Attached files

Exhibit 99.2

|

|

February 2011

Confidential

|

FORWARD LOOKING STATEMENTS

|

|

This presentation may contain forward-looking statements about the business, financial condition and prospects of the Company. Forward-looking statements, can be identified by the use of forward-looking terminology such as “believes,” “projects,” “expects,” “may,” “goal,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” or “anticipates,” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Forward-looking statements relate to anticipated or expected events, activities, trends or results. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Forward-looking statements in this presentation include, without limitation, the Company’s expectations of the oil initially in place, undiscovered resources, gross prospective barrels of oil equivalent, net prospective barrels of oil equivalent, net risked prospective barrels of oil equivalent, drilling success rates, resource information and other performance results. These statements are made to provide the public with management’s current assessment of the Company’s business, and it should not be assumed that these reserves are proven recoverable as defined by SEC guidelines or that actual drilling results will prove these statements to be correct. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, there can be no assurances that such expectations will prove to be accurate. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this presentation speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this presentation. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan.

|

Confidential

|

EXECUTIVE OFFICERS

|

|

John B. Connally III

Chief ExecutiveOfficer

|

● Founding Director of Nuevo Energy, a NYSE listed Houston based E&P company ●Founder and former CEO of Pure Energy and Pure Gas Partners, a private E&P company with operations in New Mexico ●Associations with Back Nine Energy Partners, Pin Oak Energy, and Commodore Energy Partners ●Director, Chairman of Compensation Committee and member of the Audit Committee of Endeavour International Corp. ● Former Partner at Baker Botts, specializing in corporate finance and M&A in the energy space |

|

|

|

||

|

James C. Fluker III

Vice President Exploration

|

●Professional geophysicist and geologist with over 30 years of experience in petroleum exploration

●Previous tenures at Exxon, British Gas, and Nippon Oil Exploration

●Consultant to SK Energy, Teikoku, and Consolidated Contractors Company

●Expertise in acquisition and interpretation of seismic data for onshore/offshore and domestic/international

●Proven record of accomplishment of oil discovery in South America, North Africa, and Middle East

●Speaks, reads, and writes Spanish fluently

|

|

|

Ernest B. Miller IV

Executive Vice President

|

●18 years of development, operations, and financial experience with energy companies in the US, Canada, and United Kingdom

●Partner in Rodeo Development, a private E&P company that was sold in 2008

●Former Director of Finance at Calpine specializing in project finance and a&D of natural gas reserves

●Associations with Daytona Energy, BPZ Energy, and Tiger Midstream

|

|

|

Jim D. Ford

Executive Vice President

|

●Over 30 years of experience in the energy sector

●Senior international negotiator with Santa Fe Energy Resources Inc.

●Extensive international exposure in South America, Africa, Former Soviet Union, and Asia

●Responsible for the negotiations of the first ever production sharing agreement in onshore China

●Associations with Rodeo Development, Riata Resources, Intercap Resource Management, and Daytona Energy

|

|

Confidential

|

CONTEMPLATED OFFERING

|

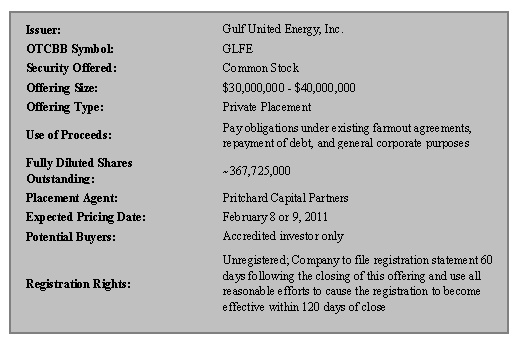

Issuer: Gulf United Energy, Inc. OTCBB Symbol: GLFE Security Offered: Common Stock Offering Size: $30,000,000-$40,000,000 Offering Type: Private Placement Use of Proceeds: Pay oligations under existing formout agreements, repayment of debt, and general corporate purposes Fully Diluted Shares Outstanding: ~367,725,000 Placement Agent: Pritchard Capital Partners Expected Pricing Date: February 8 or 9, 2011, Potential Buyers: Accredited investor only Registration Rights: Unregistered; Company to file registration statement 60 days following the closing of this offering and use all reasonable efforts to cause the registration to become effective within 120 days of close

Confidential

|

KEY INVESTMENT HIGHLIGHTS

|

|

■

|

Asset Base: A unique portfolio of large reserve potential projects in Colombia and Peru

|

|

■

|

Visibility to Cashflow: Near-term seismic defined oil prospects with spud to revenue cycle approximately 100 days

|

|

■

|

Attractive Returns: The well profile and associated economics developed by Gulf United and its operating partners support well cost payout in less than three months ($80 WTI, base case)

|

|

■

|

Leadership: Professional management team with significant experience within South America including Colombia, Peru, and Ecuador

|

|

■

|

Technical Horsepower: Significant technical partner with SK Energy, a leading Asian integrated oil and gas company

|

Confidential

|

STRONG OPERATING PARTNER

|

|

SK Energy- Subsidiary of SK Group, one of South Korea’s top five

industrial conglomerates

|

|

■

|

Integrated business model includes refining, petrochemical, and E&P

|

|

•

|

Korea’s largest petroleum refiner operating over 1 million barrels of capacity

|

|

•

|

Currently active in 33 oil and gas blocks in 17 countries

|

|

•

|

Over 500 million BOE of proved reserves

|

|

•

|

Currently involved in 4 LNG projects

|

|

■

|

SK Energy’s revenues exceeded $30 billion in 2010

|

|

■

|

SK Energy’s Bogotá branch office oversees operations of three blocks, including CPO-4

|

Confidential

|

COMPANY OVERVIEW

|

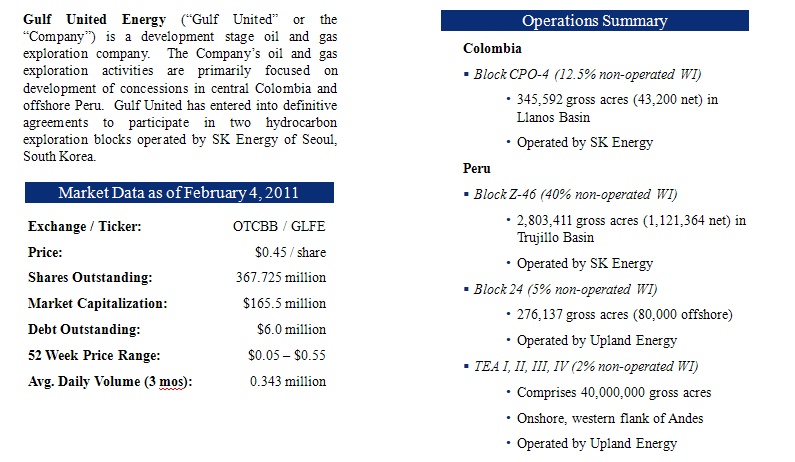

Gulf United Energy (“Gulf United” or the “Company”) is a development stage oil and gas exploration company. The Company’s oil and gas exploration activities are primarily focused on development of concessions in central Colombia and offshore Peru. Gulf United has entered into definitive agreements to participate in two hydrocarbon exploration blocks operated by SK Energy of Seoul, South Korea. Market Data as of February 4, 2011 Exchange/Ticker: OTCBB/GLFE Price: $0.45/share Shares Outstanding: 367.725 million Market Capitalization: $165.5 million Debt Outstanding: $6.0 million 52 Week Price Range: $0.05-$0.55 Avg. Daily Volume (3 mos): 0.343 million. Operations Summary Colombia§ Block CPO-4 (12.5% non-operated WI)• 345,592 gross acres (43,200 net) in Llanos Basin• Operated by SK Energy Peru§ Block Z-46 (40% non-operated WI)• 2,803,411 gross acres (1,121,364 net) in Trujillo Basin• Operated by SK Energy§ Block 24 (5% non-operated WI)• 276,137 gross acres (80,000 offshore)• Operated by Upland Energy§ TEA I, II, III, IV (2% non-operated WI) • Comprises 40,000,000 gross acres• Onshore, western flank of Andes• Operated by Upland Energy

Confidential

|

FARMOUT & JOINT OPERATING AGREEMENT - CPO-4

|

|

■

|

Contract entered between National Hydrocarbon Agency of Colombia and SK Energy

|

|

■

|

Right to earn an undivided 12.5% of the CPO-4 contract in the highly productive western margin of the Llanos Basin

|

|

■

|

The CPO-4 Block consists of 345,592 acres and is in close proximity to oil and gas infrastructure

|

|

■

|

On the northeast side of CPO-4 Block lie the Corcel and Guatiquia Blocks where initial production rates of up to 15,000 bbls/d have recently been announced. CPO-4 is also adjacent to the Apiay field which is estimated to contain over 600 million barrels.

|

|

■

|

All future cost and revenue sharing will be on a pro rata basis: 50% SK Energy, 37.5% Houston American Energy, and 12.5% Gulf United Energy; no carried or promoted interest on the block going forward

|

|

■

|

Gulf United has paid SK Energy 12.5% of all past costs and a promote on the Phase 1 seismic acquisition cost equal to $1.7 million

|

|

■

|

Gulf United has agreed to pay Houston American Energy $3.9 million (past cost and $1.7 million promote)

|

|

●

|

Payment due upon approval of assignment from the National Hydrocarbon Agency of Columbia

|

|

■

|

Highly favorable government royalties – Sliding scale royalty rates based on field size, with an 8% royalty rate for most fields

|

Confidential

|

ASSET BASE -- CPO-4

|

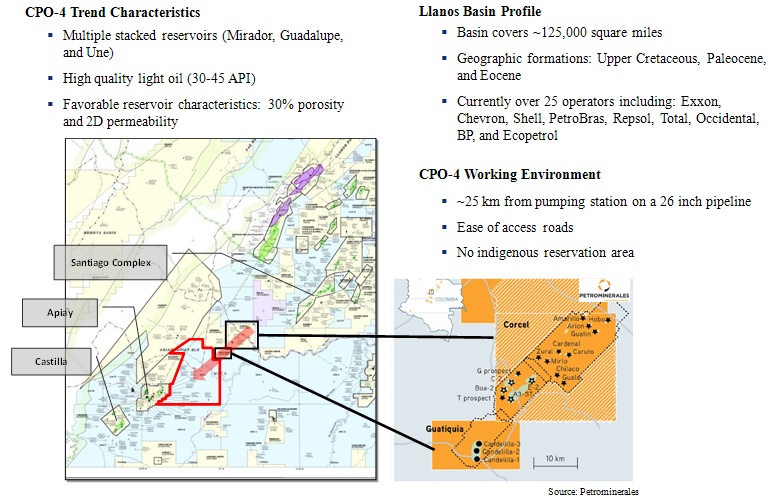

CPO-4 Trend Characteristics *Multiple stacked reservoirs (Mirador, Guadalupe, and Une)*High quality light oil (30-45 API)*Favorable reservoir characteristics: 30% porosity and 2D permeability. Santiago Complex. Apiay. Castilla. Llanos Basin Profile*Basin covers ~125,000 square miles*Geographic formations: upper cretaceous, paleocene, eocene* Currently over 25 operators including: Exxon, Chevron, Shell, PetroBras, Repsol, Total, Occidental, BP, and Ecopetrol. CPO-4 Working Environment*~25km from pumping station on a 26 inch pipeline*Ease of access roads*No indigenous reservation area. Corcel, Amarillo, Hobo, Arion, Guatin, Cardenal, Zurall, Caruto, Mirlo, Chilaco, Guala, G Prospect, C-2, Boa-2, 7 Prospect, Candelilla-3, Candelilla-2, Candelilla-1. Source: Petrominerales

Confidential

|

ASSET BASE -- CPO-4

|

|

Petrominerales’ Candelilla Well Detail

|

|

■

|

CPO-4 Block is located ~3 kilometers from Petrominerales’ (TSX:PMG) Candelilla 1 and Candelilla 2 wells

|

|

■

|

Gulf United and its partners have mapped 17 structures on 3D seismic. Seismic indicates four way rollovers and up thrown fault closures on trend with Corcel / Guatiquia development.

|

|

■

|

PMG’s three Candelilla wells in the Guatiquia field have produced >7.2 million barrels of oil approximately 12 months of production (as of December 31, 2010)

|

| Spud |

Depth

(feet)

|

Reservoir |

IP

(bbls/d)

|

Cumulative

Production (mmbo)

|

|

| Candelilla 1 | Nov-2009 | 11,681 | Une | 11,500 | 2.0 |

| Candelilla 2 | Dec-2009 | 11,740 | Une | 15,800 | 2.7 |

| Candelilla 3 | Feb-2010 | 12,162 | Une | 15,600 | 2.5 |

| 7.2 |

|

■

|

A small portion of Corcel & Guatiquia acreage has contributed to over 75% of total company production (~32,500 bopd in Q3 2010); majority of acreage still to be explored (Source: PMG November 2010 Investor Presentation)

|

|

■

|

Petrominerales continues to seek additional Llanos Basin acreage

|

|

■

|

PMG was competing bidder for CPO-4

|

|

■

|

PMG was awarded Block 59 in June 2010, which is located immediately adjacent and west of CPO-4

|

Confidential

|

CPO-4 RESERVOIR DISTRIBUTION

|

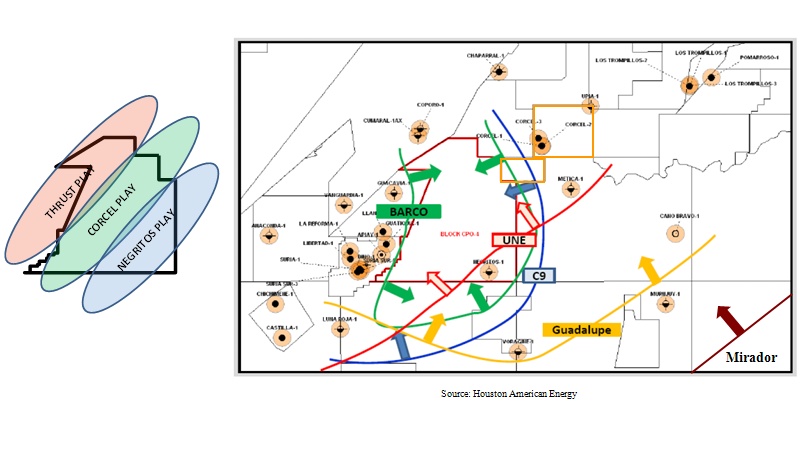

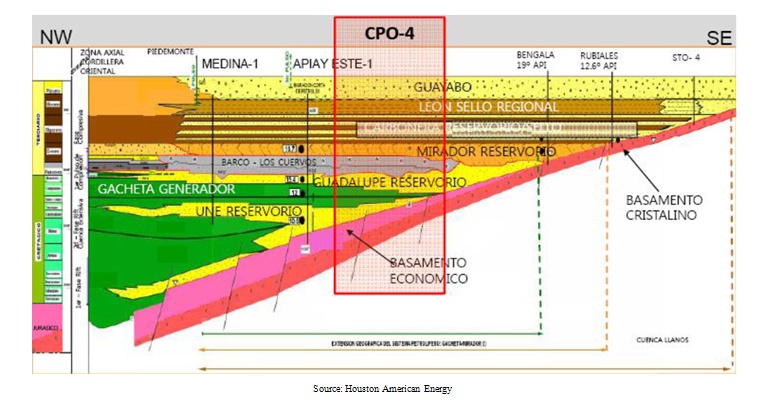

THRUST PLAN CORCEL PLAY NEGRITOS PLAY Mirador Souce: Houston American Energy Guadalupe BARCO UNE C9

Confidential

|

CPO-4 MULTI RESERVOIR CROSS SECTION

|

NW CPO-4 BASAMENTO ECONOMICO ONA AXIAL CORDELERA ORIENTAL PIEDEMONTE MEDINA-1 APIAY ESTE-1 BENGALA 19degrees API RUBIALES 12.6 degrees API STO-4 BALAMENTO CRISTALINO GUADALUPE RESERVORIO MIRADOR RESERVORIO LEON SELLO REGIONAL GUAYABO GACHETA GENERADOR UNE RESERVORIO BARCO-LOS CUERVOS SE Source: Houston American Energy

Confidential

|

FORECASTED CPO-4 WELL ECONOMICS & SENSITIVITIES

|

| Well economics are based on management's assumptions and derived from: |

| ■ Seismic interpretation | ■ Review of PMG Corcel & Guatiquia well performance | |

| ■ Discussion with CPO-4 partners | ■ Knowledge of Llanos Basin | |

| vAt $80 WTI oil price, the average CPO-4 well is expected to have a payout period of < 2 months based on current well economic assumptions | ||

| Type Curve | "Apiay" / "Corcel" | CPO-4 (mid-case) | "Guatiquia" | Well Economic Assumptions | |||

| IP Rate (bopd) | 6,000 | 7,500 | > 12,000 | 8/8th: | |||

| Payout period ($80 WTI) | < 3 months | < 2 months | Cost per Well (000"s) | $ | 14,000 | ||

| 12-month Cumulative | Initial Production (boepd) | 7,500 | |||||

| Production (mboe) | > 1,200 | > 1,700 | Operating Costs (per bbl) | $ | 17.50 | ||

| Rate after 12-month (bopd) | 2,300 | 3,700 | Gulf United | ||||

| Working Interest | 12.5% | ||||||

| Net Revenue Interest | 7.6%-5.5% | ||||||

Confidential

|

ASSET BASE - Z-46

|

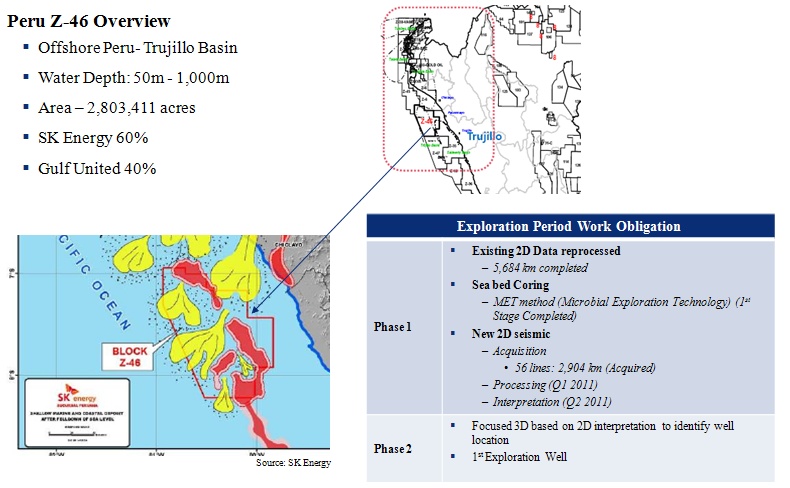

Peru Z-46 Overview*Offshore Peru-Trujillo Basin *Water Depth: 50m-1,000m*Area-2,803,411 acres*SK Energy 60%*Gulf United 40% Pacific Ocean Block Z-48 SK Energy Source. Exploration Period Work Obligation

Confidential

|

ASSET BASE - Z-46

|

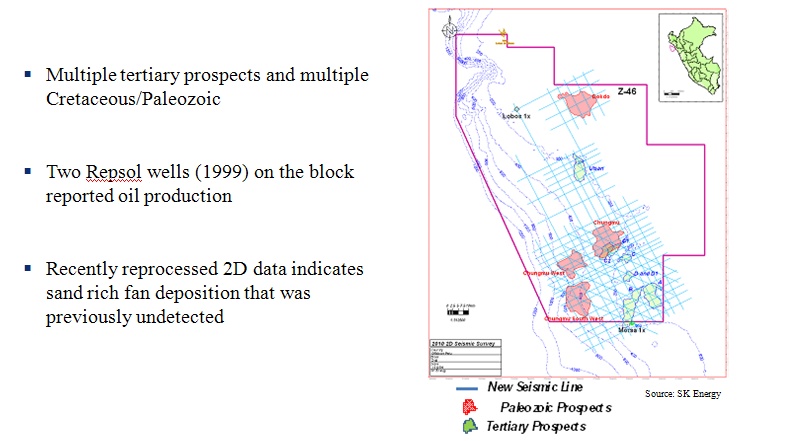

Multiple tertiary prospects and multiple Cretaceous/Paleozoic*Two Repsol wells (1999) on the block reported oil production*Recently reprocessed 2D data indicates sand rich fan deposition that was previously undetected. New Seismic Line. Paleozoic Prospects. Tertiary Prospects. Source: SK Energy

Confidential

|

ASSET BASE - BLOCK 24

|

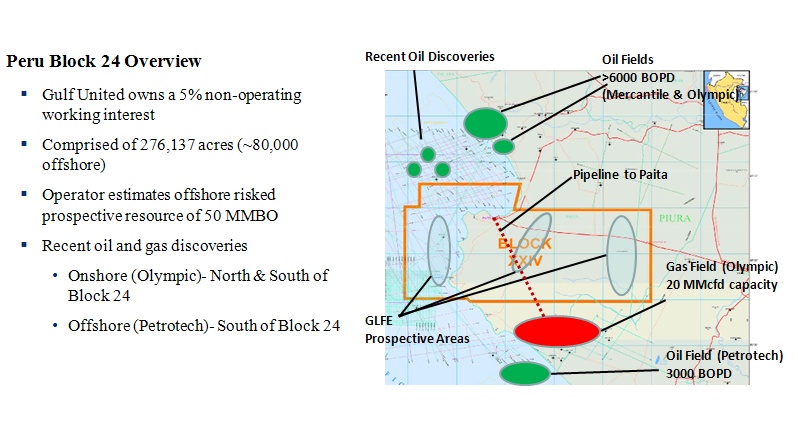

Peru Block 24 Overview *Gulf United owns a 5% non-operating working interest*Comprised of 276,137 acres (~80,000 offshore)*Operator estimates offshore risked prospective resource of 50 MMBO*Recent oil and gas discoveries*Onshore (Olympic)- North & South of Block 24*Offshore (Petrotech)- South of Block 24. Recent Oil Discoveries. Oil Fields >6000 BOPD (Mercantile & Olympic), Pipeline to Paita, Gas Fiele (Olympic) 20 MMcfd capacity, Oil Field (Petrotech) 3000 BOPD, GLFE Prospective Areas, BLOCK XXIV, Pipeline to Paita

Confidential

|

ASSET BASE - TECHNICAL EVALUATION AREA (TEA)

|

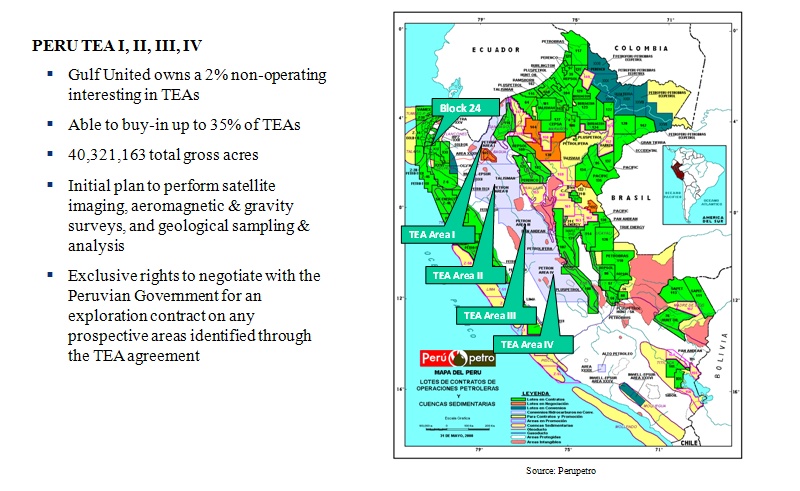

PERU TEA I, II, III, IV. *Gulf United owns a 2% non-operating interesting in TEAs*Able to buy-in up to 35% of TEAs*40,321,163 total gross acres*Initial plan to perform satellite imaging, aeromagnetic & gravity surveys, and geological sampling & analysis*Exclusive rights to negotiate with the Peruvian Government for an exploration contract on any prospective areas identified through the TEA agreement. bLOCK 24 TEA Area I TEA Area II TEA Area III TEA Area IV Peru petro Mapa Del Peru Lotes de Contratos de Operaciones Petroleras Y Cuencas Sedimentarias

Confidential

|

2011 SOURCES AND USES

|

| (in millions) | |||||||

| Sources | Uses | ||||||

| Contemplated Offering | $ | 25.0 | CPO-4: Seismic Reimbursement | $ | 4.0 | ||

| CPO-4: Drilling Costs | 8.0 | ||||||

| Z-46: Past Costs & Seismic | 2.9 | ||||||

| Repayment: Bridge Financing | 3.8 | ||||||

| Repayment: Other ST Debt | 3.4 | ||||||

| General Corporate & Working Capital | 1.0 | ||||||

| Offering Expenses | 1.9 | ||||||

| Offering Sources & Uses | $ | 25.0 | $ | 25.0 | |||

| Cash on hand | 2.5 | Debt | 2.2 | ||||

| Cashflow from CPO-4 Operations | 6.0 | General Corporate & Working Capital | 1.5 | ||||

| Block Z-46 | 4.8 | ||||||

| Total 2011 Sources & Uses | $ | 33.5 | $ | 33.5 | |||

Confidential

|

THREE YEAR DEVELOPMENT PLAN

|

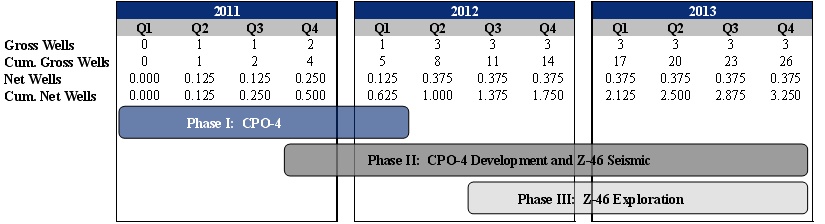

Phase I: CPO-4 Exploration

|

■

|

Maintain strategic vision by continuing partnership with SK Energy and participating in well development

|

|

■

|

SK Energy executed rig contract in January 2011

|

Phase II: CPO-4 Development and Z-46 Seismic

|

■

|

Additional 3D seismic acquisition on CPO-4 and continue development of the 26-well drilling program

|

|

■

|

Begin 3D seismic on Block Z-46

|

Phase III: Z-46 Exploration and South American Project Development

|

■

|

First Z-46 exploration well is expected to spud Q3 2012 and expand exploration program throughout South American concessions

|

Gross Wells 2011 Q1 0 Q2 1 Q3 1 Q4 2 Cum. Gross Wells 0 1 2 4 Net Wells 0.000 0.125 0.125 0.250 Cum. Net Wells 0.000 0.125 0.250 0.500 Phase I: CPO-4 2012 Q1 Q2 Q3 Q4 Gross Wells 1 3 3 3 Cum. Gross Wells 5 8 11 14 Net Wells 0.125 0.375 0.375 0.375 Cum. Net Wells 0.625 1.000 1.375 1.750 2013 Q1 Q2 Q3 Q4 Gross Wells 3 3 3 3 Cum. Gross Wells 17 20 23 26 Net Wells 0.375 0.375 0.375 0.375 Cum. Net Wells 2.125 2.500 2.875 3.250 Phase II: CPO-4 Development and Z-46 Seismic Phase III: Z-46 Exploration

Confidential