Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Eco Energy Pumps, Inc. | ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Eco Energy Pumps, Inc. | ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - Eco Energy Pumps, Inc. | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Eco Energy Pumps, Inc. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

FOR THE FISCAL YEAR ENDED: OCTOBER 31, 2010

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to ____________

Commission File Number: 333-158203

ECO ENERGY PUMPS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

263550371

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

112 North Curry Street, Carson City, NV 89703-4934

|

|

|

(Address of principal executive office and zip code)

|

|

|

(775) 284-3713

|

|

|

(Registrant’s telephone number, including area code)

|

|

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months ( or for such shorter period that the registrant was required to submit and post such files.

Yes o No x (Not required by smaller reporting companies)

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of February 11, 2011, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the Pink Sheets) was approximately $14,350.00 Shares of the Registrant’s common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 11, 2011, there were 2,267,320 shares of the Registrant’s common stock issued and outstanding.

ECO ENERGY PUMPS, INC.

FORM 10-K

For the Fiscal Year Ended October 31, 2010

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

4 |

|

Item 1A.

|

Risk Factors

|

8 |

|

Item 2.

|

Properties

|

12 |

|

Item 3.

|

Legal Proceedings

|

12 |

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

12 |

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13 |

|

Item 6.

|

Selected Financial Data

|

14 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

14 |

|

Item 8.

|

Financial Statements and Supplementary Financial Data

|

18 |

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

18 |

|

Item 9A(T)

|

Controls and Procedures

|

19 |

|

Item 9B.

|

Other Information.

|

20 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

20 |

|

Item 11.

|

Executive Compensation

|

22 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

24 |

|

Item 13.

|

Certain Relationships and Related Party Transactions, and director independence

|

24 |

|

Item 14.

|

Principal Accountant Fees and Services

|

25 |

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statements Schedules

|

25 |

2

Forward-Looking Statements

Statements contained in this annual report include “forward-looking statements” within the meaning of such term in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements not to occur or be realized. Forward-looking statements made in this Report generally are based on our best estimates of future results, performances or achievements, predicated upon current conditions and the most recent results of the companies involved and their respective industries. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “should,” “project,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” “potential,” “opportunity” or similar terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions. Potential risks and uncertainties include, among other things, such factors as:

|

|

our heavy reliance on limited number of consumers;

|

|

|

|

strong competition in our industry;

|

|

|

|

increases in our raw material costs; and

|

|

|

|

an inability to fund our capital requirements.

|

Additional disclosures regarding factors that could cause our results and performance to differ from results or performance anticipated by this annual report are discussed in Item 1A. “Risk Factors.” Readers are urged to carefully review and consider the various disclosures made by us in this annual report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this annual report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

3

PART I

|

ITEM 1.

|

BUSINESS

|

Organizational History

Eco Energy Pumps, Inc. (“Eco Energy Pumps”, “we”, “the Company”) was incorporated as a for-profit company in the State of Nevada on October 14, 2008 and established a fiscal year end of October 31. Until October 2010, the Company was a development-stage Company that intended to develop an efficient water pump powered by solar energy with an exclusive pump design.

On October 25, 2010, the Company acquired DLT International Limited, a privately held corporation organized under the laws of the British Virgin Islands (“DLT”), in accordance with a Securities Exchange Agreement (the “Agreement”). DLT was organized under the laws of the British Virgin Islands on March 18, 2010. DLT is a holding company whose principal operating company develops, manufactures and distributes automotive testing equipment in the People's Republic of China. Upon consummation of the Exchange, the Registrant adopted the business plan of DLT.

Pursuant to the terms of the Agreement, the Company acquired DLT in exchange for an aggregate of 2,267,320 newly issued shares (the “Exchange Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”) issued to DLT Shareholders in accordance with their pro rata ownership of DLT equity (the “Exchange”). As a result of the Exchange, DLT became a wholly-owned subsidiary of the Company. In addition, our principal stockholder agreed to retire their 9,300,000 shares of Common Stock. Following the Exchange, and upon giving effect to the Split, the Company had an aggregate of approximately 36,000,000 shares issued and outstanding.

Pursuant to a Agreement with DLT, the Company agreed to file the Amendments (as defined below) as soon as practicable following the closing of the Exchange. On October 18, 2010, a majority of the Company’s Shareholders voted to amend the Company’s Articles of Incorporation to (i) change the name of the Company to “DLT International, Ltd.” (the “Name Change”) (ii) increase the number of the Company’s authorized shares of capital stock from 75,000,000 shares to 310,000,000 of which 300,000,000 shares will be common stock par value $0.001 per share (the “Common Stock”) and 10,000,000 shares will be preferred stock par value $0.001 per share (the “Preferred Stock”) (the “Authorized Stock Increase”); (iii) effectuate a forward stock split of our issued and outstanding Common Stock by changing and reclassifying each 1 share of our issued and outstanding Common Stock into fourteen 14 and 29/100 (14.29) fully paid and non-assessable shares of Common Stock (“Forward Split”); and (iv) authorize the Board of Directors to provide for the issuance of shares of preferred stock in series and, by filing a certificate pursuant to the Nevada Revised Statutes (hereinafter, along with any similar designation relating to any other class of stock that may hereafter be authorized, referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, power, preferences and rights of the shares of each such series and the qualifications, limitations and restrictions thereof (the “Blank Check Preferred Stock”) (the Name Change, Authorized Stock Increase, Forward Split and creation of Blank Check Preferred Stock are collectively referred to as the “Amendments”).

At the effective time of the Exchange, our Board of Directors was reconstituted by the resignation of John David Palmer and Jeannette Aparecida da Silva from their role as the Company’s officers and director, and the appointment of Xiu Liang Zhang as the Company’s Chairman and President; Jun Liu as a Director and Chief Executive Officer; and Zhengying Li as a Director and Chief Financial Officer. See “Directors and Executive Officers, and Corporate Governance.”

Following the issuance of the Exchange Shares and the retirement of our principal shareholder shares, DLT’s sole shareholder, KME Investments Group Limited, became the Registrant’s principal shareholder, owning approximately eighty-nine percent (89%) of the Registrant’s outstanding Common Stock. Accordingly, the Exchange represents a change in control. As of the date of this report, and upon giving effect to the Split, there are 36,000,000 shares of Common Stock issued and outstanding. For financial accounting purposes, the acquisition was a reverse acquisition of the Company by DLT under the purchase method of accounting, and was treated as a recapitalization with DLT as the acquirer. Upon consummation of the Exchange, the Company adopted the business plan of DLT.

Overview

Eco Energy Pumps, Inc. (“Eco Energy Pumps”, “we”, “the Company”) was incorporated as a for-profit company in the State of Nevada on October 14, 2008 and established a fiscal year end of October 31. Prior to the Exchange, we were a development-stage Company that intended to develop an efficient water pump powered by solar energy. As a result of the Exchange with DLT International Limited (“DLT”), we have adopted the business plan of DLT.

4

DLT, through its wholly-owned Chinese subsidiary, Dalei Vehicle Inspecting Technology (Shen Zhen) Co., Ltd (“Dalei”), is a manufacturer and supplier of automotive emissions testing equipment and software control systems and a provider of comprehensive inspection station management services. Such services include the establishment of systems, standards and equipment supply, create inspection service market rules and formulate market rules with the government together in order to constitute a complete set of industry management methods and management measures, which include staff training, equipment access, inspection technology standards, management content and specific requirements.

The initial goal of Dalei is to construct a chain of inspection stations in China. DLT has established a joint venture of two vehicle inspection stations, and has commenced operations. At present company's main business is motor vehicle testing equipment and software control systems. The main target clients are the comprehensive testing centers owned by the Ministry of Transportation and the Safety Testing Centers owned by the Ministry of Public Security, military, garage workshops, motor vehicle manufacturers, public transport companies and motor vehicle exhaust gas emission testing centers owned by Ministry of Environmental Protection.

Market Opportunity

The National Bureau of Statistics announced that in 2009, the number of on road motor vehicles reached 180 million in China, an average annual growth rate of 23%. As a comparison, in 2007, there were 70 million vehicles on the road in China. As a result, the Peoples Republic of China has provided a regulatory framework to mandate the regulation of emissions including China's Air Pollution Prevention Law, Vehicle Emission Pollution Control Technology Policy, 2005-2007 On Road Use of Motor Vehicle Pollution Control Requirements and Light-engine Vehicle Exhaust gas emission Limits and Measurement Methods (even idling law and the Summary condition).

It is estimated that by 2010 the number of on-road motor vehicles in China will reach 200 million; market total demand for 73,900 sets for exhaust gas detection equipment. At an average of 500,000 RMB per set of equipment, market capacity could reach approximately 36.95 billion RMB. It is further estimated that by 2013 there will be a demand for 30,000 safety inspection and comprehensive inspection stations in the domestic market. The equipment cost for each station is approximately 500,000 RMB. The total market capacity could be 15 billion RMB.

In May 2004, the People’s Republic of China enacted the Road Traffic Safety Law which required that vehicle inspection agency must be private agency after February 2006. In 2006, the State Environmental Protection Bureau began to construct automobile exhaust emissions inspection stations across the whole nation. The government wants capable professional organizations with experience and strength to undertake this business project, which can bring a comprehensive plan to the solution in order to reduce the burden of the government administration.

As a result of additional regulatory requirements, including National Standards GB7258-2004, GB8565-2001, GA 468-2004 and JT/T478 which govern motor vehicle testing station computer control system of technical specifications and other series of technical specifications, inspection and comprehensive testing stations are required to upgrade their technology. At present; there are more than 4,000 motor vehicle safety inspection stations nationwide. The average upgrading cost for each station is approximately 300,000 RMB. The total market capacity may be approximately 1.2 billion RMB.

Motor vehicle repair industry business standards (GB/T16739-2004) and motor vehicle passenger transport station management regulations require that motor vehicle repair workshops and passenger transport stations must be equipped with vehicle testing equipments.

At present, it is estimated that there are approximately 6,000 “second grade” motor vehicle passenger transport stations which could potentially require upgrading. The equipment cost for each passenger transport station is approximately 200,000 RMB. Thus, since less than 10% of the stations are equipped with testing equipment must market capacity could be 1.2 billion RMB.

Vehicle inspection service currently requires compulsory annual inspection and environmental protection inspection pursuant to federal and local law. The inspection services are conducted only by approved inspection agency according to the rules and laws stipulated by the government. It is a public service provided to the society with scope covering all vehicles for annual inspection.

5

Products

Smart Fuel Control System (SFCS) is a system that can change diesel or petrol vehicle into diesel/gas or petrol/gas dual-fuel vehicles.

1. Diesel / Gas (LNG/CNG) dual-fuel system

System features

Double decompressions, positive pressure air intake, ECU intelligent electronic control, control of diesel fuel ignited, and unique conversion throttle body.

Applicable automobile models

|

|

Ordinary diesel vehicles

|

|

|

Turbocharged diesel engine vehicles

|

Fuel species

|

|

Diesel

|

|

|

Compressed natural gas (CNG)

|

|

|

Liquefied natural gas (LNG)

|

Performance benefits

Advantage – International advanced mechanical and electrical integration technology is compatible with a variety of vehicle models and offers easy installation.

Safety – The fuel of turbocharged diesel vehicle is mixed with air after the booster.

Economic – The average replacement rate is of 50% or more. Reducing fuel costs about 30% significantly lower the total costs.

Environmental –Optimization of emissions, reduction of vehicle emissions and protection of the environment.

6

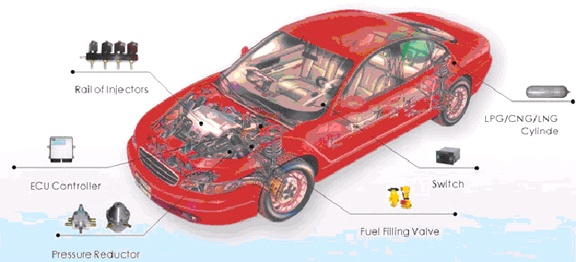

2. Petrol / Gas (LPG / CNG / LNG) dual-fuel system

System function

Use of SFCS to convert vehicles into petrol / gas dual-fuel vehicles, so that the petrol and gas can be easily switched between the two fuel modes. The operation is safe and reliable. Vehicle can still obtain its normal power and also achieve significant economic benefits.

System features

Positive atmosphere for the pressure. Multi-point sequential injection. ECU intelligent electronic control. Real-time precise control of gas volume. Strong horsepower, lower gas consumption.

Applicable automobile models

|

|

Gasoline fuel burning cars

|

|

|

Small and medium sized vans

|

Fuel species

|

|

Gasoline, or liquefied petroleum gas (LPG),

|

|

|

Compressed natural gas (CNG),

|

|

|

Liquefied natural gas (LNG)

|

Performance benefits

Advantage – Internationally advanced mechanical and electrical integration technology. Engine power and nozzle self-cleaning function.

Safety – Front pressure injection gas, no ignite break-down.

Economic – Reducing fuel costs about 50% or more. Significantly lower the costs. Investment can be recovered within 4 – 6 months

Environmental –Optimization of emissions, reduction of vehicle emissions and protection for the environment.

3. Vehicle exhaust gas emission testing equipment

The rapid increase in the number of cars in China has developed rapidly and heavily polluted city air, threatening the population’s physical health. As a result the government has focused on reducing air pollution through a framework of regulations including such as subjecting the automobile exhaust gas emissions to rigorous testing.

Competition

Compared with other competitors in the industry, DLT has the following advantages in the vehicle testing station’s investment, construction, operation and management.

7

Brand advantage. DLT’s management has nearly 20 years experience in the field , as the biggest and most complete vehicle inspection repair equipment, computer control system and software product supplier in China, a hi-tech enterprise in Shenzhen, “DLT “ is the registered trade mark by the state industrial and commercial bureau, as well as the main equipment manufacturers in the inspection field around the country.

Professional technology advantage. DLT’s management has professional capability in building plan, equipment manufacture, and installation testing, with nearly 20 years experience in the field of vehicle inspection.

Customer resources advantage. DLT’s management has built approximately 1,000 inspection stations which includes safety inspection station, comprehensive inspection station, vehicle quality control station, and motorcycle performance test centers.

Sales and service network advantage. DLT’s management has established marketing network and technical support system nation wide.

|

ITEM 1A.

|

RISK FACTORS

|

Risk related to our Business

Because we have not yet commenced our full scale production operations, unexpected factors may hamper our efforts to implement our business plan.

The Company’s main business area is automotive inspection and testing equipment and services to vehicle operators which requires advanced and green technology for its operation. Our business plan contemplates that we will become a major provider in the field of automotive testing services and equipment. In order to achieve this, we plan to expand our chain of automotive environmental and safety testing stations from four to 100 and also expand the production of automotive environmental testing equipment. To date, however, we have built and operated testing stations only in limited areas. If we can obtain sufficient funding as planned, we will commence our operations on a much larger scale. Therefore, appropriate risk management is indispensable. The following business risks which if they occur may materially affect the Company’s performance, stock price, financial position and the decisions of our prospective investors. The actual occurrence of any of those risk factors may materially adversely affect the Company’s results of operation and financial condition.

The capital investments that we plan may result in dilution of the equity of our present shareholders.

Our business plan contemplates that we will invest approximately $3.5 million on our large-scale operations. We intend to raise a large portion of the necessary funds by selling our equity. At present, we have no commitment from any source for those funds. We cannot determine, therefore, the terms on which we will be able to raise the necessary funds. It is possible that we will be required to dilute the value of our current shareholders’ equity in order to obtain the funds. The shareholders may face potential dilution from later rounds of new investors. If, however, we are unable to raise the necessary funds, our growth will be limited, as will our ability to compete effectively. Any failure on raising sufficient funds may affect the Company’s ability to grow and develop.

If contract suppliers become unavailable or delay their production, our business will be negatively impacted.

Our future operating results may depend substantially on the good cooperation with key suppliers. It is important for the company to obtain materials, components and other goods in a timely and proper manner. If we are unable to obtain the necessary materials or components, we may experience production delays which could cause us loss of revenue. If these companies were to terminate their agreements with us without adequate notice, or fail to provide the required capacity and quality on a timely basis, we would be delayed in our ability or unable to process and deliver our products to our customers. It is necessary to procure materials, components and other goods at competitive costs and to optimize the entire supply chain, including suppliers, in order for the company to bring competitive products to market. Furthermore, any case of defective materials, components or other goods may also have an adverse effect on the reliability and reputation of the Company.

Our business and growth will suffer if we are unable to hire and retain key personnel that are in high demand.

Our future success depends on our ability to attract and retain highly skilled human resource personnel in every business area and process, including product development, production, marketing and business management Competition to obtain human resources is intensifying. In general, qualified individuals are in high demand in China, and there are insufficient experienced personnel to fill the demand. If the company is unable to retain and obtain key human resources, this may affect the company’s performance and development. If we are unable to successfully attract or retain the personnel we need to succeed, we will be unable to implement our business plan.

8

Increased government regulation of our production and/or marketing operations could diminish our profits.

The fuel production and supply business is highly regulated. Government authorities are concerned with effect of fuel distribution on the national and local economy. To achieve optimal availability of fuel, governments regulate many key elements of both production and distribution of fuel. Increased government regulation may affect our business in ways that cannot be predicted at this time, potentially involving price regulation, distribution regulation, and regulation of manufacturing processes. Any such regulation or a combination could have an adverse effect on our profitability.

In addition, the day-to-day operations of our business will require frequent interaction with representatives of the Chinese government institutions. The national, provincial and local governments in the People’s Republic of China are highly bureaucratized. The effort to obtain the registrations, licenses and permits necessary to carry out our business activities can be daunting. Significant delays can result from the need to obtain governmental approval of our activities. These delays can have an adverse effect on the profitability of our operations. In addition, compliance with regulatory requirements applicable to fuel manufacturing and distribution may increase the cost of our operations, which would adversely affect our profitability.

Capital outflow policies in China may hamper our ability to pay dividends to shareholders in the United States.

The People’s Republic of China has adopted currency and capital transfer regulations. Although Chinese governmental policies were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange. We may be unable to obtain all of the required conversion approvals for our operations, and Chinese regulatory authorities may impose greater restrictions on the convertibility of the RMB in the future. Because most of our future revenues will be in RMB, any inability to obtain the requisite approvals or any future restrictions on currency exchanges will limit our ability to pay dividends to our shareholders.

Currency fluctuations may adversely affect our operating results.

The Company conducts its main business in China and generates revenues and incurs expenses and liabilities in RMB, the currency of the People’s Republic of China. However, as a subsidiary of DLT in China, the financial results will be reported in the United States in U.S. Dollars. Consequently, as a general rule, appreciation of RMB has a negative effect on the Company’s business performance and a depreciation of RMB has a positive effect. In this way, fluctuations in exchange rates may affect the company’s operating results.

Protection of intellectual property rights risk

DLT owns various patents and intellectual property rights. And we make every effort to secure intellectual property rights. However, in China, it may not be possible to secure sufficient protection. There is a possibility that the company’s technologies may be disclosed or misused by a third party. It is also possible that any suit in respect of intellectual property rights may be brought against the company or that the company may have to file suit in order to protect its intellectual property rights. In such cases, the company’s business operation and performance may be affected.

We are not likely to hold annual shareholder meetings in the near future.

Management does not expect to hold annual meetings of shareholders in the next few year, due to the expenses involved. The current members of the Board of Directors were appointed to that position by the previous directors. If other directors are added to the Board in the future, it is likely that the current directors will appoint them. As a result, the shareholders of the Company will have no effective means of exercising control over the operations of the Company.

New face a risk of natural disasters affecting our operations.

The Company’s test stations are located in China and expanding around the country. Some natural disasters, such as earthquakes or typhoons in areas where test stations are located, may damage or destroy operations cause transportation interruptions or other similar disruptions, and thus affect the company’s performance and operations significantly.

9

Risks Related to the Securities Markets and Investments in Our Common Stock

Because our common stock is quoted on the "OTCBB," your ability to sell your shares in the secondary trading market may be limited.

Our common stock is currently quoted on the over-the-counter market on the OTC Electronic Bulletin Board. Consequently, the liquidity of our common stock is impaired, not only in the number of shares that are bought and sold, but also through delays in the timing of transactions, and coverage by security analysts and the news media, if any, of our company. As a result, prices for shares of our common stock may be lower than might otherwise prevail if our common stock was quoted and traded on Nasdaq or a national securities exchange.

Because our shares are "penny stocks," you may have difficulty selling them in the secondary trading market.

Federal regulations under the Securities Exchange Act of 1934 regulate the trading of so-called "penny stocks," which are generally defined as any security not listed on a national securities exchange or Nasdaq, priced at less than $5.00 per share and offered by an issuer with limited net tangible assets and revenues. Since our common stock currently is quoted on the "OTCBB" at less than $5.00 per share, our shares are "penny stocks" and may not be traded unless a disclosure schedule explaining the penny stock market and the risks associated therewith is delivered to a potential purchaser prior to any trade.

In addition, because our common stock is not listed on Nasdaq or any national securities exchange and currently is quoted at and trades at less than $5.00 per share, trading in our common stock is subject to Rule 15g-9 under the Securities Exchange Act. Under this rule, broker-dealers must take certain steps prior to selling a "penny stock," which steps include:

• obtaining financial and investment information from the investor;

• obtaining a written suitability questionnaire and purchase agreement signed by the investor; and

• providing the investor a written identification of the shares being offered and the quantity of the shares.

If these penny stock rules are not followed by the broker-dealer, the investor has no obligation to purchase the shares. The application of these comprehensive rules will make it more difficult for broker-dealers to sell our common stock and our shareholders, therefore, may have difficulty in selling their shares in the secondary trading market.

Our stock price may be volatile and your investment in our common stock could suffer a decline in value.

As of October 26, 2010, there has been no trading activities in the Company’s common stock. There can be no assurance that a market will ever develop in the Company’s common stock in the future. If a market does not develop then investors would be unable to sell any of the Company’s common stock likely resulting in a complete loss of any funds therein invested.

Should a market develop, the price may fluctuate significantly in response to a number of factors, many of which are beyond our control. These factors include:

• acceptance of our products in the industry;

• announcements of technological innovations or new products by us or our competitors;

• developments or disputes concerning patent or proprietary rights;

• economic conditions in China and or abroad;

• actual or anticipated fluctuations in our operating results;

• broad market fluctuations; and

• changes in financial estimates by securities analysts.

A registration of a significant amount of our outstanding restricted stock may have a negative effect on the trading price of our stock.

At October 31, 2010, shareholders of the Company had approximately 32,400,000 post-split adjusted shares of restricted stock, or 90% of the outstanding common stock. If we were to file a registration statement including all of these shares, and the registration is allowed by the SEC, these shares would be freely tradable upon the effectiveness of the planned registration statement. If investors holding a significant number of freely tradable shares decide to sell them in a short period of time following the effectiveness of a registration statement, such sales could contribute to significant downward pressure on the price of our stock.

We do not intend to pay any cash dividends in the foreseeable future and, therefore, any return on your investment in our capital stock must come from increases in the fair market value and trading price of the capital stock.

We have not paid any cash dividends on our common stock and do not intend to pay cash dividends on our common stock in the foreseeable future. We intend to retain future earnings, if any, for reinvestment in the development and expansion of our business. Any credit agreements, which we may enter into with institutional lenders, may restrict our ability to pay dividends. Whether we pay cash dividends in the future will be at the discretion of our board of directors and will be dependent upon our financial condition, results of operations, capital requirements and any other factors that the board of directors decides is relevant. Therefore, any return on your investment in our capital stock must come from increases in the fair market value and trading price of the capital stock.

10

We may issue additional equity shares to fund the Company's operational requirements which would dilute your share ownership.

The Company's continued viability depends on its ability to raise capital. Changes in economic, regulatory or competitive conditions may lead to cost increases. Management may also determine that it is in the best interest of the Company to develop new services or products. In any such case additional financing is required for the Company to meet its operational requirements. There can be no assurances that the Company will be able to obtain such financing on terms acceptable to the Company and at times required by the Company, if at all. In such event, the Company may be required to materially alter its business plan or curtail all or a part of its operational plans as detailed further in Management's Discussion and Analysis in this Form 10-K. While the Company currently has no offers to sell it securities to obtain financing, sale or the proposed sale of substantial amounts of our common stock in the public markets may adversely affect the market price of our common stock and our stock price may decline substantially. In the event that the Company is unable to raise or borrow additional funds, the Company may be required to curtail significantly its operational plans as further detailed in Requirements for Additional Capital in the Management Discussion and Analysis of this Form 10-K.

The Company has been authorized to amend its Articles of Incorporation to issue up to 300,000,000,000 shares of Common Stock without additional approval by shareholders. As of October 31, 2010, we had 36,000,000 post-split adjusted shares of common stock outstanding.

Because our common stock is quoted only on the Over the Counter Bulletin Board, your ability to sell your shares in the secondary trading market may be limited.

Our common stock is quoted only on the Over the Counter Bulletin Board. Consequently, the liquidity of our common stock is impaired, not only in the number of shares that are bought and sold, but also through delays in the timing of transactions, and coverage by security analysts and the news media, if any, of our company. As a result, prices for shares of our common stock may be different than might otherwise prevail if our common stock was quoted or traded on a national securities exchange such as the New York Stock Exchange.

Large amounts of our common stock will be eligible for resale under Rule 144.

As of October 26, 2010, approximately 32,400,000 of the 36,000,000 issued and outstanding post-split shares of the Company's common stock are restricted securities as defined under Rule 144 of the Securities Act of 1933, as amended (the “Act”) and under certain circumstances may be resold without registration pursuant to Rule 144.

In general, under Rule 144, a person (or persons whose shares are aggregated) who has satisfied a six month holding period may, under certain circumstances, sell within any three-month period a number of securities which does not exceed the greater of 1% of the then outstanding shares of common stock or the average weekly trading volume of the class during the four calendar weeks prior to such sale. Rule 144 also permits, under certain circumstances, the sale of securities, without any limitation, by a person who is not an Affiliate, as such term is defined in Rule 144(a)(1), of the Company and who has satisfied a one year holding period. Any substantial sale of the Company's common stock pursuant to Rule 144 may have an adverse effect on the market price of the Company's shares. This filing will satisfy certain public information requirements necessary for such shares to be sold under Rule 144.

The requirements of complying with the Sarbanes-Oxley act may strain our resources and distract management

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Sarbanes-Oxley Act of 2002. The costs associated with these requirements may place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls over financial reporting. Historically, as a private company we have maintained a small accounting staff, but in order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, significant additional resources and management oversight will be required. This includes, among other things, retaining independent public accountants. This effort may divert management's attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, we may need to hire additional accounting and financial persons with appropriate public company experience and technical accounting knowledge, and we cannot assure you that we will be able to do so in a timely fashion.

11

Our executive officers, directors and principal stockholders control our business and may make decisions that are not in our stockholders' best interests.

As of October 31, 2010 our officers, directors, and principal stockholders, and their affiliates, in the aggregate, beneficially owned approximately 90% of the outstanding shares of our common stock on a fully diluted basis. As a result, such persons, acting together, have the ability to substantially influence all matters submitted to our stockholders for approval, including the election and removal of directors and any merger, consolidation or sale of all or substantially all of our assets, and to control our management and affairs. Accordingly, such concentration of ownership may have the effect of delaying, deferring or preventing a change in discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our business, even if such a transaction would be beneficial to other stockholders.

|

ITEM 2.

|

PROPERTIES

|

The Company’s production factory is located in ShuShan District in HeFei City. The production facilities cover 36 different equipments and platforms at value of 5.1 million RMB. The Company’s office is located in the High-tech Zone in HeFei City. Total area of 800 square meters which values 7.6 million RMB.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

The Company is not a party to any pending legal proceedings, and no such proceedings are known to be contemplated.

No director, officer, or affiliate of the Company and no owner of record or beneficial owner of more than 5.0% of the securities of the Company, or any associate of any such director, officer or security holder is a party adverse to the Company or has a material interest adverse to the Company in reference to pending litigation.

|

ITEM 4.

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

On October 18, 2010, John David Palmer, formerly the sole member of our Board of Directors and majority shareholder, authorized the Certificate of Amendment of the Articles of Incorporation of Eco Energy Pumps, Inc. to amend the Company’s Articles of Incorporation to: (i) change the name of the Company to “DLT International, Ltd.” (the “Name Change”) (ii) increase the number of the Company’s authorized shares of capital stock from 75,000,000 shares to 310,000,000 of which 300,000,000 shares will be common stock par value $0.001 per share (the “Common Stock”) and 10,000,000 shares will be preferred stock par value $0.001 per share (the “Preferred Stock”) (the “Authorized Stock Increase”); (iii) effectuate a forward stock split of our issued and outstanding Common Stock by changing and reclassifying each 1 share of our issued and outstanding Common Stock into fourteen 14 and 29/100 (14.29) fully paid and non-assessable shares of Common Stock (“Forward Split”); and (iv) authorize the Board of Directors to provide for the issuance of shares of preferred stock in series and, by filing a certificate pursuant to the Nevada Revised Statutes (hereinafter, along with any similar designation relating to any other class of stock that may hereafter be authorized, referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, power, preferences and rights of the shares of each such series and the qualifications, limitations and restrictions thereof (the “Blank Check Preferred Stock”) (the Name Change, Authorized Stock Increase, Forward Split and creation of Blank Check Preferred Stock are collectively referred to as the “Amendments”).

12

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

Market for Our Common Stock

The following table sets forth, for the periods indicated, the high and low closing prices of our common stock. These prices reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

|

Closing Prices (1)

|

||||||||

|

High

|

Low

|

|||||||

|

Year Ended October 31, 2010

|

||||||||

|

1st Quarter

|

$ | 0 | $ | 0 | ||||

|

2nd Quarter

|

$ | 0 | $ | 0 | ||||

|

3rd Quarter

|

$ | 0 | $ | 0 | ||||

|

4th Quarter

|

$ | 0 | $ | 0 | ||||

|

Year Ended October 31, 2009

|

||||||||

|

1st Quarter

|

$ | 0 | $ | 0 | ||||

|

2nd Quarter

|

$ | 0 | $ | 0 | ||||

|

3rd Quarter

|

$ | 0 | $ | 0 | ||||

|

4th Quarter

|

$ | 0 | $ | 0 | ||||

|

(1)

|

The above tables set forth the range of high and low closing prices per share of our common stock as reported by OTC Bulletin Board and the Pink Sheets, as applicable, for the periods indicated.

|

Approximate Number of Holders of Our Common Stock

On October 31, 2010, there were approximately 33 stockholders of record of our common stock.

Dividend Policy

The Company has not declared or paid cash dividends or made distributions in the past, and we do not anticipate that we will pay cash dividends or make distributions in the foreseeable future. We currently intend to retain and reinvest future earnings, if any, to finance our operations.

Recent Sales of Unregistered Securities.

Since inception of the Company on October 14, 2008, the Company sold the following unregistered securities:

On November 6, 2008, we issued 9,300,000 shares of Common Stock to John David Palmer, who at the time was our sole Officer and Director, for total consideration of $9,300, or $0.001 per share.

On October 25, 2010, the Registrant authorized the issuances of 2,267,320 shares of Common Stock in connection with the execution of a Securities Exchange Agreement with DLT International Limited.

Except as noted above, the sales of the securities identified above were made pursuant to privately negotiated transactions that did not involve a public offering of securities and, accordingly, we believe that these transactions were exempt from the registration requirements of the Securities Act pursuant to Section 4(2) thereof and rules promulgated thereunder. Each of the above-referenced investors in our stock represented to us in connection with their investment that they were “accredited investors” (as defined by Rule 501 under the Securities Act) and were acquiring the shares for investment and not distribution, that they could bear the risks of the investment and could hold the securities for an indefinite period of time. The investors received written disclosures that the securities had not been registered under the Securities Act and that any resale must be made pursuant to a registration or an available exemption from such registration. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

Repurchase of Equity Securities.

The Company did not repurchase any of its equity securities that were registered under Section 12 of the Securities Act during the fourth quarter of fiscal 2010.

Securities Authorized for Issuance Under Equity Compensation Plans

We currently do not have any equity compensation plans.

13

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

Not applicable.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

This Annual Report contains forward-looking statements within the meaning of the federal securities laws. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as "anticipate," "expect," "intend," "plan," "will," "we believe," "management believes" and similar language. The forward-looking statements are based on the current expectations of the Company and are subject to certain risks, uncertainties and assumptions, including those set forth in the discussion under "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this report. Actual results may differ materially from results anticipated in these forward-looking statements. We base the forward-looking statements on information currently available to us, and we assume no obligation to update them.

Investors are also advised to refer to the information in our previous filings with the Securities and Exchange Commission (SEC), especially on Forms 10-K, 10-Q and 8-K, in which we discuss in more detail various important factors that could cause actual results to differ from expected or historic results. It is not possible to foresee or identify all such factors. As such, investors should not consider any list of such factors to be an exhaustive statement of all risks and uncertainties or potentially inaccurate assumptions.

Results of Operations

Eco Energy Pumps, Inc. (“the Company”) was incorporated as a for-profit company in the State of Nevada on October 14, 2008 and established a fiscal year end of October 31.

On October 25, 2010, the Company acquired DLT International Limited., DLT International Limited (the “DLT”) was incorporated under the laws of the British Virgin Islands on March 18, 2010 and currently operates through one operating company located in People’s Republic of China (the PRC): Dalei Automobile Testing Technology (Shenzhen) Co., Ltd. (“Dalei”). Dalei was incorporated under the laws of the PRC as a limited company on June 3, 2010. Dalei is a vehicle inspecting technology provider in the PRC.

From March 18, 2010 (inception) to October 31, 2010, we generated revenues of $6,638,632 from the sales of vehicle inspecting machines to a number of customers.

Our gross profit margin during the period from March 18, 2010 (inception) to October 31, 2010 was 49.20%. During the year ended October 31, 2010, our cost of sales of testing equipment consists of purchasing machinery and equipment, outsourced instrumentation and control pane, software, freight, and installation.

Selling, general and administrative expenses for the period from March 18, 2010 (inception) to October 31, 2010 were $1,188,948 or 17.91% of net sales. Selling, general and administrative expenses consist primarily of payroll.

Income from operations for the period from March 18, 2010 (inception) to October 31, 2010 was $2,077,179, and net income after income taxes for the same period was $1,557,885.

Our business operates primarily in Chinese Renminbi (“RMB”), but we report our results in our SEC filings in U.S. Dollars. The conversion of our accounts from RMB to Dollars results in translation adjustments. While our net income is added to the retained earnings on our balance sheet; the translation adjustments are added to a line item on our balance sheet labeled “accumulated other comprehensive income,” since it is more reflective of changes in the relative values of U.S. and Chinese currencies than of the success of our business. During the period from March 18, 2010 (inception) to October 31, 2010, the effect of converting our financial results to Dollars was to add $75,746 to our accumulated other comprehensive income.

Liquidity and Capital Resources

Our principal liquidity requirements are for working capital, capital expenditures and cash dividends. We fund our liquidity requirements primarily through cash on hand, and cash flow from operations. We believe our cash on hand, future funds from operations and borrowings from our related parties will be sufficient to fund our cash requirements for at least the next twelve months.

14

We ended fiscal 2010 with $9,106 of cash and cash equivalents. The following table sets forth a summary of our cash flows for the periods indicated:

|

Year Ended October 31,

|

2010

|

|||

|

Net cash provided by operating activities

|

$ | 161,990 | ||

|

Net cash used in investing activities

|

(1,577,178 | ) | ||

|

Net cash provided by financing activities

|

1,424,189 | |||

|

Effect of foreign currency translation

|

105 | |||

|

Net change in cash

|

$ | 9,106 | ||

Operating Activities – For the fiscal period ended October 31, 2010, net cash used in operating activities was $161,990. This is primarily attributable to our net income of $1,557,885, offset by a $1,430,796 increase in working capital. Specifically, the working capital increase was primarily due to (i) a $2,703,757 increase in net trade receivables; (ii) a $215,886 increase in prepaid expenses; (iii) a $28,282 increase in sales commission payable; (iv) a $32,950 increase in trade payables; (v) a $1,099,918 increase in VAT payables and (vi) $519,295 increase in income tax payables.

Investing Activities – Net cash used in investing activities for fiscal year 2010 was $1,577,178. Capital expenditures represented substantially all of the net cash used in investing activities for each period. Capital expenditures primarily include our purchases of property, plant and equipment.

Financing Activities – Net cash proceeds from financing activities for fiscal 2010 was $1,424,189. All of our cash from financing activities are the proceeds from the issue of capital.

Future Capital Requirements – We had cash on hand of $9,106 at October 31, 2010. We did not expect any material capital expenditures for fiscal 2011.

We believe we will be able to fund our cash requirements, for at least the next twelve months, from cash on hand, and operating cash flows. However, our ability to satisfy our cash requirements depends upon our future performance, which in turn is subject to general economic conditions and regional risks, and to financial, business and other factors affecting our operations, including factors beyond our control.

If we are unable to generate sufficient cash flow from operations to meet our obligations and commitments, we will be required to refinance or restructure our indebtedness or raise additional debt or equity capital. Additionally, we may be required to sell material assets or operations, suspend or further reduce dividend payments or delay or forego expansion opportunities. We might not be able to implement successful alternative strategies on satisfactory terms, if at all.

Capital Expenditure

We did not have any capital expenditures during the period from March 18, 2010 (inception) to October 31, 2010.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition or results of operations.

Critical Accounting Policies and Estimates

This discussion and analysis of our financial condition and results of operations are based on our financial statements that have been prepared under accounting principle generally accepted in the United States of America. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

15

Cash and Cash Equivalents

Cash and cash equivalents include cash and all highly liquid instruments with original maturities of three months or less.

Accounts Receivable

Accounts receivable are carried at original invoice amount less estimates made for doubtful receivables. Management determines the allowance for doubtful accounts at the end of the period based on a review of the current status of existing receivables, account aging, historical collection experience, subsequent collections, management's evaluation of the effect of existing economic conditions, and other known factors. The provision is provided for the above estimates made for all doubtful receivables. Account balances are charged off against the allowance only when the Company considers it is probable that a receivable will not be recovered. Recoveries of trade receivables previously written off are recorded when received.

Recent Accounting Pronouncements

ASC 105, Generally Accepted Accounting Principles (“ASC 105”) (formerly Statement of Financial Accounting Standards No. 168, The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles a replacement of FASB Statement No. 162) reorganized by topic existing accounting and reporting guidance issued by the Financial Accounting Standards Board (“FASB”) into a single source of authoritative generally accepted accounting principles (“GAAP”) to be applied by nongovernmental entities. All guidance contained in the Accounting Standards Codification (“ASC”) carries an equal level of authority. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. Accordingly, all other accounting literature will be deemed “non-authoritative”. ASC 105 is effective on a prospective basis for financial statements issued for interim and annual periods ending after September 15, 2009. The Company has implemented the guidance included in ASC 105 as of July 1, 2009. The implementation of this guidance changed the Company’s references to GAAP authoritative guidance but did not impact the Company’s financial position or results of operations.

ASC 855, Subsequent Events (“ASC 855”) (formerly Statement of Financial Accounting Standards No. 165, Subsequent Events) includes guidance that was issued by the FASB in May 2009, and is consistent with current auditing standards in defining a subsequent event. Additionally, the guidance provides for disclosure regarding the existence and timing of a company’s evaluation of its subsequent events. ASC 855 defines two types of subsequent events, “recognized” and “non-recognized”. Recognized subsequent events provide additional evidence about conditions that existed at the date of the balance sheet and are required to be reflected in the financial statements. Non-recognized subsequent events provide evidence about conditions that did not exist at the date of the balance sheet but arose after that date and, therefore; are not required to be reflected in the financial statements. However, certain non-recognized subsequent events may require disclosure to prevent the financial statements from being misleading. This guidance was effective prospectively for interim or annual financial periods ending after June 15, 2009. The Company implemented the guidance included in ASC 855 as of April 1, 2009. The effect of implementing this guidance was not material to the Company’s financial position or results of operations.

ASC 805, Business Combinations (“ASC 805”) (formerly included under Statement of Financial Accounting Standards No. 141 (revised 2007), Business Combinations) contains guidance that was issued by the FASB in December 2007. It requires the acquiring entity in a business combination to recognize all assets acquired and liabilities assumed in a transaction at the acquisition-date fair value, with certain exceptions. Additionally, the guidance requires changes to the accounting treatment of acquisition related items, including, among other items, transaction costs, contingent consideration, restructuring costs, indemnification assets and tax benefits. ASC 805 also provides for a substantial number of new disclosure requirements. ASC 805 also contains guidance that was formerly issued as FSP FAS 141(R)-1, Accounting for Assets Acquired and Liabilities Assumed in a Business Combination That Arise from Contingencies which was intended to provide additional guidance clarifying application issues regarding initial recognition and measurement, subsequent measurement and accounting, and disclosure of assets and liabilities arising from contingencies in a business combination. ASC 805 was effective for business combinations initiated on or after the first annual reporting period beginning after December 15, 2008. The Company implemented this guidance effective January 1, 2009. Implementing this guidance did not have an effect on the Company’s financial position or results of operations; however it will likely have an impact on the Company’s accounting for future business combinations, but the effect is dependent upon acquisitions, if any, that are made in the future.

ASC 810, Consolidation (“ASC 810”) includes new guidance issued by the FASB in December 2007 governing the accounting for and reporting of noncontrolling interests (previously referred to as minority interests). This guidance established reporting requirements which include, among other things, that noncontrolling interests be reflected as a separate component of equity, not as a liability. It also requires that the interests of the parent and the noncontrolling interest be clearly identifiable. Additionally, increases and decreases in a parent’s ownership interest that leave control intact shall be reflected as equity transactions, rather than step acquisitions or dilution gains or losses. This guidance also requires changes to the presentation of information in the financial statements and provides for additional disclosure requirements. ASC 810 was effective for fiscal years beginning on or after December 15, 2008. The Company implemented this guidance as of January 1, 2009. The effect of implementing this guidance was not material to the Company’s financial position or results of operations.

16

ASC 820, Fair Value Measurements and Disclosures (“ASC 820”) (formerly included under Statement of Financial Accounting Standards No. 157, Fair Value Measurements) includes guidance that was issued by the FASB in September 2006 that created a common definition of fair value to be used throughout generally accepted accounting principles. ASC 820 applies whenever other standards require or permit assets or liabilities to be measured at fair value, with certain exceptions. This guidance established a hierarchy for determining fair value which emphasizes the use of observable market data whenever available. It also required expanded disclosures which include the extent to which assets and liabilities are measured at fair value, the methods and assumptions used to measure fair value and the effect of fair value measures on earnings. ASC 820 also provides additional guidance for estimating fair value when the volume and level of activity for the asset or liability have significantly decreased. The emphasis of ASC 820 is that fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants, under current market conditions. ASC 820 also further clarifies the guidance to be considered when determining whether or not a transaction is orderly and clarifies the valuation of securities in markets that are not active. This guidance includes information related to a company’s use of judgment, in addition to market information, in certain circumstances to value assets which have inactive markets.

Fair value guidance in ASC 820 was initially effective for fiscal years beginning after November 15, 2007 and for interim periods within those fiscal years for financial assets and liabilities. The effective date of ASC 820 for all non-recurring fair value measurements of nonfinancial assets and nonfinancial liabilities was fiscal years beginning after November 15, 2008. Guidance related to fair value measurements in an inactive market was effective in October 2008 and guidance related to orderly transactions under current market conditions was effective for interim and annual reporting periods ending after June 15, 2009.

The Company applied the provisions of ASC 820 to its financial assets and liabilities upon adoption at January 1, 2008 and adopted the remaining provisions relating to certain nonfinancial assets and liabilities on January 1, 2009. The difference between the carrying amounts and fair values of those financial instruments held upon initial adoption, on January 1, 2008, was recognized as a cumulative effect adjustment to the opening balance of retained earnings and was not material to the Company’s financial position or results of operations. The Company implemented the guidance related to orderly transactions under current market conditions as of April 1, 2009, which also was not material to the Company’s financial position or results of operations.

In August 2009, the FASB issued ASC Update No. 2009-05, Fair Value Measurements and Disclosures (Topic 820): Measuring Liabilities at Fair Value (“ASC Update No. 2009-05”). This update amends ASC 820, Fair Value Measurements and Disclosures and provides further guidance on measuring the fair value of a liability. The guidance establishes the types of valuation techniques to be used to value a liability when a quoted market price in an active market for the identical liability is not available, such as the use of an identical or similar liability when traded as an asset. The guidance also further clarifies that a quoted price in an active market for the identical liability at the measurement date and the quoted price for the identical liability when traded as an asset in an active market when no adjustments to the quoted price of the asset are required are both Level 1 fair value measurements. If adjustments are required to be applied to the quoted price, it results in a level 2 or 3 fair value measurement. The guidance provided in the update is effective for the first reporting period (including interim periods) beginning after issuance. The Company does not expect that the implementation of ASC Update No. 2009-05 will have a material effect on its financial position or results of operations.

In September 2009, the FASB issued ASC Update No. 2009-12, Fair Value Measurements and Disclosures (Topic 820): Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent) (“ASC Update No. 2009-12”). This update sets forth guidance on using the net asset value per share provided by an investee to estimate the fair value of an alternative investment. Specifically, the update permits a reporting entity to measure the fair value of this type of investment on the basis of the net asset value per share of the investment (or its equivalent) if all or substantially all of the underlying investments used in the calculation of the net asset value is consistent with ASC 820. The update also requires additional disclosures by each major category of investment, including, but not limited to, fair value of underlying investments in the major category, significant investment strategies, redemption restrictions, and unfunded commitments related to investments in the major category. The amendments in this update are effective for interim and annual periods ending after December 15, 2009 with early application permitted. The Company does not expect that the implementation of ASC Update No. 2009-12 will have a material effect on its financial position or results of operations.

17

In June 2009, FASB issued Statement of Financial Accounting Standards No. 167, Amendments to FASB Interpretation No. 46(R) (“Statement No. 167”). Statement No. 167 amends FASB Interpretation No. 46R, Consolidation of Variable Interest Entities an interpretation of ARB No. 51 (“FIN 46R”) to require an analysis to determine whether a company has a controlling financial interest in a variable interest entity. This analysis identifies the primary beneficiary of a variable interest entity as the enterprise that has a) the power to direct the activities of a variable interest entity that most significantly impact the entity’s economic performance and b) the obligation to absorb losses of the entity that could potentially be significant to the variable interest entity or the right to receive benefits from the entity that could potentially be significant to the variable interest entity. The statement requires an ongoing assessment of whether a company is the primary beneficiary of a variable interest entity when the holders of the entity, as a group, lose power, through voting or similar rights, to direct the actions that most significantly affect the entity’s economic performance. This statement also enhances disclosures about a company’s involvement in variable interest entities. Statement No. 167 is effective as of the beginning of the first annual reporting period that begins after November 15, 2009. Although Statement No. 167 has not been incorporated into the Codification, in accordance with ASC 105, the standard shall remain authoritative until it is integrated. The Company does not expect the adoption of Statement No. 167 to have a material impact on its financial position or results of operations.

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 166, Accounting for Transfers of Financial Assets an amendment of FASB Statement No. 140 (“Statement No. 166”). Statement No. 166 revises FASB Statement of Financial Accounting Standards No. 140, Accounting for Transfers and Extinguishment of Liabilities a replacement of FASB Statement 125 (“Statement No. 140”) and requires additional disclosures about transfers of financial assets, including securitization transactions, and any continuing exposure to the risks related to transferred financial assets. It also eliminates the concept of a “qualifying special-purpose entity”, changes the requirements for derecognizing financial assets, and enhances disclosure requirements. Statement No. 166 is effective prospectively, for annual periods beginning after November 15, 2009, and interim and annual periods thereafter. Although Statement No. 166 has not been incorporated into the Codification, in accordance with ASC 105, the standard shall remain authoritative until it is integrated. The Company does not expect the adoption of Statement No. 166 will have a material impact on its financial position or results of operations.

Impact of Accounting Pronouncements

There were no recent accounting pronouncements that have had a material effect on the Company’s financial position or results of operations.

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY FINANCIAL DATA

|

Consolidated Financial Statements

The full text of our audited consolidated financial statements as of October 31, 2010, and 2009 begins on page F-1 of this Report.

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

On January 3, 2011, the Board of Directors of the Registrant dismissed its independent registered public accounting firm, Seale and Beers, CPAs (“Seale and Beers”). None of the reports of Seale & Beers on the Registrant’s financial statements for either of the past two years and the interim period from October 31, 2009, the date of the last audited financial statements, through July 31, 2010, contained an adverse opinion or disclaimer of opinion, or was qualified or modified as to uncertainty, audit scope or accounting principles, except that the Registrant's audited financial statements contained in its Form 10-K for the period ended October 31, 2009 contained a going concern qualification in the Registrant's audited financial statements.

During the Registrant's most recent fiscal years and the subsequent interim period through January 3, 2011, the date of dismissal, there were no disagreements with Seale and Beers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to the satisfaction of Seale and Beers, would have caused it to make reference to the matter in connection with its reports. There were no "reportable events" in connection with its report on the Registrant’s financial statements.

18

On January 4, 2011, the Registrant approved the engagement Albert Wong & Co. (“Wong & Co.”) as its new independent registered public accountants. The Registrant did not consult Wong & Co. regarding either: (i) the application of accounting principles to a specified transaction, completed or proposed, or the type of audit opinion that might be rendered on the Registrant's financial statements, or (ii) any matter that was either the subject of a disagreement or a reportable event in connection with its report on the Registrant’s financial statements.

The Registrant has made the contents of its Form 8-K available to Seale and Beers and requested it to furnish a letter to the Commission as to whether Seale and Beers agrees or disagrees with, or wishes to clarify the Registrant's expression of their views. A copy of the letter dated January 3, 2011 furnished by Seale & Beers in response to that request is filed as Exhibit 16.1 to the Form 8-K filed on January 4, 2011.

|

ITEM 9A(T).

|

CONTROLS AND PROCEDURES.

|

Our management is responsible for establishing and maintaining adequate internal control over financial report for the company (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act). Internal control over financial reporting is to provide reasonable assurance regarding the reliability of our financial reporting for external purposes in accordance with accounting principles generally accepted in the United States of America. Internal control over financial reporting includes maintain records that in reasonable detail accurately and fairly reflect our transactions; providing reasonable assurance that transactions are recorded as necessary for preparation of our financial statements; providing reasonable assurance that receipts and expenditures of company assets are made in accordance with management authorization; and providing reasonable assurance that unauthorized acquisition , use or disposition of company assets that could have a material effect on our financial statements would be prevented or detected.

As of October 31, 2010, management assessed the effectiveness of the Company’s internal control over financial reporting based on the criteria for effective internal control over financial reporting established in SEC guidance on conducting such assessments. Based on this evaluation under the COSO Framework, our management concluded that our internal control over financial reporting are not effective as of October 31, 2010. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework. Based on that evaluation, they concluded that, during the period covered by this report, such internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully described below. This was due to deficiencies that existed in the design or operation of our internal control over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

The matters involving internal controls and procedures that the Company’s management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee and lack of a majority of outside directors on the Company's board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by the Company's Chief Financial Officer in connection with the review of our financial statements as of October 31, 2010 and communicated to our management.