Attached files

| file | filename |

|---|---|

| EX-3.2 - EXHIBIT 3.2 - Genufood Energy Enzymes Corp. | exhibit32.htm |

| EX-5.1 - EXHIBIT 5.1 - Genufood Energy Enzymes Corp. | exhibit51.htm |

| EX-3.1 - EXHIBIT 3.1 - Genufood Energy Enzymes Corp. | exhibit31.htm |

| EX-23.1 - EXHIBIT 23.1 - Genufood Energy Enzymes Corp. | exhibit231.htm |

| EX-99.1 - EXHIBIT 99.1 - Genufood Energy Enzymes Corp. | exhibit991.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GENUFOOD ENERGY ENZYMES CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 2833 | 68-0681158 |

| (State or jurisdiction of incorporation | Primary Standard Industrial | IRSEmployer |

Two Allen Center

1200 Smith Street, Suite 1600

Houston, TX, 77002

Telephone: (713) 353-8834Facsimile: (713) 353-4601

(Address and telephone number of principal executive offices)

Incsmart.biz, Inc.

4421 Edward Avenue

Las Vegas, Nevada 89108

Telephone: (702) 403-8432

(Name, address and telephone number of agent for service)

with a copy to:

Dean Law Corp.

601 Union Street, Suite 4200

Seattle, Washington 98101

Telephone:(206) 274-4598 Facsimile: (206) 493-2777

| Approximate date of proposed sale to the public: | as soon as practicable after the effective date of this Registration Statement. |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company: in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

| TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | AMOUNT TO BE REGISTERED | PROPOSED MAXIMUM OFFERING PRICE PER SHARE | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE | AMOUNT OF REGISTRATION FEE (1) |

| Common Stock | 888,472 | $0.30 per share | $266,541.60 | $30.95 |

| Common Stock | 10,000,000 (2) | $0.30 per share | $3,000,000 | $348.30 |

| TOTAL | 10,888,472 | $0.30 per share | $3,266,541.60 | $379.25 |

(1)

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act.

(2)

Being sold in a Direct Public Offering.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, Dated January __, 2010

2

PROSPECTUS

![[genufoodenergyenzymess1001.jpg]](genufoodenergyenzymess1001.jpg)

GENUFOOD ENERGY ENZYMES CORP.

10,888,472 SHARES

COMMON STOCK

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus for a period of up to two years from the effective date.

Our common stock is presently not traded on any market or securities exchange.

----------------

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. See section entitled "Risk Factors" on pages 7to10of this prospectus.

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The selling shareholders will sell our shares at $0.30 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined the offering price by considering, among other factors, a business valuation that was conducted by our management. There is no assurance of when, if ever, our stock will be listed on an exchange. We are offering up to 10,000,000 shares of our common stock in a direct public offering, without any involvement of underwriters or broker-dealers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

----------------

The Date of This Prospectus Is: January __, 2010

3

Table of Contents

4

Prospective investors are urged to read this prospectus in its entirety.

We are a development stage company. We have earned no revenues to date. We have minimal assets, and have incurred losses since inception.

We are a marketing, distribution and export company specialized in enzyme products for human and animal consumption. Enzyme is a catalyst responsible for biochemical reactions in living things (including animals, plants, microorganisms), synthesis, decomposition, oxidation, transfer and isomerisation. The biotic phenomena would stop without enzymes, or the lack of it, or with its destruction. DNA would undergo a drastic change, unusual illness would occur and metabolism would become abnormal, among others. Thus, we can conclude that “Biotic phenomena are testimonies of enzyme’s activities.” Enzyme is actually a complex globule protein. It reacts optimally under body temperature. Reaction is many times faster with added enzymes. Therefore, regular consumption of enzyme does good to our well-being. In fact it has been categorized under “GRAS” (Generally Regarded As Safe) by the Food and Drug Administration. Our body loses enzymes as we grow old. It has been proven that many chronic, hereditary diseases and functional imbalance are caused by the deficiency of certain enzymes, for example, lipase (fat enzyme) deficiency causes hepatic diseases, diabetes and Vitamin A deficiency. Amylase (carbohydrate enzyme) deficiency results in liver diseases and gastro enteric diseases. Enzyme is neither a drug, medicine nor a herb. It is extracted from fruits and vegetables. It can be a natural complex enzyme, plant-based complex enzyme or microbial enzyme. It is for the body cell. It is the “Cell Activator.”Human beings and animal will die without enzyme. We plan to begin marketing and exporting our enzyme products within the next 12 months. Our initial target market is Asia, which includes: Taiwan, China, Hong Kong, Macau, Singapore, Malaysia, Thailand and Sri Lanka. Our goal is to appoint a Country Sole Distributor in each country, each distributing our enzyme products for human consumption, animal consumption and special outlet category

We have no revenues, have achieved significant losses since inception, have had only limited operations and have been issued a going concern opinion by our auditors. To date, we have entered into agreements with the following parties:

·

On July 1, 2010, we entered into a Sole Export Marketing Agent Agreement with Origo Biochemical Technologies Inc. to represent them and to market their enzyme products to Thailand. These enzyme products are for human consumption. We earn a sales commission on export sales to Thailand as arranged by us.

·

On July 6, 2010, we entered into a Manager Consulting Service Agreement with Access Finance and Securities (NZ) Limited to provide management and consulting services related to the following: negotiation with professionals on our behalf, manage parties related to the S-1 registration statement, and to assist us in the determination of an effective future strategy.

·

On July 26, 2010, we have reached a verbal agreement with Specialty Enzymes and Biotechnologies Co. (AST Enzymes) for supplying their enzyme products for human and animal consumption under our private label. The brand name for the enzyme products for human consumption is Cellax-FG1, Cellax-SP, Cellax-E2AF, Cellax-E, Cellax-SNU and Cellax-DG1. The brand name for the enzyme products for animal consumption is Anilax-SP3, Anilax-EPET, Anilax-SW1013, Anilax-SEB and Anilax-AFL2500. These brand names belong to us.

·

On September 21, 2010, we entered into an OEM Manufacturing Agreement with Origo Biochemical Technologies Inc. for contract manufacturing of enzyme products for human and animal consumption under our private label. The brand name for the OEM Enzyme Products for human consumption is Cellax-NCE, Cellax-NCE Plus, Cellax-GFL, Cellax-GFL Plus, Cellax-TT and Cellax-TT Plus. They come in powder form as well as in capsules. For animal consumption, the brand name is Anilax-Super. For human consumption, enzyme products cater hospitals, medical centers, clinics, pharmacies and drug stores which are classified as Special Outlet, the brand name is Medilax, and Armilax the brand name for the enzyme products supplying to armed forces and the police forces. These brand names belong to us.

·

On September 21, 2010, we entered into a Sole Marketing Agent Agreement with Access Management Consulting and Marketing Pte Ltd. for the marketing of our range of enzyme products and to source, select and interview country sole distributors for the distribution of our range of enzyme products to the world at large.

·

On October 11, 2010, we entered into a Sole Distributorship Agreement (General Outlet-Human Consumption) and Private Placement with Taiwan Cell Energy Enzymes Corporation for marketing and distribution of our range of enzyme products in the Republic of China (Taiwan).

5

As of September 30, 2010, we have cash on hand of $38,677. We may need to raise additional funds through public or private debt or sale of equity to achieve our current business strategy. The financing we need may not be available when needed. Even if financing is available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences or other terms. Our inability to obtain financing will inhibit to implement our development strategy, which could require us to diminish or suspend our operations and possibly cease our operations.

We were incorporated on June 21, 2010 under the laws of the state of Nevada. Our principal office is located at Two Allen Center, 1200 Smith Street, Suite 1600, Houston, Texas 77002. Our telephone number is (713) 353-8834.

The Offering:

| Securities Being Offered | Up to 10,888,472 shares of common stock. |

| Offering Price | The selling shareholders will sell our shares at $0.30 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined the offering price by considering, among other factors, a business valuation that was conducted by our management. |

| Terms of the Offering | The selling shareholders will determine when and how they will sell the common stock offered in this prospectus. |

| Termination of the Offering | The offering will conclude when all of the 10,000,000shares of common stock have been sold, the shares no longer need to be registered to be sold due to the operation of Rule 144 or we decide at any time to terminate the registration of the shares at our sole discretion. In any event, the offering shall be terminated no later than two years from the effective date of this registration statement. |

| Securities Issued And to be Issued | 233,308,472 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders. |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. However, we will receive proceeds from the shares of our common stock that we sell we sell pursuant to our Direct Public Offering. See “Use of Proceeds.” |

| Market for the common stock | There has been no market for our securities. Our common stock is not traded on any exchange or on the Over-the-Counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with FINRA for our common stock to become eligible for quotation on the Over-the-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. There is no assurance that a trading market will develop or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so. |

6

Summary Financial Information

The following financial information summarizes the more complete historical financial information at the end of this prospectus.

| | | As of September 30, 2010 (Audited) |

| Balance Sheet | | |

| Total Assets | $ | 45,115 |

| Total Liabilities | $ | 309,561 |

| Stockholders’ Deficit | $ | (264,446) |

| | | Period from June 21, 2010 (date of inception) to September 30, 2010 (Audited) |

| Income Statement | | |

| Total Expenses | $ | 23,947 |

| Other Income | $ | 1 |

| Net Loss | $ | (23,946) |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

Our business plan calls for ongoing expenses in connection with the marketing and development of enzyme products. We have generated no revenues from our inception to September 30, 2010.

While at September 30, 2010, we had cash on hand of $38,677 we have accumulated a deficit of $23,946 in business development and administrative expenses. At this rate, we anticipate that additional funding will be needed for general administrative expenses and marketing costs.

In order to expand our business operations, we anticipate that we will have to raise additional funding. If we are not able to raise the capital necessary to fund our business expansion objectives, we may have to delay the implementation of our business plan.

We do not currently have any arrangements for financing. Obtaining additional funding will be subject to a number of factors, including general market conditions, investor acceptance of our business plan and initial results from our business operations. These factors may impact the timing, amount, terms or conditions of additional financing available to us. The most likely source of future funds available to us is through the sale of additional shares of common stock or advances from our sole director.

7

WE LACK AN OPERATING HISTORY AND HAVE NOT GENERATED SIGNIFICANT REVENUES OR PROFIT TO DATE. THERE IS NO ASSURANCE OUR FUTURE OPERATIONS WILL RESULT IN PROFITABLE REVENUES. IF WE CANNOT GENERATE SUFFICIENT REVENUES TO OPERATE PROFITABLY, WE MAY HAVE TO CEASE OPERATIONS.

We were incorporated on June 21, 2010. We have just started our proposed business operations and have only realized minimal revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to earn profit by developing and marketing enzyme products. We cannot guarantee that we will be successful in generating significant revenues and profit in the future. Failure to generate significant revenues and profit will cause us to suspend or cease operations.

IF YI LUNG LIN, OUR SOLE OFFICER, SHOULD RESIGN OR DIE, WE WILL NOT HAVE A CHIEF EXECUTIVE OFFICER. THIS COULD RESULT IN OUR OPERATIONS SUSPENDING, AND YOU COULD LOSE YOUR INVESTMENT.

We depend on the services of our sole officer and director, Yi Lung Lin, for the future success of our business. The loss of the services of Mr. Lin could have an adverse effect on our business, financial condition and results of operations. If he should resign or die we will not have a chief executive officer. If that should occur, until we find another person to act as our chief executive officer, our operations could be suspended. In that event it is possible you could lose your entire investment. We do not carry any key personnel life insurance policies on Mr. Lin and we do not have a contract for his services.

WE MAY HAVE DIFFICULTY ATTRACTING AND RETAINING SKILLED PERSONNEL. OUR FAILURE TO DO SO COULD CAUSE US TO GO OUT OF BUSINESS.

Our future success will depend in large part on our ability to attract and retain highly skilled management, sales, marketing, and finance and product development personnel. Competition for such personnel is intense, and there can be no assurance that we will be successful in attracting or retaining such personnel. Failure to attract and retain such personnel could have a material adverse effect on our operations and financial condition or cause us to go out of business.

WE WILL NEED SIGNIFICANT CAPITAL REQUIREMENTS TO CARRY OUT OUR BUSINESS PLAN, AND WE WILL NOT BE ABLE TO FURTHER IMPLEMENT OUR BUSINESS STRATEGY UNLESS SUFFICIENT FUNDS ARE RAISED, WHICH COULD CAUSE US TO DISCONTINUE OUR OPERATIONS.

We will require significant expenditures of capital in order to acquire and develop our planned operations. We plan to obtain the necessary funds through private equity offerings. We may not be able to raise sufficient amounts from our planned sources. In addition, if we drastically underestimate the total amount needed to fully implement our business plan, our ability to continue our business will be adversely affected.

Our ability to obtain additional financing is subject to a number of factors, including market conditions, investor acceptance of our business plan, and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financing unattractive or unavailable to us. If we are unable to raise additional financing, we will have to significantly reduce our spending, delay or cancel planned activities or substantially change our current corporate structure. In such an event, we intend to implement expense reduction plans in a timely manner. However, these actions would have material adverse effects on our business, revenues, operating results and prospects, resulting in a possible failure of our business.

WE MAY BE SUSCEPTIBLE TO AN ADVERSE EFFECT ON OUR BUSINESS DUE TO THE CURRENT WORLDWIDE ECONOMIC CRISIS

Our market and sales results could be greatly impacted by the current worldwide economic crisis, making it difficult to reach sales goals and thus generate significant revenue.

8

WE HAVE NO EXPERIENCE AS A PUBLIC COMPANY. OUR INABILITY TO SUCCESSFULLY OPERATE AS A PUBLIC COMPANY COULD CAUSE YOU TO LOSE YOUR ENTIRE INVESTMENT.

We have never operated as a public company. We have no experience in complying with the various rules and regulations, which are required of a public company. As a result, we may not be able to operate successfully as a public company, even if our operations are successful. We plan to comply with all of the various rules and regulations, which are required of a public company. However, if we cannot operate successfully as a public company, your investment may be materially adversely affected. Our inability to operate as a public company could be the basis of your losing your entire investment.

WE WILL INCUR INCREASED COSTS AS A RESULT OF BEING A PUBLIC COMPANY

Upon completion of this offering, we will become a public company and expect to incur significant legal, accounting and other expenses that we did not incur as a private company. Moreover, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the Securities and Exchange Commission and the Nasdaq Stock Market, has imposed additional requirements on corporate governance practices of public companies. We expect these new rules and regulations to increase our legal and financial compliance costs and to make some corporate activities more time-consuming and costly, which may have a materially adverse impact on our business.

U.S. INVESTORS MAY EXPERIENCE DIFFICULTIES IN ATTEMPTING TO EFFECT SERVICE OF PROCESS AND TO ENFORCE JUDGMENTS BASED UPON U.S. FEDERAL SECURITIES LAWS AGAINST THE COMPANY AND ITS SOLE NON-U.S. RESIDENT OFFICER AND OUR DIRECTORS AND A U.S. OR FOREIGN PLAINTIFF MAY LACK STANDING OR OTHERWISE BE UNABLE TO BRING A LAWSUIT IN A TAIWANESE OR CHINESE COURT, INCLUDING A CASE WHICH IS PREDICATED UPON U.S. SECURITIES LAWS.

Our sole officer and all of our directors are not residents of the United States. Consequently, it may be difficult for investors to effect service of process on Mr. Huang and our other directors in the United States and to enforce judgments obtained in United States courts against Mr. Huang based on the civil liability provisions of the United States securities laws. Since all our assets are located in Taiwan it may be difficult or impossible for U.S. investors to collect a judgment against us. As well, any judgment obtained in the United States against us may not be enforceable in the United States.

In addition, a U.S. or foreign plaintiff may lack standing or otherwise be unable to bring a lawsuit in a Taiwanese or Chinese court, including a case which is predicated upon U.S. securities laws.

RISKS RELATED TO OUR INDUSTRY

CURRENCY EXCHANGE RATE FLUCTUATIONS MAY INCREASE OUR COSTS.

The exchange rates between the U.S. dollar and non-U.S. currencies in which we conduct our business have and will likely fluctuate in the future. Any appreciation in the value of these non-U.S. currencies would result in higher expenses for our company. We do not have any hedging arrangements to protect against such exchange rate exposures.

IMPORT/EXPORT REGULATIONS AND TARIFFS MAY CHANGE AND INCREASE OUR COSTS.

We are subject to risks associated with the regulations relating to the export of products. We cannot predict whether the export of our products will be adversely affected by changes in, or enactment of new quotas, duties, taxes or other charges or restrictions imposed by the Asian countries in the future. Any of these factors could have a material adverse effect on our operating costs.

9

RISKS RELATED TO OUR OFFERING

OUR SHARES OF COMMON STOCK ARE SUBJECT TO THE “PENNY STOCK’ RULES OF THE SECURITIES AND EXCHANGE COMMISSION AND THE TRADING MARKET IN OUR SECURITIES WILL BE LIMITED, WHICH WILL MAKE TRANSACTIONS IN OUR STOCK CUMBERSOME ANDMAY REDUCE THE VALUE OF AN INVESTMENT IN OUR STOCK.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in "penny stocks.” Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. A broker-dealer must also provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer, and sales person in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for stock that becomes subject to those penny stock rules. If a trading market for our common stock develops, our common stock will probably become subject to the penny stock rules, and shareholders may have difficulty in selling their shares.

THERE IS NO CURRENT TRADING MARKET FOR OUR SECURITIES AND IF A TRADING MARKET DOES NOT DEVELOP, PURCHASERS OF OUR SECURITIES MAY HAVE DIFFICULTY SELLING THEIR SHARES.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to have a market maker apply for admission to quotation of our securities on the Over-the-Counter Bulletin Board after the Registration Statement relating to this prospectus is declared effective by the SEC. We do not yet have a market maker who has agreed to file such application. If for any reason our common stock is not quoted on the Over-the-Counter Bulletin Board or a public trading market does not otherwise develop, purchasers of the share may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

ANY ADDITIONAL FUNDING WE ARRANGE THROUGH THE SALE OF OUR COMMON STOCK WILL RESULT IN DILUTION TO EXISTING SHAREHOLDERS.

We must raise additional capital in order for our business plan to succeed. Our most likely source of additional capital will be through the sale of additional shares of common stock. Such stock issuances will cause stockholders' interests in our company to be diluted. Such dilution will negatively affect the value of investors’ shares.

YOUR PERCENTAGE OWNERSHIP IN US MAY BE DILUTED BY FUTURE ISSUANCES OF CAPITAL STOCK, WHICH COULD REDUCE YOUR INFLUENCE OVER MATTERS ON WHICH STOCKHOLDERS VOTE.

Our Board of Directors has the authority, without action or vote of our stockholders, to issue all or any part of our authorized but unissued shares of common stock, including shares issuable upon the exercise of options or shares that may be issued to satisfy our payment obligations. Issuances of additional common stock would reduce your influence over matters on which our stockholders vote.

10

WE DO NOT EXPECT TO PAY DIVIDENDS IN THE FORESEEABLE FUTURE WHICH MAY MAKE IT MORE DIFFICULT FOR YOU TO EARN A RETURN ON YOUR INVESTMENT WITH US.

We have never paid any dividends on our common stock. We do not expect to pay cash dividends on our common stock at any time in the foreseeable future. The future payment of dividends directly depends upon our future earnings, capital requirements, financial requirements and other factors that our board of directors will consider. Since we do not anticipate paying cash dividends on our common stock, return on your investment, if any, will depend solely on an increase, if any, in the market value of our common stock. Therefore, you may have difficulty earning a return on your investment with us.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in the “Risk Factors” section and elsewhere in this prospectus.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Based on the maximum offering price, we estimate that our net proceeds from the Offering, after deducting commission and other estimated expenses payable in relation to the Offering (estimated to be $50,000) will be approximately $2,950,000.

We intend to use our net proceeds from the Offering for the following purposes:

·

approximately $500,000 for enzyme research and development including the establishment of laboratory research with clinical test facility;

·

approximately $200,000 for the purchase of computers, computer software, office equipment and furniture and fittings; and

·

approximately $2,250,000for working capital.

The foregoing represents our best estimate of our allocation of our net proceeds from the Offering based on our current plans and estimates regarding our anticipated expenditures. Actual expenditures may vary from these estimates, and we may find it necessary or advisable to re-allocate our net proceeds within the categories described above or to use portions of our net proceeds for other purposes.

Pending the use of our net proceeds in the manner described above, we may also use our net proceeds for our working capital, place the funds in fixed deposits with banks and financial institutions or use the funds to invest in short-term money market instruments, as our Directors may deem appropriate in their absolute discretion.

We estimate that the expenses of the Offering and the application for listing, including the underwriting fees and selling commission, and all other incidental expenses relating to the Offering, will amount to approximately $50,000.

11

Our direct public offering is being made on a self-underwritten basis - with no minimum and a maximum of $3,000,000. The table below sets forth the use of proceeds if 25%, 50%, 75% or 100% is sold.

|

| 25% | 50% | 75% | 100% |

| Gross Proceeds | $750,000 | $1,500,000 | $2,250,000 | $3,000,000 |

| Offering Expenses | $50,000 | $50,000 | $50,000 | $50,000 |

| Net Proceeds | $700,000 | $1,450,000 | $2,200,000 | $2,950,000 |

Determination of Offering Price

The selling shareholders will sell our shares at $0.30 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined the offering price by considering, among other factors, a business valuation that was conducted by our management. There is no assurance of when, if ever, our stock will be listed on an exchange.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

The selling shareholders named in this prospectus are offering all of the 888,472 shares of common stock offered through this prospectus, not including our direct public offering. These shares were acquired from us in private placements that were exempt from registration provided under Regulation S of the Securities Act of 1933. Our reliance upon the exemption under Rule 903 of Regulation S of the Securities Act was based on the fact that the sale of the securities was completed in an "offshore transaction,” as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities. Each investor was not a US person, as defined in Regulation S, and was not acquiring the securities for the account or benefit of a US person.

12

The following table provides as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

-

the number of shares owned by each prior to this offering;

-

the total number of shares that are to be offered for each;

-

the total number of shares that will be owned by each upon completion of the offering; and

-

the percentage owned by each upon completion of the offering.

|

|

|

|

|

|

| Name Of Selling Shareholder | Shares Owned Prior To This Offering | Total Number Of Shares To Be Offered For Selling Shareholders Account | Total Shares to Be Owned Upon Completion Of This Offering | Percentage of Shares owned Upon Completion of This Offering |

| Access Equity Capital Management Corp. (1) | 50,000,000 | 25,000 | 49,975,000 | 21.4% |

| Access Finance and Securities (NZ) Limited (2) | 50,000,000 | 25,000 | 49,975,000 | 21.4% |

| Hsi-Ling Chang | 6,667 | 6,667 | Nil | Nil |

| I-Jen Chen (3) | 20,010,000 | 50,000 | 19,960,000 | 8.6% |

| Jen-Yi Chen | 6,667 | 6,667 | Nil | Nil |

| Mei-Yu Chen | 7,000 | 7,000 | Nil | Nil |

| Ming-Sheng Chen | 4,800 | 4,800 | Nil | Nil |

| Yi-Chou Chen (4) | 20,010,000 | 50,000 | 19,960,000 | 8.6% |

| Yong-Liang Chen | 7,000 | 7,000 | Nil | Nil |

| Chiu-Hsiang Chen Wu | 7,000 | 7,000 | Nil | Nil |

| Ssu-Yu Chou | 2,800 | 2,800 | Nil | Nil |

| Chun-Min Chu | 2,800 | 2,800 | Nil | Nil |

| Chu-Ao Fang | 25,000 | 25,000 | Nil | Nil |

| Chao-Yuan Hsieh | 6,667 | 6,667 | Nil | Nil |

| Chen-Wen Hsu (5) | 6,000,000 | 50,000 | 5,950,000 | 2.6% |

| Ching-Ming Hsu | 2,000,000 | 50,000 | 1,950,000 | (8) |

| Fu-Chung Hsu | 6,667 | 6,667 | Nil | Nil |

| Hui-Cheng Hsu Lin | 1,875,000 | 50,000 | 1,825,000 | (8) |

| Chien-Yi Huang | 6,667 | 6,667 | Nil | Nil |

| Hsiu-Lien Huang | 10,000 | 10,000 | Nil | Nil |

| Pi-Chiu Huang | 2,800 | 2,800 | Nil | Nil |

| Shih-Ming Huang | 2,800 | 2,800 | Nil | Nil |

| Ya-Lin Jao | 6,000,000 | 50,000 | 5,950,000 | 2.6% |

| Chi-Ju Lee | 2,800 | 2,800 | Nil | Nil |

| Shun-Li Li | 6,667 | 6,667 | Nil | Nil |

| Hsuan-I Lin | 7,000 | 7,000 | Nil | Nil |

| Jong-Tsun Lin | 25,000 | 25,000 | Nil | Nil |

| Shu-Chen Lin | 6,667 | 6,667 | Nil | Nil |

| Shu-Hui Lin | 6,667 | 6,667 | Nil | Nil |

| Tzu-Yin Lin | 18,000 | 18,000 | Nil | Nil |

| Hsiao-Ping Liu | 18,000 | 18,000 | Nil | Nil |

| Yueh-E Lo | 18,000 | 18,000 | Nil | Nil |

| Hsin-Yin Lu | 6,667 | 6,667 | Nil | Nil |

| Pei-Ching Pai | 1,875,000 | 50,000 | 1,825,000 | (8) |

| Chi-Hua Shih | 6,667 | 6,667 | Nil | Nil |

| Chin-Lien Sun | 7,000 | 7,000 | Nil | Nil |

| Taiwan Cell Energy Enzymes Corp. (6) | 25,000,000 | 50,000 | 24,950,000 | 10.7% |

| Kuei-Hua Tsai | 5,625,000 | 50,000 | Nil | Nil |

| Ching-Tsung Tseng | 6,667 | 6,667 | Nil | Nil |

| Tz-Jie Tseng | 6,667 | 6,667 | Nil | Nil |

| Yen-Lun Tseng | 6,667 | 6,667 | Nil | Nil |

| Chiung-Hui Wang | 6,667 | 6,667 | Nil | Nil |

| Hsiu-Yu Wang | 6,667 | 6,667 | Nil | Nil |

| Huei-Ling Wang (7) | 38,625,000 | 50,000 | 38,575,000 | 16.5% |

| An-Ya Wu | 6,000,000 | 50,000 | 5,950,000 | 2.6% |

| Ching-Pao Wu | 6,667 | 6,667 | Nil | Nil |

| En-Chi Wu | 7,000 | 7,000 | Nil | Nil |

| Hsueh-Wei Yang | 7,000 | 7,000 | Nil | Nil |

(1)

Yi Lung Lin, our President, has voting and investment control over shares held by Access Equity Capital Management Corp.

(2)

Yi Lung Lin, our President, has voting and investment control over shares held by Access Finance and Securities (NZ) Limited.

(3)

I-Jen Chen is a director on our Board of Directors.

(4)

Yi-Chou Chen is a director on our Board of Directors.

(5)

Chen Wen Hsu is a director on our Board of Directors.

(6)

Chen Wen Hsu is a director on our Board of Directors, and has voting and investment control over shares held by Taiwan Cell Energy Enzymes Corp.

(7)

Huei-Ling Wang is the wife of our President Yi Lung Lin.

(8)

Less than 1%.

13

The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The percentages are based on 233,308,472 shares of common stock outstanding on the date of this prospectus.

Other than disclosed above, none of the selling shareholders:

1.

has had a material relationship with us other than as a shareholder at any time within the past three years;

2.

has ever been one of our officers or directors;

3.

is a broker-dealer; or broker-dealer's affiliate.

In addition, we are offering up to 10,000,000 shares of common stock on a direct public offering, without any involvement of underwriters or broker-dealers, no minimum. The offering price is $0.30 per share or prevailing market prices. The shares are being offered for a period not to exceed 180 days, unless extended by our Board of Directors for an additional 90 days.

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions. There are no arrangements, agreements or understandings with respect to the sale of these securities.

The selling shareholders will sell our shares at $0.30 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined the offering price by considering, among other factors, a business valuation that was conducted by our management. There is no assurance of when, if ever, our stock will be listed on an exchange or quotation system.

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144, when eligible.

If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above. If these shares being registered for resale are transferred from the named selling shareholders and the new shareholders wish to rely on the prospectus to resell these shares, then we must first file a prospectus supplement naming these individuals as selling shareholders and providing the information required concerning the identity of each selling shareholder and he or her relationship to us. There is no agreement or understanding between the selling shareholders and any partners with respect to the distribution of the shares being registered for resale pursuant to this registration statement.

We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1.

Not engage in any stabilization activities in connection with our common stock;

2.

Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

3.

Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act.

14

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which:

-

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

-

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements;

-

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price;

-

contains a toll-free telephone number for inquiries on disciplinary actions;

-

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

-

contains such other information and is in such form (including language, type, size, and format) as the Commission shall require by rule or regulation;

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with:

-

bid and offer quotations for the penny stock;

-

the compensation of the broker-dealer and its salesperson in the transaction;

-

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

-

monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

In addition, we are offering up to 10,000,000 shares of common stock on a direct public offering, without any involvement of underwriters or broker-dealers, no minimum. The offering price is $0.30 per share or prevailing market prices. The shares are being offered for a period not to exceed 180 days, unless extended by our Board of Directors for an additional 90 days.

General

Our authorized capital stock consists of 500,000,000 shares of common stock at a par value of $0.001 per share.

Common Stock

As of January 12, 2010, there were 233,308,472 shares of our common stock issued and outstanding that are held by 48 stockholders of record.

15

Holders of our common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of our common stock representing a majority of the voting power of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our articles of incorporation.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

We do not have an authorized class of preferred stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, an interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Dean Law Corp. has provided an opinion on the validity of our common stock.

16

The financial statements included in this prospectus and the registration statement have been audited by M&K CPAS, PLLC to the extent and for the periods set forth in their report appearing elsewhere in this document and in the registration statement filed with the SEC, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

General

We were incorporated in the State of Nevada on June 21, 2010.

We are a start-up company and our main focus is to promote, market, distribute and export enzyme products to the Asian market, to begin with, Taiwan, and then followed by China, Hong Kong, Macau, Thailand, Malaysia, Singapore and Sri Lanka. These enzyme products are specifically formulated for our marketing and distribution under contract manufacturing arrangements. There are two contracted OEM manufacturers, one in Taiwan and the other in the United States.

Enzymes are not living things, they are inanimate like minerals. But unlike minerals, they are made by living cells. Thus, enzyme is a catalyst responsible for biochemical reactions in living things (including animals, plants, microorganisms), synthesis, decomposition, oxidation, transfer and isomerisation. Without enzyme, the lack of it or with its destruction, biotic phenomena would stop, DNA would undergo a drastic change, unusual illnesses would occur and metabolism would become abnormal, among others. Hence, we can conclude that “Biotic phenomena are testimonies of enzyme’s activities.”

Enzyme is actually a complex globule protein. It reacts optimally under body temperature. Reaction takes many times faster with added enzymes. Therefore, regular consumption of enzyme is good to our well-being. In fact it has been categorized under “GRAS” (Generally Regarded As Safe) by the Food and Drug Administration. Our body loses enzymes as we grow old. It has been proven that many chronic, hereditary diseases and functional imbalance are caused by the deficiency of certain enzymes, for example, lipase (fat enzyme) deficiency causes hepatic diseases, diabetes and Vitamin A deficiency. Amylase (carbohydrate enzyme) deficiency results in liver diseases and gastro enteric diseases. An enzyme is neither a drug, medicine nor a herb. It is the “Cell Activator.” It is extracted from fruits and vegetables. It can be a natural complex enzyme, plant-based complex enzyme or microbial enzyme. It is for the body cell. It is the “Cell Activator.”Human beings and animal will die without enzyme. Therefore, there are two types of enzyme products, Enzyme for Human Consumption and Enzyme for Animal consumption that we intend to promote, market, distribute and export.

We have been appointed by Origo Biochemical Technologies Inc, Taiwan as their Sole Export Marketing Agent to market their enzyme products for human consumption to Thailand and business has started since July 1, 2010. Our goal is to commence promoting, marketing, distribution and export of the enzyme products specifically formulated for us, packed under our private label, pursuant to the contract manufacturing arrangements for the Asian market by the appointment of country sole distributor for each category of the enzyme products. These country sole distributors will in turn distribute it to wholesalers and retailers for resale to the general public for consumption, following the Multi Level Marketing – Franchise Investor Dealer Related (MLM-FIDR) concept.

17

Aside for the general public consumption or General Outlet Category, a country sole distributor each for Special Outlet – Category A, such as the hospital, medical centre, clinic, pharmacies and drug stores. Category B, for the country armed forces and police force, and Category C, for animal and bird racing such as pigeon racing, will be appointed.

To date, through our duly appointed Marketing Agent, Access Management Consulting and Marketing Pte Ltd, we have entered into one sole distributorship agreement in which a distributor with exclusive right has been appointed for the marketing and distribution of our range of enzyme products for human consumption in the territory of the Republic of China (Taiwan). It is for the General Outlet Category. In order to successfully promote, market and distribute our range of enzyme products for human consumption throughout the general public, we intend to establish a GEEC Enzyme Club and to educate the general public through a series of enzyme education programs including enzyme club exchange program with other enzyme clubs established elsewhere.

As part of our expansion plans, we have begun to target and hope to make contact formal commitments with other marketing and distribution companies for marketing and distribution of our range of enzyme products for human consumption and animal consumption in targeted countries. This includes the Special Outlet Category, but there is no guarantee that we will be able to do so.

To date, we have succeeded in the appointment of Taiwan Cell Energy Enzymes Corporation, a marketing and distribution company in Taiwan specialized in the promotion and distribution of enzyme products. They will distribute our range of enzyme products for human consumption to the general public in Taiwan with an annual purchase quota of US $2 million. The enzyme market for human consumption is very substantial and how successful we can penetrate and capture the market like Taiwan for example will depend on how successful we are implementing our business plan. Both enzyme products for human consumption and animal consumption have a tremendous consumption volume in the Asian market. It is a virgin market for enzyme products. We plan to begin market and distribute our range of enzyme products, under our private label, within the next 12 months.

We now have an office in the United States. It is situated at Two Allen Center, 1200 Smith Street, Suite 1600, Houston, Texas 77002. Our telephone number is 713 353 8834. We pay rent for this office. We intend to upgrade the present office with employment of suitable qualified personnel to manage the sales administration department and product development department. We also have plans to recruit an enzymologist and establish a laboratory for enzyme research and development with the view to improve our present range of enzyme products, innovation of new enzyme products and to carry out clinical tests. Our ability to do all these will depend on our financial condition and our ability to secure additional financing, whether through public or private equity or debt financing, arrangements with security holders or other sources to fund the operations. However, these sources of additional funding may not be available, or if available, may be on terms unacceptable to us.

Enzyme for Human Consumption

There is only one specialized natural complex enzyme manufacturer in Taiwan producing natural enzyme for human consumption since 1997, Origo Biochemical Technologies Inc. Our Directors, Mr. Chen Yi Chou and Mr. Chen I Jen are brothers, and are the sons of the Madam Wang Feng Peng, the President of Origo Biochemical Technologies Inc. Mr. Chen I Jen is the general manager of Origo Biochemical Technologies Inc. On July 1, 2010, we entered into a Sole Export Marketing Agent Agreement with Origo Biochemical Technologies Inc to market their enzyme products for human consumption to Thailand. On September 21, 2010, we entered into an OEM Manufacturing Agreement with Origo Biochemical Technologies Inc for contract manufacturing a range of enzyme products for human consumption under our private label. Origo has a monthly production output capacity of about 12 to 15 tons of enzymes in powder form.

18

There is a limited enzyme manufacturer in the United States for contract manufacturing for our private label. On September 21, 2010, we reached an agreement with Specialty Enzymes and Biochemicals Co. (BSC Biochemicals), USA for supplying various types of enzyme product to us under our private label. SEB has been in operation since 1957 and is the largest enzyme manufacturer and enzymes provider in the US.

Both enzyme manufacturers operate under ISO 9001:2000 certified manufacturing facilities using advanced fermentation technologies.

Origo Natural Complex Enzyme

![[genufoodenergyenzymess1002.jpg]](genufoodenergyenzymess1002.jpg)

* Note – we do not own or produce the above enzyme product; it is just an example of the enzyme product we market for export to Thailand in which we are the Sole Export Marketing Agent for

Origo Biochemical Technologies Inc.

* Note – we do not own or produce the above enzyme product; it is just an example of the enzyme product we market for export to Thailand in which we are the Sole Export Marketing Agent for

Origo Biochemical Technologies Inc.

19

Our Range Of Enzyme Products for Human Consumption

![[genufoodenergyenzymess1003.jpg]](genufoodenergyenzymess1003.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-NCE” belongs to us.

Extracted from fruits and vegetables, Cellax-NCE is a natural complex digestive enzyme which enhances digestion and for absorption of nutrients. Enhance metabolism and anti-inflammation. It is a dietary supplement. It comes in original powder form, one packet 5g. One box has 50 packets.

![[genufoodenergyenzymess1004.jpg]](genufoodenergyenzymess1004.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-GFL” belongs to us.

Extracted from fruits and vegetables, Cellax-GFL is a natural complex enzyme assists liver recovery and stimulates immune system health. It also enhance metabolism, drug detoxification, reduce carcinogens and promote cell activation. Therapeutic type. It is a dietary supplement that is ideal for a liver patient. It comes in original powder form, one packet 7g. One box has 60 packets.

20

![[genufoodenergyenzymess1005.jpg]](genufoodenergyenzymess1005.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-TT” belongs to us.

Extracted from fruits and vegetables, Cellax-TT is a natural complex enzyme assists health recovery and maintains immune system health. Therapeutic type. It is a dietary supplement. With mucosaccride-peptide, Cellax-TT gives protection to body cell during radiation process. It mitigates the side effect of chemotherapy. It is ideal for a cancer patient. It comes in original powder form, one packet 10g. One box has 50 packets.

![[genufoodenergyenzymess1007.gif]](genufoodenergyenzymess1007.gif)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-FG1” belongs to us.

It is a microbial enzyme. A full-spectrum blend of probiotics; prebiotics and enzymes expertly formulated to help maintain a proper balance of intestinal micro flora and may prevent the growth of Candida. It is a dietary supplement. It comes in capsule form each capsule 500mg. There are 180 capsules per bottle.

21

![[genufoodenergyenzymess1009.gif]](genufoodenergyenzymess1009.gif)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-SP” belongs to us.

It is a microbial enzyme. Cellax-SP Serrapeptase is enterically coated to survive the acidic conditions of the stomach. This allows for greater absorption in the small intestine and thus, greater fibrinolytic activity. It is a dietary supplement that comes in capsule form, each capsule being 500mg. There are 60 capsules per bottle.

![[genufoodenergyenzymess1011.gif]](genufoodenergyenzymess1011.gif)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-E2AF” belongs to us.

It is a microbial enzyme. Cellax-E2AF is a dietary supplement providing nutritional support for healthy joint function. An enzyme therapy solution for inflammation management that comes in capsule form; each capsule being 750mg.There are 90 capsules per bottle.

22

![[genufoodenergyenzymess1013.gif]](genufoodenergyenzymess1013.gif)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-E” belongs to us.

It is a microbial enzyme. Cellax-E is a powerful systemic enzyme blend formulated to support normal fibrin metabolism and healthy response to inflammation. It features an enterically coated serrapeptase that can survive the acidic conditions of the stomach. It is a dietary supplement. It comes in capsule form each capsule 500mg. There are 450 capsules per bottle.

![[genufoodenergyenzymess1015.gif]](genufoodenergyenzymess1015.gif)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-SNU” belongs to us.

It is a microbial enzyme, plant enzyme, herbs and vitamins. Cellax-SNU is a powerful systemic enzyme blend formulated to support a healthy cardiovascular system and to maintain normal fibrin metabolism. It promotes healthy circulation by reducing excessive fibrin levels and reducing blood viscosity. It is a dietary supplement. It comes in capsule form each capsule 500mg. There are 150 capsules per bottle.

23

![[genufoodenergyenzymess1017.gif]](genufoodenergyenzymess1017.gif)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Cellax-DG1” belongs to us.

It is a microbial enzyme, plant enzyme, herbs and vitamins. Cellax-DG1 is a broad-spectrum digestive enzyme blend formulated to enhance nutrient absorption and bioavailability. It supports proper digestion of dairy, legumes, cruciferous vegetables, cereal grains, proteins and other foods. It is a dietary supplement. It comes in capsule form each capsule 500mg. There are 90 capsules per bottle.

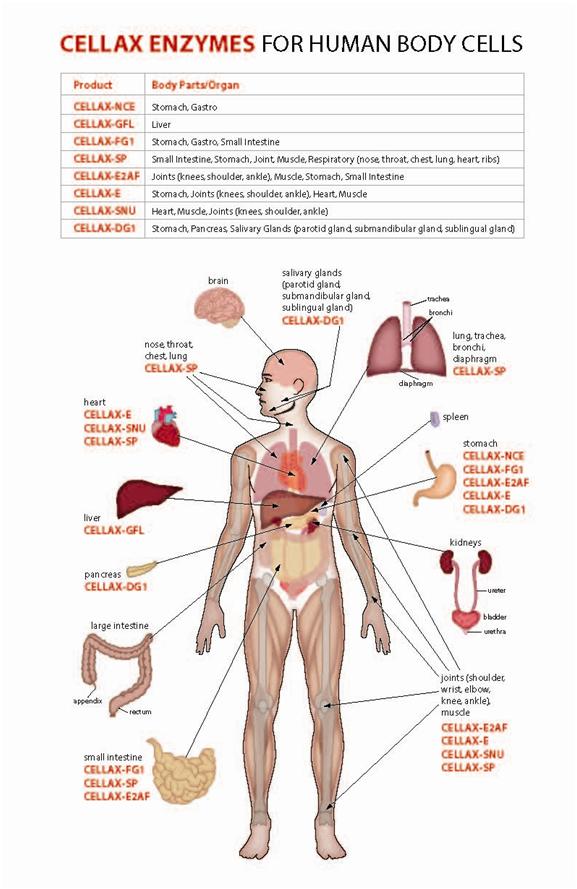

In summary, our Cellax range of enzyme products in capsule is displayed below:

![[genufoodenergyenzymess1018.jpg]](genufoodenergyenzymess1018.jpg)

Cellax Range of Enzyme Products in Capsule

24

The following is a Cellax Enzymes for Human Body Cells Chart, which shows the Cellax enzyme products applicability to the human body cells to the respective organs:

25

Our Range of Enzyme Products for Animal Consumption

![[genufoodenergyenzymess1020.jpg]](genufoodenergyenzymess1020.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Anilax-Super” belongs to us.

It is a natural complex enzyme. Anilax-Super is a supplement feed for porcine, chicken and bovine consumption. It enhances porcine to gain weight fast. For chicken, it increases fertilization rate, hatching rate and increases egg weight. As to Bovine, improves growth, increase protein digestion rate and increase lactation.

![[genufoodenergyenzymess1021.jpg]](genufoodenergyenzymess1021.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Anilax-SP3” belongs to us.

Anilax-SP3 is a product specially formulated for the digestive system of dogs and cats. It provides natural relief such as dry or scaly hair coat, skin problems, digestive disorders, joint difficulties, immune disorders, excessive shedding, weight problems, allergies, bloating, lethargy, hairballs, flatulence, coprophagia and wound healing.

26

![[genufoodenergyenzymess1022.jpg]](genufoodenergyenzymess1022.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Anilax-EPET” belongs to us.

Anilax-EPET is a multi enzyme blend of non-animal source enzymes containing a combination of proteases as well as other enzymes to facilitate movement as well as tissue and muscle healing. It contains Rutin, an important bioflavonoid that may help repair damaged tissue.

27

![[genufoodenergyenzymess1023.jpg]](genufoodenergyenzymess1023.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Anilax-SW1013” belongs to us.

Anilax-SW1013 is a unique blend of enzymes developed especially for swine feed supplementation. The enzymes encompassing a wide range of activities, aid in the breakdown of organic feed substrates, thereby encouraging the bio-availability of otherwise trapped nutrients, while improving live weight and feed conversion efficiency (feed:gain) in diets based on barley, corn, soybean meal, sunflower meal, whet meal, rapeseed meal and others.

28

![[genufoodenergyenzymess1024.jpg]](genufoodenergyenzymess1024.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Anilax-SEB” belongs to us.

Anilax-SEB is a unique blend of enzymes developed especially for poultry feed supplementation. The enzymes encompassing a wide range of activities, aid in the breakdown of organic feed substrates, thereby encouraging the bio-availability of otherwise trapped nutrients, while improving live weight and feed conversion efficiency (feed:gain) in diets based on corn, soybean meal, sunflower meal, wheat meal, rapeseed meal and others.

29

![[genufoodenergyenzymess1025.jpg]](genufoodenergyenzymess1025.jpg)

We do not manufacture the above enzyme product. It is specifically formulated for our distribution. It is packed under our private label pursuant to the contract manufacturing arrangements. The brand name “Anilax-AFL2500” belongs to us.

Anilax-AFL2500 is a highly concentrated, non-animal, liquid multi-enzyme blend derived from non GMO Trichoderma spp. It is specially designed to maximize the digestibility and nutritional value of pelletized feed, silage and other forms of ruminant feed.

30

Sales and Marketing Strategy

We rely on our appointed Marketing Agent to source, select and interview suitable qualified country sole distributor for each Category of our enzyme products. We therefore intend to rely on those appointed country sole distributors to promote, market and distribute our Cellax, Medilax, Armilax, Anilax and AniTra-XO range of enzyme products to the Asian market. We will begin with the Republic of China (Taiwan).

Our enzyme range of products for human consumption

Under the General Outlet Category, the country sole distributor has an annual purchase quota to achieve for the promotion, marketing and distribution of Cellax range of enzyme products. The annual purchase quota varies from country to country. The marketing effort the country sole distributor will follow adopting our Multi Level Marketing – Franchise Investor Dealer Related concept (MLM-FIDR) concept. This means that the country sole distributor will distribute the Cellax range of enzyme products to wholesalers who then re-distribute to dealers. The dealers will then distribute it to retailers for retailing to consumers, the general public. Attractive incentive bonus will be awarded to wholesalers, dealers, retailers and to consumers. These wholesalers, dealers and retailers are probably shareholders of the country sole distributor and the country sole distributor is entitled to invest in our business by way of private placement. Therefore, effective sales and marketing is achieved through strong one on one selling but also effective retail distribution and management. This is supported by our GEEC Enzyme Club activities for our enzyme consumers whose membership is free of charge.

Under the Special Outlet Category, the country sole distributor has an annual purchase quota to achieve for the promotion, marketing and distribution of Medilax range of enzyme products directly to hospital, medical centre, clinics, pharmacies and drug stores. Another country sole distributor will be appointed for the supply of Armilax range of enzyme products directly to the country armed forces and police force.

31

Our enzyme range of products for animal consumption

A country sole distributor each will be appointed for the promotion, marketing and distribution of Anilax range of enzyme products to area sub-distributors who in turn re-distribute it directly to farmers and animal clinics, and AniTra-XO feed supplement for racing pigeons.

![[genufoodenergyenzymess1026.jpg]](genufoodenergyenzymess1026.jpg)

Anilax Range of Enzyme Products in Bulk Packed Powder Form

We intend, through our Marketing Agent, to contact as many country sole distributors for we can market our range of enzyme products more effectively. We could then give them and their wholesalers, dealers and retailers proper enzyme education and dealership program – the MLM-FIDR concept.

To enhance our sales and to advertise our range of enzyme products we distribute, we have registered a domain name: www.geecenzymes.com. This website is currently under construction and we anticipate that it will display and expose our products, provide free registration to the GEEC Enzyme Club membership, provide enzyme education, allow our country sole distributors to order products and possibly allow consumers to purchase directly from us at a higher retail price. We will also have a password secured portion of the website where our GEEC Enzyme Club members can log in for enzyme education and membership activities, and a possible link to our country sole distributor’s website for placing orders by its customers. Once launched, our website will be available 24 hours a day, seven day a week allowing our customer service to entertain country sole distributors and dealers and customers to shop our range of enzyme products from their home, office or even from their mobile phone.

32

Competition

The enzyme market in Asia is still a virgin market. The public is aware about medicine, drug, herb and vitamin pills but not enzymes. We plan to enter the enzyme business with a chance to be the leader in the distribution of enzyme products in Asia. For example, our first target market, Taiwan, there is no enzyme product similar to our Cellax, Medilax, Armilax, Anilax and AniTra-XO range of enzyme products. Notable enzyme manufacturers like Kuo-chi Biotechnology Corp. producing enzymes for Chinese herbal health products; Linden Biological Technology Co. Ltd. producing enzyme for cosmetics; Easy Cure Biotechnology Co. Ltd. produces enzyme as nutrition supplement added with vitamins and minerals under the brand “Lohas”, and China Chemical Pharmaceutical Co. Ltd. producing enzyme mix with additives as a feed for animal. Imported brand like NOW, a plant-based enzyme product from the US is perhaps the only imported enzyme product promoted in Taiwan.

Competition in this market revolves around price, quality, reliability, product features and activities. At the dealer/retailer level, competition is based mainly on sales and marketing support programs, such as the dealer’s bonus incentive, advertisement support and GEEC Enzyme Club activities. We need to create deeper distribution channels via our MLM-FIDR concept and strong brand awareness but do not possess such financial capabilities at this current time. We may never be able to effectively enter the enzyme business and thus may not be in a position to complete with competitors who enters the market with strong financial means.

Compliance with Government Regulation

We currently do not have substantial operations. However, once we do have a substantial operations, our business will be affected by numerous laws and regulations. To ensure that our operations are conducted in full and substantial regulatory compliance, as part of our current internal procedures and policies, we will verify and ensure that the OEM manufacturers we contracted in Taiwan and the US have obtained the ISO 9001:2000 certification and to qualify for the China health food supplement regulation. In Taiwan and China, enzyme products are classified as “Food Supplement” and are regulated or governed by the Ministry of Health. Our Taiwan OEM manufacturer, Origo Biochemical Technologies Inc. has obtained importation approval from the China Ministry of Health for the enzyme product they manufactured and by virtual of the provisions of the OEM Manufacturing Agreement, we can exercise their permit to import our natural complex enzyme into China.

Failure to comply with any laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of injunctive relief or both. Moreover, changes in any of these laws and regulations could have a material adverse effect on business. In view of the many uncertainties with respect to current and future laws and regulations, including their applicability to us, we cannot predict the overall effect of such laws and regulations on our future operations.

Currently we do not have substantial operations and believe that once we do have substantial operations, we will comply in all material respects with applicable laws and regulations, and that the existence and enforcement of such laws and regulations have no more restrictive an effect on our operations than on other similar companies in the enzyme industry. We do not anticipate any material capital expenditures to comply with federal and state environmental requirements.

Employees

We currently do not have any employees other than our sole officer who devotes approximately 40 hours per week to our operations. To assist him, we have entered into an agreement with Albeck Financial Services to provide accounting services.

33

Research and Development Expenditures

We have not incurred any expenditure on research and development since our inception.

Subsidiaries

We do not have any subsidiaries.

Patent and Trademarks

We do not own any patents but the following trademarks belong to us:

·

Cellax-NCE

·

Cellax-GFL

·

Cellax-TT

·

Cellax-FG1

·

Cellax-SP

·

Cellax-E2AF

·

Cellax-E

·

Cellax-SNU

·

Cellax-DG1

·

Anilax-Super

·

Anilax-SP3

·

Anilax-EPET

·

Anilax-Sw1013

·

Anilax-SEB

·

Anilax-AFL2500

·

AniTra-XO

·

Medilax

·

Armilax

Offices

Our business office is located at Two Allen Center, 1200 Smith Street, Suite 1600, Houston, Texas 77002. Our telephone number is (713) 353-8834. We pay monthly rent of $219 for our office.

We are not currently a party to any legal proceedings. Our address for service of process in Nevada is 4421 Edward Avenue, Las Vegas, Nevada 89108.

34

Market for Common Equity and Related Stockholder Matters

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate applying for quotation of our common stock on the over the counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the bulletin board or, if traded, that a public market will materialize.

Stockholders of Our Common Shares

As of the date of this registration statement, we have 48 registered shareholders.

Rule 144 Shares

The SEC has recently adopted amendments to Rule 144 which became effective on February 15, 2008 and applies to securities acquired both before and after that date. Under these amendments, a person who has beneficially owned restricted shares of our common stock for at least six months is entitled to sell their securities provided that (i) such person is not deemed to have been one of our affiliates at the time of, or at any time during the three months preceding the sale and (ii) we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale.

Persons who have beneficially owned restricted shares of our common stock for at least six months but who are our affiliates at the time of, or at any time during the three months preceding the sale, are subject to additional restrictions. Such person is entitled to sell within any three-month period only a number of securities that does not exceed the greater of either of the following:

·

1% of the total number of securities of the same class then outstanding, which will equal 54,200 shares as of the date of this prospectus; or

·

the average weekly trading volume of such securities during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale;

provided, in each case that we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale.

Such sales must also comply with the manner of sale and notice provisions of Rule 144.

As of the date of this prospectus none of our shares are eligible for resale pursuant to Rule 144.

Stock Option Grants

To date, we have not granted any stock options.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

35

Dividends