Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED FEBRUARY 14, 2011 - EVERGREEN ENERGY INC | f8k_021411i701.htm |

Exhibit 99.1

NYSE Arca: EEE

NYSE Arca: EEE

February 2011

February 2011

www.evgenergy.com

www.evgenergy.com

Safe Harbor Statement

2

Statements in this presentation that relate to future plans or projected results of

Evergreen Energy Inc. are "forward-looking statements" within the meaning of Section

27A of the Securities Act of 1933, as amended by the Private Securities Litigation

Reform Act of 1995 (the "PSLRA"), and Section 21E of the Securities Exchange Act of

1934, as amended by the PSLRA, and all such statements fall under the "safe harbor"

provisions of the PSLRA. Our actual results may vary materially from those described in

any "forward-looking statement" due to, among other possible reasons, the realization

of any one or more of the risk factors described in our annual or quarterly reports, or in

any of our other filings with the Securities and Exchange Commission. Readers of this

presentation are encouraged to study all of our filings with the Securities and Exchange

Commission. Our ability to execute our business plan and develop the GreenCert™ or K

-Fuel® technologies may be adversely impacted by unfavorable decisions in pending

litigation, the inability of the Company to satisfy the terms of the settlement agreement

with the holders of its 2007 and 2009 Notes, delays in the commencement of operations

at our Fort Union test facility, or by our inability to raise sufficient additional capital in a

timely manner to pursue the development of our technology. Readers of this

presentation are cautioned not to put undue reliance on forward-looking statements.

Evergreen Energy Inc. are "forward-looking statements" within the meaning of Section

27A of the Securities Act of 1933, as amended by the Private Securities Litigation

Reform Act of 1995 (the "PSLRA"), and Section 21E of the Securities Exchange Act of

1934, as amended by the PSLRA, and all such statements fall under the "safe harbor"

provisions of the PSLRA. Our actual results may vary materially from those described in

any "forward-looking statement" due to, among other possible reasons, the realization

of any one or more of the risk factors described in our annual or quarterly reports, or in

any of our other filings with the Securities and Exchange Commission. Readers of this

presentation are encouraged to study all of our filings with the Securities and Exchange

Commission. Our ability to execute our business plan and develop the GreenCert™ or K

-Fuel® technologies may be adversely impacted by unfavorable decisions in pending

litigation, the inability of the Company to satisfy the terms of the settlement agreement

with the holders of its 2007 and 2009 Notes, delays in the commencement of operations

at our Fort Union test facility, or by our inability to raise sufficient additional capital in a

timely manner to pursue the development of our technology. Readers of this

presentation are cautioned not to put undue reliance on forward-looking statements.

Statements in this presentation that relate to future plans or projected results of

Evergreen Energy Inc. are "forward-looking statements" within the meaning of Section

27A of the Securities Act of 1933, as amended by the Private Securities Litigation

Reform Act of 1995 (the "PSLRA"), and Section 21E of the Securities Exchange Act of

1934, as amended by the PSLRA, and all such statements fall under the "safe harbor"

provisions of the PSLRA. Our actual results may vary materially from those described in

any "forward-looking statement" due to, among other possible reasons, the realization

of any one or more of the risk factors described in our annual or quarterly reports, or in

any of our other filings with the Securities and Exchange Commission. Readers of this

presentation are encouraged to study all of our filings with the Securities and Exchange

Commission. Our ability to execute our business plan and develop the GreenCert™ or K

-Fuel® technologies may be adversely impacted by unfavorable decisions in pending

litigation, the inability of the Company to satisfy the terms of the settlement agreement

with the holders of its 2007 and 2009 Notes, delays in the commencement of operations

at our Fort Union test facility, or by our inability to raise sufficient additional capital in a

timely manner to pursue the development of our technology. Readers of this

presentation are cautioned not to put undue reliance on forward-looking statements.

Evergreen Energy Inc. are "forward-looking statements" within the meaning of Section

27A of the Securities Act of 1933, as amended by the Private Securities Litigation

Reform Act of 1995 (the "PSLRA"), and Section 21E of the Securities Exchange Act of

1934, as amended by the PSLRA, and all such statements fall under the "safe harbor"

provisions of the PSLRA. Our actual results may vary materially from those described in

any "forward-looking statement" due to, among other possible reasons, the realization

of any one or more of the risk factors described in our annual or quarterly reports, or in

any of our other filings with the Securities and Exchange Commission. Readers of this

presentation are encouraged to study all of our filings with the Securities and Exchange

Commission. Our ability to execute our business plan and develop the GreenCert™ or K

-Fuel® technologies may be adversely impacted by unfavorable decisions in pending

litigation, the inability of the Company to satisfy the terms of the settlement agreement

with the holders of its 2007 and 2009 Notes, delays in the commencement of operations

at our Fort Union test facility, or by our inability to raise sufficient additional capital in a

timely manner to pursue the development of our technology. Readers of this

presentation are cautioned not to put undue reliance on forward-looking statements.

Executive Summary

§ K-Fuel® is a patented coal technology which upgrades low value sub-bituminous, lignite and

brown coals to high ranking thermal coal quality, for example from 3,500 kcal/kg (~6,300 BTU/lb)

to 5,650 kcal/kg (~10,200 BTU/lb)

brown coals to high ranking thermal coal quality, for example from 3,500 kcal/kg (~6,300 BTU/lb)

to 5,650 kcal/kg (~10,200 BTU/lb)

§ The proven technology creates a large market for the massive low quality coal resources that

exist globally, and which have not been economical to mine. Through the K-Fuel® process, this

coal becomes a saleable product available to power plants

exist globally, and which have not been economical to mine. Through the K-Fuel® process, this

coal becomes a saleable product available to power plants

§ Evergreen has a clear timeline for moving into potential commercial demonstration activities and

realize value from the deployment of K-Fuel® process to upgrade low quality coal reserves

realize value from the deployment of K-Fuel® process to upgrade low quality coal reserves

§ Recent financial and corporate developments allows management to re-focus on building the

company

company

3

EEE’s K-Fuel® is a proven coal upgrading process that is market-ready and can

be deployed in a large and addressable, growing global market

be deployed in a large and addressable, growing global market

(i). Based on the Indonesian Coal Model

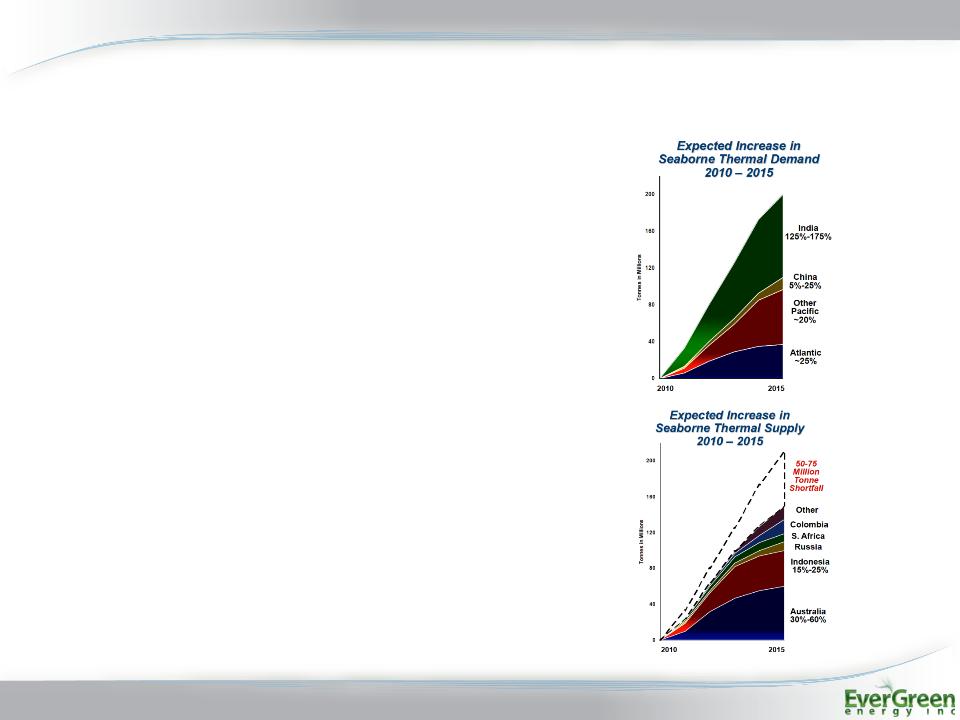

§ Coal upgrading technologies are becoming increasingly

relevant as supply of low moisture high rank thermal coals

are in decline in North America and Asia

relevant as supply of low moisture high rank thermal coals

are in decline in North America and Asia

§ Approximately 465 billion tons of coal or 47% of world’s

reserves are sub-bituminous, lignite and brown coals which

are of limited use unless upgraded. The K-Fuel® process

of upgrading low value coal allows EEE to take advantage

of the significant price arbitrage opportunity

reserves are sub-bituminous, lignite and brown coals which

are of limited use unless upgraded. The K-Fuel® process

of upgrading low value coal allows EEE to take advantage

of the significant price arbitrage opportunity

§ Given the vast amount of sub-bituminous resources in

these key markets, EEE has only begun to capitalize on

commercialization of its technology. This translates to a

massive potential upside from a full commercial roll-out

these key markets, EEE has only begun to capitalize on

commercialization of its technology. This translates to a

massive potential upside from a full commercial roll-out

§ Global demand for thermal coal is driven by major new

global build out of coal generation capacity. This

phenomenon is not restricted to Asia

global build out of coal generation capacity. This

phenomenon is not restricted to Asia

4

Value Proposition - The Global Opportunity

Source: Peabody

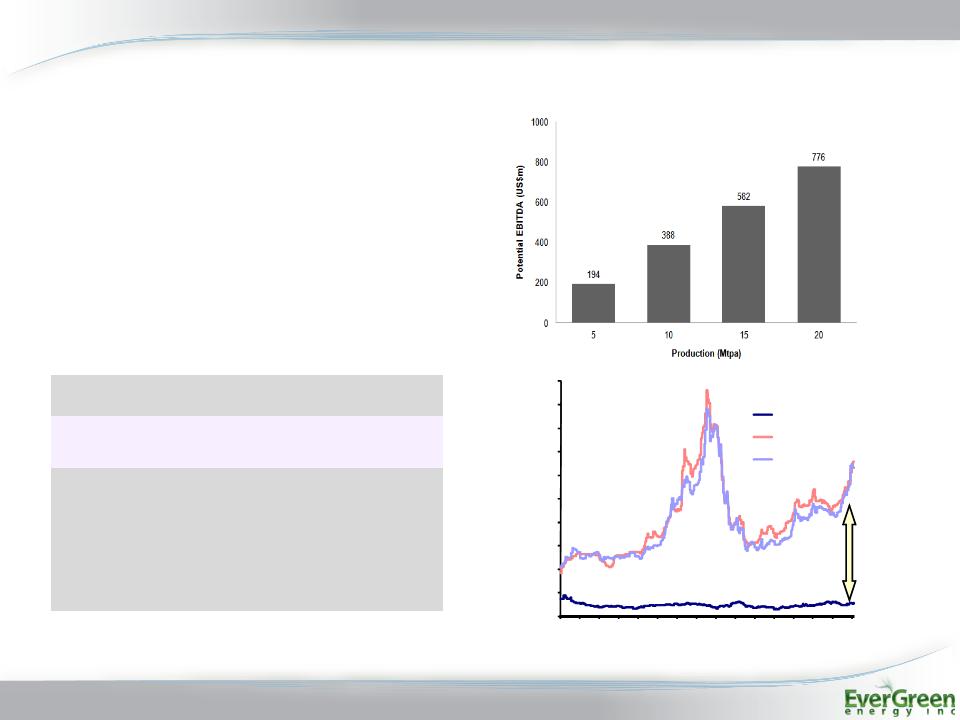

Value Proposition - The Economic Opportunity

§ K-Fuel® upgrades low rank coal reserves

and helps take advantage of the price

spread that exists between low rank and

high rank coal prices

and helps take advantage of the price

spread that exists between low rank and

high rank coal prices

§ An installed production capacity of just

5MMtpa could yield an approximate EBITDA

over $150 million - an extremely compelling

value proposition

5MMtpa could yield an approximate EBITDA

over $150 million - an extremely compelling

value proposition

|

Value Increase per metric ton (tonne) of upgraded coal

sensitivity table (i) |

|||

|

Selling value of

Upgraded Coal |

Value increase/tonne at cost of

|

||

|

$10.00

|

$12.00

|

$14.00

|

|

|

US$50

|

$22.00

|

$18.80

|

$15.70

|

|

US$60

|

$32.00

|

$28.80

|

$25.70

|

|

US$70

|

$42.00

|

$38.80

|

$35.70

|

|

US$80

|

$52.00

|

$48.80

|

$45.70

|

|

US$90

|

$62.00

|

$58.80

|

$55.70

|

5

(i). Based on the hypothetical K-Fuel® forecast for Indonesian Coal

Source: Bloomberg

0

20

40

60

80

100

120

140

160

180

200

Jan

06

May

06

Sep

06

Jan

07

May

07

Sep

07

Jan

08

May

08

Sep

08

Jan

09

May

09

Sep

09

Jan

10

May

10

Sep

10

Jan

11

Historical coal prices US$ 2006-11

Power River Basin

4670 kcal/kg

FOB Newcastle 6700

kcal/kg

FOB Richards Bay

6000 kcal/kg

Price Spread

K-Fuel® Process

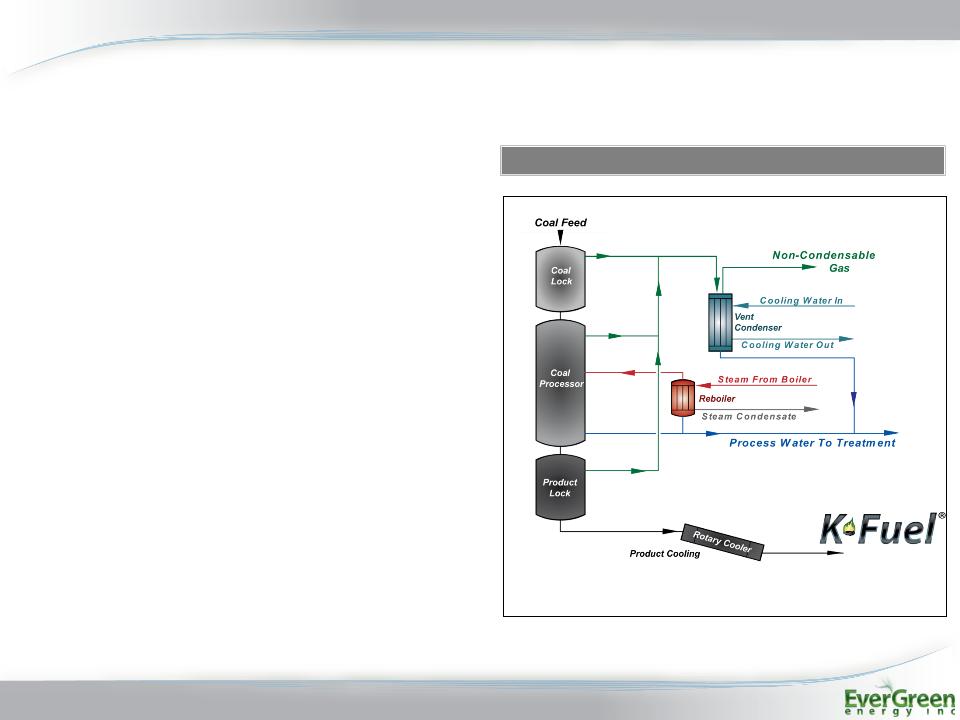

§ The K-Fuel® process was developed at

Stanford Research Institute by Edward

Koppelman. Over the last 26 years, $375

million has been invested in research and

development of the technology process

Stanford Research Institute by Edward

Koppelman. Over the last 26 years, $375

million has been invested in research and

development of the technology process

§ The patented process involves the heating and

pressurization of low value coals, and the

irreversible removal of the water content, and

converting the product into a higher energy K-

Fuel® product

pressurization of low value coals, and the

irreversible removal of the water content, and

converting the product into a higher energy K-

Fuel® product

§ A 750,000 tpa K-Fuel® commercial plant and

testing labs in Gillette Wyoming processed and

tested over 60 low rank coal feed stocks and

demonstrated substantial heat value increases

testing labs in Gillette Wyoming processed and

tested over 60 low rank coal feed stocks and

demonstrated substantial heat value increases

§ Coal feed stocks tested and upgraded included

coals from Inner Mongolia, Indonesia, Russia

and the US, from dozens of sources

coals from Inner Mongolia, Indonesia, Russia

and the US, from dozens of sources

§ Test burns of K-Fuel® at multiple US power

generation facilities validate combustion

benefits

generation facilities validate combustion

benefits

6

Schematic Overview of the K-Fuel® Process

7

K-Fuel® is a value-added product

§ K-Fuel® upgrading technology processes low quality sub-bituminous coal resulting

in:

in:

§ Higher energy value - Demonstrated to increase the efficiency and heating value of

sub-bituminous, lignite and brown coals by 30% on average, accomplished by

decreasing equilibrium moisture content by 50%

sub-bituminous, lignite and brown coals by 30% on average, accomplished by

decreasing equilibrium moisture content by 50%

§ Higher economic value - Allows product to compete with bituminous coals and makes

low rank coal marketable

low rank coal marketable

§ Physically and chemically stable product - Handled/transported as the feed coal

§ Significantly reduced transport costs - Reduced moisture content can lead to lower

transportation costs

transportation costs

§ More environmentally friendly product - More efficient burning could lead to lower

carbon emissions, and in particular reduced Hg, SO2 and NOx

carbon emissions, and in particular reduced Hg, SO2 and NOx

§ The consequence is that a significantly large number of low quality, high moisture

coal deposits worldwide become economically viable and more environmentally

friendly

coal deposits worldwide become economically viable and more environmentally

friendly

8

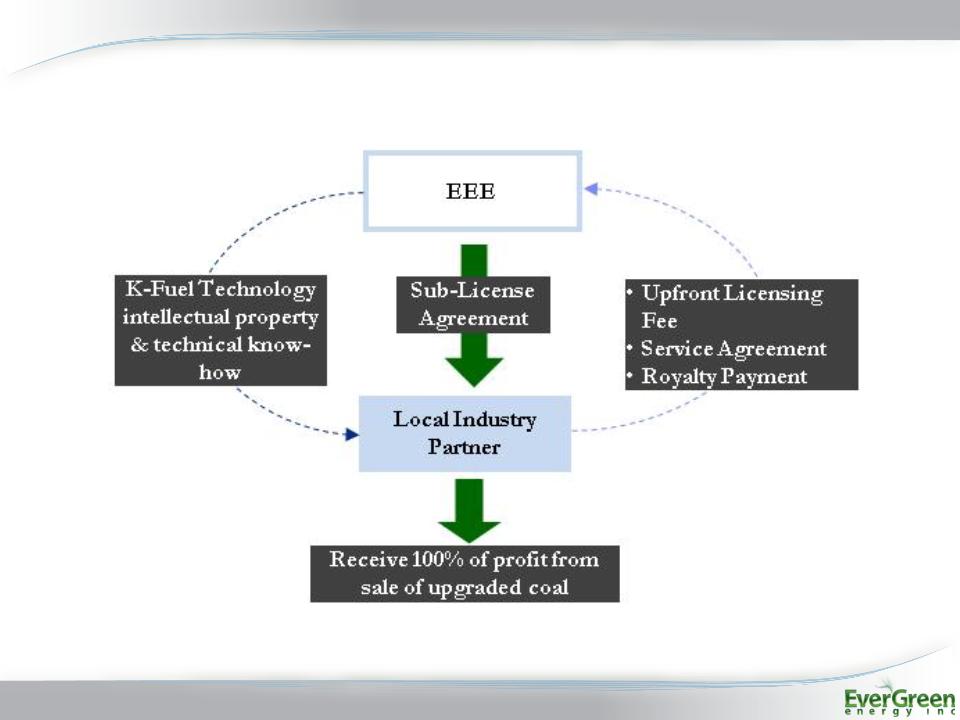

EEE Business Model

§ EEE’s business model is based on a plan to generate a number of diverse upfront and recurring

revenue streams

revenue streams

§ EEE plans to sub-license the K-Fuel® technology to one or multiple projects in the local market.

EEE expects to provide technical, engineering and construction services

EEE expects to provide technical, engineering and construction services

§ EEE expects to receive an upfront licensing fee for sub-licensing the K-Fuel® technology into a

project.

project.

§ EEE anticipates to receive a royalty payment based on volume of upgraded coal produced and the

price that it is sold at earned equity share of the JV on the output/reserve upgraded as a result of the

application of the K-Fuel® technology

price that it is sold at earned equity share of the JV on the output/reserve upgraded as a result of the

application of the K-Fuel® technology

§ A licensing model minimizes the upfront capital commitment requirement by EEE, and ensures an

ongoing economic participation in the project’s success via the royalty payment. This also reduces

the engineering and construction risk

ongoing economic participation in the project’s success via the royalty payment. This also reduces

the engineering and construction risk

§ Other revenue streams include: coal enhancement fees based on plant output (relating increased

energy content of the coal); marketing fees in relation to the marketing of the upgraded coal;

management fees in relation to the operation and management of the plants; and participation in any

value derived from the reduction in greenhouse gas emissions

energy content of the coal); marketing fees in relation to the marketing of the upgraded coal;

management fees in relation to the operation and management of the plants; and participation in any

value derived from the reduction in greenhouse gas emissions

§ EEE expects to partner with groups who can effectively underwrite a project

9

EEE Business Model

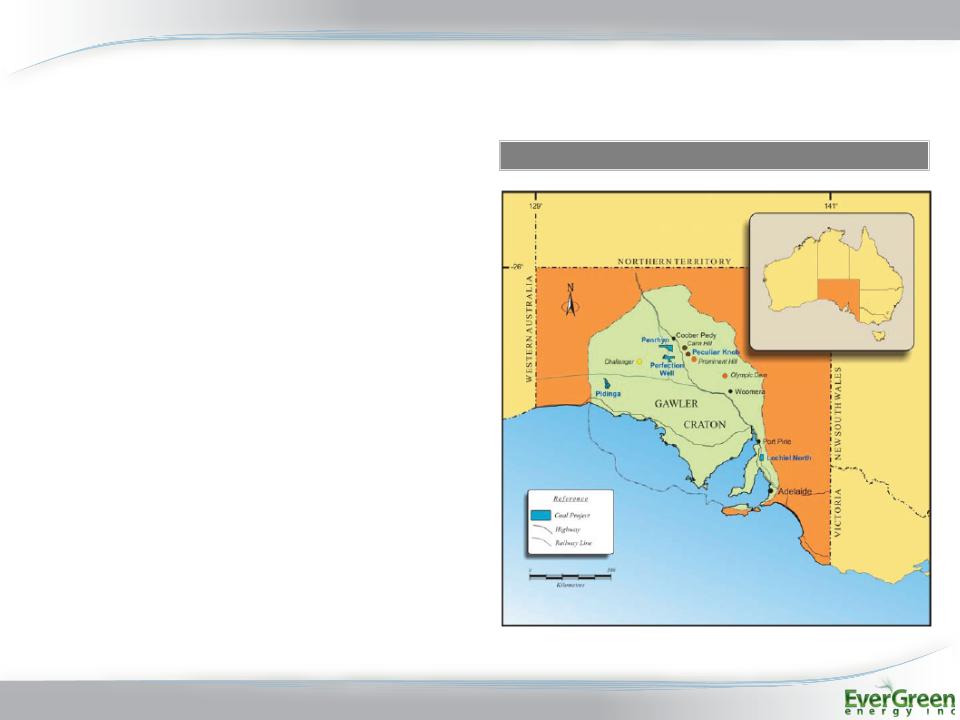

Strategic Joint Venture with WPG Resources

§ In February 2011, EEE signed an MOU

agreement with WPG Resources (ASX: WPG)

to jointly develop and commercialize EEE’s K-

Fuel® technology throughout Australia

agreement with WPG Resources (ASX: WPG)

to jointly develop and commercialize EEE’s K-

Fuel® technology throughout Australia

§ Under the proposed 50/50 JV, it is anticipated

that WPG may contribute its South Australian

Penrhyn and other coal assets and EEE will

contribute its coal upgrading technology

that WPG may contribute its South Australian

Penrhyn and other coal assets and EEE will

contribute its coal upgrading technology

§ Penrhyn is a sub bituminous coal deposit

located 25km from the rail loading loop and

accommodation village built for WPG’s flagship

Peculiar Knob iron ore project

located 25km from the rail loading loop and

accommodation village built for WPG’s flagship

Peculiar Knob iron ore project

§ In addition to the announced MOU, WPG has

also subscribed to US$2 million of EEE’s

capital raising announced on 2 February 2011

to achieve a 3.1% stake in EEE.

also subscribed to US$2 million of EEE’s

capital raising announced on 2 February 2011

to achieve a 3.1% stake in EEE.

10

Location of Penrhyn Coal Asset

11

EEE Commercial Strategy for 2011

§ EEE’s immediate plan is to use its enhanced capital base to accelerate the

commercialization of the K-Fuel® technology. In addition to a re-launched test facility in the

United States that is expected to be operational prior to the end of August; EEE plans to

commercialization of the K-Fuel® technology. In addition to a re-launched test facility in the

United States that is expected to be operational prior to the end of August; EEE plans to

§ Execute on Australian Joint Venture with WPG Resources

§ Enter into joint venture agreements with major groups in Asia and USA to commence

testing and large scale commercialization of K-Fuel® technology to build earnings and

cash flow

testing and large scale commercialization of K-Fuel® technology to build earnings and

cash flow

§ EEE is currently evaluating Asian and US market strategies

§ The ability of the K-Fuel® technology to upgrade a large base of low rank, high

moisture coal reserve represents enormous commercial opportunity

moisture coal reserve represents enormous commercial opportunity

§ Significant interest has been expressed by Asian and US coal mining and power

utilities seeking to partner with EEE

utilities seeking to partner with EEE

§ A number of Indonesian and US coal samples have been tested by EEE and

successfully processed, confirming the applicability of K-Fuel® technology

successfully processed, confirming the applicability of K-Fuel® technology

12

EEE Commercial Strategy 2011 (cont’d)

§ Additional strategic plans:

§ Continue to evaluate joint venture opportunities with a view to adding sub-bituminous,

lignite and brown coal assets and rolling out K-Fuel® process

lignite and brown coal assets and rolling out K-Fuel® process

§ Continue to develop core K-Fuel® process

§ Invest in potential PCI / Coking coal application of K-Fuel® and pick up from successful

research and development previously undertaken

research and development previously undertaken

§ Evaluate the potential for a dual listing of EEE on TSX-V to complement existing NYSE

Arca listing

Arca listing

Investment Summary

|

Highlight

|

EEE

|

|

Operates in Large and

Growing Markets |

§ Increasing global demand for economic, high energy value coal

§ Global shift towards ‘clean’ energy sources

|

|

Strong Platform to

Establish Dominant Market Position |

§ Advanced commercial and technical viability

§ Strategic relationships to accelerate global platform and growth

|

|

Proprietary, Proven and

Differentiated Technology |

§ Proprietary K-Fuel® technology, upgrading low quality sub-bituminous coal into

coal with higher energy content and lower end user greenhouse emissions § Patented coal upgrading process developed over 25 years

§ Currently exploring PCI / Coking Coal application of K-Fuel® technology

|

|

Compelling Business

Model |

§ Margin structure typically sustainable in variable market conditions

§ Evolutionary process presents additional development opportunities

|

|

Diverse Revenue Streams

|

§ Number of diverse upfront and recurring revenue streams

|

|

Experienced Management

Team Focussed on Growth and Profitability |

§ Relevant experience in developing and financing coal technologies

§ Significant global expertise and relationships

|

13