Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STATE STREET CORP | d8k.htm |

Investor & Analyst Forum

10 February 2011

Exhibit 99.1 |

Extending Our Leadership

AGENDA

Joseph L. Hooley

Chairman, President and

Chief Executive Officer

Scott F. Powers

Chief Executive Officer

State Street Global Advisors

James S. Phalen

Executive Vice President

Operations & Technology

Edward J. Resch

Executive Vice President and

Chief Financial Officer |

3

Reminder

This presentation contains “forward-looking statements” within the meaning of U.S.

securities laws, including statements about industry trends, management’s expectations about our

financial performance, market growth, acquisitions and divestitures, new technologies, services and

opportunities and earnings, management’s confidence in our strategies and other matters

that do not relate strictly to historical facts. Forward-looking statements are often identified by such forward-looking terminology as “expect,” “look,” “believe,” “anticipate,”

“estimate,” “seek,” “may,” “will,” “trend,”

“target” and “goal,” or similar statements or variations of such terms. Forward-looking statements are subject to various risks and uncertainties,

which change over time, are based on management’s expectations and assumptions at the time the

statements are made, and are not guarantees of future results. Management’s expectations

and assumptions, and the continued validity of the forward-looking statements, are subject to change due to a broad range of factors affecting the national and global

economies, the equity, debt, currency and other financial markets, as well as factors specific to

State Street and its subsidiaries, including State Street Bank. Therefore, actual

outcomes and results may differ materially from what is expressed in those statements, and those

statements should not be relied upon as representing our expectations or beliefs as of any date

subsequent to February 10, 2011. Factors that could cause changes in the expectations or assumptions on which forward-looking

statements are based include, but are not limited to: the manner in which the Federal Reserve

implements the Dodd-Frank Act, including any changes to our minimum regulatory capital ratios; changes to our business model, or how we provide services, required by our

compliance with the Dodd-Frank Act, and similar non-U.S. rules and regulations; required

regulatory capital ratios under Basel II and Basel III, in each case as fully implemented by

State Street and State Street Bank (and in the case of Basel III, when finally adopted by the Federal

Reserve), which may result in the need for substantial additional capital or increased levels

of liquidity in the future; changes in law or regulation that may adversely affect our, our clients’ or our counterparties’ business activities and the products or services

that we sell, including additional or increased taxes or assessments thereon, capital adequacy

requirements and changes that expose us to risks related to compliance; financial market

disruptions and the economic recession, whether in the U.S. or internationally; the liquidity of the U.S. and international securities markets, particularly the markets for fixed

income securities, and the liquidity requirements of our clients; increases in the volatility of, or

declines in the levels of, our net interest revenue, changes in the composition of the assets

on our consolidated balance sheet and the possibility that we may be required to change the manner in which we fund those assets; the financial strength and continuing

viability of the counterparties with which we or our clients do business and to which we have

investment, credit or financial exposure; the credit quality, credit agency ratings, and fair

values of the securities in our investment securities portfolio, a deterioration or downgrade of which

could lead to other-than-temporary impairment of the respective securities and the

recognition of an impairment loss in our consolidated statement of income; delays or difficulties in

the execution of our previously announced global multi-year program designed to enhance our

operating model, which could lead to changes in our estimates of the charges, expenses or savings associated with the planned program, resulting in increased volatility

of our earnings; the maintenance of credit agency ratings for our debt and depository obligations as

well as the level of credibility of credit agency ratings; the risks that acquired businesses

will not be integrated successfully, or that the integration will take longer than anticipated, that expected synergies will not be achieved or unexpected disynergies will be

experienced, that client and deposit retention goals will not be met, that other regulatory or

operational challenges will be experienced and that disruptions from the transaction will harm

relationships with clients, employees or regulators; the ability to complete acquisitions, divestitures and joint ventures, including the ability to obtain regulatory approvals, the

ability to arrange financing as required and the ability to satisfy closing conditions; the

performance of and demand for the products and services we offer, including the level and timing

of redemptions and withdrawals from our collateral pools and other collective investment products; the

possibility of our clients incurring substantial losses in investment pools where we act as

agent, and the possibility of significant reductions in the valuation of assets; our ability to attract deposits and other low-cost, short-term funding;

potential changes to the competitive environment, including changes due to the effects of

consolidation, and perceptions of State Street as a suitable service provider or counterparty;

the level and volatility of interest rates and the performance and volatility of securities, credit,

currency and other markets in the U.S. and internationally; our ability to measure the fair

value of the investment securities on our consolidated balance sheet; the results of litigation,

government investigations and similar disputes or proceedings; our ability to control operating

risks, information technology systems risks and outsourcing risks, and our ability to protect our intellectual property rights, the possibility of errors in the quantitative models

we use to manage our business and the possibility that our controls will prove insufficient, fail or

be circumvented; ‰ adverse publicity or other reputational harm; our ability to grow

revenue, attract and/or retain and compensate highly skilled people, control expenses and attract the

capital necessary to achieve our business goals and comply with regulatory requirements; the

potential for new products and services to impose additional costs on us and expose us to increased operational risk; changes in accounting standards and

practices; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and

non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by

any forward-looking statements are set forth in our 2010 Annual Report on Form 10-K and

our subsequent SEC filings, including the risk factor disclosures in our Current Report on Form 8-K filed on February 2, 2011. We encourage investors to read these filings,

particularly the sections on risk factors, for additional information with respect to any

forward-looking statements and prior to making any investment decision. The forward-looking

statements contained in this presentation speak only as of the date hereof, February 10, 2011 and we

do not undertake efforts to revise those forward-looking statements to reflect events after

that date. |

4

Extending Our Leadership

Agenda

Forward Focus

Financial Update

Summary

Solutions Innovation

Operations & IT Transformation

Risk and Capital Management

Global Expansion |

5

Forward Focus

1

The NASDAQ Stock Market Inc., Data Products, as of 12/31/10.

2

Scrip Issue Global Report, 9/10.

3 ICFA Annual Fund Administration Survey, 2010; HFN Biannual Fund

Administration Survey, 6/10. 4

Pension and Investments 6/28/10.

5 Pension and Investments 5/31/10.

LEADERSHIP TODAY

•

No. 1:

–

U.S. Mutual Fund Accounting

1

–

Global Investment Manager

Operations Outsourcing

2

–

Global Alternative Asset Servicing

3

–

Securities Finance

2

•

Leading Transition Manager

•

Electronic Trading Innovator

•

No. 2:

–

Worldwide

Institutional

Asset Management

4

–

Passive Manager of Domestic Equities

and Bonds

5

–

ETF provider

4

FORWARD FOCUS

Operations & IT Transformation

Risk and Capital Management

Solutions Innovation

Global Expansion |

6

Forward Focus

Solutions Innovation

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management

GLOBAL

SERVICES

•

Investment Manager

Operations Outsourcing

–

No.1 provider in market

1

with $7.9TN in AUA

2

•

Leading suite of Alternative

Asset servicing capabilities

–

No.1 provider in market

3

with $660BN in AUA

2

•

Services augmented by

comprehensive array of

data, risk and analytics

capabilities

1

Greensted

Scripp

Issue report, 9/10.

2 As of 12/31/10.

3

ICFA Annual Fund Administration Survey, 2010; HFN Biannual Fund Administration

Survey, 6/10. |

7

Forward Focus

Solutions Innovation

GLOBAL

MARKETS

•

Advisory relationships

informing portfolio

strategies, including trading

and securities finance,

integrated with transition

management

–

Relationships with 89 of

the top 100 global

investment managers

•

Robust e-exchange platform

•

Leader in research with

unique partnership with

academia (State Street

Associates)

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management |

8

Forward Focus

Solutions Innovation

GLOBAL

ADVISORS

•

Multi-asset class, multi-

strategy approach meeting

needs of global investors

•

Core strength in passive and

quantitative investment

management

•

Strategy to grow business in

Defined Contribution plans,

cash management, and

Exchange-Traded Funds

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management |

9

Forward Focus

Operations & IT Transformation

SUPPORTING

GROWTH

•

Market expansion

•

Mergers and acquisitions

•

Geographic expansion

ENABLING

PRODUCTIVITY

•

Business process

excellence

•

Flexible global workforce

•

Global shared services

ACCELERATING

INNOVATION

•

New product development

•

Technology leadership

•

Global solutions

BENEFITING THE

CLIENT

•

Service excellence

•

Time to market

•

New products and services

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management |

10

Forward Focus

Risk and Capital Management

RISK FOCUS

•

Adjusting to evolving

regulatory requirements

•

Developing best-in-class

capabilities

CAPITAL

POSITION

•

Capital strength as a

competitive differentiator

•

Well positioned to meet

Basel III requirements

DEPLOYMENT

•

Restoring dividend

a priority

•

Evaluate share repurchase

and

potential acquisitions

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management |

11

Forward Focus

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management |

12

Year ended

12/31/00²

Year ended

12/31/10

% Change

Operating-basis revenue

$3.45BN

$8.71BN

+152%

Operating-basis non-US revenue

$0.94BN

$3.18BN

+238%

Employees³

17,281

28,670

+66%

Non-US employees³

3,463

12,518

+261%

Forward Focus

Global Expansion1

1 Financial data presented on an operating-basis (which is adjusted to

exclude, among other things, discount accretion). For a description of operating-basis revenue and resulting

reconciliation, see the Appendix.

2 Data exclude the revenue and employees associated with the Corporate Trust

and Private Asset Management businesses divested in 2002 and 2003, respectively.

3 At period end.

North America

2000

$2.687BN

14,471 Employees

2010

$5.728BN

17,391 Employees

Europe, Middle East, Africa

2000

$0.439BN

1,695 Employees

2010

$2.348BN

8,458 Employees

Asia / Pacific

2000

$0.327BN

1,115 Employees

2010

$0.638BN

2,821 Employees

Revenue in $ |

13

Forward Focus

Global Expansion

European Collective, Pension, Insurance Markets:

$19.1TN¹ European market forecast to grow 5.5%

per year over next 3 years 5

1

Total assets include seven key European markets: UK, Netherlands, Germany, Ireland

/ Luxembourg offshore assets, Italy, Switzerland and France. 2

EFAMA, 9/30/10.

3

Towers Watson Global Pension Study 2010, STT estimates.

4

CEA European Insurance 12/09; Datamonitor

as of 9/10.

5

Collectives, EFAMA, 9/10;

Strategic Insight (1/11); Pensions BCG (1/11); Insurance BCG (1/11).

|

14

Forward Focus

Global Expansion

1

Total assets include seven key European markets: UK, Netherlands, Germany, Ireland

/ Luxembourg offshore assets, Italy, Switzerland and France. 2 AUA

represents all European assets under custody / administration. 3

Sources: Collectives: ICI (12/05); Pensions: Watson Wyatt Global Pension Asset Study (12/05); OECD Pension Market (Italy, (12/05); Insurance: CEA Insurance (12/05).

4 See footnotes 2-4, slide 14. |

15

Forward Focus

Global Expansion |

16

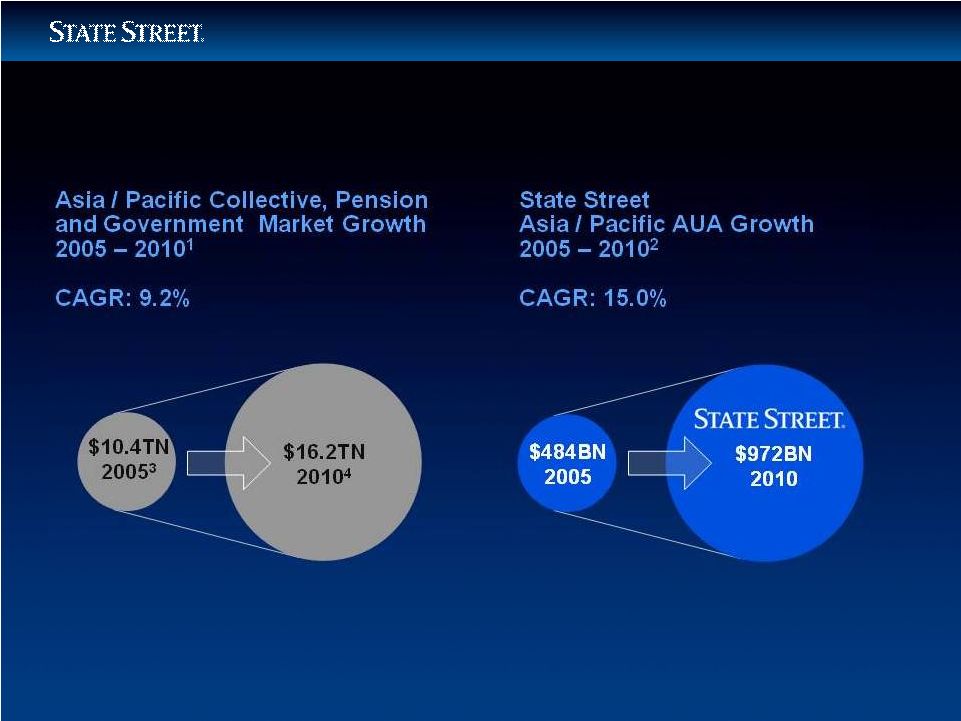

Forward Focus

Global Expansion

1

Total assets include seven key markets: Japan, Australia, Hong Kong, South Korea,

Taiwan, China and Singapore. 2 AUA represents all Asia / Pacific

assets under custody / administration. 3 Sources: Collectives: ICI

(12/05); Pensions: Watson Wyatt Global Pension Asset Study (01/06); Singapore Central Provident Board (12/05); Government: International Financial

Statistics (12/05); Japan Post Bank Annual Reports (03/05); Economist Intelligence

Unit (Taiwan, (12/05); Chungwha Post Bank (12/05); Temasek

Holdings (12/05), GIC (12/05).

4 Sources: see footnotes 2-4, slide 16. |

17

Forward Focus

Global Expansion –

Contribution of Acquisitions

NON-US

ACQUISITIONS

Deutsche Bank’s Global

Securities Services

Established State Street’s leadership position in Europe

Mourant International

Finance Administration

Established State Street as No. 1 servicer of private equity and

hedge funds worldwide

Intesa Sanpaulo

Securities Services

Expanded State Street’s footprint in Europe and established

leadership position in Italy

Bank Of Ireland

Asset Management

Added fundamental capabilities to SSgA’s suite of solutions

(closed 1/11)

OTHER

IFS

Added hedge fund servicing capability

Currenex

Expanded electronic high-speed trading capability

Palmeri

Accelerated State Street’s leadership in private

equity servicing

Investors Financial

Expanded share of mutual fund and hedge fund

servicing markets |

18

Forward Focus

Global Expansion |

19

Forward Focus

•

Aligned against strong secular growth trends

•

Comprehensive global footprint and infrastructure

•

Well positioned in fast-growing markets with significant market share

•

Deep client relationships fueling strong organic growth

•

Opportunistic about acquisitions to expand market share or capabilities

for clients

Summary |

20

Extending Our Leadership

Agenda |

21

Solutions Innovation

Investment Management

1

Pension & Investments 6/28/10.

2

Pensions & Investments 5/31/10.

3

eVestment Alliance 9/30/10.

4 Pensions & Investments 9/20/2010.

5

Pensions & Investments 10/4/2010.

LEADERSHIP TODAY

•

No. 2 in worldwide institutional

asset management¹

•

No. 2 passive manager of domestic

equities and bonds²

•

No. 2 ETF provider¹

•

No. 1 endowment / foundation assets²

•

No. 1 defined benefit assets²

•

No. 1 global equity²

•

No. 1 emerging markets manager³

•

No. 2 index manager

4

•

No. 6 defined contribution assets

5

FORWARD FOCUS

•

Defined Contribution Plans

•

Cash Management

Global Investment

Management Solutions

•

Exchange Traded Funds |

22

Solutions Innovation

Investment Management Solutions

Asia / Pacific

North America

Europe, Middle East

Atlanta

Boston

Chicago

Montreal

New York

Rye Brook, NY

San

Francisco

Wilton, CT

Toronto

Investment Center

Management Office

Global Alliance

Amsterdam

Brussels

London

Paris

Geneva

Frankfurt

Munich

Milan

Dubai

Bangalore

Hong Kong

Melbourne

Seoul

Singapore

Shanghai

Tokyo

Sydney

Dublin

•

10 investment centers; 24-hour global trading capability

•

39% of 2010 operating-basis revenue from non-US sources

Leading Global Asset Manager

As of December 31, 2010. |

23

Solutions Innovation

Investment Management Solutions

$2.0TN AUM

*

* As of December 31, 2010.

Note: Assets in Asset Allocation are not counted in the underlying asset

class. BROAD CAPABILITIES

CLIENTS

•

3,000 global clients

–

37% non-US domiciled

–

24 Central Bank relationships

–

24 Sovereign Wealth Fund clients

•

65% of clients use two or

more strategies

•

86% of new business in 2010 came

from existing SSgA clients

–

65% of new business came from

non-US sources

Cash

$426BN

21%

Other

$28BN

1%

Equities

$655BN

33%

ACTIVE

Fixed

Income

$20BN

1%

Equities

$55BN

3%

PASSIVE

Fixed Income

$361BN

18%

Currency Sub-advised Assets,

Multi-asset Class Solutions $210BN 10%

Exchange Traded Funds

$255BN

13% |

24

Solutions Innovation

Investment Management Solutions

VALUE

PROPOSITION

A broad range of investment solutions

•

Includes active, enhanced, passive, fixed-income, cash, pure

alpha and multi-asset class solutions

•

More than 120 ETFs

Advanced research behind every portfolio

•

Dedicated asset class and credit research teams

•

Advanced Research Center (ARC), with 32 experienced

professionals

Strong performance

•

More than 70%

of all active strategies outperformed their

benchmarks in 2010

•

An efficient passive provider with low tracking error |

25

•

AUM in Defined Contribution plans is projected to grow at a CAGR

of 10% over the

next 5 years as Defined Benefit plans decelerate

*

•

This trend is expected to accelerate as sponsors shift the burden of retirement risk

onto participants

Solutions Innovation

Defined Contribution Plans

*

Source: McKinsey Retirement Practice, 1/11.

Defined Contribution and Defined Benefit Assets

= 100%

41

42

43

45

47

49

52

54

55

58

59

58

57

55

53

51

48

46

45

42

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Defined Benefit

Defined Contribution

15.5

16.3

13.4

14.0

14.5

15.1

15.8

16.5

17.2

18.5

Global

$TN |

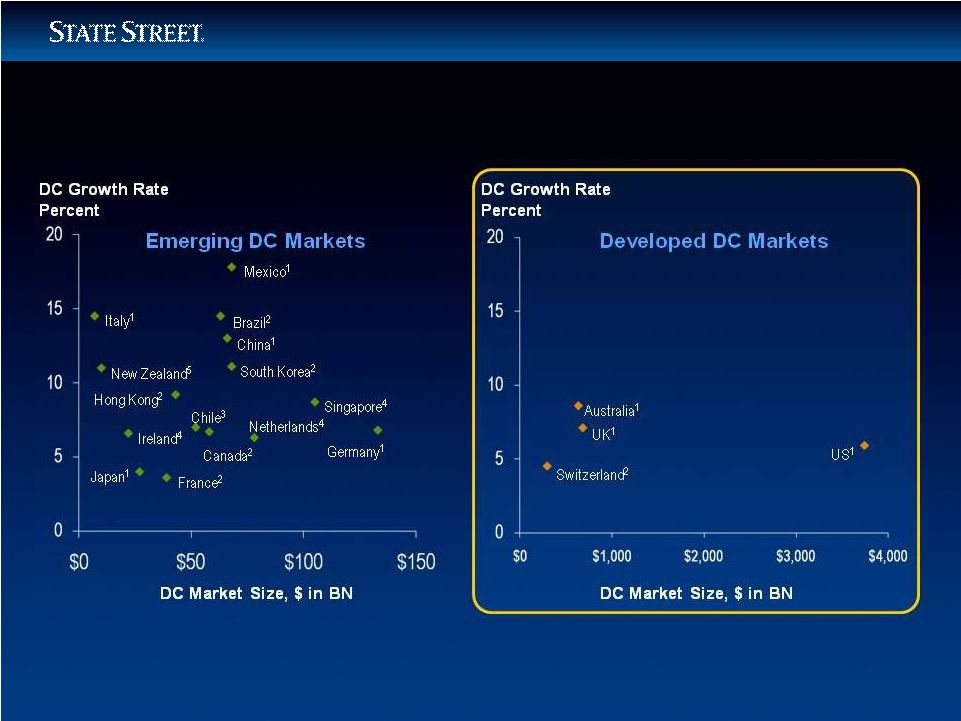

26

Solutions Innovation

Defined Contribution Plans –

Global Growth Rates

1

Using 2008 –

2013 projected DC AUM growth rate (CAGR) from Cerulli.

2

Using 2008 –

2013 projected total pension growth rate (CAGR) from Cerulli.

3

Using 2004 –

2008 historic DC AUM growth rate (CAGR) from Cerulli.

4 Using 1998 –

2008 historic total pension growth rate (CAGR) from Watson Wyatt.

5

Using 2001 –

2007 historic total pension growth rate (CAGR) from IFSL.

Source: McKinsey Retirement Practice; Cerulli; IFSL; Watson Wyatt; WMM; team

analysis. |

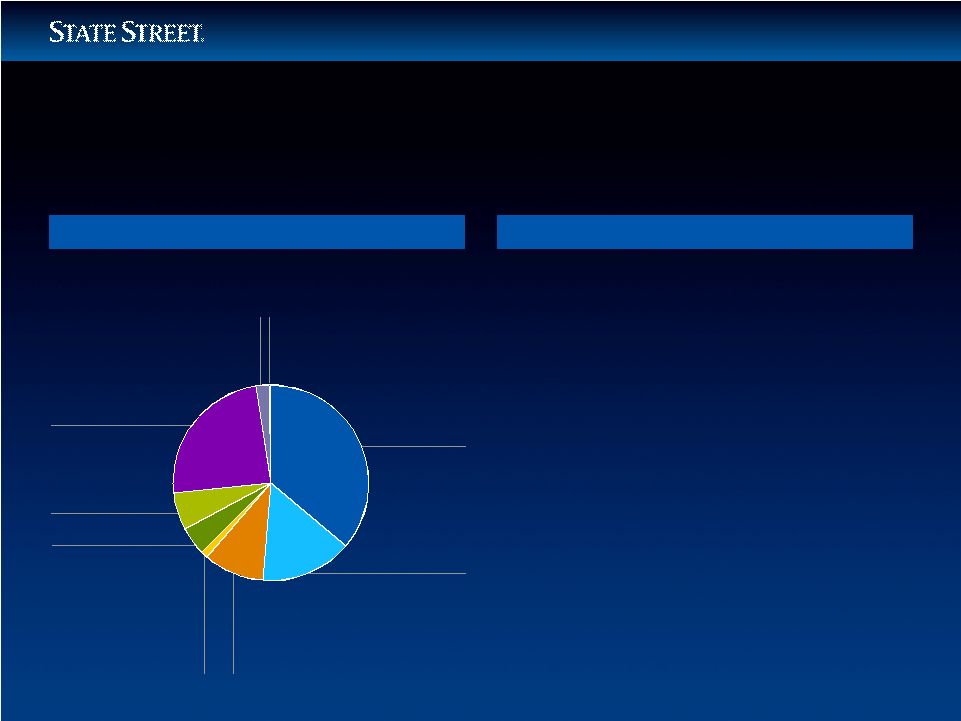

27

International

Equities

$30BN

15%

Solutions Innovation

Defined Contribution Plans

Company Stock

Management

$49BN

24%

Cash

$4BN

2%

Alternative Indices*

$1BN

1%

Balanced

$12BN

6%

Target Date

$10BN

5%

Stable Value

$2BN

1%

Fixed Income

$20BN

10%

US Equities

$72BN

36%

BROAD CAPABILITIES

VALUE PROPOSITION

•

Trends favoring transparency and

passive offerings

•

More than 30 years of experience in

the Defined Contribution market

•

Extensive product offerings across all

major asset classes and risk spectrum

•

Top-performing Target Date Funds

•

Opportunity to cross sell into

extensive defined-benefit client base

$200BN AUM*

* As of 12/31/10. |

28

Solutions Innovation

Cash Management

GLOBAL MARKET SIZE

Cash AUM

Projected Growth in Cash

*

5-Year CAGR = 3%

$TN

*

Source: Cerulli, 6/10.

7.4

7.7

8.0

8.2

8.4

8.5

$6

$7

$8

$9

2009

2010E

2011E

2012E

2013E

2014E |

29

Separate

Accounts

45%

Solutions Innovation

Cash Management

BROAD CAPABILITIES

VALUE PROPOSITION

•

Broad global experience managing

cash in six locations and seven

currencies worldwide

•

Full range of global risk-controlled

cash options

•

Significant credit research and

portfolio management resources

•

Opportunities to cross-sell liquidity

management solutions to existing

corporate, sovereign wealth fund and

central bank clients

*

As of 12/31/10.

Registered

Funds

26%

Pooled Account

and Other

29%

$426BN* AUM |

30

ETF and Other Exchange-Traded Products AUM

1,2

5-yr CAGR¹: 26.7%

$0

$1

$2

$3

$4

$5

2010

2011

2012

2013

2014

2015

Solutions Innovation

Exchange-Traded Funds –

Global AUM Growth Forecast1

$TN

1.5

1.8

2.3

2.9

3.7

4.7

1 The global forecast includes estimates for Americas, Europe, Asia (ex-Japan) plus all other

regions (e.g. Japan, Mideast, etc.). 2 Includes all

exchange-traded products (e.g., ETF, ETN, ETC) and baseline steady state growth (no shocks to system).

Source: ETF Landscape Year-end 2010, industry reports, McKinsey analysis as of 1/2011.

|

31

Solutions Innovation

Exchange-Traded Funds -

Continued Growth and Innovation

$255BN in Global ETF AUM¹

Sector

$51BN

Size

(e.g. Large, Mid, Small Cap)

$115BN

Fixed Income

$16BN

Commodity

$58BN

Dividend /

Fundamental / Other

$7BN

1 As of 12/31/10.

2 Annual ETF Global Awards, 4/10.

BROAD CAPABILITIES

VALUE PROPOSITION

•

Pioneered market in 1993 by launching

the first US-listed ETF

•

SPDR

®

is “most recognized”

brand²

–

Represents more than 100 global

offerings across asset classes and

geographies

•

Committed to service and support of

investment professionals

–

56 product, strategy, and marketing

professionals

–

78 sales professionals

•

Institutional caliber products and

services traditionally available in “pure

institutional”

arena, now available to

sophisticated investment professionals

International

$8BN |

32

Solutions Innovation

•

Well positioned against large fast-growing market segments

•

Leveraging core competencies

•

Extensive global footprint

•

Deep, long-standing relationships with world’s leading institutions

•

Ability to cross-sell to existing State Street clients

Summary |

33

Extending Our Leadership

Agenda |

34

Operations & IT Transformation

LEADERSHIP TODAY

•

Global footprint

•

Global platform

•

Secure, reliable infrastructure

•

World-class Lean skills

•

Shared service / COE

operating model

FORWARD FOCUS

Enabling Productivity

Accelerating Innovation

Supporting Growth

Benefiting Clients |

35

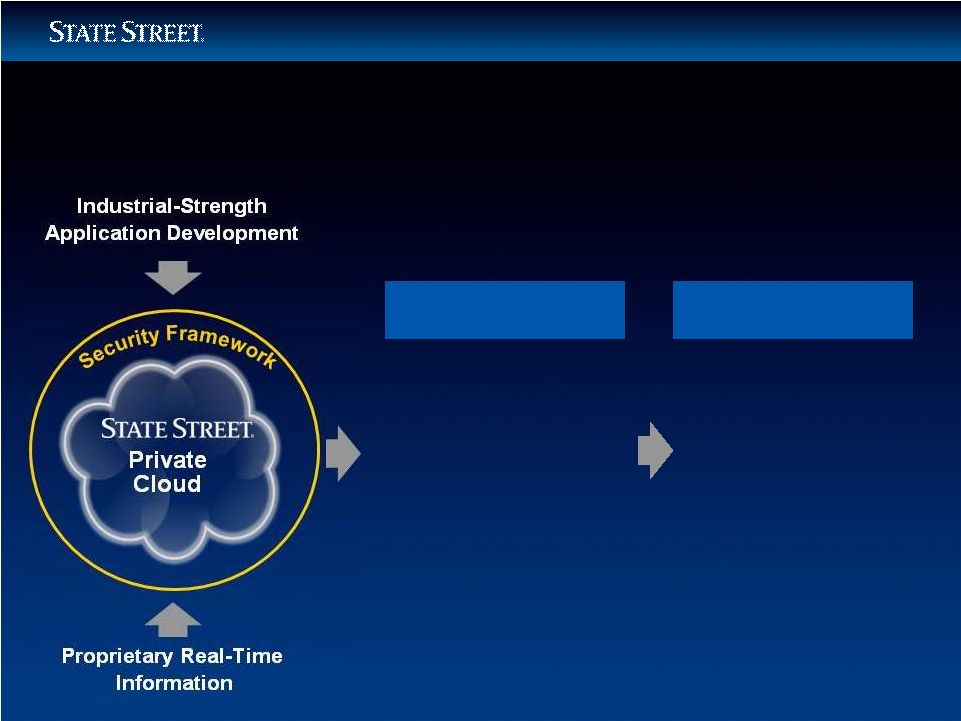

Operations & IT Transformation

•

Deploy leading-edge

technologies to fuel

innovation

•

Shift to new, private cloud

computing paradigm

•

Leverage Lean to standardize

processes and platforms

•

Improve speed to market

and enhance service delivery

•

Deliver real-time analytics

and data

Supporting Growth –

Program Profile |

36

Operations & IT Transformation

Supporting Growth –

Program Profile

*

National Institute of Standards and Technology.

Lean*

A systematic approach to identifying

and eliminating waste through

continuous improvement, flowing the

product at the pull of the customer in

pursuit of perfection

Cloud Computing*

A model for enabling convenient,

on-demand network access to a shared

pool of configurable computing

resources (e.g. networks, servers,

storage, applications, and services) that

can be rapidly provisioned and released

with minimal management effort or

service provider interaction |

37

Operations & IT Transformation

Enabling Productivity

Service Excellence

Client-backed model

World class engineering

Follow the sun model

Resource Optimization

Functional centers

of excellence (COEs)

Capacity on demand

Right-shore talent by

location

Process Standardization

Global processes for

the core

More efficient

organization

LEAN METHODOLOGIES

GLOBAL FLEXIBLE

WORKFORCE

Fact-Based

Engineering Approach

Technology investment

based on detail analysis

Higher productivity |

38

Operations & IT Transformation

Accelerating Innovation

•

Automation / capacity on

demand

•

Accelerated time

to market

•

Integrated security

environment

•

Real-time data

infrastructure

•

Advanced platform for

product innovation

•

Strengthened client

service

KEY BENEFITS

•

Custom analytics and

data

•

Risk and control

Services

•

Performance,

compliance and

advisory services

NEW PRODUCTS

AND SERVICES |

39

Operations & IT Transformation

Benefiting Clients

Leading Multi-Asset Global Investment Manager

Benefits

Today

Future Plan

STATE STREET

SERVICE DELIVERY

Speed and Agility

•

New test systems and

applications take 3 to 6

weeks to deploy

•

New test systems

and applications

take minutes to

deploy

•

Aggregate data views

available end of day

•

Aggregate data view

real time

Innovation

•

Managing multiple

data feeds and inputs

including external data

providers

•

Holistic real-time

reporting with risk

and analytics

capabilities

•

Enhanced controls

and reporting to

deliver component

solutions

•

A cloud-enabled life

cycle solution with

on demand capacity |

40

Operations & IT Transformation

Progress to Date

PRIVATE CLOUD

•

Global pilot conducted in 2010

•

Multiple independent reviews

•

Security parameters successfully tested

LEAN

•

700 Lean professionals trained

•

33 projects completed in ’09 and ’10

CENTERS OF

EXCELLENCE

•

Key processing centers established in China, India and Poland

•

Core functions aligned against client needs / demand

GLOBAL FLEXIBLE

WORFORCE

•

4,800

employees in China, India & Poland*

•

Ability to move work from center of excellence to enhance client

service and reduce cost

*

As of 12/31/10. Includes JV in India. |

41

Operations & IT Transformation

Financial Profile

NET BENEFIT

•

Expect to achieve annual pre-tax run rate of $575MN to $625MN

by the end of 2014

CUMULATIVE NET

OPERATING

IMPACT

•

2011: slight benefit

•

2012: about 1/3 of the total expected

•

2013: about 2/3 of the total expected

•

2014: 100% of total expected

IMPLEMENTATION

EXPENSES

•

Incremental costs to range between $15MN to $20MN per

quarter

•

Costs are expected to peak in 2012 and trail off in 2014

RESTRUCTURING

CHARGES

•

Expect about $400MN to $450MN

–

$156MN in 2010

•

Expect charges to peak in 2012, similar to the ramp of the

implementation expenses

2011 –

2014 |

42

Operations & IT Transformation

•

Strengthens service excellence

•

Heightens introduction of new products and services

•

Accelerates time to market

•

Enables flexible global workforce

•

Enhances data security

Summary |

43

Extending Our Lead

Agenda |

44

Risk and Capital Management

Capital

NEW WORLD

NEW RULES

•

Adjusting to new global

evolving capital

requirements

•

Developing best-in-class

capabilities

SOURCES OF

CAPITAL

•

Strong organic

capital generator

USES OF

CAPITAL

•

Reinstating dividend

a priority

•

Evaluating share repurchase

program and potential

acquisitions

WELL-

POSITIONED

PORTFOLIO

•

Strategically repositioned

portfolio in 2010

•

90% of assets rated

AAA / AA

*

•

Recent actions better

prepared STT for Basel III

ahead of implementation

dates

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management

*

As of 12/31/10. |

45

Risk and Capital Management

Capital Ratios

State Street Corporation

“Well

Capitalized”¹

12/31/10

Actual

under Basel I

12/31/10

Adjusted to reflect

Basel III proposal

5

Tier 1 Leverage

5.0%²

8.2%

5.9%

Tier 1 Capital

6.0%

20.5%

10.6%

Tier 1 Common Ratio³

----

18.1%

9.4%

Total Capital

10.0%

22.0%

11.6%

Tangible Common Equity

4

----

7.6%

7.6% |

46

Risk and Capital Management

Transition from Basel I to Basel III Regulations

CAPITAL CHANGES

•

FAS 115 (unrealized loss) and FAS 158 (pension funding)

no longer added back

•

Trust preferred and subordinated debt phased out

•

Deferred tax assets treated less restrictively

•

Revised methodology for expected credit losses

RISK-WEIGHTED

ASSET CHANGES

•

Model for operational risk internally driven

•

Changes to risk weightings related to credit risk

•

Asset securitization deduction

AVERAGE ASSETS

•

Off-balance sheet loan commitments

•

Stand-by purchase agreements

•

Derivative exposures included |

47

Extending Our Lead

Agenda |

48

Financial Update

Business

2010 New Wins

*

($BN)

Installed through Q4

($BN)

To be Installed

($BN)

US Asset Servicing

$911.4

$640.2

$271.2

Non-US Asset Servicing

$454.8

$335.5

$119.3

Total Asset Servicing

$1,366.2

$975.7

$390.5

US Asset Management

$88.7

$63.8

$24.9

Non-US Asset Management

$70.5

$55.4

$15.1

Total Asset Management

$159.2

$119.2

$40.0

Revenue Drivers –

Winning New Business

*

Assets as of 12/31/10. |

49

SECURITIES

FINANCE

•

Average assets on loan over the past six quarters were $397BN per

quarter, with NYSE short interest below historic levels

•

2011 outlook is cautious:

–

Volumes declined from Q3 2010 level to $368B in Q4 2010

–

Rate environment (FF to 3-month LIBOR) remains compressed

•

From Q1 ’07 to Q4 ’10 our global market share increased from 21% to

almost 26%¹

FOREIGN

EXCHANGE

•

Q4 volumes annualized ($3.0TN) tracking above 2009 level ($2.9TN),

but not at level of 2007 and 2008, averaged ($3.3TN)

–

Improvement in volume from 2009 based on modest increase in

cross-border trading and re-risking by equity managers

•

Average annual volatility in ’10 (1.06%) is below the average level in

’09 (1.34%) and ’08 (1.39%)²

Financial Update

Market-Driven Revenues

1 Based on data from Data Explorers Universe as of period end.

2 Based on customer-weighted volumes. |

50

Financial Update

Balance Sheet Management

AS OF 12/31/10

•

Total Balance Sheet: $161BN; normalized: $144BN

*

-

Duration gap: 0.53 years

•

Investment Portfolio: $95.3BN

-

Duration: 1.7 years

-

Unrealized after-tax loss of $504MN, down 78%

from 12/31/09

•

Liabilities: Customer driven

•

Reinvestment Strategy

-

Re-invested $7BN of the $11BN from the securities sold in

December, 2010

-

Expect about $15BN to mature or pay down in 2011

-

Expect to purchase primarily Treasuries and Agencies, as

well as AAA-

and AA-rated asset-backed and mortgage-

backed securities

*

Excludes $17BN in excess deposits held at the Federal Reserve and other central

banks. |

51

ASSUMPTIONS

FOR 2011

•

Worldwide administered rates remain unchanged

•

Steepness of yield curve remains at its current level

•

Average earning assets expected to increase modestly from the 2010 level

•

Ratio of Fixed / Floating assets in the investment portfolio = about 45% / 55%

Financial Update

Net Interest Revenue / Net Interest Margin |

52

Financial Update

Disciplined Expense Control

Objective

•

Achieve positive operating leverage on an annual basis

Recent Past

•

Focused on expense discipline

–

Streamlined levels of management

–

Implemented Lean processes throughout the organization

–

Ran technology expenses at lower end of 20% to 25% range

Future

•

Implement operations/IT transformational program to achieve:

–

Increased efficiency

–

Improved processes

–

Optimization of global footprint

•

Short-term expect modest pressure from increased regulatory costs

|

53

Financial Update

•

Continued strength in servicing fee revenue

•

Modest improvement in management fee revenue as investors begin

to re-risk

•

Conservative approach to addressing market-driven revenue

•

Balance sheet to generate 155 to 165 BPS of NIM

•

Increased capital flexibility

•

Disciplined expense control

•

Focused on executing multi-year plan to transform our business model

through technological innovation

Expectations Driving 2011 Outlook |

54

Extending our Leadership

Agenda |

55

Summary

•

Global Services

–

Leader in servicing

solutions for asset

managers and

asset owners

•

Global Markets

–

Pioneer in

electronic trading

and portfolio

solutions

•

Global Advisors

–

Well positioned

in high-growth

markets

•

Secular Trends

Support Growth

•

Global Scale

•

Deep Client

Relationships

•

Strong Momentum

in Core Business

CORE BUSINESS

WELL-POSITIONED

Solutions Innovation

Operations & IT Transformation

Global Expansion

Risk and Capital Management

FORWARD FOCUS |

Non-GAAP Financial Measures

This presentation includes financial information presented on a GAAP basis as well as on an operating basis. Operating-basis financial information is a non-GAAP presentation. Management measures and compares certain financial information on an operating basis, as it believes that this presentation supports meaningful comparisons from period to period and the analysis of comparable financial trends with respect to State Street’s normal ongoing business operations. Management believes that operating-basis financial information, which reports revenue from non-taxable sources on a fully taxable-equivalent basis and excludes the impact of revenue and expenses outside of the normal course of business, facilitates an investor’s understanding and analysis of State Street’s underlying financial performance and trends in addition to financial information prepared in accordance with GAAP.

This presentation also includes capital ratios in addition to, or adjusted from, those calculated in accordance with applicable regulatory requirements. These include capital ratios based on tier 1 common capital and capital ratios adjusted to reflect our estimate of the application of the Basel III capital requirements. These non-regulatory and adjusted capital measures are non-GAAP financial measures. Management presently evaluates the non-GAAP capital ratios presented in this presentation to aid in its understanding of State Street’s capital position under a variety of standards, including presently applicable and evolving regulatory requirements. Management believes that the use of the non-GAAP capital ratios described in this presentation similarly aids in an investor’s understanding of State Street’s capital position and therefore is of interest to investors.

In addition to the reconciliations described in the descriptions on the next slide of the capital ratios referenced in this presentation, the Appendix to this presentation also includes reconciliations of the following other non-GAAP financial measures referenced in this presentation: operating-basis results to GAAP-basis results and Basel III-adjusted capital ratios to capital ratios calculated under presently applicable requirements.

Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP and capital ratios determined in accordance with presently applicable regulatory requirements.

56

Capital Ratios

The total capital, the tier 1 capital, and the tier 1 leverage ratios are capital ratios used regularly by bank regulatory authorities to evaluate State Street’s capital adequacy. The tier 1 common ratio is sometimes used by the Federal Reserve in connection with its supervisory capital assessment programs. The TCE ratio is another capital ratio management believes provides additional context for understanding and assessing State Street’s capital adequacy.

The total capital, the tier 1 risk-based capital, or tier 1 capital, and tier 1 leverage ratios, as applicable, are each calculated in accordance with applicable bank regulatory requirements.

The tier 1 risk-based common, or tier 1 common, ratio is calculated by dividing (a) tier 1 capital less non-common elements including qualifying perpetual preferred stock, qualifying minority interest in subsidiaries and qualifying trust preferred securities, by (b) total risk-weighted assets, which assets are calculated in accordance with applicable bank regulatory requirements. The tier 1 common ratio is not required by GAAP or on a recurring basis by bank regulations. Management is currently monitoring this ratio, along with the other capital ratios described in this presentation, in evaluating State Street’s capital levels and believes that, at this time, the ratio may be of interest to investors. A reconciliation with respect to tier 1 common capital as of December 31, 2010 is provided in the Appendix.

The ratio of tangible common equity to adjusted tangible assets, or TCE ratio, is calculated by dividing consolidated total common shareholders’ equity by consolidated total assets, after reducing both amounts by goodwill and other intangible assets net of related deferred taxes. Total assets reflected in the TCE ratio also exclude cash balances on deposit at the Federal Reserve Bank and other central banks in excess of required reserves. The TCE ratio is not required by GAAP or by bank regulations, but is a metric used by management to evaluate the adequacy of State Street’s capital levels. Since there is no authoritative requirement to calculate the TCE ratio, our TCE ratio is not necessarily comparable to similar capital measures disclosed or used by other companies in the financial services industry. Tangible common equity and adjusted tangible assets are non-GAAP financial measures and should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP. Reconciliations with respect to the calculation of the TCE ratio as of December 31, 2010 are provided in the Appendix.

57

STATE STREET CORPORATION

RECONCILIATION OF REPORTED RESULTS TO OPERATING-BASIS RESULTS

State Street prepares its consolidated financial statements in accordance with accounting principles generally accepted in the United States, or GAAP.

State Street also presents certain financial information on an “operating” basis as well as a GAAP, or reported, basis. Management measures and compares certain financial information on an operating basis, as it believes that this presentation supports meaningful comparisons from period to period and the analysis of comparable financial trends with respect to State Street’s normal ongoing business operations. Management believes that operating-basis financial information, which reports revenue from non-taxable sources on a fully taxable-equivalent basis and excludes the impact of revenue outside of the normal course of business, facilitates an investor’s understanding and analysis of State Street’s underlying financial performance and trends in addition to financial information prepared in accordance with GAAP.

| (Dollars in millions) |

Year Ended December 31, 2000 | Year Ended December 31, 2010 | % Change | |||||||||||||||||||||||||

| 2010 | ||||||||||||||||||||||||||||

| Reported | Operating - Basis | Reported | Operating - Basis | vs | ||||||||||||||||||||||||

| Results | Adjustments | Results | Results | Adjustments | Results | 2000 | ||||||||||||||||||||||

| Total fee revenue |

$ | 2,690 | $ | (206 | )(1) | $ | 2,484 | $ | 6,540 | $ | 6,540 | |||||||||||||||||

| Net interest revenue |

894 | 65 | (2) | 959 | 2,699 | $ | (583 | )(3) | 2,116 | |||||||||||||||||||

| Gains related to investment securities, net |

2 | 2 | (286 | ) | 344 | (4) | 58 | |||||||||||||||||||||

| Total revenue |

$ | 3,586 | $ | (141 | ) | $ | 3,445 | $ | 8,953 | $ | (239 | ) | $ | 8,714 | 152.9 | % | ||||||||||||

| (1) | Represents revenue associated with the Corporate Trust and Private Management businesses divested in 2002 and 2003, respectively. |

| (2) | Represents tax-equivalent adjustment of $65 million, which is not included in reported results. |

| (3) | Represents tax-equivalent adjustment of $129 million, which is not included in reported results, net of $712 million of discount accretion related to former conduit assets. |

| (4) | Represents a net sale loss related to a restructuring of the investment portfolio. |

58

STATE STREET CORPORATION

Tangible Common Equity and Tier 1 Common Ratios - Reconciliations

As of Period End

The ratio of tangible common equity to adjusted tangible assets, or TCE ratio, is calculated by dividing consolidated total common shareholders’ equity by consolidated total assets, after reducing both amounts by goodwill and other intangible assets net of related deferred taxes. Total assets reflected in the TCE ratio also exclude cash balances on deposit at the Federal Reserve Bank and other central banks in excess of required reserves. The TCE ratio is not required by GAAP or by bank regulations, but is a metric used by management to evaluate the adequacy of State Street’s capital levels. Since there is no authoritative requirement to calculate the TCE ratio, our TCE ratio is not necessarily comparable to similar capital measures disclosed or used by other companies in the financial services industry. Tangible common equity and adjusted tangible assets are non-GAAP financial measures and should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP.

The tier 1 risk-based common, or tier 1 common, ratio is calculated by dividing tier 1 capital, which is calculated in accordance with applicable bank regulatory requirements, less non-common elements, including qualifying trust preferred securities, by total risk-weighted assets, which assets are also calculated in accordance with applicable bank regulatory requirements. The tier 1 common ratio is not required by GAAP or on a recurring basis by bank regulations. However, this ratio has been used by the Federal Reserve in connection with its evaluation of the capital adequacy of certain large U.S. bank holding companies. In addition, management is currently monitoring this ratio, along with the other capital ratios, in evaluating State Street’s capital levels and believes that, at this time, the ratio may be of interest to investors.

The table set forth below presents the calculations of State Street’s ratios of tangible common equity to total tangible assets and tier 1 common capital to total risk-weighted assets.

| December 31, | ||||||||

| (Dollars in millions) |

2010 | |||||||

| Consolidated Total Assets |

$ | 160,505 | ||||||

| Less: |

||||||||

| Goodwill |

5,597 | |||||||

| Other intangible assets |

2,593 | |||||||

| Excess reserves held at central banks |

16,612 | |||||||

| Adjusted assets |

135,703 | |||||||

| Plus deferred tax liabilities |

747 | |||||||

| Total tangible assets |

A | $ | 136,450 | |||||

| Consolidated Total Common Shareholders’ Equity |

$ | 17,787 | ||||||

| Less: |

||||||||

| Goodwill |

5,597 | |||||||

| Intangible assets |

2,593 | |||||||

| Adjusted equity |

9,597 | |||||||

| Plus deferred tax liability |

747 | |||||||

| Total tangible common equity |

B | $ | 10,344 | |||||

| Tangible common equity ratio |

B/A | 7.6 | % | |||||

| Tier 1 capital |

$ | 12,318 | ||||||

| Less trust preferred securities |

1,450 | |||||||

| Tier 1 common capital |

C | $ | 10,868 | |||||

| Total risk-weighted assets |

D | 60,177 | ||||||

| Ratio of tier 1 common capital to total risk-weighted assets |

C/D | 18.1 | % | |||||

59

STATE STREET CORPORATION

BASEL III CAPITAL RECONCILIATION

December 31, 2010

| Current Requirements (1) | Basel III Requirements (3) | |||||||||

| (Dollars in millions) |

||||||||||

| Tier 1 capital |

$ | 12,318 | A | $ | 11,460 | |||||

| Less trust preferred securities |

1,450 | 1,305 | ||||||||

| Tier 1 common capital |

10,868 | B | 10,155 | |||||||

| Total capital |

13,225 | C | 12,441 | |||||||

| Total risk-weighted assets |

60,177 | D | 107,672 | |||||||

| Adjusted quarterly average assets |

150,768 | E | 195,768 | |||||||

| Total tangible common equity (2) |

10,344 | F | 10,344 | |||||||

| Total tangible assets (2) |

136,450 | G | 136,450 | |||||||

| Tier 1 capital ratio |

20.5 | % | A/D | 10.6 | % | |||||

| Total capital ratio |

22.0 | % | C/D | 11.6 | % | |||||

| Tier 1 common ratio |

18.1 | % | B/D | 9.4 | % | |||||

| Tier 1 leverage ratio |

8.2 | % | A/E | 5.9 | % | |||||

| Tangible common equity ratio (2) |

7.6 | % | F/G | 7.6 | % | |||||

| (1) | Actual (unaudited) total capital, tier 1 capital and tier 1 leverage ratios were calculated in accordance with currently applicable bank regulatory requirements. Tier 1 common ratio was calculated by dividing (a) tier 1 capital less non-common elements including qualifying perpetual preferred stock, qualifying minority interest in subsidiaries and qualifying trust preferred securities (tier 1 common capital), by (b) total risk-weighted assets, which were calculated in accordance with currently applicable bank regulatory requirements. |

| (2) | The ratio of tangible common equity to adjusted tangible assets, or TCE ratio, is calculated by dividing consolidated total common shareholders’ equity by consolidated total assets, after reducing both amounts by goodwill and other intangible assets net of related deferred taxes. Total assets reflected in the TCE ratio also exclude cash balances on deposit at the Federal Reserve Bank and other central banks in excess of required reserves. The TCE ratio is not required by GAAP or by bank regulations, but is a metric used by management to evaluate the adequacy of State Street’s capital levels. |

| (3) | For purposes of the calculations in accordance with Basel III (see below), total capital, tier 1 capital and tier 1 leverage ratios and total risk-weighted assets were calculated based on State Street’s estimates, based upon published statements of the Basel Committee and the Federal Reserve, of the effects of the requirements under Basel III affecting capital. The tier 1 common ratio is calculated by dividing (a) tier 1 common capital (as described in footnote (1)), but with tier 1 capital calculated in accordance with Basel III by (b) total risk-weighted assets, which are calculated in accordance with Basel III. State Street reports its financial ratios in accordance with the requirements of the Board of Governors of the Federal Reserve System, which has not yet adopted Basel III. There remains considerable uncertainty concerning the timing for adoption and implementation of Basel III by the Federal Reserve. When adopted, the Federal Reserve may implement Basel III with some or more modifications or adjustments. Therefore, State Street’s current understanding of Basel III, as reflected in the table above, may be different from the ultimate application of Basel III by the Federal Reserve to State Street. |

| • | Tier 1 capital used in the calculation of the tier 1 capital and tier 1 leverage ratios decreased by $858 million, as a result of applying estimated Basel III requirements to tier 1 capital of $12.318 billion as of December 31, 2010. Total capital used in the calculation of the total capital ratio decreased by $784 million, as a result of applying estimated Basel III requirements to total capital of $13.225 billion as of December 31, 2010. |

| • | Tier 1 common capital used in the calculation of the tier 1 common ratio was $10.155 billion, reflecting the adjustments to tier 1 capital described in (A) above. Tier 1 common capital used in the calculation is therefore calculated as adjusted tier 1 capital of $11.460 billion less non-common elements of capital, composed of trust preferred securities of $1.305 billion as of December 31, 2010, resulting in tier 1 common capital of $10.155 billion. At December 31, 2010, there was no qualifying perpetual preferred stock or qualifying minority interest in subsidiaries. |

| • | Total risk-weighted assets used in the calculation of the total capital, tier 1 capital and tier 1 common ratios increased by $47.495 billion as a result of applying estimated Basel III requirements to total risk-weighted assets of $60.203 billion as of December 31, 2010. |

| • | Consolidated adjusted quarterly average assets used in the calculation of the leverage ratio increased by $45.000 billion as a result of applying estimated Basel III requirements to the actual consolidated adjusted quarterly average assets as of December 31, 2010 of $150.896 billion. |

60

61 |

62 |