Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SP Bancorp, Inc. | d8k.htm |

2010

4

TH

QUARTER

RESULTS

FEBRUARY 14, 2011

Jeff Weaver –

President and CEO

Suzy Salls

–

Senior Vice President and CFO |

2

2

Safe Harbor Statement

2

When used in filings by SP Bancorp, Inc. (the “Company”) with the

Securities and Exchange Commission (the “SEC”), in the

Company’s press releases or other public or shareholder communications, and in oral

statements made with the approval of an authorized executive officer, the

words or phrases “will likely result,” “are expected

to,” “will continue,” “is anticipated,” “estimate,” “project,” “intends” or similar

expressions are intended to identify “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of

1995. Such statements are subject to certain risks and uncertainties,

including, among other things, changes in economic conditions, legislative

changes, changes in policies by regulatory agencies, fluctuations in

interest rates, the risks of lending and investing activities, including

changes in the level and direction of loan delinquencies and write-offs and changes in

estimates of the adequacy of the allowance for loan losses, the Company’s

ability to access cost-effective funding, fluctuations in real estate

values and both residential and commercial real estate market conditions,

demand for loans and deposits in the Company’s market area, competition, changes in

management’s business strategies and other factors, that could cause actual

results to differ materially from historical earnings and those presently

anticipated or projected. The Company wishes to advise readers that the

factors listed above could materially affect the Company’s financial performance and

could cause the Company’s actual results for future periods to differ

materially from any opinions or statements expressed with respect to

future periods in any current statements. The Company does not undertake –and specifically declines any obligation

–to publicly release the result of any revisions which may be made to

any forward-looking statements to reflect events or circumstances

after the date of such statements or to reflect the occurrence of anticipated or

unanticipated events. |

3

3

SPBC At A Glance

Publicly traded Savings Bank Holding Company

SharePlus Federal Bank

www.shareplus.com

$238.8 million in total assets

Headquartered in Plano, Texas

4 Locations in North Texas,

2 in Louisville, Ky. and 1 in Irvine, Ca.

1.725 million shares outstanding

12% Insider/ESOP Ownership

Price to Book Ratio of 50.4% at 12/31/10

3 |

4

4

History

Founded in 1958 as Frito Employees Federal Credit Union

As a credit union, SharePlus

eventually served the

employees of Frito-Lay, PepsiCo, YUM! Brands, as well as

employees of dozens of other companies.

Converted to Mutual Savings Bank in October 2004

Completed conversion and IPO in October 2010

Traded on NASDAQ for the first time on November 1

st

Community bank with Commercial, Mortgage, and

Consumer Banking businesses

4 |

5

5

Management Overview

Jeffrey Weaver –

President and CEO

Suzanne Salls –

SVP and CFO

Jerald Sanders –

SVP Commercial Lending

Gaye Rowland –

SVP Mortgage Lending

Each with over 25 years experience in the Southwest with

national, regional, and local banks

5 |

6

6

Simple and Focused Strategy

North Texas Community Bank focused on Mortgage,

Commercial, and Consumer banking and providing:

•

Customers

-

Broad array of products at competitive rates with

outstanding personalized service

•

Investors

–

Provide long term shareholder value

•

Community

-

Good corporate citizen

Out national the locals and out local the nationals with

High Tech/High Touch delivery

We build relationships by providing exceptional service

through consistent execution

6 |

7

7

Our Business Model

Comprehensive community banking services seamlessly

delivered through three integrated operating strategies:

Commercial –

focused on relationships with local small to medium

sized businesses.

Mortgage

–

Service leadership distinguishes the bank and provides fee

income and quality earning assets

Consumer Banking

–

Focused on service and value propositions that

drive low cost funding for the bank

7 |

8

Dallas Ft. Worth Market Overview

The twelve county region is the nation's fourth most

populous metro area.

Continued in-migration of over 140,000 in 2009

6.2 million current area population expected to grow to 6.8

million by 2015 and 7.3 million by 2020*

Increased 35,600 jobs YTD through November 2010

Unemployment rate 8.6%

The Dallas-Fort Worth region’s high quality of life

and low cost of living serve as catalysts to continued

economic growth

*Source: Texas State Data Center Projections

8 |

9

9

Strategic Priorities

Grow interest earning assets with specific emphasis

on business banking growth

Grow non-interest income across all business lines

Leverage expenses to drive efficiency ratios toward

industry norms

Maintain service excellence through growth cycles

Mitigate credit risk and expedite problem asset

resolution

9 |

10

10

Commercial Banking Overview

Delivers a full array of commercial services to a

diversified group of companies with revenues of $1 -

$30 million

Primarily in the DFW Metroplex

Start Up business line in 2007

$31.8 million in loans outstanding as of 12/31/10

CRE, Retail, Office, Medical, C & I

10 |

11

11

Retail Lending Overview

Key Value Proposition

Superior service quality with Relationship pricing

Multiple wholesale and retail business sources

Distribution

7 retail branches, Customer Care Center, Internet, select

wholesale brokers

Key Products

Mortgages, Home Equity, Auto and Overdraft LOCs

11 |

12

12

Retail Lending Overview, Contd.

$164.3 million outstanding at year end

$154 million of 1 –

4 family real estate

First and second liens, Home Equity, Home Improvement

$10.3 million of consumer loans

Auto, unsecured, OD protection LOC

12 |

13

13

Consumer Banking

7 locations, Website, Customer Care Center, 8 ATMs

Serving over 18,000 personal and small business

accounts

$188 million in deposits

30% checking, 37% savings and MMDA, 33% CDs

$.613 million brokered CDARs -

customer accommodation only

$24 million assets under management through

SharePlus Financial Services*

*Offered through relationship with UVEST Financial Services

13 |

14

14

Consumer Banking Overview

Implemented In 2010

On the Horizon

Concierge Branch Concept

Website Redesign

Full Function Image ATM

Mobile banking

Business Remote Deposit Capture

Consumer RDC

Enhanced Mystery Shop Program

Social Media

Balance Alerts

Online Banking and Bill Pay Upgrade

Transaction Alerts

14 |

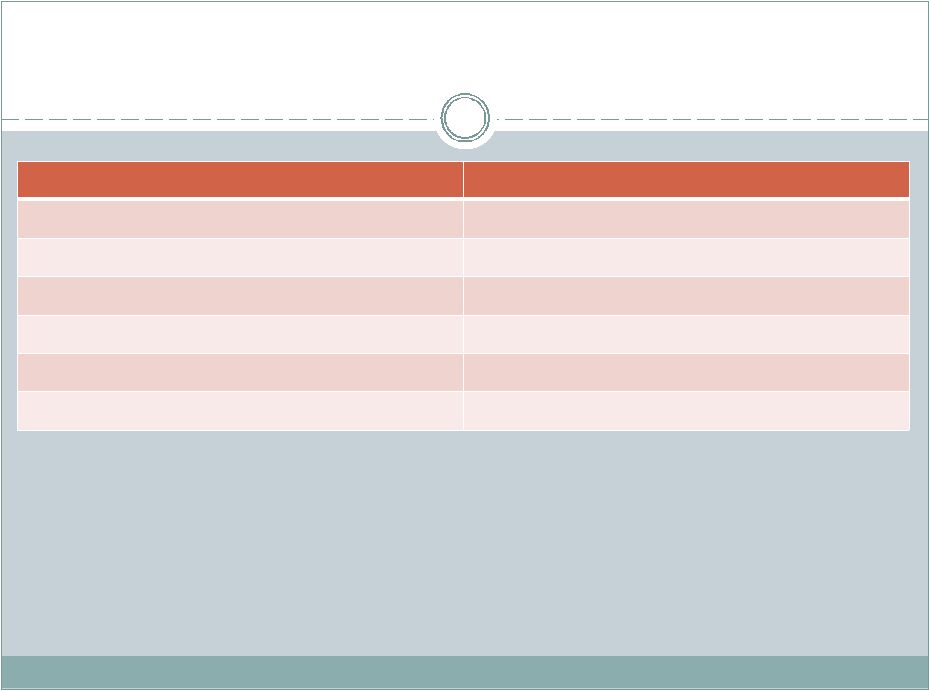

15

Earnings Highlights

Quarterly Net Income Increases 96.9%

Net income for the three months ended:

(Unaudited)

12/31/10

9/30/10

12/31/09

( in ‘000’s)

$319

$247

$162 |

16

16

Earnings Highlights

Twelve Months Ended December 31,

2010

2009

(Unaudited)

(in ‘000’s, except per share amounts)

Net interest income

8,227

7,845

Noninterest income

2,908

2,371

Noninterest expense

8,847

8,674

Net income

524

493

Basic

and

diluted

EPS

(1)

.15

N/A

(1) Calculated from the stock conversion completion date of October 29,

2010 |

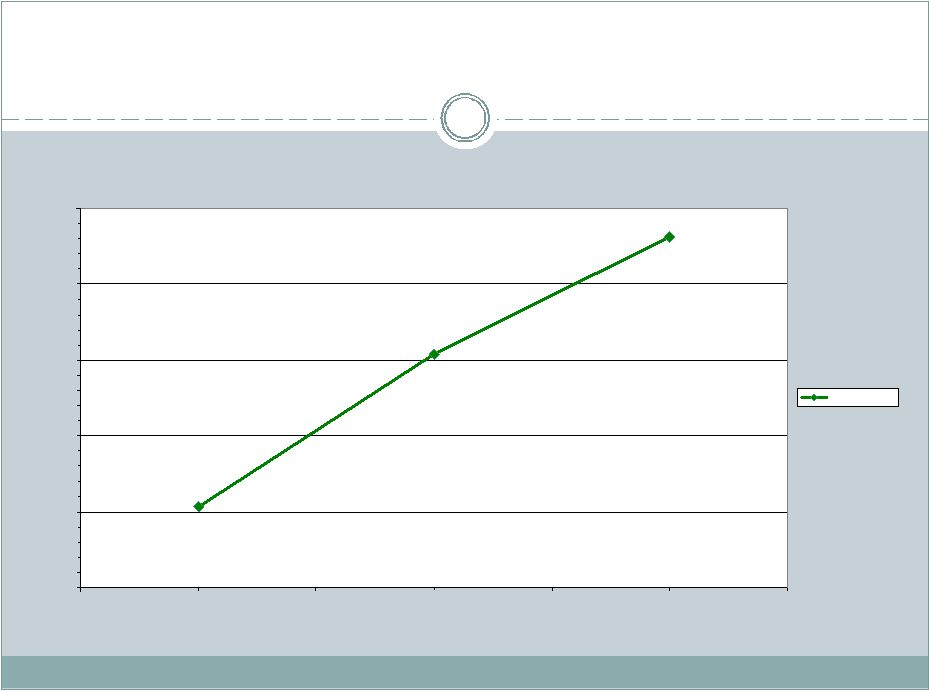

17

17

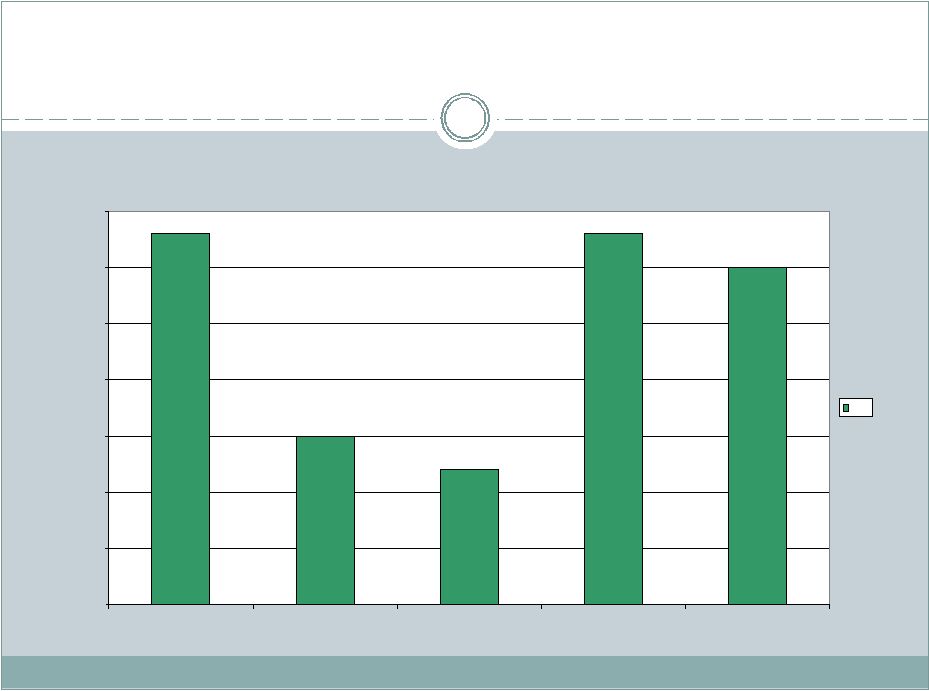

Core Earnings Trend

Pre-Tax/PreProvision "PTPP" Income Growth

0

500

1,000

1,500

2,000

2,500

2008

2009

2010

PTPP Income

in '000s

17 |

18

18

Balance Sheet Highlights

As of December 31,

2010

2009

(Unaudited)

(in ‘000’s)

Total assets

238,817 208,132

Loans, net

191,065 170,535

Deposits

188,244 172,591

Stockholders’

equity

32,104 17,262

|

19

19

Financial Performance Ratios

December 31, 2010

Net interest margin

3.80%

NPAs/Total Assets

2.28%

Net charge-offs/Avg. loans

.15%

ALLL/Total loans

1.11%

Tier 1 Core Capital

11.78%

Total Risk-based Capital

18.46%

Texas Ratio

15.00% *

* -

Loans 90 days or greater past due plus repossessed assets/capital plus general

reserves 19 |

20

20

Asset Quality

20

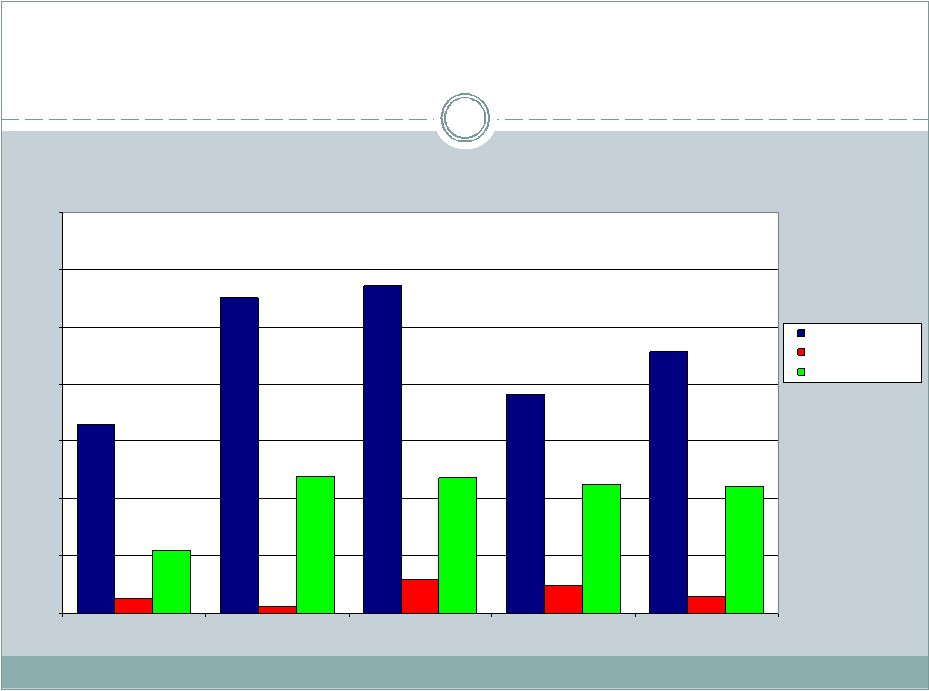

Asset Quality Ratios

1.65%

2.75%

2.86%

1.90%

2.28%

0.14%

0.06%

0.29%

0.24%

0.15%

0.55%

1.19%

1.18%

1.12%

1.11%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

Dec-09

Mar-10

Jun-10

Sep-10

Dec-10

NPA / Total Assets

NCOs / Avg Loans

ALLL / Total Loans |

21

21

Net Interest Margin

21

Net Interest Margin

3.83%

3.65%

3.62%

3.83%

3.80%

3.50%

3.55%

3.60%

3.65%

3.70%

3.75%

3.80%

3.85%

Dec-09

Mar-10

Jun-10

Sep-10

Dec-10

NIM |

22

22

Summary

Growing community bank in DFW market

Increasing core earnings

Strong capital position

Experienced management team

Manageable credit issues

Significant discount to book value

www.shareplus.com

–

SharePlus

Federal

Bank

http://investor.shareplus.com

–

SP

Bancorp,

Inc.

22 |