Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d8k.htm |

Seizing profitable Flat Rolled growth

opportunities in Europe –

Feb 3rd 2011

Bernd Schaefer –

Alcoa European Mill Products

Alcoa Logo

Exhibit 99 |

Cautionary Statement

Forward-Looking Statements

This

presentation

contains

statements

that

relate

to

future

events

and

expectations

and

as

such

constitute

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

include

those

containing

such

words as “anticipates,”

“estimates,”

“expects,”

“forecasts,”

“intends,”

“outlook,”

“plans,”

“projects,”

“should,”

“targets,”

“will,”

or other

words

of

similar

meaning.

All

statements

that

reflect

Alcoa’s

expectations,

assumptions,

or

projections

about

the

future

other

than

statements

of

historical

fact

are

forward-looking

statements,

including,

without

limitation,

forecasts

concerning

global

demand

for

aluminum,

aluminum

end-market

growth,

aluminum

consumption

rates,

or

other

trend

projections,

targeted

financial

results

or

operating

performance,

and

statements

about

Alcoa’s

strategies,

objectives,

goals,

targets,

outlook,

and

business

and

financial

prospects.

Forward-looking

statements

are

subject

to

a

number

of

known

and

unknown

risks,

uncertainties,

and

other

factors

and

are

not

guarantees

of

future

performance.

Actual

results,

performance,

or

outcomes

may

differ

materially

from

those

expressed

in

or

implied

by

those

forward-looking

statements.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

in

the

forward-

looking

statements

include:

(a)

material

adverse

changes

in

aluminum

industry

conditions,

including

global

supply

and

demand

conditions

and

fluctuations

in

London

Metal

Exchange-based

prices

for

primary

aluminum,

alumina,

and

other

products,

or

the

effect

of

the

move

toward

index-based

pricing

for

alumina;

(b)

unfavorable

changes

in

general

business

and

economic

conditions,

in

the

global

financial

markets,

or

in

the

markets

served

by

Alcoa,

including

automotive

and

commercial

transportation,

aerospace,

building

and

construction,

distribution,

packaging,

oil

and

gas,

defense,

and

industrial

gas

turbines;

(c)

the

impact

of

changes

in

foreign

currency

exchange

rates

on

costs

and

results,

particularly

the

Australian

dollar,

Brazilian

real,

Canadian

dollar,

and

Euro;

(d)

increases

in

energy

costs,

including

electricity,

natural

gas,

and

fuel

oil,

or

the

unavailability

or

interruption

of

energy

supplies;

(e)

increases

in

the

costs

of

other

raw

materials,

including

caustic

soda

or

carbon

products;

(f)

Alcoa’s

inability

to

achieve

the

level

of

revenue

growth,

cash

generation,

cost

savings,

improvement

in

profitability

and

margins,

fiscal

discipline,

or

strengthening

of

operations

(including

improving

the

position

of

its

bauxite,

refining

and

smelter

system

on

the

world

cost

curve),

anticipated

from

its

productivity

improvement,

cash

sustainability

and

other

initiatives;

(g)

Alcoa's

inability

to

realize

expected

benefits

from

newly

constructed,

expanded

or

acquired

facilities

or

from

international

joint

ventures

as

planned

and

by

targeted

completion

dates,

including

the

joint

venture

in

Saudi

Arabia

or

the

upstream

operations

in

Brazil;

(h)

political,

economic,

and

regulatory

risks

in

the

countries

in

which

Alcoa

operates

or

sells

products,

including

unfavorable

changes

in

laws

and

governmental

policies;

(i)

the

outcome

of

contingencies,

including

legal

proceedings,

government

investigations,

and

environmental

remediation;

(j)

the

outcome

of

negotiations

with,

and

the

business

or

financial

condition

of,

key

customers,

suppliers,

and

business

partners;

(k)

changes

in

tax

rates

or

benefits;

and

(l)

the

other

risk

factors

summarized

in

Alcoa's

Form

10-K

for

the

year

ended

December

31,

2009,

Forms

10-Q

for

the

quarters

ended

March

31,

2010,

June

30,

2010,

and

September

30,

2010,

and

other

reports

filed

with

the

Securities

and

Exchange

Commission

(SEC).

Alcoa

disclaims

any

obligation

to

update

publicly

any

forward-looking

statements,

whether

in

response

to

new

information,

future

events

or

otherwise,

except

as

required

by

applicable

law.

2

Alcoa

Logo |

3

Content

The Alcoa footprint

Strategic objectives and markets

Renewable energies

Consumer electronics

Substitution

Transportation

Leading to results

Alcoa

Logo |

4

The Alcoa footprint

Alcoa

Logo |

5

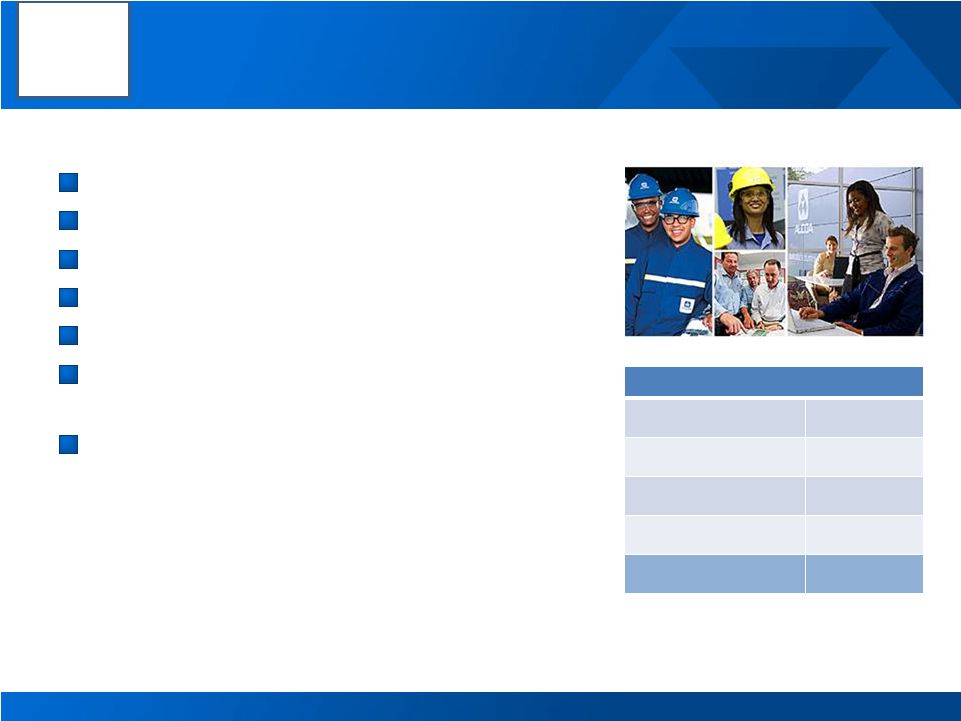

Alcoa at a Glance

Number of Employees

U.S.

23,000

Europe

19,000

Other Americas

10,000

Pacific

7,000

59,000

Founded in 1888

200+ locations

31 countries

$21.0 billion revenue in 2010

59,000 employees

Award-winning sustainability

leadership

120 years of patents, including the

original Aluminium

process

Alcoa

Logo |

Alcoa

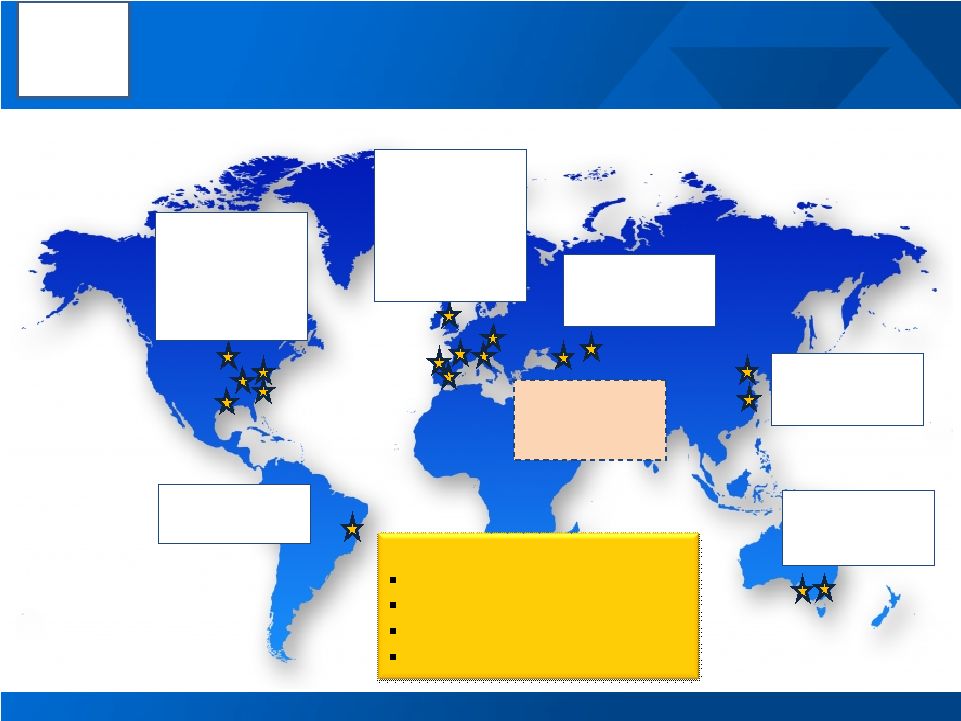

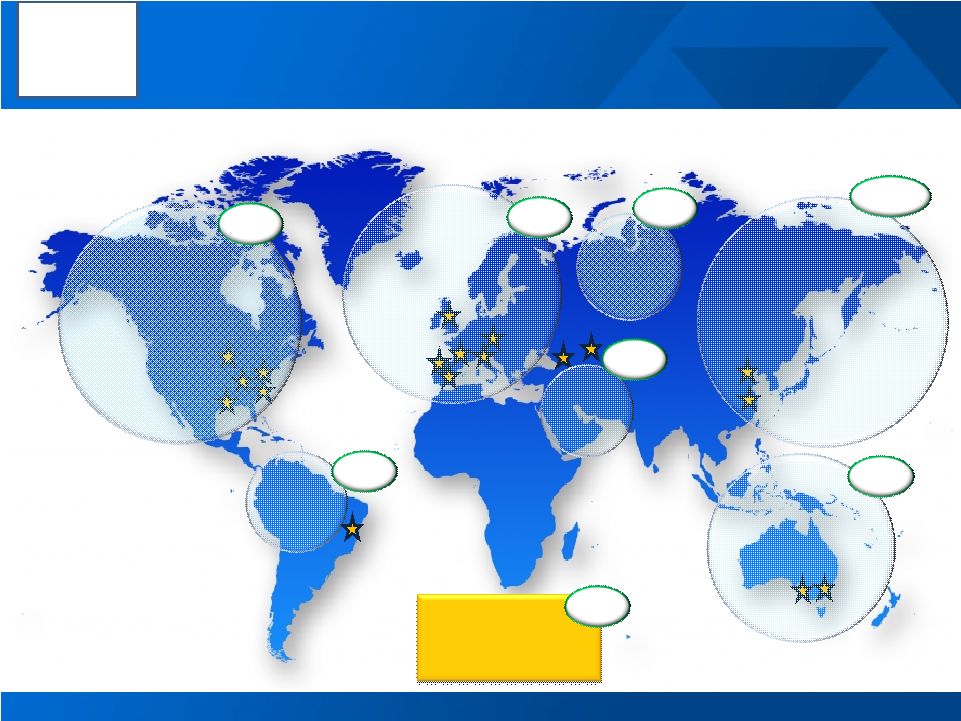

Global Rolled Products: 18 Facilities on 5 Continents 6

North America

Davenport

Lancaster

Tennessee

Texarkana (idled)

Warrick

Europe

Kitts Green (UK)

Kofem (HU)

Fusina (IT)

Castelsarrasin (FR)

Amorebieta (SP)

Alicante (SP)

Russia

Samara

Belaya Kalitva

China

Bohai

Kunshan

Australia

Yennora

Point Henry

Latin America

Itapissuma (BR)

Global Rolled Products (GRP) Location Map and Summary Data

Middle East

Raz Az Zawr (SA)

Ma’aden project location.

First production in 2013

2010 Full Year Data

1.7m metric tons shipments

$6.3B total revenue

18 locations

on 5 continents

14,000 employees

Alcoa

Logo |

Alcoa

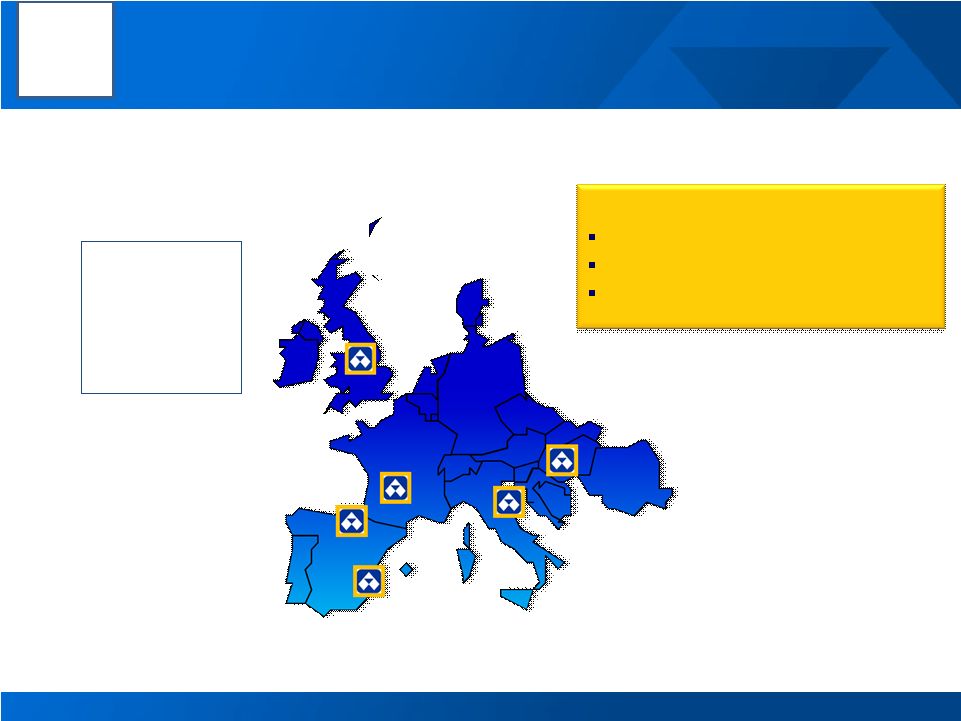

Rolled Products European Footprint Overview

Approx. 2,500

Employees

6 Locations

5 Countries

7

European Rolled Products Location Map and Summary Data

Europe

Amorebieta (SP)

Fusina (I)

Kitts Green (UK)

Alicante (SP)

Castelserrasin (F)

Köfém (HU)

Alcoa

Logo |

8

North

America

4.3mMT

South

America

0.8mMT

Western

Europe

3.5mMT

China

4.6mMT

Middle

East

0.6mMT

Rest of Asia

2.7mMT

Source: Aug. 2010 CRU and Alcoa analysis

Geographically positioned to capture Growth

Rolled Products Consumption (2010E) and CAGR (2010E-2013E)

+5%

+3%

+11%

E. Europe,

Russia

& CIS

0.9mMT

+8%

+7%

+5%

+6%

World

17.6mMT

+7%

Alcoa

Logo |

9

Strategic objectives and markets

Alcoa

Logo |

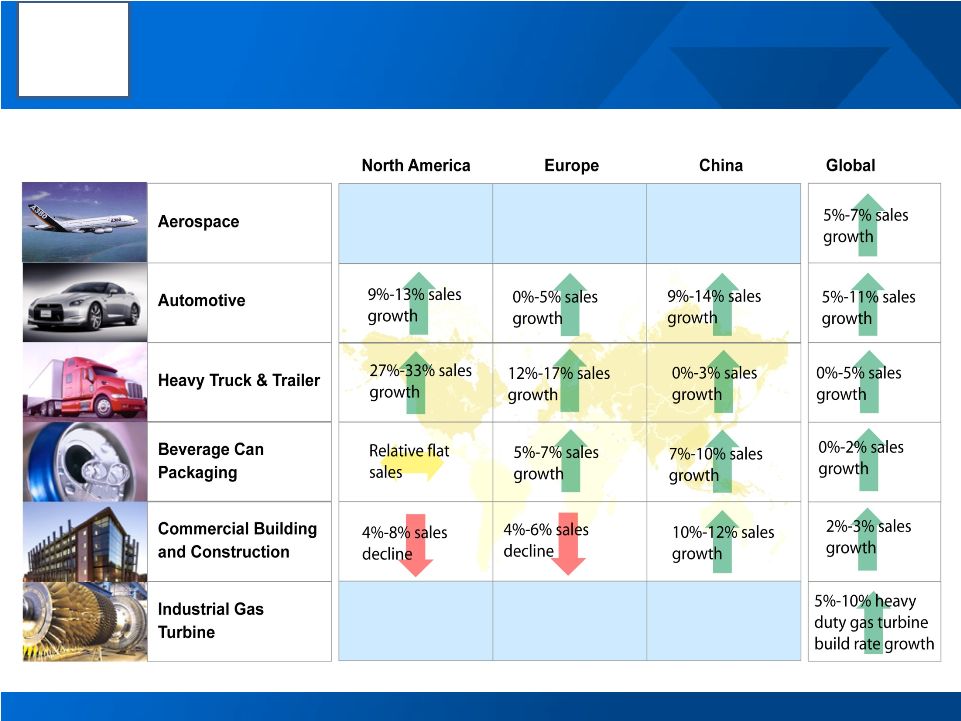

Market Conditions in 2011 –

All Aluminium

Source:

Alcoa

analysis

of

10

January

2011

10

Alcoa End Markets: Current Assessment of 2011 vs. 2010 Conditions

Alcoa

Logo

th |

11

11

Alcoa European Mill Products serves a Variety of Markets

European Mill Products Portfolio

Regional

Commodities

Mould plates

Marine

Lithographic

Sheet

Commercial

Transportation

Brazing

HVAC

Defense

Consumer

Electronics

Industrial

Products

Building &

Construction

Common

Alloys

Regional Specialties

Industrial

Consumers

Renewable

Energy

Aerospace

Alcoa

Logo |

12

The Alcoa aluminium

Proposition

Renewable Energies: Increasing Efficiency through

Innovations

Solar thermal collectors,

Aluminium

used in absorbers,

casings and frames. Between 3.1

kg/m²

to 4.3 kg/m²

(flat-plate).

Today (2010) 210 million m²

have

been installed yearly.

Photovoltaic systems,

Aluminium

used in

construction/mounting

structure (72%), followed

by input to panel frames

(22%), and Aluminium

use in inverters (6%).

Between 23 kg/kW and

59 kg/kW.

Concentrated solar

panels (CSP), 33 ktons

of

Aluminium

are installed in

CSP technologies.

Market sales potential of

Aluminium

could be

increased replacing glass

and steel.

Wind turbines, Aluminium

usage from 0.01% up to

about 2.5 % of the total

material input. Increase

thanks to offshore

installations and replacing

the coverings of the wind

turbine nacelle and rotors

with Aluminium.

Source: EAA, ifeu

-Institut

für

Energie

und Umweltforschung

Heidelberg GmbH

Alcoa

Logo |

13

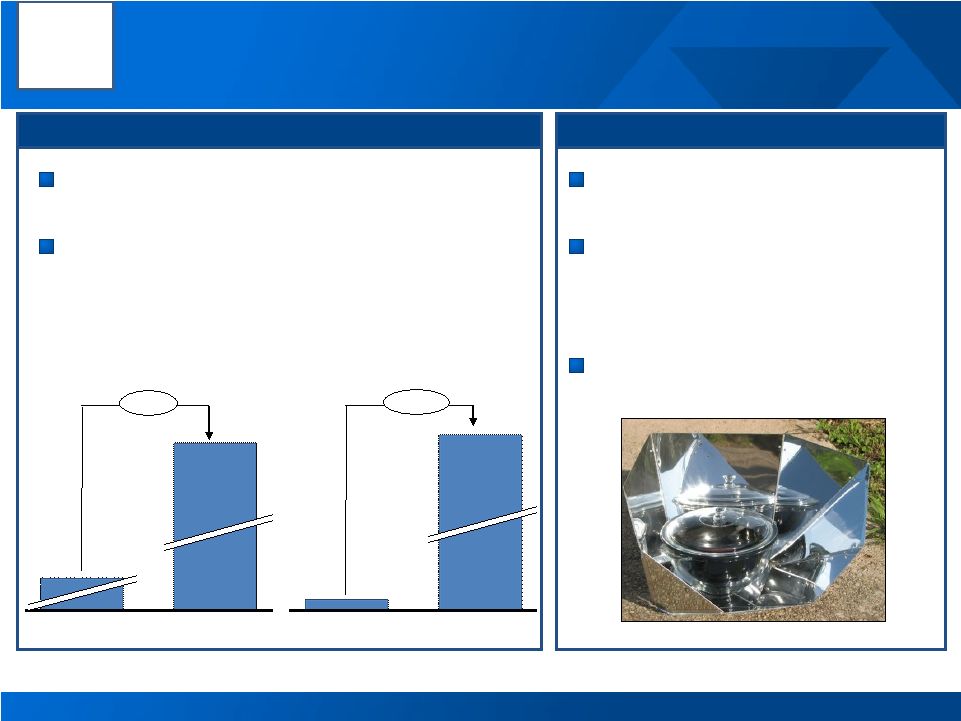

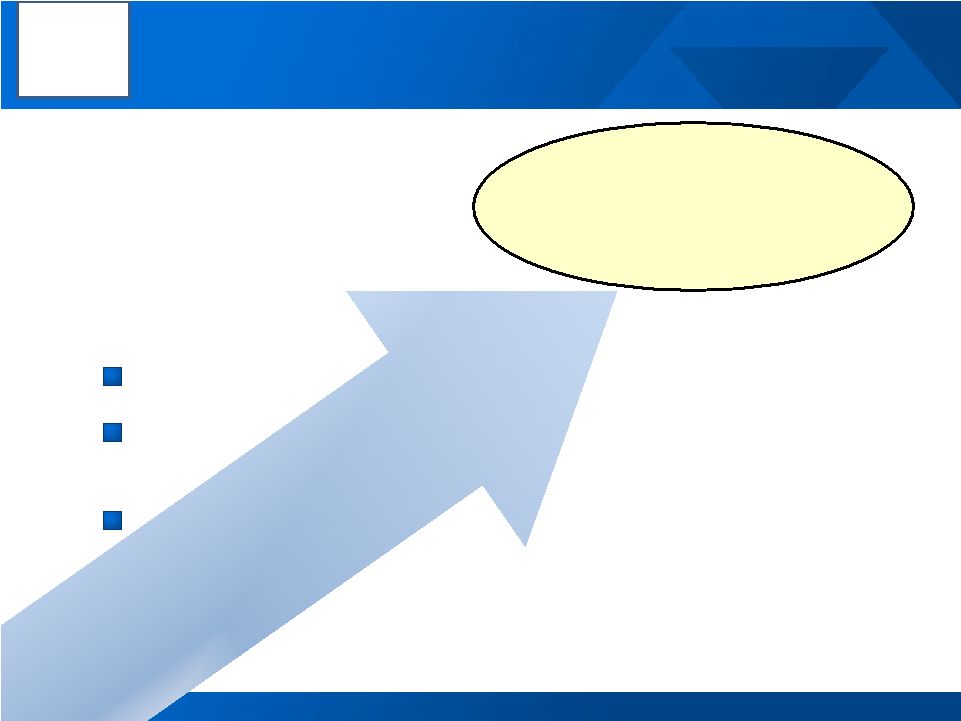

Renewable Energies: Adding Value for the Customer

Our Innovations add Value

Strategy

2030E

2010E

2030E

2010E

Aluminium

Content

in PV

Aluminium

Content

in CSP

Joint development initiatives with

major stake holders

Europe's market share of 12% in

thermal collectors, 48% in

windmills, 65% in photovoltaic

Capture

major

opportunities

for

industry growth

Grow revenue and profitability

globally

by

targeting

more

differentiated offerings -

products,

surfaces, materials

Leverage Alcoa solutions globally

+400%

+1300%

Source: EAA, ifeu

-Institut

für

Energieund

Umweltforschung

Heidelberg GmbH

13

Alcoa

Logo |

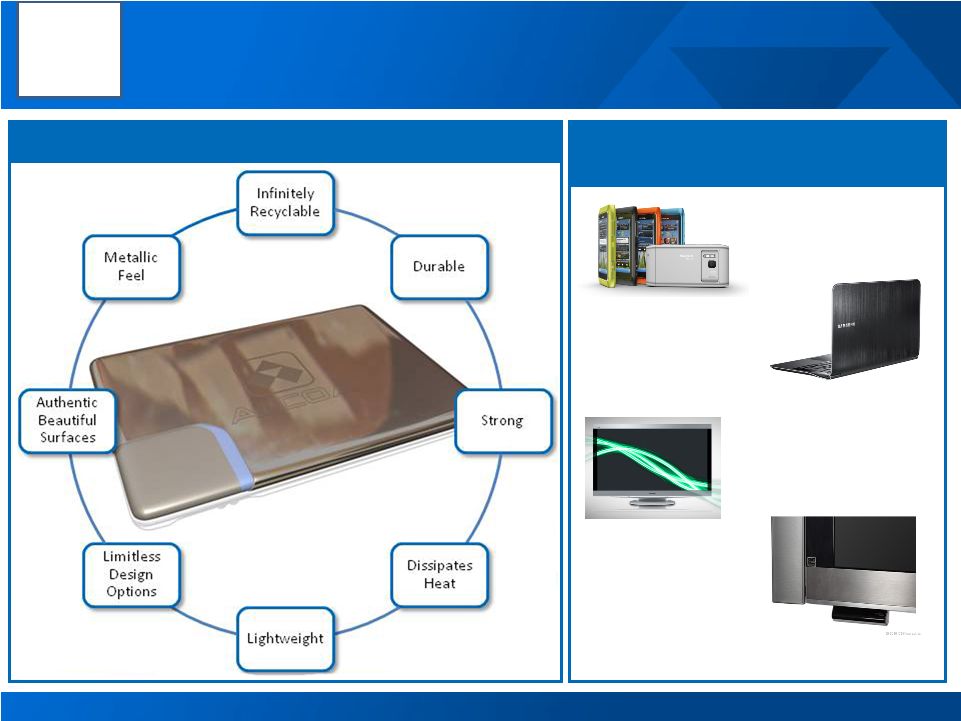

Consumer Electronics: Making it “Cool”

14

Samsung 9 Series Notebook

(anodized / brushed cover)

Samsung 8000 Series LED TV

(coated / brushed bezel)

Advantages of Aluminum

Aluminum-Intensive Devices

CES 2011

Nokia N Series Smartphone

(color anodized case)

Panasonic Viera

TV

(brushed bezel)

Alcoa

Logo |

15

Consumer Electronics: Adding Value for the Customer

Our innovations add value

Strategy

+30%

2013E

2010E

+465%

2013E

2010E

Aluminium

Content

in Laptops

LCD TV Aluminium

Back-

Panel Growth

World-class customer base

Market is moving to Aluminium

Alcoa differentiated solutions

Targeting revenue growth of

approx. 40% CAGR 2010-2013

Grow revenue and profitability

globally

by

targeting

more

differentiated offerings—products,

surfaces, materials

Leverage Alcoa solutions globally

Closer to our customers in Asia

15

Alcoa

Logo |

Opportunities to replace Copper: Aluminium

wins

16

Copper Prices Moving Up

Low Voltage

Electrical wiring

& cable

Transportation

Cladding

Other

Sources: Bank of America / Merrill Lynch, International Copper Study Group and Alcoa

Analysis 320%

19 mmt

Refined Cu

Aluminium

Is The Natural Substitute

•Heat sinks for electronics, PCB’s

•Building façades

•Bussed electrical center components

•Wire harnesses

•High Voltage Cables

•Utility buss bars

•Low voltage installations in cities, industrial

or commercial buildings

•Battery cables

Aluminium

Replacement Examples

High Voltage

$2,321

$9,740

12/31/03

12/31/10

•Alcoa is best positioned to supply

differentiated products and proprietary

alloys

•Alcoa EMP is aiming to supply customized

solutions for FRPs

Alcoa

Logo |

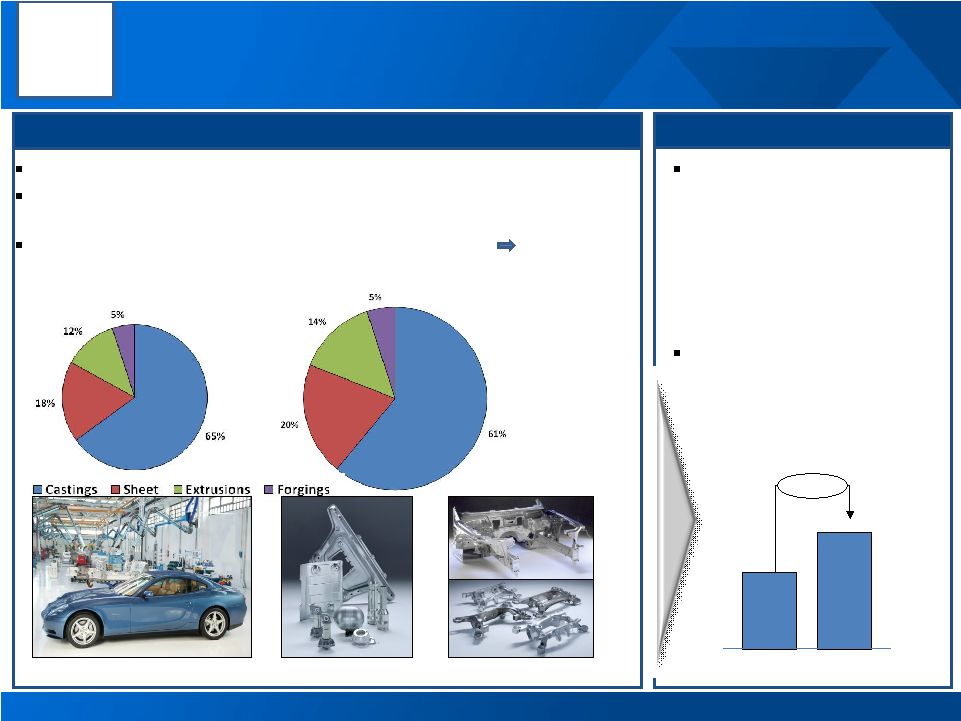

Automotive Aluminium: European cars best in class

thanks to Aluminium

FRPs

Source: Alcoa Analysis, EAA Ducker research, KGP

Leverage on our

cooperation with

automakers (NA, Europe,

Japan) and supply

differentiated product

offering

to Tier 1 and 2

customers

Drive Aluminium

conversion

Aluminum

provides

3x

the

fuel

economy

benefit

of

high

strength

steel

European cars have more aluminium in the body, closures, chassis

and

suspension

compared

to

North

America

and

Japan

Aluminium

penetration

per

car

in

Europe:

135Kg

in

2010

150Kg

in

2015

+55%

2016E

2010

Europe

Auto Sheet Volume

17

Drivers of the opportunity for increased Aluminium

Strategy

2010

2016E

1,6million tons

2,2million tons

Aluminium

intensive design

Components and

Heatshields

Chassis and Structures

Source : EAA Drucker

research

Alcoa

Logo |

Commercial Transportation: Aluminium

use could more

than double by 2020

Leverage our distinctive

relationships and

differentiated product

offering

Work with multiple

customers proposing

conversion to Aluminium

components

Drivers of Aluminium

opportunity in Europe

Strategy

2010 vs

2011

+ > 12%

Transport

of

1

t

additional

payload

is

worth

4800

€

per

year

Introduction

of

Euro

VI

(2012)

will

increase

weigh

of

road

tractors

by

300Kg

Trailers

18

Western Europe Tractor

Application

Al-

penetration

Average weight per

part [kg]

Fuel Tank

80%

45

HVAC

90%

40

Pressure Vessels

35%

8

Transmission Housing

40%

50

Bracket / Tread Plate

60%

10

Underrunning Protection

80%

30

Western Europe

Trailer Type

% of fleet

Cube vs

weigh out

Average Al-content

per trailer [kg]

Tanker

5

W

1.800

Dumper/Tipper

15

W

2.000

Reefer

12

C

500

Box/Dry Van

6

C

350

Curtain Sider

38

C

300

Flatbed

18

C

250

Special/Others

7

C

300

Tractor

280

Tractors Components

Source: EAA

Aluminium

consumption

growth in CT

Alcoa

Logo |

Commercial Transportation: Success created through

brand intimacy -

Endur-Al

Endur-Al

is an advanced 5456 alloy in H34

temper

Shate material for tipper bottoms and sides of

exceptional hardness and abrasion

resistance.

20-30% less weight compared to steel offer

bigger payloads, fuel savings and lower

operating costs.

High yield strength offers good welding and

cold bending performance.

19

Alcoa

Logo |

Marine: Success created through brand intimacy -

Nautic-Al

Alcoa is a market leader

for marine

applications.

Nautic-Al

provides the exceptional

strength, workability and corrosion

resistance

Can be welded by TIG, MIG, FSW and Laser

Welding.

Meets or exceeds the ASTM B928-04a

standard

for high magnesium Aluminium-

alloy for marine environments.

20

Alcoa

Logo |

21

Leading to results

Alcoa

Logo |

22

Alcoa European Mill Products Strategic Objectives

Growing faster than the market

Driving profitable and sustainable growth through

innovation and product development

Aluminize the market by substituting competitive

materials

Setting a new level

of

profitability

for

the

business

Alcoa

Logo |

23

Alcoa: Great Past, Present & Future

2010

We reshaped

the industry

We innovated

markets

We invented

the industry

1888

1900

Alcoa can’t wait

Alcoa can’t wait

for tomorrow

for tomorrow

Alcoa

Logo |

24

Thank you!

Alcoa Europe SA

European Mill Products

Avenue Giuseppe Motta 31-33

CH-1202 Geneva

Switzerland

T: +41 22 919 60 00

F: +41 22 919 61 00

W: www.alcoa.com/emp

Alcoa Logo |