Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): January 25,

2011

|

22nd

CENTURY GROUP, INC.

|

|

(Exact

name of registrant as specified in its

charter)

|

|

Nevada

|

000-54111

|

98-0468420

|

||

|

(State

or other jurisdiction

|

(Commission

File

|

(IRS

Employer

|

||

|

of

incorporation)

|

|

Number)

|

|

Identification

No.)

|

|

8201

Main Street, Suite 6, Williamsville, NY 14221

|

|

(Address

of principal executive offices, including ZIP

code)

|

|

(716)

270-1523

|

|

(Registrant’s

telephone number, including area

code)

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 C.F.R.

§230.425)

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 C.F.R.

§230.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 C.F.R.

§14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 C.F.R.

§13e-4(c))

|

Cautionary

Note Regarding Forward Looking Statements

This Current Report on Form 8-K and

other written reports and oral statements made from time to time by us may

contain “forward-looking statements,” all of which are subject to risks and

uncertainties. You can identify these forward-looking statements by their use of

words such as “expects,” “plans,” “will,” “estimates,” “forecasts,” “projects”

and other words of similar meaning. You can identify them by the fact that they

do not relate strictly to historical or current facts. These statements are

likely to address our growth strategy, financial results and product and

development programs. You must carefully consider any such statement and should

understand that many factors could cause actual results to differ from these

forward-looking statements. These factors include inaccurate assumptions and a

broad variety of other risks and uncertainties, including some that are known

and some that are not. No forward-looking statement can be guaranteed and actual

future results may vary materially.

Information regarding market and

industry statistics contained in this Current Report on Form 8-K is included

based on information available to us that we believes is accurate. It is

generally based on industry and other publications that are not produced for

purposes of securities offerings or economic analysis. We have not reviewed or

included data from all sources, and cannot assure investors of the accuracy or

completeness of the data included in this Current Report on Form 8-K. Forecasts

and other forward-looking information obtained from these sources are subject to

the same qualifications and the additional uncertainties accompanying any

estimates of future market size, revenue and market acceptance of products and

services. We do not assume the obligation to update any forward-looking

statement. You should carefully evaluate such statements in light of factors

described in our filings with the United States Securities and Exchange

Commission (the “SEC”), especially on Forms 10-K, 10-Q and 8-K. In various

filings, we have identified important factors that could cause actual results to

differ from expected or historic results. We note these factors for investors as

permitted by the Private Securities Litigation Reform Act of 1995. You should

understand that it is not possible to predict or identify all such factors.

Consequently, the reader should not consider any such list to be a complete list

of all potential risks or uncertainties.

Explanatory

Note

This

Current Report on Form 8-K is being filed in connection with a series of

transactions consummated by us that relate to the merger by us with 22nd Century

Limited, LLC, and certain related actions taken by us.

This

Current Report on Form 8-K responds to the following items of Form

8-K:

|

Item

1.01

|

Entry

into a Material Definitive

Agreement.

|

|

Item

2.01

|

Completion

of Acquisition or Disposition of

Assets.

|

|

Item

3.02

|

Unregistered

Sales of Equity Securities.

|

|

Item

4.01

|

Change

in Registrant’s Certifying

Accountants.

|

|

Item

5.01

|

Changes

in Control of Registrant.

|

|

Item

5.02

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain

Officers.

|

|

Item

5.03

|

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal

Year.

|

|

Item

5.06

|

Change

in Shell Company Status.

|

|

Item

9.01

|

Financial

Statements and Exhibits.

|

-2-

As used

in this Current Report on Form 8-K and unless otherwise indicated, the terms the

“Parent,” “we,” “us,” and “our” refer to 22nd Century Group, Inc. after giving

effect to our merger with 22nd Century Limited, LLC, and the related

transactions described below, unless the context requires

otherwise.

|

Item

1.01.

|

Entry into a Material

Definitive Agreement.

|

On January 25, 2011, 22nd Century

Group, Inc., a Nevada corporation (the “Parent”) entered into an Agreement and

Plan of Merger and Reorganization (the “Merger Agreement”) by and among Parent,

22nd Century Limited, LLC, a privately held Delaware limited liability company

(“22nd Century”), and 22nd Century Acquisition Subsidiary, a newly formed,

wholly-owned Delaware limited liability company subsidiary of Parent

(“Acquisition Sub”). Upon the closing of the merger transaction

contemplated under the Merger Agreement (the “Merger”), Acquisition Sub was

merged with and into 22nd Century, and 22nd Century, as the surviving entity,

became a wholly-owned subsidiary of Parent.

The Merger Agreement and the Merger are

described in Item 2.01 below, which disclosure is incorporated herein by

reference.

Prior to the transactions contemplated

by the Merger Agreement with 22nd Century, there were no material relationships

between Parent and 22nd Century, or any of their respective affiliates,

directors or officers, or any associates of their respective officers or

directors.

|

Item

2.01.

|

Completion

of Acquisition or Disposition of

Assets.

|

The

Merger

On January 25, 2011, Parent entered

into the Merger Agreement with 22nd Century and Acquisition Sub. Upon

closing of the Merger on January 25, 2011, Acquisition Sub was merged with and

into 22nd Century, and 22nd Century became a wholly-owned subsidiary of

Parent. Pursuant to the terms and conditions of the Merger

Agreement:

|

·

|

Prior

to the closing of the Merger, Parent (i) obtained forgiveness of all its

outstanding promissory notes in the aggregate principal amount of

$162,327, (ii) cancelled the 386,389 shares of the Parent’s common stock,

$0.00001 par value per share (the “Common Stock”), held by Milestone

Enhanced Fund Ltd. and 10,015,200 shares of Common Stock held by Nanuk

Warman, (iii) entered into contractual agreements with certain

shareholders of Parent pursuant to which an aggregate of 139,800 shares of

Common Stock (the “Contractual Cancellations”) will be cancelled as soon

as practicable following the closing of the Merger (such 139,800 shares of

Common Stock being deemed to be no longer issued and outstanding as of

January 25, 2011) and (iv) effected a 2.782-for-one forward stock split by

way of dividend and subsequent cancellation to ensure that the pre-Merger

shareholders of Parent owned an aggregate of 5,325,200 shares of Common

Stock immediately prior to the closing of the Merger, such 5,325,200

shares of Common Stock representing approximately 19.9% of the issued and

outstanding shares of Common Stock immediately following the closing of

the Merger. In addition, prior to the closing of the Merger,

Parent transferred all of its pre-Merger operating assets and remaining

liabilities to Touchstone Split Corp., a Delaware corporation and

wholly-owned subsidiary of Parent (the “Split-Off Subsidiary”) pursuant to

the terms of that certain Split-Off Agreement dated as of January 25, 2011

by and between Parent, David Rector (the “Buyer”), and the Split-Off

Subsidiary (the “Split-Off Agreement”). Prior to the Merger and

pursuant to the terms of the Split-Off Agreement, Parent transferred and

sold all of the issued and outstanding shares of capital stock of the

Split-Off Subsidiary to Buyer in exchange for $1, such consideration being

deemed to be adequate by Parent’s board of

directors;

|

-3-

|

·

|

Prior

to the closing of the Merger, Parent adopted an equity incentive plan and

reserved 4,250,000 shares of Common Stock for issuance as incentive awards

to officers, directors, employees and other qualified persons in the

future;

|

|

·

|

Prior

to the closing of the Merger, 22nd Century completed a private placement

offering (the “Private Placement Offering”) of 5,434,446 securities (the

“PPO Securities”) at the purchase price of $1.00 per PPO Security (the

“PPO Price”), each such PPO Security consisting of one (1) limited

liability company membership interest unit of the 22nd Century (each, a

“Unit”) and a five year warrant to purchase one half of one (1/2) Unit at

an exercise price of $1.50 per whole

Unit;

|

|

·

|

In

conjunction with the Private Placement Offering, 22nd Century issued to

Rodman & Renshaw, LLC a non-transferrable five-year warrant to

purchase 394,755 Units of 22nd Century at an exercise price of $1.50 per

Unit and issued to Gottbetter Capital Markets, LLC a non-transferrable

five-year warrant to purchase 40,000 Units of 22nd Century at an exercise

price of $1.50 per Unit;

|

|

·

|

At

the closing of Merger, Parent issued to Rodman & Renshaw, LLC a

non-transferrable five-year warrant to purchase 500,000 shares of Common

Stock at an exercise price of $1.50 per share in connection with the

provision of financial advisory services to

Parent;

|

|

·

|

At

the closing of the Merger, each Unit of 22nd Century issued and

outstanding immediately prior to the closing of the Merger was exchanged

for one (1) share of Common Stock, and each warrant to purchase Units of

22nd Century was exchanged for one warrant of like tenor and term to

purchase shares of Common Stock. An aggregate of 21,434,446

shares of Common Stock and warrants to purchase an aggregate of 8,151,980

shares of Common Stock were issued to the holders of Units and warrants,

respectively, of 22nd Century, and immediately following the closing of

the Merger an aggregate of 26,759,646 shares of Common Stock were issued

and outstanding and an aggregate of 10,220,000 shares are Common Stock

were reserved for issuance pursuant to the exercise of warrants to

purchase shares of Common Stock;

|

|

·

|

Upon

the closing of the Merger, the board of directors was expanded and

reconstituted, as described below;

|

|

·

|

Pursuant

to the terms of the Merger Agreement, Parent assumed all of 22nd Century’s

obligations, including those related to 22nd Century’s outstanding

warrants;

|

|

·

|

Each

of Parent, 22nd Century and Acquisition Sub provided customary

representations and warranties, pre-closing covenants and closing

conditions in the Merger Agreement;

and

|

-4-

|

·

|

Following

(i) the closing of the Merger, (ii) the closing of the Private Placement

Offering for $5,434,446, (iii) Parent’s cancellation of 386,389 shares

Common Stock held by Milestone Enhanced Fund Ltd. and 10,015,200 shares of

Common Stock held by Nanuk Warman, (iv) consummation of the Split-Off

Agreement and the transactions contemplated thereby, and (v) taking into

account a 2.782-for-one forward stock split by way of dividend of the

shares of Common Stock that took place on November 29, 2010 (with any

resulting fractional shares being rounded upward to the nearest whole

share) and subsequent cancellation as well as the Contractual

Cancellations, there were 26,759,646 shares of Common Stock issued and

outstanding. Approximately 59.8% of such issued and outstanding

shares were held by individuals and entities that were holders of Units of

22nd Century prior to consummation of the Private Placement Offering,

approximately 20.3% were held by the investors in the Private Placement

Offering and approximately 19.9% were held by the pre-Merger stockholders

of Parent.

|

The foregoing description of the Merger

Agreement does not purport to be complete and is qualified in its entirety by

reference to the complete text of the Merger Agreement, which is filed as

Exhibit 2.1 hereto and incorporated herein by reference.The Merger and related

transactions were approved by the holders of a requisite number of 22nd Century

Units pursuant to written consent dated as of December 15, 2010.

The shares of Common Stock issued to

former holders of 22nd Century Units in connection with the Merger, and 22nd

Century Units and warrants to purchase Units issued in the Private Placement

Offering, were not registered under the Securities Act of 1933, as amended (the

“Securities Act”), and were issued and sold in reliance upon the exemption

from registration provided by Section 4(2) and Section 4(6) of the Securities

Act or pursuant to Regulation D or Regulation S promulgated

thereunder. These securities may not be offered or sold in the United

States absent registration or an applicable exemption from the registration

requirements. Certificates representing these securities contain a legend

stating the same.

The 5,325,200 shares of Common Stock

issued and outstanding immediately prior to the closing of the Merger constitute

the entirety of Parent’s “public float” eligible for resale without further

registration by the holders thereof. Additional shares of Common Stock will be

eligible for resale at such time as a further registration statement is filed

and declared effective pursuant to the Securities Act or at such time as

additional shares of Common Stock are eligible to be resold pursuant to an

exemption from registration under the Securities Act.

Changes

Resulting from the Merger

Parent intends to carry on 22nd

Century’s business as its sole line of business. Parent has relocated

its executive offices to 8201 Main Street, Suite 6, Williamsville, NY 14221 and

its telephone number is (716) 270-1523.

The Parent intends to adopt the fiscal

year of 22nd Century, which ends December 31.

Changes

to the Board of Directors and Officers

In connection with the Merger, the

Parent’s board of directors was expanded to five (5)members. The sole

officer and sole member of the board of directors prior to the closing of the

Merger, David Rector, resigned as an officer but continues to serve as a member

of the board of directors of Parent. Immediately following the

closing of the Merger, Joseph Pandolfino was appointed to serve as a member of

Parent’s board of directors. As of the date ten (10) days following

the filing of a Schedule 14F-1 with the SEC after the closing of the Merger,

David Rector will resign as a member of Parent’s board of directors and will be

replaced by an individual appointed by the pre-Merger stockholders of

Parent. Each of Henry Sicignano III, Joseph Alexander Dunn, Ph.D.,

and James W. Cornell will also be appointed to serve as members of Parent’s

board of directors as of that date. Immediately following the closing

of the Merger, Joseph Pandolfino was appointed as our Chief Executive Officer,

Henry Sicignano III was appointed as our President and Secretary, and C. Anthony

Rider was appointed as our Chief Financial Officer and

Treasurer.

-5-

All directors hold office for one-year

terms until the election and qualification of their

successors. Officers are elected by the board of directors and serve

at the discretion of the board.

Accounting

Treatment

The Merger is being accounted for as a

reverse acquisition and recapitalization of 22nd Century for financial

accounting purposes whereby 22nd Century is deemed to be the acquirer for

accounting and financial reporting purposes. Consequently, the assets and

liabilities and the historical operations that will be reflected in the

financial statements prior to the Merger will be those of 22nd Century and will

be recorded at the historical cost basis of 22nd Century, and the consolidated

financial statements after completion of the Merger will include the assets and

liabilities of Parent and 22nd Century, historical operations of 22nd Century

and operations of Parent beginning on the closing date of the Merger. As a

result, all the historical financial information reported herein is 22nd

Century’s.

Tax

Treatment; Smaller Reporting Company

The transfer of operating assets and

liabilities to the Split-Off Subsidiary, the forgiveness of indebtedness by

certain shareholders of Parent, and the Split-Off of the Split-Off Subsidiary,

will result in taxable income to Parent in an amount equal to the difference

between the fair market value of the assets transferred and Parent’s tax basis

in the assets. Any gain recognized, to the extent not offset by Parent’s net

operating losses carry-forwards, if any, will be subject to federal income tax

at regular corporate income tax rates.

The exchange of Membership Units for

Common Stock in the Merger is expected to qualify for treatment as a tax-free

transfer under section 351 of the United States Internal Revenue Code (“IRC”) as

long as the exchange results in the members of 22nd Century Limited, LLC

immediately prior to the Merger having at least 80% “control” (within the

meaning of IRC §351(a)) of Parent immediately following the Merger and certain

other requirements are met. If the Merger qualifies as a tax-free transfer under

IRC § 351, the shares of Common Stock received in the exchange will have the

same tax basis as the Membership Units for which they were exchanged. A

“significant transferor” (as defined in Treas. Reg. §1.351-3(d)(1)) will be

required to include certain information with his income tax return for the year

of the Merger.

Parent will continue to be a “smaller

reporting company,” as defined in Regulation S-K under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), following the Merger.

Company

Background

Parent was formed as a Nevada

corporation on September 12, 2005 to engage in the acquisition, exploration and

development of mineral deposits and reserves. Parent has been in a

development stage since its inception and had minimal business operations prior

to the Merger. Immediately prior to the closing of the Merger, the

existing asset and liabilities of Parent were disposed of pursuant to the

cancellation of certain indebtedness owed to shareholders of Parent, the

cancellation of certain shares of Common Stock held by shareholders of Parent,

and the Split-Off.

-6-

22nd Century was formed as a New

York limited liability company on February 20, 1998 as 21st Century

Limited, LLC, which merged with a newly-formed Delaware limited liability

company, 22nd Century Limited, LLC on November 29, 1999. Our offices

are located in Williamsville, New York. Since beginning operations,

we have worked to modify the content of nicotine alkaloids in tobacco plants

through genetic engineering and plant breeding.

After the Merger with Parent, Parent

succeeded to the business of 22nd Century as its sole line of

business.

Company

Overview

Founded

in 1998, we are a plant biotechnology company and a global leader in modifying

the content of nicotinic alkaloids in tobacco plants through genetic engineering

and plant breeding. We own or exclusively control 97 issued patents in 79

countries where at least 75% of the world’s smokers reside. We believe that our

proprietary technology will enable us to capture a significant share of the

global market for approved smoking cessation aids and the emerging market for

modified risk tobacco products.

We plan

to use a substantial portion of the proceeds of the Private Placement Offering

to complete the remaining clinical trials necessary to seek approval from the

U.S. Food and Drug Administration (“FDA”) for X-22, our prescription

smoking cessation aid. X-22 will be a

prescription-only kit containing very low nicotine (“VLN”) cigarettes made from

our proprietary tobacco, which has 95% less nicotine compared to tobacco in

existing “light” cigarettes. The therapy protocol allows the patient to smoke

our VLN cigarettes without restriction over the six-week treatment period to

facilitate the goal of the patient quitting smoking by the end of the treatment

period. We believe this therapy protocol has been successful because VLN

cigarettes made from our proprietary tobacco satisfy smokers’ cravings for

cigarettes while (i) greatly reducing nicotine exposure and nicotine dependence

and (ii) extinguishing the association between the act of smoking and the rapid

delivery of nicotine. We believe X-22 will be more attractive

to smokers than other therapies since it smokes and tastes like a typical

cigarette, involves the same smoking behavior, and does not expose the smoker to

any new drugs or new side effects.

We have

met with the FDA regarding the remaining X-22 clinical trials and,

based on the FDA’s guidance, we plan to conduct a small Phase II-B trial and two

larger and concurrent Phase III trials with the same protocols, all of which

entail measuring the quitting efficacy of the X-22 cigarette against a

typical cigarette with conventional nicotine content that is visually

indistinguishable from X-22. We believe that X-22 will qualify for “Fast

Track” designation by the FDA, and that we will obtain FDA approval for X-22 in the fourth quarter of

2012 at the earliest.

Independent

studies, including two Phase II clinical trials, have demonstrated that VLN

cigarettes made from our proprietary tobacco are at least as effective as

FDA-approved smoking cessation aids. Due to the limited effectiveness and/or

serious side effects of existing FDA-approved smoking cessation products, we

believe that we are well-positioned to capture a significant share of this

market. Since X-22 is

the only smoking cessation product that functions exactly like a regular

cigarette, it will not only take sales and market share from existing smoking

cessation products, but it will also expand the smoking cessation market by

encouraging more smokers to attempt to quit smoking.

We intend

to seek FDA authorization to market BRAND A and BRAND B as Modified Risk

Cigarettes. Compared to other commercial cigarettes, the tobacco in BRAND A has approximately 95%

less nicotine than tobacco in cigarettes marketed as “light” cigarettes and

BRAND B’s smoke

contains the lowest amount of tar per milligram of nicotine. We believe that

BRAND A and BRAND B will achieve

significant market share in the global cigarette market among smokers who will

not quit but are interested in reducing the harmful effects of

smoking.

-7-

The 2009

Family Smoking Prevention and Tobacco Control Act, or Tobacco Control Act,

granted the FDA authority over the regulation of all tobacco products. While it

prohibits the FDA from banning cigarettes outright, it allows the FDA to require

the reduction of nicotine or any other compound in cigarettes. The Tobacco

Control Act also banned all sales in the U.S. of cigarettes with flavored

tobacco (other than menthol). As of June 2010, all cigarette companies were

required to cease the use of the terms “low tar,” “light” and “ultra light” in

describing cigarettes sold in the U.S. We believe this new regulatory

environment represents a paradigm shift for the tobacco industry and will create

opportunities for us in marketing BRAND A and BRAND B and in licensing our

proprietary technology and tobaccos to larger competitors. Within our two

product categories, the Tobacco Control Act offers us the following specific

advantages:

Smoking

Cessation Aids

FDA

approval must be obtained, as has been the case for decades, before a product

can be marketed for quitting smoking or reducing withdrawal symptoms. The

Tobacco Control Act provides that products for smoking cessation, such as X-22, be considered for “Fast

Track” designation by the FDA. The “Fast Track” programs of the FDA are intended

to facilitate development and expedite review of drugs to treat serious and

life-threatening conditions so that an approved product can reach the market

expeditiously. We believe that X-22 will qualify for “Fast

Track” designation by the FDA.

Modified

Risk Cigarettes

For the

first time in history, the FDA will evaluate cigarettes that may pose lower

health risks as compared to conventional cigarettes. The Tobacco Control Act

establishes procedures for the FDA to regulate the labeling and marketing of

Modified Risk Cigarettes and requires the FDA to issue additional guidance

regarding applications that must be submitted to the FDA for approval to market

these Modified Risk Cigarettes. We believe, based in part on the timelines

contained in the Tobacco Control Act, that the FDA will issue such guidance in

2011 and we also believe that BRAND A and BRAND B will qualify as

Modified Risk Cigarettes under these guidelines. In addition, the Tobacco

Control Act allows the FDA to mandate the use of reduced risk technologies in

conventional cigarettes which could create opportunities for us to license our

technology and/or tobaccos.

Tar,

Nicotine, and Smoking Behavior

The

dependence of many smokers on tobacco is largely due to the properties of

nicotine, but the adverse effects of smoking on health are mainly due to other

components present in tobacco smoke, including tar and carbon monoxide. “Tar” is

the common name for the (resinous) total particulate matter minus nicotine and

water produced by the burning of tobacco (or other plant material) during the

act of smoking. Tar and nicotine are commonly measured in milligrams per

cigarette trapped on a Cambridge filter pad under standardized conditions using

smoking machines. These results are referred to as “yields” or, more

specifically, tar yield and nicotine yield.

Individual

smokers generally seek a certain amount of nicotine per cigarette and can easily

adjust how intensely each cigarette is smoked to obtain a satisfactory amount of

nicotine. Smoking of low yield (“light” or “ultra light”) cigarettes compared to

high yield (“full flavor”) cigarettes often results in taking more puffs per

cigarette, larger puffs and/or smoking more cigarettes per day to obtain a

satisfactory amount of nicotine, a phenomenon known as “compensation” or

“compensatory smoking.” A report by the National Cancer Institute in 2001 stated

that due to compensatory smoking, low yield cigarettes are not safer than high

yield cigarettes, which is the reason that the Tobacco Control Act has banned

the use of the terms “low tar,” “light” and “ultra light” in the U.S. market.

Studies have shown that smokers do not compensate when smoking cigarettes made

with our VLN tobacco, and that smoking VLN cigarettes actually assist smokers to

smoke fewer cigarettes per day and reduce their exposure to tar and nicotine.

Other studies have shown that non-commercial cigarettes with low tar-to-nicotine

ratios (tar yield divided by nicotine yield from smoking machines), such as

BRAND B, result in

smokers inhaling less tar and carbon monoxide (CO).

-8-

Market

Cigarettes

and Smoking Cessation Aids

The U.S.

cigarette market consists of approximately 44 million adult smokers who spent

approximately $75 billion in 2009 on 320 billion cigarettes. The World Health

Organization (“WHO”) predicts that the current 1.3 billion smokers worldwide

will increase to 1.7 billion smokers by the year 2025. Worldwide manufacturer

sales in 2009 were 5.91 trillion cigarettes, which has been increasing at

approximately 1.0% per year, resulting in annual retail sales of over $300

billion. Our products address unmet needs of smokers; for those who want to

quit, an innovative smoking cessation aid, and for those who do not quit,

cigarettes that can reduce the level of exposure to nicotine, tar and other

chemicals in cigarettes they smoke.

In 2009,

annual sales of smoking cessation aids in the U.S., all of which must be

approved by the FDA, were approximately $1.0 billion. Outside the United States,

the smoking cessation market is in its infancy. Visiongain estimates the 2008

global smoking cessation market at approximately $3.0 billion. According to

Datamonitor, the prescription smoking cessation market in the United States,

Germany, United Kingdom, France, Italy, Spain and Japan is expected to grow at a

compound annual rate of 16%, reaching approximately $4.6 billion by 2016. This

figure does not consider China, Russia, Brazil, India and other large smoking

markets.

Approximately

50% of U.S. smokers attempt to quit smoking each year, but only 2% to 5%

actually quit smoking in a given year. It takes smokers an average of 8 to 11

“quit attempts” before achieving long-term success. Approximately 95% of

“self-quitters” (i.e., those who attempt to quit smoking without any treatment)

relapse and resume smoking. The Institute of Medicine, the health arm of the

National Academy of Sciences, in a 2007 report concludes: “There is an enormous

opportunity to increase population prevalence of smoking cessation by reaching

and motivating the 57 percent of smokers who currently make no quit attempt per

year.” We believe that our X-22 smoking cessation aid

will be attractive to smokers who have been frustrated in their previous

attempts to quit smoking using other therapies.

Use of

existing smoking cessation aids results in relapse rates that can be as high as

90% in the first year after a smoker initially “quits.” Smokers currently have

only the following limited choices of FDA-approved products to help them quit

smoking:

|

·

|

varenicline

(Chantix®/Champix® outside the U.S.), manufactured by

Pfizer,

|

|

·

|

bupropion

(Zyban®), manufactured by GlaxoSmithKline,

and

|

|

·

|

nicotine

replacement therapy (“NRT”) in several forms — gums, patches,

nasal sprays, inhalers and

lozenges.

|

Chantix®

and Zyban® are pills and are nicotine free. Chantix®, Zyban®, the nicotine nasal

spray and the nicotine inhaler are available by prescription only. Nicotine

gums, nicotine patches, and lozenges are available

over-the-counter.

Chantix®

was introduced in the U.S. market in the fourth quarter 2006. Since 2007,

Chantix® has been the best selling smoking cessation aid in the United States,

with sales of $701 million in 2007, $489 million in 2008 and $386 million in

2009. In July 2009, the FDA required a “Boxed Warning,” the most serious type of

warning in prescription drug labeling, for both Chantix® and Zyban® based on the

potential side effects of these drugs. Despite this warning, sales of Chantix®

in 2009 were approximately $700 million worldwide.

-9-

Other

than Chantix® and Zyban®, the only FDA-approved smoking cessation therapy in the

United States is NRT. These products consist of gums, patches, nasal sprays,

inhalers and lozenges. Nicotine gums and nicotine patches have been sold in the

U.S. for 26 years and 18 years, respectively, and millions of smokers have

already tried NRT products and failed to stop smoking due to the limited

effectiveness of these products. According to Perrigo Company, a pharmaceutical

company that sells NRT products, sales of NRT products in the United States have

averaged approximately $500 million annually from 2007 to 2009.

Modified

Risk Tobacco Products

A

substantial number of adult smokers are unable or unwilling to quit smoking. For

example, each year one-half of the adult smokers in the United States do not

attempt to quit. Nevertheless, we believe the majority of these smokers are

interested in reducing the harmful effects of smoking.

In a 2005

analyst report, The Third

Innovation, Potentially Reduced Exposure Cigarettes (PREPs), JP Morgan

examined the effects of FDA regulation of tobacco, including the market for

safer cigarettes. Its proprietary survey of over 600 smokers found that 90% of

smokers are willing to try a safer cigarette. Among JP Morgan’s other

conclusions, it states: “FDA oversight would imbue PREPS [‘potential reduced

exposure products’ equate to modified risk tobacco products] with a regulatory

‘stamp of approval’ and allow for more explicit comparative health claims with

conventional cigarettes. Consumers should trust the FDA more than industry

health claims.” Up until the Tobacco Control Act became law in 2009, no agency

or body had the authority to assess health claims made by tobacco companies or

set standards for what constitutes reduced risk to smokers.

Some

major cigarette manufacturers have developed and marketed alternative cigarette

products. For example, Philip Morris USA developed an alternative cigarette,

called Accord®, in which the tobacco is heated rather than burned. R.J. Reynolds

Tobacco Company has developed and is marketing an alternative cigarette, called

Eclipse®, in which the tobacco is primarily heated, with only a small amount of

tobacco burned. Philip Morris and RJ Reynolds have indicated that their products

may deliver fewer smoke components compared to conventional cigarettes. Vector

Tobacco Inc. has marketed a cigarette offered in three brand styles with reduced

levels of nicotine, called Quest®. Both Accord® and Eclipse®, which are not

conventional cigarettes (e.g., they do not burn down),

have only achieved limited sales. With the exception of Eclipse®, the above

products are no longer being manufactured.

Complete

cessation from all tobacco and medicinal nicotine products is the ultimate goal

of the public health community; however, some public health officials desire to

migrate cigarette smokers en masse to medicinal nicotine (also known as NRT) or

smokeless tobacco products to replace cigarettes. We believe this is

unattainable in the foreseeable future for many reasons including that the

smoking experience is much more complex than simply seeking nicotine. In a 2009

WHO report, statistics demonstrate that approximately 90% of global tobacco

users smoke cigarettes. Worldwide cigarette sales are approximately 20 times

greater than sales of smokeless tobacco products and approximately 100 times

greater than sales of NRT products. Although a small segment of the smoking

population is willing to use NRT or smokeless tobacco products in conjunction

with cigarettes (known as dual users), a large percentage of smokers is not

interested in using NRT or smokeless tobacco products exclusively.

There are

newer forms of smokeless tobacco products that have been introduced in the

market that are less messy to use than chewing tobacco or dry snuff (since

spitting is not involved). These products include Swedish-style snus and

dissolvable tobacco products such as Ariva® and Stonewall® tablets made by Star

Scientific Inc., and Camel® Orbs, Camel® Strips and Camel® Sticks recently

introduced by R.J. Reynolds Tobacco Company. Although use of such products may

be more discreet and convenient than traditional forms of smokeless tobacco,

they have the same route of delivery of nicotine as nicotine gum and nicotine

lozenges, which have been available over-the-counter in the United States for 15

years and 7 years, respectively, and have not significantly replaced

cigarettes.

-10-

Products

X-22

Smoking Cessation Aid

X-22 is a tobacco-based

botanical medical product for use as a smoking cessation therapy. X-22 will be a

prescription-only kit containing very low nicotine (“VLN”) cigarettes made from

our proprietary tobacco, which has 95% less nicotine compared to tobacco in

existing “light” cigarettes. The therapy protocol allows the patient to smoke

our VLN cigarettes without restriction over the six-week treatment period to

facilitate the goal of the patient quitting smoking by the end of the treatment

period. We believe this therapy protocol has been successful because VLN

cigarettes made from our proprietary tobacco satisfy smokers’ cravings for

cigarettes while (i) greatly reducing nicotine exposure and nicotine dependence

and (ii) extinguishing the association between the act of smoking and the rapid

delivery of nicotine. We also believe X-22 will be more attractive

to smokers than other therapies since it smokes and tastes like a typical

cigarette, involves the same smoking behavior, and does not expose the smoker to

any new drugs or new side effects.

We

further believe that X-22 offers the following

advantages over existing smoking cessation products:

|

·

|

X-22 separates the act

of smoking from the rapid delivery of

nicotine;

|

|

·

|

X-22 is more attractive

than other therapies since it smokes, tastes and smells like a typical

cigarette and involves the same smoking

behavior;

|

|

·

|

X-22 does not expose

smokers to any new drugs or new side effects;

and

|

|

·

|

X-22 is more effective

than other smoking cessation aids

because:

|

|

|

·

|

X-22 provides greater

relief from withdrawal symptoms than the FDA-approved nicotine

lozenge;

|

|

|

·

|

X-22 reduces cravings

more than the FDA-approved prescription nicotine inhaler;

and

|

|

|

·

|

X-22 decreases the

likelihood of relapse (in the case of Chantix®, approximately half of

those who quit relapse within 8 weeks after the end of

treatment).

|

We have

met with the FDA regarding the remaining X-22 clinical trials and,

based on the FDA’s guidance, we plan to conduct a small Phase II-B trial and two

larger and concurrent Phase III trials with the same protocols, all of which

entail measuring the quitting efficacy of the X-22 cigarette against a

typical cigarette with conventional nicotine content that is visually

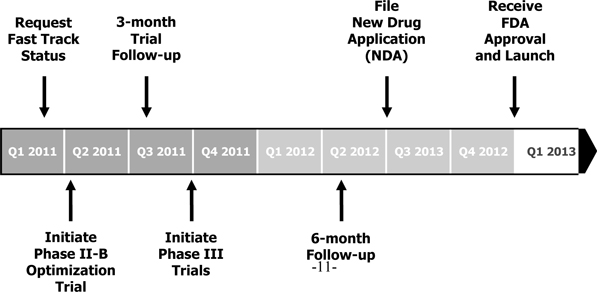

indistinguishable from X-22. As depicted below, we

plan to complete the FDA-approval process for our X-22 smoking cessation aid

and upon such approval launch X-22 in the U.S. market in

the fourth quarter of 2012 at the earliest (as a prescription), and in other top

smoking cessation markets thereafter.

-11-

Our

Modified Risk Cigarettes

We

believe that our BRAND

A and BRAND B

cigarettes will benefit smokers who are unable or unwilling to quit

smoking and who may be attracted to cigarettes which potentially pose a lower

health risk than conventional cigarettes. This includes the approximate one-half

of the 44 million adult smokers in the United States who do not attempt to quit

in a given year. Compared to other commercial cigarettes, the tobacco in BRAND A has approximately 95%

less nicotine than tobacco in cigarettes marketed as “light” cigarettes and

BRAND B’s smoke

contains the lowest amount of tar per milligram of nicotine. We believe that

BRAND A and BRAND B will qualify as

Modified Risk Cigarettes and we intend to seek FDA authorization in 2011 to

market BRAND A and

BRAND B as Modified

Risk Cigarettes. However, the FDA has not yet issued comprehensive guidance

regarding applications that must be submitted to the FDA for Modified Risk

Cigarettes, including the criteria for such authorizations. We believe the FDA

will issue such guidance in 2011.

BRAND

A Cigarettes

Compared

to other commercial tobacco cigarettes, BRAND A has the lowest

nicotine content. The tobacco in BRAND A contains

approximately 95% less nicotine than tobacco in leading “light” cigarette

brands. Clinical studies have demonstrated that smokers who smoke VLN cigarettes

containing our proprietary tobacco smoke fewer cigarettes per day resulting in

significant reductions in smoke exposure, including tar, nicotine and carbon

monoxide. Due to the very low nicotine levels, compensatory smoking does not

occur with VLN cigarettes containing our proprietary tobacco.

In a June

16, 2010 press release, former FDA Commissioner, Dr. David Kessler recommended,

“The FDA should quickly move to reduce nicotine levels in cigarettes to

non-addictive levels. If we reduce the level of the stimulus, we reduce the

craving. It is the ultimate harm reduction strategy.” Shortly thereafter in a

Washington Post

article, Dr. Kessler said that the amount of nicotine in a cigarette should drop

from about 10 milligrams to less than 1 milligram. BRAND A contains

approximately 0.7 milligram of nicotine.

A Phase

II smoking cessation clinical trial at the University of Minnesota Masonic

Comprehensive Cancer Center, which is further described below, also measured

exposure of various smoke compounds in smokers from smoking a VLN cigarette

containing our proprietary tobacco over a 6-week period. Smokers significantly

reduced their smoking as compared to their usual brand of cigarettes. As

depicted below, the number of VLN cigarettes smoked per day on average decreased

from 19 (the baseline number of cigarettes of smokers’ usual brand) to 12 by the

end of the 6-week period, even though participants were instructed to smoke

ad libitum (as many

cigarettes as desired) during treatment. Furthermore, and besides significant

reductions in other biomarkers, carbon monoxide (CO) levels, an indicator of

smoke exposure, significantly decreased from 20 parts per million (baseline) to

15 parts per million. Cotinine, a metabolite and biomarker of nicotine,

significantly decreased from 4.2 micrograms/mL (baseline) to 0.2 micrograms/mL.

All differences were statistically significant (P<0.05).

-12-

We

believe these findings and future exposure studies the FDA may require will

result in a Modified Risk Cigarette claim for BRAND A. We further believe

smokers who desire to smoke fewer cigarettes per day while also satisfying

cravings and reducing exposure to nicotine will find BRAND A beneficial. We intend

that BRAND A will be

available in regular and menthol; with both styles being king size (85 mm)

cigarettes.

BRAND

B Cigarettes

Compared

to other commercial tobacco cigarettes, BRAND B’s smoke contains the

lowest amount of tar per milligram of nicotine. Using a proprietary high

nicotine tobacco blend in conjunction with a unique cigarette design,

BRAND B allows the

smoker to achieve a satisfactory amount of nicotine per cigarette while inhaling

less tar and carbon monoxide. At the same time, we do not expect exposure to

nicotine from BRAND B

to be significantly higher than some full flavor cigarette brands. We believe

smokers who desire to reduce smoke exposure but are less concerned about

nicotine will find BRAND

B beneficial. We intend that BRAND B will be available in

regular and menthol; with both styles being king size (85 mm)

cigarettes.

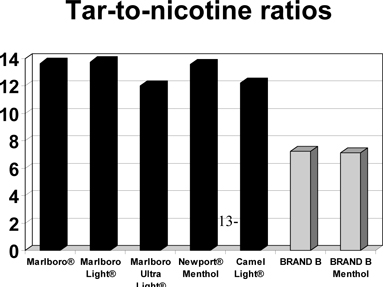

BRAND B has a tar yield

between typical “light” and “ultra-light” cigarettes, but a nicotine yield of

typical full flavor cigarettes. The graph below compares the tar-to-nicotine

ratios of BRAND B and

BRAND B menthol to

those of the leading cigarette brands. As shown, smokers are expected to inhale

much more tar for every milligram of nicotine from the leading brands than from

BRAND B. For example,

the smoke from BRAND B

has approximately 47% less tar per milligram of nicotine compared to the smoke

from Marlboro Light®.

-13-

In a 2001

report, entitled Clearing the

Smoke, Assessing the Science Base for Tobacco Harm Reduction, the

Institute of Medicine notes that a low tar/moderate nicotine cigarette is a

viable strategy for reducing the harm caused by smoking. It states: “Retaining

nicotine at pleasurable or addictive levels while reducing the more toxic

components of tobacco is another general strategy for harm reduction.” We

believe that evaluation of BRAND B in short-term human

exposure studies will confirm that exposure to smoke, including tar and carbon

monoxide, is significantly reduced when smoking BRAND B as compared to

smoking the leading brands of cigarettes. We believe results from these exposure

studies will warrant a Modified Risk Cigarette claim for BRAND B.

Additional

Tobacco Products

We expect

to introduce other cigarettes into the U.S. market in the first quarter of 2011,

particularly to tobacconists, smoke shops and tobacco outlets. The

ban in 2009 by the FDA of all flavored cigarettes (with the exception of

menthol) has resulted in a product void in these tobacco channels. Certain

wholesalers and retailers are now seeking other specialty cigarettes to replace

the banned flavored cigarettes. We believe that certain U.S.

cigarette wholesalers and retailers will purchase these cigarettes to replace

their lost sales of flavored cigarettes as well as lost sales of “light”

cigarettes.

Clinical

Trials with Cigarettes Containing our Very Low Nicotine (“VLN”)

Tobacco

VLN

cigarettes containing our proprietary tobacco have been the subject of various

independent studies, including two Phase II clinical trials for smoking

cessation which were not funded by us. Both of these Phase II clinical trials

were “intent to treat” trials, meaning that any patients who dropped out of the

trials for any reason at any time during treatment or during the follow-up

periods were considered failures (still smoking and not abstinent). Dropout

rates during smoking cessation trials are generally high since patients either

quit smoking or resume smoking their usual brand. In either case, they may

believe there is no reason to continue.

One of

these two Phase II clinical trials compared the quitting efficacy of a VLN

cigarette containing our proprietary tobacco versus a low nicotine cigarette and

an FDA-approved nicotine lozenge (4 mg) in a total of 165 patients treated for 6

weeks (Hatsukami et al. 2010). This clinical trial was led by Dr. Dorothy

Hatsukami, Director of the National Transdisciplinary Tobacco Use Research

Center (TTURC) at the University of Minnesota Masonic Comprehensive Cancer

Center. For reference, Dr. Hatsukami was selected in 2010 as one of the nine

voting members of the 12-person Tobacco Products Scientific Advisory Committee

(“TPSAC”) within the FDA’s Center for Tobacco Products created by the Tobacco

Control Act. TPSAC will make recommendations and issue reports to the FDA

Commissioner on tobacco regulatory matters, including but not limited to, the

impact of the use of menthol in cigarettes, altering levels of nicotine in

tobacco products, and applications submitted to the FDA for modified risk

tobacco products.

Results

from this Phase II trial conclude that patients exclusively using the VLN

cigarette containing our proprietary tobacco achieved a 43% quit rate (confirmed

four-week continuous abstinence) as compared to a quit rate of 35% for the group

exclusively using the nicotine lozenge and a 21% quit rate for the group

exclusively using the low nicotine cigarette. Smoking abstinence at the 6-week

follow-up after the end of treatment was 47% for the VLN cigarette group, 37%

for the nicotine lozenge group and 23% for the low nicotine cigarette group.

Furthermore, the VLN cigarette was also associated with greater relief from

withdrawal symptoms and cravings of usual brand cigarettes than the nicotine

lozenge. Carbon monoxide (CO) levels in patients were tested at each treatment

clinic visit to verify smoking abstinence.

-14-

Unlike

Phase III clinical trials for other FDA-approved smoking cessation aids,

four-week continuous abstinence in the University of Minnesota Phase II trial

was measured after the treatment period, when patients were “off” medication as

shown in the chart below, rather than during the last four weeks of the

treatment period. For example, according to the prescription Chantix® label,

four-week continuous abstinence in the Chantix® Phase III clinical trials (the

44 percent quit rate advertised by Pfizer) was measured during the last four

weeks of the 12-week treatment period, while patients were still taking

Chantix®. In one of these Chantix® Phase III clinical trials, approximately

one-third of those who had been abstinent during the last week of treatment

returned to smoking within four weeks after they stopped taking Chantix®, and

approximately 45% returned to smoking within eight weeks after they stopped

taking Chantix®.

Patients

who used the VLN cigarette containing our proprietary tobacco over the 6-week

treatment period significantly reduced their smoking as compared to their usual

brand of cigarettes. The number of VLN cigarettes smoked per day on average

decreased from 19 (the baseline number of cigarettes of the smoker’s usual

brand) to 12 by the end of the 6-week treatment period, even though participants

in this clinical trial were instructed to smoke ad libitum (as many

cigarettes as desired) during treatment. Carbon monoxide (CO) levels, an

indicator of smoke exposure, significantly decreased from 20 parts per million

(baseline) to 15 parts per million. Cotinine, a metabolite and biomarker of

nicotine, significantly decreased from 4.2 micrograms/mL (baseline) to 0.2

micrograms/mL. All differences in the above three measurements were

statistically significant (P<0.05).

-15-

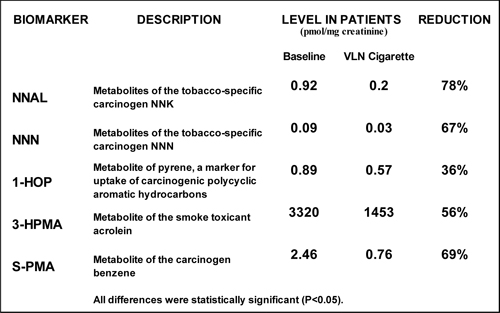

Additional

biomarkers of smoke exposure were significantly reduced on average from baseline

measurements (taken before the 6-week treatment period) in patients who used the

VLN cigarette containing our proprietary tobacco:

In a

separate Phase II clinical trial funded by Vector Tobacco, our former licensee,

under Investigational New Drug (“IND”) Application 69,185, a randomized

double-blind, active controlled, parallel group, multi-center Phase II smoking

cessation clinical trial was conducted to evaluate the quitting efficacy of

Quest® reduced-nicotine cigarettes as a smoking cessation treatment in 346

patients (Becker et al.

2008). Treatment consisted of smoking three reduced-nicotine cigarette styles

(Quest 1®, Quest 2® and Quest 3®) for 2 weeks each, with nicotine yields per

cigarette of 0.6 mg (a low nicotine cigarette made with a blend of regular

tobacco and our proprietary VLN tobacco), 0.3 mg (an extra low nicotine

cigarette made with a blend of regular tobacco and our proprietary VLN tobacco)

and 0.05 mg (a VLN cigarette made with tobacco only from our proprietary VLN

variety) either in combination with nicotine patch therapy (a nicotine

replacement product) or placebo patches.

In this

three-arm clinical trial in which patients were treated over sixteen weeks, use

of reduced-nicotine cigarettes in combination with nicotine patches was more

effective (the difference was statistically significant) in achieving four-week

continuous abstinence than use of nicotine patches alone (32.8% vs. 21.9%), and

use of reduced-nicotine cigarettes without nicotine patches yielded an

abstinence rate similar (the difference was not statistically significant) to

that of nicotine patches (16.4% vs. 21.9%). No serious adverse events were

attributable to the investigational product.

-16-

The major

difference between the Vector Phase II clinical trial and the University of

Minnesota Phase II clinical trial is that VLN cigarettes in the Vector trial

were smoked by patients for only 2 weeks and either in combination with using a

nicotine patch or placebo patch. In both arms that smoked the VLN cigarette for

2 weeks, patients continued to use nicotine patches or placebo patches for the

subsequent 10 weeks. We believe that the effectiveness of VLN cigarettes for use

in smoking cessation is higher when they are used alone (without another

therapy) for a longer time period, as in the University of Minnesota trial,

rather than with concurrent use of nicotine replacement therapy. We have

therefore decided to have patients use VLN cigarettes alone and for 6 weeks in

our upcoming clinical trials.

A 2008

binding arbitration award, which was completely fulfilled by Vector Tobacco in

2009, provided us with copies of all of Vector’s FDA submissions relating to

Vector’s IND for Quest® and awarded to us a right of reference to Vector’s IND

for Quest®, including all results of Vector’s Phase II clinical trial. This

arbitration award allows us to use all such information in our IND with the FDA

for our VLN cigarette that contains our same proprietary tobacco that Vector

used in its IND submissions to the FDA. This arbitration award has been helpful

to us with the FDA, since analytical reports produced by our former licensee

pertaining to our proprietary tobacco and cigarettes made from our tobacco are

being utilized by us with the FDA.

Another

smoking cessation clinical trial using VLN cigarettes containing our proprietary

tobacco was a randomized controlled trial conducted at Roswell Park Cancer

Institute, Buffalo, New York, to investigate the effect of smoking a very low

nicotine cigarette in combination with a nicotine patch for 2 weeks prior to the

quit date (Rezaishiraz et

al. 2007). Ninety-eight adult smokers were randomized to two treatments:

(i) 2 weeks of a very low nicotine cigarette (Quest 3®) and 21-mg nicotine patch

before the quit date and (ii) a reduced nicotine cigarette (Quest 1®) during the

2 weeks before the quit date. After the quit date, all subjects received

counseling for smoking cessation and nicotine patch therapy for up to 8 weeks (4

weeks of 21-mg patches, 2 weeks of 14-mg patches, and 2 weeks of 7-mg patches).

Group 1, which used very low nicotine cigarettes and a nicotine patch before

quitting, had lower combined craving score during the 2 weeks before and after

the quit date. Self-reported point prevalence of smoking abstinence at the 3-

and 6-month follow-up points was higher in Group 1 (43% vs. 34% and 28% vs.

21%).

A study

at Dalhousie University, Halifax, Nova Scotia (Barrett 2010), compared the

effects of low nicotine cigarettes and an FDA-approved nicotine inhaler on

cravings and smoking behavior of smokers who did not intend to quit. In separate

laboratory sessions, each of twenty-two participants used a VLN cigarette (Quest

3®), a reduced nicotine cigarette (Quest 1®, which contains approximately

two-thirds conventional tobacco and one-third VLN tobacco), a nicotine inhaler

(10 mg; 4 mg deliverable, Pharmacia), or a placebo inhaler (identical in

appearance to the nicotine inhaler, but containing no nicotine). Cravings,

withdrawal and mood descriptors were rated before and after a 20-minute

treatment session during which subjects were instructed to smoke two cigarettes

or to use an inhaler every 10 seconds. The reduction in the rating of intent to

smoke (usual cigarette brand) after using the VLN cigarette (-10.0) was

significantly greater than the reduction with the nicotine inhaler (-1.9). Use

of the VLN cigarette was also associated with significantly increased

satisfaction and relaxation compared to the nicotine inhaler.

Technology

Platform

Our

proprietary technology enables us to decrease or increase the level of nicotine

in tobacco plants by decreasing or increasing the expression of gene(s)

responsible for nicotine production in the tobacco plant using genetic

engineering. The basic techniques are the same as those used in the production

of genetically modified varieties of other crops, which in 2009 were planted on

330 million acres in 25 countries according to the International Service for the

Acquisition of Agri-Biotech Applications (ISAAA). This includes 85% of the corn

and soybeans grown in the United States. The only components of the technology

that are distinct from those in commercialized genetically modified varieties of

major crops are segments of tobacco genes (DNA sequences) that are also present

in all conventional tobacco plants. Genetically modified tobacco that we use in

our products is produced from plants that have been deregulated by the USDA.

Thus, plants may be grown and used in products in the United States without

legal restrictions or labeling requirements related to the genetic modification.

Nevertheless, our proprietary genetically engineered tobacco is grown only by

farmers under contracts that require segregation and prohibit transfer of

material to other parties.

-17-

During

the development of genetically modified varieties, many candidate lines are

evaluated in the field in multiple locations over several years, as in any other

variety development program. This is carried out in order to identify lines that

have not only the specific desired trait, e.g., very low nicotine, but

have overall characteristics that are suitable for commercial production of the

desired product. This allows us to see if there are undesirable effects of the

genetic modification approach or the specific genetic modification event,

regardless of whether the effects are anticipated or unanticipated. For example,

since nicotine is known to be an insecticide effective against a wide range of

insects, reduction of nicotine content in the plants may be expected to affect

susceptibility to insect pests. While there are differences in the

susceptibility of VLN tobacco to some insects, all tobacco is attacked by a

number of insects. The measures taken to control insect pests of conventional

tobacco are adequate to control insect pests in VLN tobacco.

Once a

modified tobacco plant with the desired characteristics is obtained, each plant

can produce hundreds of thousands of seeds. When each seed is germinated, the

resulting tobacco plant has identical characteristics, including nicotine

content, as the parent and sibling plants. Tobacco products with either low or

high nicotine content are easily produced through this method. For example, one

of our proprietary tobacco varieties contains the lowest nicotine content of any

tobacco ever commercialized, with approximately 95% less nicotine than tobacco

in leading “light” cigarette brands. This proprietary tobacco grows with

virtually no nicotine without adversely affecting the other leaf constituents

important to a cigarette’s characteristics, including taste and

aroma.

Intellectual

Property

Our

proprietary technology is covered by 12 patent families consisting of 97 issued

patents in 79 countries, and approximately 44 pending patent applications, which

are either owned by or exclusively licensed to us. A “patent family” is a set of

patents granted in various countries to protect a single invention. Our patent

coverage in the United States, the most valuable smoking cessation market and

cigarette market, consists of 14 issued patents and 6 pending applications. In

China, the world’s largest cigarette market, we exclusively control 5 issued

patents and 3 pending patent applications. We have exclusive worldwide rights to

all uses of the following genes responsible for nicotine content in tobacco

plants: QPT, A622, NBB1, MPO and genes for several

transcription factors. We have exclusive rights to plants with altered nicotine

content produced from modifying expression of these genes and tobacco products

produced from these plants. We also have the exclusive right to license and

sublicense these patent rights. The patents owned by or exclusively licensed to

us are issued in countries where at least 75% of the world’s smokers

reside.

We own

various registered trademarks in the United States. We also have

exclusive rights to plant variety protection (“PVP”) certificates in the United

States (issued by the U.S. Department of Agriculture) and Canada. A PVP

certificate prevents anyone other than the owner/licensee from planting a plant

variety for 20 years in the U.S. or 18 years in Canada. The protections of PVP

are independent of, and in addition to, patent protection.

Sales

and Marketing

X-22

Smoking Cessation Aid

We intend

to enter into arrangements in both the U.S. and international markets with

pharmaceutical companies to market and sell X-22. We will seek marketing

partners with existing pharmaceutical sales forces that already call on medical

and dental offices in their geographic markets.

-18-

There are

approximately 700,000 physicians in the United States, including approximately

80,000 general practitioners, many of whom are aware of new medications, even

before they achieve FDA approval. There are also approximately 170,000 dentists

in the U.S. who can write prescriptions for smoking cessation aids. We plan to

initially concentrate on a “push” strategy to develop demand for X-22 in the United States by

educating physicians and dentists about our X-22 smoking cessation aid.

We intend to advertise in professional journals, use direct mail campaigns to

medical professionals, and attend trade shows and professional conferences. We

also intend to use internet advertising and pharmacy circulars to reach

consumers and to encourage them to ask their physicians and dentists about our

X-22 smoking cessation

aid. We expect to use public relations to increase public awareness about X-22. We will seek to use

federal and state-funded smoking cessation programs and clinics to inform

clinicians and patients about, and encourage the use of, X-22 as a smoking cessation

aid. We will also seek to participate in various government-funded programs

which purchase approved smoking cessation aids and then distribute these to

smokers at no charge or at greatly reduced prices.

BRAND

A and BRAND B

We expect

significant sales in the U.S. of Brand A and Brand B within specialty

tobacco channels such as tobacconists, smoke shops and tobacco outlets. The ban

in 2009 by the FDA of all flavored cigarettes (with the exception of menthol)

has resulted in a product void in these tobacco channels. Certain wholesalers

and retailers are now seeking other specialty cigarettes to replace the banned

flavored cigarettes. We believe that certain U.S. cigarette wholesalers and

retailers will purchase our BRAND A and BRAND B cigarette brands to

replace their lost sales of flavored cigarettes as well as lost sales of “light”

cigarettes.

Government

Research Cigarettes

The

National Institute on Drug Abuse (“NIDA”), a component of the National

Institutes of Health (“NIH”), provides the scientific community with controlled

and uncontrolled research chemicals and drug compounds in its Drug Supply Program. In 2009,

NIDA included an option to develop and produce research cigarettes with ten

different levels of nicotine, including a minimal (placebo) level (“Research

Cigarette Option”) in its request for proposals for a 5-year contract for Preparation and Distribution of

Research and Drug Products. We have agreed, as a subcontractor to RTI

International (“RTI”) in RTI’s contract with NIDA for the Research Cigarette

Option, to supply modified nicotine cigarettes to NIDA. In August 2010, we met

with officials from NIDA, FDA, RTI, the National Cancer Institute and the

Centers for Disease Control and Prevention to finalize certain aspects of the

design of these research cigarettes. These research cigarettes will

be distributed under the mark SPECTRUM.

In 2010,

we received our first purchase order of $152,660 for 1.15 million research

cigarettes which included a design phase fee of $40,604. We expect to receive

two more purchase orders for an additional 8.275 million research cigarettes

over the next three months. We estimate the revenue from this contract,

including other direct orders from researchers, will be approximately $700,000

in 2011 and $3 million over the next 5 years.

Healthcare

Reimbursement

Government

and private sector initiatives to limit the growth of healthcare costs,

including price regulation, competitive pricing, coverage and payment policies,

and managed-care arrangements, are continuing in many countries where we intend

to sell our X-22

smoking cessation aid, including the United States. These changes are causing

the marketplace to put increased emphasis on the delivery of more cost-effective

medical products.

-19-

Government

healthcare programs in the United States, including Medicare and Medicaid,

private healthcare insurance and managed-care plans have attempted to control

costs by limiting the amount of reimbursement for which they will pay for

particular procedures or treatments. This may create price sensitivity among

potential customers for our X-22 smoking cessation aid,

even if we obtain FDA approval for it. Some third-party payers must also approve

coverage for new or innovative devices or therapies before they will reimburse

healthcare providers who use the medical devices or therapies. Even though a new

medical product may have been cleared for commercial distribution, we may find

limited demand for X-22

until reimbursement approval has been obtained from governmental and private

third-party payers.

Approximately

160 million Americans have private health insurance with prescription coverage

and the majority, and an increasing number of these plans, cover pharmacologic

treatments for smoking cessation. Healthcare payers, including governmental

bodies, are increasingly willing to fund smoking cessation treatments due to the

expected savings from reducing the incidence of smoking-related illnesses.

Approximately 46 million Americans were covered by Medicare in 2009. Medicare

provides insurance coverage for up to two smoking cessation attempts per year

and each attempt may include four counseling sessions.

Approximately

47 million Americans were covered by state Medicaid programs in 2009.

Approximately 30% of Medicaid recipients are smokers. Medicaid programs in 42

states and the District of Columbia cover at least one form of pharmacologic

treatment for smoking cessation (Chantix®, Zyban® or NRT). The new healthcare

legislation is expanding Medicaid coverage to all 50 states. The current retail

price of the 12-week prescription of Chantix® is over $450, which should give us

great latitude in pricing X-22. We expect X-22 to be price competitive

with any FDA-approved smoking cessation aid, especially Chantix®, which will not

only encourage governmental and private third-party payers to cover X-22, but will encourage

smokers to attempt to quit with X-22 since they will not have

to purchase their usual brand of cigarettes over the 6-week treatment period.

This equates to approximately $239 in out-of-pocket savings to the consumer if

their insurance plan covers X-22.

Manufacturing

We are in

the process of entering into agreements with several cigarette manufacturing

companies to manufacture X-22 for us for sale in the

United States and foreign markets. We are also in the process of

entering into agreements with several cigarette manufacturing companies to

manufacture BRAND A and

BRAND B for us for sale

in the Unites States and foreign markets, subject to FDA approval to market

BRAND A and BRAND B as Modified Risk

Cigarettes.

Competition

In the

market for FDA-approved smoking cessation aids, our principal competitors

include Pfizer Inc., GlaxoSmithKline PLC, Novartis International AG, and

Niconovum AB, a subsidiary of Reynolds American Inc. The industry consists of

major domestic and international companies, most of which have existing

relationships in the markets into which we plan to sell, as well as financial,

technical, marketing, sales, manufacturing, scaling capacity, distribution and

other resources and name recognition substantially greater than

ours.

Cigarette

companies compete primarily on the basis of product quality, brand recognition,

brand loyalty, taste, innovation, packaging, service, marketing, advertising,

retail shelf space and price. Cigarette sales can be significantly influenced by

weak economic conditions, erosion of consumer confidence, competitors’

introduction of low-price products or innovative products, higher cigarette

taxes, higher absolute prices and larger gaps between price categories, and

product regulation that diminishes the ability to differentiate tobacco

products. Domestic competitors include Philip Morris USA, Reynolds American

Inc., Lorillard Inc., Commonwealth Brands, Inc., Liggett Group LCC, Vector

Tobacco Inc., and Star Scientific Inc. International competitors include Philip

Morris International, British American Tobacco, Japan Tobacco Inc. and regional

and local tobacco companies; and, in some instances, government-owned tobacco

enterprises, principally in China, Egypt, Thailand, Taiwan, Vietnam and

Algeria.

-20-

Potential

Smoking Cessation Aids

Nicotine

Vaccines

Nicotine

vaccines are under development in clinical trials; however they have not yet

achieved the efficacy of other FDA-approved smoking cessation therapies.

Nicotine itself is not recognized by the body as a foreign compound since the

molecule is too small. In order to stimulate the production of antibodies,

nicotine must be attached to a carrier to make the vaccine work. Different

vaccine development programs use different carriers. Four companies, Cytos

Biotechnology AG, Celtic Pharmaceuticals Holdings, Nabi Biopharmaceuticals, L.P.

and Independent Pharmaceutica AB have or have had vaccine candidates in clinical

trials. Cytos exclusively licensed its nicotine vaccine candidate to Novartis in

2007 for 35 million Swiss Francs ($30 million) and up to 565 million Swiss

Francs ($492 million) in milestone payments and royalties. In October 2009, it

was announced that Cytos’ nicotine vaccine candidate failed to show efficacy in

a Phase II trial.

GlaxoSmithKline

Biologicals SA exclusively licensed Nabi’s nicotine vaccine candidate,

NicVAX®, in a

deal which was approved by Nabi’s shareholders in March 2010. Together with an

upfront non-refundable fee of $40 million paid by GlaxoSmithKline, Nabi is

eligible to receive over $500 million in option fees and milestones, not

including potential royalties on global sales. Phase III NicVAX® clinical

trials are commenced in 2010.

These

vaccine treatments entail six to seven consecutive monthly injections. Increases

in abstinence rates have been reported but only among a minority of trial

subjects with the highest levels of anti-nicotine antibodies. To date, all

subjects do not develop sufficient antibody levels despite receiving multiple

injections. Even in those who do develop sufficient antibody levels, cravings

for cigarettes are not addressed by this treatment, although the pharmacological

reward of nicotine is suppressed. Expectations are that the treatment, if

approved, would need to be repeated every 12 to 18 months to assist in

preventing relapse. Dr. Michael C. Fiore, lead chairperson and author of the

2008 U.S. government report on clinical practice guidelines for treating tobacco

use and co-principal Investigator of the Transdisciplinary Tobacco Use Research

Center at the University of Wisconsin, Madison, estimated in 2009 that any

approval of a nicotine vaccine may be 5 to 10 years away.

Electronic

or E-cigarettes

Although

the FDA has not evaluated electronic cigarettes, or e-cigarettes, for quitting

smoking, and we are not aware of any published result of a controlled clinical

trial of e-cigarettes as a smoking cessation aid, e-cigarettes are included here

since there have been unconfirmed claims that these products facilitate

cessation. E-cigarettes have been the subject of much controversy for this and

various other reasons, including the fact that these products are actually not

cigarettes or tobacco products at all but are battery-operated devices filled

with nicotine, flavor and other chemicals. They turn nicotine and other

chemicals into a vapor that is inhaled. E-cigarettes have very similar nicotine

delivery as nicotine inhalers, a prescription NRT product already approved by

the FDA, which is the reason we believe that using e-cigarettes to quit smoking