Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-8174

DUCOMMUN INCORPORATED

(Exact name of registrant as specified in its charter)

| Delaware | 95-0693330 | |

| (State or other jurisdiction of incorporation or organization) |

I.R.S. Employer Identification No. | |

| 23301 Wilmington Avenue, Carson, California | 90745-6209 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (310) 513-7200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

x | |||

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and nonvoting common equity held by nonaffiliates computed by reference to the price of which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter ended July 3, 2010 was approximately $201 million.

The number of shares of common stock outstanding on January 31, 2011 was 10,507,143.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated by reference:

(a) Proxy Statement for the 2011 Annual Meeting of Shareholders (the “2011 Proxy Statement”), incorporated partially in Part III hereof.

Table of Contents

FORWARD-LOOKING STATEMENTS AND RISK FACTORS

Certain statements in the Form 10-K and documents incorporated by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any such forward-looking statements involve risks and uncertainties. The Company’s future financial results could differ materially from those anticipated due to the Company’s dependence on conditions in the airline industry, the level of new commercial aircraft orders, production rates for Boeing commercial aircraft, the C-17 aircraft and Apache helicopter rotor blade programs, the level of defense spending, competitive pricing pressures, manufacturing inefficiencies, start-up costs and possible overruns on new contracts, technology and product development risks and uncertainties, product performance, risks associated with acquisitions and dispositions of businesses by the Company, increasing consolidation of customers and suppliers in the aerospace industry, possible goodwill impairment, and other factors beyond the Company’s control. See the “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Risk Factors,” and other matters discussed in this Form 10-K.

2

Table of Contents

PART I

| ITEM 1. | BUSINESS |

GENERAL

Ducommun Incorporated (“Ducommun” or the “Company”), is the successor to a business founded in California in 1849, first incorporated in California in 1907, and reincorporated in Delaware in 1970. Ducommun, through its subsidiaries, designs, engineers and manufactures aerostructure and electromechanical components and subassemblies, and provides engineering, technical and program management services principally for the aerospace industry. These components, assemblies and services are provided principally for domestic and foreign commercial and military aircraft, helicopter, missile and space programs.

Domestic commercial aircraft programs include the Boeing 737NG, 747, 767, 777 and 787. Foreign commercial aircraft programs include the Airbus Industrie A330 and A340 aircraft, Bombardier business and regional jets, and the Embraer 145 and 170/190. Major military programs include the Boeing C-17, F-15 and F-18 and Lockheed Martin F-16, F-22 and F-35 aircraft, and various aircraft and shipboard electronics upgrade programs. Commercial and military helicopter programs include helicopters manufactured by Boeing (principally the Apache and Chinook helicopters), United Technologies, Bell, Augusta and Carson. The Company also supports various unmanned space launch vehicle and satellite programs.

On December 23, 2008, the Company acquired DynaBil Industries, Inc. (“DynaBil”), a privately-owned company based in Coxsackie, New York for $45,386,000 (net of cash acquired and excluding acquisition costs) and subsequently changed its name to Ducommun AeroStructures New York Inc. (“DAS-New York”). DAS-New York is a leading provider of titanium and aluminum structural components and assemblies for commercial and military aerospace applications. The acquisition was funded from internally generated cash, notes to the sellers, and borrowings of approximately $10,500,000 under the Company’s credit agreement. The cost of the acquisition was allocated on the basis of the estimated fair value of the assets acquired and liabilities assumed. The operating results for the acquisition have been included in the consolidated statements of income since the date of the acquisition.

On September 1, 2006, the Company acquired CMP, a privately-owned company based in Newbury Park, California for $13,804,000 (net of cash acquired and excluding acquisition costs). CMP manufactures incandescent, electroluminescent and LED edge lit panels and assemblies for the aerospace and defense industries. The cost of the acquisition was allocated on the basis of the estimated fair value of the assets acquired and liabilities assumed. The acquisition broadens the Company’s lighted human machine interface product line. The acquisition was funded from notes to the sellers, and borrowings of approximately $10,800,000 under the Company’s credit agreement. The operating results for this acquisition have been included in the consolidated statements of income since the date of the acquisition.

On May 10, 2006, the Company acquired WiseWave, a privately-owned company based in Torrance, California for $6,827,000 (net of cash, including assumed indebtedness and excluding acquisition costs). WiseWave manufactures microwave and millimeterwave products for both aerospace and non-aerospace applications. The acquisition broadens the Company’s

3

Table of Contents

microwave product line and adds millimeterwave products to its offerings. The cost of the acquisition was allocated on the basis of the estimated fair value of the assets acquired and liabilities assumed. The acquisition was funded from notes to the sellers, and borrowings of approximately $5,100,000 under the Company’s credit agreement. The operating results for this acquisition have been included in the consolidated statements of income since the date of the acquisition.

On January 6, 2006, the Company acquired Miltec, a privately-owned company based in Huntsville, Alabama for $46,811,000 (net of cash, including assumed indebtedness and excluding acquisition costs). Miltec provides engineering, technical and program management services (including design, development, integration and test of prototype products) principally for aerospace and military markets. The acquisition provided the Company a platform business with leading-edge technology in a large and growing market with substantial design engineering capability. The cost of the acquisition was allocated on the basis of the estimated fair value of the assets acquired and liabilities assumed. The acquisition was funded from internally generated cash, notes to the sellers, and borrowings of approximately $24,000,000 under the Company’s credit agreement. The operating results for this acquisition have been included in the consolidated statements of income since the date of the acquisition.

PRODUCTS AND SERVICES

Ducommun operates in two business segments: Ducommun AeroStructures, Inc. (“DAS”), which engineers and manufactures aerospace structural components and subassemblies, and Ducommun Technologies, Inc. (“DTI”), which designs, engineers and manufactures electromechanical components and subassemblies, and provides engineering, technical and program management services (including design, development, integration and test of prototype products) principally for the aerospace and military markets. DAS provides aluminum stretch-forming, titanium and aluminum hot-forming, machining, composite lay-up, metal bonding, and chemical milling services principally for domestic and foreign commercial and military aircraft, helicopter and space programs. DTI designs and manufactures illuminated push button switches and panels, microwave and millimeterwave switches and filters, fractional horsepower motors and resolvers, and mechanical and electromechanical subassemblies, and provides engineering, technical and program management services. Components and assemblies are provided principally for domestic and foreign commercial and military aircraft, helicopter and space programs as well as selected nonaerospace applications. Engineering, technical and program management services are provided principally for advanced weapons and missile defense systems.

Business Segment Information

The Company supplies products and services to the aerospace industry. The Company’s subsidiaries are organized into two strategic businesses (DAS and DTI), each of which is a reportable operating segment. The accounting policies of the Company and its two segments are the same.

4

Table of Contents

Ducommun AeroStructures, Inc.

Stretch-Forming, Hot-Forming and Machining

DAS supplies the aerospace industry with engineering and manufacturing of complex components using stretch-forming and hot-forming processes and computer-controlled machining. Stretch-forming is a process for manufacturing large, complex structural shapes primarily from aluminum sheet metal extrusions. DAS has some of the largest and most sophisticated stretch-forming presses in the United States. Hot-forming is a metal working process conducted at high temperature for manufacturing close-tolerance titanium and aluminum components. DAS designs and manufactures the tooling required for the production of parts in these forming processes. Certain components manufactured by DAS are machined with precision milling equipment, including three 5-axis gantry profile milling machines and seven 5-axis numerically-controlled routers to provide computer-controlled machining and inspection of complex parts up to 100 feet long.

Composites and Metal Bonding

DAS engineers and manufactures metal, fiberglass and carbon composite aerostructures. DAS produces helicopter main and tail rotor blades, and adhesive bonded assemblies, including spoilers, winglets, and fuselage structural panels for aircraft.

Chemical Milling

DAS is a major supplier of close tolerance chemical milling services for the aerospace industry. Chemical milling removes material in specific patterns to reduce weight in areas where full material thickness is not required. This sophisticated etching process enables DAS to produce lightweight, high-strength designs that would be impractical to produce by conventional means. DAS offers production-scale chemical milling on aluminum, titanium, steel, nickel-base and super alloys. Jet engine components, wing leading edges and fuselage skins are examples of products that require chemical milling.

Ducommun Technologies, Inc.

Panels, Switches and Related Components

DTI develops, designs and manufactures illuminated switches, switch assemblies, keyboard panels, and edge lit panels, used in many military and commercial aircraft, helicopter, and space programs. DTI manufactures switches and panels where high reliability is a prerequisite. DTI also develops, designs and manufactures microwave and millimeterwave switches, filters, and other components used principally on commercial and military aircraft and satellites. In addition, DTI develops, designs and manufactures high precision actuators, stepper motors, fractional horsepower motors and resolvers principally for space and oil service applications, and microwave and millimeterwave products for certain non-aerospace applications.

5

Table of Contents

Mechanical and Electromechanical Subassemblies

DTI is a leading manufacturer of mechanical and electromechanical subassemblies for the defense electronics and commercial aircraft markets. DTI has a fully integrated manufacturing capability, including manufacturing engineering, fabrication, machining, assembly, electronic integration and related processes. DTI’s products include sophisticated radar enclosures, gyroscopes and indicators, aircraft avionics racks, and shipboard communications and control enclosures.

Engineering, Technical and Program Management Services

DTI (through its Miltec subsidiary) is a leading provider of missile and aerospace systems design, development, integration and testing. Engineering, technical and program management services are provided principally for advanced weapons systems and missile defense primarily for United States defense, space and homeland security programs.

SALES AND MARKETING

Military components manufactured by the Company are employed in many of the country’s front-line fighters, bombers, helicopters and support aircraft, as well as sea-based applications. Engineering, technical and program management services are provided principally for United States defense, space and homeland security programs. The Company’s defense business is diversified among a number of military manufacturers and programs. In the space sector, the Company continues to support various unmanned launch vehicle and satellite programs. Sales related to military and space programs were approximately 60% of sales in 2010, 64% of total sales in 2009 and 61% of total sales in 2008.

Many of the Company’s contracts covering defense and space programs are subject to termination at the convenience of the customer (as well as for default). In the event of termination for convenience, the customer generally is required to pay the costs incurred by the Company and certain other fees through the date of termination.

The Company’s commercial business is represented on many of today’s major commercial aircraft. Sales related to commercial business were approximately 40% of total sales in 2010, 36% of total sales in 2009 and 39% of total sales in 2008. The Company’s commercial sales depend substantially on aircraft manufacturers’ production rates, which in turn depend upon deliveries of new aircraft. Deliveries of new aircraft by aircraft manufacturers are dependent on the financial capacity of the airlines and leasing companies to purchase the aircraft. Sales of commercial aircraft could be affected as a result of changes in new aircraft orders, or the cancellation or deferral by airlines of purchases of ordered aircraft. The Company’s sales for commercial aircraft programs also could be affected by changes in its customers’ inventory levels and changes in its customers’ aircraft production build rates.

MAJOR CUSTOMERS

The Company had substantial sales to Boeing, Raytheon, United Technologies and the United States government. During 2010, sales to Boeing were $107,466,000, or approximately 26% of total sales; sales to Raytheon were $48,198,000, or approximately 12% of total sales;

6

Table of Contents

sales to the United Technologies were $30,680,000, or approximately 8% of total sales and sales to the United States government were $16,875,000, or approximately 4% of total sales. Sales to Boeing, Raytheon, United Technologies and the United States government are diversified over a number of different programs.

INFORMATION ABOUT FOREIGN AND DOMESTIC OPERATIONS AND EXPORT SALES

In 2010, 2009, and 2008, sales to foreign customers worldwide were $37,970,000, $32,121,000 and $32,850,000, respectively. The Company has manufacturing facilities in Thailand and Mexico. The amounts of revenues, profitability and identifiable assets attributable to foreign sales activity were not material when compared with the revenue, profitability and identifiable assets attributed to United States domestic operations during 2010, 2009 and 2008. The Company had no sales to a foreign country greater than 3% of total sales in 2010, 2009 and 2008. The Company is not subject to any significant foreign currency risks since all sales are made in United States dollars.

RESEARCH AND DEVELOPMENT

The Company performs concurrent engineering with its customers and product development activities under Company-funded programs and under contracts with others. Concurrent engineering and product development activities are performed for commercial, military and space applications. The Company also performs high technology systems engineering and analysis, principally under customer-funded contracts, with a focus on sensors system simulation, engineering and integration.

RAW MATERIALS AND COMPONENTS

Raw materials and components used in the manufacture of the Company’s products, including aluminum, titanium, steel and carbon fibers, are generally available from a number of vendors and are generally in adequate supply. However, the Company, from time to time, has experienced increases in lead times for and deterioration in availability of, aluminum, titanium and certain other materials. Moreover, certain components, supplies and raw materials for the Company’s operations are purchased from single sources. In such instances, the Company strives to develop alternative sources and design modifications to minimize the potential for business interruptions.

COMPETITION

The aerospace industry is highly competitive, and the Company’s products and services are affected by varying degrees of competition. The Company competes worldwide with domestic and international companies in most markets it serves, some of which are substantially larger and have greater financial, sales, technical and personnel resources. Larger competitors offering a wider array of products and services than those offered by the Company can have a competitive advantage by offering potential customers bundled products and services that the Company cannot match. The Company’s ability to compete depends principally on the quality of its goods and services, competitive pricing, product performance, design and engineering capabilities, new product innovation and the ability to solve specific customer problems.

7

Table of Contents

PATENTS AND LICENSES

The Company has several patents, but it does not believe that its operations are dependent on any single patent or group of patents. In general, the Company relies on technical superiority, continual product improvement, exclusive product features, superior lead time, on-time delivery performance, quality and customer relationships to maintain its competitive advantage.

BACKLOG

Backlog is subject to delivery delays or program cancellations, which are beyond the Company’s control. As of December 31, 2010, backlog believed to be firm was approximately $328,045,000, compared to $367,138,000 at December 31, 2009. The reduction in year-over-year backlog is reflective of (i) late order release on C-17 and F-15 programs and (ii) declines in the engineering services business resulting from lower RDT&E budgets, reduced demand for specific engineering services as a result of increases in government in-sourcing and reduced Congressional earmarks. Approximately $225,000,000 of total backlog is expected to be delivered during 2011.

Trends in the Company’s overall level of backlog may not be indicative of trends in future sales because the Company’s backlog is affected by timing differences in the placement of customer orders and because the Company’s backlog tends to be concentrated in several programs to a greater extent than the Company’s sales.

ENVIRONMENTAL MATTERS

The Company’s business, operations and facilities are subject to numerous stringent federal, state and local environmental laws and regulations issued by government agencies, including the Environmental Protection Agency (“EPA”). Among other matters, these regulatory authorities impose requirements that regulate the emission, discharge, generation, management, transportation and disposal of hazardous materials, pollutants and contaminants. These regulations govern public and private response actions to hazardous or regulated substances that may be or have been released to the environment, and they require the Company to obtain and maintain licenses and permits in connection with its operations. The Company may also be required to investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. Additionally, this extensive regulatory framework imposes significant compliance burdens and risks on the Company. The Company anticipates that capital expenditures will continue to be required for the foreseeable future to upgrade and maintain its environmental compliance efforts. The Company does not expect to spend a material amount on capital expenditures for environmental compliance during 2011.

The DAS chemical milling business uses various acid and alkaline solutions in the chemical milling process, resulting in potential environmental hazards. Despite existing waste recovery systems and continuing capital expenditures for waste reduction and management, at least for the immediate future, this business will remain dependent on the availability and cost of remote hazardous waste disposal sites or other alternative methods of disposal.

8

Table of Contents

DAS has been directed by California environmental agencies to investigate and take corrective action for ground water contamination at its facilities located in El Mirage and Monrovia, California. Based on currently available information, the Company has established a reserve for its estimated liability for such investigation and corrective action in the approximate amount of $1,509,000. DAS also faces liability as a potentially responsible party for hazardous waste disposed at two landfills located in Casmalia and West Covina, California. DAS and other companies and government entities have entered into consent decrees with respect to each landfill with the United States Environmental Protection Agency and/or California environmental agencies under which certain investigation, remediation and maintenance activities are being performed. Based upon currently available information, the Company has established a reserve for its estimated liability in connection with the landfills in the approximate amount of $1,090,000. The Company’s ultimate liability in connection with these matters will depend upon a number of factors, including changes in existing laws and regulations, the design and cost of construction, operation and maintenance activities, and the allocation of liability among potentially responsible parties.

In the normal course of business, Ducommun and its subsidiaries are defendants in certain other litigation, claims and inquiries, including matters relating to environmental laws. In addition, the Company makes various commitments and incurs contingent liabilities. While it is not feasible to predict the outcome of these matters, the Company does not presently expect that any sum it may be required to pay in connection with these matters would have a material adverse effect on its consolidated financial position, results of operations or cash flows.

EMPLOYEES

At December 31, 2010 the Company employed 1,815 persons. The Company’s DAS subsidiary is a party to a collective bargaining agreement, expiring July 1, 2012, with labor unions at its Monrovia, California facility covering 242 full-time hourly employees at year end 2010. If the unionized workers were to engage in a strike or other work stoppage, if DAS is unable to negotiate acceptable collective bargaining agreements with the unions, or if other employees were to become unionized, the Company could experience a significant disruption of the Company’s operations and higher ongoing labor costs and possible loss of customer contracts, which could have an adverse effect on its business and results of operations. The Company has not experienced any material labor-related work stoppage and considers its relations with its employees to be good.

AVAILABLE INFORMATION

The Company’s Internet website address is www.ducommun.com. The Company makes available through its Internet website its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after filing with the Securities and Exchange Commission.

9

Table of Contents

| ITEM 1A. | RISK FACTORS |

The Company’s business, financial condition, results of operations and cash flows may be affected by known and unknown risks, uncertainties and other factors. Any of these risks, uncertainties and other factors could cause the Company’s future financial results to differ materially from recent financial results or from currently anticipated future financial results. In addition to those noted elsewhere in this report, the Company is subject to the following risks and uncertainties:

Aerospace Markets Are Cyclical

The aerospace markets in which the Company sells its products are cyclical and have experienced periodic declines. The Company’s sales are, therefore, unpredictable and tend to fluctuate based on a number of factors, including economic conditions and developments affecting the aerospace industry and the customers served.

Military and Space-Related Products Are Dependent Upon Government Spending

In 2010 approximately 60% of sales were derived from military and space markets. These markets are largely dependent upon government spending, particularly by the United States government.

These defense and space programs could be adversely affected by reductions in defense spending and other government budgetary pressures which would result in reductions, delays or stretch-outs of existing and future programs. Additionally, the Company’s contracts may be subject to reductions or modifications in the event of changes in government requirements. Although the Company’s fixed-price contracts generally permit it to realize increased profits if costs are less than projected, the Company bears the risk that increased or unexpected costs may reduce profits or cause losses on the contracts. The accuracy and appropriateness of certain costs and expenses used to substantiate the Company’s direct and indirect costs for the United States government are subject to extensive regulation and audit by the Defense Contract Audit Agency, an arm of the Department of Defense.

The Company Is Dependent on Various Aircraft and Helicopter Programs Including Boeing Commercial and Military Aircraft Programs, United Technologies (Sikorsky Blackhawk Helicopter Program) and Raytheon Military Programs

In 2010 approximately 26% of its sales were for Boeing commercial and military aircraft programs, 7% of its sales were for United Technologies (Sikorsky Blackhawk helicopter) programs and 12% of its sales were for Raytheon military aircraft programs. Any significant change in production rates for Boeing commercial and military aircraft programs, the United Technologies (Sikorsky Blackhawk helicopter) and the Raytheon military programs would have a material effect on the Company’s results of operations and cash flows. In addition, there is no guarantee that the Company’s current significant customers will continue to buy products from the Company at current levels. The loss of a key customer could have a material adverse effect on the Company.

10

Table of Contents

The Company Faces Risks Associated With Competitive Pricing Pressures

The aerospace industry is highly competitive and competitive pressures may adversely affect the Company. The Company competes worldwide with a number of domestic and international companies that are larger than it in terms of resources and market share. The Company is experiencing competitive pricing pressures in both its DAS and DTI businesses. These pressures have had, and are expected to continue to have, an adverse effect on the Company’s financial condition and operating results.

The Company Faces Risks of Cost Overruns and Losses on Fixed-Price Contracts

The Company sells many of its products under firm, fixed-price contracts providing for a fixed price for the products regardless of the production costs incurred by the Company. As a result, manufacturing inefficiencies, start-up costs and other factors may result in cost overruns and losses on contracts. The cost of producing products also may be adversely affected by increases in the cost of labor, materials, outside processing, overhead and other factors. In many cases, the Company makes multiyear firm, fixed-price commitments to its customers, without assurance the Company’s anticipated production costs will be achieved.

Risks Associated With Foreign Operations Could Adversely Impact the Company

The Company has facilities in Thailand and Mexico. Doing business in foreign countries is subject to various risks, including political instability, local economic conditions, foreign currency fluctuations, foreign government regulatory requirements, trade tariffs, and the potentially limited availability of skilled labor in proximity to the Company’s facilities.

The Company’s Products and Processes Are Subject to Risks from Changes in Technology

The Company’s products and processes are subject to risks of obsolescence as a result of changes in technology. To address this risk, the Company invests in product design and development, and for capital expenditures. There can be no guarantee that the Company’s product design and development efforts will be successful, or funds required to be invested for product design and development and capital expenditures will not increase materially in the future.

The Company Faces Risks Associated With Acquisitions and Dispositions of Businesses

A key element of the Company’s long-term strategy has been growth through acquisitions. The Company is continuously reviewing and actively pursuing acquisitions, including acquisitions outside of its current aerospace markets. Acquisitions may require the Company to incur additional indebtedness, resulting in increased leverage. Any significant acquisition may result in a material weakening of the Company’s financial position and a material increase in the Company’s cost of borrowings. Acquisitions also may require the Company to issue additional equity, resulting in dilution to existing stockholders. This additional financing for acquisitions and capital expenditures may not be available on terms acceptable or favorable to the Company. Acquired businesses may not achieve anticipated results, and could result in a material adverse effect on the Company’s financial condition, results

11

Table of Contents

of operations and cash flows. The Company also periodically reviews its existing businesses to determine if they are consistent with the Company’s strategy. The Company has sold, and may sell in the future, business units and product lines, which may result in either a gain or loss on disposition.

The Company’s acquisition strategy exposes it to risks. The Company may not be able to consummate acquisitions on satisfactory terms or, if any acquisitions are consummated, to satisfactorily integrate these acquired businesses. The Company’s ability to grow by acquisition is dependent upon, among other factors, the availability of suitable acquisition candidates. Growth by acquisition involves risks that could have a material adverse effect on the Company’s business, financial condition and operating results, including difficulties in integrating the operations and personnel of acquired companies, the potential amortization of acquired intangible assets, potential impairment of goodwill and the potential loss of key customers or employees of acquired companies.

Goodwill Could Be Impaired in the Future

In assessing the recoverability of the Company’s goodwill at December 31, 2010, management was required to make certain critical estimates and assumptions. These estimates and assumptions included that during the next several years the Company will make improvements in manufacturing efficiency, achieve reductions in operating costs, and obtain increases in sales and backlog. Due to many variables inherent in the estimation of a business’s fair value and the relative size of the Company’s recorded goodwill, differences in estimates and assumptions may have a material effect on the results of the Company’s impairment analysis. If any of these or other estimates and assumptions are not realized in the future, or if market multiples decline the Company may be required to record an additional impairment charge for the goodwill. The goodwill of the Company was $100,442,000 at December 31, 2010.

Significant Consolidation in the Aerospace Industry Could Adversely Affect the Company’s Business and Financial Results

The aerospace industry is experiencing significant consolidation, including the Company’s customers, competitors and suppliers. Consolidation among the Company’s customers may result in delays in the award of new contracts and losses of existing business. Consolidation among the Company’s competitors may result in larger competitors with greater resources and market share, which could adversely affect the Company’s ability to compete successfully. Consolidation among the Company’s suppliers may result in fewer sources of supply and increased cost to the Company.

The Company’s Failure to Meet Quality or Delivery Expectations of Customers Could Adversely Affect the Company’s Business and Financial Results

The Company’s customers have increased, and are expected to increase further in the future, their expectations with respect to the on-time delivery and quality of the Company’s products. In some cases, the Company does not presently satisfy these customer expectations, particularly with respect to on-time delivery. If the Company fails to meet the quality or delivery expectations of its customers, this failure could lead to the loss of one or more significant customers of the Company.

12

Table of Contents

Environmental Liabilities Could Adversely Affect the Company’s Financial Results

The Company is subject to various environmental laws and regulations. The Company’s DAS subsidiary has been directed by government environmental agencies to investigate and take corrective action for groundwater contamination at two of its facilities. DAS is also a potentially responsible party at certain sites at which it previously disposed of hazardous wastes. There can be no assurance that future developments, lawsuits and administrative actions, and liabilities relating to environmental matters will not have a material adverse effect on the Company’s results of operations or cash flows.

The DAS chemical milling business uses various acid and alkaline solutions in the chemical milling process, resulting in potential environmental hazards. Despite existing waste recovery systems and continuing capital expenditures for waste reduction and management, at least for the immediate future, this business will remain dependent on the availability and cost of remote hazardous waste disposal sites or other alternative methods of disposal.

Product Liability Claims in Excess of Insurance Could Adversely Affect the Company’s Financial Results and Financial Condition

The Company faces potential liability for personal injury or death as a result of the failure of products designed or manufactured by the Company. Although the Company maintains aircraft product liability insurance of approximately $150,000,000, any material product liability not covered by insurance could have a material adverse effect on the Company’s financial condition, results of operations and cash flows.

Damage or Destruction of the Company’s Facilities Caused by Earthquake or Other Causes Could Adversely Affect the Company’s Financial Results and Financial Condition

Although the Company maintains standard property casualty insurance covering its properties, the Company does not carry any earthquake insurance because of the cost of such insurance. Many of the Company’s properties are located in Southern California, an area subject to frequent and sometimes severe earthquake activity. Even if covered by insurance, any significant damage or destruction of the Company’s facilities could result in the inability to meet customer delivery schedules and may result in the loss of customers and significant additional costs to the Company. As a result, any significant damage or destruction of the Company’s properties could have a material adverse effect on the Company’s business, financial condition or results of operations.

The Company Is Dependent on Its Ability to Attract and Retain Key Personnel

The Company’s success depends in part upon its ability to attract and retain key engineering, technical and managerial personnel. The Company faces competition for management, engineering and technical personnel from other companies and organizations. Therefore, the Company may not be able to retain its existing management and other key personnel, or be able to fill new management, engineering and technical positions created as a result of expansion or turnover of existing personnel. The loss of members of the Company’s senior management group, or key engineering and technical personnel, could have a material adverse effect on the Company’s business.

13

Table of Contents

Effective Income Tax Rate Could Change

The Company’s effective income tax rate for 2010, 2009 and 2008, was approximately 20%, 26% and 23%, respectively, compared to the statutory federal income tax rate of 35% and state income tax rates ranging from 6% to 9%, for each of the years. The Company’s effective tax rate was lower than the statutory rates in recent years primarily due to the benefit of research and development tax credits (which have been extended through 2011). The effective tax rate for the Company could be significantly higher in the future than it has been in recent years due to changes in the Company’s level or sources of income, changes in the Company’s spending, eligibility for research and development tax credits, and changes in tax laws.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

| ITEM 2. | PROPERTIES |

The Company occupies approximately 21 facilities with a total office and manufacturing area of over 1,458,000 square feet, including both owned and leased properties. At December 31, 2010, facilities which were in excess of 50,000 square feet each were occupied as follows:

| Location |

Segment |

Square Feet |

Expiration of Lease |

|||||||

| Carson, California |

Ducommun AeroStructures |

286,000 | Owned | |||||||

| Monrovia, California |

Ducommun AeroStructures |

274,000 | Owned | |||||||

| Parsons, Kansas |

Ducommun AeroStructures |

120,000 | Owned | |||||||

| Carson, California |

Ducommun Technologies |

117,000 | 2013 | |||||||

| Phoenix, Arizona |

Ducommun Technologies |

100,000 | 2012 | |||||||

| Orange, California |

Ducommun AeroStructures |

76,000 | Owned | |||||||

| El Mirage, California |

Ducommun AeroStructures |

74,000 | Owned | |||||||

| Iuka, Mississippi |

Ducommun Technologies |

66,000 | 2013 | |||||||

| Carson, California |

Ducommun AeroStructures |

65,000 | 2014 | |||||||

| Huntsville, Alabama |

Ducommun Technologies |

52,000 | 2015 | |||||||

The Company’s facilities are, for the most part, fully utilized, although excess capacity exists from time to time based on product mix and demand. Management believes these properties are in good condition and suitable for their present use.

14

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS |

The Company is a defendant in a lawsuit entitled United States of America ex rel Taylor Smith, Jeannine Prewitt and James Ailes v. The Boeing Company and Ducommun Inc., filed in the United States District Court for the District of Kansas (the “District Court”). The lawsuit is a qui tam action brought against The Boeing Company (“Boeing”) and Ducommun on behalf of the United States of America for violations of the United States False Claims Act. The lawsuit alleges that Ducommun sold unapproved parts to the Boeing Commercial Airplanes-Wichita Division which were installed by Boeing in aircraft ultimately sold to the United States government. The number of Boeing aircraft subject to the lawsuit has been reduced to 25 aircraft following the District Court’s granting of partial summary judgment in favor of Boeing and Ducommun. The lawsuit seeks damages, civil penalties and other relief from the defendants for presenting or causing to be presented false claims for payment to the United States government. Although the amount of alleged damages are not specified, the lawsuit seeks damages in an amount equal to three times the amount of damages the United States government sustained because of the defendants’ actions, plus a civil penalty of $10,000 for each false claim made on or before September 28, 1999, and $11,000 for each false claim made on or after September 28, 1999, together with attorneys’ fees and costs. The Company intends to defend itself vigorously against the lawsuit. The Company, at this time, is unable to estimate what, if any, liability it may have in connection with the lawsuit.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None.

15

Table of Contents

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The common stock of the Company (DCO) is listed on the New York Stock Exchange. On December 31, 2010, the Company had approximately 313 holders of record of common stock. The Company paid $3,147,000 of dividends in 2010, consisting of dividends of $0.075 per common share in the first, second, third and fourth quarters of 2010; and paid dividends of $0.075 per common share in the first, second, third and fourth quarters of 2009. The following table sets forth the high and low sales closing prices per share for the Company’s common stock as reported on the New York Stock Exchange for the fiscal periods indicated.

| 2010 | 2009 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 21.47 | $ | 16.35 | $ | 20.02 | $ | 11.68 | ||||||||

| Second Quarter |

24.17 | 16.91 | 20.22 | 14.67 | ||||||||||||

| Third Quarter |

22.88 | 16.20 | 20.40 | 15.37 | ||||||||||||

| Fourth Quarter |

23.29 | 20.27 | 20.41 | 17.00 | ||||||||||||

Equity Compensation Plan Information

The following table provides information about the Company’s compensation plans under which equity securities are authorized for issuance.

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c)(2) |

|||||||||

| Equity compensation plans approved by security holders(1) |

1,086,216 | $ | 18.191 | 406,310 | ||||||||

| Equity compensation plans not approved by security holders |

0 | 0 | 0 | |||||||||

| Total |

1,086,216 | $ | 18.191 | 406,310 | ||||||||

| (1) | The number of securities to be issued consists of 929,850 for stock options, 66,366 for restricted stock units and 90,000 for performance stock units at target. The weighted average exercise price applies only to the stock options. |

| (2) | Awards are not restricted to any specified form or structure and may include, without limitation, sales or bonuses of stock, restricted stock, stock options, reload stock options, stock purchase warrants, other rights to acquire stock, securities convertible into or redeemable for stock, stock appreciation rights, limited stock appreciation rights, phantom stock, dividend equivalents, performance units or performance shares, and an award may consist of one such security or benefit, or two or more of them in tandem or in the alternative. |

16

Table of Contents

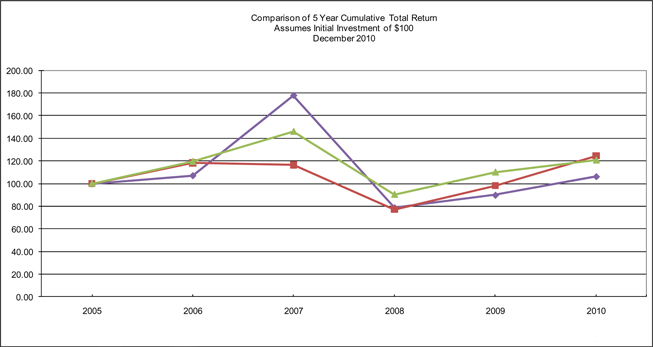

Performance Graph

The following graph compares the yearly percentage change in the Company’s cumulative total shareholder return with the cumulative total return of the Russell 2000 Index and the Spade Defense Index for the periods indicated, assuming the reinvestment of any dividends. The graph is not necessarily indicative of future price performance.

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

|

Ducommun Inc.

|

100.00 | 107.13 | 177.90 | 78.76 | 89.85 | 106.22 | ||||||||||||||||||

|

Russell 2000 Index

|

100.00 | 118.35 | 116.52 | 77.14 | 98.11 | 124.45 | ||||||||||||||||||

|

Spade Defense Index

|

100.00 | 119.33 | 145.79 | 90.34 | 109.96 | 120.54 | ||||||||||||||||||

17

Table of Contents

Issuer Purchases of Equity Securities

The following table provides information about Company purchases of equity securities that are registered by the Company pursuant to Section 12 of the Exchange Act during the quarter ended December 31, 2010.

| Period |

Total Number of Shares (or Units) Purchased |

Average Price Paid Per Share (or Unit) |

Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs (1) |

||||||||||||

| Month beginning October 3, 2010 and ending October 30, 2010 |

0 | $ | 0.00 | 0 | $ | 2,773,030 | ||||||||||

| Month beginning October 31, 2010 and ending November 27, 2010 |

0 | $ | 0.00 | 0 | $ | 2,773,030 | ||||||||||

| Month beginning November 28, 2010 and ending December 31, 2010 |

0 | $ | 0.00 | 0 | $ | 2,773,030 | ||||||||||

| Total |

0 | $ | 0.00 | 0 | $ | 2,773,030 | ||||||||||

| (1) | The Company did not repurchase any of its common shares during 2010. The Company repurchased 74,300 and 69,000 of its common shares during 2009 and 2008, respectively. At December 31, 2010, $2,773,030 remained available to repurchase common stock of the Company under stock repurchase programs previously approved by the Board of Directors. |

18

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

| Year Ended December 31, |

2010 | 2009(a) | 2008(a)(b) | 2007 | 2006(c) | |||||||||||||||

| (In thousands, except per share amounts) |

||||||||||||||||||||

| Net Sales |

$ | 408,406 | $ | 430,748 | $ | 403,803 | $ | 367,297 | $ | 319,021 | ||||||||||

| Gross Profit as a Percentage of Sales |

19.6 | % | 18.3 | % | 20.3 | % | 20.6 | % | 19.6 | % | ||||||||||

| Income from Operations Before Taxes |

24,663 | 13,760 | 17,049 | 27,255 | 18,088 | |||||||||||||||

| Income Tax Expense |

(4,855 | ) | (3,577 | ) | (3,937 | ) | (7,634 | ) | (3,791 | ) | ||||||||||

| Net Income |

$ | 19,808 | $ | 10,183 | $ | 13,112 | $ | 19,621 | $ | 14,297 | ||||||||||

| Per Common Share: |

||||||||||||||||||||

| Basic earnings per share |

$ | 1.89 | $ | 0.97 | $ | 1.24 | $ | 1.89 | $ | 1.40 | ||||||||||

| Diluted earnings per share |

1.87 | 0.97 | 1.23 | 1.88 | 1.39 | |||||||||||||||

| Dividends Per Share |

0.30 | 0.30 | 0.15 | — | — | |||||||||||||||

| Working Capital |

$ | 90,106 | $ | 85,825 | $ | 69,672 | $ | 77,703 | $ | 55,355 | ||||||||||

| Total Assets |

345,452 | 353,909 | 366,186 | 332,476 | 297,033 | |||||||||||||||

| Long-Term Debt, Including Current Portion |

3,280 | 28,252 | 30,719 | 25,751 | 30,436 | |||||||||||||||

| Total Shareholders’ Equity |

254,185 | 233,886 | 224,446 | 214,051 | 187,025 | |||||||||||||||

| (a) | The results for 2009 and 2008 include after-tax non-cash goodwill impairment charges of $7,753,000 and $8,000,000, respectively resulting from annual impairment testing required by ASC 350. There was no goodwill impairment in 2010, 2007 or 2006. |

| (b) | In December 2008 the Company acquired DynaBil, which is now a part of DAS. This transaction was accounted for as a purchase business combination. |

| (c) | In January, May and September 2006 the Company acquired Miltec, WiseWave and CMP, which are now part of DTI. These transactions were accounted for as purchase business combinations. |

19

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

Ducommun Incorporated (“Ducommun” or the “Company”), through its subsidiaries designs, engineers and manufactures aerostructure and electromechanical components and subassemblies, and provides engineering, technical and program management services principally for the aerospace industry. These components, assemblies and services are provided principally for domestic and foreign commercial and military aircraft, helicopter, missile and space programs.

Domestic commercial aircraft programs include the Boeing 737NG, 747, 767, 777 and 787. Foreign commercial aircraft programs include the Airbus Industrie A330 and A340 aircraft, Bombardier business and regional jets, and the Embraer 145 and 170/190. Major military programs include the Boeing C-17, F-15 and F-18 and Lockheed Martin F-16, F-22 and F-35 aircraft, and various aircraft and shipboard electronics upgrade programs. Commercial and military helicopter programs include helicopters manufactured by Boeing (principally the Apache and Chinook helicopters), United Technologies, Bell, Augusta and Carson. The Company also supports various unmanned space launch vehicle and satellite programs.

In the fourth quarter of 2009, the Company recorded a non-cash charge of $12,936,000 at DTI (relating to its Miltec reporting unit) for the impairment of goodwill. In the fourth quarter of 2008, the Company recorded a non-cash charge of $13,064,000 at DTI (relating to its Miltec reporting unit) for the impairment of goodwill. The charge in both 2009 and 2008 reduced goodwill recorded in connection with the acquisition of Miltec and did not impact the Company’s normal business operations. There was no impairment of goodwill in 2010.

20

Table of Contents

The Company manufactures components and assemblies principally for domestic and foreign commercial and military aircraft, helicopter and space programs. The Company’s Miltec subsidiary provides engineering, technical and program management services almost entirely for United States defense, space and homeland security programs. The Company’s mix of military and space and commercial business in 2010, 2009 and 2008, respectively, was approximately as follows:

| 2010 | 2009 | 2008 | ||||||||||

| Commercial |

||||||||||||

| Large Aircraft |

20 | % | 18 | % | 17 | % | ||||||

| Regional and Business Aircraft |

8 | % | 7 | % | 9 | % | ||||||

| Helicopter |

7 | % | 7 | % | 8 | % | ||||||

| Other |

5 | % | 4 | % | 5 | % | ||||||

| Total Commercial |

40 | % | 36 | % | 39 | % | ||||||

| Military and Space |

||||||||||||

| Aircraft |

27 | % | 26 | % | 21 | % | ||||||

| Helicopter |

20 | % | 22 | % | 22 | % | ||||||

| Engineering Services |

9 | % | 12 | % | 13 | % | ||||||

| Space and Other |

4 | % | 4 | % | 5 | % | ||||||

| Total Military and Space |

60 | % | 64 | % | 61 | % | ||||||

| Total |

100 | % | 100 | % | 100 | % | ||||||

21

Table of Contents

The Company is dependent on various aircraft and helicopter programs including Boeing commercial and military aircraft programs, United Technologies (Sikorsky Blackhawk helicopter program) and Raytheon military programs. Sales to these programs, as a percentage of total sales, for 2010, 2009 and 2008, respectively, were approximately as follows:

| 2010 | 2009 | 2008 | ||||||||||

| Boeing Commercial and Military Aircraft |

26 | % | 32 | % | 32 | % | ||||||

| United Technologies (Sikorsky Blackhawk Helicopter) |

7 | % | 7 | % | 2 | % | ||||||

| Raytheon Military Programs |

12 | % | 8 | % | 8 | % | ||||||

| All Other |

55 | % | 53 | % | 58 | % | ||||||

| Total |

100 | % | 100 | % | 100 | % | ||||||

Sales, gross profit as a percentage of sales, selling, general and administrative expense as a percentage of sales, the effective tax rate and the diluted earnings per share in 2010, 2009 and 2008 , respectively, were as follows:

| 2010 | 2009 | 2008 | ||||||||||

| Sales (in $000’s) |

$ | 408,406 | $ | 430,748 | $ | 403,803 | ||||||

| Gross Profit % of Sales |

19.6 | % | 18.3 | % | 20.3 | % | ||||||

| SG&A Expense % of Sales |

13.1 | % | 11.5 | % | 12.5 | % | ||||||

| Effective Tax Rate |

19.7 | % | 26.0 | % | 23.1 | % | ||||||

| Diluted Earnings Per Share |

$ | 1.87 | $ | 0.97 | $ | 1.23 | ||||||

Net sales in 2010 were $408,406,000, compared to net sales of $430,748,000 for 2009. The decrease in net sales in 2010 from 2009 was primarily due to lower sales of engineering services and lower product sales for military helicopters, partially offset by growth in product sales of commercial aircraft programs.

Gross profit, as a percent of sales, increased to 19.6% in 2010 from 18.3% in 2009. Gross profit margins in 2010 were negatively impacted by approximately $4,948,000, or 1.8 percentage points, due to start-up and development costs on several new programs which generated approximately $10,448,000 in sales. In addition, gross profit for 2010 was favorably impacted by an adjustment to operating expense of approximately $1,285,000, or 0.3 percentage points, relating to the reversal of certain accounts payable accruals recorded in prior periods. The Company determined that certain accounts payable that were accrued during the period from 2004 to 2010, in fact had been paid or were not otherwise owed to suppliers. The Company assessed the materiality of this reversal and concluded it was immaterial to previously reported annual and interim amounts. Gross profit margin in 2009 was negatively impacted by inventory reserves and valuation adjustments of $5,141,000 and a liability recorded for uncollected sales tax from customers of $617,000.

22

Table of Contents

Selling, general and administrative (“SG&A”) expense increased to $53,678,000, or 13.1% of sales in 2010, compared to $49,615,000, or 11.5% of sales in 2009. The increase in SG&A expense was primarily due to higher expenses from the amortization of intangible assets of approximately $1,142,000, higher compensation costs and increased investments in product development programs. SG&A expenses in 2009 were favorably impacted by a reduction in environmental reserves of $2,241,000.

Interest expense was lower in 2010, due to lower debt levels. Income tax expense increased in 2010 due to higher income before taxes, partially offset by a lower effective tax rate.

Critical Accounting Policies

Critical accounting policies are those accounting policies that can have a significant impact on the presentation of our financial condition and results of operations, and that require the use of subjective estimates based upon past experience and management’s judgment. Because of the uncertainty inherent in such estimates, actual results may differ from these estimates. Below are those policies applied in preparing our financial statements that management believes are the most dependent on the application of estimates and assumptions. For additional accounting policies, see Note 1 of “Notes to Consolidated Financial Statements.”

Revenue Recognition

The Company recognizes product sales when persuasive evidence of an arrangement exists, the price is fixed or determinable, collection is reasonably assured and delivery of products has occurred or services have been rendered. Revenue from products sold under long-term contracts is recognized by the Company on the same basis as other sale transactions using the unit of delivery method. The Company recognizes revenue on the sale of services (including prototype products) based on the type of contract: time and materials, cost-plus reimbursement and firm-fixed price. Revenue is recognized (i) on time and materials contracts as time is spent at hourly rates, which are negotiated with customers, plus the cost of any allowable materials and out-of-pocket expenses, (ii) on cost-plus reimbursement contracts based on direct and indirect costs incurred plus a negotiated profit calculated as a percentage of cost, a fixed amount or a performance-based award fee, and (iii) on fixed-price service contracts on the percentage-of-completion method measured by the percentage of costs incurred to estimated total costs.

Provision for Estimated Losses on Contracts

The Company records provisions for estimated losses on contracts considering total estimated costs to complete the contract compared to total anticipated revenues in the period in which such losses are identified. The provisions for estimated losses on contracts require management to make certain estimates and assumptions, including those with respect to the future revenue under a contract and the future cost to complete the contract. Management’s estimate of the future cost to complete a contract may include assumptions as to improvements in manufacturing efficiency and reductions in operating and material costs. If any of these or other assumptions and estimates do not materialize in the future, the Company may be required to record additional provisions for estimated losses on contracts.

23

Table of Contents

Goodwill

The Company’s business acquisitions have resulted in goodwill. In assessing the recoverability of the Company’s goodwill, management must make assumptions regarding estimated future cash flows, comparable company analyses, discount rates and other factors to determine the fair value of the respective assets. If actual results do not meet these estimates, if these estimates or their related assumptions change in the future, or if adverse equity market conditions cause a decrease in current market multiples and the Company’s stock price the Company may be required to record additional impairment charges for these assets. In the event that a goodwill impairment charge is required, it could adversely affect the operating results and financial position of the Company.

Other Intangible Assets

The Company amortizes purchased other intangible assets with finite lives over the estimated economic lives of the assets, ranging from one to fourteen years generally using the straight-line method. The value of other intangibles acquired through business combinations has been estimated using present value techniques which involve estimates of future cash flows. Actual results could vary, potentially resulting in impairment charges.

Accounting for Stock-Based Compensation

The Company uses a Black-Scholes valuation model in determining the stock-based compensation expense for options, net of an estimated forfeiture rate, on a straight-line basis over the requisite service period of the award. The Company has one award population with an option vesting term of four years. The Company estimated the forfeiture rate based on its historic experience.

For performance and restricted stock units, the Company calculates compensation expense, net of an estimated forfeiture rate, on a straight line basis over the requisite service/performance period of the awards. The performance stock units vest based on a three-year cumulative performance cycle. The restricted stock units, vest over various periods of time ranging from one to five years. The Company estimates the forfeiture rate based on its historic experience.

Inventories

Inventories are stated at the lower of cost or market, cost being determined on a first-in, first-out basis. Inventoried costs include raw materials, outside processing, direct labor and allocated overhead, adjusted for any abnormal amounts of idle facility expense, freight, handling costs, and wasted materials (spoilage) incurred, but do not include any selling, general and administrative expense. Costs under long-term contracts are accumulated into, and removed from, inventory on the same basis as other contracts. The Company assesses the inventory carrying value and reduces it, if necessary, to its net realizable value based on customer orders on hand, and internal demand forecasts using management’s best estimates given information currently available. The Company’s customer demand can fluctuate significantly caused by factors beyond the control of the Company. The Company maintains an allowance for potentially excess and obsolete inventories and inventories that are carried at costs that are higher than their estimated net realizable values. If market conditions are less favorable than those projected by management, such as an unanticipated decline in demand and not meeting expectations, inventory write-downs may be required.

24

Table of Contents

Environmental Liabilities

Environmental liabilities are recorded when environmental assessments and/or remedial efforts are probable and costs can be reasonably estimated. Generally, the timing of these accruals coincides with the completion of a feasibility study or the Company’s commitment to a formal plan of action. Further, the Company reviews and updates its environmental accruals as circumstances change and/or additional information is obtained that reasonably could be expected to have a meaningful effect on the outcome of a matter or the estimated cost thereof.

Acquisitions

On December 23, 2008, the Company acquired DynaBil Industries, Inc., a privately-owned company based in Coxsackie, New York, for $45,386,000 (net of cash acquired and excluding acquisition costs) and subsequently changed its name to Ducommun AeroStructures, New York Inc. (“DAS-New York”). DAS-New York is a leading provider of titanium and aluminum structural components and assemblies for commercial and military aerospace applications. The acquisition was funded from internally generated cash, notes to the sellers, and borrowings of approximately $10,500,000 under the Company’s credit agreement. The operating results for this acquisition have been included in the consolidated statements of income since the date of the acquisition.

Results of Operations

2010 Compared to 2009

Net sales in 2010 were $408,406,000, compared to net sales of $430,748,000 for 2009. Net sales in 2010 decreased 5% from 2009 primarily due to approximately $17,500,000 decrease in sales of engineering services and lower product sales for military helicopters (primarily Apache and Chinook helicopters), partially offset by growth in product sales of large and regional jet commercial aircraft programs. The Company’s mix of business in 2010 was approximately 60% military and space and 40% commercial, compared to 64% military and space and 36% commercial in 2009.

25

Table of Contents

The Company had substantial sales, through both of its business segments, to Boeing, Raytheon, United Technologies and the United States government. During 2010 and 2009, sales to Boeing, Raytheon, United Technologies and the United States government were as follows:

| December 31, |

2010 | 2009 | ||||||

| (In thousands) | ||||||||

| Boeing |

$ | 107,466 | $ | 133,007 | ||||

| Raytheon |

48,198 | 34,009 | ||||||

| United Technologies |

30,680 | 42,117 | ||||||

| United States government |

16,875 | 29,224 | ||||||

| Total |

$ | 203,219 | $ | 238,357 | ||||

At December 31, 2010, trade receivables from Boeing, Raytheon, United Technologies and the United States government were $9,685,000, $4,520,000, $2,049,000 and $1,262,000, respectively. The sales and receivables relating to Boeing, Raytheon, United Technologies and the United States government are diversified over a number of different commercial, military and space programs.

Military components manufactured by the Company are employed in many of the country’s front-line fighters, bombers, helicopters and support aircraft, as well as sea-based applications. Engineering, technical and program management services are provided principally for United States defense, space and homeland security programs. The Company’s defense business is diversified among military manufacturers and programs. Sales related to military and space programs were approximately $244,485,000, or 60% of total sales, compared to $275,304,000, or 64% of total sales, in 2009. The decrease in military and space sales in 2010 was primarily due to lower sales of engineering services and lower product sales for military helicopters.

Military and space product sales during 2010 and 2009 included the following programs:

| December 31, |

2010 | 2009 | ||||||

| (In thousands) | ||||||||

| Blackhawk |

$ | 42,646 | $ | 37,699 | ||||

| C-17 |

36,198 | 42,198 | ||||||

| Apache |

25,001 | 36,067 | ||||||

| F-18 |

24,495 | 21,543 | ||||||

| F-15 |

17,764 | 10,394 | ||||||

| Chinook |

9,726 | 18,642 | ||||||

| X-47B UCAS |

— | 6,652 | ||||||

| Space |

2,342 | 2,178 | ||||||

| Other |

45,470 | 41,554 | ||||||

| Military and Space Product Sales |

203,642 | 216,927 | ||||||

| Engineering Services |

40,843 | 58,377 | ||||||

| Total |

$ | 244,485 | $ | 275,304 | ||||

26

Table of Contents

The Company’s commercial business is represented on many of today’s major commercial aircraft. Sales related to commercial business were approximately $163,921,000, or 40% of total sales in 2010, compared to $155,444,000, or 36% of total sales in 2009. The increase in commercial sales during 2010 compared 2009 was primarily due to an increase in demand in the regional jet and aviation markets, and an increase in commercial large aircraft, partially offset by declines in sales for commercial helicopters.

Commercial sales during 2010 and 2009 included the following programs:

| December 31, |

2010 | 2009 | ||||||

| (In thousands) | ||||||||

| 737NG |

$ | 43,296 | $ | 42,439 | ||||

| 777 |

13,825 | 16,395 | ||||||

| Carson Helicopter |

13,674 | 14,636 | ||||||

| Other |

93,126 | 81,974 | ||||||

| Total |

$ | 163,921 | $ | 155,444 | ||||

Backlog is subject to delivery delays or program cancellations, which are beyond the Company’s control. As of December 31, 2010, backlog believed to be firm was approximately $328,045,000, compared to $367,138,000 at December 31, 2009. The reduction in year-over-year backlog is reflective of (i) late order release on C-17 and F-15 programs and Chinook and Bell helicopter programs and (ii) declines in the engineering services business resulting from lower RDT&E budgets, reduced demand for specific engineering services as a result of increases in government in-sourcing and reduced Congressional earmarks. Approximately $225,000,000 of total backlog is expected to be delivered during 2011. The backlog at December 31, 2010 included the following programs:

| Backlog (In thousands) |

||||||||

| 2010 | 2009 | |||||||

| 737NG |

$ | 61,891 | $ | 53,349 | ||||

| Blackhawk Helicopter |

39,368 | 22,925 | ||||||

| Apache Helicopter |

27,299 | 26,064 | ||||||

| F-18 |

24,692 | 24,807 | ||||||

| Carson Helicopter |

24,558 | 22,926 | ||||||

| 777 |

13,082 | 13,280 | ||||||

| C-17 |

11,563 | 29,564 | ||||||

| F-15 |

7,384 | 17,964 | ||||||

| $ | 209,837 | $ | 210,879 | |||||

27

Table of Contents

Trends in the Company’s overall level of backlog, however, may not be indicative of trends in future sales because the Company’s backlog is affected by timing differences in the placement of customer orders and because the Company’s backlog tends to be concentrated in several programs to a greater extent than the Company’s sales.

Gross profit, as a percent of sales, increased to 19.6% in 2010 from 18.3% in 2009. Gross profit margins in 2010 were negatively impacted by approximately $4,948,000, or 1.8 percentage points, due to start-up and development costs on several new programs which generated approximately $10,448,000 in sales. In addition, gross profit for 2010 was favorably impacted by an adjustment to operating expense of approximately $1,285,000, or 0.3 percentage points, relating to the reversal of certain accounts payable accruals recorded in prior periods. The Company determined that certain accounts payable that were accrued during the period from 2004 to 2010, in fact had been paid or were not otherwise owed to suppliers. The Company assessed the materiality of this reversal and concluded it was immaterial to previously reported annual and interim amounts. Gross profit margin in 2009 was negatively impacted by inventory reserves and valuation adjustments of $5,141,000 and a liability recorded for uncollected sales tax from customers of $617,000.

Selling, general and administrative (“SG&A”) expense increased to $53,678,000, or 13.1% of sales in 2010, compared to $49,615,000, or 11.5% of sales in 2009. The increase in SG&A expense was primarily due to higher expenses from the amortization of intangible assets of approximately $1,142,000, higher compensation costs and increased investments in product development programs. The SG&A expenses in 2009 was favorably impacted by a reduction in environmental reserves of $2,241,000.

In accordance with ASC 350 – Goodwill and Other Intangible Assets, the Company performed its required annual impairment test for goodwill using a discounted cash flow analysis supported by comparative market multiples to determine the fair values of its businesses versus their book values. The test as of December 31, 2010 indicated that there was no impairment of goodwill during 2010. In the fourth quarter of 2009, the Company recorded a non-cash charge of

28

Table of Contents

$12,936,000 at DTI (relating to its Miltec reporting unit) for the impairment of goodwill. The charge in 2009 reduced goodwill recorded in connection with the acquisition of Miltec. The principal factors used in the discounted cash flow analysis requiring judgment are the projected results of operations, weighted average cost of capital (“WACC”), and terminal value assumptions. The WACC takes into account the relative weights of each component of the Company’s consolidated capital structure (equity and debt) and represents the expected cost of new capital adjusted as appropriate to consider risk profiles associated with growth projection risks. The terminal value assumptions are applied to the final year of discounted cash flow model. Due to many variables inherent in the estimation of a business’s fair value and the relative size of the Company’s recorded goodwill, differences in assumptions may have a material effect on the results of the Company’s impairment analysis.

Interest expense was $1,805,000 in 2010, compared to $2,522,000 in 2009, primarily due to lower debt levels in 2010 compared to the previous year.

Income tax expense increased to $4,855,000 in 2010, compared to $3,577,000 in 2009. The increase in income tax expense was due to the higher income before taxes, partially offset by a lower effective income tax rate. The Company’s effective tax rate for 2010 was 19.7%, compared to 26.0% in 2009. Cash expended to pay income taxes was $2,546,000 in 2010, compared to $6,960,000 in 2009.

Net income for 2010 was $19,808,000, or $1.87 diluted earnings per share, compared to $10,183,000, or $0.97 diluted earnings per share in 2009. Net income for 2009 includes an after-tax charge of $3,444,000, or $0.33 per diluted share for the Eclipse inventory write-off and inventory valuation adjustment discussed above and a non-cash goodwill impairment charge of $7,753,000 or $0.74 per share.

2009 Compared to 2008

Net sales in 2009 were $430,748,000, compared to net sales of $403,803,000 for 2008. Net sales in 2009 increased 7% from 2008 primarily due to sales from DAS-New York, which was acquired in December 2008. Sales in 2009 from DAS-New York were $42,103,000. Excluding DAS-New York sales were lower in 2009 principally due to lower sales for the Apache helicopter and regional and business aircraft programs. The Company’s mix of business in 2009 was approximately 62% military, 36% commercial, and 2% space, compared to 59% military, 39% commercial, and 2% space in 2008.

29

Table of Contents

The Company had substantial sales, through both of its business segments, to Boeing, Raytheon, the United States government, and United Technologies. During 2009 and 2008, sales to Boeing, Raytheon, the United States government and United Technologies were as follows:

| December 31, |

2009 | 2008 | ||||||

| (In thousands) | ||||||||

| Boeing |

$ | 133,007 | $ | 130,783 | ||||

| Raytheon |

34,009 | 33,248 | ||||||

| United States government |

29,224 | 33,335 | ||||||

| United Technologies |

42,117 | 17,982 | ||||||

| Total |

$ | 238,357 | $ | 215,348 | ||||

At December 31, 2009, trade receivables from Boeing, Raytheon, the United States government and United Technologies were $8,719,000, $4,321,000, $1,742,000 and $2,295,000, respectively. The sales and receivables relating to Boeing, Raytheon, the United States government and United Technologies are diversified over a number of different commercial, military and space programs.

Military components manufactured by the Company are employed in many of the country’s front-line fighters, bombers, helicopters and support aircraft, as well as sea-based applications. Engineering, technical and program management services are provided principally for United States defense, space and homeland security programs. The Company’s defense business is diversified among military manufacturers and programs. Sales related to military and space programs were approximately $275,304,000, or 64% of total sales, in 2009, compared to $246,114,000, or 61% of total sales, in 2008. The increase in military sales in 2009 resulted principally from an increase in sales to the Blackhawk helicopter, primarily at DAS-New York, the X-47B UCAS and the C-17 programs at DAS and an increase in sales to the F-18 aircraft program at DTI, partially offset by a reduction in sales to the Apache helicopter program at DAS and a reduction in sales to the F-15 aircraft program at DTI.

In the space sector, the Company produces components for a variety of unmanned launch vehicles and satellite programs and provides engineering services. Sales related to space programs were approximately $8,382,000, or 2% of total sales in 2009, compared to $8,805,000, or 2% of total sales in 2008. The decrease in sales for space programs resulted principally from a decrease in engineering services at DTI.

30

Table of Contents

Military and space sales during 2009 and 2008 included the following programs:

| December 31, |

2009 | 2008 | ||||||

| (In thousands) | ||||||||

| C-17 |

$ | 42,198 | $ | 36,714 | ||||

| Blackhawk |

37,699 | 13,054 | ||||||

| Apache |

36,067 | 52,480 | ||||||

| F-18 |

21,543 | 17,542 | ||||||

| Chinook |

18,642 | 17,048 | ||||||

| F-15 |

10,394 | 13,263 | ||||||