Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): February 14, 2011 (February

11, 2011)

Sooner Holdings,

Inc.

(Exact

name of registrant as specified in its charter)

|

Oklahoma

(State

or Other Jurisdiction of

Incorporation)

|

0-18344

(Commission

File Number)

|

73-1275261

(IRS

Employer

Identification

No.)

|

|

Long

Shan Development Area

Han

Jiang Town, ShiShi City

Fujian, PRC

(Address

of Principal Executive Offices)

|

N/A

(Zip

Code)

|

86-13505080536

(Registrant’s

telephone number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| o |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

| o |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

| o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

| o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Special

Note Regarding Forward Looking Statements

This

report contains forward-looking statements. The forward-looking statements are

contained principally in the sections entitled “Description of Business,” “Risk

Factors,” and “Management's Discussion and Analysis of Financial Condition and

Results of Operations.” These statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results, performance

or achievements to be materially different from any future results, performances

or achievements expressed or implied by the forward-looking statements. These

risks and uncertainties include, but are not limited to, the factors described

in the section captioned “Risk Factors” below. In some cases, you can identify

forward-looking statements by terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “would” and similar expressions intended to identify

forward-looking statements. Forward-looking statements reflect our current views

with respect to future events and are based on assumptions and subject to risks

and uncertainties. Given these uncertainties, you should not place undue

reliance on these forward-looking statements. These forward-looking statements

include, among other things, statements relating to:

|

·

|

our

anticipated growth strategies and our ability to manage the expansion of

our business operations

effectively;

|

|

·

|

our

ability to maintain or increase our market share in the competitive

markets in which we do business;

|

|

·

|

our

ability to keep up with rapidly changing technologies and evolving

industry standards, including our ability to achieve technological

advances;

|

|

·

|

our

dependence on the growth in demand for our

products;

|

|

·

|

our

ability to diversify our product offerings and capture new market

opportunities;

|

|

·

|

our

ability to source our needs for skilled labor, machinery and raw materials

economically;

|

|

·

|

the

loss of key members of our senior management;

and

|

|

·

|

uncertainties

with respect to the PRC legal and regulatory

environment.

|

Also,

forward-looking statements represent our estimates and assumptions only as of

the date of this report. You should read this report and the documents that we

reference and filed as exhibits to this report completely and with the

understanding that our actual future results may be materially different from

what we expect. Except as required by law, we assume no obligation to update any

forward-looking statements publicly, or to update the reasons actual results

could differ materially from those anticipated in any forward-looking

statements, even if new information becomes available in the

future.

2

Use

of Certain Defined Terms

Except

where the context otherwise requires and for the purposes of this report

only:

|

·

|

the

“Company,” “we,” “us,” and “our” refer to the combined business of Sooner

Holdings Inc., a Oklahoma corporation, and its subsidiaries, Chinese

Weituo Technical Limited (“Chinese Weituo”), a BVI limited company,

HongKong Weituo Technical Limited (“HK Weituo”), a Hong Kong limited

company, and Shishi Feiying Plastic Co., Ltd. (“SFP”), a PRC

wholly-Foreign Owned Enterprise;

|

|

·

|

“BVI”

refers to the British Virgin

Islands;

|

|

·

|

“Exchange

Act” refers the Securities Exchange Act of 1934, as

amended;

|

|

·

|

“Hong

Kong” refers to the Hong Kong Special Administrative Region of the

People’s Republic of China;

|

|

·

|

“PRC,”

“China,” and “Chinese,” refer to the People’s Republic of

China;

|

|

·

|

“Renminbi”

and “RMB” refer to the legal currency of

China;

|

|

·

|

“SEC”

refers to the Securities and Exchange

Commission;

|

|

·

|

“Securities

Act” refers to the Securities Act of 1933, as amended;

and

|

|

·

|

“U.S.

dollars,” “dollars,” “USD” and “$” refer to the legal currency of the

United States.

|

|

·

|

All

currency amounts are in USD unless otherwise stated. Foreign

currency translation in this Form 8-K (excluding financial statements or

amounts from the financial statements) is based on the conversion of RMB

to U.S. Dollars as of December 31,

2010.

|

3

Item

1.01 Entry Into A Material Definitive Agreement

On

February 14, 2011, Sooner Holdings Inc., an Oklahoma corporation, entered into a

Securities Exchange Agreement with R.C. Cunninghham II and R.C.

Cunningham III (collectively the “Control Shareholders”) and Chinese Weituo

Technical Limited (“Chinese Weituo”), a BVI corporation and its shareholders,

China Changsheng Investment Limited, a BVI company, China Longshan Investment

Limited, a BVI company, High-Reputation Assets Management Longshan Limited, a

BVI company, Joint Rise Investment Limited, a BVI company, and W-Link Investment

Limited, a BVI company (collectively, the “Chinese Weituo Shareholders”),

pursuant to which Sooner Holdings acquired 100% of the issued and outstanding

capital stock of Chinese Weituo in exchange for the issuance of

19,200 shares of Series A Preferred Stock. Each share of Series A

Preferred Stock is convertible in one thousand shares of common stock, $0.001,

par value which will constitute approximately 96.0% of Sooner Holdings’ issued

and outstanding common stock on an as converted basis and after giving effect to

a proposed share consolidation. Subsequent to the completion of the

Securities Exchange Agreement, Sooner Holdings intends to amend its articles to

change its name and effect a 1 for 18.29069125 share consolidation.

In

addition, pursuant to the Securities Exchange Agreement, in the event that

Chinese Weituo’s subsidiary ShiShi Feiying’s net income is less than $5.5

million as determined in accordance with generally accepted accounting

principles of the United States and set forth in ShiShi Feiying’s audited

financial statements for the year ended December 31, 2010, then we will be

required to issue an additional 113,637 shares of common stock (post

consolidation) in the aggregate to the Control Shareholders.

As

discussed in more detail in Item 5.06 of this report, as a result the share

exchange, (i) Sooner Holdings ceased being a shell company as such term is

defined in Rule 12b-2 under the Securities Exchange Act of 1934, and (ii) we

indirectly control though subsidiaries, ShiShi Feiying Plastic, which is engaged

in the business of manufacturing of and selling of synthetic polyurethane

leather (“PU leather”) for the retail leather industry and for the flip-flops

and slippers industry. ShiShi Feiying Plastic is located in ShiShi

City, Fujian, China.

The

foregoing description of the terms of the Share Exchange Agreement is qualified

in its entirety by reference to the provisions of the agreements filed as

Exhibit 2.1 to this report, which are incorporated by reference

herein.

Item

2.01 Completion Of Acquisition Or Disposition Of Assets

On

February 14, 2011, we completed the acquisition of Chinese Weituo pursuant to

the Securities Exchange Agreement described in Item 1.01 above. The acquisition

was accounted for as a recapitalization effected by a share exchange, wherein

Chinese Weituo is considered the acquirer for accounting and financial reporting

purposes. The assets and liabilities of the acquired entity have been brought

forward at their book value and no goodwill has been recognized.

Form

10 Disclosure

As

disclosed elsewhere in this report, on February 11, 2011, we acquired Chinese

Weituo in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states

that if the registrant was a shell company, as we were immediately before the

reverse acquisition transaction disclosed under Item 2.01, then the registrant

must disclose the information that would be required if the registrant were

filing a general form registration of securities on Form 10.

Accordingly,

we are providing information that would be included in a Form 10 had we been

required to file such form. Please note that the information provided

below relates to the combined entity after the acquisition of Chinese Weituo,

except that information relating to periods prior to the date of the Securities

Exchange Agreement only relate to Chinese Weituo unless otherwise specifically

noted.

4

Description

of Business

Overview

We are

one of the largest Fujian synthetic polyurethane leather (“PU leather”)

manufacturer for the shoe industry in Fujian Province, China. Our

primary business is the design, manufacturing and sale of PU leather for the

shoe manufacturing industry in China. In addition, we manufacture

flip-flops and slippers (footwear) for sale in China and abroad. For

the nine months ended September 30, 2010 and year ended December 31, 2009, our

sales were $16,492,775 and $15,210,827, respectively, for PU leather and

$6,970,015 and $6,012,252, respectively, for footwear.

Our PU

leather production facilities are strategically located in Fujian Province, the

shoe manufacturing center in China. This puts us in close proximity to our

target customers. We plan to increase our PU leather production capacity and

expand our sales to other industries. Toward this goal, our growth strategy

includes expansion projects to build a new fabrication facility in the DaTian

technology park in Fujian province, China where many of our customers are

located.

Mr. Ang

Kan Han is our chairman of the board, president and largest

shareholder. Mr. Ang is also known as “Hong Jiang Han” which is Mr.

Ang’s Mandarin name spelled in English. As discussed, we intend to

build two new PU leather factories. Mr. Ang established Fuijian

Feiying Plastic Co., Ltd. (FFP) and Feiying Industrial Co., Ltd. (San Ming)

which are wholly-foreign owned enterprises (WFOE) in the PRC, to build the PU

leather factories. To facilitate the building of the PU leather

factories, we have from time to time advanced funds to both FFP and San

Ming. Further, we have entered into a call option agreement with Mr.

Ang to allow us to purchase the factories being built by FFP and San Ming at 90%

of the net tangible asset value when they are completed. Because Mr.

Ang is our president and chairman of the board, we have the power to direct the

activities of FFP and San Ming. We have also determined that neither

FFP or San Ming currently have been adequately capitalized to carry out their

principal operating activities, which is to build a PU leather

factory.

Currently,

from an accounting perspective, we have determined FFP and San Ming to be

variable interest entities (VIE) because of their insufficient capital to carry

out their principal operating activities, and we are the primary

beneficiary. We will continue to reassess FFP’s and San Ming’s status

as VIEs including any potential change in VIE status.

History

Sooner

Holdings, Inc.

Our

company, Sooner Holdings, Inc., an Oklahoma corporation, was formed in 1986 to

enter the in-home soda fountain business. We never developed this

business into a national market. Subsequently, we evolved into a

multi-subsidiary holding company in diverse businesses. From 1993,

when we were restructured, until June 1998 we sought acquisitions. In

November 1987 we acquired a business park from R.C. Cunningham II, our president

and a director. In June 1998 we acquired, through our subsidiary ND

Acquisition Corp., the assets and certain liabilities of New Direction Centers

of America, LLC and entered the minimum-security correctional

business. In May 2000 we purchased the rights to a new, Class 5,

hardware and software computer-based platform that resembles the computer-based

soft switch. We named it "Cadeum" and organized a wholly owned

subsidiary, Sooner Communications, Inc., through which we proposed to market

Cadeum to telecommunications carriers.

5

We

operated the three above-described businesses through three subsidiaries, ND

Acquisition Corp., Charlie O Business Park Incorporated and Sooner

Communications, Incorporated. In fiscal years 2003 and 2004, for

business reasons, we ceased doing business in these

areas. Subsequently, we disposed of these subsidiaries.

Until we

entered into the Securities Exchange Agreement, our business plan was to seek,

investigate, and, if warranted, acquire one or more properties or businesses,

and to pursue other related activities intended to enhance shareholder

value.

Shishi

Feiying Plastic Co., Ltd.

All of

our business operations are conducted through our wholly-foreign owned Chinese

subsidiary, Shishi Feiying Plastic Co., Ltd. (“SFP”). SFP was

registered in China as a wholly-foreign owned enterprise under Chinese law in

December, 2003. Initially SFP original business scope was limited to

the preparation of the production of plastic goods. In 2006, SFP

expanded its business to the production of plastic when all of the $5,000,000

capital contribution was fully paid as registered capital. Soon thereafter, SFP

started the production of PU leather for sale in China.

In 2007,

SFP acquired all of the assets of our footwear business from Shishi Changsheng

Shoe Industry Co., Ltd., a wholly-foreign owned enterprise under Chinese law

(“Shishi Changsheng”). Shishi Changsheng has been manufacturing

footwear since 1998.

Reverse

Acquisition of Chinese Weituo

Pursuant

to the Securities Exchange Agreement, we acquired 100% of the issued and

outstanding capital stock of Chinese Weituo in exchange for 19,200 shares of

Series A Preferred Stock which upon conversion will constitute approximately

96.0% of our issued and outstanding common stock after the consummation of the

transaction contemplated by the Securities Exchange Agreement As a

result of the reverse acquisition, we have assumed the business and operations

of Chinese Weituo and its subsidiaries.

For

accounting purposes, the reverse acquisition with Chinese Weituo was treated as

a reverse acquisition, with Chinese Weituo as the acquirer and Sooner Holdings

as the acquired party. Unless the context suggest otherwise, when we refer in

this report to business and financial information for periods prior to the

consummation of the reverse acquisition, we are referring to the business and

financial information of Chinese Weituo.

6

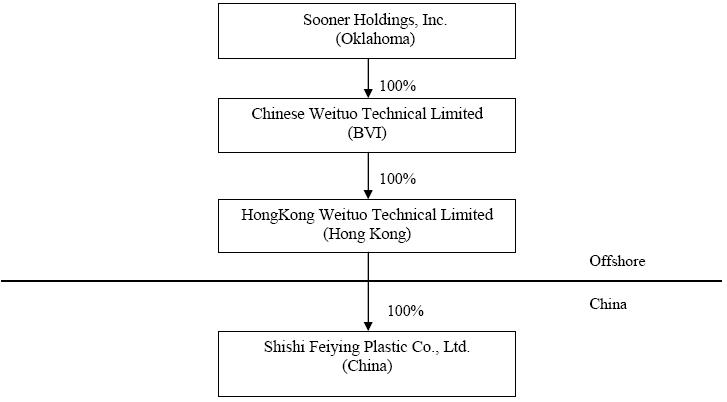

Corporate

Structure

All of

our operations are conducted through our Chinese subsidiary SFP. The chart below

presents our current corporate structure:

Our

principal executive office is located at Han Jiang Town, ShiShi City Fujian,

PRC. Our telephone number at our principal executive office is

86-13505080536.

Products

We have

two business divisions; our PU leather division and our footwear

division. Our primary business is manufacturing PU

leather. We maintain our footwear business because of our established

distributors and customers, and low cost of manufacturing.

PU

Leather

Development

of PU Leather

As

natural leather has excellent natural characteristics, it is widely used in the

production of commodities and industrial products. However, with the

world's population growth, human demand for leather has increased rapidly, and

the production of natural leather cannot satisfy such demand. To

solve the shortage in supply of natural leather, with the progress of chemical

textile industry, scientists began to study and develop artificial leather and

synthetic leather as early as five decades ago.

Polyvinyl

chloride (“PVC”) leather is the first generation of artificial leather. Although

PVC has advantages including, acid alkali resistance, resistance to water, and

bright luster, PVC leather has poor air permeability, feels stiff in cold

environment and has worse touch feel than PU leather. Another

weakness of PVC is that it can damage the environment. Because it is

hard to degrade, the discarded PVC leather pollutes the

environment. In the production process of PVC leather, plasticizer,

stabilizer and other addictives are added. Stabilizers in PVC leather contain

lead, cadmium and other heavy metals, which are prohibited by developed

countries including the EU, Japan and the USA. As PVC leather is

lower in price, it is mainly used in low-grade bags, sofa, and

decorations.

7

Polyurethane

synthetic leather (PU leather) is the second generation artificial leather. In

1937, polyurethane was successfully developed, laying a foundation for the

development of PU leather and the progress of artificial leather

industry. In 1953, Germany-based Bayer firstly applied for the patent

for PU leather; in 1963, Japan Xingguo chemical company produced PU leather; and

in 1964, American DuPont Company developed a kind of PU leather used for

production of shoe upper.

PU

leather has certain advantages such as mild burnish, soft feeling, similar

feeling to genuine leather, fine low temperature resistance, fine air

permeability, and washability. In addition, PU leather has excellent

adhering function to base material, is abrasion resistant, resists flexure, and

has excellent mechanical properties of aging resistance. Compared to

natural leather, PU leather processing is simpler at a lower cost. As

a result, PU leather had become an ideal substitute for natural leather

products, and it has been widely used for clothing, furniture, and luxury

shoes.

Superfine

fiber PU leather is the third generation artificial leather. It

adopts bunchy superfine fiber that is similar to bunchy collagenous fiber in

natural leather in terms of structure and performance, which is processed into

three-dimensional network structured high-density nonwovens, and filled with

optimal form microporous-structured polyurethane. The superfine fiber

PU leather comes out after a special post-processing. Superfine fiber

PU leather has better function and performance than genuine leather including:

tear resistance, high pulling tension, wear-resistance, low temperature

resistance, acid and alkali resistance, fade resistance, hydrolysis resistance,

light quality, soft and fine air permeability, smooth feel and even

thickness. In terms of chemical resistance, quality uniformity and

production processing adaptability, waterproof, mildew-proof, superfine fiber PU

exceeds natural leather. Superfine fiber PU leather is suitable for

fabrics for high-grade sport clothes, shoes, bags and furniture.

The PU

leather industry is developing rapidly in terms of product quality, varieties

and output, and it is undergoing a transition from ordinary PU synthetic leather

to high-quality PU synthetic leather through technology and more salient

physical performance.

Our

Industry

Artificial

synthetic leather is mainly composed of base cloth and coating resin. In

industrial practice, the artificial leather with PVC resin as coating is

generally called PVC artificial leather; the artificial leather with PU resin as

coating is called PU leather; the synthetic leather with superfine fiber

nonwoven cloth as base cloth and PU resin as coating is called superfine fiber

genuine leather (also called superfine fiber synthetic leather). In industrial

statistics, superfine fiber genuine leather is listed as the category of

synthetic leather.

PU

leather is similar to genuine leather in terms of structure and performance.

With a three-dimensional appearance, PU synthetic leather has superior

durability, resilience, softness, tensile strength and solvent resistance. It

can be cut, ground and processed like genuine leather to be air permeable and

moisture permeable.

PU

leather is used in a wide variety of industries including clothing, shoes,

furniture, and athletic equipment. Different uses require different

types and quality of PU leather. Traditionally, Japanese companies where known

for their technology in creating synthetic leather while Italian companies were

know for creating fashionable synthetic leather for higher-end

products. Taiwanese and Korean companies also grew to produce

high-tech synthetic leather. Lately, Chinese companies have emerged

as producers of high-quantity PU leather. According to TaiWan

Industrial Technology Research Institute, China National Bureau of Statistics,

China’s output of synthetic leather makes up 70% of the world’s total output,

becoming the top manufacturer and consumer of synthetic leather. The synthetic

leather products are raw materials for shoes, bags, garments, and furniture

products.

8

Increasing

Demand for Artificial and Synthetic Leather

According

to China Plastics Processing Industry Association, by 2013 the quantity demanded

for the domestic artificial leather and synthetic leather will reach 3.24

billion ㎡

(square meters). According to the National Bureau of Statistics, in

2009 the production of artificial leather in China was 1.07 billion ㎡ representing a

year-on-year increase of 6.6% while the production of synthetic leather is 1.28

billion ㎡

representing a year-on-year increase of 13.2%. The gross output value of

industry is 58.67 billion RMB with a year-on-year increase of 11.24

%.

In

addition, it is anticipated that PU synthetic leather, which is the second

generation of artificial leather and synthetic leather, will increase as

customers look for alternatives to the PVC artificial leather, which is

currently the main product of artificial leather and synthetic

leather. In terms of performance, PU synthetic leather is better than

PVC artificial leather and it is replacing PVC artificial leather

gradually. At present, the EU has limited the production and sale of

PVC artificial leather and Japan has already banned the use of PVC artificial

leather as car decoration material. With the tightening of

international environmental policy, it is anticipated that the demand for PU

synthetic will grow.

According

to Statistics on synthetic

leather factories and their production lines in domestic China in 2008 by

Chinapu.com which is specialized in PU market research, in 2008 there were

approximately 364 synthetic leather enterprises in Mainland China, which had

1,343 production lines. Among them there are 694 dry process

production lines and 649 wet process production lines. These

enterprises are mainly concentrated in provinces including Zhejiang, Fujian,

Guangdong and Jiangsu. Manufacturers in Fujian Province, China

represented approximately 13% of all of the manufacturers included in the

statistical report. In addition, according to China National Bureau

of Statistics, Guangdong, Fujian and Zhejiang are three major leather shoe

production bases in China, producing 83% of the country’s total

output. These three provinces are main areas with demand for

synthetic leather in China and 80% of domestic production lines of synthetic

leather are distributed in the three provinces.

PU

Applications

PU

leather is used in the following application fields: shoe leather, furniture

leather, leather for luggage and case, leather for garment, leather for balls,

and leather for inner decoration of cars. Sports shoes are an

important application area of synthetic leather. China’s annual

output of sneakers stands at about 3 billion pairs, which are mainly produced in

Fujian and Guangdong. Jinjiang of Fujian province is the largest

production base of sports shoes. There are more than 3,000

shoe-making manufacturers in Jinjiang, with a total annual output of 1.2 billion

pairs of sports shoes and sneakers, accounting for 40% of China’s output, or 20%

of the world's total output. If calculated on the basis that the shoe

upper of 60% of sports shoes are made of synthetic leather and each pair of

sports shoes needs 0.12 ㎡ of synthetic

leather, the sports shoes making industry consumes 216 million ㎡ of synthetic

leather. In Jinjiang alone, the demand for synthetic leather reaches

86 million ㎡.

9

In

addition, there are a lot of shoe-manufacturers who engaged in production with

leather shoe upper, mainly distributed in Guangdong and

Zhejiang. Huidong of Guangdong is “China’s Production Base of Ladies

Shoes,” with more than 3,000 shoe-making enterprises, more than 95% of which

produce ladies shoes of synthetic leather; these enterprises produce a total of

300 to 400 million pairs of ladies shoes a year. Wenling of Zhejiang

mainly produces shoes of synthetic leather, and this city has more than 6,000

shoe-making enterprises, with a total annual output of 400 million

pairs.

Market

We are

one of the leading manufacturers of PU leather for the shoe manufacturing

industry in Fujian Province, China. We are located in the area of

Jinjiang and Quanzhou, which is China’s largest production base of sports shoes,

sneakers and casual shoes. There are over 4,000 shoe manufacturers in this area

including well known companies, such as “Anta,” “Peak,” “361°,” “Voit,” “Xtep,”

“Erke” and “Deerway.” Collectively, the annual production of various

types of shoes in Quanzhou is above 1 billion pairs. Our major

customers are shoe factories which are concentrated in the area of Quanzhou and

Jinjiang. As the production base is close to the sales market, our

sales and transportation costs are greatly reduced. Meanwhile because

the production base is close

to the market, we can quickly access the customers’ information which becomes a

significant advantageous position in terms of R&D and market

response. In addition, over 60% of the shoe leather needed by the PU

leather factories in this area are currently from outside the province and the

local production capacity of PU leather manufacturers can’t meet with the demand

of PU leather here. Therefore, we have enough market capacity to

absorb the expansion of production capacity in the future.

Manufacturing

PU

synthetic leather refers to a type of artificial leather with PU resin coatings

applied and dried over the release paper and then transferred to the base cloth

or wet-process substrate layer (BASE). PU synthetic leather is

similar to genuine leather in terms of structure and performance. With a

three-dimensional appearance, PU synthetic leather has superior durability,

resilience, softness, tensile strength and solvent resistance. It can

be cut, ground and processed like genuine leather to be air permeable and

moisture permeable. PU synthetic leather can be further categorized

by intended use as follows: ball leather, footwear leather, upholstery leather,

garment leather, bag leather, car interior leather, fancy leather, industrial

accessory / packaging leather etc.

High-performance

PU leather refers to PU synthetic leather using high-density nonwoven fabric as

base cloth and featuring superior hydrolysis resistance, peel strength, tear

strength, durability, air permeability and moisture

permeability. High-performance PU leather is mainly used to make

high-grade athletic shoes. In China, nearly 50% of the

high-performance PU leather products are imported.

We

manufacture a variety of PU leather products including the conventional and

high-performance series. These products are basically intended for

footwear applications.

We have a

66,700 square meter factory for the production of five lines of PU

leather. Our five production lines consist of three wet-process and

two dry-process production lines. Altogether, we can produce over 12

million meters of PU leather per year.

10

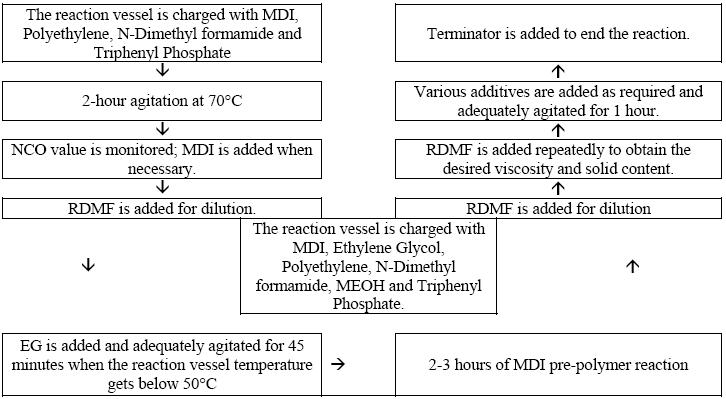

A brief

overview of the wet-process and dry process is described below.

Wet-Process Resin

Production

Dry-Process Resin

Production

|

1-hour

agitation at 70°C

|

|

â

|

|

RDMF

is added for dilution.

|

|

â

|

|

RDMF

and MEK are added repeatedly to obtain the desired viscosity and solid

content.

|

|

â

|

|

Various

additives are added as required and adequately agitated for 1

hour.

|

|

â

|

|

Terminator

is added to end the reaction.

|

In

addition to our manufacturing process for the PU leather, we also produce

roughly 14,400 tons of resins a year that we use for our manufacturing process

as well as to sell to other manufacturers. This allows us to be less

dependent on suppliers and market conditions of raw materials. We

also developed a proprietary process to recover and reuse our production remains

as part of our manufacturing process. This reduces waste in our manufacturing

process. As discussed in growth strategy, subject to availability of

funds we intend to expand our manufacturing capacity by acquiring one or two

production plants.

11

Raw

Materials and Suppliers

Resin

pastes and base cloths are the key raw materials used in the production of PU

synthetic leather and therefore constitute a major part of approximately 80% of

the production cost, specifically, resin pastes 60% and base cloths

20%. We have established a resin paste plant to support our

production needs. The new base cloth production line is expected to

start operations in 2012, so we will be able to manufacture the resin pastes and

base cloths required for production of PU leather and minimize the adverse

impact of the rise in raw material price on the profit margin of PU leather

products. The key raw materials of PU resins are coal-based DMF,

petroleum-based AA and MDI and other chemical products. DMF, AA and MDI stand at

approximately 70% of the total cost of PU resins. We purchase our raw

materials from a number of suppliers and are not dependent on any single

supplier. We do not have a formal long term contract with any of our

suppliers. During the fiscal years ended December 31, 2009 and 2008,

and nine months ended September 30, 2010, purchases from any one vendor did not

exceed 10% of our total purchases.

Marketing,

Sales and Distribution

We sell

PU leather mostly to shoe factories in China. 90% of our sales are to

distributors, and the remaining through direct sales to customers. We

are developing our foreign market (outside of China) and plan to export 20-30%

of our PU leather production by 2011.

In

connection with our sales, we provide consistent and reliable customer services

from product development, communication in production to after-sales support and

maintenance. At the point of product development, the sales

representative will introduce the market trends to the customer and provide

market research and product-specific consultation services upon the customer’s

request. During the product process, we strive to be highly

responsive to the changes in terms of specifications such as physical

properties, and since we have our own resin plant we are able to accommodate

changes quickly with accurate adjustment to the resin formulas in response to

customer needs. During the after-sales stage, we provide training,

on-site instruction and call center services. We give information to

our customers about how to preserve PU leather products, especially

high-performance PU leather, for a longer period of time, so as to prevent

product returns or disputes due to improper storage.

Seasonality

We

experience some seasonal trends in the sale of our products. Sales in

our PU leather division are often stronger in our second, third and fourth

quarter and often weaker in first quarter. Historically, the net

result of seasonal trends has not been material relative to our overall results

of operations, but many of the factors that create and affect seasonal trends

are beyond our control.

Backlog

At the

end of calendar year ended December 31, 2009 and 2008, we had no

backlog. We do not believe that backlog is a meaningful indicator of

sales that can be expected for any period, and there can be no assurance that

the backlog at any point in time will translate into sales in any subsequent

period, particularly in light of our policy of allowing customers to cancel or

reschedule orders without penalty prior to commencement of

manufacturing. Since 2007, we have not recorded any provision for

sales returns as of December 31, 2009 and 2008, and for the nine months ended

September 30, 2010.

Inventory

Levels

We

produce according to sales and this strategy gives us the ability to operate

with reduced levels of raw materials and finished goods

inventories. Fluctuations in market demand may nevertheless result in

excess inventory. However, we believe that any excess inventory can

be used since it is in semi-finished process which can be used, thus minimizing

declining inventory values and obsolescence. Maintaining a low

inventory level is dependent upon our ability to achieve targeted revenue and

product mix, to further minimize complexities in its product line and to

maximize commonality of parts. There can be no assurance that we will

be able to maintain low inventory levels in future periods.

12

Growth

Strategy

We intend

to continue to focus on mid- to high-grade PU leather products in the next few

years while (i) entering other regional markets in China, such as Hunan and

Jiangxi Provinces that are located near our manufacturing facility in Fujian,

and (ii) increasing our presence in high-end overseas markets such as Europe and

America. We intend to achieve growth by pursuing the following

strategies:

· Focus on key

markets. China continues to present strong growth

opportunities especially in the Fujian Province, with increasing demand for our

high quality PU leather. We are also planning to work closely with

our distributors to explore direct sales opportunities to large-scale customers

outside of China.

· Focus on shoe

industry. We will continue to focus our sales to the shoe

industry which demand higher quality PU leather such as ours. We will

continue to improve the quality of our products, develop proprietary technology

and formulas, and upgrade aesthetic designs to differentiate our products from

our competitors. We will also seek to expand our sales to other

industries that focus on higher quality of PU leather.

· Research and

Development. We will continue to commit resources for research

and development in order to improve our manufacturing process and develop new

formulas to improve the quality of our PU leather. In particular, our

efforts will focus on (1) developing more advanced technologies to increase our

productivity and efficiency in the manufacturing process and reduce cost of

production; (2) developing and refining our proprietary manufacturing process

for the resins used in our manufacturing process as well as methods of recycling

our used manufacturing remains to cut costs and preserve the environment; and

(3) enhancing our product quality to satisfy stringent manufacturing

requirements and to keep abreast of rapidly changing industry standards and

evolving market trends.

· Upgrade on

technology. We will continue to upgrade and refurbish our

machinery so that we can stay ahead of the technology curve with the most

efficient use of capital investment.

· New manufacturing

facilities. We intend to increase our production to meet

current and future demand by building new manufacturing facilities in Yong’an

city and DaTian city, Fujian Province. We have recently entered into

options agreements with Feiying Industrial Co., Ltd. (San Ming) and Fuijian

Feiying Plastic Co., Ltd. (FFP) to purchase 100% interests in San Ming and

FFP.

13

Competitive

Strengths

We

believe that the following competitive strengths enable us to compete

effectively in, and to capitalize on the growth of, the PU leather

market:

|

·

|

Strong Cost

Control. We produce our own raw materials for the

production of PU leather. In addition, we recover and reuse our

waste manufacturing materials.

|

|

·

|

Strong

Relationships. We enjoy long-term relationships with our

suppliers.

|

|

·

|

Loyalty. We

cultivate strong employee loyalty to the

company.

|

|

·

|

Differentiation. We

have unique formulations for certain PU leather

products.

|

|

·

|

Strong

Trademarks. Our WINTOP, WINTOP plus graphic, and NIVIANI

plus graphic trademarks are well-known in

China.

|

|

·

|

Strong Research and Development

Capabilities. We place a strong emphasis on research and

development, particularly focusing on improving the quality and uniqueness

of our products. Our strong research and development commitment

have enabled us to develop special formulas to differentiate our products

from our competitors. We have in-house engineers who calculate

the best formula for each batch of raw materials based on their

experience.

|

|

·

|

Recognized Quality

Products. We strive to manufacture quality

products. We have the facilities for experimenting, inspecting

and testing as well as a sophisticated production process. Our

products receive accreditation from famous footwear manufacturers such as

Erke and Xtep. As a leading supplier of PU leather, our

products are used in both domestic athletic shoe brands and

internationally recognized brands.

|

|

·

|

Eco-Friendly

Production. We are committed to a long-term strategy of

green, eco-friendly and sustainable development. We have

maintained a sophisticated recycling and post-treatment

process. We have entered a call option agreement to acquire San

Ming within three years. We are contemplating acquiring the

DaTian production line to replace the conventional HTF heating solution

with a steam recovery and zero heat emission system. This new

technique is estimated to save costs

annually.

|

|

·

|

Low-cost manufacturing

model. We conduct all of our manufacturing activities in

Fujian Province, China. Our access to China's abundant supply of skilled

and low-cost labor, as well as our ability to source raw materials,

equipment, land and manufacturing facilities locally and economically, has

considerably lowered our operating cost and expenses as a percentage of

revenues.

|

|

·

|

Location. We are located

near our customers. Our manufacturing facility is situated in

Fujian Province which is the shoe manufacturing center in

China. This reduces cost of transportation and allows us to

better serve our customers.

|

|

·

|

Brand Awareness and Customer

Loyalty. We have established a good long-term

cooperative relationship with our customers. Our ability to

adjust, accommodate and update our products in time and develop new

products to adapt to the needs of our consumers have resulted in a group

of long-term loyal customers. In addition, our relationships

with our customers allow us to gather important market

information.

|

Competitors

The

competition in our industry is intense and there is a high concentration of

competitors in our geographical area. Our products are positioned to

be medium and high-end PU synthetic leather and our major competitors are

domestic competitors which we have identified to include Jinjiang Lanfeng

Leather Manufacturing Co., Ltd., Kunshan Xiefu Group, and Jinjiang

Tianshou Artificial Leather Co., Ltd. In general, our direct

competitors have overseas sales capacity. However, they lack our low

cost advantage, focused concentration on research and development, close

proximity to customers, high quality, and centralized product

offerings.

14

Footwear

There is

a tremendous continuing demand for PVC flip-flops and slippers all over the

world, and particularly in countries with hot climates such as those in Africa,

the Middle East, Southeast Asia and South America.

Manufacturing

Our PVC

foam slippers are made of PVC resins which are transformed into lightweight and

soft sheets through high-pressure foaming and then stamped and cut into soles

with reserved holes. Non-foam PVC materials are used to make the

Y-shaped strap through injection molding which is then fastened to the sole to

form a thong flipper.

PVC foam

slippers are mainly made of PVC, DOP, DDP and AS. We have a 5,000

square meter factory that manufacturers PVC flip-flops and

slippers. We use a semi-automated processes to boil, mix, vulcanize,

mold, drill, and press raw PVC and chemicals into innovative fashionable

flip-flops and slippers. We can currently produce more than 40

million flip-flops and slippers per year. We are one of the leading

PVC slipper manufacturers in China, with state-of-the-art production process and

equipment. We are one of the key suppliers of White Dove, an

internationally recognized slipper brand. We also have our own brand

WINTOP which is well received in Africa, Middle East, Southeast Asia and South

America for its premium quality, stylish design, attractive patterns and

competitive price.

Raw

Materials and Suppliers

The key

raw materials of PVC foam slippers are PVC (Polyvinyl chloride) resins, DOP

(Dibutyl phthalate), and DDP. We purchase our raw materials from a

number of suppliers and are not dependent upon any raw material supplier for PVC

slipper production. We do not have a formal long term contract of any

of our suppliers. During the fiscal year ended December 31, 2009 and

2008, we had no suppliers that accounted for more than 10% of our purchases of

raw materials.

Sales

and Distribution

We sell

our footwear to distributors that have built an extensive sale and distribution

network in Asia and other parts of the world. The bulk of our sales

occur in Africa, Middle East, Southeast Asia, and South America. For

the nine months ended September 30, 2010 and year ended December 31, 2009, our

percentage revenues were 82.3%, 9.9% and 7.8% and 76.7%, 10.6% and 12.7% in

China, Middle East and Africa, respectively. Sales in our footwear

division are often stronger in our second, third and fourth quarter, and often

weaker in first quarter.

Customers

For PVC

foam slippers, our customers are from the overseas markets. We have

an established relationship with the end customers in other

countries. In addition, we have signed contracts with a number of

overseas trading companies, such as Randsford Limited, who sell our products in

Africa and Middle East countries. Randsford Limited accounted for 19%

and 26% respectively of our sale during the nine months ended September 30, 2010

and year ended December 31, 2009. We also receive orders directly

from the overseas end customers by attending various trade fairs such as Canton

Fair. During the year ended December 31, 2009, for slippers, we had

one distributor, with a dozen customers, account for more than 10% of our sales

revenue and collectively accounted for 26% of our sales

revenue. During the fiscal year ended December 31, 2008, we had one

distributor, which has a dozen customers, account for more than 10% of our sales

revenue and collectively accounted for 40% of our sales revenue.

15

Competitors

We have

been in this business since 1998 and our WINTOP brand is well known by our

customers and end users. However, the PVC flip-flop and slipper

business is highly competitive and fragmented where manufactures around the

world competes by pricing. As such, we will competitive in the market

place as long as we can maintain our low cost of production.

PRC

Government Regulations.

Business

License

Any

company that conducts business in the PRC must have a business license that

covers a particular type of work. We obtained a business license from

the Quanzhou Administration for Industry and Commerce on November 24, 2010,

which identifies our business scope as “Production of plastic.” Prior

to expanding our business beyond that of our business licenses, we may be

required to apply and receive approval from the relevant PRC government

authorities and we cannot assure you that we will be able to obtain the

necessary government approval for any change or expansion of our

business.

Environmental

Regulations

Major

regulations applicable to us include the PRC Environmental Protections Law, the

PRC Law on Prevention and Control of Water Pollution and its associated

Implementation Rules. In compliance with these regulations, we have

obtained a Pollution Emission License and an Environmental Protection Opinion

from the Shishi Municipal Environmental Protection Bureau.

Taxation

On March

16, 2007, the National People’s Congress of China passed a new Enterprise Income

Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed

its implementing rules, which took effect on January 1, 2008. Before

the implementation of the EIT Law, foreign invested enterprises, or FIEs,

established in the PRC, unless granted preferential tax treatments by the PRC

government, were generally subject to an earned income tax, or EIT, rate of

33.0%, which included a 30.0% state income tax and a 3.0% local income

tax. The EIT Law and its implementing rules impose a unified EIT of

25.0% on all domestic-invested enterprises and FIEs, unless they qualify under

certain limited exceptions. Despite these changes, the EIT Law gives

FIEs established before March 16, 2007, or Old FIEs, a five-year grandfather

period during which they can continue to enjoy their existing preferential tax

treatments. During this five-year grandfather period, the Old FIEs

which enjoyed tax rates lower than 25% under the original EIT law will be

subject to gradually increased EIT rates over a 5-year period until their tax

rate reaches 25%. In addition, the Old FIEs that are eligible for

other preferential tax treatments by the PRC government under the original EIT

law are allowed to continue enjoying their preference until these preferential

treatment periods expire. The discontinuation of any such special or

preferential tax treatment or other incentives would have an adverse effect on

any organization's business, fiscal condition and current operations in

China.

In

addition to the changes to the current tax structure, under the EIT Law, an

enterprise established outside of China with “de facto management bodies” within

China is considered a resident enterprise and will normally be subject to an EIT

of 25% on its global income. The implementing rules define the term

“de facto management bodies” as “an establishment that exercises, in substance,

overall management and control over the production, business, personnel,

accounting, etc., of a Chinese enterprise.” If the PRC tax

authorities subsequently determine that we should be classified as a resident

enterprise, then our organization's global income will be subject to PRC income

tax of 25%. For detailed discussion of PRC tax issues related to

resident enterprise status, see “Risk Factors – Risks Related to Our Business –

Under the Enterprise Income Tax Law, we may be classified as a ‘resident

enterprise' of China. Such classification will likely result in

unfavorable tax consequences to us and our non-PRC shareholders.”

16

In

addition, the EIT Law and its implementing rules generally provide that a 10%

withholding tax applies to China-sourced income derived by non-resident

enterprises for PRC enterprise income tax purposes unless the jurisdiction of

incorporation of such enterprises’ shareholder has a tax treaty with China that

provides for a different withholding arrangement. SFP is considered

FIEs and are directly held by our subsidiary in Hong Kong. According

to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an

FIE in China to the company in Hong Kong who directly holds at least 25% of the

equity interests in the FIE will be subject to a no more than 5% withholding

tax. We expect that such 5% withholding tax will apply to dividends

paid to HK Weituo by SFP, but this treatment will depend on our status as a

non-resident enterprise.

Pursuant

to the Provisional Regulation of China on Value Added Tax and its implementing

rules, all entities and individuals that are engaged in the sale of goods, the

provision of repairs and replacement services and the importation of goods in

China are generally required to pay value added tax, or VAT, at a rate of 17.0%

of the gross sales proceeds received, less any deductible VAT already paid or

borne by the taxpayer. Further, when exporting goods, the exporter is entitled

to some or all of the refund of VAT that it has already paid or

borne.

Employment

Laws

We are

subject to laws and regulations governing our relationship with our employees,

including: wage and hour requirements, working and safety conditions, and social

insurance, housing funds and other welfare. These include local labor

laws and regulations, which may require substantial resources for

compliance.

China’s

National Labor Law, which became effective on January 1, 1995, and China’s

National Labor Contract Law, which became effective on January 1, 2008, permits

workers in both state and private enterprises in China to bargain

collectively. The National Labor Law and the National Labor Contract

Law provide for collective contracts to be developed through collaboration

between the labor union (or worker representatives in the absence of a union)

and management that specify such matters as working conditions, wage scales, and

hours of work. The laws also permit workers and employers in all

types of enterprises to sign individual contracts, which are to be drawn up in

accordance with the collective contract. The National Labor Contract

Law has enhanced rights for the nation’s workers. The legislation

requires employers to provide written contracts to their workers, restricts the

use of temporary labor and makes it harder for employers to lay off

employees. It also requires that employees with fixed-term contracts

be entitled to an indefinite-term contract after a fixed-term contract is

renewed twice or the employee has worked for the employer for a consecutive

ten-year period.

Foreign

Currency Exchange

Under the

PRC foreign currency exchange regulations applicable to us, the Renminbi is

convertible for current account items, including the distribution of dividends,

interest payments, trade and service-related foreign exchange

transactions. Conversion of Renminbi for capital account items, such

as direct investment, loan, security investment and repatriation of investment,

however, is still subject to the approval of the PRC State Administration of

Foreign Exchange, or SAFE. FIEs established in the PRC may only buy,

sell and remit foreign currencies at those banks authorized to conduct foreign

exchange business after providing valid commercial documents and, in the case of

capital account item transactions, obtaining approval from the

SAFE. Capital investments by FIEs outside of China are also subject

to limitations, which include approvals by the Ministry of Commerce, the SAFE

and the State Reform and Development Commission. We currently do not

hedge our exposure to fluctuations in currency exchange rates.

17

Dividend

Distributions

Under

applicable PRC regulations, FIEs in China may pay dividends only out of their

accumulated profits, if any, determined in accordance with PRC accounting

standards and regulations. In addition, a FIE in China is required to

set aside at least 10% of its after-tax profit based on PRC accounting standards

each year to its general reserves until the accumulative amount of such reserves

reach 50% of its registered capital. These reserves are not

distributable as cash dividends. The board of directors of a FIE has

the discretion to allocate a portion of its after-tax profits to staff welfare

and bonus funds, which may not be distributed to equity owners except in the

event of liquidation.

Property

All land

in China is owned by the State. Individuals and companies are permitted to

acquire rights to use land or land use rights for specific purposes. In the case

of land used for industrial purposes, the land use rights are granted for a

period of 50 years. Granted land use rights are transferable and may be used as

security for borrowings and other obligations.

We

currently have approximately 639,430 square feet of space, comprised of

manufacturing facilities, warehousing and packaging facilities, dormitory space,

dining halls and administrative offices. We believe that all leased space is in

good condition and that the property is adequately insured by us.

We own

various properties, both land use right and buildings, which are used for office

and industrial purposes. We own two parcels of land in Shishi City;

and five buildings that house our workers. Our land and buildings are

subject to mortgages with different banks.

We lease

our land use rights from Shishi Changsheng. The lease is

approximately 137,852 square feet used for the slippers factory. The

lease is for four years at an annual payment of $35,652 (RMB

234,851).

New manufacturing

facilities. We intend to increase production to meet current

and future demand by building new manufacturing facilities. We

currently have a factory project underway in San Ming in Fujian Province and we

are working out the land right agreement for another possible factory in Da Tian

city in Fujian Province The San Ming facility is being

constructed by Feiying Industrial Co. Ltd. (San Ming”) a China WFOE 100% owned

by Mr. Ang, our president and chairman of the board. San Ming will be

consolidated as a Variable Interest Entity (“VIE”) through the relationship with

Mr. Ang and construction on the San Ming facility started in June

2010. We have a three year option to purchase the San Ming facility

at 90% of the net tangible asset value.

Research

and Development

Our

research and development efforts are supported by our consultant from South

Korea who has been studying and manufacturing PU leather products for nearly two

decades. We also have many technical experts with years of

experience. We have developed a variety of proprietary PU leather

products with high-performance and proven performance. In addition we continue

to develop technology upgrades to stay competitive, i.e. constantly improving

resin formulas and production processes for PU leather to achieve premium

performance while reducing the amount of resin used in the coating process,

which results in the greater value of equipment and effective cost

reduction.

18

We have

focused most of our research and development attention on the further

development of our PU leather products: high-density PU leather and Nano PU

leather.

We intend

to continue to grow and maintain our competitive advantage by focus on the

development and use of our new materials, expand our formularies, production

process and new product development.

Intellectual

Property

Our

proprietary PU leather technology is based on our resin formula and production

process. However, the core technology is not suitable for patent

application. Given the current status of patent protection in China,

we have reason to believe that the patent application process could result in

the leakage of core technology. Therefore, we have not applied for a

patent yet.

We have

an exclusive right to use the trademark “WINTOP” pursuant to a trademark license

contract with Shishi Changsheng. The trademark fee is $3,036 (RMB

20,000) annually ending on January 1, 2012. There are four trademarks

with registered numbers; 3646701, 5342599, 3646699, 3646700 (Wintop; Pattern;

Wintop with pattern and NIVIANI). Shishi Changsheng owns the

trademarks.

We have

signed a confidentiality agreement with its employees and signed the Commercial

and Technical Non-disclosure Agreement with our key employee to ensure that our

intellectual property and intangible assets are properly

protected. The core technology used in our production process is

proprietary and only make known to a couple of key employees, all of them have

signed the above-mentioned confidentiality agreement to prevent the leakage of

core technology. The core technology is independently developed and

free from any third-party claim of infringement. We rely on

intellectual property such as trade secrets and technical innovations, to

protect and build our competitive position.

Employees

We

currently employ approximately 390 full time employees. In compliance with the

relevant PRC labor laws, our employees are subject to labor

contracts. The Feiying Company has currently applied for social

insurance for part of its staff.

Legal

Proceedings

During

the normal course of business, we are engaged in certain litigation, none of

which we believe will have a material adverse effect on our financial

position.

Risk

Factors

An

investment in our common stock involves a high degree of risk. You

should carefully consider the risks described below, together with all of the

other information included in this report, before making an investment

decision. If any of the following risks actually occurs, our

business, financial condition or results of operations could

suffer. In that case, the trading price of our common stock could

decline, and you may lose all or part of your investment. You should

read the section entitled “Special Note Regarding Forward Looking Statements”

above for a discussion of what types of statements are forward-looking

statements, as well as the significance of such statements in the context of

this report.

19

RISKS

RELATED TO OUR OVERALL BUSINESS OPERATIONS

Current

economic conditions may adversely affect consumer spending and the overall

general health of our customers, which, in turn, may adversely affect our

financial condition, results of operations and cash resources.

Uncertainty

about the current and future global economic conditions may cause our customers

to defer purchases or cancel purchase orders for our products in response to

tighter credit, decreased cash availability and weakened consumer

confidence. Our financial success is sensitive to changes in general

economic conditions, both globally and nationally. Recessionary

economic cycles, higher interest borrowing rates, higher fuel and other energy

costs, inflation, increases in commodity prices, higher levels of unemployment,

higher consumer debt levels, higher tax rates and other changes in tax laws or

other economic factors that may affect consumer spending or buying habits could

continue to adversely affect the demand for our products. In

addition, a number of our customers may be impacted by the significant decrease

in available credit that has resulted from the current financial

crisis. If credit pressures or other financial difficulties result in

insolvency for our customers it could adversely impact our financial

results.

We

may be unable to successfully execute our long-term growth strategy or maintain

our current revenue levels.

Although

we exhibited significant growth from our inception through 2009, no assurance

can be given that our revenues will continue to grow. Our ability to

maintain our revenue levels or to grow in the future depends upon, among other

things, the continued success of our efforts to maintain our brand image and

bring new products to market and our ability to expand within our current

distribution channels and other distributors.

Our

sales are dependent on the sales of our customer’s products.

Because

our PU leather products are part of our customers’ products, our sales and

success is dependent on the success of our customers’ products. If

our customers’ products are no longer popular, and our customers reduce the

purchase for our products, this will have an adverse effect on our

revenues.

If

we do not accurately forecast consumer demand, we may have excess inventory to

liquidate or have greater difficulty filling our customers' orders, either of

which could adversely affect our business.

The

footwear industry is subject to cyclical variations, consolidation, contraction,

and closings, as well as fashion trends, rapid changes in consumer preferences,

the effects of weather, general economic conditions, and other factors affecting

demand. These factors make it difficult to forecast our product

demand and, if we overestimate demand for our products, we may be forced to

liquidate excess inventories at a discount to customers, resulting in markdowns

and lower gross margins. Conversely, if we underestimate customer

demand, we could have inventory shortages, which can result in lost potential

sales, delays in shipments to customers, strains on our relationships with

customers and diminished brand loyalty. Moreover, because our product

line is limited, we may be disproportionately affected by cyclical downturns in

the footwear industry, changes in consumer preferences, and other factors

affecting demand, which may make it more difficult for us to accurately forecast

our production needs, exacerbating these risks. A decline in demand

for our products, or any failure on our part to satisfy increased demand for our

products, could adversely affect our business and results of

operations.

20

We

are dependent on sales of a small number of products, and the absence of

continued market demand for these products would have a significant adverse

effect on our operating results.

We

generated approximately 72.0% and 57.0% of our revenues for the years ended

December 31, 2009 and 2008 from sales of PU leather products. Because

we are dependent on a line of footwear models that have substantial

similarities, factors such as changes in consumer preferences and general market

conditions in the footwear industry may have a disproportionately greater impact

on us than on our competitors. In addition, other footwear companies

have introduced products that are substantially similar to our footwear models,

which may reduce sales of our footwear products. In the event that

consumer preferences evolve away from our footwear models or from casual

lifestyle footwear in general, or if our retail customers purchase similar

products sold by our competitors, the resulting loss of sales, increase in

inventories and discounting of our products are likely to be significant, which

could have a material and adverse impact on our business and

operations.

Our

operating results are dependent on a number of factors which may cause our

operating results to fluctuate from time to time.

Our

operating results may fluctuate from period to period and will depend on

numerous factors, including customer demand and market acceptance of our

products, new product introductions, product obsolescence, raw material price

fluctuations, varying product mix, foreign currency exchange rates, foreign

currency, income tax rates, timely payment and other factors. Our

business is sensitive to the spending patterns of our end customers, which in

turn are subject to prevailing economic conditions and other factors beyond the

our control. If demand does not meet our expectations in any given

period, the sales shortfall may result in an increased effect on operating

results if we unable to adjust operating expenditures quickly enough to

compensate for such a shortfall, which will affect our operating

results.

Since we

are dependent on a key customer, the loss of this customer would cause a

significant decline in our revenues while a delay or failure to collect on trade

receivables from our key customer will adversely affect our results of

operations.

One

distributor accounted for 58%, 88% and 75% of our trade receivables as of

December 31, 2008 and 2009, and September 30, 2010, respectively. The

loss of this distributor would adversely affect our revenues and

profitability. In addition, we do not require collateral or security

to support the trade receivables. Accordingly, if we are unable to

receive payment from the key distributor, our operating results will be

adversely affected.

We

are dependent on our short term loans with financial institutions and

substantially all of our short term loans are secured by our real

estate.

We have

short term loans and notes payable with financial institutions. The

short term loans are due within one year and the notes payable are due in less

than a year. The short term loans are secured by our real

estate. Although the notes payable are not secured, the financial

institutions require that we have a cash reserve of 20% to 100% of the total

outstanding balance. As of December 31, 2008, 2009 and September 30,

2010, we had $6,342,096, $6,966,302, and $11,872,442, respectively, amounts

outstanding in short term loans and notes payable. Although we are

current in our obligations under the short term loans and notes payable, a

default in these loans, could require all amounts to be due immediately and

result in the loss of our real property.

We

are guarantors to loans of unrelated third parties pursuant to a cross guarantee

arrangement, and in the event of a default of the loans by the third party we

will assume the liabilities of the third parties, which will adversely affect

our operating results and business.

We have

entered into arrangements with unrelated third parties pursuant to which we have

agreed to guarantee their loans with financial institutions and exchange for a

guarantee by the third parties for our loans with financial

institutions. Although cross guarantee arrangements with unrelated

parties in different industries are common in China, our business and results of

operations will be adversely affected in the event the third parties default on

their loans. As of December 31, 2010, the third parties were current

with their obligations to the financial institution; however, if the third

parties are unable to satisfy the terms of the loans, we will be obligated to

assume the liabilities of the third parties.

21

Our

limited operating history may not serve as an adequate basis to judge our future

prospects and results of operations.

We have a

limited operating history because we have only been in operation since

2006. This limited operating history makes it difficult for investors

to evaluate our businesses and predict future operating results. An

investor in our securities must consider the risks, uncertainties and

difficulties frequently encountered by companies in new and rapidly evolving

markets. The risks and difficulties we face include challenges in

accurate financial planning as a result of limited historical data and the

uncertainties resulting from having had a relatively limited time period in

which to implement and evaluate our business strategies as compared to older

companies with longer operating histories.

Our

expansion plans may not be successful.

We plan

to expand our production capacity by constructing a new production

plant. The new production facility will allow us to expand our

production capabilities for new markets. We need to raise additional

capital and expect to incur significant costs in connection with the expansion

of our business, and any failure to successfully implement our expansion plans

may materially and adversely affect our business, financial condition and

results of operations.

Our

production capacity might not be able to meet with growing market demand or

changing market conditions.

We cannot

give assurance that our production capacity will be able to meet our obligations

and the growing market demand for our products in the

future. Furthermore, we may not be able to expand our production

capacity in response to the changing market conditions. If we fail to

meet demand from our customers, we may lose our market share.

We

may not be able to develop new products or expand into new markets.

We intend

to continue research and development of new products and to expand our

facilities to produce and sell PU synthetic leather. The development

of new products involves considerable time and commitment. If we are

not able to develop and introduce new products successfully, or if our new

products fail to generate sufficient revenues to offset our research and

development costs, our business, financial condition and operating results could

be adversely affected. Failure of such could lead to wasted

resources. There is no guarantee that we will be successful to

execute our strategy for growth and if we should fail to execute our growth

strategy successfully, it may have a material and adverse affect on our future

revenue and profitability.

We

manufacture our products in a single location, and any material disruption of

our operations could adversely affect our business.

Our

operations are subject to uncertainties and contingencies beyond our control

that could result in material disruptions in our operations and adversely affect

our business. These include industrial accidents, fires, floods,

droughts, storms, earthquakes, natural disasters and other catastrophes,

equipment failures or other operational problems, strikes or other labor

difficulties.

22

All of

our products were manufactured in our production facilities in Fujian Province,

PRC. If there is any damage to our production facilities, we may not

be able to remedy such situations in a timely and proper manner, and our

production could be materially and adversely affected. Any breakdown

or malfunction of any of our equipment could cause a material disruption of our

operations. Any such disruption in our operations could cause us to

reduce or halt our production, prevent us from meeting customer orders,

adversely affect our business reputation, increase our costs of production or

require us to make unplanned capital expenditures, any one of which could

materially and adversely affect our business, financial condition and results of

operations.

The

prices for the raw materials and the costs for labor may increase.

Raw

material cost is one of the major components in our cost of sales. We

purchase a majority of our raw materials from local suppliers in the

PRC. The prices for our major raw materials, fluctuate depending

mainly on general market conditions of the local and the PRC

market. Increases in the costs of such raw materials and our

inability to pass on such increases in raw material costs to our customers by

increasing the prices of our products may materially and adversely affect our

cost of sales and our gross profit margins. The manufacturing

industry is labor intensive. Labor costs in the PRC have been

increasing over the past few years, and we cannot assure you that the cost of

labor in the PRC will not continue to increase in the future or that we will be