Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - Annec Green Refractories Corp | v210578_ex2-1.htm |

| EX-3.3 - EX-3.3 - Annec Green Refractories Corp | v210578_ex3-3.htm |

| EX-10.2 - EX-10.2 - Annec Green Refractories Corp | v210578_ex10-2.htm |

| EX-10.1 - EX-10.1 - Annec Green Refractories Corp | v210578_ex10-1.htm |

| EX-10.5 - EX-10.5 - Annec Green Refractories Corp | v210578_ex10-5.htm |

| EX-21.1 - EX-21.1 - Annec Green Refractories Corp | v210578_ex21-1.htm |

| EX-10.4 - EX-10.4 - Annec Green Refractories Corp | v210578_ex10-4.htm |

| EX-99.1 - EX-99.1 - Annec Green Refractories Corp | v210578_ex99-1.htm |

| EX-10.3 - EX-10.3 - Annec Green Refractories Corp | v210578_ex10-3.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): February 11, 2011 (February

9, 2011)

E-BAND MEDIA,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

000-54117

|

27-2951584

|

||

|

(State

or Other Jurisdiction of

|

(Commission

File Number)

|

(IRS

Employer

|

||

|

Incorporation)

|

Identification

No.)

|

|

No.5

West Section, Xidajie Street, Xinmi City,

Henan

Province,

P.R. China

|

452370

(Zip

Code)

|

|

|

(Address

of Principal Executive Offices)

|

86-371-

69999012

(Registrant’s

telephone number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

SPECIAL

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

report contains forward-looking statements. The forward-looking

statements are contained principally in the sections entitled “Description of

Business,” “Risk Factors,” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.” These statements

involve known and unknown risks, uncertainties and other factors which may cause

our actual results, performance or achievements to be materially different from

any future results, performances or achievements expressed or implied by the

forward-looking statements. These risks and uncertainties include,

but are not limited to, the factors described in the section captioned “Risk

Factors” below. In some cases, you can identify forward-looking

statements by terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,”

“should,” “would” and similar expressions intended to identify forward-looking

statements. Forward-looking statements reflect our current views with

respect to future events and are based on assumptions and subject to risks and

uncertainties. Given these uncertainties, you should not place undue

reliance on these forward-looking statements. These forward-looking

statements include, among other things, statements relating to:

|

|

·

|

our

anticipated growth strategies and our ability to manage the expansion of

our business operations

effectively;

|

|

|

·

|

our

ability to maintain or increase our market share in the competitive

markets in which we do business;

|

|

|

·

|

our

ability to keep up with rapidly changing technologies and evolving

industry standards, including our ability to achieve technological

advances;

|

|

|

·

|

our

dependence on the growth in demand for our

products;

|

|

|

·

|

our

ability to diversify our product offerings and capture new market

opportunities;

|

|

|

·

|

our

ability to source our needs for skilled labor, machinery and raw materials

economically;

|

|

|

·

|

the

loss of key members of our senior management;

and

|

|

|

·

|

uncertainties

with respect to the PRC legal and regulatory

environment.

|

Also, forward-looking statements

represent our estimates and assumptions only as of the date of this

report. You should read this report and the documents that we

reference and file as exhibits to this report completely and with the

understanding that our actual future results may be materially different from

what we expect. Except as required by law, we assume no obligation to

update any forward-looking statements publicly, or to update the reasons actual

results could differ materially from those anticipated in any forward-looking

statements, even if new information becomes available in the

future.

2

Use

of Certain Defined Terms

Except

where the context otherwise requires and for the purposes of this report

only:

|

|

·

|

the

“Company,” “we,” “us,” and “our” refer to the combined business of E-Band

Media, Inc., a Delaware corporation, and its subsidiaries, China Green

Refractories (“China Green”), a BVI limited company, Alex Industrial

Investment Limited (“Alex Industrial”), a Hong Kong limited company,

Zhengzhou Annec Industrial Co., Ltd. (“Annec”), a PRC wholly-Foreign Owned

Enterprise, and Annec’s variable interest entity, through its contractual

arrangement with Annec (Beijing) Engineering Technology Co., Ltd.

(“Beijing Annec”), a PRC limited

company;

|

|

|

·

|

“BVI”

refers to the British Virgin

Islands;

|

|

|

·

|

“Exchange

Act” refers the Securities Exchange Act of 1934, as

amended;

|

|

|

·

|

“Hong

Kong” refers to the Hong Kong Special Administrative Region of the

People's Republic of China;

|

|

|

·

|

“PRC,”

“China,” and “Chinese,” refer to the People's Republic of

China;

|

|

|

·

|

“Renminbi”

and “RMB” refer to the legal currency of

China;

|

|

|

·

|

“SEC”

refers to the Securities and Exchange

Commission;

|

|

|

·

|

“Securities

Act” refers to the Securities Act of 1933, as amended;

and

|

|

|

·

|

“U.S.

dollars,” “dollars”, “USD” and “$” refer to the legal currency of the

United States.

|

|

|

·

|

All

currency amounts are in USD unless otherwise stated. Foreign currency

translation in this Form 8-K (excluding financial statements or amounts

from the financial statements) is based on the conversion of $1.00 = RMB

6.84090.

|

3

Item

1.01 Entry Into A

Material Definitive Agreement

On February 11, 2011, E-Band Media,

Inc. ("E-Band Media") entered and closed a Share Exchange Agreement

(“Share Exchange Agreement”), with certain shareholders and warrant

holders, Dean Konstantine, Muzeyyen Balaban, Bernieta Masters, and Linda

Masters, and with China Green Refractories ("China Green"), a BVI corporation,

and its shareholders, New-Source Group Limited, a BVI company, High-Sky Assets

Management Limited, a BVI company, Joint Rise Investments Limited, a BVI

company, Giant Harvest Investment Limited, a BVI company, and Mr. QIAN Yun

Ting (collectively the “China Green Shareholders”), pursuant to which

E-Band Media acquired 100% of the issued and outstanding capital stock

of China Green in exchange for 19,220 shares of E-Band Media's Series

A Convertible Preferred Stock ("Series A Preferred Stock"). Pursuant to the

terms of the Share Exchange Agreement, E-Band Media will effect a 1-for-14.375

reverse stock split ("Reverse Split") of its outstanding common stock. In

addition, pursuant to the Share Exchange Agreement, the China Green Shareholders

acquired all 10,000,000 shares of E-Band Media's common stock from Dean

Konstantine ("Controlled Shares") and all outstanding warrants of E-Band Media

from Muzeyyen Balaban, Bernieta Masters, and Linda Masters (“Warrants”) for an

aggregate purchase price of $250,000 and 100 shares of Series A Preferred Stock

held by China Green Shareholders. The Warrants were cancelled by the

China Green Shareholders pursuant to the Share Exchange Agreement. As a result

of the Share Exchange Agreement, the China Green Shareholders will own 98% of

our issued and outstanding common stock on an as-converted common stock basis as

of and immediately after the effectiveness of the Reverse Split as contemplated

by the Share Exchange Agreement.

As discussed in more detail in Item

5.06 of this report, as a result the share exchange, (i) we indirectly control

through subsidiaries, Annec, which is engaged in the business of design,

manufacturing of and selling of medium and high level refractory materials for

top combustion type, internal combustion type, and external combustion type hot

blast stoves, and (ii) through our variable interest entity (“VIE”),

Beijing Annec, we provide turnkey service for large hot blast stove projects,

integrating the structural design, equipment purchase, construction, refractory

production/sale and after-sale service of hot blast

stoves.

The foregoing description of the terms

of the Share Exchange Agreement is qualified in its entirety by reference to the

provisions of the agreements filed as Exhibit 2.1 to this report, which are

incorporated by reference herein.

Item

2.01 Completion Of Acquisition Or Disposition Of Assets

On February 11, 2011, we completed the

acquisition of China Green pursuant to the Share Exchange Agreement described in

Item 1.01 above. The acquisition was accounted for as a recapitalization

effected by a share exchange, wherein China Green is considered the acquirer for

accounting and financial reporting purposes. The assets and liabilities of the

acquired entity have been brought forward at their book value and no goodwill

has been recognized.

Form

10 Disclosure

As disclosed elsewhere in this report,

on February 11, 2011, we acquired China Green in a reverse acquisition

transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell

company, as we were immediately before the reverse acquisition transaction

disclosed under Item 2.01, then the registrant must disclose the information

that would be required if the registrant were filing a general form registration

of securities on Form 10.

4

Accordingly, we are providing

information that would be included in a Form 10 had we been required to file

such form. Please note that the information provided below relates to

the combined entity after the acquisition of China Green, except that

information relating to periods prior to the date of the Share Exchange

Agreement only relate to China Green unless otherwise specifically

noted.

Description

of Business

Overview

We are

one of leading refractory enterprises in China. Through Annec and our VIE,

Beijing Annec, we provide integrated stove design, turnkey contracting,

refractory production and sales, and are one of the largest manufacturers of

refractory materials and products for hot blast stoves in China.

History

Our company, E-Band Media, Inc., was

organized under the laws of the State of Delaware on April 29, 2010 as part of

the implementation of the Chapter 11 plan of reorganization of AP Corporate

Services,

Inc. ("AP").

AP was incorporated in the State of

Nevada in 1997 and was formed to provide a variety of services to small,

entrepreneurial businesses. These services included business planning, market

research, accounting advice, incorporation and resident agent services. Between

1997 and 1999 AP's business focus changed. In addition to providing business

services, AP began to own and develop businesses related to the medical

professions. In 1999 AP organized E-Band Media.com with the intent of offering

live "chat" consultations via the internet with nurses and physicians. A website

was developed but it was unable to

generate significant revenues and the site was terminated prior to AP's

bankruptcy filing in 2008.

AP filed for Chapter 11 Bankruptcy in

September 2008 in the U.S. Bankruptcy Court for the Central District of

California. AP's plan of reorganization was confirmed by the Court on December

24, 2009 and became effective on January 4, 2010. This plan of reorganization

provided, among other things, for the incorporation of E-Band Media and the

distribution of 1,085,000 shares in it to AP's bankruptcy creditors. The shares

were distributed pursuant to section 1145 of the U.S. Bankruptcy Code. The plan

also provided for the transfer to E-Band Media of any interest which AP and/or

E-Band Media.com had in the development of a medical "chat" website. However, no

assets existed at the time of reorganization.

As stated in the Plan of Reorganization

ordered by the Court, these shares were issued "to enhance the distribution to

creditors," i.e. to enhance their opportunity to recover the losses they

sustained in the AP bankruptcy. To this end, AP, by and through its president,

agreed "to use its best efforts to have the

shares... publicly traded on the Over-The-Counter market in order to provide an

opportunity for liquidity to the creditors" (from the Court approved "Disclosure

Statement" describing the Plan of Reorganization). The present filing is a

result of this commitment. Subsequent to the effectiveness of the plan of

reorganization the Company issued 10,000,000 restricted shares to its President,

Dean Konstantine, at par value ($0.0001) for services rendered and costs

advanced totaling $1,000.

On September 14, 2010, E-Band Media

filed a Registration Statement on Form 10SB (File No.: 000-54117) with the SEC

to register its common stock under Section 12(g) of the Exchange

Act. The Registration Statement went effective by operation of law on

November 13, 2010, at which point we became a reporting company under the

Exchange Act.

As a result of our acquisition of China

Green, we are no longer a shell company and active business operations were

revived.

5

Reverse

Acquisition of China Green

Pursuant to the Share Exchange

Agreement, we acquired 100% of the issued and outstanding capital stock of China

Green in exchange for 19,220 shares of our Series A Preferred Stock which will

constitute 98% of our issued and outstanding common stock on an as-converted

common stock basis as of and immediately after the effectiveness of the Reverse

Split as contemplated by the Share Exchange Agreement.

As a result of the reverse acquisition,

we have assumed the business and operations of China Green and its

subsidiaries, and its VIE, Beijing Annec.

For accounting purposes, the reverse

acquisition with China Green was treated as a reverse acquisition, with China

Green as the acquirer and E-Band Media as the acquired party. Unless the context

suggest otherwise, when we refer in this report to business and financial

information for periods prior to the consummation of the reverse acquisition, we

are referring to the business and financial information of China

Green.

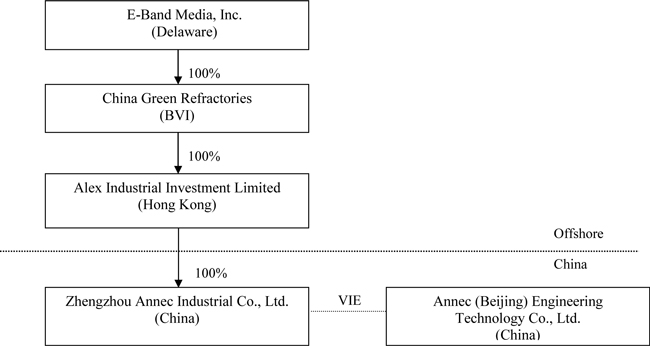

Our

Corporate Structure

All of our business operations are

conducted through our wholly-foreign owned Chinese subsidiary, Annec, and our

VIE, Beijing Annec.

Annec was founded in 2003 with

approximately $3.0 million as its registered capital. Effective as of

January 14, 2011, Annec was acquired by China Green through its wholly-owned

subsidiary Alex Industrial and became a wholly-foreign owned enterprise under

Chinese law.

Beijing Annec was founded in 2008 with

approximately $0.9 million as it initial registered capital. In 2010, Beijing

Annec's registered capital was increased to approximately $2.8

million. Beijing Annec mainly engages in turnkey services of

large-scale hot blast stove projects, including stove structure design,

equipment purchase, project construction, refractory production sales and

after-sale support. On January 14, 2011, Beijing Annec entered into a

contractual agreement, or the VIE Agreement, with Annec pursuant to which

Beijing Annec became our VIE. The VIE structure is a common structure used to

acquire PRC companies, particularly in certain industries where foreign

investment is restricted or forbidden by the PRC government. The VIE

Agreements include the following arrangements:

(1) Exclusive

Business Cooperation Agreement ("Cooperation Agreement"), where Annec, in

general, becomes Beijing Annec's exclusive services provider to provide Beijing

Annec with business support and technical and consulting services in exchange

for annual service fee equal to all of Beijing Annec's audited total net income

for such year;

(2) Equity

Interest Pledge Agreement ("Pledge Agreement") under which Mr. LI Fuchao, our

chairman and 100% owner of all of the equity interest in Beijing Annec (as of

August 25, 2011), has pledge all of his equity interest in Beijing Annec to

Annec as a guarantee of Beijing Annec's performance of its obligations under the

Cooperation Agreement;

(3) Exclusive

Option Agreement ("Option Agreement") under which Mr. LI Fuchao grants Annec an

irrevocable right and option to acquire any and all of Mr. LI Fuchao's equity

interest in Beijing Annec, as and when permitted by PRC laws, for an exercise

price equal to the actual capital contributions paid in the registered capital

of Beijing Annec by Mr. LI Fuchao unless an appraisal is required by applicable

PRC laws; and

6

(4) Power

of Attorney ("POA") under which Mr. LI Fuchao grants Annec the right to (i)

attend shareholders meetings of Beijing Annec, (ii) exercise all of Mr. LI

Fuchao's shareholder's rights and shareholder's voting rights in Beijing Annec,

including, but not limited to the sale or transfer or pledge or disposition of

his stock in whole or in part, and (iii) designate and appoint on Mr. LI

Fuchao's behalf the legal representative, the executive director and/or

director, supervisor, the chief executive officer and other senior management of

Beijing Annec.

As a result of the foregoing structure,

we control 100% of Beijing Annec and have rights to all of Beijing Annec's

audited total net income for such year revenues.

The foregoing description of the terms

of the Cooperation Agreement, the Pledge Agreement, the Option Agreement, and

the POA is qualified in its entirety by the agreements filed as Exhibits 10.1,

10.2, 10.3, 10.4, and 10.5 attached hereto and incorporated herein by

reference.

Our principal executive office is

located at No.5 West Section, Xidajie Street, Xinmi City, Henan Province,

452370. The telephone number at our principal executive office is (86-371-

69999012).

Industry

In general, refractory materials are

inorganic, non-metallic, materials that can withstand temperatures of more than

1,580°C, with specific high temperature mechanical properties and high

stability. Refractory materials are an important supporting material

for iron and steel thermodynamic equipment, non-ferrous metals, and building

materials, and are used in the chemical and electrical power

industries. According to Luoyang Institute of Refractories, 70% of

the world's refractories are used for smelting of iron and steel, 17% for

building materials, 4% for chemical industry, 3% for non-ferrous metals

industry, and 6% for other industry. In China, the consumption of refractories

for the iron and steel industry is approximately 65%.

7

Historically, the European refractory

industry has led the development and output of the world refractory

industry. However, the refractory industry has been gradually

shifting to China because of China’s abundant resources in refractory raw

materials and rapid growth of the iron, steel and cement

markets. Presently, the total refractory output of China is more than

70% of the total refractory output of the world, making China the largest

refractory producing country in the world.

Industry

Trends in China

The China refractory industry is a

large, highly fragmented and competitive industry whose overall performance is

closely tied to the performance of other industries, such as the iron and steel

industry. As such, we believe that the following trends in the

iron and steel industry will have an effect on the refractory industry in

China:

|

|

·

|

Demand for Green

Refractory. The high temperature iron and steel industry is

continuously making progress to increase efficiency, lower energy

consumption and develop new technologies that rely heavily on high quality

of refractory products. As such, the refractory industry must continually

develop and improve its refractory products to keep pace with the iron and

steel industry. We are now seeing a demand for “green refractory” which

are refractory materials that meet certain performance levels, are

environmentally friendly, and have the following characteristics: high

quality, low consumption of resources and energy, environmentally friendly

during production and use, and meets national environment policy and high

temperature industrial standards. We intend to focus our

research and development in green refractory to take advantage of this

growing trend.

|

|

|

·

|

Total

Solutions. Traditionally, most refractory enterprises have focused

on the production of refractory products, with less emphasis on

services. However, that trend is changing. The iron and steel

industry, in order to reduce refractory costs and meet new requirements

for iron and steel smelting technologies, is now demanding total solutions

where one or more refractory companies are responsible for the supply of

refractory, masonry, operation and maintenance, and dismantling of the

lining after the useful life of the refractory. Through Beijing Annec, we

believe that we are well positioned to take advantage of this

trend.

|

In addition, even though China is the

largest refractory producing country in the world, most of China’s refractory

enterprises are small-scale with low industrial centralization and market

shares. We are seeing a trend towards industry consolidation and

restructuring. We believe that given our market leadership position,

we are well positioned to acquire smaller refractory companies to expand our

market share and customer base.

Products

and Services

We are a

refractory and technology-based company that designs, develops, produces, and

markets refractory products. In addition, through our VIE, Beijing

Annec, we provide integrated stove design, turnkey contracting, refractory

production and sales.

Refractory

Products

We offer

a broad range of refractory products primarily marketed to the iron and steel

industry. Our sales for refractory products were $23,408,259 and

$38,187,579 for the years ended December 31, 2009 and 2008, respectively. We

produce our refractory products through three divisions: Fuliang, Fuhua and

Fugang.

8

Fuliang

and Fuhua are mainly responsible for design and production of medium and high

level refractory materials for top combustion type, internal combustion type,

and external combustion type hot blast stoves. Since 2008, we have focused our

resources and production on the design and production of our patented 37 holes

checker brick and burner for hot blast stove.

Fugang is

responsible for a low temperature sintering production line for special steel

smelting, consumables for production of shaped and non-shaped steels, with

excellent slag resistance, thermal shock resistance and stability. Currently,

the sales of consumables has been limited by the scale of our production line

and we are only providing the consumables to small steel factories, such as

Wuhan Iron and Steel Company, Xinjiang Iron and Steel Company, Anyang Iron and

Steel Company and one foreign client, India Diangang. We believe that

the demand for consumable will increase and we intend to increase our sales and

production capacity of consumables by expanding our production

facility.

The below

table is an illustration of our product category in 2009:

|

Product

|

Percent of variety

structure

|

|||

|

High-alumina

brick

|

45 | % | ||

|

Clay

brick

|

33 | % | ||

|

Silica brick

|

5 | % | ||

|

Carbonic

brick

|

2 | % | ||

|

Non-shaped

material

|

15 | % | ||

|

Total

|

100 | % | ||

Marketing and

Sales

The Company's principal market for its

refractory products is the iron and steel industry in

China. We sell and market our products mainly

through the following channels:

|

|

·

|

State-owned

large–scale design institutes that design hot blast stoves. Currently

there are five main iron and steel design institutes in China and we have

established good long-term strategic relationships with three of those

institutes: MCC Jingcheng, MCC Nanfang and MCC

CISDI.

|

|

|

·

|

Direct

customer sales developed through our own marketing channels and through

Beijing Annec.

|

Currently most of our marketing

efforts and sales are focused in China. However, we have a

large-scale steel work project in India and several other opportunities outside

of China.

The following are our top ten

refractory clients for fiscal year ended December 31, 2009:

|

Clients

|

Sales (US$)

|

|||

|

Shougang

Jingtang United Iron & Steel Co., Ltd

|

$ | 3,847,269 | ||

|

Shougang

Qianan Iron & Steel Co., Ltd

|

$ | 2,962,787 | ||

|

Tangshan

Ganglu Iron & Steel Co., Ltd

|

$ | 2,498,796 | ||

|

MCC

Jingcheng Engineering Technology Co., Ltd – Tianguan

projet

|

$ | 1,696,683 | ||

|

Fujian

Desheng Nickel Industry Co., Ltd

|

$ | 1,607,976 | ||

|

MCC

Jingcheng Engineering Technology Co., Ltd – Jiujiang

project

|

$ | 1,369,340 | ||

|

Yangchun

New Iron & Steel Co., Ltd

|

$ | 1,244,385 | ||

|

Sinosteel

Equipment & Engineering –Cangzhou project

|

$ | 1,161,940 | ||

|

MCC

Nanfang Engineering Technology Co., Ltd – Xianggang

project

|

$ | 849,591 | ||

|

Shanxi

Liheng Iron & Steel Co., Ltd.

|

$ | 795,682 | ||

9

Production

process

The raw materials for our refractory

products consist primarily of ores, clay, and certain additives. Upon

receipt of these raw materials at our facilities, we sort and classify these

materials according to various specifications. Next, these materials

are conveyed to a crusher for crushing. After being crushed, the raw

materials are weighed and conveyed to our electronic blender which is

computer-controlled where they are mixed and fully agitated into the various

mixtures required for the production of different products. The use

of our electronic mixture ensures the accuracy of our mixtures which improves

product quality. After being mixed, the materials are conveyed to the

forming workshop where the mixtures are formed into bricks – we have the ability

to form bricks according to specifications submitted to us by our

customers. The shaped bricks are then sent to sintering workshop for

sintering after being dried, and formed into the finished products, which are

then sorted according to the relevant standards. All finished products are

promptly stored and packed for deliver to our customers. All rejected

products are recovered and reworked.

Production

equipment

We have five (5) special production

lines of refractory for hot blast stove and steel and iron smelting consumables,

including two silica product production lines, two alumina product production

line, and one consumables production line. We also have more than 1,000 sets of

modern processing equipment and four (4) high temperature tunnel kilns. One of

our high temperature tunnel kilns is 313 meter long and is the longest one in

Asia. Clean energy-coal seam gas is used as source of energy, and the raw

material is pulverized through cone and Raymond mill. The forming equipment are

400 ton, and 600 ton pneumatic brick press. In addition, in 2010, we rented a

1,000 ton brick press and blast furnace tunnel kiln.

Suppliers

We procure raw materials and chemicals

to manufacture into our end products. All of our suppliers are in

China and we believe that there are an ample numbers of suppliers and raw

materials to meet our current needs. The principal raw materials and

our suppliers for our products are:

10

|

Materials

|

Supplier

|

Percent

of

total supply

|

||||

|

Aluminite

|

Jinzhong

Dongbao mineral products Co., Ltd

|

20.46 | % | |||

|

Andalusite

|

Kefumin

Andalusite Mining Co., Ltd

|

29.17 | % | |||

|

Sillimanite

|

Jixi

Tiansheng Nonmetallic Mining Co., Ltd

|

48.09 | % | |||

|

Bituminite

|

A

local private coal mine

|

98.33 | % | |||

|

Poshan

bauxite

|

Pingdingshan

Huanai Mining Co., Ltd

|

20.51 | % | |||

In recent years, the domestic demand

for raw materials has been steadily increasing due to China’s rapid growth. As a

result, the prices of raw materials have increased dramatically. This

increase in cost has affected our profits. Moreover, the grades of

many raw materials have been declining due to gradual exploitation, resulting in

a certain risk to our product quality and production cost. To control

the quality, supply and price of our main raw materials, we may acquire

mines in the future to ensure our supply of raw materials and reduce pricing

volatility.

However, at this present time, we

typically do not enter into supplier agreements. When we do, they are usually

long term contracts and do not impose minimum purchase

requirements. We enter into supplier agreement not to ensure

availability of the raw material but to ensure the quality of the raw

material. The cost of raw materials purchased during the term

of a supplier agreement usually is the market price for the raw materials at the

time of purchase. We generally do not engage in speculative raw material

commodity contracts. Rather, we attempt to reflect raw material price

changes in the sale price of our products.

Design

and Engineering Services

In keeping pace with the demands from

the iron and steel industry, through our VIE, Beijing Annec, we provide design

and engineering services for hot blast stoves and blast furnace. Our design and

engineering services often entails equipment specification and refractory

optimization, project construction, and follow up services. In addition, as part

of our services, we also supply the refractory materials for our

projects.

The table below summarizes the largest

refractory turnkey projects we contracted in 2010:

|

Client

|

Stove body

|

Total price of contract

|

Completion

|

||||

|

Tangshan

Changcheng Iron and Steel Group Songting Iron and Steel Co., Ltd #6 blast

furnace

|

1780m3

blast furnace and refractory for matching hot blast stove, and stove

pipe

|

$ | 7,235,890 |

In

progress

|

|||

|

Tangshan

Changcheng Iron and Steel Group Songting Iron and Steel Co., Ltd #7 blast

furnace

|

1780m3

blast furnace and refractory for matching hot blast stove, and stove

pipe

|

$ | 7,235,890 |

In

progress

|

|||

|

Tianjin

Tiangang Joint Iron and Steel Co., Ltd

|

Turnkey

service of refractory for 3×1080m3 blast furnace project

|

$ | 7,908,316 |

In

progress

|

|||

11

|

Client

|

Stove body

|

Total price of contract

|

Completion

|

||||

|

Changzhou

Zhongfa Iron-smelting Co., Ltd

|

850m3,

2×1580m3 phase II blast furnace and general contract service of refractory

for matching hot blast stove

|

$ | 13,929,226 |

In

progress

|

|||

|

Xinjiang

County Gaoyi Smelting Co., Ltd

|

General

contract service of refractory for hot blast stove system of 630m3 blast

furnace

|

$ | 2,675,087 |

Completed

|

|||

Research

and Development

The development of new products and new

technology is critical to our success. Accordingly, we devote

significant resources to research and development. We have a

39-person research and development team, which includes nine professionals and

professors. Our research and development team operates our central

laboratory, which facilitates chemical examination of raw material, accessory

material and our final product. In addition, the team operates the

new product research and development office, which is responsible for

researching and developing our products.

We also have established long term

relationships with some of China’s top iron and steel design institutes. For

example, with MCC JingCheng Engineering Technology Company, we developed a top

combustion swirl type stove that can generate 1400°C air temperature, 100°C higher than

ordinary types stoves. This improvement reduces the consumption of

coke to or by 20kg/t iron which has the effect of reducing the cost per ton iron

by $4.43. The cost price per ton of iron is $354-$443. At an annual

output of 0.50 million tons of iron, the cost savings associated with our

development amount to approximately $2.21 million per year. This new

top combustion stove has promoted our research and development abilities and

effectively expand our sales. This service is mainly applicable for the current

new-built stove and reforming of old stoves.

Competition

The refractory manufacturing business

is extremely competitive in China. We are continuing to explore ways

to increase our market share in China including, but not limited to, acquiring

our competitors.

Our main

competitors in China include Yuxing Refractory Co., Xinmi Zhengtai Refractory

Co., Ltd, Wunai Group, and Luoyang Refractory. Yuxing Refractory

mainly produces the ceramic burner, combination brick on hot blast stove,

checker brick, and refractory ball. Yuxing Refractory has an license agreement

with MCC CISDI where all of the stoves designed by MCC CISDI using Yuxing

Refractory patented technology shall use the refractory from Yuxing Refractory.

Xinmi Zhengtai Refractory Co., Ltd. has three production lines, one 198m high

temperature tunnel kiln and 400t and 600t presses. Wunai Group has one 200m high

temperature tunnel kiln, and has engaged Lin Binyin, professor, a senior

engineer from Wuhan University of Science and Technology, as its chief

engineer.

12

Growth

Strategy

Our

growth strategy is as follows:

|

|

•

|

Product

Development and Enhancement. We continue to develop our

refractory products for blast furnaces and steel making and improve our

other refractory products. Further, we plan to produce

high-tech carbon bricks through technology cooperation with international

companies.

|

|

|

•

|

Pursue

Sales Opportunities in New Markets. We are actively

pursuing additional market channels outside of China in order to increase

our international market share. We intend to distribute our

products in India.

|

|

|

•

|

Promote

Refractory Contract Service Model. We continuously and

vigorously promote our refractory contract service model to generate

additional significant and continuous revenue

stream.

|

|

|

•

|

Strategic

Acquisitions. We intend to expand our market

share by pursuing strategic acquisitions of our competitors and other

companies in related industries that will expand our product line and

manufacturing efficiency.

|

|

|

•

|

Research

and Development Investment. We will continue to invest

heavily into research and development to further develop unique and

quality products to further our position as a market leader in some areas,

and increase our presence in

others.

|

Intellectual

Property

We take precaution to protect our

products and our technical and proprietary know-how. In addition, we

own several patents and trademarks described below.

The PRC’s intellectual property

protection regime is consistent with those of other modern industrialized

countries. The PRC has domestic laws for the protection of rights in

copyrights, patents, trademarks and trade secrets.

We have

five independently developed patents, and one patent jointly developed patent

with MCC Jingcheng. See table below for a summary of patents in

China:

|

Patent Name

|

Patent No.

|

Owned by

|

Validity period

|

|||

|

19

holes cell-type checker brick

|

ZL200520031144.X

|

Annec

|

Apr.

11, 2007 -

Apr.

11, 2017

|

|||

|

31

holes cell-type checker brick

|

ZL200620008222.9

|

Annec

|

Jun.

27, 2007 -

Jun

27, 2017

|

|||

|

37

holes cell-type checker brick

|

ZL200620113567.X

|

Annec

|

Apr.

11, 2007 -

Apr.

11, 2017

|

|||

|

61

holes cell-type checker brick

|

ZL200720142954.1

|

Annec

|

May

14, 2008 -

May

14,

2018

|

13

|

Patent Name

|

Patent No.

|

Owned by

|

Validity period

|

|||

|

Perforated

wave-shaped cell-type checker brick

|

ZL200720148139.6

|

Annec

|

May

8, 2008 -

May

8, 2018

|

|||

|

Swirl

type top combustion hot blast stove burner

|

ZL200420008906.X

|

Annec

and MCC Jingcheng

|

Sept.

28, 2005 -

Sept.

28,

2015

|

We also have several trademarks as

follows:

|

Trademark

|

Registration No.

|

Country

|

||

|

3977113

|

PRC

|

||

|

安耐克

|

6802049

|

PRC

|

||

|

ANNEC

|

6769885

|

PRC

|

Competitive

Strengths

|

|

·

|

Technical

superiority. We employ experts known for their research

and development skills and innovation and we observe and utilize the

advanced technology of international business leaders in our

industry.

|

|

|

·

|

Product

advantage. We have a variety of high quality patented

products available in the refractory and hot-blast stove

fields.

|

|

|

·

|

Marketing

advantage. We maintain excellent relationships with our

customers who include many large and medium size companies in China, and

we have a marketing network all over China. Further, we have

received high praise for the quality of our products, our post-sale

service and its delivery time.

|

|

|

·

|

Brand

advantage. Our brands are well known in the hot stove

and refractory fields and have received a number of

awards.

|

|

|

·

|

Environmentally

friendly and energy efficient. Our products are in

compliance with the PRC’s requirements related to efficiency and

environmental protection.

|

|

|

·

|

Recurring

revenue stream. We have developed a series of patented

refractory products which we use in our hot-blast furnace designs and

other refractory products. These products require Our customers

to engage us to maintain and repair our proprietary products and,

accordingly, provide us a recurring revenue

stream.

|

PRC

Government Regulations

Business

license

Annec was

established on July 30, 2003 with a registered capital of approximately $0.73

million. On October 8, 2003, the shareholders of Annec reached a resolution of

increasing the registered capital of Annec from approximately $0.73 million to

$3.0 million. This increase of registered capital was evidenced by

amendment to the articles of association, capital assessment report, and

registration of alteration filed with Zhengzhou AIC. According to the business

license of Annec issued on April 29, 2005, the registered capital of Annec was

increased to approximately $3.0 million. Any company that conducts

business in the PRC must have a business license that covers a particular type

of work. Annec obtained a business license from the Zhengzhou Administration for

Industry and Commerce on January 14, 2011, which identifies the business scope

of Annec as “production, sale and after-sale support of refractory and

electrofusion products”.

14

Annec

Beijing was established on January 16, 2008 with a registered capital of

approximately $0.87 million. Annec Beijing obtained a business license from the

Beijing Administration

for Industry and Commerce on August 25, 2010, which demonstrates that the

registered capital of Annec Beijing has been increased to approximately $2.8

million and identifies the business scope of Annec Beijing as “technology

development, technology transfer, technology support, image-text design and

production, project technology consultation, sale of construction materials,

computer, software and auxiliary equipment, mechanical equipment, chemical

products (not include dangerous chemical materials), import and export agency,

import and export”. Prior to expanding our business beyond that of our business

licenses, we may be required to apply and receive approval from the relevant PRC

government authorities and we cannot assure you that we will be able to obtain

the necessary government approval for any change or expansion of our

business.

Environmental

Regulations

We are subject to various PRC laws and

regulations on environmental protection, water pollution, occupational disease,

air pollution, solid waste pollution, noise pollution and labor

contracts. We intend to comply with these various laws and

regulations and we regularly monitor and review our operations and procedures to

ensure that we are compliant.

Taxation

On March

16, 2007, the National People's Congress of China passed a new Enterprise Income

Tax Law, or New EIT Law, and on December 6, 2007, the State Council of China

passed its implementing rules, which took effect on January 1, 2008. Before the

implementation of the New EIT Law, foreign invested enterprises, or FIEs,

established in the PRC, unless granted preferential tax treatments by the PRC

government, were generally subject to an earned income tax, or EIT, rate of

33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The

New EIT Law and its implementing rules impose a unified EIT of 25.0% on all

domestic-invested enterprises and FIEs, unless they qualify under certain

limited exceptions. Despite these changes, the New EIT Law gives FIEs

established before March 16, 2007, or Old FIEs, a five-year transition period

since January 1, 2008, during which time the tax rate will be increased step by

step to the 25% unified tax rate set out in the New EIT Law. From January 1,

2008, for the enterprises whose applicable tax rate was 15% before the

promulgation of the New EIT Law , the tax rate will be increased to 18% for year

2008, 20% for year 2009, 22% for year 2010, 24% for year 2011, 25% for year

2012. For the enterprises whose applicable tax rate was 24%, the tax rate will

be changed to 25% from January 1, 2008. The discontinuation of any

such special or preferential tax treatment or other incentives would have an

adverse effect on any organization's business, fiscal condition and current

operations in China.

In

addition to the changes to the current tax structure, under the New EIT Law, an

enterprise established outside of China with “de facto management bodies” within

China is considered a resident enterprise and will normally be subject to an EIT

of 25% on its global income. The implementing rules define the term “de facto

management bodies” as “an establishment that exercises, in substance, overall

management and control over the production, business, personnel, accounting,

etc., of a Chinese enterprise.” If the PRC tax authorities subsequently

determine that we should be classified as a resident enterprise, then our

organization's global income will be subject to PRC income tax of 25%. For

detailed discussion of PRC tax issues related to resident enterprise status, see

“Risk Factors – Risks Related to Our Business – Under the Enterprise Income Tax

Law, we may be classified as a ‘resident enterprise' of China. Such

classification will likely result in unfavorable tax consequences to us and our

non-PRC shareholders.”

15

The New

EIT Law provides that an income tax rate of 20% may be applicable to dividends

payable to non-PRC investors that are “non-resident enterprises”. Non-resident

enterprises refer to enterprises which do not have an establishment or place of

business in the PRC, or which have such establishment or place of business in

the PRC but the relevant income is not effectively connected with the

establishment or place of business, to the extent such dividends are derived

from sources within the PRC. The income tax for non-resident enterprises shall

be subject to withholding at the income source, with the payor acting as the

obligatory withholder under the New EIT Law, and therefore such income taxes

generally called withholding tax in practice. The State Council of the PRC has

reduced the withholding tax rate from 20% to 10% through the Implementation

Rules of the New EIT Law. It is currently unclear in what circumstances a source

will be considered as located within the PRC. We are a U.S. holding company and

substantially all of our income is derived from dividends we receive from our

subsidiaries located in the PRC. Thus, if we are considered a “non-resident

enterprise” under the New EIT Law and the dividends paid to us by our subsidiary

in the PRC are considered income sourced within the PRC, such dividends may be

subject to a 10% withholding tax. Annec is considered a FIE and is directly held

by our subsidiary in Hong Kong. According to a 2006 tax treaty between the

Mainland and Hong Kong, dividends payable by an FIE in China to the company in

Hong Kong which directly holds at least 25% of the equity interests in the FIE

will be subject to a no more than 5% withholding tax. We expect that such 5%

withholding tax will apply to dividends paid to Alex Industrial by Annec, but

this treatment will depend on our status as a non-resident

enterprise.

Pursuant

to the Provisional Regulation of China on Value Added Tax and its implementing

rules, all entities and individuals that are engaged in the sale of goods, the

provision of repairs and replacement services and the importation of goods in

China are generally required to pay value added tax, or VAT, at a rate of 17.0%

of the gross sales proceeds received, less any deductible VAT already paid or

borne by the taxpayer. Further, when exporting goods, the exporter is entitled

to some or all of the refund of VAT that it has already paid or

borne.

Pursuant

to the New EIT Law, designated hi-tech corporation may be accorded a tax

preference at the rate of 15%. Zhengzhou Annec qualified as a hi-tech

corporation and was accorded certain tax incentives for said designation.

Accordingly, Zhengzhou Annec was subject to tax at a statutory rate of 15% for

the years ended December 31 2008 and 2009. Zhengzhou Annec will continue to be

subject to a 15% tax rate for the years ending December 31, 2010, 2011, and

2012, and expects that thereafter will become subject to a rate of 25% unless

Zhengzhou Annec applies for and receives a further tax preference for the

succeeding five years.

Employment

laws

We are

subject to laws and regulations governing our relationship with our employees,

including: wage and hour requirements, working and safety conditions, and social

insurance, housing funds and other welfare. These include local labor

laws and regulations, which may require substantial resources for

compliance.

16

China’s

National Labor Law, which became effective on January 1, 1995, and China’s

National Labor Contract Law, which became effective on January 1, 2008, permit

workers in both state and private enterprises in China to bargain

collectively. The National Labor Law and the National Labor Contract

Law provide for collective contracts to be developed through collaboration

between the labor union (or worker representatives in the absence of a union)

and management that specify such matters as working conditions, wage scales, and

hours of work. The laws also permit workers and employers in all

types of enterprises to sign individual contracts, which are to be drawn up in

accordance with the collective contract. The National Labor Contract

Law has enhanced rights for the nation’s workers. The legislation requires

employers to provide written contracts to their workers, restricts the use of

temporary labor and makes it harder for employers to lay off

employees. It also requires that employees with fixed-term contracts

be entitled to an indefinite-term contract after a fixed-term contract is

renewed twice or the employee has worked for the employer for a consecutive

ten-year period.

Foreign

Currency Exchange

Foreign

currency exchange in the PRC is governed by a series of regulations, including

the Foreign Currency

Administrative Rules (1996), as amended, and the Administrative Regulations Regarding

Settlement, Sale and Payment of Foreign Exchange (1996), as amended.

Under these regulations, the Renminbi is convertible for current account items,

including the distribution of dividends, interest payments, trade and

service-related foreign exchange transactions. Conversion of Renminbi for

capital account items, such as direct investment, loan, security investment and

repatriation of investment, however, is still subject to the approval of the PRC

State Administration of Foreign Exchange, or SAFE. FIEs established in the PRC

may only buy, sell and remit foreign currencies at those banks authorized to

conduct foreign exchange business after providing valid commercial documents

and, in the case of capital account item transactions, obtaining approval from

the SAFE. Capital investments by FIEs outside of China are also subject to

limitations, which include approvals by the Ministry of Commerce, the SAFE and

the State Reform and Development Commission. We currently do not hedge

our exposure to fluctuations in currency exchange rates.

Dividend

Distributions

The

principal laws and regulations in the PRC governing distribution of dividends by

FIEs include:

|

|

·

|

The

Sino-foreign Equity Joint Venture Law (1979), as amended, and the

Regulations for the Implementation of the Sino-foreign Equity Joint

Venture Law (1983), as amended;

|

|

|

·

|

The

Sino-foreign Cooperative Enterprise Law (1988), as amended, and the

Detailed Rules for the Implementation of the Sino-foreign Cooperative

Enterprise Law (1995), as amended;

and

|

|

|

·

|

The

Foreign Investment Enterprise Law (1986), as amended, and the Regulations

of Implementation of the Foreign Investment Enterprise Law (1990), as

amended.

|

Under

applicable PRC regulations, FIEs in China may pay dividends only out of their

accumulated profits, if any, determined in accordance with PRC accounting

standards and regulations. In addition, a FIE in China is required to set aside

at least 10% of its after-tax profit based on PRC accounting standards each year

to its general reserve fund until the accumulative amount of such reserve

fund reaches 50% of its registered capital. The general reserve fund

is not distributable as cash dividends. The board of directors of a FIE has the

discretion to allocate a portion of its after-tax profits to staff welfare and

bonus funds, which may not be distributed to equity owners except in the event

of liquidation.

17

Employees

As of February 11, 2011, we employed

approximately 1,263 employees as follows, 110 in management, 1,091 in

production, 30 in research and development, and 32 in marketing.

We maintain a satisfactory working

relationship with our employees, and we have not experienced any significant

labor disputes or any difficulty in recruiting employees for our operations.

None of our employees are represented by a labor union.

Our employees are all in China and

participate in the state pension plan organized by the Chinese municipal and

provincial government. We are required by Chinese law to cover employees in

China with various types of social insurance. We believe that we are in material

compliance with the relevant PRC laws.

Property

All land

in China is owned by the State. Individuals and companies are permitted to

acquire rights to use land or land use rights for specific purposes. In the case

of land used for industrial purposes, the land use rights are generally granted

for a period of 50 years. Granted land use rights are transferable and may be

used as security for borrowings and other obligations.

All of

our facilities are located in Xinmi, Henan Province. We own one manufacturing

facility which includes offices, workshops, dormitory, and dining halls that

total approximately 998,758 square feet. In addition, we own another workshop

located on land that we lease from He Xi village of Xinmi city. The land is

approximately 370,666 square feet and the rent is $7,551 per year for 50 years

starting in 2010. We also lease another workshop from an unrelated

third party. The rent for the workshop is $207,575 per year for 4

years.

We believe that our facilities, which

are of varying ages and are of different construction types, have been

satisfactorily maintained. They are in good conditions and are suitable for our

operations and generally provide sufficient capacity to meet our production and

operational requirements.

Legal

Proceedings

From time to time, we may become

involved in various lawsuits and legal proceedings which arise in the ordinary

course of business. However, litigation is subject to inherent

uncertainties and an adverse result in these or other matters may arise from

time to time that may harm our business.

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You

should carefully consider the risks described below, together with all of the

other information included in this report, before making an investment

decision. If any of the following risks actually occur, our business,

financial condition or results of operations could suffer. In that

case, the trading price of our common stock could decline, and you may lose all

or part of your investment. You should read the section entitled

“Special Note Regarding Forward Looking Statements” above for a discussion of

what types of statements are forward-looking statements, as well as the

significance of such statements in the context of this report.

18

Risks Related To Our Overall

Business Operations

Current economic conditions may

adversely affect consumer spending and the overall general health of our retail

customers, which, in turn, may adversely affect our financial condition, results

of operations and cash resources.

Uncertainty about the current and

future global economic conditions may cause our customers to defer purchases or

cancel purchase orders for our products in response to tighter credit, decreased

cash availability and weakened consumer confidence. Our financial

success is sensitive to changes in general economic conditions, both globally

and nationally. Recessionary economic cycles, higher interest

borrowing rates, higher fuel and other energy costs, inflation, increases in

commodity prices, higher levels of unemployment, higher consumer debt levels,

higher tax rates and other changes in tax laws or other economic factors that

may affect consumer spending or buying habits could continue to adversely affect

the demand for our products. In addition, a number of our customers

may be impacted by the significant decrease in available credit that has

resulted from the current financial crisis. If credit pressures or

other financial difficulties result in insolvency for our customers it could

adversely impact our financial results. There can be no assurances

that government and consumer responses to the disruptions in the financial

markets will restore consumer confidence.

We may be unable to successfully

execute our long-term growth strategy or maintain our current revenue

levels.

Our ability to maintain our revenue

levels or to grow in the future depends upon, among other things, the continued

success of our efforts to maintain our brand image and bring new products to

market and our ability to expand within our current distribution channels. For

year ended 2009, we experienced a decrease in our revenues. There can be no

assurances that we will be able to maintain or grow our revenues, or

successfully execute our long-term growth strategy.

A downturn or negative changes in the

highly volatile steel and iron industry will harm our business and

profitability.

Our main customers consist largely of

iron and steel companies. Accordingly, our business performance is

closely tied to the performance of the steel industry. The sector as

a whole is cyclical and its profitability can be volatile as a result of general

economic conditions, labor costs, competition, import duties, tariffs and

currency exchange rates. These factors have historically resulted in

wide fluctuations in the Chinese and the global economies in which steel

companies sell their products. In the event that these fluctuations

occur, a resulting decreased demand for steel products could negatively impact

our sales, margins and profits.

Industry growth rate for refractory

products may decelerate and may affect our future revenue growth.

As a result of the growth of the

Chinese steel industry, the production of refractory materials in China has

experienced tremendous growth in recent years. If the steel industry

growth rate slows, it will likely negatively impact our growth

rate.

Our inability to overcome fierce

competition in the highly competitive Chinese refractory market could reduce our

revenue and net income.

We compete with many other refractory

manufacturers in China and, if we are successful in expanding our market reach,

we will have international competitors as well. Remaining competitive

requires a variety of things – market share and customer growth, continued

success in technology development, access to reasonable priced raw materials and

other supplies, etc. Much of our future success will be dependent on our ability

to secure and retain adequate financing of our current operations and research

and development. If we are unable to secure financing, or if any

other market factor makes it difficult to remain competitive, our revenue and

net income will be adversely affected.

19

Our limited operating history may not

serve as an adequate basis to judge our future prospects and results of

operations.

We have a limited operating history

because we have only been in operation since 2003. This limited

operating history makes it difficult for investors to evaluate our businesses

and predict future operating results. An investor in our securities

must consider the risks, uncertainties and difficulties frequently encountered

by companies in new and rapidly evolving markets. The risks and

difficulties we face include challenges in accurate financial planning as a

result of limited historical data and the uncertainties resulting from having

had a relatively limited time period in which to implement and evaluate our

business strategies as compared to older companies with longer operating

histories.

Our ability to obtain additional

financing may be limited, which could delay or prevent the completion of one or

more of our strategies.

We have, to date, financed our working

capital and capital expenditure needs primarily from capital contributions of

shareholders of our operating entities, bank loans provided by local banking

institutions and operating cash flows. We expect our working capital

needs and our capital expenditure needs to increase in the future as we continue

to expand and enhance our production facilities, increase our design, research

and development capabilities and as we continue to implement our other

strategies. Our ability to raise additional capital will depend on

the financial success of our current business and the successful implementation

of our key strategic initiatives, as well as financial, economic and market

conditions and other factors, some of which are beyond our

control. We may not be successful in raising any required capital on

reasonable terms and at required times, or at all. Further, equity

financings may have a further dilutive effect on our stockholders. If

we require additional debt financing, the lenders may require us to agree on

restrictive covenants that could limit our flexibility in conducting future

business activities, and the debt service payments may be a significant drain on

our free capital allocated for research and other

activities. If we are unsuccessful in raising additional capital or

if new capital funding costs are higher than our prior capital funding costs,

our business operations and our development programs may be materially and

adversely impacted, with similar effects on our results of operations and

financial condition.

Our production capacity might not be

able to meet with growing market demand or changing market

conditions.

We cannot give assurance that our

production capacity will be able to meet our obligations and the growing market

demand for our products in the future. Furthermore, we may not be

able to expand our production capacity in response to the changing market

conditions. If we fail to meet demand from our customers, we may lose

our market share.

We may not be able to develop new

products or expand into new markets.

We intend to develop and produce new

refractory products. The launch and development of new products

involve considerable time and commitment which may exert a substantial strain on

our ability to manage our existing business and operations. We cannot

ensure our research and development capacity and capability is sufficient to

develop any marketable new products or that any income will be generated from

such new products. If we are not able to develop and introduce new

products successfully, or if our new products fail to generate sufficient

revenues to offset our research and development costs, our business, financial

condition and operating results could be adversely affected. Failure

of such could lead to wasted resources. An element of our strategy

for growth also envisages us selling existing or new products into new markets

other than the PRC market. There is no guarantee that we will be

successful in executing our growth strategy and if we should fail to execute our

growth strategy successfully, it may have a material and adverse affect on our

future revenue and profitability.

20

We manufacture our products in a single

location, and any material disruption of our operations could adversely affect

our business.

Our operations are subject to

uncertainties and contingencies beyond our control that could result in material

disruptions in our operations and adversely affect our

business. These include industrial accidents, fires, floods,

droughts, storms, earthquakes, natural disasters and other catastrophes,

equipment failures or other operational problems, strikes or other labor

difficulties.

All of our products are manufactured in

our production facilities in the PRC. If there is any damage to our

production facilities, we may not be able to remedy such situations in a timely

and proper manner, and our production could be materially and adversely

affected. Any breakdown or malfunction of any of our equipment could

cause a material disruption of our operations. Any such disruption in

our operations could cause us to reduce or halt our production, prevent us from

meeting customer orders, adversely affect our business reputation, increase our

costs of production or require us to make unplanned capital expenditures, any

one of which could materially and adversely affect our business, financial

condition and results of operations.

The prices for the raw materials and

the costs for labor may increase.

Any decrease in the availability, or

increase in the cost, of raw materials and energy could materially increase our

costs and jeopardize our current profit margins and

profitability. Our ability to achieve our sales target depends on our

ability to maintain what we believe to be adequate inventories of raw materials

to meet reasonably anticipated orders from our customers.

Further, if our existing suppliers are

unable or unwilling to deliver our raw materials requirements on time to meet

our production schedules, we may be unable to produce certain products, which

could result in a decrease in revenues and profitability, a loss of good will

with our customers, and could tarnish our reputation as a reliable supplier in

our industry. In the event that our raw material and energy costs

increase, we may not be able to pass these higher costs on to our customers in

full or at all due to contractual agreements or pricing pressures in the

refractory market. Any increase in the prices for raw materials or

energy resources could materially increase our costs and therefore lower our

earnings and profitability.

The manufacturing industry is labor

intensive. Labor costs in the PRC have been increasing over the past

few years, and we cannot assure you that the cost of labor in the PRC will not

continue to increase in the future or that we will be able to increase the

prices of our products to offset such increases. If we are unable to

identify and employ other appropriate means to reduce our costs of production or

to pass on the increased labor and other costs of production to our customers by

selling our products at higher prices, our business, financial condition,

results of operations and prospects could be materially and adversely

affected.

21

Our insurance coverage may not be

sufficient to cover all losses.

Although we have obtained insurance

coverage for the operation of our business that we believe is customary in the

PRC refractory industry, covering risks such as loss as a result of fire, theft

or occurrence of certain natural disasters, the insurance may not cover all

types of loss. If we incur substantial losses or liabilities that are

not covered or compensated by our insurance coverage fully or at all, our

business, financial condition and results of operations may be materially and

adversely affected.

We may not be able to comply with all

applicable government regulations.

We are subject to extensive

governmental regulation by the central, regional and local authorities in the

PRC, where our business operations take place. We believe that we are

currently in substantial compliance with all laws and governmental regulations

and that we have all material permits and licenses required for our

operations. Nevertheless, we cannot assure investors that we will

continue to be in substantial compliance with current laws and regulations, or

that we will be able to comply with any future laws and

regulations. To the extent that new regulations are adopted, we will

be required to conform our activities in order to comply with such

regulations. Failure to comply with applicable laws and regulations

could subject us to civil remedies, including fines, injunctions, recalls or

seizures, as well as potential criminal sanctions, which could have a material

adverse effect on its business, operations and finances.

Actions by the Chinese government could

drive up our material costs and could have a negative impact on our

profitability.

In the past years, the Chinese

government has shut down some outdated mineral mines in China. These shutdowns

have decreased the overall supply of raw materials needed to produce refractory

products. As a result, the materials costs for our products have

increased. If the Chinese government shuts down more mineral mines,

we could experience further supply shortages and price increases that could have

a negative impact on our profitability.

Approximately 56% of our sales revenues

were derived from our ten largest customers, and any reduction in revenues from

any of these customers would reduce our revenues and net income.

While we have numerous customers,

approximately 56% of our sales revenue came from our top ten customers in 2009.

If we cease to do business at or above current levels with any one of our large

customers which contribute significantly to our sales revenues, and we are

unable to generate additional sales revenues with new and existing customers

that purchase a similar amount of our products, then our revenues and net income

would decline considerably.

A significant interruption or casualty

loss at any of our facilities could increase our production costs and reduce our

sales and earnings.

Our manufacturing process requires

large industrial facilities for crushing, smashing, batching, molding and baking

raw materials. After the refractory products come off the production

line, we need additional facilities to inspect, package, and store the finished

goods. Our facilities may experience interruptions or major accidents

and may be subject to unplanned events such as explosions, fires, accidents and

other events. Any shutdown or interruption of any facility would

reduce the output from that facility, which could substantially impair our

ability to meet sales targets. Interruptions in production

capabilities will inevitably increase production costs and reduce our sales and

earnings. In addition to the revenue losses, longer-term business

disruption could result in the loss of goodwill with our

customers. To the extent these events are not covered by insurance,

our revenues, margins and cash flows may be adversely impacted by events of this

type.

22

Compliance with environmental

regulations can be expensive, and noncompliance with these regulations may

result in adverse publicity and potentially significant monetary damages and

fines.

We have environmental liability risks

and limitations on operations brought about by the requirements of environmental

laws and regulations. We are subject to various national and local

environmental laws and regulations concerning issues such as air emissions,

wastewater discharges, and solid and hazardous waste management and

disposal. These laws and regulations are becoming increasingly

stringent. While we believe that our facilities are in material

compliance with all applicable environmental laws and regulations, the risks of

substantial unanticipated costs and liabilities related to compliance with these

laws and regulations are an inherent part of our business. It is