Attached files

| file | filename |

|---|---|

| EX-99.1 - MANAGEMENT'S PRESENTATION - Mueller Water Products, Inc. | dex991.htm |

| 8-K - FORM 8-K - Mueller Water Products, Inc. | d8k.htm |

Earnings

Conference Call For The First Quarter Ended

December 31, 2010

These slides are not intended to be a stand-

alone presentation, but are for use in

conjunction with the Earnings Call.

February 2, 2011

Exhibit 99.2 |

Earnings Conference Call for Quarter Ended December 31, 2010

2

Non-GAAP Financial Measures

The Company presents adjusted income (loss) from operations, adjusted EBITDA, adjusted

net income (loss), adjusted net income (loss) per share, free cash flow and net

debt as non-GAAP measures. Adjusted income (loss) from operations

represents income (loss) from operations excluding restructuring. Adjusted EBITDA represents

income (loss) from operations excluding restructuring, depreciation and amortization.

The Company presents adjusted EBITDA because it is a measure management believes

is frequently used by securities analysts, investors and interested parties in

the evaluation of financial performance. Adjusted net income (loss) and adjusted net

income (loss) per share exclude restructuring, certain costs from settled interest rate

swap contracts and the income tax effects of the previously mentioned

items. These items are excluded because they are not considered indicative

of recurring operations. Free cash flow represents cash flow from operating activities less

capital expenditures. It is presented as a measurement of cash flow because it is

commonly used by the investment community. Net debt represents total debt

less cash and cash equivalents. Net debt is commonly used by the

investment community as a measure of indebtedness. Adjusted income (loss) from operations,

adjusted EBITDA, adjusted net income (loss), adjusted net income

(loss) per share, free cash flow and net debt

have limitations as analytical tools, and securities analysts, investors and interested

parties should not consider any of these non-GAAP measures in isolation or

as a substitute for analysis of the Company's results as reported under

accounting principles generally accepted in the United States ("GAAP").

A reconciliation of GAAP to non-GAAP results is included as an attachment to the

applicable press release and has been posted online at

www.muellerwaterproducts.com Non-GAAP Financial Measures

|

Earnings Conference Call for Quarter Ended December 31, 2010

3

Safe Harbor Statement

This press release contains certain statements that may be deemed

“forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements that address activities, events or

developments that we intend, expect, plan, project, believe or anticipate will or may

occur in the future are forward-looking statements. Examples of

forward-looking statements include, but are not limited to, statements

we

make

regarding

benefits

we

expect

to

realize

from

operational

savings,

reduced

fixed

costs

associated

with

operational excellence initiatives and our U.S. Pipe plant closure and the impact of

these factors on our businesses. Forward-looking statements are based

on certain assumptions and assessments made by us in light of our experience and

perception of historical trends, current conditions and expected future developments. Actual

results and the timing of events may differ materially from those contemplated by the

forward-looking statements due to a number of factors, including regional,

national or global political, economic, business, competitive, market and

regulatory conditions and the following: •the spending level for water and wastewater infrastructure;

•the demand

level of manufacturing and construction activity; •our ability to service our debt obligations; and

•the other

factors that are described in the section entitled “RISK

FACTORS”

in Item 1A of our most recently

filed Annual Report on Form 10-K.

Undue reliance should not be placed on any forward-looking statements. We do not

have any intention or obligation to update forward-looking statements,

except as required by law. Safe Harbor Statement |

Earnings Conference Call for Quarter Ended December 31, 2010

4

Consolidated Non-GAAP Results

•

Financial results at both U.S. Pipe and Anvil improved year-over-year

•

Mueller Co. shipment volumes declined due to higher distributor inventory levels coming

into the quarter as well as uncertainty in the municipal market

•

Plant closure, manufacturing and other cost savings benefitted U.S. Pipe

•

Higher sales prices benefitted all three business segments; offset increased raw

material costs $ in millions (except per share amounts)

2011

2010

Net sales

$287.6

$313.1

Adj. income (loss) from operations

($2.4)

$0.7

Adj. operating income (loss) % of net sales

(0.8%)

0.2%

Adj. net loss per share

($0.06)

($0.07)

Adj. EBITDA

$17.7

$21.5

Adj. EBITDA % of net sales

6.2%

6.9%

First Quarter Fiscal

FY 1Q11 results exclude restructuring $1.9 million, $1.2 million net of tax; and interest rate swap

costs of $1.9 million, $1.2 million net of tax. FY 1Q10 results exclude restructuring $0.4

million, $0.2 million net of tax. |

Earnings Conference Call for Quarter Ended December 31, 2010

5

Consolidated GAAP Results

•

Net sales

–

Essentially flat excluding $24.9 million of first quarter 2010 sales related to two

divested Anvil businesses –

Benefitted from $12.8 million from higher sales prices across all three business

segments, $0.7 million favorable Canadian currency exchange rates, reduced by

$14.1 million lower shipment volumes •

Gross profit

–

$13.7 million higher manufacturing and other cost savings and $12.8 million higher

sales prices partially offset by $10.0 million higher raw material costs, $9.2

million higher per-unit overhead costs due to lower production, and $6.3

million lower shipment volumes •

SG&A

–

1Q10 included $1.6 million gain from the Anvil business sold

$ in millions (except per share amounts)

2011

2010

Net sales

$287.6

$313.1

Gross profit

$49.6

$55.9

Gross profit % of net sales

17.2%

17.9%

Income (loss) from operations

($4.3)

$0.3

Net loss per share

($0.08)

($0.07)

First Quarter Fiscal |

Earnings Conference Call for Quarter Ended December 31, 2010

6

Consolidated Non-GAAP Results

•

Adjusted income (loss) from operations

–

$10.0 million higher raw material costs, $9.2 million higher per-unit overhead

costs due to lower production,

$6.3

million

lower

shipment

volumes

and

$1.6

million

gain

on

sale

of

business

–

Partially offset by $13.7 manufacturing and other cost savings and $12.8 million

higher sales prices •

Interest expense, net

–

Net interest expense included $1.9 million non-cash costs related to interest rate

swap contracts $ in millions (except per share amounts)

2011

2010

Adj. income (loss) from operations

($2.4)

$0.7

Adj. operating income (loss) % of net sales

(0.8%)

0.2%

Adj. EBITDA

$17.7

$21.5

Adj. EBITDA % of net sales

6.2%

6.9%

SG&A

$52.0

$55.2

Interest expense, net

$15.9

$16.8

Adj. net loss per share

($0.06)

($0.07)

First Quarter Fiscal

FY 1Q11 results exclude restructuring $1.9 million, $1.2 million net of tax; and interest rate swap

costs of $1.9 million, $1.2 million net of tax. FY 1Q10 results exclude restructuring $0.4

million, $0.2 million net of tax. |

Earnings Conference Call for Quarter Ended December 31, 2010

7

Mueller Co. Segment

•

Net sales

–

$3.7 million from higher prices and $0.7 million of favorable Canadian exchange

rates –

More than offset by $7.9 million lower shipment volumes

•

Adjusted income from operations and adjusted EBITDA

–

$5.4 million of higher per-unit overhead costs due to lower production,

$4.0 million of higher raw material

costs and $3.0 million of lower shipment volumes

–

Partially offset by $3.7 million of higher sales prices and $3.2

million of manufacturing and other cost

savings

FY 1Q11 results exclude restructuring $0.4 million FY 1Q10 results exclude

restructuring $0.1 million $ in millions

2011

2010

Net sales

$129.8

$133.3

Adj. income from operations

$8.8

$16.0

Adj. operating income % of net sales

6.8%

12.0%

Adj. EBITDA

$20.5

$28.4

Adj. EBITDA % of net sales

15.8%

21.3%

First Quarter Fiscal |

Earnings Conference Call for Quarter Ended December 31, 2010

8

U.S. Pipe Segment

•

Net sales

–

$11.7 million lower shipment volumes partially offset by $6.4 million from higher

prices –

Prices for ductile iron pipe increased 19% year-over-year and 4% sequentially

•

Adjusted loss from operations and adjusted EBITDA

–

$7.5 million of manufacturing and other cost savings and $6.4 million higher sales

prices –

Partially offset by $4.2 million of higher costs due to lower production, $3.7 million

lower shipment volumes and $3.2 million higher raw material costs

FY 1Q11 results exclude restructuring $0.9 million FY 1Q10 results exclude

restructuring $0.3 million $ in millions

2011

2010

Net sales

$74.4

$79.7

Adj. loss from operations

($9.4)

($11.9)

Adj. operating loss % of net sales

(12.6%)

(14.9%)

Adj. EBITDA

($4.9)

($7.5)

Adj. EBITDA % of net sales

(6.6%)

(9.4%)

First Quarter Fiscal |

Earnings Conference Call for Quarter Ended December 31, 2010

9

Anvil Segment

•

Net sales

–

Increased by $8.2 million year-over-year excluding $24.9 million of first

quarter 2010 net sales due to two

businesses divested early in 2010

–

$5.5 million higher shipment volumes and $2.7 million from higher prices

•

Adjusted income from operations and adjusted EBITDA

–

$3.0 million manufacturing and other cost savings, $2.7 million higher sales prices,

partially offset by $2.8 million higher raw material costs

–

First quarter 2010 included a gain of $1.6 million from the sale

of a business

FY 1Q11 results exclude restructuring $0.6 million

$ in millions

2011

2010

Net sales

$83.4

$100.1

Adj. income from operations

$6.5

$4.5

Adj. operating income % of net sales

7.8%

4.5%

Adj. EBITDA

$10.2

$8.4

Adj. EBITDA % of net sales

12.2%

8.4%

First Quarter Fiscal |

Earnings Conference Call for Quarter Ended December 31, 2010

10

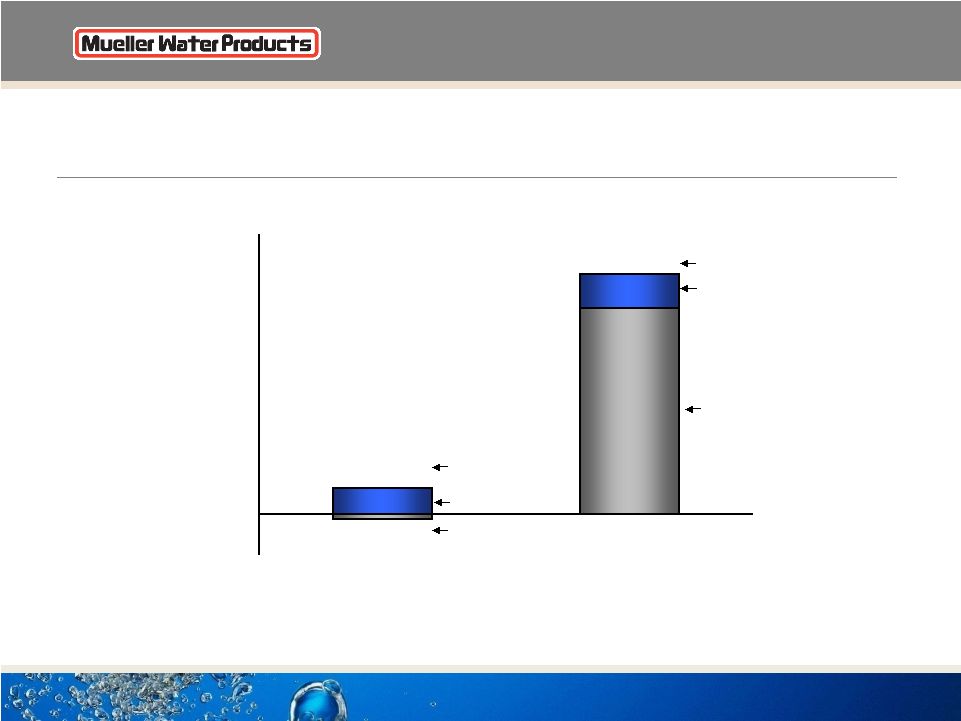

•

Year-over-year change in free cash flow due to timing of cash collections from

customers and an income tax refund of $26.7 million in the 2010 first

quarter Free Cash Flow

$5.2

$60.1

Capital

Expenditures

Cash Flow from

Operations

Free Cash Flow

Cash Flow from

Operations

Free Cash Flow

Capital

Expenditures

Quarter ended December 31,

2010

2009

($1.2)

$51.4

$6.4

$8.7

($10.0)

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

2010

2009 |

Earnings Conference Call for Quarter Ended December 31, 2010

11

Net Debt

$692.5

$737.4

Net Debt

Cash

December 31,

$ in Millions

2010

ABL Revolver (LIBOR + 300 Basis Points)

$49.0

Senior Subordinated Notes (7

3

/

8

%)

420.0

Senior Unsecured Notes (8

3

/

4

%)

221.5

Other

2.0

Total Debt

$692.5

$620.6

$613.4

$71.9

$124.0

$0

$100

$200

$300

$400

$500

$600

$700

$800

12/31/2010

12/31/2009

($ in Millions) |

Earnings Conference Call for Quarter Ended December 31, 2010

12

Second Quarter Comments

and 2011 Outlook

End of formal slide presentation. Appendix slides to follow.

|

|

Earnings Conference Call for Quarter Ended December 31, 2010

14

Segment Results and Reconciliation of Non-GAAP to

GAAP Performance Measures

(in millions, except per share amounts)

Three months ended December 31, 2010

Mueller Co.

U.S. Pipe

Anvil

Corporate

Total

GAAP results:

Net sales

129.8

$

74.4

$

83.4

$

-

$

287.6

$

Gross profit (loss)

29.2

$

(2.4)

$

22.4

$

0.4

$

49.6

$

Selling, general and administrative expenses

20.4

7.0

15.9

8.7

52.0

Restructuring

0.4

0.9

0.6

-

1.9

Income (loss) from operations

8.4

$

(10.3)

$

5.9

$

(8.3)

$

(4.3)

Interest expense, net

15.9

Income tax benefit

(8.1)

Net loss

(12.1)

$

Net loss per diluted share

(0.08)

$

Capital expenditures

3.2

$

1.4

$

1.4

$

0.4

$

6.4

$

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations

8.4

$

(10.3)

$

5.9

$

(8.3)

$

(4.3)

$

Impairment

-

-

-

-

-

Restructuring

0.4

0.9

0.6

-

1.9

Adjusted income (loss) from operations

8.8

(9.4)

6.5

(8.3)

(2.4)

Depreciation and amortization

11.7

4.5

3.7

0.2

20.1

Adjusted EBITDA

20.5

$

(4.9)

$

10.2

$

(8.1)

$

17.7

$

Adjusted net loss:

Net loss

(12.1)

$

Interest rate swap settlement costs, net of tax

1.2

Restructuring, net of tax

1.2

Adjusted net loss

(9.7)

$

Adjusted net loss per diluted share

(0.06)

$

Free cash flow:

Net cash provided by operating activities

5.2

$

Capital expenditures

(6.4)

Free cash flow

(1.2)

$

Net debt (end of period):

Current portion of long-term debt

0.8

$

Long-term debt

691.7

Total debt

692.5

Less cash and cash equivalents

(71.9)

Net debt

620.6

$ |

Earnings Conference Call for Quarter Ended December 31, 2010

15

Segment Results and Reconciliation of Non-GAAP to

GAAP Performance Measures

(in millions, except per share amounts)

Three months ended December 31, 2009

Mueller Co.

U.S. Pipe

Anvil

Corporate

Total

GAAP results:

Net sales

133.3

$

79.7

$

100.1

$

-

$

313.1

$

Gross profit (loss)

36.9

$

(4.0)

$

23.0

$

-

$

55.9

$

Selling, general and administrative expenses

20.9

7.9

18.5

7.9

55.2

Restructuring

0.1

0.3

-

-

0.4

Income (loss) from operations

15.9

$

(12.2)

$

4.5

$

(7.9)

$

0.3

Interest expense, net

16.8

Income tax benefit

(5.8)

Net loss

(10.7)

$

Net loss per diluted share

(0.07)

$

Capital expenditures

3.7

$

4.0

$

1.0

$

-

$

8.7

$

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations

15.9

$

(12.2)

$

4.5

$

(7.9)

$

0.3

$

Restructuring

0.1

0.3

-

-

0.4

Adjusted income (loss) from operations

16.0

(11.9)

4.5

(7.9)

0.7

Depreciation and amortization

12.4

4.4

3.9

0.1

20.8

Adjusted EBITDA

28.4

$

(7.5)

$

8.4

$

(7.8)

$

21.5

$

Adjusted net loss:

Net loss

(10.7)

$

Restructuring, net of tax

0.2

Adjusted net loss

(10.5)

$

Adjusted net loss per diluted share

(0.07)

$

Free cash flow:

Net cash provided by operating activities

60.1

$

Capital expenditures

(8.7)

Free cash flow

51.4

$

Net debt (end of period):

Current portion of long-term debt

11.7

$

Long-term debt

725.7

Total debt

737.4

Less cash and cash equivalents

(124.0)

Net debt

613.4

$ |

|