Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON GENERATION CO LLC | d8k.htm |

Credit Suisse 2011 Energy Summit

William A. Von Hoene, Jr., EVP Finance & Legal

February 9, 2011

Exhibit 99.1 |

2

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, that are subject to risks

and uncertainties. The factors that could cause actual results to differ

materially from these forward-looking statements include those discussed

herein as well as those discussed in (1) Exelon’s 2009 Annual Report on Form

10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations and

(c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2) Exelon’s

Third Quarter 2010 Quarterly Report on Form 10-Q in (a) Part II, Other

Information, ITEM 1A. Risk Factors, (b) Part 1, Financial Information,

ITEM 2. Management’s Discussion and Analysis of Financial Condition and

Results of Operations and (c) Part I , Financial Information, ITEM 1. Financial

Statements: Note 13 and (3) other factors discussed in filings with the Securities

and Exchange Commission (SEC) by Exelon Corporation, Commonwealth Edison

Company, PECO Energy Company and Exelon Generation Company, LLC (Companies).

Readers are cautioned not to place undue reliance on these

forward-looking statements, which apply only as of the date of this

presentation.

None

of

the

Companies

undertakes

any

obligation

to

publicly

release

any

revision

to

its

forward-looking statements to reflect events or circumstances after the date of

this presentation. This presentation includes references to adjusted

(non-GAAP) operating earnings and non-GAAP cash flows that exclude

the impact of certain factors. We believe that these adjusted operating

earnings and cash flows are representative of the underlying operational results of

the Companies. Please refer to the appendix to this presentation for a

reconciliation of adjusted (non-GAAP) operating earnings

to

GAAP

earnings.

Please

refer

to

the

footnotes

of

the

following

slides

for

a

reconciliation

non-GAAP cash flows to GAAP cash flows. |

3

(1)

Refer to 1/26/11 Earnings Release Attachments for additional details and to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2)

Cash from operations primarily includes net cash flows provided by operating

activities, excludes counterparty collateral and includes net cash from investing activities other than

capital expenditures, acquisition of Exelon Wind (in 2010) and change in restricted

cash. 2011: Expect a Solid Year

EPS guidance of $3.90-$4.20

(1)

Strong cash flow –

expect to

generate cash from operations

of $4.3 billion

(2)

Increasing investment in growth

projects at ExGen and Utilities

Efficient use of cash benefits

from bonus depreciation

Key Financial Messages

2010: Another Strong Year

Financial and operational

performance

•

Operating earnings of

$4.06/share

(1)

•

2010 cash from operations

of $5.3 billion

(2)

•

Returned $1.4 billion in cash

to shareholders through

dividends

•

93.9% capacity factor at

Nuclear

Continuing to position Exelon

for cleaner energy future |

4

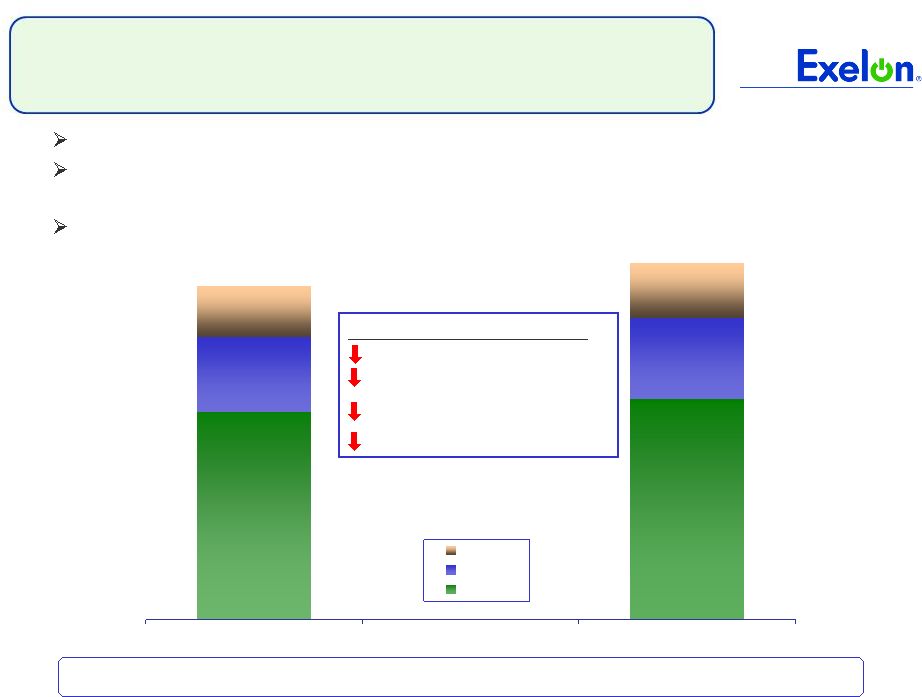

Largest merchant nuclear fleet in the U.S.

Consistent world-class performance in nuclear

operations

Utilities serving two of the largest metropolitan areas

in the U.S.

Stable dividend that has yielded ~5% on average

over the past year

Why Is Exelon a Good Investment?

Commitment to investment grade credit ratings and

financial discipline

Exelon is able to execute from a position of strength based on solid

fundamentals |

5

Exelon Wind Expenditures

(Advanced Development Projects)

$0

$50

$100

$150

$200

$250

$300

2010A

2011E

2012E

0

50

100

150

200

250

300

Annual Project CapEx

MW Online (Cumulative)

Growing Our Clean Generation

(1) Dollars shown are nominal, reflecting 6% escalation, in millions and

exclude TMI and Clinton extended power uprates, which are currently under review. MW shown at ownership.

Note: PPA = power purchase agreement; MUR = measurement uncertainty recapture; EPU

= extended power uprate. Data contained in this slide is rounded.

$150

$275

$550

$475

$475

$ millions

$50

Exelon is positioned as a key player in the US wind market and has the

largest size and scale for nuclear uprates

$ millions

Wind Development Projects

Nuclear Uprates Program

Highest return projects are being completed

in early years

Leverages Exelon’s substantial experience

managing

successful

uprate

projects

–

1,100

MW completed from 1999 to 2008, 101 MWs

added in 2009-2010

Attractive economics for both operating and

advanced

development

projects

–

PPAs

already executed

Provides diversity in geographic presence

and generation type

$225

$265

$20

Exelon's Uprate

Plan Expenditures

(1)

$0

$100

$200

$300

$400

$500

$600

$700

2008A

2009A

2010A

2011E

2012E

2013E

0

100

200

300

400

500

Megawatt Recovery

MUR

EPU

MW Online (Cumulative) |

6

6

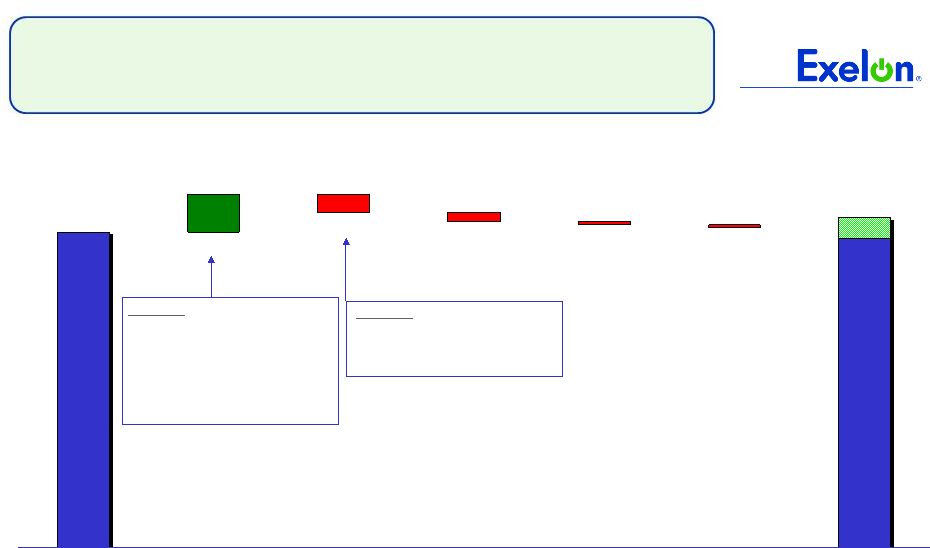

Moving Generation to Market

110,594

142,400

42,003

5,295

13,897

26,300

0

50,000

100,000

150,000

200,000

2010

2011E

ComEd Swap

IL Auction

PECO Load

Actual Forward Hedges & Open Position

171,789

168,700

(1) Represents values as of December 31, 2010.

Transition to market at PECO provides additional channels to market for

Exelon Generation, including opportunities at Exelon Energy

Exelon Energy Electric Volumes

-

5

10

15

20

25

30

2008

2009

2010

2011E

2012E

2013E

MWh - Millions

COMED / Ameren

PECO/PPL

Other

Expected

Total

Sales

(GWh)

(1)

2011-2013 Sales as % of

Expected Generation

(1)

Exelon

Energy

6%

Standard

Product Sales

29%

Open

Generation

36%

Options

5%

Utility

Procurements

24% |

7

7

Pursuing Transmission Investment

Moving forward on project planning

with partner ETA

Total Investment ~$1.6 billion

ComEd/Exelon ~$1.1 billion

FERC incentive rate joint filing

expected late 1Q or early 2Q 2011

Exelon companies are investing in projects that ensure reliability and support

further clean energy development

Note: Electric Transmission America (ETA) is an American Electric Power &

MidAmerican Energy Holdings joint venture company. RITE Line

Ensures reliable service to the

Chicago central business district

Estimated cost of ~$170 million

recoverable under ComEd’s FERC

formula rate

Expected in-service December 2011

West Loop Phase II |

8

Driving Financial Discipline

Going to market to refinance 2012 maturities in the first half of this year

(in millions)

Generation

PECO

Corporate

ComEd

Total

Unsecured Revolving Credit

Facilities

(4)

$4,834

$574

$957

$1,000

$7,365

Expiration date

Oct 2012

Oct 2012

Oct 2012

March 2013

Maintaining a strong balance sheet and liquidity position

$2.1B Pension Contribution in 2011

Credit Facilities

Continued Strong Balance Sheet

FFO / Debt

(1)(2)

Pension Contributions

615

2,100

765

110

175

160

195

780

790

170

485

2010

2011

2012

2013

2014

2015

With $2.1B

Original Plan*

($ millions)

*

Original

Plan

reflects

preliminary

2010

underlying

assumptions

(including

discount rate and asset returns).

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

2009A

2010A

2011E

2012E

2013E

ExGen/Corp

ComEd

PECO

(3)

S&P Target Range

S&P Target Range

(1)

Reflects FFO / Debt as calculated by S&P.

(2)

Dashed lines represent S&P Target Ranges (30-35% for ExGen/Corp and 15-18% for ComEd and

PECO). See slide 24 for reconciliations to GAAP. (3)

FFO/Debt Target Range reflects ExGen FFO/Debt in addition to the debt obligations of Exelon

Corp. (4)

Excludes $94 million of credit facility agreements arranged with minority and community banks on

10/22/10 that are utilized solely to issue letters of credit. |

9

9

Factors Influencing PJM RPM Capacity Auction

(Comparison of PY 14/15 and PY 13/14 Price Drivers)

Exelon

Price Impact

Cost of Environmental Upgrades

(1)

Higher Net CONE

(2)

Higher Net ACRs

For Coal Units

(3)

Import Transmission Limits And Objectives

(muted impact on portfolio revenues due to regional diversification)

NJ CCGT Proposal / PJM Minimum Offer Price Rules

Peak Load

(4)

Demand Response Growth

2014/15 PJM Capacity Auction: Expected

Changes Since Planning Year 2013/14

Exelon’s capacity position, split almost evenly between the west and the east,

dampens the volatility to portfolio revenues from changes to transmission

limits while retaining upside across the fleet from upcoming EPA

regulations (1) We expect generators to reflect cost of capital

expenditures into their cost based offers at the upcoming auction. (2)

Cost

of

new

entry

(CONE)

increased

by

7.6%

(for

RTO)

and

5.3%

to

6.5%

(within

Locational

Deliverability

Areas

(LDAs)).

(3) Replacing

2007

net

revenues

with

significantly

lower

2010

revenues

in

the

Net

ACR

(avoidable

cost

rate)

calculations

for

coal

generators

may

increase

offer

caps

for

certain coal generators in the next auction. However, some coal units may not be

affecteddue to high net revenues compared to avoidable costs. (4) Peak

load reduced by approx. 1% in RTO (excluding the impact from Duke Ohio integration).

Note: RPM = Reliability Pricing Model; CCGT = combined cycle gas

turbine |

10

EPA Regulations Will Move Forward in 2011

Note: RPM auctions take place annually in May.

For

definition

of

the

EPA

regulations

referred

to

on

this

slide,

please

see

the

EPA’s

Terms

of

Environment

(http://www.epa.gov/OCEPAterms/). |

11

Q&A |

12

Appendix |

13

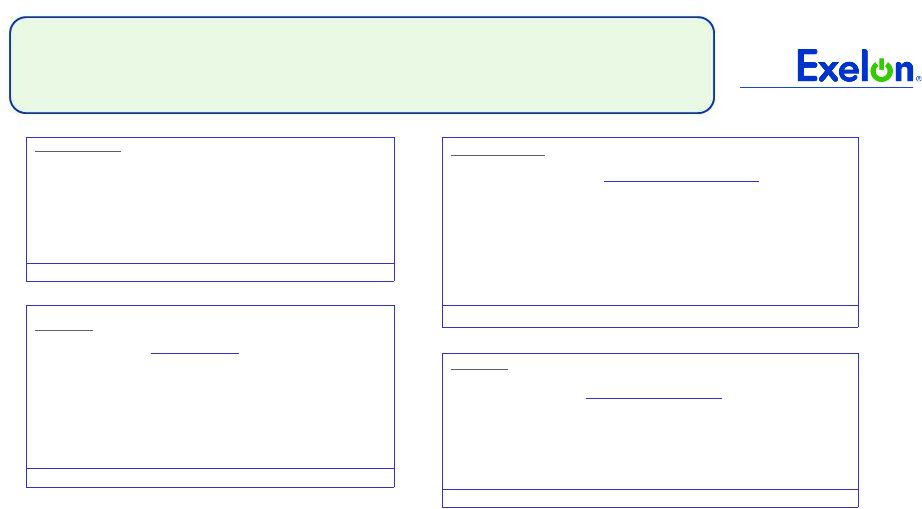

2011 Events of Interest

Q1

Q2

Q3

Q4

RPM Auction results

(5/13)

Illinois Power Agency

RFP (April)

ALJ Proposed Order

–

DST Rate Case

(3/31)

Procurement RFP

(bids due 5/23;

results by 6/23)

DST Rate Case Final

Order (by 5/31)

EPA Final HAP

Rule (November)

Retirement of Cromby

1 & Eddystone 1 units

(5/31)

Proposed HAP EPA

Regulation (by 3/16)

Procurement RFP

(bids due 9/19;

results by 10/19)

Retirement of

Cromby 2 unit

(12/31)

Proposed 316(b) EPA

Regulation (by 3/14)

For

definition

of

the

EPA

regulations

referred

to

on

this

slide,

please

see

the

EPA’s

Terms

of

Environment

(http://www.epa.gov/OCEPAterms/).

Note: ALJ = administrative law judge; DST = delivery service tariff

EPA Final Transport

Rule (June) |

14

2011 Operating Earnings Guidance

2011E

(2)

2010A

$0.54

$2.91

$4.06

(1)

ComEd

PECO

Exelon

Generation

ComEd

PECO

Exelon

Generation

Holdco

Holdco

Exelon

$0.68

Exelon

$3.90 -

$4.20

(1)

$0.55 -

$0.65

$0.50 -

$0.55

$2.85 -

$3.05

(1)

Refer to 1/26/11 Earnings Release Attachments for additional details and to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2)

Earnings guidance for OpCos may not add up to consolidated EPS guidance.

Key

Drivers

of

FY

Guidance

+

Generation margins driven by PECO

PPA roll-off, partially offset by lower

capacity revenues

+

Higher PECO gross margin driven by

new distribution rates effective 1/1/11

-

Higher O&M expense

-

Higher depreciation & amortization

expense

2011

operating

earnings

guidance

of

$3.90

–

$4.20/share

and

1Q

2011

guidance of $1.00 –

$1.10/share

(1) |

15

$0.98

$0.68

$2.74

$2.91

$1.07

$0.71

2010A

2011E

PECO

ComEd

ExGen

Operating O&M Outlook

2010 to 2011 Drivers (per share)

Inflation $(0.08)

Full year of Exelon Wind $(0.05)

Two additional nuclear refueling

outages $(0.05)

ComEd uncollectibles $(0.04)

Estimated 2011 O&M represents a new “base”

level for operating O&M

$4.39B

$4.68B

2010 Operating O&M below 2008 levels for second consecutive year

One-time savings in 2010 included executive salary freezes and reduced

compensation benefits

Anticipate annual O&M growth rate of ~2% for 2011-2013

(1) Amounts

may

not

add

due

to

rounding.

Refer

to

slide

43

for

a

reconciliation

of

GAAP

O&M

to

Operating

O&M.

(1)

(1) |

16

Exelon Generation 2011 EPS Contribution

(1)

Estimated contribution to Exelon’s operating earnings guidance.

RNF = revenue net fuel

$ / Share

$0.35

$(0.03)

RNF

O&M

Other

Depreciation &

Amortization

$(0.08)

Key Items:

Inflation

Exelon Wind

Nuclear Outages

2010A

2011E

(1)

$2.85 -

$3.05

$2.91

Key Items:

PECO

PPA

Exelon Wind

Capacity Market Prices

Nuclear Fuel

Market/portfolio conditions

and Exelon Energy

$(0.17)

$(0.03)

Interest

Expense

Note: Drivers add up to mid-point of 2011 EPS range.

$0.62

$0.08

$(0.29)

$(0.09)

$0.07

$(0.05)

$(0.05)

$(0.05) |

17

ComEd 2011 EPS Contribution

2010A

Depreciation &

Amortization

Interest

Expense

$0.55 -

$0.65

$0.03

$(0.08)

$(0.03)

2011E

(3)

$ / Share

$(0.02)

$0.02

Other

RNF

(1)

O&M

(1)

Key Items:

Weather

Uncollectibles

Appellate Court ruling

Distribution revenue

(2)

Key Items:

Uncollectibles

Inflation

Note: Drivers add up to mid-point of 2011 EPS range.

$0.68

(1)

Excludes estimated impact of Rider EDA (Energy Efficiency and Demand Response Adjustment) of

+/-$0.05/share. 2010 net income includes a one-time benefit for collections of

under-recovered 2008 and 2009 bad debt costs, as provided by the uncollectible expense rider approved by the ICC in February 2010. Going forward,

the rider provides for full recovery of all bad debt costs.

(2)

Distribution rate case currently pending, new rates will be effective in June 2011. Earnings

guidance assumes mid-point of ComEd’s requested revenue increase. (3)

Estimated contribution to Exelon’s operating earnings guidance.

$(0.04)

$(0.02)

$(0.01)

$0.08

$(0.04)

$(0.02) |

18

PECO 2011 EPS Contribution

$ / Share

RNF

(2)

$(0.03)

$0.54

(1)

CTC,net

2011E

(3)

Key Items:

Electric & Gas

Distribution Rate

$0.19

Weather

$(0.05) Key Items:

Inflation

$(0.01) Bad

Debt $(0.01)

$0.14

O&M

(2)

$0.50 -

$0.55

(1)

$(0.04)

2010A

(1)

Excludes preferred dividends.

(2)

Excludes items that are income statement neutral and estimated impact of energy

efficiency and smart meter costs recoverable under a rider of $0.10/share.

(3)

Estimated contribution to Exelon’s operating earnings guidance.

CTC = competitive transition charge

Note: Drivers add up to mid-point of 2011 EPS range.

$(0.03)

Depreciation

$(0.05)

Income Taxes

Key Items:

Revenue net $(0.06)

of amortization

Interest on PECO

transition bonds $0.02 |

19

Key Assumptions

38.0

31.1

29.5

PECO

40.8

39.7

37.9

ComEd

37.1

37.5

38.3

Exelon Generation

38.1

36.7

37.2

Effective Tax Rate -

Operating (%)

136.59

144.40

106.13

RTO Capacity Price ($/MW-day)

2009 Actual

2010 Actual

2011 Est.

(3)

Nuclear Capacity Factor (%)

(1)

93.6

93.9

93.0

Total Generation Sales Excluding Trading (GWh)

173,065

171,789

168,700

Henry Hub Gas Price ($/mmBtu)

3.92

4.37

4.56

PJM West Hub ATC Price ($/MWh)

38.30

45.93

45.45

Tetco M3 Gas Price ($/mmBtu)

4.64

5.10

5.32

PJM West Hub Implied ATC Heat Rate (mmbtu/MWh)

8.25

9.01

8.54

NI Hub ATC Price ($/MWh)

28.85

33.09

30.69

Chicago City Gate Gas Price ($/mmBtu)

3.92

4.46

4.61

NI Hub Implied ATC Heat Rate (mmbtu/MWh)

7.36

7.42

6.66

MAAC Capacity Price ($/MW-day)

158.48

181.34

136.59

EMAAC Capacity Price ($/MW-day)

173.73

181.34

136.59

Electric Delivery Growth (%)

(2)

PECO

0.6

0.1

0.0

ComEd

(0.1)

0.2

0.0

(1)

Excludes Salem.

.

(2)

Weather-normalized retail load growth.

(3)

Reflects forward market prices as of December 31, 2010.

Note: The estimates of planned generation do not represent guidance or a forecast of future

results as Exelon has not completed its planning or optimization processes. |

20

Pension and OPEB Expense and

Contributions –

As of 12/31/10

$190

$240

Pre-tax

expense

$205

$1,655

$3,875

$2,220

$765

$8,860

$12,525

$3,665

Actual

contribution

$210

$2,140

$225

$185

$2,180

$210

5.83% in 2010

5.30% in 2011

5.52% in 2012

11.6% in 2010

7.08% in 2011

7.08% in 2012

OPEB

Assets

Obligations

Unfunded balance –

end of year

$110

$1,015

$240

$2,100

$1,305

$200

5.83% in 2010

5.26% in 2011

5.48% in 2012

11.9% in 2010

8.0% in 2011

7.5% in 2012

Pension

Assets

Obligations

Unfunded balance –

end of year

Expected

contribution

Pre-tax

expense

Expected

contribution

Pre-tax

expense

Discount Rate

(used for

expense)

Asset Returns

(actual for 2010 and

expected for

2011 and 2012)

($ in millions)

Assumptions

2011

2012

2010

The decrease in pension expense in 2011 is primarily due to the $2.1 billion pension

contribution,

partially

offset

by

the

effects

of

lower

discount

rates

and

a

decrease

in

EROA

(1)

Pension expense amounts exclude settlement charges.

(2)

Management considers various factors when making pension funding decisions, including actuarially

determined minimum contribution requirements under ERISA, contributions required to avoid

benefit restrictions and at-risk status as defined by the Pension Protection Act of 2006 (the Act), management of the pension obligation and regulatory

implications. The Act requires the attainment of certain funding levels to avoid benefit restrictions

(such as an inability to pay lump sums or to accrue benefits prospectively), and at-risk

status (which triggers higher minimum contribution requirements and participant notification).

Note: Slide provided for illustrative purposes and not intended to represent a forecast of future

outcomes. Assumes an ~25% capitalization of pension and OPEB costs. EROA = earned

return on assets The decrease in pension expense in 2011 is primarily due to the $2.1 billion pension

contribution, partially offset by the effects of lower discount rates and a decrease in EROA

|

21

2011 Pension Contribution

$2.1 billion contribution to pension in 2011

•

Timing:

~$850

million

funded

by

the

accelerated cash benefits generated as a

result of bonus depreciation

•

Tax

efficient:

Income

tax

deduction

of

pension contribution creates $750 million

of cash benefit

•

Economic:

Reduces

estimated

future

pension expense, lowers future minimum

funding requirements and reduces volatility

Improves financial flexibility

•

Creates debt capacity for future growth

•

Improves ability to weather commodity

cycle in 2012 and 2013 and maintain the

dividend

Contributes to improved pension funded

status of 71% at 12/31/10, projected to be

89% at 12/31/11

Pension Contributions

615

2,100

765

110

175

160

195

780

790

170

485

2010

2011

2012

2013

2014

2015

With $2.1B

Original Plan*

(1) Assumes an ~25% capitalization rate.

$ millions

$ millions

* Original

Plan

reflects

preliminary

2010

underlying

assumptions

(including

discount

rate

and

asset

returns)

Pre-Tax

Pension

Expense

(1)

240

300

265

200

240

2010

2011

2012 |

22

2011 Projected Sources and Uses of Cash

(1)

Excludes counterparty collateral activity.

(2)

Cash Flow from Operations primarily includes net cash flows provided by operating

activities and net cash flows used in investing activities other than capital expenditures.

(3)

Assumes 2011 dividend of $2.10/share. Dividends are subject to declaration by

the Board of Directors. (4)

Includes $475 million in Nuclear Uprates and $225 million for Exelon Wind.

(5)

Represents new business, smart grid/smart meter investment and transmission growth

projects. (6)

Excludes ComEd’s $191 million of tax-exempt bonds that are backed by

letters of credit (LOCs). Excludes PECO’s $225 million Accounts Receivable (A/R) Agreement with Bank of Tokyo.

PECO’s A/R Agreement was extended in accordance with its terms through

September 6, 2011. (7)

“Other”

includes proceeds from options and expected changes in short-term debt.

(8) Includes cash flow activity from Holding Company, eliminations, and

other corporate entities. ($ millions)

Exelon

(8)

Beginning Cash Balance

(1)

$800

Cash Flow from Operations

(2)

425

775

3,150

4,325

CapEx

(excluding Nuclear Fuel, Nuclear

Uprates, Exelon Wind, Utility Growth CapEx)

(700)

(325)

(850)

(1,875)

Nuclear Fuel

n/a

n/a

(1,025)

(1,025)

Dividend

(3)

(1,400)

Nuclear Uprates

and Exelon Wind

(4)

n/a

n/a

(700)

(700)

Utility Growth CapEx

(5)

(325)

(125)

n/a

(450)

Net Financing (excluding Dividend):

Planned Debt Issuances

(6)

1,000

--

--

1,000

Planned Debt Retirements

(350)

(250)

--

(600)

Other

(7)

250

--

--

300

Ending Cash Balance

(1)

$375 |

23

Key Credit Metrics

0.0x

2.0x

4.0x

6.0x

8.0x

10.0x

12.0x

2009A

2010A

2011E

ExGen/Corp

ComEd

PECO

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

2009A

2010A

2011E

ExGen/Corp

ComEd

PECO

FFO / Debt

(1)

(1)

Reflects FFO / Debt, Interest Coverage and Debt / Cap ratios as calculated by

S&P. (2)

Reflects S&P Target Range. See slide 24 for reconciliations to

GAAP. (3)

FFO/Debt Target Range reflects Generation FFO/Debt in addition to the debt

obligations of Exelon Corp. (4)

Current senior unsecured ratings for Exelon and Exelon Generation and senior

secured ratings for ComEd and PECO as of January 31, 2011. 30-35%

(3)

15-18%

15-18%

FFO / Debt

Target

Range

(2)

BBB+

A

BBB+

BBB+

Fitch

Credit

Ratings

(4)

BBB

A-

A-

BBB-

S&P

Credit

Ratings

(4)

A3

A1

Baa1

Baa1

Moody’s

Credit

Ratings

(4)

ComEd:

PECO:

Generation:

Exelon:

Interest Coverage

(1)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2009A

2010A

2011E

ExGen/Corp

ComEd

PECO

Debt / Cap

(1) |

24

Metric Calculations and Ratios

+ Other

Non-Cash

items

(1)

-

AFUDC/Cap. Interest

-

Decommissioning activity

+/-

Change in Working Capital

FFO Calculation:

= FFO

-

PECO Transition Bond Principal Paydown

Net Cash Flows provided by Operating Activities

Adjusted Interest:

Net Interest Expense

Adjusted Interest

FFO + Adjusted Interest

= Adjusted Interest

+ AFUDC & Capitalized interest

+ Interest on Present Value (PV) of Operating Leases

+ Interest on Imputed Debt Related to PV of Power Purchase Agreements (PPA)

-

PECO Transition Bond Interest Expense

Interest Coverage:

FFO

= Adjusted Debt

+ Off-balance

sheet

debt

equivalents

(3)

-

PECO Transition Bond Principal Balance

+ STD

LTD

Adjusted Debt:

Adjusted Debt

(2)

FFO / Debt:

+ Adjusted Debt

(3)

Debt / Cap:

= Adjusted Capitalization

Adjusted Debt

(2)

Adjusted Capitalization

Adjusted Capitalization:

Total shareholder’s equity

+ Preferred Securities of Subsidiaries

(1)

Reflects depreciation adjustment for PPAs and operating leases and pension/OPEB contribution

normalization. (2)

Uses current year-end adjusted debt balance.

(3)

Metrics are calculated in presentation adjusted for debt equivalents for PV of Operating Leases,

PPAs, unfunded Pension and OPEB obligations (after-tax) and other minor debt

equivalents. |

25

ComEd 2010 Rate Case Update

ComEd Surrebuttal (1/3/11)

$326M increase requested

11.50% ROE / 47.28% equity ratio

Rate base $7,349M

2009 test year with pro forma plant

additions through 6/30/11

ICC Staff Position

$116M increase proposed in Dec 2010

rebuttal testimony

10.00% ROE / 47.11% equity ratio

Rate base $6,602M

Pro forma plant additions and

depreciation reserve through 12/31/10

(ICC Docket No. 10-0467)

$ millions

ComEd Original Request (6/30/10)

396

$

Adjustments:

Bonus Depreciation

(14)

Pro forma plant adds/O&M update

(4)

Errata in Initial Filing

(12)

Reduction to Reg Asset Amortization

(8)

Other Items

(4)

ComEd Rebuttal (11/22/10)

354

$

Adjustments:

New Bonus Depreciation

(22)

Pro forma plant adds/O&M update

(4)

Reduction to AMI/Other

(2)

ComEd Surrebuttal (1/3/2011)

326

$

Note: See slide 13 for ComEd rate case key dates.

* ComEd request does not reflect Appellate Court decision relating to

depreciation reserve, which we estimate would have a $85M reduction

to revenue requirement.

*

Reconciliation of ComEd

Request to ComEd

Surrebuttal |

26

26

ComEd Load Trends

Chicago

U.S.

Unemployment rate

(1)

9.3%

9.4%

2010 annualized growth in

gross domestic/metro product

(2)

1.6%

2.8% Note: C&I = Commercial &

Industrial Weather-Normalized Load Year-over-Year

4Q10

2010 2011E

Average Customer Growth

0.4%

0.2%

0.5%

Average Use-Per-Customer

(4.5)%

(1.4)%

0.0%

Total Residential

(4.1)%

(1.2)% 0.5%

Small C&I

(1.5)%

(0.6)% (0.3)%

Large C&I

1.9%

2.6% (0.2)%

All Customer Classes

(1.2)%

0.2% 0.0%

(1)

Source: U.S. Dept. of Labor (December 2010) and Illinois

Department of Security (December 2010)

(2) Source: Global Insight December 2010

-6.0%

-3.0%

0.0%

3.0%

6.0%

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

-6.0%

-3.0%

0.0%

3.0%

6.0%

All Customer Classes

Large C&I

Residential

Gross Metro Product

Key Economic Indicators

Weather-Normalized Load |

27

PECO Load Trends

Philadelphia

U.S.

Unemployment rate

(1)

8.4%

9.4% 2010 annualized growth in

gross domestic/metro product

(2)

2.8%

2.8% Note: C&I = Commercial & Industrial

4Q10

2010 2011E

Average Customer Growth

0.5%

0.3%

0.4%

Average Use-Per-Customer

(1.2)%

0.3%

(0.3)%

Total Residential

(0.7)%

0.5% 0.1%

Small C&I

(2.0)%

(1.9)% (0.5)%

Large C&I

1.5%

0.8% 0.1%

All Customer Classes

0.0%

0.1% 0.0%

(1)

Source:

U.S

Dept.

of

Labor

(PHL

–

November

2010

preliminary

data,

US

-

December 2010)

(2)

Source: Global Insight December 2010

-5.0%

-2.5%

0.0%

2.5%

5.0%

1Q10

2Q10

3Q10

4Q10

1Q11E

2Q11E

3Q11E

4Q11E

-5.0%

-2.5%

0.0%

2.5%

5.0%

All Customer Classes

Large C&I

Residential

Gross Metro Product

Weather-Normalized Load Year-over-Year

Key Economic Indicators

Weather-Normalized Load |

28

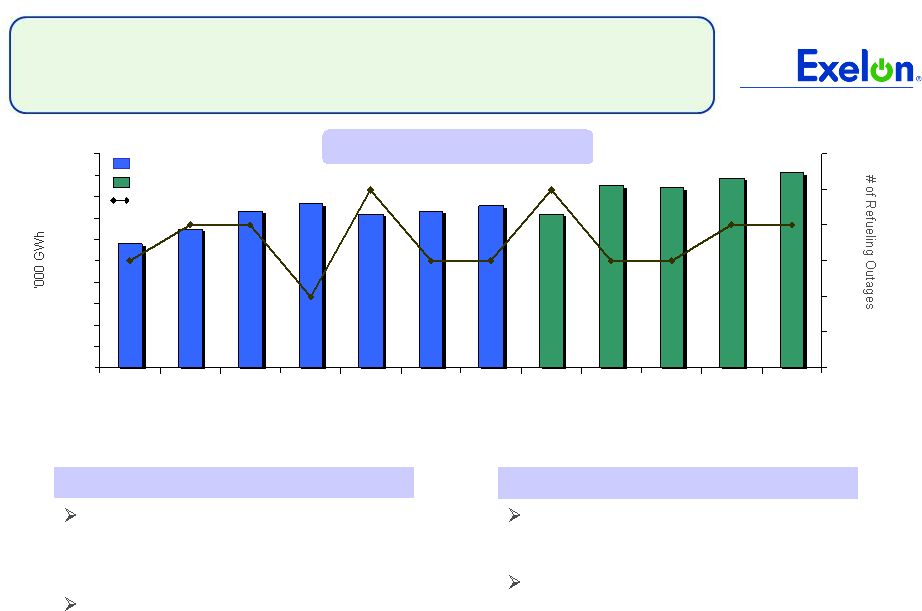

Refueling Outage Schedule

All Exelon owned units on a 24-month

cycle except for Braidwood U1/U2,

Byron U1/U2 and Salem U1/U2,

which are on 18-month cycles

Average outage duration (2009-10):

~29 days

(1)

Nuclear Refueling Cycle

12 planned refueling outages,

including 2 at Salem; Clinton outage

was moved from 2012 to 2011

6 refueling outages planned for the

spring and 6 refueling outages

planned for the fall

2011 Refueling Outage Impact

(1) Excludes Salem.

125

127

129

131

133

135

137

139

141

143

145

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

7

8

9

10

11

12

13

Nuclear Output

Actual

Plan

# of Outages

Note: Data includes Salem. Net nuclear generation data based on ownership interest. The

estimates of planned generation do not represent guidance or a forecast of future results as

Exelon has not completed its planning or optimization processes. |

29

29

Total Portfolio Characteristics

110,594

142,400

42,003

5,295

13,897

26,300

0

50,000

100,000

150,000

200,000

2010

2011E

ComEd Swap

IL Auction

PECO Load

Actual Forward Hedges & Open Position

92,493

91,300

47,517

48,100

27,090

26,500

4,689

2,800

0

50,000

100,000

150,000

200,000

2010

2011E

Forward / Spot Purchases

Fossil and Renewables

Mid-Atlantic Nuclear

Midwest Nuclear

171,789

171,789

168,700

168,700

Expected Total Supply (GWh)

Expected Total Sales (GWh)

Notes: Represents values as of December 31, 2010. The estimates of planned generation do not

represent guidance or a forecast of future results as Exelon has not completed its planning or

optimization processes. |

30

Exelon Generation Hedging Disclosures

(as of December 31, 2010) |

31

31

Important Information

The following slides are intended to provide additional information regarding the hedging

program at Exelon Generation and to serve as an aid for the purposes of modeling Exelon

Generation’s gross margin (operating revenues less purchased power and fuel expense). The

information on the following slides is not intended to represent earnings guidance or a forecast

of future events. In fact, many of the factors that ultimately will determine Exelon

Generation’s actual gross margin are based upon highly variable market factors outside of

our control. The information on the following slides is as of December 31, 2010. We

update this information on a quarterly basis.

Certain information on the following slides is based upon an internal simulation model that

incorporates assumptions regarding future market conditions, including power and commodity

prices, heat rates, and demand conditions, in addition to operating performance and dispatch

characteristics of our generating fleet. Our simulation model and the assumptions therein are

subject to change. For example, actual market conditions and the dispatch profile of our

generation fleet in future periods will likely differ – and may differ significantly –

from the assumptions underlying the simulation results included in the slides. In addition,

the forward- looking information included in the following slides will likely change over time

due to continued refinement of our simulation model and changes in our views on future market

conditions. |

32

32

Portfolio Management Objective

Align Hedging Activities with Financial Commitments

Power Team utilizes several product types

and channels to market

•

Wholesale and retail sales

•

Block products

•

Load-following products

and load auctions

•

Put/call options

Exelon’s hedging program is designed to

protect the long-term value of our

generating fleet and maintain an

investment-grade balance sheet

•

Hedge enough commodity risk to meet future cash

requirements if prices drop

•

Consider: financing policy (credit rating objectives,

capital structure, liquidity); spending (capital and

O&M); shareholder value return policy

Consider market, credit, operational risk

Approach to managing volatility

•

Increase hedging as delivery approaches

•

Have enough supply to meet peak load

•

Purchase fossil fuels as power is sold

•

Choose hedging products based on generation

portfolio –

sell what we own

•

Heat rate options

•

Fuel products

•

Capacity

•

Renewable credits

% Hedged

High End of Profit

Low End of Profit

Open Generation

with LT Contracts

Portfolio

Optimization

Portfolio

Management

Portfolio Management Over Time |

33

33

Percentage of Expected

Generation Hedged

•

How many equivalent MW have been

hedged at forward market prices; all hedge

products used are converted to an

equivalent average MW volume

•

Takes ALL

hedges into account whether

they are power sales or financial products

Equivalent MWs Sold

Expected Generation

=

Our normal practice is to hedge commodity risk on a ratable basis

over the three years leading to the spot market

•

Carry operational length into spot market to manage forced outage and

load-following risks

•

By

using

the

appropriate

product

mix,

expected

generation

hedged

approaches

the

mid-90s percentile as the delivery period approaches

•

Participation in larger procurement events, such as utility auctions, and some

flexibility in the timing of hedging may mean the hedge program is not

strictly ratable from quarter to quarter

Exelon Generation Hedging Program |

34

34

2011

2012

2013

Estimated

Open

Gross

Margin

($

millions)

(1)(2)(3)

$5,200

$5,050

$5,700

Open gross margin assumes all expected generation is sold

at the Reference Prices listed below

Reference Prices

(1)

Henry Hub Natural Gas ($/MMBtu)

NI-Hub ATC Energy Price ($/MWh)

PJM-W ATC Energy Price ($/MWh)

ERCOT

North

ATC

Spark

Spread

($/MWh)

(4)

$4.56

$30.69

$45.45

$1.12

$5.08

$32.38

$46.41

$0.82

$5.33

$35.09

$48.25

$1.84

Exelon Generation Open Gross Margin and

Reference Prices

(1)

Based on December 31, 2010 market conditions.

(2)

Gross margin is defined as operating revenues less fuel expense and purchased power

expense, excluding the impact of decommissioning and other incidental revenues. Open

gross margin is estimated based upon an internal model that is developed by

dispatching our expected generation to current market power and fossil fuel prices. Open gross margin

assumes

there

is

no

hedging

in

place

other

than

fixed

assumptions

for

capacity

cleared

in

the

RPM

auctions

and

uranium

costs

for

nuclear

power

plants.

Open

gross

margin

contains assumptions for other gross margin line items such as various ISO bill and

ancillary revenues and costs and PPA capacity revenues and payments. The estimation of open

gross margin incorporates management discretion and modeling assumptions that are

subject to change. (3)

As of December 31, 2010 disclosure, Exelon Wind included. Assets in IL,

MI and MN are in Midwest region and assets in ID, KS, MO, OR and TX are in South and West region.

(4)

ERCOT North ATC spark spread using Houston Ship Channel Gas, 7,200 heat rate, $2.50

variable O&M. |

35

35

2011

2012

2013

Expected Generation

(GWh)

(1)

165,900

165,800

163,300

Midwest

99,600

98,500

96,200

Mid-Atlantic

56,800

57,200

56,500

South & West

9,500

10,100

10,600

Percentage of Expected Generation Hedged

(2)

90-93%

67-70%

32-35%

Midwest

91-94

69-72

31-34

Mid-Atlantic

93-96

67-70

36-39

South & West

70-73

51-54

39-42

Effective Realized Energy Price

($/MWh)

(3)

Midwest

$43.00

$41.50

$43.50

Mid-Atlantic

$57.00

$50.50

$51.50

South & West

$2.50

$(1.00)

$(3.50)

Generation Profile

(1)

Expected generation represents the amount of energy estimated to be

generated or purchased through owned or contracted for capacity. Expected generation is based upon a simulated dispatch model that

makes assumptions regarding future market conditions, which are

calibrated to market quotes for power, fuel, load following products, and options. Expected generation assumes 12 refueling outages in

2011 and 10 refueling outages in 2012 and 2013 at Exelon-operated

nuclear plants and Salem. Expected generation assumes capacity factors of 93.0%, 93.6% and 93.1% in 2011, 2012 and 2013 at Exelon-

operated nuclear plants. These estimates of expected generation in 2012

and 2013 do not represent guidance or a forecast of future results as Exelon has not completed its planning or optimization processes

for those years.

(2)

Percent of expected generation hedged is the amount of equivalent sales

divided by the expected generation. Includes all hedging products, such as wholesale and retail sales of power, options, and swaps.

Uses expected value on options. Reflects decision to permanently retire

Cromby Station and Eddystone Units 1&2 as of May 31, 2011.

(3)

Effective realized energy price is representative of an all-in

hedged price, on a per MWh basis, at which expected generation has been hedged. It is developed by considering the energy revenues and costs

associated with our hedges and by considering the fossil fuel that has

been purchased to lock in margin. It excludes uranium costs and RPM capacity revenue, but includes the mark-to-market value of

capacity contracted at prices other than RPM clearing prices including

our load obligations. It can be compared with the reference prices used to calculate open gross margin in order to determine the mark-

to-market value of Exelon Generation's energy hedges.

|

36

36

Gross Margin Sensitivities with Existing Hedges ($ millions)

(1)

Henry Hub Natural Gas

+ $1/MMBtu

-

$1/MMBtu

NI-Hub ATC Energy Price

+$5/MWH

-$5/MWH

PJM-W ATC Energy Price

+$5/MWH

-$5/MWH

Nuclear Capacity Factor

+1% / -1%

2011

$5

$(5)

$30

$(20)

$15

$(10)

+/-

$40

2012

$175

$(95)

$185

$(165)

$115

$(110)

+/-

$45

2013

$495

$(445)

$340

$(335)

$200

$(195)

+/-

$50

Exelon Generation Gross Margin Sensitivities

(with Existing Hedges)

(1)

Based on December 31, 2010 market conditions and hedged position. Gas price sensitivities are based on

an assumed gas-power relationship derived from an internal model that is updated

periodically. Power prices sensitivities are derived by adjusting the power price assumption while keeping all other prices inputs constant. Due to

correlation of the various assumptions, the hedged gross margin impact calculated by aggregating

individual sensitivities may not be equal to the hedged gross margin impact calculated when

correlations between the various assumptions are also considered. |

37

37

95% case

5% case

$5,400

$7,100

$6,800

$6,300

Exelon Generation Gross Margin Upside / Risk

(with Existing Hedges)

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2011

2012

$7,200

$5,000

2013

(1)

Represents an approximate range of expected gross margin, taking into account hedges in place, between

the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot

market. Approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market

inputs, future transactions and potential modeling changes. These ranges of approximate gross margin

in 2012 and 2013 do not represent earnings guidance or a forecast of future results as Exelon

has not completed its planning or optimization processes for those years. The price distributions that generate this range are calibrated to market

quotes for power, fuel, load following products, and options as of December 31, 2010.

|

38

38

Midwest

Mid-Atlantic

South & West

Step 1

Start

with

fleetwide

open

gross

margin

$5.20 billion

Step 2

Determine

the

mark-to-market

value

of energy hedges

99,600GWh * 92% *

($43.00/MWh-$30.69MWh)

= $1.13 billion

56,800GWh * 94% *

($57.00/MWh-$45.45MWh)

= $0.62 billion

9,500GWh * 71% *

($2.50/MWh-$1.12/MWh)

= $0.01 billion

Step 3

Estimate

hedged

gross

margin

by

adding open gross margin to mark-to-

market value of energy hedges

Open gross

margin: $5.20 billion

MTM value of energy

hedges: $1.13billion

+

$0.62billion

+

$0.01

billion

Estimated hedged gross margin:

$6.96 billion

Illustrative Example

of Modeling Exelon Generation 2011 Gross Margin

(with Existing Hedges) |

39

35

40

45

50

55

60

65

70

75

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

50

55

60

65

70

75

80

85

90

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

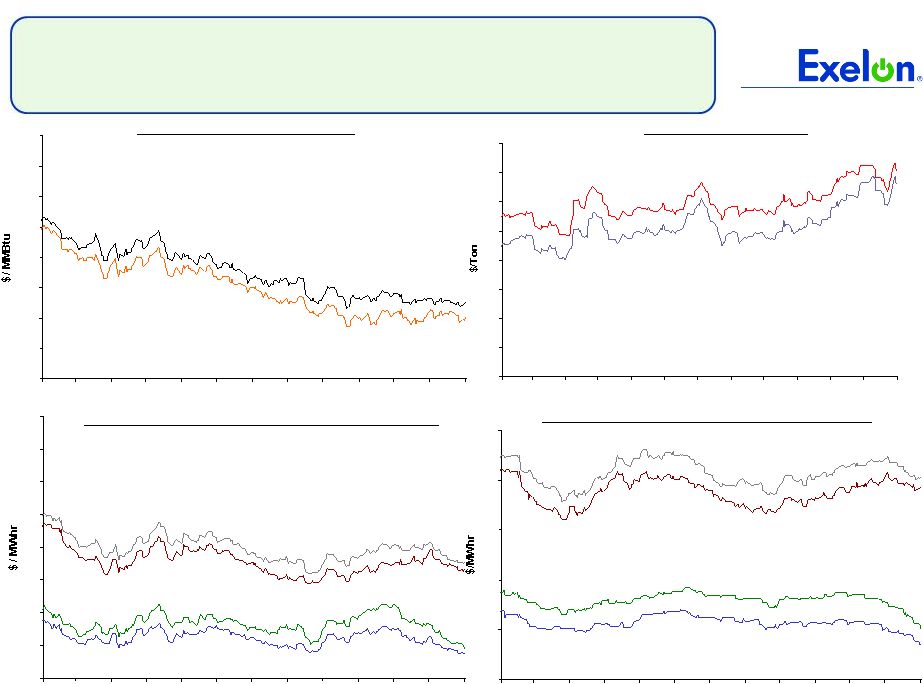

Market Price Snapshot

Forward NYMEX Natural Gas

PJM-West and Ni-Hub On-Peak Forward Prices

PJM-West and Ni-Hub Wrap Forward Prices

2012

$5.49

2013 $5.74

Rolling

12

months,

as

of

February

2

2011.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily.

Forward NYMEX Coal

2012

$75.91

2013

$79.79

2012 Ni-Hub $41.18

2013 Ni-Hub

$43.29

2013 PJM-West $54.85

2012 PJM-West

$52.84

2012 Ni-Hub

$25.68

2013 Ni-Hub

$27.95

2013 PJM-West

$40.70

2012 PJM-West

$38.77

20

25

30

35

40

45

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

nd |

40

8.0

8.2

8.4

8.6

8.8

9.0

9.2

9.4

9.6

9.8

10.0

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

35

40

45

50

55

60

65

70

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

Market Price Snapshot

2013

9.30

2012

9.11

2012

$48.99

2013

$52.31

2012

$5.37

2013

$5.62

Houston Ship Channel Natural Gas

Forward Prices

ERCOT North On-Peak Forward Prices

ERCOT North On-Peak v. Houston Ship Channel

Implied Heat Rate

2012

$7.68

2013

$9.10

ERCOT North On Peak Spark Spread

Assumes a 7.2 Heat Rate, $1.50 O&M, and $.15 adder

4.5

5.5

6.5

7.5

8.5

9.5

10.5

11.5

12.5

13.5

2/10

3/10

4/10

5/10

6/10

7/10

8/10

9/10

10/10

11/10

12/10

1/11

2/11

Rolling

12

months,

as

of

February

2

2011.

Source:

OTC

quotes

and

electronic

trading

system.

Quotes

are

daily.

nd |

41

4Q GAAP EPS Reconciliation

(0.01)

-

-

-

(0.01)

2007 Illinois electric rate settlement

(0.01)

-

-

-

(0.01)

John Deere Renewables acquisition costs

0.01

-

-

0.01

-

Asset Retirement Obligation reduction

(0.03)

-

-

-

(0.03)

Retirements of fossil generation units / plant retirements

(0.17)

-

-

-

(0.17)

Mark-to-market adjustments from economic hedging activities

$0.79

$(0.01)

$0.03

$0.14

$0.63

4Q 2010 GAAP Earnings (Loss) Per Share

$0.96

$(0.01)

$0.03

$0.13

$0.81

2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

0.04

-

-

-

0.04

Unrealized gains related to nuclear decommissioning trust funds

Exelon

Other

PECO

ComEd

ExGen

Three Months Ended December 31, 2010

NOTE: All amounts shown are per Exelon share and represent contributions to

Exelon's EPS. Amounts may not add due to rounding. 0.04

-

-

-

0.04

Mark-to-market adjustments from economic hedging activities

(0.01)

-

-

(0.01)

-

City of Chicago settlement with ComEd

(0.02)

(0.01)

-

-

(0.01)

Costs associated with early debt retirements

(0.02)

-

-

-

(0.02)

2007 Illinois electric rate settlement

(0.05)

-

-

-

(0.05)

Retirement of fossil generating units

0.02

-

-

-

0.02

Unrealized gains related to nuclear decommissioning trust funds

$0.88

$(0.03)

$0.12

$0.15

$0.64

4Q 2009 GAAP Earnings (Loss) Per Share

$0.92

$(0.02)

$0.12

$0.16

$0.66

2009 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

Exelon

Other

PECO

ComEd

ExGen

Three Months Ended December 31, 2009 |

42

Full Year GAAP EPS Reconciliation

NOTE: All amounts shown are per Exelon share and represent contributions to

Exelon's EPS. Amounts may not add due to rounding. (0.01)

-

-

-

(0.01)

John Deere Renewables acquisition costs

0.01

-

-

0.01

-

Asset Retirement Obligation reduction

(0.10)

(0.01)

(0.03)

(0.16)

0.10

Non-cash remeasurement of income tax uncertainties

(0.10)

(0.02)

(0.02)

(0.02)

(0.04)

Non-cash charge resulting from health care legislation

(0.05)

-

-

-

(0.05)

Impact of certain emission allowances

0.08

-

-

-

0.08

Mark-to-market adjustments from economic hedging activities

(0.08)

-

-

-

(0.08)

Retirement of fossil generating units

$3.87

$(0.10)

$0.49

$0.51

$2.97

FY 2010 GAAP Earnings (Loss) Per Share

$4.06

$(0.07)

$0.54

$0.68

$2.91

2010 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

(0.02)

-

-

-

(0.02)

2007 Illinois electric rate settlement

0.08

-

-

-

0.08

Unrealized gains related to nuclear decommissioning trust funds

Exelon

Other

PECO

ComEd

ExGen

Twelve Months Ended December 31, 2010

0.16

-

-

-

0.16

Mark-to-market adjustments from economic hedging activities

(0.05)

-

-

-

(0.05)

Retirement of fossil generating units

(0.01)

-

-

(0.01)

-

City of Chicago settlement with ComEd

(0.10)

-

-

(0.01)

(0.09)

2007 Illinois electric rate settlement

(0.11)

(0.04)

-

-

(0.07)

Costs associated with early debt retirements

(0.20)

-

-

-

(0.20)

Impairment of certain generating assets

(0.03)

-

(0.00)

(0.02)

(0.01)

2009 severance charges

0.05

-

-

-

0.05

Nuclear decommissioning obligation reduction

(0.03)

(0.03)

-

-

-

NRG acquisition costs

0.19

-

-

-

0.19

Unrealized gains related to nuclear decommissioning trust funds

0.10

(0.02)

-

0.06

0.06

Non-cash remeasurement of income tax uncertainties and reassessment of state

deferred income taxes

$4.09

$(0.21)

$0.53

$0.56

$3.21

FY 2009 GAAP Earnings (Loss) Per Share

$4.12

$(0.12)

$0.54

$0.54

$3.16

2009 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

Exelon

Other

PECO

ComEd

ExGen

Twelve Months Ended December 31, 2009 |

43

GAAP to Operating Adjustments

Exelon’s 2011 adjusted (non-GAAP) operating earnings outlook excludes the

earnings effects of the following:

•

Mark-to-market adjustments from economic hedging activities

•

Unrealized gains and losses from nuclear decommissioning trust fund investments to

the extent not offset by contractual accounting as described in the notes

to the consolidated financial statements •

Significant impairments of assets, including goodwill

•

Changes in decommissioning obligation estimates

•

Costs associated with ComEd’s 2007 settlement with the City of Chicago

•

Financial impacts associated with the planned retirement of fossil generating

units •

Other unusual items

•

Significant changes to GAAP

Operating earnings guidance assumes normal weather for full year

O&M reconciliation:

2010

2011

ExGen

ComEd

PECO

Other

Exelon

ExGen

ComEd

PECO

Other

Exelon

Operating and maintenance (GAAP)

2,812

1,069

733

(14)

4,600

3,010

1,220

820

(10)

5,040

JDR acquisition costs

(11)

-

-

-

(11)

-

-

-

-

-

Retirement of fossil generating units

(3)

-

-

-

(3)

(30)

-

-

-

(30)

Non-cash charge resulting from health care legislation

(4)

(3)

(2)

8

(1)

-

-

-

-

-

Asset retirement obligation reduction

-

10

1

-

11

-

-

-

-

-

Adjusted Non-GAAP O&M

2,794

1,076

732

(6)

4,596

2,980

1,220

820

(10)

5,010

Decommissioning accretion

(57)

-

-

-

(57)

(70)

-

-

-

(70)

Regulatory required programs

-

(94)

(53)

-

(147)

-

(150)

(110)

-

(260)

Operating O&M (as shown on slide 15)

2,737

982

679

(6)

4,392

2,910

1,070

710

(10)

4,680

($ millions) |