Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Laredo Resources Corp. | ex23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1 /A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

LAREDO RESOURCES CORP.

(Exact name of Registrant as specified in its charter)

| Nevada | 1000 | Pending |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

|

Hero de Nacarozi #10, PO Box 177,

C.P. 63732, Colonia Centtro

Bucerias, Nayarit, Mexico

|

______

|

|

|

(Name and address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code: 775-636-6937 OR 52-329-298-3649

|

||

|

|

||

|

Nevada Agency and Transfer Company

50 West Liberty Street, Suite 880Reno, Nevada

|

89501

|

|

|

(Name and address of agent for service of process)

|

(Zip Code)

|

|

|

Telephone number of agent for service of process: (775) 636-6937

|

||

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

|

||

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer |__| Accelerated filer |__|

Non-accelerated filer |__| Smaller reporting company |X|

| CALCULATION OF REGISTRATION FEE | ||||

|

TITLE OF EACH

CLASS OF

SECURITIES

TO BE

REGISTERED

|

AMOUNT TO BE

REGISTERED

|

PROPOSED

MAXIMUM

OFFERING

PRICE PER

SHARE (1)

|

PROPOSED

MAXIMUM

AGGREGATE

OFFERING

PRICE (2)

|

AMOUNT OF

REGISTRATION

FEE

|

|

Common Stock

|

1,099,000

|

$0.008

|

$8,792

|

$0.63

|

|

(1)

|

This price was arbitrarily determined by Laredo Resources Corp.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

COPIES OF COMMUNICATIONS TO:

The Law Offices of Ryan Alexander

Attn: Ryan Alexander

520 S. 4th St., Suite 340

Las Vegas, NV 89101

SUBJECT TO COMPLETION, Dated February 2 , 201 1

PROSPECTUS

LAREDO RESOURCES CORP.

1,099,000

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

The selling shareholders named in this prospectus are offering up to 1,099,000 shares of common stock offered through this prospectus. We will not receive any proceeds from this offering and have not made any arrangements for the sale of these securities. We have, however, set an offering price for these securities of $0.008 per share. We will use our best efforts to maintain the effectiveness of the resale registration statement from the effective date through and until all securities registered under the registration statement have been sold or are otherwise able to be sold pursuant to Rule 144 promulgated under the Securities Act of 1933.

|

Offering Price

|

Underwriting Discounts

and Commissions

|

Proceeds to

Selling Shareholders

|

|

|

Per Share

|

$0.008

|

None

|

$0.008

|

|

Total

|

$8,792

|

None

|

$8,792

|

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.008 per share until such time as the shares of our common stock are traded on the Over-The-Counter Bulletin Board (“OTCBB”), which is sponsored by the Financial Industry Regulatory Authority (“FINRA”), formerly known as the National Association of Securities Dealers or NASD. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Although we intend to apply for quotation of our common stock on the FINRA Over-The-Counter Bulletin Board through a market maker, public trading of our common stock may never materialize. If our common stock becomes traded on the FINRA Over-The-Counter Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section of this Prospectus entitled "Risk Factors" on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: February 2, 201 1

Table of Contents

| 8 | |

| 8 | |

| Because title to the property is held in the name of another entity, if that entity transfers the property to someone other than us, we will cease activities. | 12 |

Laredo Resources Corp.

We were incorporated on August 17, 2010, under the laws of the state of Nevada. We are in the business of mineral exploration. On November 30, 2010, our wholly owned subsidiary, LRE Exploration LLC, a Nevada limited liability company, (“LRE”) entered into a Property Option Agreement (the “Property Option Agreement”) with Arbutus Minerals LLC (“Arbutus”) to acquire an option to purchase a 100% interest in the 20 ABR mineral claims (the “ABR Claims”).

Under the terms of the Property Option Agreement between Arbutus and LRE, we acquired an option to acquire a 100% interest in the mineral rights for the ABR Claims currently held by Arbutus for an initial payment of $10,000. Arbutus holds only the mineral rights to the ABR Claims as the ABR Claims are on Bureau of Land Management managed land. Thus, we do not have the right to purchase the real property rights for the land underlying the ABR Claims. In order to exercise the option, we must pay the following monies to Arbutus and make the following expenditures on the ABR Claims by the following dates:

|

·

|

Payments to Arbutus

|

|

| o | $10,000 on or before November 30, 2011; |

|

o

|

$20,000 on or before November 30, 2012; and

|

|

o

|

$50,000 on or before November 30, 2013.

|

|

·

|

Exploration Expenditures

|

|

| o |

$15,000 in aggregate exploration expenditures prior to November 30, 2012;

|

|

o

|

$65,000 in aggregate exploration expenditures prior to November 30, 2013; and

|

|

o

|

$215,000 in aggregate exploration expenditures prior to November 30, 2014.

|

We will either satisfy the payment terms of the Property Option Agreement in the time frame provided, thereby resulting in us exercising this option or we will fail to satisfy the payment terms and be in default of the Property Option Agreement. If we are in default of the Property Option Agreement, Arbutus can terminate the Property Option Agreement if we fail to cure any default within 45 days after the receipt of notice of default. Our option will expire if we are in default of the Property Option Agreement and fail to cure any default within 45 days after the receipt of notice of default. Additionally, and notwithstanding the foregoing, if we fail to perform condition precedent to exercise the option, Arbutus shall be entitled to terminate the Property Option Agreement.

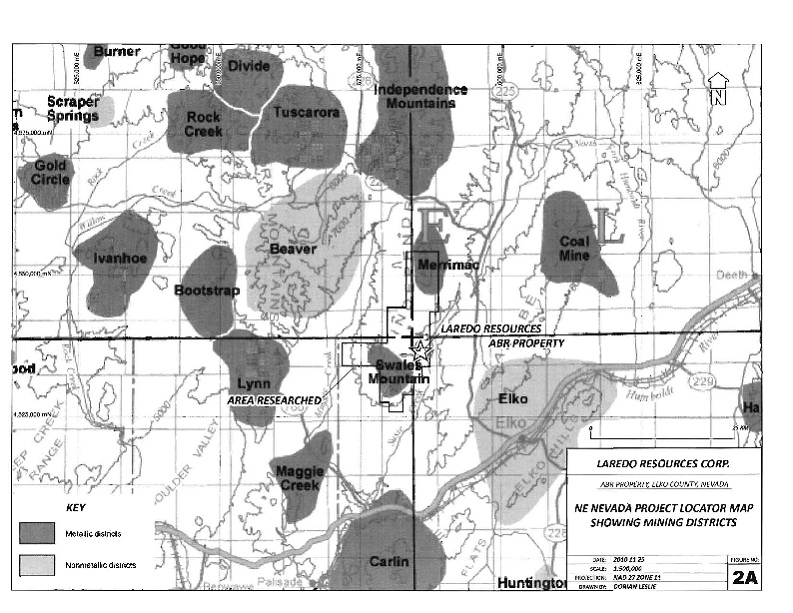

The ABR Claims are located approximately 15 miles northwest of the community of Elko in the northeastern portion of the State of Nevada on Bureau of Land Management managed land. The ABR claims are about 413 acres of lode claims consisting of 20 en bloc unpatented mineral claims. Each claim is approximately 1500 feet by 600 feet. The existence of commercially exploitable mineral deposits in the ABR Claims is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our planned exploration program.

Prior to acquiring the option to acquire the ABR Claims, we retained the services of Mr. Carl von Einsiedel, an independent consulting geologist who holds the degree of Bachelor of Science in Geology. Mr. von Einsiedel prepared a geological report for us on the mineral exploration potential of the ABR Claims. Included in this report is a recommended exploration program.

Phase I of the exploration program will be conducted over a one year period and has a budget of $15,000. We do not currently possess sufficient capital to fully fund Phase I. Therefore our plan is to continue to raise additional monies in order to be able to fully fund Phase I. We believe that is preferable to possess capital sufficient to complete Phase I prior to initiating it. We are hopeful that we will be able to raise an amount of capital during our first full fiscal year (September 1, 2010 to August 31, 2011) that will allow us to fully fund Phase I and undertake that Phase during the end of our first full fiscal year or the beginning of the second full fiscal year. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for mined minerals and the costs of exploring for or commercial production of these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

We will make the decision to proceed with any further programs based upon our consulting geologist’s review of the results and recommendations. If we do decide to proceed with Phase II, then it would commence in the late summer or early fall of 2012 and should completed in late summer or early fall of 2013. In order to complete Phase II we will need to raise additional capital. In order to maintain our rights under our Property Option Agreement, we will be required to make the contractual payments detailed above regardless of whether we proceed with Phases II and III of our planned exploration program.

We intend to conduct mineral exploration activities on the ABR Claims in order to assess whether the claims possess commercially exploitable mineral deposits. Our exploration program is designed to explore for commercially viable deposits of gold, silver, lead, zinc, copper, tungsten and barite. The mineral exploration program, consisting of surface reconnaissance, and geological mapping and sampling, is oriented toward defining drill targets on mineralized zones within the ABR Claims.

Mineral exploration is essentially a research activity that does not produce a product. Successful exploration often results in increased project value that can be realized through the optioning or selling of the claimed site to larger companies.

We have not conducted any mining or exploration, aside from the aforementioned geological report on the ABR Claims. We are an exploration stage company, no proven commercial reserves have been identified on the ABR Claims and there is no assurance that a commercially viable mineral deposit currently exists on the ABR Claims. Ms. Ruth Cruz Santos, our president and director, does not have any training as a geologist or an engineer. As a result, our management may lack certain skills that are advantageous in managing an exploration company. In addition, neither Ms. Santos, nor our consulting geologist, Mr. von Einsiedel, has visited the property. As a result, we face an enhanced risk that, upon physical examination of the ABR Claims property, no commercially viable deposits of minerals will be located.

Currently, we are uncertain of the number of mineral exploration phases we will conduct before we are able to determine whether there are commercially viable minerals present on the ABR Claims. Further phases beyond the current exploration program will be dependent upon a number of factors such as our consulting geologist recommendations and our available funds.

Since we are in the exploration stage of our business plan, we have not earned any revenues from our planned operations. As of November 30 , 2010, we had $ 19,360 in current assets. As of November 30 , 2010 our current liabilities amounted to $ 5,000 . Accordingly, our working capital position as of November 30 , 2010, was $ 14,360 . Since our inception through November 30 , 2010, we have incurred a net loss of $ 18,625 . We attribute our net loss to having no revenues to offset our expenses, which have consisted primarily of the professional fees related to the creation and operation of our business and filing of this registration statement .

In the next 12 months, we anticipate spending approximately $30,000 on administrative expenses, including fees payable in connection with the filing of this registration statement and complying with reporting obligations. As stated above, our working capital position as of November 30 , 2010, was $ 19,360 . Therefore, we feel that we have sufficient funds on hand to cover all of our anticipated administrative expenses for our first full fiscal year (September 1, 2010 to August 31, 2011) , but not sufficient capital to fully fund Phase I. Thus, during our first full fiscal year (September 1, 2010 to August 31, 2011) we will focus on raising capital sufficient to fully fund Phase I. If successful, then we intend to initiate Phase I during the end of our first full fiscal year or the beginning of the second full fiscal year.

In the event the results of our initial exploration program prove not to be sufficiently positive to proceed with further exploration on the ABR claims, we intend to seek out and acquire interests in additional mineral exploration properties which, in the opinion of our consulting geologist, offer attractive mineral exploration opportunities. Presently, we have not given any consideration to the acquisition of other exploration properties because we have not yet commenced our initial exploration program and have not received any results.

Our fiscal year end is August 31.We were incorporated on August 17, 2010, under the laws of the state of Nevada. Our principal offices are located at Hero de Nacarozi #10, PO Box 177, C.P. 63732, Bucerias, Nayarit, Mexico. Our mailing address is 50 West Liberty Street, Suite 880, Reno, Nevada, and our telephone number is 775-636-6937 OR 52-329-298-3649.

We are currently considered a “shell company” within the meaning of Rule 12b-2 under the Exchange Act, in that we currently have nominal operations and nominal assets other than cash. Accordingly, the ability of holders of our common stock to re-sell their shares may be limited by applicable regulations. Specifically, the securities sold through this offering can only be resold through registration under the Securities Act of 1933, pursuant to Section 4(1) of the Securities Act, or by meeting the conditions of Rule 144(i) under the Securities Act.

The Offering

|

Securities Being Offered

|

Up to 1,099,000 shares of our common stock.

|

|

Offering Price and Alternative Plan of Distribution

|

The offering price of the common stock is $0.008 per share. We intend to apply to the FINRA over-the-counter bulletin board to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

|

|

Minimum Number of Shares To Be Sold in This Offering

|

None

|

|

Securities Issued and to be Issued

|

3,570,000 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders. There will be no increase in our issued and outstanding shares as a result of this offering.

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the common stock by the selling shareholders.

|

|

Summary Financial Information

|

|||||

|

Balance Sheet Data

|

November 30, 2010 (unaudited)

|

August 31, 2010

(audited)

|

|||

|

Cash

|

$ | 19,360 | $ | 27,400 | |

|

Total Assets

|

$ | 29,360 | $ | 27,400 | |

|

Liabilities

|

$ | 20,000 | $ | 6,740 | |

|

Total Stockholder’s Equity

|

$ | 20,660 | |||

| $ | 9,360 | ||||

|

Statement of

Operations

|

For the Quarter Ended November 30, 2010 (unaudited)

|

From Inception on August 17, 2010 to

August 31, 2010

(audited)

|

|||

|

Revenue

|

$ | - | $ | - | |

|

Net Loss

|

$ | 11,300 | $ | 7,325 | |

Risk Factors

You should consider each of the following risk factors and any other information set forth herein and in our reports filed with the SEC, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. If any of the following risks actually occur, our business and financial results or prospects could be harmed. In that case, the value of the Common Stock could decline.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business will fail. Because we will need additional financing to fund our extensive exploration activities, our accountants believe there is substantial doubt about our ability to continue as a going concern.

As of August 31, 2010, we had cash in the amount of $ 19,360 . We expect that these monies , $15,000 of which were loaned to us by our President in September 2010, will allow us to complete our first year of operation. However, in order to complete our initial one year work program recommended by our consulting geologist, and any subsequent work programs, we will require additional financing as we currently do not have any operations and we have no income. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for mined minerals and the costs of exploring for or commercial production of these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

Additionally, as we have incurred a net loss of $ 18,625 for the period from our inception on August 17, 2010, to November 30 , 2010, and have had no revenue generated during that same time period, our auditors have issued a going concern opinion and have raised substantial doubt about our continuance as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the company will continue to operate indefinitely and not go out of business and liquidate its assets. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time. Potential investors should also be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The auditor’s going concern opinion may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

The risky nature of mineral exploration in general and our lack of tangible assets other than our mineral claim places our ability to obtain outside debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until such time as an economically viable mine can be demonstrated. Without additional infusions of equity capital, our ability to fund our ongoing operations beyond the current fiscal year may be limited.

The existence of commercially exploitable mineral deposits in the ABR Claims is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program. Accordingly, we currently face a high risk that we will be unable to generate any revenues or otherwise realize any value from the ABR mineral claims.

Because we have only recently commenced business operations, we face a high risk of business failure.

We have just planned the initial stages of exploration on the ABR Claims. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on August 17, 2010, and to date have been involved primarily in organizational activities, the optioning of our mineral claim, and obtaining an independent consulting geologist’s report on our mineral claim. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

Because our executive officers do not have any training specific to the technicalities of mineral exploration, there is a higher risk our business will fail.

Ms. Ruth Cruz Santos, our president and director, does not have any training as a geologist or an engineer. As a result, our management may lack certain skills that are advantageous in managing an exploration company. In addition, Ms. Cruz’s decisions and choices may not take into account standard engineering or managerial approaches that mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in geology and engineering.

Because the ABR Claims have not been physically examined by a professional geologist or mining engineer, we face a significant risk that the property will not contain commercially viable deposits of minerals.

Although we have obtained an independent geologist’s report on the ABR Claims, the property has not been physically examined in the field by a professional geologist or mining engineer. In addition, neither our sole officer, Ms. Cruz, nor our consulting geologist, Mr. von Einsiedel, has visited the property. As a result, we face an enhanced risk that, upon physical examination of the ABR Claims property, no commercially viable deposits of minerals will be located. In the event that our planned exploration of the ABR Claims property reveals that no commercially viable deposits exist on the site, our business will likely fail.

Because we conduct our business through verbal agreements with consultants and arms-length third parties, there is a substantial risk that such persons may not be readily available to us and the implementation of our business plan could be impaired.

We have a verbal agreement with our consulting geologist that requires them to review all of the results from the exploration work performed upon the mineral claim that we have optioned and then make recommendations based upon those results. In addition, we have a verbal agreement with our accountants to perform requested financial accounting services and a written agreement with our outside auditors to perform auditing functions. Each of these functions requires the services of persons in high demand and these persons may not always be available. The implementation of our business plan may be impaired if these parties do not perform in accordance with our verbal agreement. In addition, it may be difficult to enforce a verbal agreement in the event that any of these parties fail to perform.

Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position, results of operations, and cash flows. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to complete the exploration of the ABR Claims. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues from the exploration of the mineral claims if we exercise our option. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because we will incur additional costs as the result of becoming a public company, our cash needs will increase and our ability to achieve net profitability may be delayed.

Upon the effectiveness of our Registration Statement, we will become a publicly reporting company and will be required to stay current in our filings with the SEC, including, but not limited to, quarterly and annual reports, current reports on materials events, and other filings that may be required from time to time. We believe that, as a public company, our ongoing filings with the SEC will benefit shareholders in the form of greater transparency regarding our business activities and results of operations. In becoming a public company, however, we will incur additional costs in the form of audit and accounting fees and legal fees for the professional services necessary to assist us in remaining current in our reporting obligations. We expect that, during our first full fiscal year (September 1, 2010 to August 31, 2011), we will incur costs for administrative fees of approximately $30,000 consisting primarily of $12,500 in professional fees for our operations and $15,000 in professional fees which we expect to incur in this offering. W e estimate that ongoing professional fees to be incurred as result of becoming a reporting company will run approximately $15,000 per year during the exploration phase of our business. These costs will increase our cash needs and may hinder or delay our ability to achieve net profitability even after we have begun to generate revenues from the extraction of minerals on our mining claims.

Because our president has only agreed to provide her services on a part-time basis, she may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Ms. Cruz, our president and chief financial officer, devotes 5 to 10 hours per week to our business affairs. We do not have an employment agreement with Ms. Cruz nor do we maintain a key man life insurance policy for her. Currently, we do not have any full or part-time employees. If the demands of our business require the full business time of Ms. Cruz, it is possible that Ms. Cruz may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

Because our president, Ms. Ruth Cruz owns 56.02% of our outstanding common stock, investors may find that corporate decisions influenced by Ms. Cruz are inconsistent with the best interests of other stockholders.

Ms. Cruz is our president, chief financial officer and sole director. She owns 56.02% of the outstanding shares of our common stock. Accordingly, she will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Ms. Cruz may still differ from the interests of the other stockholders.

Because our president, Ms. Ruth Cruz owns 56.02% of our outstanding common stock, the market price of our shares would most likely decline if she were to sell a substantial number of shares all at once or in large blocks.

Our president, Ms. Ruth Cruz Santos, owns 2,000,000 shares of our common stock which equates to 56.02% of our outstanding common stock. There is presently no public market for our common stock and we plan to apply for quotation of our common stock on the FINRA over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. If our shares are publicly traded on the over-the-counter bulletin board, Ms. Cruz will eventually be eligible to sell her shares publicly subject to the volume limitations in Rule 144. The offer or sale of a large number of shares at any price may cause the market price to fall. Sales of substantial amounts of common stock or the perception that such transactions could occur, may materially and adversely affect prevailing market prices for our common stock.

If we are unable to successfully compete within the mineral exploration business, we will not be able to achieve profitable operations.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and no small number of competitors dominates this industry with respect to any of the large volume metallic minerals. Our exploration activities will be focused on attempting to locate commercially viable mineral deposits on the ABR Claims. Many of our competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities on the ABR Claims. If we are unable to retain qualified personnel to assist us in conducting mineral exploration activities on the ABR Claims if a commercially viable deposit is found to exist, we may be unable to enter into production and achieve profitable operations.

Because of factors beyond our control which could affect the marketability of any substances found, we may have difficulty selling any substances we discover.

Even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. These factors could inhibit our ability to sell minerals in the event that commercial amounts of minerals are found.

Because our sole officer and director, Ms. Ruth Cruz Santos is not a United States Citizen and is located outside the United States, you may have difficulty enforcing judgments against her.

Our sole officer and director, Ms. Ruth Cruz Santos, lives in Mexico and is a Mexican citizen. As a result, it may be difficult for you to effect service of process within the United States upon her. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against her. In addition, there is uncertainty as to whether the courts of Mexico would recognize or enforce judgments of U.S. courts. Whether courts in Mexico will recognize and enforce foreign judgments will depend upon the requirements of Mexican law based on treaties between Mexico and the country where the judgment is made or on reciprocity between jurisdictions. The outcome of such legal determinations is inherently uncertain.

Risks Related To Legal Uncertainty

Because we will be subject to compliance with government regulation which may change, the anticipated costs of our exploration program may increase.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business, prevent us from carrying out our exploration program, and make compliance with new regulations unduly burdensome.

Future legislation and administrative changes to the mining laws could prevent us from exploring our properties.

New state and U.S. federal laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations.

Third parties may challenge our rights to our mineral properties or the agreements that permit us to explore our properties may expire if we fail to timely renew them and pay the required fees.

In connection with the acquisition of our mineral properties, we sometimes conduct only limited reviews of title and related matters, and obtain certain representations regarding ownership. These limited reviews do not necessarily preclude third parties from challenging our title and, furthermore, our title may be defective. Although we are not aware of any such claims, third parties could challenge the location notice for the ABR claims under claim of prior right under an earlier claim location notice or other filing covering some or all of the area encompassed by the ABR claims. Consequently, there can be no guarantee that , upon exercise of our option to acquire the ABR Claims, we will hold good and marketable title to all of the included mining concessions and mining claims. If any of our concessions or claims were challenged, we could incur significant costs and lose valuable time in defending such a challenge. These costs or an adverse ruling with regards to any challenge of our titles could have a material adverse affect on our financial position or results of operations. There can be no assurance that any such disputes or challenges will be resolved in our favor.

We are not aware of challenges to the location or area of any of our mining claims. There is, however, no guarantee that title to the claims will not be challenged or impugned in the future.

Because title to the property is held in the name of another entity, if that entity transfers the property to someone other than us, we will cease activities.

Title to the property upon which we intend to conduct exploration activities is not held in our name. Title to the property is recorded in the name of Arbutus Minerals LLC. An unpatented mining claim is a selected parcel of U.S. federal land, valuable for a specific mineral deposit or deposits, for which the claimant has asserted a right of possession. A patented mining claim is one for which the federal government has conveyed title, making it private land. The ABR Claims are unpatented mining claims. Arbutus’ rights to the ABR Claims are thus restricted to the exploration and extraction of a mineral deposit. ABR’s rights to the ABR claim are recorded, however, with the county and the BLM. If Arbutus, as the record owner of the claim, transfers the property to a third person, the third person will obtain good title and we will have nothing. If this should occur, we will subsequently not own any property and we will have to cease all exploration activities.

Because legislation, including the Sarbanes-Oxley Act of 2002, increases the cost of compliance with federal securities regulations as well as the risks of liability to officers and directors, we may find it more difficult for us to retain or attract officers and directors.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and it is costly to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in our inability to achieve profitability.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares

A market for our common stock may never develop. We currently plan to apply for quotation of our common stock on the FINRA over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the bulletin board, or, if traded, a public market may not materialize. If our common stock is not traded on the bulletin board or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The selling shareholders are offering 1,099,000 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent 30.78% of the common shares issued and outstanding as of the date of this prospectus.

Because we will be subject to the “Penny Stock” rules the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

If our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 or 60 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

If we undertake future offerings of our common stock, purchasers in this offering will experience dilution of their ownership percentage.

Generally, existing shareholders will experience dilution of their ownership percentage in the company if and when additional shares of common stock are offered and sold. In the future, we may be required to seek additional equity funding in the form of private or public offerings of our common stock. In the event that we undertake subsequent offerings of common stock, your ownership percentage, voting power as a common shareholder, and earnings per share, if any, will be proportionately diluted. This may, in turn, result in a substantial decrease in the per-share value of your common stock.

We are currently considered a “shell company” within the meaning of Rule 12b-2 under the Exchange Act, in that we currently have nominal operations and nominal assets other than cash. Accordingly, the ability of holders of our common stock to re-sell their shares may be limited by applicable regulations. Specifically, the securities sold through this offering can only be resold through registration under the Securities Act of 1933, pursuant to Section 4(1) of the Securities Act, or by meeting the conditions of Rule 144(i) under the Securities Act.

Forward-Looking Statements

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

Use of Proceeds

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Determination of Offering Price

The $0.008 per share offering price of our common stock was arbitrarily chosen using the last sales price of our stock from our most recent private offering of common stock. There is no relationship between this price and our assets, earnings, book value or any other objective criteria of value.

Upon effectiveness of the Registration Statement of which this Prospectus is a part, w e intend to apply through a market maker to the FINRA over-the-counter bulletin board for the quotation of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. We intend to file a registration statement under the Exchange Act concurrently with the effectiveness of the registration statement of which this prospectus forms a part. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 1,099,000 shares of common stock offered through this prospectus. The selling shareholders purchased their shares in an offering completed on August 27, 2010. All of the shares were acquired from us by the selling shareholders in an offering that was exempt from registration pursuant to Rule 903(a)&(b)(3) of Regulation S of the Securities Act of 1933 as the following criteria were satisfied:

|

·

|

All offers and sales were made to non-U.S. persons outside of the United States ;

|

|

·

|

No directed selling efforts were made in the United States by any party;

|

|

·

|

Offering restrictions were implemented;

|

|

·

|

The offer or sale was made only to natural persons who are Mexican citizens; and

|

|

·

|

All of the provisions of Rule 903(b)(3)(iii)(B) were complied with. Specifically:

|

|

|

o

|

The purchasers of the shares certified that they were not U.S. persons and were not acquiring the securities for the account or benefit of any U.S. person

|

|

|

o

|

The purchasers of the shares agreed to resell such securities only in accordance with the provisions of Regulation S, pursuant to registration under the Securities Act, or pursuant to an available exemption from registration; and agreed not to engage in hedging transactions with regard to such securities unless in compliance with the Act.

|

|

o

|

The share certificates will contain a legend to the effect that transfer is prohibited except in accordance with the provisions of Regulation S, pursuant to registration under the Act, or pursuant to an available exemption from registration; and that hedging transactions involving those securities may not be conducted unless in compliance with the Act; and

|

|

o

|

Per the subscriptions for the shares, we are required to refuse to register any transfer of the shares not made in accordance with the provisions of Regulation S, pursuant to registration under the Act, or pursuant to an available exemption from registration.

|

The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders as of February 2 , 201 1 including:

1. the number of shares owned by each prior to this offering;

2. the total number of shares that are to be offered by each;

3. the total number of shares that will be owned by each upon completion of the offering;

4. the percentage owned by each upon completion of the offering; and

5. the identity of the beneficial holder of any entity that owns the shares.

The named parties beneficially own and have sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The percentages are based on 3,570,000 shares of common stock outstanding on February 2 , 201 1 .

|

Name of Stockholder

|

Shares Owned Prior to this Offering

|

Total Number of Shares to be Selling Shareholder Account

|

Total Shares to be Owned Upon Completion of this Offering

|

Percent Owned Upon Completion of this Offering

|

|

Pablo Quintero Aguilar

|

30,000

|

21,000

|

9,000

|

0.25%

|

|

Nain Garcia Albarran

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Aurora Ramos Balcazar

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Maria Elena Bernal Belloso

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Ofelia Lopez Carrillo

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Ma Concepcion Manzano Chavez

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Ambrocio Moreno Cruz

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

Felicitas Belloso Dominguez

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Jose Garcia Espinoza

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

Dioscoro Gonzalez Garcia

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Maribel Reynaga Garcia

|

30,000

|

21,000

|

9,000

|

0.25%

|

|

Pedro Avila Garcia

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

Antonio Hernandez Gonzalez

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Ilda Mendoza Gonzales

|

30,000

|

21,000

|

9,000

|

0.25%

|

|

Carmelo Perez Gonzalez

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Maria Isabel Rodriguez Guerra

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Rosa Alicia Gutierrez

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Maria Luisa Moreno Hernandez

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

Maria Cristina Esparza Lara

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Ana Laura Raygoza Leon

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

Guadalupe Paz LLanez

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Rosario Judith Garcia Manzano

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Bernado Garcia Martinez

|

30,000

|

21,000

|

9,000

|

0.25%

|

|

Gerardo Garcia Martinez

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

J Guadalupe Garcia Martinez

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

Jose De Jesus Esparza Mireles

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Martina Gomez Morales

|

20,000

|

14,000

|

6,000

|

0.17%

|

|

Vicencia Quinonez Olguin

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Noe Vilchis Ortega

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Rodolfo Ramos Ortega

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Cinthia Belen Trevino Palomera

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Victor Hugo Trevino Palomera

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

I Gnacio Garcia Perez

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Jose Eduardo Charvez Ramos

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Maria Magdalena Ramos

|

30,000

|

21,000

|

9,000

|

0.25%

|

|

Juan Carlos Lopez Rodriguez

|

30,000

|

21,000

|

9,000

|

0.25%

|

|

Miguel Angel Calixto Rodriguez

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Erika Adriana Ramos Ruiz

|

40,000

|

28,000

|

12,000

|

0.34%

|

|

Genaro Ochoa Salazar

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Blanca Guadalupe Pacheco Santos

|

50,000

|

35,000

|

15,000

|

0.42%

|

|

Zoila Maribel Garcia Viorato

|

30,000

|

21,000

|

9,000

|

0.25%

|

None of the selling shareholders; (1) has had a material relationship with us other than as a shareholder at any time within the past three years; (2) has been one of our officers or directors; or (3) are broker-dealers or affiliate of broker-dealers.

The selling shareholders and any broker/dealers who act in connection with the sale of the shares may be deemed to be “underwriters” within the meaning of the Securities Acts of 1933, and any commissions received by them and any profit on any resale of the shares as a principal might be deemed to be underwriting discounts and commissions under the Securities Act.

Plan of Distribution

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

|

1.

|

on such public markets or exchanges as the common stock may from time to time be trading;

|

|

2.

|

in privately negotiated transactions;

|

|

3.

|

through the writing of options on the common stock;

|

|

4.

|

in short sales, or;

|

|

5.

|

in any combination of these methods of distribution.

|

The sales price to the public is fixed at $0.008 per share until such time as the shares of our common stock become traded on the FINRA Over-The-Counter Bulletin Board or another exchange. Upon effectiveness of the Registration Statement of which this Prospectus is a part , we intend to apply through a market maker for quotation of our common stock on the FINRA Over-The-Counter Bulletin Board . P ublic trading of our common stock , however, may never materialize. If our common stock becomes traded on the FINRA Over-The-Counter Bulletin Board, or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

1. the market price of our common stock prevailing at the time of sale;

2. a price related to such prevailing market price of our common stock, or;

3. such other price as the selling shareholders determine from time to time.

Presently, the selling shareholders cannot sell their common stock of our Company in accordance with Rule 144 under the Securities Act.

The selling shareholders may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as an agent may receive a commission from the selling shareholders or from such purchaser if they act as agent for the purchaser. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act of 1933 and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. not engage in any stabilization activities in connection with our common stock;

2. furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and;

3. not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act.

Description of Securities

Common Stock

We have 90,000,000 common shares with a par value of $0.001 per share of common stock authorized, of which 3,570,000 shares were outstanding as of February 2 , 201 1 .

Voting Rights

Holders of common stock have the right to cast one vote for each share of stock in his or her own name on the books of the corporation, whether represented in person or by proxy, on all matters submitted to a vote of holders of common stock, including the election of directors. There is no right to cumulative voting in the election of directors. Except where a greater requirement is provided by statute or by the Articles of Incorporation, or by the Bylaws, the presence, in person or by proxy duly authorized, of the holder or holders of a majority of the outstanding shares of our common voting stock shall constitute a quorum for the transaction of business. The vote by the holders of a majority of such outstanding shares is also required to effect certain fundamental corporate changes such as liquidation, merger or amendment of the Company's Articles of Incorporation.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. we would not be able to pay our debts as they become due in the usual course of business, or;

2. our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover Laws

Nevada Revised Statutes sections 78.378 to 78.379 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our company.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries or the ABR Claims. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

The Law Offices of Ryan Alexander, PLLC, our legal counsel, has provided an opinion on the validity of our common stock.

De Joya Griffith & Company LLC, an independent registered public accounting firm, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. De Joya Griffith & Company LLC has presented their report with respect to our audited financial statements. The report of De Joya Griffith & Company LLC is included in reliance upon their authority as experts in accounting and auditing.

Mr. Carl von Einsiedel, Bachelor of Science in Geology, Professional Geoscientist, Consulting Geologist, has provided a geological evaluation report on the ABR Claims. He was employed on a flat rate consulting fee basis and he has no interest, nor does he expect any interest in the property or securities of Laredo Resources Corp.

Organization within the Last Five Years

We were incorporated on August 17, 2010 under the laws of the state of Nevada. On August 31, 2010, we formed a wholly owned subsidiary known as LRE Exploration LLC. (“LRE”), organized under the laws of the state of Nevada. LRE was formed to conduct our exploration operations within the United States of America. On November 30, 2010, we entered into a Property Option Agreement (the “Property Option Agreement”) between LRE, and Arbutus Minerals LLC, (“Arbutus”) whereby we acquired an option to purchase a 100% interest in 20 mineral claims known as the ABR Mineral Claims (the “ABR Claims”), located in the northeastern portion of the state of Nevada. Under the terms of the Property Option Agreement, LRE is the operator of the exploration program that is to be conducted on the claim. The Property Option Agreement sets forth each party's rights and responsibilities relating to both the exploration and potential mining stages of the operations to be conducted on the ABR Claims.

We have entered into two transactions with Ms. Cruz. First, Ms. Cruz purchased 2,000,000 shares of our common stock on August 19, 2010, at a price of $0.0078125 per share. Second, on September 2, 2010, she loaned us $15,000. The loan is interest free. The principal balance is due on or before September 30, 2012. Other than the foregoing, Ms. Cruz has not acquired from us anything of value either directly or indirectly.

Description of Business

Business of Company

We are an exploration stage company that intends to engage in the exploration of mineral properties with a view to exploiting any mineral deposits we discover. We, through our wholly owned subsidiary, LRE Exploration LLC, a Nevada limited liability company, (“LRE”) own an option to acquire an undivided 100% beneficial interest in a mineral claim located in Elko County, in the State of Nevada, known as the ABR Claims. Although we hold an option to the mineral exploration rights relating to the twenty mineral claims in the ABR Claims, we do not own any real property interest in the ABR Claims or any other property.

Overview of Our Mineral Exploration Business

Mineral exploration is essentially a research activity that does not produce a product. Successful exploration often results in increased project value that can be realized through the optioning or selling of the claimed site to larger companies. As such, we intend to acquire properties which we believe have potential to host economic concentrations of minerals. These acquisitions have and may take the form of unpatented mining claims on federal land, or leasing claims, or private property owned by others. An unpatented mining claim is an interest that can be acquired to the mineral rights on open lands of the federally owned public domain. Claims are staked in accordance with the Mining Law of 1872, recorded with the federal government pursuant to laws and regulations established by the Bureau of Land Management (the Federal agency that administers America’s public lands), and grant the holder of the claim a possessory interest in the mineral rights, subject to the paramount title of the United States.

We plan to perform basic geological work on the ABR mineral claims to identify specific drill targets on the propert y , and then collect subsurface samples by drilling to confirm the presence of mineralization (the presence of economic minerals in a specific area or geological formation). If successful, w e may enter into joint venture agreements with other companies to fund further exploration work on the ABR mineral claims. If we are not successful in determining the presence of mineralization on the ABR claims, we may seek out other mineral claims prospects. By such prospects, we mean properties that may have been previously identified by third parties, including prior owners such as exploration companies, as mineral prospects with potential for economic mineralization. Often these properties have been sampled, mapped and sometimes drilled, usually with indefinite results. Accordingly, such acquired projects will either have some prior exploration history or will have strong similarity to a recognized geologic ore deposit model. Geographic emphasis will be placed on the western United States. The focus of our activity will be to acquire properties that we believe to be undervalued; including those that we believe to hold previously unrecognized mineral potential.

Our strategy with the ABR mineral claims and other prospects deemed to be of higher risk or those that would require very large exploration expenditures is to present them to larger companies for joint venture. Our joint venture strategy is intended to maximize the abilities and skills of the management group, conserve capital, and provide superior leverage for investors. If we present a property to a major company and they are not interested, we will continue to seek an interested partner.

Property Option Agreement

Under the terms of the Property Option Agreement between Arbutus and LRE, our wholly owned mining exploration subsidiary, we acquired an option to acquire a 100% interest in the mineral rights for the ABR Claims for an initial payment of $10,000. In order to exercise the option, we must pay the following monies to Arbutus and make the following expenditures on the ABR Claims by the following dates:

|

·

|

Payments to Arbutus

|

|

| o | $10,000 on or before November 30, 2011; |

|

o

|

$20,000 on or before November 30, 2012; and

|

|

o

|

$50,000 on or before November 30, 2013.

|

|

·

|

Exploration Expenditures

|

|

| o | $15,000 in aggregate exploration expenditures prior to November 30, 2012; |

|

o

|

$65,000 in aggregate exploration expenditures prior to November 30, 2013; and

|

|

o

|

$215,000 in aggregate exploration expenditures prior to November 30, 2014.

|

We will either satisfy the payment terms of the Property Option Agreement in the time frame provided, thereby resulting in us exercising this option or we will fail to satisfy the payment terms and be in default of the Property Option Agreement. If we are in default of the Property Option Agreement, Arbutus can terminate Property Option Agreement if we fail to cure any default within 45 days after the receipt of notice of default. Our option will expire if we are in default of the Property Option Agreement and fail to cure any default within 45 days after the receipt of notice of default. If we are in default of the Property Option Agreement and fail to cure the default within 45 days we shall have no recourse to previous incurred property option payments made to Arbutus Minerals LLC or to previously incurred exploration expenditures. Additionally, and notwithstanding the foregoing, if we fail to perform condition precedent to exercise the option, Arbutus shall be entitled to terminate the Property Option Agreement.

We have the right at any time to terminate the Property Option Agreement with Arbutus by providing at least 45 days written notice to Arbutus. Should we terminate the Property Option Agreement, we shall have no recourse to previous incurred property option payments made to Arbutus Minerals LLC or to previously incurred exploration expenditures.

We are named as the initial operator of the ABR Claims. The operator has the full right, power and authority to do everything necessary or desirable to carry out a program and the project and to determine the manner of exploration of the property. We can resign as operator without notice to Arbutus. We also possess the authority to appoint a new operator.

The Operator Agreement included as Appendix B to the Property Option Agreement has not been concluded or executed at this time, and therefore includes some blanks. The contracting parties included the Operator Agreement shown as Appendix B to the Option Agreement as a reflection of the required and intended form Operator Agreement.

ABR Claims

The ABR claims consist of 20 adjoining unpatented mineral claims totaling 413 acres. Each claim is approximately 1500 feet by 600 feet.

Location and Means of Access to ABR Claims

The ARB mineral Claims are located approximately 15 miles northwest of the city of Elko, Nevada on BLM-managed land in Elko County, a county in northeastern Nevada. Access is by way of a 2 wheel drive road to within ½ mile of the claims. From the road, access is approximately ½ mile to the east of the road across public lands.

Power and rail facilities are available within 10 miles of the mineral claims. Supplies and services would be obtained from Elko or Reno, Nevada.

Title to ABR Claims

In 2010 Arbutus Minerals LLC, a limited liability company organized under the laws of Nevada, staked the ABR Claims. As a result of this staking, Arbutus possesses the right to develop the mineral rights on the ABR Claims. The ABR Claims are on BLM managed land. The annual claim payments for Bureau of Land Management managed land are $140. Arbutus is responsible for making these payments.

Previous Operations on the ABR Claims.

To our knowledge, there have been no prior operations on these claims.

Present Condition of ABR Claims.

At present, the property does not have any plant, buildings, equipment or mining assets.

Work Completed on the ABR Claims.

No work has been performed on the ABR Claims by either us or Artubus.

Proposed and Current State of Exploration and Development on the Southern Beardmore Claims.

There is not currently any exploration on the property. We retained Mr. Carl von Einsiedel, Bachelor of Science in Geology and Professional Geoscientist to conduct a study and produce a report on the exploration potential of the property. He had the following recommendation:

|

·

|

Phase I

|

|

o

|

An initial assessment of the ABR Mineral Claims that should include extensive research on known occurrences in the Merrimac and Swale Mountain Districts and an initial reconnaissance exploration program. The estimated cost of this program is $15,000 (Phase I) and would require one year to complete.

|

|

·

|

Phase II

|

|

o

|

Subject to the results of the initial assessment, (Phase 1) a follow up program of detailed sampling and ground magnetic surveys would be warranted at a cost of $50,000 (Phase II) and would require one year to complete.

|

|

·

|

Phase III

|

|

o

|

In the event that Phase II identifies a significant altered or mineralized zone a second follow up program (Phase III) would be warranted at a cost of $150,000 and would require one year to complete.

|