Attached files

| file | filename |

|---|---|

| 8-K - DEUTSCHE BANK CONFERENCE - Celanese Corp | form8-k.htm |

EXHIBIT 99.1

Celanese Corporation

Celanese Corporation

February 2011

2

Forward-Looking Statements

This presentation may contain “forward-looking statements,” which include information concerning the company’s plans, objectives, goals, strategies, future revenues or performance,

capital expenditures, financing needs and other information that is not historical information. When used in this presentation, the words “outlook,” “forecast,” “estimates,” “expects,”

“anticipates,” “projects,” “plans,” “intends,” “believes,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking

statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will

prove correct.

capital expenditures, financing needs and other information that is not historical information. When used in this presentation, the words “outlook,” “forecast,” “estimates,” “expects,”

“anticipates,” “projects,” “plans,” “intends,” “believes,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking

statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will

prove correct.

There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in this

presentation. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we

operate; the length and depth of business cycles, particularly in the automotive, electrical, electronics and construction industries; changes in the price and availability of raw materials; the

ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned

capacity additions and expansions; the ability to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of

competing products by other companies; market acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to

the company; changes in the degree of intellectual property and other legal protection afforded to our products; compliance and other costs and potential disruption of production due to

accidents or other unforeseen events or delays in construction or operation of facilities; potential liability for remedial actions and increased costs under existing or future environmental

regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or

other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; and various other factors discussed from time to time in the

company’s filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the company undertakes no obligation

to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or

circumstances.

presentation. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we

operate; the length and depth of business cycles, particularly in the automotive, electrical, electronics and construction industries; changes in the price and availability of raw materials; the

ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned

capacity additions and expansions; the ability to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of

competing products by other companies; market acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to

the company; changes in the degree of intellectual property and other legal protection afforded to our products; compliance and other costs and potential disruption of production due to

accidents or other unforeseen events or delays in construction or operation of facilities; potential liability for remedial actions and increased costs under existing or future environmental

regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or

other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; and various other factors discussed from time to time in the

company’s filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the company undertakes no obligation

to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or

circumstances.

Results Unaudited

The results in this presentation, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished

to management. Quarterly and LTM results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

to management. Quarterly and LTM results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Use of Non-U.S. GAAP Financial Information

This presentation includes the following non-U.S. GAAP financial measures: operating EBITDA, proportional EBITDA, and adjusted earnings per share. These measurements are not

recognized in accordance with U.S. GAAP and should not be viewed as an alternative to U.S. GAAP measures of performance. The most directly comparable financial measure presented

in accordance with U.S. GAAP in our consolidated financial statements for operating EBITDA is net income; for proportional share EBITDA is equity in net earnings of affiliates; and for

adjusted earnings per share is earnings per common share-diluted. Reconciliations of these non-U.S. GAAP financial measures are included in the Appendix.

recognized in accordance with U.S. GAAP and should not be viewed as an alternative to U.S. GAAP measures of performance. The most directly comparable financial measure presented

in accordance with U.S. GAAP in our consolidated financial statements for operating EBITDA is net income; for proportional share EBITDA is equity in net earnings of affiliates; and for

adjusted earnings per share is earnings per common share-diluted. Reconciliations of these non-U.S. GAAP financial measures are included in the Appendix.

Operating EBITDA, a measure used by management to measure performance, is defined by the company as net earnings plus loss from discontinued operations, interest expense, taxes,

and depreciation and amortization, and further adjusted for Other Charges and Adjustments. We may provide guidance on operating EBITDA and are unable to reconcile forecasted

operating EBITDA to a U.S. GAAP financial measure because a forecast of Other Charges and Adjustments is not practical.

and depreciation and amortization, and further adjusted for Other Charges and Adjustments. We may provide guidance on operating EBITDA and are unable to reconcile forecasted

operating EBITDA to a U.S. GAAP financial measure because a forecast of Other Charges and Adjustments is not practical.

Proportional EBITDA of Affiliates is defined by the company as proportional operating profit plus the proportional depreciation and amortization of its equity investments.

Adjusted earnings per share is defined by the company as net earnings (loss) available to common shareholders plus preferred dividends, adjusted for Other Charges and Adjustments,

and divided by the number of basic common shares, diluted preferred shares, and options valued using the treasury method. We may provide guidance on an adjusted earnings per share

basis and are unable to reconcile forecasted adjusted earnings per share to a U.S. GAAP financial measure without unreasonable effort because a forecast of Other Items is not practical.

Note: The tax rate used for adjusted earnings per share approximates the midpoint in a range of forecasted tax rates for the year, excluding changes in uncertain tax positions, discrete

items and other material items adjusted out of our U.S. GAAP earnings for adjusted earnings per share purposes, and changes in management's assessments regarding the ability to

realize deferred tax assets. We analyze this rate quarterly and adjust if there is a material change in the range of forecasted tax rates; an updated forecast would not necessarily result in a

change to our tax rate used for adjusted earnings per share. The adjusted tax rate is an estimate and may differ significantly from the tax rate used for U.S. GAAP reporting in any given

reporting period. It is not practical to reconcile our prospective adjusted tax rate to the actual U.S. GAAP tax rate in any future period.

and divided by the number of basic common shares, diluted preferred shares, and options valued using the treasury method. We may provide guidance on an adjusted earnings per share

basis and are unable to reconcile forecasted adjusted earnings per share to a U.S. GAAP financial measure without unreasonable effort because a forecast of Other Items is not practical.

Note: The tax rate used for adjusted earnings per share approximates the midpoint in a range of forecasted tax rates for the year, excluding changes in uncertain tax positions, discrete

items and other material items adjusted out of our U.S. GAAP earnings for adjusted earnings per share purposes, and changes in management's assessments regarding the ability to

realize deferred tax assets. We analyze this rate quarterly and adjust if there is a material change in the range of forecasted tax rates; an updated forecast would not necessarily result in a

change to our tax rate used for adjusted earnings per share. The adjusted tax rate is an estimate and may differ significantly from the tax rate used for U.S. GAAP reporting in any given

reporting period. It is not practical to reconcile our prospective adjusted tax rate to the actual U.S. GAAP tax rate in any future period.

3

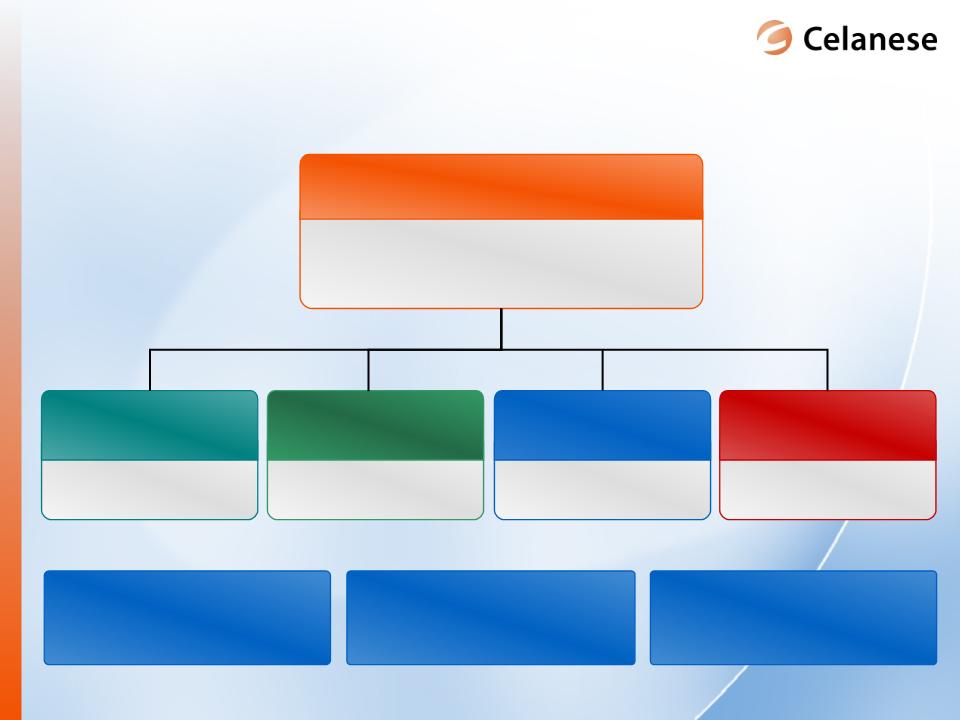

Celanese technology-focused portfolio -

building on a track record of execution

and value creation

building on a track record of execution

and value creation

Celanese

($ in millions)

2010 Revenue: $5,918

2010 Operating EBITDA: $1,122

Revenue: $1,089

Operating EBITDA: $371

Revenue: $1,109

Operating EBITDA: $363

Revenue: $1,036

Operating EBITDA: $111

Revenue: $2,682

Operating EBITDA: $411

Consumer Specialties

Advanced Engineered

Materials

Materials

Industrial Specialties

Acetyl Intermediates

Note: Celanese total includes Other Activities’ revenue and operating EBITDA of $2 million and ($134) million, respectively; $409 million of intersegment sales are excluded

Significant value

opportunity for

investors

opportunity for

investors

Strong earnings growth

Leading portfolio with

strategic affiliates

strategic affiliates

4

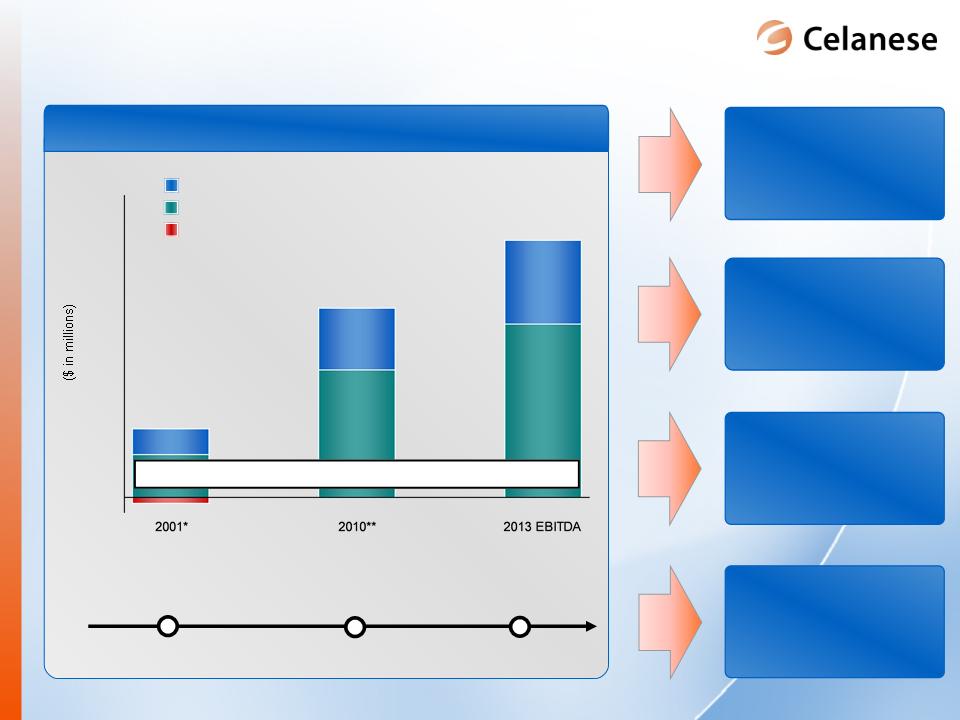

Today’s Celanese:

A Technology and Specialty Materials Company

A Technology and Specialty Materials Company

“Undifferentiated

Era”

Era”

“Hybrid

Transition”

Transition”

“Technology &

Specialty

Materials Era”

Materials Era”

Advantaged Intermediates

Specialty Materials

Commodity

Celanese Portfolio Transformation

Operating EBITDA Shift Towards Specialty Materials

500 -

1,000 -

0 -

* Celanese management estimates, based on unaudited similar information of predecessor company

** Excludes Other Activities segment

Specialty Materials: 2001 - 2013 CAGR: >12%

1,500 -

2,000 -

Modest earnings

volatility

volatility

Relatively higher

margins

margins

Sustained

earnings growth

of 10 - 15%

earnings growth

of 10 - 15%

High capital

return

return

5

Continued generation

& deployment of cash

& deployment of cash

Improved earnings

power

power

Accelerated topline

growth

growth

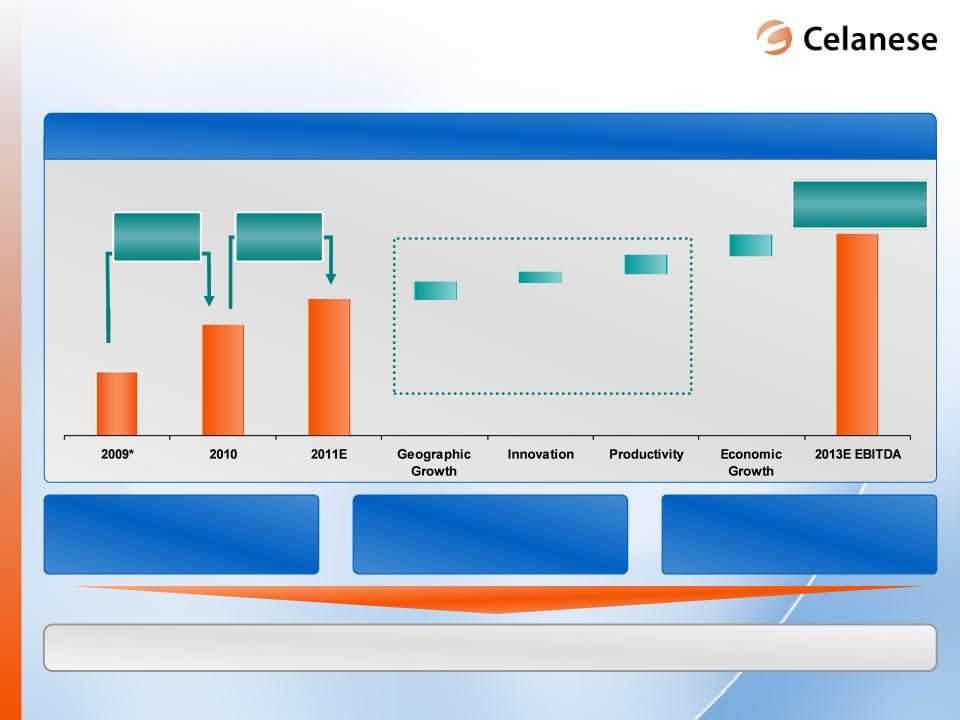

Earnings power of advantaged portfolio

Operating EBITDA

$857 million

Multiple strategic levers accelerate earnings growth

+$265

million

million

+~$150

million

million

$1,600- $1,800

million

million

CE Specific:

70% of 2011 to 2013

Earnings Improvement

* Adjusted to reflect the change in accounting method for Ibn Sina; includes Other Activities segment

$1,122 million

6

Portfolio

► Synergistic acquisition

► Portfolio extensions to reduce

earnings volatility

earnings volatility

► Emerging technologies

Innovation

Value growth levers drive increased earnings

Productivity

► Value-added products drive margin

expansion

expansion

► Access to new application space

supports accelerated growth

supports accelerated growth

► Efficient manufacturing technologies

Geographic Growth

► Emerging-region leadership

► Participation in > GDP growth

markets in developed economies

markets in developed economies

► Deliver cost improvements

2x fixed cost inflation

2x fixed cost inflation

► Strengthens operating leverage

Increasing the earnings power of the portfolio to $1.6 - $1.8 billion

7

Diversified end-uses capture economic AND

geographic growth

geographic growth

Note: Celanese management estimates of end-uses and geographic revenue based on Celanese 2009 net sales - includes strategic affiliates' proportional revenue

Other

8%

8%

Construction

3%

3%

Paints &

Coatings

13%

Coatings

13%

Consumer &

Medical

Applications

12%

Medical

Applications

12%

Consumer

& Industrial

Adhesives

9%

& Industrial

Adhesives

9%

Textiles

5%

5%

Food &

Beverage

4%

Beverage

4%

Chemical

Additives

3%

Additives

3%

Paper &

Packaging

3%

Packaging

3%

Industrial

Performance

Applications

7%

Performance

Applications

7%

Consolidated Revenue by Region (USD)

Americas

25%

EU

36%

AOC

21%

China

18%

7

8

IS: Nanjing expansion supports vinyl system

growth

growth

► Vinyl system leadership

• Focus on product technology

differentiation

differentiation

• Partner with leading Western and

Chinese companies

Chinese companies

► 2008 Nanjing I

• Achieved a leading position in China for

key segments

key segments

• Sales growth 18 months ahead of plan

• Developed business in other emerging

regions

regions

► 2011 Nanjing II

• Announced doubling of Nanjing VAE

capacity in October 2009

capacity in October 2009

• Startup expected mid-2011

Expanding vinyl technology into emerging markets

Source: Celanese management estimates

Asia Growth

Nanjing II VAE

startup

Nanjing I VAE

startup

Celanese Emulsion Asia Revenue

9

CS: China position continues to strengthen

portfolio

portfolio

Acetate Dividends

► Dec 2009 - Announced

Memorandum of understanding for next phase

of China expansion

Memorandum of understanding for next phase

of China expansion

► April 2010 - Approved

Memorandum of understanding NDRC

approval

Memorandum of understanding NDRC

approval

Zhuhai Cellulose Fibers Co., Ltd.

Kunming Cellulose Fibers Co., Ltd

Nantong Cellulose Fibers Co., Ltd

Dividend

Reinvestmen

t

Reinvestmen

t

Strong Partnership for Future Growth

Expansion project approved with current China partner

10

Portfolio

► Synergistic acquisition

► Portfolio extensions to reduce

earnings volatility

earnings volatility

► Emerging technologies

Innovation

Value growth levers drive increased earnings

Productivity

► Value-added products drive margin

expansion

expansion

► Access to new application space

supports accelerated growth

supports accelerated growth

► Efficient manufacturing technologies

Geographic Growth

► Emerging-region leadership

► Participation in > GDP growth

markets in developed economies

markets in developed economies

► Deliver cost improvements

2x fixed cost inflation

2x fixed cost inflation

► Strengthens operating leverage

Increasing the earnings power of the portfolio to $1.6 - $1.8 billion

11

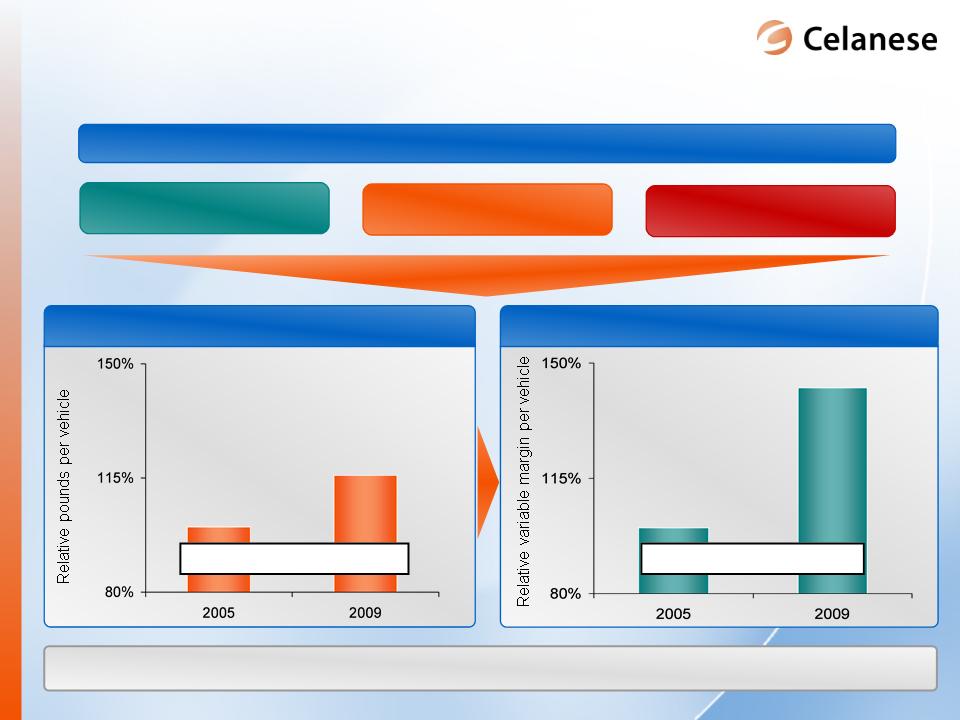

Ticona Polymers Weight per Vehicle

AEM: Application development with key

customers drives increasing value per vehicle

customers drives increasing value per vehicle

Ticona Polymers Value per Vehicle

Strong history of translating applications into value

2005 - 2009 CAGR: 5%

2005 - 2009 CAGR: >9%

Fuel Efficiency

Electrical Systems

Key Global Automotive Trends

Safety Systems

Source: Celanese management estimates

12

AI: Attractive technology driven cost curve

fueled by sustainable process innovation

fueled by sustainable process innovation

By-Product

Avg Other Leading

Technology

Ethylene

Highest Cost

China MeOH

China MeOH

Ethanol

Effective Industry Utilization Rates

Lower Cost

China MeOH

China MeOH

Pricing for CE to

earn >15%

EBITDA

EBITDA

75 - 80%

2011E Acetic Acid Cost Curve*

Avg Non-China

MeOH Carbonylation

Average Celanese

Additional

advantage

achievable

advantage

achievable

Minimum

15%

advantage

exists

today

15%

advantage

exists

today

Disadvantaged

Technology

Technology

Lowest

Cost Local

Cost Local

China

Celanese

Celanese

Near Term

Near Term

► $10 per ton of variable cost reduction

= $30 million of Operating EBITDA improvement

= $30 million of Operating EBITDA improvement

Continued technology enhancement contributes to earnings growth

► $15 per ton of variable cost reduction

= $20 million of Operating EBITDA improvement

= $20 million of Operating EBITDA improvement

Disadvantaged

Technology

Technology

Celanese

Celanese

Near Term

Near Term

* Source: Celanese management estimates, available public information; based on recent raw material costs

13

|

|

Prevailing Ethanol

Technology |

Celanese Ethanol

Technology |

|

Technology

|

Undifferentiated

fermentation processes |

Proprietary and

breakthrough technology leveraging Celanese industry- leading acetyl platform |

|

Feedstock

|

Corn, cassava,

sugarcane, and other carbohydrates |

|

|

Growth

|

Economically

constrained in target regions |

High growth potential

|

|

Energy Balance

|

Low returns from energy

inputs |

High returns from

energy invested |

AI: Paradigm shift in proprietary cost

advantaged ethanol technology

advantaged ethanol technology

Significant

Revenue

Opportunity

Revenue

Opportunity

Sustained

Earnings

Growth

Earnings

Growth

High Operating

Margins

Margins

Attractive

Capital Returns

Capital Returns

14

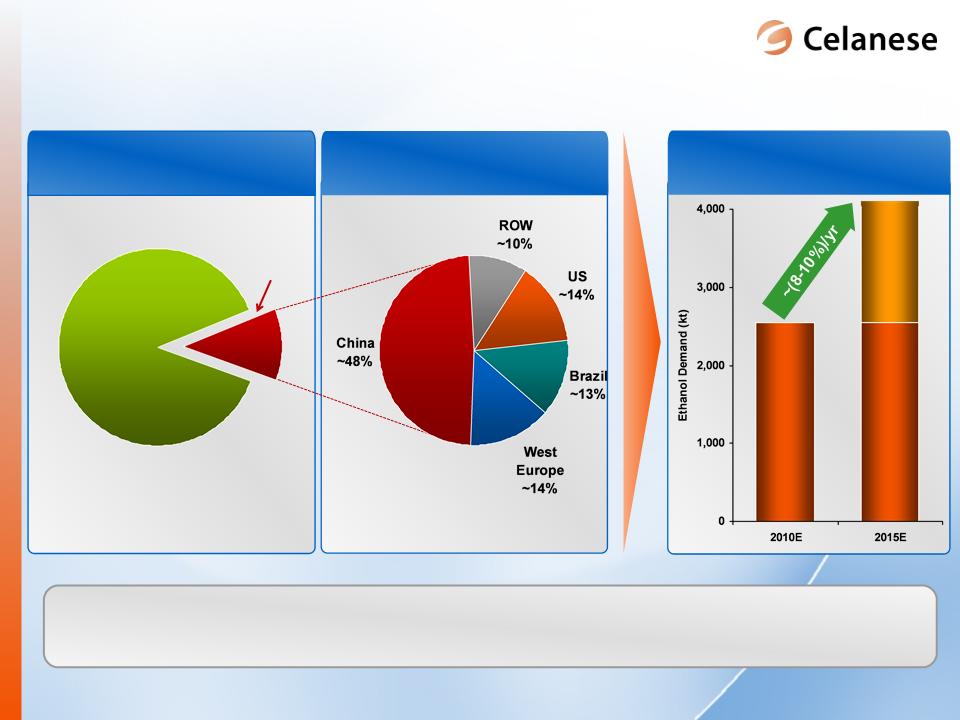

AI: Innovation creates opportunity for growth

with increasing demand for industrial ethanol

with increasing demand for industrial ethanol

Significant, and growing, demand in China

(paints, coatings, inks, and pharmaceuticals)

Source: Celanese management estimates, SRI Consulting, GAIN report

Fuel

~40-50 mmT

~5-6 mmT

Industrial

Global Ethanol Demand

Industrial vs. Fuel

Industrial vs. Fuel

Industrial Ethanol

Demand by Region

Demand by Region

Chinese Industrial Ethanol

Opportunity

Opportunity

15

Example - China Fuel Ethanol

Potential extension of our technology breakthrough to fuel segment

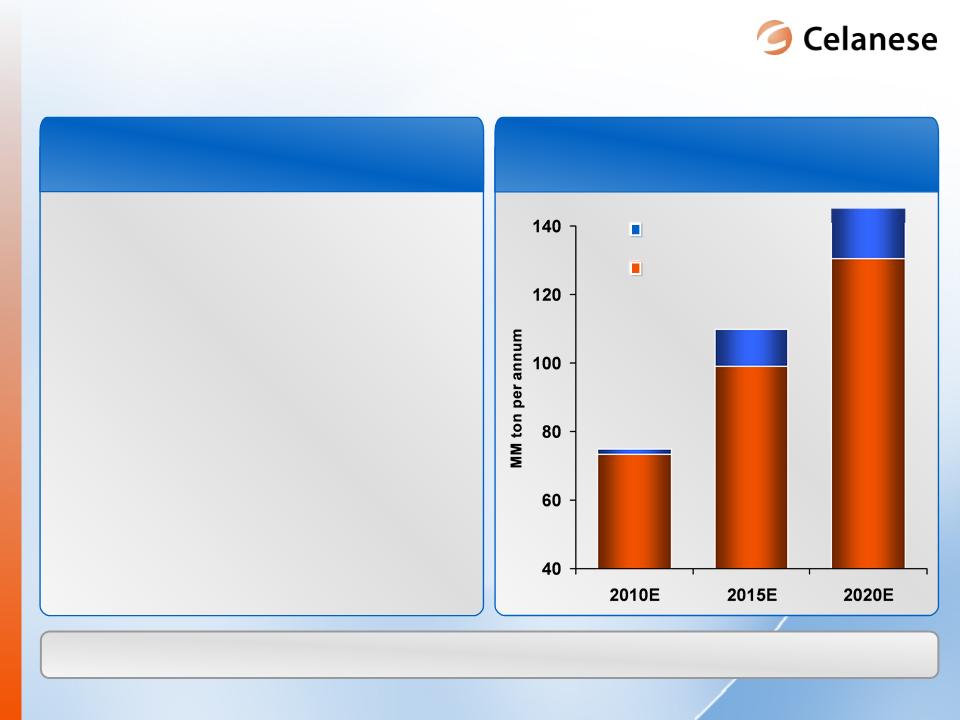

AI: Exploring fuel ethanol opportunities in

commercially supportive regions

commercially supportive regions

Source: Celanese management estimates, Purvin & Gertz, Inc.

~10MM

~10MM

~15MM

~15MM

Current fuel

ethanol

ethanol

Current fuel

ethanol

ethanol

~1.6MM

~1.6MM

Gasoline Demand

Gasoline Demand

Government Targeted

Fuel Ethanol Blending

Fuel Ethanol Blending

Government Targeted

Fuel Ethanol Blending

Fuel Ethanol Blending

► Have desire to reduce

dependence on imported

energy

dependence on imported

energy

► Have access to economically

attractive hydrocarbons

attractive hydrocarbons

► Have policies which promote

“technology and feedstock

neutrality”

“technology and feedstock

neutrality”

Focus on Regions with Favorable

Commercial Environment

Commercial Environment

16

Portfolio

► Synergistic acquisition

► Portfolio extensions to reduce

earnings volatility

earnings volatility

► Emerging technologies

Innovation

Value growth levers drive increased earnings

Productivity

► Value-added products drive margin

expansion

expansion

► Access to new application space

supports accelerated growth

supports accelerated growth

► Efficient manufacturing technologies

Geographic Growth

► Emerging-region leadership

► Participation in > GDP growth

markets in developed economies

markets in developed economies

► Deliver cost improvements

2x fixed cost inflation

2x fixed cost inflation

► Strengthens operating leverage

Increasing the earnings power of the portfolio to $1.6 - $1.8 billion

17

Consistently delivering productivity over

fixed cost inflation

fixed cost inflation

1) Fixed costs exclude energy, fixed distribution, depreciation and amortization; FX adjusted; 2004 is pro forma of current portfolio based on Celanese management estimates

2) Assumes stable currency and raw material pricing

Fixed Costs1

Spending2

Productivity

Inflation

2011E

2012E

2013E

Thereafter

Base

2011-2013 productivity

net of inflation

$120 - $180

net of inflation

$120 - $180

► Process technology improvements

• Catalyst / yield

• Digitization

► Energy reduction

• Multi-year initiative

• Critical to meeting

sustainability goals

sustainability goals

► Strategic programs

• Raw materials

► Business process excellence

• Six Sigma

• Lean manufacturing

18

Portfolio

► Synergistic acquisition

► Portfolio extensions to reduce

earnings volatility

earnings volatility

► Emerging technologies

Innovation

Value growth levers drive increased earnings

Productivity

► Value-added products drive margin

expansion

expansion

► Access to new application space

supports accelerated growth

supports accelerated growth

► Efficient manufacturing technologies

Geographic Growth

► Emerging-region leadership

► Participation in > GDP growth

markets in developed economies

markets in developed economies

► Deliver cost improvements

2x fixed cost inflation

2x fixed cost inflation

► Strengthens operating leverage

Increasing the earnings power of the portfolio to $1.6 - $1.8 billion

19

FACT LFT

Acquisition

Acquisition

Recent portfolio enhancements build on

advantaged specialty materials

advantaged specialty materials

► Expands

customer/application

space

customer/application

space

► Enables manufacturing

footprint optimization

footprint optimization

► Adds technology

capabilities

capabilities

► Extends current

relationship and

advantaged raw

material position

relationship and

advantaged raw

material position

► Increases economic

participation

participation

► Supports future growth

Increasing the earnings power of the business through

effective cash deployment

effective cash deployment

Advanced Engineered Materials

Ibn Sina POM

Expansion

Expansion

► Builds on leading

technology platform

technology platform

► Increases presence in

high growth regions

high growth regions

► Provides access to

new customers and

application space

new customers and

application space

DuPont LCP and PCT

Acquisition

Acquisition

20

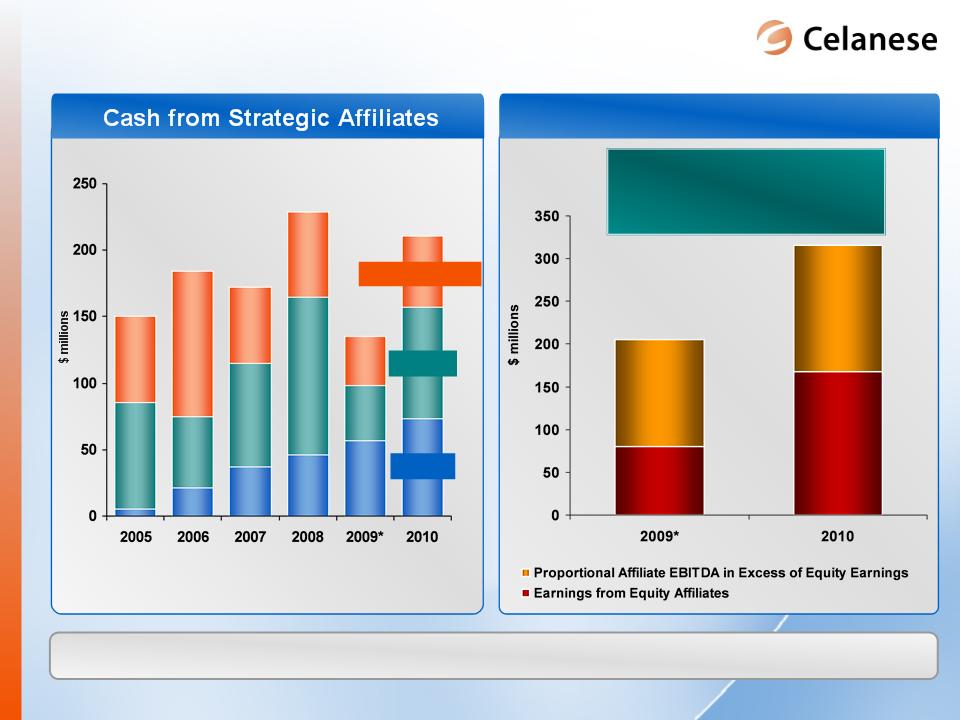

Economic value of our strategic affiliates

Significant earnings AND cash contributions

Acetate

Ibn Sina

Other Equity Affiliates

Proportional EBITDA of Affiliates

>$120 million annual EBITDA

in affiliates not reflected in

CE Operating EBITDA

in affiliates not reflected in

CE Operating EBITDA

* Full year 2009 excludes a one-time tax adjustment to Equity in net earnings of affiliates of $19 million.

21

|

2011E Adjusted Free Cash Outflows

(off EBITDA Base)

|

|

|

Cash Taxes

|

$75 - $100

|

|

Capital Expenditures

|

$300 - $350

|

|

Reserve/Other

|

$100 - $120

|

|

Net Interest

|

$220 - $230

|

|

Pension

|

$120 - $140

|

|

Working Capital

|

$30 - $50

|

|

Adjusted Free Cash Outflows*

|

$845 - $990

|

► Dividend, debt service and share repurchases of ~$90-110 million

► Expect approximately $100 million net cash outflow for Kelsterbach

expansion in 2011, including capital expenditures and project expense

expansion in 2011, including capital expenditures and project expense

Strong cash generation continues

throughout economic cycle

throughout economic cycle

|

Available Cash

|

|

|

Cash (as of 12/31/2010)

|

$740

|

|

Operating Cash

|

~($100 - $200)

|

|

Cash Available for

Strategic Purposes |

~$600

|

$ in millions

$ in millions

* Excludes Ticona Kelsterbach expansion cash flows

22

Debt Repayment

Strategic uses of cash

($ in Millions)

Comments

► Priority use of cash - strategic

growth opportunities, M&A, and

strategic reserve replenishment

growth opportunities, M&A, and

strategic reserve replenishment

► Debt paydown next largest use of

cash

cash

► Modest annual increases in

dividends

dividends

► Flexible use of cash for

opportunistic share repurchase

opportunistic share repurchase

• Share repurchase offsetting equity

compensation dilution

compensation dilution

• Move towards industry norm

+

+

+

$30 / yr

Current Level —

Dividends

++

$20-30 / yr

Opportunistic (migrate towards peers) —

Current Level —

Strategic Opportunities

Reserve

$500 - $1,000

Future Cash

Generation

Generation

Pro Forma

12/31/2010*

12/31/2010*

Excess Cash

Approx. $600

* Ending cash on 12/31/2010 of $740 million less $100-$200 million of operating cash.

23

Represents ~ $0.60 per share in 2011 earnings improvement

Increasingly advantaged portfolio drives

2011 earnings improvement

2011 earnings improvement

Advanced

Engineered

Materials

Engineered

Materials

Consumer

Specialties

Specialties

Industrial

Specialties

Specialties

Acetyl

Intermediates

Intermediates

24

Celanese growth opportunities represent an

attractive investment for shareholders

attractive investment for shareholders

► Technology-focused; specialty materials

► Strategic affiliates: Add to attractive portfolio

Leading portfolio with

strategic affiliates

strategic affiliates

► Significant mid-term earnings growth

opportunities

opportunities

► Celanese-specific value growth levers

Strong earnings

growth

growth

► Increasingly confident in strategic objective of

$1.6 to $1.8 billion mid-term operating EBITDA

$1.6 to $1.8 billion mid-term operating EBITDA

► Cash deployment opportunities add to value

creation

creation

Significant value

opportunity for

investors

opportunity for

investors

Celanese Corporation

APPENDIX

26

Confident in short-term earnings growth

2010

2009*

Geographic

Growth

Growth

Innovation

Portfolio

Productivity

Economic

Growth

Growth

YOY Improvement

+$265 million operating EBITDA

+$1.62 Adjusted EPS

Operating

EBITDA

$857 million

EBITDA

$857 million

Adjusted EPS

$1.75

$1.75

• Continued strength in emerging economies

• Nanjing expansion supports further growth

• Commercialization of new Ticona polymer

technology

technology

• Emulsions low VOC products

• Acquired FACT’s LFT business

• Acquired DuPont’s LCP/PCT businesses

• Economic recovery off low 2009 base

• Accelerated pace of recovery in 2010

• Manufacturing optimization

• Energy reduction

• SG&A process improvements

Low

High

In-Year Impact

* Adjusted to reflect the change in accounting method for Ibn Sina

27

Geographic

Growth

Growth

Innovation

Portfolio

Productivity

Economic

Growth

Growth

Confident in short-term earnings growth

YOY Improvement

+ ~$150 million operating EBITDA

+ ~$0.60 Adjusted EPS

YOY Improvement

+$265 million operating EBITDA

+$1.62 Adjusted EPS

Low

High

In-Year Impact

• Continued growth in emerging economies

• New VAE unit in China

• IS and AEM innovation pipeline

• AI process innovation

• Further manufacturing optimization

• Energy reduction

• Acquisition synergies

• Additional deployment of cash

• Continue gradual economic recovery

Operating

EBITDA

$857 million

EBITDA

$857 million

Adjusted EPS

$1.75

$1.75

2010

2011

2009*

* Adjusted to reflect the change in accounting method for Ibn Sina

28

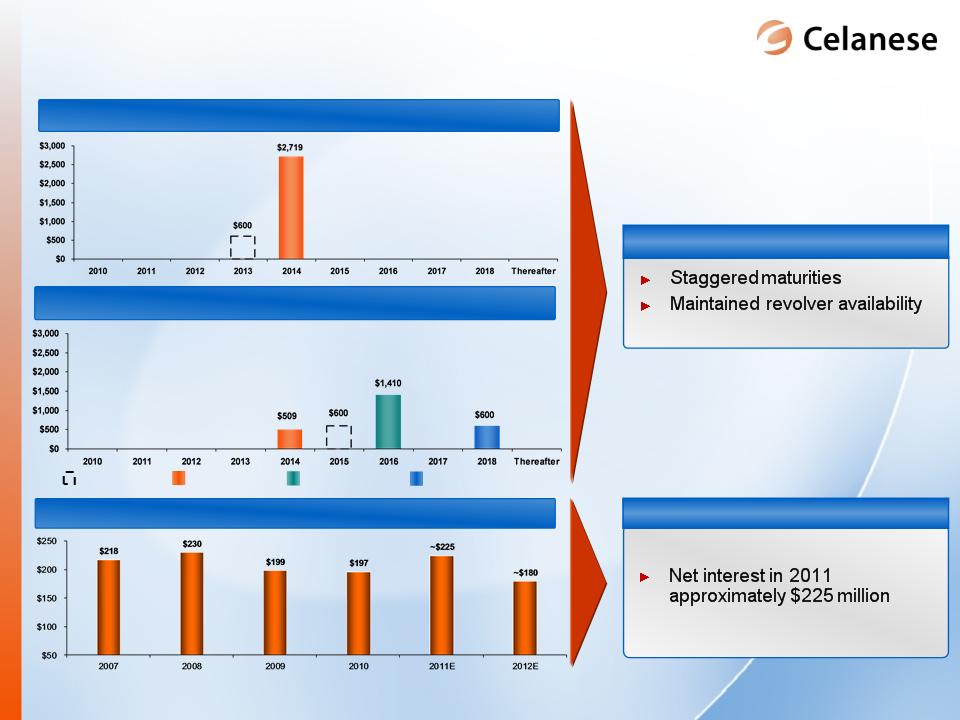

Impact on Interest Cost

Debt maturities and interest cost

Net Interest Cost

($mm)

($mm)

► Minimal effect in 2010

► Significant decrease in 2012 as

fixed LIBOR declines sharply

fixed LIBOR declines sharply

Existing Term Loan

Extended Term Loan

New Senior Unsecured Notes

Revolver Capacity

After Transaction

Before Transaction

► Maintained flexibility

($mm)

($mm)

($mm)

($mm)

Note: Does not reflect maturities of capital leases, industrial revenue bonds, other bank obligations, or affiliate borrowings. Excludes impact of amortization of deferred financing costs.

LIBOR assumptions for 2010 [0.46%], 2011 [0.64%], and 2012 [1.27%]

Benefits

29

30

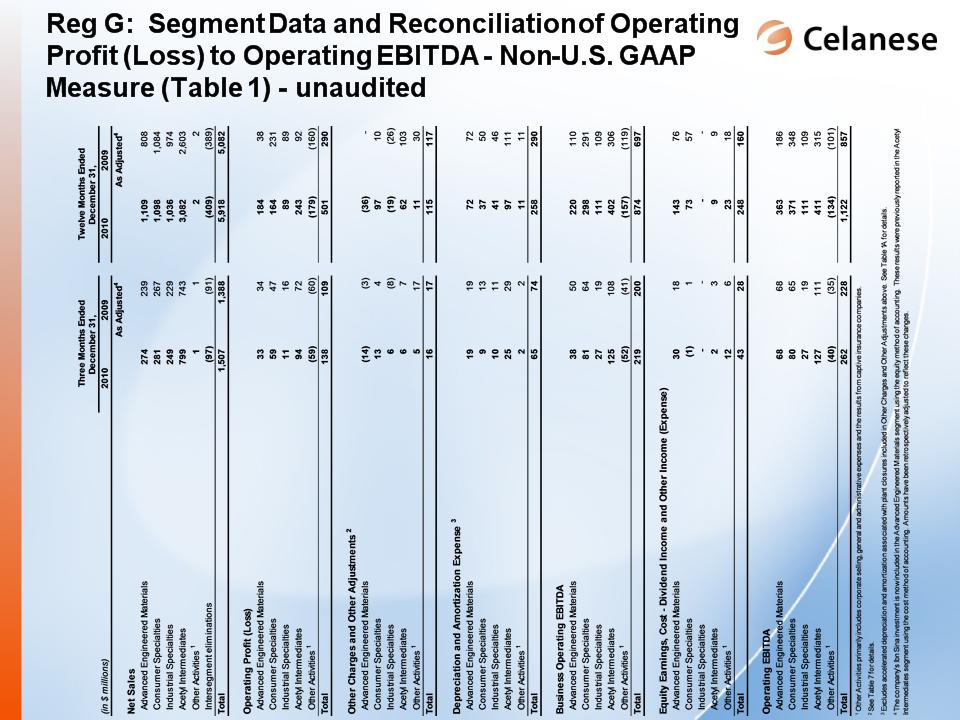

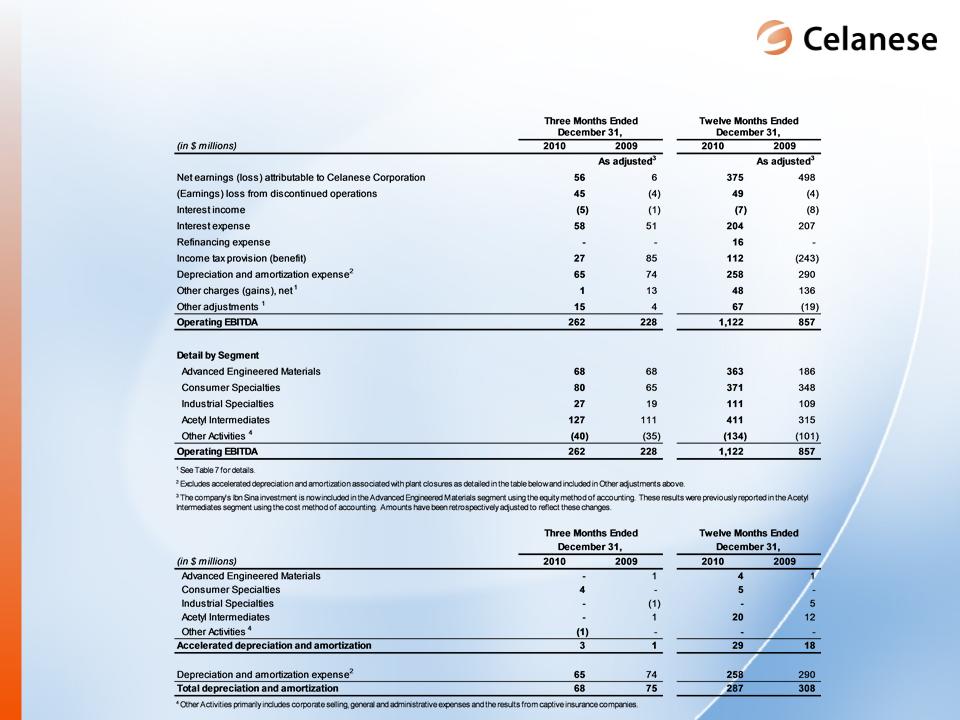

Reg G: Reconciliation of consolidated Operating

EBITDA to net earnings (loss) - Non-U.S. GAAP

Measure (Table 1A) - unaudited

EBITDA to net earnings (loss) - Non-U.S. GAAP

Measure (Table 1A) - unaudited

31

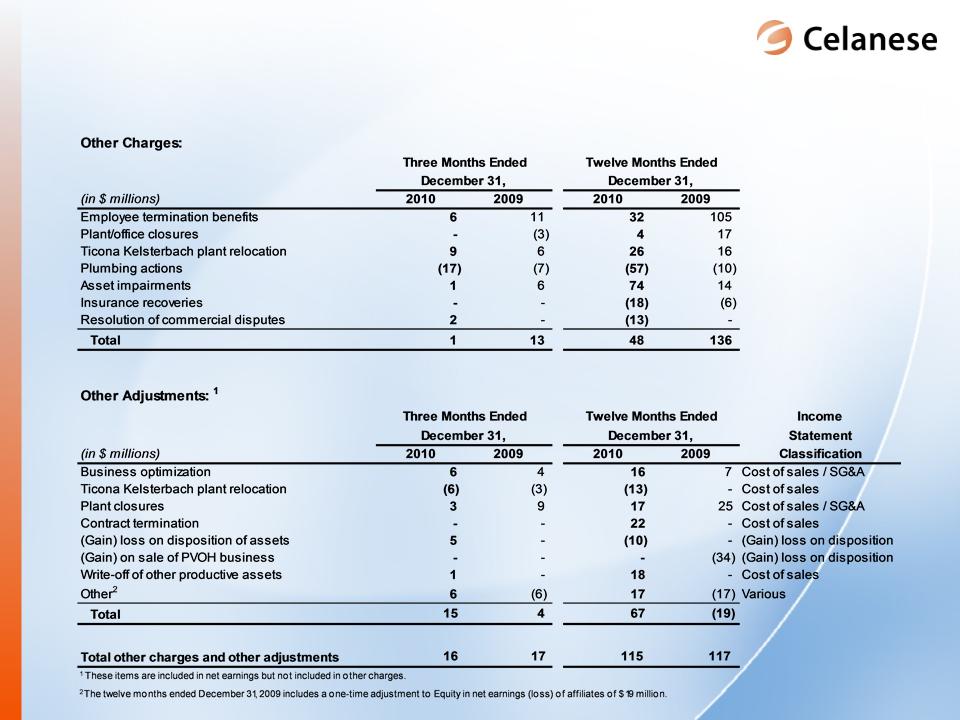

Reg G: Reconciliation of other charges and other

adjustments (Table 2) - Non-U.S. GAAP Measure -

unaudited

adjustments (Table 2) - Non-U.S. GAAP Measure -

unaudited

32

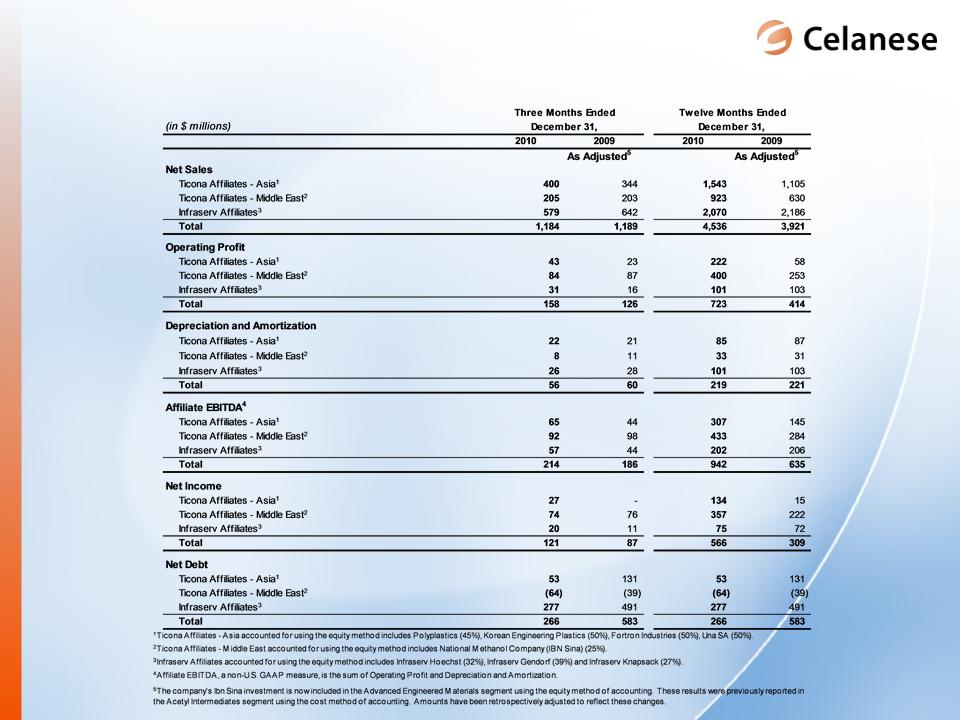

Reg G: Equity affiliate preliminary results - Total

(Table 3) - Non-U.S. GAAP Measure - unaudited

(Table 3) - Non-U.S. GAAP Measure - unaudited

33

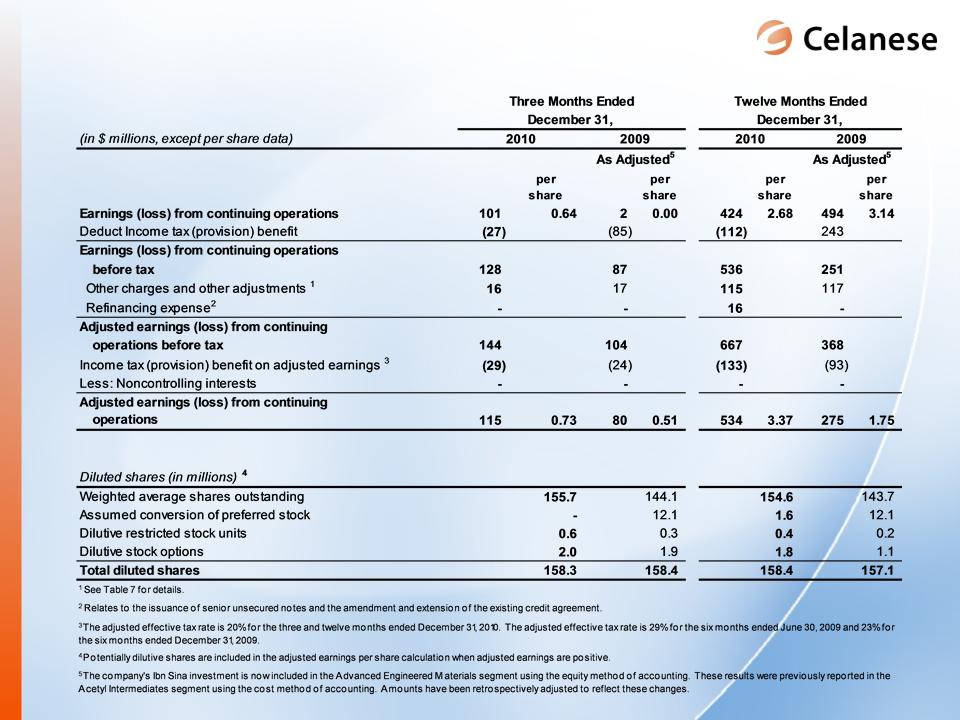

34

Reg G: Reconciliation of adjusted EPS (Table 4) -

Non-U.S. GAAP Measure - unaudited

Non-U.S. GAAP Measure - unaudited