Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sunstone Hotel Investors, Inc. | d8k.htm |

Company Presentation

January 2011

Exhibit 99.1 |

1

Forward-Looking Statements

This presentation contains forward-looking statements that have been made

pursuant to the provisions of the Private Securities Litigation Reform Act

of 1995. These statements relate to future events or our future financial

performance. In some cases, you can identify forward-looking statements by

terminology

such

as

“anticipate,”

“believe,”

“continue,”

“could,”

“estimate,”

“expect,”

“intend,”

“may,”

“plan,”

“predict,”

“project,”

“should,”

“will”

or the negative of such terms and other comparable

terminology. These statements are only predictions. Actual events or results may

differ materially from those expressed or implied by these

forward-looking statements. In evaluating these statements, you

should

specifically

consider

the

risks

outlined

in

detail

under

the

heading

“Risk

Factors”

in

our

Annual

Report on Form 10-K, filed with the Securities and Exchange Commission

(“SEC”) on February 23, 2010, as revised by the filing of our

Current Report on Form 8-K on January 14, 2011, and under the heading

“Risk Factors” on page 2 of our Registration Statement on Form

S-3, filed with the SEC on January

14,

2011,

including,

but

not

limited

to,

the

following

factors:

general

economic

and

business

conditions affecting the lodging and travel industry, both nationally and locally,

including a prolonged U.S. recession; the need to operate as a REIT and

comply with other applicable laws and regulations; rising operating

expenses; relationships with and requirements of franchisors and hotel brands;

relationships with and the performance of the managers of our hotels; the ground or

air leases for 7 of the 32 hotels; our ability to complete acquisitions and

dispositions; and competition for the acquisition of hotels.

These factors may cause our actual events to differ materially from the

expectations expressed or implied by any forward-looking statement. We

do not undertake to update any forward-looking statement.

This presentation includes non-GAAP financial information that the issuer

considers useful to investors as a key measure of operating

performance. A reconciliation to U.S. GAAP can be found on the

issuer's website at www.sunstonehotels.com. |

2

Sunstone’s Mission and Vision

Mission

Sunstone

is

a

hotel

investment

company

focused

on

maximizing

shareholder

value

through a comprehensive, cycle-appropriate approach to portfolio management.

Sunstone’s strategy is predicated on:

Acquiring

upper-upscale

hotels

with

nationally

recognized

brands

in

markets

with

high

barriers

to

entry

Enhancing

the

value

of

our

hotels

through

major

capital

projects

and

repositioning

Optimizing

the

performance

of

our

portfolio

through

aggressive

asset

management

Recycling

capital

through

opportunistic

disposition

of

non-core

assets

Maximizing

financial

flexibility

and

minimizing

cost

of

capital

through

disciplined

balance

sheet

management

Near-term Objectives

Improve

profitability

of

existing

hotels

through

a

focused

asset

management

and

capital

expenditure program

Enhance

corporate

credit

statistics

through

a

measured

and

deliberate

approach

to

balance

sheet management

Increase

portfolio

size

and

quality

through

disciplined

acquisitions

Improve

communications

and

accessibility

to

investors

through

frequent

conference

calls

and

investor meetings

Build

a

top-quality

“talent-based”

organization

by

selectively

adding

industry

professionals

who

will complement the proven strengths of the existing team

|

3

•

Chairman since October 26, 2004; Co-Chairman since March 19, 2007

•

Chairman of Wolff Urban Management, Inc. since 1980 and also CEO. Wolff Urban

Management, Inc. is a real estate acquisition, investment, development and

management firm. •

Co-founder of Maritz, Wolff & Co., a privately-held hotel investment

group that owns top-tier luxury hotels

•

Chairman

and

CEO

of

Wolff

Urban

Development,

LLC,

a

private

real

estate

and

select

business

investment

opportunity

organization

that

invests

in

and

develops

commercial

urban

real

estate,

professional

sports

activities,

luxury

hotel

and

resort

properties,

hotel

management

companies

and

hospitality related assets

•

Former Director of Maguire Properties, Inc.

•

Former Co-Chairman of Fairmont Hotels & Resorts

•

Co-owner of the Oakland Athletics (MLB) and the San Jose Earthquakes

(MLS) •

Holds a B.A. in Business Administration from the University of Wisconsin, Madison

and an M.B.A. from Washington University in St. Louis, Missouri

Board of Directors

Lewis N. Wolff

Co-Chairman |

4

•

Founded predecessor companies in 1988 and served as CEO through October 2007

•

Acquired 122 hotels with over 20,000 rooms and disposed of 79 hotels during the

22-year period while CEO

•

Built 7 ground-up hotels including the JW Marriott Cherry Creek

•

Oversaw approximately $500 million of renovations and brand conversions

•

Grew Sunstone from 10 to 59 hotels in 2004

•

Acquired

four

major

portfolios

from

1997

–

2005:

23

hotels

for

$335

million

in

1997,

10

hotels

for

$135

million in 2000, 14 hotels for $400 million in 2002, and 6 hotels for over $600

million in 2005 •

Owner of hotels since 1976

•

Former president of the Holiday Inn Franchise Association

•

Former member of the Marriott Franchise Board

•

Former Chairman of the Governmental Affairs Committee of the American Hotel &

Lodging Association •

Holds a B.S. in Hotel Administration from the Cornell School of Hotel

Administration Board of Directors

Robert A. Alter

Founder and Executive Chairman |

5

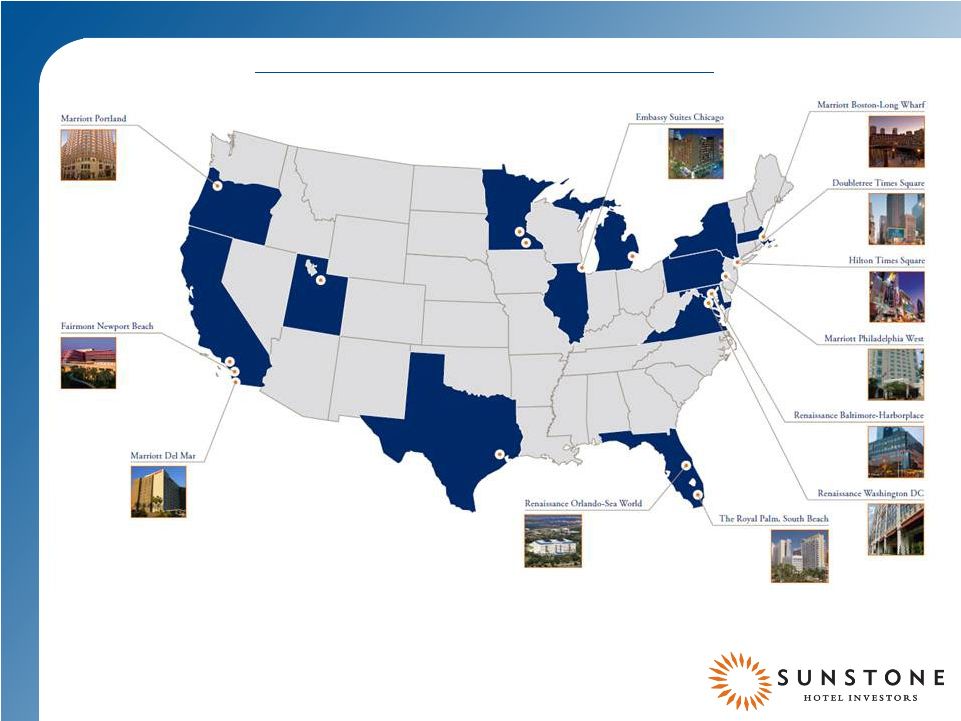

Sunstone Portfolio

West Coast Revenue: 25%

NY/Bos/Phil Revenue: 30%

Baltimore/DC Revenue: 18%

Chicago/Rochester Revenue: 9%

Other Revenue: 18%

82% of 2010 Revenue from Primary Coastal Markets |

6

Sunstone Portfolio

Hilton Times Square

Marriott Boston Long Wharf

Renaissance Washington D.C.

Fairmont Newport Beach

Royal Palm South Beach

Doubletree Guest Suites Times Square |

7

Sunstone Portfolio

Brand Concentration

(by 2010 total revenue)

Independent |

8

Proven Approach To Portfolio Management

Hotel acquired September 2005 for $293 million ($404k per key)

Developed comprehensive business plan that included:

$38 million renovation

All rooms

Addition of X-Bar lounge

Addition of Equinox health club

Repositioned the hotel to maximize its appeal to both group and business travelers

in light of re-emergence of Century City as the premier entertainment

business district Rebranded to Hyatt

Received $27 million of yield support from Hyatt

Tripled annual EBITDA during ownership period

Sold

May

2008

for

$366.5

million

($504k

per

key)

18.6x

trailing

EBITDA

(1)

The combination of a well planned renovation, creative asset management and

meaningful yield support from Hyatt enabled Sunstone to realize total internal

rate of return of approximately 19%

(1)

(1) As reported in press release dated June 2, 2008. See reconciliation to net income

in press release dated June 2, 2008.

Hyatt Regency Century Plaza Case Study

Significant

stockholder

value

created

through

Sunstone’s

execution

of

a

proven

Renovate,

Reposition,

Rebrand

investment

strategy. |

9

The Royal Palm

World-class asset in prime location

1.9-acres of beachfront real estate in the heart of South Beach

409 guest rooms: two-thirds have ocean views, one-third are

suites Proximity to dining, shopping, entertainment, and the Miami Beach

convention center Attractive market fundamentals

As of June 2010, Miami has recorded the fourth strongest RevPAR

of the top 25 US markets according to STR

Also as of August 2010, Miami has recorded 10.4% RevPAR

growth according to STR

New supply is limited

Value-add opportunity

Rebranding opportunity –

few institutional assets of this scale / quality

Comprehensive renovation and repositioning program

Renovation would improve guestrooms, F&B spaces, and exterior and public

spaces 10,000

sq

ft.

prime

Collins

Avenue

frontage

-

currently

vacant

3 towers allow for staging of renovation

Discount to replacement cost

$286,000 per key acquisition cost for prime South Beach address

Recent comps $650,000 -

$700,000 per room

Long-term benefits to portfolio and credit profile

Grows Sunstone’s asset base without increasing indebtedness

Consistent with our core strengths

Sunstone’s

Renovate,

Reposition,

Rebrand

strategy

is

proven

Hyatt Century Plaza success |

10

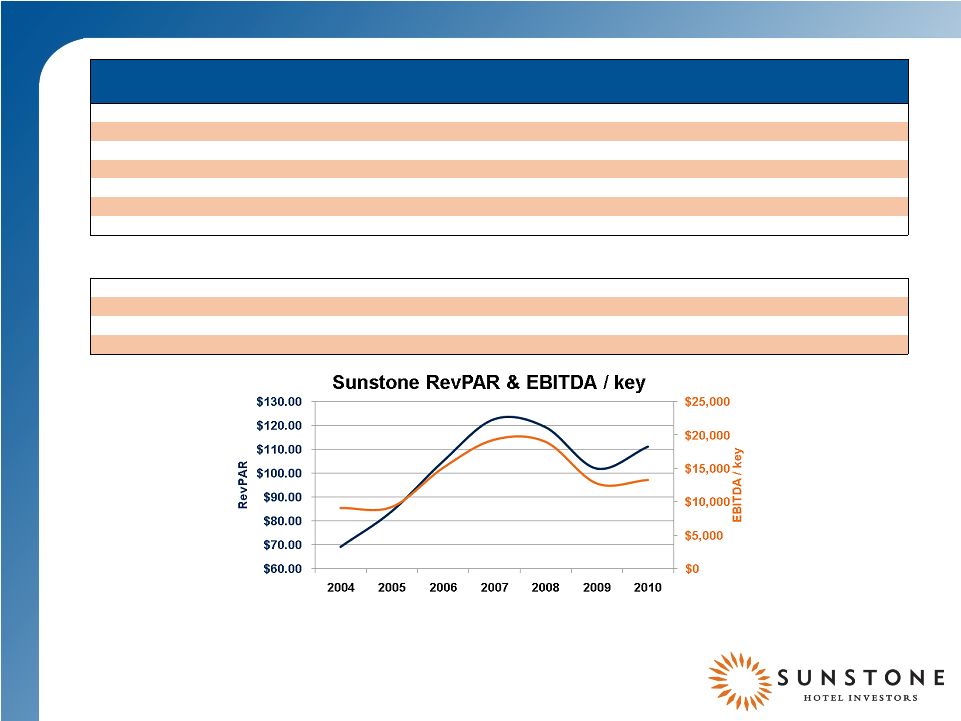

Current Portfolio & Financial Information

SHO Historical Stats / Performance

2004

(1)

2005

(1)

2006

(1)

2007

(1)

2008

(1)

2009

(1)

2010

(2)

Number of Hotels

54

62

51

46

44

38

32

Number of Rooms

13,183

18,069

16,717

16,085

15,029

13,199

12,182

Rooms/Hotel

244

291

328

350

342

347

381

Comparable RevPAR

$69.38

$84.22

$105.11

$120.15

$119.18

$102.09

$111.27

Total Revenue

(in millions)

$489.6

$651.1

$903.1

$1,056.7

$969.2

$717.8

$707.4

Adjusted EBITDA

(in millions)

$120.3

$167.4

$252.1

$310.1

$285.1

$168.6

$161.9

Adjusted EBITDA per key

$9,125

$9,269

$15,080

$19,279

$18,970

$12,774

$13,287

Valuation

Market Value of Equity

$717,297

$1,386,706

$1,551,947

$1,085,218

$300,171

$872,059

$1,215,009

Debt

$712,461

$1,181,178

$1,499,828

$1,722,151

$1,712,765

$1,145,139

$1,415,600

Total Enterprise Value

$1,394,858

$2,717,333

$3,298,996

$3,016,207

$2,113,086

$1,934,848

$2,651,859

Debt to TEV

51%

43%

45%

57%

81%

59%

53%

(1) As reported on earnings releases dated 2/22/05, 2/15/06, 2/7/07, 2/21/08, 2/12/09,

and 2/23/10, respectively. (2) Reflects year-to-date adjusted EBITDA as of

09/30/10 plus the midpoint of fourth quarter guidance as reported on earnings release dated 1/13/11 and

Doubletree Guest Suites Times Square 2010 prior ownership data.

|

11

Current Portfolio & Financial Information

Average weighted debt maturity: 6.0 years

Average weighted interest rate: 4.72%

Assumed

debt

associated

with

Doubletree

Guest

Suites

Times

Square

of

approximately

$270.0

million

to

be

refinanced

during

2011. |

12

Near Term Objectives: Enhance Corporate Credit Statistics

Improving credit story

Focus is on measured improvement of credit statistics through portfolio growth

Minimal dilution

Structure transactions with higher equity weighting

Long-term

focus

-

build

strength,

flexibility,

and

positioning

over

the

next

few

years

Position

Sunstone

to

capitalize

on

opportunities

during

the

next

cyclical

trough

Credit targets

18-month:

1.65x

Fixed

Charge

Coverage,

6.0x

Debt

to

EBITDA

As reported in Compliance Certificates to Revolving Credit Agreement s dated 3/18/08, 2/20/09,

11/13/09, and 1/10/11, respectively. |

13

Primary focus is toward driving rate

Weekly revenue management reviews with all operators

Benchmark hotels using a sophisticated business intelligence system

Roll out beverage cost reduction program throughout portfolio

Average of 300 basis point reduction in beverage cost

Continue menu-maximization effort

Combination of restaurants and bars to Gastro-Bar concept

Continue investing in energy management systems

Energy investments between 2008-2010 of $4 million with 35% IRR

Retro-commissioning/full plant replacements

Continue enhancing charge for parking technology

Parking margin has improved from 55% to 75% with new technology and

elimination of vendors

Optimize laundry efficiency

Recently outsourced laundry operations have eliminated the need for over

$2 million in capital investments and reduced operating expenses

by $500k

Near Term Objectives: Improve Profitability of Existing Hotels

|

14

Near Term Objectives: Improve Profitability of Existing Hotels

Hotel

Budget

Timing

Scope of Work

Guestrooms

Guest

Bathrooms

Lobby

Meeting

Spaces

Exterior

Royal Palm Miami

Beach

$43.1 million

Q4 2010 –

2013

Embassy Suites

Chicago

$12.3 million

Q3 2010 –

Q1 2011

Marriott Boston

Long Wharf

$18.9 million

Q4 2010 –

2011

Marriott Houston

$10.2 million

Q3 2010 –

2011

Renaissance

Washington DC

$30.4 million

Q4 2010 –

2012

Marriott Quincy

$6.7 million

Q4 2010 –

2011

Renaissance

Orlando

$9.8 million

Q3 2010 –

2011

*

**

Kahler

Grand

Rochester

$8.9 million

Q4 2010 –

2011

***

Hilton Houston

$7.2 million

Q3 2010 –

2011

Marriott Tysons

Corner

$6.6 million

Q4 2010 –

2011

Marriott Rochester

$5.7 million

Q4 2010 –

2011

*64 Executive King Suites

** Creation of a half-acre aquatic playground and a separate 10,000 sq. ft.

function lawn *** 55 Deluxe Rooms

Focused renovation program

Re-evaluated

all

2011

–

2013

projects

by

their

short-

and

long-term

potential

to

generate

incremental EBITDA

Executing on revised 2011 CapEx

plan with focus on minimizing displacement |

15

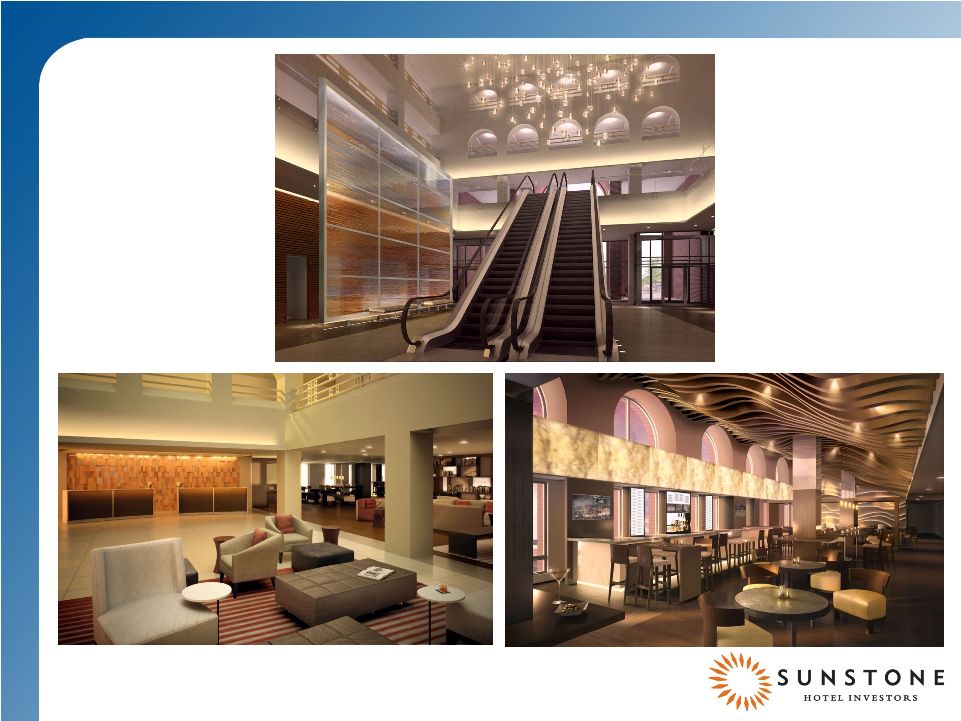

Near Term Objectives: Improve Profitability of Existing Hotels

Marriott Boston Long Wharf

Lobby Rendering |

16

Marriott Tysons Corner

Guestroom Rendering

Near Term Objectives: Improve Profitability of Existing Hotels

|

17

Renaissance Long Beach

Lobby Renovation

Near Term Objectives: Improve Profitability of Existing Hotels

|

18

Near Term Objectives: Improve Profitability of Existing Hotels

Renaissance Washington DC

Before Lobby Renovation |

19

Near Term Objectives: Improve Profitability of Existing Hotels

Renaissance Washington DC

After Lobby Renovation |

20

Near Term Objectives: Improve Profitability of Existing Hotels

Renaissance Washington DC

After Lobby Renovation |

21

Near-term Objectives: Increase Portfolio Size and Quality

Early phase of potentially

prolonged cyclical recovery

Objective is to meaningfully

increase the size and quality of

Sunstone’s portfolio over the

next several years

Better visibility

Improved access to capital

Enhanced total returns

Focused on disciplined

acquisitions of institutional

quality hotels

$100+ RevPAR

350+ keys

Top-25 US gateway markets

Upper-upscale in quality

Discount to replacement cost |

22

Near-term Objectives: Increase Portfolio Size and Quality

2010 Pro-Forma

Sunstone 31-Hotel

Portfolio (1) (2)

Doubletree Guest

Suites Times

Square (3)

Pro-Forma 32-

Hotel Portfolio

No. Keys

11,722

460

12,182

No. Hotels

31

1

32

Avg. Rooms per Hotel

378

460

381

Occupancy

69.6%

93.5%

70.5%

ADR

$149.11

$323.17

$157.83

RevPAR

$103.78

$302.25

$111.27

Adjusted EBITDA (in millions)

$142.4

$19.5

$161.9

Adjusted EBITDA per key

$12,148

$42,391

$13,290

(1) Room statistics reflect current estimate.

(2) Adjusted EBITDA reflects year-to-date as of September 30, 2010 and

midpoint of guidance as provided on 11/4/10. (3) Reflects 2010

estimate. Doubletree Guest Suites Times Square Acquisition

Top quality asset

Exceptional location

Discount valuation

Meaningful potential synergies

with Hilton Times Square

22 |

23

Communications

Maximize accessibility to senior management team

Continue inter-quarter update calls

Clearly articulate major initiatives

Continue to communicate what we have done rather than what we will do

Team

Build on Sunstone’s “Talent Based”

organization

Add one or more industry leaders into key roles

Complement skills of existing team

Enhance team cohesion and stability

Improve ability to execute on value adding transactions

More results, more fun, less drama

Near Term Objectives: Improve Communication & Enhance Team

|

24

Sunstone Organizational Structure

Ken Cruse

President

Marc Hoffman

EVP & COO

Bob Alter

Executive Chairman

TBD

CFO

Lindsay Monge

SVP –

Treasury &

Administration

TBD

SVP –Acquisitions

Guy Lindsey

SVP –

Design &

Construction

Bryan Giglia

SVP -

Finance

Building a talent-based organization |

25

Sunstone Valuation –

Illustrative Scenarios

Based on Company Assumptions -

Actual Results May Differ

RevPAR

111.37

$

Keys

12,182

Debt

1,415.6

Cash

(255.0)

Net Debt

1,160.6

Pref

276.3

Shares

117.6

Share Price

10.50

$

Common Equity

1,234.80

$

TEV

2,671.7

Adjusted EBITDA

161.9

Adjusted EBITDA Multiple

16.5x

TEV / Key

219,311

$

1.38

$

Implied TEV /

Key change with $1.00 increase in stock price 9,654

$

Estimated minimum

replacement cost (3)

300,000

$

Implied stock price at estimated minimum replacement

cost 18.86

$

(1)

RevPAR

reflects

the

pro

forma

comparable

31-hotel

porfolio

RevPAR,

including

prior

ownership

periods

for

the

Doubletree

Guest

Suites

Times

Square.

Adjusted EBITDA reflects year-to-date as of 9/30/10 plus the midpoint of

guidance provided on 11/14/10 and the full-year 2010 EBITDA for the

Doubletree Guest Suites Times Square, including prior ownership.

(2) Represents current renovation budget and implied Adjusted EBITDA calculated

using a 14.0x multiple and total investment of $124.4M. (3) Based on

internal estimates and may not reflect actual replacement cost. Base

(1)

Implied stock price change with 1.0x increase in Adjusted EBITDA

Multiple |

26

Investment Thesis

Attractively valued compared to peers

Currently trading at approximately $219k / key ($9.7k / key = approx.

$1.00 per share)

Strong liquidity and access to inexpensive capital

Substantial unrestricted cash balance, undrawn revolver

Levered to the recovery

Primarily fixed-rated debt with well-staggered maturities

Clear objectives, simple strategy:

Improve profitability of existing hotels

through a focused asset

management and capital expenditure program

Enhance corporate credit statistics

through a measured and deliberate

approach to balance sheet management

Increase

portfolio

size

and

quality

through

disciplined

acquisitions

Improve communications

and accessibility to investors through frequent

conference calls and investor meetings

Build

a

top-quality

“talent

based”

organization

by

selectively

adding

industry professionals to complement the strengths of the existing team

|

|

28

Sunstone 32-Hotel Portfolio

Hotel

City

State

Chain

Scale

Segment

(1)

Service

Category

Rooms

Manager

Marriott

Boston

Massachusetts

Upper Upscale

Full Service

412

Marriott

Marriott

Del Mar

California

Upper

Upscale

Full

Service

284

Marriott

Marriott

Houston

Texas

Upper

Upscale

Full

Service

390

Interstate SHP

Marriott

Park City

Utah

Upper Upscale

Full Service

199

Interstate SHP

Marriott

Philadelphia

Pennsylvania

Upper Upscale

Full Service

289

Marriott

Marriott

Portland

Oregon

Upper Upscale

Full Service

249

Interstate SHP

Marriott

Quincy

Massachusetts

Upper Upscale

Full Service

464

Marriott

Marriott

Rochester

Minnesota

Upper Upscale

Full Service

203

Interstate SHP

Marriott

Troy

Michigan

Upper Upscale

Full Service

350

Marriott

Marriott

Tysons Corner

Virginia

Upper Upscale

Full Service

396

Marriott

Courtyard by Marriott

Los Angeles

California

Upscale

Select Service

179

Interstate SHP

Renaissance Harborplace

Baltimore

Maryland

Upper Upscale

Full Service

622

Marriott

Renaissance Los Angeles Airport

Los Angeles

California

Upper Upscale

Full Service

499

Marriott

Renaissance Long Beach

Long Beach

California

Upper Upscale

Full Service

374

Marriott

Renaissance Orlando at SeaWorld®

Orlando

Florida

Upper Upscale

Full Service

781

Marriott

Renaissance Washington D.C.

Washington, D.C.

District of Columbia

Upper Upscale

Full Service

807

Marriott

Renaissance Westchester

White Plains

New York

Upper Upscale

Full Service

347

Marriott

Residence Inn by Marriott

Rochester

Minnesota

Upscale

Extended Stay

89

Interstate SHP

Fairmont

Newport Beach

California

Luxury

Full Service

444

Fairmont

Hilton

Del Mar

California

Upper Upscale

Full Service

257

Sage

Hilton

Houston

Texas

Upper Upscale

Full Service

480

Interstate SHP

Hilton

Times Square

New York

Upper Upscale

Full Service

460

Interstate SHP

Doubletree

Minneapolis

Minnesota

Upscale

Full Service

229

Interstate SHP

Doubletree

Times Square

New York

Upscale

Full Service

460

Highgate

Embassy Suites

Chicago

Illinois

Upper Upscale

Extended Stay

367

Davidson

Embassy Suites

La Jolla

California

Upper Upscale

Extended Stay

340

Hilton

Hyatt Regency

Newport

Beach

California

Upper Upscale

Full Service

403

Hyatt

Sheraton

Cerritos

California

Upper Upscale

Full Service

203

Interstate SHP

Independent—Valley

River Inn

Eugene

Oregon

Upscale

Full Service

257

Interstate SHP

Independent—Kahler Inn & Suites

Rochester

Minnesota

Midscale

with

F/B

Extended Stay

271

Interstate SHP

Independent—The Kahler Grand

Rochester

Minnesota

Upscale

Full Service

668

Interstate SHP

Independent—Royal Palm

Miami Beach

Florida

Upscale

Full Service

409

Denihan

Total number of rooms

12,182 |