Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - QUANTUM SOLAR POWER CORP. | exhibit31-1.htm |

| EX-31.2 - CERTIFICATION - QUANTUM SOLAR POWER CORP. | exhibit31-2.htm |

| EX-32.2 - CERTIFICATION - QUANTUM SOLAR POWER CORP. | exhibit32-2.htm |

| EX-32.1 - CERTIFICATION - QUANTUM SOLAR POWER CORP. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

COMMISSION FILE NUMBER 000-52686

QUANTUM SOLAR POWER CORP.

(Exact name of registrant as specified in its charter)

| NEVADA | 27-1616811 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 3900 Paseo del Sol, Suite A311 | |

| Santa Fe, NM | 87507 |

| (Address of principal executive offices) | (Zip Code) |

(505)-216-5021

(Registrant's telephone number,

including area code)

N/A

(Former name, former address and

former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[X] Yes

[ ] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

[ ] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act):

[ ]

Yes [X]No

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: As of February 3, 2011, the Issuer had 146,726,192 shares of common stock, issued and outstanding.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

The accompanying unaudited financial statements have been prepared in accordance with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, and, therefore, do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders' equity in conformity with generally accepted accounting principles. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. Operating results for the six month period ended December 31, 2010 are not necessarily indicative of the results that can be expected for the year ending June 30, 2011.

As used in this Quarterly Report, the terms "we,” "us,” "our,” and “Quantum” mean Quantum Solar Power Corp., unless otherwise indicated. All dollar amounts in this Quarterly Report are in U.S. dollars unless otherwise stated.

2

QUANTUM SOLAR POWER CORP. AND SUBSIDIARY

(A

Development Stage Company)

CONSOLIDATED BALANCE SHEETS

(Expressed in United States Dollars)

| December 31, | ||||||

| 2010 | June 30, 2010 | |||||

| ASSETS | ||||||

| Current | ||||||

| Cash | $ | 1,936,853 | $ | 70,230 | ||

| Receivables | - | 4,638 | ||||

| Security Deposits | 1,677 | 11,376 | ||||

| Total Current Assets | 1,938,530 | 86,244 | ||||

| Equipment (Note 3) | 2,224 | 2,780 | ||||

| Patents (Note 4) | 1,534,818 | 1,573,189 | ||||

| Total Assets | $ | 3,475,572 | $ | 1,662,213 | ||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||

| Current | ||||||

| Accounts payable and accrued liabilities | $ | 239,277 | $ | 382,456 | ||

| Subscriptions received in advance | 10,000 | 76,500 | ||||

| Line of credit (Note 5) | 0 | 18,713 | ||||

| Total Liabilities | $ | 249,277 | $ | 477,669 | ||

| Stockholders' equity | ||||||

| Preferred

stock, $0.001 par value 10,000,000 shares

authorized no shares outstanding |

||||||

| Common

stock, $0.001 par value 400,000,000 shares

authorized and 146,726,192 (2010 - 142,130,000) shares outstanding as of December 31, 2010 (Note 6) |

146,726 | 142,130 | ||||

| Commitment to issue shares (Note 6) | ||||||

| Additional Paid in capital (Note 6) | 322,956 | 112,632 | ||||

| Accumulated deficit during development stage | 6,894,127 | 2,577,498 | ||||

| (4,137,514 | ) | (1,647,716 | ) | |||

| Total Stockholders' Equity | ||||||

| 3,226,295 | 1,184,544 | |||||

| Total Liabilities and Stockholders' Equity | ||||||

| $ | 3,475,572 | $ | 1,662,213 |

The accompanying notes are an integral part of these consolidated financial statements.

QUANTUM SOLAR POWER CORP. AND SUBSIDIARY

(A

Development Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS

(Expressed in United States Dollars)

| For the Period | |||||||||||||||

| For the 6 | From April 14, | ||||||||||||||

| For the 3 | For the 3 | Months | For the 6 | 2004 | |||||||||||

| Months Ended | Months Ended | Ended | Months Ended | (Inception) to | |||||||||||

| December 31, | December 31, | December | December 31, | December 31, | |||||||||||

| 2010 | 2009 | 31, 2010 | 2009 | 2010 | |||||||||||

| OPERATING EXPENSES | |||||||||||||||

| Amortization of equipment | 278 | 556 | 1,112 | ||||||||||||

| Amortization of patents | 19,185 | 38,371 | 76,741 | ||||||||||||

| General and administrative | 168,958 | 12,283 | 351,958 | 15,328 | 649,183 | ||||||||||

| Professional fees | 148,775 | 221,211 | 571,329 | ||||||||||||

| Research and development | 868,924 | 1,270,924 | 1,966,662 | ||||||||||||

| Stock-based compensation (Note 6) | 79,855 | 234,778 | 394,487 | ||||||||||||

| (1,285,975 | ) | (12,283 | ) | (2,117,798 | ) | (15,328 | ) | (3,659,514 | ) | ||||||

| OTHER ITEM | |||||||||||||||

| Impairment of intangible assets | (106,000 | ) | |||||||||||||

| Loss and comprehensive loss for the period | (1,285,975 | ) | (12,283 | ) | (2,117,798 | ) | (15,328 | ) | (3,765,514 | ) | |||||

| Basic and diluted loss per common share | (0.01 | ) | (0.00 | ) | (0.01 | ) | (0.00 | ) | |||||||

| Weighted average number of common shares outstanding |

145,190,610 | 141,800,000 | 143,750,673 | 141,666,848 |

The accompanying notes are an integral part of these consolidated financial statements.

QUANTUM SOLAR POWER CORP. AND SUBSIDIARY

(A

Development Stage Company)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(Expressed in United States Dollars)

| Common Stock | ||||||||||||||||||

| Accumulated | ||||||||||||||||||

| Additional | Commitment | Deficit | Total | |||||||||||||||

| Paid in | to Issue | During the | Stockholders' | |||||||||||||||

| Shares | Amount | Capital | Shares | Dev. Stage | Equity | |||||||||||||

| Balance, April 14, 2004 (Inception) | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| Common shares issued at par | 117,200,000 | 15 | 92,485 | 0 | 0 | 92,500 | ||||||||||||

| Net loss | (9,557 | ) | (9,557 | ) | ||||||||||||||

| Balance, June 30, 2004 | 117,200,000 | 15 | 92,485 | 0 | (9,557 | ) | 82,943 | |||||||||||

| Net loss | (40,111 | ) | (40,111 | ) | ||||||||||||||

| Balance, June 30, 2005 | 117,200,000 | 15 | 92,485 | 0 | (49,668 | ) | 42,832 | |||||||||||

| Net loss | (26,654 | ) | (26,654 | ) | ||||||||||||||

| Balance, June 30, 2006 | 117,200,000 | 15 | 92,485 | 0 | (76,322 | ) | 16,178 | |||||||||||

| Net loss | (15,652 | ) | (15,652 | ) | ||||||||||||||

| Balance, June 30, 2007 | 117,200,000 | 15 | 92,485 | 0 | (91,974 | ) | 526 | |||||||||||

| Common

shares issued at $2.00 per share |

100,000 | 100 | 199,900 | 200,000 | ||||||||||||||

| Net loss | (166,032 | ) | (166,032 | ) | ||||||||||||||

| Balance, June 30, 2008 | 117,300,000 | 115 | 292,385 | 0 | (258,006 | ) | 34,494 | |||||||||||

| Net loss | (28,747 | ) | (28,747 | ) | ||||||||||||||

| Balance, June 30, 2009 | 117,300,000 | 115 | 292,385 | 0 | (286,753 | ) | 5,747 | |||||||||||

| Private placement | 280,000 | 280 | 559,720 | 560,000 | ||||||||||||||

| Share issuance costs | (4,140 | ) | (4,140 | ) | ||||||||||||||

| Stock-based compensation | 159,709 | 159,709 | ||||||||||||||||

| Commitment to issue shares | 112,632 | 112,632 | ||||||||||||||||

| Acquisition of patents | 71,500,000 | 71,500 | 1,540,059 | 1,611,559 | ||||||||||||||

| Shares issued for services | 50,000 | 50 | 99,950 | 100,000 | ||||||||||||||

| Par value reclassification | 117,185 | (117,185 | ) | 0 | ||||||||||||||

| Return to treasury | (47,000,000 | ) | (47,000 | ) | 47,000 | 0 | ||||||||||||

| Net loss | (1,360,963 | ) | (1,360,963 | ) | ||||||||||||||

| Balance, June 30, 2010 | 142,130,000 | 142,130 | 2,577,498 | 112,632 | (1,647,716 | ) | 1,184,544 | |||||||||||

| Dividend - warrants | 372,000 | (372,000 | ) | 0 | ||||||||||||||

| Private placement | 4,039,560 | 4,039 | 4,035,521 | 4,039,560 | ||||||||||||||

| Return to nonqualified investors | (8,000 | ) | (8 | ) | (15,992 | ) | (16,000 | ) | ||||||||||

| Exercise of warrants | 372,000 | 372 | 3,348 | 3,720 | ||||||||||||||

| Share issuance costs | (505,465 | ) | (505,465 | ) | ||||||||||||||

| Stock-based compensation | 234,778 | 234,778 | ||||||||||||||||

| Shares issued for services | 192,632 | 193 | 192,439 | (112,632 | ) | 80,000 | ||||||||||||

| Commitment to issue shares | 322,956 | 322,956 | ||||||||||||||||

| Net loss | (2,117,798 | ) | (2,117,798 | ) | ||||||||||||||

| Balance, December 31, 2010 | 146,726,192 | 146,726 | 6,894,127 | 322,956 | (4,137,514 | ) | 3,226,295 | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

QUANTUM SOLAR POWER CORP. AND SUBSIDIARY

(A

Development Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in United States Dollars)

| For the 6 | For the Period | |||||||||||

| For the 6 | Months | For the 6 | April 14, 2004 | |||||||||

| Months Ended | Ended | Months Ended | (Inception) to | |||||||||

| December 31, | December | December 31, | December 31, | |||||||||

| 2010 | 31, 2009 | 2008 | 2010 | |||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

| Loss for the year | (2,117,798 | ) | (15,328 | ) | (13,480 | ) | (3,765,514 | ) | ||||

| Items not affecting cash: | ||||||||||||

| Amortization of equipment | 556 | 1,112 | ||||||||||

| Amortization of intangible assets | 38,371 | 76,741 | ||||||||||

| Impairment of intangible assets | 106,000 | |||||||||||

| Stock-based compensation | 234,778 | 394,487 | ||||||||||

| Shares for management services | 100,000 | |||||||||||

| Shares for consulting and management bonuses | 160,000 | 272,632 | ||||||||||

| Changes in non-cash working capital items: | ||||||||||||

| Changes in receivables | 4,638 | |||||||||||

| Changes in prepaid expenses | 9,699 | (1,677 | ) | |||||||||

| Changes in accounts payable and accrued liabilities | (143,179 | ) | 1,607 | (6,000 | ) | 248,277 | ||||||

| Net cash used in operating activities | (1,812,935 | ) | (13,721 | ) | (19,480 | ) | (2,567,942 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||||||

| Equipment | (3,336 | ) | ||||||||||

| Purchase of technology rights | (15,000 | ) | ||||||||||

| Purchase of intangible assets | (100,000 | ) | ||||||||||

| Net cash used in investing activities | 0 | 0 | 0 | (118,336 | ) | |||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

| Proceeds from line of credit and loans payable | 500 | 43,713 | ||||||||||

| Proceeds from issuance of common stock | 3,963,060 | 4,815,560 | ||||||||||

| Proceeds from exercise of warrants | 3,720 | 3,720 | ||||||||||

| Share issuance costs | (262,509 | ) | (266,649 | ) | ||||||||

| Refunds to nonqualified investors | (16,000 | ) | (16,000 | ) | ||||||||

| Subscriptions received in advance | 10,000 | 86,500 | ||||||||||

| Cash used to pay line of credit and loans payable | (18,713 | ) | (43,713 | ) | ||||||||

| Net cash provided by financing activities | 3,679,558 | 500 | 4,623,131 | |||||||||

| Change in cash during the period | 1,866,623 | (13,221 | ) | (19,480 | ) | 1,936,853 | ||||||

| Cash and Cash Equivalents, beginning of period | 70,230 | 13,247 | 41,994 | 0 | ||||||||

| Cash and Cash Equivalents, end of period | 1,936,853 | 26 | 22,514 | 1,936,853 | ||||||||

| Supplemental disclosures with respect to cash flows (Note 7) | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| QUANTUM SOLAR POWER CORP. AND SUBSIDIARY |

| (A Development Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| (Expressed in United States dollars) |

| DECEMBER 31, 2010 |

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

Quantum Solar Power Corp. (the “Company”) was incorporated in Nevada on April 14, 2004. The Company is a development stage company engaged in the business of developing and commercializing next generation solar power technology under the name Next Generation Device™ abbreviated NGD™. Quantum’s NGD™ is a patent pending, functioning, laboratory model that demonstrates its utility in solar power conversion. On June 16, 2008 stockholders by way of Proxy Statement confirmed and ratified the change of the company’s name from QV, Quantum Ventures, Inc. to Quantum Solar Power Corp. |

|

The Company operates in one reportable segment being the research and development of solar power technology in Canada and the United States of America. Revenues will be substantially derived from royalty based licensing arrangements in this reporting segment. |

|

Going Concern |

|

These consolidated financial statements have been prepared consistent with accounting policies generally accepted in the United States (“U.S. GAAP”) assuming the Company will continue as a going concern. Currently, the Company has no sales and has incurred a net loss of $2,117,798 for the six months ending December 31, 2010 and an accumulated loss of $3,765,514 for the period from April 14, 2004 (inception) to December 31, 2010. The future of the Company is dependent upon its ability to obtain financing and upon future profitable operations from development and commercialization of an NGD™. Management has plans to seek additional capital through private placements and public offerings of its common stock. These factors raise substantial doubt that the Company will be able to continue as a going concern. |

|

Management's plans for the continuation of the Company as a going concern include financing the Company's operations through issuance of its common stock. If the Company is unable to complete its financing requirements or achieve revenue as projected, it will then modify its expenditures and plan of operations to coincide with the actual financing completed and actual operating revenues. There are no assurances, however, with respect to the future success of these plans. |

|

The accompanying financial statements do not include any adjustments to the recorded assets or liabilities that might be necessary should the Company fail in any or the above objectives and is unable to operate for the coming year. |

|

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation |

|

The accompanying unaudited financial statements have been prepared by the Company in conformity with U.S. GAAP applicable to interim financial information. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed, or omitted. In the opinion of management, the unaudited interim financial statements include all adjustments necessary for the fair presentation of the results of the interim periods presented. All adjustments are of a normal recurring, nature, except as otherwise noted below. These financial statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended June 30, 2010, included in the Company's Annual Report on Form 10-K, filed September 13, 2010, with the Securities Exchange Commission. The results of operations for the interim periods are not necessarily indicative of the results of operations for any other interim period or for a full fiscal year. |

| QUANTUM SOLAR POWER CORP. AND SUBSIDIARY |

| (A Development Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| (Expressed in United States dollars) |

| DECEMBER 31, 2010 |

| 2. | SIGNIFICANT ACCOUNTING POLICIES (cont'd... ) |

Basis of Presentation (cont'd... ) |

|

Certain comparative figures have been reclassified to conform with the current period's presentation. |

|

Recent accounting pronouncements |

|

Recent accounting pronouncements that the Company has adopted or will be required to adopt in the future are summarized below. |

|

In January 2010, the FASB issued ASU 2010-06 which is intended to improve disclosures about fair value measurements. The guidance requires entities to disclose significant transfers in and out of fair value hierarchy levels, the reasons for the transfers and to present information about purchases, sales, issuances and settlements separately in the reconciliation of fair value measurements using significant unobservable inputs (Level 3). Additionally, the guidance clarifies that a reporting entity should provide fair value measurements for each class of assets and liabilities and disclose the inputs and valuation techniques used for fair value measurements using significant other observable inputs (Level 2) and significant unobservable inputs (Level 3). The Company has applied the new disclosure requirements as of January 1, 2010, except for the disclosures about purchases, sales, issuances and settlements in the Level 3 reconciliation, which will be effective for interim and annual periods beginning after December 15, 2010. The adoption of this guidance has not had and is not expected to have a material impact on the Company's financial statements. |

|

In April 2010, the FASB issued ASU 2010-13, Compensation - Stock Compensation (Topic 718), amending ASC 718. ASU 2010-13 clarifies that a share-based payment award with an exercise price denominated in the currency of a market in which the entity's equity securities trade should not be classified as a liability if it otherwise qualifies as equity. ASU 2010-13 also improves GAAP by improving consistency in financial reporting by eliminating diversity in practice. ASU 2010-13 is effective for interim and annual reporting periods beginning after December 15, 2010 (January 1, 2011 for the Company). The Company is currently evaluating the impact of ASU 2010-09, but does not expect its adoption to have a material impact on the Company's financial reporting and disclosures. |

| QUANTUM SOLAR POWER CORP. AND SUBSIDIARY |

| (A Development Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| (Expressed in United States dollars) |

| DECEMBER 31, 2010 |

| 3. | EQUIPMENT |

| 6 months | |||||||||||||||||||

| ended | Year ended | ||||||||||||||||||

| December | June 30, | ||||||||||||||||||

| 31, 2010 | 2010 | ||||||||||||||||||

| Accumulated | Net | Accumulated | Net | ||||||||||||||||

| Cost | Amortization | Book Value | Cost | Amortization | Book Value | ||||||||||||||

| Computer equipment | $ | 3,336 | $ | 1,112 | $ | 2,224 | $ | 3,336 | $ | 556 | $ | 2,780 | |||||||

| 4. | TECHNOLOGY PURCHASE AGREEMENT |

On April 15, 2008, QV, Quantum Ventures, Inc. entered into a License agreement ( “The Agreement”) with Canadian Integrated Optics International Ltd. of Douglas, Isle of Man (“CIOI”), to manufacture and market CIOI’s patent pending solar technology based on a new approach for the generation of solar power. On May 7, 2008 the Agreement was subsequently amended and executed by CIOI and on May 16, 2008 the agreement was executed by QV, Quantum Ventures, Inc. closing of this agreement and is subject to certain terms and conditions. The purchase price paid in cash for the License was $100,000. These costs were later written-off and charged to operations in fiscal 2008. |

|

In December 2009 the Company executed an agreement with CIOI to purchase technology and associated patents related to the development of certain solar technology in an exchange for 71,500,000 common stock of the Company valued at $1,611,559. The patents have an estimated useful life of 21 years since acquisition. The Company has recorded $76,741 in amortization through the quarter ended December 31, 2010. |

|

| 5. | LINE OF CREDIT |

On February 20, 2010, the Company entered into an unsecured, non-interest bearing revolving line of credit with CIOI of up to $250,000 in available financing. The Company had withdrawn $43,713 and repaid the balance in full. As at December 31, 2010 the line of credit has a zero balance. |

|

| 6. | STOCKHOLDERS’ EQUITY |

On May 7, 2004 the Company issued 8,650,000 of its common shares for cash of $86,500. |

|

On June 30, 2004, the Company issued 6,000,000 of its common shares for cash of $6,000. |

|

On February 25, 2008, the Board of Directors of the registrant passed unanimously a resolution authorizing a forward split of the authorized and issued and outstanding common shares on an eight to one (8 - 1) basis bringing the total common shares issued and outstanding to 117,200,000 and authorized common shares to 400,000,000. |

| QUANTUM SOLAR POWER CORP. AND SUBSIDIARY |

| (A Development Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| (Expressed in United States dollars) |

| DECEMBER 31, 2010 |

| 6. | STOCKHOLDERS' EQUITY (cont'd... ) |

The Company has completed a private placement on April 15, 2008 to issue 100,000 common shares at a price of $2.00 per share. The net proceeds received were $200,000. No commissions were paid and no registration rights have been granted. |

|

On December 16, 2009, the Company entered into an agreement with CIOI as amended, wherein the Company agreed to purchase all of their solar cell technology in consideration of 71,500,000 restricted shares of common stock. As part the transaction, the Company's President returned and cancelled 47,000,000 shares of the Company's common stock. |

|

In April 2010, 50,000 shares valued at $100,000 were issued as compensation for a performance bonus to a director of the Company. |

|

In April 2010 the Company completed a private placement to issue 280,000 shares at a share price of $2.00 per share. The net proceeds received were $560,000. |

|

During the quarter ended September 30, 2010, 274,060 shares were issued through a private placement at a stock price of $1.00 per share; net proceeds were $274,060 of which $76,500 was received during the year ended June 30, 2010. On September 27, 2010, the Board granted 372,000 warrants to those shareholders who had purchased shares at $2.00 per share to allow them to purchase a matching number of shares at $0.01 in order to make them whole as a result of the change in the share sale price. |

|

During the quarter ended December 31, 2010, 3,765,500 shares were issued through two private placements and a total of $262,509 in share issue costs were paid. In addition, 372,000 shares were issued when the warrants described above were exercised. Net proceeds were $3,768,720, all of which were received by December 31. 2010. Also, $16,000 was returned to several investors who previously paid for 8,000 shares and were found not to be qualified. |

|

In October 2010, 30,000 shares were issued for consulting services and 50,000 for a management performance bonus relating to services provided during the previous quarter. |

|

Commitment to issue shares |

|

According to the terms of a contract entered into during the year ended June 30, 2010, the Company agreed to issue 50,000 shares per quarter to management and 10,000 shares per month to a consultant. Accordingly, the Company has a commitment to issue 80,000 common shares at a value of $80,000. |

|

The Company entered into an agreement with various fund raisers to compensate them for their activities on the behalf of the Company by issuing common shares. Accordingly, the Company has recorded a commitment to issue 242,956 shares at a value of $242,956. |

| QUANTUM SOLAR POWER CORP. AND SUBSIDIARY |

| (A Development Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| (Expressed in United States dollars) |

| DECEMBER 31, 2010 |

| 6. | STOCKHOLDERS’ EQUITY (cont’d…) |

Stock options |

|

The Company does not have a formal stock option plan in place. Stock option grants are determined on as individual basis. |

|

Stock options are summarized as follows: |

| Stock | |||||||

| Options | |||||||

| Weighted | |||||||

| Average | |||||||

| Number | Exercise | ||||||

| of Shares | Price | ||||||

| Balance outstanding, April 14, 2004 (inception) to June 30, 2009 | - | - | |||||

| Granted | 500,000 | $ | 0.50 | ||||

| Balance outstanding, June 30, 2010 | 500,000 | 0.50 | |||||

| Granted | 100,000 | 0.50 | |||||

| Balance outstanding, December 31, 2010 | 600,000 | $ | 0.50 | ||||

| Exercisable, December 31, 2010 | 266,667 | $ | 0.50 |

The following table summarizes information about the stock options outstanding at December 31, 2010:

| Number | Exercise | ||||||||||||

| of Shares | Price | Expiry Date | |||||||||||

| Options | 500,000 | $ | 0.50 | January 1, 2013 | |||||||||

| 50,000 | $ | 0.50 | July 9, 2011 | ||||||||||

| 50,000 | $ | 0.50 | July 15, 2011 |

| QUANTUM SOLAR POWER CORP. AND SUBSIDIARY |

| (A Development Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| (Expressed in United States dollars) |

| DECEMBER 31, 2010 |

| 6. | STOCKHOLDERS’ EQUITY (cont’d…) |

Stock-based compensation |

|

The Company used the Black-Scholes option pricing model to determine the fair value of options granted. During fiscal 2010, the Company granted 500,000 (2009 – Nil; 2008 – Nil) options with a weighted average fair value of $1.91 (2009 – $Nil; 2008 - $Nil) per option to a director of the Company, which is being recognized over the vesting periods of the options. |

|

During the period ended December 31, 2010, 100,000 options with a weighted average fair value of $0.75 were granted to two former board members, exercisable at any time after the date of the agreement. Total stock-based compensation paid in the 6 month period ended December 31, 2010 was $234,778 (2009 -$Nil). This amount represents the value of vested options. |

|

The fair value of stock options has been estimated with the following assumptions: |

| Period ended September 30 | 2010 | 2009 | 2008 | |||||||

| Dividend yield | 0.00% | - | - | |||||||

| Expected volatility | 229% | - | - | |||||||

| Risk free interest rate | 1.93% | - | - | |||||||

| Expected life of options | 1.83 years | - | - |

Common share purchase warrants outstanding |

|

During the 6 month period ended December 31, 2010 the Company granted 372,000 common share purchase warrants for an exercise price of $0.01 expiring October 25, 2010. The warrant issue is treated as a dividend and has a fair value of $372,000. During the period ended December 31, 2010 the warrants were exercised. |

|

| 7. | SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS |

| For the | |||||||||||||

| 6 months | 6 months | 6 months | period from | ||||||||||

| ended | ended | ended | April 14, | ||||||||||

| December | December | December | 2004 | ||||||||||

| 31, 2010 | 31, 2009 | 31, 2008 | (inception) to | ||||||||||

| December | |||||||||||||

| 31, 2010 | |||||||||||||

| Cash paid for interest | $ | - | $ | - | $ | - | $ | - | |||||

| Cash paid for income taxes | $ | - | $ | - | $ | - | $ | - |

| QUANTUM SOLAR POWER CORP. AND SUBSIDIARY |

| (A Development Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| (Expressed in United States dollars) |

| DECEMBER 31, 2010 |

| 7. | SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS (cont’d…) |

|

Significant non-cash transactions for the 6 month period ended December 31, 2010 include the Company: |

||

| a) | Issuing 112,632 common shares at a value of $112,632 from commitment to issue shares to share capital and additional paid in capital; and |

|

| b) | Granting 372,000 warrants for a fair value of $372,000 to various shareholders as a dividend. |

|

| c) | Committing to issue 242,956 common shares at a value of $242,956 as finders’ fees. |

|

| 8. | RELATED PARTY TRANSACTIONS |

|

During the 6 months ended December 31, 2010 the Company paid or accrued $868,924 in research and development costs with CIOI, a former significant shareholder, of which $212,814 is included in accrued liabilities as at December 31, 2010. |

||

| 9. | SUBSEQUENT EVENTS |

|

Subsequent to December 31, 2010, the Company: |

||

| a) | Entered into a consulting agreement with Teatyn Enterprises Inc. Under the terms of this agreement, Teatyn provides investor relations services to the Company. The term of the agreement is 12 months for a total cash fee including a one-time start-up payment of $10,250 CDN (paid in January 2011) , $93,500 CDN paid in monthly instalments, and a one-time pament of $4,250 CDN for the last, partial month of the agreement, for a total of $108,000 CDN. In addition, the Company sold Teatyn 600,000 warrants for an aggregate consideration of $6,000, vesting 25,000 immediately, 50,000 shares per month from February 1 to December 1, 2011, and 25,000 on January 2012, which may be exercised at $1.90 per share. |

|

| b) | Issued 10,000 common shares for proceeds of $10,000 of which were received during the period ended December 31, 2010. |

|

| c) | Extended its Research Agreement, through CIOI, with Simon Fraser University until July 31, 2011 in the amount of CDN $476,482. |

|

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Quarterly Report constitute "forward-looking statements". These statements, identified by words such as “plan,” "anticipate," "believe," "estimate," "should," "expect" and similar expressions, include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under this caption "Management's Discussion and Analysis of Financial Condition and Results of Operation" and elsewhere in this Quarterly Report. We intend to discuss in our Quarterly and Annual Reports any events and circumstances that occurred during the period to which such document relates that are reasonably likely to cause actual events or circumstances to differ materially from those disclosed in this Quarterly Report. We advise you to carefully review the reports and documents we file from time to time with the United States Securities and Exchange Commission (the “SEC”).

OVERVIEW

We were incorporated on April 14, 2004 under the laws of the State of Nevada. Our principal executive offices are located at 3900 Paseo del Sol, Suite A311, Santa Fe, New Mexico, USA.

We are currently in the business of developing and marketing our NGD™ Technology for the production of solar energy without the need for expensive silicon based absorber components or other rare earth elements. The NGD™ Technology which is covered by three provisional U.S. patents differs from conventional solar technology as it does not require expensive silicon based absorber components or rare earth elements. Our researchers at Simon Fraser University in British Columbia, Canada have developed and built a proof of concept prototype of a next generation device utilizing the NGD™ Technology (see “Technology Acquisition” and “NGDTM Technology” below).

We are a development stage company. We have not earned any revenue to date nor have we engaged in any licensing agreements to date. We do not anticipate earning revenue until we have completed the development and testing of our NGD™ Technology. We are presently in the development stage of our business and we can provide no assurance that we will be able to complete commercial development or successfully sell or license products incorporating our solar power generation devices, once development and testing is complete. We have limited operations. We conduct all of our research and development on a contractual basis with Simon Fraser University. We have relied on the sale of our securities and loans or capital infusions from our officers and directors to fund our operations to date.

RECENT CORPORATE DEVELOPMENTS

Since the filing of our Quarterly Report for the fiscal quarter ended September 30, 2010 with the SEC, we experienced the following significant corporate developments:

| (1) |

On January 28, 2011, we entered into an investor relations consulting agreement (the “Agreement”), dated for reference January 15, 2011, with Teatyn Enterprises Inc. (“Teatyn”). Under the terms of the Agreement, Teatyn has agreed to provide us with investor relations services. In consideration of Teatyn’s investor relations services, we agreed to pay to Teatyn: | ||

| (a) |

CDN $10,250 on execution of the Agreement (which has been paid); and | ||

| (b) |

CDN $97,750 as follows: | ||

| (i) |

CDN $8,500 per month commencing on February 1, 2011 and ending on December 31, 2011; and | ||

3

| (ii) |

CDN $4,250 for the period from January 1, 2012 to January 14, 2012. |

|

Under the terms of the Agreement, we also agreed to issue to Teatyn 600,000 warrants (the “Warrants”) for aggregate proceeds of CDN $6,000 (which have been issued). Each warrant will be exercisable to purchase one share of our common stock at a price of USD $1.90 per share. The Warrants vest and become exercisable as follows: 25,000 vested immediately upon issuance; an additional 50,000 will vest on the first day of each month from February 1, 2011 to December 31, 2011; and 25,000 will vest on January 1, 2012. The Warrants were issued pursuant to the provisions of Regulation S of the Securities Act of 1933 (the “Act”) as Teatyn represented that it was not a "U.S. Person" as defined under Regulation S and that it was not acquiring the shares for the account or benefit of a U.S. Person. The term of the Agreement is for a period of one year effective as of January 15, 2011. | |

| (2) |

Pursuant to the terms of a takeover bid, under Canadian Securities Laws, Canadian Integrated Optics (IOM) Ltd. (“CIO”), our largest shareholder, has transferred over 99% of its 71,500,000 shares of our common stock to 47 different shareholders. As a result of the transaction, CIO no longer holds a significant amount of our common shares. |

| (3) |

On November 24, 2010, we issued 63,000 shares at a price of $1.00 per share for cash proceeds of $63,000. The issuances were completed pursuant to the provisions of Rule 506 of Regulation D of the Act. Each subscriber represented that they were an accredited investor as defined under Regulation D. This share issuance represents the sole tranche under the $5,000,000 U.S. private placement offering approved by the Company's board of directors on May 28, 2010. Following completion of this tranche, our Board of Directors approved the closing and termination of the U.S. private placement offering. |

| (4) |

On November 24, 2010, we completed our final tranche of our $5,000,000 foreign private placement offering (the “Foreign Private Placement”) by issuing a 1,972,500 shares of common stock pursuant to the provisions of Regulation S of the Act to persons who represented that they were not "U.S. Persons" as defined under Regulation S and that they were not acquiring the shares for the account or benefit of a U.S. Person. Following the completion of the final tranche, we have issued a total of 3,986,560 shares of common stock for gross proceeds of $3,986,560 under the Foreign Private Placement. Following completion of this tranche, our Board of Directors approved the closing and termination of the Foreign Private Placement. |

| (5) |

On November 24, 2010, we issued an aggregate of 372,000 common shares on the exercise of warrants which were issued for no consideration to shareholders who had purchased shares on a private placement basis at a price of $2.00 per share. Each warrant entitled the holder to purchase a common share our common stock at $0.01 per share. This enabled previous investors who exercised the warrants to have an average price per share substantially the same as those purchasing shares under our $1.00 per share Foreign Private Placement. The shares were issued pursuant to the provisions of Regulation S of the Act to persons who represented that they were not "U.S. Persons" as defined under Regulation S and that they were not acquiring the shares for the account or benefit of a U.S. Person. |

|

Proceeds from the above offerings will be used to for the development and marketing of our NGDTM Technology and for general corporate purposes over the next twelve months. |

TECHNOLOGY ACQUISITION

We acquired the NGDTM Technology on December 16, 2009 by an agreement (the “Technology Acquisition Agreement”) with Canadian Integrated Optics (IOM) Limited, (“CIO”). In consideration of the NGD™ Technology, we issued 71,500,000 shares of our common stock to CIO (of which CIO transferred over 99% pursuant to the terms of a takeover bid, under Canadian Securities Laws) and Desmond Ross, our former director and executive officer, returned 47,000,000 shares to the treasury. Under the Technology Acquisition Agreement, we also agreed to pay CIO, or such other parties designated by CIO, for ongoing development and research costs under CIO’s existing research agreement (the “CIO Research Agreement) with Simon Fraser University (“SFU”). The initial term of the CIO Research Agreement was until July 30, 2010.

4

Subsequent to entering into the Technology Acquisition Agreement, CIO entered into an amendment agreement to the CIO Research Agreement, whereby SFU agreed to extend the term until December 31, 2010 and in consideration of which we paid $310,076 CDN. On December 23, 2010, CIO entered into another amendment agreement dated January 1, 2011, whereby SFU agreed to further extend the term until July 31, 2011 and in consideration of which we will pay $476,482 CDN plus expenses, during the term.

As at December 31, 2010 we have paid $1,738,489 CDN under the CIO Research Agreement.

NGD™ TECHNOLOGY

Our NGD™ Technology is a patent pending, technology and proof of concept prototype for producing solar power without the necessity of utilizing expensive silicon based absorber components or other rare earth elements.

Solar cells based on the NGD™ Technology can reach a regime of cost and efficiency not obtainable with conventional solar cells. As a result, we believe our NGD™ Technology has the potential to enable the manufacture of solar cells at significantly less cost per Watt than current producers.

Thin Film solar cell technologies have proven inexpensive to manufacture but are at present only capable of efficiencies in the 10% power conversion efficient (“PCE”) range. Crystalline silicon solar cells are in the 15% to 20% PCE range but are very expensive to manufacture due to the cost of silicon processing. The reason for both these shortfalls is directly linked with the semiconductors used in the fabrication process.

All currently available solar cell technologies rely on a photovoltaic effect in which an incoming solar photon knocks loose a negative charge, leaving behind a positive charge, in a semiconducting material such as silicon. The positive and negative charges are then collected through separate conducting layers to be delivered as current to a load. Defects within the semiconductor layer can affect the power conversion efficiency by reducing the voltage and the current delivered to the load. Elimination of these defects can only occur through expensive purification and processing.

The NGD™ Technology’s principle of operation avoids the detrimental effects of defects within the semiconductor absorber layers by disposing of it altogether, and thus has the potential to simultaneously satisfy the requirements of high power conversion efficiencies and low costs. In addition, by eliminating expensive and exotic materials and manufacturing in a continuous rather than batch or wafer based process, we believe module costs can be reduced well below $1 per Watt-peak (Wp), the nominal price of a solar module widely recognized as the standard of solar commercial enablement.

The market for solar energy has been limited by the costs of panels and by their low efficiencies. Quantum expects that with its low cost, high efficiency NGD™ that the economics of solar power will prove to be superior to alternatives and that new and unforeseen markets will open for solar devices.

The solar panel business has been in a high growth phase over the past years however it is not sustainable since the growth has been fundamentally based on the availability of tax incentives, subsidies and other inducements. The economics of unsubsidized solar power are not attractive except in certain niche applications where choices are limited and the high costs can be justified.

An average crystalline silicon cell solar module has an efficiency of 15%, an average thin film cell solar module has an efficiency of 6%. Thin film manufacturing costs potentially are lower, though. Crystalline silicon cell technology forms about 90% of solar cell demand. The balance comes from thin film technologies. Approximately 45% of the cost of a silicon cell solar module is driven by the cost of the silicon wafer, a further 35% is driven by the materials required to assemble the solar module.

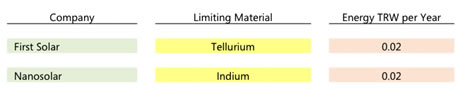

Thin film manufacturer First Solar is reported in some publications to have approximately $6 billion in contracts between 2010 and 2013. If First Solar were to have the opportunity to accept contracts worth $1 trillion and had the manufacturing capability to fulfill these contracts they would still be inhibited and negatively governed by material availability. According to the U.S. Geological Survey, there is enough tellurium available in global reserves to meet only 0.02 Terawatts (“TRW”) of energy provision using existing thin film technology. The same applies to San Jose, California-based Nanosolar’s Indium supply. Both companies current material choices (according to the Andrea Feltrin, Alex Freundlich Report, Photovoltaics and Nanostructures Laboratories, Center for Advanced Materials and Physics Department, University of Houston, Texas) limits these companies forever to sub-Gigawatt energy production (maximum 0.02 TRW per year).

5

Current Thin Film companies are coming close to competing commercially with coal but the materials they use such as tellurium and indium are very rare and capable of meeting only 0.13% of the worldwide energy demand even if they accessed the entire worldwide reserves of these materials.

PLAN OF OPERATION

The following discussion and analysis summarizes our plan of operation for the next twelve months, our results of operations for the six month period ended December 31, 2010 and changes in our financial condition from June 30, 2010. This discussion should be read in conjunction with the Management’s Discussion and Analysis of Financial Condition and Results of Operation included in our Annual Report on Form 10-K for the year ended June 30, 2010 filed with the SEC on September 13, 2010.

If we can obtain sufficient financing we intend to continue the final development of our NGD™ Technology, and identify and engage original equipment manufacturers (“OEM’s”) interested in licensing our technology. We anticipate that the licensing agreements will be between us and OEM’s with the expertise and facilities required to mass manufacture solar cells based on our NGD™ technology and that the OEM’s will distribute the solar cells worldwide using their existing sales and marketing channels and at their expense. The cost of manufacture will be solely the responsibility of the OEM’s. We expect to receive revenue on royalties based on the number of cells produced by the OEM’s. This business model should allow us to maximize capital resources available at startup and through our OEM licensees positively address the demand for high efficiency solar cell devices. This business model should enable us to increase revenues and create brand recognition without the time, capital and risk associated with manufacturing plant construction.

There is no assurance that we will be able to obtain sufficient financing to proceed with our plan of operation.

RESULTS OF OPERATIONS

| Three and Six | Three Months Ended | Percentage | Six Months Ended | Percentage | ||||||||||||||

| Months Summary | December 31 | Increase / | December 31 | Increase / | ||||||||||||||

| 2010 | 2009 | (Decrease) | 2010 | 2009 | (Decrease) | |||||||||||||

| Revenue | $ | - | $ | - | n/a | $ | - | $ | - | n/a | ||||||||

| Operating Expenses | (1,285,975 | ) | (12,283 | ) | 10369.5% | (2,117,798 | ) | (15,328 | ) | 13716.5% | ||||||||

| Net Loss | $ | (1,285,975 | ) | $ | (12,283 | ) | 10369.5% | $ | (2,117,798 | ) | $ | (15,328 | ) | 13716.5% | ||||

For the period from inception on April 14, 2004 to December 31, 2010, we have not earned any operating revenue. We had an accumulated net loss of $3,765,514 since inception. We incurred total operating expenses of $3,659,514 since inception.

We have not earned any revenues since inception. We do not anticipate earning revenues until such time as we complete further development of, and enter into licensing agreements for our NGD™ Cell Technology. We are presently in the development stage of our business and we can provide no assurance that we will be able to generate revenues from sales of our product or that the revenues generated will exceed the operating costs of our business.

6

Operating Expenses

We have incurred operating expenses in the amount of $1,285,975 for the fiscal quarter ended December 31, 2010. Operating expenses for this period included the following expenses:

| Three Months Ended December 31, 2010 | Three Months Ended December 31, 2009 | Percentage Increase / (Decrease) | Six Months Ended December 31, 2010 | Six Months Ended December 31, 2009 | Percentage Increase / (Decrease) | |||||||||||||

| Amortization of equipment | $ | 278 | $ | - | 100% | $ | 556 | $ | - | 100% | ||||||||

| Amortization of patents | 19,185 | - | 100% | 38,371 | - | 100% | ||||||||||||

| General and administrative | 168,958 | 12,283 | 1275.5% | 351,958 | 15,328 | 2196.2% | ||||||||||||

| Professional fees | 148,775 | - | 100% | 221,211 | - | 100% | ||||||||||||

| Research and Development | 868,924 | - | 100% | 1,270,924 | - | 100% | ||||||||||||

| Stock Based Compensation | 79,855 | - | 100% | 234,778 | - | 100% | ||||||||||||

| Total Operating Expenses | $ | 1,285,975 | $ | 12,283 | 10369.5% | $ | 2,117,798 | $ | 15,328 | 13716.5% |

Our operating expenses for the three and six months ended December 31, 2010 have increased as a result of increased operations in the development of our NGDTM Technology. This has resulted in increased research and development activities and general and administrative expenses. All expenses increased from fiscal 2009 to 2010. Professional fees related to the acquisition of the NGDTM Technology and meeting our ongoing reporting requirements with the SEC.

We anticipate our operating expenses will increase as we undertake our plan of operation. The increase will be attributable to our development, of our NGD™ solar cell technology. We also anticipate our ongoing operating expenses will also increase as a result of our ongoing reporting requirements under the Exchange Act.

Net Loss

We incurred a loss in the amount of $3,765,514 for the period from inception to December 31, 2010. Our loss was attributable to the costs of operating expenses which primarily consisted of research and development costs, general and administrative expenses and professional fees paid in connection with acquiring our assets, preparing and filing our Current, Quarterly and Annual Reports.

LIQUIDITY AND CAPITAL RESOURCES

Working Capital

| Percentage | |||||||||

| At December 31, 2010 | At June 30, 2010 | Increase / Decrease | |||||||

| Current Assets | $ | 1,938,530 | $ | 86,244 | 2147.7% | ||||

| Current Liabilities | (249,277 | ) | (477,669 | ) | (47.8)% | ||||

| Working Capital Surplus (Deficit) | $ | 1,689,253 | $ | (391,425 | ) | (531.6)% |

7

| Cash Flows | ||||||

| Six Months Ended | Six Months Ended | |||||

| December 31, 2010 | December 31, 2009 | |||||

| Cash Used in Operating Activities | $ | (1,812,935 | ) | $ | (13,721 | ) |

| Cash Provided by Investing Activities | - | - | ||||

| Cash Provided by Financing Activities | 3,679,558 | 500 | ||||

| Net Increase (Decrease) in Cash During Period | $ | 1,866,623 | $ | (13,221 | ) |

As at December 31, 2010, we had cash of $1,936,853 and a working capital surplus of $1,689,253.

The change in our working capital at December 31, 2010 from our year ended June 30, 2010 is primarily a result of the increases in proceeds from the sale of common stock and from decreases in accounts payable and accrued liabilities and our revolving line of credit with CIO. The increase in our cash used during the period ended on December 31, 2010 from the comparable periods of the preceding fiscal years are due to subscriptions received under our foreign private placement offering.

Future Financings

As of December 31, 2010, we had cash on hand of $1,936,853. Since our inception, we have used our common stock to raise money for our operations and for our acquisition. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation. For these reasons, our auditors stated in their report to our audited financial statements for the year ended June 30, 2010, that there is substantial doubt that we will be able to continue as a going concern.

U.S. and Foreign Private Placement Offerings

U.S. Private Placement

Our Board of Directors approved a private placement offering of up to 5,000,000 shares of our common stock at a price of $1.00 per share (the “U.S. Private Placement”). This offering was made to United States persons who were accredited investors as defined in Regulation D of the Securities Act.

On November 24, 2010, we issued 63,000 shares at a price of $1.00 per share for cash proceeds of $63,000. This share issuance represents the sole tranche under of the $5,000,000 U.S. Private Placement approved by the Company's board of directors on May 28, 2010. Following completion of this tranche, our Board of Directors approved the closing and termination of the U.S. Private Placement.

Foreign Private Placement

Our Board of Directors also approved a private placement offering of up to 5,000,000 shares of our common stock at a price of $1.00 per share (the “Foreign Private Placement”). This offering was only available to persons who are not “U.S. Persons” as defined under Regulation S of the Securities Act.

On November 24, 2010, we completed our final tranche of our $5,000,000 foreign private placement offering (the “Foreign Private Placement”) We have issued a total of 3,986,560 shares of common stock for gross proceeds of $3,986,560 under the Foreign Private Placement. Following completion of this tranche, our Board of Directors approved the closing and termination of the Foreign Private Placement.

Proceeds from the above offerings will be used to market and develop the Company’s NGDTM Technology over the next twelve months.

We have no revenues to date from our inception. We anticipate continuing to rely on equity sales of our common stock in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. We believe that we have obtained sufficient financing to cover our anticipated expenses over the next twelve months. However, there is no assurance that we will achieve any of additional sales of our equity securities or arrange for debt or other financing for to fund our planned business activities.

8

Significant Trends, Uncertainties and Challenges

We believe that the significant trends, uncertainties and challenges that directly or indirectly affect our financial performance and results of operations include:

-

Our ability to achieve module efficiencies and other performance targets through our partners, and to obtain necessary or desired certifications for our photovoltaic modules based on our technology, in a timely manner;

-

Our ability to license the technology to effective manufacturers and/or distributers;

-

Our ability to achieve projected operational performance and cost metrics;

-

Our ability to consummate strategic relationships with key partners, including original equipment manufacturer (OEM) customers, system integrators, value added resellers and distributors who deal directly with manufacturers and end-users.

-

Changes in the supply and demand for photovoltaic modules as well as fluctuations in selling prices for photovoltaic modules worldwide;

-

Our ability to raise additional capital on terms favorable to us;

-

Our future strategic partners’ expansion of their manufacturing facilities, operations and personnel; and

-

Our ability and the ability of our distributors, suppliers and customers to manage operations and orders during financial crisis and financial downturn.

Contractual Obligations

Contractual Obligations |

Payments Due By Period | ||||

Total |

Less than 1 Year |

1-3 Years |

3-5 Years |

More Than 5 Years |

|

| CIO Research Agreement | $476,482 CDN | $476,482 CDN | - | - | - |

| Investor Relations Agreement | $97,750 CDN | $93,500 CDN | $4,250 CDN | - | - |

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are disclosed in Note 2 to our audited financial statements included in our Annual Report for the year ended June 30, 2010.

9

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Foreign Currency Exchange Risk

The Company is actively engaged in research and development activities internationally and is exposed to foreign currency risk. We currently conduct significant research and development operations on a contractual basis at Simon Fraser University in British Columbia, Canada.

We do not hold any derivative instruments and do not engage in any hedging activities. Because most of our purchases and sales will made in Canadian dollars, any exchange rate change affecting the value of the in Canadian dollar relative to the U.S. dollar could have an effect on our financial results as reported in U.S. dollars. If the Canadian dollar were to depreciate against the U.S. dollar, amounts reported in U.S. dollars would be correspondingly reduced. If the in Canadian dollar were to appreciate against the U.S. dollar, amounts reported in U.S. dollars would be correspondingly increased.

Although our reporting currency is the U.S. dollar, we may conduct business and incur costs in the local currencies of other countries in which we may operate, make sales and buy materials. As a result, we are subject to currency translation risk. Further, changes in exchange rates between foreign currencies and the U.S. dollar could affect our future net sales and cost of sales and could result in exchange losses.

We cannot accurately predict future exchange rates or the overall impact of future exchange rate fluctuations on our business, results of operations and financial condition.

Interest Rate Risk

Our exposure to market risks for changes in interest rates relates primarily to our cash equivalents. This can also have an effect on the ability of manufacturers and consumers to obtain sufficient financing to license, manufacture, distribute or purchase a device using our technology.

Commodity and Component Risk

Failure to receive timely delivery of production tools by our future licensee’s equipment suppliers could delay manufacturing capacity and materially and adversely affect our results of operations and financial condition in future periods. The failure of any suppliers to perform could disrupt our future licensee’s supply chain and impair our operations.

If delivery of production tools or raw materials are not made on schedule or at all, then our licensees might be unable to carry out our commercialization and manufacturing plans, produce photovoltaic modules in the volumes and at the times that we expect or generate sufficient revenue from operations, and our business, results of operations and financial condition could be materially and adversely affected.

Credit Risk

We currently do not hold financial instruments that subject us to credit risk. Our receivables are all in the form of security deposits and travel advances to employees and so expose us to minimal risk.

ITEM 4. CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures

We carried out an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of December 31, 2010 (the “Evaluation Date”). This evaluation was carried out under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were not effective as of the Evaluation Date as a result of the material weaknesses in internal control over financial reporting discussed in our Annual Report on Form 10-K for the fiscal year ended June 30, 2010.

10

Disclosure controls and procedures are those controls and procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Notwithstanding the assessment that our internal control over financial reporting was not effective and that there were material weaknesses as identified in this report, we believe that our financial statements contained in our Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2010 fairly present our financial condition, results of operations and cash flows in all material respects.

Changes in internal control over financial reporting

There were no changes in our internal control over financial reporting that occurred during the fiscal quarter months ended December 31, 2010 that have materially affected, or that are reasonably likely to materially affect, our internal control over financial reporting.

Limitations on the effectiveness of controls and procedures

Our management, including our Chief Executive Officer and the Chief Financial Officer, do not expect that the our controls and procedures will prevent all potential errors or fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

11

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

None.

ITEM 1A. RISK FACTORS.

If photovoltaic technology is not suitable for widespread adoption, or if sufficient demand for solar modules does not develop or takes longer to develop than we anticipate, we may never earn revenues or become profitable.

The solar energy market is at a relatively early stage of development and the extent to which solar modules will be widely adopted is uncertain. If photovoltaic technology proves unsuitable for widespread adoption or if demand for solar modules fails to develop sufficiently, we may be unable to grow our business or generate sufficient net sales to sustain profitability. In addition, demand for solar modules in our targeted may not develop or may develop to a lesser extent than we anticipate. Many factors may affect the viability of widespread adoption of photovoltaic technology and demand for solar modules, including the following:

| 1. |

cost-effectiveness of the electricity generated by photovoltaic power systems compared to conventional energy sources and products, including conventional energy sources, such as natural gas, and other non-solar renewable energy sources, such as wind; |

| 2. |

availability and substance of government subsidies, incentives and renewable portfolio standards to support the development of the solar energy industry; |

| 3. |

performance and reliability of photovoltaic systems compared to conventional and other non-solar renewable energy sources and products; |

| 4. |

success of other renewable energy generation technologies, such as hydroelectric, tidal, wind, geothermal, solar thermal, concentrated photovoltaic, and biomass; |

| 5. |

fluctuations in economic and market conditions that affect the price of, and demand for, conventional and non-solar renewable energy sources, such as increases or decreases in the price of oil, natural gas and other fossil fuels; and |

| 6. |

fluctuations in capital expenditures by end-users of solar modules, which tend to decrease when the economy slows and interest rates increase. |

An increase in interest rates or lending rates or tightening of the supply of capital in the global financial markets (including a reduction in total tax equity availability) could make it difficult for end-users to finance the cost of a photovoltaic system and could reduce the demand for solar modules utilizing our NGD™ Technology and/or lead to a reduction in the average selling price for photovoltaic modules.

Many of potential solar technology customers will depend on debt financing to fund the initial capital expenditure required to develop, build and purchase a photovoltaic system. As a result, an increase in interest rates or lending rates could make it difficult for our potential customers to secure the financing necessary to develop, build, purchase or install a photovoltaic system on favorable terms, or at all, and thus lower demand for our solar modules which could limit our growth or reduce our net sales. Due to the overall economic outlook, our end-users may change their decision or change the timing of their decision to develop, build, purchase or install a photovoltaic system. In addition, we believe that a significant percentage of our end-users install photovoltaic systems as an investment, funding the initial capital expenditure through a combination of equity and debt. An increase in interest rates and/or lending rates could lower an investor’s return on investment in a photovoltaic system, increase equity return requirements or make alternative investments more attractive relative to photovoltaic systems, and, in each case, could cause these end-users to seek alternative investments. A reduction in the supply of project debt financing or tax equity investments could reduce the number of solar projects that receive financing and thus lower demand for solar modules.

Existing regulations and policies and changes to these regulations and policies may present technical, regulatory and economic barriers to the purchase and use of photovoltaic products, which may significantly reduce demand for our solar modules.

12

The market for electricity generation products is heavily influenced by foreign, federal, state and local government regulations and policies concerning the electric utility industry, as well as policies promulgated by electric utilities. These regulations and policies often relate to electricity pricing and technical interconnection of customer-owned electricity generation. In the United States and in a number of other countries, these regulations and policies have been modified in the past and may be modified again in the future. These regulations and policies could deter end-user purchases of photovoltaic products and investment in the research and development of photovoltaic technology. For example, without a mandated regulatory exception for photovoltaic systems, utility customers are often charged interconnection or standby fees for putting distributed power generation on the electric utility grid. If these interconnection standby fees were applicable to photovoltaic systems, it is likely that they would increase the cost to our end-users of using photovoltaic systems which could make them less desirable, thereby harming our business, prospects, results of operations and financial condition. In addition, electricity generated by photovoltaic systems mostly competes with expensive peak hour electricity, rather than the less expensive average price of electricity. Modifications to the peak hour pricing policies of utilities, such as to a flat rate for all times of the day, would require photovoltaic systems to achieve lower prices in order to compete with the price of electricity from other sources.

We anticipate that solar modules utilizing our technology and their installation will be subject to oversight and regulation in accordance with national and local ordinances relating to building codes, safety, environmental protection, utility interconnection and metering and related matters. It is difficult to track the requirements of individual states and design equipment to comply with the varying standards. Any new government regulations or utility policies pertaining to our solar modules may result in significant additional expenses to us, our resellers and their customers and, as a result, could cause a significant reduction in demand for our solar modules.

We face intense competition from manufacturers of crystalline silicon solar modules, thin film solar modules and solar thermal and concentrated photovoltaic systems; if global supply exceeds global demand, it could lead to a reduction in the average selling price for photovoltaic modules.

The solar energy and renewable energy industries are both highly competitive and continually evolving as participants strive to distinguish themselves within their markets and compete with the larger electric power industry. Within the global photovoltaic industry, we face competition from crystalline silicon solar module manufacturers, other thin film solar module manufacturers and companies developing solar thermal and concentrated photovoltaic technologies.

Even if demand for solar modules continues to grow, the rapid expansion plans of many solar cell and module manufacturers could create periods where supply exceeds demand.

During any such period, our competitors could decide to reduce their sales price in response to competition, even below their manufacturing cost, in order to generate sales. As a result our partners may be unable to sell solar modules based on our technology at attractive prices, or for a profit, during any period of excess supply of solar modules, which would reduce our net sales and adversely affect our results of operations. Also, we may decide to lower our average selling price to certain customers in certain markets in response to competition.

Our failure to further refine our technology and develop and introduce improved photovoltaic products could render solar modules based on our technology uncompetitive or obsolete and reduce our net sales and market share.

We will need to invest significant financial resources in research and development to continue to improve our module conversion efficiency and to otherwise keep pace with technological advances in the solar energy industry. However, research and development activities are inherently uncertain and we could encounter practical difficulties in commercializing our research results. We seek to continuously improve our products and processes, and the resulting changes carry potential risks in the form of delays, additional costs or other unintended contingencies. In addition, our significant expenditures on research and development may not produce corresponding benefits. In addition, other companies could potentially develop a highly reliable renewable energy system that mitigates the intermittent power production drawback of many renewable energy systems, or offers other value-added improvements from the perspective of utilities and other system owners, in which case such companies could compete with us even if the levelized cost of electricity associated with such new system is higher than that of our systems. Our solar modules may be rendered obsolete by the technological advances of our competitors, which could reduce our net sales and market share.

13

Our failure to protect our intellectual property rights may undermine our competitive position and litigation to protect our intellectual property rights or defend against third-party allegations of infringement may be costly.

Protection of our proprietary processes, methods and other technology is critical to our business. Failure to protect and monitor the use of our existing intellectual property rights could result in the loss of valuable technologies. We rely primarily on patents, trademarks, trade secrets, copyrights and contractual restrictions to protect our intellectual property. Our existing provisional patents and future patents could be challenged, invalidated, circumvented or rendered unenforceable. Our pending patent applications may not result in issued patents, or if patents are issued to us, such patents may not be sufficient to provide meaningful protection against competitors or against competitive technologies.

We also rely upon unpatented proprietary manufacturing expertise, continuing technological innovation and other trade secrets to develop and maintain our competitive position. While we generally enter into confidentiality agreements with our associates and third parties to protect our intellectual property, such confidentiality agreements are limited in duration and could be breached and may not provide meaningful protection for our trade secrets or proprietary manufacturing expertise. Adequate remedies may not be available in the event of unauthorized use or disclosure of our trade secrets and manufacturing expertise. In addition, others may obtain knowledge of our trade secrets through independent development or legal means. The failure of our patents or confidentiality agreements to protect our processes, equipment, technology, trade secrets and proprietary manufacturing expertise, methods and compounds could have a material adverse effect on our business. In addition, effective patent, trademark, copyright and trade secret protection may be unavailable or limited in some foreign countries, especially any developing countries into which we may expand our operations. In some countries we have not applied for patent, trademark or copyright protection.

Third parties may infringe or misappropriate our proprietary technologies or other intellectual property rights, which could have a material adverse effect on our business, financial condition and operating results. Policing unauthorized use of proprietary technology can be difficult and expensive. Also, litigation may be necessary to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others. We cannot assure you that the outcome of such potential litigation will be in our favor. Such litigation may be costly and may divert management attention and other resources away from our business. An adverse determination in any such litigation may impair our intellectual property rights and may harm our business, prospects and reputation. In addition, we have no insurance coverage against litigation costs and would have to bear all costs arising from such litigation to the extent we are unable to recover them from other parties.

We have yet to attain profitable operations and we will need additional financing to fund continued development of solar energy products.

We have incurred a net loss of $3,765,514 for the period from inception to December 31, 2010, and have earned no revenues to date. We expect to spend additional capital in order produce and market solar energy products which we are licensed to do, and establish our infrastructure and organization to support anticipated operations. We cannot be certain whether we will ever earn a significant amount of revenues or profit, or, if we do, that we will be able to continue earning such revenues or profit. Also, any economic weakness may limit our ability to continue development and ultimately market our products and services. Any of these factors could cause our stock price to decline and result in investors losing a portion or all of their investment. These factors raise substantial doubt that we will be able to continue as a going concern. We have cash in the amount of $1,936,853 as at December 31, 2010.

We believe that we have obtained sufficient financing to fund our anticipated expenditures for the next twelve months. However, business activities beyond the next twelve months will require additional funding in the event that our cash on hand is insufficient for any additional work proposed. We currently do not have sufficient arrangements for future financing and we may not be able to obtain financing when required.

14

Our financial statements included with this Quarterly Report have been prepared assuming that we will continue as a going concern. If we are not able to earn revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected. These factors raise substantial doubt that we will be able to continue as a going concern and adversely affect our ability to obtain additional financing.

Our short operating history makes our business difficult to evaluate, accordingly, we have a limited operating history upon which to base an evaluation of our business and prospects.

Our business is in the early stage of development and we have not generated any revenues or profit to date. We commenced our operations in April, 2004. Because of our limited operating history, investors may not have adequate information on which they can base an evaluation of our business and prospects. To date, we have done the following:

| 1. |

Completed organizational activities; |

| 2. |

Developed a business plan; |

| 3. |

Obtained interim funding; |

| 4. |

Engaged consultants for professional services; and |

| 5. |

Acquired NGD™ Technology. |