Attached files

Exhibit 10.3

MAGELLAN PETROLEUM CORPORATION - YOUNG ENERGY PRIZE S.A.

EVANS SHOAL PROJECT INVESTMENT

INVESTMENT AGREEMENT

Strictly private and confidential

This Investment Agreement is entered into on FEBRUARY 11, 2011, and sets out the key commercial terms which Magellan Petroleum Corporation (MPC) and Young Energy Prize S.A (YEP) (MPC and YEP being the Parties) agree to be bound by in relation to, amongst other matters (a) the acquisition by Magellan Petroleum Australia Limited (MPAL Old) from Santos Offshore Pty Ltd (Santos) pursuant to the Evans Shoal – Assets Sale Deed dated 25 March 2010 entered into between Santos and MPAL Old (as amended by the Deed of Variation – Assets Sale Deed dated 31 January 2011 and otherwise from time to time, the Assets Sale Deed) of Santos’s 40% interest in the Operating Agreement Covering Exploration Permit NT/P 48 dated 3 June 1996 (as amended) and related interests (the Evans Shoal Interests) between Santos and the other persons party thereto and (b) the ongoing investment and development of the Evans Shoal project (the Project) to which the Operating Agreement relates (together, the Transaction).

Terms defined in the Assets Sale Deed or the Operating Agreement shall have the meanings where used in this Investment Agreement unless a contrary intention appears.

| 1. INTRODUCTION |

||||||

| 1.1 Objectives and scope of obligations |

The principal objectives of the Parties in relation to the Transaction are to: | |||||

| (a) | effect YEP’s participation in MPAL Old’s acquisition of the Evans Shoal Interests under the Assets Sale Deed; | |||||

| (b) | set out the basis on which post-Completion payments required to be made by MPAL Old to Santos under the Assets Sale Deed will be funded by the Parties; | |||||

| (c) | set out the obligations of each Party to implement and give effect to the steps specified in the Acquisition and Reorganisation Plan with a view to: | |||||

| (i) | funding MPAL Old’s acquisition of the Evans Shoal Interests under the Assets Sale Deed; | |||||

| (ii) | structuring the legal form of each Party’s direct or indirect ownership of, and participation in, the Evans Shoal Interests; and | |||||

| (iii) | define and give effect to the respective direct or indirect Stage Interests of MPC and YEP in respect of the Evans Shoal Interests after Completion; and | |||||

| (d) | set out the obligations of the Parties to implement and fund the Project and carry out certain related activities. | |||||

1

| 1.2 Further assurances |

(a) | Each Party acknowledges that the Acquisition and Reorganisation Plan is a framework only and does not necessarily detail all actions that may be necessary or desirable to implement the Acquisition and Reorganisation Plan and to give effect to the principal objectives and commercial intent of the Parties. | ||

| (b) | Each Party agrees that it shall do all things reasonably necessary to ensure that all action is taken that may be necessary or desirable to implement the Acquisition and Reorganisation Plan and to give effect to the principal objectives and commercial intent of the Parties. | |||

| (c) | If and to the extent it becomes possible for the Parties to amend the terms of the Transaction Documents and/or restructure the Parties’ investment in the Project so as to enable MPC for financial reporting and taxation purposes to consolidate within the MPC group its direct or indirect interest in the Evans Shoal Interests, the Parties shall conduct good faith discussions with a view to so amending the Transaction Documents and/or restructuring the Parties’ investment in the Project, but only to the extent that YEP’s economic interests, governance rights and funding obligations as reflected in this Investment Agreement and in the Acquisition and Reorganization Plan are not materially and adversely prejudiced. | |||

| 2. ACQUISITION AND REORGANISATION PLAN | ||||

| 2.1 Ernst & Young Steps Paper |

Ernst & Young, in conjunction with the Parties and their legal advisors, has prepared a proposed acquisition and reorganisation plan (the Acquisition and Reorganisation Plan) which sets out the key steps by which MPC and YEP will, amongst other things, directly or indirectly, fund completion of the acquisition by MPAL Old of the Evans Shoal Interests and structure and effect the direct or indirect participation by each Party in the Evans Shoal Interests, including the exercise by a new entity (MPAL New) as contemplated in the Acquisition and Reorganisation Plan of MPAL Old’s Participating Interest. | |||

| The current form of the Acquisition and Reorganisation Plan is attached to this Investment Agreement as Annex I (Short Form) and Annex II (Full Form) and the Parties will work together to finalise and implement the Acquisition and Reorganisation Plan. | ||||

| 2.2 Interim, Partnership and Corporate Structures |

Prior to the Cut-Off Date, the Parties shall take all actions necessary to implement the Interim Structure (as contemplated in the Acquisition and Reorganisation Plan) to enable MPAL Old to be funded with the amounts required for it to achieve Completion. | |||

| The Interim Structure provides time, if required and if the Parties so choose, for the Parties to seek to obtain the requisite Participants’ Consent to the transfer of the Evans Shoal Interests from MPAL Old to MPAL New (for itself or as nominee for the ES Partnership) pursuant to the exercise by MPAL New under the Evans Shoal Interests Option Deed of the option to acquire the Evans Shoal Interests. | ||||

2

| The Interim Structure facilitates a conversion to a Partnership Structure, if and when the Participants’ Consent is obtained and related issues are resolved and YEP elects to adopt a Partnership Structure. The Interim Structure also allows for the structure to be converted into an alternative Corporate Structure, if the Parties so choose or if the Participants’ Consent is unable to be obtained and or if YEP elects to adopt a Corporate Structure. | ||||

| Following the Completion Date and the implementation of the Interim Structure but no later than the date which is 12 months after the Completion Date under the Assets Sale Deed), YEP shall deliver to MPC either a Partnership Structure Election Notice or a Corporate Structure Election Notice. A Corporate Election Notice will be deemed to have been delivered by YEP if it has not provided a Partnership Structure election notice by such date.

The Parties acknowledge that if feasible in all material respects the Partnership Structure is the preferred structure for the holding of the Evans Shoal Interests. | ||||

| 3. COMPLETION FUNDING | ||||

| 3.1 YEP funding |

YEP shall provide funding required for the completion of the acquisition by MPAL Old of the Evans Shoal Interests in the amount of approximately A$85,450,000, which shall include the proceeds of the US$15,6000,000 PIPE Investment to be made by YEP to MPC, and of which A$ 10,000,000 shall be paid to MPC in reimbursement of the payment made by MPC to Santos which will have been credited by Santos to such required completion payment, plus 50% (up to a cap of US$3,500,000) of all out of pocket costs and expenses incurred by MPC, MPAL Old or YEP associated with the acquisition. Notwithstanding the foregoing, such A$85,450,000 payment by YEP shall not be due unless: | |||

| (a) | the other owners of Evans Shoal Interests shall have consented to the acquisition by MPAL Old of the Evans Shoal Interests in accordance with the documents relating to such other owners and to such acquisition; and | |||

| (b) | all other requirements and conditions for the acquisition of the Evans Shoal Interests set forth in the Asset Sale Deed shall have been satisfied or waived. | |||

| 4. MANAGEMENT AND DECISION MAKING | ||||

| 4.1 Management |

The supplemental documentation will to the extent necessary and agreed by the Parties set out general management principles and guidelines, including the establishment of a significant presence in Darwin or other city in Australia agreed by the Parties for the purpose of carrying out necessary operations in relation to the Project. | |||

| 4.2 Decision-making |

The Parties will agree upon a framework for the making of decisions in relation to the Project and such framework will be incorporated into the joint venture documentation (which will be included in the supplemental | |||

3

| documentation) to be entered into to give effect to the investment structure and economic interests of the Parties and their permitted transferees. | ||||

| The following categories of decisions and their voting requirements are currently intended: | ||||

| (a) | a limited number of decisions that may adversely and unfairly impact the rights of the owners of Stage Interests will require the unanimous approval of all Stage Interest owners; | |||

| (b) | all other decisions in relation to the Project, including exercise of the rights and obligations of MPAL Old or MPAL New (as applicable) under the Operating Agreement and including decisions in relation to operatorship of the Project, will require the approval of at least 66.67% of the owners of (i) Stage A Interests, if the decision relates to Stage A aspects of the Project, (ii) Stage B Interests, if the decision relates to Stage B aspects of the Project, or (iii) all Stage Interests if the decision relates to the Project generally. | |||

| 4.3 Deadlock |

The Parties will agree and incorporate into the supplemental documentation (a) a list of material decisions which reasonably require affirmative action in relation to the Project and that will constitute “deadlock events”, if the Parties are within 45 days unable to agree upon a decision including after escalation to the respective boards of the Parties and (b) mechanisms for resolving deadlock events. | |||

| A deadlock event shall be referred to a third party (qualified with respect to the matters involved with the deadlock event) who shall be required to make a binding recommendation with respect to such deadlock event to the relevant Stage Interest owners, on an expedited basis. The relevant Stage Interest owners will be bound to implement the recommendation as soon as reasonably practicable after such recommendation is made. If a relevant Stage Interest owner determines, in good faith and on reasonable grounds, that the effect of implementing the recommendation would result in its interests in such Stage Interest being materially prejudiced, it shall be entitled to deliver to the other relevant Stage Interest owners a notice specifying the grounds on which it has made its determination and requiring the other owners of such Stage Interest to buy (on a pro rata basis) its Stage Interest at a fair market value price determined by a valuer appointed by the Stage Interest owners or if they fail to agree thereon appointed by the third party who made the binding recommendation and on an ‘as is where is’ basis. The completion of such acquisition shall be effected by the relevant Stage Interest owners within a period not later than 120 days after the determination of the value of the Stage Interest to be acquired. All third party costs in relation to the foregoing shall be paid by the relevant Stage Interest owners on a pro rata basis. | ||||

| 4.4 Other obligations |

Each Party shall: | |||

| (a) | ensure that each Transaction Related Party which it controls; and | |||

| (b) | use its reasonable endeavours to procure that any Transaction Related Party which it does not control but in which it directly or | |||

4

| indirectly owns any voting share capital or otherwise has voting or other rights of control over (whether by way of direct or indirect ownership of shares or other securities, proxy, contract, agency or otherwise), | ||||||

| complies with all material laws and regulations to which it is subject, maintains all filings and registrations and to the extent applicable in the relevant jurisdictions maintains good standing. | ||||||

| 5. ECONOMIC INTERESTS IN THE EVANS SHOAL INTERESTS | ||||||

| 5.1 General Principles |

The commercial intention is for the Parties to have different economic interests in the Evans Shoal Interests, which shall vary depending on the amount of Project product derived from the Evans Shoal Interests. These economic interests will entitle the Parties to receive a designated percentage share of revenues from Project product and fund certain Project development costs.

MPC and YEP (or their subsidiaries) will obtain a 51% and 49% economic interest, respectively, in Project product (excluding associated hydrocarbons but including C02) with agreed offtakers of up to an amount of 3tcf (the Stage A Allocated Quantity) plus associated hydrocarbons. | |||||

| MPC and YEP (or their subsidiaries) will obtain a 5% and 95% economic interest in, respectively, Project product in amounts greater than the Stage A Allocated Quantity. | ||||||

| To this end, the Parties wish to: | ||||||

| (a) | notionally split the Evans Shoal Interests into a Stage A interest (corresponding to the Stage A Allocated Quantity) (the Stage A Interest) and a Stage B Interest (corresponding to all other Project product) (the Stage B Interest); and | |||||

| (b) | further notionally split: | |||||

| (i) | the Stage A Interest into a Stage A1 interest (initially to be owned by MPC or an affiliate and will constitute a 51% share of the Stage A Interest) and a Stage A2 interest (initially to be owned by YEP or an affiliate and will constitute a 49% share of the Stage A Interest); and | |||||

| (ii) | the Stage B Interest into a Stage B1 interest (initially to be owned by MPC or an affiliate and will constitute a 5% share of the Stage B Interest), a Stage B2 interest (initially to be owned by YEP or an affiliate and will constitute a 49% share of the Stage B Interest) and a Stage B3 interest (initially to be owned by YEP or an affiliate, subject to the option described in Section 5.4 below, and will constitute a 46% share of the Stage B Interest). | |||||

| The Parties may recombine any such interests (each, a Stage Interest) and re-split any Stage Interests by agreement in writing. | ||||||

5

| 5.2 Stage A Interests |

The owner of a Stage A Interest shall: | |||

| (a) | be entitled to receive the applicable Stage Interest percentage of the difference between the Stage A Interest revenue (being revenue derived from offtake contracts entered into in respect of the Stage A Allocated Quantity) and the Stage A Interest costs (which shall be calculated by reference to Project development costs expended for the development of the Stage A Interest); and | |||

| (b) | fund the applicable Stage Interest percentage of all Stage A Interest costs. | |||

| 5.3 Stage B Interests |

The owner of a Stage B Interest shall: | |||

| (a) | be entitled to receive the applicable Stage Interest percentage of the difference between the Stage B Interest revenue (being revenue derived from offtake contracts entered into in respect of all Project product other than the Stage A Allocated Quantity) and the Stage B Interest costs; and | |||

| (b) | fund the applicable Stage Interest percentage of all Stage B Interest costs (which shall be calculated by reference to the incremental Project development costs expended for the development of the Stage B Interest). | |||

| The owners of the Stage B Interest shall not be required to pay to the owners of the Stage A Interests any “shared facilities fee” or similar as consideration for the owners of the Stage B Interest receiving the benefit of the Project facilities constructed, operated and maintained for the purpose of producing all or any part of the Stage A Allocated Quantity. | ||||

| 5.4 Stage B3 Interest Option |

YEP shall grant MPC an option to acquire up to a 46% interest in the Stage B Interest. Such option shall be with respect to the Stage B3 interest and may only be exercised upon a date which is 6 months after (a) a final investment decision with respect to the development of the Project in relation to the Stage B Interest and (b) entry into of the Stage B offtake contract(s) in relation to the remaining reserves in the Evans Shoal Field. | |||

| The exercise price shall be based upon 90% of the independently engineered discounted future cashflow of the portion of the Stage B3 Interest which MPC elects to acquire (as determined by three valuers; one appointed by each Party and the third appointed by the valuers) which shall be payable 50% to 75% in common shares of MPC valued at their traded market price at that time and 25% to 50% in cash, as determined by MPC. | ||||

| 5.5 Transfers of Stage Interests |

(a) | The owner of a Stage Interest may, subject to paragraph (b) below, without requiring the consent of any other owner of a Stage Interest, assign or transfer, including by way of novation (each a transfer) to any person (a transferee) all or part of its rights and/or obligations under or in respect of a Stage Interest, so long as: | ||

6

| (i) | the transfer and accession requirements, and all other conditions and requirements to any assignment or transfer of a Stage Interest, set out in the relevant joint venture/partnership documentation and any other applicable Transaction documents are complied with; | |||||

| (ii) | the transferee is not named in any list of sanctioned persons with respect to embargoes or terrorism maintained by any government authority in Australia or the United States of America; | |||||

| (iii) | if the proposed transferee is a person whose commercial interests could reasonably be expected to be detrimental to the interests of the other Stage Interest owners, each other owner of a Stage Interest also agrees, in its discretion, to such proposed transfer; | |||||

| (iv) | if the transferee is controlled by one or more persons resident in the Peoples Republic of China, the consent of MPC and YEP (not to be unreasonably withheld or delayed) is obtained prior to the transfer; | |||||

| (v) | the transferee has the requisite financial capability to assume the responsibilities and obligations as an owner of the relevant Stage Interest, including funding and credit support obligations to Third Party Financiers, under the Transaction Documents and all documents required to be entered into by any Third Party Financier providing Third Party Financing; and | |||||

| (vi) | the requirements of any Third Party Financier who is providing, or who has indicated an intention or provided a commitment to provide, Third Party Financing, are or are reasonably likely at the required time to be satisfied. | |||||

| (b) | Notwithstanding anything to the contrary set forth in this Section 5.5, an owner of a Stage Interest who desires to transfer all or any part of its interest in such Stage Interest shall first communicate to the other owners of interests in such Stage Interest such desire and the price and terms which such owner desires to achieve for such transfer. Such other owners may then elect to acquire such interest pursuant to such price and such terms (on a pro rata basis if more than one other owner so elects). If they fail to acquire all of such interest to be transferred, the transferring owner may transfer such interest to one or more other parties provided that if such transfer to such other parties is to be made at a price or on terms which are at least 20 percent more favourable to such other parties than the price and terms previously communicated to the other owners of interests in such Stage Interest, such other owners shall have a right of first refusal (on a pro rata basis if more than one other owner exercises such right) to purchase such interest upon the basis of such more favourable price or terms. | |||||

7

| (c) | In addition to the above, the owner of a Stage Interest may, without any restrictions, transfer a non-voting, non-membership economic interest in the distributions received with respect to its Stage Interest to a third party without requiring the consent of the other Stage Interest owners. | |||||

| (d) | The owner of a Stage Interest may not grant security over its rights in respect of such Stage Interest without obtaining the prior written consent of the owners of all other Stage Interests unless such security interest is granted to a Third Party Financier as security for Third Party Financing. | |||||

| 6. PROJECT DEVELOPMENT | ||||||

| 6.1 Project scope and implementation |

The Parties will collaborate and implement the Project. The Parties shall seek and use reasonable endeavours to procure the Participants to seek: | |||||

| (a) | to develop the Project area and the Project facilities with a view, to the extent feasible, to producing Project product in committed quantities of at least the Stage A Allocated Quantity; | |||||

| (b) | to develop the strategy and arrangements for the sale of Project product so that one or more long term offtake contracts are entered into for the sale of Project product in committed quantities of at least the Stage A Allocated Quantity and to the extent feasible the Stage B Allocated Quantity, and on bankable terms, to allow the financing objectives of the Parties as set out in Section 6.2 to be satisfied; | |||||

| (c) | to the extent commercially possible to sell all Project product on an aggregated basis to offtakers and to obtain necessary agreements (including letters of intent, heads of agreement, memoranda of understanding, term sheets, sale and purchase agreements and similar agreements) with offtakers and to the extent that the Project comprises the tolling of Project product, to deliver all or any Project product to one or more Tollers for processing prior to delivery of Project product to an offtaker; | |||||

| (d) | to the extent consistent with the foregoing objectives: | |||||

| (i) | to develop the Project on the basis that at least the Stage A Allocated Quantity, and to the extent feasible the Stage B Allocated Quantity, will be processed into methanol by an international and reputable methanol producer(s); | |||||

| (ii) | identify and negotiate arrangements with persons satisfying the requirements specified in subparagraph (i) above; | |||||

| (iii) | identify and negotiate with potential offtakers to sell committed quantities of all other Project product; and | |||||

| (iv) | generally to structure the Project and the related | |||||

8

| agreements to be entered into in such a way to give effect to the objectives set out in the foregoing subparagraphs. | ||||||

| (e) | The Parties shall use their reasonable endeavours to procure the Participants to work in good faith (including with the owner(s) of any Downstream Project Plant) to explore the feasibility of including any Downstream Project Plant within the scope of the Project. | |||||

| 6.2 Financing |

The Parties shall seek to obtain third party funding to implement the Project in manner which achieves tax and cost of capital efficiencies and with minimum or no recourse to the Parties and their affiliates. | |||||

| Third party financiers (Stage A Third Party Financiers) providing financing to fund Project development costs for the production and sale of the Stage A Allocated Quantity shall be entitled, subject to the requirements of the Operating Agreement, to take security over: | ||||||

| (a) | MPAL Old or MPAL’s New’s (as applicable) interest in and share of the Project reserves (including Project reserves intended to be used to produce Project product to be sold under Stage B offtake contracts); | |||||

| (b) | MPAL Old or MPAL New’s (as applicable) rights and interest in the Operating Agreement and the Evans Shoal Title; | |||||

| (c) | all shares held in MPAL Old or MPAL New; and | |||||

| (d) | such other rights and interests necessary to give effect to the security contemplated above. | |||||

| If commercially acceptable to Stage A Third Party Financiers, the terms of any Stage A financing shall permit any expansion to the Project facilities in connection with implementing the Project for the purpose of producing Project product to be sold under one or more Stage B offtake contracts. | ||||||

| Such expansion financing terms are to include intercreditor arrangements between Stage A Third Party Financiers and financiers financing any such expansion (Expansion Financiers); alignment of the terms and conditions of the expansion financing with the terms and conditions of the Stage A financing; appropriate restrictions on the terms, conditions and extent of the expansion financing; and appropriate financial and credit support to be provided to the Expansion Financiers by the Stage B Interest owners and on the basis that the Stage A Interests owners shall not be required to provide any such credit support. | ||||||

| Should a Third Party Financier require recourse to the owners of a Stage Interest the development costs of which the Third Party Financier is funding, each such Stage Interest owner shall provide such recourse based on the following principles: | ||||||

| (a) | such recourse will be several among such Stage Interest owners; and | |||||

9

| (b) | each such Stage Interest owner will be liable for its Stage Interest percentage of such recourse. | |||||

| 6.3 Project Operator |

The Parties shall use their reasonable endeavours to procure that the Participants appoint MPAL Old and/or, following the exercise of the Evans Shoal Interests Option Deed, MPAL New, as the Operator of the Project. | |||||

| If MPAL Old or MPAL New (as applicable) is appointed by the Participants as the Operator: | ||||||

| (a) | MPC shall enter into and perform, and the Parties shall procure that MPAL Old or MPAL New (as applicable) enters into and performs, its obligations under an Operating Services Agreement; and | |||||

| (b) | if MPAL New is elected as Operator, the Parties shall use their reasonable endeavours to procure that Santos, MPAL Old and MPAL New enter into such agreements as may be necessary or desirable to effect a novation or transfer of MPAL Old’s rights and obligations under the Technical Services Agreement to MPAL New. | |||||

| The Parties agree to undertake good faith negotiations in respect of service fees payable to MPC and the scope and standard of services to be provided by MPC and how such services may be procured through third parties, with consideration given to the manner in which the cost of such MPC services may be borne by the Participants. | ||||||

| 7. FUNDING OBLIGATIONS | ||||||

| 7.1 Development Costs |

The first A$50,000,000 of Project development costs incurred by MPAL Old or MPAL New prior to the occurrence of final investment decision in relation to the Stage A Interest shall be funded by YEP and all such Project development costs exceeding A$50,000,000 shall be funded by MPC (as to 51% of such amounts) and YEP (as to 49% of such amounts). If a Party procures a third party to perform development costs, the obligations of that Party to fund Project development costs shall be satisfied on a dollar for dollar basis if and to the extent that the Evans Shoal Percentage of such development costs payable by MPAL Old or MPAL New (as applicable) is reduced (or waived) by that third party from what would otherwise have been the full invoiced amount. | |||||

| 7.2 Post-Completion payments to Santos |

All amounts payable by MPAL Old to Santos under the Assets Sale Deed after Completion shall be funded on a timely basis by MPC (as to 51 % of such amounts) and YEP (as to 49% of such amounts). | |||||

| 7.3 Project Costs and Shared Costs |

With effect from (but excluding) the FID Date, each owner of a Stage Interest shall be responsible for funding an amount equal to: | |||||

| (a) | if its Stage Interest is derived from the Stage A Interest, its Stage Interest percentage of all Stage A Interest costs; and | |||||

10

| (b) | if its Stage Interest is derived from the Stage B Interest, its Stage Interest percentage of all Stage B Interest costs. | |||||

| 7.4 Funding Structure |

All Project development costs payable by the Parties as set forth above shall be paid to MPAL Old or MPAL New in a timely manner and be structured to achieve tax efficiencies and to ensure that no owner of a Stage Interest shall have any commercial, legal or structural advantage over the owner of another Stage Interest with respect to its rights to receive payment or repayment of such funding. | |||||

| 7.5 Default |

The owner of a Stage Interest will be in default if: | |||||

| (a) | it fails to perform any obligation to make any payment or provide any funding in accordance with this Investment Agreement or the supplemental documentation (except that for payments or funding of amounts other than amounts due under the Operating Agreement such amounts must be material), within ten Business Days after notice from any other owner of a Stage Interest of the due date for the relevant payment (the unpaid amount being the Shortfall Amount); | |||||

| (b) | it fails to perform any other material obligation under this Investment Agreement or the supplemental documentation and fails to remedy the default within 60 days after the date on which it receives a notice from any other owner of a Stage Interest specifying the default and requiring it to remedy the default; or | |||||

| (c) | it becomes insolvent or is subject to winding up or liquidation or similar proceedings which are not discharged within 14 days after initiation of such proceedings. | |||||

| 7.6 Remedies for default |

If the owner of a Stage Interest is in default (the Defaulting Party), then: | |||||

| (a) | if the default is under Section 7.5(a) above, any other owner of a Stage Interest (and if more than one, each such owner of a Stage Interest on a pro rata basis) shall be entitled (at its option): | |||||

| (i) | to provide funding to MPAL Old or MPAL New (as applicable) in an amount equivalent of the Shortfall Amount not later than 10 Business Days after the due date on which the Defaulting Party was required to make the relevant payment, and receive, prior to the Defaulting Party being entitled to receive, the Defaulting Party’s Stage Interest percentage (of each Stage Interest which it owns) of all Stage A Interest distributions and Stage B Interest distributions (as applicable), up to an amount equal to the Shortfall Amount multiplied by a factor of three; and / or | |||||

| (ii) | if the Defaulting Party is in default under Section 7.5(a) above on three or more occasions, to compulsorily acquire the Defaulting Party’s relevant Stage Interests at fair market value as determined by three valuers (one | |||||

11

| appointed by the Defaulting Party, one appointed by the acquiring Stage Interest owners and the third appointed by the valuers); | ||||||

| (b) | if the default is under Section 7.5(b) or Section 7.5(c), any other owner of a Stage Interest (and if more than one, each such owner of a Stage Interest on a pro rata basis) shall be entitled to compulsorily acquire the Defaulting Party’s relevant Stage Interests at fair market value as determined by three valuers (one appointed by the Defaulting Party, one appointed by the acquiring Stage Interest owners and the third appointed by the valuers); | |||||

| (c) | any other owner of a Stage Interest shall, unless it has exercised any rights under the foregoing paragraphs in respect of the default, be entitled to exercise its rights and remedies (including obtaining any equitable relief or remedies) under applicable general law in respect of such default; and | |||||

| (d) | during the period of the default, the Defaulting Party shall not be entitled to exercise any voting rights (whether at board level or shareholder level). | |||||

| 8. GOVERNING LAW AND DISPUTE RESOLUTION | ||||||

| 8.1 Governing law |

This Investment Agreement and the supplemental documentation shall be governed by New York Law. | |||||

| 8.2 Dispute resolution |

Any disputes between the Parties with respect to the Parties rights and obligations under the Investment Agreement or the supplemental documentation shall be resolved by arbitration in New York City pursuant to the commercial arbitration rules of the American Arbitration Association. | |||||

| 9. OTHER PROVISIONS | ||||||

| 9.1 Non-compete; Area of Mutual Interest; Adjacent Fields |

The Parties shall agree upon an area of mutual interest (the AMI) reasonably associated with the Project. None of the Parties shall compete with the Project within the AMI and any business opportunity within the AMI known to a Party shall first be presented to the other Parties and thereafter pursued by such Party for its own account only if the other Parties, following a reasonable period of time and on the basis of material information, elect not to pursue such business opportunity. | |||||

| 9.2 Binding agreement |

This Investment Agreement is binding upon the Parties but shall be supplemented and superseded by more detailed documents consistent with the provisions and intent of this Investment Agreement. | |||||

| 9.3 Other |

The supplemental documentation will include provisions relating to confidentiality, intellectual property, notices and other customary and reasonable provisions typically included in documentation covering similar subject matter to this Investment Agreement. | |||||

12

| Acknowledged and agreed: | ||

| MAGELLAN PETROLEUM CORPORATION | ||

| by: |

| |

| YOUNG ENERGY PRIZE S.A. | ||

| By: |

| |

ANNEX 1

Magellan Petroleum Corporation

Evans Shoal Transaction

Ernst & Young

Quality In Everything We Do

Background

MPC and YEP are jointly investing in the Evans Shoal field

Ultimately, the parties desire to have differing interests in different stages of the field, being 3Tcf of output (NewCo A) and any Tcf over 3 (NewCo B)

Various consent related issues in the Joint Operating Agreement and the inability to resolve these prior to closing of the transaction have necessitated the establishment of an interim structure

Detailed steps have been prepared to achieve the final structures and there are a number of tax risks and costs associated with these steps. We have discussed these risks with MPC and these are the subject of a separate advice.

This document cannot be relied upon by any party, other than MPC, for any purpose without our prior written consent.

Page 2

Ernst & Young

Quality In Everything We Do

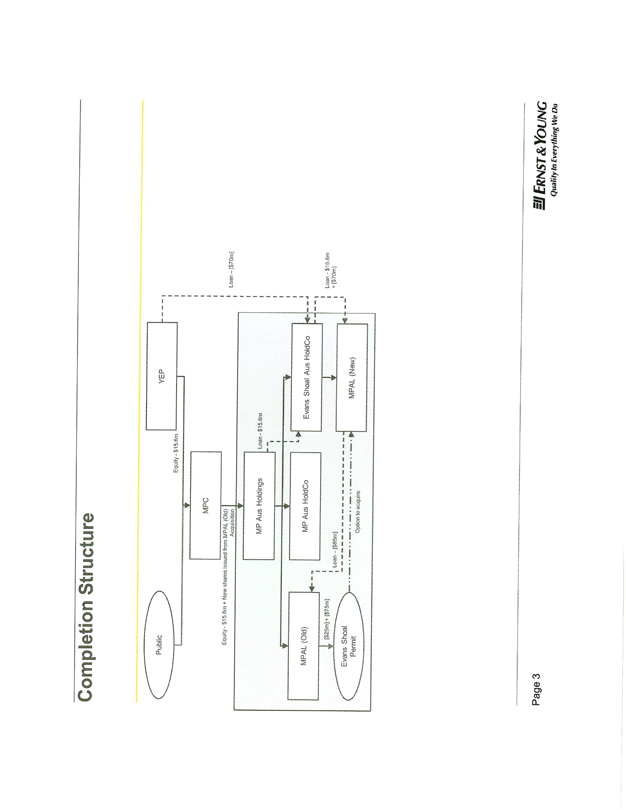

Completion Structure

Public YEP

Equity - $15.6m

MPC

Equity – $15.6m + New shares issued from MPAL (Old) Acquisition Loan – [$70m]

MP Aus Holdings Loan - $15.6m

MPAL (Old)

MP Aus HoldCo

Evans Shoal Aus HoldCo

[$25m]+[$75m]

Loan – [$85m] Loan – $15.6m +[$70m]

Evans Shoal Permit Option to acquire MPAL (New)

Page 3

Ernst & Young

Quality In Everything We Do

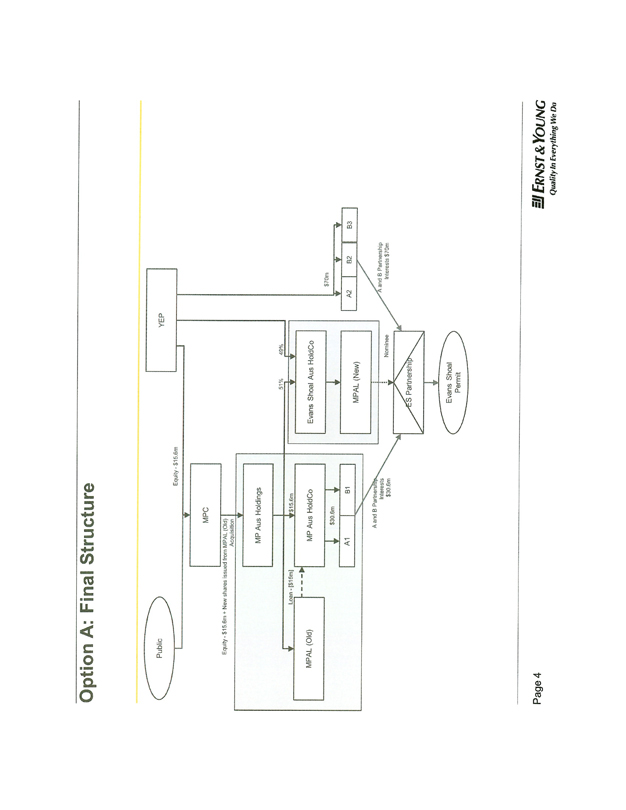

Option A: Final Structure

Public

YEP

Equity - $15.6m

MPC

Equity - $15.6m + New shares issued from MPAL (Old) Acquisition

51% 49%

MP Aus Holdings

Loan - [$15m] $15.6m

MPAL (Old) MP Aus HoldCo

Evans Shoal Aus HoldCo

$30.6m $70m

A1 B1

MPAL (New) A2 B2 B3

A and B Partnership Interests $70m

A and B Partnerships

Interests $30.6m Nominee

ES Partnership

Evans Shoal Permit

Page 4

ERNST & YOUNG

Quality In Everything We Do

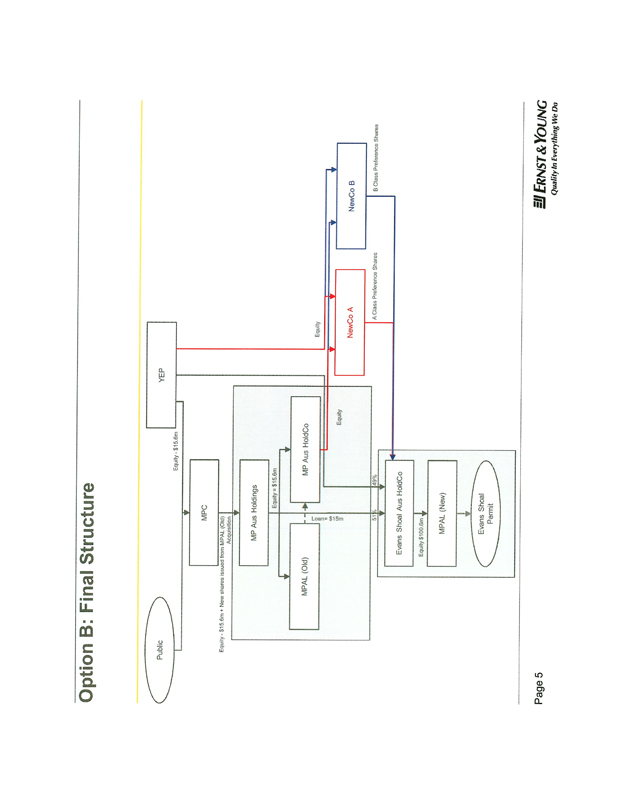

Option B: Final Structure

Public Equity - $15.6m YEP

MPC

Equity - $15.6m + New shares issued from MPAL (Old) Acquisition

MP Aus Holdings

Equity = $15.6m

MPAL (Old) MP Aus HoldCo

Equity

Loan= $15m

Equity

NewCo A NewCo B

51% 49% A Class Preference Shares B Class Preference Shares

Evans Shoal Aus HoldCo

Equity $100.6m

MPAL (New)

Evans Shoal

Permit

Page 5

ERNST & YOUNG

Quality In Everything We Do

ERNST & YOUNG

Quality In Everything We Do

Annex 2

Note: Pursuant to Item 601(b)(2) of Regulation S-K, the registrant has omitted Annex II. The registrant will furnish supplementally to the Securities and Exchange Commission such annex, upon request