Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANCORP RHODE ISLAND INC | form8k21711.htm |

1

Sterne Agee

Financial Institutions Investor Conference

February 17, 2011

2

Certain statements contained in this presentation are “Forward Looking

Statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward Looking Statements may be identified by

the use of forward looking terminology such as “may,” “believes,”

“intends,” “expects,” and “anticipates” or similar terms or variations of

these terms. Actual results could differ materially from those set forth in

Forward Looking Statements due to a variety of factors including, without

limitation, competition, interest rate risk, credit risk, political and economic

conditions and regulatory issues. Further information on these risk

factors is included in our Annual Report on Form 10-K and other filings

with the Securities and Exchange Commission.

Statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward Looking Statements may be identified by

the use of forward looking terminology such as “may,” “believes,”

“intends,” “expects,” and “anticipates” or similar terms or variations of

these terms. Actual results could differ materially from those set forth in

Forward Looking Statements due to a variety of factors including, without

limitation, competition, interest rate risk, credit risk, political and economic

conditions and regulatory issues. Further information on these risk

factors is included in our Annual Report on Form 10-K and other filings

with the Securities and Exchange Commission.

3

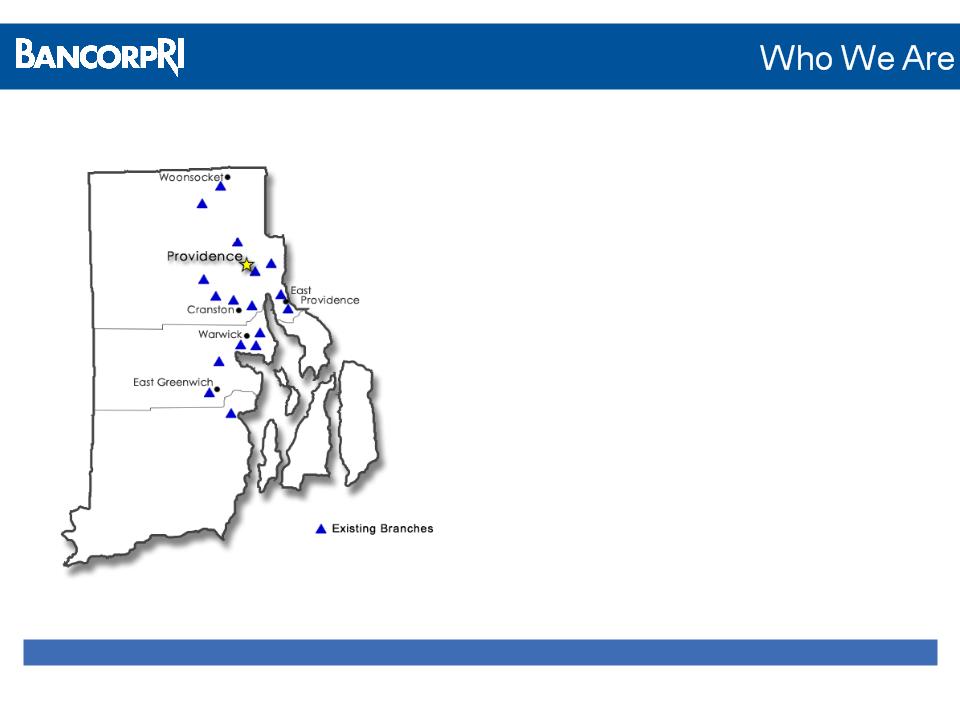

• Cities/Towns

Profile:

§ Formed in March 1996

§ $1.6 billion commercial bank

§ NASDAQ listed: BARI

§ 17 branches in Greater Providence area

§ Approximately 75% of RI’s population, jobs

and businesses are located in Greater

Providence area

4

Oct

1995

Sep

2010

2010

Agreement to

purchase RI

branches of

Shawmut

purchase RI

branches of

Shawmut

BankRI

opened

opened

Mar

1996

1996

Jun

2009

2009

May

2005

2005

Nov

2002

2002

Mar

1998

1998

Sep

2009

2009

Secondary

offering;

NASDAQ listed:

offering;

NASDAQ listed:

BARI

Reached $1.0B

in assets

in assets

Acquired

Macrolease

Listed on Russell

3000 Index

3000 Index

#1 SBA lender

in RI

#1 SBA lender

in RI

Total Assets

Total Deposits

# of Branches

# of Employees

$465 million

$421 million

12

150

$1.6 billion

$1.1 billion

17

274

Mar 1996

Dec 2010

Profitable in every year since inception

5

§ Strong financial performance in a difficult environment

§ Credit quality consistently sound

§ Capital position well above regulatory thresholds

§ Experienced management team

§ Attentive to shareholder returns

6

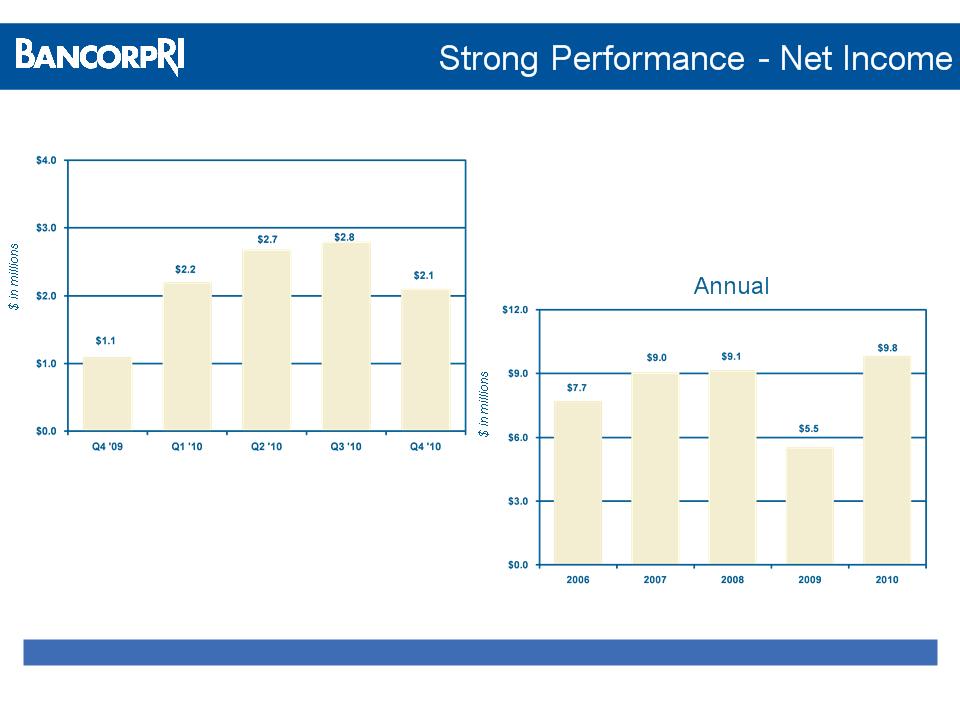

Quarterly

7

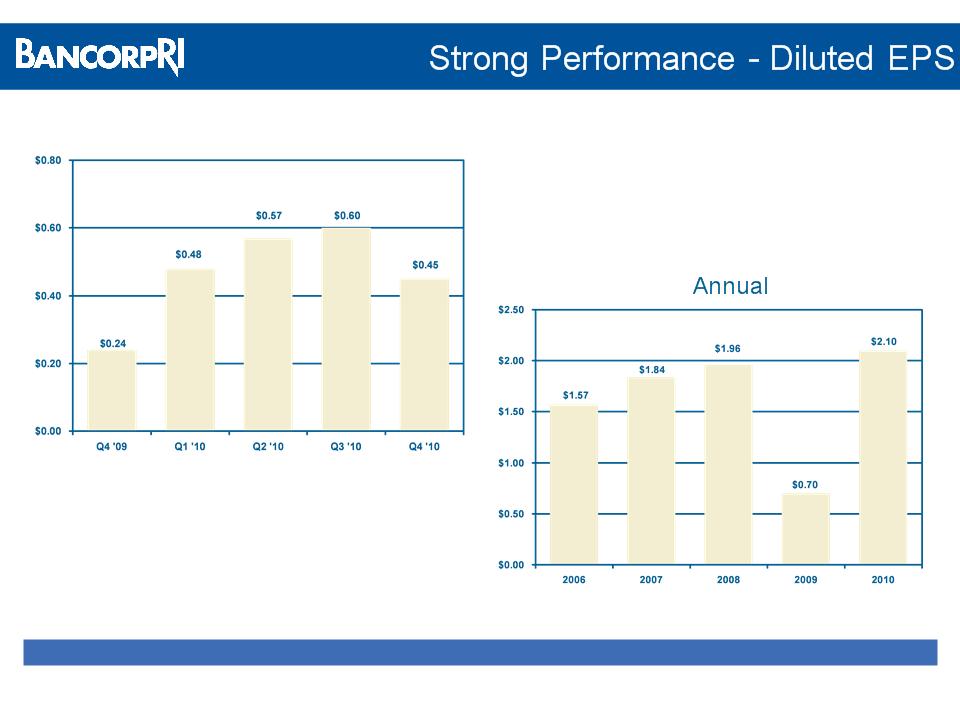

Quarterly

* Diluted EPS after preferred stock dividends and discount accretion related to TARP

*

*

8

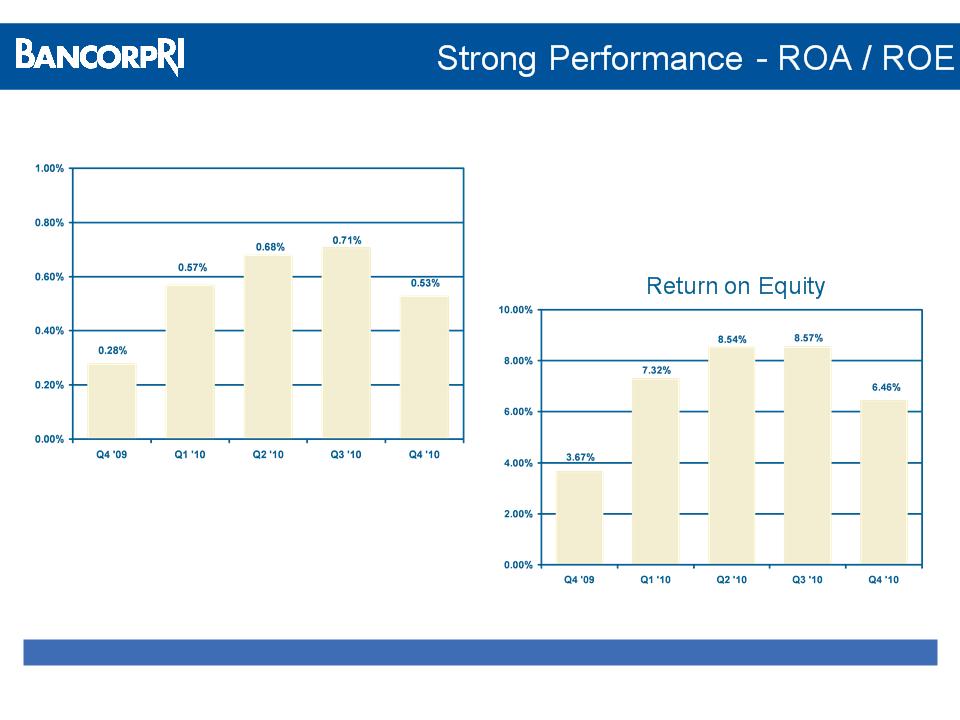

Return on Assets

9

§ Commercial loan growth

§ Low-cost core deposit growth

§ Treasury management sophistication

§ Modest credit costs

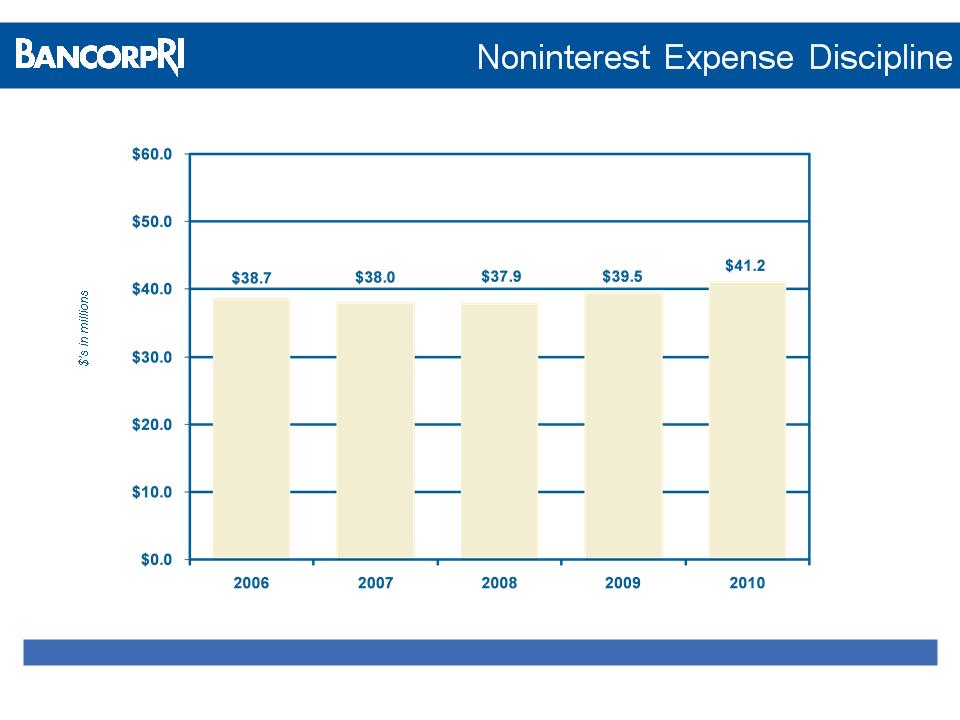

§ Disciplined expense management

10

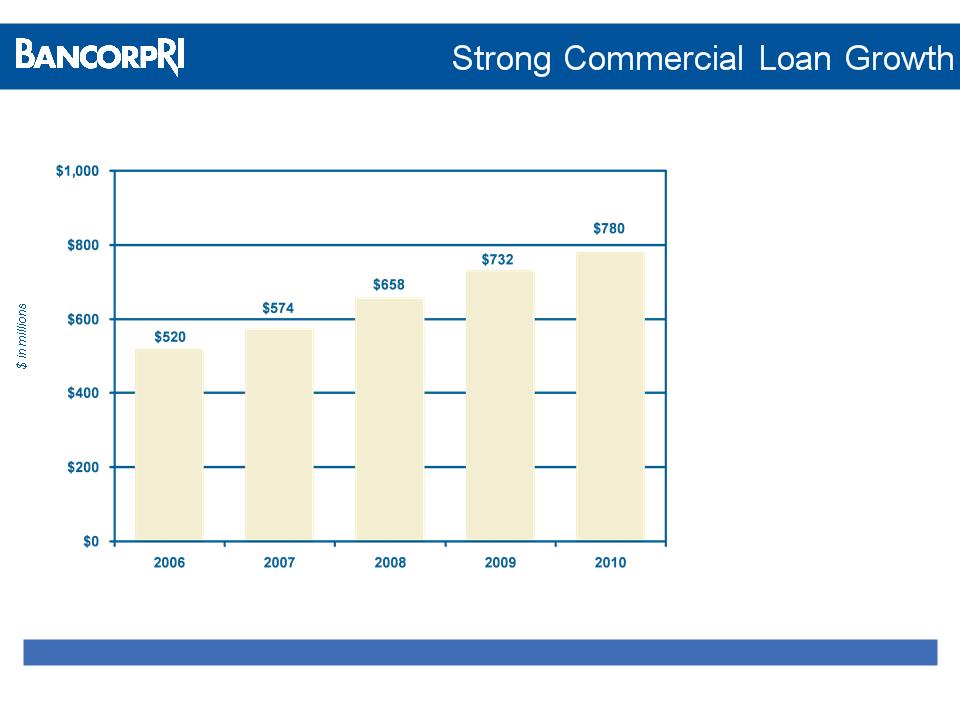

• Double digit growth from

2006 - 2009

2006 - 2009

• Drives low-cost core

deposit growth

deposit growth

• Grew from 41% of total

loans to 68% over past

10 years

loans to 68% over past

10 years

11

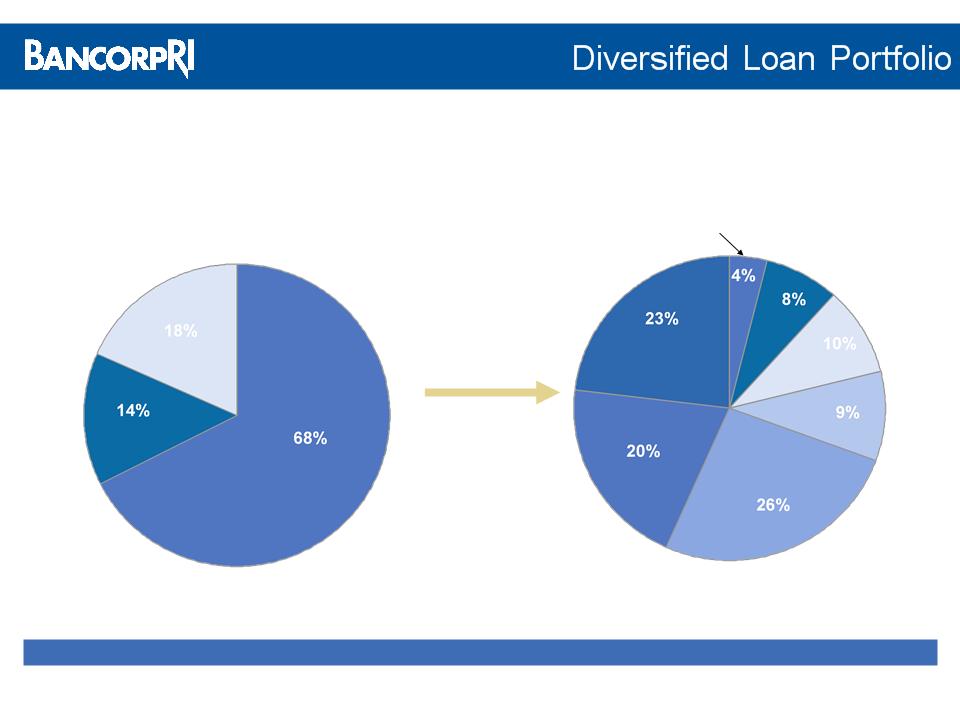

Commercial

Loans

Residential

Mortgages

Consumer/

Other

Total loan portfolio - $1.16 billion as of 12/31/10

Small

Business

Business

Commercial

and

Industrial

Construction

Lease and

Other

Other

CRE

(owner

occupied)

Multi-Family

CRE

(non-owner

occupied)

occupied)

Breakdown of Commercial

Loan Portfolio

Loan Portfolio

Total Loan Portfolio

12

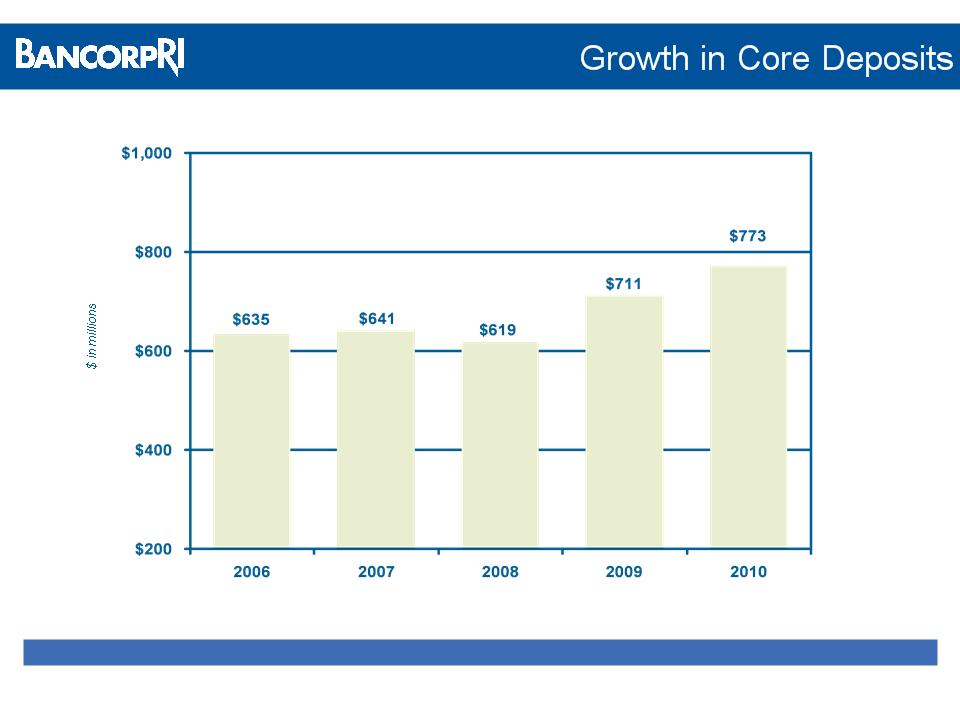

Core deposits are defined as DDA, NOW, money market and savings accounts

62% 63% 59% 65% 69%

% of

total

deposits

total

deposits

13

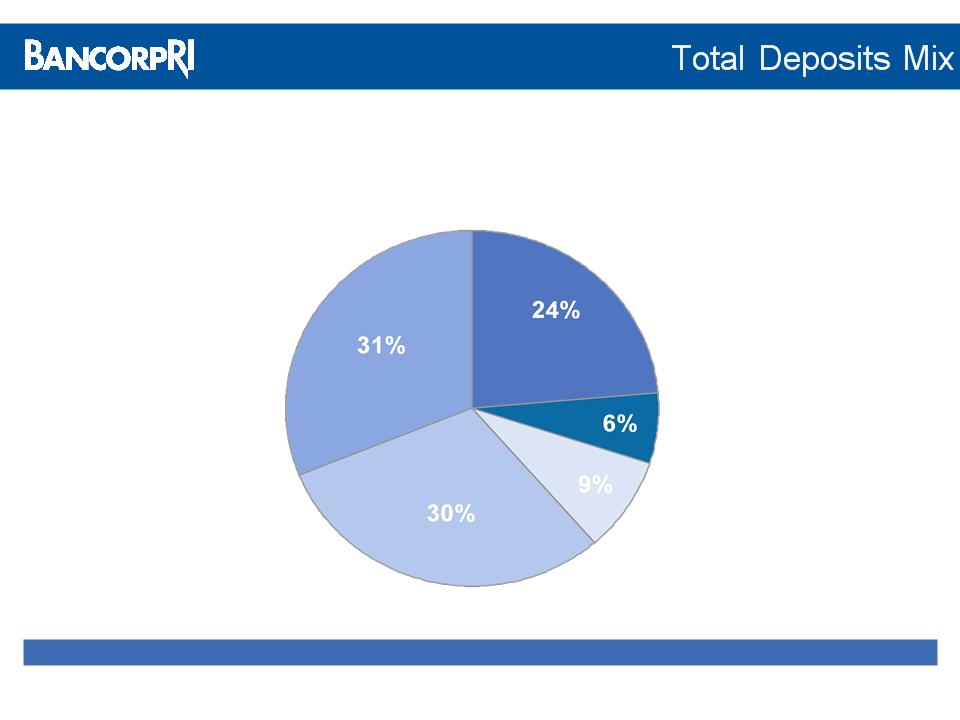

Money

Market

Certificate of

Deposits

Demand

Deposits

Core Deposits - 69% of total deposits as of 12/31/10

NOW

Savings

Total deposits - $1.12 billion as of 12/31/10

14

15

§ Conservative credit culture

§ Significant credit and credit management expertise

§ Extensive portfolio monitoring processes

§ Relatively low level of net charge-offs despite:

− Double-digit commercial loan growth

− Recessionary environment

16

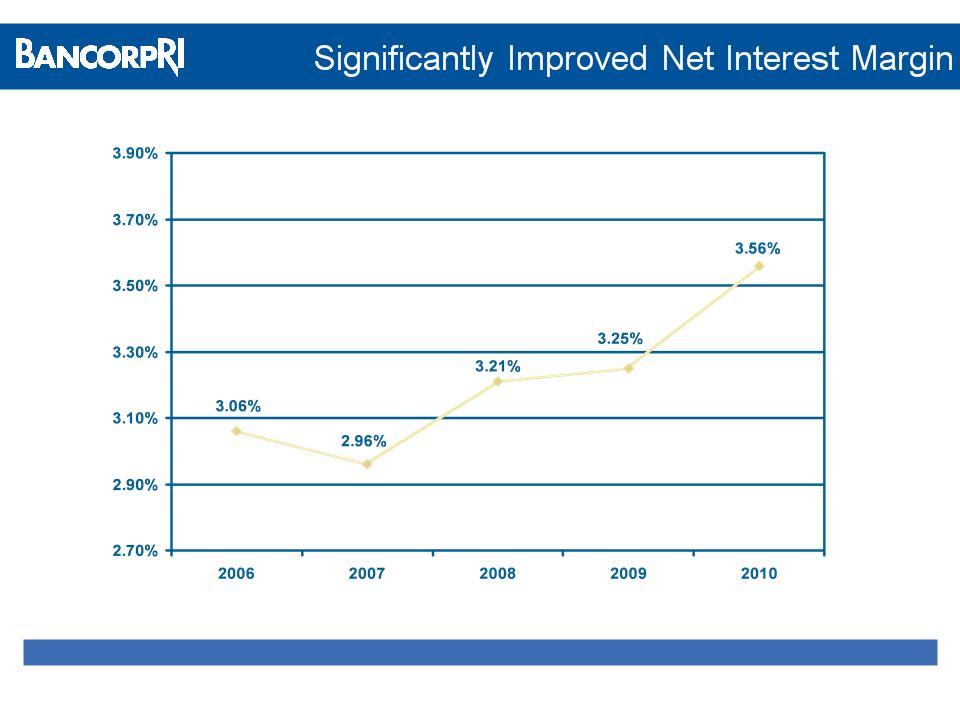

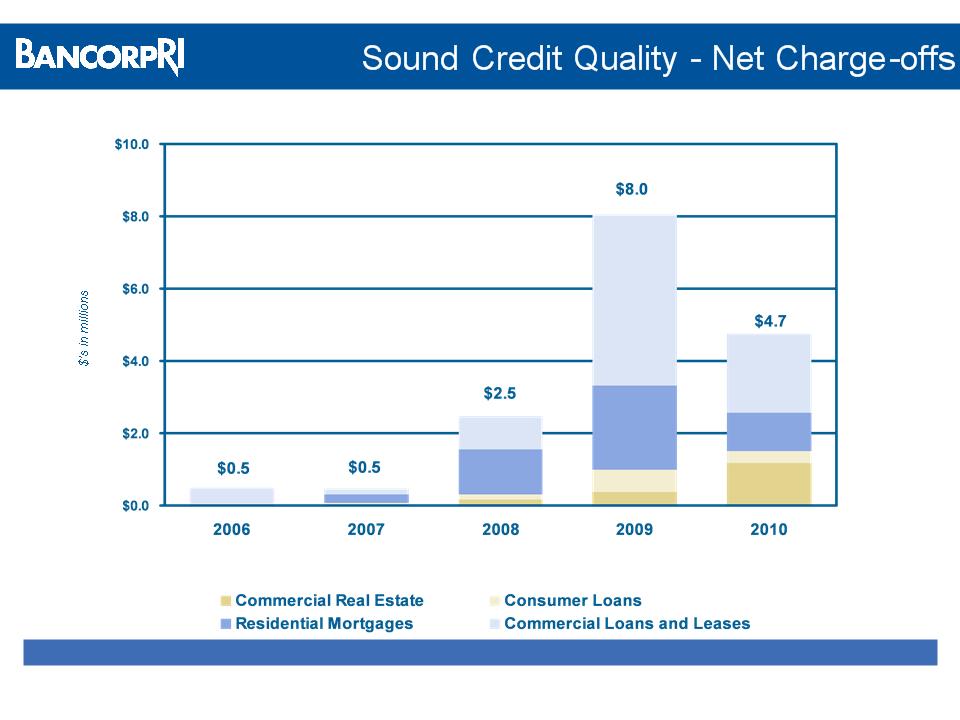

0.05% 0.05% 0.24% 0.73% 0.42%

% of avg. loans

and leases

and leases

17

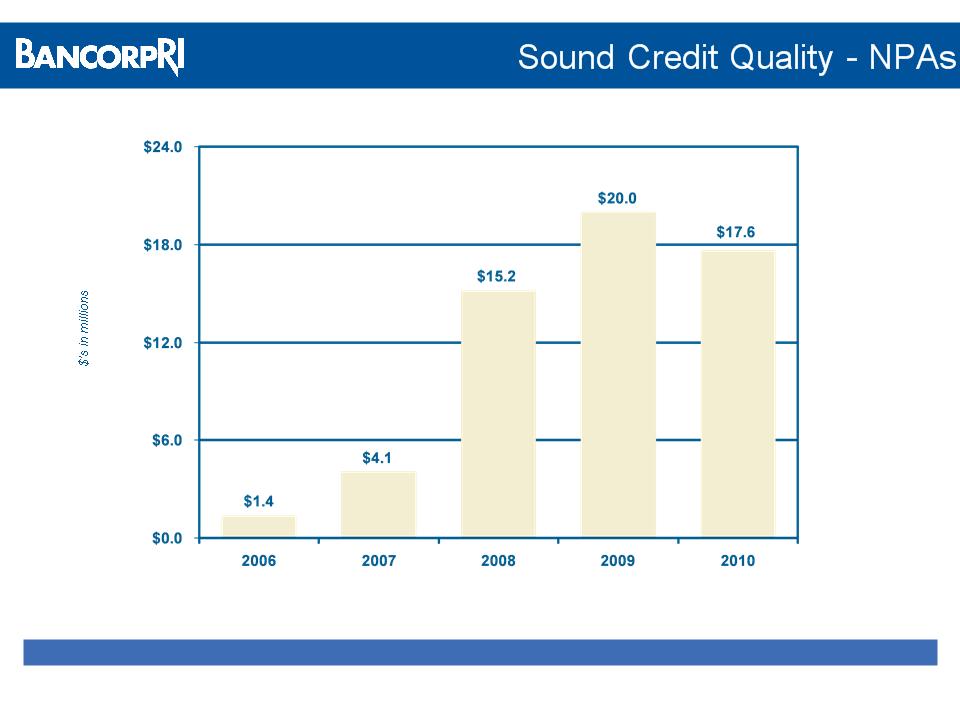

0.10% 0.28% 1.00% 1.26% 1.10%

% of

total

assets

total

assets

18

19

Capital ratios well above regulatory thresholds

As of

Tier 1 Capital Ratio

8.10%

Total Risk-Based Capital Ratio

12.53%

Tangible Common Equity Ratio

7.31%

20

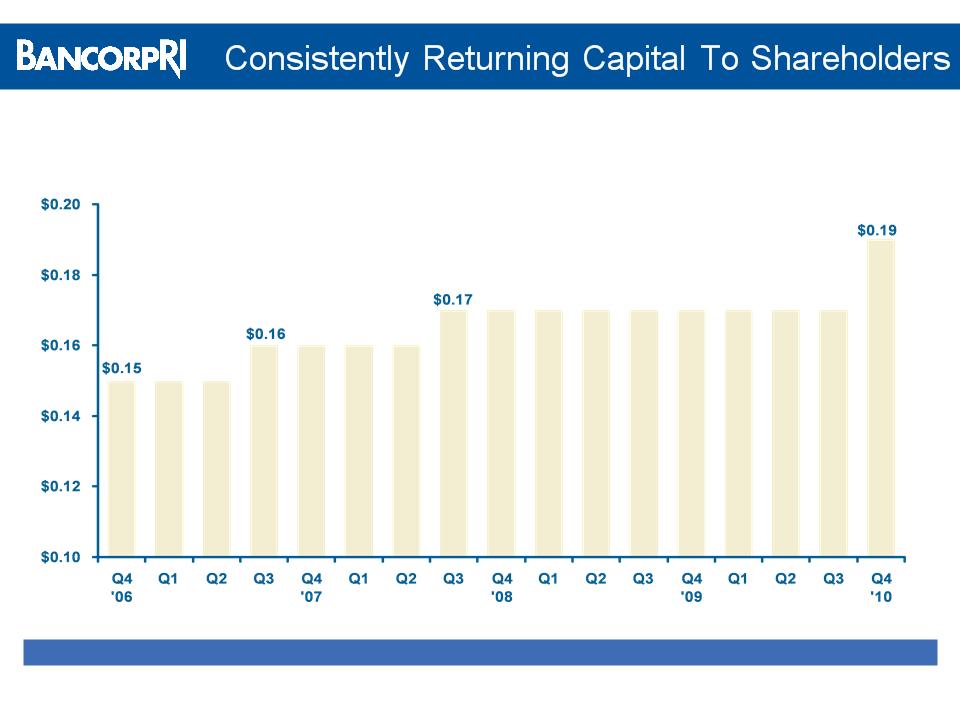

Dividend Track Record

12% increase approved in Q4 ‘10

21

§ Commercial banking is a sustainable, attractive market niche for

community banks

community banks

− Ability to differentiate from major competitors

• Responsive / accessible

• Local decision-making / policy setting

• High touch retail network with solid branch footprint

− Dense, urban market well-suited for business generation

− Generates higher yielding assets, lower cost deposits and fee

income

income

− Forms leverageable platform

22

§ Attractive franchise

− One of the few sizeable independent franchises in New England

§ Solid credit quality and capital position

§ Proven track record for delivering results

§ Strong management team

§ Positioned to grow franchise

§ Attentive to shareholder returns

§ Market Valuations (as of 1/31/11)

− 121% of tangible book value

− 14.3x of earnings (TTM)

23

NASDAQ: BARI