Attached files

| file | filename |

|---|---|

| 8-K - GOLUB CAPITAL BDC, Inc. | v210286_8k.htm |

Golub Capital BDC, Inc. First Quarter 2011 Investor

Presentation

Important Notice This presentation contains “forward

looking statements” within the meaning of Section 21E of the Securities Exchange

Act of 1934, as amended, that are subject to risks and uncertainties . Actual

outcomes and results could differ materially from those suggested by this

presentation due to the impact of many factors beyond the control of Golub

Capital BDC, Inc., including those listed in the “Risk Factors” section of our

filings with the Securities and Exchange Commission (“SEC”) . Any such forward

-looking statements are made pursuant to the safe harbor provisions available

under applicable securities laws, and Golub Capital BDC, Inc. assumes no

obligation to update or revise any such forward -looking statements

. The following slides contain summaries

of certain financial and statistical information about Golub Capital BDC, Inc.

The information contained in this presentation is summary information that is

intended to be considered in the context of our SEC filings and other public

announcements that we may make, by press release or otherwise, from time to

time. We undertake no duty or obligation to publicly update or review the

information contained in this presentation . In addition, information related to

past performance, while helpful as an evaluative tool, is not necessarily

indicative of future results, the achievement of which cannot be assured . You

should not view the past performance of Golub Capital BDC, Inc., as indicative

of Golub Capital BDC, Inc.’s future results . This presentation does not

constitute an offer to sell or the solicitation of an offer to buy any

securities of Golub Capital BDC, Inc.

Financial and Portfolio

Highlights

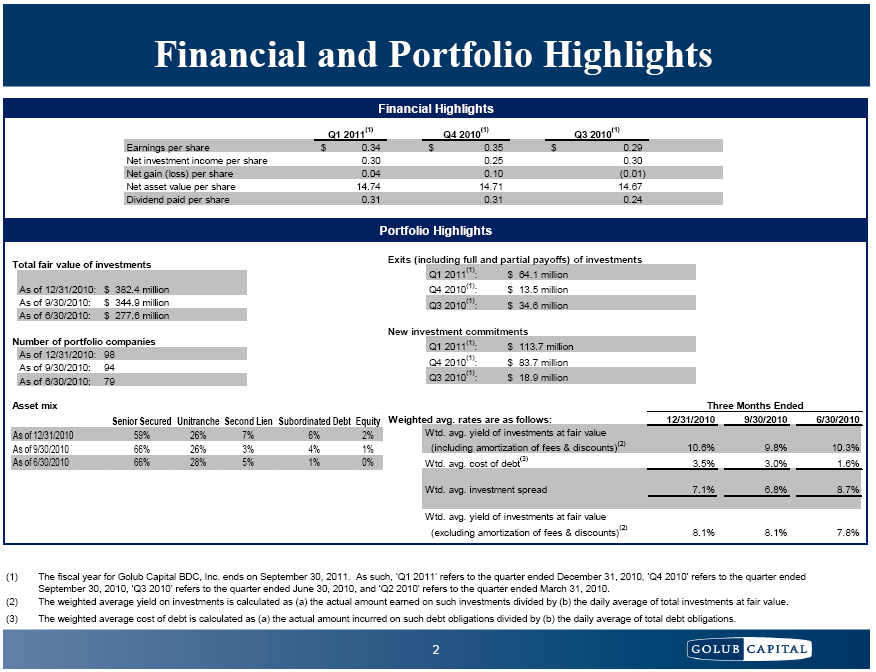

Financial Highlights Q1 2011(1)

Q4 2010(1)

Q3 2010(1)

Earnings per share $ 0.34 $ 0.35 $

0.29 Net investment income per share 0.30 0.25 0.30 Net gain (loss) per share

0.04 0.10 (0.01) Net asset value per share 14.74 14.71 14.67 Dividend paid per

share 0.31 0.31 0.24 Portfolio Highlights Total fair value of

investments

As of 12/31/2010: $ 382.4 million

As of 9/30/2010: $ 344.9 million As of 6/30/2010: $ 277.6 million Number of portfolio

companies

As of 12/31/2010: 98 As of

9/30/2010: 94 As of 6/30/2010: 79 Exits (including full and partial

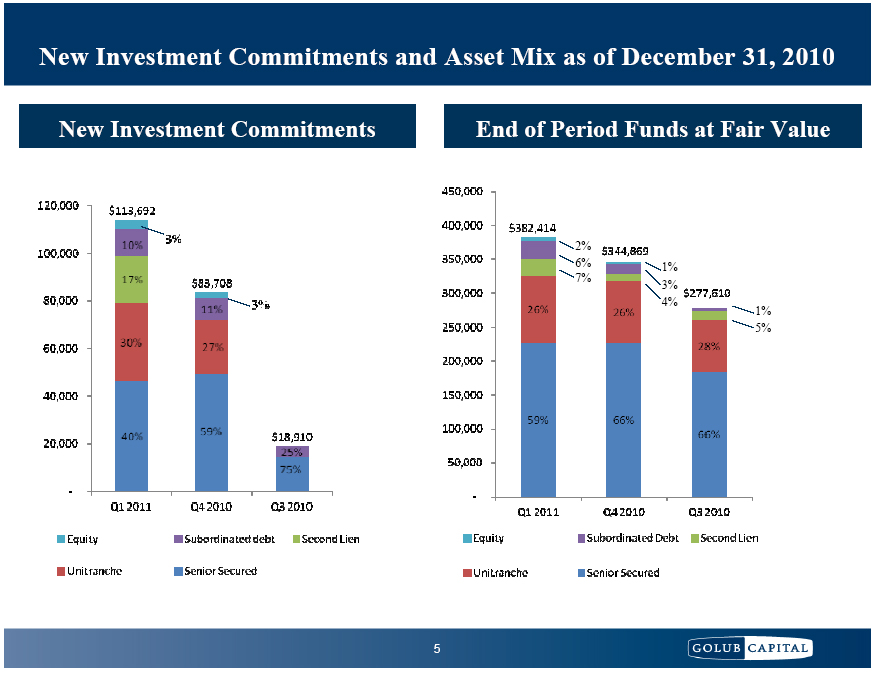

payoffs) of investments Q1 2011(1): $ 64.1 million Q4 2010(1): $ 13.5 million Q3 2010(1): $ 34.6 million New investment commitments Q1 2011(1): $ 113.7 million Q4 2010(1): $ 83.7 million Q3 2010(1): $ 18.9 million Asset mix Senior Secured Unitranche Second Lien

Subordinated Debt Equity As of 12/31/2010 59% 26% 7% 6% 2% As of

9/30/2010 66% 26% 3% 4% 1% As of 6/30/2010 66% 28% 5% 1% 0% Three Months Ended Weighted avg. rates

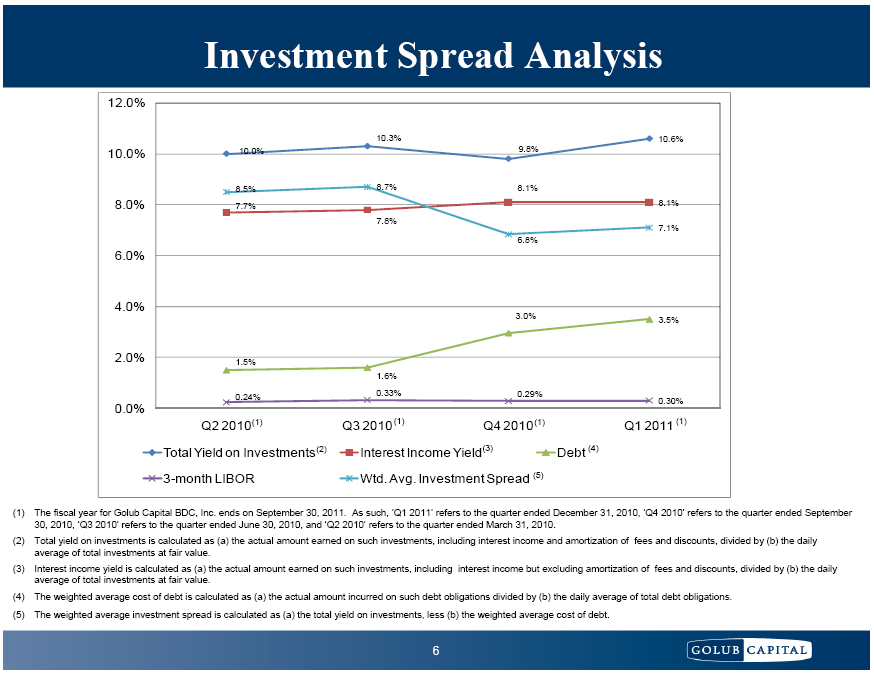

are as follows: 12/31/2010 9/30/2010 6/30/2010 Wtd. avg. yield of investments at fair

value (including amortization of fees &

discounts) (2) 10.6% 9.8% 10.3% Wtd. avg. cost of debt(3)

3.5% 3.0% 1.6% Wtd. avg. investment spread 7.1% 6.8%

8.7% Wtd. avg. yield of investments at fair

value (excluding amortization of fees &

discounts) (2) 8.1% 8.1% 7.8% (1) The fiscal year for Golub Capital

BDC, Inc. ends on September 30, 2011. As such, ‘Q1 2011’ refers to the quarter

ended December 31, 2010, ‘Q4 2010’ refers to the quarter ended September 30,

2010, ‘Q3 2010’ refers to the quarter ended June 30, 2010, and ‘Q2 2010’ refers

to the quarter ended March 31, 2010. (2) The weighted average yield on

investments is calculated as (a) the actual amount earned on such investments

divided by (b) the daily average of total investments at fair value. (3) The

weighted average cost of debt is calculated as (a) the actual amount incurred on

such debt obligations divided by (b) the daily average of total debt

obligations.

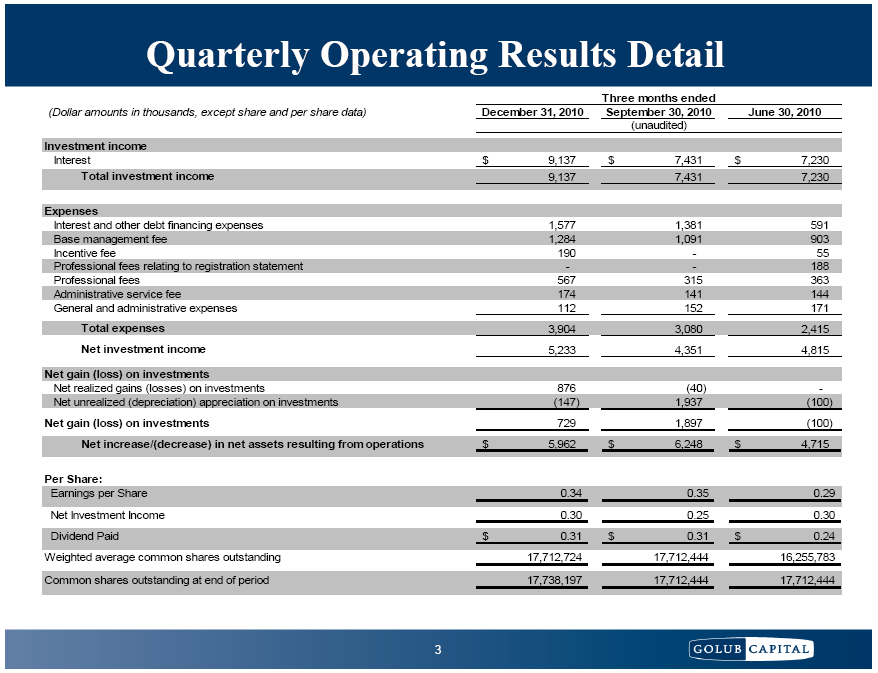

Quarterly Operating Results

Detail Three months ended (Dollar amounts in thousands, except

share and per share data) December 31, 2010 September 30, 2010

June 30, 2010

(unaudited) Investment income Interest $ 9,137 $ 7,431 $

7,230 Total investment income 9,137 7,431 7,230 Expenses Interest and other debt financing

expenses 1,577 1,381 591 Base management fee 1,284 1,091 903 Incentive fee 190 -

55 Professional fees relating to registration statement - - 188 Professional

fees 567 315 363 Administrative service fee 174 141 144 General and

administrative expenses 112 152 171 Total expenses 3,904 3,080 2,415 Net investment income 5,233 4,351 4,815 Net gain (loss) on

investments

Net realized gains (losses) on

investments 876 (40) -Net unrealized (depreciation) appreciation on investments

(147) 1,937 (100) Net gain (loss) on investments

729 1,897 (100)

Net increase/(decrease) in

net assets resulting from operations $ 5,962 $ 6,248 $ 4,715 Per Share: Earnings per Share 0.34 0.35 0.29 Net

Investment Income 0.30 0.25 0.30 Dividend Paid $ 0.31 $ 0.31 $ 0.24 Weighted

average common shares outstanding 17,712,724 17,712,444 16,255,783 Common shares outstanding at end of

period 17,738,197 17,712,444 17,712,444

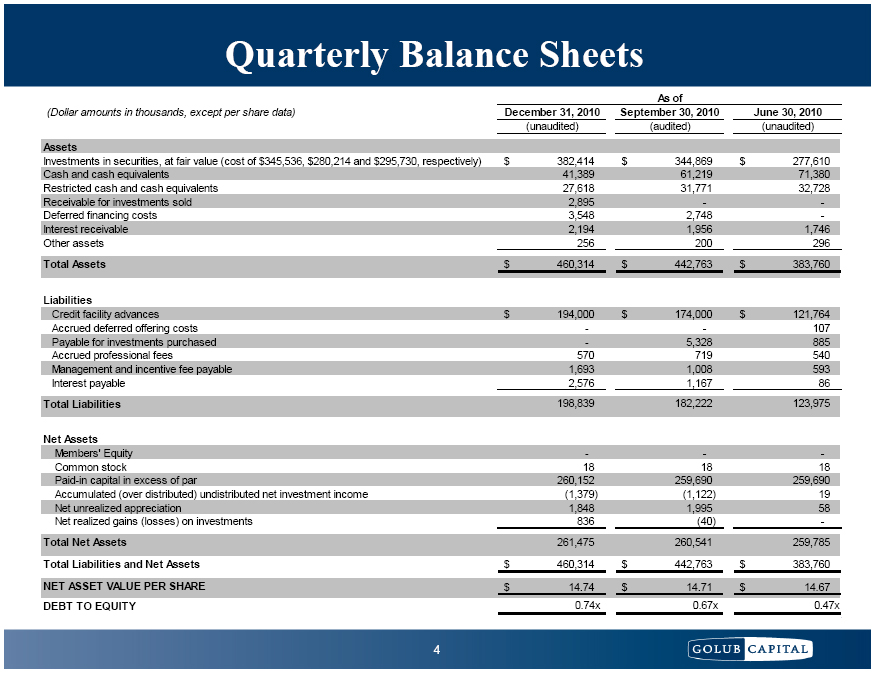

Quarterly Balance Sheets As of (Dollar amounts in thousands, except per

share data) December 31,

2010 September 30, 2010 June 30, 2010 (unaudited) (audited)

(unaudited)

Assets Investments in securities, at fair value

(cost of $345,536, $280,214 and $295,730, respectively) $ 382,414 $ 344,869 $

277,610 Cash and cash equivalents 41,389 61,219 71,380 Restricted cash and cash

equivalents 27,618 31,771 32,728 Receivable for investments sold 2,895 -

-Deferred financing costs 3,548 2,748 -Interest receivable 2,194 1,956 1,746

Other assets 256 200 296 Total Assets $ 460,314 $ 442,763 $

383,760 Liabilities Credit facility advances $ 194,000 $

174,000 $ 121,764 Accrued deferred offering costs - - 107 Payable for

investments purchased - 5,328 885 Accrued professional fees 570 719 540

Management and incentive fee payable 1,693 1,008 593 Interest payable 2,576

1,167 86 Total

Liabilities 198,839 182,222

123,975 Net Assets Members' Equity - - -Common stock 18 18

18 Paid-in capital in excess of par 260,152 259,690 259,690 Accumulated (over

distributed) undistributed net investment income (1,379) (1,122) 19 Net

unrealized appreciation 1,848 1,995 58 Net realized gains (losses) on

investments 836 (40) -Total

Net Assets 261,475 260,541

259,785 Total Liabilities and Net Assets

$ 460,314 $ 442,763 $

383,760 NET ASSET VALUE PER

SHARE $ 14.74 $ 14.71 $

14.67 DEBT TO EQUITY 0.74x 0.67x 0.47x

New Investment Commitments and Asset Mix

as of December 31, 2010 New Investment Commitments End of Period

Funds at Fair Value 2% 6% 1% 7% 3% 4% 1% 5%

Investment Spread Analysis 12.0% 10.3% 10.6% 10.0% 10.0% 9.8% 8.5% 8.7% 8.1% 8.0% 7.7% 8.1% 7.8% 7.1%

6.8% 6.0% 4.0% 3.0% 3.5% 2.0% 1.5% 1.6% 0.33% 0.29% 0.24% 0.30% 0.0%

Q2 2010 (1) Q3 2010 (1) Q4 2010 (1) Q1

2011 (1) Total Yield on Investments (2) Interest Income Yield(3) Debt (4)

3-month LIBOR Wtd. Avg. Investment Spread (5) (1) The fiscal year for Golub Capital

BDC, Inc. ends on September 30, 2011. As such, ‘Q1 2011’ refers to the quarter

ended December 31, 2010, ‘Q4 2010’ refers to the quarter ended September 30,

2010, ‘Q3 2010’ refers to the quarter ended June 30, 2010, and ‘Q2 2010’ refers

to the quarter ended March 31, 2010. (2) Total yield on investments is

calculated as (a) the actual amount earned on such investments, including

interest income and amortization of fees and discounts, divided by (b) the daily

average of total investments at fair value. (3) Interest income yield is

calculated as (a) the actual amount earned on such investments, including

interest income but excluding amortization of fees and discounts, divided by (b)

the daily average of total investments at fair value. (4) The weighted average

cost of debt is calculated as (a) the actual amount incurred on such debt

obligations divided by (b) the daily average of total debt obligations

. (5) The weighted average investment

spread is calculated as (a) the total yield on investments, less (b) the

weighted average cost of debt.

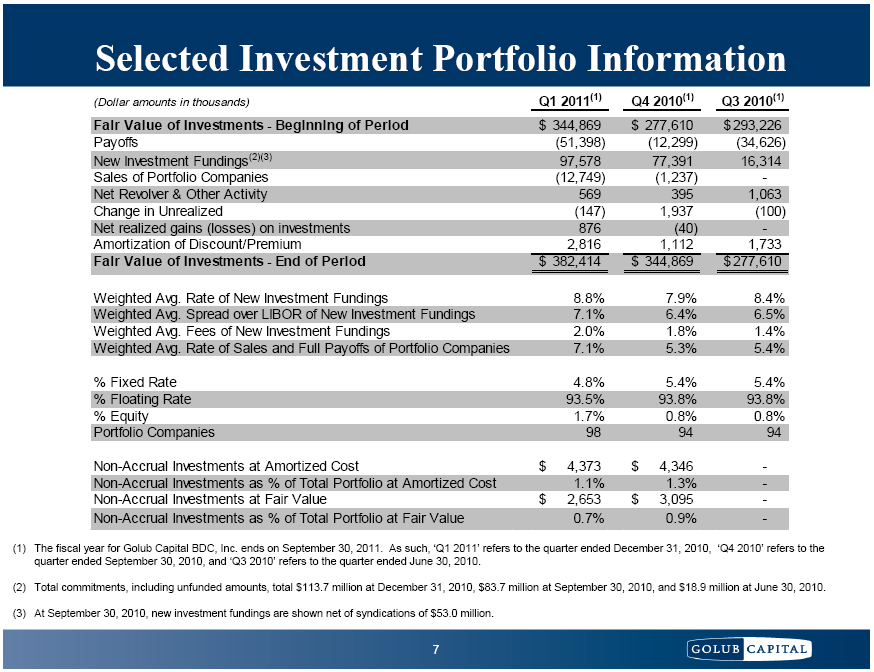

Selected Investment Portfolio

Information

(Dollar amounts in thousands)

Q1 2011(1)

Q4 2010(1)

Q3 2010(1)

Fair Value of Investments -

Beginning of Period $

344,869 $ 277,610 $ 293,226 Payoffs (51,398) (12,299) (34,626) New Investment

Fundings (2)(3) 97,578 77,391 16,314 Sales of Portfolio Companies (12,749)

(1,237) -Net Revolver & Other Activity 569 395 1,063 Change in Unrealized

(147) 1,937 (100) Net realized gains (losses) on investments 876 (40)

-Amortization of Discount/Premium 2,816 1,112 1,733 Fair Value of Investments - End of

Period $ 382,414 $ 344,869

$ 277,610

Weighted Avg. Rate of New

Investment Fundings 8.8% 7.9% 8.4% Weighted Avg. Spread over LIBOR of New

Investment Fundings 7.1% 6.4% 6.5% Weighted Avg. Fees of New Investment Fundings

2.0% 1.8% 1.4% Weighted Avg. Rate of Sales and Full Payoffs of Portfolio

Companies 7.1% 5.3% 5.4% % Fixed Rate 4.8% 5.4% 5.4% % Floating Rate 93.5% 93.8% 93.8% %

Equity 1.7% 0.8% 0.8% Portfolio Companies 98 94 94 Non-Accrual Investments at Amortized

Cost $ 4,373 $ 4,346 -Non-Accrual Investments as % of Total Portfolio at

Amortized Cost 1.1% 1.3% -Non-Accrual Investments at Fair Value $ 2,653 $ 3,095

-Non-Accrual Investments as % of Total Portfolio at Fair Value 0.7% 0.9%

- (1) The fiscal year for Golub Capital

BDC, Inc. ends on September 30, 2011. As such, ‘Q1 2011’ refers to the quarter

ended December 31, 2010, ‘Q4 2010’ refers to the quarter ended September 30,

2010, and ‘Q3 2010’ refers to the quarter ended June 30, 2010. (2) Total commitments, including

unfunded amounts, total $113.7 million at December 31, 2010, $83.7 million at

September 30, 2010, and $18.9 million at June 30, 2010. (3) At September 30, 2010, new

investment fundings are shown net of syndications of $53.0

million.

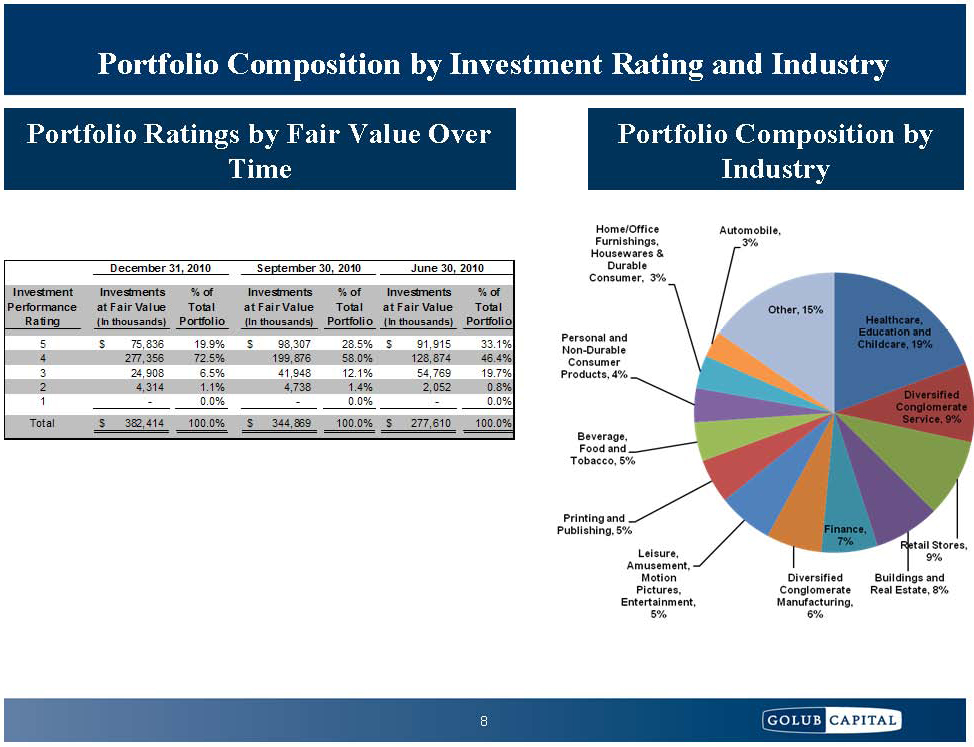

Portfolio Composition by Investment Rating and

Industry Portfolio Ratings by Fair Value Over

Portfolio Composition by Time Industry December 31, 2010 September 30, 2010

June 30, 2010

Investment Investments % of

Investments % of Investments % of Performance at Fair Value Total at Fair Value

Total at Fair Value Total Rating (In thousands) Portfolio (In thousands)

Portfolio (In thousands) Portfolio 5 $ 75,836 19.9% $ 98,307 28.5% $ 91,915

33.1% 4 277,356 72.5% 199,876 58.0% 128,874

46.4% 3 24,908 6.5% 41,948 12.1% 54,769

19.7% 2 4,314 1.1% 4,738 1.4% 2,052

0.8% 1 - 0.0% - 0.0% - 0.0% Total $ 382,414

100.0% $ 344,869 100.0% $ 277,610 100.0%

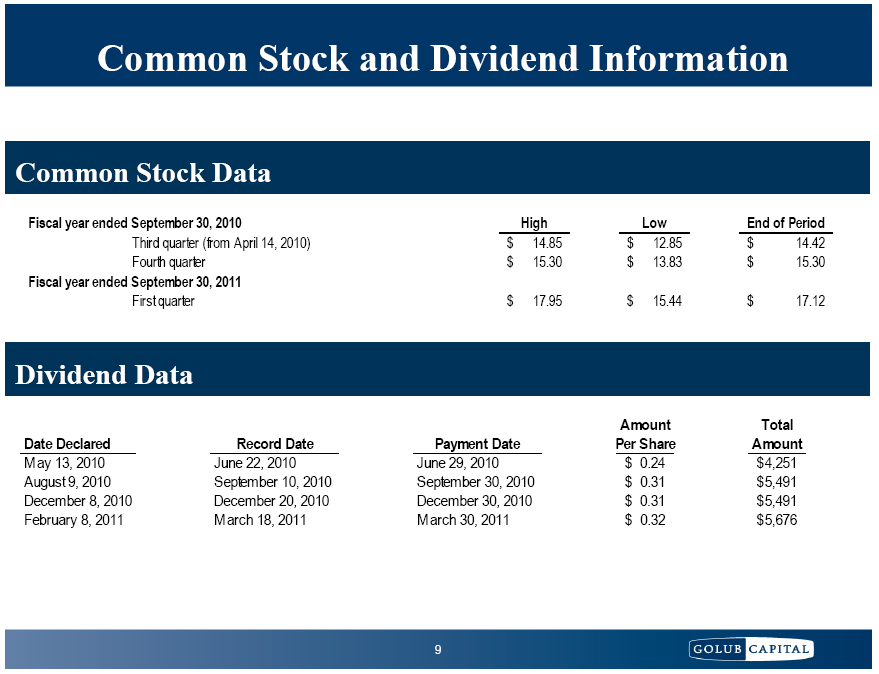

Common Stock and Dividend

Information

Common Stock Data Fiscal year ended September 30, 2010

High Low End of Period Third quarter (from April 14, 2010) $

14.85 $ 12.85 $ 14.42 Fourth quarter $ 15.30 $ 13.83 $ 15.30 Fiscal year ended September 30,

2011 First quarter $ 17.95 $ 15.44 $

17.12 Dividend Data Amount Total Date Declared Record Date

Payment Date Per Share Amount May 13, 2010 June 22, 2010 June 29, 2010

$ 0.24 $ 4,251 August 9, 2010 September 10, 2010 September 30, 2010 $ 0.31 $

5,491 December 8, 2010 December 20, 2010 December 30, 2010 $ 0.31 $ 5,491

February 8, 2011 March 18, 2011 M arch 30, 2011 $ 0.32 $

5,676

Liquidity and Investment

Capacity aCash and cash equivalents totaled $41.4

million as of December 31, 2010. aRestricted cash and cash equivalents

totaled $27.6 million as of December 31, 2010. Restricted cash is available for

investment for deals that qualify for our securitization vehicle. aLiquid

broadly syndicated loans totaled $34.9 million as of December 31, 2010. We

anticipate selling these loans in future periods as we find new opportunities to

deploy capital. aWe have $28.3 million in available debt

commitments from the SBA as December 31, 2010. These commitments may be drawn

upon subject to customary SBA procedures.