Attached files

Table of Contents

As filed with the Securities and Exchange Commission on January 28, 2011

Registration No. 333-171271

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

ServiceSource International, LLC

(Exact name of Registrant as specified in its charter)

| Delaware | 7380 | 81-0578975 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

634 Second Street

San Francisco, California 94107

(415) 901-6030

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Michael A. Smerklo

Chief Executive Officer

634 Second Street

San Francisco, California 94107

(415) 901-6030

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey D. Saper Tony Jeffries Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Paul D. Warenski Senior Vice President and General Counsel 634 Second Street San Francisco, California 94107 (415) 901-6030 |

Sarah K. Solum Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||

| Common Stock, par value $0.0001 per share |

$75,000,000 | $5,347.50 | ||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | The Registrant previously paid this registration fee in connection with a previous filing of this Registration Statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

ServiceSource International, LLC, the registrant whose name appears on the cover of this registration statement, is a Delaware limited liability company. Prior to the issuance of any shares of common stock subject to this registration statement, ServiceSource International, LLC will convert into a Delaware corporation and change its name from ServiceSource International, LLC to ServiceSource International, Inc. Shares of the common stock of ServiceSource International, Inc. are being offered by the prospectus.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued January 28, 2011

Shares

COMMON STOCK

ServiceSource International, Inc. is offering shares of common stock and the selling stockholders are offering shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. This is our initial public offering and no public market exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share.

We intend to apply for a listing of our common stock on The Nasdaq Global Market under the symbol “ .”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 11.

PRICE $ A SHARE

| Price to Public |

Underwriting |

Proceeds to |

Proceeds to | |||||

| Per share |

$ | $ | $ | $ | ||||

| Total |

$ | $ | $ | $ |

We and the selling stockholders have granted the underwriters the right to purchase up to an additional shares of common stock to cover over-allotments, with up to an additional shares sold by us and up to an additional shares sold by the selling stockholders.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2011.

| MORGAN STANLEY | DEUTSCHE BANK SECURITIES |

| WILLIAM BLAIR & COMPANY | LAZARD CAPITAL MARKETS | PIPER JAFFRAY |

JMP SECURITIES

, 2011

Table of Contents

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

Until , 2011 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we, the selling stockholders nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

ServiceSource is our registered trademark and Service Revenue Intelligence Platform, Channel Sales Cloud and our logo are our trademarks. All other trademarks and trade names appearing in this prospectus are the property of their respective owners.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. Before deciding to invest in shares of our common stock, you should read this summary together with the more detailed information, including our consolidated financial statements and the related notes, elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in “Risk Factors,” our consolidated financial statements and related notes, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this prospectus.

Except where the context otherwise requires or where otherwise indicated, the terms “ServiceSource,” “we,” “us,” “our,” “our company” and “our business” refer, prior to the conversion discussed below, to ServiceSource International, LLC and, after the conversion, to ServiceSource International, Inc., in each case together with its consolidated subsidiaries as a combined entity.

SERVICESOURCE INTERNATIONAL, INC.

Overview

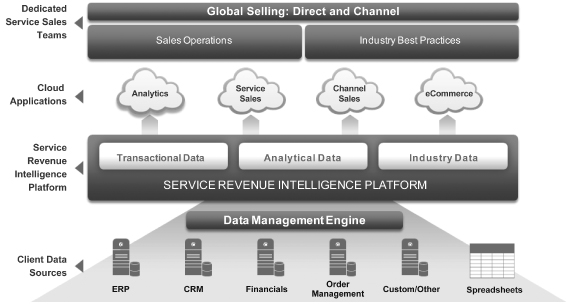

ServiceSource is a leader in service revenue management, providing solutions that drive increased renewals of maintenance, support and subscription agreements for technology companies. Our integrated solution consists of a suite of cloud applications, dedicated service sales teams working under our customers’ brands and a proprietary Service Revenue Intelligence Platform. By integrating software, managed services and data, we provide end-to-end management and optimization of the service contract renewals process, including data management, quoting, selling and service revenue business intelligence. Our business is built on our pay-for-performance model, whereby customers pay us based on renewal sales that we generate on their behalf. As of September 30, 2010, we managed over 90 engagements across more than 50 customers, representing over $5 billion in service revenue opportunity under management.

According to Gartner, total spending on maintenance and support agreements across the technology sector is expected to total $141 billion in 2010.1 We define service revenue as the revenue companies earn from the sale of maintenance and support agreements, as well as subscription contracts. Service revenue has become increasingly important for technology companies as it represents a significant and growing portion of total revenue, drives margin expansion and incremental profitability, can be highly recurring and correlates with end customer satisfaction. However, we believe the complexity of effective service revenue management, coupled with underinvestment in this area has led to suboptimal renewal rates on service contracts. Many technology companies lack the resources needed to maximize service revenue performance. These resources include enterprise systems and applications built specifically for service revenue data management as well as global service sales teams with the expertise to sell service contracts directly and through channel partners.

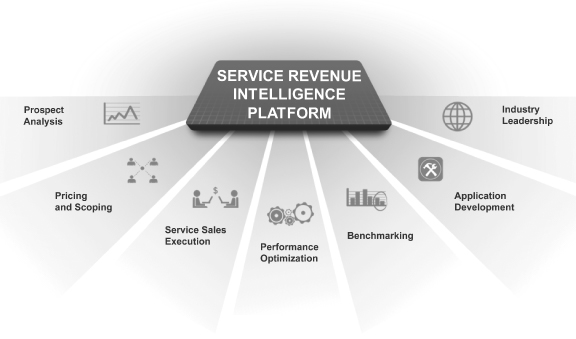

The foundation of our solution is our proprietary Service Revenue Intelligence Platform, a data warehouse that incorporates transactional, analytical and industry data gathered from over two million service renewal transactions since our inception. The data housed within this platform fuels our applications, enables our service sales teams to improve service revenue performance, and allows us to provide analytical insights that we believe other third-party or internally-developed alternatives do not provide. Our suite of cloud applications increases visibility and control of service revenue management and is utilized by customers, channel partners, end customers and our service sales teams. Our dedicated service sales teams have specific expertise in our customers’ businesses, are deployed under our customers’ brands and follow a sales process tailored specifically to increase service contract renewals. Taken together, these elements of our solution help us increase our

| 1 | Gartner, Inc., IT Services Market Metrics Worldwide: Forecast Database, Kathryn Hale et al., September 9, 2010 |

1

Table of Contents

customers’ service revenue, drive their profitability and improve end customer satisfaction. Based on our analysis of customer renewal rates for new engagements added in 2009, we generated renewal rates on contracts delivered to us in the first half of 2010 that on a dollar value basis increased by an average of over 15 percentage points over historical customer renewal rates calculated in our Service Performance Analysis (“SPA”).

Our total revenue was $75.2 million, $100.3 million and $110.7 million for the years ended December 31, 2007, 2008 and 2009, respectively, and was $76.9 million and $108.5 million for the nine months ended September 30, 2009 and 2010, respectively. We had approximately 50, 60 and 80 engagements as of December 31, 2007, 2008 and 2009, respectively, and over 90 engagements as of September 30, 2010.

Our Solution

We have developed an end-to-end solution to increase service revenue performance for our customers. The components of our integrated solution consist of a suite of cloud applications, dedicated service sales teams and our proprietary Service Revenue Intelligence Platform. We deploy our solution through offerings that are tailored either to address specific challenges of the renewals process or to provide end-to-end management of this process. Our highly scalable solution allows us to sell globally on behalf of our customers in over 30 languages. It is designed to provide effective service revenue management irrespective of revenue models, distribution models, and segments within the technology and technology-enabled healthcare and life sciences industries, including hardware, software and software-as-a-service.

Key benefits of our solution include:

Financial Benefits

| • | Increased service revenue. Our solution is designed to increase customers’ service revenues. We actively monitor the service contract renewal rates we drive on behalf of our customers in each engagement. When we generate higher renewal rates, we drive incremental service revenue for both the associated period as well as for subsequent periods due to the recurring nature of service contracts. |

| • | Increased margin and profitability. We believe that the costs associated with delivering maintenance, support and subscription services by many of our customers can be relatively fixed, and thus growth of service revenue can benefit our customers’ bottom line. As a result, each incremental dollar of service revenue generated by our solution can drive greater profitability for our customers. |

Operational Benefits

| • | Improved end customer satisfaction. Our regular dialogue with end customers allows us to communicate the value of our customers’ maintenance, support and subscription services, and capture and address questions and concerns about our customers’ products. |

| • | Greater business insight and analytics. Our Service Revenue Intelligence Platform allows us to analyze our customers’ renewals against similar transactions and to identify areas for improvement, enabling greater insight into their renewals business. By tracking all transactions in our intelligence platform, we are able to provide benchmarking, end customer metrics, sales efficiency data and insight into successful and unsuccessful renewal efforts. The breadth of our data allows us to provide analysis across regions, industries, channel partners and product segments. |

| • | Greater visibility and forecasting tools. Our cloud applications deliver real-time analytics and visibility into a customer’s service revenue performance, sales efficiency and forecasts. CFOs and other executives utilize our cloud applications to assist in forecasting their company’s service revenue and to measure progress against their forecasts on a real-time basis. |

2

Table of Contents

| • | Strengthened channel loyalty. Our Channel Sales Cloud application and service sales teams empower our customers’ channel partners to generate higher sales by providing accurate, real-time data on their renewal opportunities and performance as well as tools to sell more effectively to end customers. These cloud applications help our customers develop a closer relationship with their channel partners. |

| • | Global consistency. We maintain a globally consistent renewals process for our customers as we leverage a unified intelligence platform. Our solution automates the application of best practices to the renewals process and provides a consistent view of the data. |

Our Competitive Advantages

We believe our business is difficult to replicate, as it incorporates a combination of several important and differentiated elements, including:

| • | Proprietary Service Revenue Intelligence Platform. Our proprietary Service Revenue Intelligence Platform aggregates transactional, analytical and industry data from over two million service renewal transactions. This intelligence platform allows us to improve service revenue performance for each customer’s unique business, enabling us to increase the effectiveness and accuracy of our SPA, the pricing and scoping of our solutions and customer benchmarking. We continue to enhance our intelligence platform with each renewal transaction. |

| • | Pay-for-performance business model. With our pay-for-perfomance business model, customers pay us based on the renewal sales that we generate on their behalf, with little or no upfront customer investment. This business model directly aligns our interests with our customers’ interests to drive greater service revenue. Our Service Revenue Intelligence Platform is the critical element that allows us to price effectively on a pay-for-performance basis. |

| • | Industry leadership. Our industry leadership, based on our nearly decade-long history, enables us to innovate best practices, continue to enhance our intelligence platform and attract new customers. |

| • | Service revenue focused solution. Our entire solution, combining software, managed services and data, is built from the ground up to deliver industry-leading service revenue performance across the key elements of the renewals process. |

| • | Renewal sales methodology. Our service sales teams leverage our intelligence platform, sales processes and best practices to manage the end customer relationship and enhance service contract renewal rates. We engage in extensive ongoing training of our service sales teams to ensure consistency of execution across our entire organization. |

| • | Global scale and expertise. Our service sales teams sell in over 30 languages from six sales centers around the globe, enabling them to deliver localized capabilities to better serve the increasingly global nature of our customers’ businesses. |

3

Table of Contents

Our Strategy

We intend to continue our industry leadership in service revenue management. The key elements of our strategy include:

| • | expanding our customer base within existing industry verticals; |

| • | continuing to build, deploy and increase the revenue we generate from our cloud applications; |

| • | increasing our footprint with existing customers to drive greater revenue per customer; |

| • | increasing our operating efficiency by developing additional technology; and |

| • | adding new customers from additional industry verticals and geographic markets. |

Selected Risk Factors

Investing in our common stock involves risks. You should carefully read “Risk Factors” beginning on page 12 for an explanation of these risks before investing in our common stock. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our growth strategy, which could cause a decline in the price of our common stock and result in a loss of all or a portion of your investment:

| • | our quarterly results of operations may fluctuate as a result of numerous factors, many of which may be outside of our control; |

| • | the market for our solution is relatively undeveloped and may not grow; |

| • | our estimates of service revenue opportunity under management and our analysis of renewal rates may prove inaccurate; |

| • | if close rates fall short of our predictions, our revenue will suffer and our ability to grow and achieve broader market acceptance of our solution could be harmed; |

| • | our revenue will decline if there is a decrease in the overall demand for our customers’ products and services for which we provide service revenue management; |

| • | if there is a widespread shift away from business consumers purchasing maintenance and support service contracts, we could be adversely impacted if we are not able to adapt to new trends or expand our target market; |

| • | if we are unable to compete effectively against current and future competitors, our business and operating results will be harmed; |

| • | the loss of one or more of our significant customers as a result of consolidation in the technology sector or otherwise, as occurred when Oracle acquired Sun Microsystems in 2010 and terminated its contract with us effective as of September 30, 2010, could slow our revenue growth and adversely impact our margins; and |

| • | upon the closing of this offering, our directors and executive officers and their affiliates will beneficially own a significant percentage of our outstanding common stock, and may, as a result, be able to determine substantially all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. |

4

Table of Contents

Key Business Metrics

We refer to various key business metrics, including service revenue opportunity under management, engagements and renewal rates, in this Prospectus Summary and elsewhere in this prospectus. We describe how we calculate these metrics and material aspects and limitations of these metrics in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics.”

Conversion to a Corporation

We are currently a Delaware limited liability company. Prior to the issuance of any of our shares of common stock in this offering, we will convert into a Delaware corporation and change our name from ServiceSource International, LLC to ServiceSource International, Inc. In conjunction with the conversion, all of our outstanding common shares will automatically be converted into shares of our common stock. See “Description of Capital Stock” for additional information regarding a description of the terms of our common stock following the conversion and the terms of our certificate of incorporation and bylaws as will be in effect upon the closing of this offering. While as a limited liability company our outstanding equity is called our common shares, in this prospectus for ease of comparison we refer to such common shares as our common stock for periods prior to the conversion, unless otherwise indicated in this prospectus. Similarly, unless otherwise indicated, we refer to members’ equity in this prospectus as stockholders’ equity. In this prospectus, we refer to all of the transactions related to our conversion to a corporation as the “Conversion.” See “Certain Relationships and Related Party Transactions—Conversion to a Corporation.”

Corporate Information

Our principal executive offices are located at 634 Second Street, San Francisco, California 94107, and our telephone number is (415) 901-6030. Our website address is www.servicesource.com. Information contained on or accessible through our website is not incorporated by reference into this prospectus, and should not be considered to be part of this prospectus.

5

Table of Contents

THE OFFERING

| Shares of common stock offered by us |

shares |

| Shares of common stock offered by the selling stockholders |

shares |

| Total |

shares |

| Over-allotment option to be offered by us |

shares |

| Over-allotment option to be offered by the selling stockholders |

shares |

| Shares of common stock to be outstanding after this offering |

shares ( shares if the over-allotment option is exercised in full) |

| Use of proceeds |

We expect our net proceeds from this offering will be approximately $ , after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of the offering to repay the loan balances outstanding under our credit facility and for working capital and other general corporate purposes. We may also use a portion of the proceeds from the offering to acquire other businesses or technologies. We will not receive any of the proceeds from the shares of common stock sold by the selling stockholders. See “Use of Proceeds.” |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed Nasdaq Global Market symbol |

“ ” |

The number of shares of our common stock to be outstanding following this offering is based on 57,426,218 shares of our common stock outstanding as of September 30, 2010 after giving effect to the Conversion described under “Certain Relationships and Related Party Transactions—Conversion to a Corporation” and excludes:

| • | 15,726,057 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2010, with a weighted average exercise price of $4.09 per share; |

| • | 2,315,428 shares of common stock issuable upon the exercise of options granted after September 30, 2010, at an exercise price of $5.80 per share; and |

| • | shares of common stock reserved for issuance under our 2011 Equity Incentive Plan, which will become effective in connection with this offering. |

Unless otherwise noted, the information in this prospectus reflects and assumes the following:

| • | the consummation of the Conversion prior to the closing of this offering; |

| • | no exercise of outstanding options; and |

| • | no exercise by the underwriters of their over-allotment option. |

6

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

We have derived the summary consolidated statements of operations data for the years ended December 31, 2007, 2008 and 2009 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statements of operations data for the nine months ended September 30, 2009 and 2010 and the consolidated balance sheet data as of September 30, 2010 from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited consolidated financial statement data on a basis consistent with our audited consolidated financial statements, and, in the opinion of our management, the unaudited consolidated financial data reflects all adjustments, consisting only of normal recurring adjustments necessary for a fair statement of such data. Our historical results are not necessarily indicative of the results that may be expected in the future, and the results for the nine months ended September 30, 2010 are not necessarily indicative of results to be expected for the full year or for any other period. The following summary consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. The additional financial data presented is used in addition to the financial measures reflected in the consolidated statements of operations and balance sheet data to help us evaluate our business.

7

Table of Contents

| Years Ended December 31, | Nine Months

Ended September 30, |

|||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Net revenue |

$ | 75,189 | $ | 100,280 | $ | 110,676 | $ | 76,889 | $ | 108,468 | ||||||||||

| Cost of revenue(1) |

39,224 | 56,965 | 58,877 | 41,577 | 63,841 | |||||||||||||||

| Gross profit |

35,965 | 43,315 | 51,799 | 35,312 | 44,627 | |||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Sales and marketing(1) |

13,119 | 20,486 | 23,182 | 16,802 | 25,640 | |||||||||||||||

| Research and development(1) |

— | 1,160 | 2,054 | 1,647 | 3,927 | |||||||||||||||

| General and administrative(1) |

10,475 | 10,571 | 13,777 | 10,214 | 13,806 | |||||||||||||||

| Amortization of intangible assets |

912 | 857 | 68 | 68 | — | |||||||||||||||

| Total operating expenses |

24,506 | 33,074 | 39,081 | 28,731 | 43,373 | |||||||||||||||

| Income from operations |

11,459 | 10,241 | 12,718 | 6,581 | 1,254 | |||||||||||||||

| Interest expense |

(2,305 | ) | (2,209 | ) | (1,116 | ) | (772 | ) | (940 | ) | ||||||||||

| Loss on extinguishment of debt |

— | (561 | ) | — | — | — | ||||||||||||||

| Other income (expenses), net |

(118 | ) | (1,497 | ) | 639 | 465 | (202 | ) | ||||||||||||

| Income (loss) before provision for (benefit from) income taxes |

9,036 | 5,974 | 12,241 | 6,274 | 112 | |||||||||||||||

| Income tax (benefit) provision |

(632 | ) | 1,153 | 1,866 | 730 | 1,368 | ||||||||||||||

| Net income (loss) |

$ | 9,668 | $ | 4,821 | $ | 10,375 | $ | 5,544 | $ | (1,256 | ) | |||||||||

| Net income (loss) per common share(2): |

||||||||||||||||||||

| Basic |

$ | 0.17 | $ | 0.09 | $ | 0.18 | $ | 0.10 | $ | (0.02 | ) | |||||||||

| Diluted |

$ | 0.16 | $ | 0.08 | $ | 0.18 | $ | 0.09 | $ | (0.02 | ) | |||||||||

| Cash distributions per common share(3) |

$ | 0.09 | $ | 0.09 | $ | — | $ | — | $ | 0.04 | ||||||||||

| Weighted-average shares used in computing net income (loss) per common share(2): |

||||||||||||||||||||

| Basic |

55,936 | 56,209 | 56,750 | 56,702 | 57,167 | |||||||||||||||

| Diluted |

58,706 | 58,733 | 58,912 | 58,510 | 57,167 | |||||||||||||||

| Pro forma net income (loss) per common share(4): |

||||||||||||||||||||

| Basic |

$ | $ | ||||||||||||||||||

| Diluted |

$ | $ | ||||||||||||||||||

| Pro forma weighted-average shares used in computing net income (loss) per common share(4): |

||||||||||||||||||||

| Basic |

||||||||||||||||||||

| Diluted |

||||||||||||||||||||

| (1) | Effective January 1, 2006, we adopted FASB ASC Topic 718, Accounting for Stock-Based Compensation. Reported balances include stock-based compensation expense as follows: |

| Years Ended December 31, | Nine Months

Ended September 30, |

|||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of revenue |

$ | 1,096 | $ | 1,271 | $ | 914 | $ | 672 | $ | 843 | ||||||||||

| Sales and marketing |

1,100 | 1,570 | 2,340 | 1,706 | 2,214 | |||||||||||||||

| Research and development |

— | — | 541 | 399 | 598 | |||||||||||||||

| General and administrative |

1,680 | 2,608 | 2,265 | 1,663 | 2,362 | |||||||||||||||

| Total stock-based compensation |

$ | 3,876 | $ | 5,449 | $ | 6,060 | $ | 4,440 | $ | 6,017 | ||||||||||

8

Table of Contents

| (2) | Our basic net income (loss) per common share is calculated by dividing the net income (loss) by the weighted-average number of shares of common stock outstanding for the period. |

| (3) | Pursuant to our limited liability company agreement, we were required to pay cash distributions to our members to fund their tax obligations in respect of their equity interests. All other distributions are determined by our directors in their sole discretion. Tax distributions to members were $4.9 million, $5.1 million, $5.2 million and $0 in 2006, 2007, 2008 and 2009, and $0 and $2.5 million for the nine months ended September 30, 2009 and 2010, respectively. In 2006, the directors approved an additional $15.0 million distribution to all members. |

| (4) | Our pro forma net income (loss) per common share gives effect to the Conversion and to an assumed issuance of only that number of shares that would have been required to be issued to repay the loan balances outstanding under our credit facility as of September 30, 2010 assuming the issuance of such shares at an initial public offering price of $ per share (the midpoint of the range set forth on the cover page of this prospectus). The diluted pro forma net income (loss) per common share calculation also assumes the conversion, exercise, or issuance of all potential common shares, unless the effect of inclusion would result in the reduction of a loss or the increase in net income per common share. |

Other Financial Data:

| Years Ended December 31, | Nine Months

Ended September 30, |

|||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Adjusted EBITDA(1)(2) |

$ | 17,931 | $ | 19,046 | $ | 22,305 | $ | 13,388 | $ | 11,707 | ||||||||||

| (1) | We present Adjusted EBITDA, which we define as net income (loss), plus: income tax provision (benefit); loss on extinguishment of debt; interest expense; other (income) expense, net; depreciation; amortization of intangible assets; and stock-based compensation. Adjusted EBITDA is a financial measure that is not calculated in accordance with generally accepted accounting principles (“GAAP”). We have provided a reconciliation of Adjusted EBITDA, a non-GAAP financial measure, to net income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP. Adjusted EBITDA should not be considered as an alternative to net income (loss), operating income or any other measure of financial performance calculated and presented in accordance with GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of other organizations because other organizations may not calculate Adjusted EBITDA in the same manner as we do. We have included Adjusted EBITDA in this prospectus because it is a basis upon which our management assesses financial performance and it eliminates the impact of items that we do not consider indicative of our core operating performance. In evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. |

| (2) | We reconcile net income (loss) to Adjusted EBITDA as follows: |

| Years Ended December 31, | Nine

Months Ended September 30, |

|||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net income (loss) |

$ | 9,668 | $ | 4,821 | $ | 10,375 | $ | 5,544 | $ | (1,256 | ) | |||||||||

| Income tax (benefit) provision |

(632 | ) | 1,153 | 1,866 | 730 | 1,368 | ||||||||||||||

| Loss on extinguishment of debt |

— | 561 | — | — | — | |||||||||||||||

| Interest expense |

2,305 | 2,209 | 1,116 | 772 | 940 | |||||||||||||||

| Other (income) expense net |

118 | 1,497 | (639 | ) | (465 | ) | 202 | |||||||||||||

| Depreciation |

1,684 | 2,499 | 3,459 | 2,299 | 4,436 | |||||||||||||||

| Amortization of intangible assets |

912 | 857 | 68 | 68 | — | |||||||||||||||

| Stock-based compensation |

3,876 | 5,449 | 6,060 | 4,440 | 6,017 | |||||||||||||||

| Adjusted EBITDA |

$ | 17,931 | $ | 19,046 | $ | 22,305 | $ | 13,388 | $ | 11,707 | ||||||||||

9

Table of Contents

| As of September 30, 2010 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash |

$ | 23,231 | $ | $ | ||||||||

| Working capital(3) |

18,887 | |||||||||||

| Total assets |

99,136 | |||||||||||

| Term loan, current and non-current |

15,834 | |||||||||||

| Obligations under capital leases, current and non-current |

1,956 | |||||||||||

| Total members’/stockholders’ equity |

32,920 | |||||||||||

| (1) | The pro forma column in the summary consolidated balance sheet data above reflects the effect of the Conversion. |

| (2) | The pro forma as adjusted column in the summary consolidated balance sheet data above reflects the effect of: (i) the Conversion; (ii) our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the front cover of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us; and (iii) the repayment of the $15.8 million outstanding under our loans as of September 30, 2010 with a portion of the net proceeds from this offering. See “Use of Proceeds” for additional information. A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, would increase (decrease) cash and each of working capital, total assets and total stockholders’ equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Each increase of 1.0 million shares in the number of shares offered by us would increase cash and each of working capital, total assets and total stockholders’ equity by approximately $ million. Similarly, each decrease of 1.0 million shares in the number of shares offered by us would decrease cash and each of working capital, total assets and total stockholders’ equity by approximately $ million. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

| (3) | Working capital is defined as current assets less current liabilities. |

10

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Industry

Our quarterly results of operations may fluctuate as a result of numerous factors, many of which may be outside of our control.

Our quarterly operating results are likely to fluctuate. Some of the important factors that may cause our revenue, operating results and cash flows to fluctuate from quarter to quarter include:

| • | our ability to attract new customers and retain existing customers; |

| • | fluctuations in the value of end customer contracts delivered to us; |

| • | fluctuations in close rates; |

| • | changes in our commission rates; |

| • | seasonality; |

| • | loss of customers for any reason including due to acquisition; |

| • | the mix of new customers as compared to existing customers; |

| • | the length of the sales cycle for our solution, and our level of upfront investments prior to the period we begin generating sales associated with such investments; |

| • | the timing of customer payments and payment defaults by customers; |

| • | the amount and timing of operating costs and capital expenditures related to the operations of our business; |

| • | the rate of expansion and productivity of our direct sales force; |

| • | the cost and timing of the introduction of new technologies or new services, including additional investments in our cloud applications; |

| • | general economic conditions; |

| • | technical difficulties or interruptions in delivery of our solution; |

| • | changes in foreign currency exchange rates; |

| • | changes in the effective tax rates; |

| • | regulatory compliance costs, including with respect to data privacy; |

| • | costs associated with acquisitions of companies and technologies; |

| • | extraordinary expenses such as litigation or other dispute-related settlement payments; and |

| • | the impact of new accounting pronouncements. |

Many of the above factors are discussed in more detail elsewhere in these Risk Factors. Many of these factors are outside our control, and the variability and unpredictability of such factors could result in our failing to meet our revenue or operating results expectations for a given period. In addition, the occurrence of one or more of these factors might cause our operating results to vary widely which could lead to negative impacts on

11

Table of Contents

our margins, short-term liquidity or ability to retain or attract key personnel, and could cause other unanticipated issues. Accordingly, we believe that quarter-to-quarter comparisons of our revenue, operating results and cash flows may not be meaningful and should not be relied upon as an indication of future performance.

The market for our solution is relatively undeveloped and may not grow.

The market for service revenue management is still relatively undeveloped, has not yet achieved widespread acceptance and may not grow quickly or at all. Our success will depend to a substantial extent on the willingness of companies to engage a third party such as us to manage the sales of their support, maintenance and subscription contracts. Many companies have invested substantial personnel, infrastructure and financial resources in their own internal service revenue organizations and therefore may be reluctant to switch to a solution such as ours. Companies may not engage us for other reasons, including a desire to maintain control over all aspects of their sales activities and customer relations, concerns about end customer reaction, a belief that they can sell their support, maintenance and subscription services more cost-effectively using their internal sales organizations, perceptions about the expenses associated with changing to a new approach and the timing of expenses once they adopt a new approach, general reluctance to adopt any new and different approach to old ways of doing business, or other considerations that may not always be evident. New concerns or considerations may also emerge in the future. Particularly because our market is undeveloped, we must address our potential customers concerns and explain the benefits of our approach in order to convince them to change the way that they manage the sales of support, maintenance and subscription contracts. If companies are not sufficiently convinced that we can address their concerns and that the benefits of our solution are sufficient, then the market for our solution may not develop as we anticipate and our business will not grow.

Our estimates of service revenue opportunity under management and our analysis of renewal rates and other metrics may prove inaccurate.

We use various estimates in formulating our business plans and analyzing our potential and historical performance, including our estimate of service revenue opportunity under management. We base our estimates upon a number of assumptions that are inherently subject to significant business and economic uncertainties and contingencies, many of which are beyond our control. Our estimates therefore may prove inaccurate.

Service revenue opportunity under management (“opportunity under management”) is our estimate, as of a given date, of the value of all end customer service contracts that we will have the opportunity to sell on behalf of our customers over the subsequent twelve-month period. We estimate the value of such end customer contracts based on a combination of factors, including the value of end customer contracts made available to us by customers in past periods, the minimum value of end customer contracts that our customers are required to give us the opportunity to sell pursuant to the terms of their contracts with us, periodic internal business reviews of our expectations as to the value of end customer contracts that will be made available to us by customers, the value of end customer contracts included in the SPA and collaborative discussions with our customers assessing their expectations as to the value of service contracts that they will make available to us for sale. While the minimum value of end customer contracts that our customers are required to give us represents a portion of our estimated opportunity under management, a significant portion of the opportunity under management is estimated based on the other factors described above.

When estimating service revenue opportunity under management, we must, to a large degree, rely on the assumptions described above, which may prove incorrect. These assumptions are inherently subject to significant business and economic uncertainties and contingencies, many of which are beyond our control. Our estimates therefore may prove inaccurate, causing the actual value of end customer contracts delivered to us in a given twelve-month period to differ from our estimate of opportunity under management. These factors include:

| • | the extent to which customers deliver a greater or lesser value of end customer contracts than may be required or otherwise expected; |

| • | roll-overs of unsold service contract renewals from prior periods to the current period or future periods; |

12

Table of Contents

| • | changes in the pricing or terms of service contracts offered by our customers; |

| • | increases or decreases in the end customer base of our customers; |

| • | the extent to which the renewal rates we achieve on behalf of a customer early in an engagement affect the amount of opportunity that the customer makes available to us later in the engagement; |

| • | customer cancellations of their contracts with us due to acquisitions or otherwise; and |

| • | changes in our customers’ businesses, sales organizations, sales processes or priorities. |

In addition, opportunity under management reflects our estimate for a forward twelve-month period and should not be used to estimate our opportunity for any particular quarter within that period. The value of end customer contracts actually delivered during a twelve-month period should not be expected to occur in even quarterly increments due to seasonality and other factors impacting our customers and their end customers.

In addition, we analyze various metrics in evaluating our potential and historical performance. We analyze the renewal rates we achieve on behalf of our customers. We compare the renewal rates we achieve on behalf of our customers to the renewal rates that we calculate during the SPA, based on the data provided to us by the customer. In calculating renewal rates, we cannot provide any assurance as to the accuracy or completeness of the customer renewal data we receive during the SPA. To the extent that the actual data and information provided by our customers for use in the SPA is inaccurate, insufficient or misrepresents the contracts we would receive for renewal in future periods, our calculation of renewal rates may be inaccurate.

We also analyze our contribution margin for a period as the excess of the revenue recognized from a customer over the estimated expenses for the period associated with supporting the customer and managing the service contract renewals process for them, expressed as a percentage of associated revenue. Although we believe the estimates and assumptions we use in calculating contribution margin are reasonable, the estimated expenses and resulting contribution margin could vary significantly from the amounts disclosed herein had we used different estimates and assumptions. Moreover, we cannot assure you that we will experience similar contribution margins from customers added in other years or in future periods. You should not rely on the estimated expenses or contribution margin as being indicative of our future performance. Because of our growing customer base, we expect that there will be times when large numbers of our customers are in the initial phases of their customer relationship with us or have a material expansion of their existing engagements with us. In these scenarios, we may not be able to achieve profitability even if many of our customer relationships generate a positive contribution margin.

If close rates fall short of our predictions, our revenue will suffer and our ability to grow and achieve broader market acceptance of our solution could be harmed.

Given our pay-for-performance pricing model, our revenue is directly tied to close rates. Close rates represent the percentage of the actual opportunity delivered that we renew on behalf of our customers. If the close rate for a particular customer is lower than anticipated, then our revenue for that customer will also be lower than projected. If close rates fall short of expectations across a broad range of customers, or if they fall below expectations for a particularly large customer, then the impact on our revenue and our overall business will be significant. In the event close rates are lower than expected for a given customer, our margins will suffer because we will have already incurred a certain level of costs in both personnel and infrastructure to support the engagement. This risk is compounded by the fact that many of our customer relationships are terminable if we fail to meet certain specified sales targets over a sustained period of time. If actual close rates fall to a level at which our revenue and customer contracts are at risk, then our financial performance will decline and we will be severely compromised in our ability to retain and attract customers. Increasing our customer base and achieving broader market acceptance of our solution depends, to a large extent, on how effectively our solution increases service sales. As a result, poor performance with respect to our close rates, in addition to causing our revenue, margins and earnings to suffer, will likely damage our reputation and prevent us from effectively developing and

13

Table of Contents

maintaining awareness of our brand or achieving widespread acceptance of our solution, in which case we could fail to grow our business and our revenue, margins and earnings would suffer.

Our revenue will decline if there is a decrease in the overall demand for our customers’ products and services for which we provide service revenue management.

Our revenue is based on a pay-for-performance model under which we are paid a percentage commission based on the service contracts we sell on behalf of our customers. If a particular customer’s products or services fail to appeal to its end customers, our revenue may decline. In addition, if end customer demand decreases for other reasons, such as negative news regarding our customers or their products, unfavorable economic conditions, shifts in strategy by our customers away from promoting the service contracts we sell in favor of selling their other products or services to their end customers, or if end customers experience financial constraints and fail to renew the service contracts we sell, we may experience a decrease in our revenue as the demand for our customers’ service contracts declines.

If there is a widespread shift away from business consumers purchasing maintenance and support service contracts, we could be adversely impacted if we are not able to adapt to new trends or expand our target markets.

As a result of our historical concentration in the software and hardware industries, a significant portion of our revenue comes from the sale of maintenance and support service contracts for the software and hardware products used by our customers’ end customers. Although we also sell other types of renewals, such as subscriptions to software-as-a-service offerings, those sales have to date constituted a relatively small portion of our revenue. The emergence of cloud computing and other alternative technology purchasing models, in which technology services are provided on a remote-access basis, may have a significant impact on the size of the market for traditional maintenance and support contracts. If these alternative models continue gaining traction and reduce the size of our traditional market, we will need to continue to adapt our solution to capitalize on these trends or our results of operations will suffer.

If we are unable to compete effectively against current and future competitors, our business and operating results will be harmed.

The market for service revenue management is evolving. Historically, technology companies have managed their service renewals through internal personnel and relied upon technology ranging from Excel spreadsheets to internally-developed software to customized versions of traditional business intelligence tools and CRM or ERP software from vendors such as Oracle, SAP, salesforce.com and NetSuite. Some companies have made further investments in this area using firms such as Accenture and McKinsey for technology consulting and education services focused on service renewals. These internally-developed solutions represent the primary alternative to our integrated approach. We also face direct competition from smaller companies that offer specialized service revenue management solutions, typically providing technology for their customers to use internal personnel for their sales efforts.

We believe the principal competitive factors in our markets include the following:

| • | service revenue industry expertise, best practices, and benchmarks; |

| • | performance-based pricing of solutions; |

| • | ability to increase service revenue, renewal rates, and close rates; |

| • | global capabilities; |

| • | completeness of solution; |

| • | ability to effectively represent customer brands to end customers and channel partners; |

14

Table of Contents

| • | size of upfront investment; and |

| • | size and financial stability of operations. |

We believe that more competitors will emerge. These competitors may have greater name recognition, longer operating histories, well-established relationships with customers in our markets and substantially greater financial, technical, personnel and other resources than we have. Potential competitors of any size may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer or end customer requirements. Even if our solution is more effective than competing solutions, potential customers might choose new entrants unless we can convince them of the advantages of our integrated solution. We expect competition and competitive pressure, from both new and existing competitors, to increase in the future.

The loss of one or more of our key customers could slow our revenue growth or cause our revenue to decline.

A substantial portion of our revenue has to date come from a relatively small number of customers. During the nine months ended September 30, 2010, our top ten customers accounted for 57% of our revenue, with our largest customer, Sun Microsystems, accounting for 17% of our revenue. During the year ended December 31, 2009, our top ten customers accounted for 64% of our revenue, with Sun Microsystems accounting for 24% of our revenue. Oracle terminated our contracts with Sun Microsystems effective as of September 30, 2010. A relatively small number of customers may continue to account for a significant portion of our revenue for the foreseeable future. The loss of any of our significant customers for any reason, including the failure to renew our contracts, a change of relationship with any of our key customers or their acquisition as discussed below, may cause a significant decrease in our revenue.

Consolidation in the technology sector is continuing at a rapid pace, which could harm our business in the event that our customers are acquired and their contracts are cancelled.

Consolidation among technology companies in our target market has been robust in recent years, and this trend poses a risk for us. Acquisitions of our customers could lead to cancellation of our contracts with those customers by the acquiring companies and could reduce the number of our existing and potential customers. For example, Oracle has acquired a number of our customers in recent years, including our then largest customer, Sun Microsystems, in January 2010, and another customer, BEA Systems, in April 2008. Oracle has elected to terminate our service contracts with each customer because Oracle conducts its service revenue management internally. If mergers and acquisitions in the technology industry continue unabated or increase, we expect that some of the acquiring companies, and Oracle in particular, will terminate, renegotiate and/or elect not to renew our contracts with the companies they acquire, which could reduce our revenue.

Supporting our existing and growing customer base could strain our personnel resources and infrastructure, and if we cannot scale our operations and increase productivity, we may be unsuccessful in implementing our business plan.

Since 2003, we have experienced significant growth in our customer base, which has placed a strain on our management, administrative, operational and financial infrastructure. We anticipate that additional investments in sales personnel, infrastructure and research and development spending will be required to:

| • | scale our operations and increase productivity; |

| • | address the needs of our customers; |

| • | further develop and enhance our solution and offerings; |

| • | develop new technology; and |

| • | expand our markets and opportunity under management, including into new industry verticals and geographic areas. |

15

Table of Contents

Our success will depend in part upon our ability to manage our growth effectively. To do so, we must continue to increase the productivity of our existing employees and to hire, train and manage new employees as needed. To manage domestic and international growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting processes and procedures, and implement more extensive and integrated financial and business information systems. These additional investments will increase our operating costs, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. Moreover, if we fail to scale our operations successfully and increase productivity, our overall business will be at risk.

We enter into long-term, commission-based contracts with our customers, and our failure to correctly price these contracts may negatively affect our profitability.

We enter into long-term contracts with our customers that are priced based on multiple factors determined in large part by the SPA we conduct for our customers. These factors include opportunity size, anticipated close rates and expected commission rates at various levels of sales performance. Some of these factors require forward looking assumptions that may prove incorrect. If our assumptions are inaccurate, or if we otherwise fail to correctly price our customer contracts, particularly those with lengthy contract terms, then our revenue, profitability and overall business operations may suffer. Further, if we fail to anticipate any unexpected increase in our cost of providing services, including the costs for employees, office space or technology, we could be exposed to risks associated with cost overruns related to our required performance under our contracts, which could have a negative effect on our margins and earnings.

Many of our customer contracts allow termination for failure to meet certain performance conditions.

Although most of our customer contracts are subject to multi-year terms, these agreements often have termination rights if we fail to meet specified sales targets. During the SPA and contract negotiation phase with a customer, we typically negotiate minimum performance levels for the engagement. If we fail to meet our required targets and our customers choose to exercise their termination rights, our revenue could decline. These termination rights may also create instability in our revenue forecasts and other forward looking financial metrics.

Our business may be harmed if our customers rely upon our service revenue forecasts in their business and actual results are materially different.

The contracts that we enter into with our customers provide for sharing of information with respect to forecasts and plans for the renewal of maintenance, support and subscription agreements of our customers. Our customers may use such forecasted data for a variety of purposes related to their business. Our forecasts are based upon the data our customers provide to us, and are inherently subject to significant business, economic and competitive uncertainties, many of which are beyond our control. In addition, these forecasted expectations are based upon historical trends and data that may not be true in subsequent periods. Any material inaccuracies related to these forecasts could lead to claims on the part of our customers related to the accuracy of the forecasted data we provide to them, or the appropriateness of our methodology. Any liability that we incur or any harm to our brand that we suffer because of inaccuracies in the forecasted data we provide to our customers could impact our ability to retain existing customers and harm our brand and, ultimately, our business.

Changing global economic conditions and large scale economic shifts may impact our business.

Our overall performance depends in part on worldwide economic conditions that impact the technology and technology-enabled healthcare and life sciences industries. For example, the recent economic downturn resulted in many businesses deferring technology investments, including purchases of new software, hardware and other equipment, and purchases of additional or supplemental maintenance, support and subscription services. To a certain extent, these businesses also slowed the rate of renewals of maintenance, support and subscription

16

Table of Contents

services for their existing technology base. A future downturn could cause business customers to stop renewing their existing maintenance, support and subscription agreements or contracting for additional maintenance services as they look for ways to further cut expenses, in which case our business could suffer.

Conversely, a significant upturn in global economic conditions could cause business purchasers to purchase new hardware, software and other technology products, which we generally do not sell, instead of renewing or otherwise purchasing maintenance, support and subscription services for their existing products. A general shift toward new product sales could reduce our near term opportunities for these contracts, which could lead to a decline in our revenue.

Our inability to expand our target markets could adversely impact our business and operating results.

We derive substantially all of our revenue from customers in certain sectors in the technology and technology-enabled healthcare and life sciences industries, and an important part of our strategy is to expand our existing customer base and win new customers in these industries. In addition, because of the service revenue opportunities that we believe exist beyond these industries, we intend to target new customers in additional industry vertical markets. In connection with the expansion of our target markets, we may not have familiarity with such additional industry verticals, and our execution of such expansion could face risks where our Service Revenue Intelligence Platform is less developed within a particular new vertical. We may encounter customers in these previously untapped markets that have different pricing and other business sensitivities than we are used to managing. As a result of these and other factors, our efforts to expand our solution to additional industry vertical markets may not succeed, may divert management resources from our existing operations and may require us to commit significant financial resources to unproven parts of our business, all of which may harm our financial performance.

Our business and growth depend substantially on customers renewing their agreements with us and expanding their use of our solution for additional available markets. Any decline in our customer renewals or failure to expand their relationships with us could harm our future operating results.

In order for us to improve our operating results and grow, it is important that our customers renew their agreements with us when the initial contract term expires and that we expand our customer relationships to add new market opportunities and related service revenue opportunity under management. Our customers have no obligation to renew their contracts with us after the initial terms have expired, and we cannot assure you that our customers will renew service contracts with us at the same or higher level of service, if at all, or provide us with the opportunity to manage additional opportunity. Although our renewal rates have been historically higher than those achieved by our customers prior to their using our solution, some customers have elected not to renew their agreements with us. Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including their satisfaction or dissatisfaction with our solution and results, our pricing, mergers and acquisitions affecting our customers or their end customers, the effects of economic conditions or reductions in our customers’ or their end customers’ spending levels. If our customers do not renew their agreements with us, renew on less favorable terms or fail to contract with us for additional service revenue management opportunities, our revenue may decline and we may not realize improved operating results and growth from our customer base.

A substantial portion of our business consists of supporting our customers’ channel partners in the sale of service contracts. If those channel partners become unreceptive to our solution, our business could be harmed.

Many of our customers, including some of our largest customers, sell service contracts through their channel partners and engage our solution to help those channel partners become more effective at selling service contract renewals. These channel partners may have access to some of our cloud applications, such as our Channel Sales Cloud, in addition to other sales support services we provide. In this context, the ultimate buyers of the service contracts are end customers of those channel partners, who then receive the actual services from our customers.

17

Table of Contents

In the event our customers’ channel partners become unreceptive to our involvement in the renewals process, those channel partners could discourage our current or future customers from engaging our solution to support channel sales. This risk is compounded by the fact that large channel partners may have relationships with more than one of our customers or prospects, in which case the negative reaction of one or more of those large channel partners could impact multiple customer relationships. Accordingly, with respect to those customers and prospective customers who sell service contracts through channel partners, any significant resistance to our solution by their channel partners could harm our ability to attract or retain customers, which would damage our overall business operations.

We face long sales cycles to secure new customer contracts, making it difficult to predict the timing of specific new customer relationships.

We face a variable selling cycle to secure new customer agreements, typically spanning a number of months and requiring our effort to obtain and analyze our prospect’s business through the SPA, for which we are not paid. Moreover, even if we succeed in developing a relationship with a potential new customer, the scope of the potential service revenue management engagement frequently changes over the course of the business discussions and, for a variety of reasons, our sales discussions may fail to result in new customer acquisitions. Consequently, we have only a limited ability to predict the timing and size of specific new customer relationships.

If we experience significant fluctuations in our anticipated growth rate and fail to balance our expenses with our revenue forecasts, our results could be harmed.

Due to our evolving business model, the uncertain size of our markets and the unpredictability of future general economic and financial market conditions, we may not be able to accurately forecast our growth rate. We plan our expense levels and investments based on estimates of future sales performance for our customers with respect to their end customers, future revenue and future customer acquisition. If our assumptions prove incorrect, we may not be able to adjust our spending quickly enough to offset the resulting decline in growth and revenue. Consequently, we expect that our gross margins, operating margins and cash flows may fluctuate significantly on a quarterly basis.

If we cannot efficiently implement our offering for customers, we may be delayed in generating revenue, fail to generate revenue and/or incur significant costs.

In general, our customer engagements are complex and may require lengthy and significant work to implement our offerings. As a result, we generally incur sales and marketing expenses related to the commissions owed to our sales representatives and make upfront investments in technology and personnel to support the engagements one to three months before we begin selling end customer contracts. Each customer’s situation may be different, and unanticipated difficulties and delays may arise as a result of our failure, or that of our customer, to meet respective implementation responsibilities. If the customer implementation process is not executed successfully or if execution is delayed, we could incur significant costs without yet generating revenue, and our relationships with some of our customers may be adversely impacted.

Delayed or unsuccessful investment in new technology, services and markets may harm our financial results.

We plan to continue to invest significant resources in research and development in order to enhance our existing offerings and introduce new offerings that will appeal to customers and potential customers. We have undertaken the development of new technology to offer improved and more scalable service revenue management, including enhancements to our applications. The development of new products and services entails a number of risks that could adversely affect our business and operating results, including:

| • | the risk of diverting the attention of our management and our employees from the day-to-day operations of the business; |

18

Table of Contents

| • | insufficient revenue to offset increased expenses associated with research, development, operational and marketing activities; and |

| • | write-offs of the value of such technology investments as a result of unsuccessful implementation or otherwise. |

If our new or modified technology does not work as intended, is not responsive to user preferences or industry or regulatory changes, is not appropriately timed with market opportunity, or is not effectively brought to market, we may lose existing and potential customers or related service revenue opportunities, in which case our results of operations may suffer. The cost of future development of new service revenue management offerings or technologies also could require us to raise additional debt or equity financing. These actions could negatively impact the ownership percentages of our existing stockholders, our financial condition or our results of operations.

The length of time it takes our newly-hired sales representatives to become productive could adversely impact our success rate, the execution of our overall business plan and our costs.

It can take twelve months or longer before our sales representatives are fully trained and productive in selling our solution to prospects and customers. This long ramp period presents a number of operational challenges as the cost of recruiting, hiring and carrying new sales representatives cannot be offset by the revenue such new sales representatives produce until after they complete their long ramp periods. Further, given the length of the ramp period, we often cannot determine if a sales representative will succeed until he or she has been employed for a year or more. If we cannot reliably develop our sales representatives to a productive level, or if we lose productive representatives in whom we have heavily invested, our future growth rates and revenue will suffer.

If we lose our top executives, or if we are unable to attract, hire, integrate and retain key personnel and other necessary employees, our business will be harmed.

Our future success depends on the continued contributions of our executives, each of whom may be difficult to replace. Our future success also depends in part on our ability to attract, hire, integrate and retain qualified service sales personnel, sales representatives and management level employees to oversee such sales forces. In particular, Michael Smerklo, our chairman of the board of directors and chief executive officer, is critical to the management of our business and operations and the development of our strategic direction. The loss of Mr. Smerklo’s services or those of our other executives, or our inability to continue to attract and retain high-quality talent, could harm our business.

Because competition for our target employees is intense, we may be unable to attract and retain the highly skilled employees we need to support our planned growth.

To continue to execute on our growth plan, we must attract and retain highly qualified sales representatives, engineers and other key employees in the international markets in which we have operations. Competition for these personnel is intense, especially for highly educated, qualified sales representatives. We have from time to time in the past experienced, and we expect to continue to experience in the future, difficulty in hiring and retaining highly skilled key employees with appropriate qualifications. If we fail to attract new sales representatives, engineers and other key employees, or fail to retain and motivate our most successful employees, our business and future growth prospects could be harmed.

We depend on revenue from sources outside the United States, and our international business operations and expansion plans are subject to risks related to international operations, and may not increase our revenue growth or enhance our business operations.

For the nine months ended September 30, 2010, approximately 33% of our revenue was generated from sales centers located outside of the United States. As a result of our continued focus on international markets, we

19

Table of Contents

expect that future revenue derived from international sources will continue to represent a significant portion of our total revenue.

A portion of the sales commissions paid by our international customers is paid in foreign currencies. As a result, fluctuations in the value of these foreign currencies may make our solution more expensive or cause resulting fluctuations in cost for international customers, which could harm our business. We currently do not undertake hedging activities to manage these currency fluctuations. In addition, if the effective price of the contracts we sell to the end customers were to increase as a result of fluctuations in the exchange rate of the relevant currencies, demand for such contracts could fall, which in turn would reduce our revenue.

Our growth strategy includes further expansion into international markets. Our international expansion may require significant additional financial resources and management attention, and could negatively affect our financial condition, cash flows and operating results. In addition, we may be exposed to associated risks and challenges, including:

| • | the need to localize and adapt our solution for specific countries, including translation into foreign languages and associated expenses; |