot, Inner Mongolia, China | 010030 |

(Address of principal executive offices) | (Zip Code) |

86 (471) 339 7999

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 1,989,459 shares at February 14, 2011.

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

FORM 10-Q

QUARTERLY PERIOD ENDED DECEMBER 31, 2010

TABLE OF CONTENTS

|

| Page |

PART I - FINANCIAL INFORMATION |

| |

Item 1. | Financial Statements. |

|

| Condensed Consolidated Balance Sheets As of December 31, 2010 and June 30, 2010 | 4 |

| Condensed Consolidated Statements of Income and Comprehensive Income For the Three and Six Months Ended December 31, 2010 and 2009 | 5 |

| Condensed Consolidated Statements of Cash Flows For the Six Months Ended December 31, 2010 and 2009 | 6 |

| Notes to Unaudited Condensed Consolidated Financial Statements | 7 |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 27 |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 42 |

Item 4T. | Controls and Procedures | 42 |

|

|

|

PART II - OTHER INFORMATION |

| |

Item 1 | Legal Proceedings | 44 |

Item 1A. | Risk Factors | 44 |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 44 |

Item 3. | Defaults Upon Senior Securities | 44 |

Item 4. | (Removed and Reserved) | 44 |

Item 5. | Other Information | 44 |

Item 6. | Exhibits | 44 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, the amount of funds owed us by the Jin Ma Companies, the enforceability of our contractual arrangements with the Jin Ma Companies, the risk of doing business in the People’s Republic of China (“PRC”), our ability to implement our strategic initiatives, our access to sufficient capital, our ability to satisfy our obligations as they become due, economic, political and market conditions and fluctuations, PRC government regulations and economic policies, industry regulation, competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control.

You should consider the areas of risk described in connection with any forward-looking statements that may be made in our report as filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this quarterly report and our annual report on Form 10-K for the year ended June 30, 2010, including the risks described in Item 1A. - Risk Factors, in their entirety. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this quarterly report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

2

OTHER PERTINENT INFORMATION

Our web site is www.goldhorseinternational.com. The information which appears on our web site is not part of this report.

All share and per share information in this report gives effect to the 40:1 reverse stock split of our common stock which was effective on September 8, 2010.

Our business is conducted in China, using Renminbi (“RMB”), the currency of China, and our financial statements are presented in United States dollars. In this report, we refer to assets, obligations, commitments and liabilities in our financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

Unless specifically set forth to the contrary, when used in this prospectus the terms:

| • | “Gold Horse International,” the “Company, “we,” “us,” “ours,” and similar terms refers to Gold Horse International, Inc., a Florida corporation, |

|

|

|

| • | “Gold Horse Nevada” refers to Gold Horse International, Inc., a Nevada corporation and wholly-owned subsidiary of Gold Horse International, |

|

|

|

| • | “Global Rise” refers to Global Rise International, Limited, a Cayman Islands corporation and wholly-owned subsidiary of Gold Horse Nevada, |

|

|

|

| • | “IMTD” refers to Inner Mongolia (Cayman) Technology & Development Ltd., a Chinese company and wholly-owned subsidiary of Global Rise, |

|

|

|

| • | “Jin Ma Real Estate” refers to Inner Mongolia Jin Ma Real Estate Development Co., Ltd., a Chinese company, |

|

|

|

| • | “Jin Ma Construction” refers to Inner Mongolia Jin Ma Construction Co., Ltd., a Chinese company, |

|

|

|

| • | “Jin Ma Hotel” refers to Inner Mongolia Jin Ma Hotel Co., Ltd., a Chinese company, |

|

|

|

| • | “Jin Ma Companies” collectively refers to Jin Ma Real Estate, Jin Ma Construction and Jin Ma Hotel, which are variable interest entities under contractual arrangements with us and whose financial statements are consolidated with ours, unless the context specifically states or implies otherwise; and |

|

|

|

| • | “first quarter of 2011” refers to the three months ended September 30, 2010 and, “first quarter of 2010” refers to the three months ended September 30, 2009, unless the context otherwise defines. |

|

|

|

| • | “second quarter of 2011” refers to the three months ended December 31, 2010 and, “second quarter of 2010” refers to the three months ended December 31, 2009, unless the context otherwise defines. |

3

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

|

| As of |

| ||||

|

|

| December 31, |

|

| June 30, |

|

|

| 2010 |

| 2010 |

| ||

|

| (Unaudited) |

|

|

|

| |

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 594,349 |

| $ | 309,996 |

|

Accounts receivable, net |

|

| 11,996,798 |

|

| 7,912,119 |

|

Notes receivable on sales type lease - current portion |

|

| 1,696,005 |

|

| 1,150,333 |

|

Inventories, net |

|

| 61,718 |

|

| 64,007 |

|

Prepaid expenses |

|

| 42,173 |

|

| 210,000 |

|

Other receivables, net |

|

| 111,845 |

|

| 24,969 |

|

Cost and estimated earnings in excess of billings |

|

| 53,251 |

|

| 93,879 |

|

Real estate held for sale |

|

| 200,606 |

|

| 367,009 |

|

Deferred tax assets |

|

| 225,905 |

|

| 267,668 |

|

Construction in progress - current portion |

|

| 14,246,384 |

|

| — |

|

|

|

|

|

|

|

|

|

Total Current Assets |

|

| 29,229,034 |

|

| 10,399,980 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

| 8,630,228 |

|

| 8,727,796 |

|

Construction in progress - non-current portion |

|

| 13,243,443 |

|

| 12,860,646 |

|

Notes receivable on sales type lease - non-current portion |

|

| 15,490,077 |

|

| 15,853,319 |

|

|

|

|

|

|

|

|

|

Total Assets |

| $ | 66,592,782 |

| $ | 47,841,741 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

Loans payable - current portion |

| $ | 3,183,702 |

| $ | 3,091,678 |

|

Accounts payable |

|

| 18,463,337 |

|

| 3,522,030 |

|

Due to related parties |

|

| 506,723 |

|

| 230,453 |

|

Accrued expenses |

|

| 755,245 |

|

| 832,597 |

|

Taxes payable |

|

| 1,936,493 |

|

| 2,374,059 |

|

Advances from customers |

|

| 191,152 |

|

| 144,670 |

|

Derivative liability |

|

| 496,538 |

|

| 653,630 |

|

Billings in excess of costs and estimated earnings |

|

| 730 |

|

| 90,205 |

|

|

|

|

|

|

|

|

|

Total Current Liabilities |

|

| 25,533,920 |

|

| 10,939,322 |

|

|

|

|

|

|

|

|

|

Loans payable - net of current portion |

|

| 317,614 |

|

| 345,152 |

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

| 25,851,534 |

|

| 11,284,474 |

|

|

|

|

|

|

|

|

|

Commitments (Note 18) |

|

| — |

|

| — |

|

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

|

Preferred stock ($0.0001 par value; 20,000,000 shares authorized; none issued and outstanding) |

|

| — |

|

| — |

|

Common stock ($0.0001 par value; 300,000,000 shares authorized; 1,989,459 and 1,934,878 shares issued and outstanding at December 31, 2010 and June 30, 2010) |

|

| 199 |

|

| 193 |

|

Non-controlling interest in variable interest entities |

|

| 6,095,314 |

|

| 6,095,314 |

|

Additional paid-in capital |

|

| 7,346,784 |

|

| 7,127,577 |

|

Statutory reserve |

|

| 2,491,844 |

|

| 2,470,154 |

|

Retained earnings |

|

| 21,001,871 |

|

| 18,213,466 |

|

Accumulated other comprehensive income |

|

| 3,805,236 |

|

| 2,650,563 |

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity |

|

| 40,741,248 |

|

| 36,557,267 |

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity |

| $ | 66,592,782 |

| $ | 47,841,741 |

|

See accompanying notes to unaudited consolidated financial statements

4

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

|

| For the Three Months Ended |

| For the Six Months Ended |

| ||||||||

|

| 2010 |

| 2009 |

| 2010 |

| 2009 |

| ||||

|

| (Unaudited) |

| (Unaudited) |

| (Unaudited) |

| (Unaudited) |

| ||||

NET REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

| $ | 15,400,661 |

| $ | 4,405,892 |

| $ | 24,991,149 |

| $ | 9,596,012 |

|

Hotel |

|

| 724,213 |

|

| 734,809 |

|

| 1,565,475 |

|

| 1,512,829 |

|

Real estate |

|

| 302,400 |

|

| 158,981 |

|

| 713,369 |

|

| 158,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues |

|

| 16,427,274 |

|

| 5,299,682 |

|

| 27,269,993 |

|

| 11,267,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

|

| 13,280,141 |

|

| 3,878,214 |

|

| 21,437,820 |

|

| 8,329,680 |

|

Hotel |

|

| 393,607 |

|

| 494,312 |

|

| 909,055 |

|

| 1,008,859 |

|

Real estate |

|

| 241,712 |

|

| 167,050 |

|

| 540,214 |

|

| 167,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cost of Revenues |

|

| 13,915,460 |

|

| 4,539,576 |

|

| 22,887,089 |

|

| 9,505,589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

| 2,511,814 |

|

| 760,106 |

|

| 4,382,904 |

|

| 1,762,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other hotel operating expenses |

|

| 12,255 |

|

| 76,586 |

|

| 31,960 |

|

| 103,359 |

|

Bad debt recovery |

|

| (188,120 | ) |

| (97,564 | ) |

| (195,612 | ) |

| (105,555 | ) |

Salaries and employee benefits |

|

| 207,251 |

|

| 198,349 |

|

| 418,610 |

|

| 392,435 |

|

Depreciation |

|

| 197,965 |

|

| 191,532 |

|

| 392,437 |

|

| 385,121 |

|

Selling, general and administrative |

|

| 165,044 |

|

| 102,611 |

|

| 467,734 |

|

| 252,563 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

| 394,395 |

|

| 471,514 |

|

| 1,115,129 |

|

| 1,027,923 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

| 2,117,419 |

|

| 288,592 |

|

| 3,267,775 |

|

| 734,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

| 58 |

|

| (27 | ) |

| 6,842 |

|

| 46 |

|

Gain on extinguishment of derivative liabilities |

|

| — |

|

| 561,602 |

|

| — |

|

| 1,623,209 |

|

Gain on change in fair value of derivative liabilities |

|

| 121,612 |

|

| 1,314,381 |

|

| 157,092 |

|

| 2,002,937 |

|

Gain on sale of land use rights and property |

|

| — |

|

| 167 |

|

| — |

|

| 449,473 |

|

Interest income |

|

| 431,248 |

|

| 543,092 |

|

| 650,860 |

|

| 543,149 |

|

Interest expense |

|

| (125,960 | ) |

| (745,695 | ) |

| (252,006 | ) |

| (2,317,076 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income |

|

| 426,958 |

|

| 1,673,520 |

|

| 562,788 |

|

| 2,301,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE PROVISION FOR INCOME TAX |

|

| 2,544,377 |

|

| 1,962,112 |

|

| 3,830,563 |

|

| 3,036,048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAXES |

|

| 648,547 |

|

| 79,632 |

|

| 1,020,468 |

|

| 314,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

| $ | 1,895,830 |

| $ | 1,882,480 |

| $ | 2,810,095 |

| $ | 2,721,270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

| $ | 1,895,830 |

| $ | 1,882,480 |

| $ | 2,810,095 |

| $ | 2,721,270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized foreign currency translation gain |

|

| 529,724 |

|

| 1,716 |

|

| 1,154,673 |

|

| 33,861 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME |

| $ | 2,425,554 |

| $ | 1,884,196 |

| $ | 3,964,768 |

| $ | 2,755,131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| $ | 0.97 |

| $ | 1.22 |

| $ | 1.45 |

| $ | 1.88 |

|

Diluted |

| $ | 0.96 |

| $ | 1.22 |

| $ | 1.42 |

| $ | 1.85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 1,947,992 |

|

| 1,544,003 |

|

| 1,941,476 |

|

| 1,447,276 |

|

Diluted |

|

| 1,981,696 |

|

| 1,544,003 |

|

| 1,972,611 |

|

| 1,469,458 |

|

See accompanying notes to unaudited consolidated financial statements

5

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

| For the Six Months Ended |

| ||||

|

| December 31, |

| ||||

|

| 2010 |

| 2009 |

| ||

|

| (Unaudited) |

| (Unaudited) |

| ||

|

|

|

|

| (As Restated) |

| |

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

Net income |

| $ | 2,810,095 |

| $ | 2,721,270 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation |

|

| 392,437 |

|

| 385,121 |

|

Stock-based compensation and fees |

|

| 116,094 |

|

| 57,500 |

|

Common stock issued for interest |

|

| — |

|

| 19,085 |

|

Bad debt recovery |

|

| (195,612 | ) |

| (105,555 | ) |

Interest expense from amortization of debt discount |

|

| — |

|

| 1,931,611 |

|

Warrants issued for service |

|

| 31,188 |

|

| — |

|

Gain on sale of land use right |

|

| — |

|

| (449,472 | ) |

Gain from debt extinguishment |

|

| — |

|

| (1,623,209 | ) |

Gain on change in fair value of derivative liabilities |

|

| (157,092 | ) |

| (2,002,937 | ) |

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

| (3,597,076 | ) |

| (409,136 | ) |

Notes receivable |

|

| 318,298 |

|

| 158,067 |

|

Inventories |

|

| 4,124 |

|

| (49,770 | ) |

Other receivables |

|

| (77,145 | ) |

| 1,176,271 |

|

Advance to suppliers |

|

| — |

|

| (74,053 | ) |

Prepaid expenses |

|

| 169,253 |

|

| — |

|

Costs and estimated earnings in excess of billings |

|

| 42,700 |

|

| 6,466 |

|

Real estate held for sale |

|

| 174,377 |

|

| — |

|

Construction in progress |

|

| (14,009,349 | ) |

| (2,746,228 | ) |

Accounts payable and accrued expenses |

|

| 14,562,314 |

|

| (2,310,257 | ) |

Taxes payable |

|

| (450,871 | ) |

| (1,452,604 | ) |

Advances from customers |

|

| 41,475 |

|

| 2,621,660 |

|

Billings in excess of costs and estimated earnings |

|

| (90,626 | ) |

| 20,428 |

|

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES |

|

| 84,584 |

|

| (2,125,742 | ) |

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

Proceeds from sale of land use right |

|

| — |

|

| 2,193,441 |

|

Purchase of property and equipment |

|

| (41,033 | ) |

| (31,820 | ) |

NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES |

|

| (41,033 | ) |

| 2,161,621 |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

Repayment of loans payable |

|

| (37,182 | ) |

| (146,229 | ) |

Proceeds from advances from related party |

|

| 264,928 |

|

| 1,203,780 |

|

Repayment of convertible debt |

|

| — |

|

| (764,050 | ) |

NET CASH PROVIDED BY FINANCING ACTIVITIES |

|

| 227,746 |

|

| 293,501 |

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE ON CASH |

|

| 13,056 |

|

| (459 | ) |

|

|

|

|

|

|

|

|

NET INCREASE IN CASH & CASH EQUIVALENTS |

|

| 284,353 |

|

| 328,921 |

|

|

|

|

|

|

|

|

|

CASH & CASH EQUIVALENTS - beginning of period |

|

| 309,996 |

|

| 112,134 |

|

|

|

|

|

|

|

|

|

CASH & CASH EQUIVALENTS - end of period |

| $ | 594,349 |

| $ | 441,055 |

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

|

Interest |

| $ | 219,620 |

| $ | 391,669 |

|

Income taxes |

| $ | 1,105,666 |

| $ | 1,389,002 |

|

|

|

|

|

|

|

|

|

Non-cash activities: |

|

|

|

|

|

|

|

Common stock issued for prior and future service |

| $ | 71,931 |

| $ | 248,000 |

|

Common stock issued for conversion of convertible debt |

| $ | — |

| $ | 664,784 |

|

Common stock issued for accrued interest |

| $ | — |

| $ | 21,830 |

|

Reclassification of warrants and conversion options to derivative liabilities |

| $ | — |

| $ | 4,680,179 |

|

See accompanying notes to unaudited consolidated financial statements

6

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

Gold Horse International, Inc. (the “Company”, “we”, “us”, “our”) was incorporated on March 21, 2000 under the laws of the State of New Jersey under its former name “Segway III”. Prior to June 29, 2007, the Company was a development stage company attempting to implement its business plan to become a fully integrated online provider that links the supply and demand sides of the ground trucking industry. In November 2007, the Company filed a Certificate of Domestication in the State of Florida whereby the Company domesticated as a Florida corporation under the name Gold Horse International, Inc.

On June 29, 2007, the Company executed a Share Exchange Agreement (“Share Exchange Agreement”) with Gold Horse International, Inc. (“Gold Horse Nevada”), a Nevada corporation, whereby the Company acquired all of the outstanding common stock of Gold Horse Nevada from its stockholders in exchange for newly-issued stock of the Company. Gold Horse Nevada was incorporated on August 14, 2006 in the State of Nevada.

Under the Share Exchange Agreement, on June 29, 2007, the Company issued 1,212,500 shares of its common stock to the Gold Horse Nevada Stockholders and their assignees in exchange for 100% of the common stock of Gold Horse Nevada. Additionally, the Company’s prior President, CEO and sole director, cancelled 241,376 of the Company’s common stock he owned immediately prior to the closing. After giving effect to the cancellation of shares, the Company had a total of 37,500 shares of common stock outstanding immediately prior to Closing. After the Closing, the Company had a total of 1,250,000 shares of common stock outstanding, with the Gold Horse Nevada Stockholders and their assignees owning 97% of the total issued and outstanding shares of the Company’s common stock.

Gold Horse Nevada became a wholly-owned subsidiary of the Company and Gold Horse Nevada’s former shareholders own the majority of the Company’s voting stock.

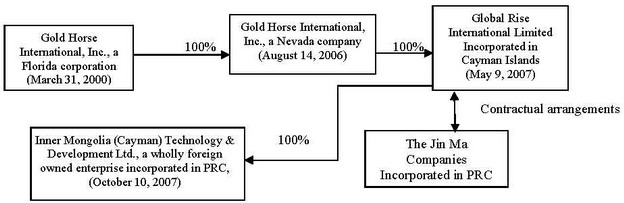

Gold Horse Nevada owns 100% of Global Rise International, Limited (“Global Rise”), a Cayman Islands corporation incorporated on May 9, 2007. Through Global Rise, Gold Horse Nevada operates, controls and beneficially owns the construction, hotel and real estate development businesses in China under a series of contractual arrangements (the “Contractual Arrangements”) with Inner Mongolia Jin Ma Real Estate Development Co., Ltd. (“Jin Ma Real Estate”), Inner Mongolia Jin Ma Construction Co., Ltd. (“Jin Ma Construction”) and Inner Mongolia Jin Ma Hotel Co., Ltd. (“Jin Ma Hotel”), (collectively referred to as the “Jin Ma Companies”). Other than the Contractual Arrangements with the Jin Ma Companies, the Company, Gold Horse Nevada nor Global Rise are engaged in any business or operations. The Contractual Arrangements are discussed below.

On October 10, 2007, the Company established Inner Mongolia (Cayman) Technology & Development Ltd. (“IMTD”), a wholly-foreign owned enterprise incorporated in the PRC and wholly-owned subsidiary of Global Rise,

The relationship among the above companies as follows:

7

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

As a result of these Contractual Arrangements, the acquisition of Gold Horse Nevada and the Jin Ma Companies by the Company was accounted for as a reverse merger because on a post-merger basis, the former shareholders of Gold Horse Nevada held a majority of the outstanding common stock of the Company on a voting and fully-diluted basis. As a result, Gold Horse Nevada is deemed to be the acquirer for accounting purposes. Accordingly, the consolidated financial statement data presented are those of the Jin Ma Companies for all periods prior to the Company’s acquisition of Gold Horse Nevada on June 29, 2007, and the financial statements of the consolidated companies from the acquisition date forward.

PRC law currently places certain limitations on foreign ownership of Chinese companies. To comply with these foreign ownership restrictions, the Company, through its wholly-owned subsidiary, Global Rise, operates its business in China through the Jin Ma Companies, each of which is a limited liability company headquartered in Hohhot, the capital city of the Autonomous Region of Inner Mongolia in China, and organized under PRC laws. Each of the Jin Ma Companies has the relevant licenses and approvals necessary to operate its business in China and none of them is exposed to liabilities incurred by the other party. Global Rise has Contractual Arrangements with each of the Jin Ma Companies and their shareholders (collectively, the “Jin Ma Companies Shareholders”) pursuant to which Global Rise provides business consulting and other general business operation services to the Jin Ma Companies. Through these Contractual Arrangements, Global Rise also has the ability to control the daily operations and financial affairs of the Jin Ma Companies, appoint each of their senior executives and approve all matters requiring shareholder approval. As a result of these Contractual Arrangements, which enable Global Rise to control the Jin Ma Companies, the Company is considered the primary beneficiary of the Jin Ma Companies. Accordingly, the Company consolidates the Jin Ma Companies’ results, assets and liabilities in its financial statements.

The Contractual Arrangements are comprised of a series of agreements, including a Consulting Services Agreement and an Operating Agreement, through which Global Rise has the right to advise, consult, manage and operate each of the Jin Ma Companies, and collect and own all of their respective net profits. Additionally, under a Shareholders’ Voting Rights Proxy Agreement, the Jin Ma Companies Shareholders have vested their voting control over the Jin Ma Companies to Global Rise. In order to further reinforce the Company’s rights to control and operate the Jin Ma Companies, these companies and their shareholders have granted Global Rise, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in the Jin Ma Companies or, alternatively, all of the assets of the Jin Ma Companies. Further the Jin Ma Companies Shareholders have pledged all of their rights, titles and interests in the Jin Ma Companies to Global Rise under an Equity Pledge Agreement.

Gold Horse Nevada entered into the Contractual Arrangements with each of the Jin Ma Companies and their respective shareholders on August 31, 2006. On June 29, 2007, concurrently with the closing of the Share Exchange Transaction, the Contractual Arrangements were amended and restated by and among Gold Horse Nevada and Global Rise, the Company’s wholly-owned subsidiary, and the Company on the one hand, and each of the Jin Ma Companies and their respective shareholders on the other hand, pursuant to which the Company was made a party to the Contractual Arrangements.

Inner Mongolia Jin Ma Construction Company Ltd.

Jin Ma Construction is an engineering and construction company that offers general contracting, construction management and building design services primarily in Hohhot City, the Autonomous Region of Inner Mongolia in China. In operation since 1980, Jin Ma Construction was formally registered as a limited liability company in Hohhot City in March 2002.

Inner Mongolia Jin Ma Real Estate Development Co. Ltd.

Jin Ma Real Estate, established in 1999, was formally registered as a limited liability company in Hohhot City in February 2004. Jin Ma Real Estate develops residential and commercial properties in the competitive and growing real estate market in Hohhot.

Inner Mongolia Jin Ma Hotel Co. Ltd.

Jin Ma Hotel was founded in 1999 and formally registered in April 2004 as a limited liability company in Hohhot City. Jin Ma Hotel presently owns, operates and manages the Inner Mongolia Jin Ma Hotel (the “Hotel”), a 22-room full service hotel with a restaurant and banquet facilities situated in Hohhot City approximately 15 kilometers from the Hohhot Baita Airport.

8

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Inner Mongolia (Cayman) Technology & Development Ltd.

IMTD, a wholly foreign owned enterprise incorporated in PRC, provides administrative support services to the Jin Ma Companies.

Principle of consolidation

These condensed consolidated financial statements include the financial statements of Gold Horse, its subsidiaries and variable interest entities. All significant inter-company balances or transactions have been eliminated on consolidation.

Basis of preparation

These interim condensed consolidated financial statements are unaudited. In the opinion of management, all adjustments and disclosures necessary for a fair presentation of these interim condensed consolidated financial statements have been included. The results reported in the condensed consolidated financial statements for any interim periods are not necessarily indicative of the results that may be reported for the entire year. The (a) condensed consolidated balance sheet as of June 30, 2010, which was derived from audited financial statements, and (b) the unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying footnotes of the Company for the year ended June 30, 2010.

Financial instruments

The accounting standard governing financial instruments adopted by the Company on July 1, 2009, defines financial instruments and requires fair value disclosures about those instruments. It defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosure requirements for fair value measures. Cash, investments, receivables, payables, short term loans and convertible debt all qualify as financial instruments. Management concluded cash, receivables, payables and short term loans approximate their fair values because of the short period of time between the origination of such instruments and their expected realization and, if applicable, their stated rates of interest are equivalent to rates currently available.

The three levels of valuation hierarchy are defined as follows:

| • | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

|

|

|

| • | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

|

|

|

| • | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The Company analyzes all financial instruments with features of both liabilities and equity under the FASB’s accounting standard for such instruments. Under this standard, financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Depending on the product and the terms of the transaction, the fair value of notes payable and derivative liabilities were modeled using a series of techniques, including closed-form analytic formula, such as the Black-Scholes option-pricing model.

9

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

The following table presents a reconciliation of the derivative liability measured at fair value on a recurring basis using significant unobservable input (Level 3) for the six months ended December 31, 2010:

| Warrant liability |

| |

Balance at June 30, 2010 | $ | 653,630 |

|

Exercise of warrants |

| — |

|

Change in fair value included in earnings |

| (157,092 | ) |

Balance at December 31, 2010 | $ | 496,538 |

|

The Company did not identify any other non-recurring assets and liabilities that are required to be presented on the consolidated balance sheets at fair value in accordance with the relevant accounting standards.

See Note 10 for more information on these financial instruments.

Concentrations of credit risk

The Company’s operations through the Jin Ma Companies are carried out in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC’s economy. The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash and trade accounts receivable. Substantially all of the Company’s cash is maintained with state-owned banks within the PRC, and no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts. A significant portion of the Company’s sales are credit sales which are primarily to customers whose ability to pay is dependent upon the industry economics prevailing in these areas; however, concentrations of credit risk with respect to trade accounts receivables is limited due to generally short payment terms. The Company also performs ongoing credit evaluations of its customers to help further reduce credit risk.

At December 31, 2010 and June 30, 2010, the Company’s bank deposits by geographic area were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2010 |

| June 30, 2010 | ||||||

|

| (Unaudited) |

|

| ||||||

Country: |

|

|

|

|

|

|

|

|

|

|

United States |

| $ | 945 |

| 0.2% |

| $ | 1,043 |

| 0.3% |

China |

|

| 593,404 |

| 99.8% |

|

| 308,953 |

| 99.7% |

Total cash and cash equivalents |

| $ | 594,349 |

| 100.0% |

| $ | 309,996 |

| 100.0% |

Accounts receivable, notes receivable and other receivables

The Company has a policy of reserving for uncollectible accounts based on its best estimate of the amount of probable credit losses in its existing receivables. The Company periodically reviews its receivables to determine whether an allowance is necessary based on an analysis of past due accounts and other factors that may indicate that the realization of an account may be in doubt. Account balances deemed to be uncollectible are charged to the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. At December 31, 2010 and June 30, 2010, the Company has established, based on a review of its outstanding accounts receivable balances, an allowance for doubtful accounts in the amount of $816,341 and $978,455, respectively, on its total accounts receivable. Management believes that the notes receivable are fully collectable. Therefore, no allowance for doubtful accounts is deemed to be required at December 31, 2010 and June 30, 2010.

10

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Other receivables are primarily related to advances made to various vendors and other parties in the normal course of business and an allowance was established when those parties are deemed to be unlikely to repay the amounts. At December 31, 2010 and June 30, 2010, the Company has established, based on a review of its outstanding other receivable balances, an allowance for doubtful accounts in the amount of $63,547 and $69,171, respectively. At such time as management exhausts all collection efforts, the other receivable balance will be netted against the allowance account. The activities in the allowance for doubtful accounts for accounts receivable and other receivables for the six months ended December 31, 2010 were as follows:

|

| Allowance for |

| Allowance for |

| Total |

| |||

Balance – June 30, 2010 |

| $ | 978,455 |

| $ | 69,171 |

| $ | 1,047,626 |

|

Reduction in allowance |

|

| (191,238 | ) |

| (7,683 | ) |

| (198,921 | ) |

Foreign currency translation adjustments |

|

| 29,124 |

|

| 2,059 |

|

| 31,183 |

|

|

|

|

|

|

|

|

|

|

|

|

Balance – December 31, 2010 (Unaudited) |

| $ | 816,341 |

| $ | 63,547 |

| $ | 879,888 |

|

Net income per common share

The following table presents a reconciliation of basic and diluted net income per common share:

|

| Three Months Ended |

| Six Months Ended |

| ||||||||

|

| 2010 |

| 2009 |

| 2010 |

| 2009 |

| ||||

Net income used for basic and diluted net income per common share |

| $ | 1,895,830 |

| $ | 1,882,480 |

| $ | 2,810,095 |

| $ | 2,721,270 |

|

Weighted average common shares outstanding - basic |

|

| 1,947,992 |

|

| 1,544,003 |

|

| 1,941,476 |

|

| 1,447,276 |

|

Effect of dilutive securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unexercised warrants |

|

| 33,704 |

|

| — |

|

| 31,135 |

|

| 22,182 |

|

Convertible debentures |

|

| — |

|

| — |

|

| — |

|

| — |

|

Weighted average common shares outstanding - diluted |

|

| 1,981,696 |

|

| 1,544,003 |

|

| 1,972,611 |

|

| 1,469,458 |

|

Net income per common share - basic |

| $ | 0.97 |

| $ | 1.22 |

| $ | 1.45 |

| $ | 1.88 |

|

Net income per common share - diluted |

| $ | 0.96 |

| $ | 1.22 |

| $ | 1.42 |

| $ | 1.85 |

|

For the three and six months ended December 31, 2009, the effect of interest expense and amortization of debt discount on net income used for diluted net income per common share and the effect on the number of weighted average common shares outstanding were deemed anti-dilutive.

The Company's aggregate common stock equivalents at December 31, 2010 and June 30, 2010 include the following:

|

| December 31, 2010 (Unaudited) |

| June 30, 2010 |

Warrants | $ | 204,945 | $ | 196,195 |

Total | $ | 204,945 | $ | 196,195 |

11

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Foreign currency translation and comprehensive income

The reporting currency of the Company is the U.S. dollar. The functional currency of the parent company is the U.S. dollar and the functional currency of the Company’s operating subsidiaries and variable interest entities is the RMB. For the subsidiaries and variable interest entities whose functional currencies are the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. All of the Company’s revenue transactions are transacted in the functional currency. The Company does not enter any material transactions in foreign currencies and accordingly, transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Company. Asset and liability accounts at December 31, 2010 and June 30, 2010 were translated at 6.6118 RMB to $1.00 USD and at 6.8086 RMB to $1.00 USD, respectively. Equity accounts were stated at their historical rate. The average translation rates applied to income statements for the six months ended December 31, 2010 and 2009 were 6.72367 RMB and 6.83857 RMB to $1.00 USD, respectively. In accordance with ASC Topic 230, cash flows from the Company’s operations are calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheets.

Advertising

Advertising is expensed as incurred. Advertising expenses for the six months ended December 31, 2010 and 2009 were deemed not material.

Recent accounting pronouncements

In July 2010, the FASB issued ASU 2010-20, “Receivables (Topic 310): Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses”. This ASU amends Topic 310 to improve the disclosures that an entity provides about the credit quality of its financing receivables and the related allowance for credit losses. As a result of these amendments, an entity is required to disaggregate by portfolio segment or class certain existing disclosures and provide certain new disclosures about its financing receivables and related allowance for credit losses. For public entities, the disclosures as of the end of a reporting period are effective for interim and annual reporting periods ending on or after December 15, 2010. The disclosures about activity that occurs during a reporting period are effective for interim and annual reporting periods beginning on or after December 15, 2010. Except for the expanded disclosure requirements, the adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

NOTE 2 – NOTES RECEIVABLE, NET

Notes receivable, which was attributable to the leasing of the Vocational School and Chemistry School pursuant to a sales-type capital lease, is accounted for using the installment method of accounting as well as original note value. In accordance with ASC Topic 360, a gain was deferred on notes not meeting the minimum initial 20% investment by the buyer expressed as a percentage of the sales value. Management believes that the notes receivable are fully collectable. Therefore, no allowance for doubtful accounts is deemed to be required. At December 31, 2010 and June 30, 2010, notes receivable, net consisted of the following:

12

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 2 – NOTES RECEIVABLE, NET (continued)

|

| December 31, 2010 |

| June 30, 2010 |

| ||

Due in 12-month periods ending December 31 and June 30, respectively, |

|

|

|

|

|

|

|

2011 |

| $ | 4,222,718 |

| $ | 2,861,153 |

|

2012 |

|

| 2,332,194 |

|

| 2,264,783 |

|

2013 |

|

| 2,332,194 |

|

| 2,264,783 |

|

2014 |

|

| 1,545,721 |

|

| 2,264,783 |

|

2015 |

|

| 1,545,721 |

|

| 1,501,043 |

|

Thereafter |

|

| 23,724,251 |

|

| 24,539,553 |

|

Notes receivable – gross |

|

| 35,702,799 |

|

| 35,696,098 |

|

Less: discount on notes receivable |

|

| (14,587,223 | ) |

| (14,808,215 | ) |

Less: deferred gain on sale |

|

| (3,929,494 | ) |

| (3,884,231 | ) |

|

|

| 17,186,082 |

|

| 17,003,652 |

|

Notes receivable – current portion, net |

|

| (1,696,005 | ) |

| (1,150,333 | ) |

Notes receivable – long-term, net |

| $ | 15,490,077 |

| $ | 15,853,319 |

|

NOTE 3 – INVENTORIES

At December 31, 2010 and June 30, 2010, inventories consisted of the following:

| December 31, 2010 (Unaudited) |

| June 30, 2010 | ||

|

|

|

| ||

Consumable goods | $ | 61,718 |

| $ | 64,007 |

|

|

|

|

|

|

| $ | 61,718 |

| $ | 64,007 |

NOTE 4 – COSTS AND ESTIMATED EARNINGS IN EXCESS OF BILLINGS

Costs and estimated earnings in excess of billings at December 31, 2010 and June 30, 2010 consisted of:

| December 31, 2010 (Unaudited) |

| June 30, 2010 |

| ||

Costs incurred on uncompleted contracts | $ | 32,701,987 |

| $ | 23,231,942 |

|

Estimated earnings |

| 7,490,284 |

|

| 5,325,326 |

|

|

| 40,192,271 |

|

| 28,557,268 |

|

Less: billings to date |

| (40,139,750 | ) |

| (28,553,594 | ) |

| $ | 52,521 |

| $ | 3,674 |

|

Amounts are included in the accompanying consolidated balance sheets under the following captions:

|

|

| December 31, 2010 (Unaudited) |

|

| June 30, 2010 |

|

Costs and estimated earnings in excess of billings |

| $ | 53,251 |

| $ | 93,879 |

|

Billings in excess of costs and estimated earnings |

|

| (730 | ) |

| (90,205 | ) |

|

|

|

|

|

|

|

|

|

| $ | 52,521 |

| $ | 3,674 |

|

13

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 5 – PROPERTY AND EQUIPMENT

At December 31, 2010 and June 30, 2010, property and equipment consist of the following:

| Useful Life |

| December 31, 2010 (Unaudited) |

| June 30, 2010 |

| ||

|

|

|

|

|

|

|

|

|

Office equipment | 5 – 8 Years |

| $ | 598,325 |

| $ | 580,827 |

|

Machinery and equipment | 5 – 15 Years |

|

| 7,395,067 |

|

| 7,181,316 |

|

Vehicles | 10 Years |

|

| 535,865 |

|

| 480,057 |

|

Building and building improvements | 20 – 40 Years |

|

| 4,022,421 |

|

| 3,906,155 |

|

|

|

|

| 12,551,678 |

|

| 12,148,355 |

|

Less: accumulated depreciation |

|

|

| (3,921,450 | ) |

| (3,420,559 | ) |

|

|

| $ | 8,630,228 |

| $ | 8,727,796 |

|

Depreciation of property and equipment is provided using the straight-line method. For the six months ended December 31, 2010 and 2009, depreciation expense amounted to $392,437 and $385,121, respectively.

NOTE 6 – CONSTRUCTION IN PROGRESS

At December 31, 2010 and June 30, 2010, construction in progress consists of the following:

| December 31, 2010 |

| June 30, 2010 |

| ||

Prepaid land use rights and buildings built for Procuratorate Housing Estates | $ | 912,034 |

| $ | 885,672 |

|

Prepaid land use rights and buildings built for Shuian Renjia project |

| 14,246,384 |

|

| — |

|

Prepaid land use rights for Wusutu Village land – JinWu project |

| 2,500,501 |

|

| 2,428,224 |

|

Prepaid land use rights for Fu Xing Ying land – Beiyuan project |

| 9,830,908 |

|

| 9,546,750 |

|

Total construction in progress |

| 27,489,827 |

|

| 12,860,646 |

|

Less: current portion |

| (14,246,384 | ) |

| — |

|

Long term construction in progress | $ | 13,243,443 |

| $ | 12,860,646 |

|

NOTE 7 – ACCRUED EXPENSES

At December 31, 2010 and June 30, 2010, accrued expenses consist of the following:

|

| December 31, 2010 (Unaudited) |

| June 30, 2010 | ||

Accrued interest payable |

| $ | 274,119 |

| $ | 234,214 |

Accrued payroll and employees benefit |

|

| 97,195 |

|

| 152,332 |

Refundable construction performance deposit |

|

| 378,112 |

|

| 440,619 |

Other |

|

| 5,819 |

|

| 5,432 |

|

| $ | 755,245 |

| $ | 832,597 |

14

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 8 – LOANS PAYABLE

Loans payable consisted of the following at December 31, 2010 and June 30, 2010:

|

| December 31, 2010 |

| June 30, 2010 |

| ||

Loans from various credit unions, due on May 10, 2011 with annual |

| $ | 2,994,646 |

| $ | 2,908,087 |

|

|

|

|

|

|

|

|

|

Loans from various unrelated parties, due in September 2010 with |

|

| — |

|

| 36,718 |

|

|

|

|

|

|

|

|

|

Loans from various unrelated parties, due in April 2012 with annual |

|

| 196,618 |

|

| 190,936 |

|

|

|

|

|

|

|

|

|

Loans from various unrelated parties, due in August 2011 with annual |

|

| 37,811 |

|

| 36,718 |

|

|

|

|

|

|

|

|

|

Loans from various unrelated parties, due in September 2012 with |

|

| 120,996 |

|

| 117,498 |

|

|

|

|

|

|

|

|

|

Loan from one unrelated individual, due in March 2011 with annual |

|

| 151,245 |

|

| 146,873 |

|

Total loans payable |

|

| 3,501,316 |

|

| 3,436,830 |

|

Less: current portion |

|

| (3,183,702 | ) |

| (3,091,678 | ) |

Long term liability |

| $ | 317,614 |

| $ | 345,152 |

|

For the six months ended December 31, 2010 and 2009, interest expense related to these loans amounted to $252,006 and $339,937, respectively. At December 31, 2010, future maturities of debt are as follows:

2011 (current liability) | $ | 3,183,702 |

2012 | $ | 317,614 |

NOTE 9 – RELATED PARTY TRANSACTIONS

Due to related parties

From time to time, companies related through common ownership advanced funds to the Company for working capital purposes. These advances are non interest bearing, unsecured and payable on demand. At December 31, 2010 and June 30, 2010, due to related parties consisted of the following:

Name |

| Relationship |

| December 31, 2010 |

| June 30, 2010 | ||

Inner Mongolia Jin Ma Group Ltd and its subsidiaries |

| Owned by Yang Liankuan |

| $ | 506,723 |

| $ | 230,453 |

Other

During the six months ended December 31, 2010 and 2009, the Company paid rent of $25,992 and $25,555 to Inner Mongolia Jin Ma Group Ltd., respectively.

15

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 10 – CONVERTIBLE DEBT AND DERIVATIVE LIABILITIES

Under the terms of a Securities Purchase Agreement, on the closing date which occurred on November 30, 2007, the Company issued $2,183,000 principal amount 10% Secured Convertible Debentures to the purchasers together with the common stock purchase warrants to purchase an aggregate of 238,009 shares of the Company’s common stock. The Company paid Next Generation Equity Research, LLC (“Next”), a broker dealer and member of FINRA, a commission of $174,640 and issued Next common stock purchase warrants to purchase an aggregate of 12,692 shares of the Company’s common stock at $20.00 per share. Additionally, the Company reimbursed one of the investors $30,000 to defer its legal fees in connection with the financing. The Company used the balance of the proceeds for general working capital.

The debentures, aggregating $2,183,000, which prior to March 31, 2009 accrued interest at 10% per annum, were originally due on March 31, 2009. The Company failed to repay the debentures on the due date. During May 2009, the Company entered into negotiations with the debenture holders to restructure the payment terms and reached an understanding, subject to the execution of definitive documents, to extend the due date of the debentures and cure the default. On May 18, 2009, the Company and the debenture holders signed a Debenture and Warrant Amendment Agreement (the “Amendment Agreement”) and an Amended and Restated 14% Secured Convertible Debenture (the “Exchanged Debentures”). The Jin Ma Companies, however, had been unable to consummate this restructure due to delays caused by China’s State Administration of Foreign Exchange (“SAFE”), the agency that the Jin Ma Companies must get approval from to wire the funds to the debenture holders. On June 30, 2009, the Company and the debenture holders executed an Amendment to the Amendment Agreement effectively consummating the Amendment Agreement and issuing the Exchanged Debentures thereby ceasing any written or non-written declarations of an event of default under its Securities Purchase Agreement and the related 10% secured convertible debentures and any process to foreclose upon the pledged shares in accordance with the terms of the pledge agreement executed in connection Securities Purchase Agreement. The exercise price per share of common stock for the original 250,701 warrants issued pursuant to the Securities Purchase Agreement was lowered from $20.00 to $4.00.

On May 14, 2010, the Company entered into a further Debenture and Warrant Amendment Agreement with the remaining debenture holders which:

| • | waived all existing defaults under the June 2009 Amendment and the debentures, |

|

|

|

| • | reduced the conversion price of the 14% secured convertible debentures and the exercise price of 238,009 warrants to $3.20 per share, |

|

|

|

| • | converted all remaining principal amount of $409,667, all accrued interest due under the 14% secured convertible debentures of $48,074 together with the penalties owed the debenture holders of $168,333 into 195,648 shares of our common stock, |

|

|

|

| • | contained an agreement by the debenture holder that individually they would not sell any shares of our common stock acquired upon the conversion of the 14% debentures or the exercise of the warrants in an amount which was more than 7% of the daily trading volume of our common stock on any given day for a one year period, |

|

|

|

| • | The Company agreed not to issue shares of Common Stock at a price, or options, warrants or convertible securities with an exercise or conversion price that is less than the conversion price of the then outstanding convertible debt or the exercise price of the then outstanding warrants, as the case may be, with the intent of eliminating the provisions for a reduction in the exercise price of the warrants in the event that the Company issues stock at a price which is less than the exercise price of the warrants. |

During the year ended June 30, 2010, Company repaid all of its convertible debt by issuing 325,467 shares of its common stock for the principal balance of $1,199,450 and repaid the remaining principal balance of $983,550 using cash.

In accordance with the FASB authoritative guidance, the conversion feature of the convertible debt was separated from the host contract and recognized as a derivative instrument. Both the conversion feature of the debt and the related warrants have been characterized as derivative liabilities to be re-measured at the end of every reporting period with the change in value reported in the consolidated statement of income. The common stock purchase warrants do not trade in an active securities market, and as such, the Company estimates the fair value of the warrants as of December 31, 2010 and June 30, 2010 using a probability-weighted Black-Scholes-Merton option-pricing model using the following assumptions:

16

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 10 – CONVERTIBLE DEBT AND DERIVATIVE LIABILITIES (continued)

|

| December 31, 2010 |

| June 30, 2010 |

Warrants: |

|

|

|

|

Risk-free interest rate |

| 0.61% |

| 1.00% |

Expected volatility |

| 153.66% |

| 179.74% |

Expected life (in years) |

| 1.92 years |

| 2.42 years |

Expected dividend yield |

| — |

| — |

|

|

|

|

|

Fair Value: | $ | 496,538 | $ | 653,630 |

Expected volatility is based primarily on historical volatility. Historical volatility was computed using weekly pricing observations for recent periods that correspond to the term of the warrants. The Company’s management believes this method produces an estimate that is representative of the expectations of future volatility over the expected term of these warrants. The Company has no reason to believe future volatility over the expected remaining life of these warrants will likely differ materially from historical volatility. The expected life is based on the remaining term of the warrants. The risk-free interest rate is based on U.S. Treasury securities according to the remaining term of the financial instruments.

As of December 31, 2010 and June 30, 2010, the outstanding numbers of warrant related to the convertible debentures were 196,195. At December 31, 2010 and June 30, 2010, the Company recorded a derivative liability of $496,538 and $653,630, respectively, related to the warrants. When the debentures converted or repaid, the derivative liability was extinguished and a gain on extinguishment of the derivative was recorded. For the six months ended December 31, 2010 and 2009, gains from the change in fair value of derivative liabilities were $157,092 and $2,002,937, respectively. For the six months ended December 31, 2010 and 2009, gains from the extinguishment of derivative liabilities were $0 and $1,623,209, respectively.

NOTE 11 – INCOME TAXES

The Company accounts for income taxes under ASC Topic 740. ASC Topic 740 requires the recognition of deferred tax assets and liabilities for both the expected impact of differences between the financial statements and the tax basis of assets and liabilities, and for the expected future tax benefit to be derived from tax losses and tax credit carryforwards. ASC Topic 740 additionally requires the establishment of a valuation allowance to reflect the likelihood of realization of deferred tax assets. Realization of deferred tax assets, including those related to the U.S. net operating loss carryforwards, are dependent upon future earnings, if any, of which the timing and amount are uncertain. Accordingly, the net deferred tax asset related to the U.S. net operating loss carryforward has been fully offset by a valuation allowance. The Company is governed by the Income Tax Law of the PRC and the United States.

The operations of the Company are in China and are governed by the Income Tax Law of the People's Republic of China and local income tax laws (the "PRC Income Tax Law"). The Company is subject to income tax at a rate of 25%.

At December 31, 2010 and June 30, 2010, taxes payable are as follows:

|

| December 31, 2010 |

| June 30, 2010 |

Income taxes payable | $ | 491,965 | $ | 610,173 |

Other taxes payable: |

|

|

|

|

- land appreciation tax |

| 1,123,012 |

| 1,273,698 |

- business tax |

| 217,682 |

| 395,426 |

- others |

| 103,834 |

| 94,762 |

Total | $ | 1,936,493 | $ | 2,374,059 |

17

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 12 – STOCKHOLDERS’ EQUITY

Common stock

On December 10, 2010, the Company issued an aggregate of 50,000 shares of its common stock to its chief executive officer and its chief financial officer for services rendered by them. The shares were valued at $3.45 per share based on the fair value on the date of grant. In connection with the issuance of these shares, the Company recorded compensation expenses of $115,000 and reduced accrued expenses of $57,500.

On December 10, 2010, the Company issued 3,750 shares of its common stock to its five directors for services rendered by them. The shares were valued at $3.45 per share based on the fair value on the date of grant. In connection with the issuance of these shares, the Company reduced accrued expenses of $12,938.

On December 10, 2010, the Company issued 750 shares of its common stock to a director for services rendered and to be rendered by him. The shares were valued at $3.45 per share based on the fair value on the date of grant. In connection with the issuance of these shares, the Company recorded compensation expenses of $1,094, reduced accrued expenses of $250 and recorded prepaid expenses of $1,244 which will be amortized over the remaining service period.

Warrants

On August 18, 2010, the Company entered into a six-month consulting agreement with Rodman & Renshaw, LLC (“Rodman”) for financial advisor services. In connection with the consulting agreement, the Company issued to Rodman warrants to purchase 8,750 shares on the Company’s common stock at a price per share of $6.00. The warrants are exercisable at any time in whole or in part during the four year period commencing one year from the date of this agreement. The Company valued these warrants utilizing the Black-Scholes options pricing model using the following assumptions at approximately $3.56 per warrant or $31,188 in total and recorded as stock-based professional fees.

Warrants: |

| At grant date |

Risk-free interest rate |

| 0.18% |

Expected volatility |

| 175.4% |

Expected life (in years) |

| 5 years |

Expected dividend yield |

| — |

Fair Value: |

| $ 31,188 |

Warrant activities for the six months ended December 31, 2010 was summarized as follows:

| Number of |

| Weighted Average | |

Balance at June 30, 2010 | 196,195 |

| $ | 3.25 |

Granted | 8,750 |

|

| 6.00 |

Exercised | — |

|

| — |

Forfeited | — |

|

| — |

Balance at December 31, 2010 (Unaudited) | 204,945 |

| $ | 3.37 |

|

|

|

|

|

Warrants exercisable at December 31, 2010 | 196,195 |

| $ | 3.25 |

18

GOLD HORSE INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2010

NOTE 12 – STOCKHOLDERS’ EQUITY (CONTINUED)

The following table summarizes the Company's stock warrants outstanding at December 31, 2010:

Warrants Outstanding |

| Warrants Exercisable | |||||||||||

Range of |

| Number |

| Weighted Average |

| Aggregate |

| Weighted Average |

| Number |

| Weighted Average | |

$ 3.20 |

| 183,503 |

| $ 3.20 |

| $ | 20,185 |

| 1.92 Years |

| 183,503 |

| $ 3.20 |

$ 4.00 |

| 12,692 |

| $ 4.00 |

| $ | — |

| 1.92 Years |

| 12,692 |

| $ 4.00 |

$ 6.00 |

| 8,750 |

| $ 6.00 |

| $ | — |

| 4.63 Years |

| — |

| $ — |

Total |

| 204,945 |

| $ 3.37 |

| $ | 20,185 |

| 1.88 Years |

| 196,195 |

| $ 3.22 |

(1) | The intrinsic value of warrants at December 31, 2010 is the amount by which the market value of the Company’s common stock of $3.31 as of December 31, 2010 exceeds the exercise price of the warrants. |

NOTE 13 – SEGMENT INFORMATION

ASC Topic 280 requires use of the “management approach” model for segment reporting. The management approach model is based on the way a company’s management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company. During the six months ended December 31, 2010 and 2009, the Company operated in three reportable business segments - (1) the Construction segment (2) Hotel segment and (3) Real estate development segment. The Company's reportable segments are strategic business units that offer different products. The Company's reportable segments, although integral to the success of the others, offer distinctly different products and services and require different types of management focus. As such, these segments are managed separately.

Condensed information with respect to these reportable business segments for the three and six months ended December 31, 2010 and 2009 is as follows:

|

| For the three months ended December 31, |

| For the six months ended December 31, |

| ||||||||

|

| 2010 |

| 2009 |

| 2010 |

| 2009 |

| ||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

| $ | 15,400,661 |

| $ | 4,405,892 |

| $ | 24,991,149 |

| $ | 9,596,012 |

|

Real Estate |

|

| 302,400 |

|

| 158,981 |

|

| 713,369 |

|

| 158,981 |

|

Hotel |

|

| 724,213 |

|

| 734,809 |

|

| 1,565,475 |

|

| 1,512,829 |

|

|

|

| 16,427,274 |

|

| 5,299,682 |

|

| 27,269,993 |

|

| 11,267,822 |

|

Depreciation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

|

| 116,507 |

|

| 112,937 |

|

| 230,870 |

|

| 227,990 |

|

Real Estate |

|

| 11,095 |

|

| 10,029 |

|

| 22,007 |

|

| 20,051 |

|

Hotel |

|

| 70,363 |

|

| 68,566 |

|

| 139,560 |

|

| 137,080 |

|

|

|

| 197,965 |

|

| 191,532 |

|

| 392,437 |

|

| 385,121 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

|

| 125,960 |

|

| 167,740 |

|

| 252,006 |

|

| 339,937 |

|

Other |

|

| — |

|

| 577,955 |

|

| — |

|

| 1,977,139 |

|

|

|

| 125,960 |

|

| 745,695 |

|

| 252,006 |

|

| 2,317,076 |

|

Net income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction |

|

| 1,516,549 |

|

| 186,776 |

|

| 2,352,925 |

|