Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Regency Energy Partners LP | d8k.htm |

| EX-99.1 - PRESS RELEASE - Regency Energy Partners LP | dex991.htm |

Exhibit 99.2

Regency Energy Partners

Fourth Quarter Earnings Release

February 17, 2011 |

Forward-Looking Statements

2

Certain matters discussed in this report include “forward-looking” statements.

Forward-looking statements are identified as any statement that does not relate strictly to

historical or current facts. Statements using words such as “anticipate,”

“believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or

similar expressions help identify forward-looking statements. Although we believe our

forward-looking statements are based on reasonable assumptions and current expectations and

projections about future events, we cannot give assurances that such expectations will prove to

be correct. Forward-looking statements are subject to a variety of risks, uncertainties and

assumptions. These risks and uncertainties include volatility in the price of oil, natural gas,

and natural gas liquids, declines in the credit markets and the availability of credit for the

Partnership as well as for producers connected to the Partnership’s system and its customers, the

level of creditworthiness of, and performance by the Partnership’s counterparties and

customers, the Partnership's ability to access capital to fund organic growth projects and

acquisitions, and the Partnership’s ability to obtain debt and equity financing on

satisfactory terms, the Partnership's use of derivative financial instruments to hedge commodity

and interest rate risks, the amount of collateral required to be posted from time-to-time in the

Partnership's transactions, changes in commodity prices, interest rates, and demand for the

Partnership's services, changes in laws and regulations impacting the midstream sector of the

natural gas industry, weather and other natural phenomena, industry changes including the

impact of consolidations and changes in competition, the Partnership's ability to obtain

required approvals for construction or modernization of the Partnership's facilities and the

timing of production from such facilities, and the effect of accounting pronouncements issued

periodically by accounting standard setting boards. Therefore, actual results and outcomes may

differ materially from those expressed in such forward-looking information. In light of these risks, uncertainties and assumptions, the events described in the

forward-looking statements might not occur or might occur to a different extent or at a

different time than the Partnership has described. The Partnership undertakes no obligation to

update publicly or to revise any forward-looking statements, whether as a result of new

information, future events or otherwise. |

3

2010 Highlights

?Key

Highlights Partnership

Energy Transfer Equity acquired 100% of Regency’s general partner

Introduced new senior leadership team with extensive experience in the midstream

industry Acquisitions

Acquired 49.9% interest in MEP Joint Venture

Completed $193-million

1

Zephyr acquisition

Acquired additional 6.99% interest in Haynesville Joint Venture

Operational

Completed construction of the Haynesville and Red River Expansion projects on time and

under budget Completed sale of east Texas assets

Added

485

MMcf/d

of

incremental

gathering

capacity

in

north

Louisiana

Announced expansions to our south Texas gathering system

Financial

Raised approximately $408 million of equity²

Completed a $600 million debt refinancing and extended maturity date of revolving

credit facility Maintained

quarterly distribution of 44.5 cents per common unit per quarter

Achieved

$327 million of adjusted EBITDA for full-year 2010

1

Final price paid, as reported in Regency’s Form 10-Q dated September 30,

2010 2

Net of underwriting discounts and commissions, inclusive of general partner’s

proportionate capital contribution |

Fundamentals Review |

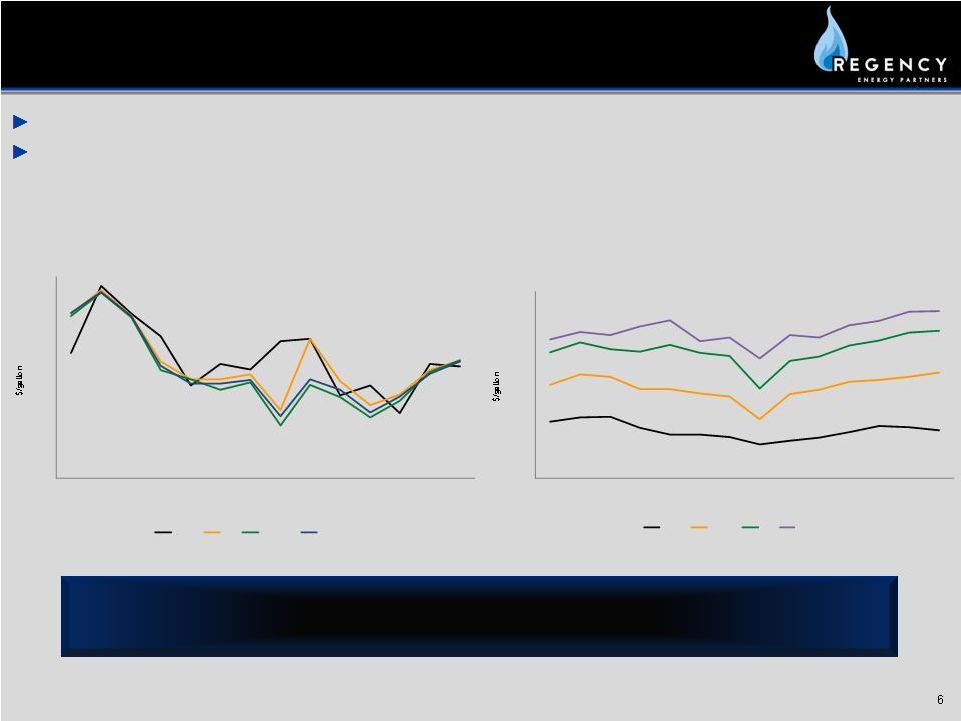

Total

U.S. land rig count increased 4% from Q3 2010 to Q4 2010 Largest increases

occurred in the liquids-rich south Texas and Texas Gulf areas Rich

gas

and

crude

plays

with

associated

gas

are

seeing

greatest

levels

of

drilling

activity

1

Tudor Pickering Holt & Company, TPH Weekly Rig Roundup, January 3, 2011, and

Regency internal analysis 2

Includes injection, geothermal and unclassified rigs

5

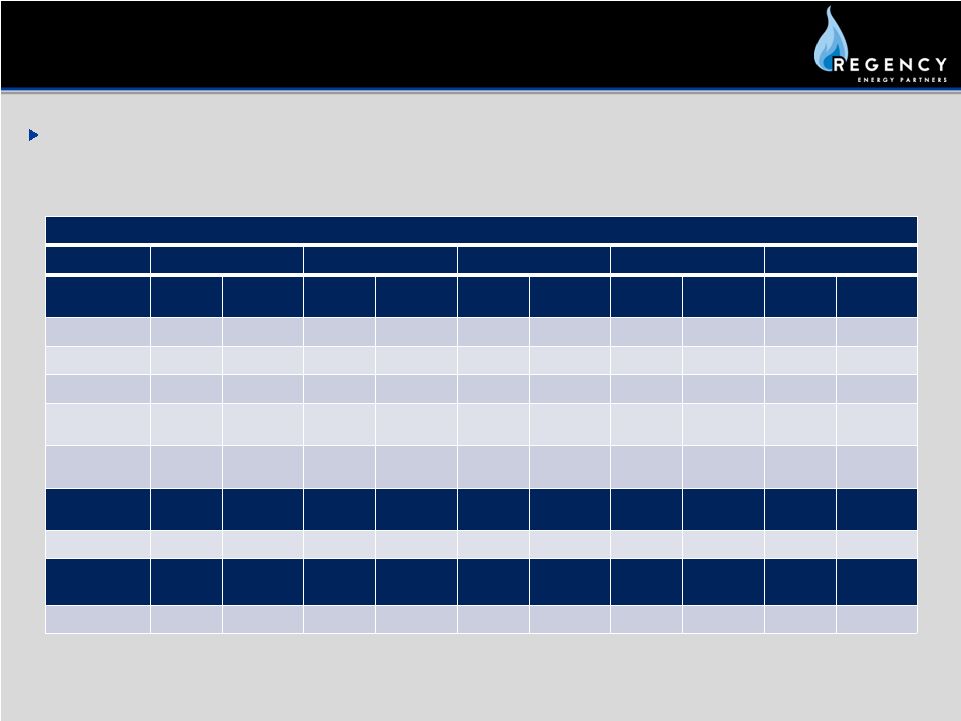

Fundamentals: Drilling Activity

Total US Land Rig Count

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

1,188

1,419

1,624

1,786

1,858

Total Regency Operating Area Rig Count

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

889

1,065

1,225

1,315

1,382

0

100

200

300

400

500

600

700

800

900

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010

U.S. Drilling Rig Trends¹

Gas

Gas/Oil

Oil

0

50

100

150

200

250

300

350

400

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Rig Count Trends -

Regency Operated Area¹

Mid-Con

West TX

South Tx

North LA / East TX

Fayetteville

TX Gulf

Non-TX Gulf

Barnett Shale

Appalachian

Other

2 |

February NYMEX contract settled at $4.32

per MMbtu

1

, which represents an 18% decrease year-over-year

WTI crude has broken out of its $70-$85/Bbl range and has reached the low $90s in

recent weeks Forward curves for natural gas and crude oil pricing suggest that

natural gas will trade at approximately $4.49/MMbtu and crude will trade at

approximately $95/Bbl for full year 2011

¹

Fundamentals: Commodity Prices

1

Forward curve pricing as of February 4, 2011

Gas Price Trends

Crude/NGL Price Trends

$2.00

$3.00

$4.00

$5.00

$6.00

Dec-09

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

NYMEX

HSC

Panhandle

Waha

$0.00

$20.00

$40.00

$60.00

$80.00

$100.00

Dec-09

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

Ethane

Propane

C4+

WTI |

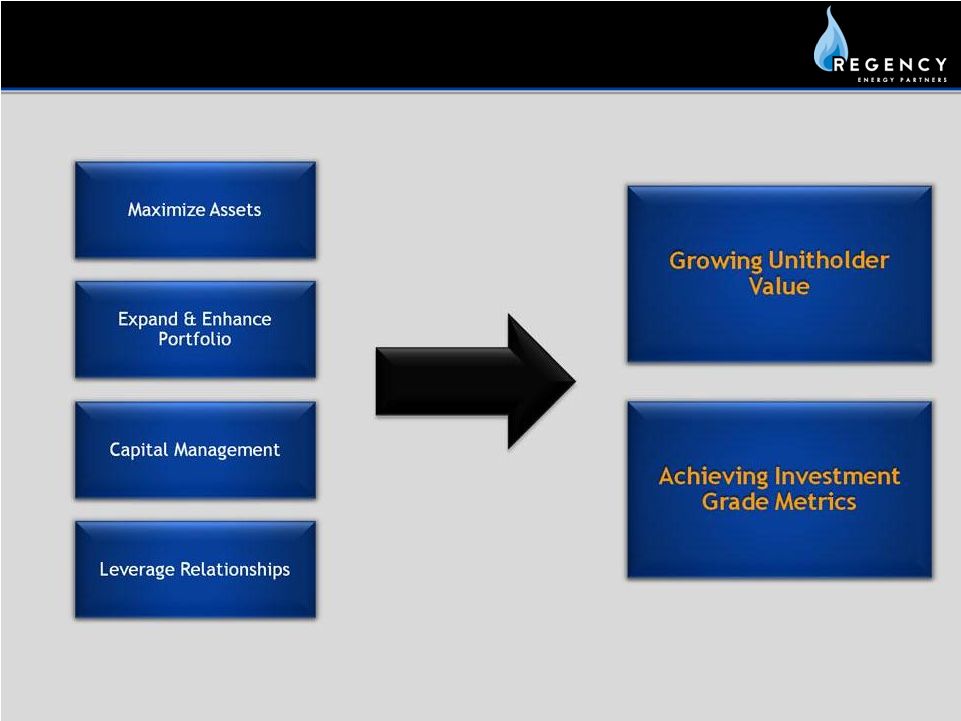

2011 Growth Strategy |

8

2011 Growth Strategy |

Business Review |

10

2010 Performance

Regency produced strong fourth-quarter and full-year 2010 financial

results Comparing full-year 2010 to full-year 2009, adjusted EBITDA

increased 55% year-over-year 1

Adjusted EBITDA varies from previously disclosed amounts as a result of the inclusion

of non-cash unit based compensation as a reconciling item to adjusted EBITDA

Pro Rata Adjusted EBITDA

1

$55

$53

$51

$53

$62

$74

$90

$102

$0

$20

$40

$60

$80

$100

$120

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010 |

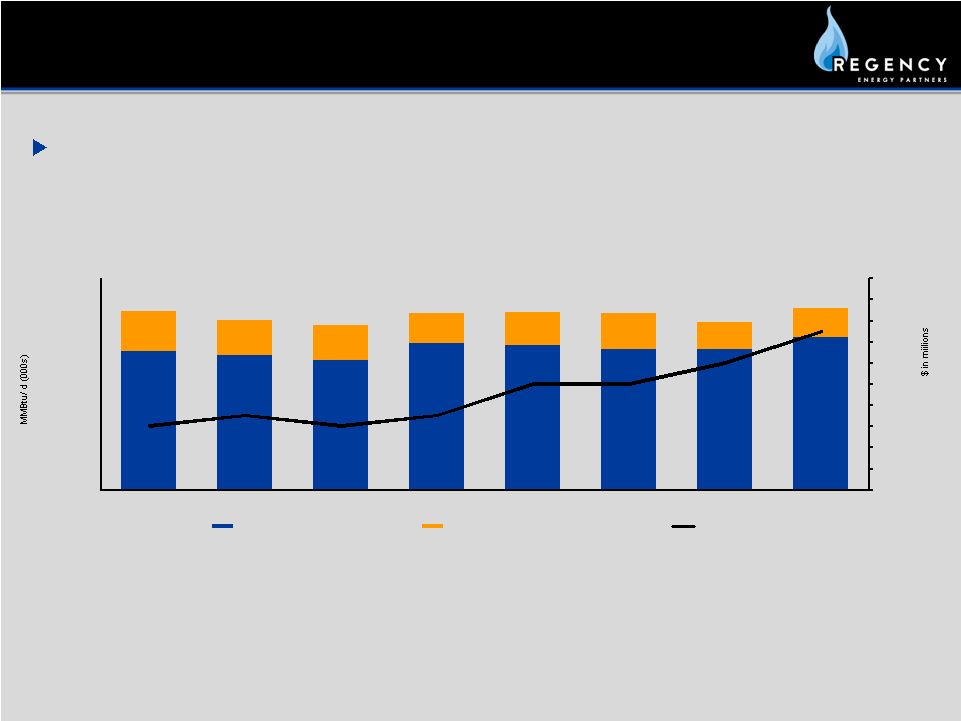

Gathering and Processing Segment

11

1

Inter-segment volumes reflect volumes moved through both Regency’s Gathering

and Processing and Transportation segments 2

Amounts differ from previously disclosed amounts due to the presentation as

discontinued operations for the disposition of east Texas assets Margins

continued to increase in the fourth quarter primarily due to increased Eagle

Ford volumes in our south Texas region

Gathering

and

Processing

Throughput

and

Adjusted

Segment

Margin

1,2

1,012

959

$45

$47

$49

$51

$53

$55

$57

$59

$61

$63

$65

0

200

400

600

800

1,000

1,200

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Throughput

Intersegment Volumes

Adjusted Segment Margin

933

1,001

1,002

1,005

951

1,030 |

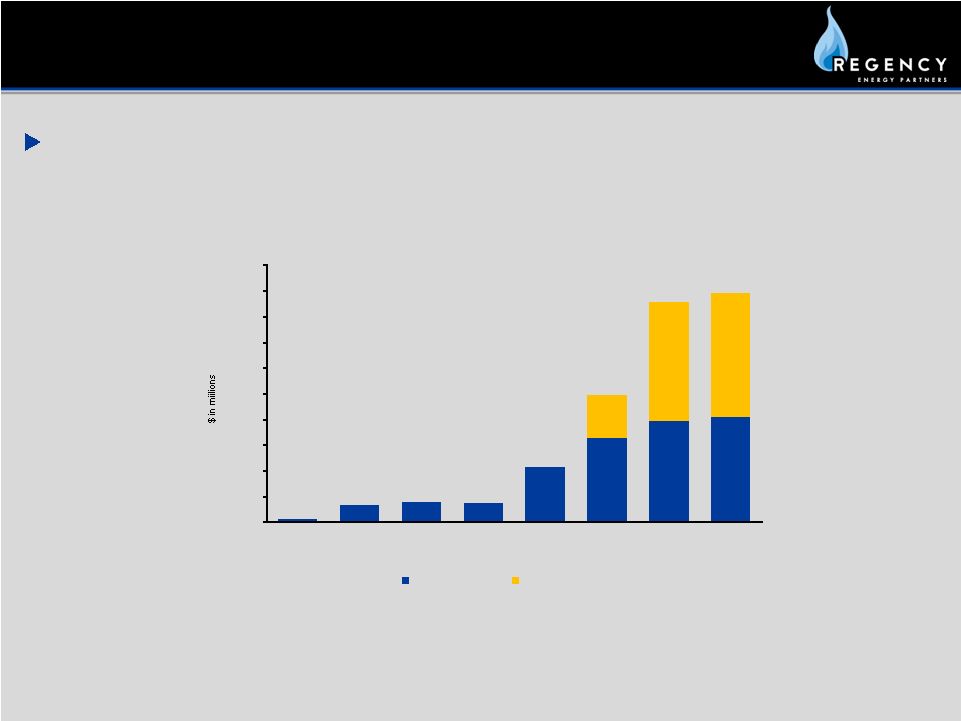

Transportation Segment

12

Regency’s share of Adjusted EBITDA increased to $123 million for full-year

2010 from $11 million for full-year 2009

1

Includes Regency’s proportionate share of adjusted EBITDA

Transportation Segment Adjusted EBITDA

1

$1

$3

$4

$4

$25

-

-

-

-

$11

$43

$44

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010

$ in millions

Haynesville JV

MEP JV |

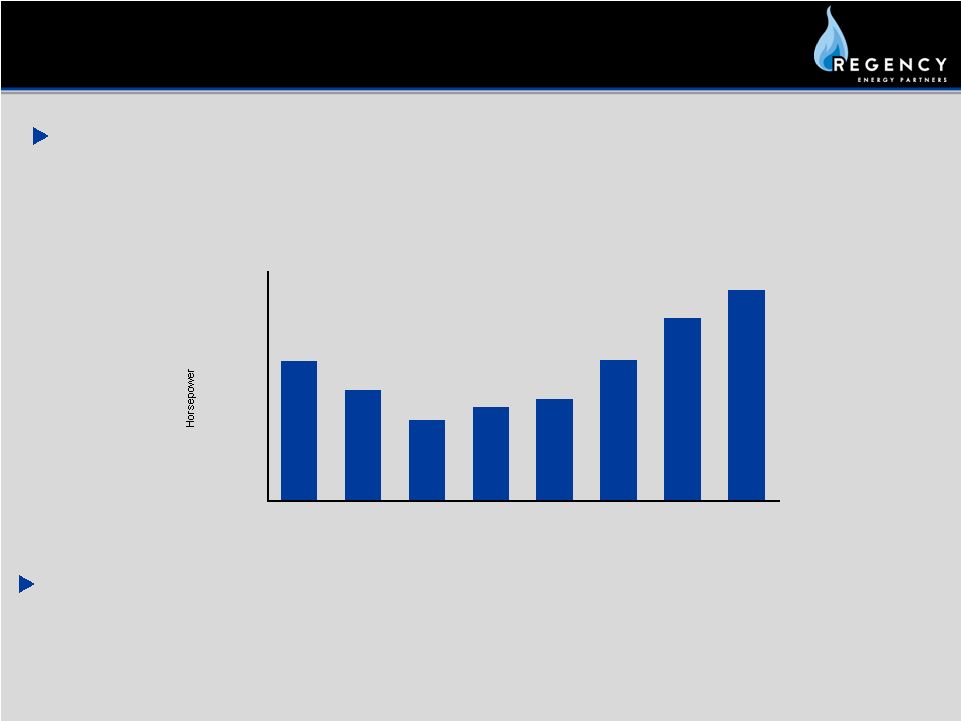

Contract Compression & Contract Treating Segments

13

Revenue Generating Horsepower

Despite challenging market conditions, Regency’s revenue generating

horsepower has increased for five

consecutive quarters and increased 12% from year end 2009 to year end 2010

The acquisition of Zephyr Gas Services extends Regency’s contract services

capabilities from wellhead to market

789,494

767,060

743,289

753,328

759,704

790,494

823,369

844,800

680,000

700,000

720,000

740,000

760,000

780,000

800,000

820,000

840,000

860,000

Q1 2009

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Q3 2010

Q4 2010 |

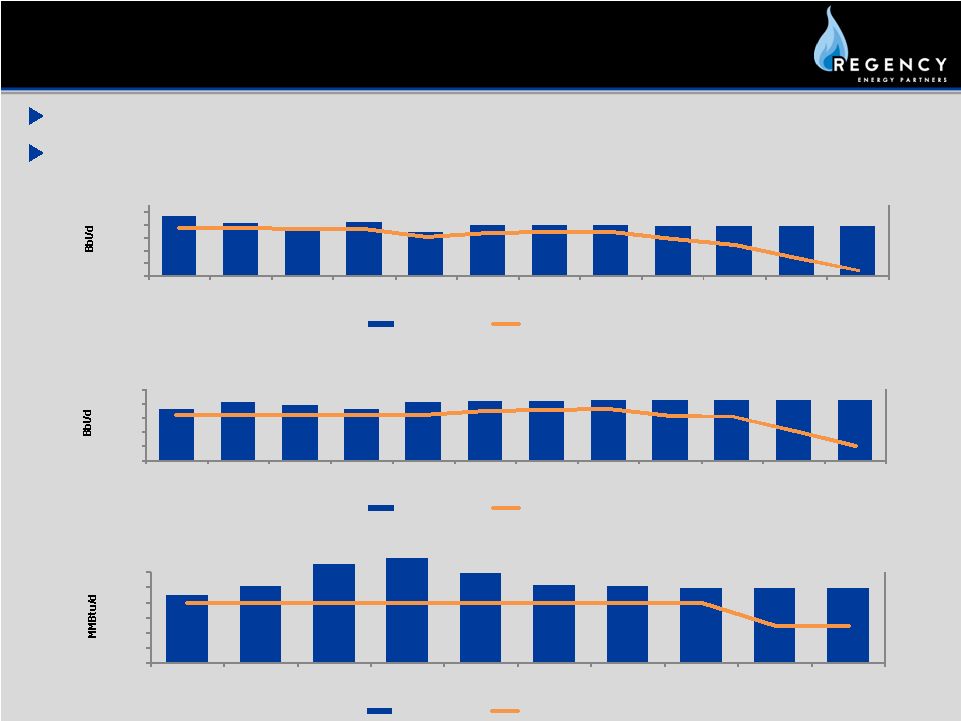

Financial Review |

15

88% of NGLs, 84% of condensate, and 76% of natural gas are hedged for 2011

47% of NGLs, 55% of condensate, and 25% of natural gas are hedged for 2012

Commodity Price Risk Management

1

Percentages as February 4, 2011

90%

79%

61%

58%

68%

78%

79%

81%

51%

51%

-

2,000

4,000

6,000

8,000

10,000

12,000

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Natural Gas Production vs. Hedged

Equity Production

Hedge

80%

92%

104%

88%

89%

86%

87%

89%

75%

63%

38%

12%

-

1,000

2,000

3,000

4,000

5,000

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

NGL Equity Production vs. Hedged

Equity Production

Hedge

90%

79%

83%

89%

79%

85%

85%

86%

75%

74%

48%

23%

-

200

400

600

800

1,000

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Condensate Equity Production vs. Hedged

Equity Production

Hedge

1

1 |

Executed Hedges by Product

2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Bbl/d

Price

($/gal)

Bbl/d

Price

($/gal)

Bbl/d

Price

($/gal)

Bbl/d

Price

($/gal)

Bbl/d

Price

($/gal)

Ethane

1,639

$0.50

1,530

$0.47

1,020

$0.46

510

$0.47

-

-

Propane

855

$1.00

730

$1.01

730

$1.05

490

$1.10

250

$1.18

Iso Butane

-

-

-

-

-

-

-

-

-

-

Normal

Butane

536

$1.34

440

$1.36

440

$1.45

300

$1.53

150

$1.62

Natural

Gasoline

295

$1.71

230

$1.75

270

$1.94

160

$2.05

80

$2.19

Bbl/d

Price

($/Bbl)

Bbl/d

Price

($/Bbl)

Bbl/d

Price

($/Bbl)

Bbl/d

Price

($/Bbl)

Bbl/d

Price

($/Bbl)

WTI

704

$83.24

640

$84.46

630

$90.36

410

$93.66

200

$98.95

MMbtu/d

Price

($/MMbtu)

MMbtu/d

Price

($/MMbtu)

MMbtu/d

Price

($/MMbtu)

MMbtu/d

Price

($/MMbtu)

MMbtu/d

Price

($/MMbtu)

Natural Gas

8,000

$5.40

5,000

$5.04

5,000

$4.79

-

-

-

-

C

3

+ is hedged for 2012 at higher prices than 2011 (8-15%), while natural gas and

ethane are both hedged at lower prices (6-8%)

16

Commodity Price Risk Management |

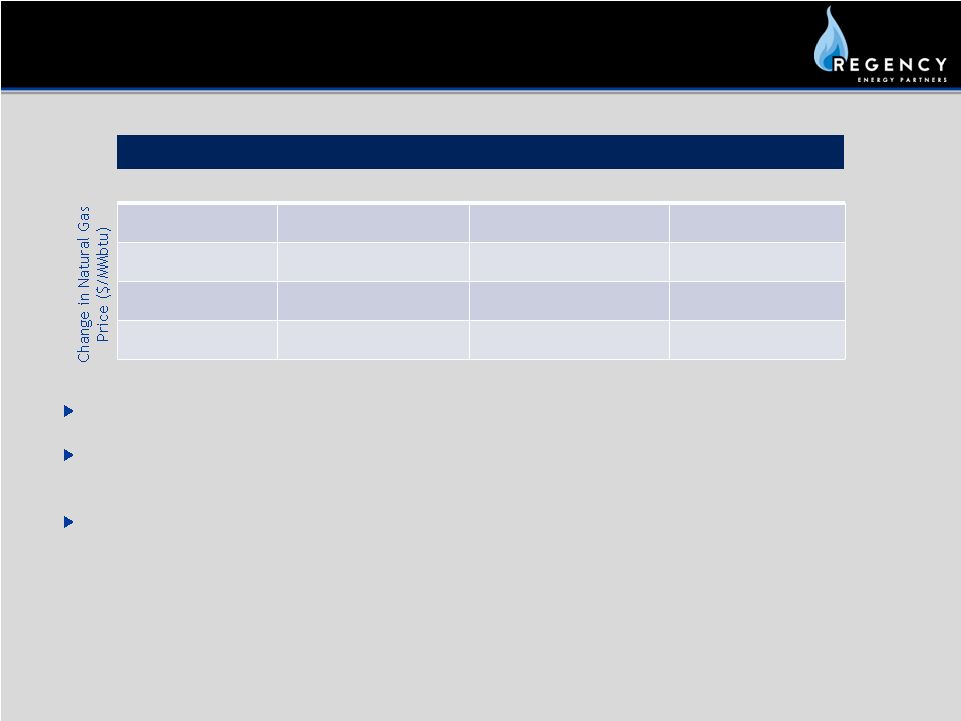

Regency

has

length

in

natural

gas

due

to

a

concerted

effort

to

minimize

“keep-whole”

exposure

A $10.00 per Bbl movement in crude along with the same percentage change in NGL pricing

would result in a $1.2 million change in Regency’s forecasted 2011

DCF A $1.00 per MMbtu movement in natural gas pricing would result in a $0.5

million change in Regency’s forecasted 2011 DCF

DCF Sensitivity to Commodity Price Changes –

2011

1

($ in millions)

Decrease $10.00

Flat

Increase $10.00

Decrease $1.00

$ (1.7)

$ (0.5)

$ 0.7

Flat

$ (1.2)

$ 0

$ 1.2

Increase $1.00

$ (0.7)

$0.5

$ 1.7

Change in WTI Price ($/Bbl)

17

Commodity Price Risk Management

1

Based on Regency’s 2011 projections |

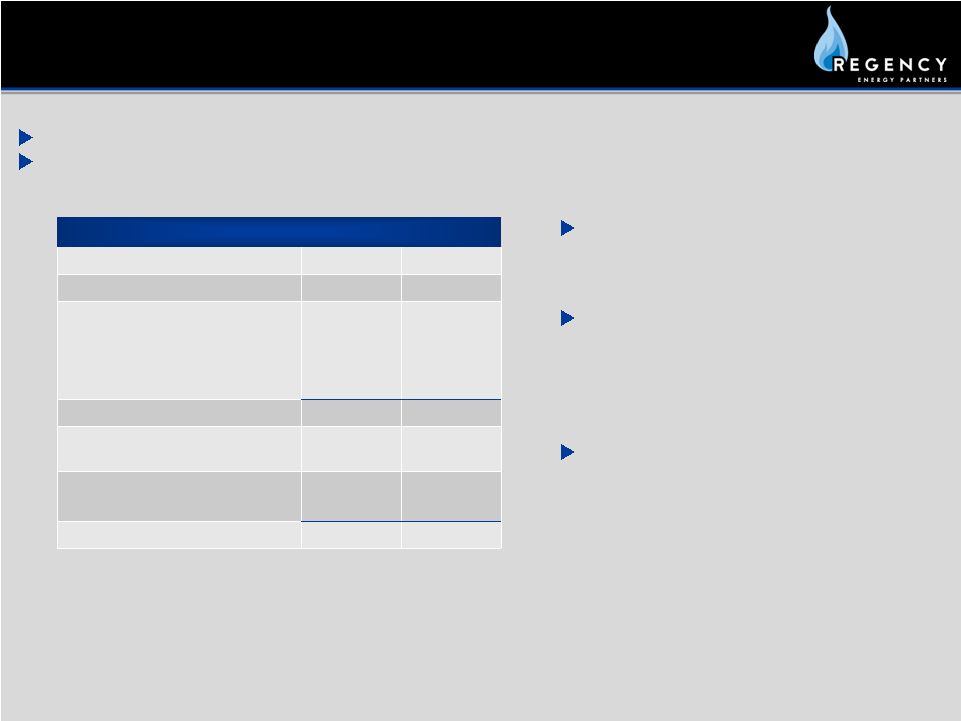

Raised

approximately $408 million of equity in August 2010 Completed a $600 million debt

restructuring/maturity extension in October 2010 18

Strong Liquidity Position

Capitalization

($ in millions)

12/31/2009

12/31/2010

Cash

$10

$9

Long-Term Debt

Revolving Credit Facility

Senior Notes Due 2013

Senior Notes Due 2016

Senior Notes Due 2018

$420

358

236

-

$285

-

256

600

Total Long-Term Debt

$1,014

$1,141

Series A Convertible Redeemable

Preferred Units

$52

$71

Partners’

Capital¹

Noncontrolling

Interest

$1,229

14

$3,261

32

Total Capitalization

$2,309

$4,505

1

Includes common units, general partner interest and accumulated other comprehensive

loss Regency’s debt maturity profile has

been extended from 4.4 years to

6.2 years

Of the $285 million drawn on the

revolving credit facility at year end,

$250 million of floating interest rate

exposure is hedged via swaps at 1.325%

through April 2012

Regency currently has over $500 million

of available liquidity on our revolving

credit facility |

Q&A |

Appendix |

Consolidated Operating Results

21

December 31, 2010

December 31, 2009 (1)

REVENUES

Gas sales, including related party amounts

519,344

$

476,077

$

NGL sales, including related party amounts

390,879

239,255

Gathering, transportation and other fees, including related party

amounts 293,295

270,071

Net realized and unrealized gain from derivatives

(8,582)

37,712

Other, including related party amounts

26,727

20,162

Total revenues

1,221,663

1,043,277

OPERATING COSTS AND EXPENSES

Cost of sales, including related party amounts

862,105

674,944

Operation and maintenance

125,650

117,080

General and administrative, including related party amounts

80,951

57,863

Loss (gain) on asset sales, net

516

(133,282)

Depreciation and amortization

117,751

100,098

Total operating costs and expenses

1,186,973

816,703

OPERATING INCOME

34,690

226,574

Income from unconsolidated subsidiaries

69,365

7,886

Interest expense, net

(82,792)

(77,665)

Loss on debt refinancing, net

(17,528)

-

Other income and deductions, net

(12,126)

(15,132)

(LOSS) INCOME BEFORE INCOME TAXES

(8,391)

141,663

Income tax (benefit) expense

956

(1,095)

(LOSS) INCOME FROM CONTINUING OPERATIONS

(9,347)

142,758

DISCONTINUED OPERATIONS

Net loss from operations of east Texas assets

(1,571)

(2,269)

NET (LOSS) INCOME

(10,918)

$

140,489

$

Net

income attributable to noncontrolling interest

(562)

(91)

NET (LOSS) INCOME ATTRIBUTABLE TO REGENCY ENERGY PARTNERS LP

(11,480)

$

140,398

$

(1)

Amounts differ from previously disclosed amounts due to the presentation as discontinued operations for the disposition of east Texas assets.

Year Ended

Regency Energy Partners LP

Consolidated Statements of Operations

($ in thousands) |

Gathering and Processing Segment

22

December 31, 2010

September 30, 2010

June 30, 2010

March 31, 2010

Gathering and Processing Segment

Financial data:

Segment margin (1)

52,915

$

42,723

$

49,568

$

50,802

$

Adjusted segment margin (1)

59,731

56,690

55,162

54,608

Operating data:

Throughput (MMbtu/d) (1)

1,029,597

950,583

1,002,089

1,005,172

NGL gross production (Bbls/d)

29,327

26,930

25,168

23,118

($ in thousands)

Three Months Ended

December 31, 2009

September 30, 2009

June 30, 2009

March 31, 2009

Gathering and Processing Segment

Financial data:

Segment margin (1)

50,982

$

54,718

$

54,321

$

53,899

$

Adjusted segment margin (1)

52,139

50,984

52,458

51,188

Operating data:

Throughput (MMbtu/d) (1)

1,000,748

932,830

959,280

1,011,588

NGL gross production (Bbls/d)

22,725

20,334

21,185

20,151

Three Months Ended

($ in thousands)

(1) Segment margin and adjusted segment margin vary from previously

disclosed amounts due to the presentation of discontinued operations for the disposition

of east Texas assets, as well as a functional reorganization of our

operating segments. (1) Segment margin

and adjusted segment margin vary from previously disclosed amounts due to the presentation of discontinued operations for the

disposition of east Texas assets, as well as a functional

reorganization of our operating segments. |

Contract Compression Segment

23

December 31, 2010

September 30, 2010

June 30, 2010

March 31, 2010

Contract Compression Segment (1)

Financial data:

Segment margin

40,855

$

38,510

$

37,814

$

37,030

$

Operating data:

Revenue generating horsepower

844,800

823,369

790,494

759,704

Average horsepower per revenue generating

832

861

853

858

compression unit

(1) Segment margin varies from previously disclosed amounts due to a

functional reorganization of our operating segments. Three Months

Ended ($ in thousands)

December 31, 2009

September 30, 2009

June 30, 2009

March 31, 2009

Contract Compression Segment (1)

Financial data:

Segment margin

34,163

$

34,085

$

35,800

$

36,980

$

Operating data:

Revenue generating horsepower

753,328

743,289

767,060

789,494

Average horsepower per revenue generating

849

836

846

858

compression unit

(1) Segment margin varies from previously disclosed amounts due to a

functional reorganization of our operating segments. Three Months

Ended ($ in thousands) |

Contract Treating Segment

24

December 31, 2010

September 30, 2010

June 30, 2010

March 31, 2010

Contract Treating Segment

Financial data:

Segment margin

8,725

$

2,729

$

-

$

-

$

Operating data:

Revenue generating gallons per minute

3,431

3,093

-

-

Three Months Ended

($ in thousands)

December 31, 2009

September 30, 2009

June 30, 2009

March 31, 2009

Contract Treating Segment

Financial data:

Segment margin

-

$

-

$

-

$

-

$

Operating data:

Revenue generating gallons per minute

-

-

-

-

Three Months Ended

($ in thousands) |

Corporate and Others Segment

25

December 31, 2010

September 30, 2010

June 30, 2010

March 31, 2010

Corporate & Others (1)

Financial data:

Segment margin

5,341

$

5,763

$

4,974

$

5,014

$

(1) Segment margin varies from previously disclosed amounts due to a

functional reorganization of our operating segments. Three Months

Ended ($ in thousands)

December 31, 2009

September 30, 2009

June 30, 2009

March 31, 2009

Corporate & Others (1)

Financial data:

Segment margin

1,964

$

1,901

$

1,754

$

656

$

(1) Segment margin varies from previously disclosed amounts due to a

functional reorganization of our operating segments. Three Months

Ended ($ in thousands) |

Transportation Segment –

Haynesville Joint Venture

26

The following provides key performance measures for 100% of the Haynesville Joint

Venture December 31, 2010

September 30, 2010

June 30, 2010

March 31, 2010

Transportation Segment - Haynesville Joint Venture

Financial data:

Segment margin

47,450

$

49,121

$

43,897

$

33,879

$

Operating data:

Throughput (MMbtu/d)

1,543,570

1,519,716

1,155,692

882,626

Three Months Ended

($ in thousands)

December 31, 2009

September 30, 2009

June 30, 2009

March 31, 2009

Transportation Segment - Haynesville Joint Venture

Financial data:

Segment margin

12,157

$

13,535

$

12,803

$

13,556

$

Operating data:

Throughput (MMbtu/d)

640,166

735,565

745,178

810,848

Three Months Ended

($ in thousands) |

Transportation Segment –

MEP Joint Venture

27

The following provides key performance measures for 100% of the MEP Joint Venture

December 31, 2010

September 30, 2010

June 30, 2010

March 31, 2010

Transportation Segment - MEP Joint Venture (1)

Financial data:

Segment margin

57,799

$

56,197

$

51,033

$

47,316

$

Operating

data: Throughput (MMbtu/d) (2)

1,541,533

1,432,783

1,310,363

1,348,044

(2) Due to pooling of

interest corrections the MEP volume data has been revised for the quarters ended March 31, 2010 and September 30, 2010.

($ in thousands)

Three Months Ended

(1) On May 26, 2010, the Partnership purchased a 49.9 percent interest

in MEP Joint Venture from ETE. The financial and operating data are presented at 100

percent of MEP Joint Venture.

December 31, 2009

September 30, 2009

June 30, 2009

March 31, 2009

Transportation Segment - MEP Joint Venture (1)

Financial data:

Segment margin

46,199

$

34,220

$

8,614

$

421

$

Operating data:

Throughput (MMbtu/d)

1,236,620

994,924

463,802

-

Three Months Ended

($ in thousands)

(1) On May 26, 2010, the Partnership purchased a 49.9 percent interest

in MEP Joint Venture from ETE. The financial and operating data are presented at 100

percent of MEP Joint Venture. |

Non-GAAP Reconciliation

28

2010

2009

2008

Net (loss) income

(10,918)

$

140,489

$

101,328

$

Add (deduct):

Interest expense, net

82,971

77,996

63,243

Depreciation and amortization

122,725

109,893

102,566

Income tax expense (benefit)

956

(1,095)

(266)

EBITDA (1) (2)

195,734

$

327,283

$

266,871

$

Add (deduct):

Non-cash loss (gain) from derivatives

42,613

5,163

(14,708)

Non-cash unit based compensation (3)

13,727

5,834

4,318

Loss (gain) on asset sales, net

591

(133,284)

472

Income from unconsolidated subsidiaries

(69,365)

(7,886)

-

Partnership's

ownership

interest

in

Haynesville

Joint

Venture's

adjusted

EBITDA

(4)

67,014

11,398

-

Partnership's

ownership

interest

in

MEP

Joint

Venture's

adjusted

EBITDA

(5)

55,682

-

-

Loss on debt refinancing, net

17,528

-

-

Other expense, net

3,432

2,486

2,374

Adjusted EBITDA (6)

326,956

$

210,994

$

259,327

$

(1) Earnings before interest, taxes, depreciation and

amortization. (4) 100%

of

Haynesville

Joint Venture's Adjusted EBITDA is calculated as follows:

Net income Haynesville Joint Venture

106,737

$

19,734

$

-

$

Add:

Depreciation and amortization

31,797

8,514

-

Interest expense

526

158

-

Gain on insurance settlement

(242)

-

-

Loss on sale of asset, net

105

-

-

Other expense, net

14

50

-

Haynesville Joint Venture's Adjusted EBITDA

138,937

$

28,456

$

-

$

Net income MEP Joint Venture

42,529

$

-

$

-

$

Add:

Depreciation and amortization

40,104

-

-

Total other income (expense)

28,954

-

-

MEP Joint Venture's Adjusted EBITDA

111,587

$

-

$

-

$

Year Ended December 31,

($ in thousands)

(3)

The

Partnership

added

non-cash

unit

based

compensation

as

a

reconciling

item

from

EBITDA

to

adjusted

EBITDA. Previous comparative periods have been restated.

(5)

100%

of

MEP

Joint

Venture's

Adjusted

EBITDA

is

calculated

as

followsand

represents

the

period

from

May

26, 2010 to December 31, 2010, as the Partnership acquired its 49.9

percent ownership interest on May 26, 2010: (6) Adjusted EBITDA and Combined

Adjusted EBITDA differs from previously disclosed amounts as a result of

the inclusion of income from unconsolidated subsidiary to account for

Regency's income from the Haynesville Joint Venture and the inclusion of

non-cash unit based compensation as a reconciling item to Adjusted EBITDA.

(2) EBITDA varies from previously disclosed amounts as a result

of new accounting pronouncement that requires disclosing non-controlling interest in income

separately on the face of the income statement. |

Non-GAAP Reconciliation

29

2010

2009

2008

Net (loss) income

(10,918)

$

140,489

$

101,328

$

Add (Deduct):

Operation and maintenance

125,650

117,080

119,715

General and administrative

80,951

57,863

51,323

Loss (gain) loss on asset sales, net

516

(133,282)

457

Management services termination fee

-

-

3,888

Transaction expenses

-

-

1,620

Depreciation and amortization

117,751

100,098

93,393

Income from unconsolidated subsidiaries

(69,365)

(7,886)

-

Interest expense, net

82,792

77,665

62,940

Loss on debt refinancing, net

17,528

-

-

Other income and deductions, net

12,126

15,132

(328)

Income tax expense (benefit)

956

(1,095)

(266)

Discontinued operations

1,571

2,269

(13,931)

Total Segment Margin (1)

359,558

368,333

420,139

Non-cash loss (gain) from derivatives

30,183

(7,151)

(17,996)

Adjusted Total Segment Margin (1)

389,741

361,182

402,143

Transportation Segment Margin (1) (2)

-

11,714

66,888

Contract Compression Segment Margin (1)

154,209

141,028

125,503

Contract Treating Segment Margin (1)

11,454

-

-

Corporate & Others Segment Margin (1)

21,092

6,275

815

Inter-segment Elimination

(23,205)

(4,604)

(4,573)

Adjusted Gathering and Processing Segment Margin (1)

226,191

$

206,769

$

213,510

$

Year Ended December 31,

($ in thousands)

(1) Segment margin and adjusted segment margin vary from previously

disclosed amounts due to the presentation of discontinued operations for the

disposition of east Texas assets, a functional reorganization of our

operating segments, as well as inter-segment eliminations. (2) Transportation segment margin and adjusted transportation

segment margin represent Regency's 100% ownership in RIGS prior to contribution of

RIGS to the Haynesville Joint Venture.

|

Non-GAAP Reconciliation

30

Three Months Ended

December 31, 2010

($ in thousands)

Net cash flows provided by operating activities

41,304

$

Add

(deduct): Depreciation and amortization, including debt issuance

cost amortization (34,556)

Write-off of debt issuance costs

1,422

Amortization of excess fair value of unconsolidated subsidiaries

(3,410)

Income from unconsolidated subsidiaries

27,028

Derivative valuation change

(18,352)

Loss on asset sales, net

(78)

Unit based compensation expenses

(1,387)

Trade accounts receivables, accrued revenues, and related party

receivables 13,708

Other current assets

1,010

Trade

accounts

payable,

accrued

cost

of

gas

and

liquids,

related

party

payables

and

deferred

revenues

(14,724)

Other current liabilities

4,667

Distributions received from unconsolidated subsidiaries

(27,028)

Other assets and liabilities

1,473

Net loss

(8,923)

$

Add:

Interest expense, net

19,791

Depreciation and amortization

33,217

Income tax benefit

(143)

EBITDA

43,942

$

Add

(deduct): Non-cash loss from derivatives

18,922

Non-cash unit based compensation

1,386

Loss on asset sales, net

78

Income from unconsolidated subsidiaries

(23,618)

Partnership's ownership interest in Haynesville Joint Venture's

adjusted EBITDA 20,374

Partnership's ownership interest in MEP Joint Venture’s adjusted

EBITDA 24,095

Loss on debt refinancing, net

15,748

Other expense, net

831

Adjusted EBITDA

101,758

$

Add

(deduct): Interest expense, excluding capitalized interest

(19,552)

Maintenance capital expenditures

(4,164)

Proceeds from asset disposal

128

Convertible preferred distribution

(1,945)

Joint venture adjustments (1)

(7,844)

Others

304

Cash available for distribution

68,685

$

(1) Adjustments for the

Partnership's share of the Haynesville Joint Venture's and MEP Joint Venture's adjustments between their respective

adjusted EBITDA and cash available for distribution. Adjustments

include interest expense, maintenance capital expenditures and the Haynesville

Joint Venture's non-cash portion of the general and

administrative management fee. |