Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF MCGLADREY & PULLEN, LLP. - LIGHTING SCIENCE GROUP CORP | dex231.htm |

| EX-24.1 - POWER OF ATTORNEY. - LIGHTING SCIENCE GROUP CORP | dex241.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 10, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIGHTING SCIENCE GROUP CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 3646 | 23-2596710 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1227 South Patrick Drive, Building 2A

Satellite Beach, Florida 32937

(321) 779-5520

(Address and telephone number of principal executive offices)

Lighting Science Group Corporation

Attention: Gregory T. Kaiser, Chief Financial Officer

1227 South Patrick Drive, Building 2A

Satellite Beach, Florida 32937

(321) 779-5520

(Name, address and telephone number of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Greg R. Samuel, Esq. Haynes and Boone, LLP 2323 Victory Avenue, Suite 700 Dallas, TX 75219 (214) 651-5000 Fax: (214) 200-0577 |

Marc D. Jaffe, Esq. Rachel W. Sheridan, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 Fax: (212) 751-4864 |

Approximate date of proposed sale to public: As soon as practicable on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee (1)(2) | ||

| Common Stock, $0.001 par value per share |

$150,000,000 | $17,415.00 | ||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes shares that the underwriters have the option to purchase to cover overallotments, if any. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated , 2011

Shares

Common Stock

Lighting Science Group Corporation is offering shares of its common stock. We intend to apply to have our common stock listed on the NASDAQ stock market under the symbol “LSGC.” We anticipate that the public offering price will be between $ and $ per share.

Our common stock is currently traded on the Over-the-Counter Bulletin Board under the symbol “LSCG.OB.”

Investing in our common stock involves risks. See “Risk factors” beginning on page 9 of this prospectus.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Lighting Science Group Corporation. |

$ | $ | ||||||

| (1) | We expect to enter into an agreement with Moelis & Company LLC pursuant to which we would pay Moelis & Company LLC a fee of $200,000 for financial advisory services in connection with this offering, and which we have not included in the underwriting discounts and commissions. |

We have granted the underwriters the right to purchase up to an additional shares of our common stock to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on , 2011.

Joint Book-Running Managers

| Credit Suisse | J.P.Morgan |

Co-Managers

| Stifel Nicolaus Weisel | Moelis & Company | Piper Jaffray |

, 2011

Table of Contents

| 1 | ||||

| 6 | ||||

| 7 | ||||

| 9 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

32 | |||

| 53 | ||||

| 70 | ||||

| 77 | ||||

| 93 | ||||

| 95 | ||||

| 101 | ||||

| 104 | ||||

| Material U.S. federal income and estate tax considerations for non-U.S. holders |

106 | |||

| 109 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. If you receive any information not authorized by us, then you should not rely on it.

We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

i

Table of Contents

Overview

We design, develop, manufacture and market general illumination products that exclusively use LEDs as their light source. Our broad product portfolio includes LED-based retrofit lamps (replacement bulbs) that can be used in existing light fixtures and sockets, as well as purpose-built LED-based luminaires (light fixtures) for many common indoor and outdoor residential, commercial, industrial and public infrastructure lighting applications. Our proprietary technology, differentiated design approach and key relationships throughout the LED lighting supply chain position us well as general illumination continues its transition to the use of LEDs as a replacement for existing lighting technologies.

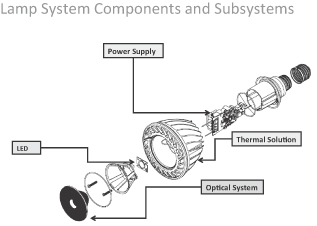

We are a technology integrator with intricate knowledge of each of the main component technologies used in our products. Our in-house design and development of power supplies, thermal management solutions and optical systems used in our products along with our detailed specification of the packaged LEDs we incorporate into our products, provides us with a distinctive ability to manage the interrelationships between these components and subsystems. This system-based approach, combined with our thorough understanding of the requirements of each lighting application our products are designed to address, enables us to provide a broader and more relevant range of products that we believe deliver industry-leading performance offering shorter payback periods relative to the products of our competitors. This performance advantage is measured by the combination of higher efficacy, as calculated by lumens of light delivered per watt of power consumed, or lm/W, light quality and reliability. As we continue to improve all of these product attributes, we believe we will help drive, and benefit from, the accelerating use of LEDs in general illumination as a replacement for existing lighting technologies.

As a pioneer in our industry, we have been producing and selling LED-based lighting products for nearly a decade. We assemble and manufacture our products both internally and through our contract manufacturer in Asia. Our internal manufacturing operations are currently based in our Monterrey, Mexico site, which commenced production in November 2010, and our Satellite Beach, Florida headquarters. Our revenue for the three months ended September 30, 2010 was $15.1 million, representing an increase of 96.6% over the same period in the prior year. In order to meet the recent and expected growth in demand for our products, we have increased our headcount, including contractors, to approximately 600 as of December 31, 2010 from 210 as of December 31, 2009.

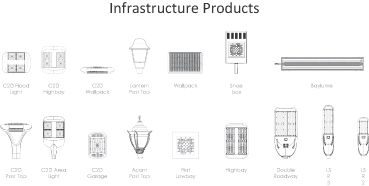

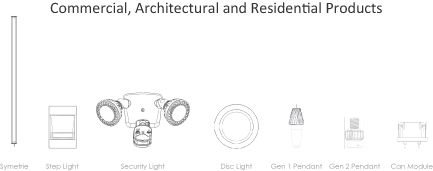

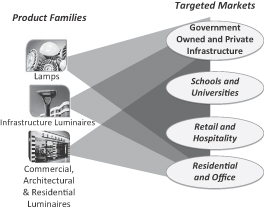

Products and applications

Our extensive product portfolio includes three distinct product families (lamps; infrastructure luminaires; and commercial, architectural and residential luminaires), as well as custom lighting solutions. We tailor our product offerings to specific applications in our target markets which include: (i) government-owned and private infrastructure, (ii) schools and universities, (iii) retail and hospitality and (iv) residential and office.

The LED retrofit lamps we produce are economically compelling replacements for traditional reflector and globe incandescent and incandescent halogen lamps and are available in a range of form factors and performance specifications to meet particular lighting needs. Our retrofit lamps have been adopted by leading retailers and original equipment manufacturers, or OEMs, of lighting products such as The Home Depot, Inc. and Osram Sylvania Inc. that sell our products on a co-branded or private label basis, as well as by large end-users to whom we sell directly and through distributors, such as Harrah’s Operating Company, Inc., Hilton Hotels Corporation, Simon Property Group, Inc. and Starbucks Corporation. Notably, we are The Home Depot’s preferred provider and product development partner for LED retrofit lamps and luminaires, which are currently sold under its EcoSmart® line on a co-branded basis. With sales of more than one million units during the second half of 2010 alone, we believe we are one of the largest worldwide suppliers of LED retrofit lamps. We also produced the first LED retrofit lamp to be successfully qualified for ENERGY STAR® designation and, as of January 25, 2011, we designed and produced more than 75% of all ENERGY STAR-qualified LED retrofit lamps.

1

Table of Contents

The infrastructure luminaires we produce combine energy efficiency, long life, high lumen output and excellent light distribution, making them ideal for use in parking garages, street lighting, outdoor area lighting, warehouses and manufacturing areas. Our luminaires, which in many cases provide payback periods of less than two years, are sold for use in large-scale infrastructure projects including, among others, those in Salt Lake City, Mexico City and Washington, D.C. We also offer a range of LED luminaires for the commercial, architectural and residential markets, including our line for retail display applications and our soon to be released line of residential luminaires. We sell luminaires through OEMs, distributors, independent sales representatives and our direct sales force. In addition, we offer customized LED lighting solutions to create highly tailored lighting effects for architects, lighting designers and research projects.

Industry background

According to the U.S. Department of Energy, or the DOE, LEDs are the most promising technology for reducing the enormous amount of energy consumed by lighting, which it estimated to account for 25% of all U.S. electricity consumption in 2009. Currently available cool white LED lighting products boast an efficacy of as much as 92 lm/W and last as long as 50,000 hours while currently available warm white LED lighting products have an efficacy of as much as 66 lm/W. This compares to an efficacy of 13 lm/W and lifetime of 1,200 hours for a typical incandescent bulb and 55 lm/W and 10,000 hours for a typical compact fluorescent bulb. Importantly, as the relevant technology continues to improve, the efficiency advantage of LED lighting products will further increase. For example, a March 2010 study from the DOE projects that cool white LED luminaire efficacies will reach 121 lm/W in 2012 and 219 lm/W in 2020. A significant portion of this improvement will be due to efficiencies gained in the areas core to our expertise rather than at the packaged LED level where most of the attention is currently focused.

LEDs have a demonstrated history of rapid adoption in various applications when their total cost of ownership, including both purchase price and ongoing energy and maintenance costs, declines to a point that warrants their use. Reductions in total cost of ownership improve users’ return on investment in LED technology and shorten the payback period for LEDs relative to other lighting technologies. We expect that continuing improvements in LED product efficacy and light quality as well as reductions in their purchase price will further reduce the total cost of ownership for LED lighting products, accelerating their adoption for general illumination. The adoption of LED lighting in general illumination will also benefit from other attributes of LED lighting and evolving market factors. These include an increasing end-user focus on energy efficiency and environmental sustainability; greater demand for enhanced lighting functionality and design differentiation enabled by the smaller size, lower heat output, dimmability, directionality and digital controllability of LED lighting products; greater government and utility financial incentives for energy efficient technologies; government regulations effectively eliminating incandescent bulb sales after certain deadlines in the United States and the European Union; and government support for energy efficient lighting.

In light of these attributes and factors, the market for LED lighting is expected to grow rapidly. A March 2010 report by Strategies Unlimited estimated that the market for packaged LEDs used in general illumination was expected to be approximately $874.0 million in 2010, growing to over $4.3 billion by 2014, representing a compound annual growth rate of approximately 45%. For our retrofit lamps and luminaires, the cost of the packaged LEDs represent on average approximately 35% of their sales prices. Therefore, the market for LED lighting products will be necessarily larger.

2

Table of Contents

Our competitive strengths

We are a leading provider of LED retrofit lamps and luminaires for the general illumination market and believe the following competitive strengths have enabled us to achieve this position:

In-depth understanding of the lighting markets we serve. We have a deep understanding of how multiple components and subsystems function when integrated into LED lighting products under actual operating conditions, as well as knowledge of what attributes end-users truly value for each application our products address. This knowledge is derived from the experience of our management, sales and product development professionals, many of whom have spent the vast majority of their careers at traditional lighting companies and is solidified by our close collaboration with customers from product development through after-market support.

Extensive proprietary technology and know-how. We are a technology integrator with expertise in each of the key technologies used in our products, including power supplies and controls, thermal management solutions, optical systems and LED technology. This expertise is complemented by a portfolio of 121 issued and pending U.S. patents that have been developed over the course of nearly a decade of operations.

Comprehensive system-based approach. We are focused on the profound impact the interrelationships between key components and subsystems have on the performance and cost of our products. Accordingly, we design and develop power supplies, thermal management solutions and optical systems used in our products and specify key attributes of the packaged LEDs we incorporate into our products enabling us to finely tune them to improve their interoperability. We do not believe our competitors have the combination of capabilities and organizational structure to duplicate our design approach.

Broad product portfolio sustained by rapid speed to market. Our modular approach to product development enables us to design and develop optimized components and subsystems that we use in multiple products while maintaining the flexibility to modify key attributes of these subsystems for the specific needs of individual applications. As a result, we believe we are able to cost-effectively design and commercialize a broader range of retrofit lamps and luminaires at a faster rate than many of our competitors. In addition, our ability to rapidly design key components and subsystems around newly introduced packaged LEDs is a key contributor to our speed to market with performance leading products. Given the rapid pace of LED technology improvement and inherent short product cycles, speed to market is a critical competitive advantage.

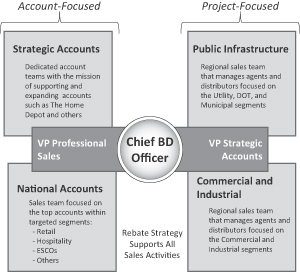

Broad market reach through established channels. Our retrofit lamp business benefits from key retailer and lighting OEM relationships, including with The Home Depot, the largest worldwide seller of light bulbs, and with Osram Sylvania, among others, for the sale of our products on a co-branded or private label basis. In addition, our direct sales force has the knowledge of lighting applications required to sell our retrofit lamps and luminaires directly to large end-users and is not impeded by conflict from legacy lighting businesses. We also maintain an established network of independent sales agents and distributors that expand our geographic coverage and offer support for large projects in the infrastructure and commercial and industrial end markets.

Flexible approach to component sourcing. The flexibility of our product designs and our ability to facilitate rapid design adjustments limit our dependence on any single technology or vendor in our supply chain. This latitude in our component sourcing, particularly for packaged LEDs, enables us to mitigate supply risk through a multi-sourcing strategy and enhances our pricing leverage. It also helps insulate us from potential technology changes that represent significant risk to less adaptable competitors.

Experienced personnel with proven ability to drive our strategies. Our long-standing focus on research and commercialization of LED lighting has been a guiding force in building our roster of talent. As a result, our senior management team consists of long-tenured lighting industry professionals as well as LED technology

3

Table of Contents

veterans. Our research and development team includes approximately 50 research scientists and engineers with Ph.D.s or master’s degrees in a range of disciplines relevant to the development of LED lighting products. Similarly, our sales and marketing team has prior experience in our markets and channels at traditional lighting companies.

Our strategies

Our objective is to leverage our leadership position in LED lighting products to become the leader in the overall lighting industry as LED adoption accelerates through the following strategies:

Improve our products while lowering their cost to sustain our market position. We will continue to enhance our products by accumulating improvements across all of our component and subsystem technologies and by availing ourselves of further efficiencies by way of their interoperation. These improvements will include innovations relating to new materials, designs and methods, which we believe will provide revolutionary, rather than evolutionary, gains in product performance and manufacturing cost. In addition, we will continue to rapidly optimize our technologies for the most recently introduced and typically higher efficacy packaged LEDs to which we often have early access. We also intend to develop products that incorporate the intelligent control enabled by solid state lighting to offer further reductions in cost of ownership and novel functionality to our customers.

Drive improvements in our manufacturing and supply chain operations. We are increasing production at our recently opened site in Monterrey, Mexico, as well as at our contract manufacturing partner in Asia to ensure that we have adequate capacity to meet future demand as well as to capture efficiencies that we expect will allow us to materially improve our profitability as we transfer high-volume manufacturing to these lower cost sites from our Satellite Beach, Florida facility. In addition, we are increasingly sourcing critical components and subsystems from suppliers closer to our points of manufacture, working with our customers to develop more robust demand forecasts and implementing new information technology systems to reduce lead times, expediting costs for inbound supplies and other operational inefficiencies.

Expand our market coverage. We will continue to invest in our sales channels to drive further adoption of LED general illumination as well as to improve our share of the market. This investment includes adding experienced lighting professionals to our direct sales force and enlarging the sales team that manages our retail and OEM partners to both help us develop new relationships and increase business with existing ones. We also plan to expand the professional sales team that manages our growing roster of independent sales agents and distributors for the infrastructure and commercial and industrial markets in order to provide them with better sales support. We are also focused on expanding our efforts in Europe and Asia as we introduce new products designed specifically for the requirements of those regions. In addition, we plan to take a leadership role in the establishment of rebate programs applicable to LED lighting which, while not necessary for the adoption of our products, has the potential to meaningfully accelerate the shift to LED lighting.

Expand our product offering to target further conventional lighting applications. We follow a disciplined approach to the expansion of our business, prioritizing only those applications for which we believe there are currently clear and compelling reasons, from a return on investment and total cost of ownership perspective for a potential customer to adopt LED lighting. As the value proposition of LED lighting continues to improve, we will increase the range of applications that we target accordingly.

Extend our technology to non-traditional markets. We plan to continue to develop products for novel applications beyond traditional lighting that can benefit from the unique properties of LED lighting. We believe these potential non-traditional markets help drive our culture of innovation as well as our understanding of LED technology. They may also represent a material market opportunity in addition to their promising social benefits.

4

Table of Contents

Risks that we face

Our business is subject to numerous risks, which are highlighted in the section entitled “Risk factors.” These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. These risks include:

| • | We have a limited amount of revenues and a history of losses and may be unable to continue operations unless we can generate sufficient operating income. Further, we have yet to achieve positive cash flow, and our ability to generate positive cash flow is uncertain. |

| • | If we are unable to manage any future growth effectively, our profitability and liquidity could be adversely affected. Further, if we are unable to adequately increase our production capacity, delays could harm our revenues and reputation. |

| • | If our developed technology or technology under development does not achieve market acceptance, prospects for our growth and profitability would be limited. Further, if we fail to anticipate and adapt to rapid technological changes in the LED lighting industry, the products we sell could become obsolete. |

| • | We rely on our relationships with The Home Depot and Osram Sylvania and the loss of either of these relationships could have a material adverse effect on our financial results. |

| • | Our financial results may vary significantly from period-to-period, which may lead to volatility in our stock price. |

| • | Our industry is highly competitive and if we are not able to compete effectively, our prospects for future success will be jeopardized. |

| • | Failure to achieve or maintain effective internal controls could have a material adverse effect on our operations and our stock price. |

| • | We rely upon key members of our management team and other key personnel and a loss of key personnel could prevent or significantly delay the achievement of our goals. |

| • | Our international operations are subject to legal, political and economic risks. |

Pegasus Capital

We are controlled by affiliates of Pegasus Capital Advisors, L.P., or Pegasus Capital, a U.S.-based private equity fund manager that provides capital and strategic solutions to middle market companies across a variety of industries. Established in 1995, Pegasus Capital currently manages approximately $2.0 billion in assets through several private equity funds and has made more than 80 investments since its inception. Historically, Pegasus Capital has invested in our capital stock through LSGC Holdings LLC, Pegasus Partners IV, L.P., or Pegasus IV, and LED Holdings, LLC.

Corporate information

We were incorporated in the state of Delaware in 1988. Unless expressly indicated or the context requires otherwise, the terms “Lighting Science Group,” “company,” “we,” “us” and “our” in this prospectus refer to Lighting Science Group Corporation, a Delaware corporation or, as applicable, its predecessor entities and, where appropriate, its wholly-owned subsidiaries. Our principal executive offices are located at 1227 South Patrick Drive, Building 2A, Satellite Beach, Florida 32937, and our telephone number is (321) 779-5520. Our website address is www.lsgc.com. This reference to our website is an inactive textual reference only and is not a hyperlink. The contents of our website are not part of this prospectus, and you should not consider the contents of our website in making an investment decision with respect to our common stock.

5

Table of Contents

| Common stock offered by us |

shares. |

| Common stock to be outstanding after this offering |

shares. |

| Use of proceeds |

We estimate that we will receive net proceeds of approximately $ million from this offering, based on an assumed public offering price of $ per share (the midpoint of the range set forth on the cover page of this prospectus) and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to repay any existing indebtedness on our Wells Fargo Facility and for general corporate purposes, including capital expenditures to expand our production capacity, investments in our research and development, expansion of our sales force and working capital needs in support of our planned business activities. See “Use of proceeds” for additional information. |

| Over allotment option |

We have granted the underwriters a 30-day option to purchase up to additional shares of our common stock at the public offering price. |

| Dividend policy |

We do not currently intend to pay any cash dividends on our common stock. See “Dividend policy.” |

| Risk factors |

You should carefully read and consider the information set forth under “Risk factors” beginning on page 9 of this prospectus and all other information set forth in this prospectus before investing in our common stock. |

| Proposed NASDAQ symbol |

LSGC |

The number of shares of our common stock outstanding after this offering is based on 185,260,534 shares outstanding as of September 30, 2010 after giving effect to the “Subsequent Issuances” described under “Capitalization” and excludes:

| • | 12,756,217 shares of common stock issuable upon the exercise of outstanding options under our Amended and Restated Equity-Based Compensation Plan, or the Equity Plan, as of September 30, 2010, with a weighted average exercise price of $1.28 per share; |

| • | 176,668 shares of common stock issuable upon the vesting of shares of restricted stock previously awarded under the Equity Plan as of September 30, 2010; |

| • | 15,067,115 (which gives effect to the 8,000,000 share increase on February 10, 2011) shares of common stock reserved and available for future issuance under the Equity Plan as of September 30, 2010; and |

| • | 14,789,424 shares of common stock, on an as-converted basis, issuable upon the exercise of outstanding warrants to purchase common stock, as of September 30, 2010, with a weighted average exercise price of $5.83 per share. |

6

Table of Contents

Summary consolidated financial data

The following table presents our summary consolidated financial data as of the dates and for our business for the periods indicated. We derived the summary consolidated financial data for the years ended December 31, 2008 and 2009 from our audited consolidated financial statements included elsewhere in this prospectus. Summary consolidated financial data for the nine months ended September 30, 2009 and 2010 and as of September 30, 2010 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected in any future period, and the results for the nine months ended September 30, 2010 are not necessarily indicative of results to be expected for the full year or for any other period. You should read this summary consolidated financial data in conjunction with “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and related notes, all included elsewhere in this prospectus.

| For the Nine Months Ended September 30, |

For the Year Ended December 31, |

|||||||||||||||

| 2010 | 2009 | 2009 | 2008 | |||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Revenue |

$ | 30,331,005 | $ | 21,969,701 | $ | 31,376,816 | $ | 20,758,593 | ||||||||

| Cost of goods sold |

31,229,947 | 17,599,574 | 24,754,819 | 16,688,600 | ||||||||||||

| Gross margin |

(898,942 | ) | 4,370,127 | 6,621,997 | 4,069,993 | |||||||||||

| Operating expenses: |

||||||||||||||||

| Sales and marketing |

6,873,194 | 4,670,459 | 7,248,311 | 5,847,833 | ||||||||||||

| Operations |

3,784,510 | 8,329,604 | 10,370,098 | 10,526,976 | ||||||||||||

| Research and development (1) |

6,719,808 | 2,444,158 | 4,395,320 | 3,259,187 | ||||||||||||

| General and administrative |

10,877,051 | 17,035,266 | 20,705,525 | 23,224,561 | ||||||||||||

| Restructuring expenses |

458,311 | 702,625 | 1,111,189 | — | ||||||||||||

| Impairment of goodwill and other long-lived assets |

10,538,307 | — | — | 53,110,133 | ||||||||||||

| Depreciation and amortization |

2,324,068 | 4,439,465 | 5,327,033 | 4,354,028 | ||||||||||||

| Total operating expenses |

41,575,249 | 37,621,577 | 49,157,476 | 100,322,718 | ||||||||||||

| Loss from operations |

(42,474,191 | ) | (33,251,450 | ) | (42,535,479 | ) | (96,252,725 | ) | ||||||||

| Total other income (expense) |

(111,479,505 | ) | (4,070,427 | ) | (6,014,450 | ) | (918,238 | ) | ||||||||

| Loss before income tax expense (benefit) |

(153,953,696 | ) | (37,321,877 | ) | (48,549,929 | ) | (97,170,963 | ) | ||||||||

| Income tax expense (benefit) |

382,645 | (263,108 | ) | (413,002 | ) | (2,207,507 | ) | |||||||||

| Net loss |

(154,336,341 | ) | (37,058,769 | ) | (48,136,927 | ) | (94,963,456 | ) | ||||||||

| Dividend requirements |

||||||||||||||||

| 6% return on Series B Preferred Stock |

784,142 | 738,586 | 1,217,642 | — | ||||||||||||

| 8% return on Series C Preferred Stock |

213,610 | 197,240 | 266,400 | — | ||||||||||||

| Net loss attributable to common stock |

$ | (155,334,093 | ) | $ | (37,994,595 | ) | $ | (49,620,969 | ) | $ | (94,963,456 | ) | ||||

| Net loss per weighted average common share: |

||||||||||||||||

| Basic and diluted |

$ | (5.11 | ) | $ | (1.30 | ) | $ | (1.69 | ) | $ | (3.55 | ) | ||||

| Pro forma basic and diluted (1) |

|

(1.13 |

) |

— | — | — | ||||||||||

| Pro forma basic and diluted as adjusted (2) |

— | — | — | |||||||||||||

| Weighted average number of shares used to compute net loss per weighted average common share |

||||||||||||||||

| Basic and diluted |

30,393,884 | 29,207,158 | 29,352,585 | 26,781,431 | ||||||||||||

| Pro forma basic and diluted (1) |

137,153,105 | |||||||||||||||

| Pro forma basic and diluted as adjusted (2) |

— | — | — | |||||||||||||

| Net loss |

$ | (154,336,341 | ) | $ | (37,058,769 | ) | $ | (48,136,927 | ) | $ | (94,963,456 | ) | ||||

| Foreign currency translation gain (loss) |

(1,039,154 | ) | 1,809,008 | (849,695 | ) | (1,886,544 | ) | |||||||||

| Comprehensive loss |

$ | (155,375,495 | ) | $ | (35,249,761 | ) | $ | (48,986,622 | ) | $ | (96,850,000 | ) | ||||

| (1) | During 2010, we modified the presentation of our operating expenses to separately convey research and development and restructuring expenses in our interim consolidated statement of operations and comprehensive loss. This table reflects management’s modified presentation for all periods presented, including its current characterization of research and development expenses. |

7

Table of Contents

| As of September 30, 2010 | ||||||||||||

| Actual | Pro forma (1) |

Pro forma as adjusted (2) |

||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash |

19,208,715 | 42,208,715 | ||||||||||

| Working capital(3) |

28,282,877 | 51,282,877 | ||||||||||

| Total assets |

59,956,590 | 82,956,590 | ||||||||||

| Total liabilities |

182,334,703 | 21,648,833 | ||||||||||

| Total stockholders’ equity (deficit) |

(122,378,113 | ) | 61,307,757 | |||||||||

| (1) | Gives pro forma effect to the Subsequent Issuances described under “Capitalization.” |

| (2) | The pro forma as adjusted data gives effect to the Subsequent Issuances and our issuance and sale of shares of our common stock in this offering at an assumed public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus and that the net proceeds will be approximately $ million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters’ over-allotment option is exercised in full, we estimate that we will receive additional net proceeds of $ million. Each $1.00 increase (decrease) in the assumed public offering price of $ per share, would increase (decrease) each of cash, working capital, total assets and total stockholders’ equity (deficit) by $ million, and deducting underwriting discounts and commissions and estimated offering expenses payable by us and assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same. Each increase (decrease) of 1.0 million in the number of shares offered by us would increase (decrease) each of cash, working capital, total assets and total stockholders’ equity (deficit) by $ million, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, assuming the assumed public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. |

| (3) | Working capital is defined as our current assets minus current liabilities. |

8

Table of Contents

This offering and an investment in our common stock involve a high degree of risk. You should carefully consider the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks related to our business and industry

We have a limited amount of revenues and a history of losses and may be unable to continue operations unless we can generate sufficient operating income from the sale of our products.

We have sustained operating losses since our inception. For the nine months ended September 30, 2010 and the year ended December 31, 2009, we had revenues of $30.3 million and $31.4 million, respectively, and as of September 30, 2010 and December 31, 2009, we had accumulated deficits of $302.3 million and $148.0 million, respectively. As evidenced by these financial results, we may not be able to achieve or maintain profitability on a consistent basis. Continuing losses may exhaust our capital resources and force us to discontinue our operations.

We have yet to achieve positive cash flow, and our ability to generate positive cash flow is uncertain. If we are unable to obtain sufficient capital when needed, our business and future prospects will be adversely affected and we could be forced to suspend or discontinue operations.

Our operations have not generated positive cash flow for any reporting period since our inception, and we have funded our operations primarily through the issuance of common and preferred stock and short-term debt. Our limited operating history makes an evaluation of our future prospects difficult. The actual amount of funds that we will need to meet our operating needs will be determined by a number of factors, many of which are beyond our control. These factors include the timing and volume of sales transactions, the success of our marketing strategy, market acceptance of our products, the success of our manufacturing and research and development efforts (including any unanticipated delays), the costs associated with obtaining and enforcing our intellectual property rights, regulatory changes, competition, technological developments in the market, evolving industry standards and the amount of working capital investments we are required to make.

Our ability to continue to operate until our cash flow from operations turns positive will depend on our ability to continue to raise funds through public or private sales of shares of our capital stock or through debt. We currently have an asset-based lending facility with Wells Fargo Bank, National Association, which we refer to as the Wells Fargo Facility, which provides us with borrowing capacity of up to a maximum of $15.0 million calculated as up to 85% of our applicable and eligible inventory and accounts receivable plus qualified cash. The Wells Fargo Facility has an initial term that expires in November 2013. As of December 31, 2010, the balance outstanding on the Wells Fargo Facility was approximately $4.7 million and we had approximately $9.5 million of additional borrowing capacity. In addition, we have a working capital facility with IFN Finance B.V., or IFN Finance, and a revolving line of credit with ABN AMRO Bank N.V., or ABN AMRO, that provide up to $2.0 million and $265,000, respectively, to our Netherlands based operations. As of December 31, 2010, the outstanding balances on the IFN Finance and ABN AMRO facilities were $1.2 million and $226,000, respectively. Other than these facilities, we do not have any committed sources of outside capital at this time.

During the recent economic downturn, we experienced limited access to the capital and credit markets, and it remains uncertain whether we will be able to obtain outside capital when we need it or on terms that would be acceptable to us. In the past we have primarily relied on, and currently rely on, financing or guaranties from

9

Table of Contents

affiliates of Pegasus Capital. There are no assurances that such related parties will continue to provide financing on terms that are acceptable to us or at all. If we raise funds by selling additional shares of our common stock or securities convertible or exercisable into our common stock, the ownership interest of our existing stockholders will be diluted. If we are unable to obtain sufficient outside capital when needed, our business and future prospects will be adversely affected and we could be forced to suspend or discontinue operations.

If we are unable to manage any future growth effectively, our profitability and liquidity could be adversely affected.

Our growth is expected to place significant strain on our limited research and development, sales and marketing, operational and administrative resources. To manage any future growth, we must continue to improve our operational and financial systems and expand, train and manage our employee base. We also need to improve our supply chain management and quality control operations and hire and train new employees, including sales and customer service representatives and operations managers. If we are unable to manage our growth effectively, our profitability and liquidity could be adversely affected.

If the transition we are currently making to an Enterprise Resource Planning systems encounters delays or difficulties, as certain other companies have experienced, the resulting problems could negatively affect our business.

We are increasingly dependent on information technology, including an ongoing transition to Enterprise Resource Planning, or ERP, systems, to enable us to improve the effectiveness of our operations and to maintain financial accuracy and efficiency. A number of other companies have experienced delays and difficulties with the implementation of ERP systems that have had a negative effect on our business. If we do not allocate and effectively manage the resources necessary to build, implement and sustain the proper technology infrastructure, or if our ERP transition encounters delays or difficulties, we could be subject to transaction errors, processing inefficiencies, loss of customers, business disruptions or loss of or unauthorized access to our intellectual property through security breaches.

If our developed technology or technology under development does not achieve market acceptance, prospects for our growth and profitability would be limited.

Our future success depends on market acceptance of our LED technology and the technology currently under development. Although adoption of LED lighting has grown in recent years, adoption of LED lighting products for general illumination has only recently begun, is still limited and faces significant challenges. Potential customers may be reluctant to adopt LED lighting products as an alternative to traditional lighting technology because of its higher initial cost or perceived risks relating to its novelty, reliability, usefulness, light quality and cost-effectiveness when compared to other established lighting sources available in the market. Changes in economic and market conditions may also affect the marketability of some traditional lighting technologies such as declining energy prices that favor existing lighting technologies that are less energy efficient. Moreover, if existing sources of light other than LED lighting products achieve or maintain greater market adoption, or if new sources of light are developed, our current products and technologies could become less competitive or obsolete. Even if LED lighting products continue to achieve performance improvements and cost reductions, limited customer awareness of the benefits of LED lighting products, lack of widely accepted standards governing LED lighting products and customer unwillingness to adopt LED lighting products in favor of entrenched solutions could significantly limit the demand for LED lighting products and adversely impact our results of operations.

10

Table of Contents

Lighting products, particularly emerging LED lighting products, are subject to rapid technological changes. If we fail to accurately anticipate and adapt to these changes, the products we sell will become obsolete, causing a decline in our sales and profitability.

LED lighting products are subject to rapid technological changes that often cause product obsolescence. Companies within the LED lighting industry are continuously developing new products with heightened performance and functionality. This puts pricing pressure on existing products and constantly threatens to make them, or causes them to be, obsolete. Our typical product’s life cycle is extremely short, generating lower average selling prices as the cycle matures. If we fail to accurately anticipate the introduction of new technologies, we may possess significant amounts of obsolete inventory that can only be sold at substantially lower prices and profit margins than we anticipated. In addition, if we fail to accurately anticipate the introduction of new technologies or are unable to develop the planned new technologies, we may be unable to compete effectively due to our failure to offer products most demanded by the marketplace. If any of these failures occur, our sales, profit margins and profitability will be adversely affected.

If we are unable to increase production capacity for our products in a cost effective and timely manner, we may incur delays in shipment and our revenues and reputation in the marketplace could be harmed.

An important part of our business plan is the expansion of production capacity for our products. In order to fulfill anticipated demand for our products, we invest in capacity in advance of actual customer orders, typically based on preliminary, non-binding indications of future demand. As customer demand for our products changes, we must be able to adjust our production capacity to meet demand while keeping costs down. We intend to expand our operations by increasing production at our recently opened manufacturing facility in Monterrey, Mexico, which may subject us to additional risks as we first scale these operations. We also expect to rely more heavily on international contract manufacturing. Uncertainty is inherent within our facility and capacity expansion, and unforeseen circumstances could offset the anticipated benefits, disrupt our ability to provide products to our customers and impact product quality.

Our ability to successfully increase production capacity in a cost effective and timely manner will depend on a number of factors, including the following:

| • | our ability to successfully scale our recently opened manufacturing facility in Monterrey, Mexico; |

| • | our ability to transition production between manufacturing facilities; |

| • | the ability of contract manufacturers to allocate more of their existing capacity to us or their ability to add new capacity quickly; |

| • | the ability of any future contract manufacturers to successfully implement our manufacturing processes; |

| • | the availability of critical components and subsystems used in the manufacture of our products; |

| • | our ability to effectively establish adequate management information systems, financial controls and supply chain management and quality control procedures; and |

| • | equipment failures, power outages, environmental risks or variations in the manufacturing process. |

If we are unable to increase production capacity for our products in a cost effective and timely manner while maintaining adequate quality, we may incur delays in shipment or be unable to meet increased demand for our products which could harm our revenues and operating margins and damage our reputation and our relationships with current and prospective customers. Conversely, due to the proportionately high fixed cost nature of our business (such as facility expansion costs), if demand does not increase at the rate forecasted, we may not be able to reduce manufacturing expenses or overhead costs at the same rate as demand decreases, which could also result in lower margins and adversely impact our business and results of operations.

11

Table of Contents

We rely on our relationships with The Home Depot and Osram Sylvania, and the loss of a material relationship with either of them would have a material adverse effect on our results of operations, our future growth prospects and our ability to distribute our products.

We form business relationships and strategic alliances with retailers and other lighting companies to market our products under private or co-branded labels. In certain cases, such relationships are important to the introduction of new products and services, and we may not be able to successfully collaborate or achieve expected synergies with these retailers or lighting companies. We do not control these retailers or lighting companies and they may make decisions regarding their business undertakings with us that may be contrary to our interests, or may terminate their relationships with us altogether. In addition, if these retailers or lighting companies change their business strategies, we may fail to maintain these relationships.

For the nine months ended September 30, 2010, Osram Sylvania and The Home Depot accounted for 21% and 6% of our net sales, respectively. Our Master Supply Agreement with Osram Sylvania has an initial term that expires in April 2013 but may be terminated earlier by Osram Sylvania in certain instances, including upon a change of control or in the event of a default by us. Our contractual commitment with The Home Depot is also not long term in nature. Specifically, our Strategic Purchasing Agreement with The Home Depot has an initial term that expires in July 2013 but may be terminated by The Home Depot for any reason upon 180 days written notice to us. The Home Depot has required, and we expect will continue to require, increased service and order accommodations as well as incremental promotional investments. We may face increased expenses to meet these demands, which would reduce our margins. In addition, we generally have little or no influence on The Home Depot’s promotional or pricing policies, which may impact our sales volume to them. In addition, neither our Master Supply Agreement with Osram Sylvania nor our Strategic Purchasing Agreement with The Home Depot requires either party to purchase a minimum quantity of products from us, although we issued a Warrant to The Home Depot that included incentive-based vesting conditions through 2015 based on annual 20% increases in product purchases made under the Strategic Purchasing Agreement. Our sales are materially affected by fluctuations in the buying patterns of these customers and such fluctuations may result from general economic conditions or other factors. A loss of Osram Sylvania or The Home Depot as a customer or a significant decline in their purchases would have a material adverse effect on our results of operations, our future growth prospectus and our ability to distribute our products.

We assemble and manufacture certain of our products and our sales, results of operations and reputation could be materially adversely affected if there is a disruption at our assembly and manufacturing facilities.

Our assembly and manufacturing operations for our products are based in Satellite Beach, Florida and Monterrey, Mexico. The operation of these facilities involves many risks, including equipment failures, natural disasters, industrial accidents, power outages and other business interruptions. We could incur significant costs to maintain compliance with, or due to liabilities under, environmental laws. Although we carry business interruption insurance and third-party liability insurance to cover claims in respect of personal injury or property or environmental damage arising from accidents on our properties or relating to our operations, our existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations. Additionally, any interruption in our ability to assemble, manufacture or distribute our products could result in lost sales, limited revenue growth and damage to our reputation in the market, all of which would adversely affect our business.

Additionally, we rely on arrangements with independent shipping companies, such as United Parcel Service, Inc. and Federal Express Corp., for the delivery of certain components and subsystems from vendors and products to our customers in both the United States and abroad. The failure or inability of these shipping companies to deliver components, subsystems or products timely, or the unavailability of their shipping services, even temporarily, could have a material adverse effect on our business. We may also be adversely affected by an increase in freight surcharges due to rising fuel costs or added security.

12

Table of Contents

We utilize a contract manufacturer to manufacture certain of our products and any disruption in this relationship may cause us to fail to meet our customers’ demands and may damage our customer relationships.

Although we assemble and manufacture certain of our products, we currently depend on Citizen Electronics Co., Ltd., or Citizen Electronics, as a contract manufacturer to manufacture a portion of our products in Asia. This manufacturer provides the necessary facilities and labor to manufacture these products, which are primarily high volume products that we intend to distribute to customers in regions outside of North America. Our reliance on a contract manufacturer involves certain risks, including the following:

| • | lack of direct control over production capacity and delivery schedules; |

| • | lack of direct control over quality assurance and manufacturing yield; and |

| • | risk of loss of inventory while in transit. |

If our contract manufacturer were to terminate its arrangements with us or fail to provide the required capacity and quality on a timely basis, we would experience delays in the manufacture and shipment of our products until alternative manufacturing services could be contracted or offsetting internal manufacturing processes could be implemented. To qualify a new contract manufacturer, familiarize it with our products, quality standards and other requirements and commence volume production may be a costly and time-consuming process. If we are required or choose to change contract manufacturers for any reason, our revenue, gross margins and customer relationships could be adversely affected.

Our industry is highly competitive and if we are not able to compete effectively, including against larger lighting manufacturers with greater resources, our prospects for future success will be jeopardized.

Our industry is highly competitive. We face competition from both traditional lighting technologies provided by numerous vendors as well as from LED-based lighting products provided by a growing roster of industry participants. The LED lighting industry is characterized by rapid technological change, short product lifecycles and frequent new product introductions, and a competitive pricing environment. These characteristics increase the need for continual innovation and provide entry points for new competitors as well as opportunities for rapid share shifts.

Currently, we view our primary competition to be from large, established companies in the traditional general lighting industry. Certain of these companies also provide, or have undertaken initiatives to develop, LED lighting products as well as other energy efficient lighting products. Additionally, we face competition from a fragmented universe of smaller niche or low-cost offshore providers of LED lighting products. We also anticipate that larger LED chip manufacturers, including some of those that currently supply us, may seek to compete with us by introducing more complete retrofit lamps or luminaires. We also expect other large technology players with packaged LED chip technology that are currently focused on other end markets for LEDs, such as backlighting for LCD displays, to increasingly focus on the general illumination market as their existing markets saturate and LED use in general illumination grows. In addition, we may compete in the future with vendors of new technological solutions for energy efficient lighting.

Some of our current and future competitors are larger companies with greater resources to devote to research and development, manufacturing and marketing, as well as greater brand name recognition. Some of our more diversified competitors could also compete more aggressively with us by subsidizing losses in their LED lighting businesses with profits from other lines of business. Moreover, if one or more of our competitors or suppliers were to merge with one another, the change in the competitive landscape could adversely affect our customer, channel or supplier relationships, or our competitive position. Additionally, any loss of a key channel partner, whether to a competitor or otherwise, could severely and rapidly damage our competitive position. To the extent that competition in our markets intensifies, we may be required to reduce our prices in order to remain competitive. If we do not compete effectively, or if we reduce our prices without making commensurate reductions in our costs, our net sales and profitability, and our future prospects for success, may be harmed.

13

Table of Contents

If we do not properly anticipate the need for critical raw materials, components and subsystems, we may be unable to meet the demands of our customers and end-users, which could reduce our competitiveness, cause a decline in our market share and have a material adverse effect on our results of operations.

The lighting industry is subject to significant fluctuations in the availability of raw materials, components and subsystems. We depend on our suppliers for certain standard electronic components as well as custom components critical to the manufacture of our lighting devices. The principal raw materials and components used in the manufacture of our products are packaged LEDs and printed circuit boards, MOSFETS, magnetic and standard electrical components such as capacitors, resistors and diodes, wire, plastics for optical systems and aluminum for housings and heat sinks. We currently rely on a select number of suppliers for packaged LEDs used in the production of our products. From time to time, packaged LEDs and electronic components have been in short supply due to demand and production constraints. We depend on our vendors to supply in a timely manner critical components and subsystems in adequate quantities and consistent quality and at reasonable costs. Finding a suitable alternate supply of required components and subsystems that meet our strict specifications and obtaining them in needed quantities may be a time-consuming process, and we may not be able to find an adequate alternative source of supply at an acceptable cost. Any significant interruption in the supply of these raw materials, components and subsystems could have a material adverse effect on our results of operations.

Our financial results may vary significantly from period-to-period due to unpredictable sales cycles in certain of the markets into which we sell our products, and changes in the mix of products we sell during a period, which may lead to volatility in our stock price.

The size and timing of our revenue from sales to our customers is difficult to predict and is market dependent. Our sales efforts often require us to educate our customers about the use and benefits of our products, including their technical and performance characteristics. We spend substantial amounts of time and money on our sales efforts and there is no assurance that these investments will produce any sales within expected time frames or at all. Given the potentially large size of purchase orders for our products, particularly in the infrastructure market, the loss of or delay in the signing of a customer order could significantly reduce our revenue in any period. Our revenues in each period may also vary significantly as a result of purchases, or lack thereof, by The Home Depot, Osram Sylvania or other significant customers. Because most of our operating and capital expenses are incurred based on the estimated number of product purchases and their timing, they are difficult to adjust in the short term. As a result, if our revenue falls below our expectations or is delayed in any period, we may not be able to proportionately reduce our operating expenses or manufacturing costs for that period, and any reduction of manufacturing capacity could have long-term implications on our ability to accommodate future demand.

Our profitability from period-to-period may also vary significantly due to the mix of products that we sell in different periods. As we expand our business we expect to sell more retrofit lamps and luminaires into additional target markets. These products are likely to have different cost profiles and will be sold into markets governed by different business dynamics. Consequently, sales of individual products may not necessarily be consistent across periods, which could affect product mix and cause gross and operating profits to vary significantly. As a result of these factors, we believe that quarter-to-quarter comparisons of our operating results are not necessarily meaningful and that these comparisons cannot be relied upon as indicators of future performance.

Our products may contain defects that could reduce sales, result in costs associated with the recall of those items and result in claims against us.

The manufacture of our products involves highly complex processes. Despite testing by us and our customers, defects have been and could be found in our existing or future products. These defects may cause us to incur significant warranty, support and repair costs, and costs associated with recall may divert the attention of our engineering personnel from our product development efforts and harm our relationships with customers and our reputation in the marketplace. We generally provide a five year warranty on our products, and such warranty

14

Table of Contents

may require us to repair, replace or reimburse the purchaser for the purchase price of the product, at the customer’s discretion. Moreover, even if our products meet standard specifications, our customers may attempt to use our products in applications they were not designed for or in products that were not designed or manufactured properly, resulting in product failures and creating customer dissatisfaction. These problems could result in, among other things, a delay in the recognition or loss of revenues, loss of market share or failure to achieve market acceptance. Defects, integration issues or other performance problems in our products could also result in personal injury or financial or other damages to our customers for which they might seek legal recourse against us. We may be the target of product liability lawsuits and could suffer losses from a significant product liability judgment against us if the use of our products at issue is determined to have caused injury. A significant product recall or product liability case could also result in adverse publicity, damage to our reputation and a loss of customer confidence in our products and adversely affect our results of operations.

If we are unable to obtain and protect our intellectual property rights, our ability to commercialize our products could be substantially limited.

As of December 31, 2010, we had filed 140 U.S. patent applications covering various inventions related to the design and manufacture of LED lighting technology. From these applications, 85 U.S. patents had been issued, 36 were pending approval and 19 were no longer active. When we believe it is appropriate and cost effective, we make corresponding international, regional or national filings to pursue patent protection in other parts of the world. Our patent applications may not be granted. Because patents involve complex legal, technical and factual questions, the issuance, scope, validity and enforceability of patents cannot be predicted with certainty. Competitors may develop products similar to our products that do not conflict with our patent rights. Others may challenge our patents and, as a result, our patents could be narrowed or invalidated. In some cases, we may rely on confidentiality agreements or trade secret protections to protect our proprietary technology. Such agreements, however, may not be honored and particular elements of our proprietary technology may not qualify as protectable trade secrets under applicable law. In addition, others may independently develop similar or superior technology, and in the absence of applicable prior patents, we would have no recourse against them.

Our business may be impaired by claims that we, or our customers, infringe intellectual property rights of others.

Our industry is characterized by vigorous protection and pursuit of intellectual property rights. These traits have resulted in significant and often protracted and expensive litigation. In addition, we may inadvertently infringe on patents or rights owned by others and licenses might not be available to us on reasonable or acceptable terms or at all. Litigation to determine the validity of patents or claims by third parties of infringement of patents or other intellectual property rights could result in significant legal expense and divert the efforts of our technical personnel and management, even if the litigation results in a determination favorable to us. Third parties have and may in the future attempt to assert infringement claims against us, or our customers, with respect to our products. In the event of an adverse result in such litigation, we could be required to pay substantial damages; stop the manufacture, use and sale of products found to be infringing; incur asset impairment charges; discontinue the use of processes found to be infringing; expend significant resources to develop non-infringing products or processes; or obtain a license to use third party technology and whether or not the result is adverse to us, we may have to indemnify our customers if they were brought into the litigation.

Failure to achieve and maintain effective internal controls could have a material adverse effect on our operations and our stock price.

We are subject to Section 404 of the Sarbanes-Oxley Act of 2002, which requires an annual management assessment of the effectiveness of our internal control over financial reporting. Effective internal controls are necessary for us to produce reliable financial reports, and failure to achieve and maintain effective internal controls over financial reporting could cause investors to lose confidence in our operating results, and could have a material adverse effect on our business and on the price of our common stock. Because of our status as a

15

Table of Contents

smaller reporting company registrant as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the independent registered public accounting firm auditing our financial statements has not been required to attest to, and report on, the effectiveness of our internal control over financial reporting. After the consummation of this offering, we believe our filing status will change and that our independent registered public accounting firm will be required to attest to, and report on, the effectiveness of our internal control over financial reporting in our Form 10-K for the fiscal year ending December 31, 2011.

During the evaluation of disclosure controls and procedures for the years ended December 31, 2009 and 2008, we concluded that our disclosure controls and procedures were not effective in reaching a reasonable level of assurance of achieving management’s desired controls and procedures objectives in our internal control over financial reporting. We believe that many of the observed material weaknesses result from our transition from a small company with immature processes and inadequate staffing in our financial accounting and reporting functions to one that is growing rapidly and must now enhance our reporting and control standards to accommodate this growth.

Although we have not yet remediated all of the identified weaknesses, the following are among the key actions taken:

| • | the hiring of a corporate controller with SEC reporting experience in September 2009 and a Chief Financial Officer with SEC reporting experience in August 2010; |

| • | the initiation of an ongoing process to develop policies and procedures over all critical financial reporting and accounting cycles; |

| • | the completion of the first phase of implementation of new ERP system including the financials and order-to-cash modules designed to automate and systemize certain internal controls over financial reporting; |

| • | the standardization of the U.S. chart of accounts of our general ledger across different locations; and |

| • | the implementation of a management system designed to automate and systemize internal control over inventory. |

Additional measures will be necessary to complete the remediation of our internal controls. We plan to continue to assess our internal controls and procedures and intend to take further action as necessary or appropriate to address any other matters we identify. The process of designing and implementing effective internal controls and procedures is a continuous effort, however, that requires us to anticipate and react to changes in our business and economic and regulatory environments. Additionally, we or our independent registered public accounting firm may identify additional weaknesses. The steps we have taken, or may subsequently take, may not have been or be sufficient to fully remediate the material weakness identified or ensure that our internal controls are effective. Complying with these requirements may place a strain on our personnel, information technology systems and resources and divert management’s attention from other business concerns. We may need to hire, at a material expense to us, additional accounting and financial staff with appropriate public company experience and technical accounting knowledge as part of the remediation of our material weakness or otherwise. Failure to achieve and maintain effective internal controls could have a material adverse effect on our operations and our stock price.

Certification and compliance are important to adoption of our lighting products, and failure to obtain such certification or compliance would harm our business.

We are required to comply with certain legal requirements governing the materials used in our products. Although we are not aware of any efforts to amend existing legal requirements or implement new legal requirements in a manner with which we cannot comply, our revenue might be materially harmed if such changes were to occur. Moreover, although not legally required to do so, we strive to obtain certification for substantially

16

Table of Contents

all of our products. In the United States, we seek, and to date have obtained, certification for substantially all of our products from Underwriters’ Laboratories, Inc., or UL®. We design our products to be UL/cUL and Federal Communications Commission, or FCC, compliant. We had also obtained ENERGY STAR qualification for 35 of our products as of January 25, 2011. Although we believe that our broad knowledge and experience with electrical codes and safety standards have facilitated certification approvals, we cannot be certain that we will be able to obtain any such certifications for our new products or that, if certification standards are amended, we will be able to maintain any such certifications for our existing products, especially since virtually all existing codes and standards were not created with LED lighting products in mind. The failure to obtain such certifications or compliance would harm our business.

The reduction or elimination of investments in, or incentives to adopt, LED lighting or the elimination of, or changes in, policies, incentives or rebates in certain states or countries that encourage the use of LEDs over some traditional lighting technologies could cause the growth in demand for our products to slow, which could materially and adversely affect our revenues, profits and margins.

We believe the near-term growth of the LED market will be accelerated by government policies in certain countries that either directly promote the use of LEDs or discourage the use of some traditional lighting technologies. Today, the upfront cost of LED lighting exceeds the upfront cost for some traditional lighting technologies that provide similar lumen output in many applications. However, some governments around the world have used policy initiatives to accelerate the development and adoption of LED lighting and other non-traditional lighting technologies that are seen as more environmentally friendly compared to some traditional lighting technologies. Reductions in (including as a result of any budgetary constraints), or the elimination of, government investment and favorable energy policies could result in decreased demand for our products and decrease our revenues, profits and margins. Further, if our products fail to qualify for any financial incentives or rebates provided by governmental agencies or utilities for which our competitors’ products qualify, such programs may diminish or eliminate our ability to compete by offering products at lower prices than our competitors.

We rely upon key members of our management team and other key personnel and a loss of key personnel could prevent or significantly delay the achievement of our goals.

Our success will depend to a large extent on the abilities and continued services of key members of our management team including Richard Weinberg, John Stanley, Frederic Maxik and Greg Kaiser, as well as other key personnel. The loss of these key members of our management team or other key personnel could prevent or significantly delay the implementation of our business plan, research and development and marketing efforts. In particular, Frederic Maxik is critical to our research and development efforts. If we continue to grow, we will need to add additional management and other personnel. Zachary Gibler, our former Chairman and Chief Executive Officer, passed away on January 2, 2011, and this loss heightened the significance of our remaining executive team. Mr. Weinberg agreed to serve as Chief Executive Officer on an interim basis, and we are currently searching for a permanent Chief Executive Officer. Competition for experienced executives and employees in our industry can be intense. Our success will depend on our ability to attract and retain highly skilled personnel, including a permanent Chief Executive Officer, and our efforts to obtain or retain such personnel may not be successful.

Our international operations are subject to legal, political and economic risks.

Our financial condition, operating results and future growth could be significantly affected by risks associated with our international activities, including economic and labor conditions, political instability, laws (including U.S. taxes on foreign subsidiaries), changes in the value of the U.S. dollar versus foreign currencies, differing business cultures, foreign regulations that may conflict with domestic regulations, intellectual property protection and trade secret risks, differing contracting process including the ability to enforce agreements, increased dependence on foreign manufacturers, shippers and distributors and import and export restrictions and tariffs.

17

Table of Contents