Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ORRSTOWN FINANCIAL SERVICES INC | d8k.htm |

The 18

th

Annual

Emerald Groundhog Day Investment Forum

February 2, 2011

The Radisson Plaza-

Warwick Hotel

Philadelphia, Pennsylvania

Jeffrey W. Embly

Jeffrey W. Embly

Embly

EVP, Chief Credit /Risk Officer

EVP, Chief Credit /Risk Officer

Bradley S. Everly

Bradley S. Everly

Everly

EVP, Chief Financial Officer

EVP, Chief Financial Officer

Thomas R. Quinn, Jr.

Thomas R. Quinn, Jr.

President & Chief Executive Officer

President & Chief Executive Officer

NASDAQ: ORRF

Exhibit 99.1 |

2

Safe Harbor Regarding Forward-Looking Statements

This

presentation

may

contain

forward-looking

information

about

Orrstown

Financial

Services,

Inc.

that

is

intended

to

be

covered

by

the

safe

harbor

for

forward-looking

statements

provided

by

the

Private

Securities

Litigation

Reform

Act

of

1995.

Actual

results

and

trends

could

differ

materially from those set forth in such statements due to various risks,

uncertainties and other factors. Such risks, uncertainties and other

factors

that

could

cause

actual

results

and

experience

to

differ

from

those

projected

include,

but

are

not

limited

to,

the

following:

ineffectiveness of the Company’s business strategy due to changes in current

or future market conditions; the effects of competition, including industry

consolidation and development of competing financial products and services; changes in laws and regulations, including the recent

Dodd-Frank Wall Street Reform and Consumer Protection Act; interest rate

movements; changes in credit quality; volatilities in the securities

markets;

and

deteriorating

economic

conditions,

and

other

risks

and

uncertainties,

including

those

detailed

in

Orrstown

Financial

Services,

Inc.’s

filings

with

the

Securities

and

Exchange

Commission.

The

statements

are

valid

only

as

of

the

date

hereof

and

Orrstown

Financial

Services, Inc. disclaims any obligation to update this information.

Non-GAAP Financial Measures

This presentation contains the non-GAAP financial measures, ratio of

tangible common equity to tangible assets and return on average

tangible equity. In order to calculate tangible common equity and tangible

assets, the Company's management subtracts intangible assets

from

both

common

equity

and

assets.

The

Company

calculates

the

return

on

average

tangible

equity

by

excluding

the

balance

of

intangible

assets and their related amortization expense from the calculation of return on

average equity. Reconciliations of these non-GAAP measures to the

most directly comparable GAAP measures are set forth in the Appendix. Legal

Disclaimers |

3

(1)

Ranking based on 3 year ROAE of publicly traded banks and thrifts of major

exchanges, pink sheets, and bulletin boards. Private companies that file

with the SEC are also included. Source: SNL Financial (2)

As published by the Central Penn Business Journal (Based on

minimum revenue of $500,000 for 3 years. Companies were first ranked by dollar growth year

one to year three, combined with percentage of growth year one to year three.)

Franchise Overview

•

Headquartered in Shippensburg, PA

•

Founded in 1919

•

20 branches in Pennsylvania and Maryland

–

8 branches in Cumberland County, PA

–

7 branches in Franklin County, PA

–

4 branches in Perry County, PA

–

1 branch in Washington County, MD

•

$1.512 billion in assets and $1.188 billion in

deposits at December 31, 2010

•

In addition to community banking services, provides

trust and investment services to individuals,

businesses, non-profits and municipalities ($929

million of trust and brokerage assets at 12/31/2010)

•

Ranked as one of the top 200 best performing

community

banks

in

the

nation

since

2006

(1)

•

Recognized

for

the

8

th

time

by

the

Central

Penn

Business Journal as one of the 50 Fastest Growing

Companies

(2) |

4

•

Listed

on

the

NASDAQ

Capital

Market

–

April,

2009

•

Included

in

the

Russell

2000

&

3000

Indices

–

June,

2009

and

June,

2010

•

Selected as one of the top 200 best performing community banks in the

nation by US Banker Magazine for 5 consecutive years

•

Recognized as one of the 50 Fastest Growing Companies by the Central

Pennsylvania

Business

Journal

for

the

8

time

•

Raised

net

capital

proceeds

of

$37.6

million

–

March,

2010

•

Posted record net income, by quarter, for all four quarters of 2010

Highlights

th |

5

•

In a challenging environment earnings up 24% year-over-year to

$16,581,000 •

Excellent Return Ratios:

–

ROA: 1.21% for 2010

–

ROE: 11.22% for 2010

–

ROTE: 13.19% for 2010

(1)

•

Asset Growth 12/31/09-12/31/10 up 26.4%

•

Deposit Growth 12/31/09-12/31/10 up 29.9%

•

Reduced NPAs

by 32% (3/31/10 –

12/31/10)

•

Reduced NPLs

by 35% (3/31/10 –

12/31/10)

•

NPAs/ Assets 1.07% at 12/31/2010

•

NPLs/ Loans 1.56% at 12/31/2010

Highlights

(1) See Appendix regarding non-GAAP financial measures.

Source: Company Documents as of 12/31/10 |

6

Highlights

•

Net Interest Margin up 6 bps to 3.72% for 2010 vs. 3.66% in 2009

•

Lowered

Cost

of

Funds

for

24

consecutive months to 85 bps at December

2010

•

Increased dividends for over 20 consecutive years, with a 10 year annual

dividend CAGR

(1)

of 14.9%.

•

Announced an increase in our quarterly cash dividend from 22.5 to 23

cents per share for the first quarter 2011

•

Efficiency ratio 54.89% for the 12 months ended 12/31/2010

(1) Compound annual growth rate

Source: Company Documents |

7

•

Continued to take advantage of market dislocation to hire talented bankers

•

Recently hired commercial lenders have generated $86 million in new loan

volume since March, 2009

•

Emphasis on growing mortgage business has resulted in 29% increase in

total volume 2010 vs. 2009

–

Expanded mortgage origination team in our East Shore market

–

Began accepting mortgage applications online in 4Q ’10

•

Trust/Brokerage assets grew 25.6% in 2010 to $929 million at 12/31/10

•

Orrstown Financial Advisors net income up 40.4% & revenue up 27.3%

2010 vs. 2009

Highlights |

8

Targeted Market Area

•

The combined population of the current

market area is approximately 578,401.

Over the next 5 years the Household

Income

is

expected

to

grow

12.4%

(1)

•

The current combined market has over

$9.6 billion in total deposits as of June

30, 2010

•

Orrstown

has $1.188 billion deposits at

December 31, 2010, or approximately

12.3% of the total share in its market

area

(2)

•

The four eastern contiguous counties

have total market deposits of $16.2

billion. Over the next 5 years the

Household Income is expected to grow

10.1%

(1)

(1)

U.S.

Census

Bureau,

2009

Population

Estimates,

2000

Census,

1990

Census

(2)

Based on June 30, 2010 total deposits in market as reported by the FDIC

Source: SNL Financial; Company Documents as of 12/31/10

PENNSYLVANIA |

9

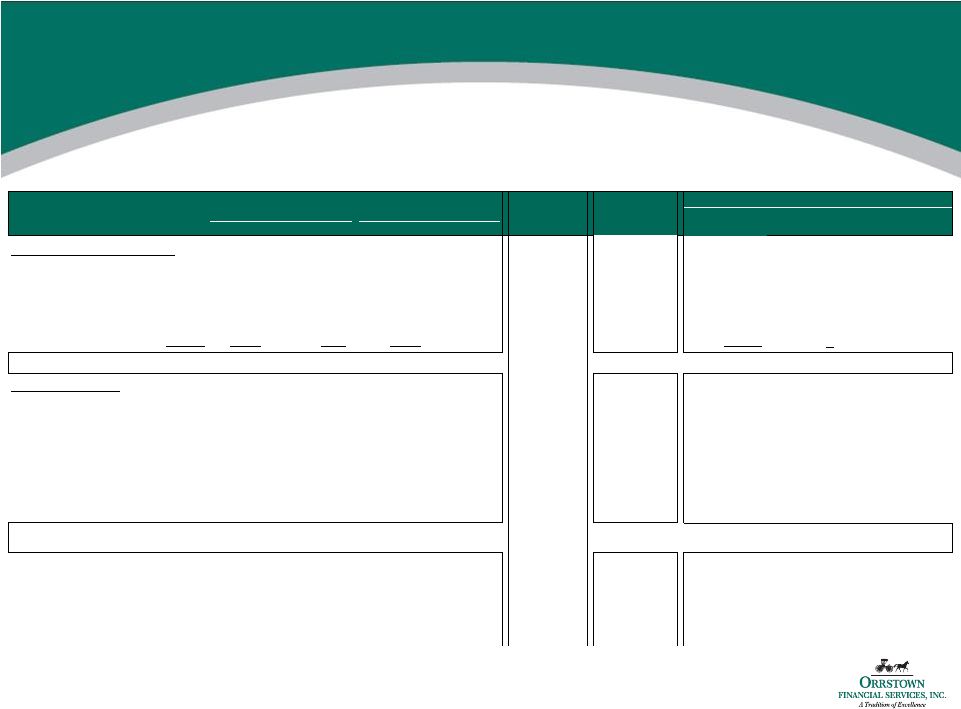

Market Share & Demographics

(1) Based on FDIC data as of June 30, 2010

Source: SNL Financial

*

Based

on

FDIC

data.

Includes

20

full

service

branches;

one

drive

up

location

in

Perry

County;

and

1

branch

in

Washington

County

that

was

closed

as

of

November

30,

2010

Total

County

2010

Pop. Growth

Institutions

Deposit

Deposits

Mkt. Share

County

Population

'00 -

'10

'10 -

'15 Est.

'00 -

'10

'10 -

'15 Est.

in Market

Totals

($000)

Branches

(%)

Rank

Current

Counties

of

Operations

Cumberland, PA

234,508

9.8%

4.2%

31.0%

14.2%

102

$5,184,059

$700,517

8

14.21

3

Franklin, PA

147,089

13.8%

5.8%

26.5%

11.9%

59

$1,924,968

$272,268

7

14.14

5

Perry, PA

45,900

5.3%

2.0%

20.6%

10.5%

21

$613,918

$93,675

5

15.26

4

Washington, MD

150,904

14.4%

6.0%

20.6%

12.8%

57

$1,922,271

$24,537

2

1.28

11

Aggregate / Median

578,401

11.8%

5.0%

23.5%

12.4%

$9,645,216

$1,090,997

Contiguous

Counties

York, PA

434,017

13.7%

5.1%

29.2%

10.7%

149

$6,151,520

Dauphin, PA

259,828

3.2%

1.5%

31.4%

14.5%

98

$5,274,611

Adams, PA

102,759

12.6%

2.6%

24.8%

9.5%

30

$1,191,582

Frederick, MD

232,704

19.2%

4.7%

28.2%

13.6%

87

$3,591,861

Aggregate / Median

1,029,308

7.9%

2.1%

27.0%

10.1%

$16,209,574

Maryland

5,730,892

8.2%

1.9%

26.4%

13.7%

1,800

$112,624,504

$24,537

2

0.02%

116

Pennsylvania

12,574,407

2.4%

0.5%

31.5%

13.3%

4,717

$285,614,733

$1,066,460

20

0.37%

29

US

311,212,863

10.6%

3.9%

29.1%

12.4%

98,180

$6,911,804,490

$1,090,997

22

0.02%

442

Household Inc. Growth

ORRF Market Share

(1)

*

22

* |

10

Favorable Performance Relative

to Regional Peers

(1)

(1) Includes publicly-traded Mid-Atlantic commercial banks with assets

between $1bn and $2bn as identified in the Appendix (2) See note in Appendix

regarding non-GAAP financial measures Source: Company Documents; SNL

Financial Peer

Metric

ORRF

High

Low

Average

YTD ROA

1.23%

1.42%

(1.24)%

0.45%

YTD ROE

11.47%

15.76%

(43.83)%

3.50%

YTD ROTCE

13.57%

18.81%

(43.83)%

4.60%

Net Interest Margin

3.72%

5.00%

2.77%

3.70%

Efficiency Ratio

53.97%

101.37%

53.57%

66.55%

Non-Interest Income/ Revenue

30.96%

46.26%

5.83%

21.56%

Tangible Common Equity Ratio

(2)

9.80%

9.90%

2.90%

7.30%

Total Risk-Based Capital Ratio

14.90%

21.20%

7.20%

14.00%

Reserves/ Gross Loans

1.67%

3.91%

0.87%

1.63%

Reserves/ NPLs

107.00%

393.99%

23.46%

100.65%

Reserves/ NPAs

90.75%

393.99%

17.45%

95.38%

NPLs/ Gross Loans

1.57%

13.39%

0.32%

3.04%

NPAs/ Assets

1.15%

8.89%

0.15%

2.15%

NCOs/ Average Loans

0.48%

2.95%

0.02%

0.78%

Peer Range

As of 9/30/2010 |

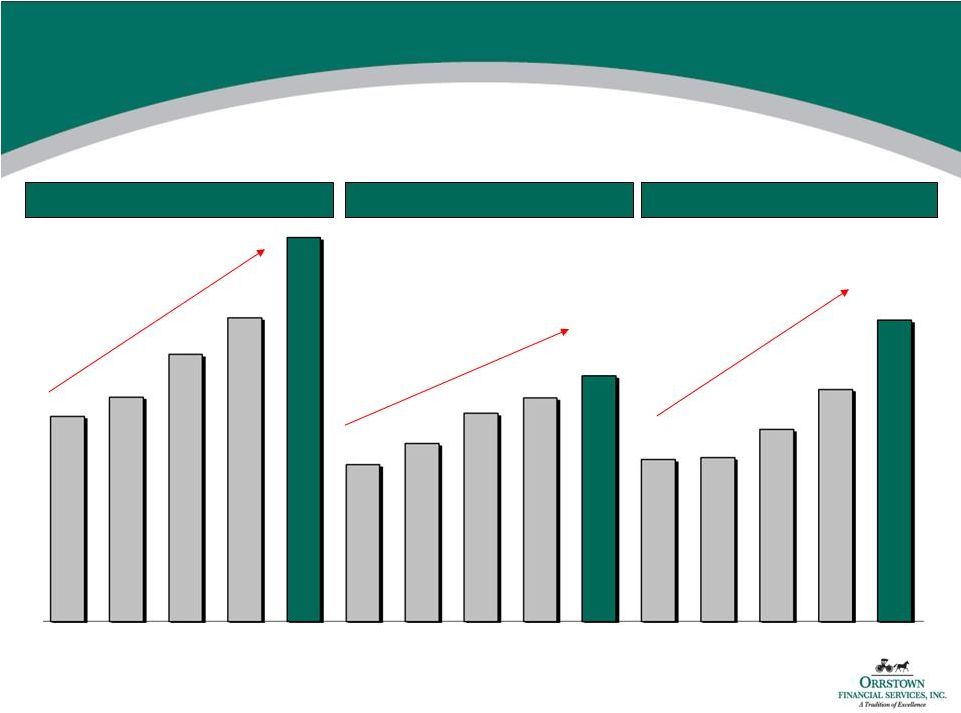

(1)

2006 reflects the acquisition of the First National Bank of Newport ($120mm of

assets and $106mm of deposits) (2)

NOTE: CAGR calculated from 12/31/05-12/31/2010: ‘05 Assets: 601,460;

‘05 Loans: 460,386; ‘05 Deposits: 462,822 Note: Dollar values in

thousands Source: Company Documents as of 12/31/10

Track Record of Strong Growth

Assets

Loans

Deposits

2006¹

2007

2008

2009

2010

2006¹

2007

2008

2009

2010

2006¹

2007

2008

2009

2010

CAGR: 15.99%

CAGR: 20.74%

CAGR: 20.23%

$809,031

$884,979

$1,051,783

$1,196,432

$1,511,722

$618,827

$701,964

$820,468

$881,074

$966,986

$638,719

$646,356

$757,368

$915,170

$1,188,377

11 |

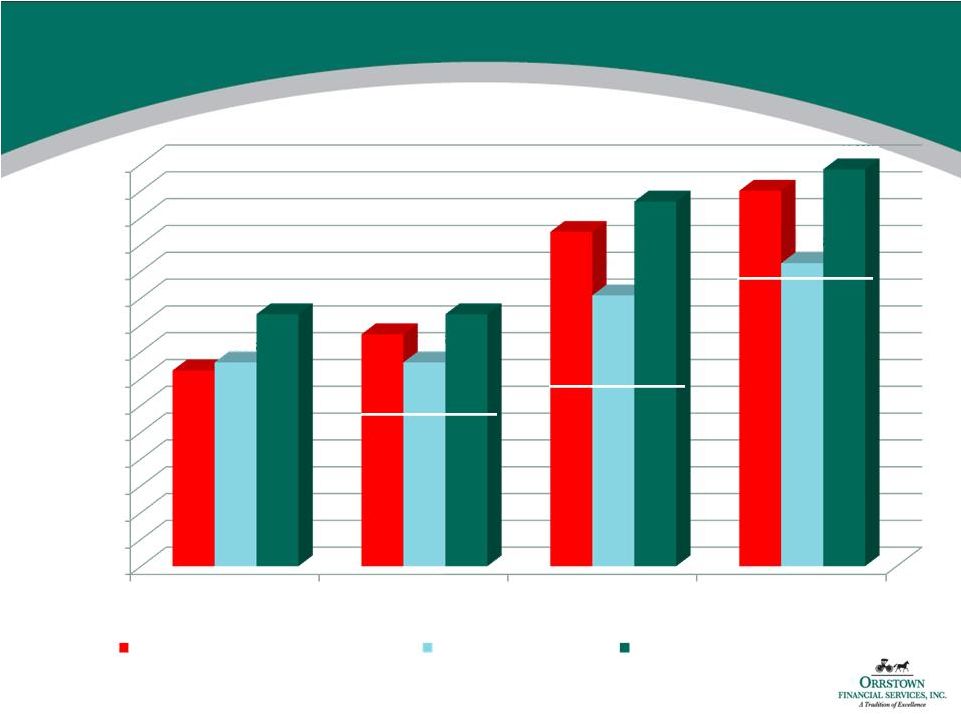

Capital Ratios

(1) See note in appendix regarding non-GAAP financial measures

(2) Calculated in accordance with bank regulatory requirements

Source: Company documents as of 12/31/10, SNL Financial

(2)

(2)

(2)

(1)

-

White line represents regulatory standard for being well capitalized

(before Capital Raise)

(after Capital Raise)

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

13.00%

14.00%

15.00%

TCE/ TA

Tier 1 Leverage

Tier 1 RBC

Total RBC

Peer Group Average 9/30/10

ORRF 12/31/09

ORRF 12/31/10

7.30%

7.60%

9.40%

8.65%

7.60%

9.40%

12.47%

10.10%

13.60%

14.00%

11.30%

14.80%

12 |

13

Deposit Composition

Source: Company Documents as of 12/31/10

(Dollars in Thousands)

December 31, 2007

December 31, 2008

December 31, 2009

December 31, 2010

Deposit Type

Amount

% of Total

Amount

% of Total

Amount

% of Total

Amount

% of Total

Period End Balances

Non-Interest Bearing DDA

$91,365

14.1%

$84,261

11.1%

$90,676

9.9%

$104,646

8.8%

Interest Bearing DDA

231,413

35.8%

272,372

36.0%

353,428

38.6%

427,085

35.9%

Savings deposits

64,292

9.9%

60,846

8.0%

60,032

6.6%

66,664

5.6%

Time deposits < $100,000

147,211

22.9%

211,354

27.9%

233,299

25.5%

415,516

35.0%

Time deposits > $100,000

112,075

17.3%

128,535

17.0%

177,735

19.4%

174,466

14.7%

Total

$646,356

100.0%

$757,368

100.0%

$915,170

100.0%

$1,188,377

100.0%

Annual Growth

1.2%

17.2%

20.8%

29.9%

Average Total Deposit Cost

2.89%

2.07%

1.52%

0.94%

•

Lowered Cost of Funds for 24 consecutive months

•

Core Deposit growth of 13% |

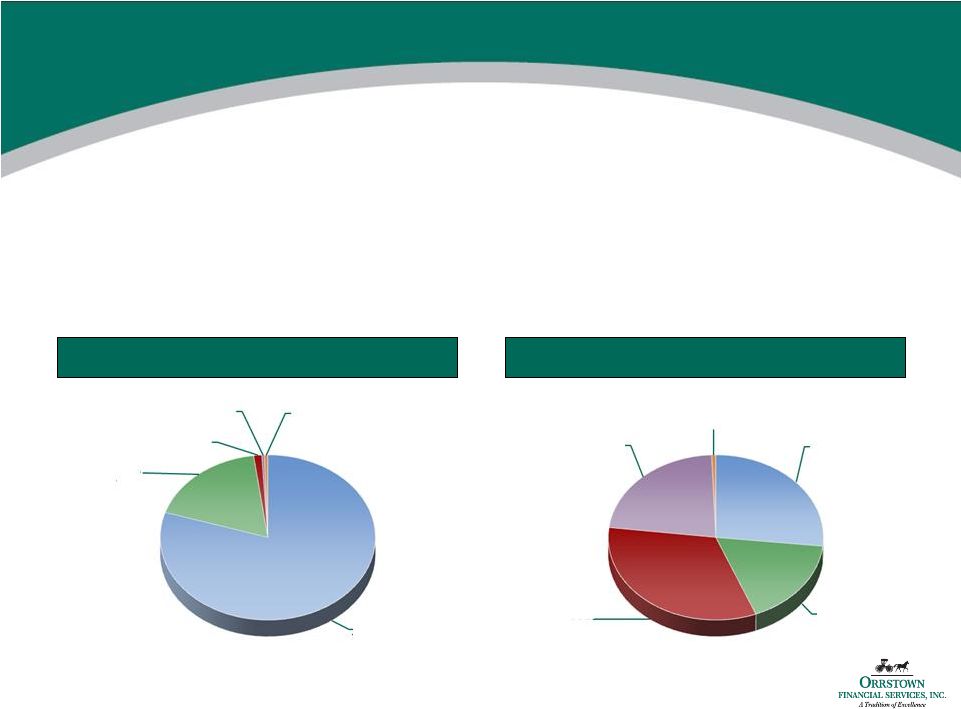

Investment Portfolio

Current Par Distribution

Source: Company Documents 12/31/2010

•

As of December 31, 2010, the market value of the investment portfolio was

approximately $432 million •

Duration of 4.7 years and average life of 5.6 years

•

Investment portfolio is comprised of 99% A or better rated securities

•

Currently do not hold any corporate or high-yield instruments

Debt Portfolio Breakdown by Rating

AAA

79.9%

AA

18.0%

A

1.2%

BBB

0.4%

NR

0.5%

Gov't

Agency

27%

CMO

17%

MBS

33%

Municipal

22%

Cert. of Dep.

1%

14 |

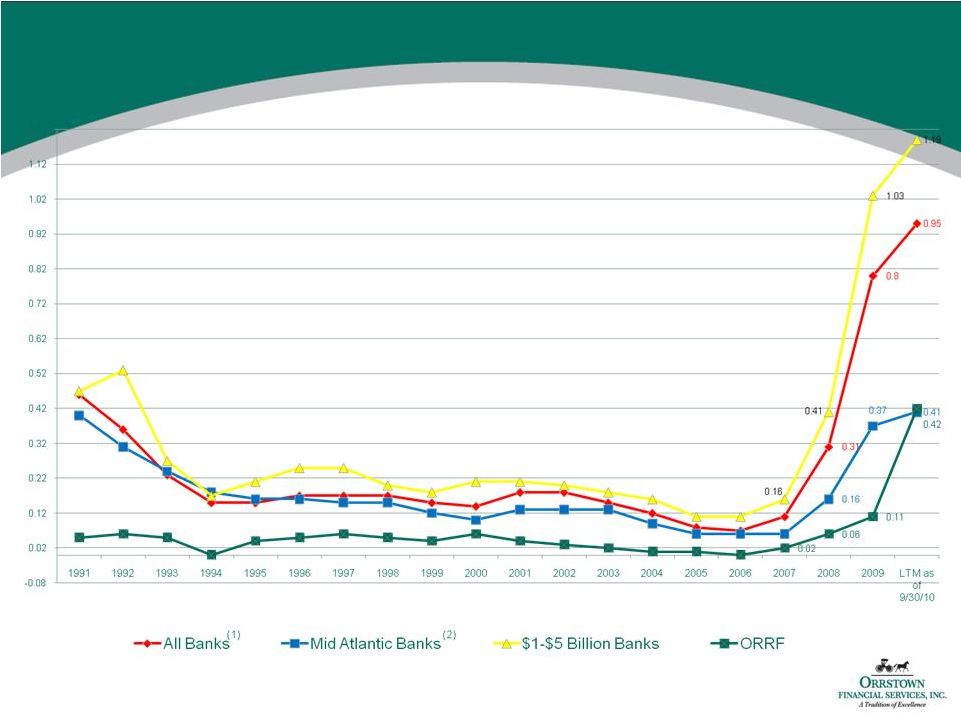

15

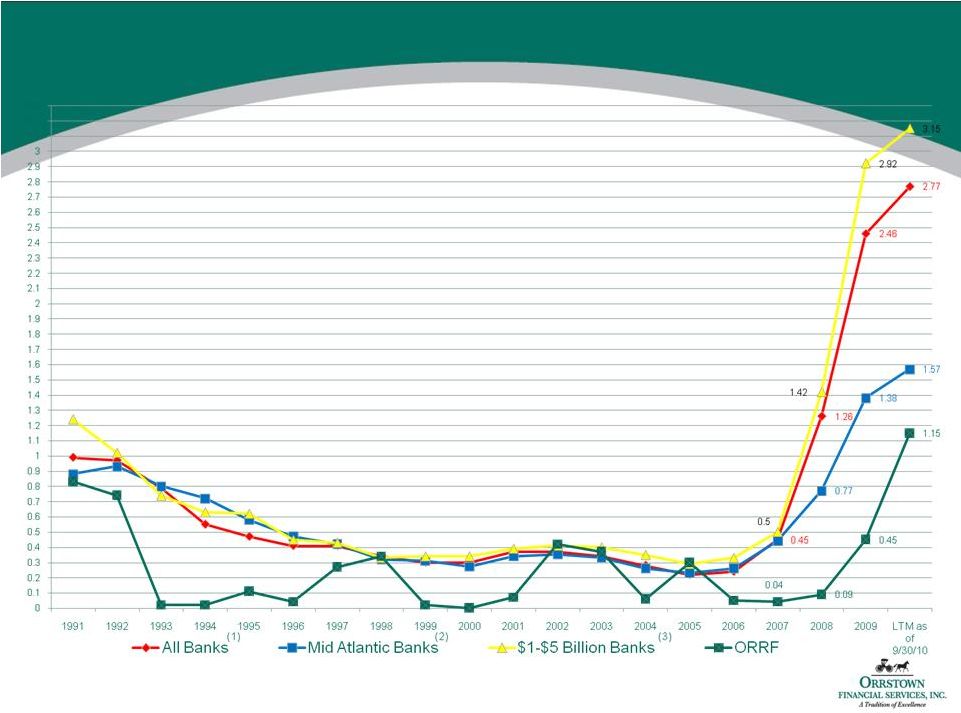

Historical Credit Cycle Analysis

NCOs/ Average Loans

(1)

All Banks as defined by SNL Financial

(2)

Mid-Atlantic Banks as defined by SNL Financial

(3)

$1-$5 Billion Banks as defined by SNL Financial

Source: Company Documents as of 12/31/10; SNL Financial

(3) |

16

Historical Credit Cycle Analysis

NPAs/ Assets

(1)

All Banks as defined by SNL Financial

(2)

Mid-Atlantic Banks as defined by SNL Financial

(3)

$1-$5 Billion Banks as defined by SNL Financial

Source: Company Documents as of 12/31/10; SNL Financial

|

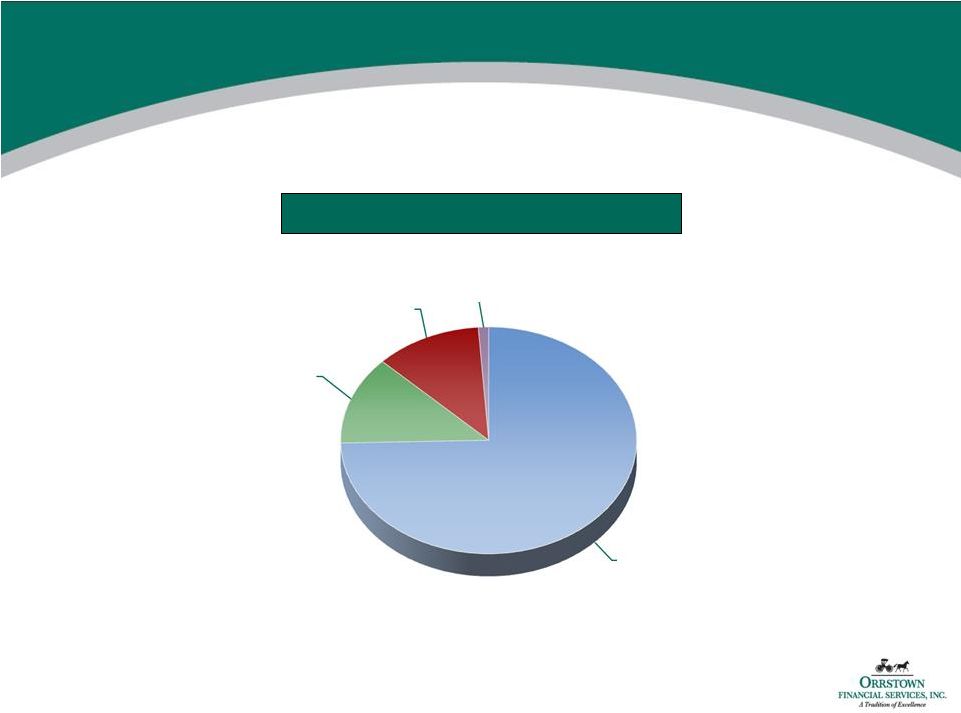

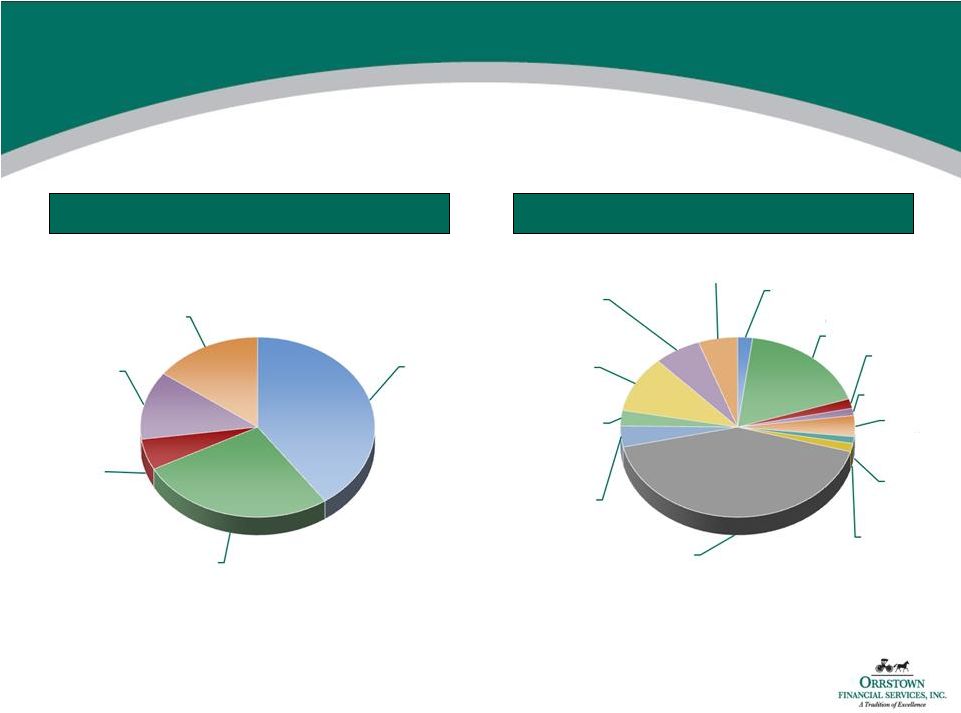

Loan Portfolio Overview

Loan Stratification by Purpose

Gross Loans: $967 million

Most Recent Quarter Yield: 5.24%

Year to Date Yield: 5.42%

Source: Company Documents as of 12/31/10

17

Commercial

74%

Residential

Mortgage

13%

Home Equity

Loans & Lines

12%

Consumer

1% |

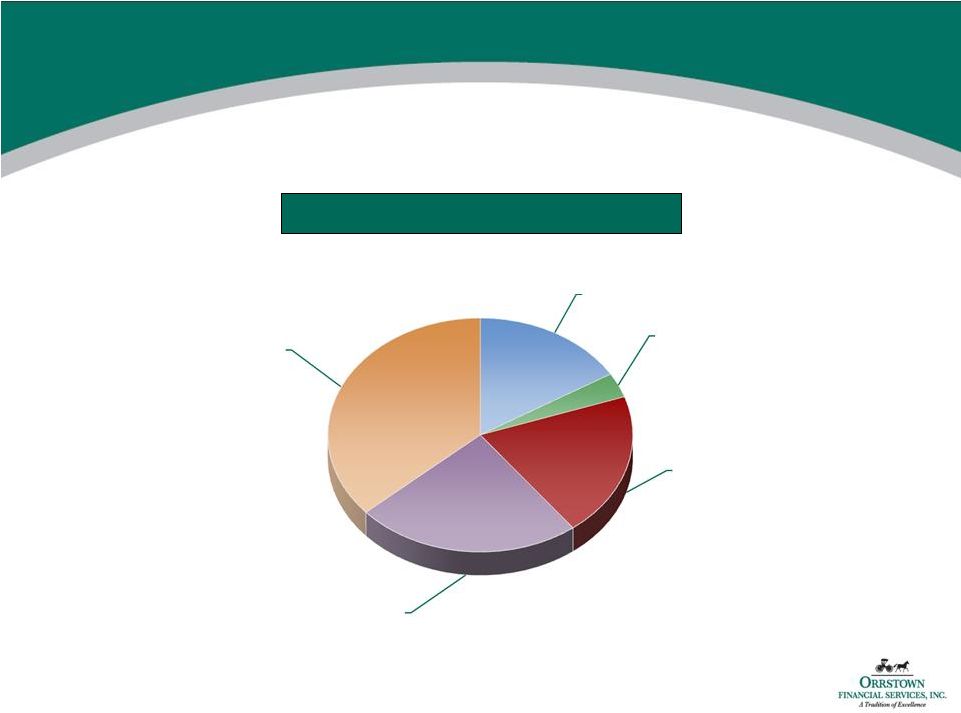

Loan Portfolio Overview

Source: Company Documents as of 12/31/10

Commercial Loans by Purpose

Commercial Loans: $721 million

Construction &

Land

Development

16%

Multifamily

3%

Non-Owner

Occupied

20%

Owner Occupied

24%

C&I, Term and

Other

37%

18 |

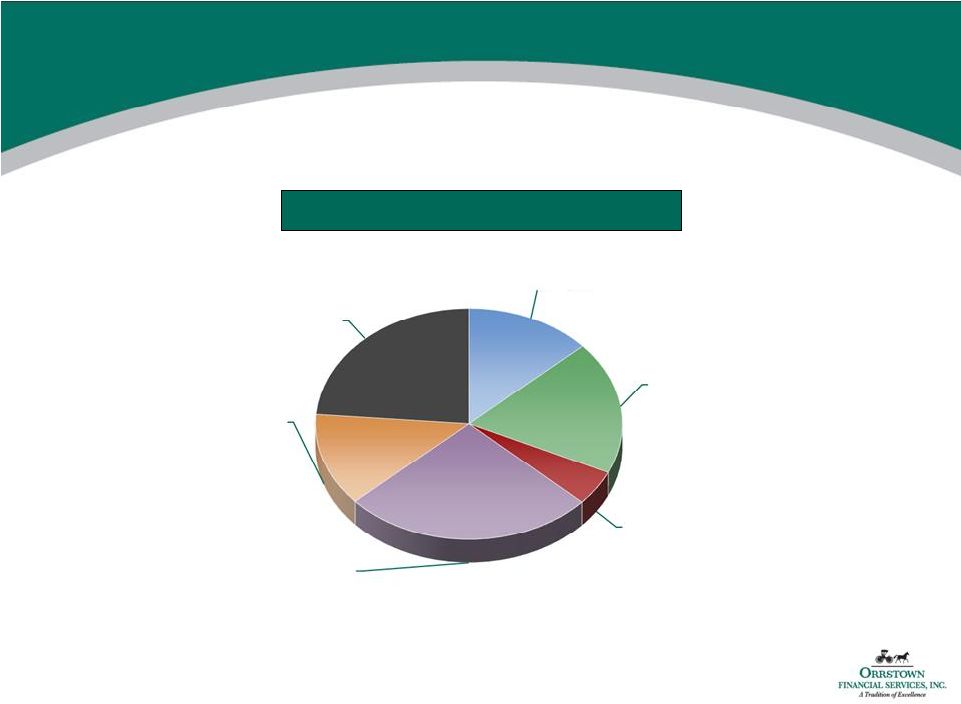

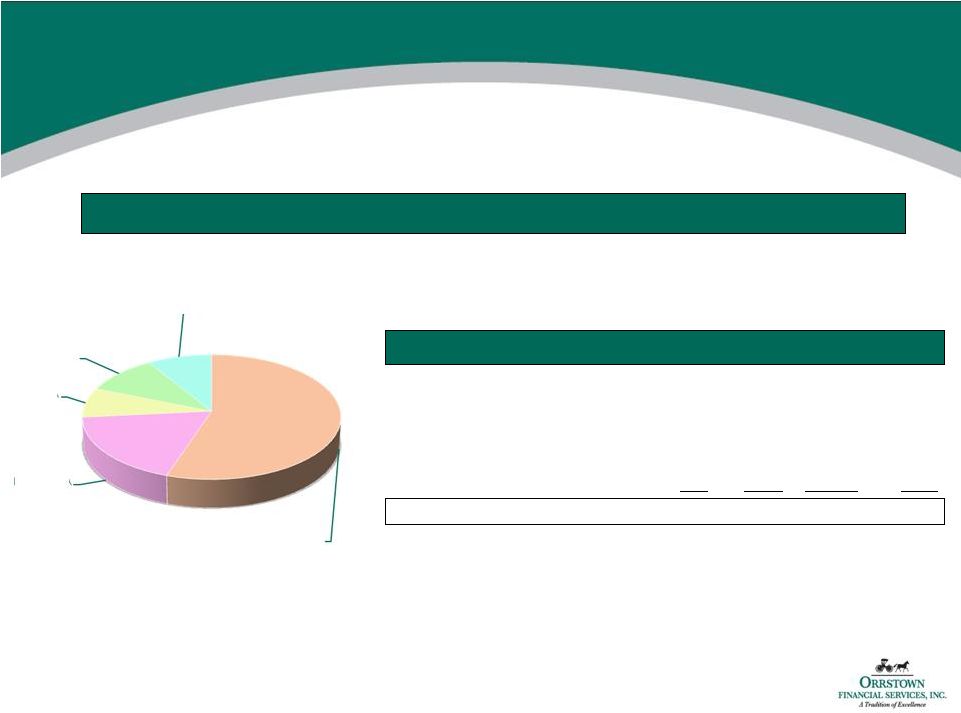

Construction & Land Development Portfolio: $117 Million

Loan Portfolio Overview

Construction & Land Development Breakdown

Source: Company Documents as of 12/31/10

Commercial

Raw Land

13%

Residential

Raw Land

19%

Commercial

Land

Development

5%

Residential

Land

Development

26%

Commercial

Vertical

Construction

13%

Residential

Vertical

Construction

24%

19 |

Loan Portfolio

Overview Geographic Distribution¹

Commercial Loans by Industry

(1) Based on location where the borrower resides

Source: Company Documents as of 12/31/10

Cumberland,

PA

40%

Franklin, PA

27%

Perry, PA

6%

Washington,

MD

12%

Other

15%

Agriculture

2%

Construction &

Development

18%

Manufacturing

2%

Wholesale Trade

1%

Retail Trade

4%

Transport

1%

Finance

2%

CRE -

Owner-Occ.

and Non Owner-

Occ.

42%

Professional

4%

Healthcare

3%

Service &

Entertainment

10%

Public Admin.

6%

Other

5%

20 |

21

Asset Quality Summary

Source: Company Documents as of 12/31/10, SNL Financial

Calendar Year to Date

(Dollars in Thousands)

12/31/2008

12/31/2009

3/31/2010

6/30/2010

9/30/2010

12/31/2010

Loans on a Nonaccrual (cash) Basis

341

$

4,267

$

23,020

$

14,496

$

14,427

$

13,896

$

Loans whose Terms have been Renegotiated

-

-

-

-

-

1,180

Total Non-Performing Loans

341

4,267

23,020

14,496

14,427

15,076

Other Real Estate Owned

608

1,065

873

1,264

2,528

1,112

Total Non-Performing Assets

949

5,332

23,893

15,760

16,955

16,188

90 Days Past Due and Still Accruing

6,176

6,155

8,929

7,255

3,526

2,249

Total Non-Performing and Other Risk Assets

7,125

$

11,487

$

32,822

$

23,015

$

20,481

$

18,437

$

Non-Performing Loans / Total Loans

0.04%

0.48%

2.56%

1.61%

1.57%

1.56%

Non-Performing Assets / Total Assets

0.09%

0.45%

1.82%

1.16%

1.15%

1.07%

Loan Loss Reserve

7,140

$

11,067

$

12,020

$

14,582

$

15,386

$

16,020

$

Loan Loss Reserves / Gross Loans

0.87%

1.26%

1.34%

1.62%

1.67%

1.66%

Reserves / NPLs

2,094%

259%

52%

101%

107%

106%

Net Charge-Offs

451

938

467

2,905

3,231

3,972

Net Charge-Offs / Average Loans

0.06%

0.11%

0.21%

0.65%

0.48%

0.44%

Provision / Net Charge-Offs

322%

519%

304%

221%

234%

225% |

Nonperforming Assets

NPAs

by Market¹

(1) Based on location where the borrower resides

Source: Company Documents as of 12/31/10

(Dollar Values in Thousands)

Non-Acc.

Total

Gross

NPAs /

County

Loans

TDRs

OREO

NPAs

Loans

Loans+REO

Cumberland, PA

$8,801

$0

$126

$8,927

$389,376

2.29%

Franklin, PA

$1,543

$710

$711

$2,964

$261,050

1.13%

Perry, PA

$1,251

$0

$0

$1,251

$53,822

2.32%

Washington, MD

$1,100

$470

$50

$1,620

$118,951

1.36%

Other

$1,201

$0

$225

$1,426

$143,787

0.99%

Total

$13,896

$1,180

$1,112

$16,188

$966,986

1.67%

Cumberland, PA

55%

Franklin, PA

18%

Perry, PA

8%

Washington,

MD

10%

Other

9%

22 |

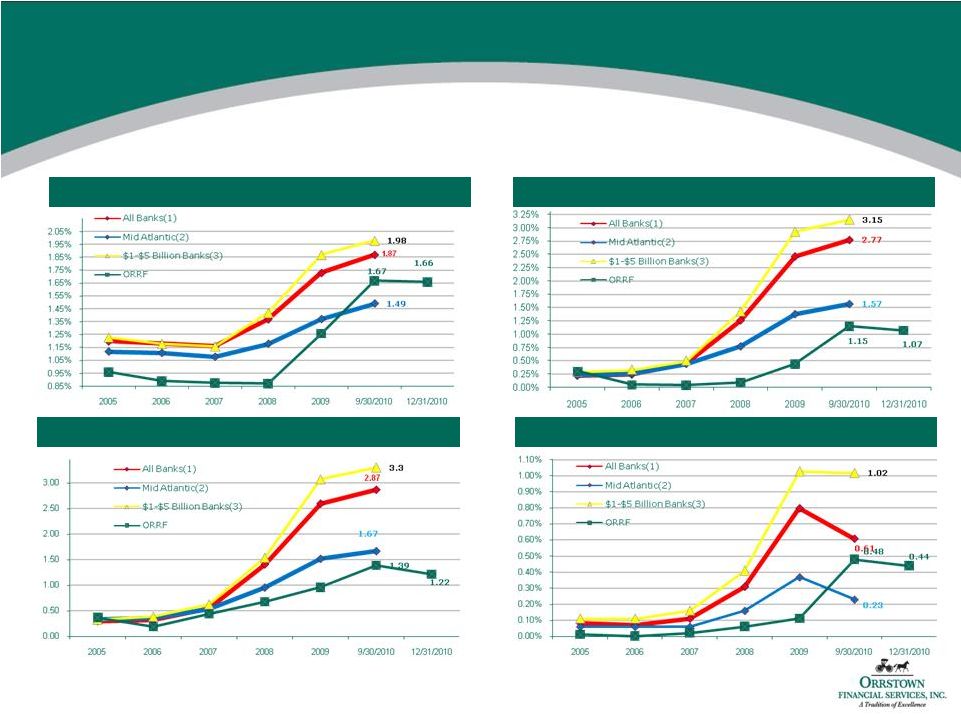

23

Credit Quality Trends

Net Charge-Offs / Average Loans

Non-Performing Assets / Total Assets

Reserves / Loans

(1)

All Banks as defined by SNL Financial

(2)

Mid Atlantic Banks as defined by SNL Financial

(3)

$1-$5 Billion Dollar Banks as defined by SNL Financial

Source: Company Documents as of 12/31/10; SNL Financial

NPAs

+90days Delinq/ Assets |

24

•

Established South Central Pennsylvania bank with a history

of strong performance

•

Emphasis on credit quality, return to shareholders, solid

financial performance, and delivering peer-group leading

results

•

Well-positioned for future growth throughout the region, both

organically and through acquisitions

•

Deep and experienced management team with strong

community ties and operational ability

Compelling Investment Considerations |

25

APPENDIX |

26

Experienced Management Team

Executive

Title

Thomas R. Quinn, Jr.

President / CEO

2

Years

20

Years

Jeffrey W. Embly

Executive Vice President / Chief Credit/Risk Officer

14

Years

20

Years

Bradley S. Everly

Executive Vice President / Chief Financial Officer

14

Years

33

Years

Philip E. Fague

Executive Vice President / Mortgage & Consumer Business

23

Years

23

Years

Jeffrey S. Gayman

Senior Vice President / Chief Commercial Officer

15

Years

16

Years

Barbara E. Brobst

Senior Vice President, Senior Trust Officer, Orrstown Financial Advisors

14

Years

29

Years

Gary R. Holder

Senior Vice President / Chief Retail Officer

8

Years

19

Years

Michelle N. Paulnock

Senior Vice President of Operations

2

Years

34

Years

Benjamin S. Stoops

Senior Vice President / Chief Technology Officer

13

Years

40

Years

Douglas P. Barton

Senior Vice President & Chief Accounting Officer

1

Years

7

Years

Mark G. Bayer

Vice President & Director of Marketing

4

Years

25

Years

Stephen C. Caldwell

Vice President & Director of Human Resources

10

Years

10

Years

Years with ORRF

Banking Experience |

27

Summary Financial Highlights

(1) See note in Appendix regarding non-GAAP financial measures

Source: Company Documents as of 12/31/10

Year Ended December 31,

(Dollar Values in Thousands)

2005

2006

2007

2008

2009

2010

Total Assets

$601,460

$809,031

$884,979

$1,051,783

$1,196,432

$1,511,722

Gross Loans

$460,386

$618,827

$701,964

$820,468

$881,074

$966,986

Total Deposits

$462,822

$638,719

$646,356

$757,368

$915,170

$1,188,377

Total Shareholder's Equity

$57,310

$89,388

$96,124

$103,347

$110,886

$160,484

Net Income

$9,987

$11,632

$12,558

$13,103

$13,373

$16,581

Basic Earnings Per Share

$1.76

$1.87

$1.95

$2.04

$2.09

$2.18

Diluted Earnings Per Share

$1.74

$1.86

$1.94

$2.03

$2.07

$2.17

Return on Average Assets

1.81%

1.61%

1.50%

1.38%

1.19%

1.21%

Return on Average Equity

18.69%

15.10%

13.64%

13.20%

12.48%

11.22%

Return on Average Tangible Equity

(1)

19.28%

18.98%

18.02%

17.02%

15.73%

13.19%

Net Interest Margin

4.55%

4.32%

4.08%

3.93%

3.66%

3.72%

Efficiency Ratio

52.86%

53.98%

55.58%

56.73%

58.85%

54.89%

Non-Interest Expense / Avg. Assets

3.14%

2.94%

2.96%

2.97%

2.82%

2.76%

Tang. Common Equity / Tang. Assets

(1)

9.2%

8.6%

8.7%

8.0%

7.6%

9.4%

Total Risk-Based Capital Ratio

12.8%

12.0%

11.6%

10.9%

11.3%

14.8%

Non-Performing Assets / Assets

0.30%

0.05%

0.04%

0.09%

0.45%

1.07%

Loan Loss Reserves / Gross Loans

0.96%

0.89%

0.87%

0.87%

1.26%

1.66% |

28

Regional Peer Analysis

(1) See note in appendix regarding non-GAAP financial measures

Note:

Includes publicly-traded commercial banks with assets between $1bn and $2bn

headquartered in the Mid Atlantic Financial data as of September 30, 2010;

Market data as of January 7, 2011 Source: Company Documents and SNL

Financial Balance Sheet

Non-

Total

Int. Inc./

Res./

NCOs/

NPAs/

Total

Total

Gross

TCE /

RBC

Eff.

Total

Gross

Res./

Ave

Total

Market

Dividend

Assets

Deposits

Loans

TA

(1)

Ratio

ROAA

ROAE

NIM

Ratio

Rev.

Loans

NPAs

Loans

Assets

Cap.

Yield

Company

St.

Ticker

($mm)

($mm)

($mm)

(%)

(%)

(%)

(%)

(%)

(%)

(%)

(%)

(%)

(%)

(%)

($mm)

(%)

Arrow Financial Corporation

NY

AROW

1,960

1,547

1,155

7.0

15.4

1.19

14.95

3.67

57.23

21.65

1.27

393.99

0.06

0.18

300.1

3.74

Eagle Bancorp, Inc.

MD

EGBN

2,006

1,646

1,602

8.8

12.7

0.82

7.91

4.05

62.04

7.54

1.39

68.67

0.37

1.65

267.4

0.00

Suffolk Bancorp

NY

SUBK

1,690

1,475

1,142

8.9

12.8

0.86

10.41

5.00

54.25

11.84

1.92

46.52

0.56

2.68

245.1

2.37

First United Corporation

MD

FUNC

1,795

1,386

1,044

3.2

12.3

(0.43)

(7.56)

2.77

73.14

23.28

2.33

37.58

0.78

3.70

26.7

0.92

First of Long Island Corporation

NY

FLIC

1,685

1,308

883

9.9

21.2

1.16

14.25

3.85

53.62

10.72

1.41

274.65

0.05

0.15

247.4

3.09

State Bancorp, Inc.

NY

STBC

1,645

1,386

1,114

7.2

13.3

0.64

6.88

4.26

62.92

5.83

2.92

208.16

0.78

0.48

154.1

2.16

Canandaigua National Corporation

NY

CNND

1,665

1,478

1,219

6.4

14.0

1.12

15.76

4.28

59.70

30.38

1.29

60.23

0.36

1.59

158.9

3.39

Peapack-Gladstone Financial Corporation

NJ

PGC

1,480

1,320

944

6.5

13.6

0.52

6.69

3.65

66.66

22.28

1.49

48.07

0.87

2.11

117.4

1.50

Tower Bancorp, Inc.

PA

TOBC

1,619

1,356

1,334

9.4

13.2

0.48

4.51

3.65

69.56

16.19

0.95

86.89

0.21

0.72

158.5

5.08

Alliance Financial Corporation

NY

ALNC

1,447

1,125

903

6.6

14.3

0.82

9.38

3.58

65.69

29.96

1.16

115.70

0.33

0.73

154.6

3.65

First Mariner Bancorp

MD

FMAR

1,333

1,107

985

2.9

7.2

(1.24)

(43.83)

2.86

99.04

46.26

1.54

17.45

1.78

6.00

9.2

0.00

Royal Bancshares of Pennsylvania, Inc.

PA

RBPAA

1,118

743

620

6.3

17.0

(0.89)

(10.18)

2.88

101.37

14.65

3.91

19.53

2.95

8.89

25.4

0.00

Citizens & Northern Corporation

PA

CZNC

1,308

984

727

9.9

16.8

1.42

12.28

3.75

53.57

24.10

1.18

89.21

0.02

0.69

187.8

3.10

VIST Financial Corp.

PA

VIST

1,361

1,078

931

5.2

12.7

0.26

2.69

3.43

69.83

32.91

1.55

33.97

0.76

2.61

53.7

2.43

Bryn Mawr

Bank Corporation

PA

BMTC

1,714

1,260

1,181

8.0

13.2

0.34

3.76

3.81

66.53

32.68

0.87

76.13

1.14

1.02

214.2

3.19

Center Bancorp, Inc.

NJ

CNBC

1,221

837

702

7.9

14.1

0.50

5.52

3.34

61.67

8.57

1.25

51.49

0.55

0.78

144.3

1.35

CNB Financial Corporation

PA

CCNE

1,363

1,115

757

7.9

15.9

0.88

12.20

3.70

58.93

18.59

1.43

58.71

0.28

0.80

179.4

4.50

Shore Bancshares, Inc.

MD

SHBI

1,135

982

906

9.4

13.0

(0.29)

(2.66)

3.98

62.15

30.73

1.45

29.94

2.12

3.86

91.9

2.20

High

2,006

1,646

1,602

9.9

21.2

1.42

15.76

5.00

101.37

46.26

3.91

393.99

2.95

8.89

300.1

5.08

Low

1,118

743

620

2.9

7.2

(1.24)

(43.83)

2.77

53.57

5.83

0.87

17.45

0.02

0.15

9.2

0.00

Mean

1,530

1,230

1,008

7.3

14.0

0.45

3.50

3.70

66.55

21.56

1.63

95.38

0.78

2.15

152.0

2.37

Median

1,550

1,284

964

7.5

13.5

0.58

6.79

3.69

62.54

21.96

1.42

59.47

0.56

1.31

156.5

2.40

Orrstown

Financial Services, Inc.

PA

ORRF

1,478

1,139

922

9.8

14.9

1.23

11.47

3.72

53.97

30.96

1.67

90.75

0.48

1.15

220.4

3.26

Asset Quality

Profitability

Valuation |

29

Ratio of Tangible Common Equity to Tangible

Assets

The ratio of tangible common equity to tangible assets is a non-GAAP-based financial measure

calculated using non-GAAP- based

amounts.

The

most

directly

comparable

GAAP-based

measure

is

the

ratio

of

stockholders’

equity to assets. In order to

calculate tangible common equity and tangible assets, the Company’s management subtracts

intangible assets from both common equity and assets. Tangible common equity is then

divided by tangible assets to arrive at the ratio of tangible common equity to tangible

assets. Management uses the ratio of tangible common equity to tangible assets to assess the

strength of the Company’s capital position. This is consistent with the treatment by bank

regulatory agencies, which exclude goodwill and other intangible assets from the calculation of

risk-based capital ratios. However, these non-GAAP financial measures are supplemental

and are not a substitute for an analysis based on GAAP measures. A reconciliation of the ratio of

stockholders’

equity to assets and tangible common equity to tangible assets is set forth below.

(Dollar Values in Thousands)

2005

2006

2007

2008

2009

9/30/2010

12/31/2010

Common Equity

57,310

89,388

96,124

103,347

110,886

163,933

160,484

Intangible Assets

1,935

21,567

21,368

21,186

20,938

20,751

20,698

Tangible Common Equity

55,375

67,821

74,756

82,161

89,948

143,182

139,786

Assets

601,460

809,031

884,979

1,051,783

1,196,432

1,477,780

1,511,722

Intangible Assets

1,935

21,567

21,368

21,186

20,938

20,751

20,698

Tangible Assets

599,525

787,464

863,611

1,030,597

1,175,494

1,457,029

1,491,024

Equity/ Assets

9.53%

11.05%

10.86%

9.83%

9.27%

11.09%

10.62%

Tangible Common Equity/ Tangible Assets

9.24%

8.61%

8.66%

7.97%

7.65%

9.83%

9.38%

Year Ended December 31, |

30

Return on Average Tangible Equity

Return on average tangible equity is a non-GAAP-based financial measure

calculated using non-GAAP-based amounts. The most directly

comparable measure is return on average equity, which is calculated using GAAP-based amounts. The

Company calculates the return on average tangible equity by excluding the balance

of intangible assets and their related amortization expense from the

calculation of return on average equity. Management uses the return on average tangible

equity to assess the Company’s core operating results and believes that this

is a better measure of our performance. Management

uses

the

return

on

average

tangible

assets

and

equity

to assess the Company’s core operating results and

believes that this is a better measure of our operating performance, as it is based

on the Company’s tangible assets and capital. Further we believe

that by excluding the impact of purchase accounting adjustments it allows for a more meaningful

comparison with the Company’s peers; particularly those that may have not have

acquired other companies. Lastly, the exclusion of goodwill and

intangible assets is consistent with the treatment by bank regulatory agencies, which exclude these

amounts from the calculation of risk-based capital ratios. However, these

non-GAAP financial measures are supplemental and are not a substitute

for an analysis based on GAAP measures. A reconciliation of return on average equity to the return on

average tangible equity is set forth below.

(Dollar Values in Thousands, Except PerShare)

2005

2006

2007

2008

2009

9/30/2010

12/31/2010

18.69%

15.10%

13.64%

13.20%

12.48%

11.47%

11.22%

0.59%

3.88%

4.38%

3.82%

3.25%

2.10%

1.97%

19.28%

18.98%

18.02%

17.02%

15.73%

13.57%

13.19%

Year Ended December 31,

Return on average equity (GAAP basis)

Effect of excluding average intangible assets and related amortization

Return on average tangible equity |

Jeffrey W. Embly

EVP, Chief Credit /Risk Officer

jembly@orrstown.com

Thomas R. Quinn, Jr.

President & Chief Executive Officer

tquinn@orrstown.com

Bradley S. Everly

EVP, Chief Financial Officer

beverly@orrstown.com

717-530-3521

31 |