Attached files

| file | filename |

|---|---|

| 8-K - DYNEGY HOLDINGS, LLC | dyn8k.htm |

| EX-99.1 - DYNEGY HOLDINGS, LLC | pressrelease.htm |

Dynegy Addresses Seneca’s Statements

in Order to Get the Facts Right

in Order to Get the Facts Right

February 2011

Forward-Looking Statements/Additional Information/

Participants in Solicitation

Participants in Solicitation

2

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward looking

statements.” Discussion of risks and uncertainties that could cause actual results to differ materially from current projections, forecasts, estimates and expectations of

Dynegy is contained in Dynegy's filings with the Securities and Exchange Commission (the “SEC”). Specifically, Dynegy makes reference to, and incorporates herein by

reference, the section entitled “Risk Factors” in its most recent Form 10-K and subsequent reports on Form 10-Q, the section entitled “Cautionary Statement Regarding

Forward-Looking Statements” in its preliminary proxy statement filed with the SEC on January 10, 2011 and the section entitled “Forward-Looking Statements” in its

preliminary consent revocation statement filed with the SEC on November 26, 2010. In addition to the risks and uncertainties set forth in Dynegy's SEC filings, the

forward-looking statements described in this presentation could be affected by, among other things, (i) the timing and anticipated benefits to be achieved through

Dynegy's 2010-2013 company-wide cost savings program; (ii) beliefs and assumptions relating to liquidity, available borrowing capacity and capital resources generally;

(iii) expectations regarding environmental matters, including costs of compliance, availability and adequacy of emission credits, and the impact of ongoing proceedings

and potential regulations or changes to current regulations, including those relating to climate change, air emissions, cooling water intake structures, coal combustion

byproducts, and other laws and regulations to which Dynegy is, or could become, subject; (iv) beliefs about commodity pricing and generation volumes; (v) anticipated

liquidity in the regional power and fuel markets in which Dynegy transacts, including the extent to which such liquidity could be affected by poor economic and financial

market conditions or new regulations and any resulting impacts on financial institutions and other current and potential counterparties; (vi) sufficiency of, access to and

costs associated with coal, fuel oil and natural gas inventories and transportation thereof; (vii) beliefs and assumptions about market competition, generation capacity

and regional supply and demand characteristics of the wholesale power generation market, including the potential for a market recovery over the longer term; (viii) the

effectiveness of Dynegy's strategies to capture opportunities presented by changes in commodity prices and to manage its exposure to energy price volatility; (ix) beliefs

and assumptions about weather and general economic conditions; (x) beliefs regarding the U.S. economy, its trajectory and its impacts, as well as Dynegy's stock price;

(xi) projected operating or financial results, including anticipated cash flows from operations, revenues and profitability; (xii) expectations regarding Dynegy's revolver

capacity, credit facility compliance, collateral demands, capital expenditures, interest expense and other payments; (xiii) Dynegy's focus on safety and its ability to

efficiently operate its assets so as to maximize its revenue generating opportunities and operating margins; (xiv) beliefs about the outcome of legal, regulatory,

administrative and legislative matters; (xv) expectations and estimates regarding capital and maintenance expenditures, including the Midwest Consent Decree and its

associated costs; (xvi) uncertainties associated with the consent solicitation (the “Seneca Capital Solicitation”) engaged in by Seneca Capital International Master Fund,

L.P., Seneca Capital, L.P., Seneca Capital Investments, L.P., Seneca Capital Investments, LLC, Seneca Capital International GP, LLC, Seneca Capital Advisors, LLC and

Douglas A. Hirsch (“Seneca Capital”) and (xvii) uncertainties associated with the proposed acquisition of Dynegy by an affiliate of Icahn Enterprises LP (the

"Transaction"), including uncertainties relating to the anticipated timing of filings and approvals relating to the Transaction, the outcome of legal proceedings that may

be instituted against Dynegy and/or others relating to the Transaction, the expected timing of completion of the Transaction, the satisfaction of the conditions to the

consummation of the Transaction and the ability to complete the Transaction. Any or all of Dynegy's forward-looking statements may turn out to be wrong. They can be

affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, many of which are beyond Dynegy's control.

statements.” Discussion of risks and uncertainties that could cause actual results to differ materially from current projections, forecasts, estimates and expectations of

Dynegy is contained in Dynegy's filings with the Securities and Exchange Commission (the “SEC”). Specifically, Dynegy makes reference to, and incorporates herein by

reference, the section entitled “Risk Factors” in its most recent Form 10-K and subsequent reports on Form 10-Q, the section entitled “Cautionary Statement Regarding

Forward-Looking Statements” in its preliminary proxy statement filed with the SEC on January 10, 2011 and the section entitled “Forward-Looking Statements” in its

preliminary consent revocation statement filed with the SEC on November 26, 2010. In addition to the risks and uncertainties set forth in Dynegy's SEC filings, the

forward-looking statements described in this presentation could be affected by, among other things, (i) the timing and anticipated benefits to be achieved through

Dynegy's 2010-2013 company-wide cost savings program; (ii) beliefs and assumptions relating to liquidity, available borrowing capacity and capital resources generally;

(iii) expectations regarding environmental matters, including costs of compliance, availability and adequacy of emission credits, and the impact of ongoing proceedings

and potential regulations or changes to current regulations, including those relating to climate change, air emissions, cooling water intake structures, coal combustion

byproducts, and other laws and regulations to which Dynegy is, or could become, subject; (iv) beliefs about commodity pricing and generation volumes; (v) anticipated

liquidity in the regional power and fuel markets in which Dynegy transacts, including the extent to which such liquidity could be affected by poor economic and financial

market conditions or new regulations and any resulting impacts on financial institutions and other current and potential counterparties; (vi) sufficiency of, access to and

costs associated with coal, fuel oil and natural gas inventories and transportation thereof; (vii) beliefs and assumptions about market competition, generation capacity

and regional supply and demand characteristics of the wholesale power generation market, including the potential for a market recovery over the longer term; (viii) the

effectiveness of Dynegy's strategies to capture opportunities presented by changes in commodity prices and to manage its exposure to energy price volatility; (ix) beliefs

and assumptions about weather and general economic conditions; (x) beliefs regarding the U.S. economy, its trajectory and its impacts, as well as Dynegy's stock price;

(xi) projected operating or financial results, including anticipated cash flows from operations, revenues and profitability; (xii) expectations regarding Dynegy's revolver

capacity, credit facility compliance, collateral demands, capital expenditures, interest expense and other payments; (xiii) Dynegy's focus on safety and its ability to

efficiently operate its assets so as to maximize its revenue generating opportunities and operating margins; (xiv) beliefs about the outcome of legal, regulatory,

administrative and legislative matters; (xv) expectations and estimates regarding capital and maintenance expenditures, including the Midwest Consent Decree and its

associated costs; (xvi) uncertainties associated with the consent solicitation (the “Seneca Capital Solicitation”) engaged in by Seneca Capital International Master Fund,

L.P., Seneca Capital, L.P., Seneca Capital Investments, L.P., Seneca Capital Investments, LLC, Seneca Capital International GP, LLC, Seneca Capital Advisors, LLC and

Douglas A. Hirsch (“Seneca Capital”) and (xvii) uncertainties associated with the proposed acquisition of Dynegy by an affiliate of Icahn Enterprises LP (the

"Transaction"), including uncertainties relating to the anticipated timing of filings and approvals relating to the Transaction, the outcome of legal proceedings that may

be instituted against Dynegy and/or others relating to the Transaction, the expected timing of completion of the Transaction, the satisfaction of the conditions to the

consummation of the Transaction and the ability to complete the Transaction. Any or all of Dynegy's forward-looking statements may turn out to be wrong. They can be

affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, many of which are beyond Dynegy's control.

This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, many of which are beyond

our ability to control or predict. Forward-looking statements may be identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “will” or words of similar meaning and include, but are not limited to, statements about the expected future business and financial performance of Icahn

Enterprises L.P. and its subsidiaries. Among these risks and uncertainties are risks related to economic downturns, substantial competition and rising operating costs;

risks related to our investment management activities, including the nature of the investments made by the private funds we manage, losses in the private funds and loss

of key employees; risks related to our automotive activities, including exposure to adverse conditions in the automotive industry, and risks related to operations in

foreign countries; risks related to our railcar operations, including the highly cyclical nature of the railcar industry; risks related to our food packaging activities, including

the cost of raw materials and fluctuations in selling prices; risks related to our scrap metals activities, including potential environmental exposure and volume

fluctuations; risks related to our real estate activities, including the extent of any tenant bankruptcies and insolvencies; risks related to our home fashion operations,

including changes in the availability and price of raw materials, and changes in transportation costs and delivery times; and other risks and uncertainties detailed from

time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or review any forward-looking information,

whether as a result of new information, future developments or otherwise.

our ability to control or predict. Forward-looking statements may be identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “will” or words of similar meaning and include, but are not limited to, statements about the expected future business and financial performance of Icahn

Enterprises L.P. and its subsidiaries. Among these risks and uncertainties are risks related to economic downturns, substantial competition and rising operating costs;

risks related to our investment management activities, including the nature of the investments made by the private funds we manage, losses in the private funds and loss

of key employees; risks related to our automotive activities, including exposure to adverse conditions in the automotive industry, and risks related to operations in

foreign countries; risks related to our railcar operations, including the highly cyclical nature of the railcar industry; risks related to our food packaging activities, including

the cost of raw materials and fluctuations in selling prices; risks related to our scrap metals activities, including potential environmental exposure and volume

fluctuations; risks related to our real estate activities, including the extent of any tenant bankruptcies and insolvencies; risks related to our home fashion operations,

including changes in the availability and price of raw materials, and changes in transportation costs and delivery times; and other risks and uncertainties detailed from

time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or review any forward-looking information,

whether as a result of new information, future developments or otherwise.

Forward-Looking Statements/Additional Information/

Participants in Solicitation (cont’d)

Participants in Solicitation (cont’d)

3

Non-GAAP Financial Measures: This presentation contains non-GAAP financial measures including Enterprise Value, EBITDA, Adjusted EBITDA, EBITDAR, Adjusted

EBITDAR, Net Debt , Adjusted Net Debt, Net Debt and Other Obligations and Adjusted Debt. Reconciliations of these measures to the most directly comparable GAAP

measures to the extent available without unreasonable effort are contained herein. To the extent required, statements disclosing the definitions of such non-GAAP

financial measures are included herein.

EBITDAR, Net Debt , Adjusted Net Debt, Net Debt and Other Obligations and Adjusted Debt. Reconciliations of these measures to the most directly comparable GAAP

measures to the extent available without unreasonable effort are contained herein. To the extent required, statements disclosing the definitions of such non-GAAP

financial measures are included herein.

Notice to Investors

This presentation is neither an offer to purchase nor a solicitation of an offer to sell any securities. The solicitation and the offer to buy the outstanding shares of

common stock of Dynegy is being made pursuant to an offer to purchase and related materials that IEH Merger Sub LLC, an affiliate of Icahn Enterprises LP, and Icahn

Enterprises Holdings L.P., as a co-bidder (collectively with IEH Merger Sub LLC, the “Offeror”), have filed with the SEC. The Offeror has filed a tender offer statement on

Schedule TO with the SEC in connection with the commencement of the offer, and Dynegy has filed a solicitation/recommendation statement on Schedule 14D-9 with

respect to the offer. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the

solicitation/recommendation statement contain important information that should be read carefully and considered before any decision is made with respect to the

tender offer. These materials have or will be sent free of charge to all stockholders of Dynegy. In addition, all of these materials (and all other materials filed by Dynegy

with the SEC) are or will be available at no charge from the SEC through its website at www.sec.gov. The Schedule 14D-9 and related materials may be obtained for free

from D.F. King & Co., Inc., Toll-Free Telephone: (800) 697-6975. Investors may also obtain copies of the Schedule TO and the related materials free from Morrow &

Company; banks and brokerage firms can call Morrow & Company at (203) 657-9400, and stockholders can call Morrow & Company toll free at (800) 607-0088 . Investors

and security holders may also obtain free copies of the documents filed with the SEC by Dynegy by directing a request by mail or telephone to Dynegy Inc., Attn:

Corporate Secretary, 1000 Louisiana Street, Suite 5800, Houston, Texas 77002, telephone: (713) 507-6400, or from Dynegy's website, http://www.dynegy.com.

common stock of Dynegy is being made pursuant to an offer to purchase and related materials that IEH Merger Sub LLC, an affiliate of Icahn Enterprises LP, and Icahn

Enterprises Holdings L.P., as a co-bidder (collectively with IEH Merger Sub LLC, the “Offeror”), have filed with the SEC. The Offeror has filed a tender offer statement on

Schedule TO with the SEC in connection with the commencement of the offer, and Dynegy has filed a solicitation/recommendation statement on Schedule 14D-9 with

respect to the offer. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the

solicitation/recommendation statement contain important information that should be read carefully and considered before any decision is made with respect to the

tender offer. These materials have or will be sent free of charge to all stockholders of Dynegy. In addition, all of these materials (and all other materials filed by Dynegy

with the SEC) are or will be available at no charge from the SEC through its website at www.sec.gov. The Schedule 14D-9 and related materials may be obtained for free

from D.F. King & Co., Inc., Toll-Free Telephone: (800) 697-6975. Investors may also obtain copies of the Schedule TO and the related materials free from Morrow &

Company; banks and brokerage firms can call Morrow & Company at (203) 657-9400, and stockholders can call Morrow & Company toll free at (800) 607-0088 . Investors

and security holders may also obtain free copies of the documents filed with the SEC by Dynegy by directing a request by mail or telephone to Dynegy Inc., Attn:

Corporate Secretary, 1000 Louisiana Street, Suite 5800, Houston, Texas 77002, telephone: (713) 507-6400, or from Dynegy's website, http://www.dynegy.com.

Additional Information About the Merger and Where to Find It

In connection with the potential merger, Dynegy filed a preliminary proxy statement with the SEC on January 10, 2011. When completed, a definitive proxy statement

and a form of proxy will be mailed to the stockholders of Dynegy. BEFORE MAKING ANY VOTING DECISION, DYNEGY’S STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Dynegy’s stockholders will be able to obtain, without charge, a copy of the preliminary proxy statement, the definitive proxy statement (when available) and other

relevant documents filed with the SEC from the SEC’s website at http://www.sec.gov. Dynegy’s stockholders will also be able to obtain, without charge, a copy of the

preliminary proxy statement, the definitive proxy statement (when available) and other relevant documents by directing a request by mail or telephone to Dynegy Inc.,

Attn: Corporate Secretary, 1000 Louisiana Street, Suite 5800, Houston, Texas 77002, telephone: (713) 507-6400, or from the Dynegy’s website, http://www.dynegy.com.

and a form of proxy will be mailed to the stockholders of Dynegy. BEFORE MAKING ANY VOTING DECISION, DYNEGY’S STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Dynegy’s stockholders will be able to obtain, without charge, a copy of the preliminary proxy statement, the definitive proxy statement (when available) and other

relevant documents filed with the SEC from the SEC’s website at http://www.sec.gov. Dynegy’s stockholders will also be able to obtain, without charge, a copy of the

preliminary proxy statement, the definitive proxy statement (when available) and other relevant documents by directing a request by mail or telephone to Dynegy Inc.,

Attn: Corporate Secretary, 1000 Louisiana Street, Suite 5800, Houston, Texas 77002, telephone: (713) 507-6400, or from the Dynegy’s website, http://www.dynegy.com.

Participants in the Solicitation

Dynegy and its directors and officers may be deemed to be participants in the solicitation of proxies from Dynegy’s stockholders with respect to the Merger. Information

about Dynegy’s directors and executive officers and their ownership of Dynegy’s common stock is set forth in the proxy statement for Dynegy’s 2010 Annual Meeting of

Stockholders, which was filed with the SEC on April 2, 2010. Stockholders may obtain additional information regarding the interests of Dynegy and its directors and

executive officers in the Merger, which may be different than those of Dynegy’s stockholders generally, by reading the preliminary proxy statement, the definitive proxy

statement (when available) and other relevant documents regarding the Merger, when filed with the SEC.

about Dynegy’s directors and executive officers and their ownership of Dynegy’s common stock is set forth in the proxy statement for Dynegy’s 2010 Annual Meeting of

Stockholders, which was filed with the SEC on April 2, 2010. Stockholders may obtain additional information regarding the interests of Dynegy and its directors and

executive officers in the Merger, which may be different than those of Dynegy’s stockholders generally, by reading the preliminary proxy statement, the definitive proxy

statement (when available) and other relevant documents regarding the Merger, when filed with the SEC.

Getting the Facts Right

4

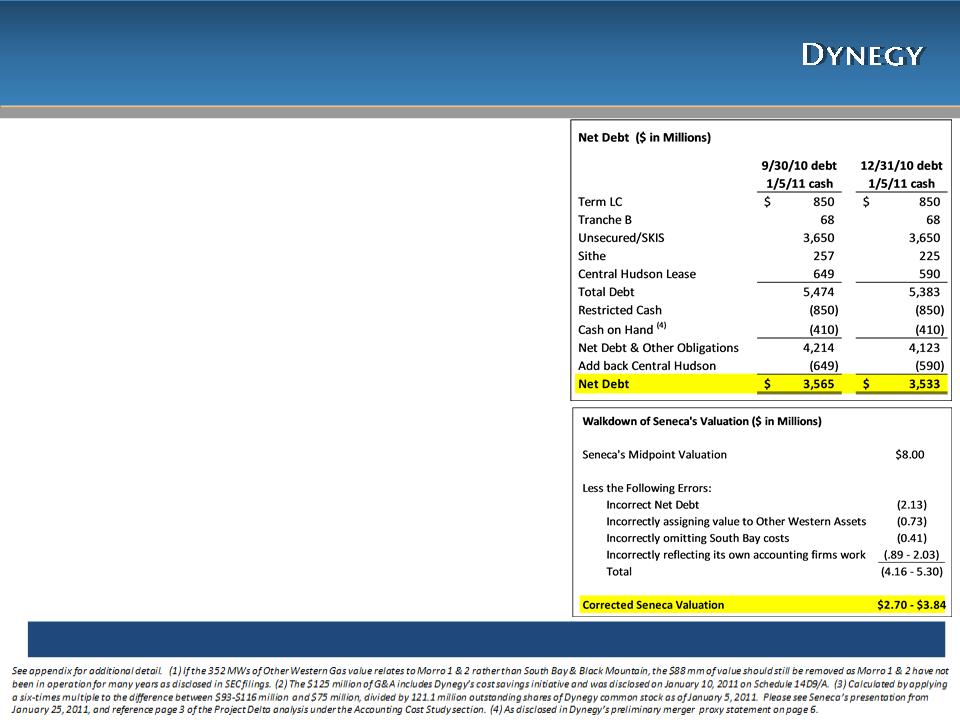

Ignoring Differences of Opinion and Just Correcting for Seneca’s Obvious

Errors of Fact Reduces Seneca’s Implied Price per Share to $2.70-$3.84

Errors of Fact Reduces Seneca’s Implied Price per Share to $2.70-$3.84

Dynegy Stockholders Must Have Accurate Information

• The following observations are meant to address the numerous public communications Seneca

has issued over the past several weeks.

has issued over the past several weeks.

• While these observations are not all inclusive, they provide a sample of how Seneca has

misstated facts and made aggressive assumptions in order to distract stockholders from the

certain value the Icahn transaction will provide to all stockholders.

misstated facts and made aggressive assumptions in order to distract stockholders from the

certain value the Icahn transaction will provide to all stockholders.

– Factual errors in valuing Dynegy at $7.50-$8.50 per share ($8.00 per share midpoint)

– Selective and aggressive assumptions about projected cash flow

• Dynegy doesn’t intend to debate each opinion about the future. However, to hope for radical,

positive near-term changes in the market is not a prudent bet for Dynegy.

positive near-term changes in the market is not a prudent bet for Dynegy.

• As Dynegy’s stockholders have the final say on the company’s future, it is important that they

have the correct information to make an informed decision.

have the correct information to make an informed decision.

4

Seneca’s Factual Errors in Valuing Dynegy

• Looking only at the uncontestable facts (excluding valuation metrics

requiring estimates and/or predictions such as $/Kw or DCF):

requiring estimates and/or predictions such as $/Kw or DCF):

– Dynegy’s net debt as of September 30, 2010 (adjusted to reflect January

5, 2011 cash balances) is $3.565 billion, NOT $3.307 billion as Seneca

stated. This error is especially glaring considering the data is publicly

available and has been filed with the SEC.

Reduction in value: $2.13 per share

5, 2011 cash balances) is $3.565 billion, NOT $3.307 billion as Seneca

stated. This error is especially glaring considering the data is publicly

available and has been filed with the SEC.

Reduction in value: $2.13 per share

– Seneca assigns $88 million of value to Other Western Gas(1) (South Bay

& Black Mountain or 352 MWs); however, Dynegy is obligated to

decommission the South Bay plant beginning 2011, which has been

publicly disclosed, and Black Mountain’s value is not material.

Reduction in value: $0.73 per share

& Black Mountain or 352 MWs); however, Dynegy is obligated to

decommission the South Bay plant beginning 2011, which has been

publicly disclosed, and Black Mountain’s value is not material.

Reduction in value: $0.73 per share

– In addition to incorrectly assigning value to Other Western Gas assets,

Seneca does not account for the fact that Dynegy is obligated to

decommission the South Bay plant. Dynegy will incur a net cash expense

of ~$50 million over several years.

Reduction in value: $0.41 per share

Seneca does not account for the fact that Dynegy is obligated to

decommission the South Bay plant. Dynegy will incur a net cash expense

of ~$50 million over several years.

Reduction in value: $0.41 per share

– Seneca has not even reflected correctly the preliminary work of its Big 4

accounting firm regarding cost estimates. Without debating the validity of

the work, Seneca included G&A of $75 million while the Big 4 accounting

firm’s report, disclosed publicly in Seneca’s SEC filings, indicated a G&A

range of $93-$116 million, which compares to Dynegy’s 2011 estimate of

$125 million (2). Seneca applied a 6x multiple in its valuation.

Reduction in value: $0.89-$2.03 per share (3)

accounting firm regarding cost estimates. Without debating the validity of

the work, Seneca included G&A of $75 million while the Big 4 accounting

firm’s report, disclosed publicly in Seneca’s SEC filings, indicated a G&A

range of $93-$116 million, which compares to Dynegy’s 2011 estimate of

$125 million (2). Seneca applied a 6x multiple in its valuation.

Reduction in value: $0.89-$2.03 per share (3)

Facts Make a Difference in Valuing Dynegy and Result in a Value Less Than the Current Offer

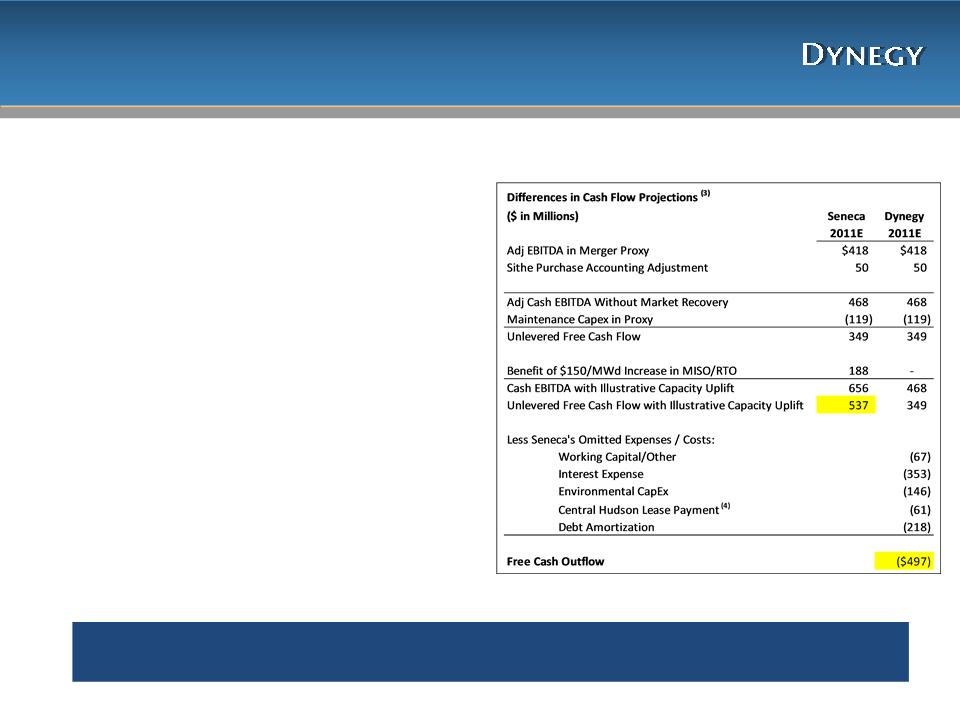

Seneca’s Selective Disclosures and Aggressive

Assumptions for Projected Cash Flow

Assumptions for Projected Cash Flow

• Seneca’s cash flow assumptions do not hold up

to basic scrutiny and raise further questions

about the validity of its valuation:

to basic scrutiny and raise further questions

about the validity of its valuation:

– Seneca’s definition of free cash flow is not

meaningful to equity holders as it does not account

for working capital, interest expense, environmental

obligations, lease payment and debt amortization

that must be paid before cash could be available to

common stockholders.

meaningful to equity holders as it does not account

for working capital, interest expense, environmental

obligations, lease payment and debt amortization

that must be paid before cash could be available to

common stockholders.

– Assumes MISO capacity prices of $150 per MW-day

starting in 2011, which is 45 times higher than the

current market price of $3.35 per MW-day.(1) This

represents over $180 million in cash flow per year

that the current market does not support.

starting in 2011, which is 45 times higher than the

current market price of $3.35 per MW-day.(1) This

represents over $180 million in cash flow per year

that the current market does not support.

§ Also, erroneously includes the Kendall plant in MISO (it

is actually in PJM West), further overstating capacity

market cash flows

is actually in PJM West), further overstating capacity

market cash flows

– Dynegy estimates a cash requirement of $1.2 billion

between 2011 - 2013,(2) versus Seneca’s estimate

of positive cash flow during this period of $1.5 billion.

between 2011 - 2013,(2) versus Seneca’s estimate

of positive cash flow during this period of $1.5 billion.

To Make Decisions, Dynegy Stockholders Should Understand Dynegy’s Full Cash

Flows and Understand that Seneca’s Assumptions may be Aggressive

Flows and Understand that Seneca’s Assumptions may be Aggressive

6

(1) Market price indication provided by energy brokers. (2) 2011-2013 cash outflow was disclosed in Dynegy’s preliminary merger proxy statement on page 59 . (3) Certain Dynegy 2011 Estimates

disclosed in preliminary merger proxy statement. (4) Total Central Hudson cash lease payment is $112 million, however ~$50 million is already in Adj. EBTIDA as lease expense.

disclosed in preliminary merger proxy statement. (4) Total Central Hudson cash lease payment is $112 million, however ~$50 million is already in Adj. EBTIDA as lease expense.

An Unfortunate Chain of Events

7

7

Stockholders Need to Make Decisions Based on Accurate Facts and a

Realistic View of Commodity Markets

Realistic View of Commodity Markets

It’s Unfortunate that Seneca:

•Did not participate in Dynegy’s open strategic alternatives process or otherwise engage

with the Company to review Seneca’s assumptions and beliefs relative to detailed

information about Dynegy’s business;

with the Company to review Seneca’s assumptions and beliefs relative to detailed

information about Dynegy’s business;

•Requested it receive a waiver of certain provisions of the Stockholder Protection Rights

Plan, which was put in place to protect all stockholders and to prevent anyone from

acquiring creeping control of Dynegy without paying a control premium.

Plan, which was put in place to protect all stockholders and to prevent anyone from

acquiring creeping control of Dynegy without paying a control premium.

•Disseminated materials that contained factual errors, inaccuracies, and exceedingly

hopeful assumptions about power markets and environmental enforcement that make

its purported equity valuation highly misleading to Dynegy’s investors.

hopeful assumptions about power markets and environmental enforcement that make

its purported equity valuation highly misleading to Dynegy’s investors.

Appendix

REFERENCES

• Net Debt: Please see Dynegy’s 3Q2010 results presentation for net debt as of 9/30/2010. We have provided two reconciliations of net

debt. One uses the same approach as Seneca, the 9/30/2010 debt balances adjusted for January 5, 2011 cash balances, which shows

that the correct number is $3,565 million. For purposes of full disclosure, we have also provided net debt balances as of 12/31/10,

adjusted for January 5, 2011 cash balance.

debt. One uses the same approach as Seneca, the 9/30/2010 debt balances adjusted for January 5, 2011 cash balances, which shows

that the correct number is $3,565 million. For purposes of full disclosure, we have also provided net debt balances as of 12/31/10,

adjusted for January 5, 2011 cash balance.

• South Bay: Please see 3Q2010 Dynegy results on page 23. Please see page 44 of our 14D9 where Dynegy has stated that it will

begin decommissioning South Bay in 2011. Dynegy estimates a net $50 million(undiscounted) in cost related to decommissioning and

rental payments over the next several years.

begin decommissioning South Bay in 2011. Dynegy estimates a net $50 million(undiscounted) in cost related to decommissioning and

rental payments over the next several years.

9