Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - Lake Victoria Mining Company, Inc. | exhibit31-2.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Lake Victoria Mining Company, Inc. | exhibit21-1.htm |

| EX-31.1 - CERTIFICATION - Lake Victoria Mining Company, Inc. | exhibit31-1.htm |

| EX-32.1 - CERTIFICATION - Lake Victoria Mining Company, Inc. | exhibit32-1.htm |

| EX-32.2 - CERTIFICATION - Lake Victoria Mining Company, Inc. | exhibit32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K /A

(Amendment No.

1)

[X] ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED MARCH 31, 2010

or

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ________________ to __________________

Commission file number 000-53291

LAKE VICTORIA MINING COMPANY,

INC.

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction

of incorporation or organization)

1781 Larkspur Drive

Golden, Colorado 80401

(Address of principal executive offices, including zip code.)

(303) 586-1390

(telephone number, including area code)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

YES

[ ] NO [X]

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or 15(d) of the Act:

YES [

] NO [X]

Indicate by checkmark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule405 of Regulation

S-T (* 229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

YES [X] NO [ ]

Indicate by check mark whether the registrant(1) has filed all

reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 day.

YES [X] NO

[ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-accelerated Filer [ ] | Smaller Reporting Company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

YES [

] NO [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of July 13, 2009 was $0.25.

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date, as of July 13, 2010, total outstanding common shares was 71,239,100.

EXPLANATORY NOTE

This Amendment No. 1 (the “Amendment”) to the annual report on Form 10-K for the fiscal year ended March 31, 2010, of Lake Victoria Mining Company, Inc. (the “Company”) which was originally filed with the Securities and Exchange Commission on July 14, 2010 (the “Original Filing”) is being filed for the following purposes:

-

to amend the consolidated statements of operations and the consolidated statements of cash flows included in the Company's audited financial statements with respect to the mineral property acquisition costs and make certain amendments to the notes to the audited financial statements with respect to the mineral properties accounting policy;

to amend the disclosure under “Item 2. Properties” to include additional disclosure regarding the Company’s mineral properties to comply with Item 102 of Regulation S-K;

-

to include certain disclosure regarding sales of equity securities during the reporting period that were not previously disclosed in accordance with Regulation S-K;

-

to include additional disclosure regarding management and director compensation during the fiscal year ended March 31, 2010 under "Item 11. Executive Compensation" to comply with Item 402 of Regulation S-K;

-

to amend Item 13. Certain Relationships and Related Transactions, and Director Independence to comply with Item 404 of Regulation S-K; and

-

to provide a list of subsidiaries of the Company as an exhibit to the Form 10-K.

Other than as expressly set forth above, this Amendment does not, and does not purport to, update or restate the information in any Item of the Original Filing or reflect any events that have occurred after the Original Filing was filed. The filing of this Amendment shall not be deemed an admission that the Form 10-K, when made, included any known, untrue statement of material fact or knowingly omitted to state a material fact necessary to make a statement not misleading.

TABLE OF CONTENTS

-2-

PART I.

ITEM 1. BUSINESS.

Lake Victoria Mining Company, Inc. (formerly known as Kilimanjaro Mining Company, Inc.) was incorporated on December 11, 2006 under the laws of the State of Nevada. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search for mineral deposits or reserves which are not in either the development or production stage. We intend to conduct mineral exploration activities on properties to find an economic mineral body containing gold. Effective September 30, 2008, we were no longer a shell company. We maintain our statutory registered agent’s office at The Corporation Trust Company of Nevada, 6100 Neil Road, Suite 500, Reno, Nevada 89511 and our business and administrative office is located at 1781 Larkspur Drive, Golden, Colorado 80401. This is our mailing address as well. Our telephone number is (303) 586-1390. Roger Newell, our president, supplies this office space on a rent-free basis. Throughout the notes to the consolidated financial statements the term “Company” refers to the consolidated combined financial information and activities of Kilimanjaro Mining Company, Inc. (“Kilimanjaro”) and its previously reporting subsidiary Lake Victoria Mining Company, Inc. (“Lake Victoria”). The Company is also referred to as “we”, “us” and “our”.

Business

The principal business of the Company both as previously reported and as restructured through the share exchange of July 8, 2009, as described below, is to search for mineral deposits or reserves which are not in either the development or production stage. The Company is an exploration stage corporation that is conducting exploration activities primarily on prospective gold properties that are located in the United Republic of Tanzania, East Africa. We are exploring our properties by conducting an extensive program of mapping geology, sampling soils and rocks, assaying the samples for gold, geophysical surveying and drilling to identify faults and other geologic structures that might be helping to control the location of important gold values.

On May 4, 2009, Kilimanjaro completed a Property Acquisition Agreement with Geo Can Resources Company Limited (“Geo Can”) a company incorporated in the United Republic of Tanzania, East Africa. Geo Can is based in Tanzania and has a common director to the Company. Geo Can has been involved in the identification, acquisition and exploration of mineral resource properties in Tanzania for more than three years and had accumulated a large desirable property portfolio. In addition it supplies contract exploration services within Tanzania for other companies. Under the terms of the May 4, 2009 agreement, Kilimanjaro acquired 100% interests of the mineral property assets of Geo Can, which included 33 gold prospecting licenses and 13 uranium licenses. Geo Can had entered into property option agreements, regarding some of these resource properties, with Lake Victoria before the Property Acquisition Agreement with Kilimanjaro, but, as a consequence of the May 4, 2009 agreement, Geo Can no longer has any interest in those prior property agreements.

On July 8, 2009, Kilimanjaro Mining Company, Inc. and Lake Victoria Mining Company, Inc. entered into a Securities Exchange Agreement (the “acquisition”) under which Lake Victoria acquired all of the issued and outstanding common shares of Kilimanjaro. Prior to the acquisition, Lake Victoria was a registrant with the Securities and Exchange Commission and a consolidated subsidiary of Kilimanjaro. Kilimanjaro and Lake Victoria had been under common control since each of the entities’ inception. The acquisition was completed on August 7, 2009 and the stockholders of Kilimanjaro received approximately 67% of the Company’s issued capital shares. The acquisition was accounted for as a “reverse acquisition restructuring” and recapitalization of Kilimanjaro. As the result of this transfer, the former stockholders of Kilimanjaro owned a majority of the outstanding shares of the common stock of the Company, and Kilimanjaro was treated as the accounting acquirer for financial statement purposes. Since Lake Victoria was a consolidated subsidiary of Kilimanjaro, all of the historical accounting information previously reported by the registrant is incorporated in the historical financial information of the Company’s consolidated financial statements. Accordingly, the two entities consolidation reflects all of the historical financial information without any modification for recognition of fair value adjustments based upon a

-3-

business combination. The equity of Kilimanjaro for accounting purposes was restated in the legal framework of its previously controlled subsidiary Lake Victoria. The continuing legal entity is Lake Victoria Mining Company, Inc. and all equity information has been restated under its share structure and the continuing accounting of the consolidated results of operations are based upon Kilimanjaro’s consolidation of financial information from inception.

In November 2009, to perform our ongoing mineral exploration of prospective gold properties, we incorporated, Lake Victoria Resources (T) Limited, a wholly-owned subsidiary in Tanzania.

All of the Company’s mineral property interests are located in the United Republic of Tanzania, East Africa. Geo Can holds the title of the resource properties in trust for Kilimanjaro. Most of our resource property interests are still formally registered to Geo Can to save on registration fees. When the annual filing for each property comes due then the formal registration of each property will be transferred to Kilimanjaro or as directed by Kilimanjaro.

The Company holds a 100% ownership interest in all of the properties that were acquired in the May 4, 2009 Property Acquisition agreement that was completed between Kilimanjaro and Geo Can. The properties are unencumbered and there are no competitive conditions which affect the properties. Further, there is no insurance covering the properties and we believe that no insurance is necessary since at this point the properties are unimproved.

We have no revenues, we have incurred losses since inception, we have been issued a going concern opinion and we have relied upon the sale of our securities to fund operations.

To date, we have not discovered a commercially viable ore body, mineral deposit, or mineral reserve, on any of our properties and we will be unable to do so until further exploration is done and a comprehensive evaluation concludes an economic and legal feasibility study.

Our property portfolio is large, therefore we may interest other companies in our properties to either participate by means of option or joint venture agreements in the exploration of them or to finance and establish production if mineralization is found.

Although our exploration focus during this reporting period was on Kinyambwiga and Singida gold projects, we plan to commence initial exploration on our other gold projects during the upcoming reporting period as we continue to advance Kinyambwiga and Singida. See ITEM 2: Properties, Table 1 and Table 2 for a complete property license list by project, license number area, district and size.

Competitive Factors

The gold mining industry is fragmented, that is there are many gold prospectors and producers, small and large. We are a small exploration stage mining company and we do not have the financial, personnel or equipment resources that many competitors possess. Because of our lack of resources we may not be able to adequately withstand the competitive forces that exist in the mining industry generally and specifically with respect to gold mining.

Regulations

Mineral rights in the United Republic of Tanzania are governed by the Mining Act of 1998, and control over minerals is vested in the United Republic of Tanzania. Prospecting for minerals may only be conducted under authority of a mineral right granted by the Ministry of Energy and Minerals under this Act.

The three types of mineral rights most often encountered, which are applicable to us include: prospecting licenses; retention licenses; and mining licenses. A prospecting license grants the holder thereof the exclusive right to prospect in the area covered by the license for all minerals, other than building and gemstones, for a period of three years.

-4-

Thereafter, the license is renewable for two further periods of two years each. On each renewal of a prospecting license, 50 percent of the area covered by the license must be relinquished. Before application is made for a prospecting license, a prospecting reconnaissance for a maximum area of 5,000 square kilometers is issued for a period of two years after which a three-year prospecting license is applied for. A company applying for a prospecting license must, inter alia, state the financial and technical resources available to it. A retention license can also be requested from the Minister, after the expiry of the 3-2-2-year prospecting license period, for reasons ranging from funds to technical considerations.

Mining is carried out through either a mining license or a special mining license, both of which confer on the holder thereof the exclusive right to conduct mining operations in or on the area covered by the license. A mining license is granted for a period of 10 years and is renewable for a further period of 10 years. A special mining license is granted for a period of 25 years and is renewable for a further period of 25 years. If the holder of a prospecting license has identified a mineral deposit within the prospecting area which is potentially of commercial significance, but it cannot be developed immediately by reason of technical constraints, adverse market conditions or other economic factors of a temporary character, it can apply for a retention license which will entitle the holder thereof to apply for a special mining license when it sees fit to proceed with mining operations.

A retention license is valid for a period of five years and is thereafter renewable for a single period of five years. A mineral right may be freely assigned by the holder thereof to another person, except for a mining license, which must have the approval of the Ministry to be assigned.

However, this approval requirement for the assignment of a mining license will not apply if the mining license is assigned to an affiliate company of the holder or to a financial institution or bank as security for any loan or guarantee in respect of mining operations.

A holder of a mineral right may enter into a development agreement with the Ministry to guarantee the fiscal stability of a long-term mining project and make special provision for the payment of royalties, taxes, fees and other fiscal imposts.

We have complied with all applicable requirements and the relevant licenses have been issued.

Environmental Law

We are also subject to Tanzania laws dealing with environmental matters relating to the exploration and development of mining properties. While in the exploration stage, on any of our project areas, we are conscious of any environmental impact we may be having. However, our obligations are very limited, as our activities cause minimal environmental disturbances and are limited to mapping, sampling, trenching, geophysical surveying and drilling. Once project areas reach a point of being commercially feasible for mining then we will be required to conduct proper environmental impact studies based on feasibility reports and planned mining operations. We do protect the environment through any regulations affecting:

| 1. | Health and Safety |

| 2. | Archaeological Sites |

| 3. | Exploration Access |

Employees

To the extent possible we intend to use the services of subcontractors for manual labor and exploration work on our properties. Lake Victoria Resources (T) Limited, our wholly owned Tanzania subsidiary may hire subcontractors and employees to complete exploration work. A large skilled and unskilled workforce is readily available within Tanzania to satisfy any labour requirements we may have. Through contractors and skilled professional employees the company does provide any necessary on the job training to accomplish our exploration objectives.

-5-

Employees and Employment Agreements

At present, we have no full-time employees. Our two officers and directors will each devote a minimum of about 30 percent of their time to our operation. Our officers and directors do not have employment agreements with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers and directors. Our president Roger Newell and secretary Heidi Kalenuik will handle our administrative duties.

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 2. PROPERTIES.

Licenses

The following chart (Table 1) is a complete list of each gold prospecting license that we own by project name, license number, the area of location, district of its location and the size in square kilometers. Table 2, a complete list of our uranium prospect licenses, follows the gold license list (Table 1). We own no prospecting property other than the following licenses listed on Table 1 and 2:

| Table 1: Gold Projects and License List | ||||

| Project | License No | Area | District | Size (SqKm) |

| KALEMELA | ||||

| PL 2747/2004 | Magu | Magu | 34.01 | |

| PL 2910/2004 | Bunda South | Bunda | 37.90 | |

| PL 3006/2005 | Bunda | Bunda | 56.56 | |

| PL 5892/2009 | Magu | Magu | 29.67 | |

| PL 5912/2009 | Magu | Magu | 56.74 | |

| PL 5988/2009 | Bunda South | Magu | 38.92 | |

| 253.80 | ||||

| GEITA | ||||

| PL 2806/2004 | Geita | Geita | 21.59 | |

| PL 5958/2009 | Geita | Geita | 20.85 | |

| 42.44 | ||||

| MUSOMA BUNDA | ||||

| PL 4511/2007 | Masinono | Musoma | 51.90 | |

| PL 3966/2006 | Suguti | Musoma | 72.95 | |

| Kinyambwiga | ||||

| PL 4653/2007 | Kinyambwiga | Musoma | 30.89 | |

| 24 PML's | ||||

| 1)PM0001173 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 2)PM0001174 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 3)PM0001175 | Kinyambwiga | Musoma | 8.36 Hectares | |

-6-

| 4)PM0001176 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 5)PM0001177 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 6)PM0001178 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 7)PM0001179 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 8)PM0001180 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 9)PM0001181 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 10)PM0001182 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 11)PM0001183 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 12)PM0001184 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 13)PM0001185 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 14)PM0001301 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 15)PM0001302 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 16)PM0001307 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 17)PM0004582 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 18)PM0004583 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 19)PM0004584 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 20)PM0004585 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 21)PM0004586 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 22)PM0004587 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 23)PM0004588 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 24)PM0004589 | Kinyambwiga | Musoma | 8.36 Hectares | |

| 155.74 | ||||

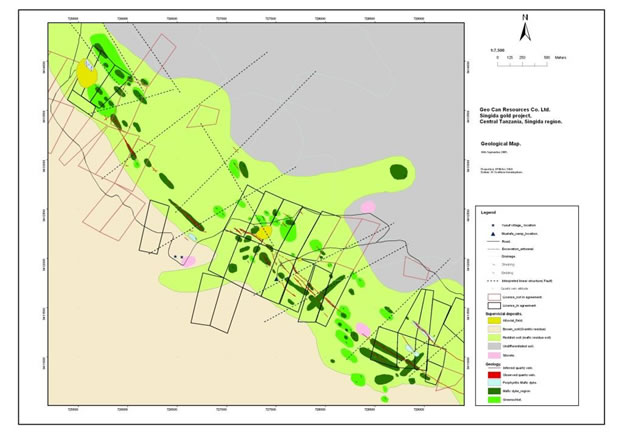

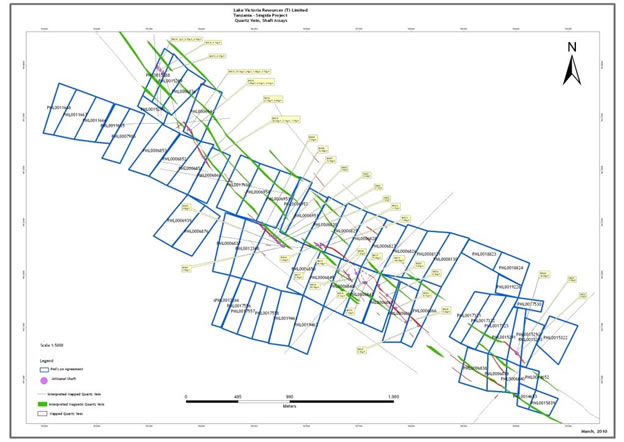

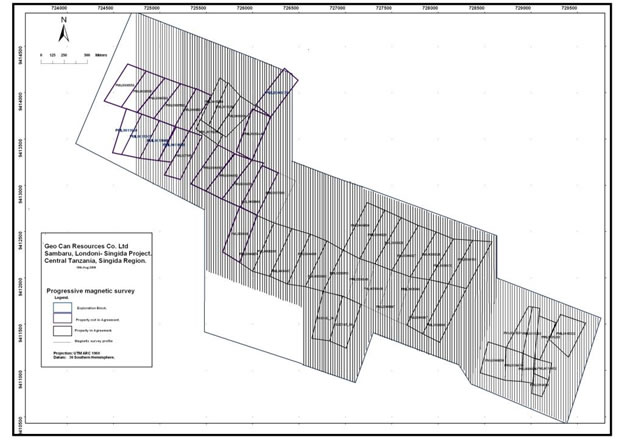

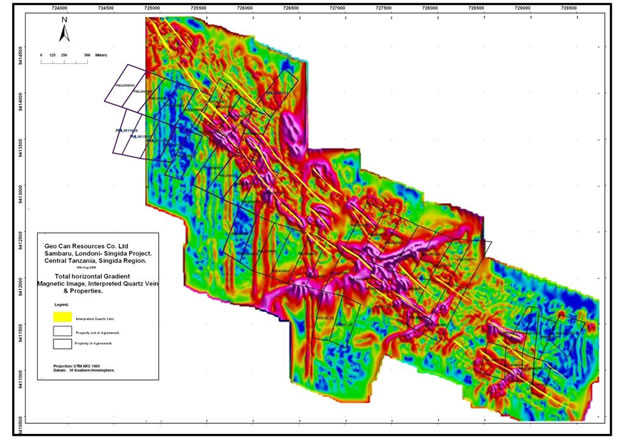

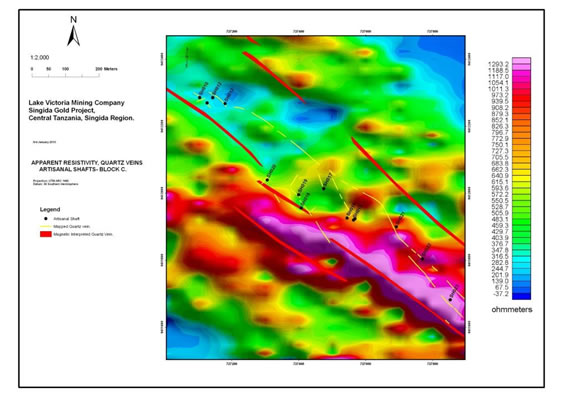

| SINGIDA | ||||

| 60 PMLs | 200mx500m | Singida - Londoni | Singida | 6 |

| 6 | ||||

| BUHEMBA | ||||

| PL 2979/2005 | Buhemba | Serengeti | 33.86 | |

| PL 5919/2009 | Buhemba | Serengeti | 34.92 | |

| 68.78 | ||||

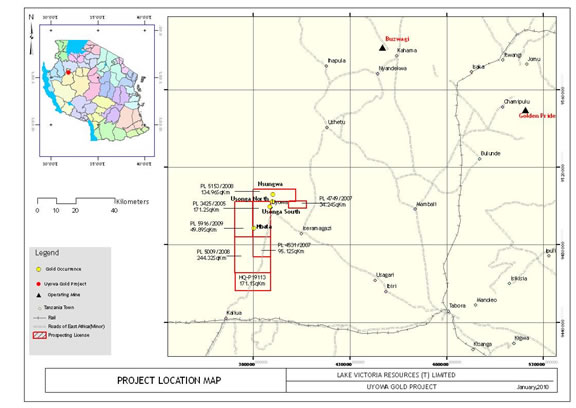

| UYOWA | ||||

| PL 4531/2007 | Uyowa | Urambo | 95.12 | |

| PL 3425/2005 | Uyowa | Uyowa | 171.20 | |

| PL 5009/2008/ | Uyowa | Urambo | 244.32 | |

| PL 5916/2009 | Uyowa | Urambo | 49.89 | |

| PL 4749/2007 | Kisimani River and Iseramigas | Urambo | 34.24 | |

| PL 5153/2008 | Uyowa | Uyowa | 134.96 | |

| PL 3557/2005 | Uyowa | Uyowa | 171.10 | |

| 900.83 | ||||

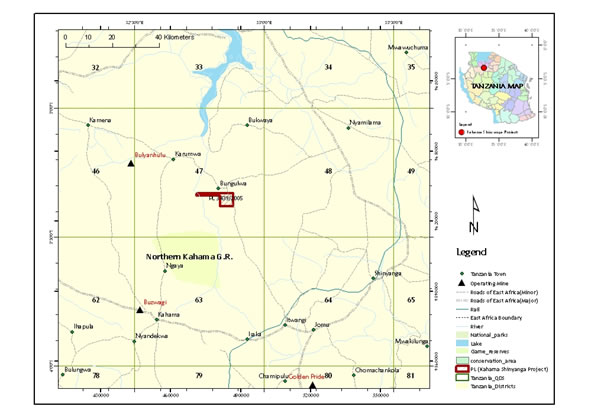

| KAHAMA | ||||

| Kahama Shinyanga | ||||

| PL 3439/2005 | Salawe | Shinyanga | 48.00 | |

| PL 5846/2009 | Mwamazengo | Misungwi | 42.00 | |

| Kahama South | ||||

| PLR 4188/2006 | Kahama South | Kahama | 184.00 | |

| PLR 4189/2006 | Kahama | Kahama | 61.09 | |

| PL 5844/2009 | Urambo | Kahama | 184.09 |

-7-

| 519.18 | ||||

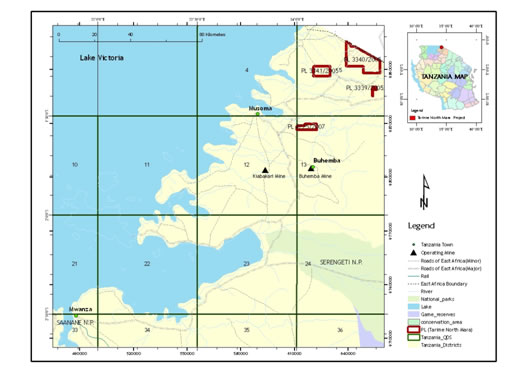

| NORTH MARA | ||||

| Tarime North Mara | ||||

| PL4882/2007 | Tarime | Nyagisa/Tarime | 61.80 | |

| PL3340/2005 | Ikoma | Tarime | 195.50 | |

| PL2677/2004 | Tarime | Tarime | 37.32 | |

| PL3005/2005 | Tarime | Mara Tarime | 85.43 | |

| PL4873/2007 | Tarime | Tarime | 40.97 | |

| PL3341/2005 | Utegi | Tarime | 51.51 | |

| PL3339/2005 | Tarime | Tarime | 3.59 | |

| PL4225/2007 | Kiagata | Musoma | 42.56 | |

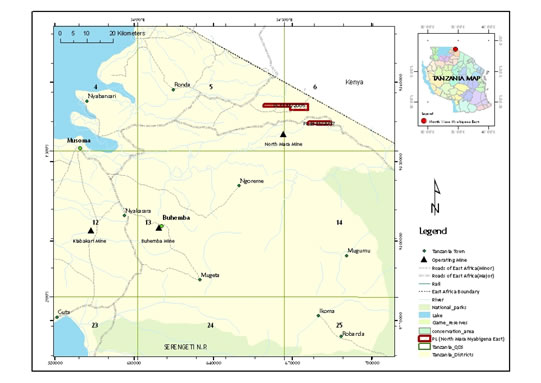

| North Mara Nyabigena East | ||||

| PL3355/2005 | Nyamwanga/Nyamongo | Tarime | 24.17 | |

| PL4645/2007 | Tarime | Tarime | 16.90 | |

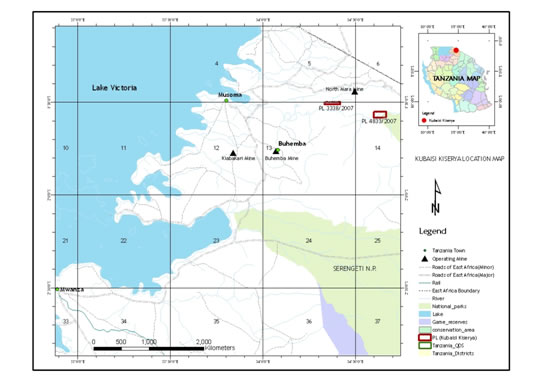

| Kubaisi-Kiserya | ||||

| PL3338/2005 | Kubaisi | Musoma | 12.53 | |

| PL4833/2007 | Kiterere Hills | Tarime & Serengeti | 27.34 | |

| 599.62 | ||||

| 37 Prospecting Licenses (PLs) - Total SqKm | 2546.39 | |||

| 84 Primary Mining Licenses (PMLs) | ||||

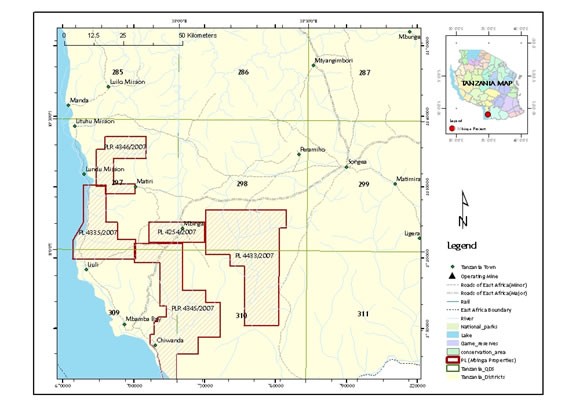

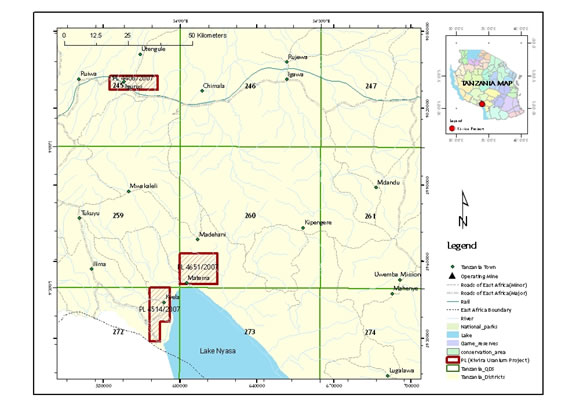

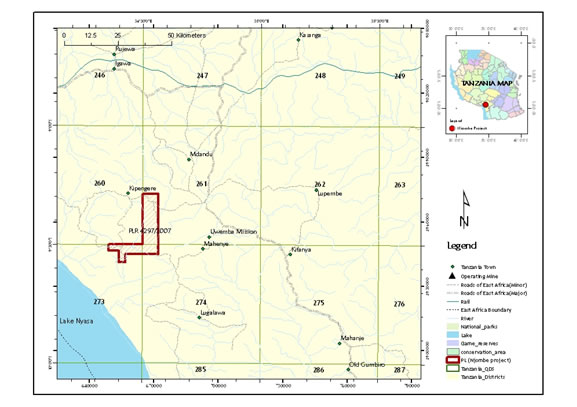

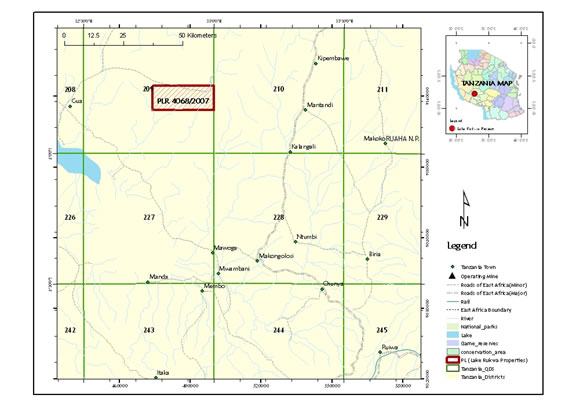

Table 2 – Uranium Projects and License List

| Project | License No | Area | District | Size (SqKm) |

| MBINGA | ||||

| PLR 4433/2007 | Mbinga | Songea | 1,101.00 | |

| PLR 4335/2007 | Litembo | Mbinga | 462.50 | |

| PL 4254/2007 | Pulambili | Mbinga | 197.50 | |

| 1,761.00 | ||||

| KIWIRA | ||||

| PL 4651/2007 | Makete | Makete & Kyela | 173.00 | |

| PL 4406/2007 | Chunya | Mbeya | 101.60 | |

| PL 4514/2007 | Kyela | Kyela | 139.60 | |

| 414.20 | ||||

| NJOMBE | ||||

| PLR 4297/2007 | Njombe | Makete | 282.20 | |

| 282.20 | ||||

| LAKE RUKWA | ||||

| PLR 4068/2007 | Chunya | Mbeya | 268.80 | |

| 268.80 | ||||

| MKUJU EAST | ||||

| PLR 4692/2007 | Madaba | Liwale | 423.50 | |

| PLR 4644/2007 | Madaba North | Liwale and Kilombero | 672.79 | |

-8-

| 1,096.29 | |||

| 10 Prospecting and Reconnaissance Licenses - Total (Sqkm) | 3,822.49 |

PROSPECTIVE PROJECTS AND PROPERTIES

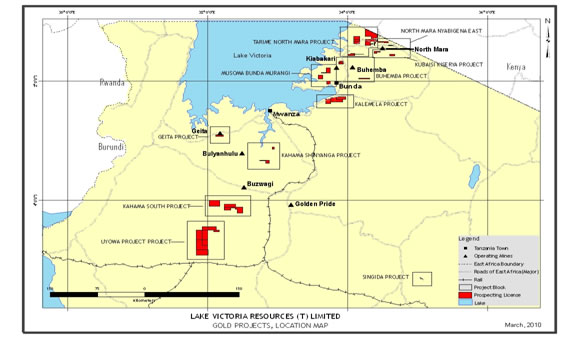

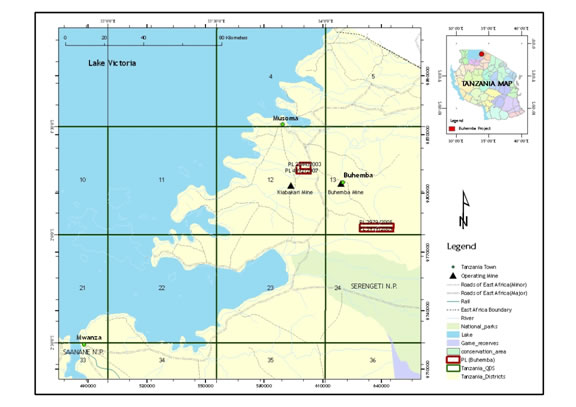

The following map (Map 1) is a gold project location map. The “red” is the outline of all of our individual Prospecting Licenses (PLs) that are combined to make a project area. Our projects are outlined in “blue”. For a detailed listing see Item 2: Properties – Table 1

Map 1: Gold Project Location Map, March 2010

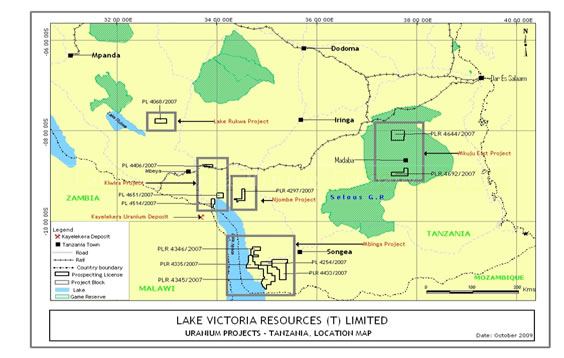

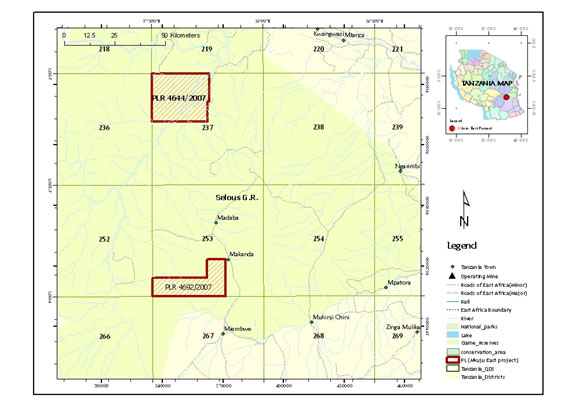

The following map (Map 2) is a uranium project location map. The “black” is the outline of all of our individual Prospecting Licenses (PLs or PLRs) that are combined to make a project. Our projects are outlined in “grey”. For a detailed listing see Item 2: Properties – Table 2

Map 2: Uranium Location Map, March 2010

-9-

Prospective Gold Projects

The following is a brief overview of our portfolio of prospective mineral properties, the exploration developments on them where applicable and some of the details of the historical option agreements for them. During this reporting period all of our exploration work was concentrated on the Kinyambwiga and Singida gold projects.

Kalemela Gold Project

Kalemela project is comprised of PL2747/2004, PL2910/2004, PL3006/2005, PL2892/2009, PL5912/2009 and PL5988/2009 totaling approximately 253.80 sq. km. The first event that occurred, on April 1, 2007, was the acquisition of the prospecting license, PL2747/2004 from Uyowa Gold Mining and Exploration Company Limited, P.O. Box 3167, Dar es Salaam, Tanzania. Kalemela Gold Project license number: PL2747/2004 is located within the Southeastern Lake Victoria Goldfields in Northern Tanzania in Magu District, Mwanza Region and is approximately 125 kilometers northeast of Mwanza. This was followed by a physical examination of the property by Dr. Roger A. Newell, a geologist, our president and director. The license is currently recorded in Geo Can’s name. Following the initial examination, we entered an Exploration Services Agreement with Geo Can to conduct geologic mapping, soil and rock sampling and ground magnetic surveys.

Subsequently, on November 18, 2008 we acquired two adjacent and contiguous licenses PL3006/2005 and PL2910/2004. We expanded our mineral exploration budget with Geo Can to complete a similar initial exploration program that was conducted on PL2747/2004. We have completed the initial exploration of PL3006/2005 and PL2910/2004. The three licenses totaled about 260 square kilometers. Results of geologic mapping, ground magnetic surveying and soil and rock sampling have identified exploration sites suitable for electrical induced polarization (I.P.) geophysical surveys to further define possible drill targets. Depending on available resources and project scheduling, follow up soil sampling will be conducted to confirm previous sampling results, followed by a targeted electrically induced polariztion (I.P.) geophysical survey and a possible initial drill program. No additional work was conducted on the Kalemela project during this reporting period.

Location and Access

-10-

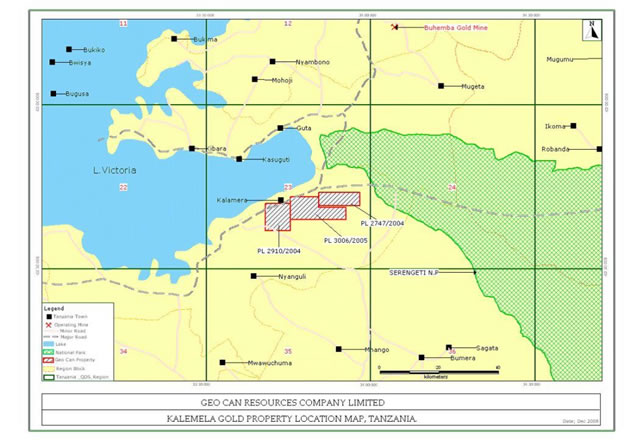

Map 3, “The Kalemela Gold Property Location Map, Tanzania” illustrates the location of the original three Kalemela licenses relative to Lake Victoria, the Serengeti National Park and to each of the other licenses.

The Kalemela Gold Project is located in the Kilimafedha greenstone belt of the Lake Victoria Gold Field in the Magu and Bunda Districts, Mwanza Region of northern Tanzania. The properties can be reached by traveling northeastwards from Mwanza city on the all-weather Mwanza-Magu-Bunda paved highway that continues northwards to Musoma. PL2747/2004 covers a total area of 70.72 square kilometers in quadrangle QDS 23/4. PL2910/2004 covers a total area of 77.20 square kilometers in quadrangle QDS 23/3. PL3006/2005 covers a total area of 113.90 square kilometers in quadrangle QDS 23/4. The original three licenses covered about 261.8 square kilometers and have each been split in half in compliance with the Mining Act of Tanzania. This has resulted in the Kalemela project now being comprised of six (6) PLs with an additional three (3) new PL numbers being assigned and totaling about 253.80 sq. km. However, all the subsequent exploration comments refer to the original three prospecting licenses (PLs)

The properties are near the eastern tip of Lake Victoria’s Speke Gulf and close to the southern shoreline of Lake Victoria. The nearest airport with regularly scheduled flights is in Musoma although the Mwanza airport is preferred where there are daily flights to and from Dar es Salaam and Kilimanjaro international airports.

Map 3: Kalemela Gold Project Location Map, December 2008

The city of Musoma has a population of about 1.5 million and a well-developed social and commercial infrastructure including: transportation, telecommunications, educational institutes, hospitals, hotels, and recreational facilities. The licenses are approximately 86 kilometers south of Musoma. Bunda, a closer, smaller commercial center than Musoma, is only about 36 kilometers north of the project area.

Road access to the licenses from Musoma, the nearest large town, is to Lamadi village over a well maintained paved highway, and then by dirt roads to all parts of the project. Two wheel vehicles are satisfactory in the dry season, but four wheel drive vehicles are required during the wet season.

-11-

Physiography and Climate

Topographically, the license consists of sweeping terrain, with several low hills in the southern and eastern parts; flat stretches of grass and dark colored clay rich mbuga soils dominate the central and northern parts of the license. The most conspicuous topographic features in the area surrounding the project are two large hills known as Ngasamo Hill and Wamangola Hill. These two hills lie south of the project and are formed by iron and magnesium rich intrusive rocks.

The project is located at the western fringe of the Kilimafedha greenstone belt. Granitoid and greenstone rocks extend northward to the Ndabaka Plains and to the Serengeti Game Reserve. The licenses constitute the northern extremity of a large and physiographically mature area known as Sukumaland. The area is adequately drained by the northwest flowing Lutubiga stream together with various other tributaries to the generally east flowing Ramadi River. All rivers in the area flow into the Duma River that eventually empties into Lake Victoria. The drainage channels are structurally controlled and follow joints, shear zones and other internal structures in the underlying bedrock. Outcrops are generally scarce as much of the area is covered with extensive amounts of Recent clay rich soils.

Geology

The most significant regional structural feature is the northwest trending Suguti Shear Zone, which is located about 25 kilometers to the northeast. This structure lies within a broad, 2-3 kilometer wide depression; smaller faults within our properties are believed to represent offshoots from the larger Suguti structure. It may be possible that these small faults have helped to control the location of elevated metal values.

Greenstone volcanic rocks and granite rocks are the major lithologies present on the Kalemela licenses. The greenstones have planar flow structures in the southwest, central and southeast parts of the Property. A major northeast trending linear feature, present in the Lutubiga area, coincides with greenstone outcrops in the central part of the Property. Minor northwest trending faults and fracture features are also present, and a well defined greenstone dike is present in the central south part of the licenses that might help control some elevated metal values.

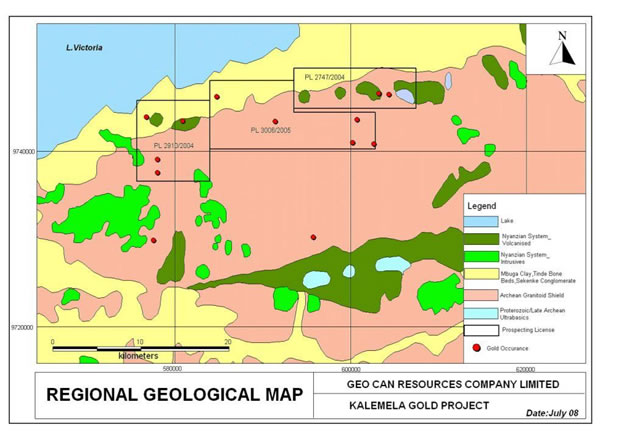

Local (Deposit) Geology

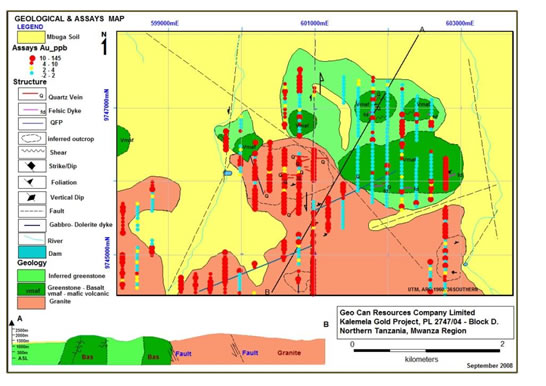

The local geology of the area is shown in Map 4, and the major rock types are briefly described below:

Dark Greyish Green Volcanic Rocks (Amphibolites)

The greenstone rocks form isolated outcrops and extend east-west through the center of the property. These are believed to be the main host rock for any metals that might be discovered on the Property.

Grey Granitic Rocks (Syn-tectonic granites)

These granitic rocks are generally grey colored and coarse-to medium-grained. They are present in the southern half of the Property.

Late Pink Granite Rocks (Late orogenic

granites)

Late pink granites are pink colored, and coarse- to fine-grained. These granites appear to be distinct from the grey granites whose outcrops tend to form rugged prominent topographical features.

Minor Intrusive Rocks

-12-

Small occurrences of generally dark green to greenish gray basaltic rocks often are present in areas of low topographic relief, and rock exposures are generally rare.

Clay Rich Dark Gray to Black Soil (Mbuga)

The northern half of the Property consists of heavy, dark colored, clay rich soils. These soils cover important geologic features in the underlying bedrock, and the Company’s mineral exploration programs are designed to identify prospective areas below the generally 2- to 3-meter thick soil cover.

History

There are no historical large mines or developed gold mineralized bodies within the Property; prior to our current activity, only limited reconnaissance exploration was conducted on the Property and within the region.

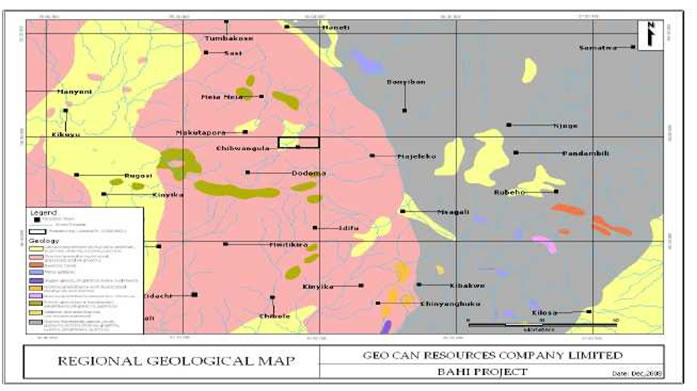

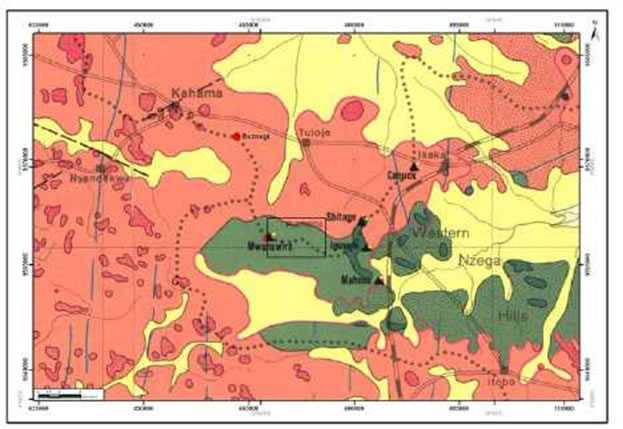

Map 4: Regional Geological Map for the Kalemela Gold Project, July 2008

Kalemela Exploration Program

The Kalemela property consists of undeveloped raw land that is easily traversed and prospected. To our knowledge, the property has only had shallow artisanal mining pits.

To evaluate the property, we implemented an initial exploration program consisting of geochemical surveys such as rock chip, soil sampling, trenching and geological mapping. These activities have to traverse faults inferred from aeromagnetic and from ground magnetic geophysical surveys.

Work done on PL2747/2004 through our exploration services agreement with Geo Can to date includes: geological mapping at a scale of 1:10,000; 61 rock chip samples; 1,589 soil samples, the soil sampling grid was 200 meters x 50 meters; ten trenches 1 to 2 meters deep were dug for a combined length of 156 meters; 50 samples were

-13-

collected on rock chip and soil anomalies to define the width of mineralization within the target area; three pits were dug and a detailed ground magnetic survey has been completed that covered the entire license. This magnetic survey has defined the structural setting and rock types present underlying below the mbuga soils.

All of the samples have been tested to determine if mineralized material is located on the property. We take our soil, grab and rock chip samples to analytical chemists, geochemists and registered assayers located in the city of Mwanza. Based upon initially encouraging results, we continued our exploration operations on the contiguous licenses, PL3006 and PL2910.

Exploration work conducted on the three Kalemela Project Licenses PL2747, PL2910 and PL3006 involved the collection and gold analysis of a total of 3,692 soil samples, 2186 line kilometers of ground magnetic surveying and the collection of 61 rock samples. In PL2747, the soil samples identified a large gold anomaly that covers an area of about 2 kilometers x 6 kilometers and is partially shown in Map 5.

Map 5: Shows a geologic contact between granite and greenstone in PL2747 corresponding with soil sample gold assay results. This contact zone may be selected for an induced polarization geophysical survey to help define drill targets. The area of Map 5 lies in the northeast quarter of Map 6, which displays the interpreted results of the ground magnetic survey that was conducted.

Map 5: Kalemela Geological and Assay Map, September 2008

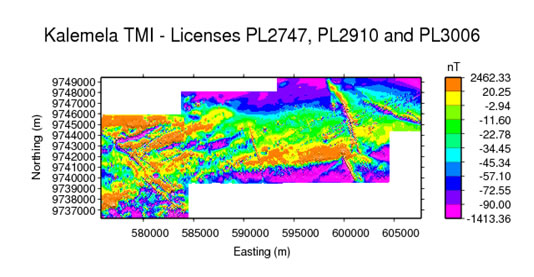

The ground magnetic survey identified geologic structures and rock contacts between granites and greenstones that could control gold mineralization; the results of 293 individual lines and 2,186 line kilometers of ground magnetic surveying are shown in Map 6.

Map 6: Interpreted Ground Magnetic Survey Results Note the strong northwest, cross cutting fracture zone image features that may control mineral formation.

-14-

Table 3 : Kalemela Project Exploration Statistics

License Number |

Ground Magnetics

(Line Km) |

Soil Samples (Number) |

Rock Samples (Number) |

| PL2747 | 688 | 1589 | 33 |

| PL2910 | 648 | 1762 | 22 |

| PL3006 | 850 | 341 | 6 |

| Total: | 2,186 | 3,692 | 61 |

The cost of the initial exploration program for all three Kalemela Gold Project licenses was approximately $618,970; expenditures for PL2747 were $267,288; for PL2910 were $177,172 and for PL3006 were $174,510. The work program consisted of gridding, soil and rock sampling, geophysical ground magnetic surveying, trenching, geological mapping, soil and rock assays, report writing, accommodations and travel. The exploration work was contracted to be conducted by Geo Can, commencing in July, 2008 and completing in February, 2009 on all three Kalemela project licenses. Additional work such as an induced polarization geophysical survey and trenching may be planned to further define possible drill RAB (rapid air blast) and RC (reverse circulation) drill targets.

State Mining Project - PL4339/2006 and Igusule PL2702/2004 and PL5469/2008 (Relingquished)

On December 22, 2008, we completed an “Option to Purchase Prospecting Licenses Agreement” with Geo Can for PL4339/2006 and PL2702/2004. Under the terms of the agreement and the consideration paid, we acquired the exclusive and irrevocable option to acquire from the State Mining Corporation a 90% undivided interest in PL4339/2006 and PL2702/2004 through the Geo Can Option. In Oct 2008, PL2702/2004 was renewed for a second period of two years and was divided into two licenses PL2702/2004 and PL5469/2008. Dr. Roger A. Newell and Mr. Ahmed Magoma completed a field visit to PL2702 and PL5469 on January 19th 2009. Shallow iron stained artisanal mine pits are present and these pits reveal 0.5 meter to 1 meter thick northeast striking and steeply dipping quartz veins. Evidence of earlier RAB drilling was also observed. Plans and budgets for the mineral exploration program on these properties were prepared with an intent for the program to be conducted during the last two quarters of 2009, but, no work was commenced.

On August 10, 2009, the Company decided to release the above three licenses and transferred them back to State Mining Company on August 11 and September 15, 2009. The Company has abandoned its interests in this project and will not be involved any further exploration activities. No exploration activities were conducted on these licenses during this reporting period.

Hombolo Village PL4339/2006

-15-

Location and Access

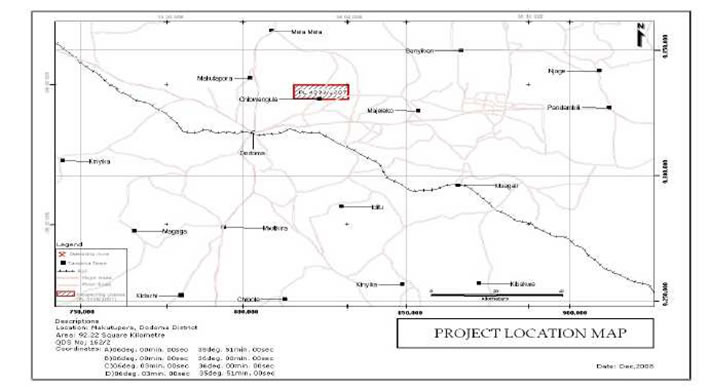

The Hombolo Prospect is under PL 4339/2006 issued to the State Mining Corporation (STAMICO) on 9th May, 2007 and is valid for 36 months from the date of grant. It was transferred to Geo Can on September 24, 2008. The total area is 92.22 km2 and lies within QDS 162/2 (Dodoma East) at Hombolo village. Access is generally easy as the properties are traversed by a number of roads that connect nearby villages (MAP 7).

Physiography

The environment for which Hombolo prospect may fall is that of “calcrete related environment in quaternary deposits”. The Hombolo prospect is in QDS 162/2 (Dodoma East). The Hombolo area is covered by mbuga and seasonal swamps. It forms an internal drainage basin. The prospect is being highly selected for uranium investigations. There has been no previous detailed investigations in the area except for the general regional mapping campaign by the Geological Survey of Tanzania.

Geology

Geological Environments for Uranium Mineralization in Tanzania

There are four know environments for uranium mineralization in Tanzania: -

- In sandstones, especially of the Karron Super Group and Bukoba Super Group

- In carbonatite complexes of Mesozoic to Recent age.

- In calcretes related secondary environment in quaternary deposits.

- In unconformities between Karagwe – Ankolean and Bukoba Super Group for vein-type uranium mineralization.

The environment for which Hombolo prospect may fall is that of “calcrete related environment in quaternary deposits”. The Hombolo area is covered by mbuga and seasonal swamps. It forms an internal drainage basin. On the basis of one of the geological environments for uranium mineralization in Tanzania -In calcretes related secondary environment in quaternary deposits, the Hombolo prospect is being highly selected for uranium investigations. There has been no previous detailed investigations in the area except for the general regional mapping campaign by the Geological Survey of Tanzania.

MAP 7: Location map of PL4339/2006

-16-

Map 8: Geology and Location Map PL4339/2006

Local (Deposit) Geology

-17-

The Hombolo area is covered by mbuga and seasonal swamps. It forms an internal drainage basin. On the basis of one of the geological environments for uranium mineralization in Tanzania - In calcretes related secondary environment in quaternary deposits, the Hombolo prospect is being highly selected for uranium investigations. The Hombolo lake is dischargeless drainage basin. The surface material consists of black, sandy, clay like material. Beneath the clays, there are clayey sediments which are calcerous and also gypsiferous. The sediments have are yet to be tested for uranium.

History

Uranium anomalies were selected from the airborne geophysical survey results for ground follow up in the 1980/81 field season. With the exception of the anomaly detected over the Ngualla Carbonatite (QDS 209), these anomalies originated from outcropping granitic/gneiss rocks and mbugas (seasonal swamps). Granitic/gneiss rocks were found to contain very low concentrations of syngenetic Uranium. Mbuga anomalies were found to be caused by secondary Uranium which has been precipitated from water drainage into these Mbugas during the wet season.

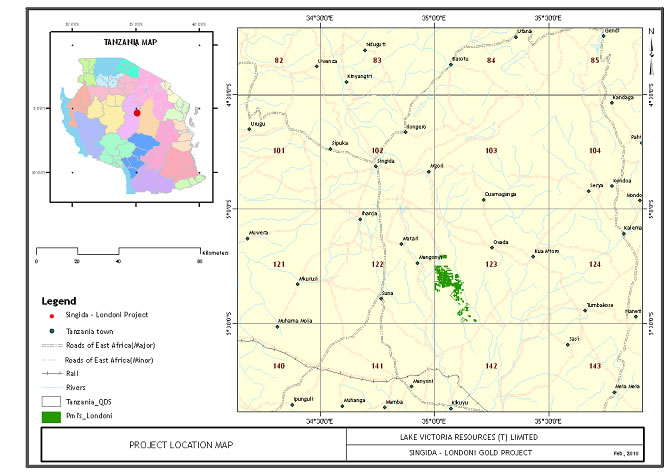

The areas that were investigated during the airborne geophysical survey comprised QDS 121, 122, 123, 124, 140, 141, 142, 143, 158, 159, 161, 162, 176, 177, 178, 179 and 209.

Aside from the countrywide Radiometric Airborne survey, there has been no previous detailed investigations on PL4339 except for the general regional mapping campaign by the Geological Survey of Tanzania.

Our Proposed Exploration Program

Plan for Hombolo PL4339

Detailed ground radiometric survey at 100m grid will be completed on the anomalous block indicated during country wide Airborne geophysics survey. Trenches and pitting will be done to validate the previous anomaly. The survey will be followed up by shallow RAB or Auger drilling.

Igusule PL2702/2004

Location and Access

The Igusule tenement, PL 2702/04, is situated within the Kahama District, Shinyanga region, about 100km SE of Bulyanhulu mine and approximately 20km SE of the Buzwagi deposit. It is located within the Nzega –Iramba greenstone belt, in the Lake Victoria Goldfields of northwestern Tanzania.

Physiography and Climate

The Igusule, PL2702/2004 is underlain by both lower Nyanzian basalts and Upper Nyanzian volcaniclastic sediments. Felsic dykes, granite and ultramafic rocks have intruded the Nyanzian lithologies in the area. Most of the area has outcropping lithologies (mainly greywacke to the east and basalt on the western boundary). Granitic sand has been mapped on the NE corner of the tenement. The area is located on the gravity high and is characterized by crustal scale structural intersections of WNW, NE, EW and NS- trending magnetic lineaments.

Map 9: Geology and Location Map of PL2702/2004

-18-

-19-

History

The Igusule, PL2702/2004 had exploration work completed by Barrick Exploration Africa Limited (BEAL) in the tenement that included; Airborne magnetic survey, Gravity survey, Geological mapping (1:20,000), soil geochemical sampling (1054) and RAB (1,905m) drilling programs.

Soil geochemical sampling program (1054 samples) has been conducted over the tenement in February and March 2006. The program started with 800m x 100m grid followed by an infill sampling at 400m x 100m spacing over the area with in-situ soils. All soil samples were analyzed for Au and multi-element -ME-ICP41. Wide-spaced RAB was used to investigate the Au-in-soil anomalies.

Three wide-spaced RAB fences (approx 100m between holes) were drilled at the tenement (PL 2702) area. A total of 1,905m of RAB drilling (23 holes) were completed in the tenement. The main lithological units encountered include, mafic volcanic (fine to medium grained), ultra-mafic intrusive and felsic dykes, which crosscuts all lithologies.

Our Proposed Exploration Program

Plan for Igusule PL2702 – By combining the Mag-Gravity superimposed image with RAB drilling results we see that there are 2 or 3 prospective targets. One just east of the Artisanal mining and the RAB drilling fence area with significant structural intersections that may be the extension of Artisanal mining and RAB drilling program area, The other target is south of the RAB drilling fence where there is another structural intersection .The third target is located east of the major fault and just in the contact between the Gravity high and low and containing several structural intersections.

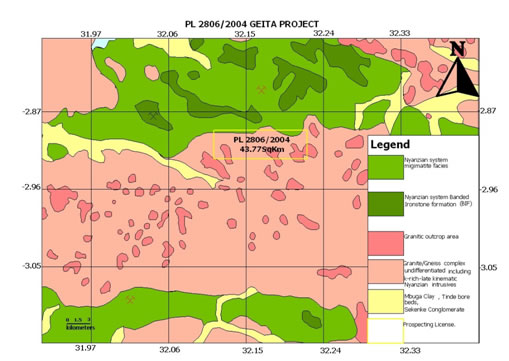

Geita Project PL2806/2004 and PL5958/2009

On January 27, 2009, we executed a definitive Option Agreement (the “Option”) with Geo Can to earn a 50% interest in Geo Can’s Geita Gold Project, Prospecting License Number PL2806. Under the terms of the Option, we acquired a 50% interest in the “Property” totaling 43.77 sq km. The “Option” also provides for the Company to acquire, through “Remaining Interest Options,” up to a 75% interest in the gold project. The Geita Gold Project (License number: PL2806/2004) is located in Northern Tanzania within the Lake Victoria goldfields in the Geita District, Mwanza Region. This license is approximately 300 meters south of AngloGold-Ashanti’s world-class Nyankanga gold deposit, about 6 kilometers west of the town of Geita and about 78 kilometers west of Mwanza. The original prospecting license PL2806 has been divided and the project is now comprised of two licenses: PL2806/2004 – 21.59 sq.km. and PL5958/2009 – 20.85 sq.km. which totals about 42.44 sq.km.

During 2008 Geo Can completed detailed ground magnetic surveys, and both reconnaissance and detailed electrical prospecting (induced polarization, I.P.) surveys. Following this work, we commenced drilling on the Geita Project in January, 2009 and completed 37 reverse circulation drill holes for a total of 3,508 meters (11,506 feet). The drilling identified sub-economic gold values; the best mineralized intersection was 2 meters of 3.03 grams per metric ton from 50 meters to 52 meters in drill hole GR-15. The geophysical and geological information continues to be reviewed to determine if additional exploration targets exist that justify additional work. No additional work was conducted on the project during this reporting period.

Description and Location

The Geita property (License number: PL2806/204) is situated in the famous Lake Victoria goldfields in Geita district, Mwanza region, northern Tanzania. It is located between Latitude 2o 54’S and 2o 92’S and Longitude 32° 06’E and 32° 22’E that encompasses an area of 43.77 square kilometers. This area lies approximately 300 meters south of AngloGold-Ashanti’s world-class Nyankanga gold deposit, 6 Km west of the town of Geita and 78 Km west of the city Mwanza. Mwanza, on the southern shore of Lake Victoria is an important port and the second largest city in Tanzania.

-20-

Accesiblility, Infrastructure, Physiography and Climate

Geita (Map 10) can be reached by air via Mwanza International airport, located in Mwanza town and then 78 Km drive to Geita town via Geita-Biharamulo tarmac road. The property can as well be reached from Kahama district, Shinyanga through Kakola–Geita road. The Geita town has several mobile telephone networks (Vodacom, Celtel, Zantel, Tigo and TTCL) and internet communication is available in local internet cafes.

Topographically on the north side, the property consists of prominent hills and relative low hills on the southern side (Map 11). Nyamalembo on the northeast side of the property is the highest reaching elevation of 1474 metres above sea level (Map 11 and 12). Most of the hills consist of granitic rocks with the exception of Samena Hill (on the northwest side), which is composed of greenstone rocks. The hill slopes are covered by Fe rich fertile red or black soil that grades to black cotton soil on the far south of the hills. The property area is drained at its midway by the Mtakuja stream, which flows northwesterly into swamps near Nungwe Bay at the Lake Victoria. The climate is tropically humid with two major seasons, a wet season that starts from November to May and a dry season the remainder of the year. The wet season’s maximum rainfall is between March and April. To date, weather has not affected exploration progress.

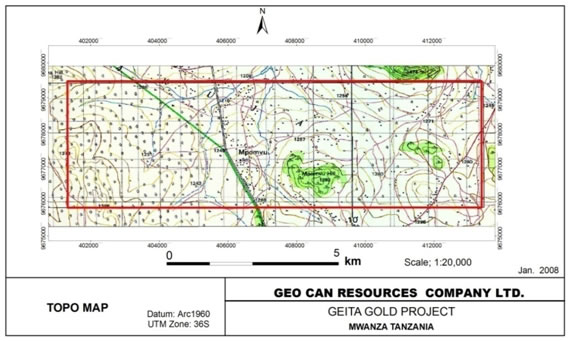

Map 10: Geita Property location, major roads, gold mines and gold occurrences

-21-

Map 11: Topographical map of the Geita property

Map 12: Geology and Location Map of PL2806/2004

History

The Geita area has been the most productive gold area in Tanzania with nearly a continuous history of mining activity from 1932 to the present. To the northwest at Samena Hill, prospecting and exploration dates back to the 1930s when the search for gold lead to the discovery of a massive sulphide deposit.

-22-

In 1961, the Geological Survey of Tanganyika carried out geophysical surveys and drilling programs. A number of boreholes contained some anomalous base metals but only small amounts of gold. Before closing in 1966, Geita Gold Mines Ltd. constituted the largest gold operation in East Africa. It produced 5.5 million tons of ore at an average grade of 5.3g/t gold from five deposits including Geita, North-East Extension, Lone Cone, Prospect 30 and Ridge 8.

In 1994, Cluff Resources (UK based company) acquired ground east and west of Geita including the Old Geita mines and surrounding prospects. Cluff conducted exploration work at Lone Cone, Samena, Nyamonge and Prospect 30. Significant discoveries were made in 1996 when Cluff was acquired by Ashanti Gold. Ashanti continued exploration work and discovered additional high grade mineralized zones at Nyankanga west of Lone Cone. Later in 1997, Samax Resources acquired properties to the north and northeast of Geita Hill (Old Geita mine) at the location called Kukuluma and Matandani. Presently AngloGold-Ashanti owns the Geita Gold mine.

The Geita Gold Mine is subdivided by northwest trending deformation corridors separated into three distinct sub-terrains, which have been named Nyamulilima in the west, Nyankanga-Geita in the central and Kukuluma to the northeast. The Nyankanga block is situated on the southern limb of a west plunging synform with a west-northwest trending axial plane. The mineralized zone extends more than a kilometer to the northeast, and to a depth of at least 150 meters.

The Kukuluma trend comprises five deposits within a five kilometer long east-southeast mineralized trend that cuts obliquely across northwest trending horseshoe ridges. The deposits are located six kilometers northeast of Nyankanga Block. The mineralization is open at depth. Grades and widths indicate an underground mine might be possible at a future time.

At Samena Hill prospecting and exploration activities are recorded back to the 1930’s. Several companies and individuals combed the area looking for gold without success. The discovery of the massive sulphides was rather accidental and the discoverers thought that in the end, the sulphides would lead them to a gold deposit.

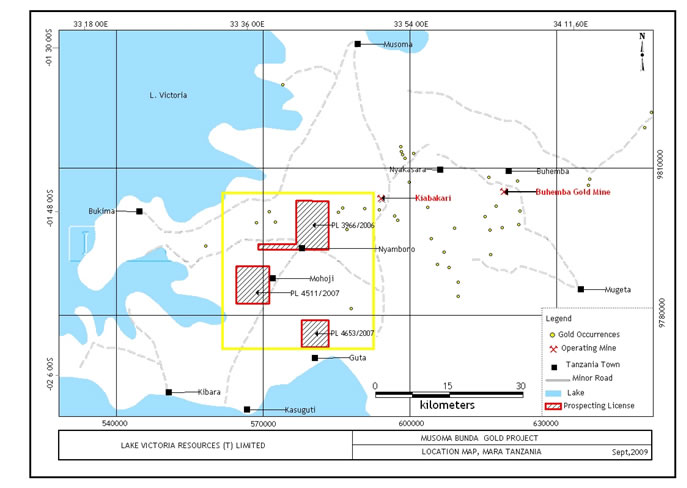

Musoma Bunda Gold Project

The Musoma Bunda Gold Project is comprised of three Prospecting Licenses (PLs) (see Table 2 and Figure 13) that are located on the eastern side of Lake Victoria. All three licenses lie within the Musoma-Mara Greenstone belt.

Location and Access

The three prospecting licenses (Table 1) lie to the west of the main Mwanza-Musoma tar road in the Musoma District (see Figure 1). The licenses are located some 30 to 60km south of Musoma, the major town in the district. Access to the individual licenses is via all weather dirt roads that connect to the various villages within the license areas. The three licenses are commonly referred to by the following names:

- Kinyambwiga (PL 4653/2007)

- Murangi (PL 4511/2007)

- Suguti (PL3966/2006)

Physiography, Climate, Vegetation and Water

The area is typically flat lying and is covered by grass and scattered woodland. Black cotton soils (mbuga) cover the entire area. The Mohoji and the Serengeti Plains lie to the south and south east of the area respectively. Perennial streams bisect the mbuga landscape and drain into Lake Victoria. The climate is tropically humid with an alternative wet (March to April) and dry season (from October to December).

-23-

History

Regional exploration has been carried out in the Musoma District from the 1920s. Geosurvey International undertook an aeromagnetic survey across the region during 1976-77. Barth compiled a geological map of the Lake Victoria Goldfields on a 1:1,000,000 scale in 1990. Exploration and exploitation of gold in the Musoma-Mara Greenstone belt commenced in the 1920’s. Mining occurred during the colonial times at Buhemba and Kiabakari, located east of the Musoma Bunda license area. Various international companies have worked on parts of the licenses since the mid-1990s and have largely concentrated around artisanal sites. Known artisanal workings occur on both the Kinyambwiga and Suguti projects.

All artisanal sites are licensed as Primary Mining Licenses (PMLs) to Tanzanian Nationals. All 24 PMLs on the Kinyambwiga prospecting license have been purchased outright by Geo Can Resources Company Limited (Geo Can) and are titled in the name of a common director of Geo Can and Lake Victoria Mining Company, Inc..

Regional Geology

The area is largely underlain by the Archaean Nyanzian Supergroup suite of granitic rocks (the Musoma Series). These have been uncomformably overlain by metavolcanic rocks of the Kavirondian System. Most of the documented gold occurrences in the Musoma-Mara region lie within the Nyanzian formation. The greenstone belt extends for over 180km from the shores of Lake Victoria in the west to the Serengeti National Park in the east.

Shear-hosted, gold bearing quartz veins, often striking NNE-SSW are typically present within the greenstone rocks. A crosscutting northwest – southeast structural fabric is present.

Kinyambwiga

On April 2, 2009 we completed an “Option to Purchase Prospecting Licenses Agreement” with Geo Can for PL4653/2007. Under the terms of the agreement and the consideration paid, we will acquire the exclusive and irrevocable option to acquire from Geo Can an 80% undivided interest in PL4653/2007. The Kinyambwiga Gold Project is about 208 kilometers northeast of the city of Mwanza in northern Tanzania, in the Precambian Musoma-Mara greenstone belt of northern Tanzania, East Africa (Figure 13 ). The project is within the gold producing area near Lake Victoria, and about 25 kilometers southwest of the past producing Kiabakari mine (0.8M -oz Au).

Current assay results, including trench assays from 2008, appear to have defined about a 1,000 meter long mineralized zone with an approximate vein grade of 3.96 grams per metric ton; additional work is required to confirm these results. A total of more than 190 samples were collected during the 2009 trenching program; eighty-five quartz vein samples averaged 3.96 grams per metric ton gold.

The property covers an area of 30.89 square kilometers in quadrangle QDS23/1.

Previous exploration work completed included: geological and regolith mapping, ground magnetics at 200m grid, geochemical soil sampling at 200X50 grid, trenching, pitting and 6000 meters of Rotary Air Blast (RAB) and 1300 meters of Reverse Circulation (RC) drilling. A detailed ground magnetic survey at 50m grid spacing was completed on a portion of the prospecting license, and on June 4th, 2009 we began to excavate exploration trenches to further expose previously identified quartz veins. Over 50 trenches were excavated and rock samples from the trenches were submitted to an assay laboratory. Detailed ground magnetic surveying suggested that the previously identified quartz veins have a strike length of at least one kilometer. A detailed trenching program further defined the quartz veins, and 134 samples collected from 22 trenches averaged 2.28 grams per

-24-

metric ton. An additional 24 bulk samples were selected for leach assaying these samples returned and average of 3.48 grams per metric ton. Routine fire assays for these same 24 bulk samples averaged 3.56 grams per metric ton. Previous excavations and shallow reconnaissance drilling suggests that multiple veins are present and may extend over a 2 kilometer distance.

Distance from the nearest town of Bunda to the project is approximately 18 kilometers. Access from Bunda is over dirt roads through Guta Village; four wheel drive vehicles are required during the rainy season. The nearest airport is in Musoma. However, the airport in Mwanza is preferred which has regularly scheduled flights, and is connected to Bunda with a major paved highway. The distance from Mwanza to Bunda is approximately 190 kilometers.

Map 13: Musoma-Bunda Gold Project Location Map includes Kinyambwiga Project PL4653

The geology at Kinyambwiga consists of granites, northwest trending mafic dykes and northeast trending gold bearing quartz veins. The granites generally fall into two main categories: syn- and post-Nyanzian ages, the mafic dykes have moderate to strong magnetic properties, and the quartz veins follow consistent, through-going fault structures and have near vertical dips.

Shallow, small scale artisanal gold mining has intermittently exposed the veins over approximately 300 to 400 meters and to an estimated depth of about 15 meters. Exploration by Lake Victoria has focused on defining the locations and gold grades of multiple veins.

-25-

Kinyambwiga has two main areas of exploration interest: a northern zone with “alluvial” gold deposits and a southern zone of significant hard rock artisanal mining activity. From June 1, 2009 to date rock sampling, geologic mapping, a detailed ground magnetic survey, and a major trenching and sampling program has extended and projected the known vein system to the northeast for at least 1,000 meters. This detailed exploration program was designed to refine and extend results from the 2008 RC and RAB drilling program.

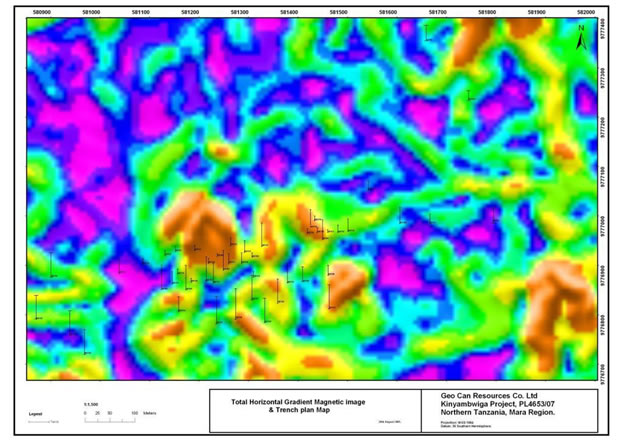

The 2009, detailed magnetic survey consists of 62 north-south lines of 2.3 kilometers long and spaced 50 meters apart; 143 line kilometers were surveyed using Company owned, state-of-the-art GPS equipped magnetometers. Interpretation of the detailed ground magnetic survey highlights the structural shift from east-northeast to a more northeast direction. From the artisanal workings, the vein-magnetic pattern extends both to the northeast and to the southwest, which suggests the quartz veins may have a length greater than one kilometer (see Map 9, magnetic image with superimposed trench locations).

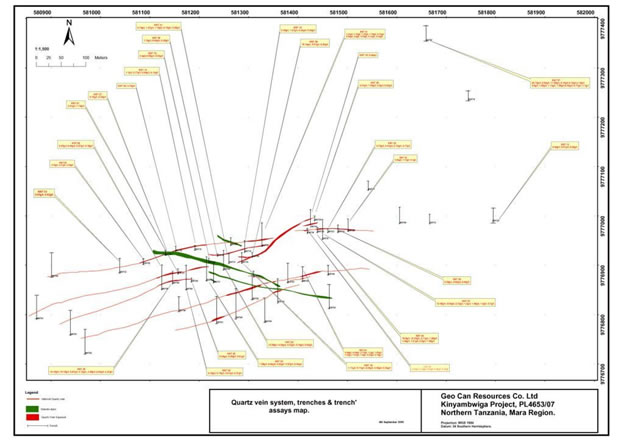

Also NW trending fault is predominant and mostly associated with dolerite dykes. During the 2009 trenching program, 54 trenches excavated and detailed samples were collected from quartz veins exposed in 37 of the trenches. The trenching and sampling program covered a strike length of about one kilometer. Gold assay results including those from trenching in 2008 appear to have defined about a 1,000 meter long mineralized zone with approximate vein grades of 3.96 grams per metric ton (Table 4); much more work is required to confirm these results and to determine whether Kinyambwiga will contain a commercial ore body. Kinyambwiga does not contain a mineralized ore body to date.

Map 14: Map of Detailed Total Horizontal Gradient Magnetic Image with Superimposed Trench Locations at Kinyambwiga Project

Trench Observations

The main observations obtained during the trenching program are:

-26-

The western part of the vein system has identified three (3) east-west striking parallel veins that are 20 to 50 meters apart; there is a northern vein, a central vein and a southern vein. The central vein curves and connects to the northern vein or main zone of artisanal mining and the intersection of these veins is an important exploration target.

A strike length of about 680 meters is present from trench KNT47 (580952E, 9776490N) in the west to trench KNT36 (581582E, 9776668N) in the east. The veins are mineralized with disseminated gold, pyrite, minor clay, sericite and hematite. Trench KNT36 has 0.8 meters of 3.465 grams per ton.

The southern vein is 100 meters south of the main vein and trench KNT40 exposed 2 meters of 2.74 grams of gold per ton. Other trenches KNT43, KNT48, KNT49, KNT51 and KNT52 also intersected the southern and provided significant gold assays (Map 15).

Granite is the main host rock, with associated cross-cutting mafic dikes. The main alteration minerals are silica, hematite and sericite. Disseminated pyrite is the main sulfide mineral; oxidation is very shallow, only 1 to 2 meters, and free gold is often observed in the shallow artisanal mine workings.

Mineralization Style

The mineralized system at Kinyambwiga consists of two or more steeply dipping, east-northeast striking quartz veins within deformed granites and with cross-cutting mafic dykes. The veins vary in thickness from 0.3 meters to 4m thick and have a tendency to narrow and widen. A structure at trench KNT07 defines a 7 meter wide quartz vein with 5.33 grams/ton that includes 1.5 meters of 15.61 grams/ton (Map 15).

Map 15: Kinyambwiga Gold Assays from Intersected Quartz Veins, Trenches and Trench Assays

-27-

Trenching and assaying results have identified possible extensions to the known quartz vein system and the gold assays confirm that the veins contain important amounts of gold. Additional work is planned to further advance the project.

Trench Assay Results

Trench samples from the quartz vein channel samples as well as chip samples show the continuity and extent of the mineralized corridor.

Alteration associated with gold mineralization includes silicification, hematite, weak sericite and disseminated fine grained pyrite is the main sulfide associated with high grade gold. Visible gold is present in trench KNT30.

Table 4 : Trench Gold Assay Results

(* indicates

samples with gold values 1 gm/ metric ton or greater)

| Trench ID | Sample No. | Sample Type | Weight(Kg) | From | To | Interval(m) | Rock type | Au(Gold) | Ore Zone width(M) | Analysis Method |

| KNT01 | KNT01_126 | channel | 2 | 18.7 | 19 | 0.3 | GR | 0.66 | FAA505 | |

| KNT01 | KNT01_127 | channel | 2 | 19 | 19.5 | 0.5 | QV | 12.95* | BLEG | |

| KNT01 | KNT01_128 | channel | 2 | 19.5 | 20 | 0.5 | QV | 1.6* | BLEG | |

| KNT01 | KNT01_129 | channel | 2 | 20 | 20.5 | 0.5 | QV | 5.08* | 3.5m | BLEG |

| KNT01 | KNT01_130 | channel | 2 | 20.5 | 21 | 0.5 | QV | 0.92 | BLEG | |

| KNT01 | KNT01_131 | channel | 2 | 21 | 21.5 | 0.5 | QV | 2.72* | BLEG | |

| KNT01 | KNT01_132 | channel | 2 | 21.5 | 22 | 0.5 | QV | 1.3* | BLEG | |

| KNT01 | KNT01_133 | channel | 2 | 22 | 22.5 | 0.5 | QV | 1.48* | BLEG | |

| KNT01 | KNT01_134 | channel | 2 | 22.5 | 22.8 | 0.3 | GR | 0.7 | FAA505 | |

| KNT01 | KNT01_368 | box sample | 2 | 19 | 21 | 2 | QV | 1.3* | BLEG | |

| KNT01 | KNT01_369 | box sample | 2 | 21 | 23 | 2 | QV | 0.37 | BLEG | |

| KNT02 | KNT02_135 | Channel | 2 | 27.1 | 27.4 | 0.3 | GR | 0.08 | FAA505 | |

| KNT02 | KNT02_136 | Channel | 2 | 27.4 | 27.7 | 0.3 | GR | 0.26 | FAA505 | |

| KNT02 | KNT02_137 | Channel | 2 | 27.7 | 28.2 | 0.5 | QV | 12.58* | BLEG | |

| KNT02 | KNT02_138 | Channel | 2 | 28.2 | 28.7 | 0.5 | QV | 4.38* | 1.3m | BLEG |

| KNT02 | KNT02_139 | Channel | 2 | 28.7 | 29 | 0.3 | QV | 2.03* | BLEG | |

| KNT02 | KNT02_141 | Channel | 2 | 29 | 29.3 | 0.3 | GR | 0.74 | FAA505 | |

| KNT02 | KNT02_375 | box sample | 2 | 27.7 | 28.7 | 1 | QV | 5.63* | BLEG | |

| KNT03 | KNT03_145 | Channel | 2 | 28.3 | 28.6 | 0.3 | GR | 0.11 | FAA505 | |

| KNT03 | KNT03_146 | Channel | 2 | 28.6 | 29.1 | 0.5 | QV | 8.68* | 1m | BLEG |

| KNT03 | KNT03_147 | Channel | 2 | 29.1 | 29.6 | 0.5 | QV | 0.57 | BLEG | |

| KNT03 | KNT03_148 | Channel | 2 | 29.6 | 29.9 | 0.3 | GR/QV | 0.92 | FAA505 | |

| KNT03 | KNT03_149 | Channel | 2 | 29.9 | 30.2 | 0.3 | GR | 0.46 | FAA505 | |

| KNT03 | KNT03_150 | Channel | 2 | 30.2 | 30.5 | 0.3 | GR | 0.63 | FAA505 | |

| KNT03 | KNT03_151 | Channel | 2 | 30.5 | 30.8 | 0.3 | GR | 1.08* | FAA505 | |

| KNT03 | KNT03_383 | box sample | 2 | 28.6 | 29.6 | 1 | QV | 1.4* | BLEG | |

| KNT04 | KNT04_157 | Channel | 2 | 19.2 | 19.5 | 0.3 | MAF | 0.57 | FAA505 | |

| KNT04 | KNT04_166 | Channel | 2 | 21.6 | 21.9 | 0.3 | MAF | 0.1 | FAA505 | |

| KNT04 | KNT04_169 | Channel | 2 | 22.5 | 22.8 | 0.3 | GR | 0.67 | FAA505 | |

| KNT04 | KNT04_170 | Channel | 2 | 39 | 39.3 | 0.3 | GR | 0.11 | FAA505 | |

| KNT04 | KNT04_171 | Channel | 2 | 39.3 | 39.6 | 0.3 | GR | 0.18 | FAA505 | |

| KNT04 | KNT04_172 | Channel | 2 | 39.6 | 39.9 | 0.3 | GR | 0.25 | FAA505 | |

| KNT04 | KNT04_173 | Channel | 2 | 39.9 | 40.2 | 0.3 | GR | 0.75 | FAA505 | |

| KNT04 | KNT04_174 | Channel | 2 | 40.2 | 40.5 | 0.3 | GR | 2.19* | FAA505 | |

| KNT04 | KNT04_175 | Channel | 40.5 | 40.8 | 0.3 | GR | 0.21 | FAA505 | ||

| KNT05 | KNT05_184 | Channel | 2 | 12.1 | 12.4 | 0.3 | GR | 0.27 | FAA505 | |

| KNT05 | KNT05_185 | Channel | 2 | 12.4 | 12.7 | 0.3 | GR | 0.44 | FAA505 | |

| KNT05 | KNT05_186 | Channel | 2 | 12.7 | 13 | 0.3 | GR | 0.17 | FAA505 | |

| KNT05 | KNT05_188 | Channel | 2 | 25.1 | 25.5 | 0.4 | QV | 0.31 | 0.4m | BLEG |

| KNT05 | KNT05_189 | Channel | 2 | 25.5 | 25.8 | 0.3 | GR | 0.18 | FAA505 | |

| KNT07 | KNT07_394 | channel | 2 | 16 | 16.5 | 0.5 | GR | 0.08 | FAA505 | |

| KNT07 | KNT07_395 | channel | 2 | 16.5 | 17 | 0.5 | GR | 4.15* | FAA505 |

-28-

| KNT07 | KNT07_396 | channel | 2 | 17 | 17.5 | 0.5 | QV | 0.6 | BLEG | |

| KNT07 | KNT07_397 | channel | 2 | 17.5 | 18 | 0.5 | QV | 9.52* | BLEG | |

| KNT07 | KNT07_398 | channel | 2 | 18 | 18.5 | 0.5 | QV | 1.99* | 3m | BLEG |

| KNT07 | KNT07_399 | channel | 2 | 18.5 | 19 | 0.5 | QV | 3.16* | BLEG | |

| KNT07 | KNT07_402 | channel | 2 | 19 | 19.5 | 0.5 | QV | 5.9* | BLEG | |

| KNT07 | KNT07_404 | channel | 2 | 19.5 | 20 | 0.5 | QV | 1.69* | BLEG | |

| KNT07 | KNT07_405 | channel | 2 | 20 | 20.5 | 0.5 | QV | 0.08 | BLEG | |

| KNT07 | KNT07_406 | channel | 2 | 20.5 | 21 | 0.5 | QV | 0.68 | BLEG | |

| KNT07 | KNT07_407 | channel | 2 | 21 | 21.5 | 0.5 | GR | 0.11 | FAA505 | |

| KNT07 | KNT07_408 | channel | 2 | 21.5 | 22 | 0.5 | GR | 0.17 | FAA505 | |

| KNT07 | KNT07_409 | channel | 2 | 22 | 22.5 | 0.5 | QV | 26.72* | BLEG | |

| KNT07 | KNT07_410 | channel | 2 | 22.5 | 23 | 0.5 | QV | 8.16* | BLEG | |

| KNT07 | KNT07_411 | channel | 2 | 23 | 23.5 | 0.5 | QV | 11.94* | 2.5m | BLEG |

| KNT07 | KNT07_412 | channel | 2 | 23.5 | 24 | 0.5 | QV | 0.16 | BLEG | |

| KNT07 | KNT07_413 | channel | 2 | 24 | 24.5 | 0.5 | QV | 1.13* | BLEG | |

| KNT07 | KNT07_414 | channel | 2 | 24.5 | 25 | 0.5 | GR | 0.32 | FAA505 | |

| KNT08 | KNT08_190 | Channel | 2 | 1.2 | 1.5 | 0.3 | GR | 0.15 | FAA505 | |

| KNT08 | KNT08_191 | Channel | 2 | 1.5 | 1.8 | 0.3 | GR | 0.85 | FAA505 | |

| KNT08 | KNT08_192 | Channel | 2 | 1.8 | 2.1 | 0.3 | GR | 0.2 | FAA505 | |

| KNT08 | KNT08_193 | Channel | 2 | 2.1 | 2.6 | 0.5 | QV | 1.74* | 0.5m | BLEG |

| KNT08 | KNT08_194 | Channel | 2 | 2.6 | 2.9 | 0.3 | GR | 0.39 | FAA505 | |

| KNT08 | KNT08_373 | box sample | 2 | 2.1 | 2.6 | 0.5 | QV | 2.25* | BLEG | |

| KNT09 | KNT09_197 | Channel | 2 | 2.7 | 3.2 | 0.5 | QV | 5.51* | BLEG | |

| KNT09 | KNT09_199 | Channel | 2 | 3.2 | 3.7 | 0.5 | QV | 5.25* | 1m | BLEG |

| KNT09 | KNT09_201 | Channel | 2 | 3.7 | 4 | 0.3 | GR | 0.16 | FAA505 | |

| KNT09 | KNT09_374 | box sample | 2 | 2.7 | 3.7 | 1 | QV | 5.79* | BLEG | |

| KNT15 | KNT15_225 | Channel | 2 | 2 | 2.3 | 0.3 | GR | 0.18 | FAA505 | |

| KNT15 | KNT15_227 | Channel | 2 | 2.6 | 3.1 | 0.5 | QV | 1.27* | BLEG | |

| KNT15 | KNT15_228 | Channel | 2 | 3.1 | 3.6 | 0.5 | QV | 0.26 | BLEG | |

| KNT15 | KNT15_229 | Channel | 2 | 3.6 | 4.1 | 0.5 | QV | 3.39* | 2m | BLEG |

| KNT15 | KNT15_230 | Channel | 2 | 4.1 | 4.6 | 0.5 | QV | 0.23 | BLEG | |

| KNT15 | KNT15_231 | Channel | 2 | 4.6 | 4.9 | 0.3 | GR | 0.25 | FAA505 | |

| KNT15 | KNT15_236 | Channel | 2 | 21.8 | 22.3 | 0.5 | QV | 0.24 | BLEG | |

| KNT15 | KNT15_376 | box sample | 2 | 2.6 | 3.1 | 0.5 | QV | 0.16 | BLEG | |

| KNT15 | KNT15_377 | box sample | 2 | 3.6 | 4.6 | 1 | QV | 0.63 | BLEG | |

| KNT15 | KNT15_378 | box sample | 2 | 21.8 | 22.3 | 0.5 | QV | 0.1 | BLEG | |

| KNT16 | KNT16_239 | channel | 2 | 3.5 | 4 | 0.5 | GR | 0.13 | FAA505 | |

| KNT16 | KNT16_242 | channel | 2 | 4 | 4.5 | 0.5 | GR | 0.54 | FAA505 | |

| KNT16 | KNT16_243 | channel | 2 | 4.5 | 5 | 0.5 | GR | 0.09 | FAA505 | |

| KNT16 | KNT16_244 | channel | 2 | 7 | 7.3 | 0.3 | GR | 1.1* | FAA505 | |

| KNT16 | KNT16_246 | channel | 2 | 7.8 | 8.3 | 0.5 | QV | 0.77 | 0.5m | BLEG |

| KNT18 | KNT18_248 | channel | 2 | 6.4 | 6.7 | 0.3 | GR | 0.09 | FAA505 | |

| KNT18 | KNT18_249 | channel | 2 | 6.7 | 7.2 | 0.5 | QV | 0.23 | BLEG | |

| KNT18 | KNT18_250 | channel | 2 | 7.2 | 7.7 | 0.5 | QV | 1.11* | 1.5m | BLEG |

| KNT18 | KNT18_251 | channel | 2 | 7.7 | 8.2 | 0.5 | QV | 0.34 | BLEG | |

| KNT18 | KNT18_252 | channel | 2 | 8.2 | 8.5 | 0.3 | GR | 0.43 | FAA505 | |

| KNT18 | KNT18_253 | channel | 2 | 8.5 | 9 | 0.5 | GR | 0.43 | FAA505 | |

| KNT18 | KNT18_255 | channel | 2 | 9.5 | 10 | 0.5 | GR | 0.26 | FAA505 | |

| KNT18 | KNT18_256 | channel | 2 | 11.5 | 12 | 0.5 | QV | 0.17 | BLEG | |

| KNT18 | KNT18-379 | box sample | 2 | 6.7 | 8.2 | 1.5 | QV | 0.93 | BLEG | |

| KNT19 | KNT19_432 | box sample | 2 | 22.8 | 23.8 | 1 | QV | 0.4 | FAA505 | |

| KNT21 | KNT21_276 | channel | 2 | 3 | 3.5 | 0.5 | QV | 1.74* | BLEG | |

| KNT21 | KNT21_278 | channel | 2 | 3.5 | 4 | 0.5 | QV | 3.51* | 1m | BLEG |

| KNT22 | KNT22_283 | channel | 2 | 2 | 2.5 | 0.5 | MAF | 3.72* | FAA505 | |

| KNT22 | KNT22_285 | channel | 2 | 2.8 | 3.3 | 0.5 | QV | 0.14 | 1m | BLEG |

| KNT22 | KNT22_286 | channel | 2 | 3.3 | 3.8 | 0.5 | QV | 0.15 | BLEG | |

| KNT23 | KNT23_326 | channel | 2 | 3 | 3.8 | 0.8 | QV | 3.73* | BLEG | |

| KNT23 | KNT23_327 | channel | 2 | 3.8 | 4.2 | 0.4 | QV | 2.41* | 1.7m | BLEG |

| KNT23 | KNT23_328 | channel | 2 | 4.2 | 4.7 | 0.5 | QV | 2.16* | BLEG | |

| KNT23 | KNT23_329 | channel | 2 | 4.7 | 5.3 | 0.6 | GR | 0.34 | FAA505 | |

| KNT23 | KNT23-370 | box sample | 2 | 3 | 4.7 | 1.7 | QV | 2.17* | BLEG |

-29-

| KNT26 | KNT26_288 | channel | 2 | 1.5 | 2 | 0.5 | MAF | 0.15 | FAA505 | |

| KNT26 | KNT26_289 | channel | 2 | 2 | 2.5 | 0.5 | MAF | 1.24* | FAA505 | |

| KNT26 | KNT26_290 | channel | 2 | 2.5 | 3 | 0.5 | GR | 0.53 | FAA505 | |

| KNT26 | KNT26_291 | channel | 2 | 3 | 3.5 | 0.5 | GR | 2.63* | FAA505 | |

| KNT26 | KNT26_292 | channel | 2 | 3.5 | 4 | 0.5 | GR | 0.43 | FAA505 | |

| KNT26 | KNT26_293 | channel | 2 | 4 | 4.5 | 0.5 | GR | 0.64 | FAA505 | |

| KNT26 | KNT26_294 | channel | 2 | 4.5 | 5 | 0.5 | GR | 0.31 | FAA505 | |

| KNT26 | KNT26_295 | channel | 2 | 5 | 5.5 | 0.5 | MAF | 0.81 | FAA505 | |

| KNT26 | KNT26_296 | channel | 2 | 5.5 | 6 | 0.5 | MAF | 0.29 | FAA505 | |

| KNT26 | KNT26_297 | channel | 2 | 6 | 6.5 | 0.5 | MAF | 0.15 | FAA505 | |

| KNT26 | KNT26_298 | channel | 2 | 6.5 | 7 | 0.5 | MAF | 0.33 | FAA505 | |

| KNT26 | KNT26_302 | channel | 2 | 7.5 | 8 | 0.5 | QV | 1.04* | BLEG | |

| KNT26 | KNT26_303 | channel | 2 | 8 | 8.5 | 0.5 | QV | 5.87* | BLEG | |

| KNT26 | KNT26_306 | channel | 2 | 9 | 9.5 | 0.5 | QV | 14.19* | 2m | BLEG |

| KNT26 | KNT26_307 | channel | 2 | 9.5 | 10 | 0.5 | QV | 3.72* | BLEG | |

| KNT26 | KNT26_309 | channel | 2 | 10.5 | 11 | 0.5 | GR | 1.9* | FAA505 | |

| KNT26 | KNT26_310 | channel | 2 | 11 | 11.5 | 0.5 | GR | 0.36 | FAA505 | |

| KNT26 | KNT26_311 | channel | 2 | 21 | 21.5 | 0.5 | GR | 2.06* | FAA505 | |

| KNT26 | KNT26_312 | channel | 2 | 21.5 | 22 | 0.5 | QV | 3.45* | BLEG | |

| KNT26 | KNT26_313 | channel | 2 | 22 | 22.5 | 0.5 | QV | 10.15* | BLEG | |

| KNT26 | KNT26_314 | channel | 2 | 22.5 | 23 | 0.5 | QV | 0.56 | BLEG | |

| KNT26 | KNT26_315 | channel | 2 | 23 | 23.5 | 0.5 | QV | 2.21* | 3m | BLEG |

| KNT26 | KNT26_316 | channel | 2 | 23.5 | 24 | 0.5 | QV | 0.43 | BLEG | |

| KNT26 | KNT26_318 | channel | 2 | 24 | 24.5 | 0.5 | QV | 0.45 | BLEG | |

| KNT26 | KNT26_323 | channel | 2 | 25.5 | 25.8 | 0.3 | GR | 0.18 | FAA505 | |

| KNT27 | KNT27_336 | channel | 2 | 6.3 | 6.7 | 0.4 | QV | 5.75* | 0.4m | BLEG |

| KNT27 | KNT27_337 | channel | 2 | 6.7 | 7 | 0.3 | MAF | 0.35 | FAA505 | |

| KNT27 | KNT27_391 | box sample | 2 | 6.3 | 6.7 | 0.4 | QV | 2.06* | BLEG | |

| KNT28 | KNT28_339 | channel | 2 | 5 | 5.5 | 0.5 | QV | 3.76* | 0.5m | BLEG |

| KNT28 | KNT28_343 | channel | 2 | 5.5 | 6 | 0.5 | GR | 2.27* | FAA505 | |

| KNT28 | KNT28_392 | box sample | 2 | 5 | 5.8 | 0.8 | QV | 4.76* | BLEG | |

| KNT29 | KNT29_345 | channel | 2 | 3.3 | 4 | 0.7 | QV | 0.5 | BLEG | |

| KNT29 | KNT29_346 | channel | 2 | 4 | 4.3 | 0.3 | GR | 1.59* | FAA505 | |

| KNT29 | KNT29_349 | channel | 2 | 9 | 9.5 | 0.5 | GR | 0.32 | FAA505 | |

| KNT29 | KNT29_371 | box sample | 2 | 3.3 | 4 | 0.7 | QV | 3.61* | BLEG | |

| KNT30 | KNT30_352 | channel | 2 | 3.7 | 4 | 0.3 | GR | 0.9 | FAA505 | |

| KNT30 | KNT30_353 | channel | 2 | 4 | 4.5 | 0.5 | QV | 1.21* | BLEG | |

| KNT30 | KNT30_354 | channel | 2 | 4.5 | 5 | 0.5 | QV | 2.71* | BLEG | |

| KNT30 | KNT30_355 | channel | 2 | 5 | 5.5 | 0.5 | QV | 1.42* | BLEG | |

| KNT30 | KNT30_356 | channel | 2 | 5.5 | 6 | 0.5 | QV | 10.63* | 2m | BLEG |

| KNT30 | KNT30_357 | channel | 2 | 6 | 6.5 | 0.5 | QV | 18.9* | FAA505 | |

| KNT30 | KNT30_358 | channel | 2 | 6.5 | 7 | 0.5 | GR | 1.59* | FAA505 | |

| KNT30 | KNT30_359 | channel | 2 | 7 | 7.3 | 0.3 | GR | 0.9 | FAA505 | |

| KNT30 | KNT30_372 | box sample | 2 | 4 | 6 | 2 | QV | 1.88* | BLEG | |

| KNT31 | KNT31_362 | channel | 2 | 17 | 17.3 | 0.3 | GR | 0.29 | FAA505 | |

| KNT31 | KNT31_363 | channel | 2 | 17.3 | 17.8 | 0.5 | QV | 1.27* | BLEG | |

| KNT31 | KNT31_364 | channel | 2 | 17.8 | 18.3 | 0.5 | QV | 2.14* | 1.5m | BLEG |

| KNT31 | KNT31_365 | channel | 2 | 18.3 | 18.8 | 0.5 | QV | 1.15* | BLEG | |

| KNT31 | KNT31_367 | channel | 2 | 18.8 | 19.1 | 0.3 | MAFIC | 0.15 | FAA505 | |

| KNT31 | KNT31_393 | box sample | 2 | 17.5 | 18.5 | 1 | QV | 0.55 | BLEG | |

| KNT36 | KNT36_495 | channel | 2 | 3 | 3.3 | 0.3 | GR | 1.37* | FAA505 | |

| KNT36 | KNT36_496 | channel | 2 | 3.3 | 3.8 | 0.5 | QV | 5.56* | 0.5m | BLEG |

| KNT36 | KNT36_503 | channel | 2 | 12 | 12.5 | 0.5 | GR | 0.1 | FAA505 | |

| KNT38 | KNT38_443 | channel | 2 | 8 | 8.5 | 0.5 | GR | 0.14 | FAA505 | |

| KNT38 | KNT38_444 | channel | 2 | 8.5 | 9 | 0.5 | GR | 0.96 | FAA505 | |

| KNT38 | KNT38_445 | channel | 2 | 9 | 9.7 | 0.7 | QV | 2.24* | BLEG | |

| KNT38 | KNT38_447 | channel | 2 | 9 | 9.7 | 0.7 | QV | 2.19* | 0.7m | BLEG |

| KNT38 | KNT38_448 | channel | 2 | 9.7 | 10 | 0.3 | GR | 0.59 | FAA505 | |

| KNT39 | KNT39_449 | channel | 2 | 3.6 | 4 | 0.4 | GR | 0.37 | FAA505 | |

| KNT39 | KNT39_450 | channel | 2 | 4 | 4.5 | 0.5 | QV | 0.23 | BLEG | |

| KNT39 | KNT39_451 | channel | 2 | 4.5 | 5 | 0.5 | QV | 0.73 | 2m | BLEG |

| KNT39 | KNT39_452 | channel | 2 | 5 | 5.5 | 0.5 | QV | 1.27* | BLEG | |

| KNT39 | KNT39_453 | channel | 2 | 5.5 | 6 | 0.5 | QV | 0.33 | BLEG | |

| KNT39 | KNT39_454 | channel | 2 | 6 | 6.7 | 0.7 | GR | 0.09 | FAA505 | |

| KNT39 | KNT39_455 | channel | 2 | 6.7 | 7.3 | 0.6 | GR | 1.27* | BLEG | |

| KNT39 | KNT39_457 | box sample | 2 | 6.7 | 7.3 | 0.6 | QV | 1.19* | 0.6m | BLEG |

| KNT39 | KNT39_458 | channel | 2 | 7.3 | 7.6 | 0.3 | GR | 0.12 | FAA505 |

-30-

| KNT39 | KNT39_459 | channel | 2 | 11.5 | 12 | 0.5 | GR | 0.18 | FAA505 | |

| KNT39 | KNT39_462 | channel | 2 | 12 | 12.7 | 0.7 | QV | 1.16* | 0.7m | BLEG |

| KNT39 | KNT39_464 | box sample | 2 | 12 | 12.7 | 0.7 | QV | 0.8 | BLEG | |

| KNT39 | KNT39_465 | channel | 2 | 12.7 | 13 | 0.3 | GR | 0.56 | FAA505 | |

| KNT39 | KNT39_466 | channel | 2 | 13 | 13.5 | 0.5 | GR | 0.1 | FAA505 | |

| KNT39 | KNT39_467 | channel | 2 | 13.5 | 14 | 0.5 | GR | 0.24 | FAA505 | |

| KNT39 | KNT39_468 | channel | 2 | 14 | 14.5 | 0.5 | GR | 0.09 | FAA505 | |

| KNT40 | KNT40_469 | channel | 2 | 2.5 | 3 | 0.5 | GR | 0.14 | FAA505 | |

| KNT40 | KNT40_470 | channel | 2 | 3 | 3.5 | 0.5 | GR | 0.11 | FAA505 | |

| KNT40 | KNT40_471 | channel | 2 | 3.5 | 4 | 0.5 | GR | 0.29 | FAA505 | |

| KNT40 | KNT40_472 | channel | 2 | 7 | 7.5 | 0.5 | GR | 1.5* | FA.A505 | |

| KNT40 | KNT40_473 | channel | 2 | 7.5 | 8 | 0.5 | GR | 1.47* | FAA505 | |