Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - COHERENT INC | a2201697zex-31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - COHERENT INC | a2201697zex-31_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended October 2, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File Number: 001-33962

COHERENT, INC.

| Delaware | 94-1622541 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

5100 Patrick Henry Drive, Santa Clara, California |

95054 |

|

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (408) 764-4000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $0.01 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of December 1, 2010, 25,045,744 shares of common stock were outstanding. The aggregate market value of the voting shares (based on the closing price reported on the NASDAQ Global Select Market on April 2, 2010, of Coherent, Inc., held by nonaffiliates was $601,999,488. For purposes of this disclosure, shares of common stock held by persons who own 5% or more of the outstanding common stock and shares of common stock held by each officer and director have been excluded in that such persons may be deemed to be "affiliates" as that term is defined under the Rules and Regulations of the Act. This determination of affiliate status is not necessarily conclusive.

DOCUMENT INCORPORATED BY REFERENCE

None.

This Annual Report on Form 10-K/A ("Form 10-K/A") is being filed as Amendment No. 1 to the Registrant's Annual Report on Form 10-K for the fiscal year ended October 2, 2010 filed with the Securities and Exchange Commission for the purposes of including information that was to be incorporated by reference from the Registrant's definitive proxy statement pursuant to Regulation 14A of the Securities and Exchange Act of 1934. The Registrant will not file its proxy statement within 120 days of its fiscal year ended October 2, 2010 and is therefore amending its Annual Report on Form 10-K as set forth below to include such information.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

The names of the directors of Coherent, Inc. (the "Company") and certain information about them as of December 31, 2010 are set forth below.

Name

|

Age | Director Since |

PrincipalOccupation | |||||

|---|---|---|---|---|---|---|---|---|

| John R. Ambroseo, PhD | 49 | 2002 | President and Chief Executive Officer | |||||

Susan M. James(1)(2) |

64 |

2008 |

Retired Consultant to Ernst & Young |

|||||

L. William Krause(2)(3) |

68 |

2009 |

President of LWK Ventures |

|||||

Garry W. Rogerson, PhD(1)(2)(3) |

58 |

2004 |

Chairman of the Board of Coherent |

|||||

Lawrence Tomlinson(1) |

70 |

2003 |

Retired Senior Vice President and Treasurer of Hewlett-Packard Co. |

|||||

Sandeep Vij(2)(3)(4) |

45 |

2004 |

President and Chief Executive Officer of MIPS Technologies, Inc. |

|||||

- (1)

- Member

of the Audit Committee.

- (2)

- Member

of the Governance and Nominating Committee.

- (3)

- Member

of the Compensation and H.R. Committee.

- (4)

- Member of the Special Litigation Committee.

Except as set forth below, each of our directors has been engaged in his or her principal occupation set forth above during the past five years. There is no family relationship between any of our directors or executive officers. The Board has determined that, with the exception of Dr. Ambroseo, all of its current members are "independent directors" as that term is defined in the marketplace rules of the NASDAQ Stock Market.

John R. Ambroseo. Dr. Ambroseo has served as our President and Chief Executive Officer as well as a member of the Board since October 2002. Dr. Ambroseo served as our Chief Operating Officer from June 2001 through September 2002. Dr. Ambroseo served as our Executive Vice President and as President and General Manager of the Coherent Photonics Group from September 2000 to June 2001. From September 1997 to September 2000, Dr. Ambroseo served as our Executive Vice President and as President and General Manager of the Coherent Laser Group. From March 1997 to September 1997, Dr. Ambroseo served as our Scientific Business Unit Manager. From August 1988, when Dr. Ambroseo joined us, until March 1997, he served as a Sales Engineer, Product Marketing Manager, National Sales

1

Manager and Director of European Operations. Dr. Ambroseo received a Bachelor degree from SUNY-College at Purchase and a PhD in Chemistry from the University of Pennsylvania.

Dr. Ambroseo's status as our Chief Executive Officer, his 22 year tenure with the Company, his extensive knowledge of our products, technologies and end markets and his over eight years of service as a director of Coherent make him an invaluable member of our Board of Directors.

Susan M. James. Ms. James originally joined Ernst & Young, a global leader in professional services, in 1975, becoming a partner in 1987 and from June 2006 to December 2009, was a consultant to Ernst & Young. During her tenure with Ernst & Young, she has been the lead partner or partner-in-charge for the audit work for a significant number of technology companies, including Intel Corporation, Sun Microsystems, Amazon.com, Autodesk and the Hewlett-Packard Corporation, and for the Ernst & Young North America Global Account Network. She also served on the Ernst & Young Americas Executive Board of Directors from January 2002 through June 2006. She is a certified public accountant and a member of the American Institute of Certified Public Accountants. Ms. James also serves on the board of directors of Applied Materials, Inc., a global leader in the manufacture of products for the advanced semiconductor, flat panel display and solar photovoltaic markets, Yahoo! Inc., an Internet technology company, and the Tri-Valley Animal Rescue, a non-profit that is dedicated to providing homes for homeless pets. Ms. James holds Bachelor's degrees from Hunter College and San Jose State University.

Ms. James' years in the accounting industry, her service on the boards and committees of a number of other publicly held companies and her over two years of service as a director of Coherent make her an invaluable member of our Board of Directors.

L. William Krause. Mr. Krause has been President of LWK Ventures, a private investment firm since 1991. In addition, Mr. Krause served as Chairman of the Board of Caspian Networks, Inc., an IP networking systems provider, from April 2002 to September 2006 and as Chief Executive Officer from April 2002 until June 2004. From September 2001 to February 2002, Mr. Krause was Chairman and Chief Executive Officer of Exodus Communications, Inc. which he guided through Chapter 11 Bankruptcy to a sale of assets. He also served as President and Chief Executive Officer of 3Com Corporation, a global data networking company, from 1981 to 1990, and as its Chairman from 1987 to 1993 when he retired. Mr. Krause currently serves as a director for Brocade Communications Systems, Inc., a networking solutions and services company, CommScope Inc., a networking infrastructure company and Core-Mark Holdings, Inc., a distributor of packaged consumer goods. Mr. Krause previously served as a director for Sybase, Inc., Packeteer, Inc. and TriZetto Group, Inc. Mr. Krause holds a B.S. degree in electrical engineering and received an honorary Doctorate of Science from The Citadel.

Mr. Krause's years of executive and management experience in the high technology industry, including serving as the chief executive officer of several companies, his service on the boards and committees of a number of other publicly held companies, and his year and a half of service as a director of Coherent make him an invaluable member of our Board of Directors.

Garry W. Rogerson. Dr. Rogerson has served as our Chairman of the Board since June 2007. Dr. Rogerson was Chairman and Chief Executive Officer of Varian, Inc., a major supplier of scientific instruments and consumable laboratory supplies, vacuum products and services, from February 2009 and 2004, respectively until the purchase of Varian by Agilent Technologies, Inc. in May, 2010. Dr. Rogerson served as Varian's Chief Operating Officer from 2002 to 2004, as Senior Vice President, Scientific Instruments from 2001 to 2002, and as Vice President, Analytical Instruments from 1999 to 2001. Dr. Rogerson received an honours degree and Ph.D. in biochemistry from the University of Kent at Canterbury.

2

Dr. Rogerson's years of executive and management experience in the high technology industry, including serving as the chief executive officer of another company, his service on the board of another publicly held company, and his over six years of service as a director of Coherent make him an invaluable member of our Board of Directors.

Lawrence Tomlinson. Mr. Tomlinson retired from Hewlett-Packard Co., a global technology company, in June 2003. Prior to retiring from Hewlett-Packard Co., from 1993 to June 2003 Mr. Tomlinson served as its Treasurer, from 1996 to 2002 he was also a Vice President of Hewlett-Packard Co. and from 2002 to June 2003 was also a Senior Vice President of Hewlett-Packard Co. Mr. Tomlinson is a member of the board of directors of Salesforce.com, Inc., a customer relationship management service provider. During the past five years, Mr. Tomlinson has also served as a director of Therma-Wave, Inc. Mr. Tomlinson received a B.S. from Rutgers University and an M.B.A. from Santa Clara University.

Mr. Tomlinson's years of executive and management experience in the high technology industry, his experience in the finance and accounting industry, his service on the boards and committees of a number of other publicly held companies and his over seven years of service as a director of Coherent make him an invaluable member of our Board of Directors.

Sandeep Vij. Mr. Vij has held the position of President and Chief Executive Officer of MIPS Technologies, Inc., a leading provider of processor architectures and cores, since January 2010. Previously, Mr. Vij was the Vice President and General Manager of the Broadband and Consumer Division of Cavium Networks, Inc., a leading provider of highly integrated semiconductor products from May 2008 to January 2010. Prior to that he held the position of Vice President of Worldwide Marketing, Services and Support for Xilinx Inc., a digital programmable logic device provider, from 2007 to April 2008. From 2001 to 2007, he held the position of Vice President of Worldwide Marketing at Xilinx. From 1997 to 2001, he served as Vice President and General Manager of the General Products Division at Xilinx. Mr. Vij joined Xilinx in 1996 as Director of FPGA Marketing. Prior to Xilinx, Mr. Vij spent five years in various senior roles at Altera Corporation. Mr. Vij is a member of the board of directors of MIPS Technologies, Inc. He is a graduate of General Electric's Edison Engineering Program and Advanced Courses in Engineering. He holds an MSEE from Stanford University and a BSEE from San Jose State University.

Mr. Vij's years of executive and management experience in the high technology industry, including serving as the chief executive officer of another company, his service on the board of another publicly held company, and his over six years of service as a director of Coherent make him an invaluable member of our Board of Directors.

Executive Officers

The name, age, position and a brief account of the business experience of our chief executive officer and each of our other executive officers as of December 31, 2010 are set forth below:

Name

|

Age | Office Held | |||

|---|---|---|---|---|---|

| John R. Ambroseo, PhD | 49 | President and Chief Executive Officer | |||

Helene Simonet |

58 |

Executive Vice President and Chief Financial Officer |

|||

Mark Sobey, PhD |

50 |

Executive Vice President and General Manager, Specialty Laser Systems |

|||

Luis Spinelli |

63 |

Executive Vice President and Chief Technology Officer |

|||

Bret M. DiMarco |

42 |

Executive Vice President, General Counsel and Corporate Secretary |

|||

3

Please see "Directors" above for Dr. Ambroseo's biographical information.

Helene Simonet. Ms. Simonet has served as our Executive Vice President and Chief Financial Officer since April 2002. Ms. Simonet served as Vice President of Finance of our former Medical Group and Vice President of Finance, Photonics Division from December 1999 to April 2002. Prior to joining Coherent, she spent over twenty years in senior finance positions at Raychem Corporation's Division and Corporate organizations, including Vice President of Finance of the Raynet Corporation. Ms. Simonet has both Master's and Bachelor degrees from the University of Leuven, Belgium.

Mark Sobey. Dr. Sobey was appointed Executive Vice President of Coherent and General Manager of Specialty Laser Systems (SLS) in April 2010. He has served as Senior Vice President and General Manager for the SLS Business Group, which primarily serves the Microelectronics and Research markets, since joining Coherent in July 2007. Prior to Coherent, Dr. Sobey has spent over 20 years in the Laser and Fiber Optics Telecommunications industries, including roles as Senior Vice President Product Management at Cymer from January 2006 through June 2007 and previously as Senior Vice President Global Sales at JDS Uniphase through October 2005. He received his PhD in Engineering and BSc in Physics, both from the University of Strathclyde in Scotland.

Luis Spinelli. Mr. Spinelli has served as our Executive Vice President and Chief Technology Officer since February 2004. Mr. Spinelli joined the Company in May 1985 and has since held various engineering and managerial positions, including Vice President, Advanced Research from April 2000 to September 2002 and Vice President, Corporate Research from September 2002 to February 2004. Mr. Spinelli has led the Advanced Research Unit from its inception in 1998, whose charter is to identify and evaluate new and emerging technologies of interest for us across a range of disciplines in the laser field. Mr. Spinelli holds a degree in Electrical Engineering from the University of Buenos Aires, Argentina with post-graduate work at the Massachusetts Institute of Technology.

Bret M. DiMarco. Mr. DiMarco has served as our Executive Vice President and General Counsel since June 2006 and our Corporate Secretary since February 2007. From February 2003 until May 2006, Mr. DiMarco was a member and from October 1995 until January 2003 was an associate at Wilson Sonsini Goodrich & Rosati, P.C., a law firm. Mr. DiMarco received a Bachelor degree from the University of California at Irvine and a Juris Doctorate degree from the Law Center at the University of Southern California. He is also an adjunct professor of law at the University of California Hastings College of the Law, teaching corporate law and mergers & acquisitions.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires our officers and directors, and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. Such officers, directors and ten-percent stockholders are also required by SEC rules to furnish us with copies of all forms that they file pursuant to Section 16(a). Based solely on our review of the copies of such forms received by us, and on written representations from certain reporting persons that no other reports were required for such persons, we believe that, during fiscal 2010, our officers, directors and greater than ten percent stockholders complied with all applicable Section 16(a) filing requirements.

Business Conduct Policy

We have adopted a worldwide Business Conduct Policy that applies to the members of our Board, executive officers and other employees. This policy is posted on our Website at www.coherent.com and may be found as follows:

- 1.

- From our main Web page, first click on "Company" and then on "corporate governance."

4

- 2.

- Next, click on "Business Conduct Policy."

We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of this Business Conduct Policy by posting such information on our Website, at the address and location specified above.

Stockholders may request free printed copies of our worldwide Business Conduct Policy from:

Coherent, Inc.

Attention: Investor Relations

5100 Patrick Henry Drive

Santa Clara, California 95054

Audit Committee Information

The Board has determined that directors James and Tomlinson are "audit committee financial experts" as that term is defined in Item 407(d)(5) of Regulation S-K of the Securities Act of 1933, as amended. All of the members of the Audit Committee are "independent" as defined under rules promulgated by the SEC and qualify as independent directors under the marketplace rules of the NASDAQ Stock Market.

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis addresses the fiscal 2010 compensation for the principal executive officer, the principal financial officer, and the other three executive officers at our fiscal year-end who were the most highly compensated executive officers of Coherent. These executives are our "Named Executive Officers" ("NEO" or "NEOs") for fiscal 2010:

- •

- John R. Ambroseo, Ph.D., our president and chief executive officer;

- •

- Helene Simonet, our executive vice president and chief financial officer;

- •

- Mark S. Sobey, Ph.D., our executive vice president and general manager, specialty laser systems;

- •

- Bret M. DiMarco, our executive vice president, general counsel and corporate secretary; and

- •

- Luis Spinelli, our executive vice president and chief technology officer.

This Compensation Discussion and Analysis describes the material elements of our executive compensation program during fiscal 2010, as well as compensation decisions made by our Compensation & H.R. Committee (the "committee") during fiscal 2011 prior to this analysis. It also provides an overview of our executive compensation philosophy, principal compensation policies and practices. Finally, it details how the committee arrived at the specific compensation decisions for our NEOs in fiscal 2010 and the key factors considered in these determinations.

Compensation Overview

Compensation Philosophy. Our executive compensation programs are designed to provide strong alignment between executive pay and performance and to focus executives on making decisions that enhance our stockholder value in both the short and long term. Executives are compensated in a manner consistent with Coherent's strategy, competitive practices, stockholder interest alignment, and evolving compensation governance standards. The committee positions the midpoint of our target compensation ranges near the 50th percentile of our peers, with actual compensation falling above or

5

below depending upon the Company's financial performance. Our executive compensation program is designed to foster practices that will enable us to attract, retain, and motivate our executives to:

- •

- Ensure that the executive team has clear goals and accountability with respect to our financial performance;

- •

- Provide market levels of pay for meeting target performance expectations, with above market pay for performance above

target and below market pay for performance below target; and

- •

- Promote our culture of integrity by properly rewarding appropriate risk taking, while not promoting excessive risk taking.

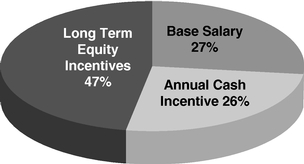

Elements of Executive Compensation. During fiscal 2010, the compensation of our NEOs, primarily consisted of base salary, an annual cash incentive award opportunity, and long-term equity incentive awards. For fiscal 2010, on average, 73% of our NEO's target compensation was delivered in the form of variable annual cash incentives or long-term equity incentives.

The average target pay mix for our named executive officers during fiscal 2010 can be illustrated as follows:

Average NEO Target FY 10 Pay Mix

Note: The annual cash incentive amounts represent target awards based on base salary and target bonuses in effect during Fiscal Year 2010. The Long Term Incentives include Stock Options (based on the dollar amount recognized for financial statement reporting purposes for fiscal 2010 in accordance with ASC 718) and Restricted Stock Units (using the grant date face value). This chart does not include other benefits, such as perquisites.

Compensation Governance. "Pay for performance" is at the core of Coherent's executive compensation approach. This is accomplished primarily by having a majority of the NEOs' potential compensation being "at risk" through a combination of a fiscal year variable cash bonus program and performance metrics in equity grants. In addition to this core philosophy the committee monitors and considers evolving governance approaches and standards in executive compensation. As more fully discussed below, recent examples of how this philosophy is applied and changes made pursuant to compensation best practices, include:

- •

- The elimination of the chief executive officer's 280G "tax gross-up" provision in the change of control

severance plan in fiscal 2011;

- •

- The elimination and phasing-out of all perquisites and Company deferred compensation contributions for

executive officers beginning in calendar 2011;

- •

- In fiscal 2009 the NEOs received less than $5,000 in total bonus pay-out, as neither the committee nor management recommended any modifications to the previously established performance metrics;

6

- •

- Despite the Company meeting the adjusted EBITDA percentage performance goals for pay-out under the

performance-based RSU grants, the Company did not meet the record revenue threshold set by the committee. Therefore, no performance-based RSUs vested at the measurement date in the first quarter of

fiscal 2011;

- •

- Named executive officers did not receive salary increases for fiscal 2009 or 2010;

- •

- Maintained the same target bonus percentage for each NEO in both fiscal 2010 and fiscal 2011;

- •

- In fiscal 2009, the Company adopted a claw-back policy for our chief executive officer and chief financial

officer in certain circumstances; and

- •

- Aside from the change of control severance plan, our executive officers do not have employment or severance agreements.

Certain Fiscal 2010 Operating Results. Coherent had strong operating performance in fiscal 2010 as compared to fiscal 2009, including net sales growth of 38.8%, or $169 million, with a corresponding net income growth of over $70 million. Accordingly, in fiscal 2010, the compensation for our NEOs increased as compared to fiscal 2009, largely due to the significantly improved financial results resulting in the maximum payout under the Company's fiscal 2010 variable cash incentive plan.

Compensation process

Role and Authority of Our Compensation and H.R. Committee

The committee held six (6) meetings in fiscal 2010. Following our annual meeting in April, 2010, the committee consisted of Messrs. Vij (Chair), Krause and Tomlinson and Dr. Rogerson.

The committee oversees our executive compensation philosophy and administers our executive compensation program. In particular, the committee reviews the corporate goals and objectives and approves the compensation for our Named Executive Officers. The committee has the sole authority delegated to it by the Board to make equity grants to our Named Executive Officers.

The committee has adopted a charter, a copy of which may be found on our website at "www.coherent.com"—"Company"—"Corporate Governance." The committee targets a review of its charter annually.

The committee may meet with or without management present, at its discretion. At most of its meetings, the committee conducts an executive session without management present.

Role of Management

The Compensation and H.R. Committee regularly meets with Dr. Ambroseo, our chief executive officer, to obtain recommendations with respect to the compensation programs, practices and packages for our Named Executive Officers other than Dr. Ambroseo. Additionally, Ms. Simonet, our executive vice president and chief financial officer, and Mr. DiMarco, our executive vice president and general counsel are regularly invited to meetings of the committee or otherwise asked to assist the committee. Additionally, during fiscal 2010, members of our human resources group regularly attended the committee's meetings. The assistance of these individuals includes providing financial information and analysis for the committee and its compensation consultant, taking minutes of the meeting or providing legal advice, developing compensation proposals for consideration, and providing insights regarding our employees (executive and otherwise) and the business context for the committee's decisions. Named Executive Officers will attend portions of committee meetings when requested, but leave the meetings when matters potentially affecting them are discussed. At the invitation of the committee, outside legal counsel frequently attends committee meetings. The committee makes decisions regarding Dr. Ambroseo's compensation without him present.

7

Role of Compensation Consultants

In fiscal 2010, the Compensation and H.R. Committee engaged Farient Advisors ("Farient") as its independent compensation consultants. Farient was retained to:

- •

- Review and analyze our executive compensation program;

- •

- Make recommendations for fiscal 2010 compensation; and

- •

- Review the Company's change of control severance plan.

Additionally in fiscal 2010, the Board of Directors retained a separate independent compensation consultant, Compensia, Inc., to review Board-related compensation matters. After reviewing prevailing governance practices and interviewing several compensation consultants, during the fourth quarter of fiscal 2010 the committee determined to consolidate all of the independent compensation consultant work with Compensia. Farient completed its work for the committee in the fourth quarter of fiscal 2010. In fiscal 2011, the committee worked with Compensia.

The independent compensation consultant serves at the discretion of the committee and is not permitted to do other work for the Company unless expressly authorized by the committee. Since their retention, neither Farient nor Compensia has performed any work for the Company other than its work with the committee or for the Board. The committee is focused on maintaining the independence of its compensation consultant and, accordingly, does not anticipate having its consultant perform any other work for the Company in addition to its direct work for the committee or the Board.

We also participate in and maintain a subscription to the Radford Global Technology Survey. This survey provides benchmark data and compensation practices reports to assist us with regards to employee compensation generally. Such data includes executive compensation data which is presented to the committee at its request.

Pay Positioning Strategy and Benchmarking of Compensation

We have striven to position the midpoint of our target compensation ranges near the 50th percentile of our peers, resulting in targeted total compensation that is competitive within our labor market for performance that meets the objectives established by the committee. A Named Executive Officer's actual salary, cash incentive compensation opportunity and equity compensation may fall below or above the target position based on the individual's experience, seniority, skills, knowledge, performance and contributions. These factors are weighed individually by the committee in its judgment, and no one factor neither takes precedence over others nor is any formula used in making these decisions. The chief executive officer's review of the performance of the other Named Executive Officers is considered by the committee in making individual pay decisions. With respect to the chief executive officer, the committee additionally considered the performance of Coherent as a whole and the views of the Board of Directors regarding the chief executive officer's performance. Actual realized pay is higher or lower than the targeted amounts for each individual based primarily on the Company's performance.

In analyzing our executive compensation program relative to this target market positioning, the committee reviews information provided by its independent compensation consultant, which includes an analysis of data from peer companies' proxy filings with respect to similarly situated individuals at the peer companies and from compensation survey sources, including a broad cross-section of technology companies of similar size to Coherent from the Radford Global Technology Survey.

For pay decisions made in fiscal 2010, Farient recommended that the committee approve modifications to the group of peer companies for conducting compensation analyses from proxies to better reflect our size, strategy and business. Accordingly, the committee removed Axcelis Technologies, Inc. and GSI Group, Inc. and added Finisar Corp., Infinera Corp., Opnext, Inc., Varian

8

Semiconductor and Veeco Instruments to the peer group for fiscal 2010. The committee also was mindful and took into consideration Institutional Shareholder Services' practices with regards to its formulation and use of peer groups and the relative size of peers, although the peer group selected is not confined to the Global Industrial Classification System (GICS) code for Coherent. For fiscal 2011, no changes were made to the group of peer companies. The peer group for fiscal 2010 comprised the following companies:

| Altera Corp. | Integrated Device Tech. | PMC-Sierra, Inc. | ||

| Cymer Inc. | JDS Uniphase | Trimble Navigation Limited | ||

| FEI Company | Linear Technology | Varian Semiconductor | ||

| Finisar Corp. | Newport Corporation | Veeco Instruments | ||

| FLIR Systems, Inc. | Opnext, Inc. | |||

| Infinera Corp. | Plantronics, Inc. |

Several factors are considered in selecting the peer group, the most important of which are:

- •

- Industry (primarily companies in the Electronic Equipment and Semiconductor sub-industry classifications

defined by the Global Industry Classification Standard (GICS) system);

- •

- Revenue level (as a proxy for complexity) (primarily companies with between $300 million and $1.5 billion in

revenues);

- •

- Geographic location (U.S. technology markets); and

- •

- Emphasizing companies with a significant R&D component, a focus on manufacturing and seeking a balance between semiconductors and other equipment manufacturers.

The committee annually reviews the composition of the peer group to ensure it is the most relevant set of companies to use for comparison purposes.

Components of Compensation

The principal components of our executive officer compensation and employment arrangements during fiscal 2010 included:

- •

- Base salary;

- •

- Variable cash incentive payments;

- •

- Equity awards; and

- •

- Other benefits.

These components were selected because the committee believes that a combination of salary, incentive pay and benefits is necessary to help us attract and retain the executive talent on which Coherent's success depends. The variable cash and equity components are structured to allow the committee to reward performance throughout the fiscal year and to provide an incentive for executives to appropriately balance their focus on short-term and long-term strategic goals.

Base Salary

Base salary is the foundation to providing an appropriate total direct compensation package. We use base salary to fairly and competitively compensate our executives for the jobs we ask them to perform. This is the most stable component of our executive compensation program, as this amount is not at risk. The committee reviewed information provided by its independent compensation consultant with respect to similarly situated individuals at the peer companies to assist it in determining the base

9

salary for each Named Executive Officer, depending upon the particular executive's experience and historical performance.

During the first quarter of fiscal 2010, upon management's recommendation, the committee determined to maintain the base salaries of the NEOs at their fiscal 2009 levels.

Effective beginning with the second quarter of fiscal 2011, based on data provided by Compensia, the committee increased the base salaries of Drs. Ambroseo and Sobey and Mr. Spinelli as a market adjustment to bring them in line with peer data for their positions. Additionally, all Named Executive Officers received a one-time salary increase of $35,000 to help offset the phased-out elimination of perquisites. These increases brought certain of the Named Executive Officers above the 50th percentile in the short-term, which the committee determined was consistent with the phased-out elimination of the perquisites coupled with the strong financial performance by the Company in fiscal 2010.

The following table summarizes the base salary adjustments for fiscal 2010 and 2011.

Named Executive Officer

|

Salary Increase for Fiscal 2010 |

Base Salary for Fiscal 2010 |

Salary Increase effective Second Quarter Fiscal 2011(1) |

Base Salary effective Second Quarter Fiscal 2011 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

John Ambroseo |

$ | 0 | $ | 580,000 | $ | 45,000 | $ | 625,000 | |||||

Helene Simonet |

$ | 0 | $ | 370,000 | $ | 35,000 | $ | 405,000 | |||||

Mark Sobey(2) |

$ | 0 | $ | 300,000 | $ | 60,000 | $ | 360,000 | |||||

Bret DiMarco |

$ | 0 | $ | 300,000 | $ | 35,000 | $ | 335,000 | |||||

Luis Spinelli |

$ | 0 | $ | 256,000 | $ | 39,000 | $ | 295,000 | |||||

- (1)

- Includes

$35,000 increase tied to phased-out elimination of perquisites.

- (2)

- Reflects the base salary and promotion increase upon Dr. Sobey's appointment as an executive officer beginning the third fiscal quarter of fiscal 2010.

Variable Cash Incentive Compensation

To focus each executive officer on the importance of the financial performance of Coherent, a substantial portion of each individual's potential short-term compensation is in the form of variable incentive pay tied to committee-established goals. In fiscal 2010, Coherent maintained one incentive cash program under which executive officers were eligible to receive bonuses, the 2010 Variable Compensation Plan ("2010 VCP").

2010 VCP

The 2010 VCP was designed to promote the growth and profitability of Coherent. It provided incentive compensation opportunity in line with targeted market rates to our Named Executive Officers. Under the 2010 VCP, participants were eligible to receive bi-annual bonuses (with measurement periods for the first half and the second half of the 2010 fiscal year). In setting the performance goals, the Compensation and H.R. Committee assessed the anticipated difficulty and importance to the success of Coherent of achieving the performance goals.

The actual awards (if any) payable for each semi-annual period varied depending on the extent to which actual performance met, exceeded or fell short of the goals approved by the committee. The 2010 VCP goals were tied to the Company achieving varying levels of adjusted EBITDA as a percentage of sales ("adjusted EBITDA %"), with a payout modifier tied to the level of the adjusted EBITDA % for each measurement period. Adjusted EBITDA was defined as earnings before interest, taxes, depreciation, amortization and certain other non-operating income and expense items and other items, such as the fiscal impact of stock option expensing under Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC 718, stock option-related litigation costs and settlement related thereto, 2010 VCP earned, impairment or restructuring charges, and the impact of significant acquisitions.

10

Due to the continuing worldwide economic downturn, the committee provided for a lower adjusted EBITDA % target in the first half of the fiscal year, with a payout cap of 100%. In order to incentivize management to drive improvement in adjusted EBITDA % over the course of the year, the committee approved a meaningful step up during the second half of the year and an increased payout cap of 200%. For the first half of fiscal 2010 no payout under the 2010 VCP would occur until the Company was profitable on a pro forma pre-tax basis, with a minimum revenue threshold. For the second half of fiscal 2010, the minimum threshold of achievement for any payment to be made required an adjusted EBITDA % greater than 12.5% in the second half of the year, with a minimum revenue threshold. Due to the Company's significantly improved operating performance, the payout cap was reached for both periods.

Fiscal 2010 Variable Compensation Plan Scale for Named Executive Officers

| First Half FY 2010 VCP Scale | Second Half FY 2010 VCP Scale | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Adjusted EBITDA % | Payout | Adjusted EBITDA % | Payout | ||||||||

| 12.5 | 0 | % | |||||||||

| 8.5 | 25 | % | 13.5 | 50 | % | ||||||

| 11.0 | 50 | % | 14.5 | 100 | % | ||||||

| 13.5 | 75 | % | 15.5 | 150 | % | ||||||

| 14.5 | 100 | % | 16.5 | 200 | % | ||||||

| Revenue Threshold $210.2 million | Revenue Threshold $233.9 million |

||||||||||

| Adjusted EBITDA % Achievement for First Half FY2010 VCP Payout |

Adjusted EBITDA% Achievement for Second Half FY2010 VCP Payout |

|

|---|---|---|

| 14.9% | 21.2% |

The committee, in consultation with its compensation consultant, chose these operating results so that the executives were incentivized to deliver the type of sustainable operations that benefits our stockholders. Given that only a modest payout was earned under the 2009 variable compensation plan, the committee believed that the goals were reasonably difficult to achieve in fiscal 2009. Accordingly, when setting the performance goals for the 2010 VCP, the committee again established reasonably difficult achievement goals. The Company's financial performance during fiscal 2010 resulted in a number of all-time financial records for Coherent and, accordingly, the payout under the 2010 VCP was demonstrably higher than in the prior fiscal year.

The tables below describes for each Named Executive Officer under the 2010 Variable Compensation Plan (i) the target percentage of base salary, (ii) the potential award range as a percentage of base salary, and (iii) the actual award earned for the measurement period in fiscal 2010.

First Half of Fiscal Year 2010

Named Executive Officer

|

Target Percentage of Salary* |

Payout Percentage Range of Salary* |

Actual Award($)(1) |

Actual Award Percentage of Salary(2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

John Ambroseo |

100 | % | 0 - 100 | % | 290,004 | 100 | % | ||||||

Helene Simonet |

70 | % | 0 - 70 | % | 129,497 | 70 | % | ||||||

Mark Sobey |

50 | % | 0 - 50 | % | 75,005 | 50 | % | ||||||

Bret DiMarco |

50 | % | 0 - 50 | % | 75,000 | 50 | % | ||||||

Luis Spinelli |

50 | % | 0 - 50 | % | 64,002 | 50 | % | ||||||

11

Second Half of Fiscal Year 2010

Named Executive Officer

|

Target Percentage of Salary* |

Payout Percentage Range of Salary* |

Actual Award($)(1) |

Actual Award Percentage of Salary(2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

John Ambroseo |

100 | % | 0 - 200 | % | 580,008 | 200 | % | ||||||

Helene Simonet |

70 | % | 0 - 140 | % | 258,993 | 140 | % | ||||||

Mark Sobey |

60 | % | 0 - 120 | % | 180,012 | 120 | % | ||||||

Bret DiMarco |

50 | % | 0 - 100 | % | 150,000 | 100 | % | ||||||

Luis Spinelli |

50 | % | 0 - 100 | % | 128,004 | 100 | % | ||||||

- *

- Salary

amounts used in the table reflect the applicable half of fiscal 2010.

- (1)

- Reflects

amounts earned during the applicable half of fiscal 2010.

- (2)

- This reflects the aggregate bonuses earned by the Named Executive Officers for the applicable half of fiscal 2010 under the 2010 VCP.

Variable Compensation Plan 2011 Performance Metrics

In the first quarter of fiscal 2011, the Committee established performance metrics for the 2011 Variable Compensation Plan (the "2011 VCP"). These performance metrics are based upon achieving semi-annual (each six month period of the fiscal year) pro forma EBITDA dollar targets, subject to achieving certain bi-annual revenue thresholds. For purposes of the 2011 VCP, "pro forma EBITDA" is defined as earnings before interest, taxes, depreciation, amortization, equity compensation expenses, major restructuring charges, the impact of mergers and acquisitions and certain other non-operating income and expense items.

The amount each participant may receive can vary between 0% and 300% of the targeted amount. If the Company fails to meet at least the minimum goal for adjusted EBITDA dollar achievement and the revenue threshold for a particular semi-annual period, the participant would not receive any bonus for that particular period. The adjusted EBITDA dollar and revenue achievement are calculated after the conclusion of each applicable semi-annual fiscal period. The Committee determined the target percentage of salary in the 2011 VCP for our NEOs, should remain the same as fiscal 2010: John Ambroseo: 100%; Helene Simonet: 70%; Mark Sobey: 60%; Bret DiMarco: 50%; and Luis Spinelli: 50%.

Equity Awards

We believe that equity awards provide a strong alignment between the interests of our executives and our stockholders. We seek to provide equity award opportunities that are consistent with our targeted peer group median, with the potential for increase for exceptional Company financial performance, consistent with the reasonable management of the Company's overall equity compensation expense and stockholder dilution. Finally, we believe that long-term equity awards are an essential tool in promoting the retention of our executives. Our long-term incentive program includes the grant of stock options, time-based restricted stock/units and/or performance-based restricted stock/units. These components provide a reward for past corporate and individual performance and as an incentive for future performance.

When making its compensation decisions, the committee reviews the compensation overview prepared by its independent compensation consultant which reflects potential realizable value under current short and long term compensation arrangements for each Named Executive Officer.

12

Fiscal 2010 Equity Grants

In fiscal 2010, the committee granted a combination of non-qualified stock options and time-based restricted stock units. To ensure that the grants provided retention and both short and long term incentives, the grants vest over three years through one-year annual cliff vesting.

The following table reflects the grants for the Named Executive Officers for the time-based restricted stock units and non-qualified stock option grants during fiscal 2010 (in shares):

Named Executive Officer

|

Time-Based RSU Grants |

Non-Qualified Stock Option Grants |

|||||

|---|---|---|---|---|---|---|---|

John Ambroseo |

37,500 | 75,000 | |||||

Helene Simonet |

14,000 | 28,000 | |||||

Mark Sobey |

12,000 | 24,000 | |||||

Bret DiMarco |

10,500 | 21,000 | |||||

Luis Spinelli |

9,000 | 18,000 | |||||

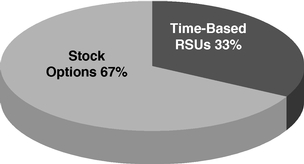

The following chart shows the aggregate composition of equity grants for fiscal 2010 to the Named Executive Officers:

FY 10 Equity Grant Components

(based on underlying shares)

Fiscal 2011 Equity Grants

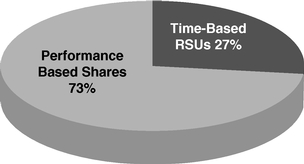

For fiscal 2011, the committee determined to base the equity program on a combination of time-based and performance-based restricted stock units. In particular, the committee determined to measure achievement for the performance grants against the Company's relative performance of its common stock versus that of the Russell 2000 Index. The committee believes that using the Russell 2000 Index (in which the Company is a member) as a representative of total stockholder return directly aligns executive compensation with stockholder interest. The committee determined that both the performance-based and time-based restricted stock unit grants provide a further retention tool in that the grants vest over three years with one-year annual cliff vesting and, for the performance-based grants, a measurement period for each of the next three years. At target achievement, all Named Executive Officers (other than the chief executive officer) will receive an equity distribution of 50% time-based and 50% performance-based equity award payouts and the chief executive officer will receive greater than half of his total equity award in performance-based equity awards.

In the event of a change of control of the Company, the performance-based grants will be measured, with respect to performance periods not yet completed, by the relative performance of the Company's common stock against the Russell 2000 Index through the date of the change of control and such performance-based shares would then convert to time-based vesting with a maximum of three one-year vesting cliffs from the grant date.

13

The following table reflects the equity grants to the Named Executive Officers during the first quarter of fiscal 2011:

Named Executive Officer

|

Time-Based RSU Grants |

Performance-Based RSU Grants Range (issuance dependent upon achievement) |

|||||

|---|---|---|---|---|---|---|---|

John Ambroseo |

20,000 | 0 - 70,000 | |||||

Helene Simonet |

7,500 | 0 - 15,000 | |||||

Mark Sobey |

7,000 | 0 - 14,000 | |||||

Bret DiMarco |

5,000 | 0 - 10,000 | |||||

Luis Spinelli |

3,000 | 0 - 6,000 | |||||

The following chart shows the aggregate composition of equity grants for fiscal 2011 to the Named Executive Officers assuming the maximum achievement under the performance-based grants:

FY 11 Equity Grant Components at Maximum Achievement

(based on underlying shares)

Equity Award Practices

Equity grants to our employees are driven by our annual review process. Grant guidelines are based on competitive market practices. Typically, an employee is granted an option or restricted stock unit upon beginning employment and may be eligible for periodic grants thereafter. The size of grants (and eligibility for the same) is influenced by the then-current guidelines for non-executive officer grants and the individual's performance or particular requirements at the time of hire. Employees, including the Named Executive Officers, are also eligible to participate in our Employee Stock Purchase Plan. Stock options are granted with an exercise price equal to the fair market value of the shares of the Company's common stock on the grant date (or, on the date of grant effectiveness of the grant in the case of grants made during closed window periods). The exercise price for our stock options is based on the last quoted price per share of the Company's common stock as reported on the NASDAQ Global Market on the grant date.

In fiscal 2010, the Compensation and H.R. Committee granted an aggregate of 681,250 shares subject to options and time-based restricted stock units, representing 2.76% of Coherent's outstanding common stock as of October 2, 2010 (excluding automatic grants to directors under the Director Option Plan). With the assistance of Farient, the committee has reviewed this burn rate relative to peer practices and guidance from RiskMetrics and found that the total dilution was consistent with the median of peer practices and complied with RiskMetrics guidelines.

14

Stock Grant Process

The committee's process for granting equity awards is as follows:

- •

- The Compensation and H.R. Committee has the authority to make equity grants to both executive officers and other service

providers;

- •

- The Compensation and H.R. Committee will make grants in open trading window periods with grants effective on the date of

such meeting, or if they meet during a closed window period, the exercise price of the option grant will be the trading date effective 45 days thereafter (or the next trading date thereafter if

the date falls on a non-trading day); and

- •

- The Compensation and H.R. Committee may not grant equity awards by written consent.

During fiscal 2010 equity grants were only made by the Compensation and H.R. Committee.

Other Benefits

Retirement Plans

Executive officers are eligible to participate in our 401(k) Retirement Plan on the same terms as all other U.S. employees, including a 4% Company matching contribution. Our 401(k) Retirement Plan is a tax-qualified plan and therefore is subject to certain Internal Revenue Code limitations on the dollar amounts of deferrals and Company contributions that can be made to plan accounts. These limitations apply to our more highly-compensated employees (including the Named Executive Officers).

We maintain a Deferred Compensation Plan for executive management personnel and members of the Board. The Deferred Compensation Plan permits eligible participants to defer receipt of compensation pursuant to the terms of the plan. The Deferred Compensation Plan permits participants to contribute, on a pre-tax basis, up to 75% of their base salary earnings, up to 100% of their bonus pay and commissions and up to 100% of directors' annual retainer earned in the upcoming plan year. Plan participants may invest deferrals in a variety of different deemed investment options. To preserve the tax-deferred status of deferred compensation plans, the IRS requires that the available investment alternatives be "deemed investments." Participants do not have an ownership interest in the funds they select; the funds are only used to measure the gains or losses that are attributed to the participant's deferral account over time.

For plan year 2010 for contributions which were in excess of the Internal Revenue Code limit to qualified 401(k) plans, the Company will make a non-qualified deferred compensation plan contribution on behalf of the Named Executive Officers. The calculation for this non-qualified plan contribution is 4% of eligible compensation (as defined under the Company's 401(k) plan) less the 401(k) plan match limit. In fiscal 2010 the Company made a contribution for the 2009 plan year at a 4% contribution rate. The Company will make a similar contribution for the 2010 plan year (which shall be contributed during calendar 2011). The Company contribution was eliminated for plan year 2011 and beyond.

The committee considers the Deferred Compensation Plan to be a reasonable and appropriate program because it promotes executive officer retention by offering a deferred compensation plan that is comparable to and competitive with what is offered by our peer group of companies.

15

Severance and Change of Control Arrangements

We have adopted the Change of Control Severance Plan (the "Change of Control Plan") which provides certain benefits in the event of a change in control of Coherent for certain executives, including each of our Named Executive Officers. Benefits are provided if there is a tender offer or merger resulting in Coherent being acquired by another entity and within two years thereafter the participant's employment is terminated without cause or is voluntarily terminated following a constructive termination. The committee believes the Change of Control Plan serves as an important retention tool in the event of a pending change of control transaction.

The Change of Control Plan was amended and restated in the first quarter of fiscal 2011. Among the amendments made to the plan in fiscal 2011 were: (i) the elimination of the gross-up payment to be made to the chief executive officer for any excise taxes resulting from the application of Section 280G of the Internal Revenue Code; and (ii) the addition of a monthly payment of $2,750 for participants in lieu of receiving company-subsidized COBRA benefits, life insurance premiums and/or any other welfare benefits under the Plan (36 months for the chief executive officer and 24 months for the other Named Executive Officers). The Change of Control Plan was amended in fiscal 2010 for Internal Revenue Code Section 409A-related matters and other administrative matters.

The committee reviews the provisions of the Change of Control Plan at a minimum every two years at or immediately prior to the termination of the plan. The committee believes that reviewing the Change of Control Plan every two years allows for the right balance in providing certainty for the participants thereof and providing the committee with the opportunity to revise the plan consistent with corporate governance best practices, evolving peer group practices and regulatory changes.

The committee does not consider the potential payments and benefits under these arrangements when making compensation decisions for our NEOs. These arrangements serve specific purposes unrelated to the determination of the NEOs' total direct compensation for a specific year.

Executive perquisites and Other Personal Benefits

In the first quarter of fiscal 2011, the committee determined, upon recommendation from management and in consultation with Compensia, to eliminate and phase-out executive perquisites effective January 1, 2011. The use of Company-leased automobiles was phased-out due to the contractual cost of early termination of the leases. The Company leases of automobiles used by executives will terminate in April 2012 (Dr. Ambroseo) and October 2011 (Ms. Simonet and Mr. DiMarco).

During fiscal 2010, the Company provided our executive officers with an automobile benefit and a capped medical reimbursement.

Automobile Benefit. During fiscal 2010, the Named Executive Officers were eligible to receive either (a) a monthly automobile allowance, or (b) a leased vehicle with up to an aggregate purchase price of up to: (i) $95,000 for the chief executive officer and (ii) $75,000 for other Named Executive Officers. For those individuals utilizing the automobile allowance alternative, the allowance amount was set annually utilizing a prescribed formula, which equaled $1,500 per month in fiscal 2010. The leased automobile alternative is administered by a third party financing agency and the Company pays the monthly lease amount. Executive officers are either reimbursed for or provided gas, oil, maintenance and insurance for automobiles leased under this program. Participants in the automobile program incur annual imputed income on the personal use of any vehicles under the program, including fuel and miles, as determined using the Internal Revenue Code rules.

Medical Reimbursement. During fiscal 2010, each Named Executive Officer also received up to $5,000 per calendar year of reimbursement for uninsured medical expenses with the Company also paying such executive's taxes on the amount of the benefit.

16

The committee determined, with advice from Farient, that the use of a company-leased vehicle or a car allowance and a medical reimbursement benefit were reasonable in the context of the overall compensation levels of our Named Executive Officers, were consistent with a number of other peer companies, had been historical components of compensation for executive officers at the Company and aided in executive retention.

One-Time Payment for Equity Expiration

During the period from November 1, 2006 to December 31, 2007, the Company had imposed a company-wide blackout on the exercise of stock options because the Company was not current in its periodic reporting obligations due to its ongoing internal investigation into its historical stock option granting practices. Certain non-executive officer employees had option grants expire during such period pursuant to the terms of grant. Following such expiration, the Company paid such employees an amount to compensate them determined by the difference between $34.21 (which was the highest sales price of the Company's common stock during the blackout period) and the exercise price of their expired stock options. In the first quarter of fiscal 2010, the committee approved the payment of the following amounts to certain of the Company's NEOs, which amounts were determined pursuant to the same formula described above for non-executive officer employees. Additionally, as a condition to payment each executive officer executed a general release with regards to the expired option grants.

Executive

|

Number of Expired Options | Amount Paid | |||||

|---|---|---|---|---|---|---|---|

John Ambroseo |

150,000 | $ | 237,000 | ||||

Helene Simonet |

5,000 | $ | 8,550 | ||||

Luis Spinelli |

5,000 | $ | 8,550 | ||||

Tax and Accounting Considerations

The Company's compensation programs are affected by each of the following:

- •

- Accounting for Stock-Based Compensation—The Company accounts

for stock-based compensation in accordance with the requirements of ASC 718. The Company also takes into consideration ASC 718 and other generally accepted accounting principles in determining changes

to policies and practices for its stock-based compensation programs.

- •

- Section 162(m) of the Internal Revenue Code—This

section limits the deductibility of compensation for our chief executive officer and our other most highly compensated Named Executive Officers (other than our chief financial officer) unless the

compensation is less than $1 million during any fiscal year or is "performance-based" under Section 162(m). Our 2001 Stock Plan and 2011 Equity Incentive Plan are designed so that option

grants and certain performance-based full value awards thereunder are fully tax-deductible. Cash compensation and time-based full-value awards are generally not

qualified as "performance-based" compensation under Section 162(m). We may from time to time pay compensation to our executive officers that may not be deductible when, for example, we believe

that such compensation is appropriate and in the best interests of the stockholders after taking various factors into consideration, including business conditions and the performance of such executive

officer.

- •

- Section 409A of the Internal Revenue Code—Section 409A imposes additional significant taxes in the event that an executive officer, director or service provider received "deferred compensation" that does not satisfy the requirements of Section 409A. We believe that we have designed and operated any plans to appropriately comply with Section 409A.

17

Other Compensation Policies

To further align our executive compensation program with the interests of our stockholders, at the end of fiscal 2009, the special litigation committee of the Board approved a recoupment policy. The recoupment policy provides that, in the event that there is an accounting restatement and there is a finding by the Board that such restatement was due to the gross recklessness or intentional misconduct of the chief executive officer or chief financial officer and it caused material noncompliance with any financial reporting requirement, then the Company shall seek disgorgement of any portion of the bonus or other incentive or equity based compensation related to such accounting restatement received by such individual during the 12-month period following the original financial document.

Compensation Committee Interlocks and Insider Participation and Committee Independence

During fiscal 2010, the Compensation and H.R. Committee of the Board consisted of Messrs. Vij (Chair), Krause and Tomlinson and Dr. Rogerson. John Hart, a former member of the Board, was a member of the committee until his retirement in the second quarter of fiscal 2010. None of the members of the Compensation and H.R. Committee has been or is an officer or employee of Coherent. None of our executive officers serves on the board of directors or compensation committee of a company that has an executive officer that serves on our Board or Compensation and H.R. Committee. No member of our Board is an executive officer of a company in which one of our executive officers serves as a member of the board of directors or compensation committee of that company.

Each of the members of the committee qualifies as (i) an "independent director" under the requirements of The NASDAQ Stock Market, (ii) a "non-employee director" under Rule 16b-3 of the Securities Exchange Act of 1934 (the "1934 Act"), (iii) an "outside director" under Section 162(m) of the Code and (iv) an "independent outside director" as that term is defined by Institutional Shareholder Services.

Compensation and H.R. Committee Report

The Compensation and H.R. Committee of the Board has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation and H.R. Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Company's Annual Report on Form 10-K.

| Respectively submitted by THE COMPENSATION AND H.R. COMMITTEE |

||

Sandeep Vij, Chair L. William Krause Garry Rogerson Larry Tomlinson |

18

Fiscal 2010 Summary Compensation Table

The table below presents information concerning the total compensation of our Named Executive Officers for the fiscal years ended October 2, 2010, October 3, 2009 and September 27, 2008.

Name and Principal Position

|

Fiscal Year |

Salary ($) | Stock Awards ($)(3) |

Option Awards ($)(4) |

Non-Equity Incentive Plan Compensation ($)(5) |

All Other Compensation ($)(6) |

Total ($) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (a) |

(b) |

(c) |

(e) |

(f) |

(g) |

(i) |

(j) |

||||||||||||||||

John Ambroseo, |

2010 | (1) | 580,008 | 981,000 | 600,390 | 870,012 | 277,527 | (7) | 3,308,937 | ||||||||||||||

Chief Executive Officer |

2009 | 602,316 | 661,218 | 688,194 | 2,262 | 76,016 | (7) | 2,030,006 | |||||||||||||||

and President |

2008 | 561,312 | 1,292,175 | (12) | 2,087,000 | 534,621 | 80,676 | (7) | 4,555,784 | ||||||||||||||

Helene Simonet, |

2010 |

(1) |

369,990 |

366,240 |

224,146 |

388,490 |

46,664 |

(8) |

1,395,530 |

||||||||||||||

Executive Vice President |

2009 | 384,221 | 236,232 | 245,329 | 1,010 | 52,951 | (8) | 919,743 | |||||||||||||||

and Chief Financial Officer |

2008 | 359,334 | 717,875 | (12) | 834,800 | 239,649 | 62,142 | (8) | 2,213,800 | ||||||||||||||

Mark Sobey(2), |

2010 |

(1) |

293,673 |

313,920 |

192,125 |

255,017 |

22,378 |

(9) |

1,077,113 |

||||||||||||||

Executive Vice President and General Manager, SLS |

|||||||||||||||||||||||

Bret DiMarco, |

2010 |

(1) |

297,309 |

274,680 |

168,109 |

225,000 |

36,527 |

(10) |

1,001,625 |

||||||||||||||

Executive Vice President |

2009 | 311,658 | 186,438 | 193,441 | 585 | 38,138 | (10) | 730,260 | |||||||||||||||

and General Counsel |

2008 | 298,076 | 574,300 | (12) | 417,400 | 143,275 | 38,607 | (10) | 1,471,658 | ||||||||||||||

Luis Spinelli, |

2010 |

(1) |

256,006 |

235,440 |

144,094 |

192,006 |

59,596 |

(11) |

887,142 |

||||||||||||||

Executive Vice President |

2009 | 265,853 | 155,172 | 161,125 | 499 | 173,720 | (11) | 756,369 | |||||||||||||||

and Chief Technology Officer |

2008 | 252,862 | 287,150 | (12) | 125,220 | 120,635 | 137,041 | (11) | 922,908 | ||||||||||||||

- (1)

- Reflects

the dollar amount of salary earned in fiscal year 2010. Due to the timing of our fiscal year, fiscal year 2009 included 27 payroll periods compared

to 26 payroll periods in fiscal 2010 and 2008.

- (2)

- Dr. Sobey

was promoted to Executive Vice President and General Manager of Specialty Lasers and Systems (SLS) and became an executive officer on

April 1, 2010. Accordingly, information for 2009 and 2008 for Dr. Sobey has been omitted.

- (3)

- Amounts

shown reflect the grant date fair value of awards granted in accordance with Financial Accounting Standards Board (FASB) Accounting Standards

Codification (ASC) Topic 718.

- (4)

- The

amounts shown reflect the grant date fair value of stock options determined pursuant to FASB ASC Topic 718. These options vest annually over a three

year period. Pursuant to FASB ASC Topic 718, the amounts shown here exclude the effect of estimated forfeitures related to service-based vesting conditions. The assumptions used in the valuation of

these awards are set forth in Note 14, "Employee Stock Option and Benefit Plans" of the Financial Statements in our annual report on Form 10-K. These amounts do not

correspond to the actual value, if any, that may ultimately be recognized by the Named Executive Officers.

- (5)

- Reflects

the dollar amounts earned under the Variable Compensation Plan (VCP) during fiscal 2010, fiscal 2009 and fiscal 2008.

- (6)

- For

Dr. Ambroseo, Mr. Spinelli and Ms. Simonet "All Other Compensation" includes a payment for expired stock option grants that we

previously disclosed on Form 8-K dated December 9, 2009. As noted in the Form 8-K, during November 1, 2006 to December 31, 2007, we imposed a

company-wide blackout on the exercise of stock options because we were not current in our financial reporting obligations due to an internal historical stock option grant practices

investigation. The Compensation and H.R. Committee approved payments to these individuals, which amounts were determined pursuant to the same formula used for non-executive officers.

- (7)

- For fiscal 2010, includes (a) amounts contributed by us under the Company's 401(k) plan ($8,902) and deferred compensation plan ($10,177), (b) the use of a Company-leased and maintained automobile ("Car Allowance") ($12,436), (c) the payment described in footnote (6) above ($237,000), (d) payment for buy-out of earned vacation ($1,785) and (e) amounts reimbursed pursuant to executive medical reimbursement

19

($5,228). For fiscal year 2009, includes (a) amounts contributed by us under the Company's 401(k) plan ($13,541) and deferred compensation plan ($20,402), (b) debt forgiveness which was reflected on Dr. Ambroseo's W-2 form during the first quarter of fiscal 2009 for his promissory note which was fully forgiven prior to the end of fiscal 2009 ($10,000), (c) a Car Allowance ($29,760), and (d) amounts reimbursed pursuant to executive medical reimbursement ($10,236). For fiscal year 2008, includes amounts (a) contributed by us under the Company's 401(k) plan ($13,501) and deferred compensation plan ($19,356), (b) payment for buy-out of earned vacation ($21,685), (c) debt forgiveness ($10,200), (d) the use of a Company-owned and maintained automobile ($8,539) and (e) amounts reimbursed pursuant to executive medical reimbursement ($5,463).

- (8)

- For fiscal 2010, includes (a) amounts contributed by us under the Company's 401(k) plan ($8,662) and

deferred compensation plan ($4,184), (b) a Car Allowance ($17,513), (d) the payment described in footnote (6) above ($8,550), and (e) amounts reimbursed pursuant to

executive medical reimbursement ($4,195). For fiscal 2009, includes (a) amounts contributed by us under the Company's 401(k) plan ($12,048) and

deferred compensation plan ($8,058), (b) a payment for buy-out of earned vacation ($7,115), (c) a Car Allowance ($15,834) and (d) amounts reimbursed pursuant to

executive medical reimbursement ($6,198). For fiscal year 2008, includes (a) amounts contributed by us under the Company's 401(k) plan ($13,800)

and deferred compensation plan ($7,591), (b) payment for buy-out of earned vacation ($17,255), (c) the use of a Company-owned and maintained automobile ($14,267) and

(d) amounts reimbursed pursuant to executive medical reimbursement ($5,775).

- (9)

- For fiscal 2010, includes (a) amounts contributed by us under the Company's 401(k) plan ($10,358) and

deferred compensation plan ($953), (b) a Car Allowance ($9,000) and (c) amounts reimbursed pursuant to executive medical reimbursement ($668).

- (10)

- For fiscal 2010, includes (a) amounts contributed by us under the Company's 401(k) plan ($10,154) and

deferred compensation plan ($1,425), (b) Car Allowance ($16,296), and (d) amounts reimbursed pursuant to executive medical reimbursement ($7,992). For fiscal

2009, includes amounts (a) contributed by us under the Company's 401(k) plan ($10,338) and deferred compensation plan ($4,200), (b) a Car Allowance ($16,876) and

(c) amounts reimbursed pursuant to executive medical reimbursement ($6,039). For fiscal year 2008, includes (a) amounts contributed by us

under the Company's 401(k) plan ($17,691), (b) the use of a Company-owned and maintained automobile ($15,835), and (c) amounts reimbursed pursuant to executive medical reimbursement

($4,447).

- (11)

- For fiscal 2010, includes (a) amounts contributed by us under the Company's 401(k) plan ($9,800),

(b) a Car Allowance ($18,000), (c) amounts earned under our patent award program where Mr. Spinelli was an inventor ($10,010) (d) the payment described in footnote

(6) above ($8,550), and (e) amounts reimbursed pursuant to executive medical reimbursement ($5,835). For fiscal 2009, includes

(a) amounts contributed by us under the Company's 401(k) plan ($11,932) and deferred compensation plan ($1,460), (b) a Car Allowance ($22,573), (c) amounts earned under our patent

award program where Mr. Spinelli was an inventor ($15,618), (d) reimbursement for tax obligations arising under Section 409A as a result of the exercise of stock options with an

exercise price less than fair market value as of the options grant date (these grants were made to Mr. Spinelli prior to him becoming an executive officer) ($107,730) and (f) amounts

reimbursed pursuant to executive medical reimbursement ($7,839). For fiscal year 2008, includes (a) amounts contributed by us under the Company's

401(k) plan ($13,520) and deferred compensation plan ($1,533), (b) payment for buy-out of earned vacation ($13,612), (c) the use of a Company-owned and maintained automobile

($19,621), (d) amounts reflecting imputed income to Mr. Spinelli from the sale of a Company car under the terms of the Company's auto policy ($25,867), (e) amounts earned under

our patent award program where Mr. Spinelli was an inventor ($5,048), (f) a reimbursement for tax obligations arising under Section 409A as a result of exercise of stock options

with an exercise price less than fair market value as of the options grant date (these grants were made to Mr. Spinelli prior to him becoming an executive officer) ($54,223) and

(g) amounts reimbursed pursuant to executive medical reimbursement ($8,494).

- (12)

- The dollar value of stock awards in fiscal 2008 includes amounts for the grant date fair value of the performance—RSU awards granted in accordance with FASB ASC Topic 718. As previously noted, one element for pay-out was not achieved and, accordingly, no shares were issued from these awards.

20

Grants of Plan-Based Awards in Fiscal 2010

Except as set forth in the footnotes, the following table shows all plan-based equity and non-equity incentive awards granted to our Named Executive Officers during fiscal 2010.

| |

|

|

|

|

|

Actual Payouts Under Non-Equity Incentive Plan Awards ($) |

All Other Stock Awards: # of Securities Underlying Options (#) |

All Other Option Awards: # of Securities Underlying Options (#) |

Exercise or Base Price of Option Awards ($) |

|

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Estimated Future Payouts Under Non-Equity Incentive Plan Awards |

|

||||||||||||||||||||||||||

| |

|

|

Grant Date Fair Value ($)(1) |

|||||||||||||||||||||||||||

Name

|

Type | Grant Date |

Threshold ($) |

Target ($) |

Maximum ($) |

|||||||||||||||||||||||||

| John Ambroseo | Option | 11/20/2009 | 75,000 | 26.16 | 600,390 | |||||||||||||||||||||||||

| RSU | 11/20/2009 | 37,500 | 981,000 | |||||||||||||||||||||||||||

| 1st semi annual | 0 | (2) | 290,004 | 290,004 | 290,004 | |||||||||||||||||||||||||

| 2nd semi annual | 0 | (2) | 290,004 | 580,008 | 580,008 | (3) | ||||||||||||||||||||||||

| Total | 0 | (2) | 580,008 | 870,012 | 870,012 | |||||||||||||||||||||||||

Helene Simonet |

Option |

11/20/2009 |

28,000 |

26.16 |

224,146 |

|||||||||||||||||||||||||

| RSU | 11/20/2009 | 14,000 | 366,240 | |||||||||||||||||||||||||||

| 1st semi annual | 0 | (2) | 129,497 | 129,497 | 129,497 | |||||||||||||||||||||||||

| 2nd semi annual | 0 | (2) | 129,497 | 258,993 | 258,993 | (3) | ||||||||||||||||||||||||

| Total | 0 | (2) | 258,994 | 388,490 | 388,490 | |||||||||||||||||||||||||

Mark Sobey |

Option |

11/20/2009 |

24,000 |

26.16 |

192,125 |

|||||||||||||||||||||||||

| RSU | 11/20/2009 | 12,000 | 313,920 | |||||||||||||||||||||||||||

| 1st semi annual | 0 | (2) | 75,005 | 75,005 | 75,005 | |||||||||||||||||||||||||

| 2nd semi annual | 0 | (2) | 90,006 | (4) | 180,012 | (4) | 180,012 | (3) | ||||||||||||||||||||||

| Total | 0 | (2) | 165,011 | 255,017 | 255,017 | |||||||||||||||||||||||||

Bret DiMarco |

Option |

11/20/2009 |

21,000 |

26.16 |

168,109 |

|||||||||||||||||||||||||

| RSU | 11/20/2009 | 10,500 | 274,680 | |||||||||||||||||||||||||||

| 1st semi annual | 0 | (2) | 75,000 | 75,000 | 75,000 | |||||||||||||||||||||||||

| 2nd semi annual | 0 | (2) | 75,000 | 150,000 | 150,000 | (3) | ||||||||||||||||||||||||

| Total | 0 | (2) | 150,000 | 225,000 | 225,000 | |||||||||||||||||||||||||

Luis Spinelli |

Option |