Attached files

| file | filename |

|---|---|

| 8-K - BOK FINANCIAL CORP 8-K 2-1-2011 - BOK FINANCIAL CORP | form8_k.htm |

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Morgan Stanley Financials Conference

February 1-2, 2011

February 1-2, 2011

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

2

ü 21st largest U.S. based publicly traded bank

holding company by asset size

holding company by asset size

ü Total Assets $23.9B

ü Loans $10.6B

ü Reserve for Loan Losses 2.89%

ü Deposits $17.2B

ü Tangible Common Equity 9.21%

ü 2010 Net Income $247MM

ü Market Cap on 1/26/11 $3.6B

Banking services provided by Bank of Oklahoma, Bank of Texas, Bank of Albuquerque, Bank

of Arkansas, Bank of Arizona, Colorado State Bank and Trust and Bank of Kansas City

of Arkansas, Bank of Arizona, Colorado State Bank and Trust and Bank of Kansas City

BOK Financial at 12/31/10

Strong Markets, Superior Results

Strong Markets, Superior Results

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

3

Source: SNL, deposit data as of 6/30/10

Market Growth Opportunity

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Consistent Strategies

Proven to Deliver Solid Results Through All Cycles

Proven to Deliver Solid Results Through All Cycles

4

4 Strategic, Long-Term View

4 Utilize a decision making framework based on long-term economic benefit

4 Actively pursue talent acquisition

4 Build the franchise through organic growth and disciplined acquisition strategies

4 Customer Focus

4 Develop long-term relationships with commercial and retail customers

4 Deliver diverse fee-based services in a personalized responsive manner

4 Offer innovative and value-added products and services

4 Balance Sheet Management

4 Originate quality loans while maintaining a consistent mix in the portfolio

4 Prudently manage risk and control expenses in relation to revenue growth

4 Remain relatively neutral to interest rate changes

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

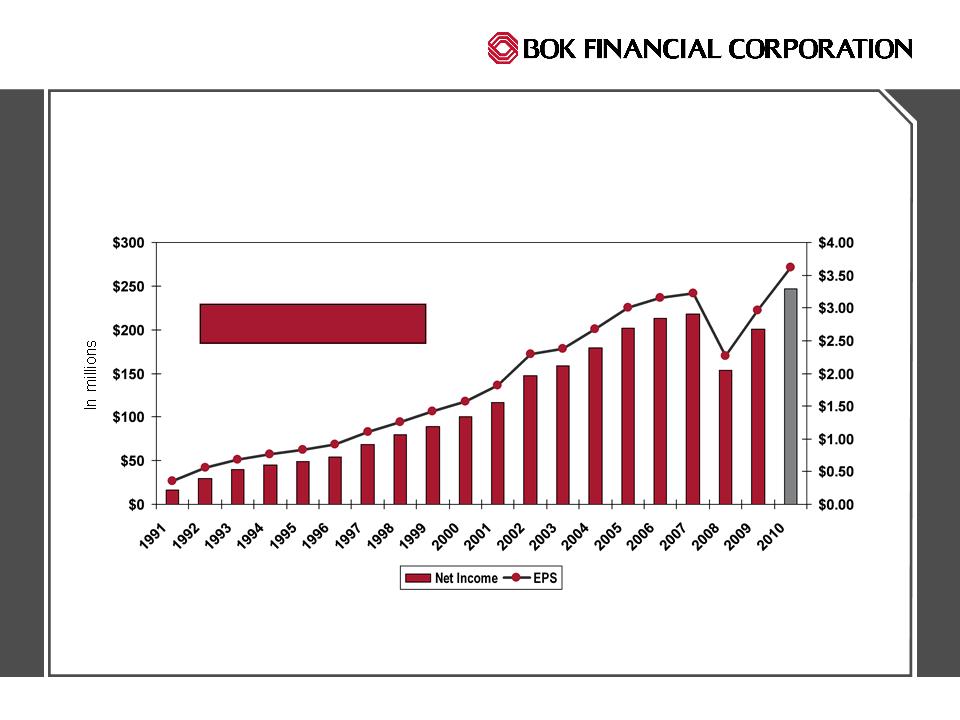

Source: SNL Financial

EPS have been restated for stock dividends and for a 2-for-1 split

EPS CAGR: 13%

5

Earnings History

Outperform Through Economic Cycles

Outperform Through Economic Cycles

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

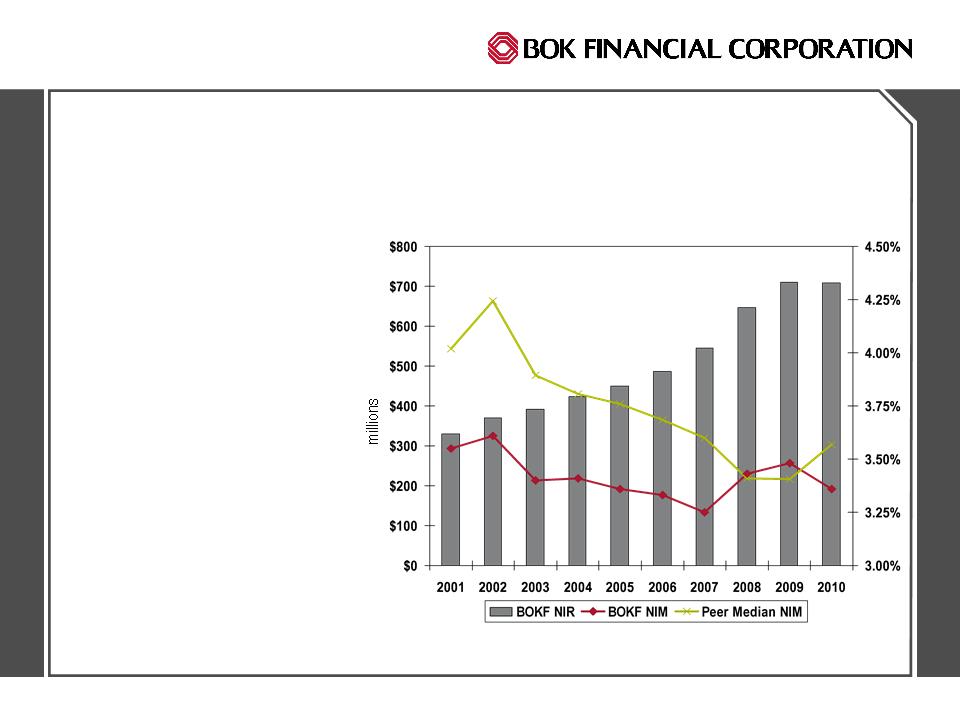

Net Interest Revenue = 58% of Total Revenue

6

Other Operating Revenue =

42% of Total Revenue

42% of Total Revenue

Deposit Service Charges 8%

Transaction Card 9%

Brokerage & Trading 8%

Mortgage Banking 7%

Trust Fees 6%

Other 4%

Components of 2010 Revenue

Fee Revenue Consistently Exceeds 40% of Total Revenue

Fee Revenue Consistently Exceeds 40% of Total Revenue

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

7

Note: Peers are defined as 20 US publicly traded banks, 10 immediately larger and 10 immediately smaller as

measured by total assets at 12/31/10. Source: SNL Results are preliminary as one peer had not yet reported.

measured by total assets at 12/31/10. Source: SNL Results are preliminary as one peer had not yet reported.

BOKF

Peer Median

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

8

2010 Results

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Diluted Earnings Per Share

Record Earnings

9

4 Record earnings of $246.8 million or $3.61

per diluted share, up 23% over 2009

per diluted share, up 23% over 2009

4 Net interest revenue totaled $709 million,

down $1.3 million from 2009; Net interest

margin declined during 2H10 due to a decline

in the yield on the securities portfolio

down $1.3 million from 2009; Net interest

margin declined during 2H10 due to a decline

in the yield on the securities portfolio

4 Fees and commissions increased $36 million

over 2009 bolstered by mortgage banking

revenue and brokerage & trading revenue

over 2009 bolstered by mortgage banking

revenue and brokerage & trading revenue

4 Prudent expense management: personnel

increased 5.6% & non-personnel expenses

increased 8.1% excluding the change in the

fair value of the MSR asset

increased 5.6% & non-personnel expenses

increased 8.1% excluding the change in the

fair value of the MSR asset

4 Credit quality continues to improve; net

charge-offs declined $33 million compared to

2009; non-accruing loans declined $109

million or 32%

charge-offs declined $33 million compared to

2009; non-accruing loans declined $109

million or 32%

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

4 NIM decline primarily due to lower

securities yield resulting from

accelerated premium amortization

and lower reinvestment rates

securities yield resulting from

accelerated premium amortization

and lower reinvestment rates

4 Loans declined slightly as runoff

continued to outpace loan demand

continued to outpace loan demand

4 Credit quality continued to improve

and we lowered the provision for

loan losses for the fifth

consecutive quarter

and we lowered the provision for

loan losses for the fifth

consecutive quarter

10

Fourth Quarter Financial Results

($ in Millions)

($ in Millions)

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

11

Select Components of NIM:

Net Interest Margin

Low Rates in 2H10 Pressured NIM

Low Rates in 2H10 Pressured NIM

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

12

Other Operating Revenue

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Mortgage

Banking

Banking

Among the rules pending are uniform lending and

servicing standards; consumer protection measures; and

several reforms affecting loan originators

servicing standards; consumer protection measures; and

several reforms affecting loan originators

Based on the $0.12 cap proposed in December, our

interchange revenue would decline $12MM-$15MM in

2011; rules will go into effect July 21, 2011

interchange revenue would decline $12MM-$15MM in

2011; rules will go into effect July 21, 2011

There is still no leader of the Bureau of Consumer

Financial Protection; the Bureau will have authority over

banks greater than $10 billion in assets

Financial Protection; the Bureau will have authority over

banks greater than $10 billion in assets

BOKF will be affected by other aspects of Dodd-Frank

including new capital rules, FDIC revised assessments,

and potentially the swap push-out rules

including new capital rules, FDIC revised assessments,

and potentially the swap push-out rules

13

Consumer

Products

Products

Bank wide revenue initiative in 2010 identified opportunities expected to generate

additional revenue to offset the potential reduction from financial reform

additional revenue to offset the potential reduction from financial reform

Interchange

Other

Revenue At Risk

Financial Reform

Financial Reform

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

14

Expense Management

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

15

Loans and Credit Quality

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

16

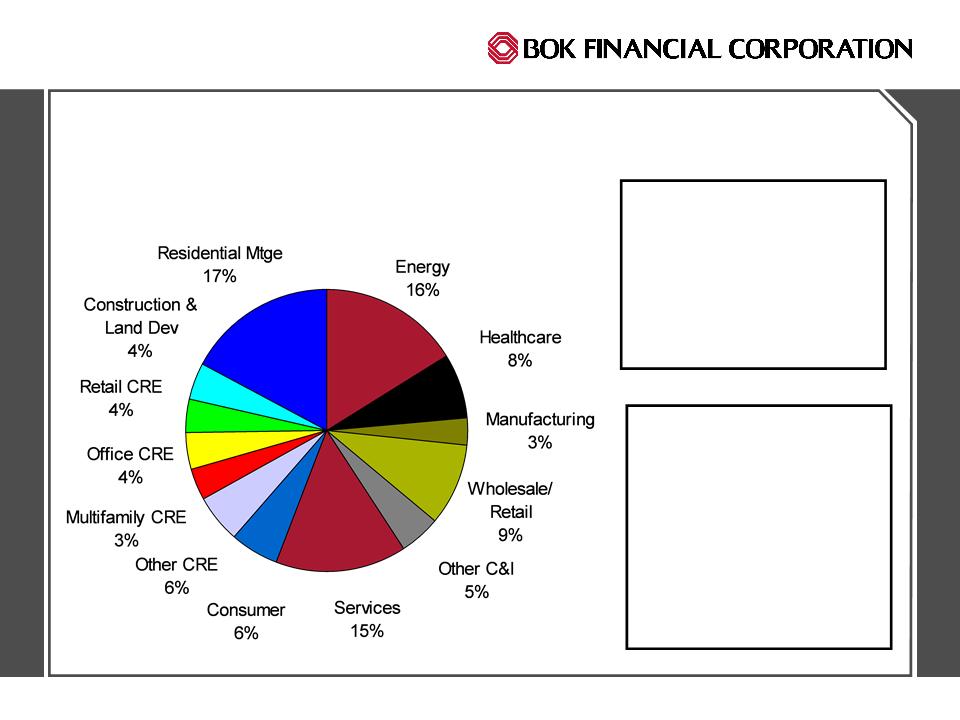

Consistent Portfolio Mix

C&I 56%

CRE 21%

Resi 17%

Consumer 6%

Regional Diversity

OK 46%

TX 28%

NM 7%

CO 7%

AZ 5%

KS/MO 4%

AR 3%

$10.6 Billion Loan Portfolio

Diversified by Sector and Geography

Diversified by Sector and Geography

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

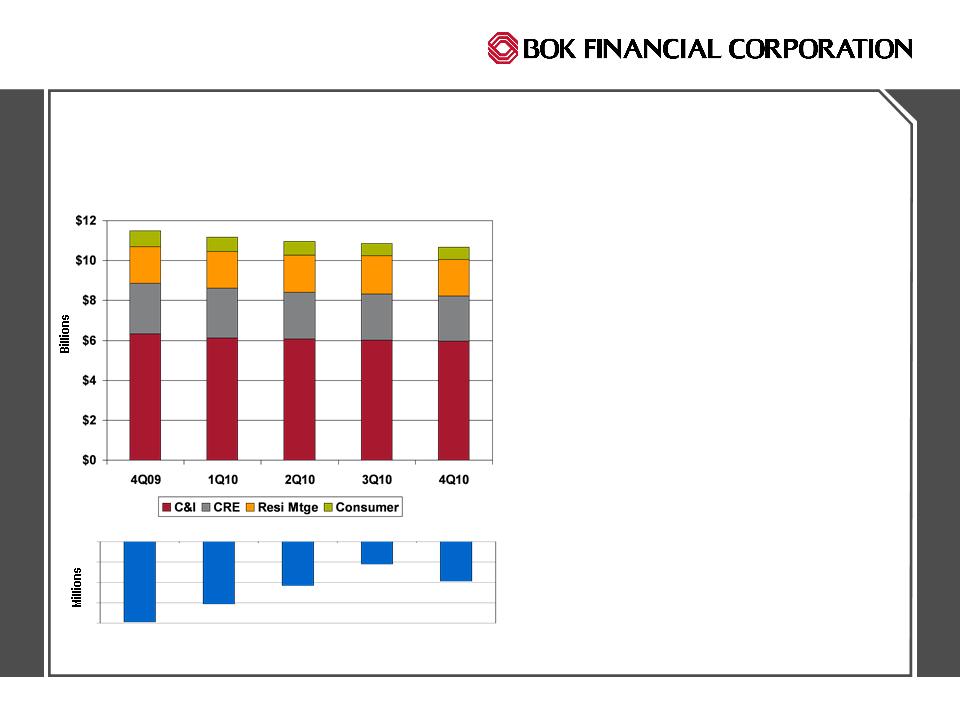

2010 Average Loan Trends

($305)

($395)

($216)

($110)

17

($194)

Continued soft loan demand through 4Q

4 C&I: Declines in energy, services and

manufacturing; recent growth in

integrated food service and healthcare

manufacturing; recent growth in

integrated food service and healthcare

4 CRE: C&D loans declined $197 million

in 2010; recent growth in multifamily

in 2010; recent growth in multifamily

4 Residential Mortgage: Home equity

loans continue to grow moderately;

partially offsetting decline in permanent

mortgage

loans continue to grow moderately;

partially offsetting decline in permanent

mortgage

4 Consumer: Indirect auto loans

declined $215 million in 2010 due to

our decision to exit the LOB in early

2009

declined $215 million in 2010 due to

our decision to exit the LOB in early

2009

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

18

Energy Portfolio

Core Competency

Core Competency

4 52% of the energy portfolio is

attributed to OK, 36% to TX and 12% to

CO

attributed to OK, 36% to TX and 12% to

CO

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Based on committed amounts at 12/31/10

19

4 193 SNCs at 12/31/10 with $3.6

billion committed and $1.4 billion

outstanding (13% of loan portfolio)

billion committed and $1.4 billion

outstanding (13% of loan portfolio)

4 Committed amounts increased $207

million during 4Q

million during 4Q

4 88% of outstanding dollars are

attributed to relationships in local

markets

attributed to relationships in local

markets

4 5 relationships were on non-accrual

at 12/31 with balances totaling $9.7

million or 0.7% of total outstanding

SNCs

at 12/31 with balances totaling $9.7

million or 0.7% of total outstanding

SNCs

Shared National Credit

Relationships

Relationships

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

20

CRE Portfolio Changes

Reduced C&D Exposure $197MM in 2010

Reduced C&D Exposure $197MM in 2010

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Outstanding principal of community development loans sold with

recourse declined $42 million during 2010 to $289 million

recourse declined $42 million during 2010 to $289 million

21

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

22

Source: SNL

Nonperforming Assets ($ in millions)

Reduce Level But Maximize Total Return

Reduce Level But Maximize Total Return

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

23

Nonaccruing Loans

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

2010 NCOs to Average Loans in Basis Points:

C&I CRE Resi Consumer Total Loans

30 238 106 145 95

24

Net Charge-Offs $ in millions

Consistently Below Peers’ During the Recession

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

25

$141MM OREO

AZ 32%

TX 26%

OK 18%*

CO 8%

NM 6%

KS/MO 5%

AR 5%

* Includes $12MM equity interest in post-

bankrupt company

bankrupt company

4 Approx. half of the 1-4 Family

homes are in Texas and Oklahoma

homes are in Texas and Oklahoma

4 Generally sell homes within 1 year;

will reduce listing price (and book

value) if property is not moving

will reduce listing price (and book

value) if property is not moving

4 May retain quality developed CRE

to maximize return

to maximize return

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

26

Balance Sheet Management

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

High Quality

27

4 No securities backed by sub-prime mortgages, collateralized debt obligations or collateralized

commercial real estate loans

commercial real estate loans

4 At December 31, the estimated duration of the MBS portfolio was 2.2 years; duration would

extend to 3.5 years with a 300 basis point increase in rates

extend to 3.5 years with a 300 basis point increase in rates

* Includes $428 million in securities purchased to hedge the MSR Asset

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

28

Net Interest Revenue

Source: SNL data as of 1/27/11. One peer had not yet reported.

4 BOKF’s ALM philosophy

produces a more stable

long term net interest

margin through varying

interest rate cycles

produces a more stable

long term net interest

margin through varying

interest rate cycles

4 Growth in deposits and

securities has mitigated

the NIR impact of the

decline in loans since

2008

securities has mitigated

the NIR impact of the

decline in loans since

2008

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

29

4 Low rates during 2H10

increased prepayment

speeds on MBS which

reduced yields through

purchase premium

amortization and

reinvestment rates

increased prepayment

speeds on MBS which

reduced yields through

purchase premium

amortization and

reinvestment rates

4 Recent 100bp curve

steepening should support

a partial recovery of

security yields and net

interest margin

steepening should support

a partial recovery of

security yields and net

interest margin

Recent NIM Trends

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Interest Rate Risk Position

Portfolio is our Primary Rate Risk Management Instrument

30

4 Securities portfolio offsets asset

sensitive core balance sheet

sensitive core balance sheet

4 Majority of loans are floating

4 Core deposits provide stable-rate

funding

funding

4 Securities balance the rate risk

position

position

4 Very low term interest rates in

early Q4 increased prepayment

speeds shortening portfolio

duration

early Q4 increased prepayment

speeds shortening portfolio

duration

4 Normal asset duration returning

with Dec 2010 curve steepening

with Dec 2010 curve steepening

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

31

4 OTTI expense of $6.3 million in 4Q

4Increased default severity assumptions

4Slowed prepayment speed assumptions with curve steepening

4 Majority of loss content is in the $205 million of Below Investment Grade

ALT A portfolio

ALT A portfolio

Other Than Temporary Impairment on

Debt Securities

Debt Securities

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

32

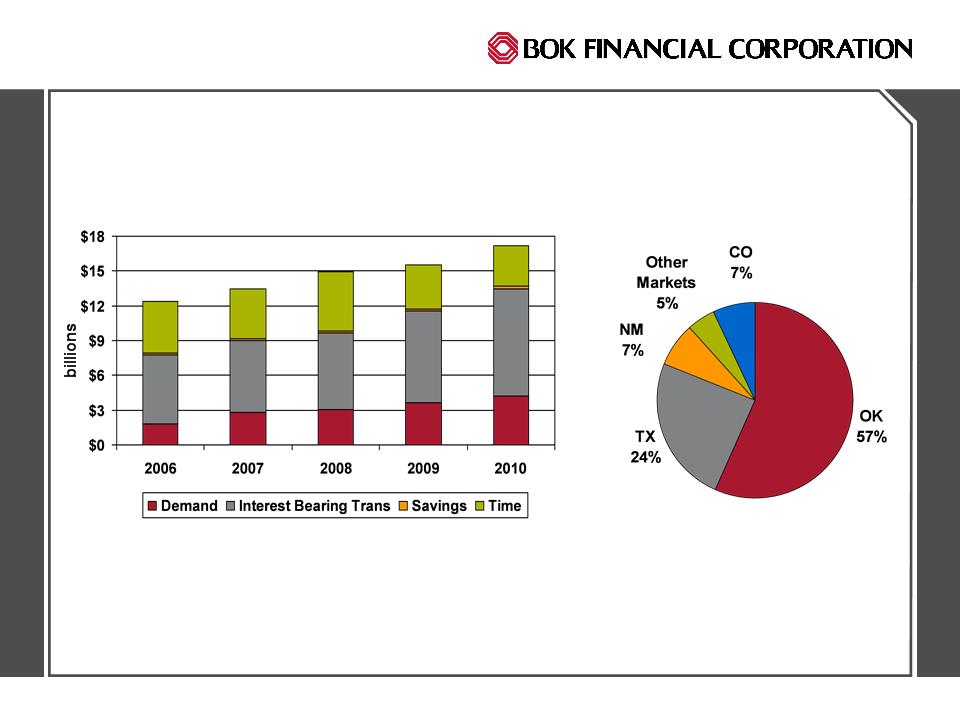

4 Consumer & Wealth Management account for ~60% of total deposits

4 #1 market share in OK, #4 in Albuquerque; deposits outside OK have grown at

a 9% CAGR over the last 5 years

a 9% CAGR over the last 5 years

4 62% loan to deposit ratio

25%

54%

20%

Deposits

Dominated by Core Deposit Relationships

Dominated by Core Deposit Relationships

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

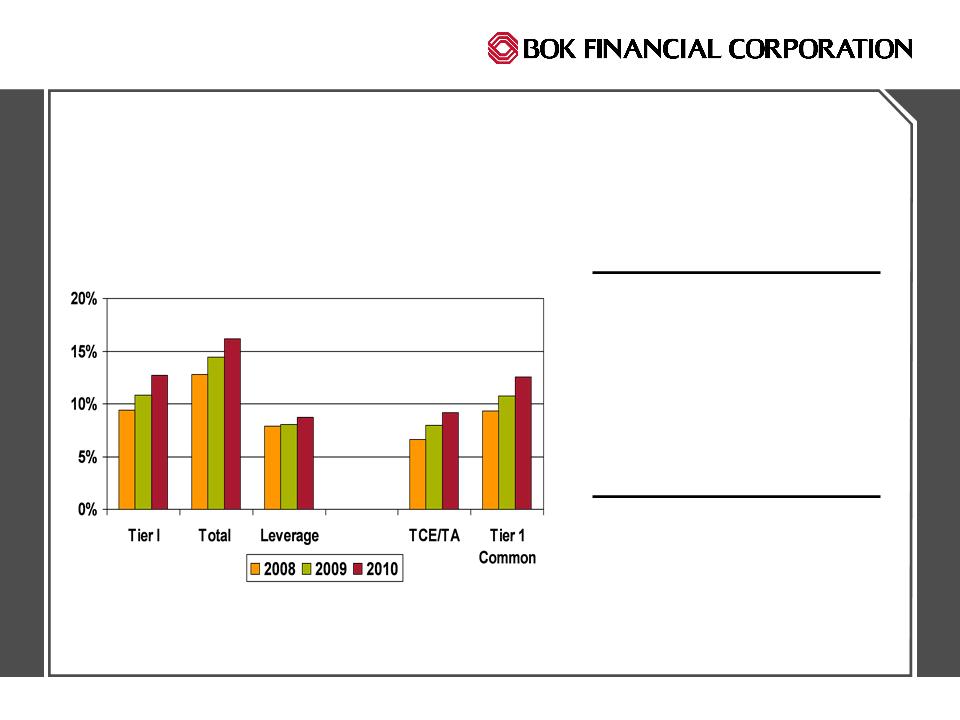

Regulatory:

Non-GAAP Measures:

Capital

Strong without TARP or Dilutive Stock Issuance

Strong without TARP or Dilutive Stock Issuance

33

Capital Strength

4 12.69% Tier 1

4 9.21% TCE

4 Considerable excess capital

above proposed Basel III

thresholds

above proposed Basel III

thresholds

Capital Deployment

4 Organic growth

4 Capacity to fund acquisitions

without additional debt or equity

without additional debt or equity

4 Stock repurchases

4 Dividends

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

34

Looking Ahead

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

2011 Strategic Focus

35

1. Restore high quality, profitable loan growth

2. Generate additional fee revenue in all markets

3. Control expense growth in relation to revenue growth

4. Seek growth through pro-active approach to traditional bank and

fee business acquisitions

fee business acquisitions

5. Maintain positive trends in credit quality

6. Generate revenue to replace the reduction from Financial Reform

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

36

Maintaining Shareholder Value

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

Q & A

37

Steven E. Nell, EVP & Chief Financial Officer

Charles E. Cotter, EVP & Chief Credit Officer

Marty Grunst, SVP & Treasurer

BOK Financial Corporation. Member FDIC. Equal Housing Lender.

Services provided by BOKF, NA doing business as Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Kansas City, Bank of Oklahoma, Bank of Texas, Colorado State Bank and Trust.

38

Forward-Looking Statements

This presentation contains forward-looking statements that are based on

management’s beliefs, assumptions, current expectations, estimates, and projections

about BOK Financial Corporation, the financial services industry, and the economy

generally. Words such as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”,

“plans”, “projects”, variations of such words, and similar expressions are intended to

identify such forward-looking statements. Management judgments relating to, and

discussion of the provision and allowance for credit losses involve judgments as to

future events and are inherently forward-looking statements. Assessments that BOK

Financial’s acquisitions and other growth endeavors will be profitable are necessary

statements of belief as to the outcome of future events, based in part on information

provided by others which BOKF has not independently verified. These statements are

not guarantees of future performance and involve certain risks, uncertainties, and

assumptions which are difficult to predict with regard to timing, extent, likelihood and

degree of occurrence. Therefore, actual results and outcomes may materially differ

from what is expressed, implied or forecasted in such forward-looking statements.

Internal and external factors that might cause such a difference include, but are not

limited to, (1) the ability to fully realize expected cost savings from mergers within the

expected time frames, (2) the ability of other companies on which BOKF relies to

provide goods and services in a timely and accurate manner, (3) changes in interest

rates and interest rate relationships, (4) demand for products and services, (5) the

degree of competition by traditional and non-traditional competitors, (6) changes in

banking regulations, tax laws, prices, levies, and assessments, (7) the impact of

technological advances, and (8) trends in customer behavior as well as their ability to

repay loans. BOK Financial Corporation and its affiliates undertake no obligation to

update, amend, or clarify forward-looking statements, whether as a result of new

information, future events, or otherwise.

management’s beliefs, assumptions, current expectations, estimates, and projections

about BOK Financial Corporation, the financial services industry, and the economy

generally. Words such as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”,

“plans”, “projects”, variations of such words, and similar expressions are intended to

identify such forward-looking statements. Management judgments relating to, and

discussion of the provision and allowance for credit losses involve judgments as to

future events and are inherently forward-looking statements. Assessments that BOK

Financial’s acquisitions and other growth endeavors will be profitable are necessary

statements of belief as to the outcome of future events, based in part on information

provided by others which BOKF has not independently verified. These statements are

not guarantees of future performance and involve certain risks, uncertainties, and

assumptions which are difficult to predict with regard to timing, extent, likelihood and

degree of occurrence. Therefore, actual results and outcomes may materially differ

from what is expressed, implied or forecasted in such forward-looking statements.

Internal and external factors that might cause such a difference include, but are not

limited to, (1) the ability to fully realize expected cost savings from mergers within the

expected time frames, (2) the ability of other companies on which BOKF relies to

provide goods and services in a timely and accurate manner, (3) changes in interest

rates and interest rate relationships, (4) demand for products and services, (5) the

degree of competition by traditional and non-traditional competitors, (6) changes in

banking regulations, tax laws, prices, levies, and assessments, (7) the impact of

technological advances, and (8) trends in customer behavior as well as their ability to

repay loans. BOK Financial Corporation and its affiliates undertake no obligation to

update, amend, or clarify forward-looking statements, whether as a result of new

information, future events, or otherwise.