Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Aurum, Inc. | a6584261_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Aurum, Inc. | a6584261_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Aurum, Inc. | a6584261_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - Aurum, Inc. | a6584261_ex31-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Aurum, Inc. | a6584261_ex10-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Aurum, Inc. | a6584261_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

For the fiscal year ended: October 31, 2010

or

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

For the transition period from: _____________ to _____________

Commission File Number: 000-53861

AURUM, INC.

(Exact name of Registrant as specified in its charter)

———————

|

Delaware

|

27-1728996

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

|

of Incorporation or Organization)

|

Identification No.)

|

Level 8, 580 St Kilda Road Melbourne, Victoria, 3004, Australia

(Address of principal executive offices) (Zip Code)

011 (613) 8532 2800

(Registrant’s telephone number, including area code)

———————

N/A

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Common Stock, par value $.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| o |

Yes

|

x

|

No

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| o |

Yes

|

x

|

No

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

x

|

Yes

|

o |

No

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for any such shorter period that the registrant was required to submit and post such file).*The registrant has not yet been phased into the interactive data requirements.

|

x

|

Yes

|

o |

No

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

| o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer

|

o |

Accelerated filer

|

o | |||

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

o |

Yes

|

x

|

No

|

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value based on the average bid and asked price on the over-the-counter market of the Registrant’s common stock (“Common Stock”) held by non-affiliates of the Company was US$4,400,000 as at April 30, 2010.

There were 105,600,000 outstanding shares of Common Stock as of January 26, 2011.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

| o |

Yes

|

o |

No

|

DOCUMENTS INCORPORATED BY REFERENCE

Not Applicable

_____________________

INDEX

|

PART I

|

||

|

1

|

||

|

6

|

||

|

11

|

||

|

11

|

||

|

11

|

||

|

11

|

||

|

PART II

|

||

|

12

|

||

|

13

|

||

|

14

|

||

|

17

|

||

|

17

|

||

|

17

|

||

|

17

|

||

|

18

|

||

|

PART III

|

||

|

19

|

||

|

22

|

||

|

22

|

||

|

23

|

||

|

24

|

||

|

PART IV

|

||

|

25

|

||

i

PART I

General

Our name is Aurum, Inc. and we sometimes refer to ourselves in this Annual Report as “Aurum”, the “Company” or as “we,” “our,” or “us.”

We were incorporated in the State of Florida on September 29, 2008 under the name Liquid Financial Engines, Inc. (“Liquid”) and we changed our name to Aurum, Inc. and our State of domicile to the State of Delaware, effective as of January 20, 2010.

Description of Business

Introduction

We were originally organized with the intention to develop and market financial software systems for banks, brokerage firms, pension funds, family offices, and hedge funds.

In July 2009, Golden Target Pty Ltd., an Australian corporation (“Golden”), acquired a 96% interest in Liquid from certain stockholders. In connection therewith, the Company appointed a new President/Chief Executive Officer and Chief Financial Officer/Secretary and a new sole Director. Commencing in September 2009, the Company shifted its focus to mineral exploration for gold and copper in the Lao Peoples Democratic Republic (Lao P.D.R or Laos). Laos is known by the Company to have significant potential for gold and copper discoveries and is a highly under explored nation with respect to all mineral commodities.

On September 29, 2009 the Company’s Board of Directors declared an 8-for-1 stock split in the form of a stock dividend that was payable in October 2009 to stockholders of record as of October 23, 2009. An aggregate of 92,400,000 shares of common stock were issued in connection with this dividend. The Company has accounted for this bonus issue as a stock split and accordingly, all share and per share data has been retroactively restated.

In 2009, the Company shifted its focus to mineral exploration for gold and copper in the Lao Peoples Democratic Republic (Lao P.D.R or Laos). Based upon publicly available information, the Company believes that Laos has significant potential for gold and copper discoveries and is a highly under explored nation with respect to all mineral commodities.

The Company has finished an intensive project generation period which generated multiple targets across highly prospective areas in Laos. The project areas have been ranked and negotiations have begun to secure title through either joint venture arrangements with current title holders or direct applications through the Laos government.

On January 20, 2010, the Company re-incorporated in the state of Delaware (the “Reincorporation”) through a merger involving Liquid Financial Engines, Inc. (“Liquid”) and Aurum, Inc., a Delaware Corporation that was a wholly owned subsidiary of Liquid. The Reincorporation was effected by merging Liquid with Aurum, with Aurum being the surviving entity. For purposes of the Company’s reporting status with the Securities and Exchange Commission, Aurum is deemed a successor to Liquid.

Recent Developments

In December 2010, the Company executed a Management and Shareholders Agreement with Argonaut Overseas Investments Ltd (“AOI”), an indirectly wholly owned Subsidiary of Argonaut Resources N.L., in respect to Argonaut’s 70% held Century Concession in Laos.

1

The agreement appoints Aurum as the manager of the Century Thrust Joint Venture Agreement and the Company has the right to earn 72.86% of AOI’s interest in the Joint Venture which is equivalent to a 51% beneficial interest in the Century Concession.

Laos

Aurum is primarily engaged in mineral exploration for gold and copper in the Lao Peoples Democratic Republic (Lao P.D.R or Laos).

Based upon publicly available information and the experience of company personnel, the Company believes that Laos has significant potential for gold and copper discoveries and is a highly under explored nation with respect to all mineral commodities. Laos has a long history of artisanal mining for gold and copper and numerous occurrences of these commodities have been recorded throughout the country. Only recently has Laos initiated a unified national geological and mineral resource knowledge database. The Laos government now sees the development of this knowledge combined with foreign investment into mineral exploration and development as integral to the future economy of Laos.

Current successful foreign owned mining operations in Laos, which are not affiliated with the Company, are the Sepon Copper Gold Mine in lower central Laos which produces approximately 65,000 tonnes of copper cathode and 100,000 ounces of gold per year and the Phu Kham mine in central northern Laos which is currently producing 60,000 tonnes of copper in concentrate and approximately 60,000 ounces of gold and 400,000 ounces of silver. Other smaller operations also exist throughout Laos as joint ventures between Laos and Vietnam or China.

Craig Michael, a Director and Executive General Manager of Aurum, was formerly based in Laos in senior management positions as a Supervisor/Trainer, both as a Mine Geologist and Resource Geologist at the Sepon Copper Gold Project, Savannakhet Province, Lao P.D.R., which is not associated with the Company. In conjunction with training the national geologic staff in all mining and resource geology functions, Mr. Michael also conducted resource estimates for public reporting and was responsible for the geological interpretation of the Khanong copper-gold deposit, and the surrounding oxide and primary gold deposits.

Aurum considers Laos to be one of the few remaining countries in the world that has favourable geology in under explored areas containing high potential for world class undiscovered gold and copper ore bodies. Utilising this knowledge, in conjunction with management’s prior experience in operating exploration logistics within Laos, has led the Company to pursue the many opportunities available in this country. Aurum has built significant relationships with the Lao government and local Lao contractors and is actively developing partnerships with these stakeholders. Relationships with these key stakeholders are considered integral for any successful mineral exploration venture in Laos.

Aurum has a registered representative office and an experienced mineral exploration team based in the capital city Vientianne. Exploration activities officially began in September 2009 and the Company has quickly rationalised target mineralisation styles for project generation and defined appropriate regions in which to stake mineral claims. The current exploration strategy is to target gold deposits which are ideally greater than 1 million ounces of gold, and copper deposits greater than 800,000 tonnes of contained copper. The following mineralisation styles have been targeted as the most prospective in Laos:

|

·

|

Sediment Hosted gold, Carlin Style gold, i.e. Sepon Mine, Laos.

|

|

·

|

Epithermal gold, i.e. Chatree Mine, Thailand.

|

|

·

|

Granite Related, Hydrothermal/Mesothermal gold, i.e. Lak Sao area, Laos.

|

|

·

|

Skarn copper/gold, i.e. Phu Kham Mine, Laos.

|

2

|

·

|

Supergene Exotic copper, i.e. Sepon Mine, Laos.

|

|

·

|

Porphyry gold/copper/molybdenum, i.e. Sepon Mine, Laos.

|

Century Concession

In January, 2011 the Company announced that it has entered into an agreement with Argonaut Resources NL, an Australian listed corporation (“Argonaut”), to earn a 51% interest in Argonaut's 70% held Century Concession (“Century”) in western Laos.

Argonaut, through a wholly owned subsidiary, holds a 70% interest in Argonaut Resources (Laos) Co. Ltd. (“ARL”) which holds a 100% interest in the 223 square kilometer (55,105 acres) Century concession in Laos.

Under the terms of the agreement, Aurum will be appointed the manager of the Century Thrust Joint Venture Agreement (“JVA”) which currently exists between Argonaut and two other parties, and will have the right to earn a 51% beneficial interest in the Century concession. In order to acquire this interest, Aurum must spend US$6.5 million on exploration within five years. The five year period includes an initial one year assessment period. Aurum is also in negotiations for the purchase of the 30% interest in the concession not held by Argonaut which is held by the two other parties. The agreement between Aurum and Argonaut is subject to the completion of a condition subsequent.

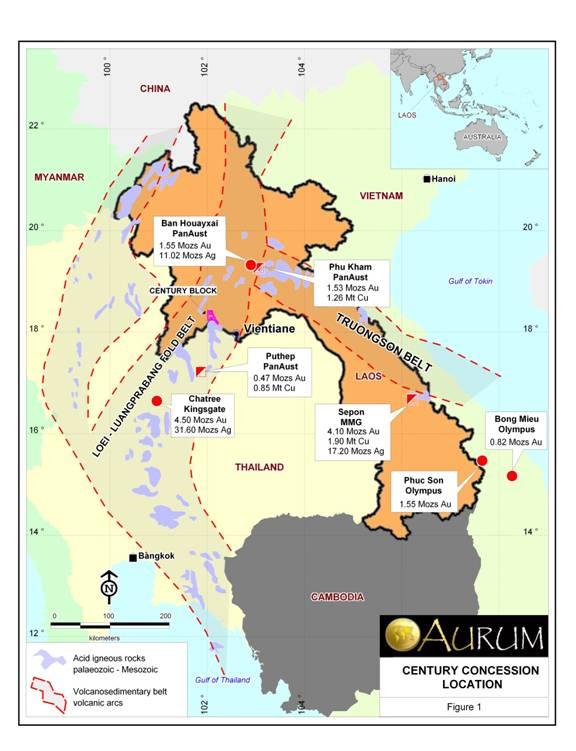

Century is located approximately 150 km north west of the capital city Vientiane on the highly prospective Loei-Luang Prabang fold belt, a prominent, regionally mineralized belt, which stretches from Thailand in the south, to Laos in the north (See Figure 1).

3

Century is an advanced stage exploration project with four priority areas ‘drill-ready’ for early resource definition drilling. Numerous extremely encouraging high grade gold intersections, which have been previously reported1, are ready for immediate follow up. A valuable, high quality geological database has been collected from multiple previous exploration programs involving soil sampling, pan concentrate sampling, stream sediment sampling, rock-chip sampling, topographic surveying, geological mapping, trenching, and drilling. The four priority prospects will be the focus of the upcoming drilling program in Aurum’s first field season. Aurum has planned an aggressive drilling program for the current dry season which will focus on defining the potential gold resources surrounding the numerous gold intercepts previously discovered1. The projects all benefit from pre-existing infrastructure including access tracks, drill pads and exploration camps which greatly reduce the cost and time involved with beginning Aurum’s planned exploration program.

4

Recognition of the potential size of the resource endowment contained in the Loei-Luang Prabang belt is growing due to the recent history of major discoveries and mining developments. On the Thailand side of the belt several prominent and highly profitable mining operations and feasibility stage projects are currently underway, including Kingsgate Consolidated's Ltd expanding Chatree gold mine (~5Moz’s Au) and PanAust Ltd’s Puthep Cu-Au deposit (0.9Mt Cu, 0.5Moz’s Au) (See Figure 1). On the Laos side, PanAust Ltd has two active mining operations, Phu Kham Cu-Au mine (1Mt Cu, 1.6Moz’s Au) and Ban Houayxai Au mine (1.6Moz’s Au, 11Moz’s Ag), and an impressive portfolio of advanced stage exploration/resource projects. In addition to these major projects, there are numerous mineral occurrences with small scale mining operations all along the Loei-Luang Prabang belt. This list of significant resource and mine developments coupled with the highly underexplored nature of Laos highlights the exciting mineral potential of this region.

Employees

We have appointed Mr. Chris Gerteisen to be the Managing Director of the Laos operations which will manage all the activities of Aurum in Laos. Mr Gerteisen has over 15 years experience working as an international geology professional and entrepreneur, managing a variety of challenging resource projects across SouthEast Asia, Australia, and North America, and focussed on a wide range of commodities, including gold and copper. Through his technical contributions and management skills, Mr. Gerteisen played a significant role in the successful start-up, operations, and exploration which resulted in further mine-life extending discoveries at several prominent projects in the Australasian region, including Oxiana’s Sepon and PanAust’s Phu Kham in Laos. He has been based in Laos for almost 10 years giving him an intimate knowledge of the local language, culture, and business environment. Dr. Peter Jones has also been appointed as Exploration Manager for Aurum in Laos. Dr. Jones is an internationally recognised professional geologist with over 30 years of experience in international gold and base metal projects. Dr. Jones is currently managing a small team of exploration geologists based in Laos’ capital city Vientianne and is conducting reconnaissance style regional exploration programs to gather data to inform the exploration process. Potential Joint Ventures with third parties who are aiming to develop mineral properties in Laos are also being investigated.

We use temporary employees for some of our activities. The services of our President, Chief Executive Officer and Director, Joseph Gutnick, our Director and Executive General Manager, Craig Michael and Chief Financial Officer and Secretary, Peter Lee, as well as clerical employees are provided to us on a part-time as needed basis pursuant to a Service Agreement (the “Service Agreement”) between us and AXIS Consultants Pty Limited (“AXIS”) effective from August 2009. AXIS also provides us with office facilities, equipment, administration and clerical services in Melbourne, Australia pursuant to the Service Agreement. The Service Agreement may be terminated by written notice by either party.

Other than this, we rely primarily upon consultants to accomplish our activities. We are not subject to a union labour contract or collective bargaining agreement.

5

SEC Reports

We file annual, quarterly, current and other reports and information with the SEC. These filings can be viewed and downloaded from the Internet at the SEC’s website at www.sec.gov. In addition, these SEC filings are available at no cost as soon as reasonably practicable after the filing thereof on our website at auruminc.net these reports are also available to be read and copied at the SEC’s public reference room located at Judiciary Plaza, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operations of the public reference room by calling the SEC at 1-800-SEC-0330.

You should carefully consider each of the following risk factors and all of the other information provided in this Annual Report before purchasing our common stock. An investment in our common stock involves a high degree of risk, and should be considered only by persons who can afford the loss of their entire investment. The risks and uncertainties described below are not the only ones we face. There may be additional risks and uncertainties that are not known to us or that we do not consider to be material at this time. If the events described in these risks occur, our business, financial condition and results of operations would likely suffer. Additionally, this Annual Report contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. This section discusses the risk factors that might cause those differences.

Risk Factors

Risks of Our Business

We Lack an Operating History And Have Losses Which We Expect To Continue Into the Future.

To date we have no source of revenue. We have no operating history as a mineral exploration or mining company upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

|

-

|

exploration and development of any mineral property we identify;

|

|

-

|

our ability to locate and obtain property with potential economically viable mineral reserves;

|

|

-

|

our ability to raise the capital necessary to conduct exploration and preserve our interest in the mineral claims on identified properties, increase our interest in the mineral claims and continue as an exploration and mining company; and

|

|

-

|

our ability to generate revenues and profitably operate a mine on the property covered by our mineral claims.

|

The Report Of Our Independent Registered Public Accounting Firm Contains An Explanatory Paragraph Questioning Our Ability To Continue As A Going Concern.

The report of our independent registered public accounting firm on our financial statements as of October 31, 2010 and 2009, and for the year ended October 31, 2010 and 2009, and for the cumulative period September 29, 2008 to October 31, 2010, includes an explanatory paragraph discussing our ability to continue as a going concern. This paragraph indicates that we have limited assets, negative working capital, have not yet commenced revenue producing operations and have accumulated losses of approximately $1,071,000 which could raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustment that might result from the outcome of this uncertainty.

6

Our Area of Operations is located in Laos and are subject to changes in political conditions and regulations in that country.

Our area of operations is located in Laos. In the past, Laos has been subject to political and social instability, changes and uncertainties which may cause changes to existing government regulations affecting mineral exploration and mining activities. Civil or political unrest could disrupt our operations at any time. Our mineral exploration and mining activities in Laos may be adversely affected in varying degrees by changing governmental regulations relating to the mining industry or shifts in political conditions that increase the costs related to our activities or maintaining our future properties. Finally, Laos’ status as a developing country may make it more difficult for us to obtain required financing for our project.

We Are A Small Operation And Do Not Have Significant Capital.

Because we will have limited working capital, we must limit our activities. If we are unable to raise the capital required to undertake adequate activities, including locating and obtaining suitable properties and/or finding a suitable business, we may not find commercial minerals even though the identified properties may contain commercial minerals or we may miss opportunities to acquire suitable businesses. If we do not find commercial minerals or cannot find suitable businesses we may be forced to cease operations and you may lose your entire investment.

We May Need Further Financing To Determine If There Is Commercial Minerals, Develop Any Minerals We Identify And To Maintain The Mineral Claims.

Our success may depend on our ability to raise further capital. We may require further substantial additional funds to conduct mineral exploration and development activities on all of our tenements. There is no assurance whatsoever that funds will be available from any source or, if available, that they can be obtained on terms acceptable to us to make investments. If funds are not available in the amounts required to achieve our business strategy, we would be unable to reach our objective. This could cause the loss of all or part of your investment.

We Could Encounter Delays Due To Regulatory And Permitting Delays.

We could face delays in obtaining mining permits and environmental permits. Such delays, could jeopardize financing, if any, in which case we would have to delay or abandon work on the properties.

There Are Uncertainties Inherent In The Estimation Of Mineral Reserves.

Reserve estimates, including the economic recovery of ore, will require us to make assumptions about recovery costs and market prices. Reserve estimation is, by its nature, an imprecise and subjective process and the accuracy of such estimates is a function of the quality of available data and of engineering and geological interpretation, judgment and experience. The economic feasibility of properties will be based upon our estimates of the size and grade of ore reserves, metallurgical recoveries, production rates, capital and operating costs, and the future price of diamonds. If such estimates are incorrect or vary substantially it could affect our ability to develop an economical mine and would reduce the value of your investment.

If We Define An Economic Ore Reserve And Achieve Production, It Will Decline In The Future. An Ore Reserve Is A Wasting Asset.

Our future ore reserve and production, if any, will decline as a result of the exhaustion of reserves and possible closure of any mine that might be developed. Eventually, at some unknown time in the future, all of the economically extractable ore will be removed from the properties, and there will be no ore remaining unless this Company is successful in near mine site exploration to extend the life of the mining operation. This is called depletion of reserves. Ultimately, we must acquire or operate other properties in order to continue as an on going business. Our success in continuing to develop reserves, if any, will affect the value of your investment.

7

There Are Significant Risks Associated With Mining Activities.

The mining business is generally subject to risks and hazards, including quantity of production, quality of the ore, environmental hazards, industrial accidents, the encountering of unusual or unexpected geological formations, cave-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. These occurrences could result in damage to, or destruction of, our mineral properties or production facilities, personal injury or death, environmental damage, reduced production and delays in mining, asset write-downs, monetary losses and possible legal liability. We could incur significant costs that could adversely affect our results of operation. Insurance fully covering many environmental risks (including potential liability for pollution or other hazards as a result of disposal of waste products occurring from exploration and production) is not generally available to us or to other companies in the industry. What liability insurance we carry may not be adequate to cover any claim.

We May Be Subject To Significant Environmental And Other Governmental Regulations That Can Require Substantial Capital Expenditure, And Can Be Time-Consuming.

We may be required to comply with various laws and regulations pertaining to exploration, development and the discharge of materials into the environment or otherwise relating to the protection of the environment in the countries that we operate, all of which can increase the costs and time required to attain operations. We may have to obtain exploration, development and environmental permits, licenses or approvals that may be required for our operations. There can be no assurance that we will be successful in obtaining, if required, a permit to commence exploration, development and operation, or that such permit can be obtained in a timely basis. If we are unsuccessful in obtaining the required permits it may adversely affect our ability to carry on business and cause you to lose part or all of your investment.

Mining Accidents Or Other Adverse Events At Our Property Could Reduce Our Production Levels.

If and when we reach production it may fall below estimated levels as a result of mining accidents, cave-ins or flooding on the properties. In addition, production may be unexpectedly reduced if, during the course of mining, unfavourable ground conditions or seismic activity are encountered, ore grades are lower than expected, or the physical or metallurgical characteristics of the ore are less amenable to mining or processing than expected. The happening of these types of events would reduce our profitably or could cause us to cease operations which would cause you to lose part or all of your investment.

The acquisition of mineral properties is subject to substantial competition. If we must pursue alternative properties, companies with greater financial resources, larger staffs, more experience, and more equipment for exploration and development may be in a better position than us to compete for properties. We may have to undertake greater risks than more established companies in order to compete which could affect the value of your investment.

If Our Officers And Directors Stopped Working For Us, We Would Be Adversely Impacted.

None of our other officers or directors work for us on a full-time basis. There are no proposals or definitive arrangements to compensate our officers and directors or to engage them on a full-time basis. They each rely on other business activities to support themselves. They each have a conflict of interest in that they are officers and directors of other companies. You must rely on their skills and experience in order for us to reach our objective. We have no employment agreements or key man life insurance policy on any of them. The loss of some or all of these officers and directors could adversely affect our ability to carry on business and could cause you to lose part or all of your investment.

8

Approximately 96% Of Our Common Stock Is Controlled By Our Chairman And Chief Executive Officer Who Has The Ability To Appoint Our Board Of Directors And Determine Other Matters Submitted To Stockholders

Mr Joseph Gutnick, our Chairman and Chief Executive Officer, beneficially owned 101.6 million shares of our common stock, which represented 96% of our shares outstanding as of January 26, 2011. As a result, Mr. Gutnick has and is expected to continue to have the ability to appoint our Board of Directors and to determine the outcome of all other issues submitted to our stockholders. The interests of Mr. Gutnick may not always coincide with our interests or the interests of other stockholders, and subject to his fiduciary duties as a director, he may act in a manner that advances his best interests and not necessarily those of other stockholders. One consequence to this substantial influence or control is that it may not be possible for investors to remove management of the Company. It could also deter unsolicited takeover, including transactions in which stockholders might otherwise receive a premium for their shares over then current market prices.

We are substantially dependent upon AXIS To Carry Out Our Activities

We are substantially dependent upon AXIS for our senior management, financial and accounting, corporate legal and other corporate headquarters functions. For example, each of our officers is employed by AXIS and, as such, is required by AXIS to devote substantial amounts of time to the business and affairs of the other shareholders of AXIS.

Pursuant to a services agreement, AXIS provides us with office facilities, and some administrative personnel and services, management and geological staff and services. No fixed fee is set in the agreement and we are required to reimburse AXIS for any direct costs incurred by AXIS for us. In addition, we pay a proportion of AXIS indirect costs based on a measure of our utilization of the facilities and activities of AXIS plus a service fee of not more than 15% of the direct and indirect costs. AXIS has not charged a service fee for 2010. This service agreement may be terminated by us or AXIS on 60 days’ notice. See “Certain Relationships and Related Party Transactions.”

We are one of ten affiliated companies. Each of the companies has some common Directors, officers and shareholders. In addition, each of the companies is substantially dependent upon AXIS for its senior management and certain mining and exploration staff. A number of arrangements and transactions have been entered into from time to time between such companies. Currently, there are no material arrangements or planned transactions between the Company and any of the other affiliated companies other than AXIS. However, it is possible we may enter into such transactions in the future which could present conflicts of interest. In addition, there may be conflicts among the Company and the other companies that AXIS provides services to with respect to access to executive and administrative personnel and other resources.

Historically, AXIS has allocated corporate opportunities to each of the companies engaged in the exploration and mining industry after considering the location of each of the companies’ operations and the type of commodity for which each company explores within its geographic region. At present, there are no conflicts among the Company and the other companies with respect to the principal geographic areas in which they operate and/or the principal commodities that they are searching for.

9

Future Sales of Common Stock Could Depress The Price Of Our Common Stock

Future sales of substantial amounts of common stock pursuant to Rule 144 under the Securities Act of 1933 or otherwise by certain stockholders could have a material adverse impact on the market price for the common stock at the time. As at January 14, 2011, there were 101,600,000 outstanding shares of common stock which are deemed “restricted securities” as defined by Rule 144 under the Securities Act or control securities. Under certain circumstances, these shares may be sold without registration pursuant to the provisions of Rule 144 following the expiration of one year after the Company ceases to be a shell company. In general, under rule 144, a person (or persons whose shares are aggregated) who has satisfied a six-month holding period and who is not an affiliate of the Company may sell restricted securities without limitation as long as the Company is current in its SEC reports. A person who is an affiliate of the Company may sell within any three-month period a number of restricted securities and/or control securities which does not exceed the greater of one (1%) percent of the shares outstanding or the average weekly trading volume during the four calendar weeks preceding the notice of sale required by Rule 144. In addition, Rule 144 permits, under certain circumstances, the sale of restricted securities by a non-affiliate without any limitations after a one-year holding period. Any sales of shares by stockholders pursuant to Rule 144 may have a depressive effect on the price of our Common stock.

Our Common Stock Is Traded Over the Counter, Which May Deprive Stockholders Of The Full Value Of Their Shares

Our common stock is quoted via the Over The Counter Bulletin Board (OTCBB). As such, our common stock may have fewer market makers, lower trading volumes and larger spreads between bid and asked prices than securities listed on an exchange such as the New York Stock Exchange or the NASDAQ Stock Market. These factors may result in higher price volatility and less market liquidity for the common stock.

A Low Market Price May Severely Limit The Potential Market For Our Common Stock

Our common stock is currently trading at a price substantially below $5.00 per share, subjecting trading in the stock to certain SEC rules requiring additional disclosures by broker-dealers. These rules generally apply to any equity security that has a market price of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our common stock.

The Market Price Of Your Shares Will Be Volatile.

The stock market price of mineral exploration companies like us has been volatile. Securities markets may experience price and volume volatility. The market price of our stock may experience wide fluctuations that could be unrelated to our financial and operating results. Such volatility or fluctuations could adversely affect your ability to sell your shares and the value you might receive for those shares.

10

As of October 31, 2010, we do not have any Securities and Exchange Commission staff comments that have been unresolved for more than 180 days.

The Company occupies certain executive and office facilities in Melbourne, Victoria, Australia which are provided to it pursuant to the Service Agreement with AXIS. See “Item 1 - Business- Employees” and “Item 13 - Certain Relationships and Related Transactions”. The Company also occupies certain office facilities in Laos to support field operations. The Company believes that its administrative space is adequate for its current needs.

There are no pending legal proceedings to which the Company is a party, or to which any of its property is the subject, which the Company considers material.

Not Applicable

11

PART II

Market Information

Our common stock is traded in the over-the-counter market and quoted on the OTCBB under the symbol “AURM”.

The following table sets out the high and low bid information for the Common Stock as reported by the National Quotation Service Bureau for each period/quarter indicated in US$:

|

Calendar Period

|

High Bid (1)

|

Low Bid (1)

|

|

2009

|

||

|

Fourth Quarter

|

0.12

|

0.12

|

|

2010

|

||

|

First Quarter

|

1.00

|

1.00

|

|

Second Quarter

|

1.10

|

1.00

|

|

Third Quarter

|

1.10

|

1.10

|

|

Fourth Quarter

|

1.10

|

1.10

|

(1) The quotations set out herein reflect inter-dealer prices without retail mark-up, markdown or commission and may not necessarily reflect actual transactions.

As of October 31, 2010 and as at January 26, 2011, there were 105,600,000 shares of common stock issued and outstanding.

Dividends

To date we have not paid any cash dividends on our common stock and we do not expect to declare or pay any cash dividends on our common stock in the foreseeable future. Payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by the Board of Directors.

On September 29, 2009 the Company’s Board of Directors declared an 8-for-1 stock split in the form of a stock dividend that was payable in October, 2009 to stockholders of record as of October 23, 2009. An aggregate of 92,400,000 shares of common stock were issued in connection with this dividend.

Shareholders

As of October 31, 2010 the Company had approximately 27 shareholders of record. Within the holders of record of the Company's Common Stock are depositories such as Cede & Co., a nominee for The Depository Trust Company (or DTC), that hold shares of stock for brokerage firms which, in turn, hold shares of stock for one or more beneficial owners. Accordingly, the Company believes there are many more beneficial owners of its Common Stock whose shares are held in "street name", not in the name of the individual shareholder.

Transfer Agent

Our United States Transfer Agent and Registrar is Continental Stock Transfer & Trust Company.

12

Our selected financial data presented below for each of the years in the two-year period ended October 31, 2010 and the balance sheet data at October 31, 2010 and 2009 have been derived from financial statements, which have been audited by PKF LLP. The selected financial data should be read in conjunction with our financial statements for each of the years in the two-year period ended October 31, 2010, and Notes thereto, which are included elsewhere in this Annual Report.

Statement of Operations Data

|

2010

US$

|

2009

US$

|

|||||||

|

Revenues

|

- | - | ||||||

| - | - | |||||||

|

Costs and expenses

|

898,087 | 88,078 | ||||||

|

(Loss) from operations

|

(898,087 | ) | (88,078 | ) | ||||

|

Foreign currency exchange gain (loss)

|

(83,334 | ) | (1,319 | ) | ||||

|

Other income - interest

|

25 | - | ||||||

|

Provision for income taxes

|

- | - | ||||||

|

Net (loss)

|

(981,396 | ) | (89,397 | ) | ||||

| $ | $ | |||||||

|

Net (loss) per share

|

(0.01 | ) | (0.00 | ) | ||||

|

Weighted average number

of shares outstanding (000’s)

|

105,600 | 101,786 | ||||||

|

Balance Sheet Data

|

||||||||

| $ | $ | |||||||

|

Total assets

|

56,436 | 29,612 | ||||||

|

Total liabilities

|

(1,106,241 | ) | (98,021 | ) | ||||

|

Stockholders’ equity (deficit)

|

(1,049,805 | ) | (68,409 | ) | ||||

13

General

The following discussion and analysis of our financial condition and plan of operation should be read in conjunction with the Financial Statements and accompanying notes and the other financial information appearing elsewhere in this report. This report contains numerous forward-looking statements relating to our business. Such forward-looking statements are identified by the use of words such as believes, intends, expects, hopes, may, should, plan, projected, contemplates, anticipates or similar words. Actual operating schedules, results of operations, ore grades and mineral deposit estimates and other projections and estimates could differ materially from those projected in the forward-looking statements.

Overview

We were incorporated in the State of Florida under the name Liquid Financial Engines, Inc (“Liquid”) in September 2008 with the intention to develop and market financial software systems for banks, brokerage firms, pension funds, family offices, and hedge funds.

In July 2009, Golden Target Pty Ltd., an Australian corporation (“Golden”), acquired a 96% interest in Aurum from certain stockholders. In connection therewith, the Company appointed a new President/Chief Executive Officer and Chief Financial Officer/Secretary and a new sole Director. Commencing in September 2009, the Company shifted its focus to mineral exploration for gold and copper in the Lao Peoples Democratic Republic (Lao P.D.R or Laos). Laos is known by the Company to have significant potential for gold and copper discoveries and is a highly under explored nation with respect to all mineral commodities.

On January 20, 2010, the Company re-incorporated in the state of Delaware (the “Reincorporation”) through a merger involving Liquid and Aurum, Inc., a Delaware Corporation that was a wholly owned subsidiary of Liquid. The Reincorporation was effected by merging Liquid with Aurum, with Aurum being the surviving entity. For purposes of the Company’s reporting status with the Securities and Exchange Commission, Aurum is deemed a successor to Liquid.

In December 2010, the Company executed a Management and Shareholders Agreement with Argonaut Overseas Investments Ltd (“AOI”), an indirectly wholly owned Subsidiary of Argonaut Resources N.L., in respect to Argonaut’s 70% held Century Concession in Laos.

The agreement appoints Aurum as the manager of the Century Thrust Joint Venture Agreement and the Company has the right to earn 72.86% of AOI’s interest in the Joint Venture which is equivalent to a 51% beneficial interest in the Century Concession.

Foreign Currency Translation

The Company has operations in Laos and administrative functions based in Australia. The Laos operations functional currency is USD but also uses Laos LAK (Lao Kip “LAK”) and Thai BHT (Thai Baht “BHT”). Australian administrative operations are in AUD (“A$”). The income and expenses of its foreign operations are translated into US dollars at the average exchange rate prevailing during the period. Assets and liabilities of the foreign operations are translated into US dollars at the period-end exchange rate. The following table shows the period-end rates of exchange of the Australian dollar, Lao Kip and Thai Baht compared with the US dollar during the periods indicated.

14

|

Year ended

|

||||

|

October 31

|

||||

|

2009

|

US$1.00

|

=

|

A$1.09782

|

|

|

US$1.00

|

=

|

LAK$8333.33

|

||

|

US$1.00

|

=

|

BHT$33.2557

|

||

|

2010

|

US$1.00

|

=

|

A$1.01700

|

|

|

US$1.00

|

=

|

LAK$8109.29

|

||

|

US$1.00

|

=

|

BHT$30.4360

|

Results of Operations

Year ended October 31, 2010 versus Year ended October 31, 2009

We are a start-up company and have not generated any revenues since inception.

Total costs and expenses have increased from $88,078 for the year ended October 31, 2009, to $898,087 for the year ended October 31, 2010. The increase was a result of:

|

i)

|

An increase in legal, accounting and professional costs from $24,457 in fiscal 2009 to $85,753 in fiscal 2010. During fiscal 2010, we incurred legal expenses of $9,119 for general legal work, audit fees of $49,270 for professional services in relation to financial statements in the quarterly reports on Form 10-Q and annual report on Form 10-K, tax fees of $15,105 and stock transfer costs of $12,259. During fiscal 2009, we incurred legal expenses of $12,902 and audit fees of $11,555.

|

|

ii)

|

An increase in administrative costs from $63,621 in fiscal 2009 to $76,701 in fiscal 2010. During fiscal 2010, we incurred $5,470 for Company filings with the SEC, $47,254 for contractors and consultants, $6,393 in bank charges and franchise taxes, and $17,584 for other sundry expenses. During fiscal 2009, we incurred $7,934 for Company filings with the SEC, $12,078 for travel and accommodation, $28,678 for consultants and contractor’s fees and $14,931 for other sundry expenses.

|

|

iii)

|

An increase in donations from $nil in fiscal 2009 to $100,000 in fiscal 2010. During fiscal 2010 we donated $100,000 to the typhoon victims in Southern Laos.

|

|

iv)

|

An increase in the exploration expense from $nil in fiscal 2009 to $635,619 in fiscal 2010. The costs primarily relate to consultants providing preliminary reviews and advice on exploration targets in Laos. Aurum commenced exploration activities in Laos in September 2009 for the first time and therefore has no comparable expenditure in fiscal 2009.

|

|

v)

|

An increase in interest expense from $nil in fiscal 2009 to $14 in fiscal 2010.

|

As a result of the foregoing, the loss from operations increased from $88,078 for the year ended October 31, 2009 to $898,087 for the year ended October 31, 2010.

The Company recorded a foreign currency exchange loss of $83,334 for the year ended October 31, 2010 compared to a foreign currency exchange loss of $1,319 for the year ended October 31, 2009, primarily due to revaluation of amounts payable to affiliates.

The Company recorded an increase in interest income from $nil for the year ended October 31, 2009 to $25 for the year ended October 31, 2010.

15

The net loss was $981,396 for the year ended October 31, 2010 compared to a net loss of $89,397 for the year ended October 31, 2009.

Liquidity and Capital Resources

For the year ended October 31, 2010, net cash used in operating activities was $876,444 consisting mainly of the net loss from operations; net cash used in investing activities was $18,845 being the cost of additional equipment; and net cash provided by financing activities was $936,469 being advances from affiliates.

The Company’s ability to continue operations through fiscal 2011 is dependent upon future funding from affiliated entities, capital raisings, or its ability to commence revenue producing operations and positive cash flows, of which there can be no assurance.

Under the terms of the agreement with Argonaut, Aurum will have the right to earn a 51% beneficial interest in the Century concession. In order to acquire this interest, Aurum must spend US$6.5 million on exploration within five years. The five year period includes an initial one year assessment period. Aurum is also in negotiations for the purchase of the 30% interest in the concession not held by Argonaut which is held by the two other parties. The agreement between Aurum and Argonaut is subject to the completion of a condition subsequent.

The Company continues to search for additional sources of capital, as and when needed; however, there can be no assurance funding will be successfully obtained. Even if it is obtained, there is no assurance that it will not be secured on terms that are highly dilutive to existing shareholders.

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplates continuation of Aurum as a going concern. However, Aurum has limited assets, negative working capital, has not yet commenced revenue producing operations and has sustained recurring losses since inception.

Cautionary “Safe Harbour” Statement under the United States Private Securities Litigation Reform Act of 1995.

Certain information contained in this Form 10-K are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“the Act”), which became law in December 1995. In order to obtain the benefits of the “safe harbor” provisions of the Act for any such forward-looking statements, we wish to caution investors and prospective investors about significant factors which, among others, have in some cases affected our actual results and are in the future likely to affect our actual results and cause them to differ materially from those expressed in any such forward-looking statements. This Form 10-K contains forward-looking statements relating to future financial results. Actual results may differ as a result of factors over which we have no control, including, without limitation, the risks of exploration and development stage projects, political risks of development in foreign countries, risks associated with environmental and other regulatory matters, mining risks and competitors, the volatility of commodity prices and movements in foreign exchange rates.

Impact of Australian Tax Law

In July, 2009 the management and control of Aurum was effectively transferred to Australia making the company an Australian resident corporation under Australian law. Australian resident corporations are subject to Australian income tax on their non-exempt worldwide assessable income (which includes capital gains), less allowable deductions, at the rate of 30%. Foreign tax credits are allowed where tax has been paid on foreign source income, provided the tax credit does not exceed 30% of the foreign source income.

16

Under the U.S./Australia tax treaty, a U.S. corporation such as us is subject to Australian income tax on net profits attributable to the carrying on of a business in Australia through a “permanent establishment” in Australia. A “permanent establishment” is a fixed place of business through which the business of an enterprise is carried on. The treaty limits the Australian tax on interest and royalties paid by an Australian business to a U.S. resident to 10% of the gross interest or royalty income unless it relates to a permanent establishment. Although we consider that we do not have a permanent establishment in Australia, it may be deemed to have such an establishment due to the location of its administrative offices in Melbourne. In addition we may receive interest or dividends from time to time.

Impact of Australian Governmental, Economic, Monetary or Fiscal Policies

Although Australian taxpayers are subject to substantial regulation, we believe that our operations are not materially impacted by such regulations nor is it subject to any broader regulations or governmental policies than most Australian taxpayers.

Impact of Recent Accounting Pronouncements

For a discussion of the impact of recent accounting pronouncements on the Company’s financial statements, see Note 3 to the Company’s Financial Statements which are included elsewhere in this Annual Report.

At October 31, 2010, the Company had no outstanding borrowings under Loan Facilities.

See F Pages

There have been no changes in accountants or any disagreements with accountants on any matter of accounting principles or practices or financial statement disclosures during the two years ended October 31, 2010.

|

(a)

|

Evaluation of disclosure controls and procedures

|

Our principal executive officer and our principal financial officer evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934 as amended) as of the end of the period covered by this report. Based on that evaluation, such principal executive officer and principal financial officer concluded that, the Company’s disclosure controls and procedures were effective as of the end of the period covered by this report at the reasonable level of assurance.

17

|

(b)

|

Management’s Report on Internal Control over Financial Reporting

|

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange act Rules 13a-15(f) under the Securities Exchange Act of 1934, as amended. Under the supervision of management and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on our evaluation of internal control over financial reporting, our management concluded that our internal controls over financial reporting was effective as of October 31, 2010.

|

(c)

|

Attestation report of the Registered Public Accounting Firm

|

This Annual Report on Form 10-K does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s independent registered public accounting firm pursuant to an exemption for smaller reporting companies under Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

|

(d)

|

Change in Internal Control over Financial Reporting

|

There were no changes in the Company’s internal control over financial reporting identified in connection with the evaluation of such internal control that occurred during the Company’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect the Company’s internal control over financial reporting.

|

(e)

|

Other

|

We believe that a controls system, no matter how well designed and operated, can not provide absolute assurance that the objectives of the controls system are met, and no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected.

None.

18

PART III

The following table sets forth our directors and officers, their ages and all offices and positions with our company. Officers and other employees serve at the will of the Board of Directors.

|

Name

|

Age

|

Position(s) Held

|

|

Joseph Gutnick

|

58

|

Chairman of the Board, President, Chief

Executive Officer and Director

|

|

Craig Michael

|

33

|

Executive General Manager and Director

|

|

Peter Lee

|

53

|

Secretary, Chief Financial Officer

and Principal Accounting Officer

|

Joseph Gutnick

Mr. Gutnick is a leading mining industry entrepreneur and has been President and Chief Executive Officer since July 2009. He has been a Director of numerous public listed companies in Australia and the USA specialising in the mining sector since 1980. He is currently President and CEO of Legend International Holdings Inc, (since 2004) Golden River Resources Corporation (for more than 10 years), and Electrum International, Inc. (since 2009), which are US corporations listed on the OTC market in the USA, President and CEO of Northern Capital Resources Corporation, Yahalom International Resources Corporation, US corporations, and Executive Chairman and Managing Director of North Australian Diamonds Limited, Top End Uranium Limited and Quantum Resources Limited, all listed on the Australian Securities Exchange. Mr. Gutnick was previously a Director of the World Gold Council. He has previously been a Director of Hawthorn Resources Limited, Astro Diamond Mines NL, Acadian Mining Corporation and Royal Roads Corporation in the last five years.He is a Fellow of the Australasian Institute of Mining & Metallurgy and the Australian Institute of Management and a Member of the Australian Institute of Company Directors.

Mr. Gutnick’s extensive experience in leading teams in building and operating major mining operations in Australia as well as his experience in founding and serving as the chief executive officer and chairman of a number of public companies will provide our Board with valuable executive leadership and management experience.

Craig Michael

Mr. Michael has over 10 years experience as a geology professional in the mining and resources industry. He is currently a Director of North Australian Diamonds Limited, Electrum International, Inc, Top End Uranium Limited and Quantum Resources Limited and Executive General Manager of Legend International Holdings, Inc. (since 2007). His previous work was with Oxiana Ltd, an international mining company with operations in South East Asia and Australia. From 2004 to 2007, Mr. Michael was based in Laos in senior management positions as a Supervisor/Trainer, both as a Mine Geologist and Resource Geologist at the Sepon Copper Gold Project, Savannakhet Province, Lao P.D.R. In conjunction with training the national geologic staff in all mining and resource geology functions, Mr. Michael also conducted resource estimates for public reporting and was responsible for the geological interpretation of the Khanong copper-gold deposit, and the surrounding oxide and primary gold deposits. During his four years based in Laos, Mr. Michael became fluent in the Lao language and became well acquainted with the unique Lao culture and people. These skills enabled Mr. Michael to understand how businesses operated in Laos and he subsequently developed strong business relationships and government liaison networks.

19

Mr. Michael’s qualifications and understanding of the Lao geology and under-explored nature of Laos will provide valuable knowledge to our Board.

Peter Lee

Mr. Lee has been Chief Financial Officer, Secretary and Principal Accounting Officer since July 2009. Mr. Lee is a Member of the Institute of Chartered Accountants in Australia, a Fellow of Chartered Secretaries Australia Ltd., a Member of the Australian Institute of Company Directors and holds a Bachelor of Business (Accounting) from Royal Melbourne Institute of Technology. He has over 30 years commercial experience and is currently CFO and Secretary of Legend International Holdings Inc, (since 2005) Director, CFO and Secretary of Golden River Resources Corporation (for more than 10 years), and CFO and Secretary of Electrum International, Inc. (since 2009), which are US corporations listed on the OTC market in the USA; CFO and Secretary of Northern Capital Resources Corporation and Yahalom International Resources Corporation, US Corporations; and CFO and Secretary of North Australian Diamonds Limited, Top End Uranium Limited and Quantum Resources Limited, all listed on the Australian Securities Exchange and a Director of Acadian Mining Corporation listed on Toronto Stock Exchange.

The Company’s directors have been appointed for a one-year term which expires in December 2011.

Messrs Gutnick, Michael and Lee devote sufficient of their business time to the affairs of the Company to advance its activities.

Directors need not be stockholders of the Company or residents of the State of Delaware. Directors are elected for an annual term and generally hold office until the next Directors have been duly elected and qualified. Directors may receive compensation for their services as determined by the Board of Directors. A vacancy on the Board may be filled by the remaining Directors even though less than a quorum remains. A Director appointed to fill a vacancy remains a Director until his successor is elected by the Stockholders at the next annual meeting of Shareholder or until a special meeting is called to elect Directors.

Involvement on Certain Material Legal Proceedings During the Last Ten Years

No director, officer, significant employee or consultant has been convicted in a criminal proceeding, exclusive of traffic violations. No director, officer, significant employee or consultant has been permanently or temporarily enjoined, barred, suspended or otherwise limited from involvement in any type of business, securities or banking activities. No director, officer or significant employee has been convicted of violating a federal or state securities or commodities law.

Mr. Gutnick was formerly the Chairman of the Board and Mr. Lee was formerly Company Secretary of Centaur Mining & Exploration Ltd., an Australian corporation, which commenced an insolvency proceeding in Australia in March 2001.

Board, Audit Committee and Remuneration Committee Meetings

Our Board of Directors consists of two directors, one of which was appointed in January 2010. During fiscal 2010, our Board of Directors met twice. The Board of Directors also use resolutions in writing to deal with certain matters, and during fiscal 2010, three resolutions in writing were signed by all Directors.

20

We do not have a nominating committee. Historically our entire Board has selected nominees for election as directors. The Board believes this process has worked well thus far particularly since it has been the Board's practice to require unanimity of Board members with respect to the selection of director nominees. In determining whether to elect a director or to nominate any person for election by our stockholders, the Board assesses the appropriate size of the Board of Directors, consistent with our bylaws, and whether any vacancies on the Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, the Board will consider various potential candidates to fill each vacancy. Candidates may come to the attention of the Board through a variety of sources, including from current members of the Board, stockholders, or other persons. The Board of Directors has not yet had the occasion to, but will, consider properly submitted proposed nominations by stockholders who are not directors, officers, or employees of Aurum, Inc. on the same basis as candidates proposed by any other person. We do not have a policy with respect to the use of diversity as a criteria for Board membership and do not consider diversity in the selection of our Directors.

Audit Committee

At October 31, 2010, the Company had not formed an audit committee or adopted an audit committee charter. In lieu of an audit committee, the Company's Board of Directors assumes the responsibilities that would normally be those of an audit committee. Given the limited scope of the Company’s operations to date, the Board of Directors does not at present have a director that would qualify as an audit committee financial expert under the applicable federal securities law regulations.

Remuneration Committee

At October 31, 2010, the Company had not formed a remuneration committee or adopted a remuneration committee charter. In lieu of a remuneration committee, the Company's board of directors assumes the responsibilities that would normally be those of a remuneration committee.

Code of Ethics

We have adopted a Code of Conduct and Ethics and it applies to all Directors, Officers and employees. A copy of the Code of Conduct and Ethics is on our website at auruminc.net. We will provide a copy of the Code of Conduct and Ethics any person without charge. If you require a copy, contact us by facsimile or email and we will send you a copy.

Stockholder Communications with the Board

Stockholders who wish to communicate with the Board of Directors should send their communications to the Chairman of the Board at the address listed below. The Chairman of the Board is responsible for forwarding communications to the appropriate Board members.

Mr. Joseph Gutnick

Aurum, Inc.

PO Box 6315 St. Kilda Road

Central Melbourne, Victoria 8008 Australia

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, our Directors, executive officers and beneficial owners of more than 10% of the outstanding Common Stock are required to file reports with the Securities and Exchange Commission concerning their ownership of and transactions in our Common Stock and are also required to provide to us copies of such reports. Based solely on such reports and related information furnished to us, we believe that in fiscal 2010 all such filing requirements were complied with in a timely manner by all Directors, executive officers and greater than 10% stockholders, except that Mr. Lee and Mr. Michael filed Form 3’s after the due dates for such forms.

21

The following table sets forth the annual salary, bonuses and all other compensation awards and pay outs on account of our Chief Executive Officer for services rendered to us during the fiscal years ended October 31, 2010 and October 31, 2009. No other executive officer received more than US$100,000 per annum during this period.

Summary Compensation Table

|

Name and

Principal

Position

|

Year

|

Salary

|

Bonus

|

Stock

Awards

|

Option

Awards

|

Non-Equity

Incentive

Plan

Compensation

|

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

|

All Other

Compensation

|

Total

|

|

Joseph

Gutnick,

Chairman

of the

Board,

President

and CEO (1)

|

2010

2009

|

$-

$-

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

$-

$-

|

|

Daniel

McKelvey, Director

and CEO (2)

|

2010

2009

|

$-

$-

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

$-

$-

|

|

1.

|

Joseph Gutnick appointed July 23, 2009.

|

|

2.

|

Daniel McKelvey was appointed September 29, 2008 and resigned July 23, 2009.

|

We have a policy that we will not enter into any transaction with an officer, Director or affiliate of the Company or any member of their families unless the terms of the transaction are no less favourable to us than the terms available from non-affiliated third parties or are otherwise deemed to be fair to the Company at the time authorised.

Outstanding Equity Awards at Fiscal Year-End

None.

Principal Officers Contracts

The principal officers do not have any employment contracts.

Compensation of Directors

The Company’s directors did not receive any compensation during fiscal 2010.

It is our policy to reimburse Directors for reasonable travel and lodging expenses incurred in attending Board of Directors meetings.

The following table sets forth certain information regarding the beneficial ownership of our common stock by each person or entity known by us to be the beneficial owner of more than 5% of the outstanding shares of common stock, each of our directors and named executive officers, and all of our directors and executive officers as a group as of January 26, 2011.

22

|

Title of

Class

|

Name and Address

of Beneficial Owner*

|

Amount and nature of

Beneficial Owner

|

Percentage

of class (1)

|

|

Shares of common stock

Shares of common stock

Shares of common stock

|

Joseph Gutnick

Craig Michael

Peter Lee

|

101,600,000 (2)

-

-

|

96.21

-

-

|

|

All officers and Directors

as a group

|

101,600,000

|

96.21

|

|

*

|

Unless otherwise indicated, the address of each person is c/o Aurum, Inc., Level 8, 580 St. Kilda Road, Melbourne, Victoria 3004 Australia

|

Notes:

|

(1)

|

Based on 105,600,000 shares outstanding as of January 14, 2011. Gives effect to an 8 for 1 stock split in the form of a dividend that was effected as of October 23, 2009.

|

|

(2)

|

Includes 101,600,000 shares owned by Golden Target Pty Ltd, of which Mr Joseph Gutnick is the sole Director and stockholder.

|

In August 2009, the Company entered into an agreement with AXIS Consultants Pty Ltd to provide geological, management and administration services to the Company. AXIS is affiliated through common management and is incorporated in Australia. AXIS’ principal business is to provide geological, management and administration services to companies. We are one of ten affiliated companies that AXIS provides services to, namely, Legend International Holdings, Inc, Quantum Resources Limited, North Australian Diamonds Ltd, Top End Uranium Ltd, Northern Capital Resources Corp, Golden River Resources Corp, Yahalom International Resources Corp, Aurum Inc, Electrum International Inc,, Acadian Mining Corporation.

Each of the companies has some common Directors, officers and shareholders. In addition, each of the companies is substantially dependent upon AXIS for its senior management and certain mining and exploration staff. A number of arrangements and transactions have been entered into from time to time between such companies. It has been the intention of the affiliated companies and respective Boards of Directors that each of such arrangements or transactions should accommodate the respective interest of the relevant affiliated companies in a manner which is fair to all parties and equitable to the shareholders of each. Currently, there are no material arrangements or planned transactions between the Company and any of the other affiliated companies other than AXIS.

AXIS is a company owned by its public companies and any profits generated by AXIS are returned to its shareholders in the form of dividends.

AXIS is paid by each company for the costs incurred by it in carrying out the administration function for each such company. Pursuant to the Service Agreement, AXIS performs such functions as payroll, maintaining employee records required by law and by usual accounting procedures, providing insurance, legal, human resources, company secretarial, land management, certain exploration and mining support, financial, accounting advice and services. AXIS procures items of equipment necessary in the conduct of the business of the Company. AXIS also provides for the Company various services, including but not limited to the making available of office supplies, office facilities and any other services as may be required from time to time by the Company as and when requested by the Company.

23

We are required to reimburse AXIS for any direct costs incurred by AXIS for the Company. In addition, we are required to pay a proportion of AXIS’s overhead cost based on AXIS’s management estimate of our utilisation of the facilities and activities of AXIS plus a service fee of not more than 15% of the direct and overhead costs. Amounts invoiced by AXIS are required to be paid by us. We are also not permitted to obtain from sources other than AXIS, and we are not permitted to perform or provide ourselves, the services contemplated by the Service Agreement, unless we first request AXIS to provide the service and AXIS fails to provide the service within one month.

The Service Agreement may be terminated by AXIS or ourselves upon 60 days prior notice. If the Service Agreement is terminated by AXIS, we would be required to independently provide, or to seek an alternative source of providing, the services currently provided by AXIS. There can be no assurance that we could independently provide or find a third party to provide these services on a cost-effective basis or that any transition from receiving services under the Service Agreement will not have a material adverse effect on us. Our inability to provide such services or to find a third party to provide such services may have a material adverse effect on our operations.

In accordance with the Service Agreement, AXIS provides the Company with the services of our Chief Executive Officer, Chief Financial Officer and clerical employees, as well as office facilities, equipment, administrative and clerical services. We pay AXIS for the actual costs of such facilities plus a maximum service fee of 15%.

During the year ended October 31, 2010, AXIS provided services in accordance with the services agreement and incurred direct costs on behalf of the Company of $1,017,493 (2009: $61,779). At October 31, 2010, the Company owed AXIS $1,079,272 (2009: $61,779). The Company intends to repay these amounts with funds raised either via additional debt or equity offerings, but as this may not occur within the next 12 months, the Company has decided to classify the amounts payable as non current in the accompanying balance sheets.

Transactions with Management.

We have a policy that we will not enter into any transaction with an Officer, Director or affiliate of us or any member of their families unless the transaction is approved by a majority of our disinterested non-employee Directors and the disinterested majority determines that the terms of the transaction are no less favourable to us than the terms available from non-affiliated third parties or are otherwise deemed to be fair to us at the time authorised.

The following table shows the audit fees that were billed or are expected to be billed by PKF LLP for fiscal 2010 and 2009.

|

2010

|

2009

|

|||||||

|

Audit fees

|

$ | 37,715 | $ | 26,555 | ||||

|

Audit related fees

|

- | - | ||||||

|

Tax fees

|

$ | 15,105 | - | |||||

|

Total

|

$ | 52,820 | $ | 26,555 | ||||

Audit fees were for the audit of our annual financial statements, review of financial statements included in our 10-Q quarterly reports, and services that are normally provided by independent auditors in connection with our other filings with the SEC. This category also includes advice on accounting matters that arose during, or as a result of, the audit or review of our interim financial statements.

24

PART IV

|

(a)

|