Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ABRAXAS PETROLEUM CORP | axas8k020211.htm |

| EX-99.1 - NEWS RELEASE - ABRAXAS PETROLEUM CORP | nr020111.htm |

| EX-99.2 - NEWS RELEASE - ABRAXAS PETROLEUM CORP | nr020211.htm |

February 3-4, 2011

Hollywood, Florida

Exhibit 99.3

2

Forward-Looking Statements

The information presented herein may contain predictions, estimates and

other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be

achieved.

other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be

achieved.

Important factors that could cause actual results to differ materially from

those included in the forward-looking statements include the timing and

extent of changes in commodity prices for oil and gas, the need to develop

and replace reserves, environmental risks, competition, government

regulation and the ability of the Company to meet its stated business

goals.

those included in the forward-looking statements include the timing and

extent of changes in commodity prices for oil and gas, the need to develop

and replace reserves, environmental risks, competition, government

regulation and the ability of the Company to meet its stated business

goals.

3

AXAS Highlights

§ NASDAQ: AXAS

§ Fully diluted shares outstanding: ~88.4 million (PF offering)

§ ~50% institutional

§ ~10% insider

§ Current average trading volume: ~840,000 shares per day

§ Market capitalization: ~$400 million (PF offering)

§ Total long-term debt: ~$87 million (PF offering)

§ High quality assets

§ Unparalleled upside opportunities

§ Significant hedge position

§ Expanded 2011 CapEx: $60 million (PF offering)

§ Recent equity offering: 20.5 million shares at $4.40

§ (12 million primary and 8.5 million secondary)

4

AXAS Assets

§ 50,000+ net acres in unconventional oil plays

§ Large inventory of unconventional and conventional drilling locations

§ Undeveloped leasehold has been largely de-risked by industry and offset operator activity

§ Undeveloped leasehold is primarily held by production

§ Substantial base of MLP-like producing properties

§ 2011 expanded budget of $60 million is 100% oil or liquids weighted

§ Secondary component of recent equity offering eliminated overhang perception

§ PF offering - 3.3 million shares(1) held by the MLP investors are freely tradable

(1) Excludes 5.2 MM shares held by Lehman and 2.4 MM shares subject to lock-ups that extend to January 2012

5

AXAS Hedges

|

|

|

2011

|

2012

|

2013

|

AVE.

|

|

OIL - weighted average price

|

|

$81.33

|

$70.89

|

$80.79

|

$75.69

|

|

% OIL PDP(1)

|

|

84%

|

84%

|

69%

|

|

|

|

|

|

|

|

|

|

GAS - weighted average price

|

|

$6.52

|

$6.77

|

$6.84

|

$6.69

|

|

% GAS PDP(1)

|

|

82%

|

81%

|

66%

|

|

NYMEX-based fixed price swaps:

(1) As of December 31, 2009

6

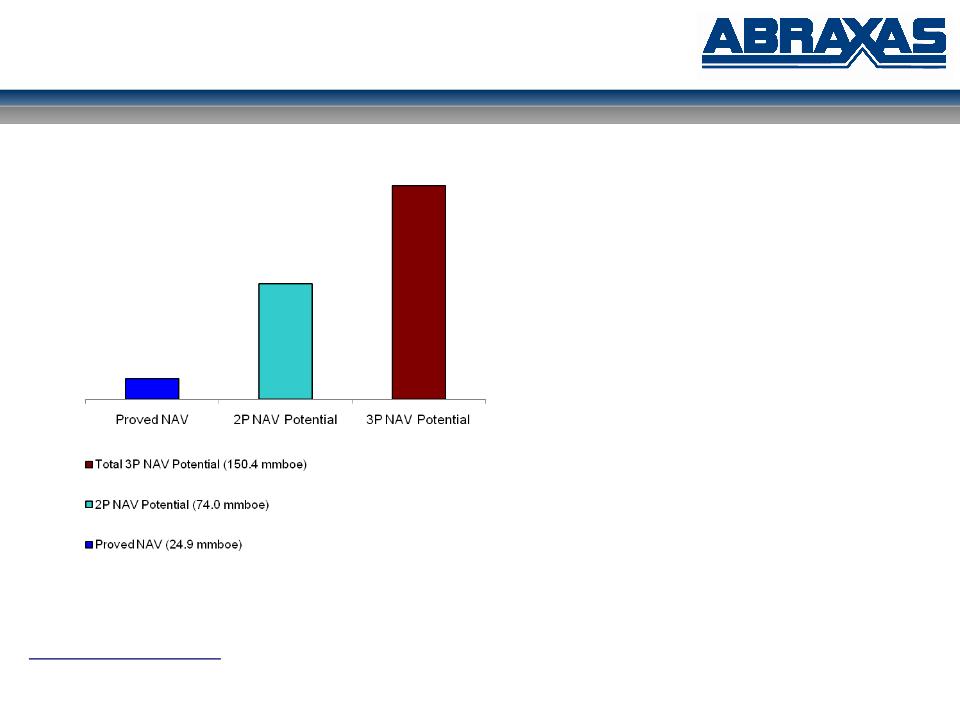

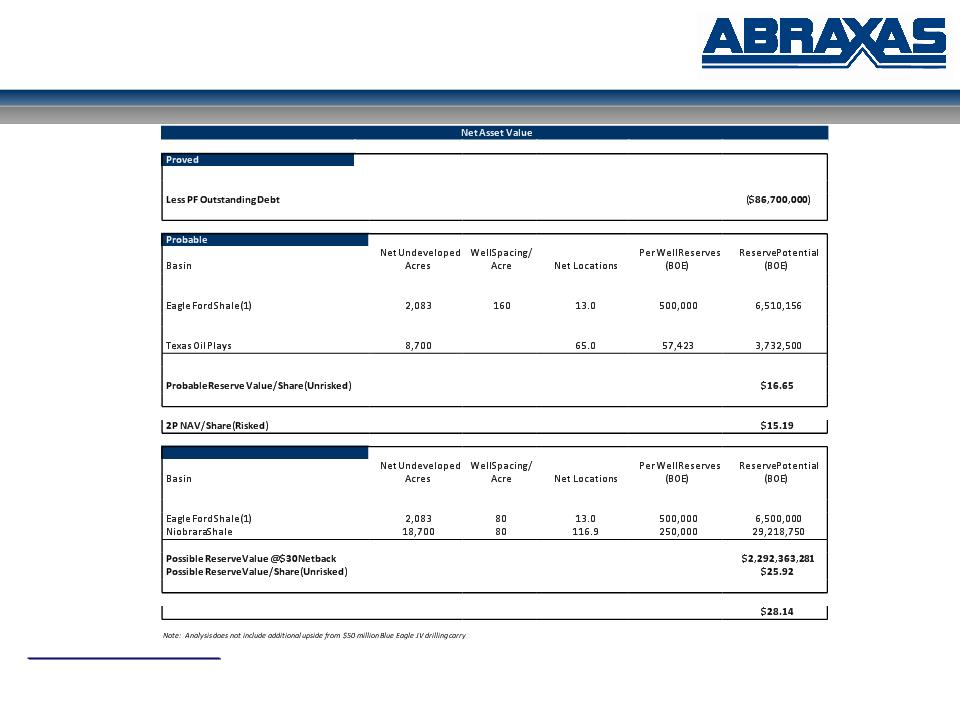

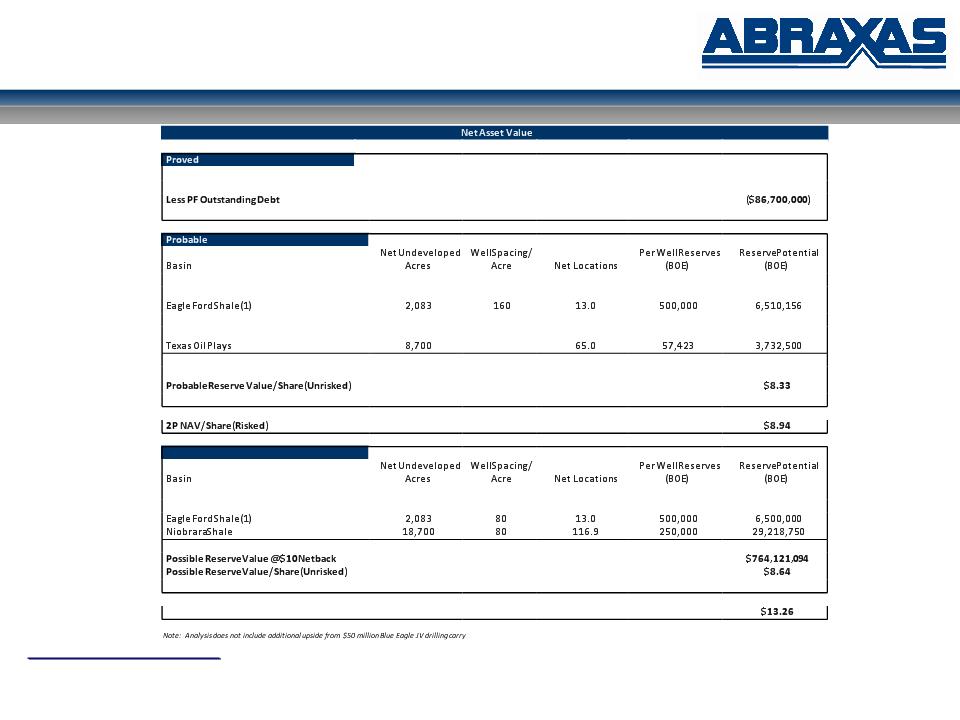

Pro Forma Net Asset Value

(1) Includes identified and resource potential on Bakken, Niobrara, Eagle Ford, Pekisko and Texas oil plays. Excludes identified and resource reserves in Alberta Basin Bakken

and $50MM value of Eagle Ford Joint Venture drilling carry.

and $50MM value of Eagle Ford Joint Venture drilling carry.

Pro Forma Net Asset Value per Share(1)

Proved Reserves Only

$ 2.69

Proved PLUS Probable Reserves

$ 15.19

Proved PLUS Probable PLUS

Possible

Possible

$ 28.14

7

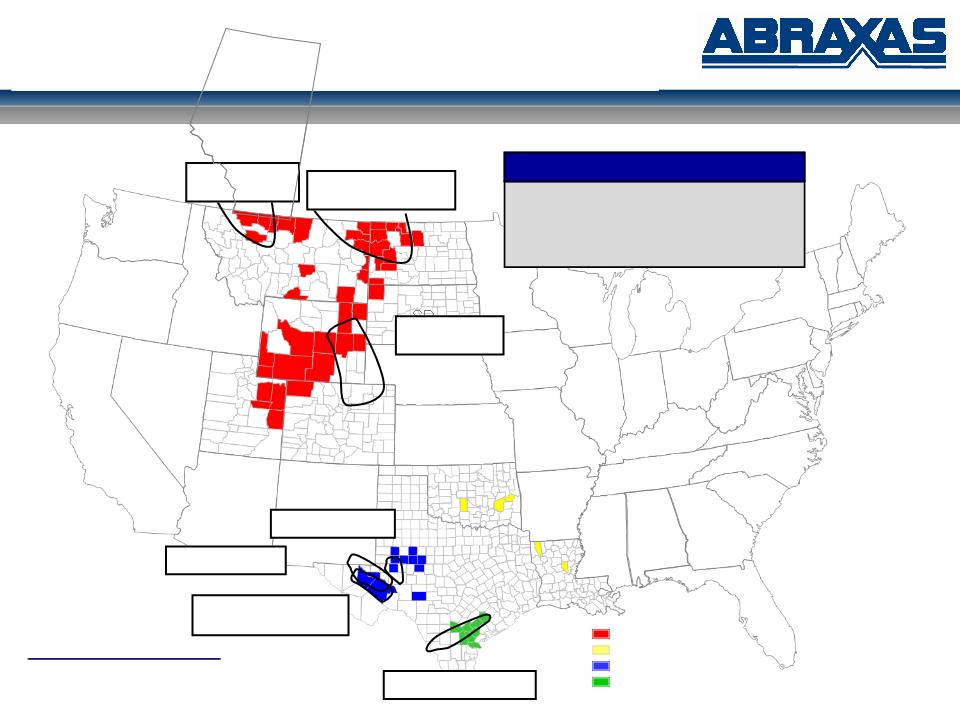

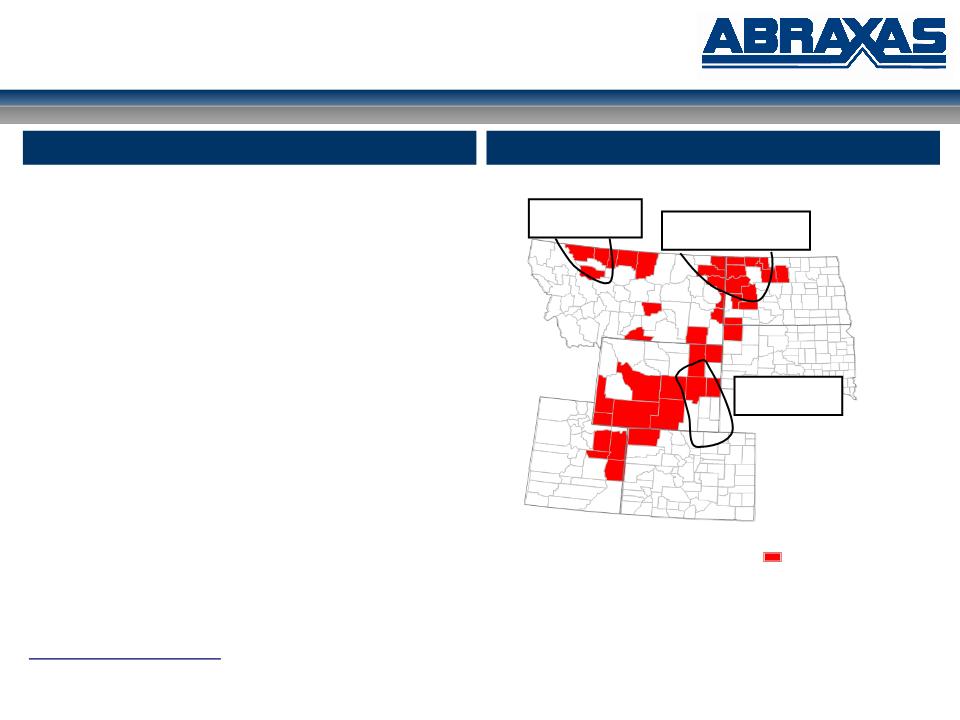

ND

MT

WY

CO

UT

TX

OK

LA

Proved Reserves (MMBoe)(1):

24.9

24.9

- Proved Developed: 56%

- Oil %: 35%

- Operated: 82%

- Operated: 82%

Abraxas Petroleum Corporation

(1) Net proved reserves as of December 31, 2009

Bakken / Three Forks

Play

Barnett / Woodford

Shale Play

Wolfberry Trend

Rocky Mountain

Mid-Continent

Permian Basin

Gulf Coast

Eagle Ford Shale Play

High Quality Assets

Alberta

Niobrara Play

Alberta Basin

Bakken Play

Alberta

Wolfbone Play

8

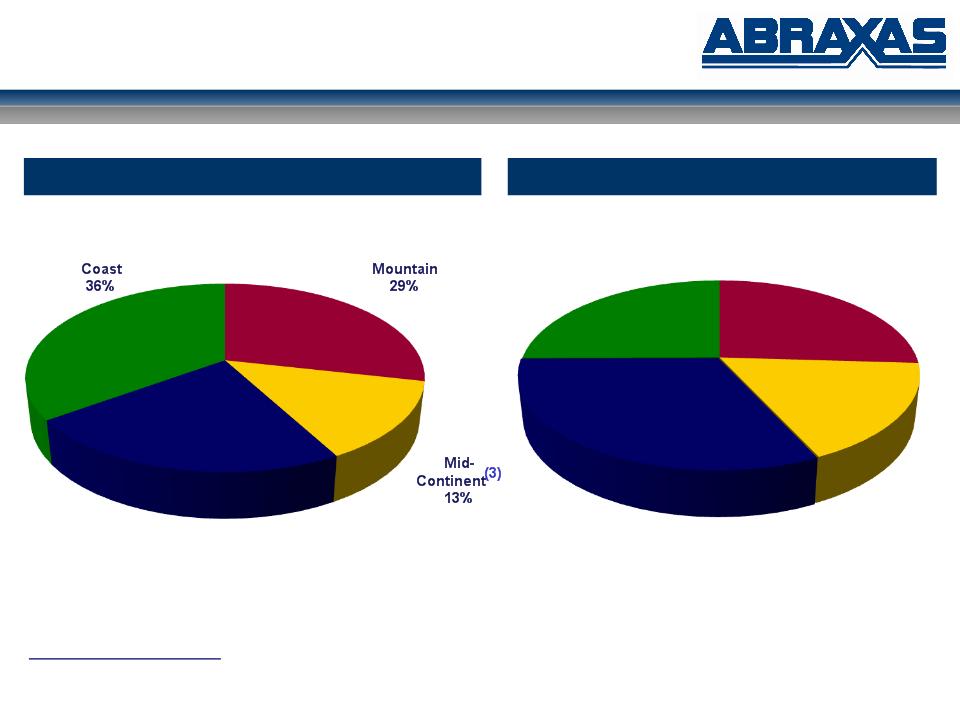

Reserve / Production Summary

Proved Reserves(1) - 24.9 MMBoe

Production(2) - 3,875 Boepd

(1) Net proved reserves as of December 31, 2009

(2) Daily net production for the quarter ended September 30, 2010

(3) 2010 divestitures of non-core assets, primarily in the Mid-Continent region, represented ~2.0 mmboe of proved reserves

Rocky

Permian

Basin

22%

Onshore Gulf

Rocky

Mountain

28%

Mid-

Continent

13%

Permian

Basin

32%

Onshore Gulf

Coast

27%

9

2011 Capital Budget

§ Large inventory of drilling locations in unconventional and conventional oil plays

§ 1H:11 oil weighted drilling program focused on low-risk / high-return Texas conventional

oil projects

oil projects

§ 2H:11 accelerate operated drilling activity in the Bakken and Three Forks plays

§ Approximately 70% of undeveloped acreage is held by production

(1) Unrisked locations based on six wells (three Bakken and three Three Forks) per 1,280 acre units; 160 acre spacing assumptions in both the Eagle Ford and Niobrara Shale

plays

plays

(2) Eagle Ford Shale acreage and locations are gross to the Blue Eagle JV which Abraxas currently owns a 50% equity interest. At full funding Abraxas will own a 25% equity

interest in the JV

interest in the JV

|

Project Area

|

|

Net Acres

|

|

Net Unrisked

Locations(1) |

|

2011 Drilling

Program |

|

2011 Net Capital

($MM) |

|

|

|

|

|

|

|

|

Gross

|

Net

|

|

|

|

Bakken / Three Forks

|

|

20,835

|

|

98

|

|

15.0

|

3.0

|

|

$21.8

|

|

Eagle Ford Shale(2)

|

|

8,333

|

|

52

|

|

4.0

|

4.0

|

|

$0.0

|

|

Niobrara Shale

|

|

18,700

|

|

117

|

|

1.0

|

1.0

|

|

$5.0

|

|

Pekisko Fairway

|

|

9,120

|

|

10

|

|

4.0

|

4.0

|

|

$12.0

|

|

Alberta Bakken

|

|

10,000

|

|

-

|

|

-

|

-

|

|

-

|

|

Texas Oil Plays

|

|

8,700

|

|

65

|

|

14.0

|

14.0

|

|

$10.4

|

|

Other

|

|

n/a

|

|

n/a

|

|

6.0

|

6.0

|

|

$10.8

|

|

Total:

|

|

75,688

|

|

342

|

|

44.0

|

32.0

|

|

$60.0

|

10

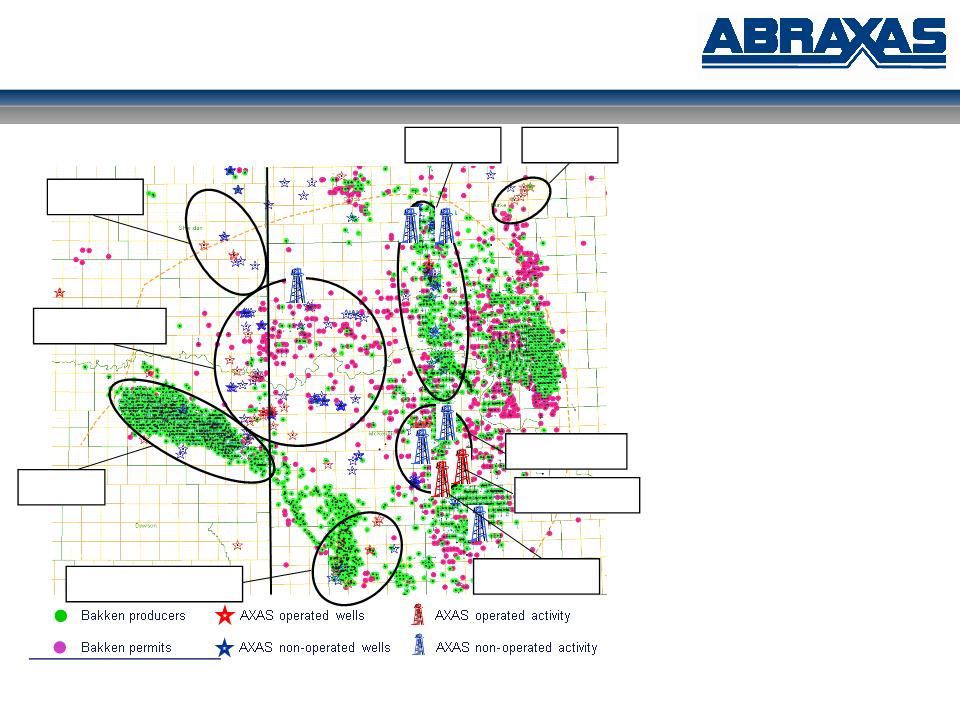

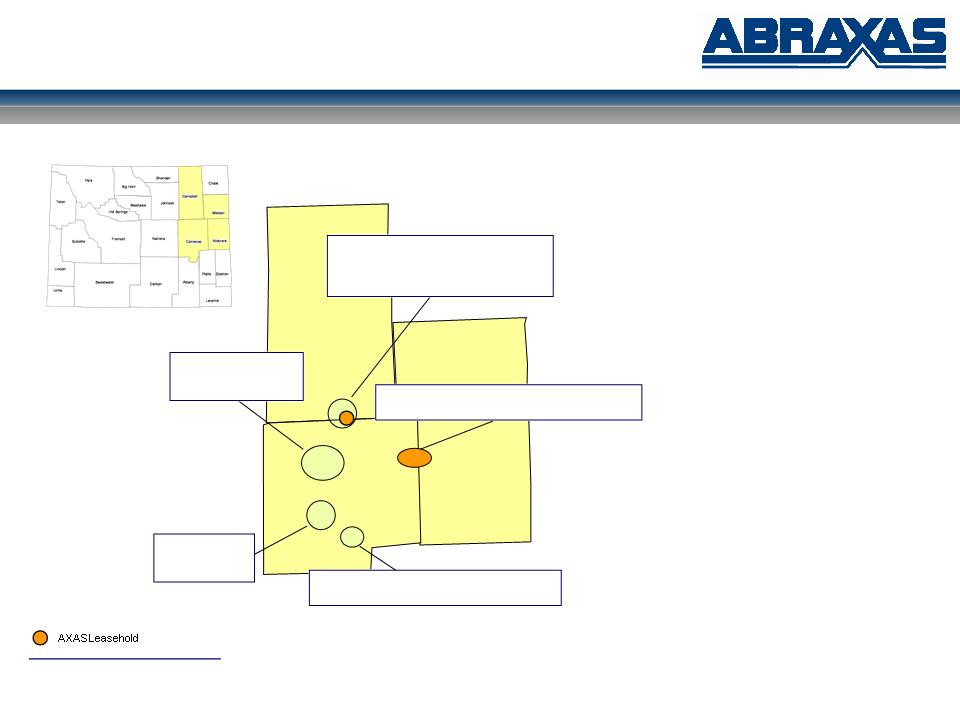

Bakken / Three Forks

Montana North Dakota

Nesson

2,270 net acres

Elm Coulee

440 net acres

Elkhorn Ranch / Lewis & Clark

2,035 net acres

Harding / Rough Rider

7,010 net acres

Carter

3,200 net acres

Sheridan

2,340 net acres

1

North Fork / Nesson

3,540 net acres

§ Gross / Net Acres:

§ 109,658 / 20,835

§ ~100% held by production

§ Drilling Inventory (1,280 acre units):

§ ~514 gross / 98 net

§ 3 Bakken / 3 Three Forks wells per

unit

unit

§ Economics:

§ D&C Cost: $7.5 MM

§ EUR: 500 mboe

§ Recent Activity:

§ 1st operated Three Forks well (Ravin

26-35 1H; 60% w.i.) - 1,705 boe/d

unrestricted rate

26-35 1H; 60% w.i.) - 1,705 boe/d

unrestricted rate

§ 1st operated Middle Bakken well

(Stenehjem 27-34 1H; 79% w.i.) -

completion expected in 1Q:11

(Stenehjem 27-34 1H; 79% w.i.) -

completion expected in 1Q:11

§ 10 gross / 0.35 net non-operated wells

§ 2011 Planned Activity:

§ $22.0 MM budget

§ 5.0 gross / 2.5 net operated wells

§ 10.0 gross / 0.5 net non-operated

wells

wells

Ravin 26-35 1H - TFS

1,705 boe/d

Stenehjem 27-34 1H

Bakken - WOC

11

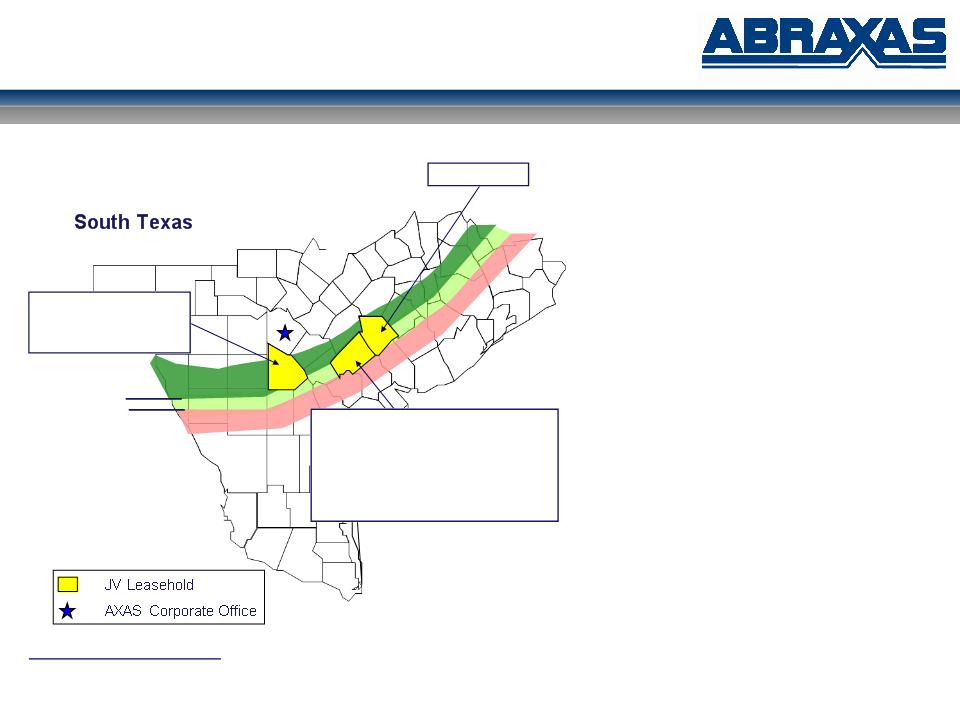

Eagle Ford Shale

§ Acreage(1):

§ 8,333

§ Atascosa, DeWitt, and Lavaca Counties, TX

§ Drilling Inventory(1):

§ 52 net JV locations

§ 160 acre spacing

§ Economics:

§ D&C Cost: $7.0 MM

§ EUR: 500 mboe

§ Blue Eagle Joint Venture:

§ AXAS operator

§ AXAS contributed 8,333 net acres

§ 50% equity interest

§ Rock Oil contributed $25 MM at closing

§ Rock Oil committed additional $50 MM

§ Upon full funding, AXAS equity interest - 25%

§ Recent Activity:

§ 1st well: T Bird 1H - 15 stage frac: flowing back

§ 2nd well: Grass Farms 1H - 2Q:11

§ 2011 Planned Activity(1):

§ $28 MM to drill 4.0 wells

§ Funded 100% by Rock Oil

(1) AXAS held 8,333 net acres prior to entering into the Blue Eagle Joint Venture. At formation of the JV, AXAS held a 50% equity interest in the JV which will decrease to 25% upon

partner fully funding the additional $50MM capital commitment

partner fully funding the additional $50MM capital commitment

Lavaca County

Atascosa County IP Rates:

EOG: Peeler 2H: 605 bo/d

EOG: Peeler 10H: 342 bo/d

EOG: Hundley 2H: 493 bo/d

DeWitt County IP Rates:

Enduring: Keach GU 1: 3,633 boe/d

TLM: Halepeska Gas Unit 1: 2,665 boe/d

PXD: Charles Riedesel GU 1: 2,616 boe/d

HK: Oliver B 1H: 1,968 boe/d

HK: Krause 1H: 1,667 boe/d

HK: Lanik 1H: 1,404 boe/d

AXAS: T-Bird 1H: 15-stage frac: flowing back

oil window

gas window

gas/condensate

window

12

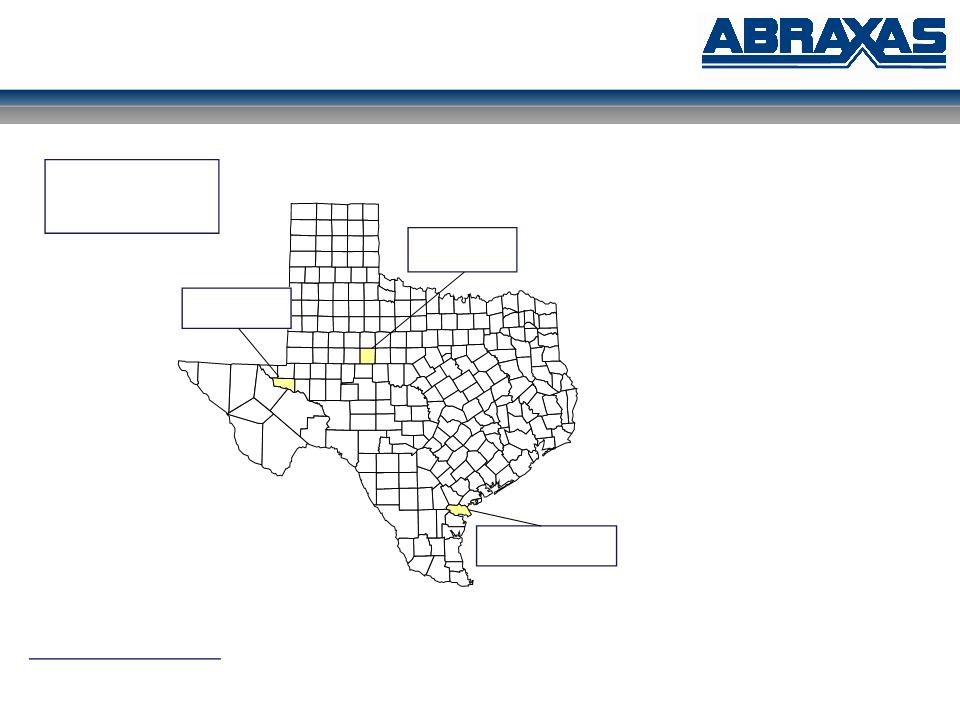

Low Risk Oil Development

West Texas - Spires Ranch

§ Gross / Net Acres: 5,600 (100% w.i.)

§ County / Formation: Nolan / Strawn

§ Locations: 10

§ D&C: $1.6 MM / EUR: 112 mboe

§ 2011 Capex / Activity:

§ $3.2 MM to drill 2.0 wells in 1H:11

West Texas - Shallow Howe

§ Gross / Net Acres: 2,000 (100% w.i.)

§ County / Formation: Ward / Yates

§ Locations: 40

§ D&C: $400K / EUR: 40 mboe

§ 2011 Capex / Activity:

§ $1.6 MM to drill 4.0 wells in 1H:11

South Texas - Portilla

§ Gross / Net Acres: 1,100 (100% w.i.)

§ County / Formation: San Patricio / Frio

7,400 and 8,100 sands

7,400 and 8,100 sands

§ Locations: 15

§ D&C: $700K - $900K / EUR: 47 - 88 mboe

§ 2011 Capex / Activity:

§ $5.6 MM to drill 8.0 infill wells in 1H:11

Portilla;

San Patricio County

Spires Ranch;

Nolan County

Shallow Howe;

Ward County

ROR%:

Spires Ranch: 145%

Shallow Howe: >1,000%

Portilla: 646%

13

Campbell

Converse

Niobrara

Weston

Niobrara Shale

Converse / Niobrara Counties, Wyoming

CHK / EOG:

Niobrara Permit

activity

activity

§ Gross / Net Acres:

§ 20,800 / 18,700

§ Primarily in Converse and

Niobrara Counties

Niobrara Counties

§ ~90% held by production

§ ~3,000 net acres in Campbell

County directly offsetting EOG

producing well

County directly offsetting EOG

producing well

§ Drilling Inventory:

§ 130 gross / 117 net locations

§ 160 acre spacing

§ Economics:

§ D&C Cost: $5.0 MM

§ EUR: 250 mboe

§ Recent Activity:

§ 12 wells drilled to date

(7 horizontal / 5 vertical)

(7 horizontal / 5 vertical)

§ 1 vertical Niobrara

§ 2011 Planned Activity:

§ $5.0 MM to drill 1.0 gross/net well

§ Other:

§ 23 sq. miles proprietary 3D

seismic data

seismic data

§ Full-diameter core data

EOG Crossbow Area:

3-19H: (Cum Oil 34 mbo / Gas 145 mmcf)

2-18H: (Cum Oil 57 mbo / Gas 428 mmcf)

15 Permits

SWN / Samson / Helis:

10 Hrz. Permits;

1 completion

1 completion

CHK:

Sims 15-26H: (Cum Oil 19 mbo / Gas 634 mmcf)

AXAS Activity:

Sage Grouse 3H: (Cum Oil 25 mbo / 50 mbo EUR)

14

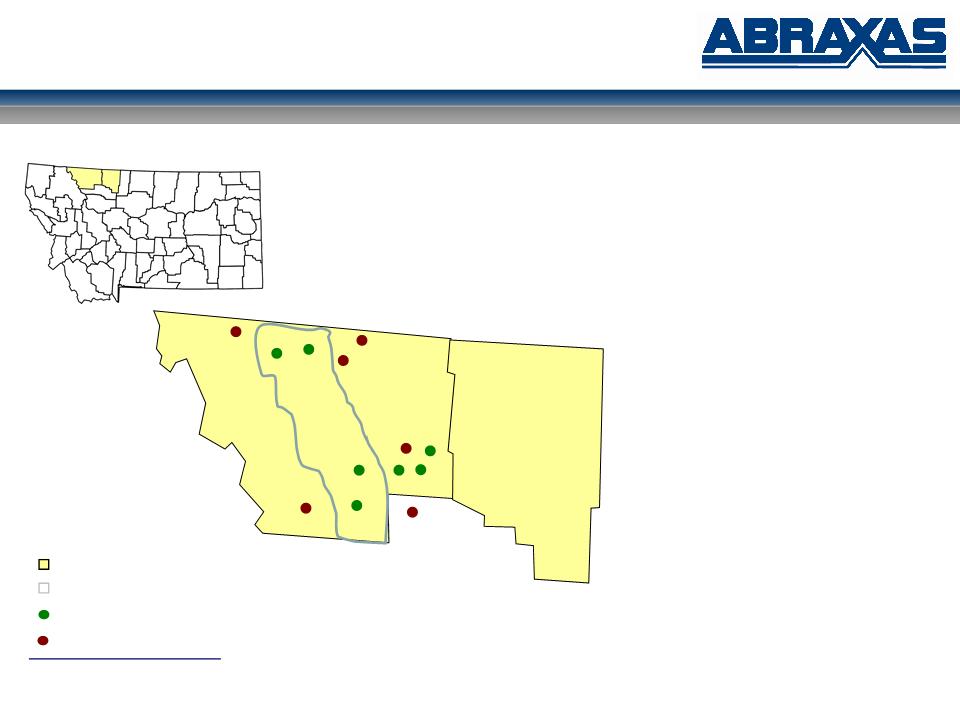

Southern Alberta Basin - Bakken

§ Gross / Net Acres:

§ >10,000 net acres

§ 800 net mineral acres

§ Glacier and Toole Counties, Montana

§ Leases have 5-10 year primary terms

§ 2011 Planned Activity:

§ Continue to add to leasehold position in

geologically specific areas

geologically specific areas

§ Monitor industry drilling activity

AXAS Leasing Area

Blackfoot Nation Territory

Newfield Wells

Rosetta & Others Wells

Toole

Glacier

Glacier / Toole Counties, Montana

15

Business Plan

§ Expanded 2011 CapEx: $60 MM

§ oil development

§ Bakken/TFS - Prudence

§ Eagle Ford - Acceleration with JV

§ Completed divestiture program: ~$33 MM

§ non-core, predominately non-operated

§ pay down debt & accelerate CapEx

§ Target 50/50 oil/gas production mix

§ Target greater than 90% operated

§ NOL preservation

§ Increase investor interest

§ recent equity offering (150+ accounts)

§ Increase analyst coverage

§ 5 new equity analyst

16

Appendix

17

(1) Eagle Ford Shale acreage and locations are net to Abraxas’ 25% equity interest in the Blue Eagle JV at full funding

(2) Possible Bakken/Three Forks locations are based on two additional Bakken and three additional Three Forks wells per 1,280 acre unit

Pro Forma NAV - Undiscounted

2009 PV-10 at Current Pricing

$323,000,000

PF Net Cash

$2,060,000

Proved NAV/Share (Assumes Pro Forma Share Count of 88.4 Million)

$2.69

Bakken / Three Forks

20,835

1280

16.3

500,000

8,138,672

Niobrara Shale

18,700

160

116.9

250,000

29,218,750

Pekisko Fairway

9,120

10.0

150,000

1,500,000

Total Probable Reserve Potential

49,100,078

Probable Reserve Value @$30 Netback

$1,473,002,344

Probable Reserve Value/Share (Risked at 75%)

$12.49

Possible

Bakken / Three Forks(2)

20,835

1280

81.4

500,000

40,693,359

Total Possible Reserve Potential

76,412,109

Possible Reserve Value/Share (Risked at 50%)

$12.96

3P NAV/Share (Risked)

Note: Based on Abraxas estimates

Note: Assumes pro forma share count of 88.4 million

18

(1) Eagle Ford Shale acreage and locations are net to Abraxas’ 25% equity interest in the Blue Eagle JV at full funding

(2) Possible Bakken/Three Forks locations are based on two additional Bakken and three additional Three Forks wells per 1,280 acre unit

Pro Forma NAV - PV Equivalent

2009 PV-10 at Current Pricing

$323,000,000

PF Net Cash

$2,060,000

Proved NAV/Share (Assumes Pro Forma Share Count of 88.4 Million)

$2.69

Bakken / Three Forks

20,835

1280

16.3

500,000

8,138,672

Niobrara Shale

18,700

160

116.9

250,000

29,218,750

Pekisko Fairway

9,120

10.0

150,000

1,500,000

Total Probable Reserve Potential

49,100,078

Probable Reserve Value @$15 Netback

$736,501,172

Probable Reserve Value/Share (Risked at 75%)

$6.25

Possible

Bakken / Three Forks(2)

20,835

1280

81.4

500,000

40,693,359

Total Possible Reserve Potential

76,412,109

Possible Reserve Value/Share (Risked at 50%)

$4.32

3P NAV/Share (Risked)

Note: Based on Abraxas estimates

Note: Assumes pro forma share count of 88.4 million

19

Canada Oil Development - Pekisko

§ Gross / Net Acres:

§ 9,120 (100% w.i.)

§ Drilling Inventory:

§ 10 gross / net locations

§ Economics:

§ D&C Cost: $3.0 MM

§ EUR: 150 mboe

§ Recent Activity:

§ Drilled two horizontal wells to earn

leasehold position

leasehold position

§ 1 shut-in pending recompletion

§ 1 shut-in pending pipeline build out

§ 2011 Planned Activity:

§ $12.0 MM to drill 4.0 gross / net

horizontal wells

horizontal wells

§ Other:

§ Horizontal development of

conventional field

conventional field

§ 5,400’ vertical depth / 4,000’

lateral length

lateral length

Tomahawk

Twining

Pekisko Trend

Alberta, Canada

20

Rocky Mountain

Ø 7.2 MMBoe of proved reserves

Ø 63% proved developed

Ø 82% crude oil

Ø 1,063 Boepd of production

Ø 19.0 R/P ratio

Ø 900 gross (110 net) producing wells

Ø 66 PUD locations

Ø 90,362 net acres

Ø Primary producing basins include:

§ Williston Basin (MT and ND)

§ Powder River & Green River Basins (WY)

§ Uinta Basin (UT)

Ø Bakken / Three Forks - HBP

Rocky Mountain

ND

SD

MT

WY

CO

UT

Area of Operations

Overview

Net proved reserves, well count and acreage as of December 31, 2009

Daily net production for the quarter ended September 30, 2010

Alberta Basin

Bakken Play

Bakken / Three Forks

Play

Niobrara Play

21

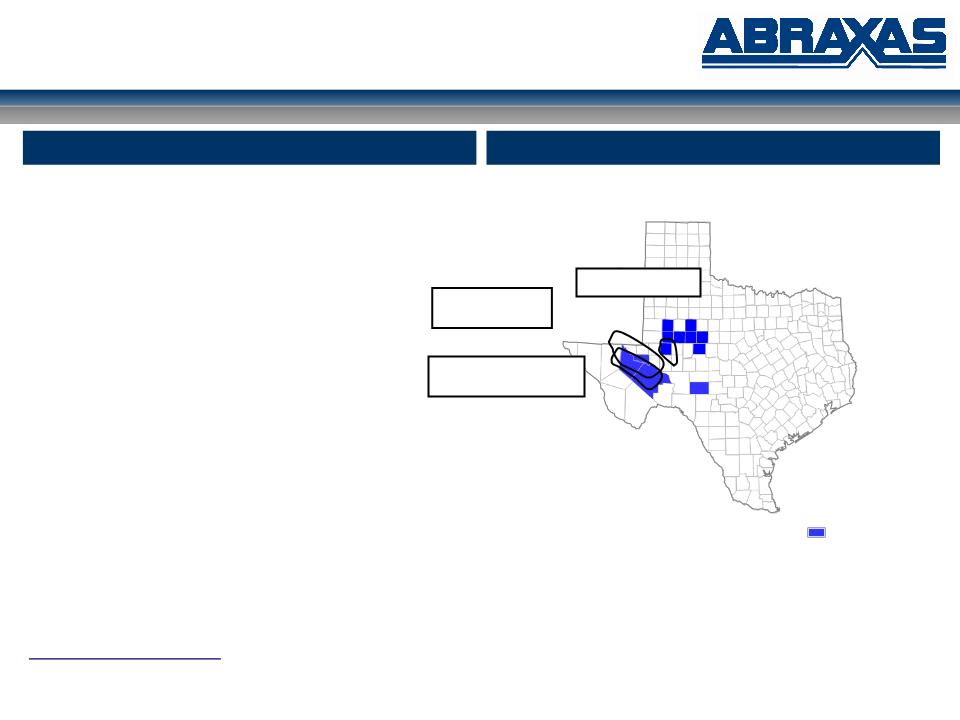

Permian Basin

Permian Basin

Ø 5.6 MMBoe of proved reserves

Ø 66% proved developed

Ø 70% natural gas

Ø 1,254 Boepd of production

Ø 11.9 R/P ratio

Ø 237 gross (158 net) producing wells

Ø 13 PUD locations

Ø 36,064 net acres

Ø Primary producing sub-basins:

§ Delaware Basin

§ Eastern Shelf

TX

Area of Operations

Overview

Barnett / Woodford

Shale Play

Wolfberry Trend

Net proved reserves, well count and acreage as of December 31, 2009

Daily net production for the quarter ended September 30, 2010

Wolfbone Play

22

Gulf Coast

Gulf Coast

Ø 9.0 MMBoe of proved reserves

Ø 38% proved developed

Ø 91% natural gas

Ø 1,044 Boepd of production

Ø 24.5 R/P ratio

Ø 74 gross (48 net) producing wells

Ø 17 PUD locations

Ø 11,414 net acres

Ø Primary producing sub-basin:

§ Onshore Gulf Coast

TX

Area of Operations

Overview

Eagle Ford

Shale Play

Net proved reserves, well count and acreage as of December 31, 2009

Daily net production for the quarter ended September 30, 2010

23

NASDAQ: AXAS