Attached files

| file | filename |

|---|---|

| EX-4.1 - SRKP 23 Inc | v210728_ex4-1.htm |

| EX-23.1 - SRKP 23 Inc | v210728_ex23-1.htm |

|

As

Filed with the Securities and Exchange Commission on February 11,

2011

|

Registration

No. 333-

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

China

Wesen Recycling Technology, Inc.

(Name

of Registrant As Specified in its Charter)

|

Delaware

|

3080

|

26-1357843

|

||

|

(State or Other Jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer Identification No.)

|

||

|

Incorporation

|

Classification Code Number)

|

|||

|

or Organization)

|

|

|

Room

405, Floor 4, North Tower, 9 Shen Zhou Road,

Guangzhou

High-tech Industrial Development Zone, Guangzhou

People’s

Republic of China

86

(20) 32290314

(Address

and Telephone Number of Principal Executive Offices)

Corporation

Service Company

2711

Centerville Road

Suite

400

Wilmington,

DE 19808

800-222-2122

(Name,

Address and Telephone Number of Agent for Service)

Copies

to

|

Thomas

J. Poletti, Esq.

Melissa

A. Brown, Esq.

K&L

Gates LLP

10100

Santa Monica Blvd., 7th Floor

Los

Angeles, CA 90067

Telephone

(310) 552-5000

Facsimile

(310) 552-5001

|

V.

Joseph Stubbs, Esq.

Scott

Galer, Esq.

Stubbs

Alderton & Markiles, LLP

15260

Ventura Boulevard, 20th Floor

Sherman

Oaks, California 91403

Telephone

(818) 444-4500

Facsimile

(818) 444-4520

|

Approximate Date of Proposed Sale to the Public: From time to time after the effective date of this Registration Statement

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box.R

If this

form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement the same

offering. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

Non-accelerated

filer ¨

|

Smaller

reporting company R

|

CALCULATION

OF REGISTRATION FEE

|

Proposed

|

Proposed

|

|||||||||||||||

|

Maximum

|

Maximum

|

Amount of

|

||||||||||||||

|

Title of Each Class of

|

Amount To Be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||||||

|

Securities To Be Registered

|

Registered (1)

|

Per Share

|

Offering Price

|

Fee

|

||||||||||||

|

Common

Stock, $0.0001 par value per share

|

1,380,000 | (2) | $ | 4.00 | (2) | $ | 5,520,000 | (2) | $ | 640.87 | ||||||

|

Common

Stock, $0.0001 par value per share

|

2,457,167 | (3) | $ | 4.00 | (4) | $ | 9,828,668 | (4) | $ | 1,141.11 | ||||||

|

Underwriter’s

Warrants to Purchase Common Stock

|

120,000 | (5) | N/A | N/A | N/A | (6) | ||||||||||

|

Common

Stock Underlying Underwriter’s Warrants, $0.0001 par value per

share

|

120,000 | (7) | $ | 4.80 | $ | 576,000 | (10) | $ | 66.87 | (10) | ||||||

|

Total

Registration Fee

|

$ | 1,848.85 | (11) | |||||||||||||

|

(1)

|

In

accordance with Rule 416(a), the Registrant is also registering hereunder

an indeterminate number of additional shares of Common Stock that shall be

issuable pursuant to Rule 416 to prevent dilution resulting from stock

splits, stock dividends or similar

transactions.

|

|

(2)

|

The

registration fee for securities to be offered by the Registrant is based

on an estimate of the Proposed Maximum Aggregate Offering Price of the

securities, and such estimate is solely for the purpose of calculating the

registration fee pursuant to Rule 457(o). Includes shares which the

underwriters have the option to purchase to cover over-allotments, if

any.

|

|

(3)

|

This

Registration Statement also covers the resale under a separate resale

prospectus (the “Resale Prospectus”) by selling stockholders of the

Registrant of up to 2,457,167 shares of Common Stock previously issued to

the selling stockholders as named in the Resale

Prospectus.

|

|

(4)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457.

|

|

(5)

|

Represents

the maximum number of warrants to purchase the Registrant’s common stock

to be issued to the underwriter in connection with the public

offering.

|

|

(6)

|

In

accordance with Rule 457(g) under the Securities Act, because the shares

of the Registrant’s common stock underlying the underwriter’s warrants are

registered hereby, no separate registration fee is required with respect

to the warrants registered hereby.

|

|

(7)

|

Represents

the maximum number of shares of the Registrant’s common stock issuable

upon exercise of the underwriter’s

warrants.

|

|

(8)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457(g) under the Securities Act, based on an exercise price of $4.80

per share.

|

|

(9)

|

Paid

herewith.

|

The

Registrant amends this registration statement on such date or dates as may be

necessary to delay its effective date until the Registrant shall file a further

amendment which specifically states that this registration statement shall

hereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933, or until the registration statement shall become effective on such date

as the Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY

NOTE

This

Registration Statement contains two prospectuses, as set forth

below.

|

|

·

|

Public

Offering Prospectus. A prospectus to be used for the public

offering by the Registrant of up to 1,200,000 shares of the Registrant's

common stock (in addition to 180,000 shares that may be sold upon exercise

of the underwriters’ over-allotment option) (the "Public Offering

Prospectus") through the underwriter named on the cover page of the Public

Offering Prospectus. We are also registering the warrants and shares

of common stock underlying the warrants to be received by the underwriter

in this offering.

|

|

|

·

|

Resale

Prospectus. A prospectus to be used for the resale by selling

stockholders of up to 2,457,167 shares of the Registrant’s common

stock (the “Resale

Prospectus”).

|

The

Resale Prospectus is substantively identical to the Public Offering Prospectus,

except for the following principal points:

|

|

·

|

they

contain different outside and inside front

covers;

|

|

|

·

|

they

contain different Offering sections in the Prospectus Summary section

beginning on page 1;

|

|

|

·

|

they

contain different Use of Proceeds sections on page

30;

|

|

|

·

|

the

Capitalization and Dilution sections are deleted from the Resale

Prospectus on page 32 and page 33,

respectively;

|

|

|

·

|

the

“Selling Stockholders” portion of the Beneficial Ownership of Certain

Beneficial Owners, Management, and Selling Stockholders on page 73 of the

Public Offering Prospectus is deleted from the Resale

Prospectus;

|

|

|

·

|

a

Selling Stockholder section is included in the Resale Prospectus beginning

on page 80A;

|

|

|

·

|

references

in the Public Offering Prospectus to the Resale Prospectus will be deleted

from the Resale Prospectus;

|

|

|

·

|

the

Underwriting section from the Public Offering Prospectus on page 80 is

deleted from the Resale Prospectus and a Plan of Distribution is inserted

in its place;

|

|

|

·

|

the

Legal Matters section in the Resale Prospectus on page 83 deletes the

reference to counsel for the underwriters;

and

|

|

|

·

|

the

outside back cover of the Public Offering Prospectus is deleted from the

Resale Prospectus.

|

The

Registrant has included in this Registration Statement, after the financial

statements, a set of alternate pages to reflect the foregoing differences of the

Resale Prospectus as compared to the Public Offering Prospectus.

Notwithstanding

the Resale Prospectus, selling stockholders named in the Resale Prospectus have

agreed that (i) if the proposed public offering that we expect to conduct is for

$5 million or more, then they would not be able to sell or transfer their shares

until at least six (6) months after the date on which the Company’s common stock

becomes listed or quoted on either the New York Stock Exchange, the NYSE Amex,

the NASDAQ Global Market, the NASDAQ Capital Market or the OTC Bulletin Board

(the “Listing Date”), and (ii) if the offering is for less than $5 million, then

one-tenth of their shares would be released from the lock-up restrictions ninety

(90) days after the Listing Date and there would be a pro rata release of the

shares thereafter every 30 days over the following nine months. WestPark

Capital, in its discretion, may also release some or all the shares from the

lock-up restrictions earlier. We currently intend this offering to be in

an amount less than $5 million. However, there can be no assurance of the actual

size of this offering.

|

The

information in this prospectus is not complete and may be changed. We may

not sell these securities until the registration statement filed with the

Securities and Exchange Commission

becomes effective. This prospectus is not an offer to sell these

securities and we are not soliciting offers to buy these securities in any

state where the offer or sale is not

permitted.

|

|

PRELIMINARY

PROSPECTUS

|

Subject

to Completion

|

February

11, 2011

|

1,200,000

SHARES

CHINA

WESEN RECYCLING TECHNOLOGY, INC.

COMMON

STOCK

This is a

public offering of our common stock. We are a reporting company under

Section 13 of the Securities Exchange Act of 1934, as amended. Our shares of

common stock are not currently listed or quoted for trading on any national

securities exchange or national quotation system. We intend to apply for the

listing of our common stock on the NASDAQ Global Market or the NYSE Amex under

the symbol “[___].” There can, however, be no assurance that our common

stock will be accepted for listing on either such exchange.

We are

offering all of the 1,200,000 shares of our common stock offered by this

prospectus. We expect that the public offering price of our common stock

will be between $3.00 and $4.00 per share.

Investing

in our common stock involves a high degree of risk. Before buying any

shares, you should carefully read the discussion of material risks of investing

in our common stock in “Risk Factors” beginning on page 11 of this

prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission

has approved or disapproved of anyone’s investment in these securities or

determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

|

Per Share

|

Total

|

|||||||

|

Public

offering price

|

$ | [___ | ] | $ | [___ | ] | ||

|

Underwriting

discounts and commissions (1)

|

$ | [___ | ] | $ | [___ | ] | ||

|

Proceeds,

before expenses, to China Wesen Recycling Technology, Inc.

|

$ | [___ | ] | $ | [___ | ] | ||

|

Proceeds,

before expenses, to selling stockholders

|

$ | [___ | ] | $ | [___ | ] | ||

(1)

The underwriter will receive compensation in addition to the discounts and

commissions as set forth under “Underwriting.”

The

Underwriter has a 45-day option to purchase up to 180,000 additional shares of

common stock at the public offering price solely to cover over-allotments, if

any, if the Underwriter sells more than 1,200,000 shares of common stock in this

offering (the “Over-allotment Shares”). The Underwriter agreed to purchase

70% of the Over-allotment Shares from the selling stockholders identified in

this prospectus and the remaining shares from us. We will not receive any

proceeds from the sale of the shares, if any, by the selling stockholders.

If the Underwriter exercises this option in full, the total underwriting

discounts and commissions will be $[__], and total proceeds, before

expenses, to the selling stockholders will be $[__] and the additional proceeds

to us, before expenses, from the over-allotment option exercise will be

$[__].

We have

agreed to pay the Underwriter an aggregate non-accountable expense allowance of

3.0% of the gross proceeds of this offering or $[__], based on a public offering

price of $[__] per share.

The

Underwriter will also receive warrants to purchase a number of shares equal to

10% of the shares of our common stock sold in connection with this offering, or

120,000 shares, exercisable at a per share price equal to 120% of the offering

price of this offering. The Underwriter is offering the common stock as

set forth under “Underwriting.” Delivery of the shares will be made on or

about [__________], 2011.

WestPark

Capital, Inc.

The Date

of this Prospectus is: ____________________, 2011

[INSIDE

FRONT COVER].

TABLE

OF CONTENTS

|

PROSPECTUS

SUMMARY

|

1

|

|

SUMMARY

FINANCIAL DATA

|

10

|

|

RISK

FACTORS

|

11

|

|

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

29

|

|

USE

OF PROCEEDS

|

30

|

|

DIVIDEND

POLICY

|

31

|

|

CAPITALIZATION

|

32

|

|

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

33

|

|

DILUTION

|

33

|

|

ACCOUNTING

FOR THE SHARE EXCHANGE

|

34

|

|

SELECTED

CONSOLIDATED FINANCIAL DATA

|

35

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

36

|

|

DESCRIPTION

OF BUSINESS

|

53

|

|

MANAGEMENT

|

63

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

68

|

|

BENEFICIAL OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS, MANAGEMENT AND

SELLING STOCKHOLDERS

|

72

|

|

DESCRIPTION

OF SECURITIES

|

74

|

|

SHARES

ELIGIBLE FOR FUTURE SALE

|

77

|

|

UNDERWRITING

|

80

|

|

CONFLICTS

OF INTEREST

|

82

|

|

LEGAL

MATTERS

|

83

|

|

EXPERTS

|

83

|

|

ADDITIONAL

INFORMATION

|

83

|

|

INDEX

TO FINANCIAL STATEMENTS

|

F-1

|

|

PART

II INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

II-1

|

|

SIGNATURES

|

II-7

|

Please

read this prospectus carefully. It describes our business, our financial

condition and results of operations. We have prepared this prospectus so that

you will have the information necessary to make an informed investment

decision.

You

should rely only on information contained in this prospectus. We have not,

and the underwriter has not, authorized any other person to provide you with

different information. This prospectus is not an offer to sell, nor is it

seeking an offer to buy, these securities in any state where the offer or sale

is not permitted. The information in this prospectus is complete and

accurate as of the date on the front cover, but the information may have changed

since that date.

i

PROSPECTUS

SUMMARY

Because

this is only a summary, it does not contain all of the information that may be

important to you. You should carefully read the more detailed information

contained in this prospectus, including our financial statements and related

notes. Our business involves significant risks. You should carefully consider

the information under the heading “Risk Factors” beginning on page

11.

As used

in this prospectus, unless otherwise indicated, the terms “we,” “our,” “us,”

“Company” and “Wesen” refer to China Wesen Recycling Technology, Inc., a

Delaware corporation, formerly known as SRKP 23, Inc. (“SRKP 23”). We conduct

our business through our subsidiaries, which include our wholly-owned

subsidiary, Weixin International Co., Limited, a company organized under the

laws of the British Virgin Islands (“Weixin BVI”), Wei Xin Holding Group

Limited, a company organized under the laws of Hong Kong and a wholly-owned

subsidiary of Weixin BVI (“Weixin HK”), Gangzhou Kelida Intelligent Equipment

Co., Ltd., a company organized under the laws of the People’s Republic of China

and a wholly-owned subsidiary of Weixin HK (“Kelida”), and Zhaoqing Hua Su

Plastic Trading Company (“Hua Su”), Zhaoqing Chuang Yi Resources Recycle Co.,

Ltd. (“Chuang Yi”), Zhaoqing Xin Ye Plastic Co., Ltd. (“Xin Ye”), and Zhaoqing

Li Jun Craftwork Co., Ltd. (“Li Jun”), each a company organized under the laws

of the People’s Republic of China and a wholly-owned subsidiary of

Kelida.

The

“selling stockholders” refers, collectively, to the selling stockholders named

in this prospectus under the heading “Beneficial Ownership of Certain Beneficial

Owners, Management, and Selling Stockholders” who have agreed to sell to the

Underwriters up to 70% of the Over-allotment Shares sold in this offering, if

any.

“China”

or “PRC” refers to the People’s Republic of China. “RMB” or “Renminbi” refers to

the legal currency of China and “$” or “U.S. Dollars” refers to the legal

currency of the United States.

Overview

We

recycle engineering plastics from complex waste streams and end-of-life

plastic-rich durable goods such as computer and business equipment, household

appliances, house wares, toys and many other sources. We produce plastic

grains and compounds which are sold to original equipment manufacturers of

consumer products and plastic injection molders which produce new consumer

products using recycled material. We specialize in the production of

high-density polyethylene, or HDPE, low-density polyethylene, or LDPE, acrylonitrile-butadiene-styrene,

or ABS, and polystyrene, or PS. In addition, we offer a line of household

and construction products which we manufacture with our own recycled plastic

compounds. Our plastic grains are sold to trading companies and

wholesalers, as well as customers in industries such as architecture industrial

equipment and engineering production, chemical and petrochemical manufacturing.

In addition, a substantial portion of our revenue is currently derived form the

resale of recycled plastic materials, including HDPE, LDPE, ABS and PS material,

which we cannot currently recycle due to our current recycling

capabilities.

Our

Strategy

Our goal

is to become a leading provider of plastic grains and compounds and proprietary

products manufactured from such material in China. We intend to achieve this

goal by implementing the following strategies:

Maximize our existing resources to

increase our profitability

We plan to use our expertise in

plastics recycling and in the production of products produced from our recycled

plastic material to further increase our profitability. Our plan is to actively

capitalize on market opportunities by:

|

|

·

|

expanding

our sale force by recruiting experienced and knowledgeable sales personnel

to reach new customers;

|

|

|

·

|

strengthening

relationships with our existing clients to increase the rate of purchase

of existing products; and

|

|

|

·

|

exploring

new opportunities for expanding our product offerings to new and existing

clients.

|

1

Expand output capacity

In November 2009, we began construction

of a new facility in Gangzhou on land for which we have obtained land use

rights. This new facility will primarily act as a research and development

center for our company, and will include a materials laboratory, an advanced

tool shop for researching various end-user products, a showroom and our new

principal corporate offices. The new facility will allow us to improve our

corporate image and increase our ability to develop high-end plastic compounds

and new end-user products, and will lessen our dependence on sales of raw

materials for profitability.

Focus on improved

efficiencies

We will continue to focus on efforts on

improving the overall efficiency of system operations and the operational

performance of our main production plants through additional engineering

improvements, additional automation and modernization of the production process

and reducing non-scheduled shut-downs of equipment. At the same time, we intend

to balance these efforts with additional focus on production safety,

environmental protection, occupational health, energy conservation and emissions

reduction, striving to comply with the requirements for the development of a

low-carbon, green economy with recyclable materials.

Strengthen relationships with suppliers

and focus on reducing commodity costs

The purchase of raw material is

fundamental to the recycling business. In order to cut costs and increase profit

margins, we focus on developing relationships with new suppliers and increasing

amount of raw material purchased directly from overseas recyclers, as opposed to

purchasing from domestic wholesalers or intermediaries. We continue to work on

obtaining more favorable terms and discounts by strengthening our relationship

with suppliers and placing more bulk orders. We also continue to monitor

commodity costs and work with our suppliers and customers to manage changes in

commodity costs.

Expand our line of proprietary products

manufactured with our recycled plastic

We intend to expand our product

offerings into higher end technology oriented products such as railroad

crossties. We intend to leverage the engineering and production capabilities of

our experienced management team to develop new high margin product offerings to

further boost our revenues and profitability. We believe that our expansion into

these new product offerings will continue to differentiate us from our

competition and will strengthen our competitiveness in the plastic recycling

industry. Additionally, the increase in our production and sale of end

products will lessen our dependency on sales of raw materials for our

revenues. Sales of proprietary higher end products yield higher revenues

than sales of raw materials, which is key to increasing our

profitability.

Pursue acquisitions to broaden our

product offerings and production capability

The plastic recycling market in China

remains highly fragmented, and the majority of recycling companies are

regionally focused with relatively few attaining national scale. We will

consider strategic acquisitions that will provide us with a broader range of

service offerings and access to new markets. When evaluating potential

acquisition targets, we will consider factors such as market position, growth

potential and earnings prospects and strength and experience of

management.

Our

business is subject to a number of risks and uncertainties, including risks

related to our ability to develop new products utilizing our recycled plastic

products, our dependence on a limited number of suppliers for a majority of our

raw materials, our ability to enter into relationships directly with suppliers

to obtain raw materials; our ability to secure plastic waste raw materials at

competitive prices, our reliance on a limited number of customers for our net

sales and PRC regulations regarding the recycled plastics industry.

Investors should carefully consider these risks and all of the risks discussed

in “Risk Factors” beginning on page 12 of this prospectus before investing in

our securities.

2

Recent

Events

Share

Exchange

On November 12, 2010,we entered into a

Share Exchange Agreement (the “Exchange Agreement”) with Weixin BVI, Weixin HK,

Kelida, Hua Su, Chuang Yi, Xin Ye, Li Jun, and all of the shareholders of Weixin

BVI (collectively, the “Weixin Shareholders”). Pursuant to the Exchange

Agreement, we agreed to issue an aggregate of 7,865,556 shares of our common

stock, $0.0001 par value per share (the “Common Stock”) to the Weixin

Shareholders in exchange for all of the issued and outstanding securities of

Weixin BVI (the “Share Exchange”). The Share Exchange closed on November

23, 2010 and Weixin BVI became our wholly-owned subsidiary. We changed our

name to “China Wesen Recycling Technology, Inc.” on November 24,

2010.

Upon the closing of the Share Exchange,

we issued an aggregate of 7,865,556 shares of our Common Stock to the Weixin

Shareholders in exchange for all of the issued and outstanding securities of

Weixin BVI. Prior to the closing of the Share Exchange and the initial

closing of the Private Placement, as described below, our stockholders prior to

the completion of the Share Exchange (the “SRKP 23 Stockholders”) canceled an

aggregate of 6,679,899 shares held by them such that there were 1,907,455 shares

of Common Stock outstanding immediately prior to the Share Exchange. The

SRKP 23 Stockholders also canceled warrants to purchase an aggregate of

7,804,803 shares of Common Stock such that the SRKP 23 Stockholders held

warrants to purchase an aggregate of 782,545 shares of Common Stock immediately

prior to the Share Exchange. Each warrant is entitled to purchase one

share of our Common Stock at $0.0001 per share and expires five years from the

closing of the Share Exchange. The stockholders did not receive any

consideration for the cancellation of the shares and warrants. The

cancellation of the shares and warrants was accounted for as a contribution to

capital. Immediately after the closing of the Share Exchange and the final

closing of the Private Placement, we had 12,230,178 shares of common stock, no

shares of preferred stock, no options, and warrants to purchase 782,545 shares

of Common Stock issued and outstanding.

The

number of shares and warrants cancelled was determined based on negotiations

with the security holders of SRKP 23 and Wexin BVI. The number of shares

and warrants cancelled by SRKP 23 was not pro rata, but based on negotiations

between the security holders and SRKP 23. As indicated in the Exchange

Agreement, the parties to the transaction acknowledged that a conflict of

interest existed with respect to the negotiations for the terms of the Share

Exchange due to, among other factors, the fact that WestPark Capital, Inc.

(“WestPark Capital”) was advising Wexin BVI in the transaction. As further

discussed below in “Recent

Events—Private Placement,” certain of the controlling stockholders and

control persons of WestPark Capital were also, prior to the completion of the

Share Exchange, controlling stockholders and control persons of SRKP 23.

Under these circumstances, the shareholders of Wexin BVI and the stockholders of

SRKP 23 negotiated an estimated value of Wexin BVI and its subsidiaries, an

estimated value of the shell company (based on similar recent transactions by

WestPark Capital involving similar public shells), and the mutually desired

capitalization of the company resulting from the Share Exchange.

With

respect to the determination of the amounts of shares and warrants cancelled,

the value of the shell company was derived primarily from its utility as a

public company platform, including its good corporate standing and its timely

public reporting status, which we believe allowed us to raise capital at an

appropriate price per share and subsequently list our stock on a national

securities exchange. We believe that investors may have been unwilling to

invest in our company in the Private Placement (as that term is defined below)

on acceptable terms, if at all, in the absence of an investment in a public

reporting vehicle and thus required us to effect the Share Exchange as a

condition to the Private Placement. We did not consider registering our

own securities directly as a viable option for accessing the public

markets. We felt that private financing absent a reverse merger was not

immediately available to us and we chose the structure offered by WestPark

Capital as the best option to becoming publicly listed on a national securities

exchange.

The

services provided by WestPark Capital were not a consideration in determining

this aspect of the transaction. Under these circumstances and based on

these factors, the shareholders of Weixin BVI and the stockholders of SRKP 23

agreed upon the amount of shares and warrants to be cancelled. Further to

such negotiations, we paid a $140,000 success fee to WestPark Capital, Inc for

services provided in connection with the Share Exchange, including coordinating

the share exchange transaction process, interacting with the principals of the

shell corporation and negotiating the definitive purchase agreement for the

shell, conducting a financial analysis of Weixin BVI, conducting due diligence

on Weixin BVI and its subsidiaries and managing the interrelationship of legal

and accounting activities. All of the fees due to WestPark Capital in

connection with the Share Exchange have been paid as of the date of this

prospectus.

3

Based on

an estimated per share offering price of $3.50, the 1,907,455 shares retained by

the SRKP 23 stockholders had an implied monetary value of approximately $6.7

million. Assuming exercise of the 782,545 warrants also retained by the

SRKP 23 stockholders, 2,690,000 shares would have been retained by the SRKP 25

stockholders with an implied monetary value of approximately $9.4 million.

The implied monetary value of the retained shares was calculated based on an

estimated $3.50 per share offering price, without regard to liquidity,

marketability, or legal or resale restrictions; accordingly, such amounts should

not be considered as an indication of the fair value of the retained

shares.

The

transactions contemplated by the Exchange Agreement, as amended, were intended

to be a “tax-free” contribution and/or reorganization pursuant to the provisions

of Sections 351 and/or 368(a) of the Internal Revenue Code of 1986, as

amended.

Private

Placement

On November 23, 2010 and December 16,

2010, we consummated the initial and final closings of a private placement of

shares of the Company’s Common Stock (the “Private Placement”). Pursuant

to subscription agreements entered into with the investors, we sold an aggregate

of 2,457,167 shares of Common Stock at $2.25 per share, for gross proceeds of

approximately $5.5 million in the Private Placement. The purpose of the

Private Placement was to increase our working capital and the net proceeds from

the Private Placement will be used to expand business operations, including

developing direct sources and dealerships, increasing production capacity,

making permitted acquisitions, purchasing manufacturing equipment, and for

general corporate purposes.

In connection with the Private

Placement, we agreed to pay WestPark Capital, the placement agent for the

Private Placement, commission equal to 10.0% with a non-accountable fee of 4.0%

of the gross proceeds from the Private Placement, for an aggregate fee of

approximately $774,008.

We agreed to file a registration

statement covering the common stock sold in the Private Placement within 30 days

of the closing of the Private Placement pursuant to the subscription agreement

entered into with each investor and to cause such registration statement to be

declared effective by the SEC no later than 150 days from the date of filing or

180 days from the date of filing if the registration statement is subject to a

full review by the SEC.

Each investor in the Private Placement

entered into lock-up agreements pursuant to which they agreed that (i) if the

proposed public offering that we expect to conduct is for $5 million or more,

then they would not be able to sell or transfer their shares until at least six

(6) months after the date on which the Company’s common stock becomes listed or

quoted on either the New York Stock Exchange, the NYSE Amex, the NASDAQ Global

Market, the NASDAQ Capital Market or the OTC Bulletin Board (the “Listing

Date”), and (ii) if the offering is for less than $5 million, then one-tenth of

their shares would be released from the lock-up restrictions ninety (90) days

after the Listing Date and there would be a pro rata release of the shares

thereafter every 30 days over the following nine months. WestPark Capital,

in its discretion, may also release some or all the shares from the lock-up

restrictions earlier. We currently intend this offering to be in an amount

less than $5 million. However, there can be no assurance of the actual size of

this offering.

Pursuant

to the Placement Agency Agreement, we entered into a lock-up agreement pursuant

to which we agreed that we will not, directly or indirectly, indirectly, (a)

offer, pledge, sell, offer to sell, contract to sell, sell any option or

contract to purchase, purchase any option or contract to sell, grant any option,

right or warrant to purchase, lend or otherwise transfer or dispose of any

shares of our Common Stock or any securities convertible into, or exercisable or

exchangeable for, shares of Common Stock, or (b) enter into any swap or other

agreement that transfers, in whole or in part, any of the economic consequences

of ownership of shares of Common Stock or such other securities convertible

into, or exercisable or exchangeable for, shares of Common Stock, other than

repurchases at cost or without cost pursuant to the terms of our option and

restricted stock purchase agreements, for a period beginning from the Listing

Date and continuing to and including the date eighteen (18) months after the

Listing Date, without the prior written consent of WestPark Capital; provided,

however, that we may, without the prior written consent of WestPark Capital,

issue equity awards to our employees pursuant to equity incentive plans approved

by our the board of directors and stockholders (provided that such grants do not

exceed 7% of the outstanding shares, which includes the issuance of the shares

issued in connection with the Private Placement).

Some of the controlling stockholders

and control persons of WestPark Capital were also, prior to the completion of

the Share Exchange, controlling stockholders and control persons of the Company,

including Richard Rappaport, who is the Chief Executive Officer of WestPark

Capital and was the President and a significant stockholder of the Company prior

to the Share Exchange, and Anthony C. Pintsopoulos, who is the President

and Treasurer of WestPark Capital and was one of the Company’s controlling

stockholders and an officer and director prior to the Share Exchange.

Mr. Rappaport is the sole owner of the membership interests in the parent

company of WestPark Capital. Each of Messrs. Rappaport and

Pintsopoulos resigned from all of their executive and director positions with

the Company upon the closing of the Share Exchange.

4

Certain

Relationships and Related Transactions

The table below identifies all the

benefits that WestPark Capital and its affiliates have received and will receive

in connection with the Share Exchange, the Private Placement and this

offering.

|

$

|

Other

|

||||

|

Share

Exchange

|

164,000 | (1) |

Registration

rights for an aggregate of 1,428,691 shares and 586,129 shares underlying

warrants (2) (3)

|

||

|

Retained

Shares and Warrants

|

2,014,820 | (4) | |||

|

Private

Placement

|

814,108 | (5) | |||

|

Public

Offering

|

[______ | ](6) |

Warrants

to purchase 120,000 shares of common stock at an exercise price of $4.20

per share

|

||

|

Total

|

[______ | ] | |||

(1)

Includes a success fee of $140,000 paid to WestPark Capital for services

provided in connection with the Share Exchange. Also includes

$24,000 for consulting fees paid to WestPark by the Company for five months of

consulting services provided to the Company by WestPark.

(2)

Pursuant to a Registration Rights Agreement executed in connection with the

closing of the Share Exchange, affiliates of WestPark Capital received

registration rights for an aggregate of 1,428,691 shares and 586,129 shares

underlying warrants. We agreed to include such shares in a subsequent

registration statement to be filed on or before the 10th after the end of the

six-month period that immediately followed the date on which we filed the

registration statement of which this prospectus is a part. The

shareholders of Weixin immediately prior to the date of the Share Exchange

holding an aggregate of 7,865,556 shares of our common stock have agreed

with the Underwriter not

to directly or indirectly sell, offer, contract or grant any option to sell,

pledge, transfer (excluding intra-family transfers, transfers to a trust for

estate planning purposes or to beneficiaries of officers, directors and

shareholders upon their death), or otherwise dispose of or enter into any

transaction which may result in the disposition of any shares of our common

stock or securities convertible into, exchangeable or exercisable for any shares

of our common stock, without the prior written consent of the Underwriter, for a period of 24

months after the date of this prospectus.

(3)

Based on an estimated per share offering price of $3.50, the 1,428,691 shares

retained by SRKP 23 stockholders who are affiliates of WestPark Capital have an

implied monetary value of approximately $5.0 million. Assuming the

exercise of the 586,129 warrants also retained by the SRKP 23 stockholders who

are affiliates of WestPark Capital, 2,014,820 shares would have been retained by

such stockholders with an implied monetary value of approximately $7.1

million. The implied monetary value of the retained shares was calculated

based on an estimated $3.50 per share offering price, without regard to

liquidity, marketability, the likelihood of this offering being consummated, or

legal or resale restrictions; accordingly, such amounts should not be considered

an indication of the fair value of the retained shares.

(4)

Represents the implied aggregate monetary value of 1,428,691 shares and 586,129

shares underlying warrants, assuming the exercise of warrants retained by

WestPark Capital and its affiliates. The implied monetary value of the

retained shares was calculated based on an estimated $3.50 per share offering

price of the common shares to be sold in this offering, without regard to

liquidity, marketability or legal or sale restrictions; accordingly, such amount

should not be considered as an indication of the fair value of the retained

shares and warrants.

(5)

Represents commissions of $552,963, a non-accountable expense allowance of

$221,145, and a reimbursement of WestPark Capital’s fees for legal counsel of

$40,000.

(6)

Represents underwriting discounts and commissions of $[__], plus a

non-accountable fee of $[_____] and a reimbursement of $[_____] for WestPark

Capital’s legal fees.

5

Corporate

Information

We were incorporated in the State of

Delaware on October 11, 2007 and were originally organized as a “blank check”

shell company to investigate and acquire a target company or business seeking

the perceived advantages of being a publicly held corporation.On November 23,

2010, we (i) closed a share exchange transaction, described below, pursuant

to which we became the 100% parent of Weixin BVI and (ii) assumed the

operations of Weixin BVI and its subsidiaries, including Weixin HK, Kelida, Hua

Su, Chuang Yi, Xin Ye and Li Jun. We changed our name from “SRKP 23, Inc.” to

“China Wesen Recycling Technology, Inc.” on November 24, 2010.

Our

principal executive offices and corporate offices are located at Room 405, Floor

4, North Tower, 9 Shen Zhou Road, Guangzhou High-tech Industrial Development

Zone, Guangzhou, People’s Republic of China. Our telephone number is 86

(20) 32290314.

We are a

reporting company under Section 13 of the Securities Exchange Act of 1934, as

amended. Our shares of common stock are not currently listed or quoted for

trading on any national securities exchange or national quotation system. We

intend to apply for the listing of our common stock on either the NASDAQ Global

Market or the NYSE Amex.

6

Corporate

Structure

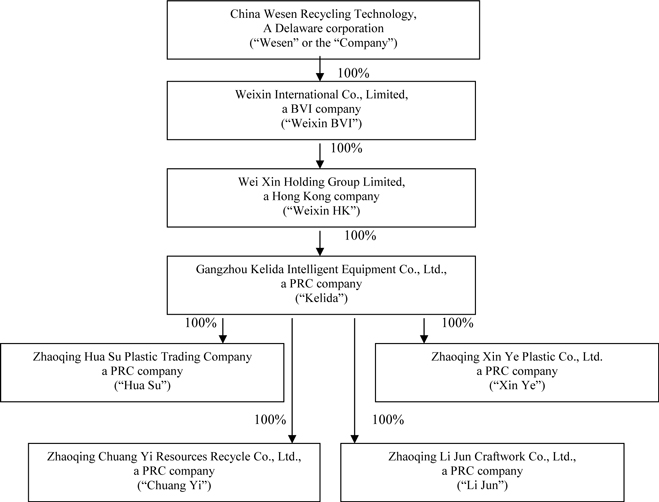

The

corporate structure of the Company is illustrated as follows:

Weixin BVI is a holding company that

was incorporated on December 3, 2009 under the laws of the British Virgin

Islands by Hongbing Wan. Hongbing Wan was the sole shareholder of Weixin

BVI upon its incorporation. On August 9, 2010, Hongbing Wan transferred

100% of the outstanding shares of Weixin BVI to Hongyu Zhang pursuant to an

instrument of transfer for consideration of $1.00. On October 28, 2010,

Hongyu Zhang transferred 100% of the shares of Weixin BVI to Wesen Environmental

Technology Limited pursuant to an instrument of transfer for consideration of

$1.00. On November 8, 2010, Weixin BVI issued additional shares to the

Weixin Shareholders pursuant to share subscription applications for

consideration of $1.00 per share.

Weixin HK is a liability company

incorporated on December 30, 2005 under the laws of Hong Kong by Hongbing Wan.

Weixin HK is a window for the group to handle business outside China, including

dealing with overseas customers and occasionally, suppliers. Weixin HK

sells metal parts for various home products, including door hardware and lock

parts, to overseas clients. On August 10, 2010, Weixin BVI acquired all

the shares of Weixin HK from Weixin HK’s sole shareholder, Hongbing Wan, for

consideration of 10,000 Hong Kong Dollars pursuant to an instrument of transfer,

sold note and bought note.

Kelida is located in Guangzhou,

Guangdong Province, PRC and was incorporated under the laws of the PRC on

September 29, 2009 by Weixin HK. Since its inception, Kelida has not conducted

any business except for the acquisition of a land use right from Guangzhou

government. Eventually Kelida will be a research and development center of the

Company.

7

Zhaoqing Hua Su Plastic Trading Company

(“Hua Su”), Zhaoqing Chuang Yi Resources Recycle Co., Ltd. (“Chuang Yi”),

Zhaoqing Xin Ye Plastic Co., Ltd. (“Xin Ye”), and Zhaoqing Li Jun Craftwork Co.,

Ltd. (“Li Jun”) are each located in Zhaoqing City, Guangdong Province,

PRC. Hua Su was incorporated under the laws of the PRC on July 20, 2006

with a registered capital of RMB 500,000. The original registered

shareholders of Hua Su were Luo Jianhua (holding 75% of the registered capital)

and He Jixiong (holding 25% of the registered capital). The registered

capital of Hua Su was later increased to RMB 1,000,000. Each of Chuang Yi,

Xin Ye, and Li Jun were incorporated under the laws of the PRC on September 27,

2007 with registered capital of RMB 1,000,000. The original registered

shareholders of Chuang Yi were Peng Zhizhong and He Jixiong, with each holding

50% of the registered capital. The original registered shareholders of Xin

Ye were Luo Zeming and Lu Jianzhong, with each holding 50% of the registered

capital. The original registered shareholders of Li Jun were Chen Wenqing,

holding 60% of the registered capital, and Qiu Yuji, holding 40% of the

registered capital.

Hongbing Wan was the actual investor of

the registered capital of each of Hua Su, Chuang Yi, Xin Ye and Li Jun.

Upon the establishment date of each of the companies, Hongbing Wan entered into

entrustment agreements with each of the original registered shareholders of each

of Hua Su, Chuang Yi, Xin Ye and Li Jun, pursuant to which Hongbing Wan

entrusted each of the original registered shareholders to hold the shares on his

behalf without paying any entrustment fees. Under the entrustment

agreements, Hongbing Wan entrusted each registered shareholder of Hua Su, Chuang

Yi, Xin Ye, and Li Jun with all of the shareholders’ rights prescribed under the

PRC Company Law and the articles of Articles of Association, including, to be

registered as the registered shareholders of each respective company, to act on

behalf of Hongbing Wan as the shareholders of Hua Su, Chuang Yi, Xin Ye, and Li

Jun, and to attend the shareholders’ meeting and to collect dividends on behalf

of Hongbing Wan. Hongbing Wan under the agreements had the right to

require each registered shareholder to transfer his shareholdings to Hongbing

Wan or any party designed by Hongbing Wan and no registered shareholder could

transfer his shareholdings in Hua Su, Chuang Yi, Xin Ye, and Li Jun without

Hongbing Wan’s prior written consent.

On November 16, 2009, each registered

shareholder of Hua Su, Chuang Yi, Xin Ye, and Li Jun transferred his shares of

each company to Kelida pursuant to equity transfer agreements for consideration

equal to the percentage of the registered capital that each registered

shareholder owned. Each of Hua Su, Chuang Yi, Xin Ye, and Li Jun completed

the required registration procedures to register Kelida as its sole shareholder

with the competent authority on February 1, 2010.

8

The

Offering

|

Common

stock we are offering

|

1,200,000

shares (1)

|

|

|

Common

stock included in Underwriter’s option to purchase shares from the selling

stockholders to cover over-allotments, if any (up to 70% of the

over-allotment option)

|

126,000

shares

|

|

|

Common

stock included in Underwriter’s option to purchase shares from us to cover

over-allotments, if any

|

54,000

shares

|

|

|

Common

stock outstanding after the offering

|

13,430,178

shares (2)

|

|

|

Offering

price

|

$3.00

to $4.00 per share (estimate)

|

|

|

Use

of proceeds

|

We

intend to use the net proceeds of this offering to pay expenses related to

the construction of our new research and development facility tin

Gangzhou. See “Use of Proceeds” on page 30 for more information

on the use of proceeds. We will not receive any proceeds from the sale of

any shares in this offering by the selling

stockholders.

|

|

|

Conflicts

of interest

|

Affiliates

of WestPark Capital beneficially own approximately 15.7% of our company

and, therefore, WestPark Capital has a “conflict of interest” under FINRA

Rule 5121. Accordingly, this offering is being conducted in

accordance with FINRA Rule 5121, which requires that a “qualified

independent underwriter” as defined in FINRA Rule 5121 participate in the

preparation of the registration statement and prospectus and exercise its

usual standards of due diligence in respect thereto. [_________] is

assuming the responsibilities of acting as the qualified independent

underwriter in the offering. See “Conflicts of Interest” on page 82

for more information.

|

|

|

Risk

factors

|

|

Investing

in these securities involves a high degree of risk. As an investor you

should be able to bear a complete loss of your investment. You should

carefully consider the information set forth in the “Risk Factors” section

beginning on page 11.

|

|

(1)

|

Excludes

(i) up to 120,000 shares of common stock underlying warrants to be

received by to Underwriter in this offering, and (ii) 2,457,167 shares of

our common stock held by the selling stockholders that are concurrently

being registered with this offering for resale by such selling stockholder

under a separate prospectus, and (iii) the 54,000 shares of our common

stock that we may issue upon the Underwriter’s over-allotment option

exercise. The exercise of the Underwriter’s over-allotment option to

purchase the 126,000 shares from selling stockholders named in this

prospectus to cover over-allotments, if any, will not affect the number of

shares outstanding after this

offering.

|

|

(2)

|

Based

on 12,230,178 shares of common stock issued and outstanding as of the date

of this prospectus and 1,200,000 shares of common stock issued in the

public offering. Excludes (i) the Underwriter’s warrants to purchase

a number of shares equal to 10% of the shares of common stock sold in this

offering excluding the shares sold in the over-allotment option, and (ii)

782,545 shares of common stock underlying warrants that are exercisable at

$0.0001. Excludes the 54,000 shares of our common stock that we may issue

upon the Underwriter’s over-allotment option exercise and is not affected

by the 126,000 shares that the Underwriter may purchase from selling

stockholders named in this

prospectus.

|

9

SUMMARY

FINANCIAL DATA

The

following summary financial information contains consolidated statement of

operations data for the nine months ended September 30, 2010 and 2009

(unaudited) and for each of the years in the five-year period ended December 31,

2009 and the consolidated balance sheet data as of September 30, 2010 and

year-end for each of the years in the four-year period ended December 31,

2009. The consolidated statement of operations data and balance sheet data

were derived from the audited consolidated financial statements, except for data

for the nine months ended and as of September 30, 2010 and 2009 and the year

ended and as of December 31, 2006. Such financial data should be read in

conjunction with the consolidated financial statements and the notes to the

consolidated financial statements starting on page F-1 and with “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.”

Consolidated Statements of

Operations

|

For the Nine Months Ended

September 30,

|

For the Year Ended

December 31,

|

|||||||||||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

||||||||||||||||||||||

|

(in thousands, except share and per share information)

|

||||||||||||||||||||||||

|

Revenue

|

$ | 21,972 | $ | 18,428 | $ | 26,151 | $ | 8,687 | $ | 910 | $ | - | ||||||||||||

|

Cost

of revenue

|

13,788 | 12,472 | 17,516 | 6,522 | 649 | - | ||||||||||||||||||

|

Gross

profit

|

8,184 | 5,956 | 8,635 | 2,165 | 261 | - | ||||||||||||||||||

|

Operating

expenses

|

||||||||||||||||||||||||

|

Selling

expenses

|

111 | 79 | 111 | 38 | 8 | - | ||||||||||||||||||

|

General

and administrative

|

632 | 398 | 591 | 422 | 167 | 5 | ||||||||||||||||||

|

Total

operating expenses

|

743 | 477 | 702 | 460 | 175 | 5 | ||||||||||||||||||

|

Income

from operations

|

7,441 | 5,479 | 7,933 | 1,705 | 86 | (5 | ) | |||||||||||||||||

|

Other

income (expenses)

|

||||||||||||||||||||||||

|

Interest

income

|

14 | 9 | 13 | 10 | 2 | - | ||||||||||||||||||

|

Other

income (expense), net

|

(53 | ) | (27 | ) | (39 | ) | (36 | ) | (26 | ) | - | |||||||||||||

|

Total

other income (expenses)

|

(39 | ) | (18 | ) | (26 | ) | (26 | ) | (24 | ) | - | |||||||||||||

|

Income

before income taxes

|

7,402 | 5,461 | 7,907 | 1,679 | 62 | (5 | ) | |||||||||||||||||

|

Income

taxes

|

(1,885 | ) | (1,354 | ) | (2,031 | ) | (441 | ) | (33 | ) | - | |||||||||||||

|

Net

income (loss)

|

$ | 5,517 | $ | 4,107 | $ | 5,876 | $ | 1,238 | $ | 29 | $ | (5 | ) | |||||||||||

|

Earnings

per share – basic and diluted

|

$ | 0.70 | $ | 0.52 | $ | 0.75 | $ | 0.16 | $ | 0.00 | $ | 0.00 | ||||||||||||

|

Weighted

average shares outstanding – basic and diluted

|

7,865,556 | 7,865,556 | 7,865,556 | 7,865,556 | 7,865,556 | 7,865,556 | ||||||||||||||||||

Consolidated

Balance Sheets

|

As of September 30,

|

As of December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

(unaudited)

|

(unaudited)

|

|||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Total

Current Assets

|

$ | 9,254 | $ | 10,897 | $ | 4,373 | $ | 833 | $ | 476 | ||||||||||

|

Total

Assets

|

15,954 | 15,951 | 8,019 | 3,236 | 477 | |||||||||||||||

|

Total

Current Liabilities

|

3,083 | 8,769 | 6,146 | 2,662 | 416 | |||||||||||||||

|

Total

Liabilities

|

3,083 | 8,769 | 6,146 | 2,662 | 416 | |||||||||||||||

|

Total

Stockholders’ Equity

|

$ | 12,871 | $ | 7,182 | $ | 1,873 | $ | 574 | $ | 61 | ||||||||||

10

RISK

FACTORS

Any

investment in our common stock involves a high degree of risk. Investors

should carefully consider the risks described below and all of the information

contained in this prospectus before deciding whether to purchase our common

stock. Our business, financial condition or results of operations could be

materially adversely affected by these risks if any of them actually

occur. Our shares of common stock are not currently listed or quoted for

trading on any national securities exchange or national quotation system.

If and when our common stock is traded, the trading price could decline due to

any of these risks, and an investor may lose all or part of his

investment. Some of these factors have affected our financial condition

and operating results in the past or are currently affecting our company.

This prospectus also contains forward-looking statements that involve risks and

uncertainties. Our actual results could differ materially from those

anticipated in these forward-looking statements as a result of certain factors,

including the risks we face as described below and elsewhere in this

prospectus.

RISKS

RELATING TO OUR BUSINESS

Our

future success depends on our ability to increase revenues from our recycling

operations

We believe that our future success

depends on our ability to significantly increase revenue from processing

recycled plastic wastes. We plan to grow by increasing our product output

volume, developing new products utilizing our recycled plastic products and

entering new markets in China and internationally. Our prospects must be

considered in light of the risks, expenses and difficulties frequently

encountered by growing companies, including:

|

|

·

|

Developing

and enhancing processing methods;

|

|

|

·

|

Entering

new markets in a cost effective

manner;

|

|

|

·

|

Expanding

on domestic and international marketing efforts to increase awareness of

our products and capture market

share;

|

|

|

·

|

Responding

to competitive pressures;

|

|

|

·

|

Maintaining

and developing relationships with customers and suppliers;

and

|

|

|

·

|

Attracting

and retaining qualified management, consultants and

employees.

|

The

success of our business is dependent upon our ability to secure plastic wastes

at competitive prices.

Our ability to generate revenue depends

in large part upon our ability to secure plastic wastes at competitive

prices. There is a world-wide market for these raw materials, and we face

competition from other low-cost users. If the market demand for plastics

wastes or the rate at which plastic materials are recycled increase, this would

likely affect both the availability and price of plastics wastes.

Additionally, as the substantial majority of the raw material used in our

manufacturing is imported, an increase in the freight costs or costs of

importing such material would increase our production costs. To the extent

that we are unable to secure sufficient plastics wastes at competitive prices,

our business, financial condition and results of operations will be materially

adversely affected.

We depend on a limited number of

suppliers for a substantial majority of our raw materials.

We import the substantial majority of

plastics wastes from a limited number of suppliers located in Hong Kong,

Australia and the United States. For the nine months ended September 30,

2010, we had six suppliers who accounted for 98% of our total purchases.

For the year ended December 31, 2009, we had four suppliers who accounted for an

aggregate of 98% of our total purchases. For the year ended December 31,

2008, we had two suppliers who accounted for an aggregate of 93% of our total

purchases of raw materials. Failure to maintain good relationships with

our current suppliers or to develop new supply sources could negatively affect

our ability to obtain the raw materials used to produce products in a timely

manner. If we are unable to obtain sufficient supplies of raw material

from our existing suppliers or develop alternative supply sources, we may be

unable to satisfy our customers’ orders which would materially and adversely

affect our revenues and our relationship with our customers. Furthermore,

we are dependent on our suppliers for the timely delivery of raw

materials. Should our suppliers fail to deliver such materials on time,

and if we are unable to source these materials from alternative suppliers on a

timely basis, our revenue and profitability would be adversely

affected.

11

The

Chinese government limits the amount of plastic waste which may be

imported.

The Chinese government limits the

amount of plastic waste which may be imported into China. Imports of

plastic waste are subject to an import quota regulated by the Ministry of

Environmental Protection; we have been approved for an import quota of 16,100

tons of plastic waste for the year ended on December 31, 2010. Although we

have not previously experienced difficulties obtaining and renewing our import

license or applying for and obtaining increases in our import quota, we cannot

guarantee that our import license or any application to increase our quota will

be approved in the future. If we fail to retain our import license or

cannot receive increases in our import quota as needed, we would have to use

domestically supplied plastics wastes which often consist largely of previously

recycled plastics of an inferior quality to virgin plastics waste. If we

are required to use domestically supplied plastics waste, the quality of our

products may decline and we could be required to lower our prices which would

adversely affect our revenue and profitability.

Changes

in Chinese environmental regulations and enforcement policies could subject us

to additional liability and adversely affect our ability to continue certain

operations.

Because Chinese environmental

regulations continue to develop and evolve rapidly, we cannot predict the extent

to which our operations may be affected by future enforcement policies as

applied to existing laws, by changes to current environmental laws and

regulations, or by the enactment of new environmental laws and

regulations. There are numerous Chinese provincial and local laws and

regulations relating to the protection of the environment and the ultimate

impact of complying with such laws and regulations is not always clearly known

or determinable because regulations under some of these laws have not yet been

promulgated or are undergoing revision. Our business and operating results

could be materially and adversely affected if we were required to increase

expenditures to comply with any new environmental regulations affecting our

operations. We may, in the future, receive citations or notices from

governmental authorities that our operations are not in compliance with our

permits or certain applicable regulations, including various transportation,

environmental or land use laws and regulations. Should we receive such

citations or notices, we would generally seek to work with the authorities to

resolve the issues raised by such citations or notices. There can be no

assurance, however, that we will always be successful in this regard, and the

failure to resolve a significant issue could result in adverse consequences to

us. As a result, we could incur material liabilities resulting from the

costs of complying with environmental laws, environmental permits or any claims

concerning noncompliance, or liability from contamination.

We cannot predict what environmental

legislation or regulations will be enacted in the future, how existing or future

laws or regulations will be administered or interpreted or what environmental

conditions may be found to exist at our facilities or at third-party sites for

which we are liable. Enactment of stricter laws or regulations, stricter

interpretations of existing laws and regulations or the requirement to undertake

the investigation or remediation of currently unknown environmental

contamination at our own or third-party sites may require us to make additional

material expenditures, which would adversely affect our

profitability.

If

environmental regulation enforcement is relaxed, the demand for our products may

decrease.

The demand for our products is

substantially dependent upon the public’s concern with, and the continuation and

proliferation of, the laws and regulations governing the recycling of

plastic. A decrease in the level of public concern, the repeal or

modification of these laws, or any signification relaxation of regulations

relating to the recycling of plastic would significantly reduce the demand for

our products and could have a material adverse effect on our operations and

financial condition.

In

order to expand our recycling operations and increase our import quota for

plastic waste, we will have to move our operations to a state-owned industrial

park in Zhaoqing City and if we are unable to move our operations into the

industrial park, our ability to expand will be greatly diminished which will

have a material adverse affect on our results of operations.

The Zhaoqing Environmental Protection

Agency promulgated new environmental regulations in 2010 that will require us to

move our current manufacturing operations in 2011 to a new state-owned

industrial park located in Zhaoqing City. The new regulations limit the

ability of plastics recycling operators located outside of the industrial park

to expand the size of the their operations or increase their import quota for

plastic waste. If we do not move our recycling and manufacturing

operations to the new industrial park, we will be unable to expand our

operations and will be unable to increase the import quota of plastic waste from

the 16,100 tons were are currently able to import. We are currently in the

process of trying to purchase a land use right in the industrial park upon which

to build our new factory, however, we cannot assure you that we will be

successful in obtaining land in the industrial park. While we hope to

complete construction on a new manufacturing facility in the industrial park in

mid-2011, we cannot assure you that construction will be occur as anticipated or

that we will have enough funds to cover the estimated $4 million in construction

costs for the new facility. If we are unable to move our operations to a

new facility in the industrial park in 2011, our results operations may be

materially adversely affected.

12

Our

business could be materially affected by a global decrease in crude oil

prices.

Since most plastic resin is made from

refined crude oil byproducts, the price of oil significantly affects the raw

material costs for plastics. Any substantial decrease in the price of oil would

make production of virgin plastic material more attractive and substantially

reduce demand for our recycled plastics products.

We

have depended on a small number of customers for the vast majority of our

sales. A reduction in business from any of these customers could cause a

significant decline in our sales and profitability.

The vast majority of our sales are

generated from a small number of customers. During the nine months ended

September 30, 2010 and the years ended December 31, 2009 and 2008, we had three,

three and two customers that generated revenues of at least 10% of our total

revenues, respectively , with our largest customer accounting for 44%, 42%

and63% of our revenues for each respective period. A total of

approximately 85%, 87% and 92% of our revenues for the nine months ended

September 30, 2010 and the years ended December 31, 2009 and 2008, respectively,

were attributable to customers that each individually accounted for at least 10%

of our sales. We believe that we may depend upon a small number of customers for

a significant majority of our sales in the future, and the loss or reduction in

business from any of these customers could cause a significant decline in our

sales and profitability.

A

substantial portion of our assets has been comprised of accounts receivable

representing amounts owed by a small number of customers. If any of these

customers fails to timely pay us amounts owed, we could suffer a significant

decline in cash flow and liquidity which, in turn, could cause us to be unable

to pay our liabilities or expand our sales volume.

Our accounts receivable represented

approximately 35.7%, 38.2% and 35.9%, of our total current assets as of

September 30, 2010, December 31, 2009 and December 31, 2008, respectively. As of

September 30, 2010, 95.9% of our accounts receivable represented amounts owed by

6 customers, each of which represented over 5% of the total amount of our

accounts receivable. As of December 31, 2009, 94.3% of our trade

receivables were owed to us by 5 customers, each of which represented over 5% of

the total amount of our trade receivables. As of December 31, 2008, 90% of

our trade receivables were owed to us by three customers, each of which

represented over 5% of the total amount of our trade receivables. As a

result of the substantial amount and concentration of our trade receivables, if

any of our major customers fails to timely pay us amounts owed, we could suffer

a significant decline in cash flow and liquidity which could adversely affect

our ability to borrow funds to pay our liabilities and to purchase inventory to

sustain or expand our current sales volume.

In addition, our business is

characterized by long periods for collection from our customers and short

periods for payment to our suppliers, the combination of which may cause us to

have liquidity problems. We experience an average accounts settlement period

ranging from 15 days to as high as three months from the time we sell our

products to the time we receive payment from our customers. In contrast, we

typically need to place certain deposits and advances with our suppliers on a

portion of the purchase price in advance and for some suppliers we must maintain

a deposit for future orders. Because our payment cycle is considerably shorter

than our receivable cycle, we may experience working capital shortages. Working

capital management, including prompt and diligent billing and collection, is an

important factor in our results of operations and liquidity. We cannot assure

you that system problems, industry trends or other issues will not extend our

collection period and adversely impact our working capital.

Our

plastics waste operations are risky and we may be subject to civil liabilities

as a result of hazards posed by such operations.

Our operations are subject to potential

hazards incident to the gathering, processing and storage of plastics waste such

as product spills, leaks, emissions and fires. These hazards can cause

personal injury and loss of life, severe damage to and destruction of property

and equipment, and pollution or other environmental damage, and may result in

curtailment or suspension of operations at the affected facility.

Consequently, we may face civil liabilities in the ordinary course of our

business. At present, we do not carry any insurance to cover such

liabilities in the ordinary course of our business, except that our employees

are insured for injuries occurring at work. Although we have not faced any

civil liabilities historically in the ordinary course of our waste treatment

operations, there is no assurance that we will not face such liabilities in the

future. If such liabilities occur in the future, they may adversely and

materially affect our operations and financial condition.

Our

business could be subject to potential liability claims.

The testing, manufacturing and

marketing of our products involve inherent risks related to product liability

claims or similar legal theories that may be asserted against us, some of which

may cause us to incur significant defense costs. We do not currently

maintain or intent to procure product liability insurance coverage. A

successful product liability claim or other judgment against us could have a

material adverse effect upon us.

13

We do not carry any business

interruption or liability insurance. As a result, we may incur uninsured

losses, increasing the possibility that you would lose your entire investment in

our company.

We could be exposed to liabilities or

other claims for which we would have no insurance protection. We do not

currently maintain any business interruption insurance or any other

comprehensive insurance policy, except for a key-man life insurance policy on

certain of officers and directors and liability insurance on our

automobiles. As a result, we may incur uninsured liabilities and losses as

a result of the conduct of our business. Business disruption insurance is

available to a limited extent in China, but we have determined that the risks of

disruption, the cost of such insurance and the difficulties associated with

acquiring such insurance make it impractical for us to have such

insurance. Should uninsured losses occur, any purchasers of our common