Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jazz Pharmaceuticals plc | d8k.htm |

EXHIBIT 99.1

Relevant portion of the slides presented by Jazz Pharmaceuticals, Inc. at the J.P. Morgan Healthcare Conference in San Francisco, California on January 12, 2011:

1

Forward-Looking Statements

This presentation contains forward-looking statements, including, but not limited

to, statements related to Jazz Pharmaceuticals' financial performance and growth

potential, including expectations with respect to 2010 financial results, sales

and earnings growth, and marketing activities, statements related to Jazz

Pharmaceuticals' product candidates, including statements related to continued

development and future regulatory matters, statements related to intellectual

property and patent position, and statements related to new product

opportunities. These forward-looking statements are based on the company's current expectations and

inherently involve significant risks and uncertainties. Jazz Pharmaceuticals' actual

results and the timing of events could differ materially from those anticipated

in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks related to: Jazz Pharmaceuticals' ability to maintain or

increase

sales

of

its

Xyrem

®

and

Luvox

CR

®

products;

Jazz

Pharmaceuticals'

dependence

on

single

source

suppliers and manufacturers; the uncertain and time-consuming clinical and

regulatory approval process for the company’s

product

candidates,

Jazz

Pharmaceuticals'

cash

flow

estimates;

the

difficulty

and

uncertainties

related

to the protection of intellectual property and defense of patents, including in ANDA

litigation; competition, including generic competition; Jazz Pharmaceuticals'

ability to successfully acquire, in-license or develop additional products

or product candidates to grow its business; and those risks detailed from time-to-time under

the caption "Risk Factors" and elsewhere in Jazz Pharmaceuticals' Securities

and Exchange Commission filings and reports, including in its Quarterly Report

on Form 10-Q for the quarter ended September 30, 2010 filed by Jazz

Pharmaceuticals with the Securities and Exchange Commission. Jazz Pharmaceuticals undertakes no duty

or

obligation

to

update

any

forward-looking

statements

contained

in

this

presentation

as

a

result

of

new

information, future events or changes in its expectations.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of

1995 |

2

Jazz Pharmaceuticals Today

•

Growing, profitable pharmaceutical company with high operating leverage

–

Two

products

with

sales

of

$164M

-$168M

in

2010

and

gross

margin

>

90%

1,2

–

$56M

-

$58M

in

2010

adjusted

net

income;

$27M

-

$29M

in

2010

GAAP

net

income

1,2

•

Highly leverageable

commercial organization

–

Specialty

sales

force

targeting

sleep

specialists,

neurologists,

psychiatrists

and

pulmonologists

•

Developing promising new product candidates

•

Strong balance sheet with significant NOLs

•

Committed to sustained growth in sales and earnings

1.

Based on guidance provided on November 4, 2010. Jazz Pharmaceuticals is not updating

the amounts in that prior guidance; however, Jazz Pharmaceuticals currently expects that, for the year ended December 31,

2010, total product sales, GAAP net income and adjusted net income will meet or exceed

the top end of the guidance ranges provided on November 4, 2010. Jazz Pharmaceuticals has not finalized its financial results

for the quarter and year ended December 31, 2010 and its actual results may therefore

differ from its current expectations. 2.

Adjusted net income is a non-GAAP financial measure that excludes

from GAAP net income revenue related to upfront and milestone payments, and certain expenses comprised of loss on extinguishment of debt,

amortization of intangible assets, non-cash interest expense, and stock-based

compensation. A reconciliation of adjusted net income to GAAP net income is in a table included with this presentation. |

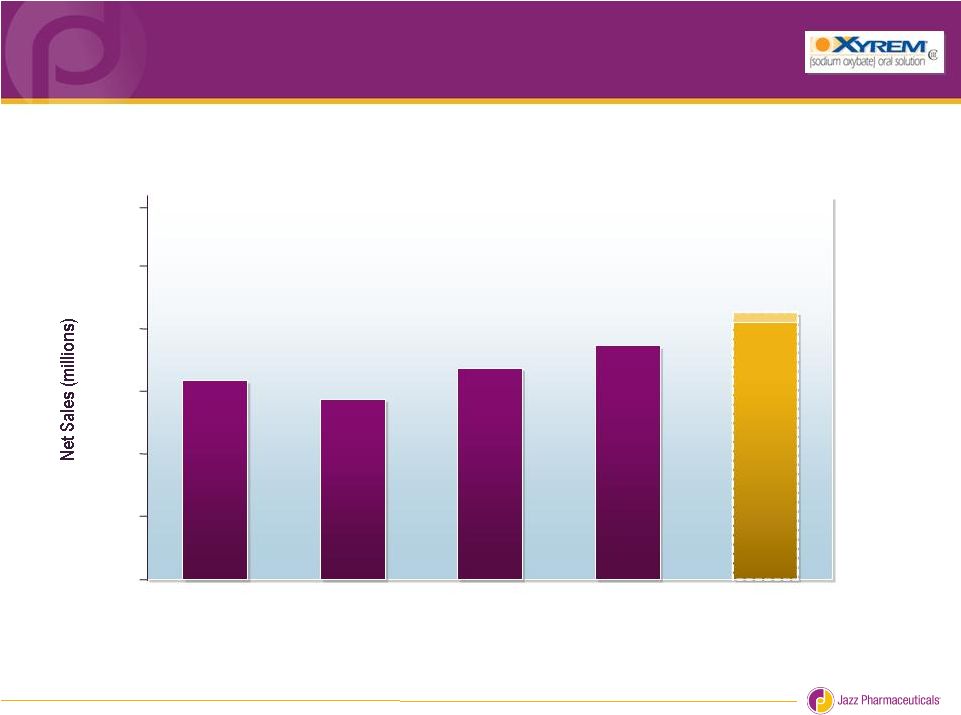

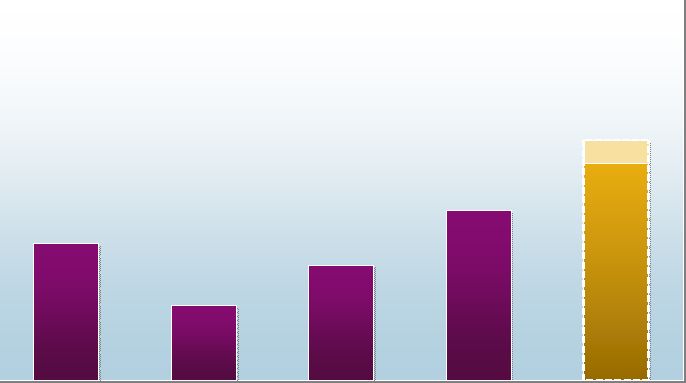

Xyrem

-

Strong Sales Growth

4Q10G

3Q10

2Q10

1Q10

4Q09

Total 2010 Xyrem

Sales $140M -

$142M

1

YOY Sales Growth 45% -

47%

1

$0

$10

$20

$30

$40

$50

$60

$32

$29

$34

$37

$40 -

$42

1

3

1. Based on guidance for 2010 provided on November 4, 2010.

Jazz Pharmaceuticals is not updating the amounts in that prior guidance; however, Jazz Pharmaceuticals currently expects

that, for the year ended December 31, 2010, Xyrem product sales will exceed the top end

of the guidance range provided on November 4, 2010. Jazz Pharmaceuticals has not finalized its

financial results for the quarter and year ended December 31, 2010 and its actual

results may therefore differ from its current expectations. |

Luvox

CR –

Continued Sales Growth

Total 2010 Luvox

CR Sales $24M -

$26M

1

YOY Sales Growth 31%-

42%

1

4Q10G

3Q10

2Q10

1Q10

4Q09

$5.7

$5.5

$5.8

$6.6

$6 -

$8

1

$0

$1

$4

$6

$7

$8

$5

$3

$2

$9

4

1. Based on guidance for 2010 provided on November 4, 2010.

Jazz Pharmaceuticals is not updating the amounts in that prior guidance; however, Jazz Pharmaceuticals currently expects that,

for the year ended December 31, 2010, Luvox CR product sales will meet or exceed the

top end of the guidance range provided on November 4, 2010. Jazz Pharmaceuticals has not

finalized its financial results for the quarter and year ended December 31, 2010 and

its actual results may therefore differ from its current expectations.

|

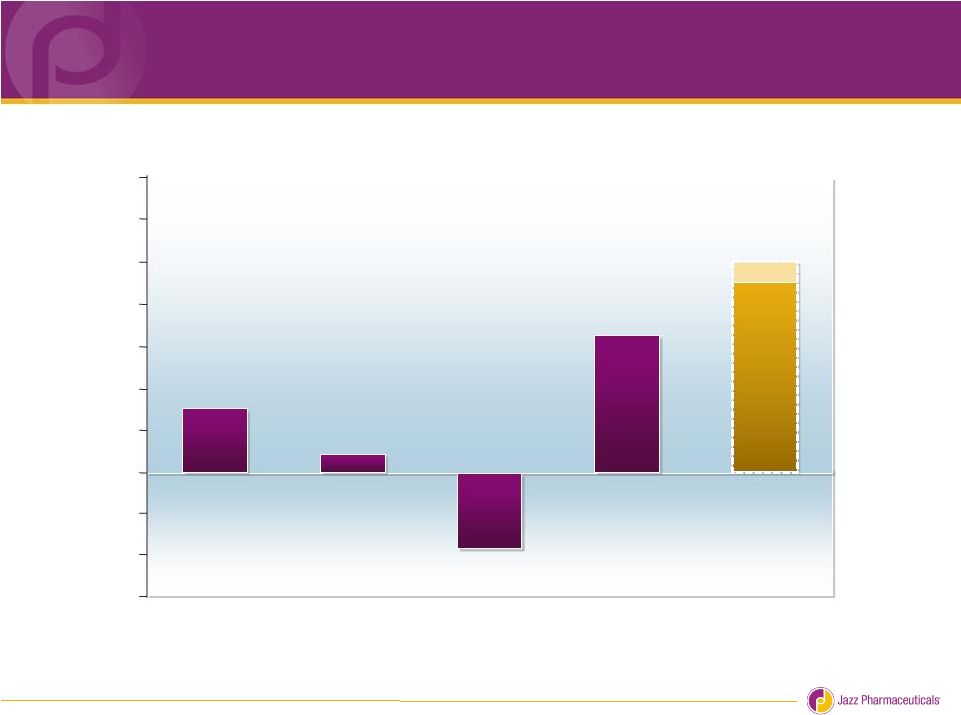

Strong Earnings Growth

2010 GAAP EPS of $0.70 -

$0.75

1

1

Based on guidance for 2010 previously provided on November 4, 2010 and estimated

shares outstanding of 42 million for 4Q10. Jazz Pharmaceuticals is not updating the amounts in that prior

guidance; however, Jazz Pharmaceuticals currently expects that, for the year ended

December 31, 2010, GAAP net income per diluted share will meet or exceed the top end of the guidance range

provided on November 4, 2010. Jazz Pharmaceuticals has not finalized its

financial results for the quarter and year ended December 31, 2010 and its actual results may therefore differ from its

current expectations.

$0.17

$0.04

($0.18)

$0.32

$0.46 -

$0.50

1

4Q10G

3Q10

2Q10

1Q10

4Q09

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

-$0.20

-$0.10

-$0.30

5 |

6

Strong Earnings Growth

2010 Adjusted EPS of $1.45 -

$1.50

1

$0.33

$0.18

$0.28

$0.41

$0.53 -

$0.58

1

4Q10G

3Q10

2Q10

1Q10

4Q09

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

1

Based on guidance for 2010 previously provided on November 4, 2010 and estimated

shares outstanding of 42 million for 4Q10. Jazz Pharmaceuticals is not updating the amounts in that prior

guidance; however, Jazz Pharmaceuticals currently expects that, for the year ended

December 31, 2010, adjusted net income per diluted share will meet or exceed the top end of the guidance range

provided on November 4, 2010. Jazz Pharmaceuticals has not finalized its

financial results for the quarter and year ended December 31, 2010 and its actual results may therefore differ from its

current expectations.

2

Adjusted net income per diluted share, or Adjusted EPS, is a non-GAAP financial

measure that excludes from GAAP net income per diluted share, or GAAP EPS, revenue related to upfront and

milestone payments, and certain expenses comprised of loss on extinguishment of

debt, amortization of intangible assets, non-cash interest expense, and stock-based compensation. A reconciliation

of Adjusted EPS to GAAP EPS is in a table included with this presentation.

|

7

2010 Financial Guidance

1

Total Product Sales

$164 –

168M

Xyrem

$140 –

142M

Luvox

CR

$24 –

26M

Gross Margin

> 90%

SG&A

$69 –

71M

R&D

$27 –

28M

GAAP EPS

$0.70 –

0.75

Adjusted EPS

2

$1.45 –

1.50

1.

Based on guidance for 2010 provided on November 4, 2010. Jazz Pharmaceuticals is not

updating the amounts in that prior guidance; however, Jazz Pharmaceuticals currently expects that, for the year ended December

31, 2010, total product sales, Xyrem product sales, Luvox CR product sales, GAAP net

income per diluted share and adjusted net income per diluted share will meet or exceed the top end of the guidance ranges provided

on November 4, 2010. Jazz Pharmaceuticals has not finalized its financial results

for the quarter and year ended December 31, 2010 and its actual results may therefore differ from its current expectations.

2. Adjusted net income per diluted share, or Adjusted EPS, is

a non-GAAP financial measure that excludes from GAAP net income per diluted share, or GAAP EPS, revenue related to upfront and milestone payments, and

certain expenses comprised of loss on extinguishment of debt, amortization of

intangible assets, non-cash interest expense, and stock-based compensation. A reconciliation of Adjusted EPS to GAAP EPS is in a table

included with this presentation. |

8

Reconciliation of GAAP Net Income and EPS to Adjusted

Net Income and EPS in 2010 Financial Guidance

FY 2010G

1

(In millions, except per share amounts)

GAAP net income

$27-29

Add:

Intangible asset amortization

8

Stock-based compensation expense

8

Non-cash interest expense

2

Loss on extinguishment of debt

12

Deduct:

Contract revenues

(1)

Adjusted net income

$56-58

GAAP net income per diluted share

$0.70-0.75

Adjusted net income per diluted share

$1.45-1.50

Shares used in computing GAAP and adjusted net

income per diluted share amounts

39

1.

Based on guidance for 2010 provided on November 4, 2010. Jazz Pharmaceuticals is not

updating the amounts in that prior guidance; however, Jazz Pharmaceuticals currently expects that, for the year ended

December 31, 2010, GAAP and adjusted net income and GAAP and adjusted net income per

diluted share will meet or exceed the top end of the guidance ranges provided on November 4, 2010. Jazz

Pharmaceuticals has not finalized its financial results for the quarter and year ended

December 31, 2010 and its actual results may therefore differ from its current expectations.

1 |

9

Reconciliation of Quarterly GAAP to Adjusted Financial

Results and Guidance

In millions, except per share amounts

4Q09

1Q10

2Q10

3Q10

4Q10G

1

GAAP net income

$5.7

$1.5

$(6.4)

$13.2

$19-21

Add:

Intangible asset amortization

2.1

2.1

2.0

1.9

2

Stock-based compensation expense

2.4

1.8

2.0

2.2

2

Non-cash interest expense

1.0

1.0

0.9

0.2

0

Loss on extinguishment of debt

-

-

12.3

-

0

Deduct:

Contract revenues

(0.3)

(0.3)

(0.3)

(0.3)

0

Adjusted net income

$10.9

$6.1

$10.5

$17.2

$22-24

GAAP net income per diluted share

$0.17

$0.04

$(0.18)

$0.32

$0.46-0.50

Adjusted net income per diluted share

$0.33

$0.18

$0.28

$0.41

$0.53-0.58

Shares used in computing:

GAAP net income per diluted share

33.3

34.9

35.4

41.7

42

Adjusted net income per diluted share

33.3

34.9

38.1

41.7

42

1.

Based on guidance for 2010 provided on November 4, 2010. Jazz Pharmaceuticals is not

updating the amounts in that prior guidance; however, Jazz Pharmaceuticals currently expects that, for the year ended

December 31, 2010, GAAP and adjusted net income and GAAP and adjusted net income per

diluted share will meet or exceed the top end of the guidance ranges provided on November 4, 2010. Jazz

Pharmaceuticals has not finalized its financial results for the quarter and year ended

December 31, 2010 and its actual results may therefore differ from its current expectations. |

Relevant portion of the transcript of the oral presentation by Jazz Pharmaceuticals, Inc. at the J.P. Morgan Healthcare Conference in San Francisco, California on January 12, 2011 accompanying the above slides:

Bruce C. Cozadd – Jazz Pharmaceuticals – Chairman and Chief Executive Officer

So, thank you for you attendance, everyone. I am delighted to present an update on Jazz Pharmaceuticals this afternoon. I will be making forward-looking statements you’ll be pleased to hear. But those are, of course, subject to risk factors detailed in our SEC filings.

…

Today, the company is a growing, profitable pharmaceutical company, and I show here some of the guidance that we gave on our 3rd quarter call on November 4th. Two products with sales of $164 to $168 million, with a very healthy growth---- gross margin north of 90%, and adjusted net income of $56 to $58 million in 2010. And I’m happy to tell all of you that we will meet or exceed the top of the range for all of these numbers.

…

We have a very strong balance sheet with significant NOLs. Specifically at year end, our cash will exceed our debt, and our NOLs will exceed $300 million, and we’re very committed to sustaining our growth in both sales and earnings. So, let’s turn to our lead product Xyrem.

…

We’ve seen continued strong sales growth of Xyrem. I show here a quarterly sales, 4th quarter 2009 through 3rd quarter of last year, and then again, our implied guidance for the 4th quarter of 2010. Again, we will meet or exceed the upper end of the range in this guidance for Xyrem sales for the 4th quarter. That’ll give us growth year-over-year in excess of 47%. We’ve seen growth on the price side and growth on the volume side. You see some dip in volume 4th quarter to 1st quarter. That’s a pattern we’ve seen for the last couple of years. Notice I’m saying that to you at the beginning of the 1st quarter of this year, so, just want to prepare you that sometimes it does happen. Specifically, the volume growth we’ve seen 1st quarter ‘10 over 1st quarter ‘09 was 5%; 2nd quarter over 2nd quarter was 6%; 3rd quarter over 3rd quarter was 8.1%; and in the 4th quarter we saw 8.3% volume growth. Some of you know we took a price increase on November 1st. It’s important for us to see that that volume growth has continued very strong through the 4th quarter. And we believe there is room for more growth in use of Xyrem.

…

Let’s turn to our second product, Luvox CR.

…

Sales of Luvox CR also showed nice growth in 2010. Again, this is the quarter progression. Our 4th quarter guidance had been in the range of $6 to $8 million, and again, we will meet or exceed our guidance, which would give us a growth rate of over 40%. Unlike Xyrem, you can track weekly prescriptions of Luvox CR, and we’ve seen nice growth in weekly prescriptions over the balance of the last year.

…

So, let me conclude with a couple of final slides, starting with earnings. I show here the last 4 quarters of reported GAAP EPS along with our guidance for the 4th quarter. We generally report our results as well on an adjusted EPS basis where we back out amortization of intangibles, stock-based compensation, non-cash interest expenses, as well as non-cash revenues, to get to something that we think is a more representative and informative number. If we take those same numbers I presented on the last slide and put them in the adjusted EPS format, the trend is a little easier to understand. We do provide a reconciliation between adjusted EPS and GAAP in all of our filings and press releases and at the back of this presentation. You can see that our guidance for the 4th quarter was in the 53 to 58 cents a share range. Again, we will meet or exceed the upper end of that range when we report our results. So, we’ve come from losing money even on an adjusted EPS basis last year to EPS that will exceed $1.50 in 2010. Our priorities for 2011 shouldn’t be a surprise to anyone in the room: continue to grow and protect the Xyrem business; grow Luvox CR sales as well; make that critical determination to us of whether additional investment pursuing a fibromyalgia indication is a good thing for the company to do; advance the JZP-8 program in acute repetitive seizures; evaluate new product opportunities. The company is in stronger financial shape now. We’re generating a lot of cash. If you take that adjusted EPS number I just gave you for the 4th quarter, multiply by just over 40 million shares, you can see our cash flow generation is already north of $20 million a quarter.