Attached files

Exhibit 10.3

PURCHASE AND SALE AGREEMENT

This Purchase and Sale Agreement (“Agreement”) is made and entered into this 20th day of December, 2010, by and between WM Realty Management LLC, a Massachusetts limited liability company with an address at 46 Baldwin Farms North, Greenwich, CT 06831 (“Seller”), and Ranor, Inc., a Delaware corporation with an address at 1 Bella Drive, Westminster, MA 01473 (“Buyer”).

Seller is the owner of certain Premises (as hereinafter defined) located at 1 Bella Drive, Westminster, Worcester County, Massachusetts. Seller now desires to sell and Buyer desires to purchase the Premises and certain tangible and intangible personal property related to the Premises, upon the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the covenants and agreements contained in this Agreement and other good and valuable consideration, and intending to be legally bound, Seller and Buyer agree as follows:

|

1.

|

AGREEMENT TO SELL AND PURCHASE.

|

Subject to the terms and conditions of this Agreement, Seller agrees to sell to Buyer, and Buyer agrees to purchase from Seller the following:

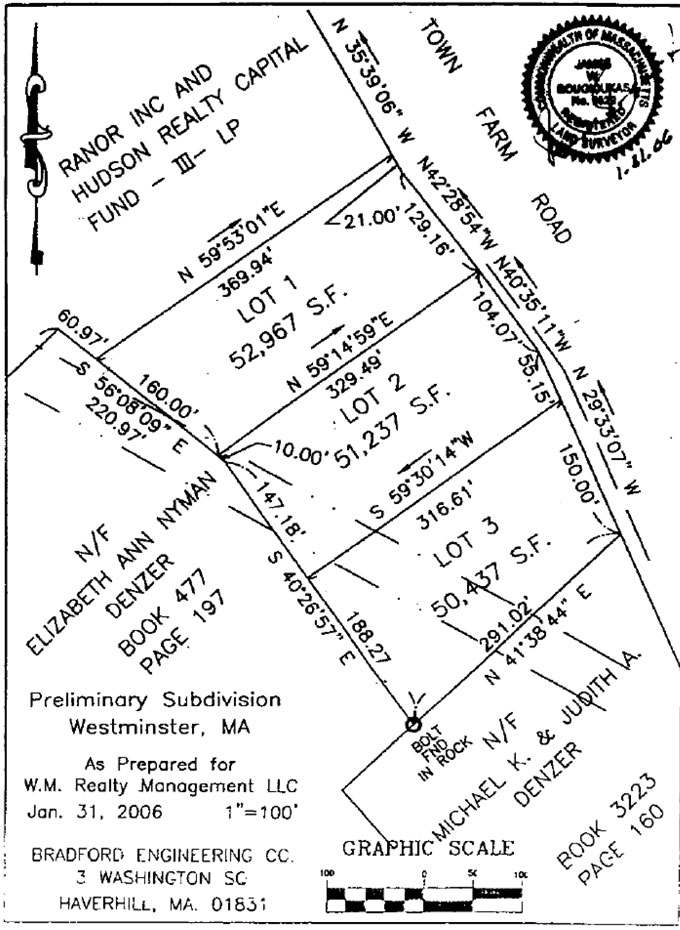

(a) Land. All that certain tract or parcel of land described by metes and bounds in Exhibit A to this Agreement (the “Land”) (which Land shall not include the three residential lots as shown on the ANR Plan attached hereto as Exhibit B and made a part hereof which lots are part of the Land currently, but which will be separate from the Land after recording of the ANR Plan in accordance with Section 12 hereof.

(b) Improvements. The buildings and other improvements located on the Land, including all fixtures, electrical, heating, ventilating, air conditioning, plumbing, security, fire suppression and other mechanical systems (the “Improvements”).

(c) Appurtenances. All easements, rights of way, licenses, privileges, hereditaments and appurtenances, if any, belonging to or inuring to the benefit of the Land, and all right, title and interest of Seller in and to any land lying in the bed of any highway, street, road or avenue, opened or proposed, in front of or abutting or adjoining the Land (collectively, the “Appurtenances”).

The Land, Improvements and Appurtenances are referred to collectively in this Agreement as the “Premises”.

(d) Intangibles. The following intangible personal property (collectively, the “Intangibles”):

(i) all licenses, authorizations, approvals, permits and certificates of occupancy issued by any governmental authority and relating to the ownership, use, operation or occupancy of the Premises (the “Permits”);

(ii) all currently effective warranties and guaranties given by any contractor, supplier or manufacturer of any Improvements, or of any work performed on any Improvements (the “Warranties”).

The Premises and Intangibles are referred to collectively as the “Property”.

|

2.

|

TITLE DEED

|

Said Premises is to be conveyed by a good and sufficient quitclaim deed, with quitclaim covenants, running to the Buyer, or to the nominee or assignee designated by the Buyer, and said deed shall convey a good and clear record and marketable title thereto such as will be insured by a title company licensed in the Commonwealth of Massachusetts at the standard rate, free from encumbrances, subject only to the Permitted Exceptions (defined below).

|

3.

|

PURCHASE PRICE

|

The agreed purchase price (“Purchase Price”) for said Property is Four Million Two Hundred Seventy-Five Thousand Dollars ($4,275,000), of which

(a) $150,000 (“Deposit”) has been paid by Buyer to Seller prior to the Effective Date. Seller acknowledges receipt of the Deposit. The “Effective Date” means the last date on which both parties have executed and received a fully executed duplicate copy of this Agreement.

(b) $4,125,000, subject to the adjustments and credits provided in this Agreement, shall be paid by Buyer at Closing by wire transfer or by bank or title company check.

|

4.

|

TIME FOR PERFORMANCE; DELIVERY OF DEED

|

(a) Provided Seller has complied with all of its obligations hereunder, closing (“Closing”) of title shall take place upon the date specified by Buyer upon not less than three (3) business days’ prior notice but not later than December 31, 2010 unless extended pursuant to subsection (b) below, at a location selected by Buyer and reasonably acceptable to Seller. The date upon which the parties close title in accordance with this Agreement shall hereinafter be referred to as the “Closing Date”.

(b) Buyer may extend the Closing Date to a date on or before January 30, 2011 (“Extended Closing Date”), provided Buyer gives Seller written notice of such extension on or before December 21, 2010. Unless the parties mutually agree by written agreement to further extend the Closing Date, Buyer shall not have the option to extend the Extended Closing Date beyond January 30, 2011. If the parties do not close on or before the Extended Closing Date and such failure to close is not due to Seller’s breach of this Agreement, this Agreement shall be null and void and Seller shall have the right to retain the Deposit, and the existing lease dated February, 2006, by and between Seller (as landlord) and Buyer (as tenant) (“Existing Lease”), shall remain in full force and effect and Buyer shall have the right to submit a new offer to purchase the Premises after July 30, 2011 and shall not have the right to do so prior to such date.

-2-

|

5.

|

POSSESSION

|

Full possession of the Premises is to be delivered by Seller to Buyer at the time of Closing and the Existing Lease shall terminate. Seller shall be entitled to pro-rated rent under the Existing Lease for any portion of the month in which the conveyance occurs, if such conveyance occurs on any date other than the first day of the month.

|

6.

|

TITLE

|

Buyer has received a current Title Commitment for the Property dated November 16, 2010 (“Title Commitment”). No matter which is added to the Title Commitment after its original issuance shall be a considered an acceptable encumbrance on the Property and Seller shall cause all of the following to be removed from the Title Commitment at or prior to Closing any deeds of trust or mortgages; judgments; mechanics’ and materialmen’s liens; tax liens; liens, encumbrances; and all exceptions, conditions and requirements described in Schedule B-Section 1 of the Title Commitment.

|

7.

|

USE OF MONEY TO CLEAR TITLE

|

To enable Seller to make conveyance as herein provided, Seller may, at the time of delivery of the deed, use the purchase money or any portion thereof to clear the title of any or all encumbrances or interests, provided that all instruments so procured are recorded simultaneously with the delivery of said deed or, in the case of institutional mortgages, arrangements for subsequent recording are made in accordance with customary conveyancing practice.

|

8.

|

ACCEPTANCE OF DEED

|

The acceptance of a deed by the Buyer or its nominee as the case may be, shall be deemed to be a full performance and discharge of every agreement and obligation herein contained or expressed, except for those obligations expressly stated to survive the termination of this Agreement or to be performed after the delivery of said deed.

|

9.

|

ADJUSTMENTS

|

It is acknowledged by the parties that the Existing Lease is a triple net lease. As a result, Buyer currently pays all water, sewer, use charges and real estate taxes for the Premises and there shall be no prorations for such expenses at Closing. Prorations for rent shall be in accordance with Section 5 hereof.

|

10.

|

BROKER

|

Seller represents and warrants to Buyer that Seller has had no dealings, negotiations or communications with any broker or other intermediary in connection with this Agreement or the sale of the Property. Buyer represents and warrants to Seller that Buyer has had no dealings, negotiations or communications with any broker or other intermediary in connection with this Agreement or the sale of the Property. In the event that any claim is asserted by any person, firm or corporation, whether broker or otherwise, claiming a commission and/or finder’s fee with respect to the sale of the Property resulting from any act, representation or promise of Seller, Seller shall indemnify and save harmless Buyer from any such claim. In the event any claim is asserted by any person, firm or corporation, whether broker or otherwise, claiming a commission and/or finder’s fee with respect to the sale of the Assets resulting from any act, representation or promise of Buyer, Buyer shall indemnify and save harmless Seller from any such claim.

-3-

|

11.

|

REPRESENTATIONS AND WARRANTIES

|

(a) Representations and Warranties of Seller. In order to induce Buyer to enter into this Agreement and with full knowledge that Buyer is relying thereon, Seller hereby warrants and represents to Buyer as follows:

(i) Power to Perform. This Agreement is duly authorized, executed and delivered by Seller, constitutes the legal and valid binding obligation of Seller, and does not violate any provision of any agreement or judicial order to which Seller is a party or to which it is subject. All documents executed by Seller which are to be delivered to Buyer at the Closing will be duly authorized, executed and delivered by Seller, and will not violate any provisions of any agreement or judicial order to which Seller is a party or to which it is subject.

(ii) Proceedings, Bankruptcy.

(A) There has not been filed by or against Seller a petition in bankruptcy or insolvency proceedings or for reorganization or for the appointment of a receiver or trustee, under state or Federal law.

(B) Seller has not made an assignment for the benefit of creditors or filed a petition for an arrangement or entered into an arrangement with creditors which petition, proceedings, assignment, or arrangement was not dismissed by final, unappealable order of the court or body having jurisdiction over the matter.

(C) Seller is not insolvent, nor has Seller admitted in writing the inability to pay its debts as they become due.

(iii) Contracts. There are not now, nor will there be on the Closing Date, any contracts or agreements, written or oral, to which Seller is a party which affect the Premises.

(iv) Assessed Valuation. To Seller’s knowledge, there is no proceeding pending for the adjustment of the assessed valuation of all or any portion of the Premises; there is no abatement in effect with respect to the real estate taxes.

(v) Assessments. To Seller’s knowledge, there are not now presently pending any special assessments with respect to any portion of the Premises, and Seller has received no notice of, or become aware of any special assessment being contemplated.

-4-

(vi) Condemnation. To Seller’s actual knowledge, there is no condemnation proceeding with regard to the Premises and Seller does not know of any proposed condemnation proceeding with regard to all or any portion of the Premises.

(vii) Litigation. To the best of Seller’s knowledge, there is not now any action, proceeding, litigation or investigation pending or, to the best of Seller’s knowledge, threatened against Seller or the Premises, or affect the ability of Seller to perform its obligation under this Agreement, or which questions the validity or enforceability of this Agreement.

(viii) Foreign Person. Seller is not a foreign person within the meaning of Section 1445 of the Internal Revenue Code.

(ix) Leases. As of the Effective Date except for the Existing Lease, there are and as of the Closing Date the Premises will be subject to no other leases, licenses, claims or rights to possession in any party the Premises shall be delivered to Buyer free of all leases, licenses or other rights of possession claiming through Seller and on the Closing Date.

(x) Other Agreements. There are no rights, options, or other agreements of any kind created by or through Seller to purchase or otherwise acquire or sell or otherwise dispose of any of the Property.

(xi) Separately Subdivided Parcel. The Premises constitutes a separately subdivided parcel and is assessed for real estate tax purposes separate and distinct from all other real property and is not treated as part of any other real property for title, zoning or building purposes.

(xii) Boundary Matters. To Seller’s actual knowledge, there are no encroachments onto, overlaps, boundary line disputes or other similar matters with respect to the Premises, nor do any of the Improvements encroach upon any adjacent property or any easement or right-of-way except as set forth on the survey delivered by Seller to Buyer.

(xiii) Service Contracts. There are no management, service, equipment, supply, maintenance or concession agreements entered into by Seller with respect to or affecting the Property.

(xiv) Equipment Leases. Seller has not entered into any lease agreement for the rental of furniture, fixtures or equipment in connection with the use or operation of the Property.

(b) Representations and Warranties of Buyer. In order to induce Seller to enter into this Agreement, Buyer hereby warrants and represents to Seller as follows: this Agreement is duly authorized, executed and delivered by Buyer, constitutes the legal and valid binding obligation of Buyer, and does not violate any provision of any agreement or judicial order to which Buyer is a party or to which it is subject. All documents executed by Buyer which are to be delivered to Seller at the Closing will be duly authorized, executed and delivered by Buyer, and will not violate any provisions of any agreement or judicial order to which Buyer is a party or to which it is subject.

-5-

(c) Representations and Warranties to Survive Closing. Each of the representations and warranties of the respective parties contained herein or made in writing pursuant to this Agreement, shall be true and correct as of the Effective Date and as of the Closing Date, shall be deemed to be material and shall survive the execution and delivery of this Agreement and Closing for a period of one (1) year after the Closing Date. All statements contained in any certificate or other instrument delivered at any time by or on behalf of Seller in conjunction with the transaction contemplated hereby shall constitute representations and warranties.

|

12.

|

RESIDENTIAL APPROVALS.

|

Seller shall use its commercially reasonable efforts to obtain all permits and approvals and relief, including but not limited to, state, county, regional and municipal governmental approvals and permits necessary or required to create on a portion of the Property up to three residential lots in the location and size as shown on Exhibit D (“Lots”), attached hereto and made a part hereof, pursuant to an Approvals Not Required Plan (“ANR Plan”) and all applicable appeal periods with respect to such approvals have expired without any appeal thereto having been taken (the “Approvals”). Seller shall make application for such Approvals within sixty (60) days after the Closing Date. The Approvals shall be obtained at Seller’s sole cost and expense and Buyer shall reasonably cooperate by executing applications and plans as necessary to obtain such Approvals. If Seller has not obtained the Approvals as set forth herein within ninety (90) days after the Closing Date, Buyer shall retain the portion of the Property intended to be subdivided from the Property with no adjustment to Purchase Price or payment of any kind and Seller shall have no rights or interests in the Property or the Approvals.

Seller shall not increase the outer perimeter of the three Lots as shown on Exhibit D nor shall the Lots be relocated to any other portion of the Property. It shall be Seller’s obligation to create no new non-conformity or increase an existing nonconformity with the Property by seeking and obtaining the Approvals or by the creation of the Lots.

Subject to the above, promptly after Seller obtaining the Approvals, Buyer shall convey the Lots back to Buyer by quitclaim deed, with quitclaim covenants, and with no additional representations or warranties by Buyer. Any transfer tax or other taxes, recording costs, plan recording costs or other expenses related to such conveyance shall be paid solely by Seller. Seller acknowledges that Buyer intends to obtain bond financing, a portion of the proceeds of which will be allocated to the acquisition of the Property. Buyer’s lender has certain requirements that must be satisfied by Buyer before lender will permit the Lots to be released from the lien of the mortgage encumbering the Property and securing the financing. If Buyer is unable to satisfy all of these requirements, and as a result, Buyer’s lender will not release the Lots from the lien of the encumbering mortgage or permit the reconveyance of the Lots to Seller, Seller shall release any and all claims to the Property or the right to reconveyance of the Lots and shall release, indemnify and hold harmless, Buyer from any liability hereunder and Buyer shall retain the entire Property, including the Lots with no adjustment to Purchase Price or payment of any kind. and Seller shall have no rights or interests in the Property.

-6-

At Closing, Seller shall provide to Buyer for the benefit of and to be relied upon by Buyer’s lender, a release from Seller indicating Seller has no claims to the remainder of the Property, such release to be in form and substance acceptable to Buyer’s lender.

This Section 12 shall survive Closing..

|

13.

|

PROVISIONS WITH RESPECT TO CLOSING.

|

(a) Period Prior to Closing.

(i) Affirmative Covenants. Between the date of this Agreement and the Closing Date, Seller agrees to:

(A) Deliver to Buyer, promptly after receipt by Seller, copies of all notices of violation issued by any board, bureau, commission, department or body of any municipal, county, state or Federal government unit with respect to the Property received by Seller after the date of this Agreement;

(B) advise Buyer promptly of any litigation, arbitration or other judicial or administrative proceeding which concerns or affect the Property of which Seller becomes aware;

(C) cure any violation of which Seller receives notice;

(D) comply with the requirements of all Permits and Warranties; and

(E) in the event Seller becomes aware that any representation or warranty made by Seller in this Agreement will not be true and correct on the Closing Date, as if made at and as of the Closing Date, give prompt written notice thereof to Buyer, which notice shall include all information related thereto that is in Seller’s possession or control.

(ii) Negative Covenants. Between the date of this Agreement and the Closing Date, Seller agrees that, without Buyer’s prior written consent, Seller will not:

(A) grant, create, assume or permit to be created any mortgage, lien, encumbrance, lease, easement, covenant, condition, right-of-way or restriction upon the Premises or take or permit any action adversely affecting the title to the Premises as it exists on the date of this Agreement;

(B) or enter into any new service contract (including, without limitation, any management, service, equipment, supply, maintenance or concession agreement) or equipment lease; or

(C) make any alterations to the Premises.

-7-

(b) At Closing:

(i) Seller Deliveries. Seller shall deliver or cause to be delivered the following:

(A) a quitclaim deed with quitclaim covenants duly executed and acknowledged by Seller, in proper form for recording, subject only to the Permitted Exceptions, to the extent valid and subsisting;

(B) an assignment conveying the Intangibles, free and clear of all liens, security interests and encumbrances, and in the form attached to this Agreement as Exhibit C;

(C) an affidavit, in accordance with the Foreign Investment in Real Property Tax Act, in the form attached to this Agreement as Exhibit E;

(D) an affidavit to the Title Company of the type customarily provided by sellers of real property to induce title companies to insure over certain “standard” or “preprinted” exceptions to title;

(E) executed originals of all Permits, and Warranties; and

(F) such other documents as reasonably requested of Seller by Buyer, the Title Company or Buyer’s lender.

(ii) Possession. Possession of the Property shall be delivered by Seller to Buyer at Closing.

(iii) Deposit. The Deposit shall be credited against the Purchase Price.

(iv) Buyer’s Deliveries. Buyer shall deliver or cause to be delivered to Seller the following:

(A) the balance of the Purchase Price; and

(B) such other documents as may be reasonably required to consummate the transactions contemplated by this Agreement.

(v) Closing Expenses.

(A) Buyer and Seller shall each pay all recording fees incurred with respect to the transactions contemplated by this Agreement in accordance with the custom for similar transactions for the jurisdiction in which the Premises is located.

(B) Buyer shall pay the costs of the Title Commitment, title policy and all endorsements thereto, the cost of the Survey, and all costs of any appraisal, engineering and environmental reports obtained by Buyer.

-8-

(C) Seller and Buyer shall each pay one-half of the transfer taxes applicable to this transaction.

(D) Seller and Buyer shall each be responsible for paying their respective attorneys’ fees and costs.

(vi) Prepayment Penalty. Seller and Buyer shall each pay one-half of the amount of the prepayment penalty charged pursuant to Seller’s current mortgage loan with Amalgamated Bank which is being satisfied and released in connection with the sale of this Property to Buyer.

|

14.

|

CONDEMNATION.

|

If after the Effective Date, and on or prior to the Closing Date, all or any material portion (more than 5% in land area or materially impacts access to the Premises) of the Premises is taken by eminent domain or a notice of any eminent domain proceeding with respect to a material portion of the Premises or any part thereof is received by Seller, Seller shall immediately give written notice thereof with specificity to Buyer. Buyer shall complete the purchase of the Premises under this Agreement, with no deduction/reduction in the Purchase Price except at the Closing Seller shall pay, assign and transfer to Buyer all net proceeds from such proceedings theretofore received by Seller with regard to the Premises and all rights Seller has to any future proceeds of such eminent domain proceedings with regard to the Premises (after deducting Seller’s reasonable, actual out-of-pocket costs incurred in connection therewith).

|

15.

|

CASUALTY

|

If at any time prior to Closing any portion of the Property is destroyed or damaged as a result of fire or any other casualty whatsoever, Seller shall, within three (3) days thereafter, give written notice to Buyer but Buyer shall be required purchase the Property. Buyer shall have the right, to participate in and approve any adjustment of any insurance claims, the proceeds of any insurance policies with respect to the Property paid between the date of this Agreement and the Closing shall be paid or credited to Buyer at time of Closing, unless the Property is restored prior to Closing, and (c) all unpaid claims and rights in connection with losses shall be assigned to Buyer at Closing without in any manner affecting the Purchase Price.

|

16.

|

CONDITIONS PRECEDENT.

|

(a) Conditions to Buyer’s Obligations To Purchase. Buyer’s obligation to purchase the Premises is conditioned upon the satisfaction (or Buyer’s written waiver) on or prior to the Closing Date of the following conditions:

(i) The Title Company shall have issued or shall have committed to issue, upon payment of the applicable premium therefor, an ALTA Owner’s Policy of Title Insurance with respect to the Premises showing title to the Premises vested in Buyer, subject only to the Permitted Exceptions.

-9-

(ii) Each of the documents required to be delivered by Seller pursuant to this Agreement shall have been delivered as provided therein, and Seller shall not otherwise be in default under this Agreement.

(iii) Seller’s representations and warranties shall be true and correct in all material respects as of the Closing Date as if such representations and warranties were made at and as of the Closing Date.

(iv) Seller shall have performed, observed and complied with all covenants, agreements and conditions required by this Agreement to be performed, observed and complied with prior to or as of the Closing.

|

17.

|

DEFAULT

|

(a) Seller Default.

(i) If the sale of the Property is not consummated because of a material default under this Agreement on the part of the Seller, Buyer may terminate this Agreement by written notice of termination to Seller on or before the Closing Date, whereupon the Deposit shall be paid to Buyer, this Agreement shall become null and void and of no further force or effect and neither Seller nor Buyer shall have any further liability or obligation to the other under this Agreement, except for those obligations expressly stated to survive the termination of this Agreement, or

(ii) Buyer shall also have the right to sue for specific performance of this Agreement.

(b) Buyer Default.

(i) If the sale of the Property is not consummated because of a default under this Agreement on the part of Buyer, Seller shall be entitled to terminate this Agreement by written notice of termination to Buyer on the Closing Date, whereupon, as Seller’s sole and exclusive remedy, the Deposit shall be retained by Seller as assessed and liquidated damages, and this Agreement shall become null and void and of no further force or effect and neither Seller nor Buyer shall have any further liability or obligation to the other under this Agreement, except for those obligations expressly stated to survive the termination of this Agreement. Buyer shall also be prohibited from submitting a new offer for purchase until July 31, 2011.

|

18.

|

NOTICES

|

Any notices required or permitted to be given under this Agreement shall be given in writing and shall be delivered (a) in person, (b) by a commercial overnight courier that guarantees next day delivery and provides a receipt, or (c) by legible facsimile (followed by hard copy sent concurrently with such facsimile in accordance with preceding subsections (a) or (b)), or (d) mailed by certified mail, return receipt requested and such notices shall be addressed to the parties at the addresses set forth in paragraph 1 of the Agreement, in the case of Seller with a copy to,

-10-

WM Realty Management LLC

46 Baldwin Farms Road

Greenwich, CT 06831

Facsimile No.:

with a copy to:

Patricia Finnegan Gates, Esq.

Mountain, Dearborn & Whiting LLP

370 Main Street

Worcester, MA 01608

Facsimile No.: 508.755.6640

and in the case of Buyer with a required copy to (but which shall not constitute notice to Buyer):

Christine S. Kimmel, Esq.

Pepper Hamilton LLP

899 Cassatt Road

400 Berwyn Park

Berwyn, PA 19312

Facsimile No.: 610.640.7835

|

19.

|

MISCELLANEOUS.

|

(a) Time of Essence. Time is of the essence on each and every provisions of this Agreement on which time is an element.

(b) Governmental Filings. If either party is required to make any filing, submission or report to any governmental authority in connection with the transactions contemplated by this Agreement, the party upon which such requirement is imposed shall make such filing, submission or report.

(c) Interpretation of Agreement. The headings and captions in this Agreement are inserted for convenience of reference only and in no way define, describe or limit the scope or intent of this Agreement or any of the provisions hereof. Where the context so requires, the use of the singular shall include the plural and vice versa and the use of the masculine shall include the feminine and the neuter. This Agreement shall be construed reasonably to carry out its intent, without presumption against or in favor of either party.

(d) Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Massachusetts.

(e) The Seller shall comply with all laws and regulations regarding the transfer of real estate in the jurisdiction, including payment of all transfer taxes and recording fees imposed upon Seller. If applicable, Seller shall provide the settlement agent with a signed, completed W-9 form, including Seller’s forwarding address and an allocation of the gross proceeds of the sale, all for the purpose of complying with the reporting requirements of 1521(a) and 1521(b) of the Tax Reform Act of l986. The Seller agrees to sign all standard and customary documents as are reasonably required by the lender or lender’s attorney in order to complete the transaction.

-11-

(f) Buyer and Seller hereby disclose their social security/taxpayer I.D. numbers for the purpose of facilitating the reporting to the I.R.S. the sale of the Premises and any interest earned by either of the parties on the deposit, as required by law:

Seller’s Taxpayer I.D. number 20-35-00189

Buyer’s Taxpayer I.D. number 27-007112

(g) Counterparts. This Agreement may be executed in two or more counterparts, by facsimile or electronically, each of which shall be deemed an original, but all of which taken together shall constitute one and the same instrument.

(h) Liability Of Trustee, Shareholder, Beneficiary, Etc. If the Seller or Buyer executes this agreement in a representative or fiduciary capacity, only the principal or the estate represented shall be bound, and neither the Seller or Buyer so executing, nor any shareholder or beneficiary of any trust, shall be personally liable for any obligation, express or implied, hereunder.

(i) Assignment; Successors and Assigns. Upon prior written notice to Seller, Buyer may assign its interest under this Agreement, without the prior written consent of Seller to any party which either controls, is controlled by or is under common control with the Buyer. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective successors and assigns.

(j) Entire Agreement; Requirement for Writing. This Agreement and the Exhibits attached to this Agreement contain the final and entire agreement of Buyer and Seller with respect to the sale and purchase of the Premises and are intended to be an integration of all prior negotiations and understandings. Neither Buyer nor Seller shall be bound by any covenants, agreements, statements, representations or warranties, oral or written, not contained in this Agreement. No change or modification to this Agreement shall be valid unless the same is in writing and signed by the parties to this Agreement. No waiver of any of the provisions of this Agreement shall be valid unless the same is in writing and is signed by the party against which it is sought to be enforced.

(k) Severability. If any provision of this Agreement, or the application thereof to any person, place or circumstance, shall be held by a court of competent jurisdiction to be invalid, unenforceable or void, the remainder of this Agreement and such provisions as applied to other persons, places and circumstances shall remain in full force and effect.

(l) Automatic Extension. In the event that the date for performance of any duty or obligation, exercise of any right or option or giving of any notice shall occur upon a Saturday, Sunday or legal holiday, the due date for such performance, exercise or giving of notice shall be automatically extended to the next succeeding Business Day. “Business Day” shall mean any day other than a Saturday, a Sunday, or a federal holiday recognized by the Federal Reserve Bank of Massachusetts.

-12-

(m) Further Assurances. Each party shall, whenever and as often as it shall be requested to do so by the other party, execute, acknowledge and deliver, or cause to be executed, acknowledged and delivered, any and all such other documents and do any and all other acts as may be necessary to carry out the intent and purpose of this Agreement.

(n) WAIVER OF TRIAL BY JURY. EACH PARTY HEREBY WAIVES, IRREVOCABLY AND UNCONDITIONALLY, TRIAL BY JURY IN ANY ACTION BROUGHT ON, UNDER OR BY VIRTUE OF OR RELATING IN ANY WAY TO THIS AGREEMENT OR ANY OF THE DOCUMENTS EXECUTED IN CONNECTION WITH THIS AGREEMENT, THE PREMISES, OR ANY CLAIMS, DEFENSES, RIGHTS OF SET-OFF OR OTHER ACTIONS PERTAINING HERETO OR TO ANY OF THE FOREGOING.

(o) No Recording. Neither this Agreement nor any memorandum or short form thereof may be recorded by either party.

(p) Drafts not an Offer to Enter into a Legally Binding Contract. The submission of a draft of this Agreement by one party to another is not intended by either party to be an offer to enter into a legally binding contract with respect to the purchase and sale of the Premises. The parties shall be legally bound with respect to the purchase and sale of the Premises pursuant to the terms of this Agreement only if and when Seller and Buyer have fully executed and delivered to each other a counterpart of this Agreement.

[REMAINDER OF THIS PAGE LEFT INTENTIONALLY BLANK]

-13-

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first written above.

| WM REALTY MANAGEMENT, LLC, | RANOR, INC., a Delaware corporation, | ||||

| a Massachusetts limited liability company | |||||

| By: |

/s/ Andrew Levy

|

By: |

/s/ Stanley Youtt

|

||

|

Name:

|

Andrew Levy

|

Name:

|

Stanley Youtt

|

||

|

Date:

|

December 20, 2010

|

Date:

|

December 20, 2010

|

||

-14-

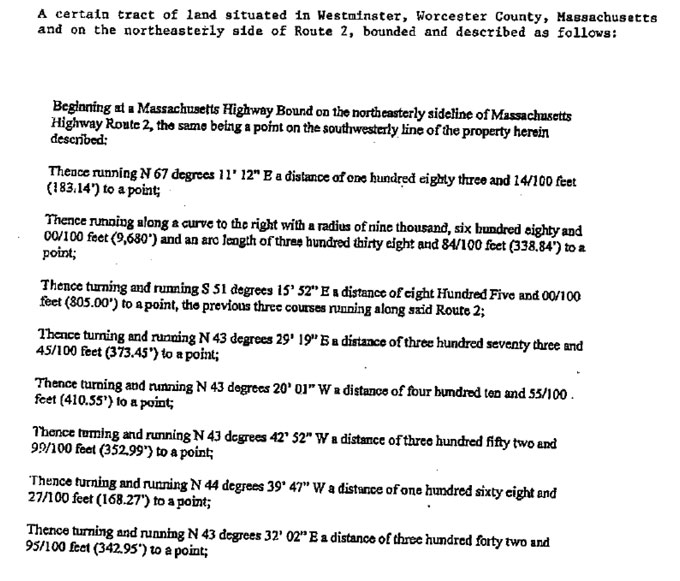

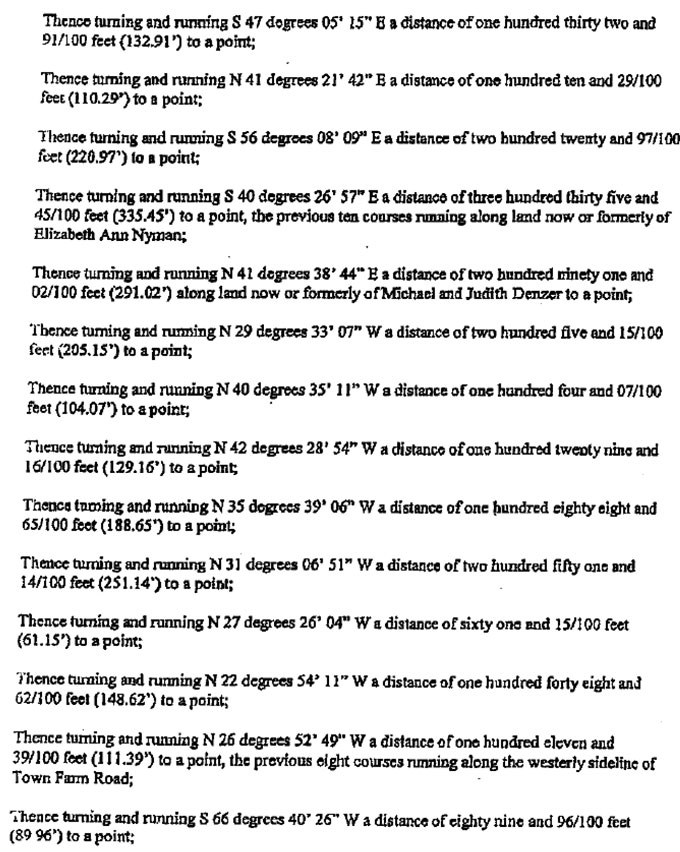

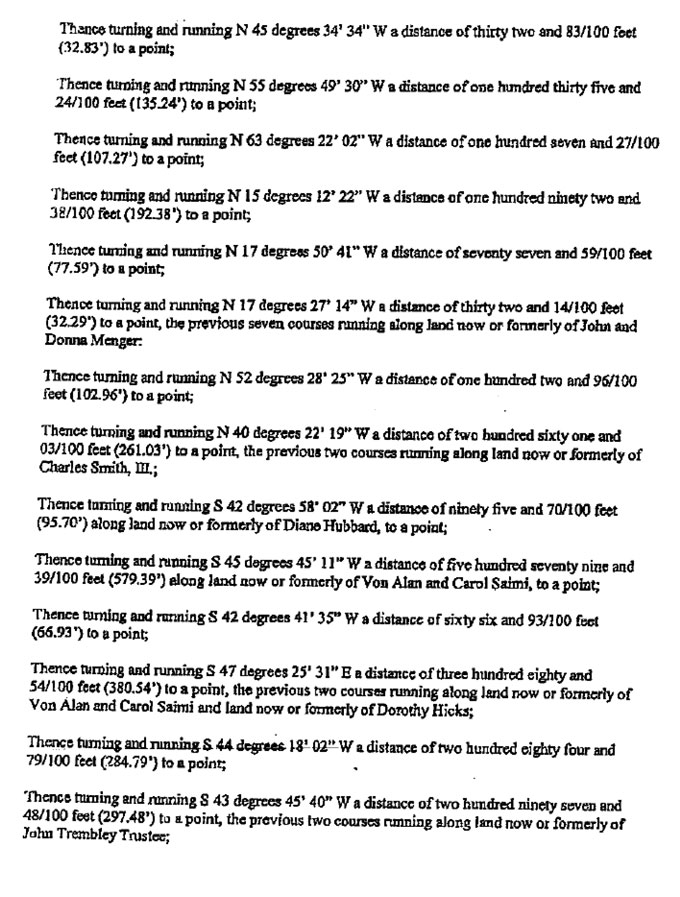

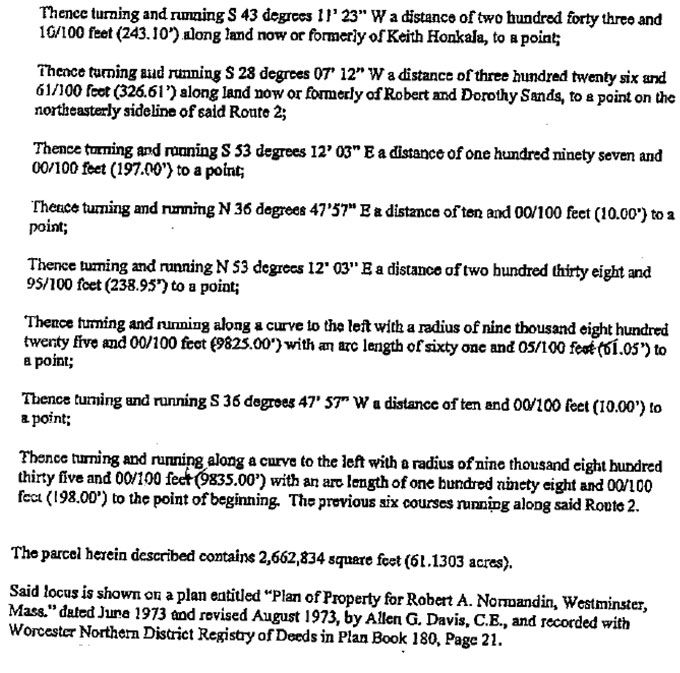

EXHIBIT A

Legal Description

-15-

-16-

-17-

-18-

EXHIBIT B

ANR Plan

-19-

EXHIBIT C

Assignment of Intangible Property

ASSIGNMENT OF INTANGIBLES

THIS ASSIGNMENT OF INTANGIBLES (the “Assignment”) is made as of the ________ day of,2010, by ___________________________________________, a ______________________ (the “Assignor”), in favor of _____________________________, a _____________________ (the “Assignee”).

WITNESSETH:

Assignor and Assignee are parties to Purchase and Sale Agreement dated_____________ (the “Agreement”) pursuant to which Assignor agreed to sell and Assignee agreed to purchase certain property located in _____________________, _________________ County, Massachusetts (the “Premises”). This Assignment is being delivered pursuant to the Agreement.

NOW, THEREFORE, for good and valuable consideration received by Assignor, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, Assignor hereby sells, assigns and transfers to Assignee all of the following (collectively, the “Intangibles”):

(a) all licenses, authorizations, approvals, permits and certificates of occupancy, if any, issued by any governmental authority and relating to the ownership, operation, maintenance, use or occupancy of the Premises;

(b) all currently effective warranties or guaranties given by any contractor, supplier or manufacturer of (i) any personal property or fixture installed in or used in connection with the Premises, and (ii) any work performed on or improvements included in the Premises.

Assignor represents and warrants to Assignee that (a) Assignor is the absolute owner of the Intangibles, (b) the Intangibles are free and clear of all liens, charges, encumbrances and security interests, and (c) Assignor has full right, power and authority to sell the Intangibles and to make this Assignment.

This Assignment shall inure to the benefit of Assignee, its successors and assigns and shall be binding upon, Assignor, its successors and assigns.

-20-

IN WITNESS WHEREOF, Assignor has executed this Assignment on the day and year first above written.

| ASSIGNOR: | |||

|

|

By:

|

||

| Name: | |||

| Title: | |||

-21-

EXHIBIT D

Subdivision Approvals

-22-

EXHIBIT E

Foreign Investment in Real Property Tax Act

ENTITY TRANSFER CERTIFICATION

Section 1445 of the Internal Revenue Code provides that a transferee of a United States real property interest must withhold tax if the transferor is a foreign person. To inform _________________________ (the “Buyer”) that withholding of tax is not required upon the disposition of United States real property interests by __________________________ (the “Seller”), Seller hereby certifies the following:

|

1.

|

SELLER IS NOT A FOREIGN CORPORATION, FOREIGN PARTNERSHIP, FOREIGN TRUST, OR FOREIGN ESTATE, AS THOSE TERMS ARE DEFINED IN THE INTERNAL REVENUE CODE AND INCOME TAX REGULATIONS.

|

|

2.

|

SELLER’S EMPLOYER IDENTIFICATION NUMBER IS __________________________.

|

|

3.

|

SELLER’S ADDRESS IS:

|

________________________________

________________________________

________________________________

________________________________

Seller understands that this certification may be disclosed to the Internal Revenue Service by Buyer and that any false statement made by Seller and contained herein could be punished by fine, imprisonment or both.

Under penalties of perjury, the undersigned individual signing this document on behalf of Seller declares that he/she has examined this certification and to the best of his/her knowledge and belief, it is true, correct and complete. The undersigned further declares that he/she has authority to sign this document on behalf of Seller.

WITNESS: _______________________________________

__________________________ By: ____________________________________

Print Name: ________________ Name: __________________________________

Title: ____________________________________

Date: _______________________

-23-