Attached files

Exhibit 10.3

PLANAR AMBERGLEN 1400 BUILDING

FIRST AMENDMENT TO LEASE

This First Amendment to Lease (this “Amendment”) is made as of October __, 2010 by and between Amberglen Properties Limited Partnership, an Oregon limited partnership (“Landlord”), and Planar Systems, Inc., an Oregon corporation (“Tenant”).

RECITALS

A. Landlord’s predecessor in interest, Equastone Amberglen, LLC, and Tenant are parties to that certain lease (the “1400 Building Lease”) for space in the office building located at 1400 NW Compton Drive, Suite 100, Hillsboro, Oregon 97006 (the “1400 Building Premises”).

B. Landlord and Tenant desire to amend the 1400 Building Lease as provided herein.

AGREEMENT

In consideration of the mutual covenants and conditions contained herein and for other good and valuable consideration, Landlord and Tenant agree as follows:

1. Amendment of Lease.

A. Term. The term of the 1400 Building Lease is extended such that the expiration date of the 1400 Building Lease shall be January 31, 2018.

B. Monthly Base Rent. From November 1, 2010 through January 31, 2018, Tenant shall pay Monthly Base Rent under the 1400 Building Lease as provided below:

| Months |

Monthly Installments |

|||

| 11/01/10 – 10/31/11 |

$ | 51,544.63 | ||

| 11/01/11 – 10/31/12 |

$ | 52,833.24 | ||

| 11/01/12 – 10/31/13 |

$ | 54,154.07 | ||

| 11/01/13 – 10/31/14 |

$ | 55,507.92 | ||

| 11/01/14 – 10/31/15 |

$ | 56,895.62 | ||

| 11/01/15 – 10/31/16 |

$ | 58,318.01 | ||

| 11/01/16 – 10/31/17 |

$ | 59,775.96 | ||

| 11/01/17 – 01/31/18 |

$ | 61,270.36 | ||

1

C. Base Year/Operating Expenses for 1400 Building Lease.

(1) Effective as of January 1, 2011, the first sentence of Section 4.1 of the 1400 Building Lease is deleted and replaced with the following:

“In addition to paying the Base Rent specified in Article 3 of this Lease, Tenant shall pay as additional rent (collectively, the “Excess”): (i) Tenant’s Share of the aggregate of the annual Operating Expenses, Insurance Expenses and Utility Expenses that are in excess of the Operating Expenses, Insurance Expenses and Utility Expenses for calendar year 2011 (the “Operating Expense Base Year”), and (ii) Tenant’s Share of the aggregate of the annual Tax Expenses that are in excess of the Tax Expenses for the 2011/2012 tax year (the “Property Tax Base Year”).”

In addition, effective as of January 1, 2011, all references in the Lease to “Expense Stop” shall collectively mean the amount of Operating Expenses, Insurance Expenses and Utility Expenses for the Operating Expense Base Year and the amount of Tax Expenses for the Property Tax Base Year.

(2) Landlord shall use commercially reasonable efforts to reduce Operating Expenses, Insurance Expenses, Tax Expenses and Utility Expenses; provided, however, in no event Landlord shall be required to take any actions to reduce such expenses if either: (i) Landlord reasonably believes that such actions to reduce such expenses could result in a diminishment in the level of services provided, or (ii) Landlord reasonably believes that the likelihood of a material reduction in such expenses is low; provided, however, if requested in writing by Tenant, Landlord shall provide Tenant with an explanation as to why Landlord reasonably believes that the likelihood of a material reduction in such expenses is low.

(3) If after the Operating Expense Base Year Landlord introduces a new category of Operating Expense that is within Landlord’s reasonable control (this provisions of this sentence shall not apply to an Operating Expense that is not within Landlord’s reasonable control) and Tenant does not approve such new category of Operating Expense (which approval shall not be unreasonably withheld, conditioned or delayed), Landlord shall not include such items in Operating Expenses.

(4) For any Operating Expenses, Insurance Expenses or Utility Expenses that is pro rated in any manner, all such pro rations shall be commercially reasonable, based on a consistent methodology from and after the Operating Expense Base Year and uniformly applied to all tenants of the Project. With respect to Insurance Expenses, Landlord shall not add new types of insurance coverages other than those existing coverages Landlord maintains with respect to the 1400 Building Premises (such coverages are described on the attached Schedule C) unless either: (i) such new type of insurance coverage is required by Landlord’s lender, or (ii) such new type of insurance coverage is commonly maintained by owners of property in the Hillsboro, Oregon area similar to the Amberglen project. In any event, consistent with clause (2) above, Landlord shall use commercially reasonably efforts to reduce the cost of such new type of insurance coverage. It is intended that if any portion of the Insurance Expense for the 1400 Building Premises is not separately delineated on Landlord’s policy of insurance and therefore is prorated, that such portion of the Insurance Expense for the 1400 Building Premises shall not be a greater percentage of the total premium than the insured asset value of the 1400 Building Premises represents as a percentage of the total insured asset values under Landlord’s policy, as such values are determined by Landlord in its reasonable business judgment. In addition, if the 1400 Building Premises is insured under a blanket insurance policy that includes properties that have insurance coverage that is not applicable to the 1400 Building Premises, in no event shall Insurance Expenses include premiums for any such coverage that is not applicable to the 1400 Building Premises.

(5) Landlord shall provide Tenant with an annual review of the condition of all HVAC equipment serving the 1400 Building Premises and shall provide Tenant with a rolling two (2) year capital improvement plan pertaining to any contemplated repairs and replacements, it being the goal of such capital improvement plan to, among other things: (i) provide a schedule for the repair or replacement of any capital items in a timely manner so as to provide for ongoing performance of any equipment that is approaching the end of its useful life, and (ii) provide Tenant with advance notice of the need for capital repairs and replacements. Except for emergency capital repairs or replacements, Landlord shall not undertake any capital repairs or replacements that cost over $20,000.00 that are not described on such capital improvement plan without the prior written consent of Tenant, which consent shall not be unreasonably withheld, conditioned or delayed.

2

(6) In connection with Tenant’s audit rights under the 1400 Building Lease, Landlord shall provide Tenant with copies of actual invoices (and, to the extent applicable, services contracts) for an Operating Expense or Utility Expense where the amount of the invoice is more than $500.00 within twenty (20) days after written request therefor or such longer period as may be reasonably necessary to obtain such invoices (and, if applicable, service contracts), and if such contract is a verbal contract, a commercially reasonable description of the service or expenses item. Requests for copies of actual invoices (and, if applicable, services contracts) shall be sent to Landlord and Landlord’s property manager (if Tenant has been given the notice address for Landlord’s property manager).

(7) Tenant shall have the right, at Tenant’s cost and expense, to appeal the property taxes for the 1400 Building Premises, and Landlord shall, at no cost or expense to Landlord, cooperate with any such appeal by Tenant. If Landlord intends to appeal the property taxes for the 1400 Building Premises, Landlord shall provide Tenant with notice of Landlord’s plans and Tenant shall have the right to participate with Landlord in such property tax appeal proceedings.

D. No Tenant Improvements/Improvement Allowance. In connection with the extension of the 1400 Building Lease, Tenant accepts the 1400 Building Premises in its “as is” condition and Landlord shall have no obligation to make any improvements to the 1400 Building Premises; provided, however, Landlord shall provide Tenant with an improvement allowance in the amount of Three Hundred Thousand Dollars ($300,000.00) (the “Improvement Allowance”). The Improvement Allowance shall first be used by Tenant to increase the efficiency of the HVAC systems serving the 1400 Building Premises, including, without limitation, providing supplemental cooling to those rooms requiring 24/7 operations. All such improvements to the HVAC systems serving the 1400 Building Premises shall be completed no later than August 31, 2011. To the extent the cost of such improvements to the HVAC systems serving the 1400 Building Premises is less than the amount of the Improvement Allowance, the balance of the Improvement Allowance may be used by Tenant to make other improvements to the 1400 Building Premises. All improvements to the 1400 Building Premises shall be performed in accordance with the alterations provisions of the 1400 Building Lease, including, without limitation, Landlord’s right to review and approve such alterations and the performance of such alterations in compliance with applicable laws, but excluding provisions relating to supervision fees and bonding. In addition, notwithstanding anything to the contrary contained in the alterations provision of the Lease, instead of Tenant providing the insurance that Tenant is required to maintain in connection with an alteration, Tenant may cause Tenant’s contractor performing the alterations to obtain such insurance so long as such insurance satisfies the insurance requirements contained in the alterations provision of the Lease. So long as Tenant is not in default under the 1400 Building Lease, Tenant shall be reimbursed for the actual costs incurred by Tenant for the cost of improvements to the HVAC systems serving the 1400 Building Premises to the extent of the Improvement Allowance within 30 days after presentation to Landlord of: (i) detailed invoices pertaining to the improvements to the HVAC systems serving the 1400 Building Premises, (ii) lien waivers with respect to all work performed and materials supplied with respect to such HVAC system improvements, and (iii) copies of all permits applicable to such HVAC system improvements. To the extent the cost of the improvements to the HVAC systems serving the 1400 Building Premises is less than the amount of the Improvement Allowance, and so long as Tenant is not in default under the 1400 Building Lease, Tenant shall be entitled to a second disbursement of the Improvement Allowance up to the remaining balance of the Improvement Allowance within 30 days after presentation to Landlord of: (a) detailed invoices pertaining to such additional alterations, (b) lien waivers with respect to all work performed and materials supplied with respect to such additional alterations, and (c) copies of all permits applicable to such additional alterations. If requested by Tenant and approved by Landlord, which approval shall not be unreasonably withheld, conditioned or delayed. Tenant may use some or all of the second disbursement of the Improvement Allowance to make improvements to that certain premises leased by Tenant from Landlord located at 1195 NW Compton Drive, Hillsboro, Oregon 97006. If any portion of the Improvement Allowance remains un-disbursed on December 31, 2012, Tenant shall have no further right to any such un-disbursed funds unless Tenant has submitted a complete reimbursement request for such un-disbursed funds from the Improvement Allowance prior to December 31, 2012.

3

E. Techpointe Consolidation. Tenant’s lease for approximately 60,000 rentable square feet of space at the project commonly known as Techpointe expires September 30, 2012 and Tenant agrees to engage in good faith space planning negotiations with Landlord regarding the possibility to relocating Tenant’s business from Techpointe to a location in the Amberglen project owned by Landlord.

F. Option Rights. All option rights, if any, contained in the 1400 Building Lease, including, without limitation, options to extend or renew the term of the 1400 Building Lease, are hereby deleted and are of no force and effect.

G. Real Estate Brokers. CresaPartners represents the Tenant (“Tenant’s Broker”) whose commission shall be paid by Landlord pursuant to a separate written agreement. Each party represents and warrants to the other that other than Tenant’s Broker, there is no real estate broker or agent who is or may be entitled to any commission or finder’s fee in connection with the representation of such party in this Amendment and each party shall indemnify and hold the other harmless from and against any and all claims, demands, losses, liabilities, lawsuits, judgments, costs and expenses (including without limitation, attorneys’ fees and costs) with respect to any leasing commission or equivalent compensation alleged to be owing on account of such party’s discussions, negotiations and/or dealings with any real estate broker or agent other than Tenant’s Broker.

2. Representations.

A. Due Authorization. Each party represents and warrants to the other that it has full power and authority to enter into this Amendment without the consent of any other person or entity;

B. No Assignment. Tenant represents and warrants to Landlord that Tenant has not assigned the 1400 Building Lease, or sublet the 1400 Building Premises;

C. No Default. Each party represents and warrants to the other that such party is not in default under the 1400 Building Lease; and

D. Binding Effect. Each party represents and warrants to the other that the 1400 Building Lease is binding on such party and is in full force and effect, and that such party does not have any defenses to the enforcement of the 1400 Building Lease.

3. General Provisions

A. Attorneys’ Fees. If a suit or an action is instituted in connection with any dispute arising out of this Amendment or the 1400 Building Lease or to enforce any rights hereunder or thereunder, the prevailing party shall be entitled to recover such amount as the court may adjudge reasonable as attorneys’ and paralegals’ fees incurred in connection with the preparation for and the participation in any legal proceedings (including, without limitation, any arbitration proceedings or court proceedings, whether at trial or on any appeal or review), in addition to all other costs or damages allowed.

4

B. Execution in Counterparts. This Amendment may be executed in counterparts and when each party has signed and delivered at least one such executed counterpart to the other party at the party’s address set forth above, then each such counterpart shall be deemed an original, and, when taken together with the other signed counterpart, shall constitute one agreement which shall be binding upon and effective as to all signatory parties.

C. Binding Effect. The provisions of this Amendment shall be binding upon and inure to the benefit of the parties and their respective successors and assigns and no amendment to this Amendment shall be binding upon the parties unless in the form of a written document executed by each party hereto. The 1400 Building Lease shall remain in full force and effect, as amended by this Amendment.

D. Integration. This Amendment contains the entire agreement and understanding of the parties with respect to the matters described herein, and supersedes all prior and contemporaneous agreements between them with respect to such matters.

5

IN WITNESS WHEREOF, Landlord and Tenant have executed this Amendment as of the date first above written.

| Landlord: |

AMBERGLEN PROPERTIES LIMITED PARTNERSHIP, an Oregon limited partnership | |||||||||

| By: | Gibralt Amberglen, LLC, a Delaware limited liability company, its general partner | |||||||||

| By: | Gibralt US, Inc., a Nevada corporation, its managing member | |||||||||

| By: |

| |||||||||

| Title: |

| |||||||||

| Tenant: |

PLANAR SYSTEMS, INC., an Oregon corporation | |||||||||

| By: |

| |||||||||

| Title: |

| |||||||||

6

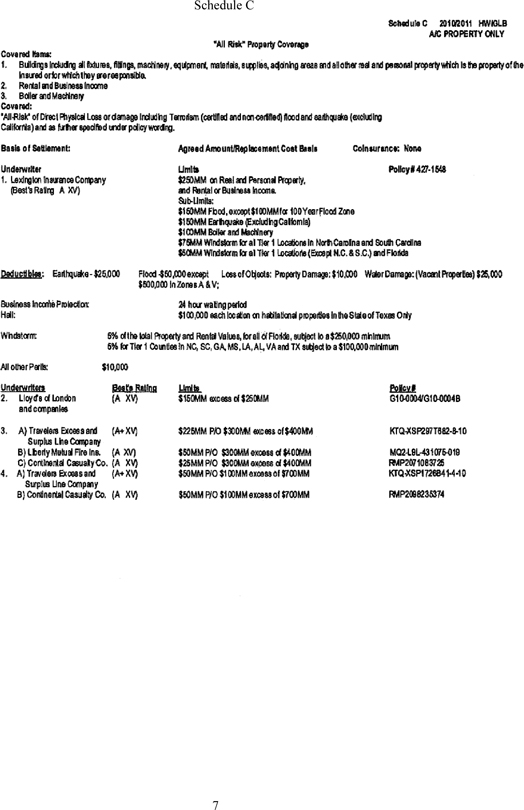

Schedule C

Schedule C 2010/2011 HWGLB

A/C PROPERTY ONLY

“All Risk” Property Coverage

Covered Name:

1. Buildings including all fixture, fillings, machinery, equipment, materials, adjoining areas and all other real and personal property which is the properly of the insured or/or which they are responsible.

2. Rental and Business income

3. Boiler and Machinery

Covered:

“All-Risk” of Direct physical Loss or damage including Terrorism (certified and non-certified) flood and earthquake (excluding California) and as further specified under policy wording.

Basis of settlement: Agreed Amount/Replacement Cost Basis Coinsurance: None

Underwriter Limits Policy# 427-1548

1. Lexington insurance company (Best’s Rating A XV)

Limits

$250MM on Real and Personal Property, and Rental or Business Income.

Sub-Limits:

$160MM Flood, except $100MM for 100 Year Flood Zone

$150MM Earthquake (Excluding California)

$100MM Boiler and Machinery

$75MM Windstorm for al Tier 1 Locations in North Carolina and South Carolina

$50MM Windstorm for al Tier 1 Locations (Except N.C. & S.C.) and Florida

Deductibles: Earthquake - $25,000 Flood -$50,000 except $500,000 in Zones A & V; Loss of Objects; Property Damage: $10,000 Water Damage: (Vacant Properties) $25,000

Business income Projections: 24 hour waiting period

Hall: $100,000 each location on habilational properties in the State of Texas Only

Windstorm: 6% of the total Property and Rental values, for all of Floride, subject to a $250,000 minimum

6% for Tier 1 Counties in NC, SC, GA, MS, LA, AL, VA and TX subject to a $100,000 minimum

All other Perils: $10,000

Underwriters

Best’s Rating

Limits

Policy#

2. Lloyd’s London and companies

(A XV)

$150MM excess of $250MM

G10-0004/G10-0004B

3. A) Travelers Excess and Surplus Line Company

(A+ XV)

$225MM P/O $300MM excess of $400MM

KTQ-XSP297T682-8-10

B) Liberty Mutual Fire Ins.

(A XV)

$50MM P/O $300MM excess of $400MM

MQ2-L9L-431075-019

C) Continental Casualty Co.

(A XV)

$25MM P/O $300MM excess of $400MM

RMP2071083725

4. A) Travelers Excess and Surplus Line Company

(A+ XV)

$50MM P/O $100MM excess of $700MM

KTQ-XSP1726841-4-10

B) Continental Casualty Co.

(A XV)

$50MM P/O $100MM excess of $700MM

RMP2098235374

7