Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SWISS HELVETIA FUND, INC. | swisshelv-8k_011911.htm |

The Swiss Helvetia Fund, Inc.

Presentation Materials

January 2011

January 2011

1

Swiss Helvetia Fund Inc.

2

• Country closed-end fund listed on NYSE (SWZ)

• Asset size USD 467 million

• Investments primarily in Swiss equity and equity linked securities for long term

capital appreciation

capital appreciation

• The Fund can invest up to 10% of net asset value in illiquid investments including

privately held companies

privately held companies

• The Fund can buy calls and put options on Swiss indexes and Swiss equities, and

sell covered call options on Swiss equities

sell covered call options on Swiss equities

• Portfolio managers: Ruedi Millisits (New York office), Philippe Comby, CFA, FRM

(New York Office), Eric Menotti, PhD (Geneva Office) and Alban Gay (Geneva

Office). Each portfolio manager has more than 15 years of cumulative knowledge

of Swiss companies

(New York Office), Eric Menotti, PhD (Geneva Office) and Alban Gay (Geneva

Office). Each portfolio manager has more than 15 years of cumulative knowledge

of Swiss companies

Description

Investment Philosophy

• Focus on under-valued growth companies with sustainable competitive

advantages

advantages

• Attention to intangible: management vision and execution, corporate culture,

corporate governance, “brand” recognition

corporate governance, “brand” recognition

• Fundamental analysis, focus on business model, size of the opportunity, deep

understanding of products and services of companies, leveraging local presence in

Switzerland for investments in mid and small sized companies

understanding of products and services of companies, leveraging local presence in

Switzerland for investments in mid and small sized companies

• Using synergies between private equity due diligence process and public equity

investment cases build-up

investment cases build-up

Swiss Economy Review

3

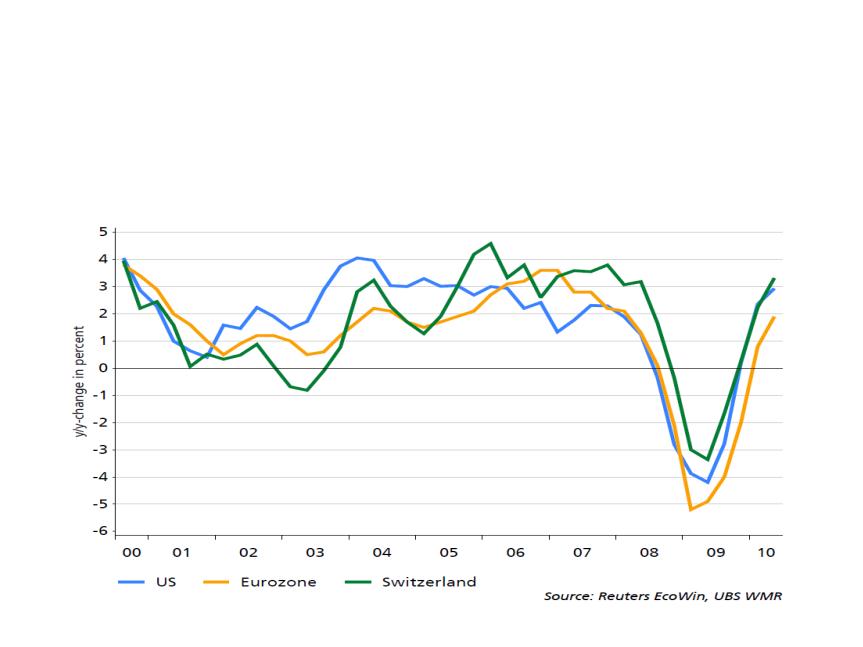

Swiss economy: still on track

• Swiss GDP growth expected to be above 2.5% in 2010

• … experiencing a strong recovery already pushing GDP growth back up to pre-

crisis levels

crisis levels

% change of real GDP over previous year

4

Economic growth in Switzerland

Quarterly growth contributions

• Expected Q4 2010 GDP growth slight setback quarter-on-quarter due to:

ü Weaker contribution from net exports

ü Growth compensation from the construction sector and private consumption

to compensate for the weak readings in Q2 2010

to compensate for the weak readings in Q2 2010

• Year-on-year growth rate estimated to be above its long-term trend

5

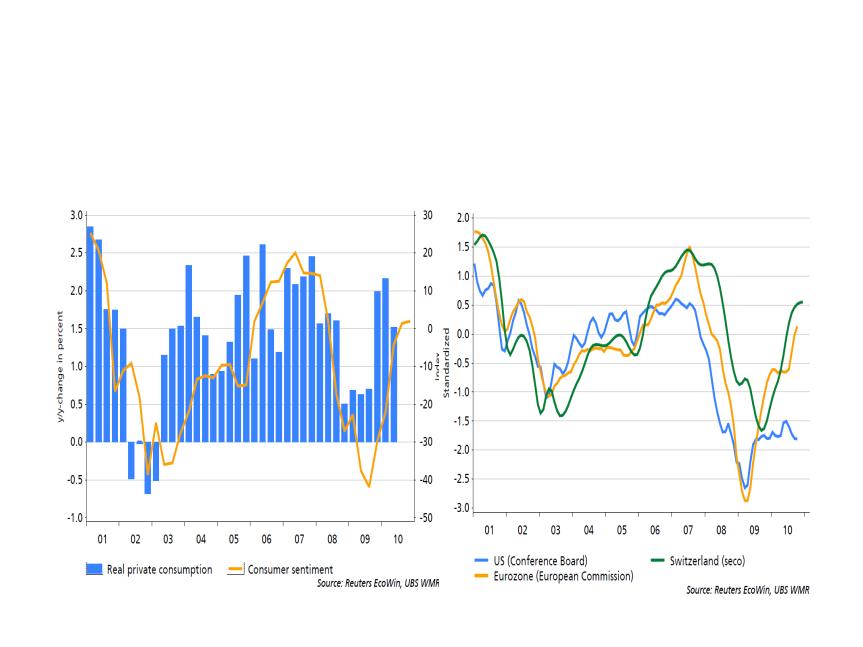

Strong consumer sentiment

• Private consumption benefits from sustained sentiment indicators

• Solid employment situation will sustain private consumption going forward

% change of real private consumption

and consumer sentiment

and consumer sentiment

Consumer sentiment

6

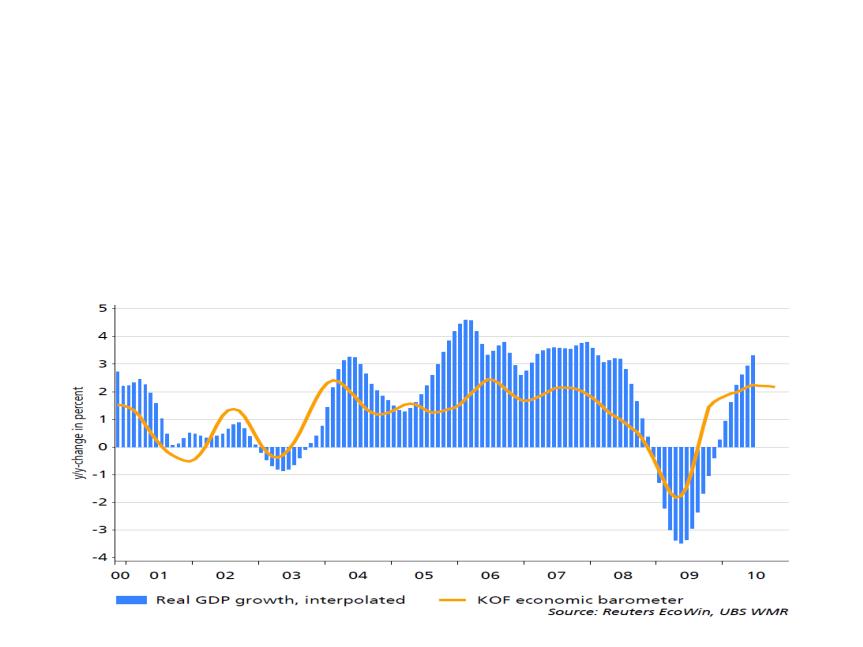

Leading economic indicator back to 2007 levels

• Swiss industrial data and business confidence remain at high levels consistent with

further economic growth

further economic growth

• Robust PMI and KOF indicators highlight the resilience of most of the Swiss business

sectors

sectors

ü Watch industry, chemical and machinery sectors being the strongest

• Swiss Franc strength, no detrimental impact yet

• The Swiss economy has a diversified export structure which is also benefiting from

the emerging economies strength

the emerging economies strength

% change over previous year

7

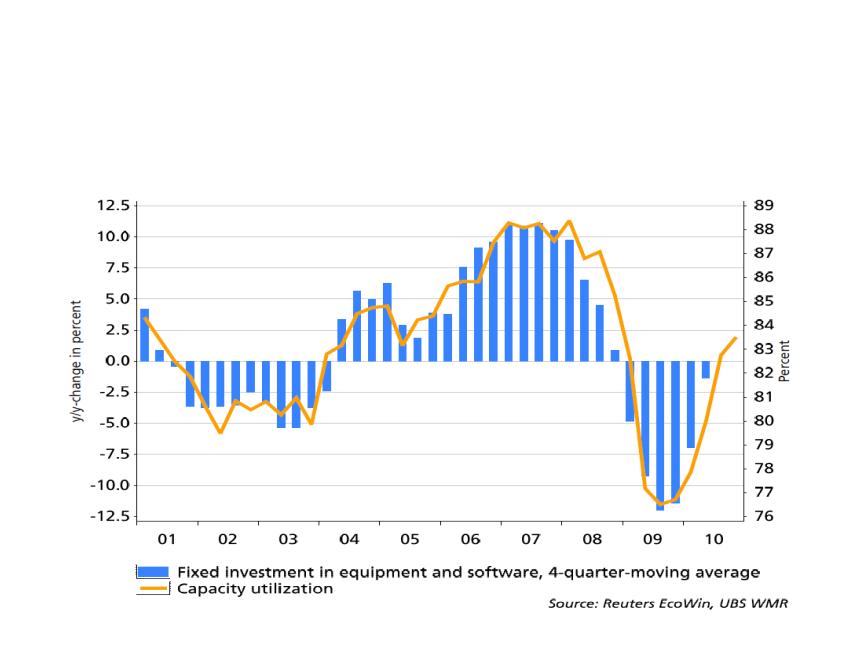

Capital spending / impressive recovery

• Steadily climbing capacity utilization rates

• Recovery has gained momentum in the last couple of months

% change over previous year

8

Portfolio Analysis

9

- Share price performance: +20.75%*

- Discount evolution: 1.43% lower

- Share buy-back: 6.5% of outstanding shares bought back for

USD 24,400,000 in cash

- Distribution: USD 14,881,535 or 4.16% yield on average share

price

-Private equity portfolio: making important progress, one

company going public, and all except one holding signing

significant partnership deals

- Discount evolution: 1.43% lower

- Share buy-back: 6.5% of outstanding shares bought back for

USD 24,400,000 in cash

- Distribution: USD 14,881,535 or 4.16% yield on average share

price

-Private equity portfolio: making important progress, one

company going public, and all except one holding signing

significant partnership deals

10

2010 Highlights

*Total return preliminary calculation, dividend reinvested at share price of last trading day of 2010 - source Citi

Group, Fund’s administrator

Group, Fund’s administrator

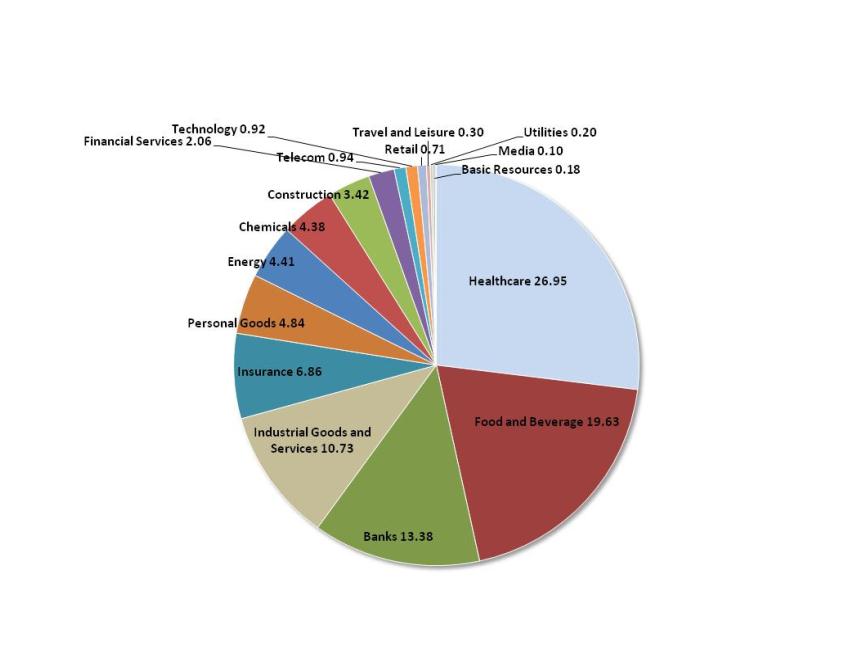

Swiss Market Structure: Industry Group Weighting (Swiss

Performance Index) 12/31/2010

Performance Index) 12/31/2010

11

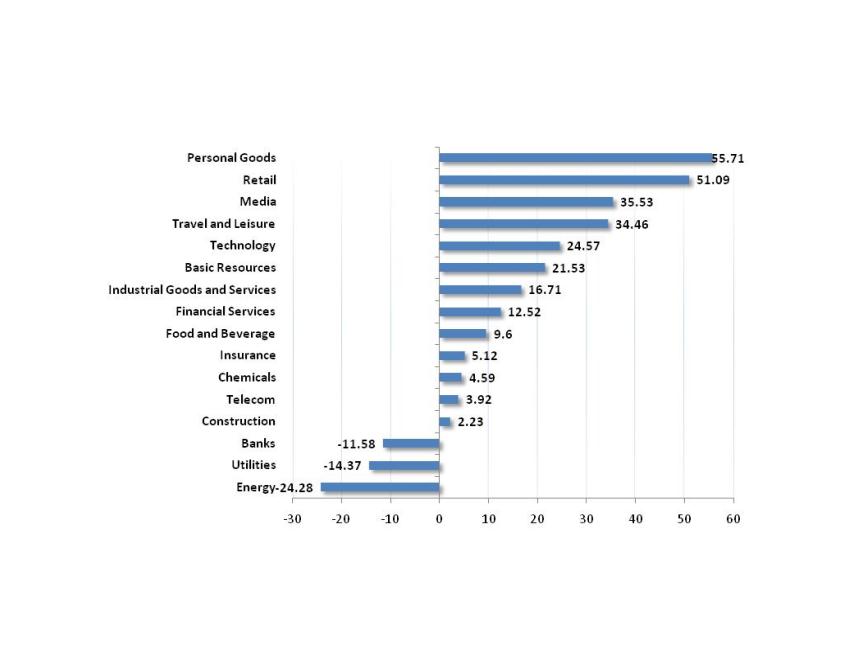

Swiss Industry Group Performance

12/31/09 - 12/31/10

SPI Index return: 2.90%

12

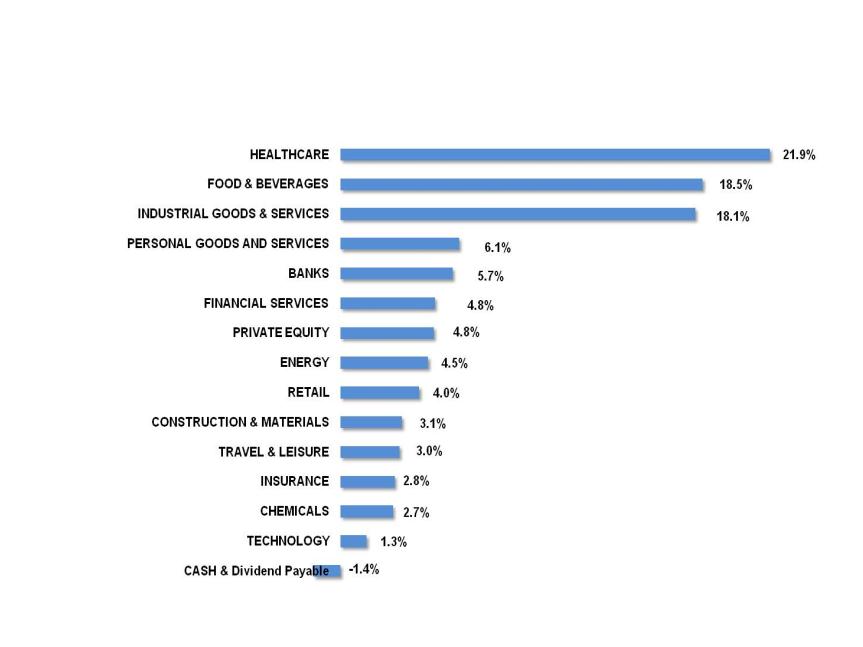

SWZ Sector Exposure (12/31/10)

13

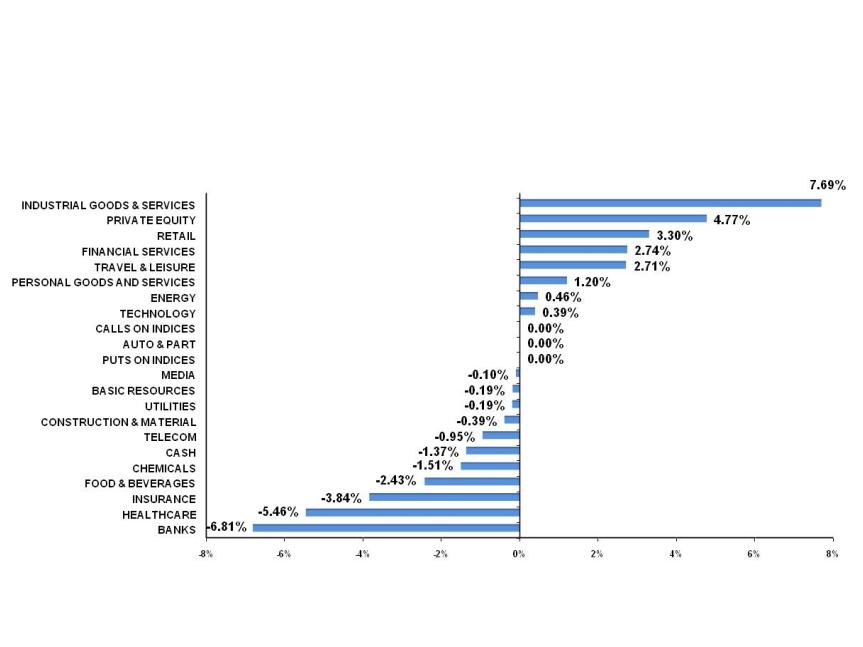

SWZ Sector Exposure vs Swiss Performance Index (12/31/10)

14

15

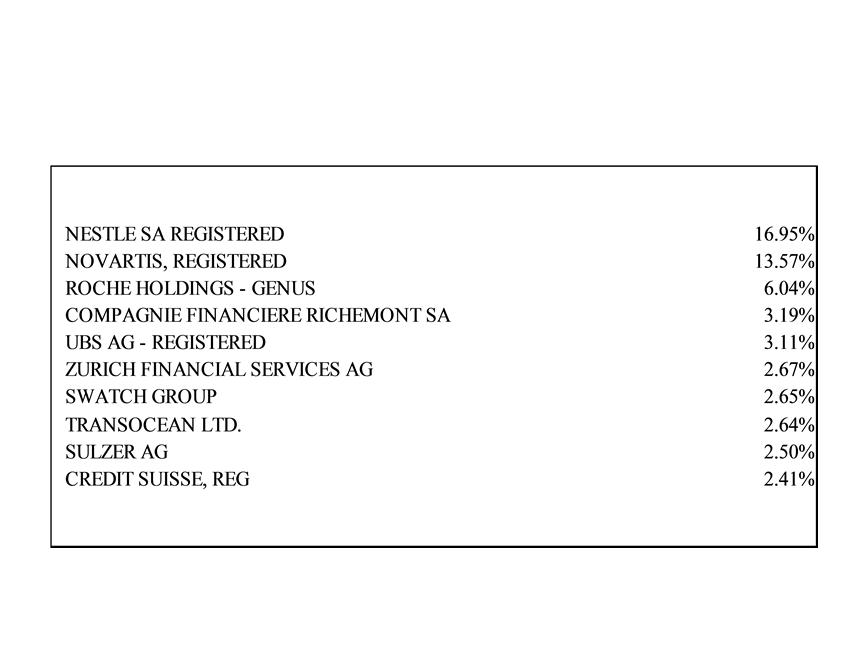

SWZ Ten Largest Positions as of 12/31/10

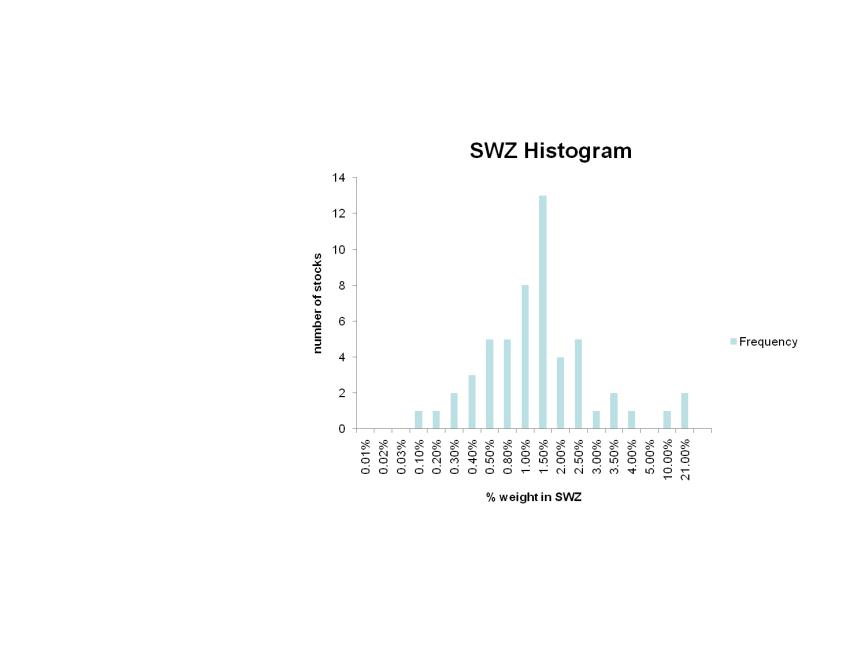

SWZ stocks weighting distribution

|

Bin

|

Frequency

|

|

0.01%

|

0

|

|

0.02%

|

0

|

|

0.03%

|

0

|

|

0.10%

|

1

|

|

0.20%

|

1

|

|

0.30%

|

2

|

|

0.40%

|

3

|

|

0.50%

|

5

|

|

0.80%

|

5

|

|

1.00%

|

8

|

|

1.50%

|

13

|

|

2.00%

|

4

|

|

2.50%

|

5

|

|

3.00%

|

1

|

|

3.50%

|

2

|

|

4.00%

|

1

|

|

5.00%

|

0

|

|

10.00%

|

1

|

|

21.00%

|

2

|

|

|

|

|

Total stocks

|

54

|

16

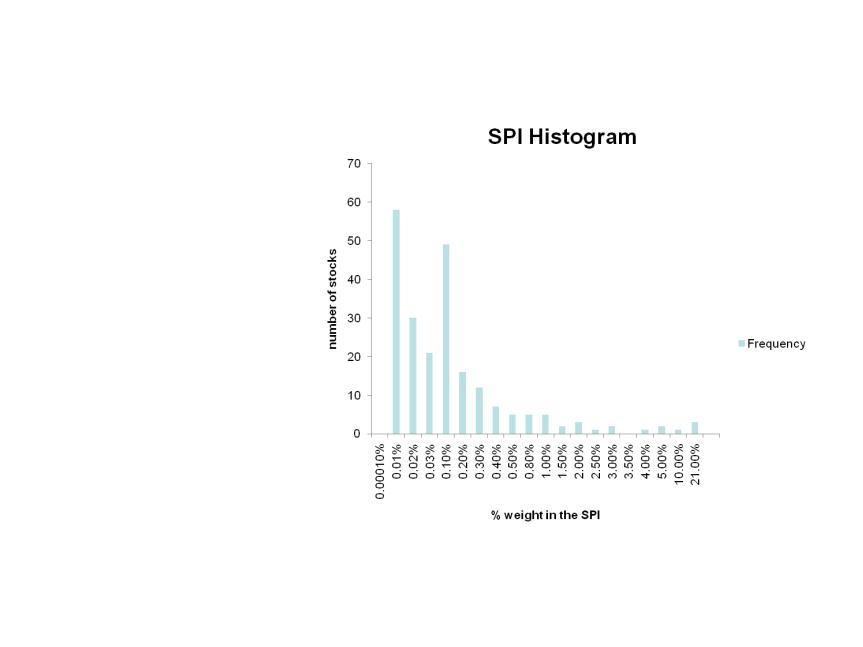

Swiss Performance Index: stocks weighting distribution

17

|

Bin

|

Frequency

|

|

0.00010%

|

0

|

|

0.01%

|

58

|

|

0.02%

|

30

|

|

0.03%

|

21

|

|

0.10%

|

49

|

|

0.20%

|

16

|

|

0.30%

|

12

|

|

0.40%

|

7

|

|

0.50%

|

5

|

|

0.80%

|

5

|

|

1.00%

|

5

|

|

1.50%

|

2

|

|

2.00%

|

3

|

|

2.50%

|

1

|

|

3.00%

|

2

|

|

3.50%

|

0

|

|

4.00%

|

1

|

|

5.00%

|

2

|

|

10.00%

|

1

|

|

21.00%

|

3

|

|

|

|

|

Total stocks

|

223

|

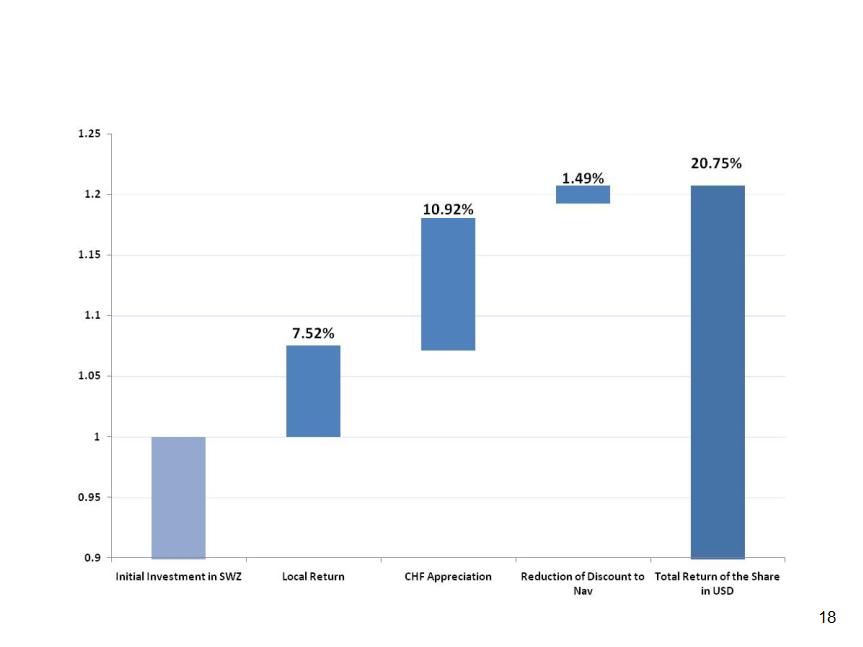

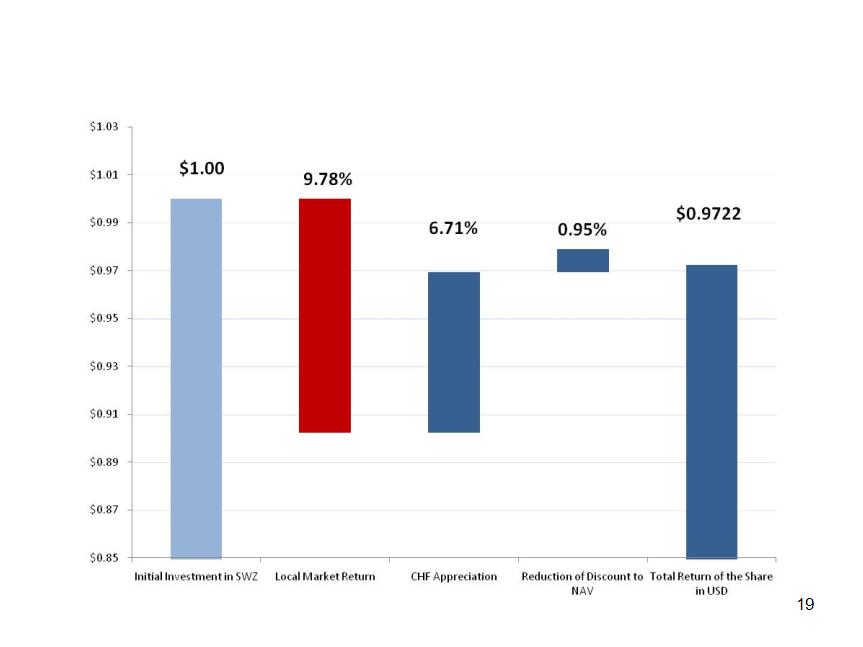

SWZ Share Price Performance Drivers

12/31/09 - 12/31/10

Total return preliminary calculation, dividend reinvested at share price of last trading day of 2010 - source Citi Group,

Fund’s administrator

Fund’s administrator

SWZ Share Price Performance Drivers

Three Years through 12/13/2010

-

*Total return for 2010 , preliminary calculation, dividend reinvested at share price of last trading day of 2010 -

source Citi Group, Fund’s administrator

source Citi Group, Fund’s administrator

20

SWZ Performance Attribution (12/31/2009-12/31/2010)

based on GICS Sectors

based on GICS Sectors

Source: Bloomberg Portfolio Analytics

21

SWZ Share Price/ NAV/ Discount to NAV (12/31/09-12/31/10)

22

SWZ Distribution Yield

|

CORRELATION MATRIX (weekly data)

|

10Y

|

1Y

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EUR-USD X-RATE (USD per Euro)

|

33.57%

|

47.35%

|

|

|

USD-CHF X-RATE (CHF per USD)

|

-26.29%

|

-62.80%

|

|

|

Bloomberg West Texas Interm.

|

20.37%

|

69.65%

|

|

|

CBOE SPX VOLATILITY INDX

|

-50.46%

|

-76.03%

|

|

|

DJ US REAL ESTATE INDEX

|

50.60%

|

64.68%

|

|

|

US Continuing Jobless Claims S

|

-2.85%

|

-14.61%

|

|

|

Federal Reserve US H.15 T Note

|

13.01%

|

13.67%

|

|

|

BBA LIBOR USD 3 Month

|

-14.35%

|

-43.68%

|

|

|

BarCap US Inflation Linked Bonds

|

-0.15%

|

8.33%

|

|

|

S&P 500 FINANCIALS INDEX

|

63.58%

|

73.23%

|

|

|

ABC News US Weekly Consumer Conf.

|

3.08%

|

22.63%

|

|

|

MSCI EM (Emerging Market Equities)

|

61.95%

|

88.59%

|

23

SWZ Returns Macro Factors Correlations

Sector Highlights (I)

Consumers

• Lindt gives an exposure to mid-sized food & beverage industry with a strong brand name

ü Key growth drivers are the US and the UK with potential for market share gains

ü Soft commodity prices (cacao, sugar) will continue to add volatility and the strong

currency will negatively impact 2010 earnings

currency will negatively impact 2010 earnings

• Exposure to airline catering industry through Gate Group

ü Gate Group is the second biggest company in revenues behind Lufthansa (LSG Sky

Chef)

Chef)

ü Consolidation within the airline catering industry will continue (Gate Group / Cara Airline

Sol and additional acquisitions expected following capital increase)

Sol and additional acquisitions expected following capital increase)

ü Pick up in passenger number (Sept) in North America and Europe

• High record sales for luxury goods for 2010 continued to benefit from Middle East and

emerging market demand

emerging market demand

ü Biggest market growth opportunity remains Hong Kong and China for the watch industry

in contrast to Europe, which remained weak

in contrast to Europe, which remained weak

ü Some watch brands are now having to contend with component shortages

• Profits were taken on high valuation of the luxury good sector despite continuous positive

outlook for 2011

outlook for 2011

24

Sector Highlights (II)

Industrials

• Recent reports on European leading indicators (PMI) are reassuring and orders intakes in the

Swiss machinery industry continued to rise in the third quarter as reported by SwissMem

Swiss machinery industry continued to rise in the third quarter as reported by SwissMem

• The outperformance of the industrial segment of the SPI (+ 12% YTD) reflect solid quarter

figures

figures

• The small and mid cap segment had the most spectacular performance since mid-2010. Early

cyclical sectors supplying machines and equipment like Georg Fischer (+40% H2) and

Winterthur Technologies (+42%) have benefitted from demand in Asia and in Continental

Europe

cyclical sectors supplying machines and equipment like Georg Fischer (+40% H2) and

Winterthur Technologies (+42%) have benefitted from demand in Asia and in Continental

Europe

• The provider of logistics services in the sea and air freight activities have benefited with double

digit volume growth (Kühne+Nagel)

digit volume growth (Kühne+Nagel)

• IATA’s market outlook expects this trend to continue and forecasts volume growth of 5% for

2011

2011

25

Sector Highlights (III)

Healthcare

• Healthcare continued to be out of favor and is seen as value trap for investors

• Rerating of the sector should not occur before mid next year. However, stock picking offers

interesting opportunities in Switzerland

interesting opportunities in Switzerland

• Healthcare reforms, challenging regulatory environment and enhanced competitions from

generics and “me-too” products are structural problems in the industry

generics and “me-too” products are structural problems in the industry

• The fundamental drivers of the industry are unchanged: need for innovative medicines,

efficient improvement in drug development.

efficient improvement in drug development.

• The following themes will be central:

ü Emerging markets: up to two-third of future growth is expected to be generated from emerging

markets. Sandoz provides a substantial competitive edge to the Novartis group

markets. Sandoz provides a substantial competitive edge to the Novartis group

ü Regulatory pathways for bio-generic drugs will be clarified. The bio-generics will represent large

opportunities in the next decade (> $60 billion in revenue). Beside Lonza and Teva, only large

players like Sandoz, Pfizer and Merck have the financial strength and skills to enter the market

(i.e. monoclonal antibody)

opportunities in the next decade (> $60 billion in revenue). Beside Lonza and Teva, only large

players like Sandoz, Pfizer and Merck have the financial strength and skills to enter the market

(i.e. monoclonal antibody)

ü Large acquisitions (Novartis and Alcon) will likely not change the perception of the pharma

industry. In Switzerland, mid-sized acquisitions could trigger new interests for the biotech sector

industry. In Switzerland, mid-sized acquisitions could trigger new interests for the biotech sector

• In medical technology, the discretionary markets such as dental implants (i.e. Nobel,

Straumann) have stabilized. The spine business suffered from deteriorating pricing conditions

in the US over the past quarters (i.e. Synthes). Q4 2010 should see another 5% to 10% price

decline before a new level is reached

Straumann) have stabilized. The spine business suffered from deteriorating pricing conditions

in the US over the past quarters (i.e. Synthes). Q4 2010 should see another 5% to 10% price

decline before a new level is reached

26

Sector highlights (IV)

Banks (SWZ: sector underweight)

• New double-taxation agreement with Germany signed in October (compliant with OECD Art.

26, ie no differentiation between tax evasion and tax fraud) coupled with further negotiations

on tax matters starting in early 2011:

26, ie no differentiation between tax evasion and tax fraud) coupled with further negotiations

on tax matters starting in early 2011:

ü Regularization of legacy assets through a unique levy of approximately 25% implying tax-

revenue of more than CHF 40 billion for Germany

revenue of more than CHF 40 billion for Germany

ü Final withholding tax on capital income collected by Swiss banks and paid to Germany

ü Extended administrative assistance in the future

ü Mutual market access for financial institutions

• Advantages from a Swiss perspective:

ü Delay pressure to join Europe-wide automated data exchange for tax purposes at least

for a number of years

for a number of years

ü Remove legal risk for institutions and individuals reducing uncertainty

ü Enhance growth prospects via improved market access in Germany and potentially other

European countries.

European countries.

ü Favorable outcome for Swiss banks and the financial center as the impact in terms of

outflows and profitability remains limited:

outflows and profitability remains limited:

§ 4-7% impact on pretax earnings in case of a German tax amnesty

ü Similar development could be expected with other countries

§ Declaration already signed between Switzerland and the UK in October

27

Sector highlights (V)

Banks (SWZ: sector underweight)

• Banking sector dramatically underperformed the SPI index year-to-date and since the

beginning of Q4 2010 as Eurozone Sovereign debt concerns intensified recently

beginning of Q4 2010 as Eurozone Sovereign debt concerns intensified recently

• Weak fiscal situation in peripheral Europe countries should continue to weigh on the sector in

2011 with Portugal likely to request IMF/EU rescue package in the foreseeable future

2011 with Portugal likely to request IMF/EU rescue package in the foreseeable future

• Investment banking faced many headwinds in H2 2010 that will continue in 2011

• Low sector valuation still prevailing (P/E 11E 8.3x, P/B 11E 1.1x) reflecting low secular growth,

lower revenue quality and declining profitability going forward

lower revenue quality and declining profitability going forward

• Swiss Commission recommendations (too-big-to-fail) impact on UBS and Credit:

ü Hold at least 10% of common Tier 1 capital ratio vs Basel III minimum requirement of 7%

ü Hold at least 19% of total capital ratio (common equity and contingent convertible capital) vs Basel III at

10.5%

10.5%

ü Starting from 2013, with fulfillment of the requirements by the latest at the end of 2018

ü UBS expected to fulfill requirements for the common Tier 1 in 2012 with no dividend paid out, while CS

expected to meet requirement from 2013 or 2014 as it will pay out dividends going forward

expected to meet requirement from 2013 or 2014 as it will pay out dividends going forward

ü Historical ROE of 15% could slightly be reduced but higher than the banking sector average

ü UBS will still benefit from positive momentum in Wealth management as well as a turnaround in PB

ü US and UK are also looking into adding an additional buffer on top of the Basel III recommended 7%

Common Tier 1 ratio for their systemically important banks

Common Tier 1 ratio for their systemically important banks

• Key risks remain contagion from sovereign debt risks to Spain and Italy. Austerity plans may

affect Eurozone GDP growth

affect Eurozone GDP growth

28

Sector highlights (VI)

Energy

• The representation of the energy sector is increasing in the Swiss indices

ü The off-shore drilling company Transocean was first traded on the SWX in April and

incorporated in SMI in June 2010

incorporated in SMI in June 2010

ü In Nov 2010, the service provider for oil and natural gas producers Weatherford started

trading on the SWX

trading on the SWX

ü Additional energy company could join the SWX (i.e. Noble Energy)

• Transocean focus on the attractive deepwater and ultra-deep water business, which will show

high structural growth

high structural growth

ü ROIC has fallen over the last few years due to significant investments (new floaters) but

is a high margin business (Ebitda ~50%)

is a high margin business (Ebitda ~50%)

ü Customers’ expectations of future commodity prices will continue to drive demand for

rigs

rigs

ü Recent reports on Deepwater Horizon may discharge Transocean and lower the liability

discount

discount

29

SWZ total return comparison versus the SPI

Fund’s total return preliminary calculation, dividend reinvested at share price of last trading day of 2010 - source

Citi Group, Fund’s administrator

Citi Group, Fund’s administrator

31

Portfolio statistics

Source: Bloomberg Portfolio Analytics

|

|

|

|

|

Risk: Weekly

|

Portfolio

|

Benchmark

|

|

Standard Deviation 1 Year(s)

|

12.68

|

14.22

|

|

Beta 1 Year(s)

|

0.86

|

--

|

|

Correlation 1 Year(s)

|

0.96

|

--

|

|

R-Squared 1 Year(s)

|

0.93

|

--

|

|

Information Ratio 1 Year(s)

|

1.02

|

--

|

|

Sharpe Ratio vs Risk Free 1 Year(s)

|

0.59

|

0.23

|

|

Tracking Error 1 Year(s)

|

4

|

--

|

Seed

Early - - - - - -

Expansion / Capital

development

development

Maturity stage

Type of investment

Equity / Convertible Debt (bridge loan)

Leverage

Late - stage

Selection of private equity holdings

SPINEART

SWZ Private Equity Holdings

32

33

Evolution of Private Equity Portfolio

Companies

Description

Progress in 2010/2011 and Exit

First Swiss Limited Partnership approved by the

Swiss regulator Finma. Aravis is one of the most

active venture capital in the Swiss market with

expertise in biotechnology and renewable energy

Swiss regulator Finma. Aravis is one of the most

active venture capital in the Swiss market with

expertise in biotechnology and renewable energy

Zurmont is a partnership focusing on the financing of

buyouts and succession solutions for small to mid-

sized industrial and consumer goods companies in

Switzerland, Germany and Austria

buyouts and succession solutions for small to mid-

sized industrial and consumer goods companies in

Switzerland, Germany and Austria

Synosia focuses on innovative best in class

products for unmet medical needs in neurology and

psychiatry

products for unmet medical needs in neurology and

psychiatry

NovImmune develops therapeutic monoclonal

antibodies to treat patients suffering from immune

related disorders

antibodies to treat patients suffering from immune

related disorders

Kuros develops biomaterial based products for

localized therapy in trauma, spine and wound

localized therapy in trauma, spine and wound

Diagnostic device company

Strategic partnership with

UCB (Oct. 2010) / Merger

with the listed company

Biotie (February 2011)

UCB (Oct. 2010) / Merger

with the listed company

Biotie (February 2011)

Strategic partnership signed

with Roche/ Genentech in July

2010

with Roche/ Genentech in July

2010

Total amount invested in

portfolio companies is 51%.

portfolio companies is 51%.

Strategic partnership signed

with Qiagen in January 2011

with Qiagen in January 2011

SPINEART

Develop and market an innovative full range of

spine products, including fusion and motion

preservation devices

spine products, including fusion and motion

preservation devices

Distribution agreement signed

with Sanofi for the German

market

with Sanofi for the German

market

Morningstar 1 awarded The Swiss Helvetia Fund, Inc.:

1 Morningstar is an independent fund performance monitor. Its ratings reflect historic risk-adjusted performance and may change monthly.

Its ratings of one (low) and five (high) stars are based on a fund’s three year five year, ten year and overall average annual total returns with fee

adjustments, and a risk factor that reflects fund performance relative to three-month Treasury Bill monthly returns. Only 33% of the funds in an

investment category may receive four or five stars. As of November 30, 2010 there were 8 funds in the Fund’s asset category rated by

Morningstar.

adjustments, and a risk factor that reflects fund performance relative to three-month Treasury Bill monthly returns. Only 33% of the funds in an

investment category may receive four or five stars. As of November 30, 2010 there were 8 funds in the Fund’s asset category rated by

Morningstar.

34