Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

Amendment No. 2

(Mark One)

[ X ] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended November 30, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________to ________

COMMISSION FILE NUMBER 000-52398

WESTMONT RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

NEVADA

|

76-0773948

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

155 108th Avenue NE, Suite 150

|

|

|

Bellevue, WA

|

98004

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(206) 922-2203

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Non-accelerated filer [ ]

|

|

Accelerated filer [ ]

(Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

APPLICABLE ONLY TO CORPORATE ISSUERS:

Page 1 of 19

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

Westmont Resources Inc.

(A Development Stage Consolidated Group of Companies)

November 30, 2010

EXPLANATORY NOTE

This Amendment No. 2 on Form 10-Q/A amends the Company’s Quarterly Report on Form 10-Q/A for the quarter ended November 30, 2010, as filed with the Securities and Exchange Commission on January 18, 2011. The consolidated balance sheet, statement of operations and cash flows were restated to reflect adjustments for a property acquistion and certain equity transactions. See Note 8 to the consolidated financial statements for details.

Page 2 of 19

WESTMONT RESOURCES INC

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

30-Nov-2010

(Restated)

|

31-May-2010

(Combined)

|

|||||||

|

ASSETS

|

||||||||

|

Cash

|

$ | 20 | $ | 1 | ||||

|

Total Current Assets

|

20 | 1 | ||||||

|

Oil and gas properties – successful efforts method

|

343,365 | 343,365 | ||||||

|

TOTAL ASSETS

|

$ | 343,385 | $ | 343,366 | ||||

|

LIABILITIES & STOCKHOLDERS’ DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable

|

$ | 63,484 | $ | 31,947 | ||||

|

Related party line of credit

|

507,894 | 357,216 | ||||||

|

Related party convertible note payable

|

51,242 | 49,979 | ||||||

|

Convertible note payable

|

325,577 | 328,956 | ||||||

|

Related party promissory note

|

200,000 | 200,000 | ||||||

|

Total Current Liabilities

|

1,148,197 | 968,098 | ||||||

|

Long Term Liabilities

|

||||||||

|

Asset retirement obligation

|

93,365 | 93,365 | ||||||

|

Convertible Note Payable

|

62,581 | 60,736 | ||||||

|

Total Liabilities

|

1,304,143 | 1,122,199 | ||||||

|

Stockholders’ Deficit

|

||||||||

|

Common Stock, 775,000,000 shares authorized, $0.001 par value, 199,916 shares issued and outstanding at November 30, 2010 and 178,332 shares issued and outstanding at May 31, 2010

|

200 | 178 | ||||||

|

Convertible Preferred Stock, 25,000,000 shares authorized, $0.001 par value, 100,000 shares issued and outstanding at November 30, 2010 and May 31, 2010

|

100 | 100 | ||||||

|

Additional Paid in Capital

|

360,050 | 336,853 | ||||||

|

Accumulated deficit

|

(1,321,108 | ) | (1,115,964 | ) | ||||

|

Total Stockholders Deficit

|

(960,758 | ) | (778,833 | ) | ||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

$ | 343,385 | $ | 343,366 | ||||

(The accompanying notes are an integral part of these consolidated unaudited financial statements)

Page 3 of 19

WESTMONT RESOURCES INC

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

For the Three Months Ended

|

For the Three Months Ended

|

For the Six Months Ended

|

For the Six Months Ended

|

|||||||||||||

|

30-Nov-10

(Restated)

|

30-Nov-09

(Combined)

|

30-Nov-10

(Restated)

|

30-Nov-09

(Combined)

|

|||||||||||||

|

Oil and gas revenues

|

$ | 10,693 | $ | 2,689 | $ | 36,095 | $ | 5,377 | ||||||||

|

Lease operating expenses

|

28,170 | 7,466 | 56,254 | 15,277 | ||||||||||||

|

General and administrative expenses

|

132,831 | 54,053 | 159,857 | 108,621 | ||||||||||||

|

Loss from operations

|

(150,308 | ) | (58,829 | ) | (180,016 | ) | (118,521 | ) | ||||||||

|

Interest Expense

|

13,024 | 9,896 | 25,128 | 18,703 | ||||||||||||

|

Net Loss

|

(163,332 | ) | (68,726 | ) | (205,144 | ) | (137,224 | ) | ||||||||

|

Deemed dividend to Preferred Shareholders

|

- | (1,500 | ) | - | (1,500 | ) | ||||||||||

|

Net Loss available to Common Shareholders

|

$ | (163,332 | ) | $ | (70,226 | ) | $ | (205,144 | ) | $ | (138,724 | ) | ||||

|

Loss per share – basic and diluted

|

$ | (0.85 | ) | $ | ( 10.90 | ) | $ | (1.11 | ) | $ | (21.53 | ) | ||||

|

Weighted average shares outstanding- basic and diluted

|

191,731 | 6,442 | 184,995 | 6,442 | ||||||||||||

(The accompanying notes are an integral part of these consolidated unaudited financial statements)

Page 4 of 19

WESTMONT RESOURCES INC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

For the Six Month Ended

|

For the Six Month Ended

|

|||||||

|

30-Nov-10

(Restated)

|

30-Nov-09

(Combined)

|

|||||||

|

OPERATING ACTIVITIES

|

||||||||

|

Net Loss

|

$ | (205,144 | ) | $ | (138,724 | ) | ||

|

Adjustments to reconcile net loss

|

||||||||

|

to net cash used in operations:

|

||||||||

|

Common stock issued for services

|

10,504 | - | ||||||

|

Preferred stock issued for services

|

- | 1,500 | ||||||

|

Changes in Operating Assets and Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

56,807 | 132,679 | ||||||

|

Net cash used in operating activities

|

(137,833 | ) | (4,545 | ) | ||||

|

FINANCING ACTIVITIES

|

||||||||

|

Advances from related parties

|

137,852 | 6,940 | ||||||

|

Net cash provided by financing activities

|

137,852 | 6,940 | ||||||

|

Net change in cash

|

19 | 2,395 | ||||||

|

Cash at Beginning of Period

|

1 | 146 | ||||||

|

Cash at end of period

|

$ | 20 | $ | 2,541 | ||||

|

Non-cash investing and financing activities

|

||||||||

|

Common stock issued for conversion of notes payable

|

$ | 12,715 | - | |||||

(The accompanying notes are an integral part of these consolidated unaudited financial statements)

Page 5 of 19

WESTMONT RESOURCES INC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

November 30, 2010

|

|

1. Basis of Presentation

|

The accompanying unaudited interim financial statements of Westmont Resources Inc. (“Westmont”) have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission, and should be read in conjunction with Westmont’s audited 2010 annual financial statements and notes thereto contained in Westmont’s Annual Report filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods present have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements, which would substantially duplicate the disclosure required in Westmont’s fiscal 2010 Annual Report and financial statements have been omitted.

The consolidated balance sheet as of May 31, 2010 and the consolidated statements of operations and cash flows for the three and six months ended November 30, 2009 present the combined financial information of Westmont and Domestic Energy Corporation as if the companies were combined on June 1, 2009 in accordance with ASC 805-10. See Note 4 for details. (1)

All significant inter-company balances and transactions have been eliminated on consolidation.

In prior periods, Wesmont Resources, Inc. was in the development stage as defined by ASC 915. With commencement of Westmont's principal oil and gas operations, Westmont is no longer a development stage company.

Oil and Gas Operations.

The Company applies the successful efforts method of accounting for oil and gas properties. Under the successful efforts method, exploration costs such as exploratory geological and geophysical costs, delay rentals and exploration overhead are charged against earnings as incurred. Acquisition costs and costs of drilling exploratory wells are capitalized pending determination of whether proved reserves can be attributed to the area as a result of drilling the well. If management determines that commercial quantities of hydrocarbons have not been discovered, capitalized costs associated with exploratory wells are charged to exploration expense. Acquisition costs of unproved leaseholds are assessed for impairment during the holding period and transferred to proved oil and gas properties to the extent associated with successful exploration activities. Significant undeveloped leases are assessed individually for impairment, based on the Company’s current exploration plans, and a valuation.

Depreciation, depletion and amortization of the cost of proved oil and gas properties are calculated using the unit-of-production method. The reserve base used to calculate depreciation, depletion and amortization is the sum of proved developed reserves and proved undeveloped reserves for leasehold acquisition costs and the cost to acquire proved properties. With respect to lease and well equipment costs, which include development costs and successful exploration drilling costs, the reserve base includes only proved developed reserves. Estimated future dismantlement, restoration and abandonment costs, net of salvage values, are taken into account.

Amortization rates are updated to reflect: 1) the addition of capital costs, 2) reserve revisions (upwards or downwards) and additions, 3) property acquisitions and/or property dispositions and 4) impairments.

The Company reviews its property and equipment in accordance with Accounting Standard Codification (ASC) 360, Property, Plant, and Equipment (ASC 360). ASC 360 requires the Company to evaluate property and equipment as an event occurs or circumstances change that would more likely than not reduce the fair value of the property and equipment below the carrying amount. If the carrying amount of property and equipment is not recoverable from its undiscounted cash flows, then the Company would recognize an impairment loss for the difference between the carrying amount and the discounted cash flow.

(1) This transaction was accounted for as a pooling of interests between entities under common control.

Page 6 of 19

Asset Retirement Obligation

ASC 410, Asset Retirement and Environmental Obligations (ASC 410) requires that the fair value of an asset retirement cost, and corresponding liability, should be recorded as part of the cost of the related long-lived asset and subsequently allocated to expense using a systematic and rational method. The Company records asset retirement obligations to reflect the Company’s legal obligations related to future plugging and abandonment of its oil and natural gas wells and gas gathering systems. The Company estimates the expected cash flow associated with the obligation and discounts the amounts using a credit-adjusted, risk-free interest rate. At least annually, the Company reassesses the obligation to determine whether a change in the estimated obligation is necessary. The Company evaluates whether there are indicators that suggest the estimated cash flows underlying the obligation have materially changed. Should those indicators suggest the estimated obligation may have materially changed on an interim basis (quarterly), the Company will accordingly update its assessment. Additional retirement obligations increase the liability associated with new oil and natural gas wells as these obligations are incurred.

An asset retirement obligation of $93,365 was recorded in association with the wells acquired from Domestic Energy Corporation. See Note 4.

Revenue Recognition

Revenues from the sale of oil and natural gas are recognized when the products are sold to a purchaser at a fixed or determinable price, delivery has occurred and title has transferred, and collectibility of the revenue is reasonably assured. The Company follows the sales method of accounting for recording oil and gas revenues. The volumes sold may differ from the volumes to which the Company is entitled based on its interests in the properties. These differences create imbalances which are recognized as a liability only when the imbalance exceeds the estimate of remaining reserves. The Company had no significant imbalances as of November 30, 2010.

|

|

2.

|

Going Concern

|

These financial statements have been prepared on a going concern basis, which implies Westmont will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has had recurring net losses and has a working capital deficit as of November 30, 2010. The ability of the Company to continue as a going concern is dependent on raising capital to fund its business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company's ability to continue as a going concern.

These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should Westmont be unable to continue as a going concern.

|

|

3.

|

Convertible Notes Payable

|

On November 21, 2008, Westmont acquired 100% of Avalon International Inc. (“Avalon”). In connection with the acquisition of Avalon International, Westmont assumed a convertible note payable previously issued by Avalon (the “Note”) totaling $387,896, bearing interest based on Libor plus 2% per annum. The Note holder has the option to convert the entire outstanding balance at any time to the equivalent of Twenty-Five Percent of the total authorized shares of Westmont provided the conversion would not cause Westmont to issue more shares than Westmont has authorized less the actual shares issued and obligations to issue shares under any outstanding agreement. Westmont evaluated the embedded conversion option to determine if it was within the scope of ASC 815-15 “Accounting for Derivative Instruments and Hedging Activities”. Westmont concluded that the conversion option should be classified as equity under ASC 815-15. Westmont also evaluated the convertible note to determine if it was within the scope of ASC 470-20 “Accounting for Convertible Securities with Beneficial Conversion Features or Contingently Adjustable Conversion Ratios” and determined there was no intrinsic value associated with the conversion option.

Page 7 of 19

|

|

·

|

On September 3, 2010, the Company issued 1,000 shares of common stock valued at $605 for partial conversion of principal on the convertible note.

|

|

|

·

|

On October 7, 2010 the Company issued 20,000 shares of common stock valued at $12,110 for partial conversion of principal on the convertible note.

|

|

|

4.

|

Domestic Energy Corporation Working Interest Transfer

|

On May 15, 2010, Westmont signed a Memorandum of Understanding (MOU) for the Purchase of a 70% working interest in 92 oil & gas wells located in Scott & Morgan County Tennessee from Domestic Energy Corporation. Transfer of ownership in these wells from Domestic Energy to Westmont began in June 2010 and was completed during the quarter ended November 30, 2010. On December 29, 2010, Westmont finalized a purchase and sale agreement with Domestic Energy for the wells in question. The final purchase price is:

|

|

(a)

|

$200,000 in the form of a promissory note bearing interest at 8%, payable in 20 equal monthly installments. Payments will commence in March of 2011. The note is secured by an interest in the wells purchased.

|

|

|

(b)

|

All of Westmont’s interest in a gold mine and business identified as NorthStar Exploration, Inc which represents an interest in gold and other mineral deposits located in British Columbia, Canada.

|

Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc. As the transfer occurred between entities under common control, the working interests were transferred at Domestic Energy Corporation’s cost basis in the properties of $250,000. ASC 805-10 requires Westmont present the transaction as if the combination occurred as of the first day of the first period presented requiring prior comparative periods to be restated to reflect separate information as if were combined for all periods with intercompany amounts subject to elimination. The fair value of the gold mine interest in (b) above was $0 and accordingly the total purchase price of the working interests was $200,000. The difference between the purchase price and value of the properties transferred of $50,000 was recorded as a contribution to capital.

No depletion expense has been recognized on the transferred properties for the quarter ended November 30, 2010 as the current production was minimal in relation to total reserves.

An asset retirement obligation of $93,365 was recorded for the wells acquired above.

|

|

5.

|

Related Party Balances and Transactions

|

|

|

a.

|

The Avalon Group Ltd

|

On June 3, 2010, Westmont formalized a “Letter of Credit” with the Avalon Group Ltd. The advances made by the Avalon Group Ltd as of November 30, 2010 are $487,508 plus accrued interest of $20,386, and are associated with a $1,000,000 Line of Credit with an interest rate of Libor +2.5% and a maturity date of May 31, 2015. The Note holder has the option to convert the outstanding balance at any time after June 15, 2011, into shares of common stock of the Company on a 75% discount to market price on the day of conversion. During the six months ended November 30, 2010, $137,852 was advanced and $12,826 of interest was accrued on this loan.

|

|

b.

|

Andrew Jarvis

|

The advances made by Andrew Jarvis, a former company Director, as of November 30, 2010 is $51,242. This debt is unsecured, with an interest rate of 5%. The Note holder has the option to convert the outstanding balance at any time after June 1, 2011, into shares of common stock of the Company on a 50% discount to market price on the day of conversion.

|

|

c.

|

Domestic Energy Corporation

|

Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc. In conjunction with the asset transfer in Note 4, a $200,000 promissory note was issued. See Note 4 for details.

Page 8 of 19

|

|

6.

|

Common Stock

|

On September 3, 2010, the Company issued 583 shares of common stock valued at $10,504 to third parties for services rendered. The shares were fully vested and non-forfeitable on the date of grant and therefore the entire amount was charged to expense during the three months ended November 30, 2010.

On September 3, 2010, the Company issued 1,000 shares of common stock valued at $605 for partial conversion of principal on the convertible note. See Note 3.

On October 7, 2010 the Company issued 20,000 shares of common stock valued at $12,110 for partial conversion of principal on the convertible note. See Note 3.

On November 23, 2010, the Company’s Board of Directors and majority shareholders voted to complete a 300:1 reverse stock-split effective as of December 30, 2010, of its issued and outstanding common stock and convertible preferred stock. All share and per share amounts in the consolidated financial statements and footnotes have been adjusted retroactively to reflect the split as if it occurred on the first day of the first period presented.

|

|

8.

|

Restatement

|

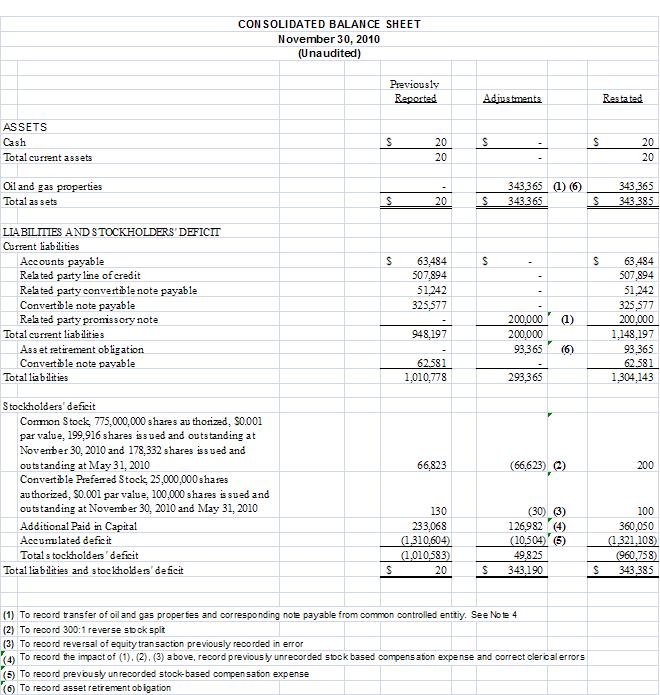

This Amendment No. 2 on Form 10-Q/A amends the Company's Quarterly Report on Form 10-Q/A for the quarter ended November 30, 2010, as filed with the Securities and Exchange Commission on January 18, 2011. The consolidated statement of operations and cash flows were restated to reflect an increase to general and administrative expenses and corresponding net loss as a result of previously unrecorded stock based compensation expense of $10,504. In addition, oil and gas revenues and lease operating expenses were reduced by $25,402 and $28,084, respectively for the three month period ended November 30, 2010 in the consolidated statement of operations due to these amounts being recorded incorrectly. The following table presents the adjustments to the consolidated balance sheet:

Page 9 of 19

Page 10 of 19

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

|

|

1. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

|

Certain statements contained in this Quarterly Report on Form 10-Q constitute “forward-looking statements.” These statements, identified by words such as “plan,” “anticipate,” “believe,” “estimate,” “should,” “expect,” and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the caption “Management’s Discussion and Analysis or Plan of Operation” and elsewhere in this Annual Report. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the “SEC”), particularly our Annual Report on Form 10-K and our Quarterly Reports on Form 10-QSB and our Current Reports on Form 8-K.

|

|

2. OTHER PERTINENT INFORMATION

|

We maintain our web site at www. westmontresources.com. Information on this web site is not a part of this prospectus. We file annual, quarterly and other reports and information with the Securities Exchange Commission. Promptly after their filing, we provide access to these reports without charge on our website at www.westmontresources.com. Our principal and administrative offices are located in Bellevue, Washington. Our common stock is traded on the Over The Counter Bulletin Board (OTCBB) under the symbol WMNS. Unless otherwise indicated, references in this report to “Westmont”, “the Company” or to “we”, “our”, “us”, and similar terms refer to and include Westmont Resources Inc., our direct and indirect wholly owned subsidiaries and our interests in sponsored drilling partnerships.

|

|

3. DEFINITIONS

|

All defined terms under Rule 4-10(a) of Regulation S-X shall have their statutorily prescribed meanings when used in this report. As used in this document:

|

|

·

|

“3-D” means three-dimensional.

|

|

|

·

|

“B/d” means barrels of oil or natural gas liquids per day.

|

|

|

·

|

“Bbl” or “Bbls” means barrel or barrels of oil.

|

|

|

·

|

“Bcf” means billion cubic feet.

|

|

|

·

|

“Boe” means barrel of oil equivalent, determined by using the ratio of one Bbl of oil or NGLs to six Mcf of gas.

|

|

|

·

|

“Boe/d” means boe per day.

|

|

|

·

|

“Btu” means a British thermal unit, a measure of heating value, which is approximately equal to one Mcf.

|

|

|

·

|

“LIBOR” means London Interbank Offered Rate.

|

|

|

·

|

“LNG” means liquefied natural gas.

|

|

|

·

|

“Mb/d” means Mbbls per day.

|

|

|

·

|

“Mbbls” means thousand barrels of oil.

|

|

|

·

|

“Mboe” means thousand boe.

|

|

|

·

|

“Mboe/d” means Mboe per day.

|

|

|

·

|

“Mcf” means thousand cubic feet of natural gas.

|

|

|

·

|

“Mcf/d” means Mcf per day.

|

|

|

·

|

“MMbbls” means million barrels of oil.

|

|

|

·

|

“MMboe” means million boe.

|

|

|

·

|

“MMBtu” means million Btu.

|

|

|

·

|

“MMBtu/d” means MMBtu per day.

|

Page 11 of 19

|

|

·

|

“MMcf” means million cubic feet of natural gas.

|

|

|

·

|

“MMcf/d” means MMcf per day

|

|

|

·

|

“NGL” or “NGLs” means natural gas liquids, which are expressed in barrels.

|

|

|

·

|

“Oil” includes crude oil and condensate.

|

|

|

·

|

“PUD” means proved undeveloped.

|

|

|

·

|

“SEC” means United States Securities and Exchange Commission.

|

|

|

·

|

“Tcf” means trillion cubic feet.

|

|

|

·

|

With respect to information relating to our working interest in wells or acreage, “net” oil and gas wells or acreage is determined by multiplying gross wells or acreage by our working interest therein. Unless otherwise specified, all references to wells and acres are gross.

|

|

|

4. CORPORATE OVERVIEW

|

Westmont Resources Inc., a Nevada corporation formed in 2004, is an independent natural resource exploration and production company that plans to explore to, develop and produce natural resources to include minerals, natural gas, crude oil, and natural gas liquids. In North America, our exploration and production interests are focused in mineral exploration in British Columbia Canada. Oil and natural gas exploration in the Appalachian Basin, Illinois Basin, Permian Basin, Williston Basin, and along the Gulf Coast in Eastern Texas.

The company is operational and engaged in the future acquisition, and planned development and production of oil and natural gas properties through the use of disruptive technology in an environmentally safe and cost effective manner.

As an independent junior oil and gas Company with ambitions to become an independent major in selected regions, the company’s strategy is two-fold. First, to grow rapidly through the acquisition or “roll-up” of undervalued oil & gas properties with proven reserves in heavy oil and oil shale which have only been partially developed. Second, through the use of proprietary disruptive technologies the company “wrings out” the untapped value of the target properties’ reserves. The company’s growth plans are in modular steps depending on the availability of capital.

Our Expansion strategy is modular and expandable based on funding. Our management team has extensive experience in the implementation of disruptive technology in various natural resources, mining and environmental remediation industries. We have brought together an exceptional team of financial, engineering, geological, geophysical, technical and operational expertise in successfully developing and operating properties in both our current and planned areas of operation. The management team is primarily focused on the acquisition and accumulation of natural resource assets, while building a strong operational management team to manage these assets to the highest effective and profitable degree possible.

Westmont Resources Inc is focused on the acquisition and development of natural resources properties, including oil and natural gas fields, with proven reserves. The company’s strategy is to shun the risks of traditional exploration of undeveloped basins. Rather, the company’s strategy is to more fully develop existing and proven fields. We seek to acquire and develop properties while economically attractive are not strategic to the oil and gas majors and which have not been fully developed by previous traditional operators. We will acquire properties that have produced and may still be producing but, while having significant proven reserves have been deemed not commercially productive. Through the use of proprietary disruptive technologies the company is in a position to “wring” out the untapped value of these proven reserves.

|

|

5. GROWTH STRATEGY

|

Westmont’s mission is to grow a profitable upstream natural resource company for the long-term benefit of our shareholders. Westmont’s long-term perspective has many dimensions, with the following core principles:

|

|

·

|

Own a balanced portfolio of core assets;

|

|

|

·

|

Maintain financial flexibility and a strong balance sheet; and

|

|

|

·

|

Optimize rates of return, earnings and cash flow.

|

Page 12 of 19

Throughout the cycles of our industries, these strategies have underpinned our commitment to deliver long-term production and reserve growth and achieve competitive investment rates of return for the benefit of our shareholders.

|

|

6. OPTIMIZE RETURNS ON INVESTED CAPITAL

|

We will focus on optimizing returns on invested capital through strict cost control and the creative application of technology.

Our management systems provide a uniform process of measuring success across Westmont. Our management systems incentivize high rate-of-return activities but allow for appropriate risk-taking to drive future growth. Results of operations and rates of return on invested capital are measured monthly, reviewed with management quarterly and utilized to determine annual performance awards. We monitor capital allocations, at least quarterly, through a disciplined and focused process that includes analyzing current economic conditions, expected rates of return on proposed development and exploration drilling targets, opportunities for tactical acquisitions or, occasionally, new core areas that could enhance our portfolio. We also use technology to optimize our rates of return by reducing risk, decreasing drilling time and costs, and maximizing recoveries from reservoirs.

|

|

7. RECENT DEVELOPMENTS

|

We completed several initiatives during 2010 to strengthen our balance sheet and add liquidity. These transactions have provided us with greater financial flexibility to take advantage of our development opportunities. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

·

|

Convertible Note Exchange:

|

|

|

o

|

On December 1, 2009 the Company issued 6,667 shares of common stock valued at $2,000 for partial settlement of principal on a convertible note.

|

|

|

o

|

On May 15, 2010, the Company issued 66,667 shares of common stock valued at $20,000 for partial settlement of principal on a convertible note.

|

|

|

o

|

On September 3, 2010 the Company issued 1,000 shares of common stock valued at $605 for partial settlement of principal on a convertible note.

|

|

|

o

|

On October 7, 2010 the Company issued 20,000 shares of common stock valued at $12,110 for partial settlement of principal on a convertible note.

|

|

|

·

|

On May 15, 2010, we signed a Memorandum of Understanding (MOU) for the Purchase of a 70% working interest in 92 oil & gas wells located in Scott & Morgan County Tennessee from Domestic Energy Corporation. Transfer of ownership in these wells from Domestic Energy to Westmont began in June 2010 and was completed on December 29, 2010. Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc.

|

|

|

·

|

On June 11, 2010, Westmont acquired exclusive sales and distribution rights to “FracSolv” manufactured and produced by NuEarth Corporation. NuEarth Corporation is 85% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc.

|

|

|

·

|

On June 13, 2010 Westmont Resources, Inc entered into two Letters of Intent to acquire 1800 lease acres in Pennsylvania with 60 existing oil wells and 1600 lease acres in West Virginia with 60 existing oil wells. Closing on the two LOI’s is scheduled for January 21, 2011.

|

|

|

·

|

On June 3, 2010, Westmont signed a memorandum of understanding (“MOU”) to acquire 10% rights to commercialize a patent pending, disruptive market making technology in the heavy oil production and extraction industry known as Heavy Oil and Gas Extraction technology (HOGEÔ). Closing on the acquisition of the 10% interest in this technology is scheduled for February 15, 2011.

|

|

|

·

|

On June 3, 2010, Westmont formalized a “Letter of Credit” with the Avalon Group Ltd. The advances made by the Avalon Group Ltd as of November 30, 2010 are $487,508 plus interest of $20,385, and are associated with a $1,000,000 Line of Credit with an interest rate of Libor +2.5% and a maturity date of May 31, 2015. The Note holder has the option to convert the outstanding balance at any time after June 15, 2011, into shares of common stock of the Company on a 75% discount to market price on the day of conversion. As of the date the financials were issued no conversion has been done on this debt.

|

Page 13 of 19

|

|

·

|

On November 23, 2010, the Company’s Board of Directors and Majority Shareholders voted to complete a 300:1 reverse stock-split effective as of December 30, 2010, of its issued and outstanding common stock and convertible preferred stock.

|

|

|

·

|

Subsequent to the end of the Quarter on November 30, 2010, Westmont complete the acquisition of the 70% working interest in 92 oil & gas wells located in Scott & Morgan County Tennessee from Domestic Energy Corporation on December 29, 2010. Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc.

|

|

|

8. PLAN OF OPERATION

|

Our plan of operation is to conduct re-working and re-entry program on the 212 wells associated with the Scott-Morgan 1 project; our Pennsylvania leasehold and our West Virginia leaseholds currently under contract for purchase in order to place these wells back into production and establish a positive cashflow at the earliest time frame. Our future plan of operation for the twelve months following the date of this annual report is to complete the acquisition of the 212 wells and start the first phase of the exploration program on our project consisting of the repair of equipment and wells to place the wells back into a minimal production plan.

Total expenditures over the next 12 months are therefore expected to be approximately $325,000, which is approximately 10% of the amount to be raised by private placement and our cash on hand. If we experience a shortage of funds prior to funding we may utilize funds from our majority shareholder, who has formally agreed to advance funds to allow us to pay for offering costs, filing fees, professional fees, initial well and equipment repair. The Avalon Group Ltd has signed a formal commitment letter and arrangement to advance or loan funds to the company on a Libor +2% compounded interest rate to a maximum of $1,000,000. If we are successful in raising the funds from this offering, we plan to commence Phase I of the program on the project claim in the fall of 2010. We expect these phases to take 6 months to complete. Subject to financing, we anticipate commencing Phase II of our re-development program in spring of 2010.

|

|

9. RESULTS OF OPERATIONS

|

As of November 30, 2010, we had cash on hand of $20; a LOC remaining balance of $512,491 and a working capital deficit of $(948,177). Westmont Resources Inc, has a current rolling line of credit for $1.0M with The Avalon Group Ltd. of Netanya, Israel, of which approximately $487,508 has been draw down on the LOC. Utilizing the remaining balance of the LOC, Westmont has sufficient working capital to pay for the anticipated costs of $325,000 for Phase I of our exploration program and meet the anticipated costs of operating our business for the next twelve months. Financial projections are based on the financial commitment arrangement made with the Avalon Group Ltd our largest beneficial shareholder. We anticipate that we will incur the following expenses over the next twelve months:

|

|

10. PLANNED EXPENDITURES OVER NEXT 12 MONTHS

|

|

Category

|

Planned Expenditures Over

The Next 12 Months (US$)

|

|||

|

Legal and Accounting Fees

|

$ | 25,000 | ||

|

Office Expenses

|

$ | 3,500 | ||

|

Oil & Gas Property Exploration Expenses

|

$ | 325,000 | ||

|

Travel Expenses

|

$ | 55,000 | ||

|

TOTAL

|

$ | 408,500 | ||

|

|

11. OIL AND GAS REVENUES AND LEASE OPERATING EXPENSES

|

In conjunction with our acquisition of oil and gas working interests from Domestic Energy Corporation described below, we entered into commercial production of our oil and gas properties. The increase in oil and gas sales of for the three and six months ended November 30, 2010 compared to the three and six months ended November 30, 2009 is due primarily to completion of the agreement with Domestic Energy and increased focus on the development of the operations.

Page 14 of 19

On May 15, 2010, Westmont signed a Memorandum of Understanding (MOU) for the Purchase of a 70% working interest in 92 oil & gas wells located in Scott & Morgan County Tennessee from Domestic Energy Corporation. Transfer of ownership in these wells from Domestic Energy to Westmont began in June 2010 and was completed during the quarter ended November 30, 2010. On December 29, 2010, Westmont finalized a purchase and sale agreement in the amount of $200,000 with Domestic Energy for the wells in question.

No depletion expense has been recognized on the transferred properties for the quarter ended November 30, 2010 as the current production was minimal in relation to total reserves.

Lease operating expenses for the three and six months ended November 30, 2010 increased compared to the three and six months ended November 30, 2009 due primarily to completion of the agreement with Domestic Energy and increased focus on the development of the operations.

|

|

12. GENERAL AND ADMINISTRATIVE EXPENSES

|

General and administrative expenses increased by $51,236 for the six months ended November 30, 2010 when compared with the same period for 2009. General and administrative expenses increased by $78,778 for the three months ended November 30, 2010 when compared with the same period for 2009.

The increases in general and administrative expenses for the three and six months ended November 30, 2010 are primarily a result of the acquisition of the 70% working interest in the 92 oil and natural gas wells located in Tennessee from Domestic Energy Corporation.

We anticipate our operating expenses will increase significantly as we proceed with our exploration and operations program associated with this acquisition.

|

|

13. LIQUIDITY AND FINANCIAL CONDITION

|

|

|

A. WORKING CAPITAL

|

|

30-Nov-10

|

31-May-10

|

|||||||

|

Total Current Assets

|

$ | 20 | $ | 1 | ||||

|

Total Current Liabilities

|

$ | 1,148,197 | $ | 968,098 | ||||

|

Working Capital / (Deficit)

|

$ | (1,148,177 | ) | $ | (968,097 | ) | ||

|

|

B. CASH FLOW

|

|

For the Six Month Ended

|

For the Six Month Ended

|

|||||||

|

30-Nov-10

|

30-Nov-09

|

|||||||

|

OPERATING ACTIVITIES

|

||||||||

|

Net Income / (Loss)

|

$ | (205,144 | ) | $ | (138,724 | ) | ||

|

Net cash provided by Operating Activities

|

$ | (137,833 | ) | $ | (4,545 | ) | ||

|

Net cash provided by Financing Activities

|

$ | 137,852 | $ | 6,940 | ||||

|

Net cash increase for period

|

$ | 20 | $ | 2,395 | ||||

|

Cash at Beginning of Period

|

$ | - | $ | 146 | ||||

|

Cash at end of period

|

$ | 20 | $ | 2,541 | ||||

The increase in our working capital deficit at November 30, 2010 from our year ended May 31, 2010, and the increase in our cash used during the 1st and 2nd Quarters of our Fiscal year ending May 31, 2011, from the preceding fiscal year are primarily a result of the increases in general expenses, which are primarily a result of the proposed acquisition of the 70% working interest in the 92 oil and natural gas wells located in Tennessee from Domestic Energy Corporation and the acquisition of the Pennsylvania and West Virginia leaseholds totaling an additional 120 wells.

Since our inception, we have used our common stock and loan financing from our shareholders to raise money for our operations and for our property acquisitions. When necessary, we have also relied on advances from our largest beneficial shareholder the Avalon Group Ltd. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation. For these reasons, our auditors stated in their report to our audited financial statements for the fiscal year ended May 31, 2010 that there is substantial doubt that we will be able to continue as a going concern.

Page 15 of 19

We anticipate continuing to rely on equity sales of our common stock and loans from the Avalon Group Ltd in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any of additional sales of our equity securities. However, there are no assurances that the Avalon Group Ltd will be willing to advance us additional funds in the future. There are no assurances that we will be able to arrange for other debt or other financing to fund our planned business activities.

|

|

14. OFF-BALANCE SHEET ARRANGEMENTS

|

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable to a small reporting Company.

ITEM 4. CONTROLS AND PROCEDURES.

|

|

1. EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES

|

Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the "Act") is accumulated and communicated to the issuer's management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. It should be noted that the design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

As of the end of the period covered by this report on Form 10-Q, our Chief Executive Officer and our Chief Financial Officer performed an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rule 13a-15(e) or Rule 15d-15(e) under the Exchange Act. Based on that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that, as of the end of the period covered by this report on Form 10-Q, our disclosure controls and procedures were not effective for the purposes stated above due to material errors in the recording of the asset transfer and equity transactions. The consolidated financial statements in this report have been adjusted to include necessary changes related to these items. Management is working on plans to improve the processes that govern the recording of these payments and other related transactions. We believe these plans, when finalized, will enable us to avoid these types of errors in the future.

|

|

2. CHANGES IN INTERNAL CONTROLS OVER FINANCIAL REPORTING

|

In connection with the evaluation of the Company's internal controls during the Company's last fiscal quarter covered by this report required by paragraph (d) of Rules 13a-15 and 15d-15 under the Exchange Act, the Company has determined that the addition of a new President and a new Chief Financial Officer have had a material affect, and will have an ongoing material affect, on the quality and effectiveness of the Company's internal controls over financial reporting.

Page 16 of 19

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

None.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

On October 26, 2009, Westmont issued Thirty Thousand (30,000) split-adjusted shares of Series A Preferred Stock to F&M Inc for services provided to the Company. These shares of Preferred Stock have 160 votes per share, and each share of Preferred Stock converts into 160 shares of Common Stock. Westmont estimated the fair value to total $30.00 and charged this amount as compensation expense.

On May 11, 2010, Westmont issued Forty Thousand (40,000) shares of Series A Preferred Stock to F&M Inc. for services provided to the Company. These shares of Preferred Stock have 160 votes per share, and each share of Preferred Stock converts into 160 shares of Common Stock. Westmont estimated the fair value to total $40 and charged this amount as compensation expense.

On May 11, 2010, Westmont issued One Hundred Thousand (100,000) shares of Common Stock to the below listed organizations for services provided to the Company. These shares of Common Stock have 1 vote per share. Westmont estimated the fair value to total $30,000 and charged this amount as compensation expense.

|

|

·

|

0692545 BC LTD

|

8,699 Common Shares

|

|

|

·

|

Bogat Family Trust

|

8,699 Common Shares

|

|

|

·

|

Harpreet Hayer

|

8,699 Common Shares

|

|

|

·

|

F&M Inc.

|

73,903 Common Shares

|

ITEM 3. DEFAULTS UPON SENIOR SECURITIES.

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

On November 23, 2010, the Board of Directors and stockholders holding a majority of the voting power of Westmont Resource Inc., took action by written consent to reduce the number of the total issued and outstanding capital stock of the Company by effectuating a reverse stock split on a 300 to 1 ratio effective on December 30, 2010.

Since the actions was approved by a majority of stockholders who collectively hold or control Fifty-Nine and Two Hundreds percent (59.02%) of the total voting rights of the Company consisting of Fifty-Two and Eighty-Five Hundreds percent (52.85%) of the Common shares voting rights and Seventy-Six and Ninety-Two Hundreds percent (76.92%) of the Class A Preferred shares voting rights. As a result, the proposal has been approved without the affirmative vote of any other stockholders of the Company. The effective date on this corporate action will take effect after the close of business on December 30, 2010.

The corporate actions involve one (1) proposal (the “Proposal”) providing for the following:

|

|

·

|

To approve a 1 – for – 300 reverse split of the issued and outstanding shares of Common Stock such that each Three Hundred (300) shares of Common Stock, $0.001 par value, issued and outstanding immediately prior to the effective date (the “Old Common Stock”) shall be recombined, reclassified and changed into one (1) share of the corporation's Common Stock, $0.001 par value (the “New Common Stock”), with any fractional interest rounded up to the nearest whole share.

|

|

|

·

|

To approve a 1 – for – 300 reverse split of the issued and outstanding shares of Class A Preferred Stock such that each Three Hundred (300) shares of Class A Preferred Stock, $0.001 par value, issued and outstanding immediately prior to the effective date (the “Old Class A Preferred Stock”) shall be recombined, reclassified and changed into one (1) share of the corporation's Class A Preferred Stock, $0.001 par value (the “New Class A Preferred Stock”), with any fractional interest rounded up to the nearest whole share.

|

Page 17 of 19

ITEM 5. OTHER INFORMATION.

|

|

1.

|

August 20, 2009: Westmont Resources, Inc., has relocated its offices. The Company’s new address is 155 – 108th Avenue NE, Suite 150, Bellevue, WA 98004. The Company’s new telephone number is (206) 922-2203.

|

|

|

2.

|

October 13, 2009: Andrew Jarvis our Secretary and Director resigned from, both positions as well as his management and Directorship in our wholly owned subsidiary NorthStar Exploration Ltd. Mr. Glenn McQuiston our Chief Financial Officer was appointed the Company Secretary. Dr. Fischer our Chief Executive Officer was appointed President, Secretary and Director of NorthStar Exploration Ltd.

|

|

|

3.

|

October 16, 2009: Peter Lindhout our President resigned from his position as President. Mr. Glenn McQuiston our Chief Financial Officer was appointed as President.

|

|

|

4.

|

April 15, 2010: Larry Grella resigns as Director of Westmont Resources Inc pursuant to Sale of Get2Networks Inc.

|

|

|

5.

|

April 16, 2010: Marcie Corbin is appointed Director and CFO of Westmont Resources Inc.

|

ITEM 6. EXHIBITS.

|

Exhibit

|

||

|

Number

|

Description of Exhibits

|

Location

|

|

3.1

|

Articles of Incorporation.

|

Incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form SB-2 as filed with the Securities & Exchange Commission on October 13, 2006, as subsequently amended.

|

|

3.2

|

Bylaws, as amended.

|

Incorporated by reference to Exhibit 3.2 to the Company’s Registration Statement on Form SB-2 as filed with the Securities & Exchange Commission on October 13, 2006, as subsequently amended.

|

|

21.1

|

List of Subsidiaries.

|

Included herein.

|

|

31.1;

and

31.2

|

Certification of Chief Executive Officer, and Chief Financial Officer pursuant to U.S.C. Section 7241, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

Included herein.

|

|

32.1;

and

32.2

|

Certification of Chief Executive Officer, and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

Included herein.

|

|

99.1

|

Security Reports

|

Page 18 of 19

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

WESTMONT RESOURCES, INC.

|

Date:

|

Friday, 19 January 2011

|

By:

|

/s/ Dr. Bruce E. Fischer

|

|

DR. BRUCE E. FISCHER

Managing Director, Chief Executive Officer

(Principal Executive Officer)

|

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Date:

|

Friday, 19 January 2011

|

By:

|

/s/ Dr. Bruce E. Fischer

|

|

DR. BRUCE E. FISCHER

Managing Director, Chief Executive Officer

(Principal Executive Officer)

|

|

Date:

|

Friday, 19 January 2011

|

By:

|

/s/ Glenn McQuiston

|

|

GLENN MCQUISTON

|

|||

|

President and Director

(Principal Operations Officer)

|

|

Date:

|

Friday, 19 January 2011

|

By:

|

/s/ Marcie Corbin

|

|

MARCIE CORBIN

|

|||

|

Chief Financial Officer and Director

(Principal Financial Officer)

|

Page 19 of 19