Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mueller Water Products, Inc. | d8k.htm |

1

Gabelli

& Company

21

st

Annual Pump, Valve and Motor

Symposium

February 17, 2011

Exhibit 99.1 |

2

Safe Harbor Statement

Safe Harbor Statement

This presentation contains certain statements that may be deemed

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements that address activities, events

or developments that the Company intends, expects, plans, projects, believes or

anticipates will or may occur in the future are forward-looking

statements. Examples of forward-looking statements include, but are not

limited to, statements the Company makes regarding general economic conditions,

spending by municipalities, the outlook for the residential and

non-residential construction markets, improvements related to capacity

utilization, the recovery, if any, of the Company’s end markets, and the potential effect

of the refinancing on the Company’s operations, and the impact of these factors on

the Company’s businesses. Forward-looking statements are based on

certain assumptions and assessments made by the Company in light of its

experience and perception of historical trends, current conditions and expected future

developments. Actual results and the timing of events may differ materially from

those contemplated by the forward-looking statements due to a number of

factors, including regional, national or global political, economic, business,

competitive, market and regulatory conditions and the following: •

the spending level for water and wastewater infrastructure;

•

the demand level of manufacturing and construction activity;

•

the Company’s ability to service its debt obligations; and

•

the other factors that are described in the section entitled “RISK FACTORS”

in Item 1A of our Annual Report on Form 10-K.

Undue reliance should not be placed on any forward-looking statements. The Company

does not have any intention or obligation to update forward-looking

statements, except as required by law. |

3

Non-GAAP Financial Measures

Non-GAAP Financial Measures

The Company presents adjusted income (loss) from operations, adjusted EBITDA, adjusted

net income (loss), adjusted net income (loss) per share, free cash flow and net

debt as non-GAAP measures. Adjusted income (loss) from operations

represents income (loss) from operations excluding impairment and restructuring.

Adjusted EBITDA represents income (loss) from operations excluding impairment,

restructuring, depreciation and amortization. The Company presents adjusted

EBITDA because it is a measure of performance management and believes it is

frequently used by securities analysts, investors and interested parties in the

evaluation of financial performance. Adjusted net income (loss) and adjusted net

income (loss) per share exclude impairment, restructuring, loss on early

extinguishment of debt, certain costs to settle interest rate swap contracts,

the tax on the repatriation of earnings from Canada and the income tax effects of the

previously mentioned items. These items are excluded because they are not

considered indicative of recurring operations. Free cash flow represents

cash flows from operating activities, less capital expenditures. It is presented

as a measurement of cash flow because it is commonly used by the investment

community. Net debt represents total debt less cash and cash equivalents. Net

debt is commonly used by the investment community as a measure of

indebtedness. Adjusted income (loss) from operations, adjusted EBITDA,

adjusted net income (loss), adjusted net income (loss) per share, free cash flow and net debt have

limitations as analytical tools, and investors should not consider any of these

non-GAAP measures in isolation or as a substitute for analysis of the

Company's results as reported under accounting principles generally accepted in

the United States ("GAAP"). A reconciliation of non-GAAP to GAAP results is included as an attachment to this

presentation and has been posted online at www.muellerwaterproducts.com.

|

4

Leading North American provider of water

infrastructure and flow control products

and services

Investment Highlights

Leading brands in water infrastructure

Leveraging brands to expand smart water

infrastructure offering for diagnostic and data

management

Low-cost manufacturing processes

Increasing investment needed in water

infrastructure industry

One of the largest installed bases in the U.S. |

5

Our Business

•

$1.3B LTM net sales (as of December 31, 2010)

•

Portfolio includes:

•

Fire hydrants

•

Valves

•

Pipe fittings

•

Ductile iron pipe

•

Metering systems

•

Leak detection

•

Specified in 100 largest U.S. metropolitan markets

(1)

•

More than 75% of FY2010 net sales from products

with #1 or #2 position

The largest publicly traded water infrastructure company in the United States

FY2010 Primary End Markets

(2)

Net Sales $1.3B

(1) Valves or hydrants

(2) Based on management estimates

* Residential construction systems driven primarily by new community development

|

6

Ductile Iron

Pipe

Restrained Pipe

Joint

Joint

Restraints Joint Fittings

Broad Product Portfolio

$609

$74

$49

$123

SEGMENT NET SALES

PRODUCT

PORTFOLIO

ADJUSTED OPERATING

INCOME (LOSS)

(1)

$373

($51)

$19

($32)

$330

$25

$15

$40

Iron Gate

Valves

Butterfly, Ball

and Plug Valves

Fittings &

Couplings

Cast Iron

Fittings

Hangers &

Supports

Metering

Systems

Pipe Nipples

Hydrants

DEPRECIATION AND

AMORTIZATION

(2)

Est. 1857

Est. 1899

Est. 1999 (1850)

HISTORICAL ROOTS

ADJUSTED EBITDA

(1) (2)

($ in millions)

Note: All statistics are actuals for LTM ended December 31, 2010

(1) Segment operating income (loss) excludes corporate expenses of $34.2mm. Mueller Co.

excludes $0.4mm of restructuring. U.S. Pipe excludes $13.1mm of restructuring. Anvil excludes $1.1mm of restructuring.

(2) Segment depreciation and amortization excludes corporate depreciation of $0.6mm.

|

7

Complete Water Transmission Solutions

Mueller Water Products

manufactures and

markets products and

services that are used in

the transmission,

distribution and

monitoring of safe, clean

drinking water and in

water treatment

facilities. |

8 |

9

Strategy And Objectives

Capitalize on the large,

attractive and growing

water infrastructure

markets worldwide

Maintain leadership positions with

customers and end users

Broaden breadth and depth of

products and services

Continue to enhance operational

and organizational excellence

Expand internationally |

10

Our End Markets |

11

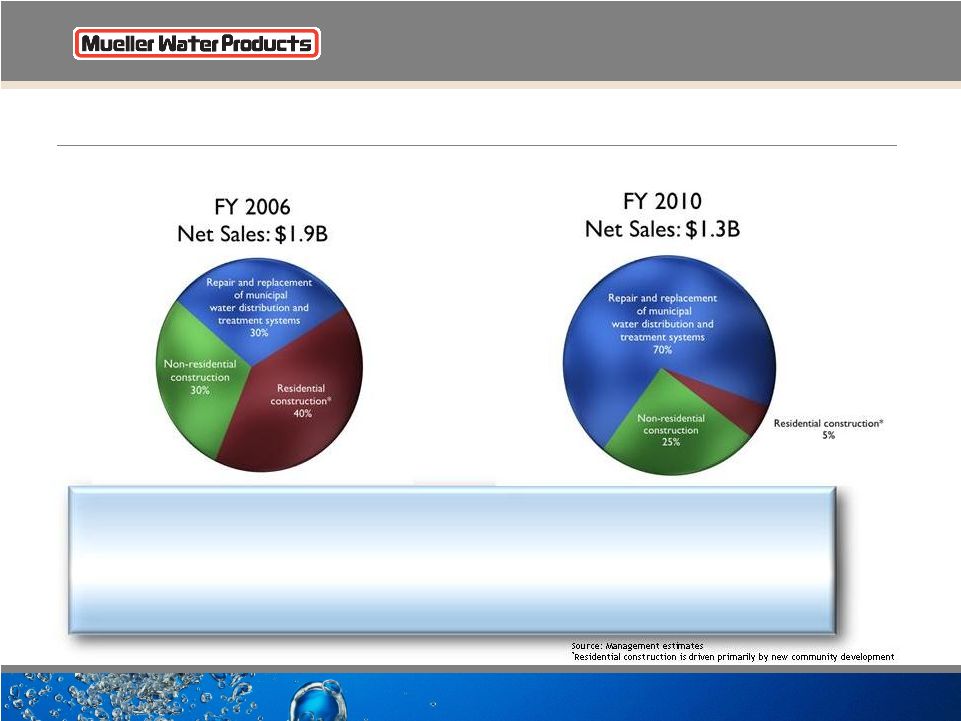

Primary End Markets: 2006-2010

Since 2006, our exposure to the residential construction

market has declined from roughly 40% to 5%. |

12

Historical Housing Starts |

13

Non-Residential Construction |

11

A Significant Market

Opportunity |

15

Aging Water Infrastructure

“America’s drinking water systems

face an annual shortfall of at

least $11 billion

to replace aging

facilities that are near the end of

their useful lives and to comply

with existing and future federal

water regulations. This does not

account for growth in the demand

for drinking water over the next

20 years.”

2009 Report Card for America’s Infrastructure

American Society of Civil Engineers (ASCE) |

16

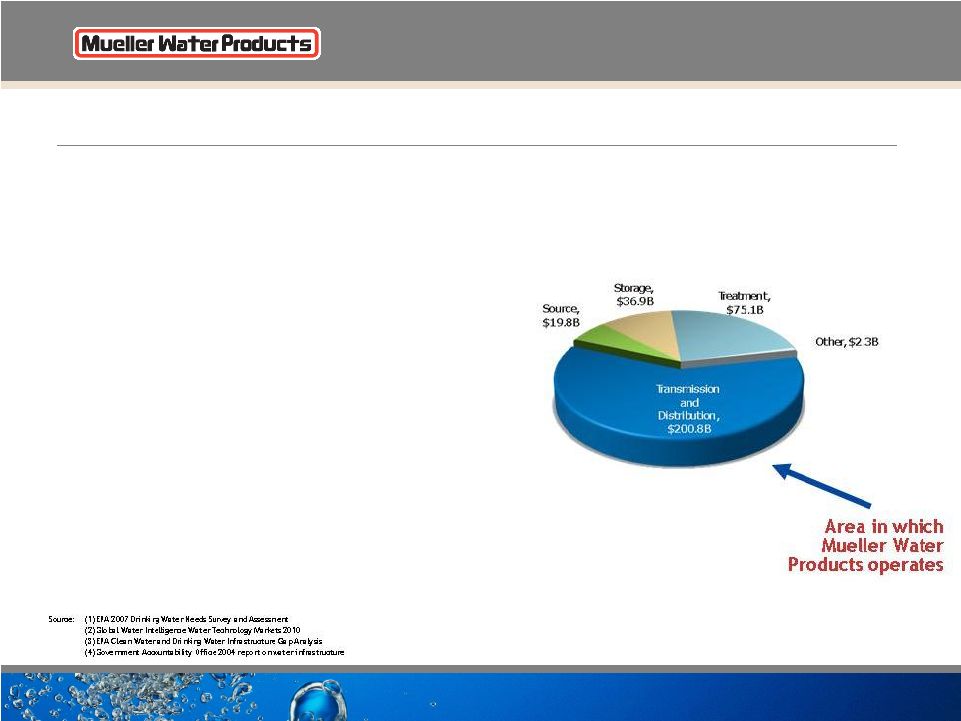

The Market Opportunity Is Significant And Growing

Repair and Replacement Market

•

Aging water pipes need to be repaired/

replaced

•

Valves and hydrants typically replaced at

same time as pipes

•

Up to 15% -

30% of treated potable water lost

in leaky pipes

(2)

•

Emphasis on improving operational

efficiencies

Funding and Spending

•

90% funded at local level

(3)

•

29% of water systems charge less than cost

(4)

Future Drinking Water

Infrastructure Expenditure Needs

(1)

20-YR Need for

Water Infrastructure = $335B |

17

Aging

Water Infrastructure |

18

Increasing Federal Awareness of Funding Needs

•

At least 40 cities under consent decrees

—

Atlanta $4.0B

—

Washington, D.C. $2.6B

—

Baltimore City and county $1.7B

—

Kansas City $2.5B

—

Cincinnati $1.5B

•

1974/1996 Safe Drinking Water Act

•

2011 proposed federal budget

—

$1.3B for Drinking Water State

Revolving Funding (SRF)

Stronger EPA regulations should lead to increased investment

“New Jersey can maintain

a viable economy with a

sound environment only if

it ensures that its water

supply, wastewater and

stormwater

infrastructure

is effectively maintained in

a manner that produces

the lowest life-cycle cost.”

The Clean Water Council of

New Jersey -

October 2010 |

19

Funding Water Infrastructure Repair

Sources of Funding

Water Infrastructure

Repair

(2)

Historical Water

Rates Compared to

Other Utilities

(1) |

11

Actions & Business

Results |

21

Management Actions/Initiatives

Objectives

Actions

Reduce costs and improve

operating leverage

•Closed six plants since FY2006

•Sold two non-core assets of Anvil

•Reduced headcount by about 24% from September 30, 2008 to December 31,

2010 from approximately 6,300 to approximately 4,800

•Took actions to lower labor costs

•Implemented Lean Six Sigma and other manufacturing improvements

(continuous improvement)

•Invested in new automated ductile iron pipe operation to lower costs

•Consolidated distribution centers and smaller manufacturing facilities at

Anvil Manage working capital and

capital expenditures to generate

free cash flow

•Capital spending decreased from FY2007/FY2008 levels

•FY2009 capital spending of $39.7 million; FY2010 capital spending of $32.8

million •Reduced inventory by $116.6 million in FY2009; $74.4 million

reduction in FY2010 •Reduced debt by $403 million from September 30, 2008

through December 31, 2010 •Inventory turns have improved about a full turn

at the end of December 2010 from

December 2009

Leverage Mueller brands to

pursue strategic growth

opportunities

•Acquired and invested in AMI technology

•Acquired leak detection and pipe condition assessment business

•Established first AMI wireless mesh agreement for water industry

•Entered

into

advanced

metering

agreement

with

Landis+Gyr

for

electric

meters |

22

History of Strong Financial Performance

(see appendices for GAAP reconciliation) |

Consolidated Non-GAAP Results

$ in millions (except per share amounts)

2011

2010

Net sales

$287.6

$313.1

Adj. income (loss) from operations

($2.4)

$0.7

Adj. operating income (loss) % of net sales

(0.8%)

0.2%

Adj. net loss per share

($0.06)

($0.07)

Adj. EBITDA

$17.7

$21.5

Adj. EBITDA % of net sales

6.2%

6.9%

First Quarter Fiscal

•

Financial results at both U.S. Pipe and Anvil improved year-over-year

•

Mueller Co. shipment volumes declined due to higher distributor inventory levels coming

into the quarter as well as uncertainty in the municipal market

•

Plant closure, manufacturing and other cost savings benefitted U.S. Pipe

•

Higher sales prices benefitted all three business segments; offset increased raw

material costs FY 1Q11 results exclude restructuring $1.9 million, $1.2 million net of tax; and

interest rate swap costs of $1.9 million, $1.2 million net of tax. FY 1Q10 results exclude

restructuring $0.4 million, $0.2 million net of tax. 23 |

24

Refinancing Highlights

•

Recapitalization provides a long-term capital

structure

•

Extended maturities with no significant required

principal payments before 2015

•

Locked in long-term capital at attractive rates

•

Preserved deleveraging capability

•

Expect greater operational flexibility

•

Eliminated financial maintenance covenants with

excess availability at the greater of $34 million or

12.5% of facility amount

•

More than $123 million of excess availability at

December 31, 2010

•

Reduced limitations on business operations

including acquisitions, investments, restricted

payments and divestitures

New structure:

•

$420 million 7.375% Senior Subordinated Notes due

2017

•

$225 million 8.75

% Senior Unsecured Notes due

2020

•

$275 million ABL Revolver Credit Facility due 2015 |

25

Key Financial Metrics

$37

$115

$94

$91

$30

$0

$20

$40

$60

$80

$100

$120

$140

FY2006

FY2007*

FY2008

FY2009**

FY2010***

Free Cash Flow

($ in millions)

$1,549

$1,127

$1,101

$1,096

$740

$692

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

Mar-2006

FY2006

FY2007*

FY2008

FY2009

FY2010

Total Debt

($ in millions)

$71

$88

$88

$40

$33

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

FY2006

FY2007

FY2008

FY2009

FY2010

Capital Expenditures

($ in millions)

* FY2007 results exclude $48.1 million of debt restructuring activities

** FY2009 results include $6.3 million of cash used to settle certain interest rate

swap contracts. *** FY2010 results include $18.3 million of cash used to

settle certain interest rate swap contracts. $73 million free cash flow average

over last five years Debt has declined $857 million from 2006

|

26

Why Invest in MWA? |

7

Supplemental Data |

28

Segment Results and Reconciliation of Non-GAAP to GAAP

Performance Measures

(in millions, except per share amounts)

Three months ended December 31, 2010

Mueller Co.

U.S. Pipe

Anvil

Corporate

Total

GAAP results:

Net sales

129.8

$

74.4

$

83.4

$

-

$

287.6

$

Gross profit (loss)

29.2

$

(2.4)

$

22.4

$

0.4

$

49.6

$

Selling, general and administrative expenses

20.4

7.0

15.9

8.7

52.0

Restructuring

0.4

0.9

0.6

-

1.9

Income (loss) from operations

8.4

$

(10.3)

$

5.9

$

(8.3)

$

(4.3)

Interest expense, net

15.9

Income tax benefit

(8.1)

Net loss

(12.1)

$

Net loss per diluted share

(0.08)

$

Capital expenditures

3.2

$

1.4

$

1.4

$

0.4

$

6.4

$

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations

8.4

$

(10.3)

$

5.9

$

(8.3)

$

(4.3)

$

Impairment

-

-

-

-

-

Restructuring

0.4

0.9

0.6

-

1.9

Adjusted income (loss) from operations

8.8

(9.4)

6.5

(8.3)

(2.4)

Depreciation and amortization

11.7

4.5

3.7

0.2

20.1

Adjusted EBITDA

20.5

$

(4.9)

$

10.2

$

(8.1)

$

17.7

$

Adjusted net loss:

Net loss

(12.1)

$

Interest rate swap settlement costs, net of tax

1.2

Restructuring, net of tax

1.2

Adjusted net loss

(9.7)

$

Adjusted net loss per diluted share

(0.06)

$

Free cash flow:

Net cash provided by operating activities

5.2

$

Capital expenditures

(6.4)

Free cash flow

(1.2)

$

Net debt (end of period):

Current portion of long-term debt

0.8

$

Long-term debt

691.7

Total debt

692.5

Less cash and cash equivalents

(71.9)

Net debt

620.6

$

|

29

Segment Results and Reconciliation of Non-GAAP to GAAP

Performance Measures

(in millions, except per share amounts)

Three months ended December 31, 2009

Mueller Co.

U.S. Pipe

Anvil

Corporate

Total

GAAP results:

Net sales

133.3

$

79.7

$

100.1

$

-

$

313.1

$

Gross profit (loss)

36.9

$

(4.0)

$

23.0

$

-

$

55.9

$

Selling, general and administrative expenses

20.9

7.9

18.5

7.9

55.2

Restructuring

0.1

0.3

-

-

0.4

Income (loss) from operations

15.9

$

(12.2)

$

4.5

$

(7.9)

$

0.3

Interest expense, net

16.8

Income tax benefit

(5.8)

Net loss

(10.7)

$

Net loss per diluted share

(0.07)

$

Capital expenditures

3.7

$

4.0

$

1.0

$

-

$

8.7

$

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations

15.9

$

(12.2)

$

4.5

$

(7.9)

$

0.3

$

Restructuring

0.1

0.3

-

-

0.4

Adjusted income (loss) from operations

16.0

(11.9)

4.5

(7.9)

0.7

Depreciation and amortization

12.4

4.4

3.9

0.1

20.8

Adjusted EBITDA

28.4

$

(7.5)

$

8.4

$

(7.8)

$

21.5

$

Adjusted net loss:

Net loss

(10.7)

$

Restructuring, net of tax

0.2

Adjusted net loss

(10.5)

$

Adjusted net loss per diluted share

(0.07)

$

Free cash flow:

Net cash provided by operating activities

60.1

$

Capital expenditures

(8.7)

Free cash flow

51.4

$

Net debt (end of period):

Current portion of long-term debt

11.7

$

Long-term debt

725.7

Total debt

737.4

Less cash and cash equivalents

(124.0)

Net debt

613.4

$

|

30

Segment Results and Reconciliation of Non-GAAP to GAAP

Performance Measures

(in millions, except per share amounts)

Year ended September 30, 2010

Mueller Co.

U.S. Pipe

Anvil

Corporate

Total

GAAP results:

Net sales

612.8

$

377.8

$

346.9

$

-

$

1,337.5

$

Gross profit (loss)

170.3

$

(22.7)

$

88.8

$

-

$

236.4

$

Selling, general and administrative expenses

89.2

30.5

66.2

33.4

219.3

Restructuring

0.1

12.5

0.5

-

13.1

Income (loss) from operations

81.0

$

(65.7)

$

22.1

$

(33.4)

$

4.0

Interest expense, net

68.0

Loss on early extinguishment of debt

4.6

Income tax benefit

(23.4)

Net loss

(45.2)

$

Net loss per diluted share

(0.29)

$

Capital expenditures

15.6

$

11.0

$

6.0

$

0.2

$

32.8

$

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations

81.0

$

(65.7)

$

22.1

$

(33.4)

$

4.0

$

Restructuring

0.1

12.5

0.5

-

13.1

Adjusted income (loss) from operations

81.1

(53.2)

22.6

(33.4)

17.1

Depreciation and amortization

49.7

18.9

15.4

0.6

84.6

Adjusted EBITDA

130.8

$

(34.3)

$

38.0

$

(32.8)

$

101.7

$

Adjusted net loss:

Net loss

(45.2)

$

Restructuring, net of tax

7.9

Interest rate swap settlement costs, net of tax

4.8

Loss on early extinguishment of debt, net of tax

2.8

Tax on repatriation on Canadian earnings

2.2

Adjusted net loss

(27.5)

$

Adjusted net loss per diluted share

(0.18)

$

Free cash flow:

Net cash provided by operating activities

63.0

$

Capital expenditures

(32.8)

Free cash flow

30.2

$

Net debt (end of period):

Current portion of long-term debt

0.7

$

Long-term debt

691.5

Total debt

692.2

Less cash and cash equivalents

(83.7)

Net debt

608.5

$

|

31

Segment Results and Reconciliation of Non-GAAP to GAAP

Performance Measures

(in millions, except per share amounts)

Year ended September 30, 2009

Mueller Co.

U.S. Pipe

Anvil

Corporate

Total

GAAP results:

Net sales

547.1

$

410.9

$

469.9

$

-

$

1,427.9

$

Gross profit (loss)

134.3

$

(5.7)

$

128.2

$

0.1

$

256.9

$

Selling, general and administrative expenses

84.2

35.6

84.9

34.4

239.1

Impairment and restructuring

820.7

101.1

96.7

0.2

1,018.7

Loss from operations

(770.6)

$

(142.4)

$

(53.4)

$

(34.5)

$

(1,000.9)

Interest expense, net

78.3

Loss on early extinguishment of debt

3.8

Income tax benefit

(86.3)

Net loss

(996.7)

$

Net loss per diluted share

(8.55)

$

Capital expenditures

16.2

$

11.2

$

11.9

$

0.4

$

39.7

$

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Loss from operations

(770.6)

$

(142.4)

$

(53.4)

$

(34.5)

$

(1,000.9)

$

Impairment and restructuring

820.7

101.1

96.7

0.2

1,018.7

Adjusted income (loss) from operations

50.1

(41.3)

43.3

(34.3)

17.8

Depreciation and amortization

50.9

21.1

17.6

0.6

90.2

Adjusted EBITDA

101.0

$

(20.2)

$

60.9

$

(33.7)

$

108.0

$

Adjusted net loss

Net loss

(996.7)

$

Impairment and restructuring, net of tax

954.9

Interest rate swap settlement costs, net of tax

3.8

Loss on early extinguishment of debt, net of tax

2.3

Adjusted net loss

(35.7)

$

Adjusted net loss per diluted share

(0.31)

$

Free cash flow:

Net cash provided by operating activities

130.5

$

Capital expenditures

(39.7)

Free cash flow

90.8

$

Net debt (end of period):

Current portion of long-term debt

11.7

$

Long-term debt

728.5

Total debt

740.2

Less cash and cash equivalents

(61.5)

Net debt

678.7

$

|

12

Questions |