Attached files

| file | filename |

|---|---|

| EX-10.1 - EXERCISE FOR LIFE SYSTEMS, INC. | ex10_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 10, 2011

EXERCISE FOR LIFE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

North Carolina

(State or other jurisdiction of incorporation)

|

333-153589

Commission File Number

|

22-3464709

(I.R.S. Employer Identification No.)

|

92 Gleneagles View, Cochrane, Alberta, Canada T4C 1P2

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (403) 932-1801

19720 Jetton Road, Suite 300, Cornelius, N.C. 28031

(704) 778-1700

(Registrant’s former name, address and telephone number)

Check the appropriate box below if the Form 8-K filing[Missing Graphic Reference] is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

Item 1.01 Entry into a Material Definitive Agreement

Item 2.01 Completion of Acquisition or Disposition of Assets

Item 3.02 Unregistered Sales of Equity Securities

Item 5.01 Changes in Control of Registrant

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers

As used in this Current Report on Form 8-K, all references to the “we,” “our”, “us” and the “Company” refer to Exercise For Life Systems, Inc., a company incorporated under the laws of the State of North Carolina.

Share Exchange

On February 10, 2011, we entered into a Plan of Exchange agreement with the shareholders of MediaMatic Ventures Inc., a privately-held company incorporated under the laws of the Province of Alberta, Canada (“MMV”), and MMV. Pursuant to the agreement, on February 11, 2011 we purchased all 15,685,692 of the issued and outstanding common shares of MMV from the MMV shareholders in exchange for issuing 28,000,000 shares of our common stock to the shareholders. MMV and its shareholders represented that on the date of the agreement MMV had total assets of at least $3,200,000 and liabilities of not greater than $850,000 (excluding contingent liabilities). At the closing, we also issued 3,980,000 shares of our common stock to one person who had provided advice in connection with the transaction, 2,737,867 shares of our common stock to each of two persons who assumed responsibility for paying certain of our obligations as required by the exchange agreement and who had provided advice in connection with the transaction, and 876,946 shares to Adam Slazer for his assistance in connection with the transaction. As a result, we issued an aggregate of 38,332,680 shares of our common stock, all of which are restricted securities.

The completion of the share exchange was conditioned upon, among other things:

|

|

(1) our eliminating all of our known or potential liabilities as of the closing date, including, but not limited to, any accounts payable, accrued expenses, and any liabilities shown on its quarterly report for the period ended September 30, 2010; Mr. Slazer and our pre-exchange shareholders are fully responsible for any unknown or undisclosed liabilities incurred prior to transfer of control under the exchange;

|

|

|

(2) in the event that there comes to exist any expenses concerning any known or unknown lawsuit, legal dispute or any correlation expense caused by the pre-exchange Company and its shareholders, Mr. Slazer and the pre-exchange shareholders shall undertake full responsibility and afford the correlation expenses after the closing;

|

|

|

(3) stock certificates representing 9,884,730 shares of our common stock (representing approximately 85% of our outstanding stock prior to the consummation of the exchange) owned by Adam Slazer are being delivered for cancellation, in consideration for which Jeremy Ostrowski, one of the MMV shareholders, is providing a $75,000 promissory note; the promissory note will not bear interest, will be due on August 9, 2011, and will be collateralized by 375,000 shares of our common stock owned the two of our pre-exchange shareholders;

|

|

|

As required by the exchange agreement, our directors prior to the exchange have resigned and five persons identified herein were appointed our directors. In addition, Adam Slazer, has resigned as our President and sole officer and Jeremy Ostrowski has been appointed as our President and sole officer.

As a result of the exchange, MMV is now our wholly owned subsidiary, and we have adopted the business of MMV, which is the providing of multimedia kiosks throughout Canada.

Before the closing of the share exchange, we had 11,552,050 issued and outstanding shares of our common stock. At the closing, (i) we issued 28,000,000 shares of our common stock to the MMV shareholders, (ii) we issued an aggregate of 10,332,680 shares of our common stock to four persons as described above, and (iii) Adam Slazer agreed to deliver for cancellation 9,884,730 shares of our common stock owned by him. As a result of such transactions, we have 40,000,000 shares of common stock outstanding.

The shares issued in the share exchange and the shares issued to four other persons at the closing of the share exchange were issued in reliance upon an exemption from registration pursuant to Rule 506 of Regulation D and/or Section 4(2) under the Securities Act of 1933, as amended (the “Securities Act”).

Accounting Treatment

The share exchange is being accounted for as an acquisition for accounting purposes, as MMV is now our wholly owned subsidiary. Consequently, the assets, liabilities and historical operations of MMV will only be reflected in our consolidated financial statements after the completion of the share exchange, as will our operations since the closing of the share exchange.

Description of Business

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “will”, “may,”, “anticipates”, “believes”, “should”, “intends”, “estimates”, and other words of similar meaning.These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

2

Overview

We were incorporated in New Jersey in August of 1996 as A.J. Glaser, Inc. and re-domiciled to North Carolina in September 2008. Our business offices are located at 225 Railway Street East, Cochrane, Alberta, Canada T4C 2C3.

Previous Business

Before we closed the transactions contemplated by the Plan of Exchange, we were a full-service operator of personal fitness training in and around the Lake Norman area of Charlotte, North Carolina. We operated from our training facility located at East Field Road, Suite 200-311 Huntersville, NC 28078. By operating our fitness center in a major metropolitan area such as Charlotte, North Carolina, we were able to offer city-wide training services, providing more value to clients and differentiating ourselves from “mom and pop” competitors while achieving operating efficiencies.

Current Business

Upon acquiring MMV on February 10, 2011 pursuant to the Plan of Exchange, we adopted the business of MMV. We are now a leading provider of multimedia kiosks throughout Canada. MMV operates the only WiFi enabled kiosk providing multimedia content, including DVD’s, video games and music; both digitally and physically. As of July 2010, MMV’s DVD kiosks were in over 80 locations in leading retailers, securing MMV as the second largest provider in Canada.

Market Opportunity

Multimedia kiosks providing both digital and physical content are a rapidly growing market. In 2007, the market leader in physical DVD kiosk rentals, RedBox, surpassed Blockbuster for number of US locations.

As traditional brick and mortar video stores are shutting down due to alternative solutions and high fixed costs, even historic market leaders such as Blockbuster have begun to adapt, particularly through a recent partnerships with NCR as the provider of their own DVD kiosks. In 2009, DVD Kiosks represented 19% ($950 million) of all DVD rentals and is estimated to reach upwards of 30% ($1.3 billion) by 2010. It is predicted that the US market can support 60,000 DVD kiosks, which should be reached in 2014, and is expected to generate sales of $2 billion.

The DVD rental business continues to be the 3rd largest source of movie revenue, while online rentals (ON-DEMAND, etc.) only generate a small amount of the total.

3

Product Overview

MMV’s DVD kiosks are highly portable condensing more than 700 square feet into 7 square feet containing more than 1000 titles that are managed by a highly technical backend content management system, including the following features:

Digital downloading

Utilizing MMV’s built in WiFi technology, customers can download digital content from any MMV kiosk through a variety of devices including computer, iPad, iTouch, PDA device, USB, Digital home boxes and any device with similar capabilities located within 100 yards of a kiosk.

24/7 Central “Remote” Monitoring System

Monitored remotely, MMV has 24/7 insight into its machines, including DVD inventory and rentals by location and technical issues. MMV has the ability to fix most technical and customer-related issues remotely as well as to manage the inventory of individual kiosks.

IP Connected

MMV DVD kiosks are connected via IP into a customer-accessible network such that customers can go online to view and rent/purchase items for all locations.

Pre-reserve titles

Consumers have the ability to “pre-reserve” their favorite titles via the MMV website. Based on the customer’s location, they are able to pick a specific location and reserve their preferred title prior to physically renting the DVD.

Multiple User Interface

In the event multiple users wish to download digital content from a single kiosk, MMV’s broadband allows up to 6 concurrent users to download their titles.

Digital advertising

Newer versions of MMV’s DVD kiosks are equipped with an LCD monitor that is able to provide movie previews and paid advertisements.

Touch screen monitor

Customers are able to interact directly with the DVD kiosks via an easy to use touch screen monitor.

Multi-tied product offering

MMV offers two payment solutions to rentals: single unit rental and monthly subscription. Customers can either pay on a per/rental basis or can sign up for a monthly subscription allowing unlimited rentals (2 DVD’s at a time). Subscription revenue typically accounts for over 30% of MMV’s monthly revenues.

CHIP Pre-paid membership

MMV offers a pre-paid membership card, which may be used to receive gifts and discounts at all MMV DVD kiosk locations.

Private label

MMV allows large retailers to private label the MMV kiosk box with their own brand.

Competitive Edge

MMV’s DVD kiosks offer a variety of features that are not available from the current competition:

Digital Downloads

MMV has the only WiFi-enabled DVD Kiosk currently in the market with digital download capabilities. With download speeds of 110MB per second, by December 2011 MMV plans to offer over 100,000 titles (movies and music) that may be downloaded digitally. Utilizing its remote content management system, MMV allows users to request specific titles at specific kiosks locations to be downloaded. If a title is not currently available at a location, but is in the system, MMV can easily switch out titles enabling the customer to have access to their preferred content. Upon a digital rental of a title, depending on the terms, the title will be removed from the device after an allotted amount of time.

No competitor offers any digital download capabilities.

4

Video Games

MMV operates the only kiosks to offer both DVD movies and video games in all of their kiosk locations. To date, video games have a higher margin than DVD’s and have been a strong revenue producer in several locations.

Subscription Mode

MMV is the only DVD kiosk provider to offer two rental models; single unit rentals or a monthly subscription. Customers have the ability use either a single unit rental or can sign up for a monthly subscription allowing unlimited rentals (2 DVD’s at a time).

Competition

MMV’s business faces competition from many other providers of movie content, from traditional stores, such as Blockbuster and Hollywood Video, to other self-service kiosks, such as Blockbuster Express, to online or postal providers, such as Netflix, to other movie distribution rental channels, such as pay-per-view, video-on-demand, online streaming, premium television, basic cable, and network and syndicated television, many of whom may be more experienced in the business or have more resources than we do or otherwise compete with us in this segment of our business as described above.

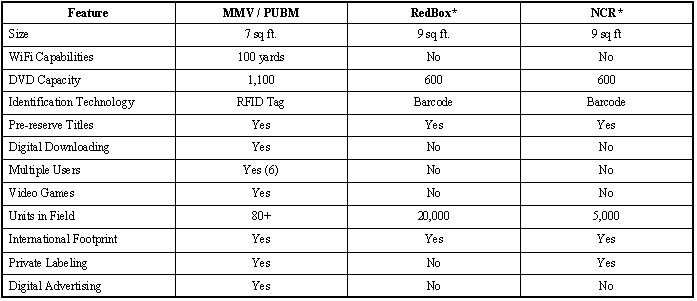

The following table provides a comparison of the features provided by MMV and its two major competitors in the providing of self-service kiosks, RedBox and NCR.

*Estimates

Coinstar Inc. is a multi-national company offering a range of 4th Wall® solutions for retailers’ storefronts. RedBox, through its parent company Coinstar ,operates the largest DVD kiosks network, with over 20,000 locations and 2009 revenues in excess of $700 million.

NCR Corporation is a global technology company that provides innovative products and services to help businesses build stronger relationships with its customers. Focused particularly in automatic teller machines and self-service kiosks, NCR has recently purchased several smaller DVD kiosk providers (TNR and DVD Play) and has a partnership with Blockbuster to be the kiosk provider for Blockbuster Express.

There are a variety of small regional multimedia kiosk companies in operation, but due to the intense capital requirements and inability to obtain top tier locations, these companies are often not viewed as significant long-term competitors.

5

Revenue Model

MMV purchases and places a corporate-owned DVD kiosk in a retail location subject to a revenue share agreement (90/10) with the site-owner. MMV is responsible for operating and maintaining the kiosks.

A typical contract for a corporate kiosk provides for an initial 12-month term. After the initial term, MMV has the sole right to extend the term up to 2 to 3 additional years, with automatic renewals. MMV has the right to remove any unit at its sole discretion, including but not limited to unprofitability of the location or due to technical issues.

MMV also developed a franchise model for DVD kiosks. Litigation presently is pending with certain franchisees as described under “Description of Business – Legal Proceedings.” Pending the resolution of such litigation, MMV has suspended its franchise model.

Pipeline

MMV has a pipeline of potential kiosk locations estimated at over 3,000. Several include:

Husky Energy

MMV has a signed contract to provide over 350 DVD kiosks to Husky Oil locations in Alberta, British Columbia, Manitoba and Saskatchewan.

Ash Payment Systems

MMV has entered into a joint venture with Ash Payment Systems (“APS”) to provide MMV’s DVD kiosks on an exclusive basis in at least 500 locations in the Eastern Canada provinces. APS is a leader in the payments industry specializing in payment hardware, payment processing services, self-service retail platforms and technical support services. APS will use its relationships in the territory and deploy and train staff and manage inventory and payments using the same kiosks used by us in Western Canada. APS partners include Pizza Hut Canada, Gino’s Pizza, VIRGIN Mobile, Petro-Canada, Domino’s Pizza. The agreement is for five years subject to annual renewals thereafter. Gross profits are divided equally between MMV and ASP.

iMOZI Canada Inc.

MMV has entered into exclusive purchase agreements, dated June 15, 2010 and October 8, 2010, with iMOZI Canada Inc. pursuant to which it will purchase goods and equipment, including 500 indoor and outdoor vending kiosks and related software to operate the kiosks. MMV provides the Internet access for the kiosks. The agreement is in effect until MMV has purchased 500 units.

Intellectual Property

We have not filed for any protection of our name or trademark. As a distribution company we do not directly own any of the intellectual property rights attached to any of the products we distribute.

Research and Development

We did not incur any research and development expenses from our inception to December 31, 2010.

Reports to Security Holders

We are subject to the reporting and other requirements of the Securities Exchange Act and we intend to furnish our shareholders with annual reports containing financial statements audited by our independent auditors and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

6

Seasonality

MMV’s business generally experiences lower revenue in the spring due in part to improved weather and Daylight Savings Time, and in September and October, due in part to the beginning of the school year and the introduction of the new television season. The year-end and summer holiday months have historically been the highest revenue months for kiosk services.

Employees

As of February 10, 2011, MMV had eight full-time and six part-time employees.

Properties

We currently rent 8,181 square feet of commercial space in Cochrane, Canada, for which we pay $63,000 per year. The facilities are adequate for our use. The lease expires on January 1, 2014.

Convertible Notes

From October 2010 through February 2011 MMV offered and sold an aggregate of approximately $475,000 principal amount of MMV Convertible Promissory Notes to certain accredited investors in a private offering. The notes bear 12% interest per annum and mature 180 days after the date of issuance, unless repayment is accelerated as a result of an event of default as specified in the Convertible Notes. Each holder may at any time, at his or her sole election, convert the outstanding principal amount of the Convertible Note, plus any accrued and unpaid interest, into shares of MMV Series A common stock at a conversion price of $0.50 per share, subject to adjustment. Holders of the Convertible Notes have certain demand and “piggyback” registration rights with respect to the MMV common stock into which the Convertible Notes are convertible. MMV agreed not to provide any other holder or prospective holder of MMV securities with registration rights unless such rights are not more favorable than the rights granted the holders of the Convertible Notes. The Convertible Notes may be prepaid at any time by MMV upon not less then 30 days prior written notice.

The terms of the Convertible Notes provides certain rights to the holders of the Convertible Notes and imposes certain restrictions on MMV, including the following:

|

|

•

|

MMV may not, without the prior written approval of purchasers of at least 75% of the principal amount of the Convertible Notes, create, incur, assume or suffer to exist any liens on any of MMV’s property, assets or revenues, other than certain specified liens, including liends securing indebtedness related to equipment financing provided by Bankers Capital;

|

|

|

•

|

in the event MMV proposes to offer or sell any additional equity securities of MMV, including rights, options or wrrrants to purchase MMV equity securities or securities convertible into or exchangeable for MMV equity securities, MMV must first make an offering of such securities to the holders of the Convertible Notes; such pre-emptive right excludes the grant of options or rights pursuant to any incentive or non-qualified stock option plan, stock purchase plan, stock ownership plan, and MMV shares or convertibles securities issued to lenders or financial institutions in connection with MMV financing arrangements, and shares issued pursuant to an acquisition of another entity by MMV, up to 250,000 MMV shares issued to advisors of MMV, and MMV securities issued in connection with certain business agreements or strategic partnerships approved by the Board of MMV;

|

|

|

•

|

MMV may not, without the prior written approval of purchasers of at least 75% of the principal amount of Convertible Notes, declare or pay any dividend or make any distribution (other than a dividend payable solely in MMV common stock);

|

|

|

•

|

MMV may not, without the prior written approval of purchasers of at least 75% of the principal amount of Convertible Notes, create, incur, assume or suffer to exist any indebtedness in excess of $50,000, other than the Convertible Notes, specified existing indebtedness, indebtedness in respect of operating leases and equipment leases taken in the ordinary course of business, and indebtedness in respect of the Bankers Capital financing;

|

|

|

•

|

MMV may not, without the prior written approval of purchasers of at least 75% of the principal amount of Convertible Notes, make any purchase or other acquisition of capital stock or other securities of another person, make a loan, advance or capital contribution to, guarantee or assume the debt of, or purchase or otherwise acquire any other debt or equity participation or interest in another person, or purchase or otherwise acquire the assets of another person that constitutes a business unit, except for readily marketable direct obligations of, or obligations guaranteed by, the United States or an agency thereof, other investment grade securities, mutual funds, the assets of which are invested in items of the kind specified above, and deposits with or certificates of deposit issued by any other bank organized in the United States or Canada having capital in excess of $100,000;

|

|

|

•

|

MMV may not, without the prior written approval of purchasers of at least 75% of the principal amount of Convertible Notes, (a) merge with or into or consolidate, or permit any subsidiary to merge with or into or consolidate, with any other entity (other than a merger or consolidation solely between the Company and one or more of its subsidiaries) or (b) sell, transfer, lease, convey or exclusively license all or substantially all of its assets (in each case, a “Sale Transaction”), except in the event that MMV (i) gives purchasers of the Convertible Notes written notice of the Sale Transaction at least fifteen (15) days prior to the closing of the Sale Transaction and (ii) gives the purchasers the opportunity to convert their Convertible Notes into MMV common stock prior to the Sale Transaction or receive payment from MMV for the outstanding principal amount and all accrued but unpaid interest for the Convertible Notes; and

|

|

|

•

|

MMV may not, without the prior written approval of purchasers of at least 75% of the principal amount of the Convertible Notes, liquidate, dissolve or effect a recapitalization or reorganization (including, without limitation, any reorganization into a limited liability company, a partnership or any other non-corporate entity) (in each case, a “Liquidation”), unless MMV (i) gives purchasers of the Convertible Notes written notice of the Liquidation at least fifteen (15) days prior to the Liquidation and (ii) gives the purchasers the opportunity (to convert their Convertible Notes into MMV common stock prior to the Sale Transaction or receive payment from MMV for the outstanding principal amount and all accrued but unpaid interest for the Convertible Notes;

|

|

|

•

|

MMV may not, without the prior written approval of purchasers of at least 75% of the principal amount of the Convertible Notes, apply any of its assets to the redemption, retirement, purchase or acquisition, directly or indirectly (including through a subsidiary), or otherwise, of any shares of its capital stock (other than repurchases of MMV common stock at cost upon termination of employment or service.

|

7

The above covenants terminate immediately before the consummation of MMV’s first underwritten public offering of its common stock, or (upon any of the foregoing:

(a) a merger or consolidation in which (i) MMV is a constituent party or (ii) a subsidiary of MMV is a constituent party and MMV issues shares of its capital stock pursuant to such merger or consolidation, except any such merger or consolidation involving MMV or a subsidiary in which the shares of capital stock of MMV outstanding immediately prior to such merger or consolidation continue to represent, or are converted into or exchanged for shares of capital stock that represent, immediately following such merger or consolidation, at least a majority, by voting power, of the capital stock of (1) the surviving or resulting corporation or (2) if the surviving or resulting corporation is a wholly owned subsidiary of another corporation immediately following such merger or consolidation, the parent corporation of such surviving or resulting corporation (provided that all shares of MMV common stock issuable upon exercise of options outstanding immediately prior to such merger or consolidation or upon conversion of convertible securities outstanding immediately prior to such merger or consolidation shall be deemed to be outstanding immediately prior to such merger or consolidation and, if applicable, converted or exchanged in such merger or consolidation on the same terms as the actual outstanding shares of MMV common stock are converted or exchanged); or

(b) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of related transactions, by MMV or any subsidiary of MMV of all or substantially all the assets of MMV and its subsidiaries taken as a whole, or the sale or disposition (whether by merger or otherwise) of one or more subsidiaries of MMV if substantially all of the assets of MMV and its subsidiaries taken as a whole are held by such subsidiary or subsidiaries, except where such sale, lease, transfer, exclusive license or other disposition is to a wholly owned subsidiary of MMV.

Legal Proceedings

We may occasionally become involved in various lawsuits and legal proceedings arising in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may have an adverse affect on our business, financial conditions or operating results. We currently are not aware of any such legal proceedings or claims that will have, individually or in the aggregate, a material adverse affect on our business, financial condition or operating results except as follows:

On May 5, 2010, MMV had a claim filed against them from a franchisee. The claim named MMV as a defendant and the franchisee as a plaintiff. The plaintiff is seeking a rescission of the franchise agreement and a refund of franchise funds paid in the amount of $325,000 paid, together with a claim for additional damages of $500,000. There has been a judgment registered with Canada’s Queens Bench in the amount of $325,000. MMV’s management estimates that they can settle the claim in the amount of $325,000 and have recorded a contingency loss in expectation of this settlement.

On May 11, 2010, MMV commenced a lawsuit against former sales agents of MMV due to the fact that the defendants started a competing business contrary to a contract which is alleged they entered into with MMV. The amount of the lawsuit is yet to be determinable regarding the settlement amount of the lawsuit as of the date of these financial statements.

On May 13, 2010, MMV had a civil claim filed against them from a franchisee for alleged additional net profits owed to them during the time that MMV operated video kiosks in its stores. The claim named MMV as the defendant and the franchisee as the plaintiff. The claim amount is for $25,000. MMV’s management estimates that they can settle the civil claim for the amount of $25,000 and have recorded a contingency loss in expectation of this settlement.

On August 18, 2010, MMV had a Statement of Claim filed against them from multiple franchisees alleging that MMV sold a franchise to them and that MMV breached the requirements of the Franchises Act of Alberta, Canada. The claim named MMV as a defendant and the multiple franchisees as a plaintiff. The plaintiffs are also seeking rescission of the franchise purchase contracts together with a refund of their monies, or alternatively damages for loss of profits aggregating $2,100,000. The plaintiffs further claim alternatively that there was a fraudulent misrepresentation made by MMV and claim damages in the amount of approximately $5,700,000. MMV’s management estimates that they can settle the claims for the amount of $2,100,000 and have recorded a contingency loss in expectation of this settlement.

On September 7, 2010, MMV had a Statement of Claim filed against them from a franchisee. The claim named MMV as a defendant and the franchisees as the plaintiff. The claim alleges that MMV breached the franchise contract and a breach of the Franchises Act of Alberta, Canada whereby the plaintiff claims recession of the Franchise Agreement and recovery of net losses in the amount of $55,000. There was a judgment filed with Canada’s Queen’s Bench on December 3, 2010 for no specified amount. The judgment gave the plaintiffs claim against the owner’s personal residence. The plaintiffs have informed the owner that they would consider settlement for MMV’s public shares and discharge the judgment filed. MMV’s management estimates that they can settle the claim in the amount of $55,000 and have recorded a contingency loss in expectation of this settlement.

On September 29, 2010, there was a Statement of Claim filed against MMV from franchisees. The claim named MMV as a defendant and the franchisees as a plaintiff. The claim alleges that MMV breached the Franchises Act of Alberta, Canada. The plaintiffs are claiming $250,000 in damages and lost profits. The plaintiffs have indicated to MMV and council that they would settle for MMV’s public shares in exchange of settlement of lawsuits. MMV filed a Statement of Defense on December 17, 2010. MMV’s management estimates that they can settle the claim in the amount of $250,000 and have recorded a contingency loss in expectation of this settlement.

On October 18, 2010, there was a Statement of Claim filed against MMV. The claim named MMV as a defendant and a former equipment leasing vendor as a plaintiff. The plaintiff claimed that MMV breached a lease equipment contract. MMV’s management estimates that they can settle the claim in the amount of $17,000 and have recorded a contingency loss in expectation of the settlement.

8

Risk Factors

Our business and an investment in our securities are subject to a variety of risks. The following risk factors describe the most significant events, facts or circumstances that could have a material adverse effect upon our business, financial condition, results of operations, ability to implement our business plan and the market price for our securities. Many of these events are outside of our control. The risks described below are not the only ones facing our company. Additional risks not presently known to us or that we consider immaterial based on information currently available to us may also materially adversely affect us. If any of the events anticipated by the risks described herein occur, our business, cash flow, results of operations and financial condition could be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks relating to our Business

Our new business has a limited operating history which makes it difficult to evaluate our future prospects and your investment.

MMV was organized as an Alberta, Canada corporation on February 8, 2007 and has a limited operating history. No assurances can be given that we will be able to successfully maintain and develop our business or meet our business objectives.

Our operating expenses will be high and there can be no assurances that we will achieve or maintain profitability.

We will have significant capital and operating expenses and significant losses and expects such losses to continue as we grow our business. Prior to earning revenue from our principal business, we must expand our product offerings and increase our sales. No assurances can be given that we will succeed in those efforts. However, if such tasks are achieved, we still will need to develop revenue channels to achieve and sustain profitability. It is possible that we may never achieve sustained profitability and, even if we do, we may not sustain or increase profitability on a quarterly or an annual basis in the future. If we are not successful in becoming profitable, we may be forced to curtail or cease operations.

In order to meet our short-term and long-term business goals, we will likely need additional funding.

It is likely that we will have insufficient capital to fund the growth of our business and will require additional financing to meet our business objectives. We can provide no assurances that we will obtain such additional funding on terms favorable to us. The overall development costs for maintaining the long-term viability of we are substantially in excess of this offering. This Company may partner with other entities and employ alternative financing structures.

We operates in a highly competitive market and may encounter competitors having greater resources and experience.

There can be no assurances that other competitors will not develop products or services that are superior to ours. There are numerous large and small competitors in our exact market space. If we cannot successfully compete against these companies, our business, results of operations and financial condition are likely to be materially and adversely affected.

Defects, failures or security breaches in and inadequate upgrade of or changes to our operating systems could harm our business.

The operation of the kiosks and equipment relating to our business depends on sophisticated software, hardware, computer networking and communication services that may contain undetected errors or may be subject to failures or complications. These errors, failures or complications may arise particularly when new, changed or enhanced products or services are added. In the past, there have been limited delays and disruptions resulting from upgrading or improving these operating systems. Future upgrades, improvements or changes that may be necessary to expand and maintain our business could result in delays or disruptions or may not be timely or appropriately made, any of which could seriously harm our operations.

Certain aspects of the operating systems relating to our business are outsourced to third-party providers. Accordingly, the effectiveness of these operating systems is to a certain degree dependent on the actions and decisions of third-party providers.

We depend upon third-party manufacturers, suppliers and service providers for key components and substantial support for our kiosks and equipment.

We conduct limited manufacturing operations and depend on outside parties to manufacture key components of our kiosks and equipment. We intend to continue to expand our installed base of machines and equipment. Such expansion may be limited by the manufacturing capacity of our third-party manufacturers and suppliers. Third-party manufacturers may not be able to meet our manufacturing needs in a satisfactory and timely manner. If there is an unanticipated increase in demand for kiosks, we may be unable to meet such demand due to manufacturing constraints.

Some key hardware components used in the kiosks are obtained from a limited number of suppliers. We may be unable to continue to obtain an adequate supply of these components in a timely manner or, if necessary, from alternative sources. If we are unable to obtain sufficient quantities of components or to locate alternative sources of supply on a timely basis, we may experience delays in installing or maintaining our kiosks, which could seriously harm our business, financial condition and results of operations.

We must attract and retain qualified personnel to be successful, and competition for qualified personnel is intense in our market.

Our success will depend to a significant extent upon the contributions of our key management and business development personnel. We must attract and retain highly talented and seasoned individuals to lead our business. Our success will depend on our ability to identify, attract and retain qualified design, sales, marketing, business development and finance personnel. The competition in our industry makes it difficult to retain key personnel and to recruit new qualified personnel. If we do not succeed in hiring and retaining candidates with appropriate qualifications, our revenues and product development efforts could be harmed.

We may not be able to adequately protect our intellectual property.

Our intellectual property is and will continue to be one of our most important assets and we expect to utilize significant resources to protect it. Our ability to compete effectively will depend substantially on our efforts in developing and maintaining proprietary aspects of our intellectual property. Moreover, there can be no assurances that any future patents, copyrights or trademarks that may be issued as a result of our applications will offer any degree of protection to our products against competitive products. Our technology may infringe on intellectual property owned by competitors. There can be no assurances that competitors, many of whom have substantial resources, will not seek to apply for and obtain patents, trademarks, or copyrights that will prevent, limit, or interfere with our ability to make, use, or sell its products. In addition, if we cannot protect our domain names, our ability to successfully brand our name and our products and services will be impaired.

We may be adversely affected by currency fluctuations.

Our operating results and cash flow are affected by changes in the Canadian dollar exchange rate relative to the currencies of other countries. Exchange rate movements can have a significant impact on results as a significant portion of our operating costs are incurred in Canadian and other currencies and a significant portion of our revenues may be earned in U.S. dollars.

Risks Related to the Market for our Securities

Sales of substantial amounts of our common stock in the open market could depress our stock price.

If substantial amounts of our common stock are sold in the public market following the exchange transaction, the market price of our common stock may decrease substantially. These sales might also make it more difficult for us to sell equity or equity-related securities at a time and price that we otherwise would deem appropriate.

Our stock price may fluctuate substantially.

The market price for our common stock may be affected by a number of factors, including those described above and the following:

|

•

|

the announcement of new products and services or product and service enhancements by us or our competitors;

|

|

•

|

actual or anticipated quarterly variations in our results of operations or those of its competitors;

|

|

•

|

changes in earnings estimates or recommendations by securities analysts that may follow our stock;

|

|

•

|

developments in our industry; and

|

|

•

|

general market conditions and other factors, including factors unrelated to our operating performance or the operating performance of our competitors.

|

In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of particular companies. Broad market and industry trends may also materially and adversely affect the market price of our common stock, regardless of our actual operating performance. Volatility in the market price and trading volume of our common stock may prevent our stockholders from selling their shares profitably. In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been initiated against that company. Class-action litigation could result in substantial costs and a diversion of management’s attention and resources.

9

Financial Information

The following discussion highlights the principal factors that have affected the financial condition and results of operations of Mediamatic Ventures, Inc. (“MMV”) as well as our liquidity and capital resources for the periods described. The financials of MMV will be our financials going forward due to the reverse takeover accounting treatment of the share exchange transaction. Pro forma financial statements are included elsewhere in this Report.

This discussion contains forward-looking statements, as discussed above. Please see the sections entitled “Forward-Looking Statements” and “Risk Factors” for a discussion of the uncertainties, risks and assumptions associated with these forward-looking statements.

The following discussion and analysis of MMV’s financial condition and results of operations are based on the unaudited financial statements as of September 30, 2010, which were prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). You should read the discussion and analysis together with such financial statements and the related notes thereto.

Overview

MMV is a DVD rental company led by an experienced management team and focused on the DVD rental market. MMV’s headquarters are located in Cochrane, Alberta, Canada.

MMV provides DVD rentals through strategically located kiosk machines in the surrounding Calgary, Alberta, Canada area. MMV’s management believes that they can harvest the new DVD kiosk technology to efficiently deliver rentals to customers on demand.

Plan of Operations

MMV’s strategy is to pursue selected opportunities that are characterized by reasonable entry costs within locations, favorable economic terms and the availability of existing technological data that may be further developed using current technology.

Results of Operations - The nine month ended September 30, 2010 compared to the nine months ended September 30, 2009

Revenues

MMV generated revenues of approximately $2,050,000 and $1,670,000 from product rentals and franchise sales for the nine months ended September 30, 2010 and 2009, respectively. The increase in revenue of approximately $380,000 was primarily due to the fact that MMV installed an additional 30 machines during the nine months ended September 30, 2010.

Cost of Revenues

MMV had cost of revenues of $556,978 and $331,332 from the amortization of DVD purchases for the nine months ended September 30, 2010 and 2009, respectively. The increase in cost of goods sold of approximately $225,000 was primarily due to the fact that MMV installed an additional 30 machines during the nine months ended September 30, 2010.

Total operating expenses

During the nine months ended September 30, 2010 and 2009 total operating expenses were approximately $843,000 and $306,726, respectively. The increase related to the selling, general and administrative expenses was approximately $535,000. This increase resulted primarily from the increase in commissions of approximately $150,000, consulting and outside services of approximately $150,000, legal fees of approximately $40,000, office expense of approximately $35,000, accounting and auditing costs of approximately $60,000 and miscellaneous administrative and operating expenses of approximately $78,000.

Total other expenses

During the nine months ended September 30, 2010 and 2009 total other expenses were approximately $3,500,000 and $112,000, respectively. The increase related to other expense was approximately $3,400,000. This increase resulted primarily from the increase in the contingent loss due to the pending lawsuits of approximately $3,100,000 and depreciation expense of approximately $300,000.

Net (loss)/income

During the nine months ended September 30, 2010 and 2009, the net (loss)/income was ($2,893,479) and $982,020, respectively.

10

Results of Operations - The year ended December 31, 2009 compared to the year ended December 31, 2008

Revenues

For the years ended December 31, 2009 and 2008, MMV generated revenues of $2,220,000 and $1,000,000 resulting from product rentals and franchise sales. The increase in revenues of approximately $1,220,000 was primarily due to the fact that MMV installed an additional 50 machines during the year ended December 31, 2009.

Cost of Revenues

MMV had cost of revenues of approximately $440,000 and $100,000 from the amortization of DVD purchases for the years ended December 31, 2009 and 2008, respectively. The increase in cost of goods sold of approximately $340,000 was primarily due to the fact that MMV installed an additional 50 machines during the year ended December 31, 2009.

Total operating expenses

For the years ended December 31, 2009 and 2008, MMV’s total operating expenses were approximately $409,000 and $421,000, respectively. The decrease related to the selling, general and administrative expenses was approximately $12,000. The decrease was primarily due to a decrease in automotive expenses of approximately $12,000 for the year ended December 31, 2009.

For the years ended December 31, 2009 and 2008, MMV had other expenses of approximately $150,000 and $142,000, respectively. The increase is primarily related to an increase in depreciation expense was approximately $8,000.

Net income

For the years ended December 31, 2009 and 2008, MMV’s net income was approximately $1,187,000 and $336,000, respectively.

Off-balance sheet arrangements

We have no off-balance sheet arrangements.

Liquidity and Capital Resources

As of December 31, 2009 and 2008, MMV had working capital of approximately $1,430,000 and $660,000 respectively. The increase in working capital in 2009 of approximately $770,000 resulted primarily from an increase in due from related party of approximately $590,000 and an increase in inventory of approximately $180,000. For the period from December 31, 2009 to December 31, 2008, MMV had approximately $70,000 of net cash increase. The cash provided by operations of approximately $620,000 was primarily due to net income of $1,190,000, approximately $590,000 was used for due from related party and approximately $180,000 was used for inventory purchases and the remaining amount for working capital and operating activities. Cash used in investing activities approximated $1,180,000, which was primarily utilized for expenditure on equipment. Cash provided by financing activities approximated $507,000 from December 31, 2009 and 2008 and was primarily due to proceeds from stockholders for additional paid-in capital. The remaining increase in cash was related to an increase in the effect of exchange rate of approximately $120,000.

As of September 30, 2010 and December 31, 2009, MMV had working capital of approximately $130,000 and $1,430,000, respectively. The working capital in September 30, 2010 results primarily from inventory of approximately $300,000 and the balance in December 31, 2009 results primarily from due from related party of $1,170,000 and inventory of $250,000.

The net cash used during the nine months ended September 30, 2010 was $39,500. The cash provided by operating activities of approximately $1,880,000 was primarily due to the adjustment to net income from the contingent liability of approximately $3,100,000, net loss of approximately $2,890,000 and cash provided by due from related party of approximately $1,230,000. The cash used in investing activities was approximately $1,950,000 was primarily due to the purchase of equipment. The cash provided by financing activities of approximately $30,000 was primarily due to the proceeds from stockholder loans. The net increase in cash during the nine months ended September 30, 2009 of approximately $69,000. The cash provided by operations was primarily due to net income of approximately $890,000, decrease in cash from due from related party of approximately $590,000 and decrease in cash due to inventory purchases of approximately $185,000. The cash used in investing activities of approximately $1,170,000 was primarily due to the purchase of equipment. The cash provided by financing activities of approximately $850,000 was primarily due to the proceeds from stockholders’ additional paid-in capital of $1,050,000 and payments to stockholders’ loan of $200,000.

MMV expects significant purchase of equipment during the next 12 months, contingent upon debt financing and sufficient operations. We anticipate that we will install 100 additional machines throughout Canada during the next 12 months. We anticipate that these machines will generate approximately $2,000 in revenues per month. However, there can be no assurance that financing will be available in amounts or on terms acceptable to MMV, if at all.

If MMV is not successful in generating sufficient financing, on terms acceptable to it, this could have a material adverse effect on its business, results of operations liquidity and financial condition. There is no assurance that the operations of the additional machines will generate sufficient revenue to continue operations on a profitable basis.

MMV will need additional investments in order to expand operations. Additional investments are being sought, but MMV cannot guarantee that it will be able to obtain such investments. Financing transactions may include the issuance of equity or debt securities, obtaining credit facilities, or other financing mechanisms. However, the trading price of MMV’s common stock and a downturn in the U.S. stock and debt markets could make it more difficult to obtain financing through the issuance of equity or debt securities. Even if MMV is able to raise the funds required, it is possible that it could incur unexpected costs and expenses or experience unexpected cash requirements that would force it to seek alternative financing. Further, if MMV issues additional equity or debt securities, shareholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of existing holders of MMV’s common stock. If additional financing is not available or is not available on acceptable terms, MMV will have to curtail its operations.

11

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts during the reporting periods. Actual results could differ from those estimates. Significant estimates and assumptions included in MMV’s financial statements relate to estimate of loss contingencies and accrued other liabilities.

Fair Value of Financial Instruments

ASC 820-10 (formerly SFAS No. 157, Fair Value Measurements) requires entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet, for which it is practicable to estimate fair value. ASC 820-10 defines the fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties. As of September 30, 2010 and December 31, 2009, the carrying value of certain financial instruments such as accounts receivable, accounts payable, accrued expenses, and amounts due to/from related party approximates fair value due to the short-term nature of such instruments.

Impairment of Long-Lived Assets

In accordance with ASC 350-30 (formerly SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets), the Company evaluates long-lived assets for impairment whenever events or changes in circumstances indicate that their then carrying values may not be recoverable. When such factors and circumstances exist, the Company compares the projected undiscounted future cash flows associated with the related asset or group of assets over their estimated useful lives against their respective carrying amount. Impairment, if any, is based on the excess of the carrying amount over the fair value, based on market value when available, or discounted expected cash flows, of those assets and is recorded in the period in which the determination is made. The Company’s management currently believes there is no impairment of its long-lived assets. There can be no assurance however, that market conditions will not change or demand for the Company’s products under development will continue. Either of these could result in future impairment of long-lived assets.

Recently Issued Accounting Pronouncements

For an update regarding the impact of recently issued accounting pronouncements, please see our financial states and note 1 thereto (Significant Accounting Policies).

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the ownership, as of February 11, 2011, of our common stock by each of our directors, by all of our executive officers and directors as a group, and by each person known to us who is the beneficial owner of more than 5% of any class of our securities, after giving effect to the share exchange and the cancellation of shares by Adam Slazer. As of February 11, 2011, there were 40,000,000 shares of our common stock issued and outstanding after giving effect to the foregoing transactions. All persons named have sole or shared voting and investment control with respect to the shares, except as otherwise noted. The number of shares described below includes shares which the beneficial owner described has the right to acquire within 60 days of the date of this Form 8-K.

|

Title of Class

|

Name and Address of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Percent of Class

|

||||||

|

Common Stock

|

Jeremy Ostrowski*

|

20,073,410 | (1) | 50.18 | % | ||||

|

Common Stock

|

Al Hayes*

|

0 | - | ||||||

|

Common Stock

|

Neil Hudd*

|

0 | - | ||||||

|

Common Stock

|

Gerald Lotterstein*

|

0 | - | ||||||

|

Common Stock

|

Terry O’Hearn*

|

3,213,119 | (2) | - | |||||

|

Common Stock

|

All Directors and Officers as a Group (5 persons)

|

23,286,529 | (1)(2) | 58.22 | % | ||||

|

Common Stock

|

Jocelyne Hughes-Ostrowski*

|

20,073,410 | (3) | 50.2 | % | ||||

|

Common Stock

|

iMOZI Canada, Inc.

4811 Fannin Avenue

Vancouver, BC V6T 1B1

|

3,213,119 | 8.03 | % | |||||

|

Common Stock

|

Greentree Financial Group, Inc.

7951 SW 6th Street, Suite 216

Plantation, FL 33324

|

2,737,867 | 6.84 | % | |||||

|

Common Stock

|

Linear Capital Group, Inc.

11693 San Vicente Blvd., Suite 824

Los Angeles, CA 90049

|

2,737,867 | 6.84 | % | |||||

|

Common Stock

|

MergersLawyer.net, Inc.

8950 W. Olympic Blvd., Suite 576

Beverly Hills, CA 90211

|

3,980,000 | 9.95 | % | |||||

|

*

|

The business address of the directors of the Company is 225 Railway Street East, Unit B, Cochrane, Alberta, Canada T4C 2C3.

|

|

(1)

|

Includes 9,103,837 shares of common stock owned of record by Jocelyn Hughes-Ostrowski, spouse of Jeremy Ostrowski.

|

|

(2)

|

Includes 3,213,119 shares of common stock owned of record by iMOZI Canada, Inc., which is controlled by Mr. O’Hearn.

|

|

(3)

|

Includes 10,969,573 shares of common stock owned of record by Jeremy Ostrowski, spouse of Jocelyn Hughes-Ostrowski.

|

12

Directors and Executive Officers

Directors and Officers

Our Bylaws state that our authorized number of directors shall be not less than three if there are three or more shareholders. In connection with the share exchange, the directors of the Company appointed the five current directors identified below and then resigned as directors of the Company. In addition, Adam Slazer resigned as the sole officer of the Company and has been replaced by Jeremy Ostrowski as President, Secretary and Treasurer (Chief Financial and Accounting Officer) of the Company. It is anticipated that additional persons will be appointed as officers of the Company in the near future.

Jeremy Ostrowski, age 44, has been President, Chief Executive Officer and Chairman of the Board of MMV since it’s founding in 2006. Mr. Ostrowski has an extensive background in technology and marketing. He was named “One of the Top 30 Canadian Entrepreneurs under the age of 30” by Southern Alberta Business Magazine in the fall of 1994. He has consulted on the development of medical care card systems in third world nations. He was instrumental in developing the technology that combined an extensive database to track individual consumer accounts with remote POS terminals, which is now commonplace. In 2006, Jeremy took his cutting edge technology to the next level and founded MMV. He is actively involved in the creation and development of new products, infrastructure, systems architecture and marketing channels.

Al Hayes, age 43, has been the President of AH Motion Pictures since November 2009, and was the Chief Executive Officer of Public Media Works from November 2007 until November 2009 and the Chief Executive Officer of Chicago Pictures from December 2006 until October 2007. It is anticipated that Mr. Hayes will provide to the Registrant expertise in the areas of media contacts, digital rights issues and financial advice. He may also be considered for an executive position with the Registrant.

Neil Hudd, age 65, has been Chairman of the Board of Ash Payment Solutions, a leader in the payments industry specializing in payment hardware, payment processing services, self-service retail platforms and technical support services, since March 2008, and was a Senior Vice President of Hypercom Corp from may 2005 until March 2008.

Gerald Lotterstein, age 76, has been recognized as one of the leading video marketing and distribution experts in the United States, having rented and sold more than 7 million videos during his career. He created the concept of the Video Super Store at a time when video rental stores wee only 1000 sq. ft. Based upon his unique concept, Mr. Lotterstein opened retail stores from 6,000 sq. ft. up to 17,000 sq. ft. After having built and managed over 100 Video Super Stores, Mr. Lotterstein then sold a majority of his stores to Blockbuster Video. Since 2004, Mr. Lotterstein, has been involved in the marketing and distribution of drug test kits to employers and parents as President of The Drug Test Consultant. It is anticipated that Mr. Lotterstein will become Chairman of the Board of the Company, with primary responsibility for business development.

Terry O’Hearn, age 45, has studied economics and accounting. Mr. O’Hearn is a successful entrepreneur with a passion for business. Over the last 25 years Mr. O’Hearn has been involved in senior executive roles in more than 12 businesses. As founder, President and Chief Executive Officer of Outdoor Access Group (“OAG”), he built a successful chain of retail stores that spanned Canada. Over a 10-year period, OAG maintained a compounded annual growth rate of 43%. OAG has a staff of 250. Mr. O’Hearn’s methodical approach to the creation of strategic supply channels, along with a focus on continuous improvement of margins, were key in establishing solid financial fundamentals for OAG’s activities. As a founder and the Chief Executive Officer of iMOZI Canada Inc., Mr. O’Hearn has applied these same business fundamentals in building iMOZI into one of the world’s preeminent automated self-service technology companies. Combining his sound understanding of corporate finance with a grasp of business dynamics, Mr. O’Hearn will lend his experience and knowledge to growing the Company.

Other Directorships

Except as disclosed above, during the last five years, none of our directors held any other directorships in any company with a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

Director Nominees

The decisions of the Board regarding director nominees will be made in part by persons who have an interest in the outcome of the determination.The Board will consider candidates for directors proposed by security holders, although no formal procedures for submitting candidates have been adopted. Unless otherwise determined, at any time not less than 90 days prior to the next annual Board meeting at which a slate of director nominees is adopted, the Board will accept written submissions from proposed nominees that include the name, address and telephone number of the proposed nominee; a brief statement of the nominee’s qualifications to serve as a director; and a statement as to why the security holder submitting the proposed nominee believes that the nomination would be in the best interests of our security holders. If the proposed nominee is not the same person as the security holder submitting the name of the nominee, a letter from the nominee agreeing to the submission of his or her name for consideration should be provided at the time of submission. The letter should be accompanied by a résumé supporting the nominee's qualifications to serve on the Board, as well as a list of references.

The Board identifies director nominees through a combination of referrals from different people, including management, existing Board members and security holders.Once a candidate has been identified, the Board reviews the individual's experience and background and may discuss the proposed nominee with the source of the recommendation. If the Board believes it to be appropriate, Board members may meet with the proposed nominee before making a final determination whether to include the proposed nominee as a member of the slate of director nominees submitted to security holders for election to the Board.

13

Conflicts of Interest

Our directors are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities that are engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

· the corporation could financially undertake the opportunity;

· the opportunity is within the corporation’s line of business; and

· it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation.

We have adopted a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent.

Significant Employees

Other than Jeremy Ostrowski, we do not expect any other individuals to make a significant contribution to our business.

Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

· been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences);

· had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

· been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

· been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

· been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

· been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Except as set forth in our discussion below in “Certain Relationships and Related Transactions, and Director Independence – Transactions with Related Persons,” none of our directors, director nominees or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Audit Committee and Charter

We do not have a separately-designated audit committee of the board. Audit committee functions are performed by our board of directors. None of our directors are deemed independent. All directors also hold positions as our officers. Our audit committee is responsible for: (1) selection and oversight of our independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters; (3) establishing procedures for the confidential, anonymous submission by our employees of concerns regarding accounting and auditing matters; (4) engaging outside advisors; and, (5) funding for the outside auditory and any outside advisors engagement by the audit committee.

None of our proposed directors or officers have the qualifications or experience to be considered a financial expert. We believe the cost related to retaining a financial expert at this time is prohibitive. Further, because of our limited operations, we believe the services of a financial expert are not warranted.

14

Code of Ethics

We have adopted a corporate code of ethics. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code.

Disclosure Committee and Charter

We intend to have a disclosure committee and disclosure committee charter. Our disclosure committee will be comprised of all of our officers and directors. The purpose of the committee is to provide assistance to the Chief Executive Officer and the Chief Financial Officer in fulfilling their responsibilities regarding the identification and disclosure of material information about us and the accuracy, completeness and timeliness of our financial reports.

Family Relationships

There is no family relationship between any of our proposed directors.

Executive Compensation

The following summary compensation table sets forth the total annual compensation paid or accrued by us to or for the account of our principal executive officer during the last completed fiscal year and each other executive officer whose total compensation exceeded $100,000 in either of the last two fiscal years:

Summary Compensation Table (1)

|

Name and Principal Position

|

Year

|

Salary($)

|

Total ($)

|

|

Adam Slazer (2)

|

2010

|

11,096 | 11,096 |

|

2009

|

$3,000

|

$3,000

|

|

|

(1)

|

We have omitted certain columns in the summary compensation table pursuant to Item 402(a)(5) of Regulation S-K as no compensation was awarded to, earned by, or paid to any of the executive officers or directors required to be reported in that table or column in any fiscal year covered by that table.

|

|

(2)

|

Adam Slazer was the President, Chief Executive Officer and director of the Company throughout 2010 and 2009.

|

Option Grants

As of the date of this report we had not granted any options or stock appreciation rights to our named executive officers or directors.

Management Agreements

There currently is no written employment agreement with Jeremy Ostrowski. We anticipate that such an agreement will be entered into in the near future.

Compensation of Directors

Our directors did not receive any compensation for their services as directors from our inception to the date of this report. We anticipate that a compensation plan for outside directors will be implemented in the near future.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the Board of Directors or a committee thereof.

Compensation Committee

We do not currently have a compensation committee of the Board of Directors or a committee performing similar functions. The Board of Directors as a whole participates in the consideration of executive officer and director compensation.

Changes in Control

As of the date of this Report, we had no pension plans or compensatory plans or other arrangements which provide compensation in the event of termination of employment or a change in our control.

15

Certain Relationships and Related Transactions, and Director Independence

On February 11, 2011, pursuant to the closing of the share exchange, we issued 10,969,573 shares of our common stock to Jeremy Ostrowski, who at the closing became our President, Chief Executive Officer and a director, in exchange for his MMV shares. In addition, we issued 9,103,837 shares of our common stock to Jocelyn Hughes-Ostrowski, the spouse of Mr. Ostrowski, in exchange for her MMV shares

As part of the share exchange, Adam Slazer, then one of our directors and our President and Chief Executive Officer, (1) delivered all 9,884,730 shares of our common stock held by him for cancellation in consideration for a promissory note for $75,000 from Jeremy Ostrowski, and (2) was issued 876,946 shares of our common stock for services rendered in connection with the share exchange.

Pursuant to the share exchange agreement, Jeremy Ostrowski has agreed to indemnify and hold harmless EFLS with respect to certain pending franchisee litigation. In connection with such indemnification, Mr. Ostrowski is obligated to deposit 4,000,000 shares of our common stock into an escrow, which shares shall be canceled to offset any settlement payments or other payments made to the plaintiffs in such litigation, at the rate of the greater of (i) $0.50 per share or (ii) the then fair market value of one share of our common stock, as represented by its average bid price for the immediately preceding five (5) business days prior to the date of such offset. Mr. Ostrowski will not be reimbursed by us for any of these costs.

Pursuant to the share exchange agreement, Jeremy Ostrowski has agreed to issue a promissory note in the principal amount of $75,000 to Adam Slazer in consideration for the cancellation of 9,884,730 shares of our common stock owned by Mr. Slazer. The note will not bear interest and will be due on August 9, 2011. The note will be collateralized by an aggregate of 375,000 shares of our common stock owned by Greentree Financial Group, Inc. and by Linear Capital Group, Inc.

We will be considering an employment agreement for Mr. Ostrowski and compensation for our outside directors in the near future.

There have been no other transactions since the beginning of our last fiscal year or any currently proposed transactions in which we are, or plan to be, a participant and the amount involved exceeds $120,000 or one percent of the average of our total assets at year end for the last two completed fiscal years, and in which any related person had or will have a direct or indirect material interest.

Director Independence

Our securities are quoted on the Electronic Bulletin Board, which does not have any director independence requirements. We plan to develop a definition of independence and scrutinize our Board of Directors with regard to this definition.

Market Price of and Dividends on Our Common Equity and Related Stockholder Matters