Attached files

| file | filename |

|---|---|

| 8-K - III TO I MARITIME PARTNERS CAYMAN I LP | v209358_8k.htm |

|

ADDENDUM

NO. 2

to

LOAN

AGREEMENT

dated

19th

December, 2008

|

|

made

between

NORDDEUTSCHE

LANDESBANK GIROZENTRALE

as

Lender, Mandated Lead Arranger and Agent

THE

TWELVE LIMITED PARTNERSHIPS

AS

MORE CLOSELY DESCRIBED HEREIN

as

jointly and severally liable Borrowers

12

A.H.T.S. Vessels

built

by Fincantieri Cantieri Navali S.p.A.

THIS ADDENDUM NO. 2 IS MADE THIS

24th DAY OF JANUARY, 2010 between

|

(1)

|

NORDDEUTSCHE

LANDESBANK GIROZENTRALE, a banking institution organized and existing

under the laws of Germany having its registered offices at Friedrichswall

10, 30159 Hannover, Germany (sometimes "NORD/LB" or the "Mandated Lead

Arranger" or the "Agent", as the case may be), and

|

|

(2)

|

The

Lenders set forth in Schedule 1 attached hereto (the

“Lenders”)

|

|

and

|

|

|

(3)

|

ATL

OFFSHORE GMBH & CO. MS "JUIST" KG (the "Borrower

1"),

|

|

(4)

|

ATL

OFFSHORE GMBH & CO. MS "NORDERNEY" KG (the "Borrower

2"),

|

|

(5)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF BALTRUM" KG (the "Borrower

3"),

|

|

(6)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF LANGEOOG" KG (the "Borrower

4"),

|

|

(7)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF AMRUM" KG (the "Borrower

5"),

|

|

(8)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF SYLT" KG (the "Borrower

6"),

|

|

(9)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF WANGEROOGE" KG (the "Borrower

7"),

|

|

(10)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF NEUWERK" KG (the "Borrower

8"),

|

|

(11)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF USEDOM" KG (the "Borrower

9"),

|

|

(12)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF FEHMARN" KG (the "Borrower

10"),

|

|

(13)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF MEMMERT" KG (the "Borrower

11"),

|

|

(14)

|

ATL

OFFSHORE GMBH & CO. "ISLE OF MELLUM" KG (the "Borrower

12")

|

| each of them a limited partnership incorporated and existing under the laws of Germany having its registered office at Neue Str. 24, 26789 Leer, Germany (collectively the "Borrowers", and each one of them a "Borrower"), as jointly and severally liable borrowers on the other part. |

WHEREAS pursuant to the terms

and conditions of a loan agreement dated 19th

December, 2008 (as amended by an addendum no. 1 dated 17th

September, 2010 the "Loan Agreement"), made between the Lenders as lenders and

the Borrowers as jointly and severally liable borrowers, the Lenders have agreed

to grant to the Borrowers loans in the aggregate maximum amount of Euros four

hundred twenty million five hundred seventy thousand (EUR 420,570,000.00) (the

"Loan") (i) for the part-financing of the construction price of twelve A.H.T.S

Vessels built or to be built at FINCANTIERI CANTIERI NAVALI ITALIANI S.P.A. of

Genoa, Italy, (the “Builder”), (ii) for the issuing of certain payment

guarantees to the Builder and (iii) to enable the Borrowers to postpone the

repayment of part of the Loan.

WHEREAS pursuant to a loan

agreement dated 6th

December, 2010 (the “WC Agreement”) made between the Agent as lender and the

Borrowers as borrowers, the Agent has agreed to grant the Borrowers a loan in

the amount of up to Euros ten million (EUR 10,000,000.00) (the “WC Facility”) to

strengthen the Borrowers’ working capital.

1

WHEREAS pursuant to the last

sentence of clause 2.3 of the Loan Agreement the Borrowers have no further right

or claim under the Loan Agreement for the utilization of the Commitment not yet

drawn down in the total amount of EUR 15,005,500.00.

WHEREAS upon request of the

Borrowers, the Lenders are willing to agree to certain amendments of the Loan

Agreement subject to the terms and conditions of this Addendum No.

2.

NOW THEREFORE in consideration

of the premises herein contained and other good and valid considerations herein

recited, the parties hereto agree as follows:

| 1. | DEFINITIONS |

|

1.1.

|

Expressions

defined in the Loan Agreement shall have the same meaning when used in

this Addendum No. 2, unless defined otherwise herein or unless the context

does not permit so.

|

|

1.2.

|

Any

term as defined in this Addendum No. 2 shall apply to the Loan Agreement

unless the context does not permit so.

|

|

1.3.

|

Where

the context of this Addendum No. 2 allows so, words importing the singular

include the plural and vice versa. Clause headings in this Addendum No. 2

are for ease of reference only and shall not affect the construction

thereof.

|

|

1.4.

|

Unless

the context does not allow so, references to "Clauses" are to clauses of

this Addendum No. 2. References to any contract or other instrument or

document include any amendment or supplement thereto.

|

| 2. | AMENDMENTS TO THE LOAN AGREEMENT |

With

effect from the date hereof, the Loan Agreement shall be amended as

follows:

|

2.1.

|

Mandatory Prepayment

|

|

In

addition to the stipulations of clause 9 of the Loan Agreement, after (i)

full repayment of the WC Facility to the satisfaction of the Lenders and

after (ii) either (a) the commitment termination date under the WC

Agreement has occurred or (b) the Borrowers have waived their rights for

re-borrowing under clause 9.2 of the WC Agreement, the Borrowers shall

make a mandatory prepayment of twenty (20) percent of their annual

earnings after tax (equalling the annual turnover less operating expenses

of the Vessels less debt service under the Loan Agreement less ten (10)

percent dividend payout in relation to the paid-in share-capital and less

any taxes to be paid by the Relevant Borrowers) in accordance with clause

9 of the Loan Agreement, being due and payable on the 31st July

of each year until all amounts outstanding under the Credit Facility have

been repaid in full.

|

|

|

2.2.

|

Asset Protection

|

|

In

alteration of clause 18 of the Loan Agreement, the outstanding balance of

the WC Facility shall be added to the outstanding balance of the Tranches

LT when calculating the loan-to value-ratio in accordance with clause 18

of the Loan Agreement.

|

|

|

2.3.

|

Change in Corporate

Structure

|

|

The

Equity Provider 2 has transferred a part of its shares in each of the

Borrowers to the Manager and the Pool Manager. Therefore, the definition

of the term “Equity Provider 2” shall be amended and read as

follows:

|

|

“Equity

Provider 2

|

Together

the Corporate Guarantor and the Manager and the Pool Manager or any of

them or an affiliated company of the Corporate Guarantor accepted by the

Agent”.

|

2

|

2.4.

|

Representations and

Warranties

|

|

In

alteration of clause 17.1.16 of the Loan Agreement, the Borrowers

represent and warrant to and for the benefit of the Lenders that (i) the

Equity Provider 2 shall be and remain a limited partner (Kommanditist) of

each of the Borrowers, such Equity Provider 2 holding at least twenty five

(25) percent of each of the Borrower's share capital, and (ii) Dr. Niels

Hartmann is the sole shareholder of (a) NH Beteiligungen

Geschäftsführungs-GmbH of Leer, Germany, being the sole general partner of

NH Beteiligungen GmbH & Co. KG of Leer, Germany and (b) NH

Beteiligungen GmbH & Co. KG of Leer, Germany, being the sole

shareholder of the General Partner.

|

|

2.5.

|

Covenants regarding Corporate

Structure

|

|

2.5.1.

|

In

alteration of clause 19.5.1 of the Loan Agreement, the Borrowers undertake

to the Lenders that during the Security Period they will not without the

prior written consent of the Agent allow any change in any of the

Borrowers’ corporate or shareholder structure to the effect that the

Equity Provider 2 holds less than twenty five (25) percent of the shares

of each of the Borrowers or to the effect that any of the Borrowers ceases

to be a limited partnership.

|

|

2.5.2.

|

In

alteration of clause 19.5.2 of the Loan Agreement, the Borrowers undertake

to the Lenders that during the Security Period they will not without the

prior written consent of the Agent allow any change of the General Partner

or any change in the General Partner's corporate or shareholder structure

without (i) promptly informing the Agent in detail prior to any such

proposed change in writing and (ii) agreeing with the Agent any amendments

to this Agreement in respect of e.g. margin, term, security or any other

terms.

|

|

2.5.3.

|

In

addition to the stipulations of clause 19.5 of the Loan Agreement, the

Borrowers undertake to procure that any of the entities referred to in the

definition of the term Equity Provider 2 shall provide the Agent with an

undertaking that it will not sell any of the its shares in any of the

Borrowers without the Agent’s prior written consent, in the form attached

hereto as New Exhibit.

|

|

2.6.

|

Event of

Default

|

|

2.6.1.

|

In

addition to the stipulations of clause 22 of the Loan Agreement, it shall

constitute an Event of Default if the General Partner changes its

corporate and/or shareholder structure as described in Clause 17.1.16 of

the Loan Agreement (as amended hereby) without the Agent’s prior written

consent

|

|

2.6.2.

|

In

addition to the stipulations of clause 22 of the Loan Agreement, it shall

further constitute an Event of Default if any of the entities referred to

in the definition of the term Equity Provider 2 sells any of its shares in

any of the Borrowers without the Agent’s prior written

consent.

|

|

2.6.3.

|

In

deviation of clauses 22.1.16 and 22.1.17 of the Loan Agreement, it shall

constitute an Event of Default if

|

3

|

2.6.3.1.

|

the

Equity Provider 1 ceases to be a limited partner (Kommanditist) of each of

the Borrowers (except for Borrower 10, Borrower 11, and Borrower 12)

holding at least seventy five (75) percent of each of the Borrowers’

(except for Borrower 10, Borrower 11 and Borrower 12) share capital,

unless (i) the Equity Provider 1 transfers its shares in the Borrowers to

any entity referred to in the definition of the term Equity

Provider 2 or an affiliated company of thereof accepted by the Agent or

(ii) the Equity Provider 1 transfers its shares in the Borrowers to

another third party accepted by the Agent;

and

|

|

2.6.3.2.

|

the

Equity Provider 2 ceases to hold at least twenty five (25) percent of the

shares of each the Borrowers or if any of the Borrowers ceases to be a

limited partnership.

|

|

3.

|

EFFECTIVENESS

|

This

Addendum No. 2 shall become effective on the date hereof.

|

4.

|

COSTS

AND EXPENSES

|

All costs

and expenses of the Lenders, in case of external services engaged in connection

with this Addendum No. 2 upon presentation of a copy of the relevant invoice,

incurred under or in connection with this Addendum No. 2 shall be borne by the

Borrowers including without limitation expenses for external attorneys or other

persons commissioned by any of the parties hereto for any action required by it

under or in connection with this Addendum No. 2 and expenses incurred by any of

the parties hereto in connection with the preparation, execution and carrying

out of this Addendum No. 2 (including any stamp, documentary, registration or

other like duties and Taxes, fees and charges), translations and legal opinions

(if any).

|

5.

|

SEVERABILITY

|

In the

event that this Addendum No. 2 or any provision thereof or any of the documents

or instruments which may from time to time be delivered hereunder or any

provision thereof shall be deemed invalid by present or future law of any nation

or by decision of any court this shall not affect the validity of this Addendum

No. 2, such documents and instruments as a whole and in such case the parties

shall execute and deliver such other and further agreements and/or documents

and/or instruments and such things as the Lenders in their sole discretion may

deem to be necessary to carry out the original intent of the parties to this

Addendum No. 2.

4

|

6.

|

CONTINUING

VALIDITY OF THE LOAN AGREEMENT

|

Save as

amended by this Addendum No. 2 and such further instruments and documents as

shall be necessary to give effect to the terms of this Addendum No. 2, the Loan

Agreement shall remain unaltered and in full force and effect. In case of

conflicts between the provisions of the Loan Agreement and this Addendum No. 2,

the provisions of this Addendum No. 2 shall prevail.

|

7.

|

APPLICABLE

LAW AND JURISDICTION

|

The terms

and conditions set out in this Addendum No. 2 shall be governed by and construed

in accordance with German law and the Borrowers submits to the jurisdiction of

the courts of Hannover, Germany. However, the Lenders reserve the right to

choose as place of jurisdiction any place where any of the Borrowers has any

assets or any place of business.

5

IN WITNESS WHEREOF the parties

hereto have caused this Addendum No. 2 to be signed by their duly authorized

attorneys the day and year first above written.

|

THE

LENDERS:

|

||

|

SIGNED

by

|

)

|

|

|

Inga

Boysen

and

|

)

|

|

|

Regina

Schulz

|

)

|

|

|

for

and on behalf of

|

)

|

|

|

NORDDEUTSCHE

LANDESBANK

|

)

|

|

|

GIROZENTRALE

|

)

|

/s/ Inga Boysen /s/ Regina

Schulz

|

|

THE

BORROWERS

|

||

|

SIGNED

by

|

)

|

|

|

Niels

Roggemann

|

)

|

|

|

for

and on behalf of

|

)

|

/s/ Niels

Roggemann .

|

ATL

OFFSHORE GMBH & CO. MS "JUIST" KG

ATL

OFFSHORE GMBH & CO. MS "NORDERNEY" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF BALTRUM" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF LANGEOOG" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF AMRUM" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF SYLT" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF WANGEROOGE" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF NEUWERK" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF USEDUM" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF FEHMARN " KG

ATL

OFFSHORE GMBH & CO. "ISLE OF MEMMERT" KG

ATL

OFFSHORE GMBH & CO. "ISLE OF MELLUM" KG

6

ACKNOWLEDGEMENT AND

UNDERTAKING

We hereby

confirm to have full knowledge of this Addendum No. 2 and to agree to its

contents.

|

THE

CORPORATE GUARANTOR

|

||

|

Signed

by

|

)

|

|

|

Niels

Roggemann

|

)

|

|

|

REEDEREI

HARTMANN

|

)

|

|

|

GMBH

& CO. KG

|

)

|

/s/ Niels

Roggemann

|

7

NEW

EXHIBIT

UNDERTAKING

8

|

____________________

|

||

|

_________________,

Germany

|

|

To:

|

NORDEUTSCHE

LANDESBANK GIROZENTRALE

|

|

Shipping

and Aircraft Finance Department

|

|

|

Friedrichswall

10

|

|

|

30159

Hannover

|

|

|

Federal

Republic of Germany

|

|

|

Fax: +49-511-3614785

|

__________________,20__

Loan

agreement dated 19th

December, 2008 (as amended by the addendum no. 1 dated 17th

September, 2010 and by an addendum no. 2 dated 24th

January, 2011 the “Loan Agreement”) made between, inter alia, you as agent and

twelve limited partnerships of Leer, Germany (the “Borrowers” as more closely

defined therein)

Dear

Sirs,

We,

__________________of ____________________, Germany, being an entity referred to

in the definition of the term “Equity Provider 2” in the Loan Agreement, hereby

undertake not to sell any of our shares in any of the Borrowers without your

prior written consent.

Sincerely,

____________________

____________________

9

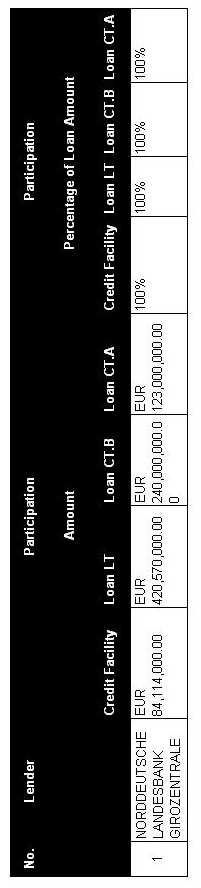

SCHEDULE

1

LIST

OF LENDERS AND PARTICIPATION

10

11